| Florida Canyon Gold Mine | Page ii |

| Florida Canyon Gold Inc. | NI 43-101 Technical Report |

Date and Signature Page

This Technical Report on the Florida Canyon Gold Mine project is submitted to Florida Canyon Gold Inc. and is effective 28 June 2024.

The Qualified Persons and Responsible Report Sections follow:

Qualified Person | Responsible for Report Sections |

Dr. Todd Harvey | 1.9,1.15,1.16,1.18,1.19,1.20,1.21,1.22,1.23.3, 13,17,18,19,21,22,24,25.4,25.8,25.12,25.13,25.14,25.15,26.3,27 |

Terre Lane | 1.1, 1.2, 1.3, 1.4, 1.10,1.11, 1.12, 1.13, 1.14, 1.16, 1.18, 1.19, 1.20, 1.21, 1.22, 1.23.2, 2; 3; 4; 5; 12.6,12.7; 14; 15; 16; 18; 19; 21; 22; 23; 24; 25.1, 25.2, 25.5, 25.6, 25.7, 25.9, 25.11, 25.12, 25.13, 25.14, 25.15; 26.2; and 27 |

Dr. Hamid Samari | 1.5, 1.6, 1.7, 1.8, 1.23.1; 6; 7; 8; 9; 10; 11; 12; 25.2, 25.3; 26.1; 27 |

Larry Breckenridge | 1.17, 1.23.4; 20; 25.10; 26.4 |

| (Signed) "Todd Harvey" | | 11 July 2024 |

| Signature Dr. Todd Harvey | | Date |

| | | |

| | | |

| (Signed) "Terre Lane" | | 11 July 2024 |

| Signature Terre Lane | | Date |

| | | |

| | | |

| (Signed) "Hamid Samari" | | 11 July 2024 |

| Signature Hamid Samari | | Date |

| | | |

| | | |

| (Signed) "Larry Breckenridge" | | 11 July 2024 |

| Signature Larry Breckenridge | | Date |

| Florida Canyon Gold Mine | Page iii |

| Florida Canyon Gold Inc. | NI 43-101 Technical Report |

TABLE OF CONTENTS

| 1.0 SUMMARY | 16 |

| 1.1 Introduction | 16 |

| 1.2 Terms of Reference | 16 |

| 1.3 Project Setting | 16 |

| 1.4 Mineral Tenure, Royalties, Environmental Liabilities and Permitting | 17 |

| 1.5 Geology, Mineralization, and Deposit Type | 17 |

| 1.6 History | 18 |

| 1.7 Drilling and Sampling | 18 |

| 1.8 Data Verification | 19 |

| 1.9 Metallurgical Test Work | 19 |

| 1.10 Mineral Resource Estimation | 20 |

| 1.11 Mineral Resource Statement | 20 |

| 1.12 Mineral Reserve Estimation | 21 |

| 1.13 Mineral Reserve Statement | 22 |

| 1.14 Mining Method | 22 |

| 1.14.1 Hydrologic Considerations | 22 |

| 1.14.2 Open Pit Geotechnical Considerations | 22 |

| 1.14.3 Mine Plan | 23 |

| 1.15 Recovery Methods | 23 |

| 1.16 Project Infrastructure | 24 |

| 1.17 Environmental, Permitting and Social Considerations | 24 |

| 1.18 Markets and Contracts | 24 |

| 1.19 Capital Cost Estimates | 24 |

| 1.20 Operating Cost Estimates | 25 |

| 1.21 Economic Analysis | 25 |

| 1.22 Interpretation and Conclusions | 26 |

| 1.23 Recommendations | 26 |

| 1.23.1 Geology | 26 |

| 1.23.2 Mining | 27 |

| 1.23.3 Metallurgy and Processing | 27 |

| 1.23.4 Environmental Studies | 27 |

| 2.0 INTRODUCTION | 28 |

| 3.0 RELIANCE ON OTHER EXPERTS | 31 |

| 4.0 PROPERTY DESCRIPTION AND LOCATION | 32 |

| 4.1 Environmental Liabilities and Permitting | 33 |

| 5.0 ACCESS, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE, AND PHYSIOGRAPHY | 37 |

| 6.0 HISTORY | 38 |

| 7.0 GEOLOGIC SETTING AND MINERALIZATION | 41 |

| 7.1 Regional Geology | 41 |

| Florida Canyon Gold Mine | Page iv |

| Florida Canyon Gold Inc. | NI 43-101 Technical Report |

7.2 Local Geology | 42 |

7.3 Florida Canyon Geology | 42 |

7.4 Mineralization | 44 |

8.0 DEPOSIT TYPE | 46 |

9.0 EXPLORATION | 47 |

9.1 Pre-Argonaut | 47 |

9.2 Argonaut | 47 |

9.2.1 Drilling | 47 |

9.3 Field Mapping | 47 |

9.3.1 Pre- Argonaut | 47 |

9.3.2 Argonaut | 48 |

10.0 DRILLING | 52 |

10.1 Introduction | 52 |

10.2 Drill Methods | 55 |

10.2.1 Pre-Argonaut | 55 |

10.2.2 Argonaut | 55 |

10.3 Logging Procedure | 56 |

10.3.1 Pre-Argonaut | 56 |

10.3.2 Argonaut | 57 |

10.4 Recovery | 57 |

10.4.1 Pre-Argonaut | 57 |

10.4.2 Argonaut | 57 |

10.5 Collar Survey | 58 |

10.5.1 Pre-Argonaut | 58 |

10.5.2 Argonaut | 58 |

10.6 Down-Hole Surveys | 58 |

10.6.1 Pre-Argonaut | 58 |

10.6.2 Argonaut | 58 |

10.7 QP Comments on Section 10 Drilling | 59 |

11.0 SAMPLE PREPARATION, ANALYSIS, AND SECURITY | 60 |

11.1 Sampling | 60 |

11.1.1 Pre-Argonaut | 60 |

11.1.2 Argonaut | 60 |

11.2 Sample Preparation | 60 |

11.2.1 Pre-Argonaut | 60 |

11.2.2 Argonaut | 61 |

11.3 Analytical Procedure | 61 |

11.3.1 Pre-Argonaut | 61 |

11.3.2 Argonaut | 61 |

11.4 Quality Assurance and Quality Control | 62 |

11.4.1 Pre-Argonaut | 62 |

| 7.2 Local Geology | 42 |

| 7.3 Florida Canyon Geology | 42 |

| 7.4 Mineralization | 44 |

| 8.0 DEPOSIT TYPE | 46 |

| 9.0 EXPLORATION | 47 |

| 9.1 Pre-Argonaut | 47 |

| 9.2 Argonaut | 47 |

| 9.2.1 Drilling | 47 |

| 9.3 Field Mapping | 47 |

| 9.3.1 Pre- Argonaut | 47 |

| 9.3.2 Argonaut | 48 |

| 10.0 DRILLING | 52 |

| 10.1 Introduction | 52 |

| 10.2 Drill Methods | 55 |

| 10.2.1 Pre-Argonaut | 55 |

| 10.2.2 Argonaut | 55 |

| 10.3 Logging Procedure | 56 |

| 10.3.1 Pre-Argonaut | 56 |

| 10.3.2 Argonaut | 57 |

| 10.4 Recovery | 57 |

| 10.4.1 Pre-Argonaut | 57 |

| 10.4.2 Argonaut | 57 |

| 10.5 Collar Survey | 58 |

| 10.5.1 Pre-Argonaut | 58 |

| 10.5.2 Argonaut | 58 |

| 10.6 Down-Hole Surveys | 58 |

| 10.6.1 Pre-Argonaut | 58 |

| 10.6.2 Argonaut | 58 |

| 10.7 QP Comments on Section 10 Drilling | 59 |

| 11.0 SAMPLE PREPARATION, ANALYSIS, AND SECURITY | 60 |

| 11.1 Sampling | 60 |

| 11.1.1 Pre-Argonaut | 60 |

| 11.1.2 Argonaut | 60 |

| 11.2 Sample Preparation | 60 |

| 11.2.1 Pre-Argonaut | 60 |

| 11.2.2 Argonaut | 61 |

| 11.3 Analytical Procedure | 61 |

| 11.3.1 Pre-Argonaut | 61 |

| 11.3.2 Argonaut | 61 |

| 11.4 Quality Assurance and Quality Control | 62 |

| 11.4.1 Pre-Argonaut | 62 |

| Florida Canyon Gold Mine | Page v |

| Florida Canyon Gold Inc. | NI 43-101 Technical Report |

| 11.4.2 Argonaut | 63 |

| 11.5 Database | 65 |

| 11.5.1 Pre-Argonaut | 65 |

| 11.5.2 Argonaut | 65 |

| 11.6 Sample Security | 65 |

| 11.6.1 Pre-Argonaut | 65 |

| 11.6.2 Argonaut | 66 |

| 11.7 QP Comments on Section 11 Sample Preparation, Analyses, And Security | 66 |

