FORM 51-102F3

MATERIAL CHANGE REPORT

Item 1 Name and Address of Company

Integra Resources Corp. ("Integra" or the "Company")

1050 - 400 Burrard Street

Vancouver, British Columbia

Canada V6C 3A6

Item 2 Date of Material Change

June 28, 2023

Item 3 News Release

Integra disseminated a new release in respect of the material change referred to in this report on June 28, 2023 to the New York Metro and TSX Venture Disclosure distribution wires using the services GlobeNewswire. The news release was subsequently filed on the Company's SEDAR profile.

Item 4 Summary of Material Change

Integra has completed a preliminary economic assessment ("PEA") and mineral resource estimates for each of the Wildcat Project ("Wildcat") and Mountain View Project ("Mountain View", and collectively with Wildcat, "Wildcat & Mountain View") located in western Nevada.

Item 5 Full Description of Material Change

PEA Study Preparation

The PEA was prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") by Micon International Limited of Toronto, Canada and included contributions from Forte Dynamics, NewFields and Convergent Mining. All references to "$" in this material change report are to U.S. dollars unless otherwise stated. The PEA is preliminary in nature and includes inferred mineral resources that are too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that PEA results will be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

The PEA demonstrates the potential for a low-cost, high-margin, heap leach gold-silver operation with a phased development and production strategy and robust economics. The average annual production of Wildcat & Mountain View and the DeLamar Project on a combined basis is expected to exceed 200kozs of gold equivalent ("AuEq"), demonstrating one of the largest heap leach production profiles among precious metal developers in the Great Basin.

Project Economics - Sensitivity to Gold and Silver Prices

Table 1 illustrates a range of metal price scenarios to evaluate the after-tax economics of Wildcat & Mountain View. As shown, Wildcat & Mountain View operations remain viable in the downside commodity price scenario and also show robust economics in the upside case.

Table 1: After-Tax NPV, IRR and Payback Sensitivity Table (US$M)

$/oz Au | $/oz Ag | NPV (5%) | NPV

(7.5%) | NPV (10%) | IRR | Payback |

$1,450 | $18.34 | $155.0 | $114.4 | $82.4 | 21.2% | 3.7 |

$1,500 | $18.97 | $186.0 | $141.4 | $106.3 | 24.4% | 3.5 |

$1,550 | $19.60 | $216.9 | $168.4 | $130.0 | 27.6% | 3.3 |

$1,600 | $20.24 | $247.6 | $195.2 | $153.6 | 30.7% | 3.2 |

$1,650 | $20.87 | $278.4 | $222.0 | $177.3 | 33.7% | 3.1 |

$1,700 | $21.50 | $309.6 | $249.3 | $201.2 | 36.9% | 3.0 |

$1,750 | $22.13 | $340.5 | $276.3 | $225.0 | 39.9% | 2.8 |

$1,800 | $22.76 | $371.4 | $303.2 | $248.7 | 42.9% | 2.6 |

$1,850 | $23.40 | $401.9 | $329.8 | $272.2 | 45.9% | 2.5 |

$1,900 | $24.03 | $432.5 | $356.4 | $295.6 | 48.8% | 2.4 |

$1,950 | $24.66 | $463.1 | $383.1 | $319.1 | 51.7% | 2.3 |

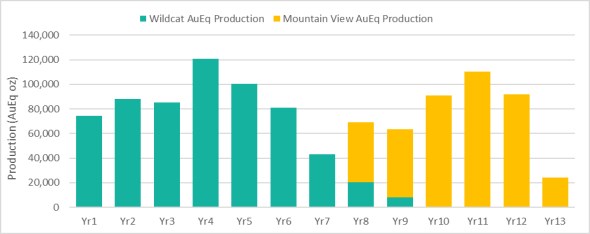

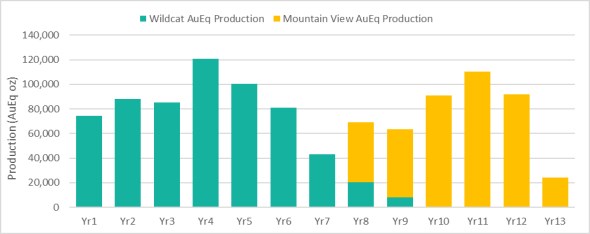

Production and Cash Flow Profile

The PEA outlines a profitable heap leach operation with a phased development approach that sees production beginning at Wildcat and expanding to Mountain View in year 8. A phased development approach allows the Company to utilize one fleet for mining and processing equipment resulting in significantly reduced total capital requirements. In total, the approximately 30,000 tonnes per day ("tpd") heap leach operation at Wildcat and 16,000 tpd heap leach operation at Mountain View is expected to process 99.5 million tonnes ("Mt") of mineralized material and produce 1,043koz AuEq (1,018koz Au and 1,933koz Ag) over the 13-year LOM.

