Effective Date: June 28, 2023

Report Date: July 30, 2023

Prepared By:

William J. Lewis, P.Geo.

Richard Gowans, P.Eng.

Christopher Jacobs, CEng, MIMMM

Andrew Hanson, P.E.

Dr. Deepak Malhotra, Ph.D.

Ralston Pedersen, P.E.

| INTEGRA RESOURCES CORP. 400 Burrard Street, Suite 1050 Vancouver, BC Canada, V6C 3A6 Tel: 1.604.416.0576 |

601 – 90 Eglinton Ave East, Toronto, Ontario, Canada M4P 2Y3

+1 416 362 5135 | www.micon-international.com

Table of Contents

| 1.0 SUMMARY | 1 |

| 1.1 INTRODUCTION | 1 |

| 1.2 PROPERTY DESCRIPTION, LOCATION AND OWNERSHIP | 2 |

| 1.2.1 Wildcat Project | 2 |

| 1.2.2 Mountain View Project | 2 |

| 1.2.3 Wildcat and Mountain View Projects, Ownership 2021 to 2023 | 3 |

| 1.3 ACCESSIBILITY, CLIMATE, PHYSIOGRAPHY, LOCAL RESOURCES AND INFRASTRUCTURE | 4 |

| 1.3.1 Accessibility | 4 |

| 1.3.2 Climate and Physiography | 4 |

| 1.3.3 Local Resources and Infrastructure | 5 |

| 1.4 HISTORY | 5 |

| 1.4.1 Wildcat Project History | 5 |

| 1.4.2 Mountain View Project History | 7 |

| 1.5 GEOLOGICAL SETTING AND MINERALIZATION | 8 |

| 1.5.1 Regional Geology | 8 |

| 1.5.2 Wildcat Project Geology | 9 |

| 1.5.3 Wildcat Project Mineralization | 9 |

| 1.5.4 Mountain View Project Geology | 9 |

| 1.5.5 Mountain View Project Mineralization | 10 |

| 1.6 MILLENNIAL 2021 TO 2022 EXPLORATION PROGRAMS | 11 |

| 1.6.1 Wildcat and Mountain View Projects Surface Exploration Programs | 11 |

| 1.6.2 Wildcat and Mountain View Projects Drilling Programs | 12 |

| 1.7 METALLURGICAL TESTWORK | 12 |

| 1.7.1 Wildcat Project | 12 |

| 1.7.2 Mountain View Project | 13 |

| 1.8 MINERAL RESOURCE ESTIMATE | 14 |

| 1.8.1 Mineral Resource Estimate for the Wildcat Project | 14 |

| 1.8.2 Mineral Resource Estimate for the Mountain View Project | 19 |

| 1.9 MINING, PROCESSING AND INFRASTRUCTURE | 25 |

| 1.9.1 Mining | 25 |

| 1.9.2 Processing | 29 |

| 1.9.3 Infrastructure | 32 |

| 1.9.4 Capital and Operating Costs | 33 |

| 1.10 ECONOMIC ANALYSIS | 33 |

| 1.11 CONCLUSIONS AND RECOMMENDATIONS | 35 |

| 1.11.1 Mineral Resource Estimate Conclusions | 35 |

| 1.11.2 Risks and Opportunities | 35 |

| 1.11.3 Planned Expenditures and Budget Preparation | 37 |

| 1.11.4 Further Recommendations | 39 |

| | |

| 2.0 INTRODUCTION | 41 |

| 2.1 TERMS OF REFERENCE | 41 |

| 2.2 QUALIFIED PERSONS, SITE VISIT AND AREAS OF RESPONSIBILITY | 42 |

| 2.3 UNITS AND ABBREVIATIONS | 42 |

| 2.4 INFORMATION SOURCES | 45 |

| | |

| 3.0 RELIANCE ON OTHER EXPERTS | 47 |

| | |

| 4.0 PROPERTY DESCRIPTION AND LOCATION | 48 |

| 4.1 GENERAL DESCRIPTION AND LOCATION | 48 |

| 4.1.1 Wildcat Property Description and Location | 48 |

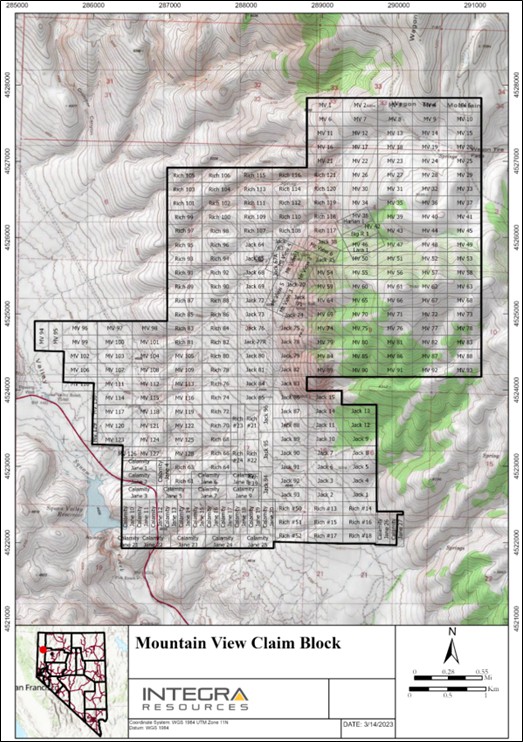

| 4.1.2 Mountain View Property Description and Location | 48 |

| 4.2 LAND TENURE, AGREEMENTS, MINERAL RIGHTS AND OWNERSHIP | 48 |

| 4.2.1 Wildcat Property Description and Ownership | 51 |

| 4.2.2 Wildcat Project, Obligations and Encumbrances | 51 |

| 4.2.3 Wildcat Environmental Liabilities and Permitting | 53 |

| 4.2.4 Mountain View Property Description and Ownership | 55 |

| 4.2.5 Mountain View Project Obligations and Encumbrances | 57 |

| 4.2.6 Mountain View Environmental Liabilities and Permitting | 59 |

| 4.3 MICON QP COMMENTS | 61 |

| | |

| 5.0 ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY | 62 |

| 5.1 CLIMATE | 62 |

| 5.2 WILDCAT PROJECT | 62 |

| 5.2.1 Accessibility | 62 |

| 5.2.2 Physiography | 63 |

| 5.2.3 Local Resources and Infrastructure | 63 |

| 5.3 MOUNTAIN VIEW PROJECT | 64 |

| 5.3.1 Accessibility | 64 |

| 5.3.2 Physiography | 64 |

| 5.3.3 Local Resources and Infrastructure | 65 |

| 5.4 MICON QP COMMENTS FOR BOTH WILDCAT AND MOUNTAIN VIEW PROJECTS | 65 |

| | |

| 6.0 HISTORY | 66 |

| 6.1 WILDCAT PROJECT | 66 |

| 6.1.1 General Ownership and Exploration History | 66 |

| 6.1.2 Mining District History and Production | 67 |

| 6.1.3 Historic Mineral Resource Estimates | 69 |

| 6.1.4 Differences in Historical Versus Current Resource Classification Definitions | 74 |

| 6.2 MOUNTAIN VIEW PROJECT | 79 |

| 6.2.1 Historical Exploration and Mining | 79 |

| 6.2.2 Historical Mineral Resource Estimates | 80 |

| | |

| 7.0 GEOLOGICAL SETTING AND MINERALIZATION | 81 |

| 7.1 REGIONAL GREAT BASIN GEOLOGY | 81 |

| 7.2 WILDCAT PROJECT GEOLOGY | 85 |

| 7.3 WILDCAT PROJECT MINERALIZATION | 88 |

| 7.4 MOUNTAIN VIEW PROJECT GEOLOGY | 90 |

| 7.5 MOUNTAIN VIEW PROJECT MINERALIZATION | 92 |

| 7.6 MICON QP COMMENTS | 93 |

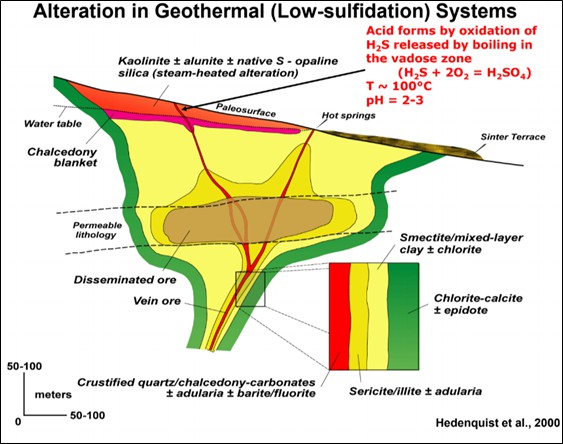

| 8.0 DEPOSIT TYPES | 94 |

| 8.1 WILDCAT AND MOUNTAIN VIEW PROJECTS | 94 |

| | |

| 9.0 EXPLORATION | 96 |

| 9.1 WILDCAT PROJECT EXPLORATION PROGRAMS | 96 |

| 9.1.1 Exploration Programs Pre-2021 | 96 |

| 9.1.2 Millennial Exploration Programs: Post-2021 | 96 |

| 9.1.3 Integra Exploration Programs | 97 |

| 9.2 MOUNTAIN VIEW PROJECT EXPLORATION PROGRAMS | 97 |

| 9.2.1 Mountain View Project, Historical Exploration Programs | 97 |

| 9.3 MICON QP COMMENTS | 98 |

| | |

| 10.0 DRILLING | 99 |

| 10.1 WILDCAT PROJECT DRILLING PROGRAMS | 99 |

| 10.1.1 Wildcat Project Historical Drilling Programs | 99 |

| 10.1.2 Wildcat Project, Millennial Drilling Programs | 100 |

| 10.1.3 Wildcat Project Integra Drilling Programs | 102 |

| 10.2 MOUNTAIN VIEW PROJECT DRILLING PROGRAM | 102 |

| 10.2.1 Mountain View Project Historical Drilling Programs | 102 |

| 10.2.2 Mountain View, Millennial Drilling Program | 107 |

| 10.2.3 Integra Drilling Programs | 110 |

| 10.3 MICON QP COMMENTS | 110 |

| | |

| 11.0 SAMPLE PREPARATION, ANALYSES AND SECURITY | 111 |

| 11.1 SAMPLING APPROACH AT THE WILDCAT AND MOUNTAIN VIEW PROJECTS | 111 |

| 11.1.1 Introduction | 111 |

| 11.1.2 Sample Handling and Security | 111 |

| 11.1.3 Assay Laboratories Accreditation and Certification | 111 |

| 11.2 SAMPLE PREPARATION AND ASSAYING | 112 |

| 11.2.1 AAL Sample Preparation and Analysis | 112 |

| 11.3 QUALITY ASSURANCE AND QUALITY CONTROL | 112 |

| 11.3.1 Wildcat QA/QC Program | 112 |

| 11.3.2 Mountain View Project QA/QC Program | 115 |

| 11.4 MICON QP COMMENTS | 118 |

| | |

| 12.0 DATA VERIFICATION | 119 |

| 12.1 SITE VISIT | 119 |

| 12.2 DATABASE REVIEW FOR THE WILDCAT AND MOUNTAIN VIEW PROJECTS | 123 |

| | |

| 13.0 MINERAL PROCESSING AND METALLURGICAL TESTING | 126 |

| 13.1 WILDCAT PROJECT | 126 |

| 13.1.1 Historical Testwork | 126 |

| 13.1.2 2022/23 McClelland Testwork | 127 |

| 13.1.3 Wildcat Project, Metallurgical Testing | 133 |

| 13.2 WILDCAT PROJECT, TESTWORK CONCLUSIONS AND RECOMMENDATIONS | 142 |

| 13.3 MOUNTAIN VIEW PROJECT | 143 |

| 13.3.1 Historical Testwork | 143 |

| 13.3.2 2022/23 McClelland Testwork | 143 |

| 13.3.3 Mountain View Project, Metallurgical Testing | 149 |

| 13.3.4 Mountain View Project, Conclusions and Recommendations | 156 |

| 13.4 NOTES REGARDING METALLURGICAL LABORATORY CERTIFICATIONS | 157 |

| | |

| 14.0 MINERAL RESOURCE ESTIMATES | 158 |

| 14.1 INTRODUCTION | 158 |

| 14.2 CIM RESOURCE DEFINITIONS AND CLASSIFICATIONS | 158 |

| 14.3 CIM ESTIMATION OF MINERAL RESOURCES BEST PRACTICES GUIDELINES | 160 |

| 14.4 WILDCAT PROJECT, MINERAL RESOURCE ESTIMATE | 160 |

| 14.4.1 Methodology | 160 |

| 14.4.2 Wildcat Resource Database | 161 |

| 14.4.3 Wildcat Project Geological Modelling | 162 |

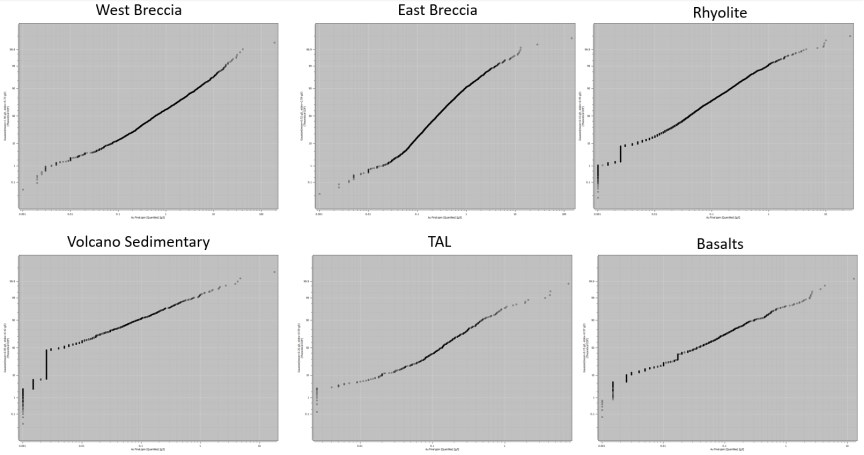

| 14.4.4 Wildcat Project Geostatistical Analysis | 163 |

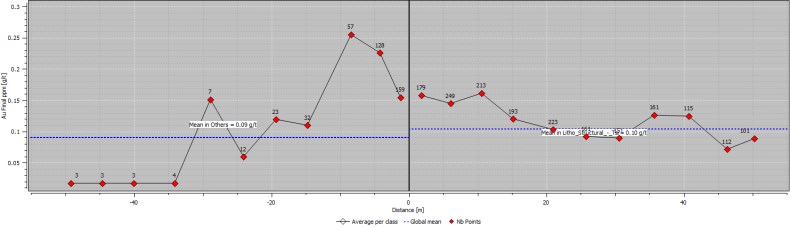

| 14.4.5 Wildcat Project, Contact Analysis | 164 |

| 14.4.6 Wildcat Project, High-Grade Capping | 164 |

| 14.4.7 Wildcat Project, Density | 166 |

| 14.4.8 Wildcat Project, Compositing | 166 |

| 14.4.9 Wildcat Project, Variogram Analysis | 168 |

| 14.4.10 Wildcat Project, Block Model | 168 |

| 14.4.11 Wildcat Project, Search Ellipse and Interpolation Parameters | 168 |

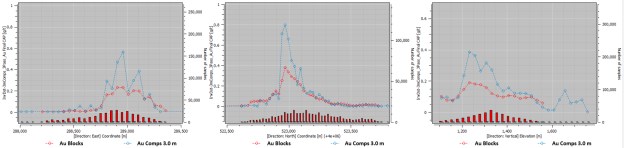

| 14.4.12 Wildcat Project, Model Validation | 169 |

| 14.4.13 Wildcat Project, Mineral Resource Classification | 170 |

| 14.4.14 Wildcat Project, Reasonable Prospects for Eventual Economic Extraction | 171 |

| 14.4.15 Wildcat Project Mineral Resource Estimate | 172 |

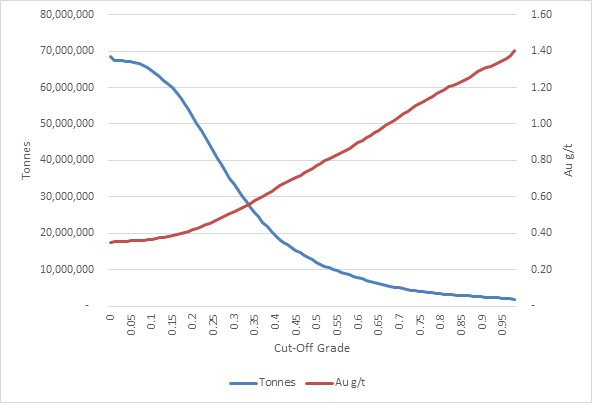

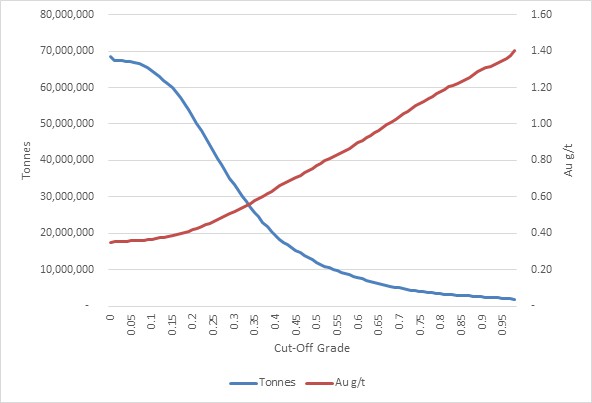

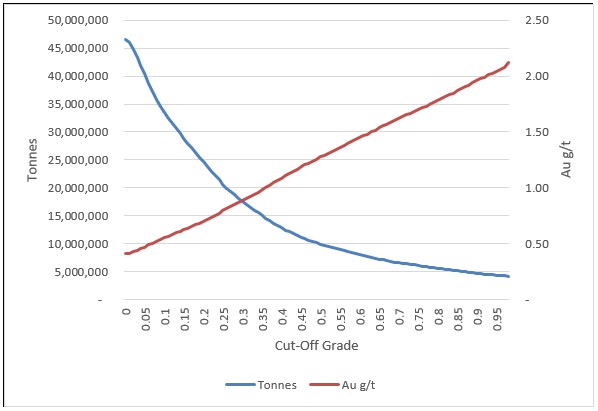

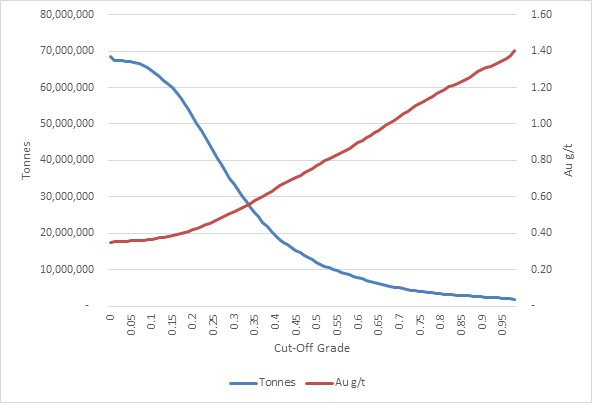

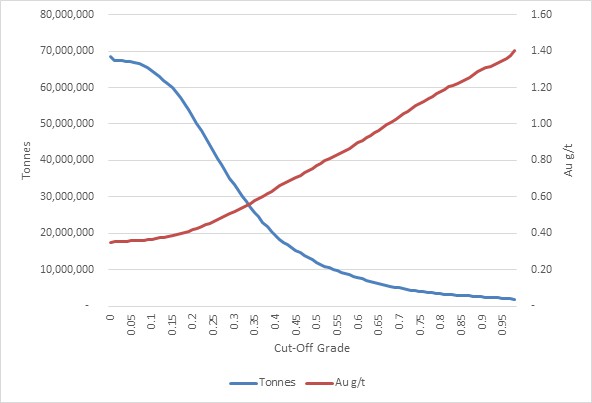

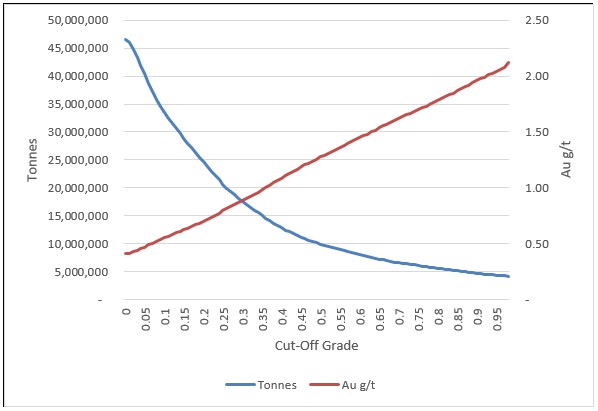

| 14.4.16 Wildcat Project, Mineral Resource Sensitivity Analysis | 173 |

| 14.4.17 Wildcat Project, 2023 Resource Estimate, Comparison with Previous 2020 Estimate | 175 |

| 14.5 MOUNTAIN VIEW PROJECT, MINERAL RESOURCE ESTIMATE | 176 |

| 14.5.1 Mountain View Project Methodology | 176 |

| 14.5.2 Mountain View Resource Database | 176 |

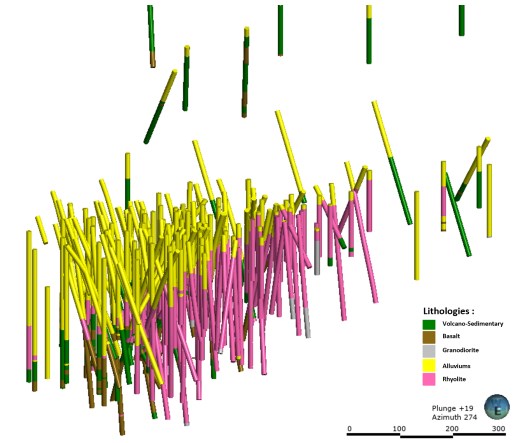

| 14.5.3 Mountain View Project, Geological Modelling | 177 |

| 14.5.4 Mountain View Project, Geostatistical Analysis | 179 |

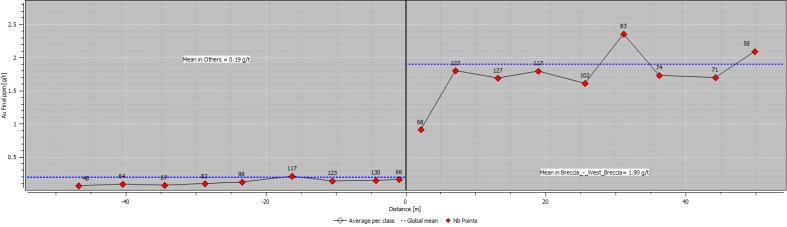

| 14.5.5 Mountain View Project Contact Analysis | 179 |

| 14.5.6 Mountain View Project, High Grade Capping | 180 |

| 14.5.7 Mountain View Project, Density | 180 |

| 14.5.8 Mountain View Project Compositing | 183 |

| 14.5.9 Mountain View Project Block Model | 185 |

| 14.5.10 Mountain View Search Ellipse and Interpolation Parameters | 185 |

| 14.5.11 Mountain View Project Model Validation | 186 |

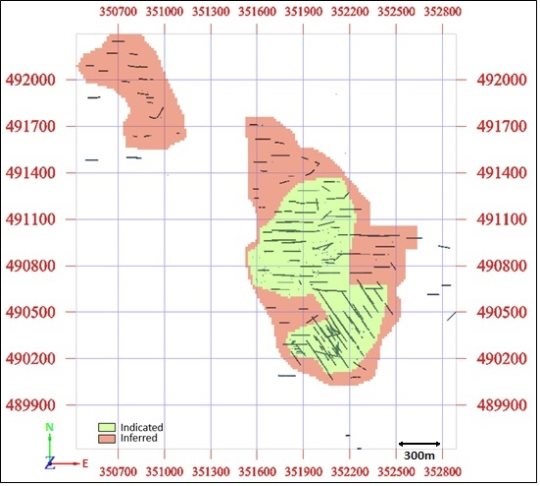

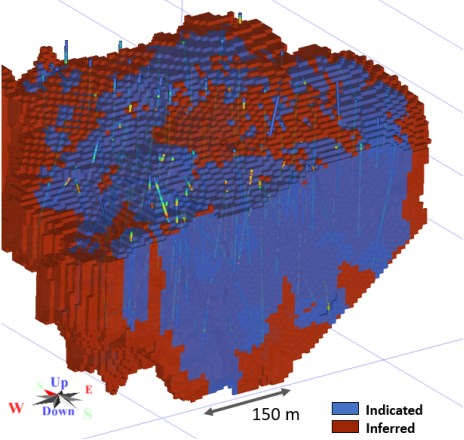

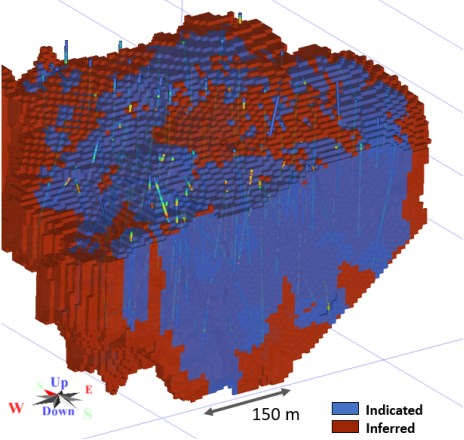

| 14.5.12 Mountain View Project, Classification | 187 |

| 14.5.13 Mountain View Project, Reasonable Prospects for Eventual Economic Extraction | 188 |