| 12.0 DATA VERIFICATION | 68 |

| 12.1 Historical Data Verification | 68 |

| 12.2 Data Verification by International Mining Consultants | 68 |

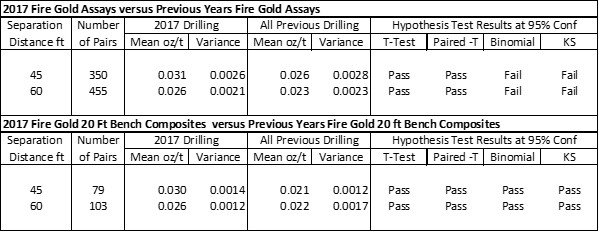

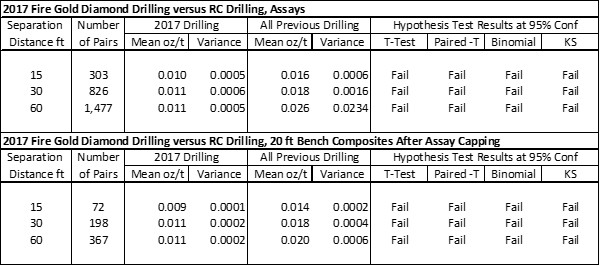

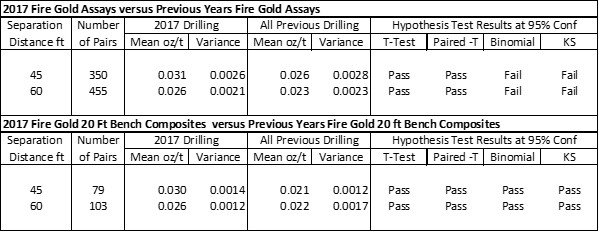

| 12.2.1 2017 Drilling Compared to Pre-2015 Drilling | 68 |

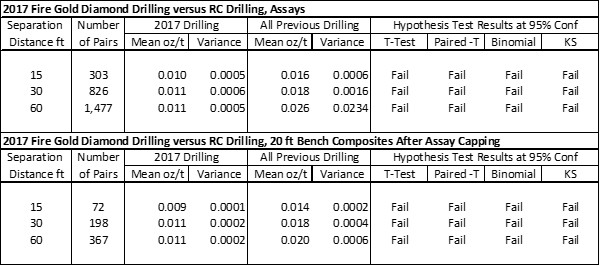

| 12.2.2 DDH to RC Comparison | 69 |

| 12.3 Data Verification by Global Resource Engineering | 70 |

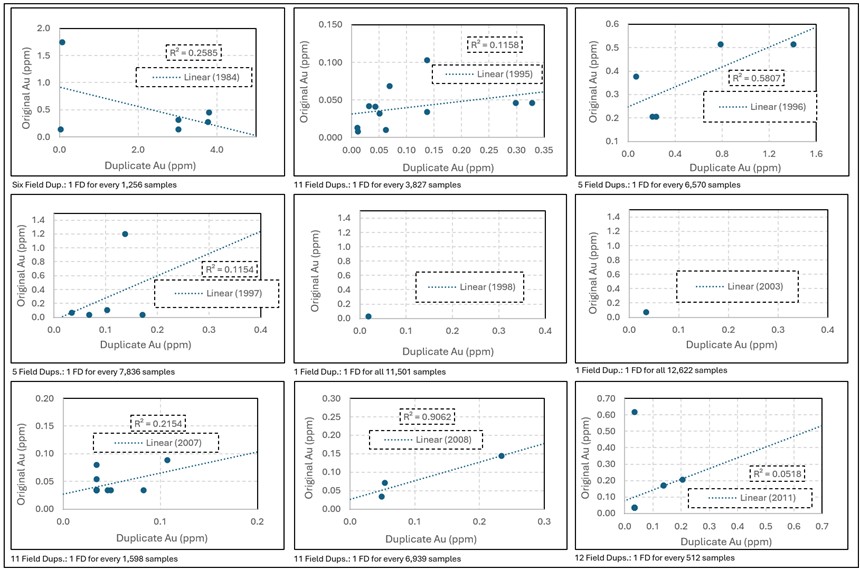

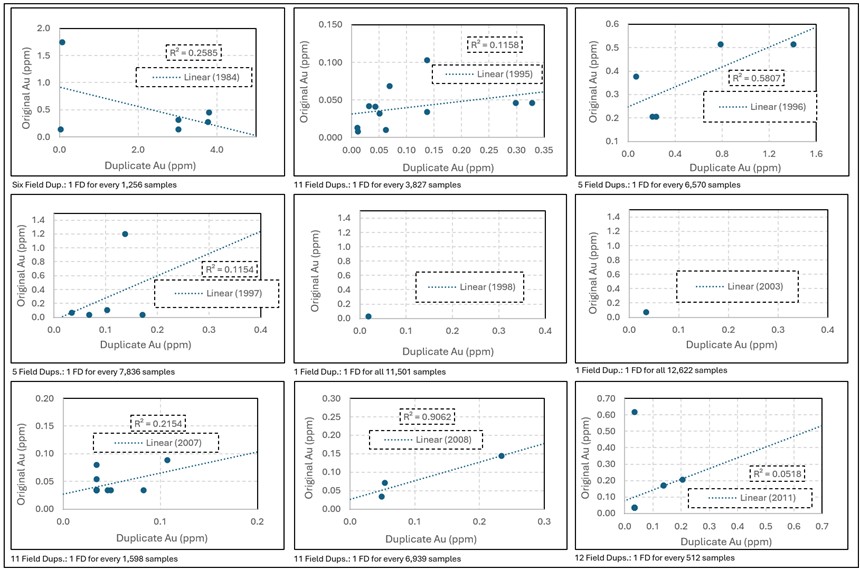

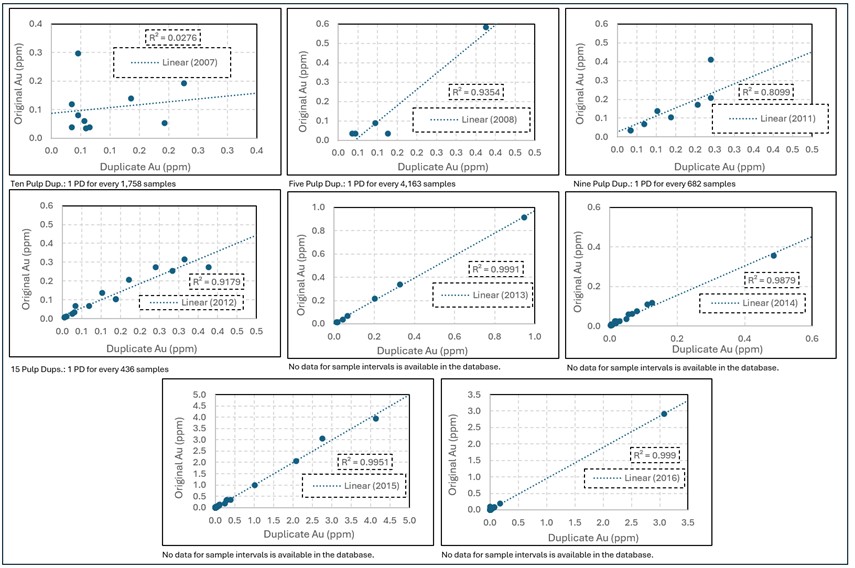

| 12.3.1 Historic Data (1981 to 2016) | 70 |

| 12.3.2 2017 QA/QC | 73 |

| 12.3.3 2020-2023 Database | 81 |

| 12.3.4 Verification of Florida Canyon Mine Analytical Quality Control Data | 82 |

| 12.3.5 2020 QA/QC | 82 |

| 12.3.6 2021 QA/QC | 87 |

| 12.3.7 2022 QA/QC | 93 |

| 12.3.8 2023 QA/QC | 101 |

| 12.3.9 The Field Visit by GRE, Geological Data Verification and Check Assays | 106 |