The average annual LOM production at Wildcat & Mountain View is expected to be 80koz AuEq per year which, assuming base case metal prices of US$1,700/oz Au and US$21.50/oz Ag will generate total net free cash flow LOM of US$485M and average annual free cash flow of US$46M from year 1-13.

Figure 1: Wildcat & Mountain View Production Profile

Figure 2: Wildcat & Mountain View Cash Flow Profile

Technical Inputs and Assumptions

Each of Wildcat & Mountain View will have its own heap leach pad and waste rock facility. The mining equipment and fleet will be moved between the two projects to provide efficient operations and value optimization. Wildcat & Mountain View will share an Adsorption/Desorption/Recovery ("ADR") plant located first at Wildcat and then moved to Mountain View in year 8, at which point the loaded carbon from production years 8 and 9 at Wildcat will be trucked to Mountain View for processing. Mining will be done using 90 tonne ("t") haul trucks and 200t and 250t shovels. Material will be crushed to 9 millimeters ("mm") at Wildcat and 19mm at Mountain View using a three-stage crushing circuit. No agglomeration is expected to be required at either project.

Table 2: Standalone Project Inputs

| Mining | Wildcat | Mountain View |

| Total Tonnage Mined (kt) | 89,909 | 130,279 |

| Total Mineralized Material (kt) | 69,974 | 29,548 |

Strip Ratio (Waste: Mineralized) | 0.28 | 3.41 |

Contained | | |

Contained Gold (koz Au) | 823.1 | 521.8 |

Contained Silver (koz Ag) | 7,065.8 | 3,037.2 |

Contained Gold Equivalent (koz AuEq) | 912.4 | 560.2 |

Processing & Grade | | |

Processing Throughput (ktpd) | 30.0 | 16.0 |

Average Gold Grade (g/t Au) | 0.38 | 0.57 |

Average Silver Grade (g/t Ag) | 3.25 | 3.30 |

Production | | |

Heap Leach Recovery | | |

LOM Average Gold Recovery (%) | 71.4% | 77.1% |

LOM Average Silver Recovery (%) | 18.0% | 20.0% |

Payable Metals | | |

LOM Gold Payable (koz Au) | 604.2 | 414.0 |

LOM Silver Payable (koz Ag) | 1,308.1 | 624.8 |

LOM Gold Equivalent Payable (koz AuEq) | 620.8 | 421.9 |

Table 3: Technical Inputs and Financial Assumptions for Combined Operation

| Mining | Wildcat & Mountain View |

| Total Tonnage Mined (kt) | 220,187 |

| Total Mineralized Material (kt) | 99,522 |

| Strip Ratio (Waste: Mineralized) | 1.21 |

| Mine Life | 13.0 |

| Contained | |

| Contained Gold (koz Au) | 1,344.9 |

| Contained Silver (koz Ag) | 10,103.0 |

| Contained Gold Equivalent (koz AuEq) | 1,472.7 |

| Production | |

| Heap Leach Recovery | |

| LOM Average Gold Recovery (%) | 73.7% |

| LOM Average Silver Recovery (%) | 18.6% |

| Payable Metals | |

| LOM Gold Payable (koz Au) | 1,018.2 |

| LOM Silver Payable (koz Ag) | 1,932.8 |

| LOM Gold Equivalent Payable (koz AuEq) | 1,042.6 |

| Average Annual Gold Payable (koz Au) | 78.3 |

| Average Annual Silver Payable (koz Ag) | 148.7 |

| Average Annual Gold Equivalent Payable (koz AuEq) | 80.2 |

| Costs per Tonne | Wildcat & Mountain View |

| Mining Costs (US$/t mined) | $1.82 |

| Mining Costs (US$/t processed) | $4.02 |

| Processing Costs (US$/t processed) | $3.59 |

| G&A Costs (US$/t processed) | $0.58 |

| Total Site Operating Cost (US$/t processed) | $8.19 |

Cash Costs | |

LOM Cash Cost, net-of-silver by-product ($/oz Au) | $862 |

LOM Cash Cost, co-product ($/oz AuEq) | $882 |

LOM AISC, net-of-silver by-product ($/oz Au) | $956 |

LOM AISC, co-product ($/oz AuEq) | $973 |

LOM AIC, net-of-silver by-product ($/oz Au) | $1,162 |

LOM AIC, co-product ($/oz AuEq) | $1,175 |