| 14.5.14 Mountain View Project, Mineral Resource Estimate | 189 |

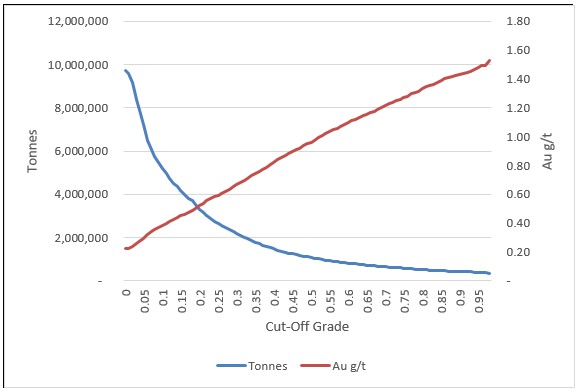

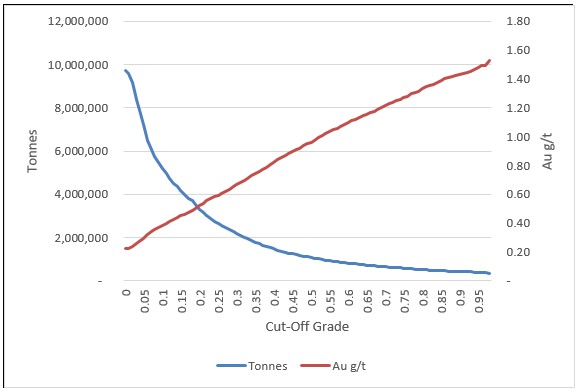

| 14.5.15 Mountain View Project, Mineral Resource Grade Sensitivity Analysis | 190 |

| 14.5.16 Mountain View Project, 2023 Mineral Resource Estimate Comparison with 2020 Estimate | 192 |

| 14.6 FACTORS THAT COULD AFFECT THE WILDCAT AND MOUNTAIN VIEW MINERAL RESOURCE ESTIMATES | 193 |

| 14.7 RESPONSIBILITY FOR THE WILDCAT AND MOUNTAIN VIEW MINERAL RESOURCE ESTIMATES | 193 |

| | |

| 15.0 MINERAL RESERVE ESTIMATES | 194 |

| | |

| 16.0 MINING METHODS | 195 |

| 16.1 PIT OPTIMIZATION | 195 |

| 16.1.1 Pit Optimization Parameters | 195 |

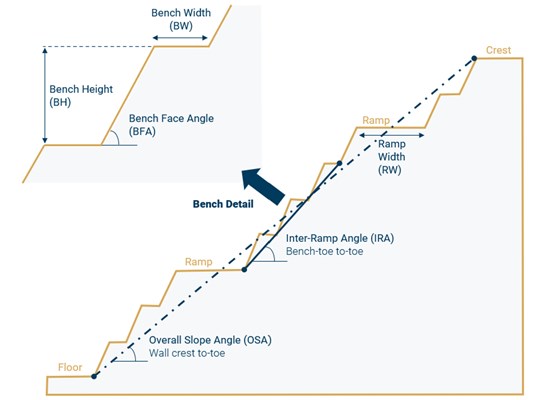

| 16.1.2 Geometrical Parameters | 197 |

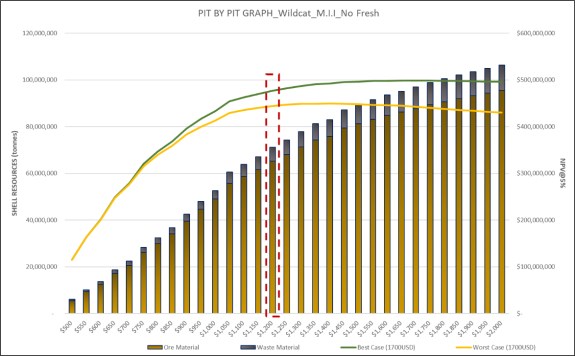

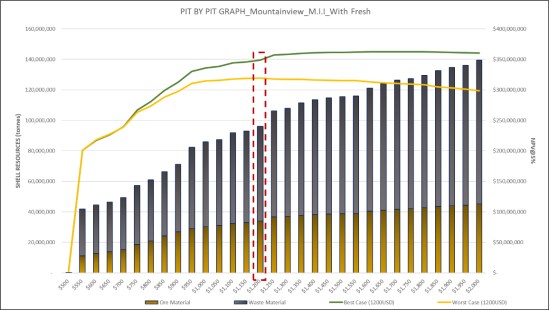

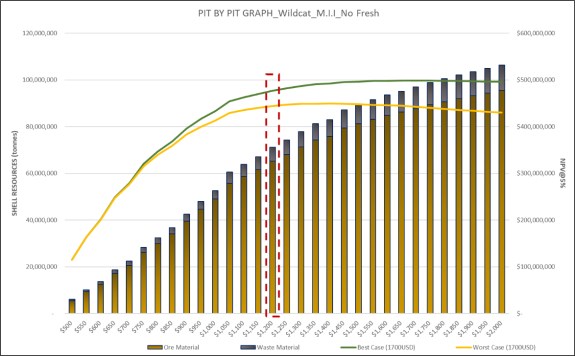

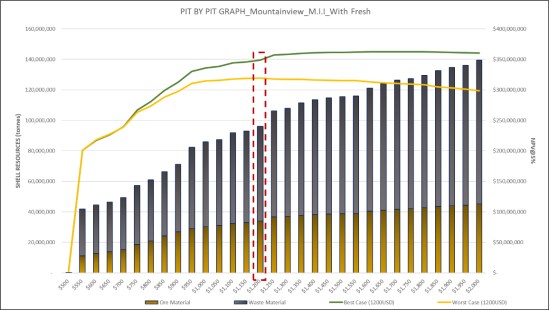

| 16.1.3 Pit Optimization Results | 197 |

| 16.2 PIT DESIGNS | 201 |

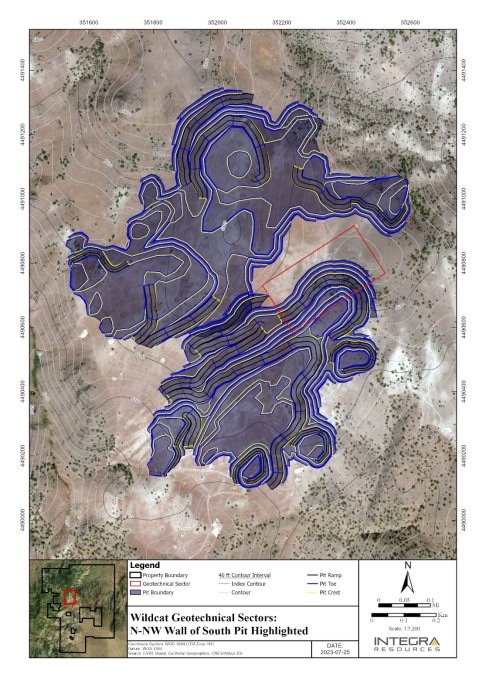

| 16.2.1 Pit Design Slope Parameters | 201 |

| 16.2.2 Bench Height | 204 |

| 16.2.3 Wildcat Project, Pit Design | 205 |

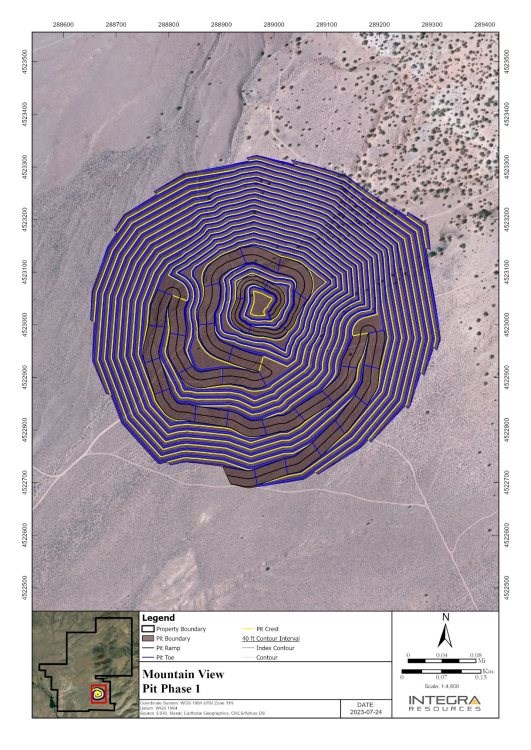

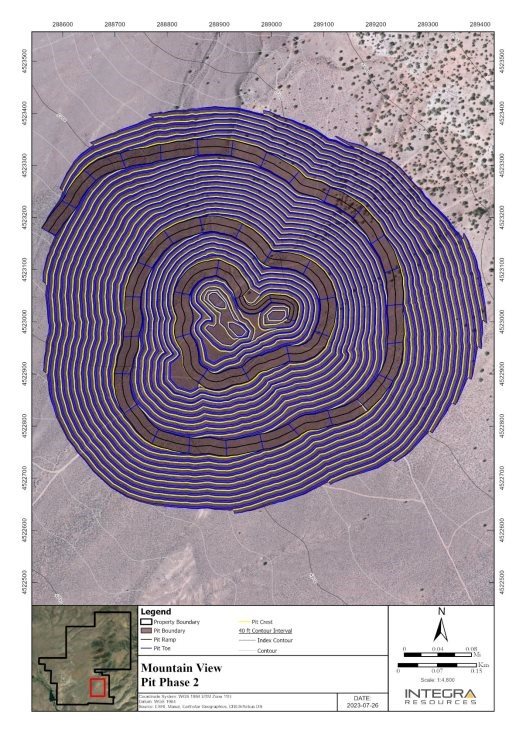

| 16.2.4 Mountain View Project, Pit Design | 210 |

| 16.2.5 Cut-Off Grade | 210 |

| 16.2.6 Dilution | 213 |

| 16.2.7 Mineral Resources in the PEA Conceptual Mine Plan | 213 |

| 16.3 MINE WASTE FACILITIES | 215 |

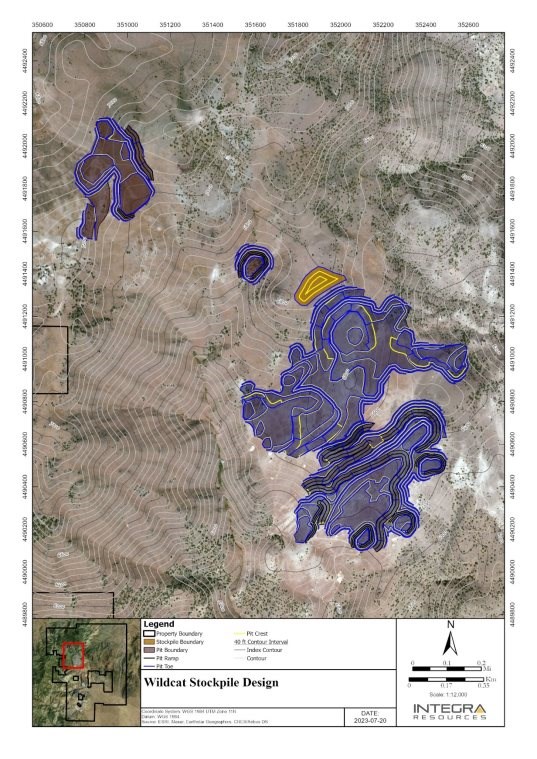

| 16.3.1 Wildcat Waste Disposal | 215 |

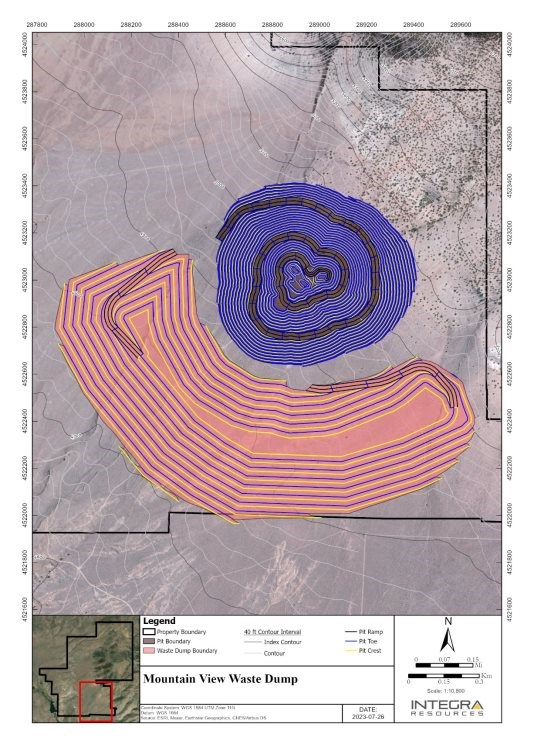

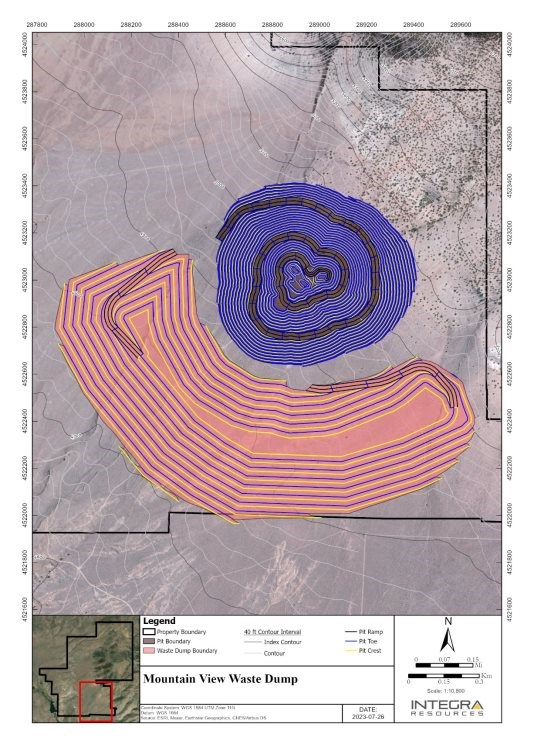

| 16.3.2 Mountain View Waste Disposal | 215 |

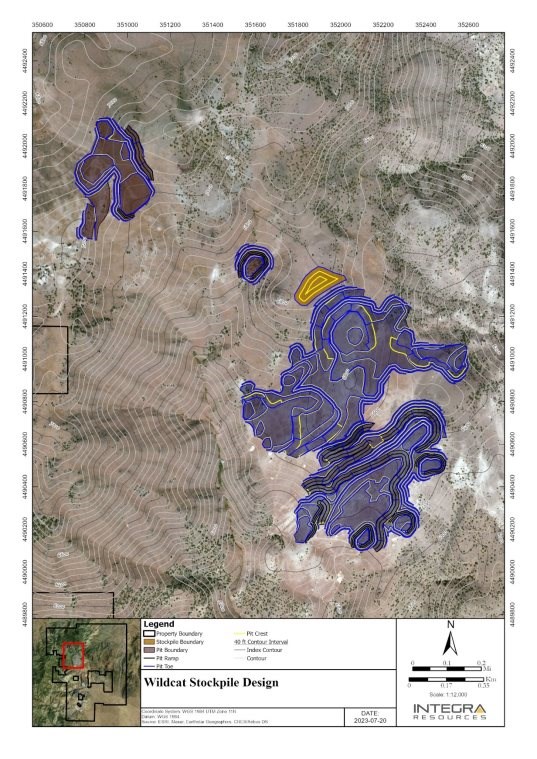

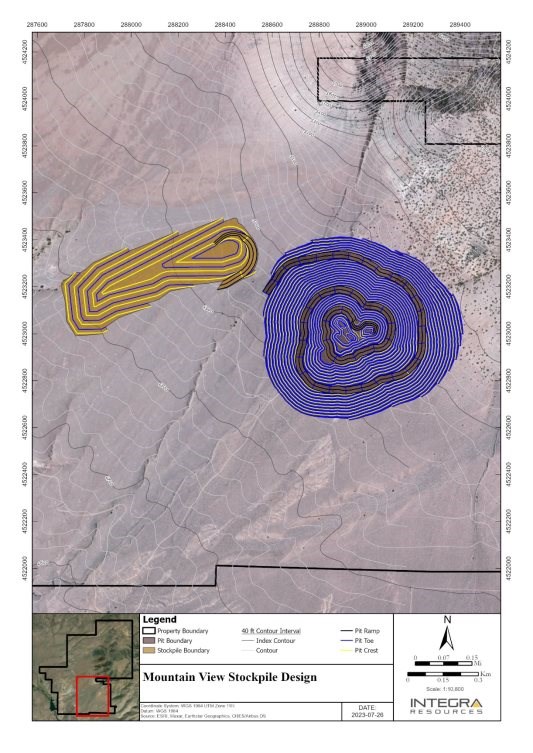

| 16.4 MINERALIZED MATERIAL STOCKPILE FACILITIES | 218 |

| 16.5 PRODUCTION SCHEDULING | 218 |

| 16.6 MINE EQUIPMENT REQUIREMENTS | 221 |

| 16.7 MINE OPERATIONS PERSONNEL | 221 |

| | |

| 17.0 RECOVERY METHODS | 226 |

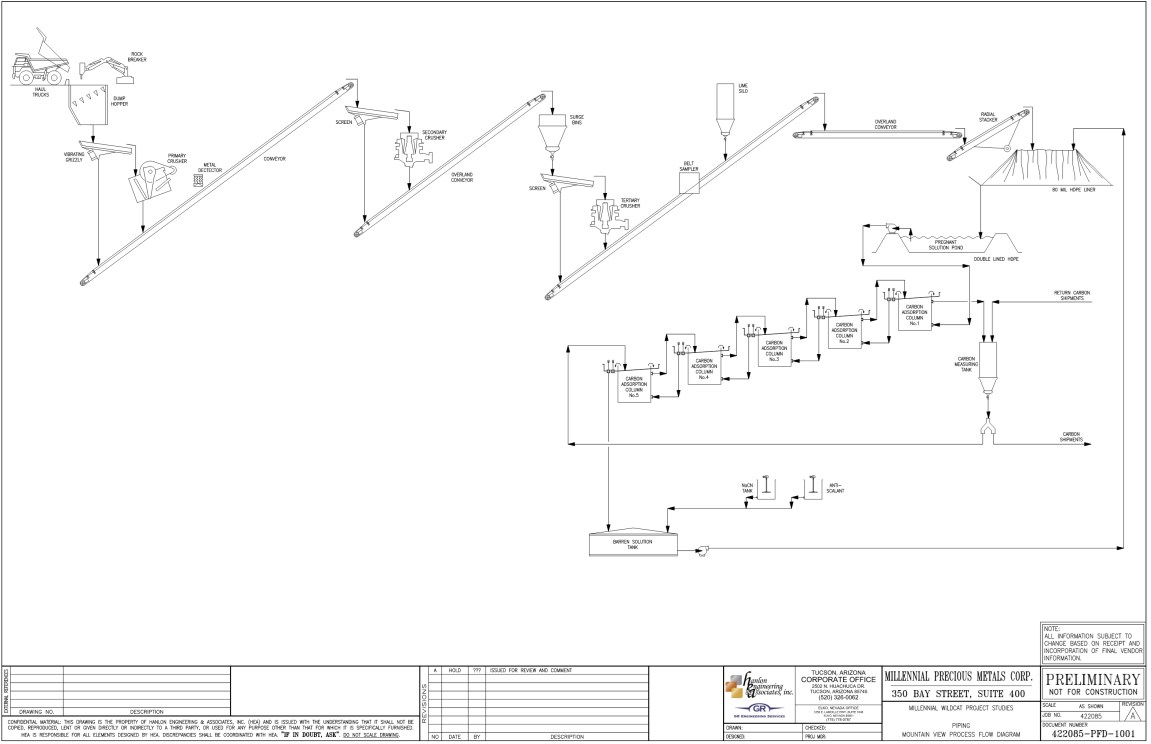

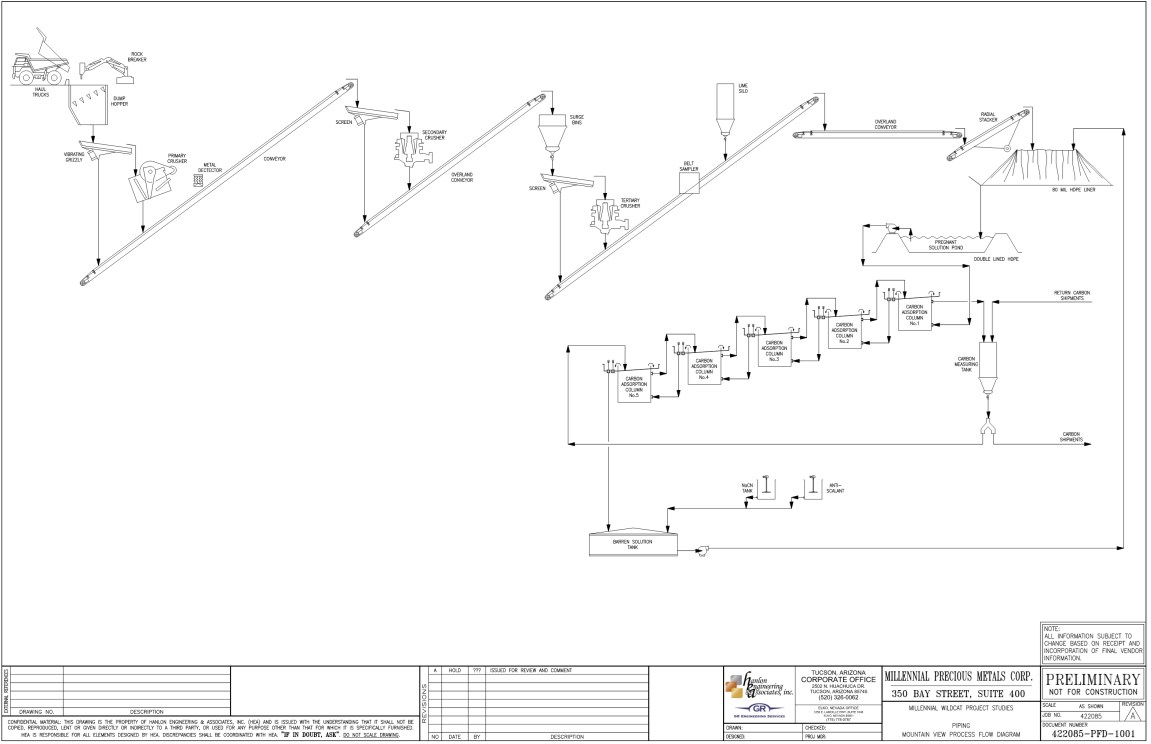

| 17.1 PROCESS FLOW | 226 |

| 17.2 PROCESS FACILITIES | 226 |

| 17.3 ENERGY, WATER AND PROCESS MATERIALS | 229 |

| 17.4 PROCESS PRODUCTION SCHEDULE | 230 |

| 17.5 PLANT AND ADMINISTRATIVE OPERATIONS PERSONNEL | 230 |

| | |

| 18.0 PROJECT INFRASTRUCTURE | 234 |

| 18.1 ACCESS ROADS | 234 |

| 18.2 BUILDINGS | 234 |

| 18.3 HEAP LEACH PAD | 234 |

| 18.3.1 Conceptual HLF, Operation Overview | 235 |

| 18.3.2 Process Ponds | 240 |

| 18.3.3 Stormwater Diversion | 240 |

| 18.4 PROCESS AREA GEOTECHNICAL REVIEW AND ANALYSIS | 240 |

| 18.5 ANCILLARY AREAS | 241 |

| 18.5.1 Wash Bay | 241 |

| 18.5.2 Explosives Magazine | 241 |

| 18.5.3 Fuel Island | 241 |

| 18.6 POWER | 241 |

| | |

| 19.0 MARKET STUDIES AND CONTRACTS | 242 |

| | |

| 20.0 ENVIRONMENTAL STUDIES, PERMITTING AND SOCIAL OR COMMUNITY IMPACT | 243 |

| 20.1 GENERAL OVERVIEW | 243 |

| 20.2 WILDCAT PROJECT | 244 |

| 20.2.1 Environmental Baseline Studies | 244 |

| 20.2.2 Permitting | 245 |

| 20.2.3 Social or Community Impacts | 246 |

| 20.2.4 Mine Closure Requirements and Cost | 247 |

| 20.3 MOUNTAIN VIEW PROJECT | 248 |

| 20.3.1 Environmental Baseline Studies | 248 |

| 20.3.2 Permitting | 248 |

| 20.3.3 Social or Community Impacts | 250 |

| 20.3.4 Mine Closure Requirements and Cost | 250 |

| | |

| 21.0 CAPITAL AND OPERATING COSTS | 252 |

| 21.1 CAPITAL COSTS - INFRASTRUCTURE | 252 |

| 21.1.1 Quantities and Estimating Methodology | 252 |

| 21.1.2 Civil (Earthworks and Utilities) | 252 |

| 21.1.3 Concrete | 252 |

| 21.1.4 Structural Steel | 253 |

| 21.1.5 Buildings | 253 |

| 21.1.6 Mechanical Equipment | 253 |

| 21.1.7 Electrical | 253 |

| 21.1.8 Instrumentation and Communication | 253 |

| 21.1.9 Labour Rates | 254 |

| 21.1.10 Construction Field Indirect Costs | 254 |

| 21.1.11 Insurance, Freight and Transportation | 254 |

| 21.1.12 Sales Tax | 254 |

| 21.1.13 Procurement | 254 |

| 21.1.14 Construction Phase Services | 254 |

| 21.1.15 Vendor Representative Assistance, Start-up and Communication Costs | 254 |