| 12.4 Data Verification QP Opinion on Adequacy | 124 |

| 12.5 Metallurgy QP Opinion on Adequacy | 124 |

| 12.6 Resource Estimation QP Opinion on Adequacy | 124 |

| 12.7 Mine Planning QP Opinion on Adequacy | 125 |

| 13.0 MINERALOGICAL PROCESSING AND METALLURGICAL TESTING | 126 |

| 13.1 Metallurgical Test Work | 126 |

| 13.2 Process Optimization Test Work | 127 |

| 13.3 Gold Recovery Modelling | 128 |

| 14.0 MINERAL RESOURCE ESTIMATE | 131 |

| 14.1 Database | 131 |

| 14.1.1 Samples and Composites | 131 |

| 14.1.2 Sample Capping | 131 |

| 14.2 Model Description | 132 |

| 14.2.1 Geologic Interpretation | 132 |

| 14.2.2 Density Assignment | 133 |

| 14.2.3 Domains | 134 |

| 14.3 Grade Estimation | 135 |

| 14.4 Mineral Resource Classification | 136 |

| Florida Canyon Gold Mine | Page vi |

| Florida Canyon Gold Inc. | NI 43-101 Technical Report |

| 14.5 Model Validation | 136 |

| 14.5.1 Sensitivity Analysis Using Grade Smoothing in the LIK Model | 141 |

| 14.5.2 Reconciliation | 141 |

| 14.6 Mineral Resource Estimate | 145 |

| 14.7 Grade Sensitivity Analysis | 147 |

| 14.8 Factors that May Affect the Mineral Resource Estimates | 148 |

| 14.9 QP Comments on Item 14 "Mineral Resource Estimates" | 149 |

| 15.0 MINERAL RESERVE ESTIMATION | 150 |

| 15.1 Open Pit Mineral Reserve Estimates | 150 |

| 15.1.1 Material Type Classification | 150 |

| 15.1.2 Open Pit Resource Mine Planning Block Model | 150 |

| 15.1.3 Open Pit Metallurgical Recoveries | 150 |

| 15.1.4 Open Pit Cut-Off Grade | 151 |

| 15.1.5 Open Pit Optimization | 152 |

| 15.1.6 Reserve Pit Design | 153 |

| 15.2 Mineral Reserves | 155 |

| 15.3 Factors that may affect the Mineral Reserves | 155 |

| 15.4 QP comments on Section 15 Mineral Reserve Estimation | 156 |

| 16.0 MINING METHODS | 157 |

| 16.1 Hydrologic Considerations | 157 |

| 16.2 Open Pit Geotechnical Considerations | 157 |

| 16.3 Open Pit Mine Design | 158 |

| 16.4 Mining Operations | 169 |

| 16.4.1 Drilling | 169 |

| 16.4.2 Blasting | 169 |

| 16.4.3 Loading | 169 |

| 16.4.4 Hauling | 169 |

| 16.4.5 Mine planning | 170 |

| 16.4.6 Equipment Requirements | 180 |

| 17.0 RECOVERY METHODS | 181 |

| 17.1 Introduction | 181 |

| 17.2 Ore Stacking | 181 |

| 17.3 Barren and Pregnant Leaching Solution Processing | 181 |

| 17.4 Carbon Processing | 182 |

| 17.5 Refining | 182 |

| 17.6 Ventilation | 182 |

| 17.7 Planned Processing Expansion Project for 2024 | 182 |

| 17.8 Primary Process Equipment and Pond Capacities | 182 |

| 17.9 Reagents | 183 |

| 17.10 Gold Recovery | 184 |

| 18.0 PROJECT INFRASTRUCTURE | 185 |

| Florida Canyon Gold Mine | Page vii |

| Florida Canyon Gold Inc. | NI 43-101 Technical Report |

| 18.1 Primary Access Road | 185 |

| 18.2 Mine Haul Roads | 185 |

| 18.3 Principal Mine and Maintenance Facilities | 185 |

| 18.3.1 Maintenance Facilities | 185 |

| 18.3.2 Truck Shop and Truck Wash | 185 |

| 18.3.3 Fuel Tank Farm | 187 |

| 18.3.4 Explosive Magazine | 187 |

| 18.3.5 Waste Rock Storage Facilities | 187 |

| 18.4 Principal Process Facilities | 187 |

| 18.4.1 Crushing Plant | 187 |

| 18.4.2 Overland Conveyor | 188 |

| 18.4.3 Leach Pad Facility | 188 |

| 18.4.4 Process Ponds | 188 |

| 18.4.5 Carbon in Column Plant | 188 |

| 18.4.6 Gold Recovery Plant | 188 |

| 18.4.7 Assay Laboratory | 189 |

| 18.5 Other Infrastructure | 189 |

| 18.5.1 Office Buildings | 189 |

| 18.5.2 Electric Power | 189 |

| 18.5.3 Water Sources | 190 |

| 19.0 MARKET STUDIES AND CONTRACTS | 191 |

| 19.1 Metal Prices | 191 |

| 19.2 Market Studies | 191 |

| 19.3 Contracts | 192 |

| 20.0 ENVIRONMENTAL STUDIES, PERMITTING, AND SOCIAL OR COMMUNITY IMPACT | 193 |

| 20.1 Environmental Studies | 193 |

| 20.2 Environmental Management Planning | 194 |

| 20.2.1 WPCP Management Plans | 195 |

| 20.2.2 Waste Rock Management | 195 |

| 20.2.3 Known Environmental Issues Nitrate Plume | 196 |

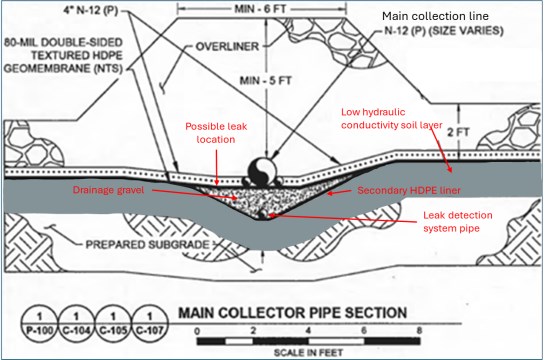

| 20.2.4 Known Environmental Issues Leak Detection System | 196 |

| 20.3 Required Permits and Status | 197 |

| 20.3.1 Federal Permitting | 200 |

| 20.3.2 State Permitting | 201 |

| 20.3.3 Local Permitting | 203 |

| 20.3.4 FCM Permit Compliance | 203 |

| 20.3.5 Future Permit Amendments | 204 |

| 20.4 Social and Community Requirements | 205 |

| 20.5 Mine Closure | 205 |

| 20.5.1 Regulatory Requirements | 205 |

| 20.5.2 Reclamation Bonding and Closure Cost Estimates | 206 |

| 20.5.3 Existing Bonding at FCM | 207 |

| Florida Canyon Gold Mine | Page viii |

| Florida Canyon Gold Inc. | NI 43-101 Technical Report |

| 21.0 CAPITAL AND OPERATING COSTS | 208 |

| 21.1 Capital Costs | 208 |

| 21.2 Operating Costs | 209 |

| 21.3 QP Comments on Section 21 Capital and Operating Costs | 209 |

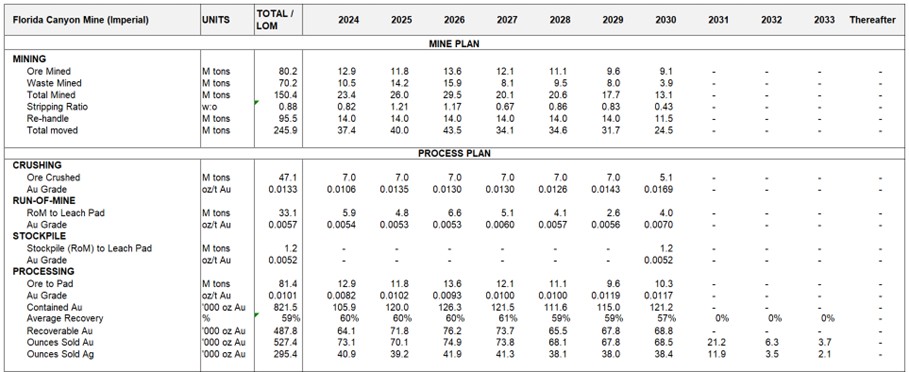

| 22.0 ECONOMIC ANALYSIS | 210 |

| 22.1 Introduction | 210 |

| 22.2 Methods, Assumptions, and Basis | 210 |

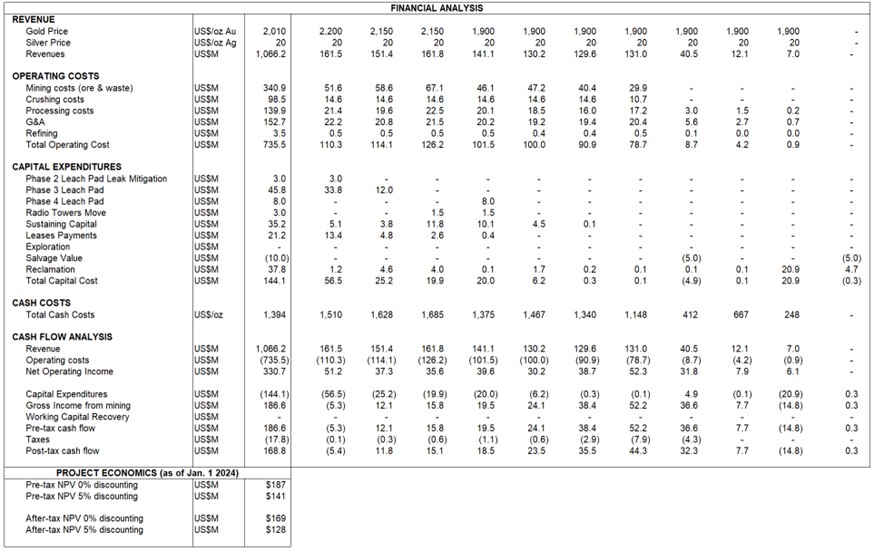

| 22.3 Base Case Financial Analysis Summary | 211 |

| 22.4 Mineral Reserve Case Financial Analysis Summary | 214 |

| 22.4.1 Sensitivity Analysis | 214 |

| 22.5 QP Comments on Section 22 Economic Analysis | 215 |

| 23.0 ADJACENT PROPERTIES | 216 |

| 24.0 OTHER RELEVANT DATA AND INFORMATION | 217 |

| 25.0 INTERPRETATION AND CONCLUSIONS | 218 |

| 25.1 Mineral Tenure, Royalties, Environmental Liabilities and Permitting | 218 |

| 25.2 Geology and Mineralization | 218 |

| 25.3 Exploration, Drilling and Analytical Data Collection in Support of Mineral Resource Estimation | 218 |