Capital Expenditure | |

Wildcat Initial Capex (US$M) (1) | $115.1 |

Mountain View Initial Capex (US$M) | $49.2 |

Expansion Capex (US$M) (2) | $49.2 |

Sustaining Capex / Equipment Financing (US$M) | $84.4 |

Reclamation Cost (US$M) | $21.7 |

Salvage Value (US$M) | ($12.1) |

Bonding Cash Collateral Return (US$M) | ($2.2) |

Total Capital (US$M) | $305.3 |

Economic Assumptions | |

Gold Price (US$/oz) | $1,700 |

Silver Price (US$/oz) | $21.50 |

FX Rate (CAD/USD) | 1.3 |

Project Economics | |

After-Tax IRR (%) | 36.9% |

After-Tax NPV5% (US$M) | $309.6 |

After-Tax NPV5% (C$M) | $408.6 |

Payback Period (years) | 3.0 |

Yr1-13 Average Annual Net Free Cash Flow (US$M) | $45.9 |

Yr1-13 Total Net Free Cash Flow (US$M) | $596.7 |

LOM Total Net Free Cash Flow (US$M) | $485.1 |

(1) Includes initial working capital and reclamation bonding

(2) Includes Wildcat and Mountain View heap leach expansion capex

Capital & Operating Costs

The total site costs including mining, processing and G&A for Wildcat & Mountain View are US$8.19/t processed over the LOM. The LOM site level cash costs net-of-silver by-product for Wildcat & Mountain View are US$862/oz Au and US$882/oz AuEq on a co-product basis. The site level AISC, which includes heap leach expansion capital for Wildcat in year 2 and Mountain View in year 9, is US$956/oz Au on a by-product basis and US$973/oz AuEq on a co-product basis. The all-in cost ("AIC") for Wildcat & Mountain View is US$1,162/oz Au on a by-product basis and US$1,175/oz AuEq on a co-product basis and includes Wildcat & Mountain View initial capital expenditure, heap leach expansion capital, sustaining capital, reclamation and closure costs.

Table 4: Operating Cost, AISC and AIC Breakdown

| | Per Tonne |

| LOM Operating Costs (US$) | Mined | Processed |

| Mining | $1.82 | $4.02 |

| Processing | | $3.59 |

| G&A | | $0.58 |

| Total Site Costs | | $8.19 |

| | | |

| | US$/oz Au | US$/oz AuEq |

| LOM Cash Costs, AISC & AIC Breakdown | By-Product | Co-Product |

| Mining | $393 | $384 |

| Processing | $351 | $343 |

| G&A | $56 | $55 |

| Total Site Costs | $801 | $782 |

| Transport & Refining | $6 | $6 |

| Royalties & Production Taxes (1) | $97 | $94 |

| Total Cash Costs | $903 | $882 |

| Silver By-Product Credits | ($41) | - |

| Total Cash Costs Net of Silver by-Product | $862 | $882 |

| Expansion Capital (2) | $48 | $47 |

| Sustaining Capital | $35 | $35 |

| Closure Costs Net of Residual Value | $10 | $9 |

| Site Level All-in Sustaining Costs | $956 | $973 |

| Non-Sustaining Capital (3) | $207 | $202 |

| Site Level All-in Costs | $1,162 | $1,175 |

(1) Includes private royalties and state-level cash taxes

(2) Expansion capital includes heap leach expansion at Wildcat in year 2 and Mountain View in year 9

(3) Non-Sustaining Capital includes initial capital at Wildcat and Mountain View and equipment leases

Note: Costs may not reconcile exactly due to rounding

The total pre-production capex for Wildcat is estimated at US$115M. A phased development approach results in expansion capital of US$31M in year 2 at Wildcat to expand the heap leach pad. In year 7, initial capital for Mountain View of US$49M is required for the heap leach pad and processing facility. Expansion capital of US$18M to increase the heap leach capacity at Mountain View is required in year 9. Other capital required throughout the LOM of US$92M includes financed mining equipment, sustaining capital, reclamation (net of residual value) and bonding.