| 21.1.16 Building Permit Fees | 255 |

| 21.1.17 Spare Parts | 255 |

| 21.1.18 Contingency | 255 |

| 21.1.19 Owner Costs | 255 |

| 21.1.20 Accuracy | 255 |

| 21.2 CAPITAL COSTS - HEAP LEACH | 256 |

| 21.3 MINING CAPITAL COSTS | 257 |

| 21.4 PLANT OPERATING COSTS | 257 |

| 21.4.1 Design Criteria | 257 |

| 21.4.2 Reagents | 257 |

| 21.5 MINING OPERATING COSTS | 259 |

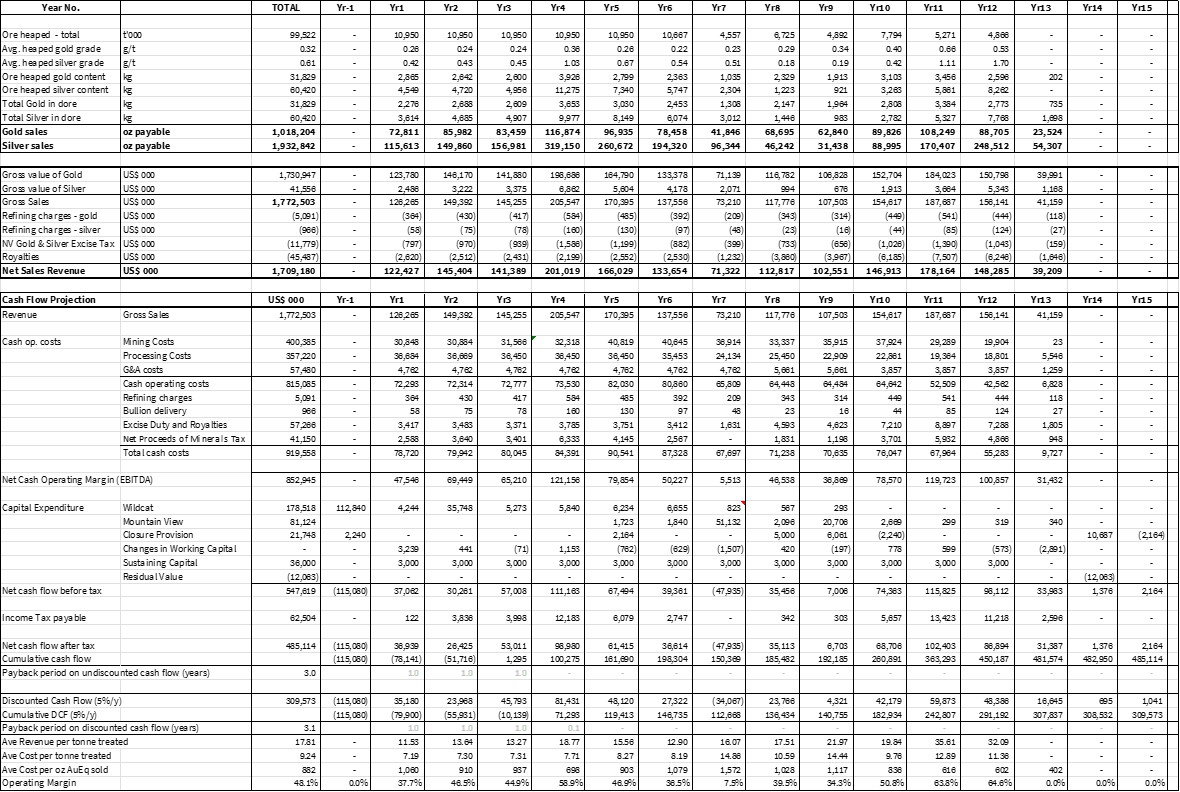

| 22.0 ECONOMIC ANALYSIS | 261 |

| 22.1 CAUTIONARY STATEMENT | 261 |

| 22.2 BASIS OF EVALUATION | 262 |

| 22.3 MACRO-ECONOMIC ASSUMPTIONS | 262 |

| 22.3.1 Exchange Rate and Inflation | 262 |

| 22.3.2 Weighted Average Cost of Capital | 262 |

| 22.3.3 Forecast Gold Price | 262 |

| 22.3.4 Taxation and Royalty Regime | 263 |

| 22.4 TECHNICAL ASSUMPTIONS | 263 |

| 22.4.1 Mining | 263 |

| 22.4.2 Processing | 264 |

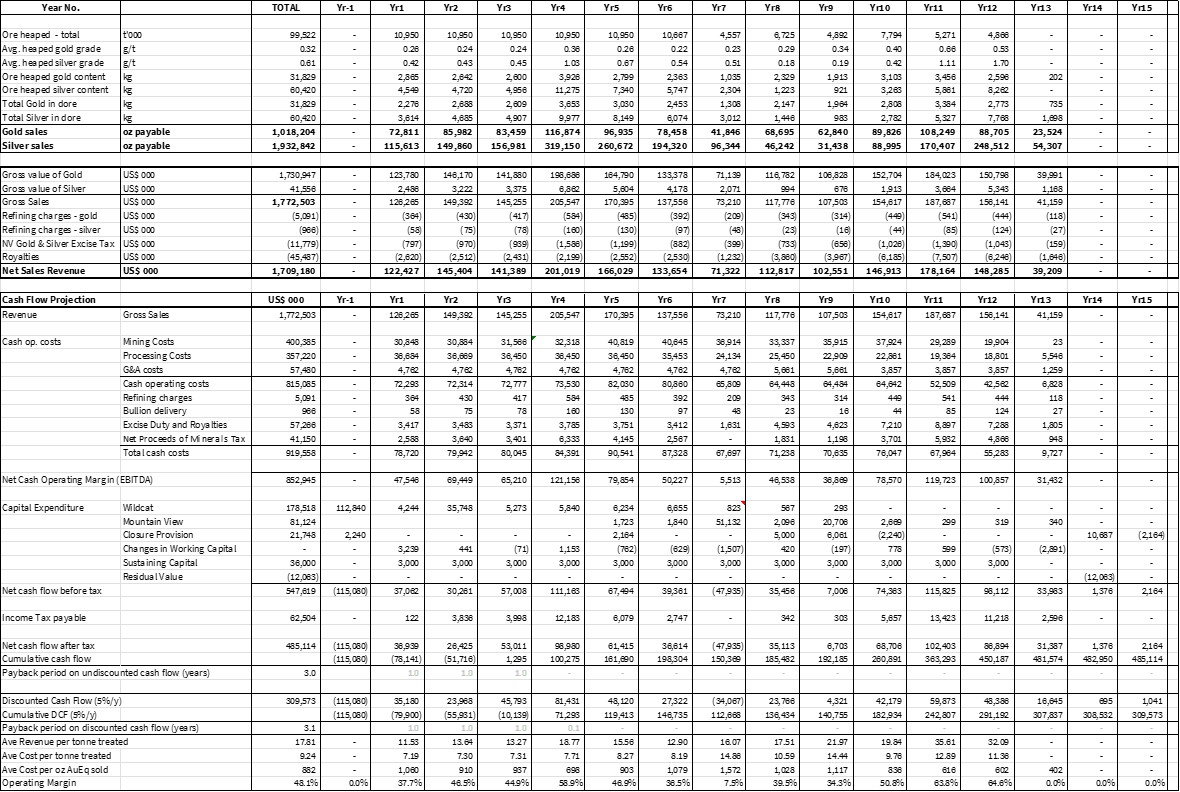

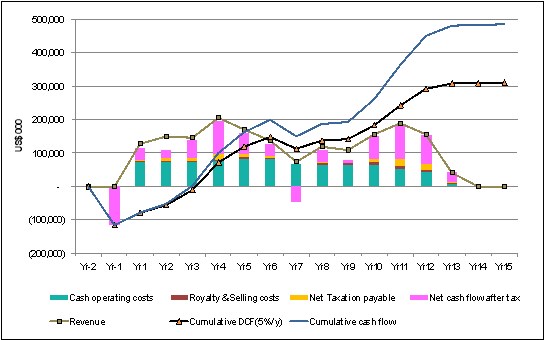

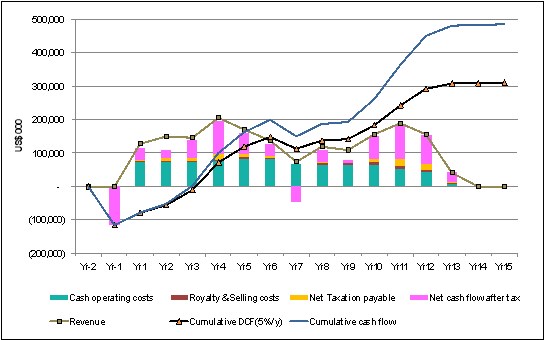

| 22.5 BASE CASE CASH FLOW | 264 |

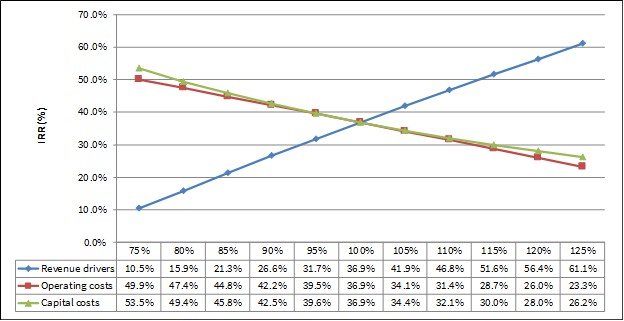

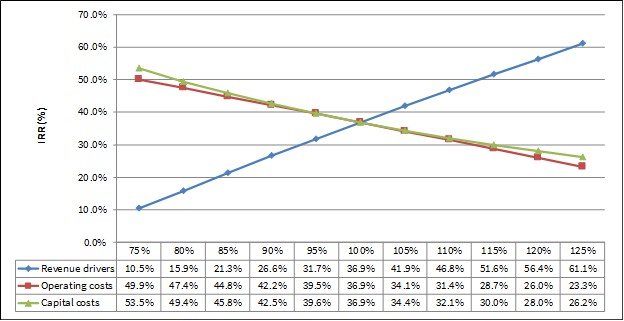

| 22.6 SENSITIVITY STUDY | 267 |

| 22.6.1 Discount Rate Sensitivity | 267 |

| | |

| 23.0 ADJACENT PROPERTIES | 269 |

| 23.1 WILDCAT PROJECT | 269 |

| 23.2 MOUNTAIN VIEW PROJECT | 269 |

| | |

| 24.0 OTHER RELEVANT DATA AND INFORMATION | 270 |

| | |

| 25.0 INTERPRETATION AND CONCLUSIONS | 271 |

| 25.1 GENERAL INFORMATION | 271 |

| 25.2 MINERAL RESOURCE ESTIMATE | 271 |

| 25.2.1 Mineral Resource Estimate for the Wildcat Project | 271 |

| 25.2.2 Mineral Resource for the Mountain View Project | 276 |

| 25.3 PEA MINING, PROCESSING AND INFRASTRUCTURE | 282 |

| 25.3.1 Mining | 282 |

| 25.3.2 Processing | 286 |

| 25.3.3 Infrastructure | 287 |

| 25.3.4 Capital and Operating Costs | 288 |

| 25.4 PEA ECONOMIC ANALYSIS | 288 |

| 25.5 CONCLUSIONS | 290 |

| 25.5.1 Mineral Resource Estimate Conclusions | 290 |

| 25.5.2 Risks and Opportunities | 290 |

| | |

| 26.0 RECOMMENDATIONS | 294 |

| 26.1 PLANNED EXPENDITURES AND BUDGET PREPARATION | 294 |

| 26.2 FURTHER RECOMMENDATIONS | 295 |

| 26.2.1 Geological and Resource Recommendations | 295 |

| 26.2.2 Metallurgical Recommendations | 295 |

| 26.2.3 Geotechnical Recommendations | 295 |

| 26.2.4 Mining Recommendations | 296 |

| 26.2.5 Infrastructure Recommendations | 296 |

| 26.2.6 Permitting Recommendations | 296 |

| 27.0 DATE AND SIGNATURE PAGES | 297 |

| | |

| 28.0 REFERENCES | 298 |

| 28.1 GENERAL REFERENCES | 298 |

| 28.1.1 Technical Reports, Papers and Other Sources | 298 |

| 28.1.2 Web Based Sources of Information | 299 |

| 28.2 WILDCAT PROJECT SPECIFIC REFERENCES | 299 |

| 28.2.1 Technical Reports, Papers and Other Sources | 299 |

| 28.2.2 Web Based Sources of Information | 300 |

| 28.3 MOUNTAIN VIEW PROJECT SPECIFIC REFERENCES | 300 |

| 28.3.1 Technical Reports, Papers and Other Sources | 300 |

| 28.3.2 Web Based Sources of Information | 301 |

| | |

| 29.0 CERTIFICATES OF QUALIFIED PERSONS | 302 |

Appendices

| Appendix I: Glossary of Mining and Other Related Terms | End of the Report |

| | |

| Appendix II: Wildcat and Mountain View Mineral Claim Details | End of the Report |

List of Tables

| Table 1.1 | Wildcat Project Mineral Resource Estimate Economic Parameters | 17 |

| | | |

| Table 1.2 | Wildcat Deposit June, 2023, Mineral Resource Estimate Statement | 17 |

| | | |

| Table 1.3 | Wildcat Project, Gold Grade Sensitivity Analysis at Different Cut-Off Grades | 18 |

| | | |

| Table 1.4 | Mountain View Project, Mineral Resource Economic Parameters | 22 |

| | | |

| Table 1.5 | Mountain View Deposit June, 2023, Mineral Resource Estimate Statement | 23 |

| | | |

| Table 1.6 | Mountain View Project, Gold Grade Sensitivity Analysis at Different Cut-Off Grades | 24 |

| | | |

| Table 1.7 | Mine Production Schedule | 30 |

| | | |

| Table 1.8 | Summary LOM Cash Flow, Wildcat and Mountain View Projects | 33 |

| | | |

| Table 1.9 | Risks and Opportunities at the Wildcat and Mountain View Projects | 36 |

| | | |

| Table 1.10 | Wildcat and Mountain View Projects, Recommended Budget for Further Work | 38 |

| | | |

| Table 2.1 | Qualified Persons, Areas of Responsibility and Site Visits | 43 |

| | | |

| Table 2.2 | List of the Abbreviations | 43 |

| | | |

| Table 4.1 | Summary of the Mineral Claims that Comprise the Wildcat and Mountain View Properties | 50 |

| | | |

| Table 5.1 | Average Climatic Data - Gerlach Station | 62 |

| | | |

| Table 6.1 | Historical Production from the Seven Troughs District | 68 |

| | | |

| Table 6.2 | Production from the Seven Troughs District by Year from 1908 to 1940 (Gold, Silver, Copper, Lead) | 68 |

| | | |

| Table 6.3 | Historical Lac Minerals 1993 Wildcat Mineral Resource Estimation* | 69 |

| | | |

| Table 6.4 | Summary of the Historical 1998 MDA Wildcat Resource Estimation | 71 |

| | | |

| Table 6.5 | Historical 2006 Wildcat Indicated Resource Estimate (0.010 oz/t gold cut-off) | 74 |

| | | |

| Table 6.6 | Historical 2006 Wildcat Inferred Resource Estimate (0.010 oz/t gold cut-off) | 74 |

| | | |

| Table 6.7 | Historical 2002 Snowden Mineral Resource Estimate, Severance Deposit, Mountain View Project | 80 |

| | | |

| Table 10.1 | Summary of the Historical Wildcat Project Drilling Programs | 99 |

| Table 10.2 | Comparison between the Core Diamond Drill Holes and the Close-by Reverse Circulation Drill Holes | 100 |

| | | |

| Table 10.3 | Summary of the 2022 Millennial Drilling Program for the Wildcat Project | 100 |

| | | |

| Table 10.4 | Summary of the Mountain View Project Drilling Programs from 1984-2004 | 102 |

| | | |

| Table 10.5 | Summary of the Drill Hole Information for the 2003 and 2004 Vista Drill Programs | 104 |

| | | |

| Table 10.6 | Summary of the 2003 and 2004 Mineralized Drill Hole Intersections | 106 |

| | | |

| Table 10.7 | Summary of the Drill Hole Information for the 2021 to 2022 Millennial Drilling Program | 107 |

| | | |

| Table 11.1 | Standards used by Millennial for the 2022 Wildcat Core Drilling Program | 112 |

| | | |

| Table 11.2 | AAL Results for the Standards used by Millennial during the 2022 Drilling Program at the Wildcat Project | 113 |

| | | |

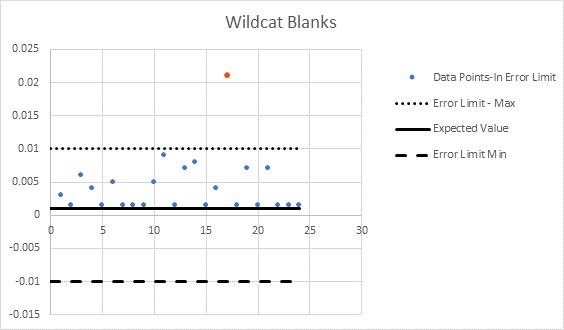

| Table 11.3 | Summary of Blank Performance at Wildcat | 113 |

| | | |

| Table 11.4 | Standards used by Millennial for the 2021-2022 Mountain View Project Core Drilling Program | 115 |

| | | |

| Table 11.5 | AAL Results of Standards used by Millennial for the 2021-2022 Drilling Program at Mountain View Program | 116 |

| | | |

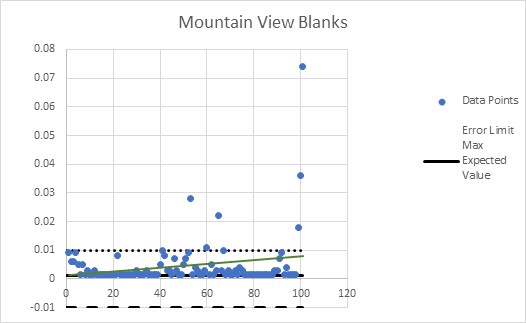

| Table 11.6 | Summary of Blank Performance at Mountain View Project | 117 |

| | | |

| Table 12.1 | Wildcat Project, Drill Hole Samples Chosen for Reassaying | 124 |

| | | |

| Table 12.2 | Mountain View Project, Drill Hole Samples Chosen for Reassaying | 124 |

| | | |

| Table 12.3 | Comparison of the Original AAL Assay and the BV Re-Assay | 125 |

| | | |

| Table 13.1 | Summary of Historical Metallurgical Testwork | 126 |

| | | |

| Table 13.2 | Wildcat Project, Metallurgical Composite Selected Analyses | 129 |

| | | |

| Table 13.3 | Column Metallurgical Composite Whole Rock Analyses | 130 |

| | | |

| Table 13.4 | Column Metallurgical Composite XRD Analyses | 130 |

| | | |

| Table 13.5 | Bottle Roll Metallurgical Variability Samples Gold, Silver and Sulphide Analyses | 131 |

| | | |

| Table 13.6 | Summary of Column Composite Sample Bottle Roll Leach Test Results | 134 |

| | | |

| Table 13.7 | Average Bottle Roll Leach Test Results for Each Mineralization-Type | 135 |

| | | |

| Table 13.8 | Summary of Final Column Leach Test Results | 137 |

| Table 13.9 | Physical Characteristics of the Wildcat Column Leach Test Samples | 140 |

| | | |

| Table 13.10 | Summary of Diagnostic Leach Test Results | 141 |

| | | |

| Table 13.11 | Summary of the Wildcat Sample Gravity Test Results | 141 |

| | | |

| Table 13.12 | Mountain View Project, Metallurgical Composite Selected Analyses | 145 |

| | | |

| Table 13.13 | Mountain View Project, Column Metallurgical Composite Whole Rock Analyses | 146 |

| | | |

| Table 13.14 | Mountain View Column Metallurgical Composite XRD Analyses | 146 |

| | | |

| Table 13.15 | Mountain View Bottle Roll Metallurgical Variability Samples, Gold, Silver and Sulphide Analyses | 147 |

| | | |

| Table 13.16 | Summary of Column Composite Sample Bottle Roll Leach Test Results | 150 |

| | | |

| Table 13.17 | Average Bottle Roll Leach Test Results for Each Mineralization-Type | 153 |

| | | |

| Table 13.18 | Summary of Final Column Leach Test Results | 154 |

| | | |

| Table 13.19 | Physical Characteristics of the Mountain View Column Leach Test Samples | 156 |

| | | |

| Table 14.1 | Wildcat Project, Drill Hole Assaying Gold and Silver Statistics | 163 |

| | | |

| Table 14.2 | Wildcat Project, Drilling Assays Sensitivity to Capping Value | 166 |

| | | |

| Table 14.3 | Wildcat Project, Drilling 4.5m Composites Statistics | 167 |

| | | |

| Table 14.4 | Wildcat Project, Block Model Geometry | 168 |

| | | |

| Table 14.5 | Wildcat Project, Search Ellipse Parameters | 169 |

| | | |

| Table 14.6 | Wildcat Project, Gold Interpolation Comparison at Zero Cut-off | 170 |

| | | |

| Table 14.7 | Wildcat Project Mineral Resource Estimate Economic Parameters | 172 |

| | | |

| Table 14.8 | Wildcat Deposit June, 2023, Mineral Resource Estimate Statement | 172 |

| | | |

| Table 14.9 | Wildcat Project, Gold Grade Sensitivity Analysis at Different Cut-Off Grades | 173 |

| | | |

| Table 14.10 | Wildcat Project, Comparison of the 2023 Mineral Resource Estimate with Previous 2020 Estimate | 175 |

| | | |

| Table 14.11 | Mountain View Project, Drilling Assay Gold and Silver Statistics | 179 |

| | | |

| Table 14.12 | Mountain View Project, West Breccia Drilling Assays Sensitivity to Gold Capping Value | 183 |

| | | |

| Table 14.13 | Mountain View Project, Selected Capping Value per Domain for Gold and Silver | 183 |

| Table 14.14 | Mountain View Project, Drilling, 4.5m Composites Statistics | 184 |

| | | |

| Table 14.15 | Mountain View Project, Block Model Geometry | 185 |

| | | |

| Table 14.16 | Mountain View Project, Search Ellipse Parameters | 185 |

| | | |

| Table 14.17 | Mountain View Project, Interpolation Parameters | 186 |

| | | |

| Table 14.18 | Mountain View Project, Gold Interpolation Comparison Cut-Off | 187 |

| | | |

| Table 14.19 | Mountain View Project, Mineral Resource Economic Parameters | 189 |

| | | |

| Table 14.20 | Mountain View Deposit June, 2023, Mineral Resource Estimate Statement | 189 |

| | | |

| Table 14.21 | Mountain View Project, Gold Grade Sensitivity Analysis at Different Cut-Off Grades | 190 |

| | | |

| Table 14.22 | Mountain View Project, Comparison between the 2023 and the 2020 Mineral Resource Estimates | 192 |

| | | |

| Table 16.1 | Pit Optimization Parameters | 196 |

| | | |

| Table 16.2 | Wildcat Project, Pit Optimization Results | 198 |

| | | |

| Table 16.3 | Mountain View Project, Pit Optimization Results | 200 |

| | | |

| Table 16.4 | Combined Wildcat and Mountain View Project Pit Optimization Results | 201 |

| | | |

| Table 16.5 | Wildcat Geotechnical Parameters | 204 |

| | | |

| Table 16.6 | Mountain View Geotechnical Parameters | 204 |

| | | |

| Table 16.7 | Cut-off Grade Estimation | 210 |

| | | |

| Table 16.8 | Dilution Factors | 213 |

| | | |

| Table 16.9 | Wildcat Project, Mineral Resources within the Conceptual Mine Plan | 214 |

| | | |

| Table 16.10 | Mountain View Project, Mineral Resources within the Conceptual Mine Plan | 214 |

| | | |

| Table 16.11 | Wildcat Project, Waste Dump Capacity | 215 |

| | | |

| Table 16.12 | Mountain View Project, Waste Dump Capacity | 215 |

| | | |

| Table 16.13 | Mineralized Material Stockpile Capacity | 218 |

| | | |

| Table 16.14 | Mine Production Schedule | 222 |

| | | |

| Table 16.15 | Mining Fleet Requirements | 224 |

| Table 16.16 | Mine Personnel Requirements | 225 |

| | | |

| Table 17.1 | Energy Requirements for the Wildcat and Mountain View Projects | 229 |

| | | |

| Table 17.2 | Reagents Requirements for the Wildcat and Mountain View Projects | 229 |

| | | |

| Table 17.3 | Process Production Schedule for the Wildcat and Mountain View Projects | 231 |

| | | |

| Table 17.4 | Plant Personnel Requirements | 232 |

| | | |

| Table 17.5 | General and Administration Personnel Requirements | 233 |

| | | |

| Table 19.1 | Average Annual High and Low London PM Fix for Gold and Silver from 2000 to July 30, 2023 | 242 |

| | | |

| Table 20.1 | Required Permits for the Wildcat Project | 245 |

| | | |

| Table 20.2 | Wildcat Project, Reclamation Cost Estimate | 247 |

| | | |

| Table 20.3 | Required Permits for the Mountain View Project | 249 |

| | | |

| Table 20.4 | Mountain View Project, Reclamation Cost Estimate | 251 |

| | | |

| Table 21.1 | General Infrastructure Estimate for the Wildcat Project | 255 |

| | | |

| Table 21.2 | General Infrastructure Estimate for Mountain View Project | 255 |

| | | |

| Table 21.3 | Heap Leach Estimate for the Wildcat Project | 256 |

| | | |

| Table 21.4 | Heap Leach Estimate for Mountain View Project | 256 |

| | | |

| Table 21.5 | Plant Operating Costs for the Wildcat Project, 11 Mt/y | 258 |

| | | |

| Table 21.6 | Plant Operating Costs for the Wildcat Project, Leaching Only | 258 |

| | | |

| Table 21.7 | Plant Operating Costs for the Mountain View Project, 5.5 Mt/y | 258 |

| | | |

| Table 21.8 | Plant Operating Costs for the Mountain View Project, Leaching Only | 259 |

| | | |

| Table 21.9 | Mining Average Operating Costs for the Wildcat Project | 259 |

| | | |

| Table 21.10 | Mining Average Operating Costs for the Mountain View Project | 260 |

| | | |

| Table 22.1 | Summary LOM Cash Flow, Wildcat and Mountain View Projects | 265 |

| | | |

| Table 22.2 | Annual LOM Cash Flow | 266 |

| | | |

| Table 25.1 | Wildcat Project Mineral Resource Estimate Economic Parameters | 274 |

| Table 25.2 | Wildcat Deposit June, 2023, Mineral Resource Estimate Statement | 275 |

| | | |

| Table 25.3 | Wildcat Project, Gold Grade Sensitivity Analysis at Different Cut-Off Grades | 275 |

| | | |

| Table 25.4 | Mountain View Project, Mineral Resource Economic Parameters | 279 |

| | | |

| Table 25.5 | Mountain View Deposit June, 2023, Mineral Resource Estimate Statement | 280 |

| | | |

| Table 25.6 | Mountain View Project, Gold Grade Sensitivity Analysis at Different Cut-Off Grades | 281 |

| | | |

| Table 25.7 | Summary LOM Cash Flow, Wildcat and Mountain View Projects | 288 |

| | | |

| Table 25.8 | Risks and Opportunities at the Wildcat and Mountain View Projects | 291 |

| | | |

| Table 26.1 | Wildcat and Mountain View Projects, Recommended Budget for Further Work | 294 |