| 25.4 Metallurgical Test Work | 219 |

| 25.5 Mineral Resource Estimations | 219 |

| 25.6 Mineral Reserve Estimates | 219 |

| 25.7 Mine Plan | 220 |

| 25.8 Metal Recovery Plan | 220 |

| 25.9 Infrastructure | 220 |

| 25.10 Environmental, Permitting and Social Considerations | 220 |

| 25.11 Markets and Contracts | 220 |

| 25.12 Capital Cost Estimates | 221 |

| 25.13 Operating Cost Estimates | 221 |

| 25.14 Economic Analysis | 221 |

| 25.15 Conclusion | 222 |

| 26.0 RECOMMENDATIONS | 223 |

| 26.1 Geology | 223 |

| 26.2 Mining | 223 |

| 26.3 Metallurgy and Processing | 223 |

| 26.4 Environmental Studies | 224 |

| 27.0 REFERENCES | 225 |

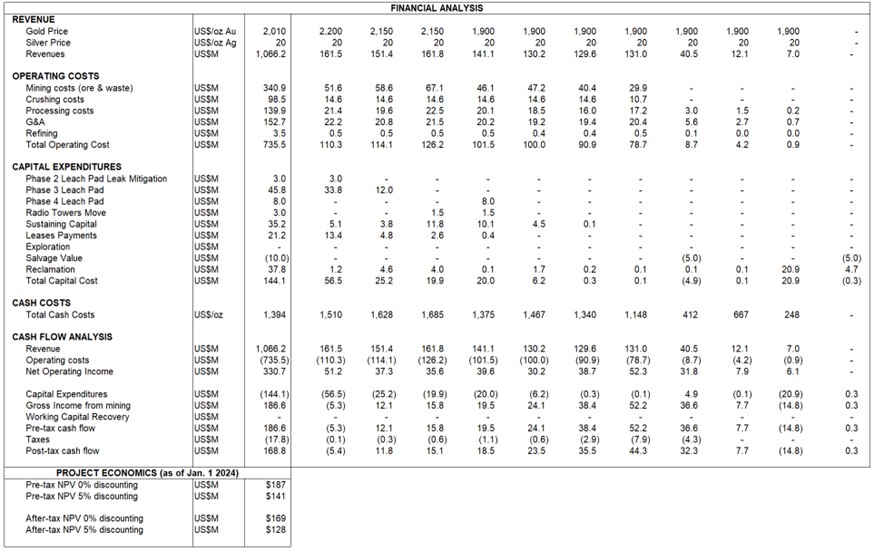

| CERTIFICATE OF QUALIFIED PERSON | 227 |

| CERTIFICATE OF QUALIFIED PERSON | 229 |

| CERTIFICATE OF QUALIFIED PERSON | 231 |

| CERTIFICATE OF QUALIFIED PERSON | 233 |

| Florida Canyon Gold Mine | Page ix |

| Florida Canyon Gold Inc. | NI 43-101 Technical Report |

LIST OF FIGURES

| Figure 4-1: Property Location in Nevada | 34 |

| Figure 4-2: Florida Canyon Land Map | 35 |

| Figure 4-3: Mining Lease and Claims | 36 |

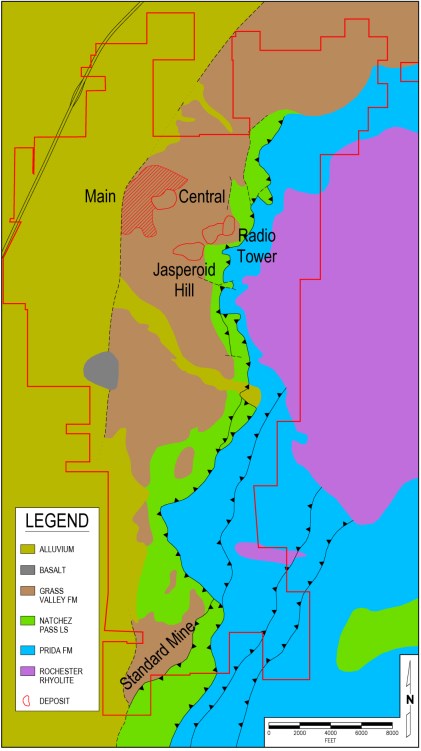

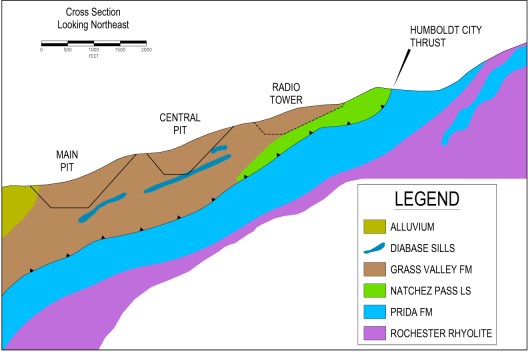

| Figure 7-1: Florida Canyon Area Geology | 43 |

| Figure 7-2: Florida Canyon Generalized Geologic Cross Section | 44 |

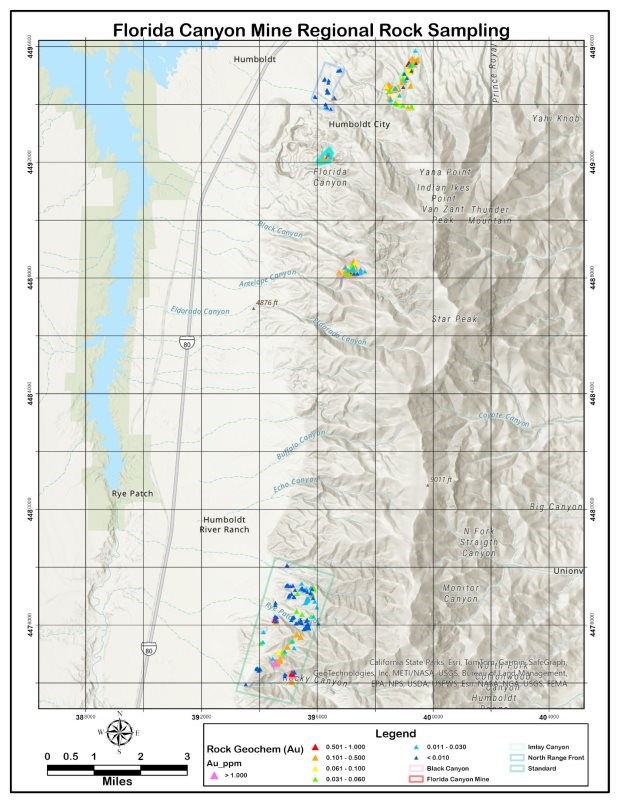

| Figure 9-1: Map of Soil Sample Grids at Exploration Targets in and Surrounding the FCM | 50 |

| Figure 9-2: Map of Rock Chip Sampling at Exploration Targets in and Surrounding the FCM | 51 |

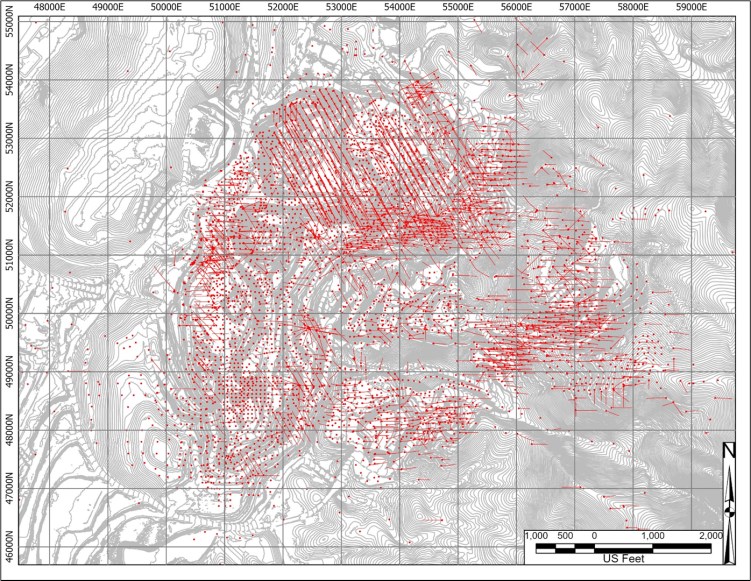

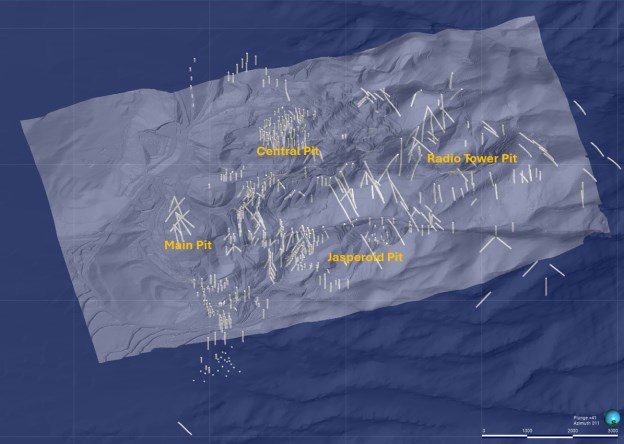

| Figure 10-1: Drill Collars over 2023 EOY Topography | 54 |

| Figure 10-2: Argonaut Drill Collars (2020-2023) | 56 |

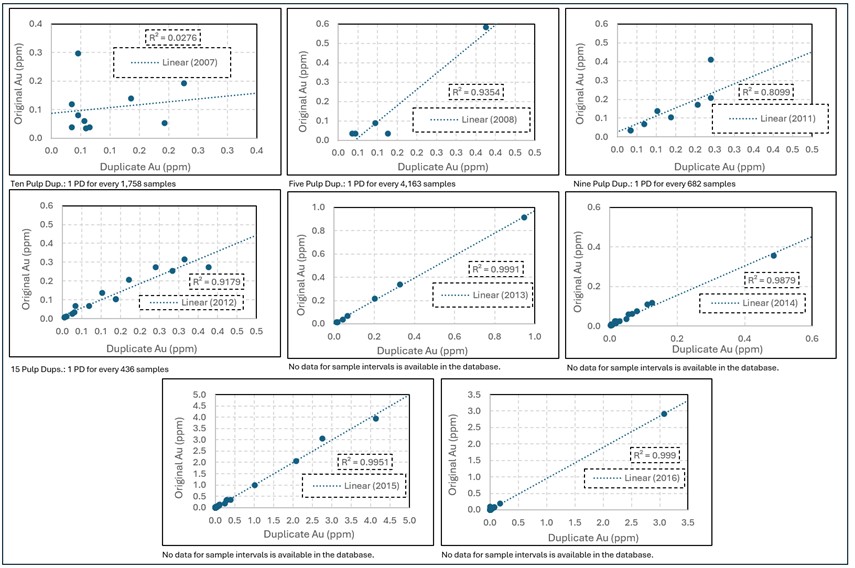

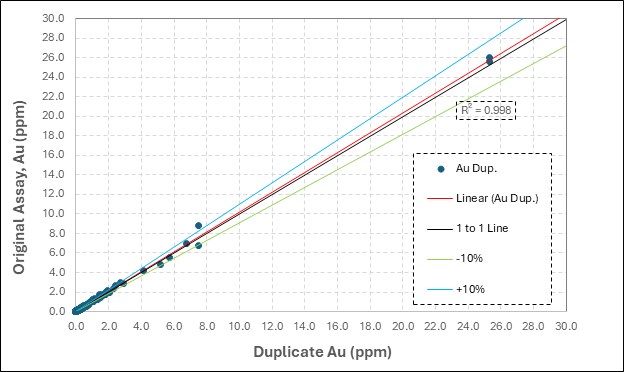

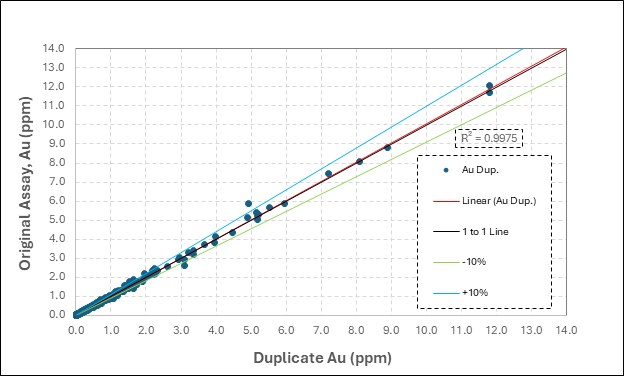

| Figure 12-1: Field Duplicate Samples from Some Drilling Programs Prior to 2017 | 71 |

| Figure 12-2: Pulp Duplicate Samples from Some Drilling Programs Prior to 2017 | 72 |