Table 5: Wildcat & Mountain View Project Capital Cost Breakdown

| Capital Cost Breakdown (US$M) | Wildcat | Mountain View | Combined |

| Wildcat Initial Capital (Y-1) | | | |

| Heap Leach Pad | $26.7 | $0.0 | $26.7 |

| Processing | $65.5 | $0.0 | $65.5 |

| Initial Cash Bonding | $2.2 | $0.0 | $2.2 |

| Contingency | $20.6 | $0.0 | $20.6 |

Total Wildcat Initial Capital | $115.1 | $0.0 | $115.1 |

Mountain View Initial Capital (Y7) | | | |

Heap Leach Pad | $0.0 | $12.5 | $12.5 |

Processing | $0.0 | $27.0 | $27.0 |

Contingency | $0.0 | $9.7 | $9.7 |

Total Mountain View Initial Capital | $0.0 | $49.2 | $49.2 |

| | | |

Expansion Capital (Y2-13) | | | |

Heap Leach Pad | $24.6 | $14.8 | $39.4 |

Contingency | $6.4 | $3.4 | $9.8 |

Total Expansion Capital | $31.0 | $18.2 | $49.2 |

| | | |

Other Capital (Y1-13) | | | |

Mining Equipment | $34.7 | $13.8 | $48.4 |

Sustaining Capital | $21.0 | $15.0 | $36.0 |

Reclamation | $11.1 | $10.7 | $21.7 |

Bonding Cash Collateral Return | ($2.2) | $0.0 | ($2.2) |

Residual Value | $0.0 | $0.0 | ($12.1) |

Total Other Capital | $64.5 | $39.4 | $91.9 |

| | | | | |

TOTAL CAPITAL | $210.6 | $106.8 | $305.3 |

| | | | | | |

Note: Figures in the table include a ~25% contingency on processing facilities and heap leach pads (excluding working capital)

Additional Information

Mining

As contemplated in the PEA study, approximately 200 mining, processing, maintenance, and general administrative workers are expected to be employed directly by Wildcat & Mountain View in peak years. In addition, Wildcat & Mountain View will contribute to the state and federal governments through taxation.

The PEA utilizes a phased development and mining approach with open pit mining beginning at Wildcat and moving to Mountain View in year 8. The Wildcat Project will produce over a 7-year period at a rate of approximately 30,000 tpd. Starting in year 5, pre-stripping as well as a mineralized material stockpiling program will commence at Mountain View. In year 7 and 8, all fixed and mobile infrastructure will move from Wildcat to Mountain View. In year 8, the majority of fixed and mobile equipment will be allocated for mining at Mountain View in conjunction with heap leaching only at Wildcat. Mountain View will process an average of 16,000 tpd over a 6-year period, followed by one year of remnant heap leaching.

The average waste to mineralization strip ratio at Wildcat is 0.28 and is 3.41 at Mountain View. The LOM strip ratio for Wildcat & Mountain View is 1.21 with approximately 220Mt of total material moved. At Mountain View, most of the waste material is quaternary alluvium that does not require drilling or blasting. The alluviums can be moved with surface equipment and represent approximately 72Mt of the 101Mt of waste material at Mountain View. A cut-off grade of 0.15 g/t Au will be used at Wildcat & Mountain View.

Integra contemplates conducting open pit mining at Wildcat & Mountain View using an owner-operated, conventional mine fleet that includes production drill rigs for mineralization definition and blasting. The operation will share mining equipment and a fleet that includes ~28 to ~33 cubic meter hydraulic shovels (200t and 250t shovels) and ~12 cubic meter front end loaders with 90t haul trucks. The Company intends to optimize equipment use by moving equipment, after a rebuild program, from Wildcat to Mountain View as production declines at Wildcat and ramps up at Mountain View in years 7 and 8.