List of Figures

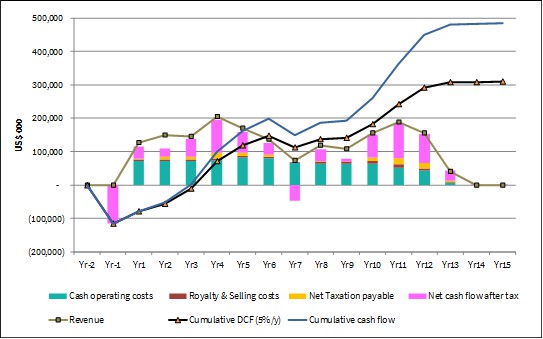

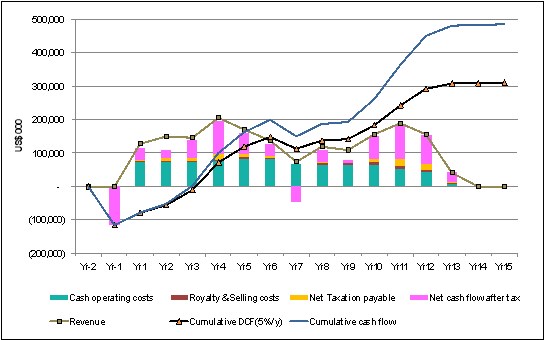

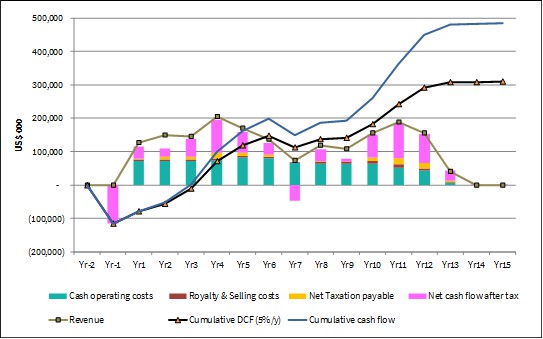

| Figure 1.1 LOM Cash Flow Chart | 35 |

| | |

| Figure 4.1 Location Map of the Wildcat and Mountain View Projects in Northwestern Nevada | 49 |

| | |

| Figure 4.2 Wildcat Project Claims Map | 52 |

| | |

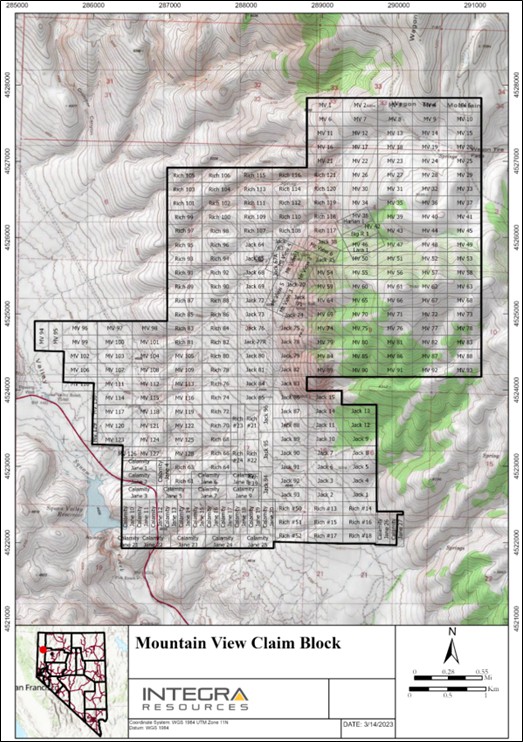

| Figure 4.3 Mountain View Project Mineral Claims Map | 56 |

| | |

| Figure 5.1 A Panoramic View of Main Hill (looking North-Northeast) at the Wildcat Project | 63 |

| | |

| Figure 5.2 A View of the Mountain View Property | 64 |

| | |

| Figure 6.1 View of the Old Wooden Headframe on the Historical Shaft | 69 |

| | |

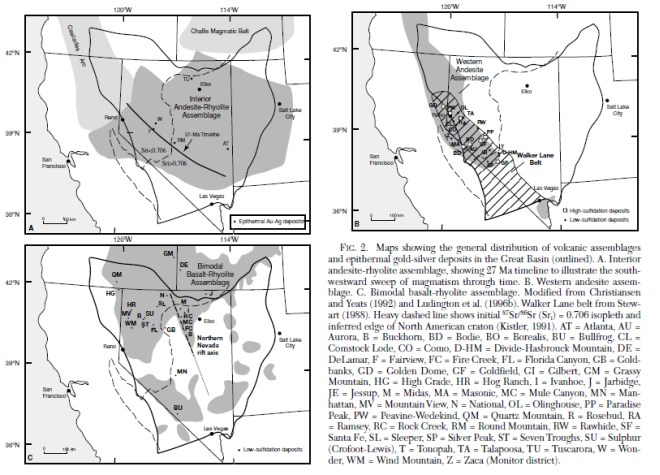

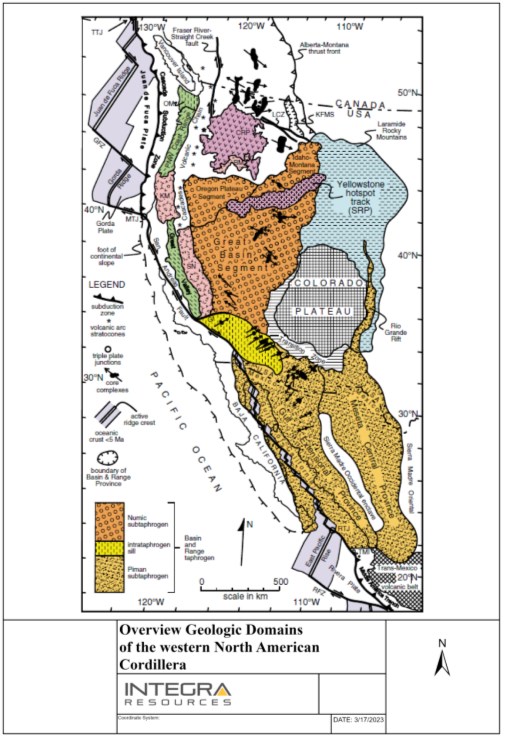

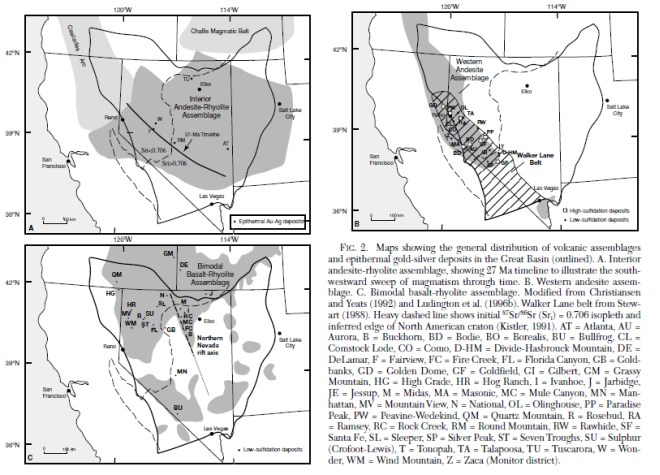

| Figure 7.1 The Bimodal Basalt-Rhyolite Assemblage | 82 |

| | |

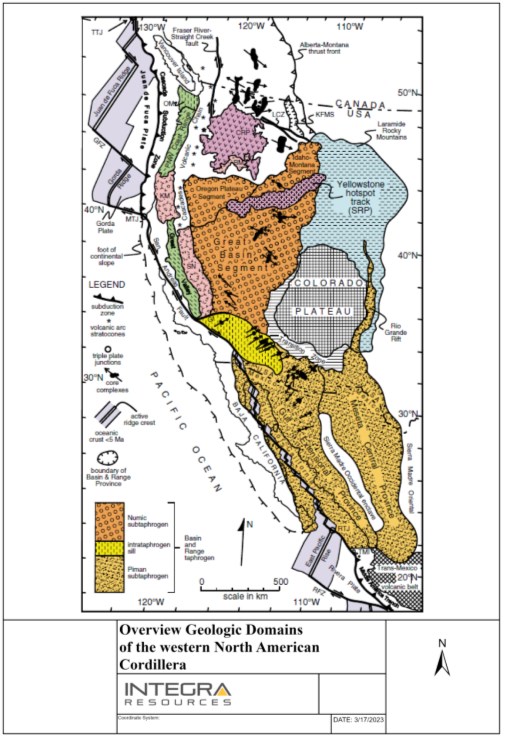

| Figure 7.2 Generalized Geology of the Western North American Cordillera | 83 |

| | |

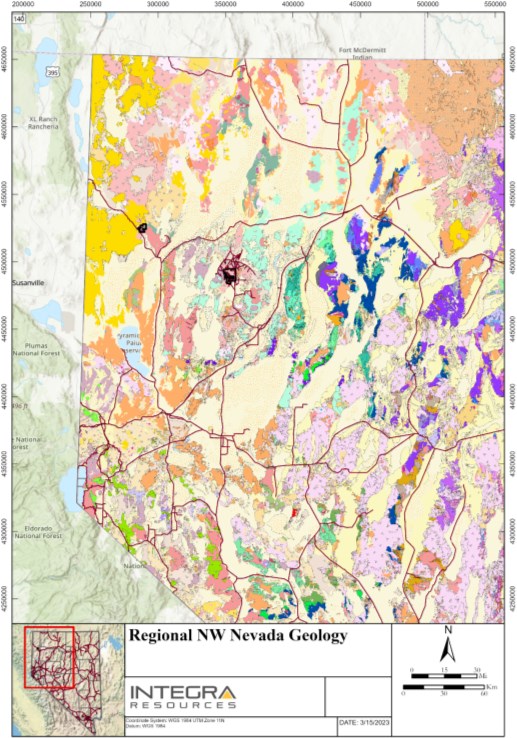

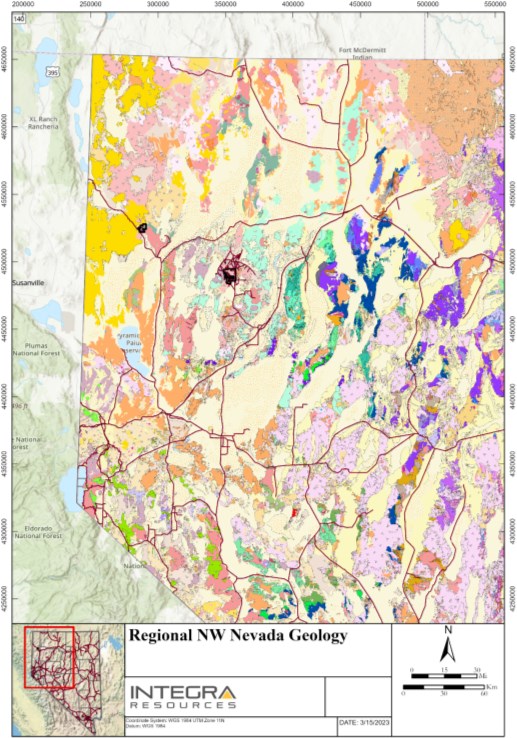

| Figure 7.3 Regional Geology Map for Northwest Nevada | 84 |

| | |

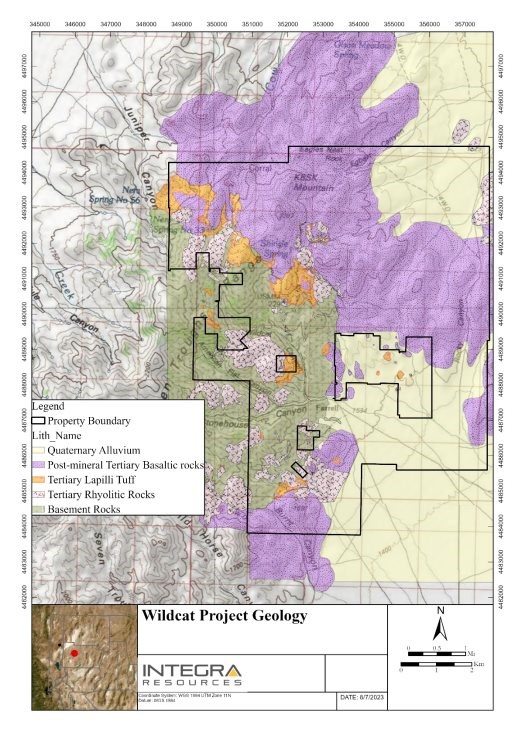

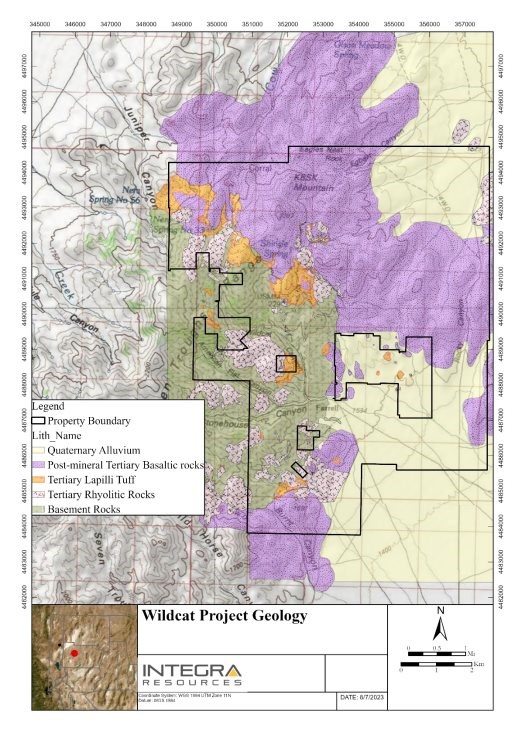

| Figure 7.4 Property Geology Map for the Wildcat Project | 86 |

| | |

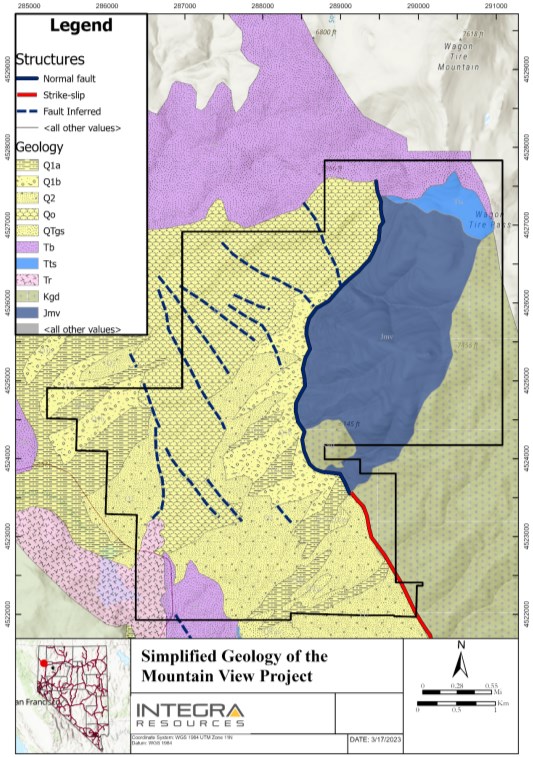

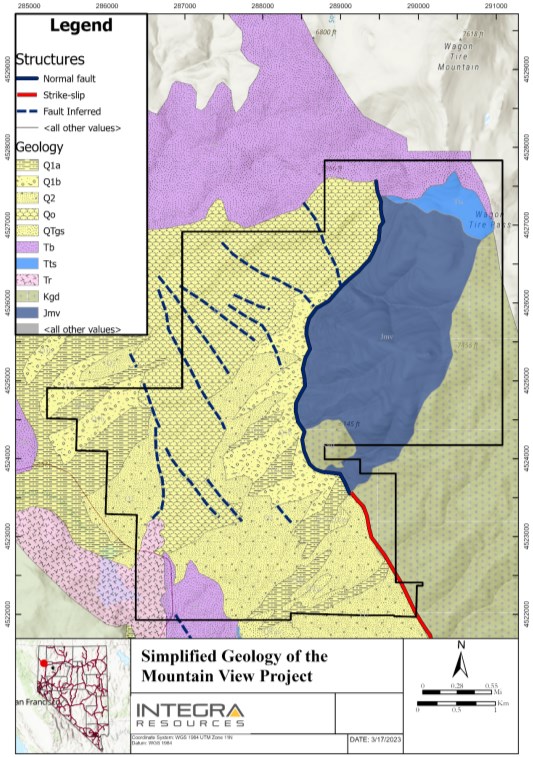

| Figure 7.5 Regional Geology Surrounding the Mountain View Project | 91 |

| | |

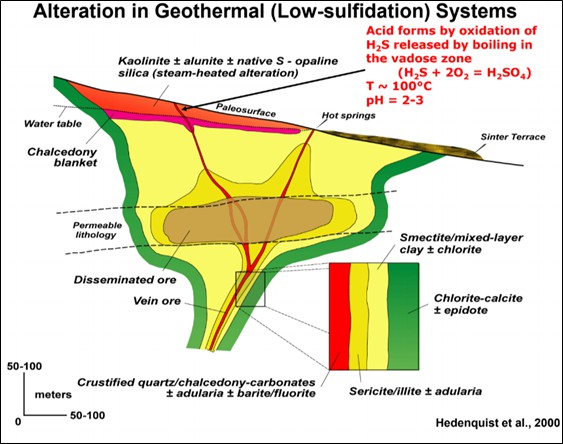

| Figure 8.1 Schematic Model of Mineral Zonation in Low-Sulphidation Epithermal Deposits. | 95 |

| | |

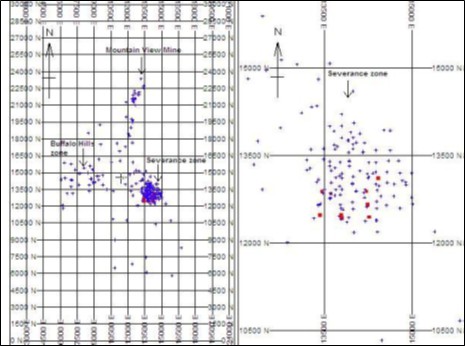

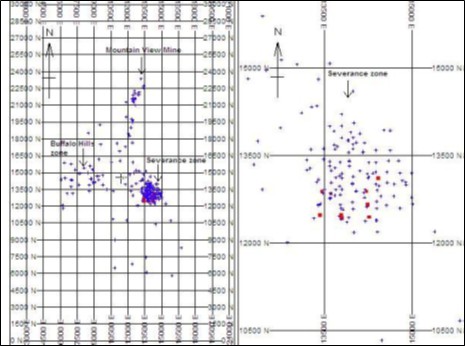

| Figure 10.1 Location of 2003 and 2004 Vista Drill Holes in Relation to Previous Drill Holes | 105 |

| | |

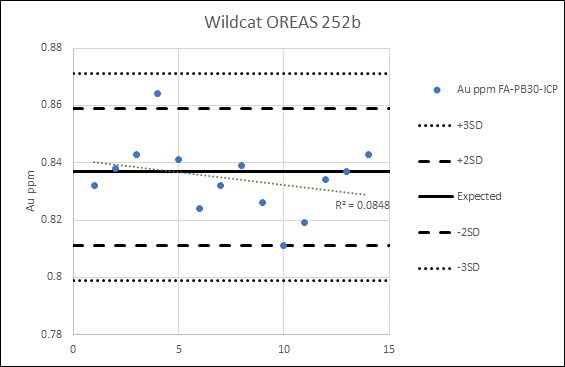

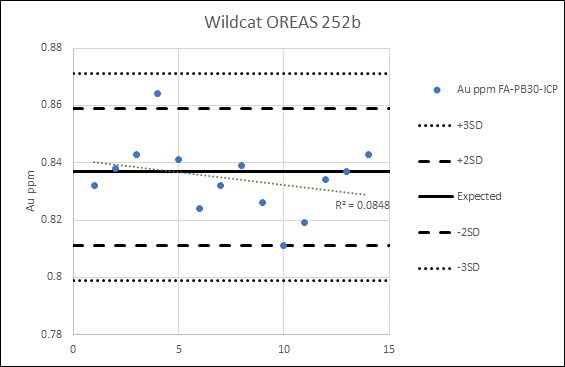

| Figure 11.1 Example of AAL Results for Standard OREAS 252b for the Wildcat 2022 Drill Program | 114 |

| | |

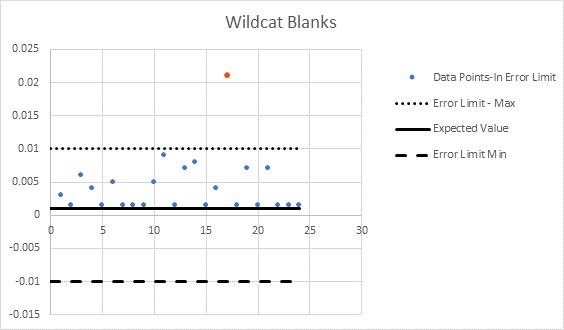

| Figure 11.2 Graph of Blank Performance at Wildcat | 114 |

| | |

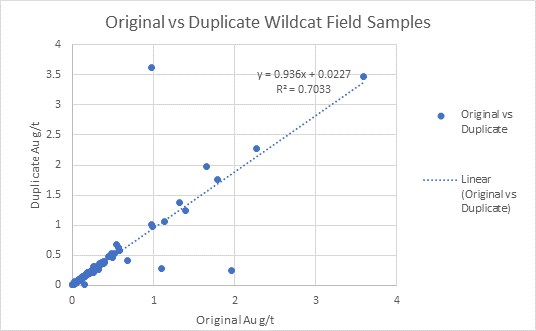

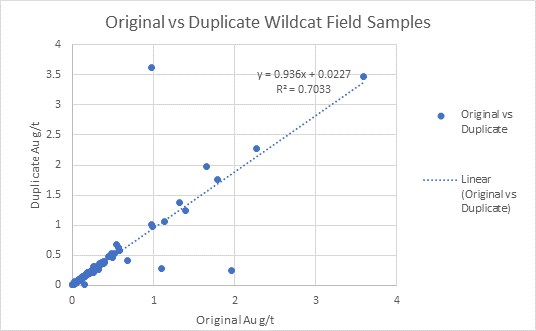

| Figure 11.3 Graph of Field Duplicate Performance at the Wildcat Project | 115 |