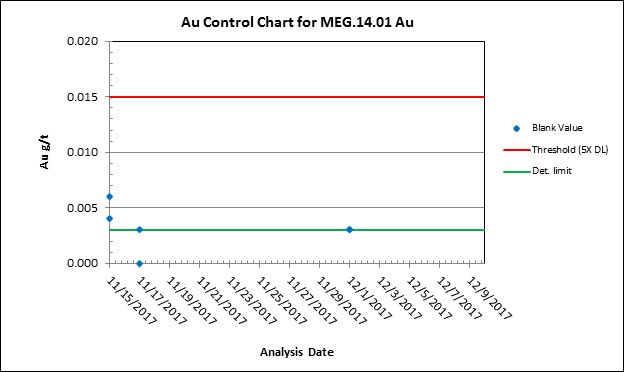

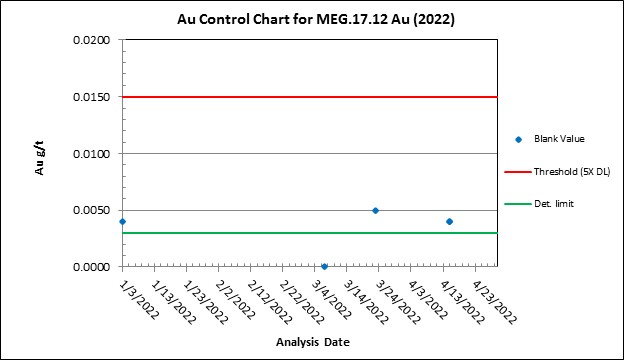

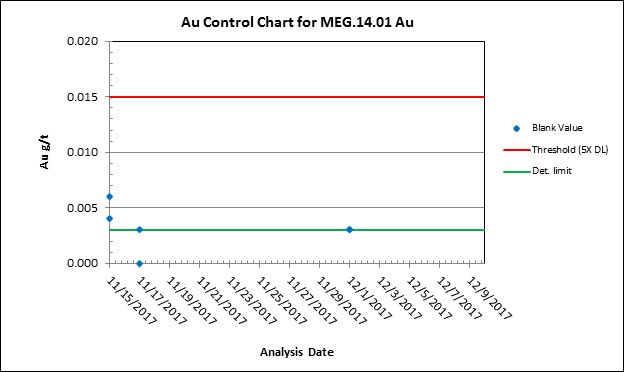

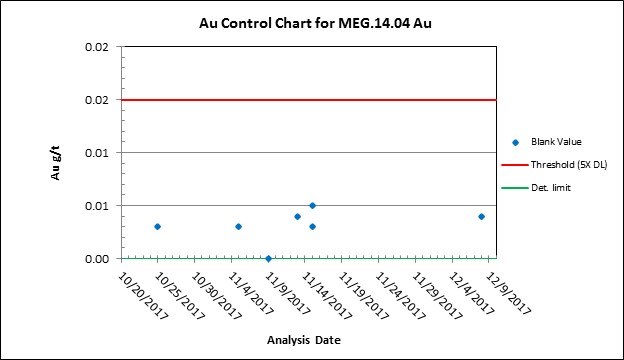

| Figure 12-3: 2017 Drilling Campaign, Blank Results | 74 |

| Figure 12-4: 2017 Drilling Campaign, Blank Results | 74 |

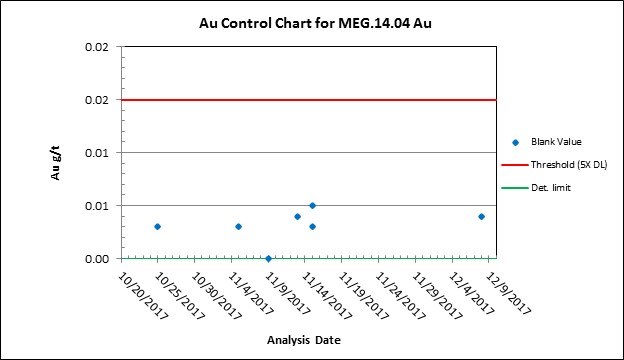

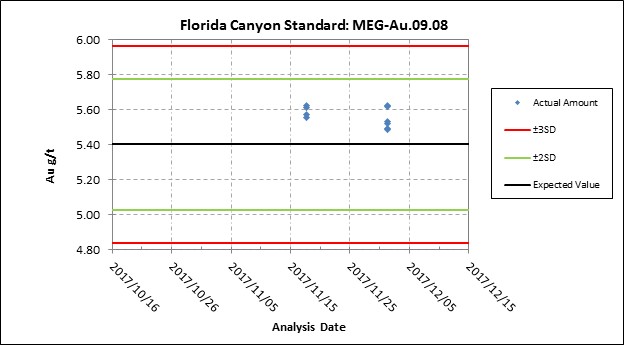

| Figure 12-5: CRM MEG-Au.09.08 from the 2017 Drilling Campaign | 75 |

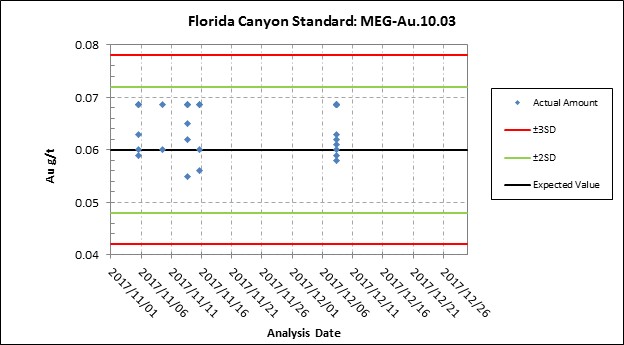

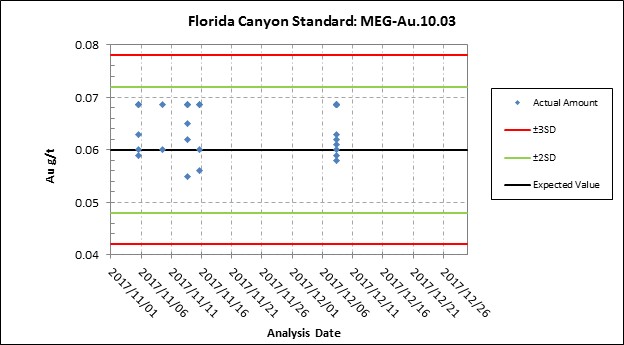

| Figure 12-6: CRM MEG-Au.10.03 from the 2017 Drilling Campaign | 76 |

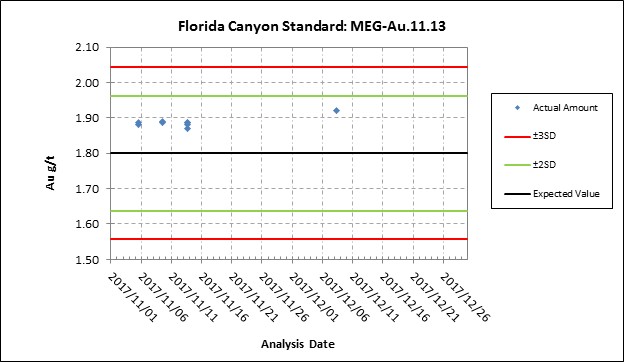

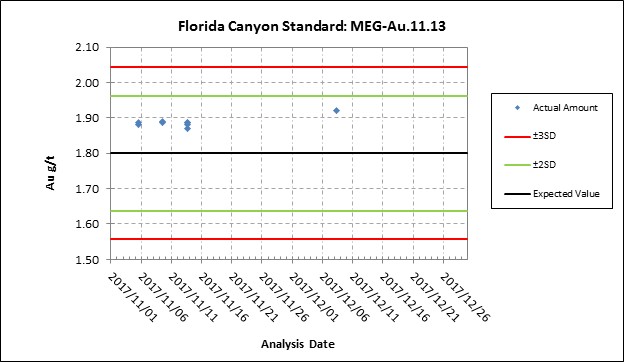

| Figure 12-7: CRM MEG-Au.11.13 from the 2017 Drilling Campaign | 76 |

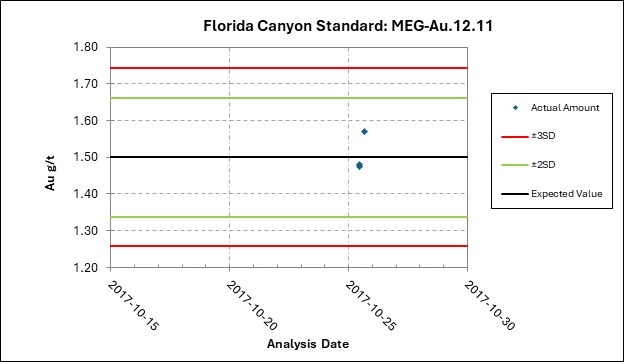

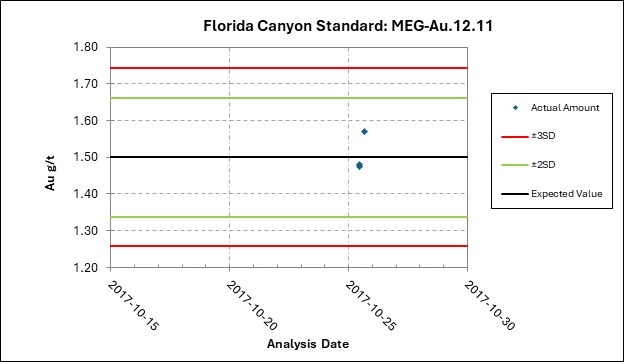

| Figure 12-8: CRM MEG-Au.12.11 from the 2017 Drilling Campaign | 77 |

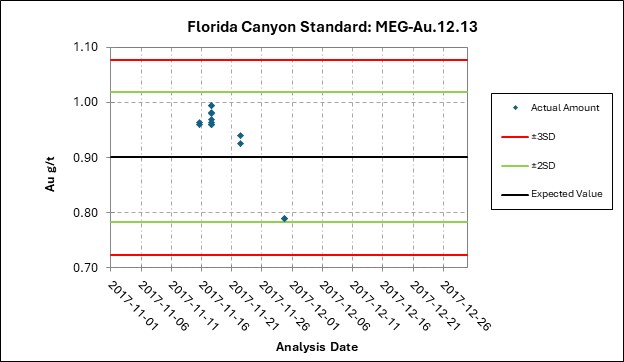

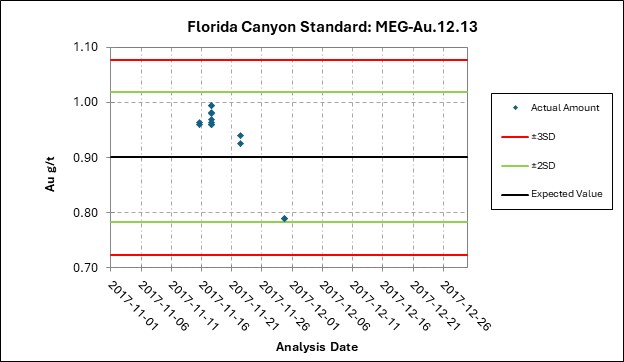

| Figure 12-9: CRM MEG-Au.12.13 from the 2017 Drilling Campaign | 77 |