Heap Leach Metallurgy

The PEA includes conventional heap leaching for the processing and recovery of gold and silver. A heap leach pad will be located at both Wildcat and Mountain View with a shared ADR plant located first at Wildcat and then moved to Mountain View. Mineralized material will be crushed to 9mm at Wildcat and 19mm at Mountain View using three stage crushing and will be placed on the pad using traditional conveyor and grasshopper stacking systems. At both projects, gold and silver will be leached using a low concentration sodium cyanide solution and recovered using an ADR plant to produce doré on site.

At Wildcat, 70Mt of mineralized material will be placed on the heap leach pad. The average gold and silver recoveries are 71.4% Au and 18.0% Ag resulting in total payable sales of 604koz Au and 1.3Moz Ag. At Mountain View, 30Mt of mineralized material will be placed on the heap leach pad. The average gold and silver recoveries are 77.1% Au and 20.0% Ag, resulting in total payable ounces of 414koz Au and 625koz Ag.

Wildcat & Mountain View Project Resource Estimates

The following table highlights the updated resource estimates for Wildcat & Mountain View that were used in the PEA study. The updated resource estimates were completed by William Lewis of Micon International Limited.

Table 6: Wildcat & Mountain View Mineral Resources

| | | Wildcat |

| | | Tonnes | g/t Au | oz Au | g/t Ag | oz Ag | g/t AuEq | oz AuEq |

| Oxide | Indicated | 59,872,806 | 0.39 | 746,297 | 3.34 | 6,437,869 | 0.43 | 829,152 |

| Inferred | 22,455,848 | 0.29 | 209,662 | 2.74 | 1,980,129 | 0.33 | 235,146 |

| | | | | | | | | |

| | | Mountain View |

| | | Tonnes | g/t Au | oz Au | g/t Ag | oz Ag | g/t AuEq | oz AuEq |

| Oxide | Indicated | 22,007,778 | 0.57 | 401,398 | 2.46 | 1,738,448 | 0.60 | 423,772 |

| Inferred | 3,579,490 | 0.44 | 50,716 | 1.43 | 165,049 | 0.46 | 52,840 |

| Transition | Indicated | 2,804,723 | 0.66 | 59,676 | 6.56 | 591,868 | 0.75 | 67,293 |

| Inferred | 215,815 | 0.40 | 2,750 | 3.77 | 26,184 | 0.44 | 3,087 |

| Non-Oxide | Indicated | 3,938,017 | 0.92 | 116,970 | 8.46 | 1,071,521 | 1.03 | 130,760 |

| Inferred | 360,198 | 0.58 | 6,679 | 4.57 | 52,955 | 0.64 | 7,361 |

| Total | Indicated | 28,750,517 | 0.63 | 578,044 | 3.68 | 3,401,836 | 0.67 | 621,826 |

| Inferred | 4,155,502 | 0.45 | 60,145 | 1.83 | 244,188 | 0.47 | 63,288 |

(1) Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

(2) William Lewis, P.Geo, and Alan S J San Martin, AusIMM(CP), of Micon International Limited have reviewed and validated the Mineral Resource Estimate for Wildcat & Mountain View. Both are independent "Qualified Persons", as defined in NI 43-101.

(3) The estimate is reported for open-pit mining scenario and with reasonable assumptions. The cut-off grade of 0.15 g/t Au was calculated using a gold price of US$1,800/oz, mining costs vary from US$1.5/t to US$2.4/t (depending on material type and project location), processing cost of US$3.1/t and US$3.7/t, G&A costs of US$0.4/t to US$0.5/t, and metallurgical gold recoveries varying from 30% to 86%. Gold equivalent in the Resource Estimate is calculated by g/t Au + (g/t Ag ÷ 77.7).

(4) Rounding as required by reporting guidelines may result in apparent discrepancies between tonnes, grades, and contained metal content.