| | |

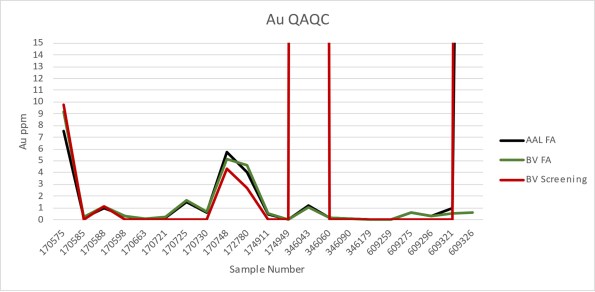

| Figure 11.4 Example of AAL Results for Standard OREAS 250b for the Mountain View 2021 and 2022 Drill Program | 116 |

| | |

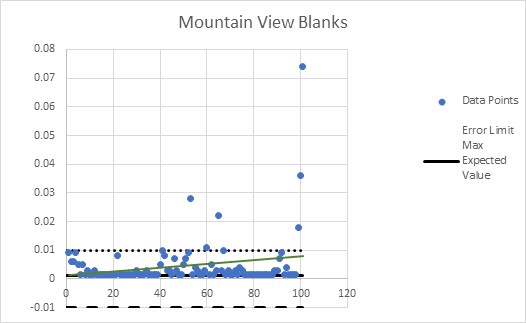

| Figure 11.5 Graph of Blank Performance at Mountain View Project | 117 |

| | |

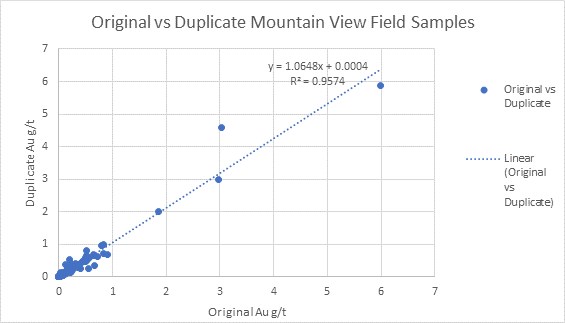

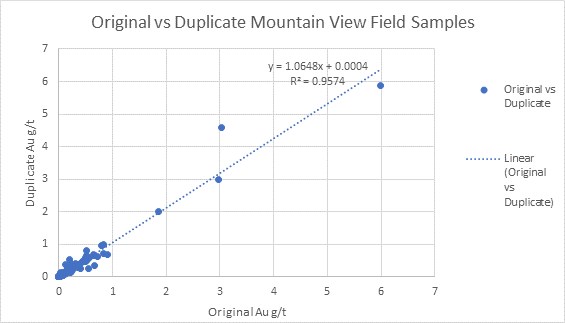

| Figure 11.6 Graph of Duplicate Performance at Mountain View Project | 118 |

| | |

| Figure 12.1 Drilling WCCD-0012 at the Wildcat Project August, 2022 Site Visit | 119 |

| | |

| Figure 12.2 Millennial Coreshack at the time of Micon's Site Visit in August, 2022 | 120 |

| | |

| Figure 12.3 Millennial Storage of Pulp Samples | 120 |

| Figure 12.4 Site of Wildcat Drill Hole WCCD-0005 | 121 |

| | |

| Figure 12.5 View of Mountain View Drill Hole MVCD-0021 | 121 |

| | |

| Figure 12.6 View of the Wildcat Project from the Access Road | 122 |

| | |

| Figure 12.7 View of the Mountain View Project from Drill Hole MVCD-0021 | 122 |

| | |

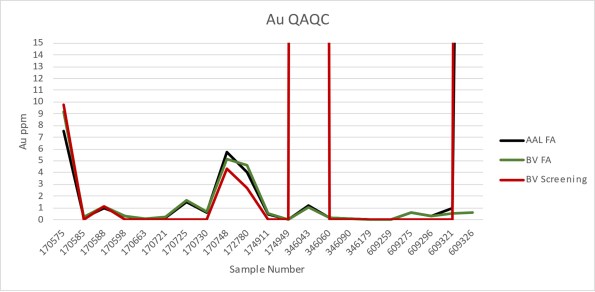

| Figure 12.8 Comparison between the Original Assay from AAL and the Bureau Veritas Check Re-Assays | 125 |

| | |

| Figure 13.1 Wildcat Metallurgical Samples Locations | 128 |

| | |

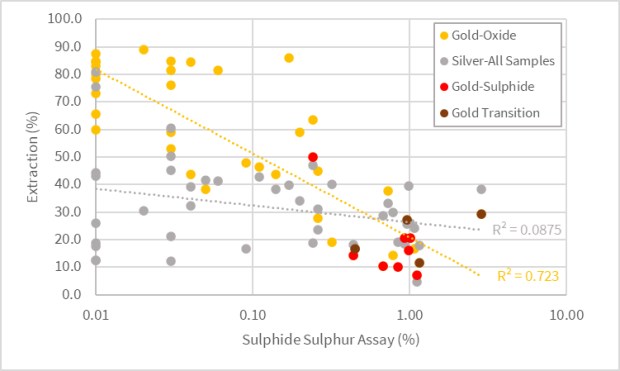

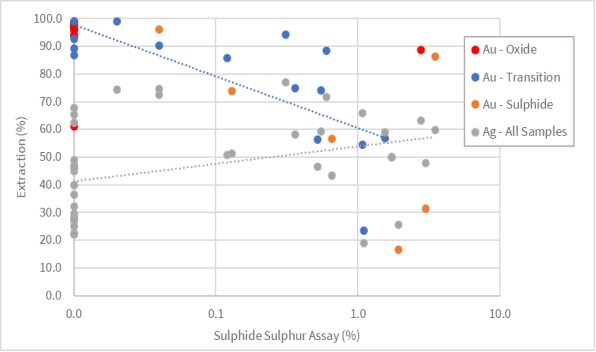

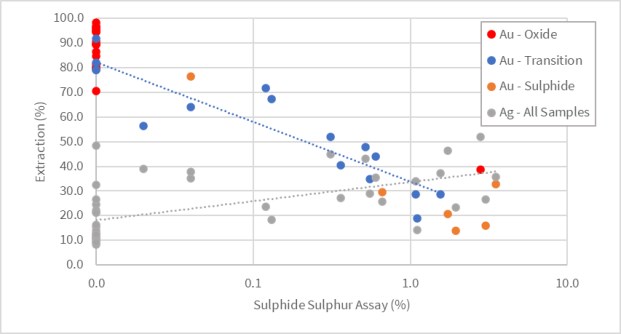

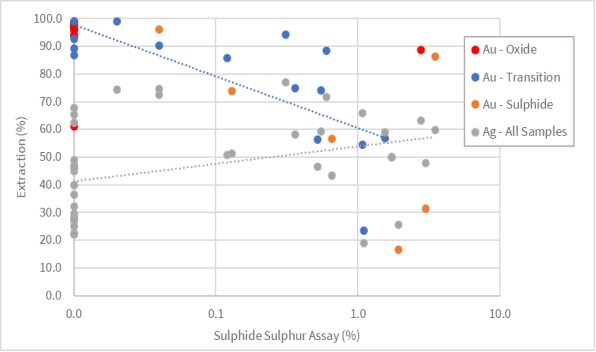

| Figure 13.2 -1.7 mm Variability Bottle Roll Tests - Au and Ag Recovery versus Sulphide Sulphur Content | 134 |

| | |

| Figure 13.3 P80 75 µm Variability Bottle Roll Tests - Au and Ag Recovery versus Sulphide Sulphur Content | 135 |

| | |

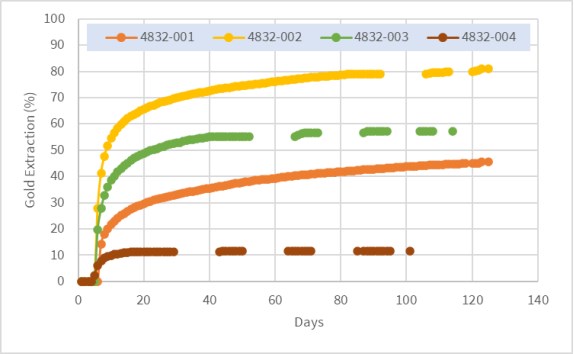

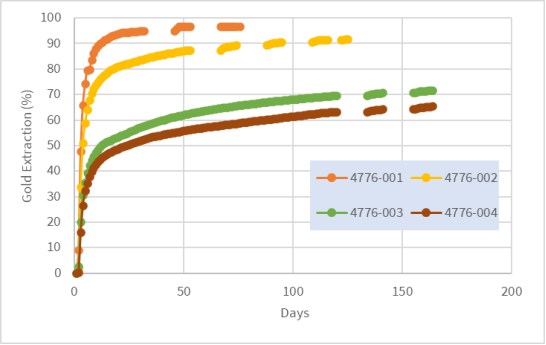

| Figure 13.4 Column Leach Gold Recoveries - P80 19 mm | 138 |

| | |

| Figure 13.5 Column Leach Gold Recoveries - P80 9.5 mm | 138 |

| | |

| Figure 13.6 Column Leach Gold Recoveries - P80 6.3 mm (HPGR) | 139 |

| | |

| Figure 13.7 Mountain View Metallurgical Samples Locations | 144 |

| | |

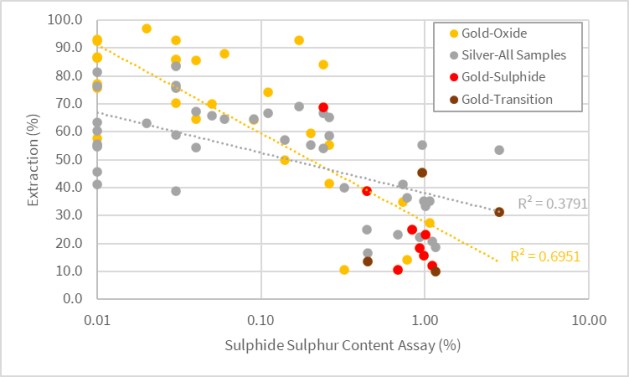

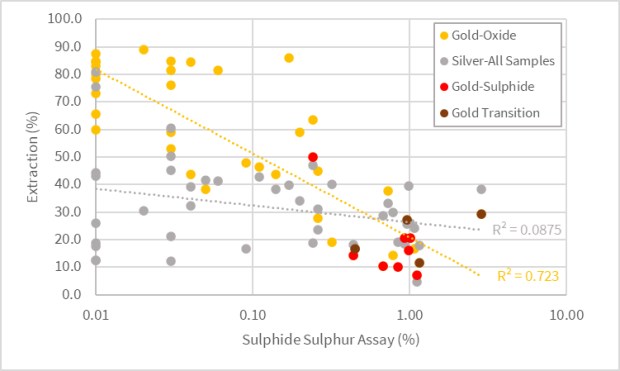

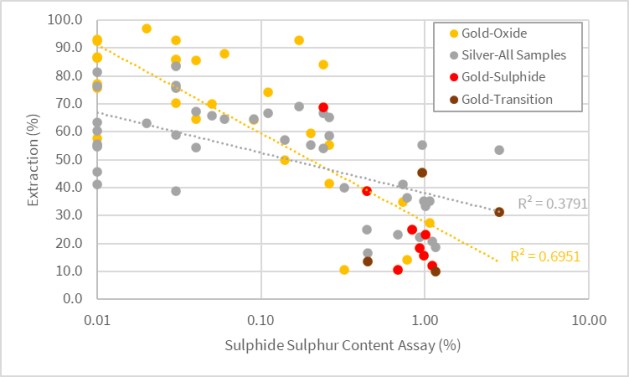

| Figure 13.8 -1.7 mm Variability Bottle Roll Tests - Au and Ag Recovery versus Sulphide Sulphur Content | 150 |

| | |

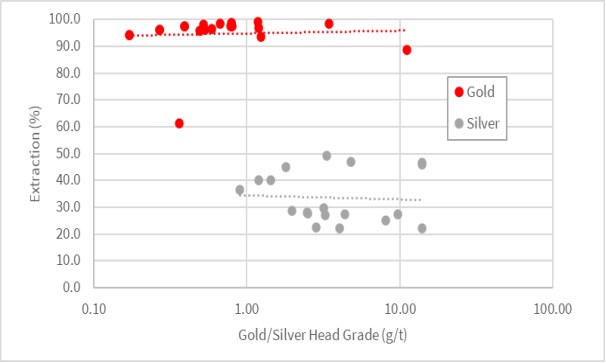

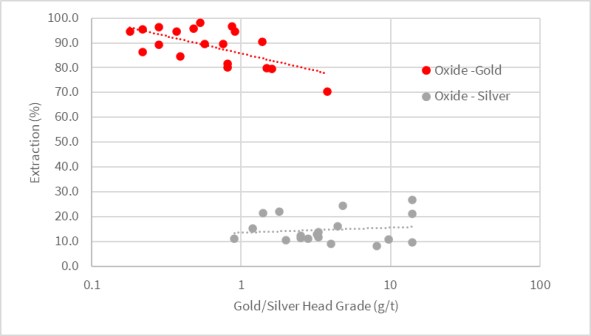

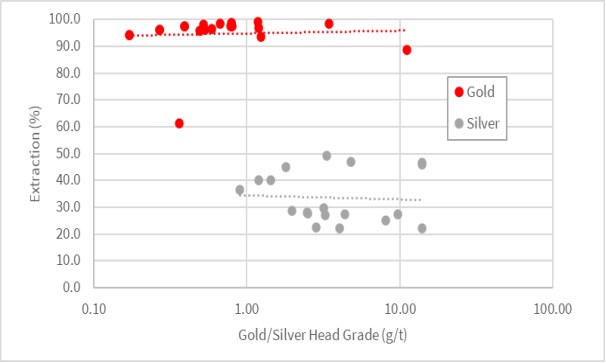

| Figure 13.9 -1.7 mm Oxide Variability Bottle Roll Tests - Au and Ag Extraction versus Head Grade | 151 |

| | |

| Figure 13.10 P80 75 µm Variability Bottle Roll Tests - Au and Ag Recovery versus Sulphide Sulphur Content | 151 |

| | |

| Figure 13.11 P80 75 µm Oxide Variability Bottle Roll Tests - Au and Ag Extraction versus Head Grade | 152 |

| | |

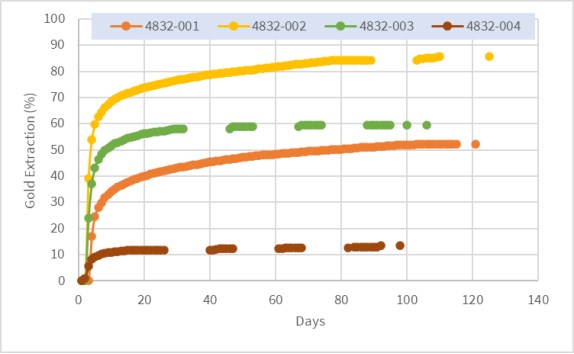

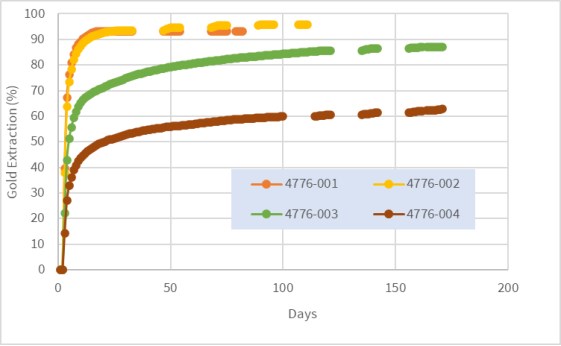

| Figure 13.12 Mountain View Project, Program Column Leach Gold Recoveries - P80 19 mm | 155 |

| | |

| Figure 13.13 Mountain View Project, Column Leach Gold Recoveries - P80 9.5 mm | 155 |

| | |

| Figure 14.1 Wildcat Project Drilling Location Plan View | 161 |

| | |

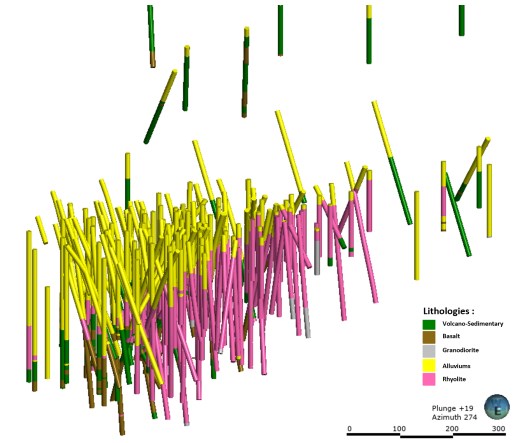

| Figure 14.2 Wildcat 3D View, Drilling Lithologies at the Main Hill Zone (Looking Northeast) | 162 |

| | |

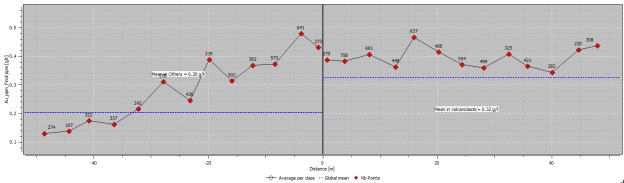

| Figure 14.3 Wildcat Project, Volcanoclastic Contact Plot | 164 |

| | |

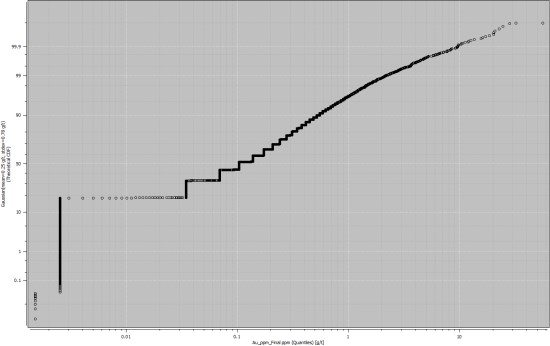

| Figure 14.4 Wildcat Project, Logarithmic Probability Plots for Gold | 165 |

| Figure 14.5 Wildcat Project, Logarithmic Probability Plots for Silver | 165 |

| | |

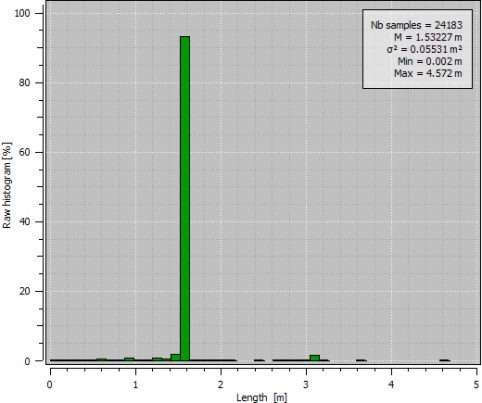

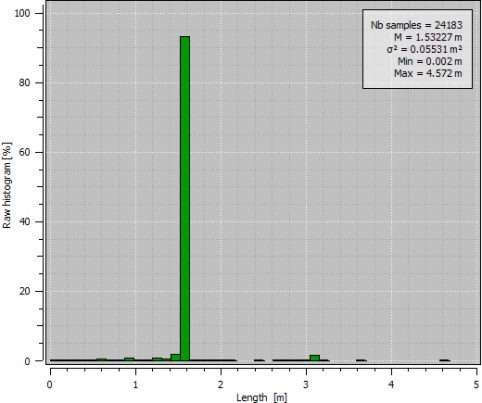

| Figure 14.6 Wildcat Project, Assays Length Histogram | 167 |

| | |

| Figure 14.7 Wildcat Project, North-South Block Model Cross Section Visual Checks (Looking West) | 169 |

| | |

| Figure 14.8 Wildcat Project, Gold Trend Plot: East, North and Elevation | 170 |

| | |

| Figure 14.9 Wildcat Project, Plan View of the Mineral Resource Classification | 171 |

| | |

| Figure 14.10 Wildcat Project, Grade Tonnage Curves for the Indicated Mineral Resources at Different Cut-Off Grades | 174 |

| | |

| Figure 14.11 Wildcat Project, Grade Tonnage Curves for the Inferred Mineral Resources at Different Cut-Off Grades | 175 |

| | |

| Figure 14.12 Mountain View Project, Plan View of Drilling Locations | 177 |

| | |

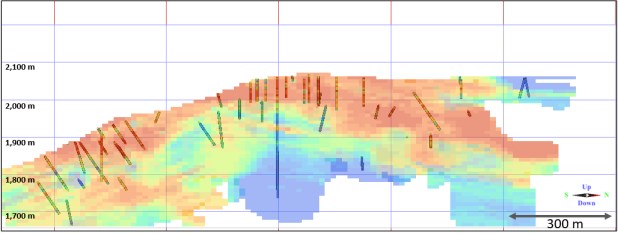

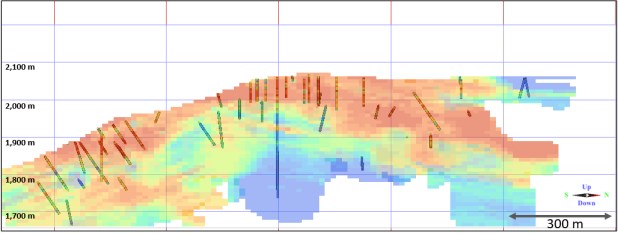

| Figure 14.13 Mountain View Project, 3D View of the Drilling Lithologies at the Main Hill Zone (Looking West) | 178 |

| | |

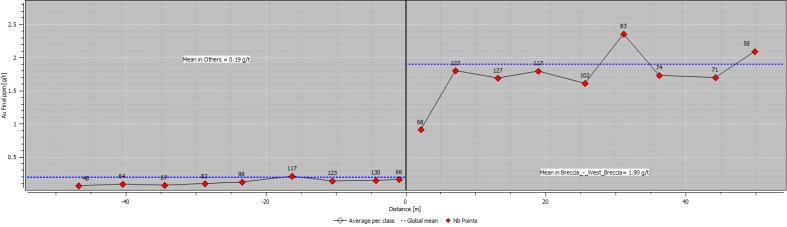

| Figure 14.14 Mountain View Project, West Breccia and Rhyolite Contact Plots | 181 |

| | |

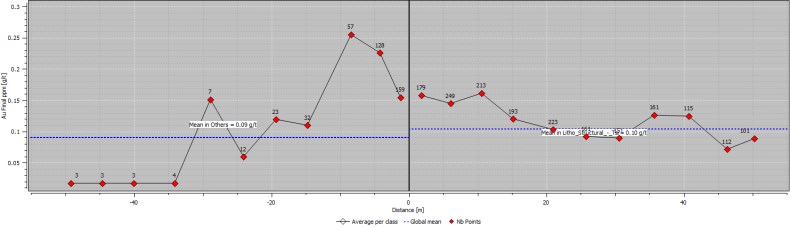

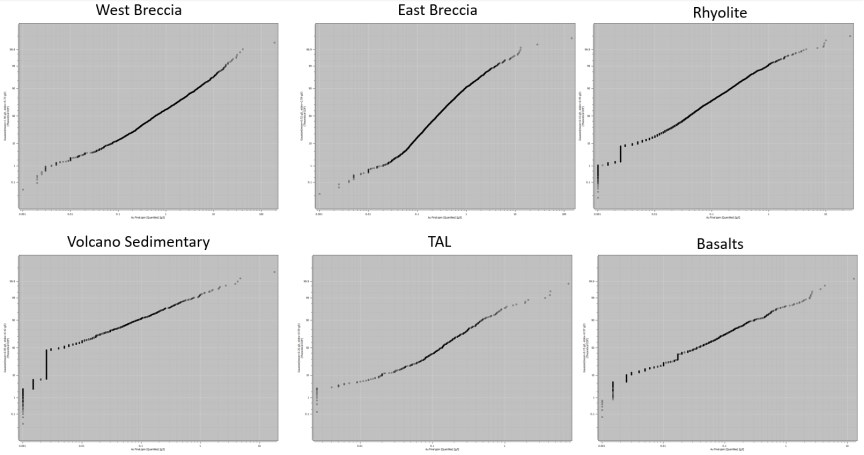

| Figure 14.15 Mountain View Project, Logarithmic Probability Plots for Gold | 182 |

| | |

| Figure 14.16 Mountain View Project, Assay Length Histogram | 184 |

| | |

| Figure 14.17 Mountain View Project, North-South Block Model Cross Section Visual Checks (Looking North) | 186 |