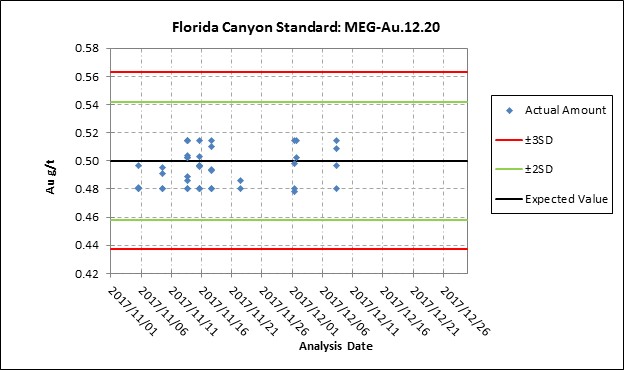

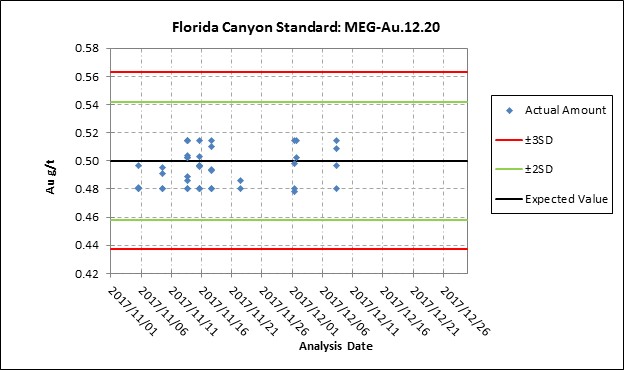

| Figure 12-10: CRM MEG-Au.12.20 from the 2017 Drilling Campaign | 78 |

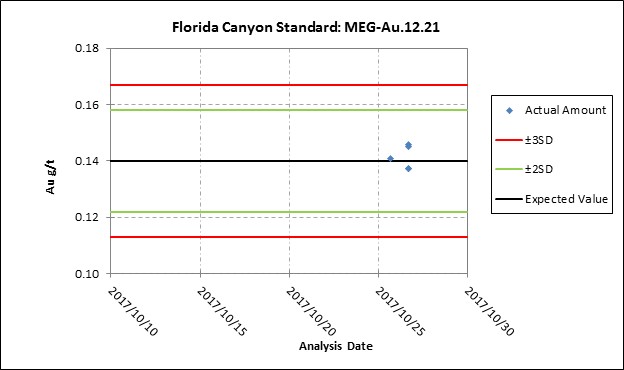

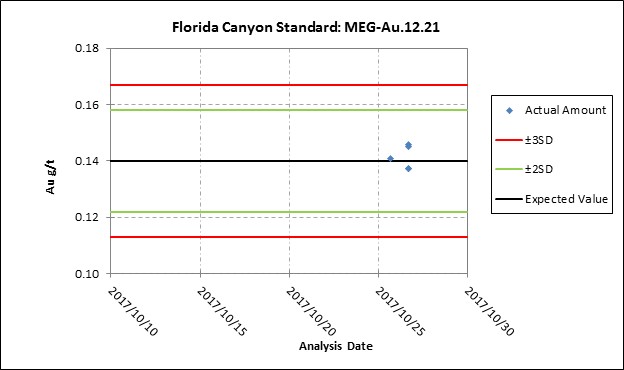

| Figure 12-11: CRM MEG-Au.12.21 from the 2017 Drilling Campaign | 78 |

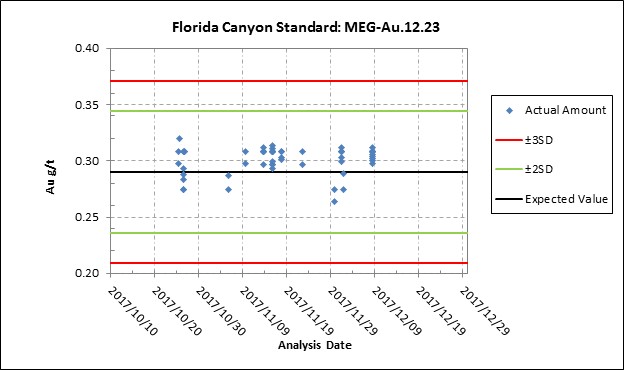

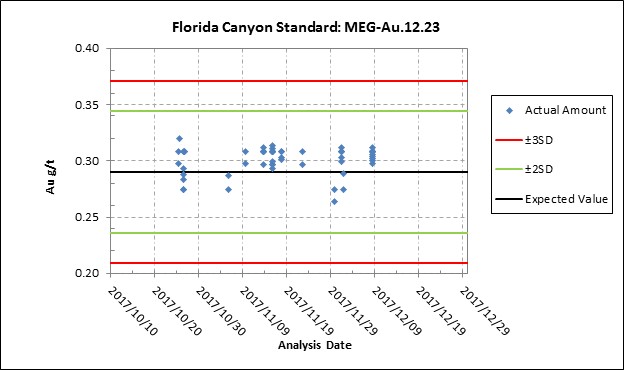

| Figure 12-12: CRM MEG-Au.12.23 from the 2017 Drilling Campaign | 79 |

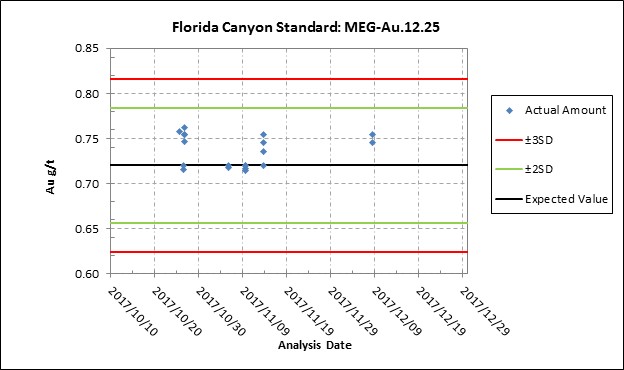

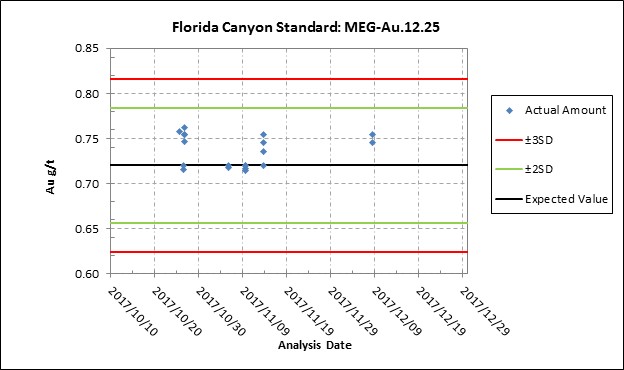

| Figure 12-13: CRM MEG-Au.12.25 from the 2017 Drilling Campaign | 79 |

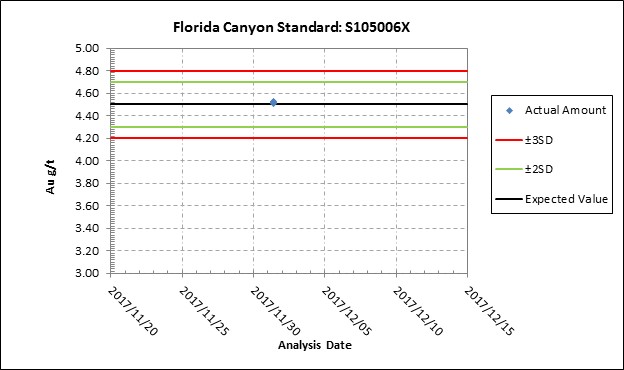

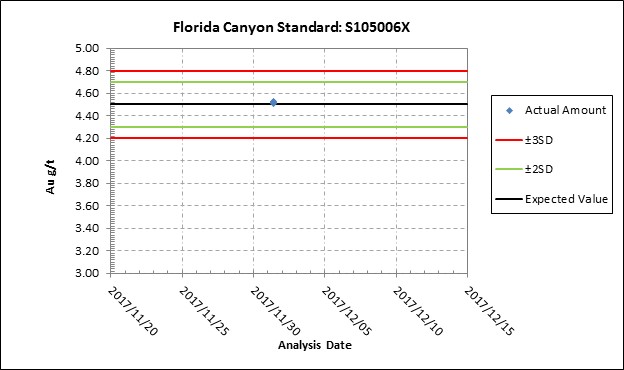

| Figure 12-14: CRM MEG-Au. S105006X from the 2017 Drilling Campaign | 80 |

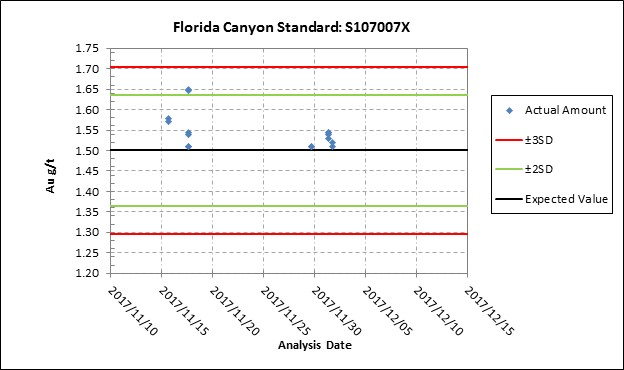

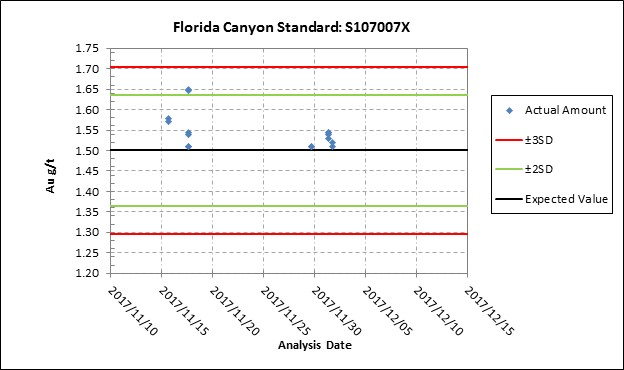

| Figure 12-15: CRM MEG-Au. S107007X from the 2017 Drilling Campaign | 80 |

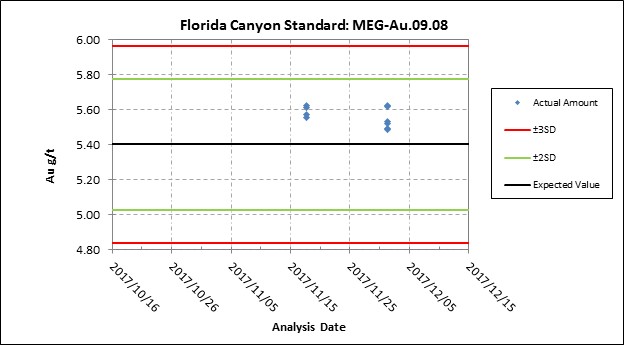

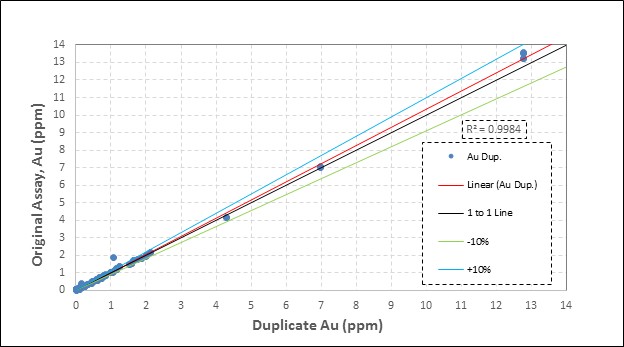