(5) The estimate of mineral resources may be materially affected by geology, environment, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

Mineral Resource

As part of the PEA, Integra completed an updated resource estimate for Wildcat & Mountain View. This resource update incorporates drilling from the 2021-2022 drill programs and is based on a new geological interpretation for both the lithological and oxidation models. In addition to new drilling, which included twinning of historical drill holes, the relogging and re-assaying of the available historical data provided enough information to upgrade most of the resources into the Indicated category. Classification of the resources was interpreted manually considering various information such as geology, grade and recovery continuity as well as interpolation parameters and drilling spacing. The Company utilized a general guideline of 50m by 50m spacing for the Indicated resource and 100m by 100m for the Inferred resource. The resources were then constrained using Lerchs-Grossmann pit optimization to respect the definition of reasonable prospects for economic extraction. The updated resource estimate saw an increase in total in-pit AuEq ounces driven primarily by the drilling that took place in 2021-2022 which allowed for the re-interpretation of the oxidation profile at Wildcat and a better constraint of the high-grade breccia body at Mountain View, new geotechnical parameters and metallurgical recoveries, and a higher Au price assumption. As a result of this geological and modeling work, approximately 80% of the resources for Wildcat & Mountain View are now classified as Indicated.

The Company utilized the resource estimate block model described above as a basis for the PEA study, however, additional 'modifying factors' were considered for the PEA. These factors included Au prices and pit designs, among others. The modifying factors in the PEA led to a substantial difference between the mineral resource estimate and the PEA production plan.

Qualified Persons

The scientific and technical information contained in this material change report has been verified and approved by the following individuals, each of whom are "Qualified Persons" as defined in NI 43-101:

- Raphael Dutaut, Ph.D (P.Geo), Integra's Vice President, Exploration;

- Tim Arnold (PE, SME), Integra's Chief Operating Officer;

- Richard Gowans, P.Eng, Micon International Limited (metallurgy and mineral processing, environmental, permitting and social considerations);

- Andrew Hanson, P.E., NewFields Project & Construction Management (heap leach infrastructure);

- Chris Jacobs, CEng, MIMMM, Micon International Limited (economic analysis);

- Deepak Malhotra, Director of Metallurgy, Forte Dynamics (infrastructure); and

- Ralston Pedersen, P.E., Convergent Mining, LLC (mining).

The Wildcat & Mountain View mineral resource estimates were reviewed and validated by William Lewis, P.Geo, and Alan SJ San Martin, AusIMM(CP), of Micon International Limited. Both are independent "Qualified Persons", as defined in NI 43-101.

Further information about the PEA and the mineral resource estimates referenced in this material change report, including information in respect of data verification, key assumptions, parameters, risks and other factors, can be found in the technical report to be filed in connection with the PEA that will be filed on SEDAR under Integra's SEDAR profile at www.sedar.com.