| | |

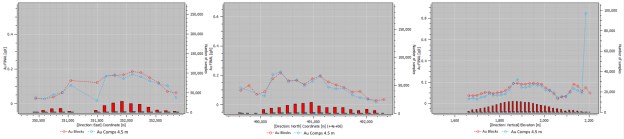

| Figure 14.18 Mountain View Project, Gold Trend Plot for East, North and Elevation | 187 |

| | |

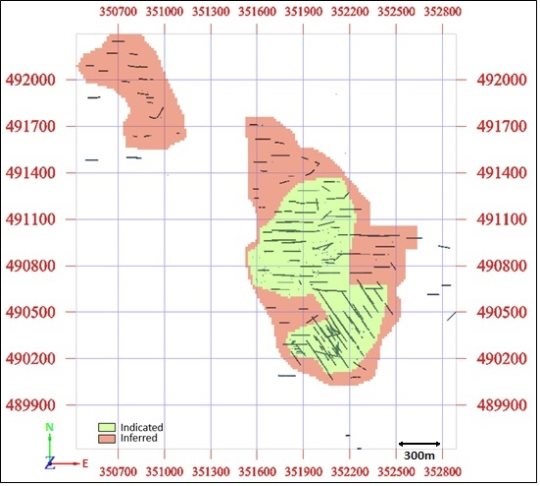

| Figure 14.19 Mountain View Project 3D View of the Classification (Looking Northeast) | 188 |

| | |

| Figure 14.20 Mountain View Project, Grade Tonnage Curves for the Indicated Mineral Resources at Different Cut-Off Grades | 191 |

| | |

| Figure 14.21 Mountain View Project, Grade Tonnage Curves for the Inferred Mineral Resources at Different Cut-Off Grades | 192 |

| | |

| Figure 16.1 Wildcat Project Pit-by-Pit Graph | 199 |

| | |

| Figure 16.2 Mountain View Project, Pit-by-Pit Graph | 200 |

| | |

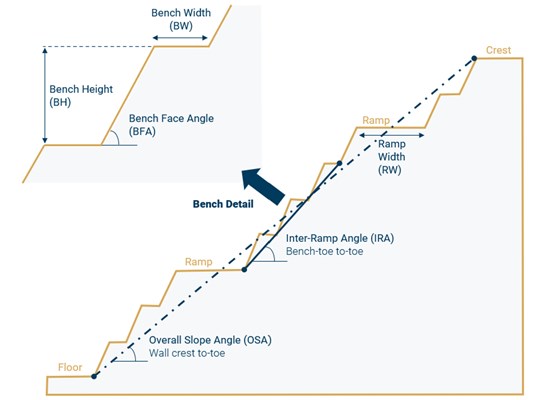

| Figure 16.3 Pit Wall Terminology | 202 |

| | |

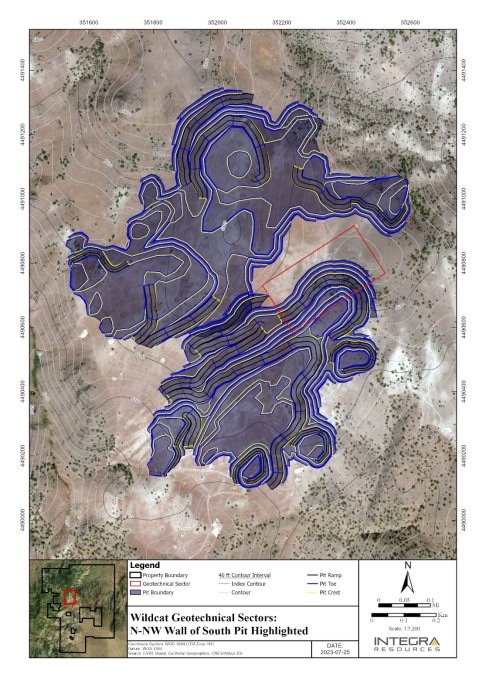

| Figure 16.4 Wildcat Geotechnical Sectors: North-Northwest Wall of South Pit Highlighted | 203 |

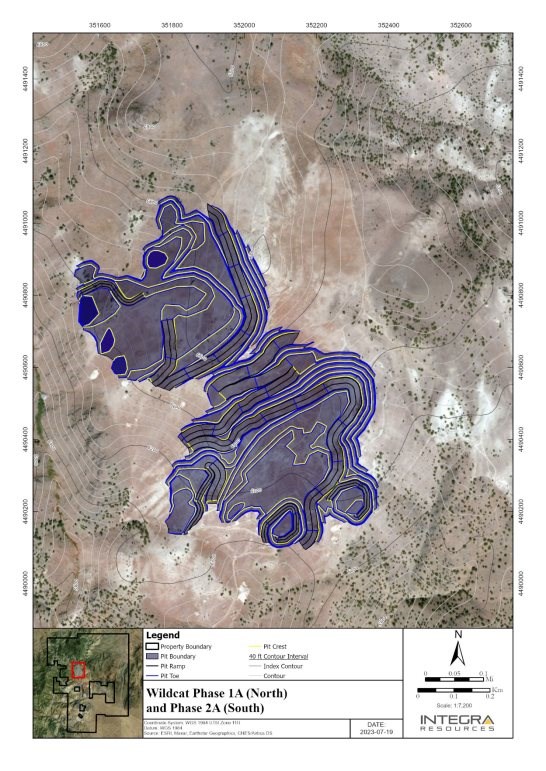

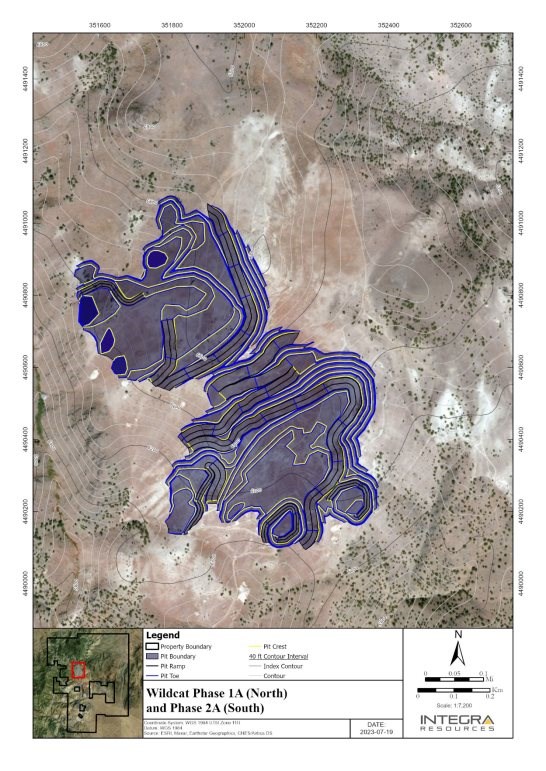

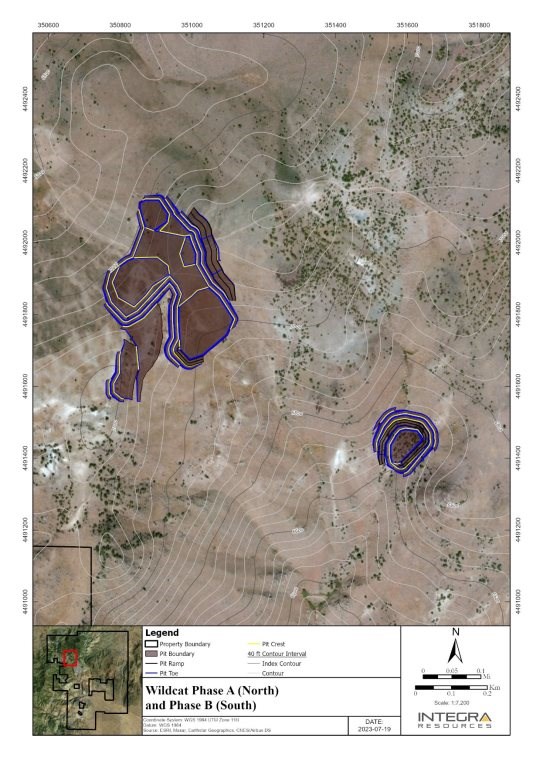

| Figure 16.5 Wildcat Pit, Phase 1A (North) and Phase 2A (South) | 206 |

| | |

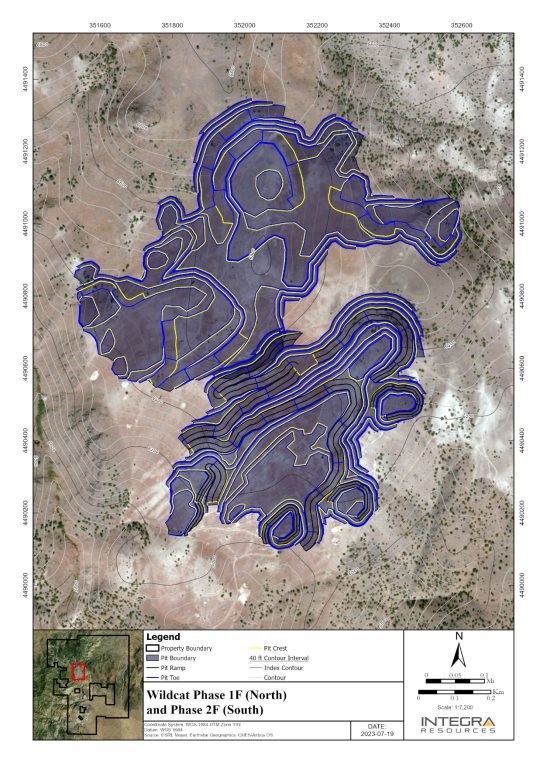

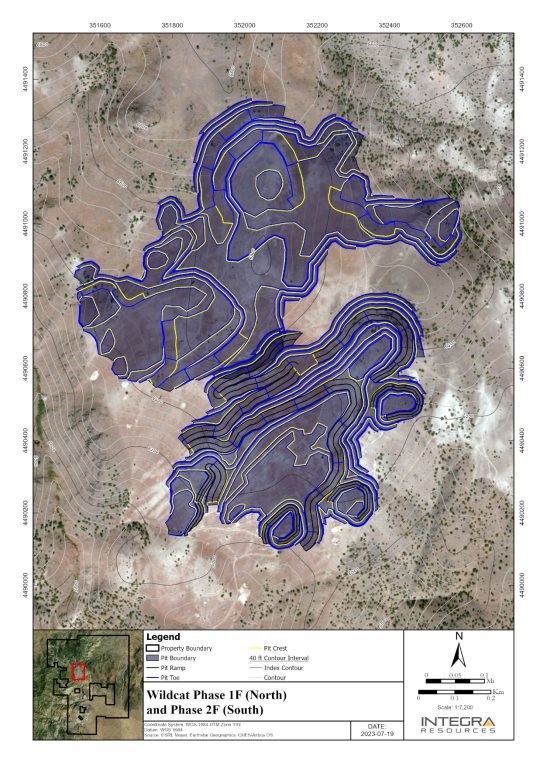

| Figure 16.6 Wildcat Pit, Phase 1F (North) and Phase 2F (South) | 207 |

| | |

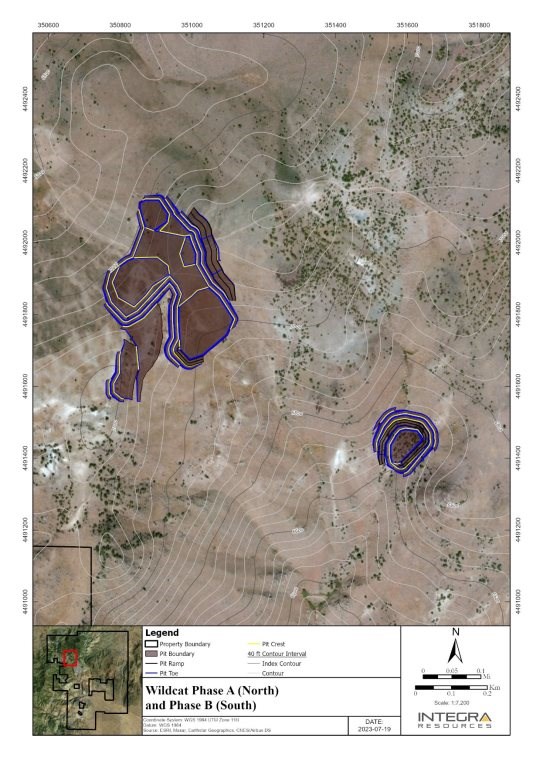

| Figure 16.7 Wildcat Pit, Phase A (North) and Phase B (South) | 208 |

| | |

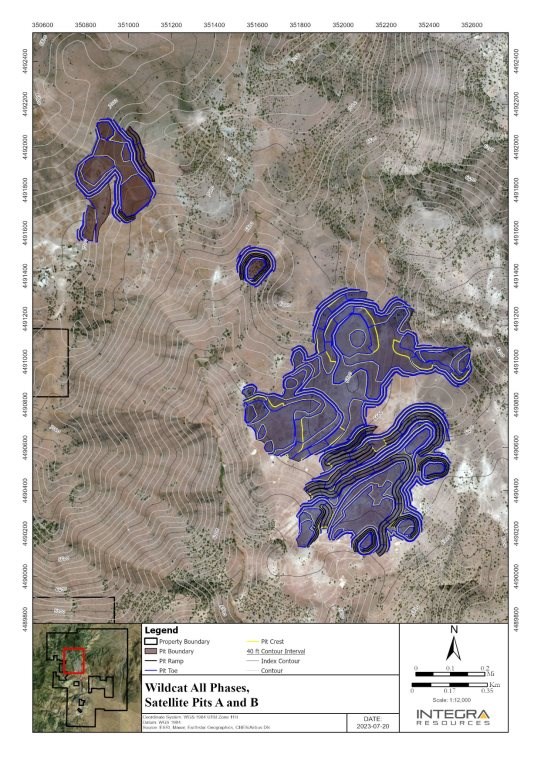

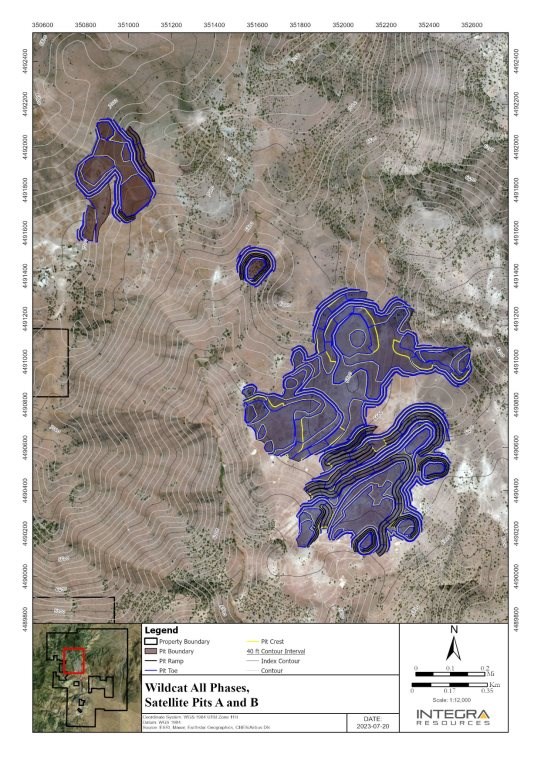

| Figure 16.8 Wildcat Pit all Phases, Satellite Pits A and B | 209 |

| | |

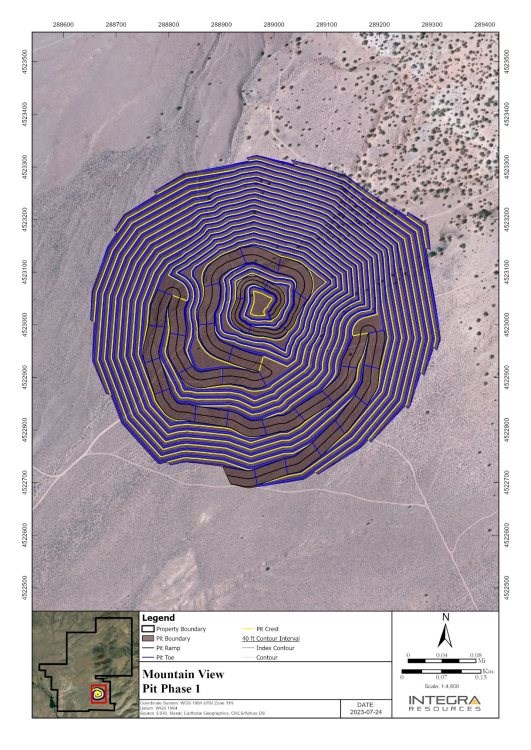

| Figure 16.9 Mountain View Pit Phase 1 | 211 |

| | |

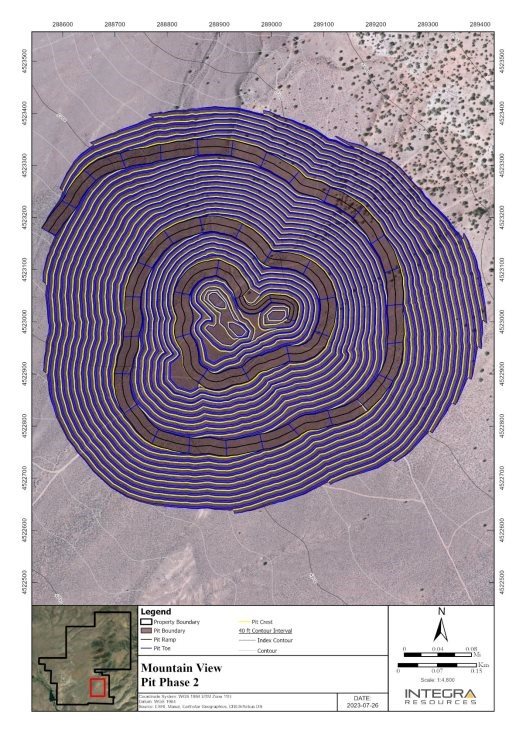

| Figure 16.10 Mountain View Final Pit Phase 2 | 212 |

| | |

| Figure 16.11 Wildcat Project, Waste Dumps | 216 |

| | |

| Figure 16.12 Mountain View Project, Waste Dump | 217 |

| | |

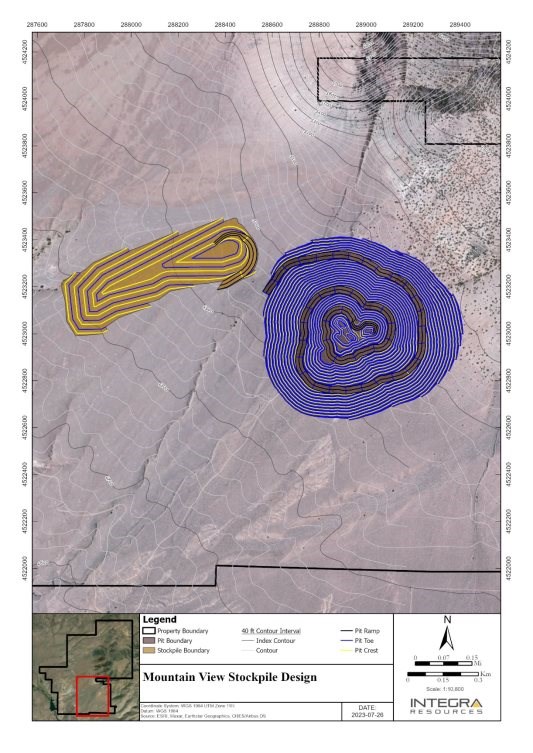

| Figure 16.13 Wildcat Project, Mineralized Material Stockpile Design | 219 |

| | |

| Figure 16.14 Mountain View Project, Mineralized Material Stockpile Design | 220 |