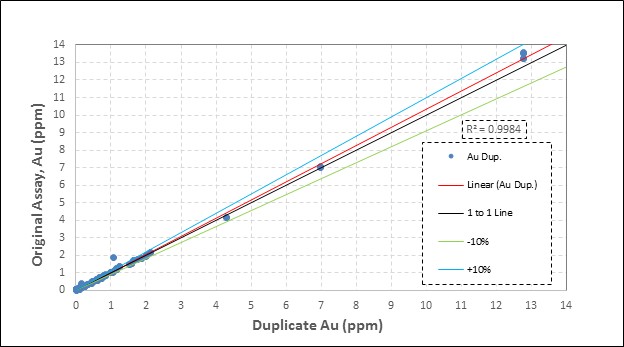

| Figure 12-16: Pulp Duplicate Samples from the 2017 Drilling Campaign | 81 |

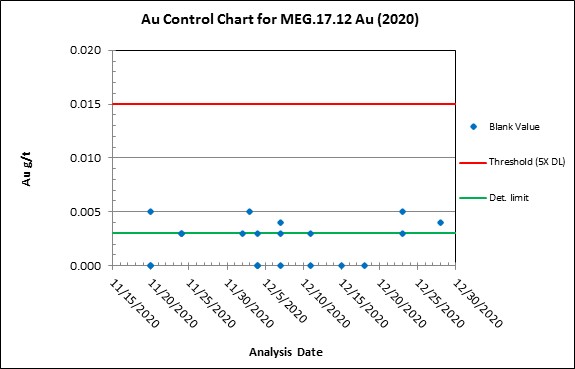

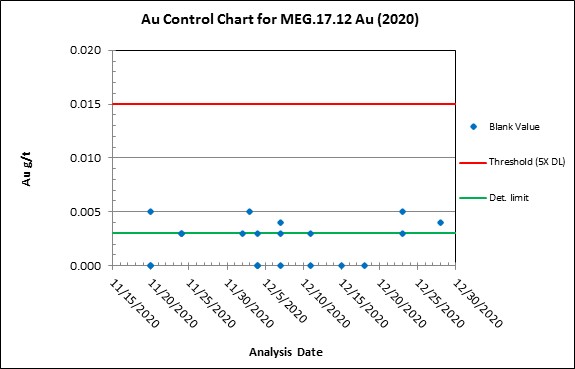

| Figure 12-17: 2020 Drilling Campaign, Blank Results | 82 |

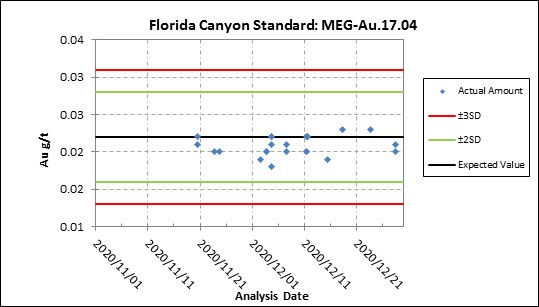

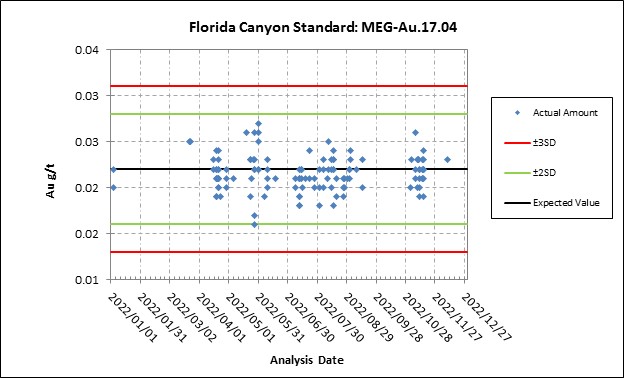

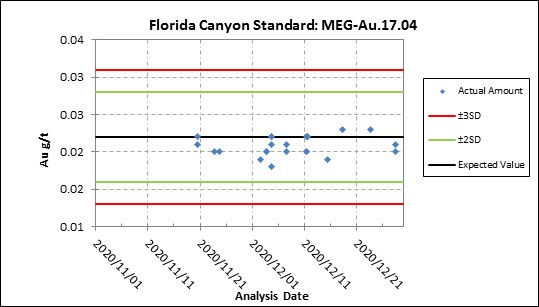

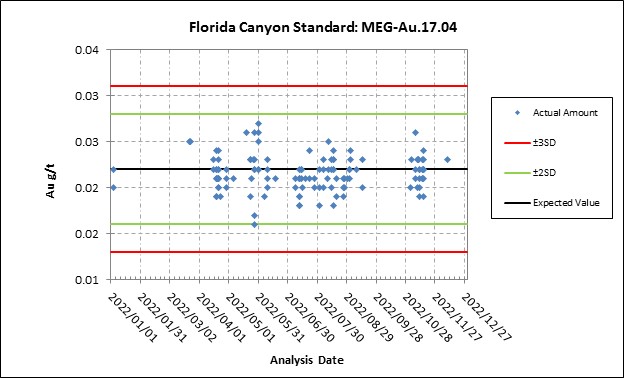

| Figure 12-18: CRM MEG-Au.17.04 from the 2020 Drilling Campaign | 83 |

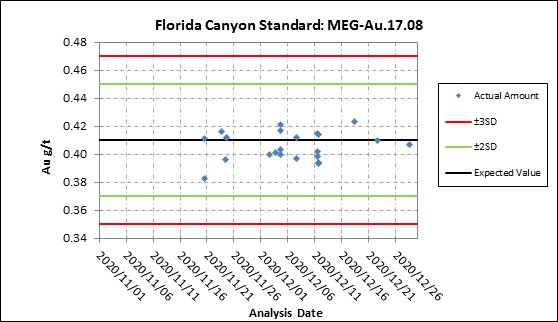

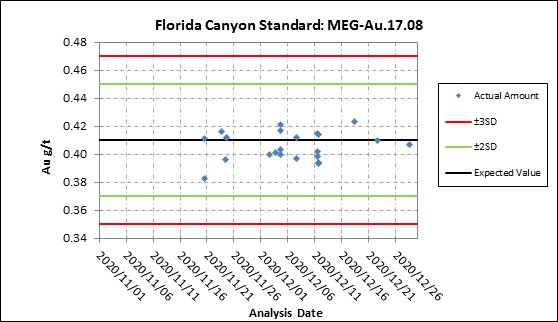

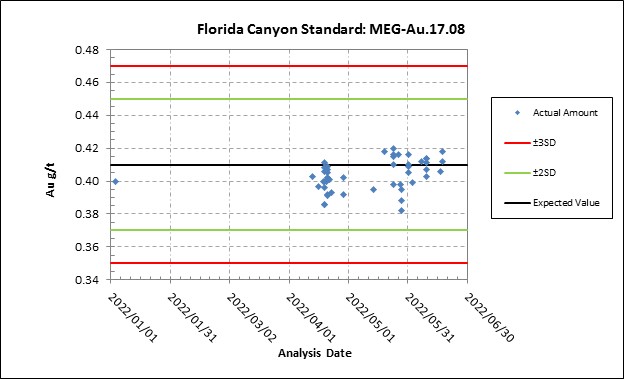

| Figure 12-19: CRM MEG-Au.17.08 from the 2020 Drilling Campaign | 83 |

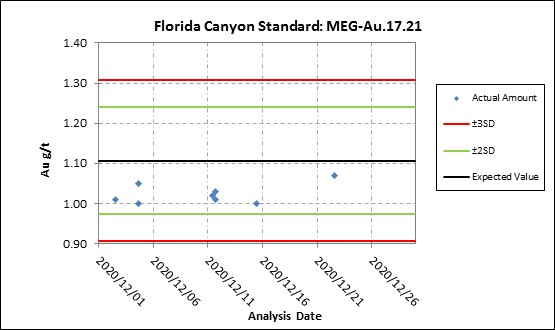

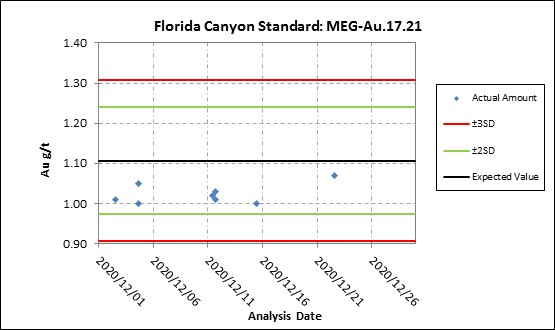

| Figure 12-20: CRM MEG-Au.17.21 from the 2020 Drilling Campaign | 84 |

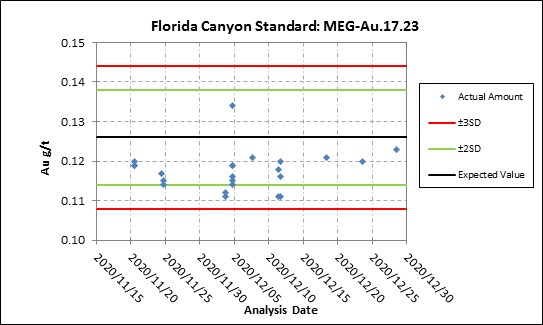

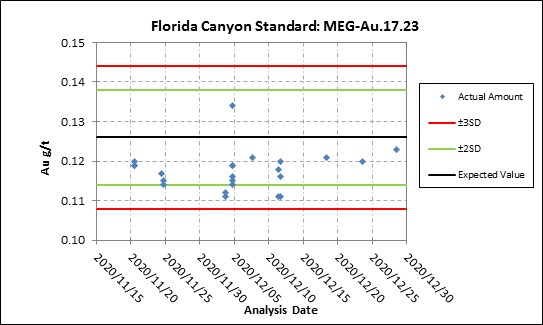

| Figure 12-21: CRM MEG-Au.17.23 from the 2020 Drilling Campaign | 84 |

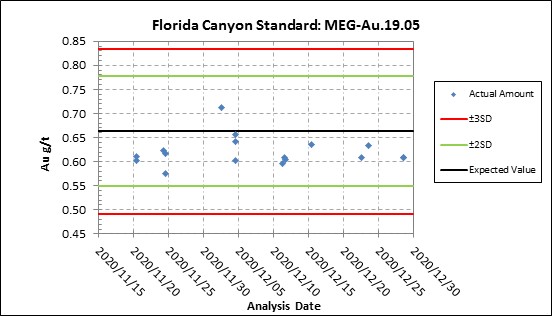