Item 6 Reliance on subsection 7.1(2) of National Instrument 51-102

N/A

Item 7 Omitted Information

N/A

Item 8 Executive Officer

Jason Kosec, Chief Executive Officer

Telephone (604) 416-0576

Item 9 Date of Report

July 7, 2023

Forward Looking and Other Cautionary Statements

Certain information set forth in this material change report contains "forward‐looking statements" and "forward‐looking information" within the meaning of applicable Canadian securities legislation and applicable United States securities laws (referred to herein together as "forward‐looking statements"). Except for statements of historical fact, certain information contained herein constitutes forward‐looking statements which includes, but is not limited to, statements with respect to: the future financial or operating performance of the Company and Wildcat & Mountain View; results from work performed to date; the estimation of mineral resources; the realization of mineral resource estimates; the development, operational and economic results of the PEA for the Wildcat and Mountain View deposits, including cash flows, revenue potential, staged development, capital expenditures, development costs and timing thereof, extraction rates, life of mine projections and cost estimates; timing of completion of a technical report summarizing the results of the PEA; magnitude or quality of mineral deposits; anticipated advancement of the mine plans for Wildcat & Mountain View; exploration expenditures, costs and timing of the development of new deposits; costs and timing of future exploration; the completion and timing of future development studies; estimates of metallurgical recovery rates; anticipated advancement of Wildcat & Mountain View and future exploration prospects; requirements for additional capital; the future price of metals; government regulation of mining operations; environmental risks; the timing and possible outcome of pending regulatory matters; the realization of the expected economics of Wildcat & Mountain View; future growth potential of Wildcat & Mountain View; and future development plans. Forward-looking statements are often identified by the use of words such as "may", "will", "could", "would", "anticipate", 'believe", expect", "intend", "potential", "estimate", "budget", "scheduled", "plans", "planned", "forecasts", "goals" and similar expressions. Forward-looking statements are based on a number of factors and assumptions made by management and considered reasonable at the time such statements are made. Assumptions and factors include: the Company's ability to complete its planned exploration programs; the absence of adverse conditions at Wildcat & Mountain View; no unforeseen operational delays; no material delays in obtaining necessary permits; the price of gold remaining at levels that render Wildcat & Mountain View economic; the Company's ability to continue raising necessary capital to finance operations; and the ability to realize on the mineral resource and reserve estimates. Forward‐looking statements necessarily involve known and unknown risks and uncertainties, which may cause actual performance and financial results in future periods to differ materially from any projections of future performance or result expressed or implied by such forward‐looking statements. These risks and uncertainties include, but are not limited to: general business, economic and competitive uncertainties; the actual results of current and future exploration activities; conclusions of economic evaluations; meeting various expected cost estimates; benefits of certain technology usage; changes in project parameters and/or economic assessments as plans continue to be refined; future prices of metals; possible variations of mineral grade or recovery rates; the risk that actual costs may exceed estimated costs; geological, mining and exploration technical problems; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); title to properties. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in the forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Readers are advised to study and consider risk factors disclosed in Integra's annual report on Form 20-F dated March 17, 2023 for the fiscal year ended December 31, 2022, and Millennial Precious Metals' management's discussion and analysis dated April 28, 2023 for the fiscal year ended December 31, 2022.

There can be no assurance that forward‐looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward‐looking statements if circumstances or management's estimates or opinions should change except as required by applicable securities laws. The forward-looking statements contained herein are presented for the purposes of assisting investors in understanding the Company's plans, objectives and goals and may not be appropriate for other purposes. Forward-looking statements are not guarantees of future performance and readers are cautioned not to place undue reliance on forward‐looking statements. This material change report also contains or references certain market, industry and peer group data which is based upon information from independent industry publications, market research, analyst reports and surveys and other publicly available sources. Although the Company believes these sources to be generally reliable, such information is subject to interpretation and cannot be verified with complete certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other inherent limitations and uncertainties. The Company has not independently verified any of the data from third party sources referred to in this material change report and accordingly, the accuracy and completeness of such data is not guaranteed.

Cautionary Note for U.S. Investors Concerning Mineral Resources and Reserves

NI 43-101 is a rule of the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Technical disclosure contained in this material change report has been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum Classification System. These standards differ from the requirements of the U.S. Securities and Exchange Commission ("SEC") and resource information contained in this press release may not be comparable to similar information disclosed by domestic United States companies subject to the SEC's reporting and disclosure requirements.

Cautionary Note Regarding Non-GAAP Financial Measures

Alternative performance measures in this material change report such as "cash cost", "AISC" "free cash flow" are furnished to provide additional information. These non-GAAP performance measures are included in this material change report because these statistics are used as key performance measures that management uses to monitor and assess performance of Wildcat & Mountain View, and to plan and assess the overall effectiveness and efficiency of mining operations. These performance measures do not have a standard meaning within International Financial Reporting Standards ("IFRS") and, therefore, amounts presented may not be comparable to similar data presented by other mining companies. These performance measures should not be considered in isolation as a substitute for measures of performance in accordance with IFRS.

Cash Costs

Cash costs include site operating costs (mining, processing, site G&A), refinery costs and royalties, but excludes head office G&A and exploration expenses. While there is no standardized meaning of the measure across the industry, the Company believes that this measure is useful to external users in assessing operating performance.

All-In Sustaining Cost

Site level AISC include cash costs and sustaining and expansion capital, but excludes head office G&A and exploration expenses. The Company believes that this measure is useful to external users in assessing operating performance and the Company's ability to generate free cash flow from potential operations.

All-In Cost

Site level AIC includes AISC level costs and also includes initial capital and equipment finance costs associated with initial capital. The Company believes that this measure is useful to external users in assessing the Company's overall ability to generate free cash flow from potential operations.

Free Cash Flow

Free cash flows are revenues net of operating costs, royalties, capital expenditures and cash taxes. The Company believes that this measure is useful to the external users in assessing the Company's ability to generate cash flows from the Project.