| | |

| Figure 17.1 Process Flow for the Wildcat Project | 227 |

| | |

| Figure 17.2 Process Flow for the Mountain View Project | 228 |

| | |

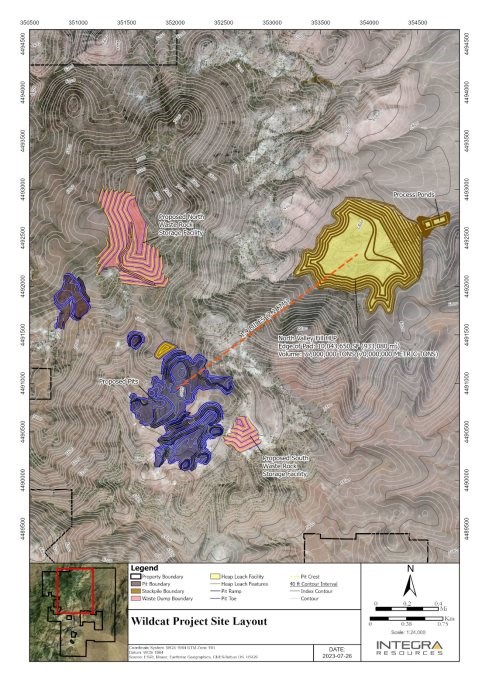

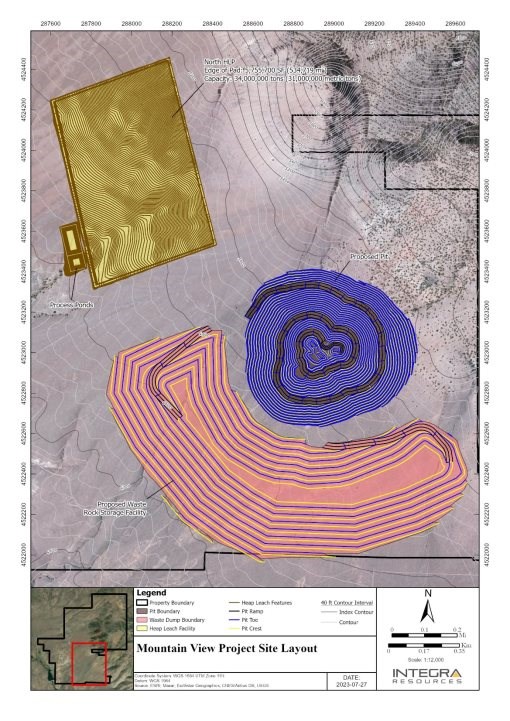

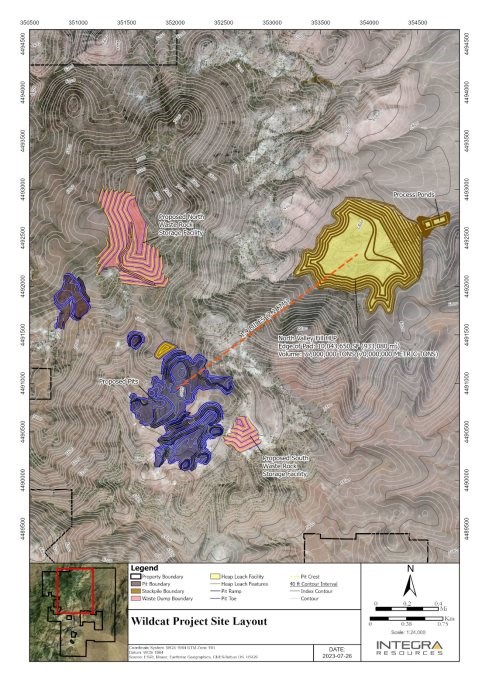

| Figure 18.1 Wildcat Project Site Layout | 236 |

| | |

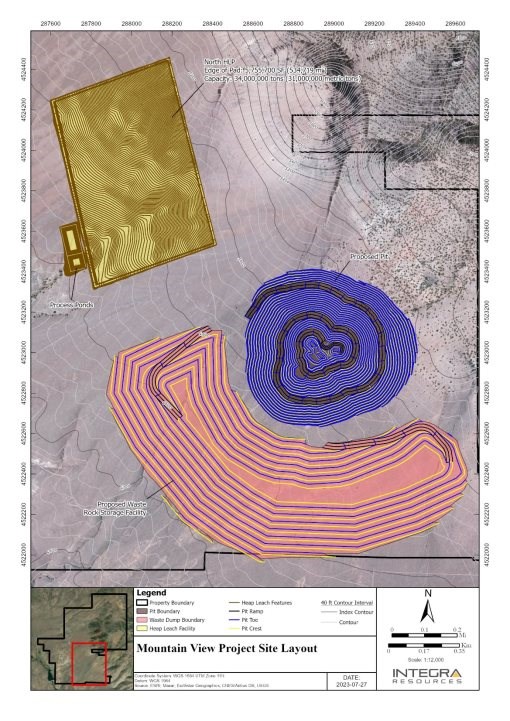

| Figure 18.2 Mountain View Project Site Layout | 237 |

| | |

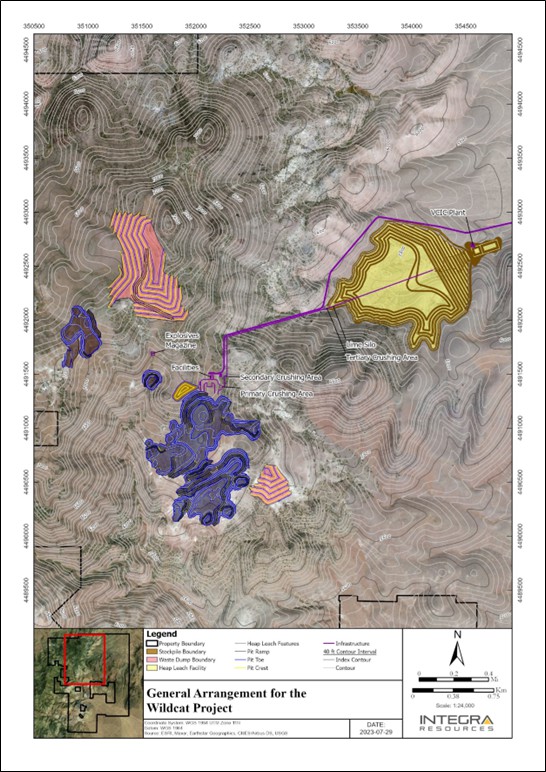

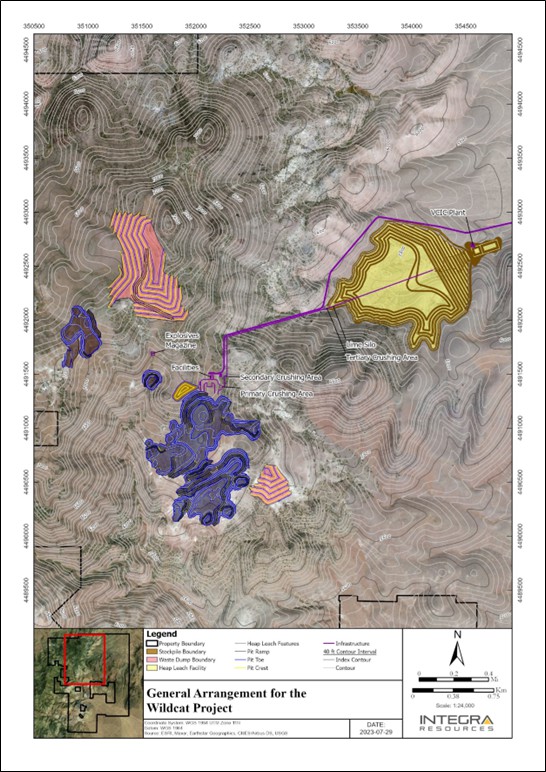

| Figure 18.3 General Arrangement for the Wildcat Project | 238 |

| | |

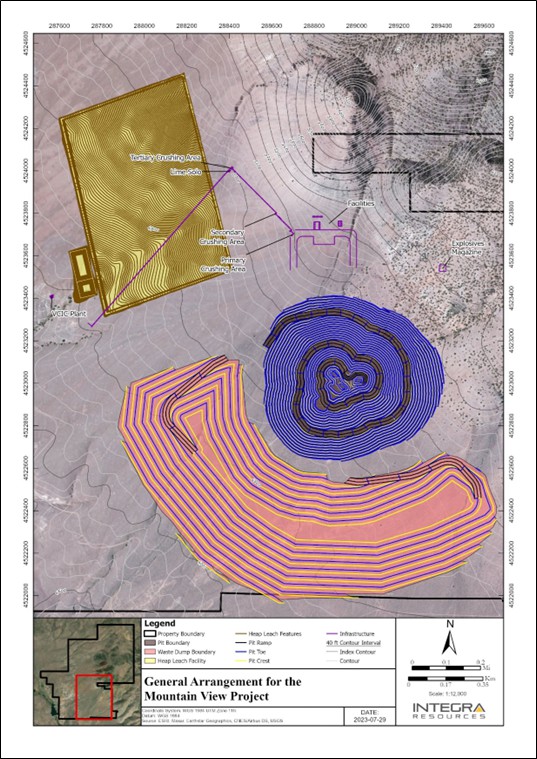

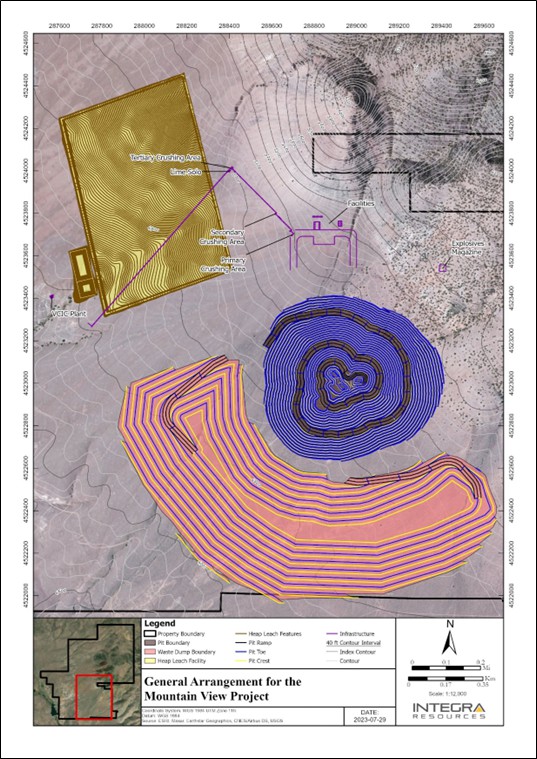

| Figure 18.4 General Arrangement for the Mountain View Project | 239 |

| | |

| Figure 22.1 Historical Gold Price (10 years) | 263 |

| | |

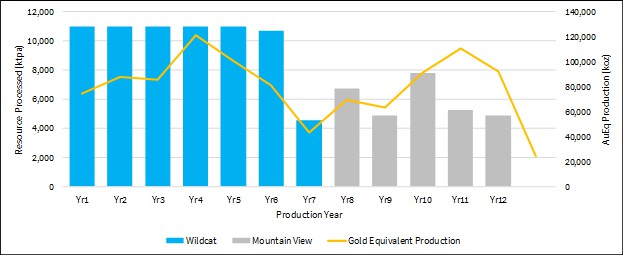

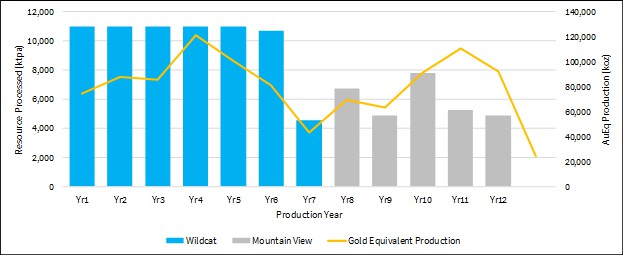

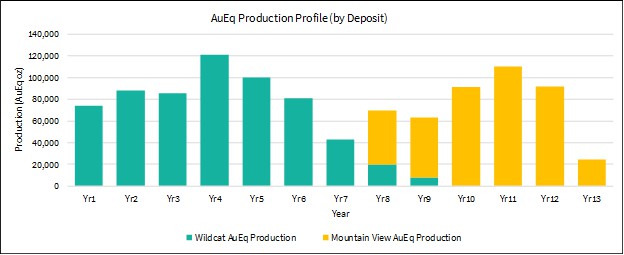

| Figure 22.2 Wildcat and Mountain View Mining Production Schedule | 264 |

| | |

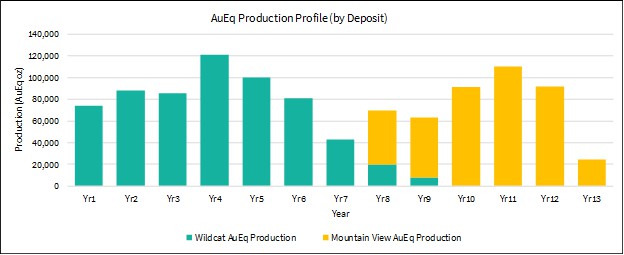

| Figure 22.3 Wildcat and Mountain View Production Schedule | 264 |

| | |

| Figure 22.4 LOM Cash Flow Chart | 267 |

| | |

| Figure 22.5 NPV Sensitivity Chart | 268 |

| | |

| Figure 22.6 IRR Sensitivity Chart | 268 |

| | |

| Figure 25.1 LOM Cash Flow Chart | 290 |

1.0 SUMMARY

1.1 Introduction

Integra Resources Corp. (Integra) has retained Micon International Limited (Micon) to assist with and compile a Preliminary Economic Assessment (PEA) for its Nevada Projects; the Wildcat Project located in Pershing County and the Mountain View Project located in Washoe County. The two Projects are located approximately 40 miles (65 km) from one another but because Integra plans to combine the two Projects and operate them sequentially as one continuous Project, a single PEA has been prepared to encompass both Projects. Micon has also been retained to compile this Technical Report to disclose the results of the PEA for the combined Project, in accordance with Canadian National Instrument (NI) 43-101 Standards of Disclosure for Mineral Projects.

On May 4, 2023, Integra Resources Corp. (Integra) and Millennial Precious Metals Corp. (Millennial) announced the completion of their previously announced at-market merger by way of a court-approved plan of arrangement. As a result, Integra and Millennial may be used interchangeably in this report.

A PEA is preliminary in nature, and it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied that would enable them to be classified as mineral reserves, and there is no certainty that the preliminary assessment will be realized. All currency amounts in this report are stated in US dollars (US$).

In this report, the terms Wildcat Project and Mountain View Project refers to the areas within the exploitation or mining concessions upon which historical exploration and mining has been conducted, while the term Wildcat property and Mountain View property refers to the entire land package within the mineral exploitation and exploration concessions.

The information in this report was derived from published material, as well as data, professional opinions and unpublished material submitted by the professional staff of Integra or its consultants, supplemented by the Qualified Person(s) (QPs) independent observations and analysis. Much of the data came from prior reports for the Wildcat and Mountain View Projects updated with information provided by Integra, as well as information researched by the QPs.

Neither the Micon QPs nor the other QPs contributing to this report have or have previously had any material interest in Integra or related entities. The relationship with Integra is solely a professional association between the client and the independent consultants. This report has been prepared in return for fees based upon agreed commercial rates and the payment of these fees is in no way contingent on the results of the reports.

This report includes technical information which requires subsequent calculations or estimates to derive sub-totals, totals and weighted averages. Such calculations or estimations inherently involve a degree of rounding and consequently introduce a margin of error. Where these occur, the QPs do not consider them to be material.

This report is intended to be used by Integra subject to the terms and conditions of its agreement with Micon. That agreement permits Integra to file this report as a Technical Report with the Canadian Securities Administrators (CSA) pursuant to provincial securities legislation or with the Securities and Exchange Commission (SEC) in the United States.

The conclusions and recommendations in this report reflect the QPs' best independent judgment in light of the information available to them at the time of writing. The QPs and Micon reserve the right, but will not be obliged, to revise this report and its conclusions if additional information becomes known to them subsequent to the date of this report. Use of this report acknowledges acceptance of the foregoing conditions.

1.2 Property Description, Location and Ownership

The Wildcat and Mountain View Projects are both located in northern Nevada, United States of America. Both Projects are northeast of Reno, which is the nearest large city. The Mountain View Project is located roughly 40 miles (65 km) northwest of the Wildcat Project.

1.2.1 Wildcat Project

The Wildcat property is located on the northeastern portion of the Seven Troughs Range, about 35 miles northwest of the town of Lovelock in Pershing County, Nevada.

The property is located in all or portions of: sections 32-36, T32N, R29E; sections 1 and 12 of T31N, R28E; sections 1-36 of T31N, R29E; and sections 4 and 5 of T30N, R29E, Mount Diablo Baseline and Meridian. The latitude and longitude of the Project are 40.5425° N, 118.7550° W and the Project is at an elevation of approximately 6,299 ft.

The Wildcat property consists of 4 patented (Fee Tracts) and 916 unpatented lode claims. The total area is 17,612 acres. The claims are on publicly owned lands administered by the U.S. Bureau of Land Management (BLM). All of the claims are located in Pershing County in northwest-north-central Nevada. Micon noted that the maintenance fee of US$151,140 has been paid, and the federal fee requirements were met for each of the claims for the assessment year ending on September 1, 2024.

According to federal and state regulations, the lode claims are renewed annually. In order to keep the claims current, a 'Notice of Intent to Hold' and payments are filed with the BLM and the counties. Tenure is unlimited, as long as filing payments are made each year.

The mineral claims were originally purchased from Clover Nevada Limited Liability Company (Clover Nevada) a subsidiary of Waterton Precious Metals Fund II Cayman, LP (Waterton). On April 29, 2021 all rights were assigned to Millennial NV Limited Liability Company (Millennial NV).

The Wildcat mineral claims are currently owned 100% by Millennial NV, which is a subsidiary of Integra.

1.2.2 Mountain View Project

The Mountain View property is located in northwest Nevada, USA, near the Granite Range, at a latitude and longitude of 40.8314° N and 119.5027° W and at an approximate elevation of 5,000 ft.

The property lies approximately 15 miles northwest of Gerlach, Nevada in Washoe County. The Mountain View property straddles the boundary between the Squaw Valley and Banjo topographic quadrangles.

The Mountain View property currently consists of 284 un-patented lode claims with a total area of approximately 5,476 acres. Millennial NV has provided Micon with copies of the mining claim maintenance fee filings, affidavits and notices of intent to hold mining claims, as filed with the BLM. Micon's QP noted that the maintenance fee of US$46,860 was paid, and that the federal fee requirements were met for each of the claims for the assessment year ending on September 1, 2024.

According to federal and state regulations, the lode claims are renewed annually. In order to keep the claims current, a 'Notice of Intent to Hold' and payments are filed with the BLM and the counties. Tenure is unlimited as long as filing payments are made each year. The land on which the claims are located is administered by the BLM.

The mineral claims were originally purchased from Clover Nevada a subsidiary of Waterton. On April 29, 2021, all rights were assigned to Millennial NV, a subsidiary of Integra.

The ownership of the claims listed in the fee filings is in the name of Millennial NV and Leslie Wittkopp. Currently Millennial NV owns 100% interest in the Mountain View Project.

1.2.3 Wildcat and Mountain View Projects, Ownership 2021 to 2023

On April 28, 2021, Millennial announced the successful completion of the previously announced series of transactions with Millennial Silver Corp. (Millennial Silver) and Clover Nevada a subsidiary of Waterton, resulting in Millennial indirectly acquiring Waterton's interest in the Wildcat property, the Mountain View property and other properties located in Nevada. The transactions were undertaken through an asset purchase agreement dated December 11, 2020 (the Asset Purchase Agreement) between Millennial (as successor to 1246768 B.C. Ltd. (768)), Millennial Silver and Waterton, and an amalgamation agreement dated December 11, 2020 between Millennial Silver and 768.

On May 4, 2023, Integra and Millennial announced the completion of their previously announced at-market merger by way of a court-approved plan of arrangement.

Under the terms of the Transaction, Integra acquired all the issued outstanding common shares of Millennial. Millennial shareholders received 0.23 of a common share of Integra for each Millennial share held. Integra subsequently consolidated its common shares on the basis of one (1) new post-consolidation common share for every two and a half (2.5) existing pre-consolidation common share. In aggregate, 16,872,050 Integra shares (post-consolidation) were issued to former Millennial shareholders as consideration for their Millennial Shares.

As a result of the Transaction, Millennial has become a wholly owned subsidiary of Integra and the Millennial shares were delisted from the TSX Venture Exchange (the TSXV) on May 5, 2023.

1.3 Accessibility, Climate, Physiography, Local Resources and Infrastructure

1.3.1 Accessibility

1.3.1.1 Wildcat Project

The Wildcat Project is accessible from the city of Reno, Nevada, via both paved and dirt roads. Access is primarily via Intestate 80 to the town of Lovelock, at approximately 91 miles from Reno. State Route 398 from Lovelock is followed (1 mile) to the intersection with State Route 399. After 12 miles, Route 399 reaches the intersection with a good-condition dirt road, which runs to the northwest. After approximately 15.6 miles, there is an intersection with a dirt road, in regular driving condition. The Project is located 4.7 miles after the intersection of this dirt road.

1.3.1.2 Mountain View Project

The Mountain View Project is easily accessed from Reno, via 124 miles of paved routes and 2.8 miles of good condition dirt roads. Access is primarily via Intestate Highway 80 up to the intersection with paved state route 447, located 33 miles east of Reno. State route 477 runs north for 75 miles, to the town of Gerlach. At Gerlach, State Route 47 turns to the northeast and at 17.6 miles, once the Squaw Valley Reservoir is reached, there is a junction with a dirt road that runs to the northwest. This dirt road is generally in good driving condition up to the Project, which is located at 2.8 miles from the intersection with the paved route.

The Wildcat and Mountain View Projects are both accessible year-round by vehicle with the only limitation being the condition of dirt roads. Potential drifting winter snow and heavy spring runoff accompanied by flooding could lead to sections of each Project's respective access road being impassible.

1.3.2 Climate and Physiography

Both the Wildcat and Mountain View Projects have semi-arid climates with high temperatures in the summer generally in the 80°F to 90°F range, with winter highs generally in the 40°F to 50°F range. Winter temperatures can be below 0°F. Precipitation at the properties usually totals more than 8 inches per year, divided between winter snow, spring rain and summer thunderstorms. The evaporation potential greatly exceeds the precipitation on an average annual basis, so the area is one with a negative water balance. The closest weather station is at Gerlach, located about 20 miles to the northwest of the Wildcat Project area and 20 miles southeast of the Mountain View Project area. Gerlach is lower in elevation than the Wildcat Project and the weather at the Project is likely to be wetter and cooler. Weather at the Mountain View Project is expected to be similar to that at the Gerlach station.

1.3.2.1 Wildcat Project

The Wildcat Project is located in the high desert of the Basin and Range Physiographic Province. It lies in the Farrell Mining District in the Seven Troughs Range, between 5,000 ft and 7,500 ft above sea level. The area is rugged and generally covered by sagebrush, grasses and a few Juniper and Pinyon trees.

1.3.2.2 Mountain View Project

The physiography of the Mountain View Project is characterized by typical basin and range topography, with north to northwest trending ranges of hills and low mountains with moderate relief, separated by wide, flat bottomed gravel filled basins. Mountain peaks east of the Project are roughly 9,000 ft and valleys are roughly 4,500 ft above sea level. Valleys in the region are typically covered by sagebrush and grasses, with scattered stands of pine trees occurring at higher elevations. The only infrastructure on the property, other than the roads, is an interstate transmission power line.

1.3.3 Local Resources and Infrastructure

1.3.3.1 Wildcat Project

The Wildcat property is located 35 miles from the town of Lovelock, Nevada. Lovelock is a town of about 3,000 people, with the infrastructure to support a mining operation. Water should be available on site, because a former water well was operated on the site by Allied Nevada Gold Corp. (Allied Nevada) and springs were observed near the access road, but power is not currently available at the site.

Claims have been staked, enlarging the Project area, to accommodate the future construction of mining infrastructure, such as heap leach pads, mine offices, equipment storage areas and resource expansion potential.

1.3.3.2 Mountain View Project

The nearest community to the Mountain View Project is Gerlach, with approximately 500 people. There are larger communities in the region that may also be used as regional supply centres should Gerlach not have the necessary supplies. Areas of the Mountain View property have been staked to account for future mine infrastructure, such as heap leach pads, mine offices, equipment storage areas and resource expansion potential.

1.3.3.3 Resources Common to the Projects

Both Projects are located north-northeast of Reno, Nevada which can provide access to international destinations if required. It is presumed that most of the skilled workforce for any operation would come from other parts of Nevada and the surrounding states.

There are larger centres and other communities in the region of both Projects that may also be used as regional supply centres, as mining is a major generator of revenue in Nevada.

1.4 History

1.4.1 Wildcat Project History

The history of the property and district has been taken directly from internal documents belonging to a prior property-holder, Lac Minerals (USA) Limited Liability Company (Lac Minerals). Mining began in the early 1900's and concentrated on epithermal quartz veins hosted within Cretaceous granodiorite. Production was small but high-grade, at less than 100,000 short tons with a grade in excess of one ounce per short ton (oz/st) gold. The patented claims on the Wildcat property were located in 1906 and 1907 and patented in May, 1912 by the Seven Troughs Monarch Mines Company. Surface cuts were taken on three main surface veins: Hero, Hillside and Wildcat. An 1,800 ft tunnel was completed in 1912 to intersect these veins at the 300 ft to 400 ft level. The veins were reported barren, but were wider than projected (Tullar, 1992).

Monex Explorations (Monex) purchased five unpatented lode claims around 1980 and worked the Tag mine intermittently. Homestake Mining Company (Homestake) took an interest in the hydrothermally altered volcanic cap northwest of the Wildcat mine area in 1982 and drilled three core holes in 1983. Based on these holes Homestake retained an interest in the property between 1984 and 1990.

Touchstone Resources Company Inc. (Touchstone), an exploration subsidiary of Cornucopia, leased the property from Homestake in 1983. Touchstone completed a 30-hole, 6,260 ft program of reverse circulation drilling in 1984. Although Touchstone reportedly developed an "inferred reserve" of 21 million short tons grading 0.021 oz/st gold at a 1.1:1 stripping ratio (Tullar, 1992), Touchstone dropped the property in 1985. Homestake drilled one 400 ft core hole to cover the 1986/1987 assessment requirement. Kincaid Exploration and Mining Co. II (Kemco) optioned the claims in 1987 and completed a 35-hole, 6,150 ft reverse circulation drilling program in the same year. Kemco dropped the property in 1988, when the Star Valley Resources/Pactolus Corporation optioned the Homestake ground, along with the Monex ground. During 1989, the Star Valley Resource/Pactolus Corporation partnership completed 12 reverse circulation drill holes totalling 3,280 ft. The partnership dropped its interest in 1989. Homestake sold its interest in the property to Monex in 1990 but retained an underlying NSR interest. Amax optioned the property in 1991 and completed a single 500 ft reverse circulation drill hole.

Lac Minerals acquired the Wildcat Project in 1992 and conducted a significant amount of exploration mapping, sampling, geophysics and the majority of the drilling on the property. In the process, it identified a large, low-grade gold resource. Sagebrush Exploration worked on the Project during the period of 1996-1998 and completed some reverse circulation drilling on the property.

On October 30, 2003, Vista Gold Corp. (Vista) announced that it has signed agreements to acquire a 100% interest in the Wildcat Project.

On July 10, 2006, Vista announced a spin-off of its existing Nevada properties into a new publicly listed company (newco) that, concurrently with the spin-off, would acquire the Nevada mining properties of the Pescio Group. The transaction was completed by way of a court-approved plan of arrangement under the Business Corporations Act (Yukon). Under the transaction, Vista's shareholders exchanged their common shares of Vista for common shares of newco and new common shares of Vista.

On May 10, 2007, Vista and Allied Nevada announced that the plan of arrangement involving Vista, Allied Nevada and the Pescio Group had closed. The transaction resulted in the acquisition by Allied Nevada of Vista's Nevada properties and the Nevada mineral assets of the Pescio Group.

On June 15, 2015, Allied Nevada announced that the United States Bankruptcy Court for the District of Delaware had approved the sale of Allied Nevada's exploration properties and related assets (excluding the Hycroft operation) to Clover Nevada.

1.4.2 Mountain View Project History

The Mountain View Project is located in the Deephole mining district and includes the old Mountain View mine, located approximately 8,000 ft north of the Severance deposit. The Mountain View vein zone averaged about 15 ft in width and cut PermoTriassic metasediments near the contact with the Granite Range batholith. The mine was originally explored from underground by the Anaconda Company in 1938, under option from the original claimants. However, no commercial mineralization was defined.

From 1939 to 1941, the Burm-Ball Co. optioned the property and produced some gold ore from a winze sunk from the main (lower) adit level. Production was said to be 1,480 ounces (oz) of gold, 6,668 oz of silver, 11,000 pounds (lbs) of copper and 6,400 lbs of lead, mostly prior to 1940 (WGM, 1997). This production was followed by intermittent unsuccessful attempts to rework the mine, most recently in 1961 and 1962.

There was little exploration or mining activity from 1940 until 1984, when the Mountain View area became the focus of a significant amount of exploration effort. The property was staked or re-staked in 1979 and there was visible activity at the time of a field examination in 1984 by NBMG staff geologists.

Rejuvenated exploration began with St. Joe in 1984 in the vicinity of the Mountain View mine and was followed by programs from US Borax in 1986, N.A. Degerstrom Inc. (Degerstrom) from 1988 to 1990, Westgold in 1989, Canyon Resources Corp. (Canyon) from 1992 to 1994, Homestake Mining Co. (Homestake) from 1995 to 1996 and, finally, Franco-Nevada Mining Corp. (Franco-Nevada) in 2000 and 2001.

In 1992, the Severance deposit was discovered by Canyon in drill hole MV92-6, which intersected 400 ft of 0.017 oz/t gold. Canyon was in a joint venture with Independence Mining at that time and went on to acquire 100% ownership in 1995. Subsequently, Homestake entered into a joint venture agreement with Canyon, with Homestake as operator.

Newmont acquired the property during the takeover of Franco-Nevada in February, 2002, and then sold the property to Vista Gold Corp. (Vista) in October, 2002.

On July 10, 2006, Vista announced a spin-off of its existing Nevada properties into a new publicly listed company (newco) that, concurrently with the spin-off, would acquire the Nevada mining properties of the Pescio Group. The transaction was completed by way of a court-approved plan of arrangement under the Business Corporations Act (Yukon). Under the transaction, Vista's shareholders exchanged their common shares of Vista for common shares of newco and new common shares of Vista.

As noted above, on June 15, 2015, Allied Nevada announced that the United States Bankruptcy Court for the District of Delaware had approved the sale of Allied Nevada's exploration properties and related assets (excluding the Hycroft operation) to Clover Nevada, a wholly-owned subsidiary of Waterton. A search by Micon could not find any press releases or Technical Reports written on or about the Mountain View Project after a Technical Report by Snowden was published in 2006.

1.5 Geological Setting and Mineralization

1.5.1 Regional Geology

The Wildcat and Mountain View Projects both lie within the Great Basin, a region and geologic province within the North American Cordillera. The Great Basin is bounded by the Colorado Plateau on the east, Sierra Nevada on the west, Snake River Plain on the north, Garlock fault and Mojave block on the south, and is approximately 600 km by 600 km in size. The majority of the Great Basin is occupied by the state of Nevada (Dickinson, 2006). The evolution of geology in the Great Basin spans from the Archean to present and is detailed by Dickinson (2006).

In the Precambrian to early Paleozoic, after the rifting of Rodinia, a miogeocline formed along the western edge of the Cordillera. This event marked the beginning of deposition of a westward thickening sedimentary package that is observed across the Great Basin today. Between Devonian and Cretaceous time, three major orogenic events, the Antler, Sonoma, and Sevier Orogenies, thrust deep-water siliciclastic rocks eastward, typically on top of shallower carbonate shelf rocks. In the Paleocene, Eocene and early-Oligocene, magmatism and volcanism, likely related to intracontinental extension, began in present-day Idaho and swept southwest across the Great Basin. This event formed numerous volcanic and intrusive units and likely had a major metallogenic influence on the Great Basin. In middle Oligocene time an ignimbrite flare up deposited additional extrusive rocks across the Great Basin. Starting at 17 Ma, crustal extension in the Great Basin formed the Northern Nevada Rift, deposited basaltic rocks, led to the formation of numerous normal faults across, and formed epithermal gold deposits across the region. Present day geological topography reflects this most recent extensional event with young basaltic rocks atop older magmatic sedimentary rocks and countless mountain ranges separated by wide basins that are bounded by range-front normal faults.

The present-day surface geology of northwest Nevada, where both the Wildcat and Mountain View Projects are located, is at the intersection of two geologic domains, defined by John (2001) as, 1) the Western andesite assemblage, commonly referred to as the Walker Lane, and 2) the Bimodal basalt-rhyolite assemblage. Underlying these Western andesite assemblage and Bimodal basalt-rhyolite assemblage are Cretaceous granodiorites, Triassic sedimentary rocks, and Paleozoic metavolcanic rocks.

Rocks within the Western andesite assemblage are interpreted to have a tectonic setting related to subduction along the continental margin arc, have a high magmatic oxidation state, and are typified by andesite-dacite, minor rhyolite, and rare basalt. Gold deposits found in the Western andesite assemblage include the Comstock Lode, Goldfield, and Tonopah.

The Bimodal basalt-rhyolite assemblage, the host assemblage of the Wildcat and Mountain View deposits, differs from the Western andesite assemblage in that these rocks are tectonically related to continental rifting, have a low magmatic oxidation state, and the most common rock types are basalt-mafic andesite and rhyolite with minor trachydacite. Aside from Wildcat and Mountain View, other gold deposits found within the Bimodal basalt-rhyolite assemblage are Fire Creek, Sleeper, Midas, Florida Canyon, and Hog Ranch. Located in northwestern Nevada, where the Walker Lane (Western andesite assemblage) and Bimodal basalt-rhyolite assemblages intersect, the Project areas around Wildcat and Mountain View are clearly in a favourable geologic terrain for the formation of economic gold deposits.

1.5.2 Wildcat Project Geology

The Wildcat Project lies in the Seven Troughs Range, which is underlain by Triassic and Jurassic sedimentary rocks and has been intruded by Cretaceous granodiorite. Cenozoic igneous activity emplaced andesite, diorite, trachyte, trachyandesite, rhyolite and basalt domes and plugs. Cenozoic flows, pyroclastic debris, and vitrophyres of rhyolitic, trachytic and andesitic composition blanket much of the area, and these are broadly related to at least four intrusive events that are mappable on the surface at the Wildcat Project. Post-mineral and Late Cenozoic conglomerates, basalt plugs and flows, tuffs, and Quaternary alluvium mask much of the area.

Deformation in the Project area is varied and locally intense. Previous workers interpreted the presence of low-angle normal faults. High-angle normal faults at the deposit and along the range front are interpreted to be related to Basin and Range faulting and regional extension. The relationship between these is uncertain, though the low angle faults have both controlled mineralization and post-dated mineralization.

Cataclastic deformation has been described in the granodiorite and probably played a role in controlling the mineralization.

1.5.3 Wildcat Project Mineralization

Precious metal mineralization at the Wildcat Project occurs with low-temperature silica, chalcedony and pyrite and can be best-described as epithermal precious metal mineralization. The entire known deposit has a footprint approximately 1,500 m long, 1,500 m wide and 150 m deep, with some areas containing significantly higher gold mineralization than others. Principal controls on the mineralization are lithologic, high-angle faults, and the contact between the granodiorite and lapilli tuff breccia.

Precious metal mineralization is identified in two lithologies at Wildcat, the granodiorite and lapilli tuff breccia. Mineralization in the granodiorite is typically limited to discontinuous quartz veins that strike north-northeast, dip steeply (70° to 80°), display localized and intense acid-bleaching (kaolinization) in the adjacent host rock, and appear to occupy a set of faults shown to predate the bulk of magmatic-hydrothermal activity in the district. Typically, these veins range in thickness from 10 cm to 2.5 m.

1.5.4 Mountain View Project Geology

The geology around the Mountain View Project consists of Miocene volcanic and volcaniclastic sedimentary rocks, greenschist facies, Jurassic rocks, and a large granodiorite (99.9 Ma) intrusion just to the east of the property.

Mapping shows that the western portion of the Project area consists of Quaternary alluvium and Miocene rocks, including mafic tuffs, rhyolite tuffs and flows, volcaniclastic sediments and basalts. At the range front, Miocene rocks are in the hanging wall of a structural contact with Cretaceous and Jurassic rocks. The normal range front fault on the western edge of the Granite range runs northwest-southeast, dips steeply southwest, and is has geometry consistent with broader Basin and Range faulting in northwestern Nevada.

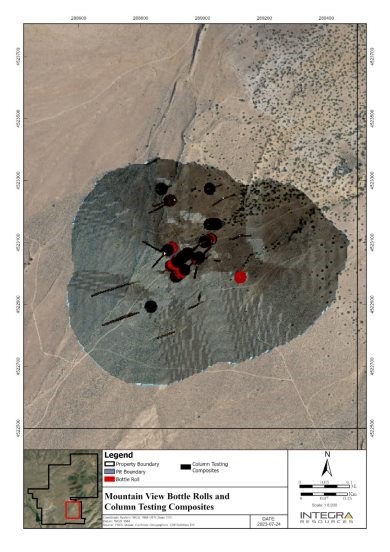

Since the late 1980s two mineralized zones, Severance and Buffalo Hills, have been the target of exploration at the Mountain View Project. This report focuses on the Severance area, as that is where drilling during 2021 and 2022 was completed. The Buffalo Hills mineralized zone is not the subject of this Technical Report.

The Severance deposit is hosted in the Severance Rhyolite (15.4 Ma). The deposit is located in the hanging wall of the northwest-striking southwest-dipping range-bounding fault on the western side of the Granite range. Juxtaposed to the deposit, in the footwall side of this fault, is Cretaceous granodiorite. In only a couple of instances, the Severance rhyolite outcrops along the range front and drilling evidence suggests it occupies an area approximately 3,200 ft long and 1,000 ft wide. Much of the Severance deposit is overlain by 500 ft to 700 ft of Quaternary alluvial cover.

A second body of rhyolite (Cañon Rhyolite) crops out near the Squaw Valley reservoir and is interpreted to extend to the northeast toward the Buffalo Hills zone, located approximately 5,000 ft to the west-northwest of Severance. The Cañon and Severance rhyolites are likely the same unit.

Structure on the property is dominated by northwest and northeast trending faults and fracture sets, though a number of north-south lineaments have been identified from aerial photographs. Major dip-slip offsets occur along the range-front fault system and these are, in turn, offset by the northeast trending structures. The latest movement on the range front fault system is interpreted to offset recent alluvium (Homestake, 1996)

1.5.5 Mountain View Project Mineralization

The mineralized zone at the Mountain View Project has a roughly tabular shape, striking towards the northwest and dipping steeply to the southwest. The mineralization occurs beneath unconsolidated alluvium, between approximately 400 ft and 1,000 ft below surface. Two different styles of epithermal gold mineralization are recognized as occurring on the Project:

Both styles of mineralization are interpreted to be the same age and are products of the same mineralizing event. Potassium-argon dating indicates that the age of mineralization is approximately 14 Ma to 15 Ma.

Both types of mineralization are geochemically similar, with high arsenic, mercury and antimony levels, low base metal levels, and high silver to gold ratios of approximately 7:1. Petrographic and microprobe work by Homestake on high grade gold samples from the Severance deposit has identified abundant silver selenides and coarse grains of electrum.

The high-grade zones at the Severance zone occur along northwest and east-northeast trending structures.

Low sulphidation epithermal mineralization at the Severance deposit has been interpreted as a somewhat planar zone of low to moderate grade gold mineralization, hosted primarily by the Severance Rhyolite. The zone has a roughly tabular shape striking toward the northwest and dipping steeply toward the southwest, roughly parallel with the interpreted orientation of the range-front fault. The mineralization occurs beneath the unconsolidated alluvium at the top of bedrock. Several small high-grade zones are interpreted as being strongly structurally controlled and are completely encompassed by lower grade mineralization. They are interpreted to have generally northwest trending and northeast trending cross-cutting orientations.

1.6 Millennial 2021 to 2022 Exploration Programs

Millennial, prior to its merger with Integra, undertook the following exploration and drilling programs, summarized below.

1.6.1 Wildcat and Mountain View Projects Surface Exploration Programs

1.6.1.1 Wildcat Surface Exploration

During the 2021 and 2022 field seasons, Millennial undertook a mapping and surface sampling program with the aim of identifying areas of interest for additional exploration drilling and to gain a broader understanding of the mineral potential of the Wildcat Project.

The Millennial surface mapping and rock chip sampling program covered the entire 17,612-acre land position, aside from areas with post-mineral rocks or cover. In areas of particular interest, identified by analysis of historical work and Millennial field mapping, sample density was higher than in areas where rocks that typically do not host the mineralization were located.

When collecting samples, Millennial attempted to take the highest-grade samples to get a complete understanding of the potential for gold mineralization at depth. In addition to trying to collect high-grade samples, Millennial sampled each mapped lithology on the property, thus gaining a comprehensive and representative understanding of which lithologies and areas have the best potential for hosting potentially economic gold mineralization.

In addition to the surface sampling program, a field mapping program of the lithology, alteration and geological structures was carried out by Millennial. Field mapping covered the entire Wildcat Project, but particular attention was given to the main Wildcat deposit area.

Results of the mapping and exploration campaigns indicated that there is good potential for additional mineralization beyond of the areas covered by the PEA discussed in this Technical Report. Mapping and sampling also indicated that, wherever the lapilli tuff breccia is located, it is likely to have gold greater than 0.25 ppm. Interpretations of mapping and sampling data north of the main Wildcat deposit, at the Cross-Roads area, indicate a favourable potential for expanding the gold resource in this area. Moreover, sampling and mapping at the Snow Squall area, south of the main Wildcat deposit, revealed that the andesite can be a viable host for gold mineralization and follow up exploration is warranted at Snow Squall.

1.6.1.2 Mountain View Surface Exploration

Neither Millennial nor Integra has undertaken any surface exploration at Mountain View.

1.6.2 Wildcat and Mountain View Projects Drilling Programs

1.6.2.1 Wildcat Drilling

In 2022, Millennial completed a 12-hole (1,297.99 m) drill program on the Wildcat property, totalling 1,297.99 m.

Historical drilling provided ample evidence for a gold deposit at the Wildcat Project and, thus the 2022 drill holes were designed to primarily collect metallurgical and geotechnical information. Each hole drilled in 2022 intersected mineralization within the planned oxide open pit. Holes WCCD-0005, WCCD-0010 and WCCD-0012, intersected mineralization outside the previous 2020 mineral resource pit shell, suggesting there is additional mineralization that can be added to the resource at the Wildcat deposit and that further exploration is warranted.

1.6.2.2 Mountain View Drilling

The drill program at the Mountain View property consisted of 32 drill holes, totalling 8,107.6 m. Two of the holes, MVRC-0001 and MVRC-0002 were drilled using reverse circulation. These holes were drilled with an RC685 drill rig. Twenty-five of the holes drilled at the Mountain View Project were diamond bit core holes that were all collared using a PQ hole diameter. One hole, MVCD-0015 had to be reduced twice in size while drilling, from PQ to HQ and from HQ to NQ, due to difficult drilling conditions. Five holes (MVCD-0001A, 0011, 0012, 0013 and 0014) were collared with reverse circulation drilling and then transitioned to PQ diamond core drilling closer to the interpreted location of the mineralization. Core holes were drilled with CT14 and CT20 drill rigs.

Throughout the program, drilling conditions were difficult, and nine holes were lost.

Historical drilling provided ample evidence for a gold deposit at the Mountain View Project, and holes for the Millennial drilling campaign were designed primarily to collect metallurgical and geotechnical information, while focusing on minimal environmental disturbance. The program was designed to confirm continuity of the mineralization in a number of areas within the deposit.

Over 50% of the holes drilled at Mountain View in 2021 and 2022 intersected mineralization, suggesting that the mineralization is fairly continuous. Some drill holes intersected economic gold grades outside the area of the pit designed for the PEA and this tends to reinforce the hypothesis that there are areas with the potential to host additional economic mineralization at the Project.

1.7 Metallurgical Testwork

Historical metallurgical testwork has been undertaken on both the Wildcat and Mountain View Projects and Millennial, prior to its merger with Integra, undertook further testwork, summarized below.

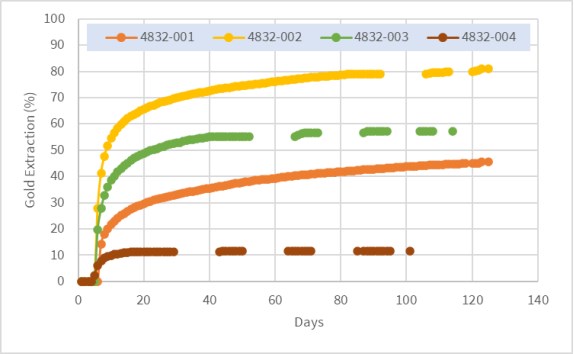

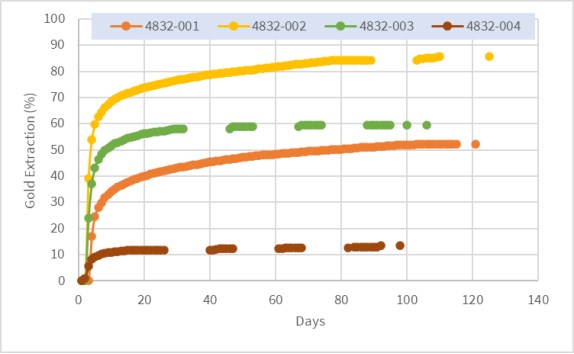

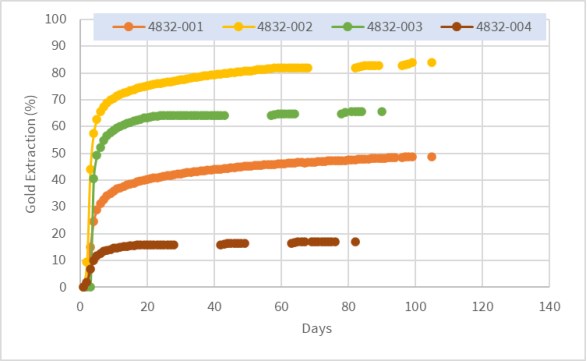

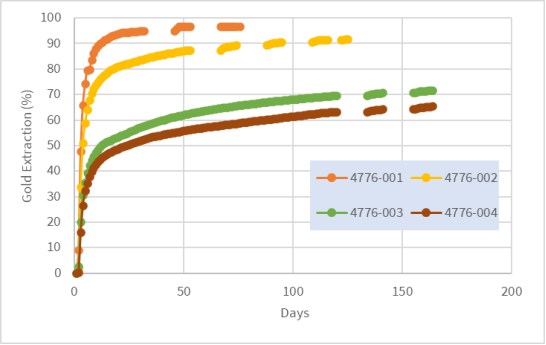

1.7.1 Wildcat Project

The composite samples selected by Millennial to represent typical oxide mineralization within the Wildcat mineral resources were amenable to heap leaching. Column leach tests suggest that gold extractions of around 60% to 80% could be achieved for the predominant mineralization-type (oxide rhyolite volcaniclastic) under typical design conditions. Gold recoveries of about 50% from oxide granodiorite were achieved from column leach tests. Corresponding silver extractions of between 20% to 30% would be expected from oxide mineralization. Column test results using sulphide mineralization suggested that this material was not amenable to heap leaching.

Bottle roll tests with both coarse and fine material indicated a significant negative relationship between gold recovery and sulphur content, with a steep drop off of gold extraction with sulphide sulphur assays higher than 0.3%. Silver recoveries also tended to reduce with higher sulphur.

Bottle roll cyanide and lime requirements for oxide rhyolite volcaniclastic samples tested were reasonable, typically about 0.2 kg NaCN /t and 1.4 kg lime /t. However, reagent requirements for the oxide granodiorite samples were significantly higher. Corresponding cyanide consumptions for the column tests were 3 to 5 times higher, primarily due to long extended leaching times.

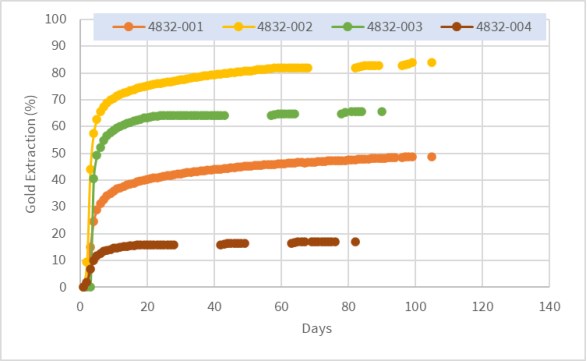

Hydraulic conductivity testing showed that permeability was high for the P80 9.5 mm oxidized rhyolitic vocaniclastic samples (4832-002 and 003), although it was lower for 4832-001, the oxidized granodiorite composite. This result suggests that oxidized granodiorite may require cement agglomeration or blending with high permeability material.

During the column tests there was very little slumping (typically less than 1%) and there were no issues with solution channelling or fines migration during leaching.

Wildcat samples were classified as "very soft" in terms of crusher work index and "moderate to very abrasive" based on Bond abrasion index tests.

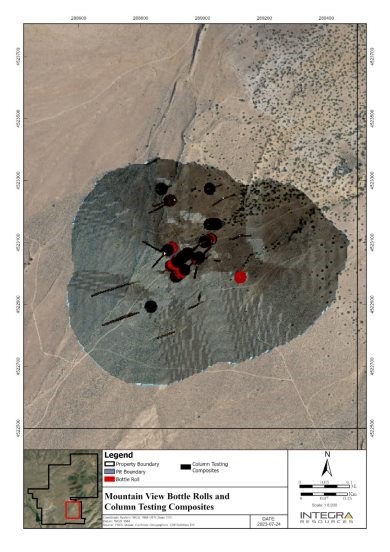

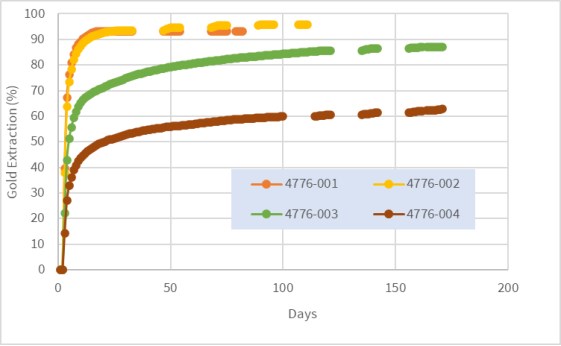

1.7.2 Mountain View Project

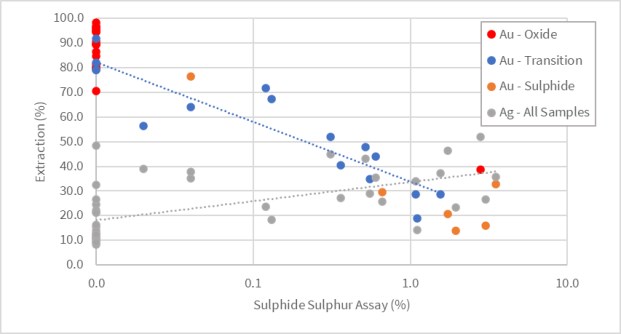

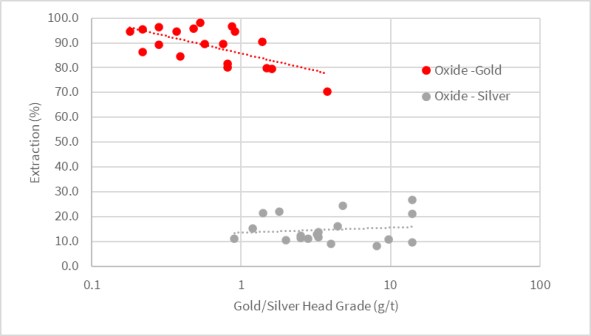

The Mountain View composite samples selected by Millennial to represent typical oxide mineralization within the mineral resources were amenable to heap leaching. Column leach tests suggest that high gold extractions (>90%) could be achieved under typical design conditions. Corresponding silver extractions of around 20% would be expected.

Bottle roll and column leach tests on transition mineralization, which would be found at the deposit oxide-sulphide boundaries, suggest that gold extraction from this material will be about 30% lower than gold extraction from oxide mineralization.

Bottle roll cyanide and lime requirements for all samples tested were reasonable, averaging 0.2 kg NaCN/t and 1.82 kg lime/t for the P80 75 µm tests. Cyanide consumptions for the column tests were relatively high (up to 2.14 kg NaCN/t), primarily due to long extended leaching times.

Hydraulic conductivity testing showed that permeability was high for all the P80 19 mm oxide samples.

During the column tests, there was very little slumping (typically less than 1%) and there were no issues with solution channeling or fines migration during leaching.

Mountain View samples were classified as "very soft" in terms of crusher work index and "moderately abrasive to abrasive" based on the Bond abrasion index tests.

Preliminary flotation tests on four transition and sulphide variability samples gave gold recoveries between 59% and 78%.

1.8 Mineral Resource Estimate

1.8.1 Mineral Resource Estimate for the Wildcat Project

1.8.1.1 Wildcat Methodology

Modelling for the Wildcat deposit was performed using LeapFrog GEO v2021.2 (LeapFrog) and Isatis NEO mining v2022.12 (Isatis). LeapFrog was used for modelling the lithological, alteration and oxidation profiles. Isatis was used for the grade estimation, which consisted of 3D block modelling and the inverse distance cubed (ID3) interpolation method. Statistical studies, capping and variography were completed using Isatis and Microsoft Excel. Capping and validations were carried out in Isatis and Excel.

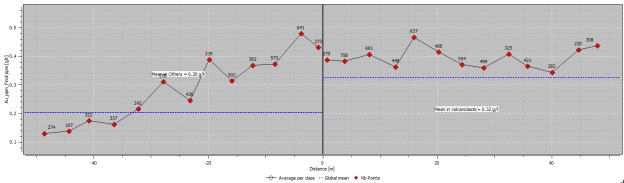

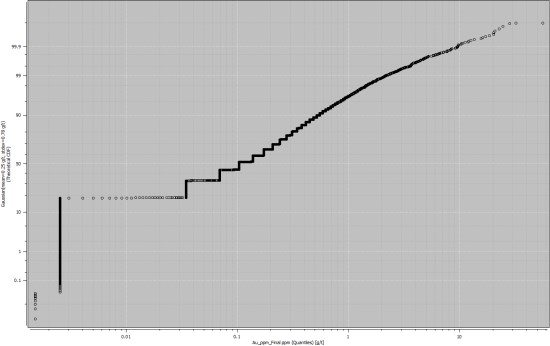

1.8.1.2 Wildcat Mineral Resource Database