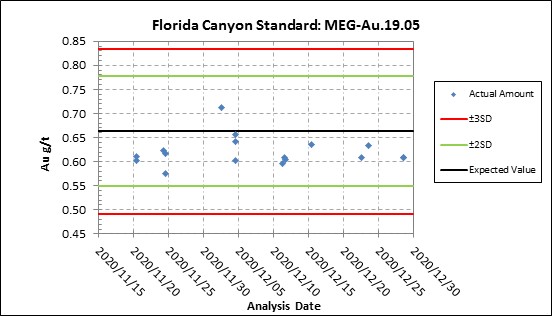

| Figure 12-22: CRM MEG-Au.19.05 from the 2020 Drilling Campaign | 85 |

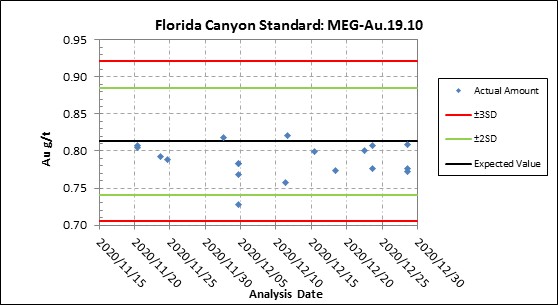

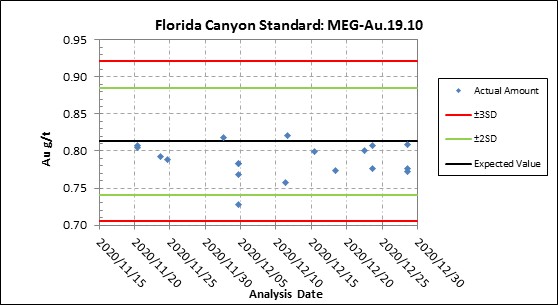

| Figure 12-23: CRM MEG-Au.19.10 from the 2022 Drilling Campaign | 85 |

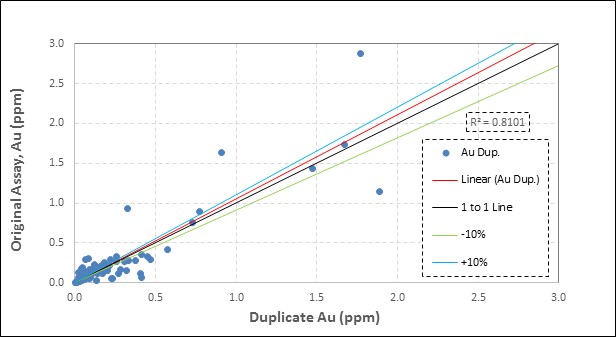

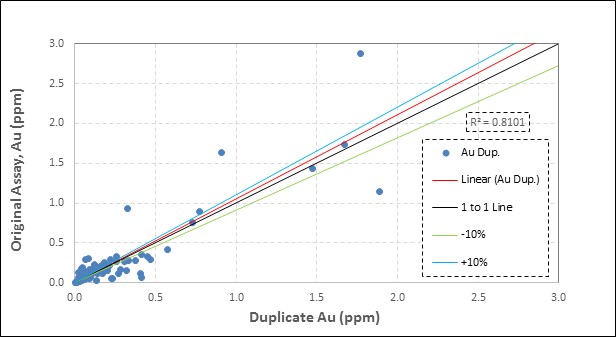

| Figure 12-24: Field Duplicate Samples from the 2020 Drilling Campaign | 86 |

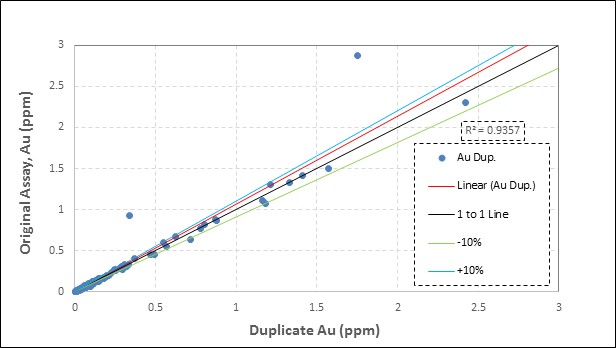

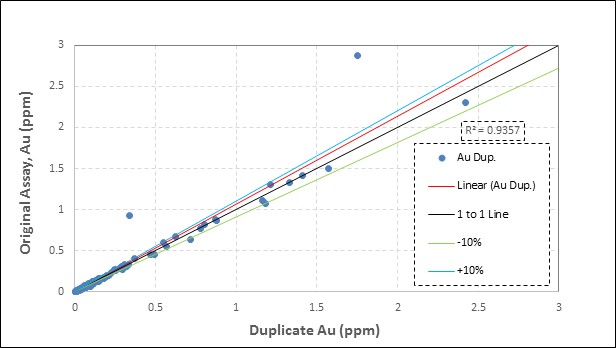

| Figure 12-25: Pulp Duplicate Samples from the 2020 Drilling Campaign | 86 |

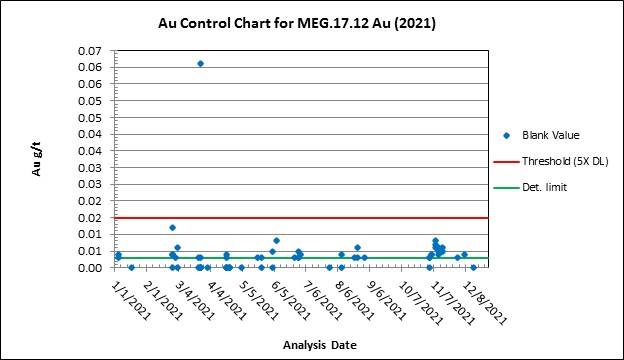

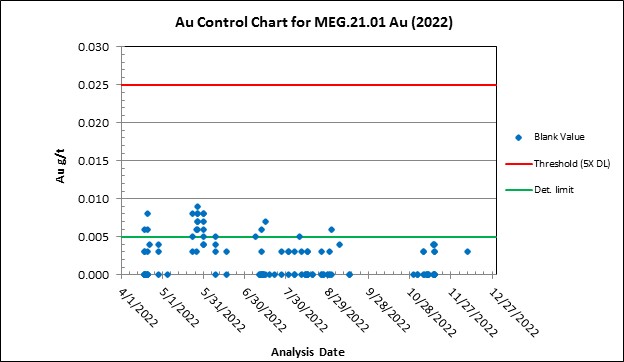

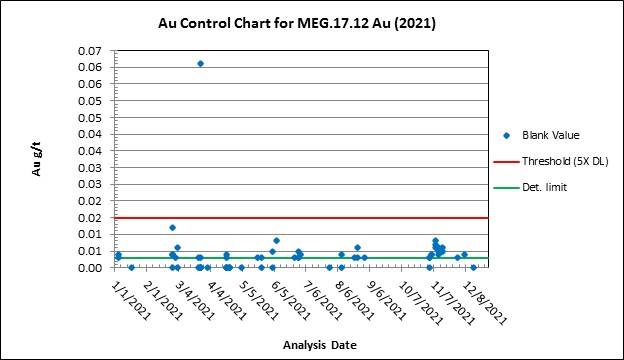

| Figure 12-26: 2021 Drilling Campaign, Blank Results | 87 |

| Figure 12-27: CRM MEG-Au.17.04 from the 2021 Drilling Campaign | 88 |

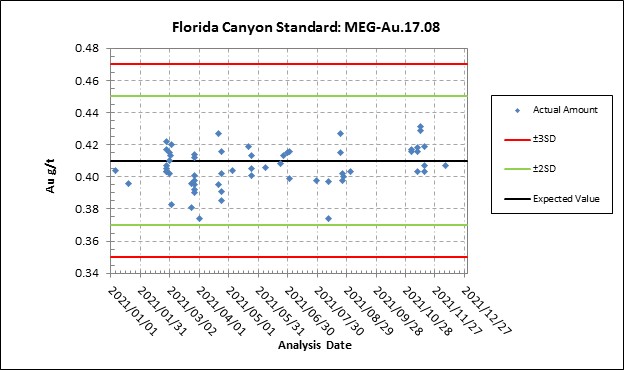

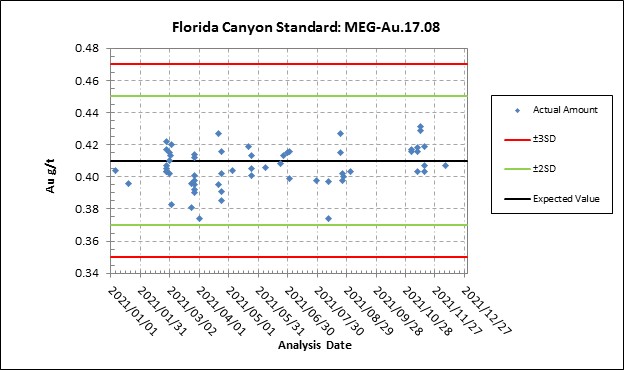

| Figure 12-28: CRM MEG-Au.17.08 from the 2021 Drilling Campaign | 88 |

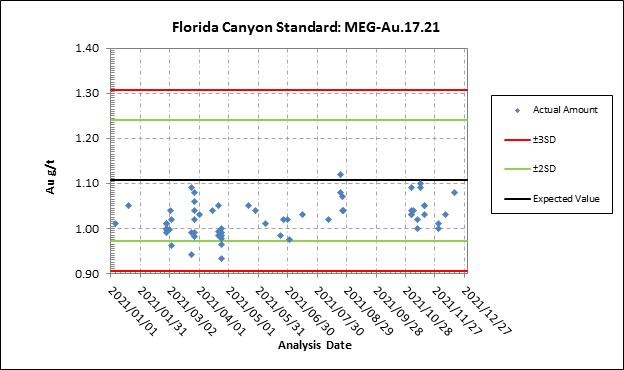

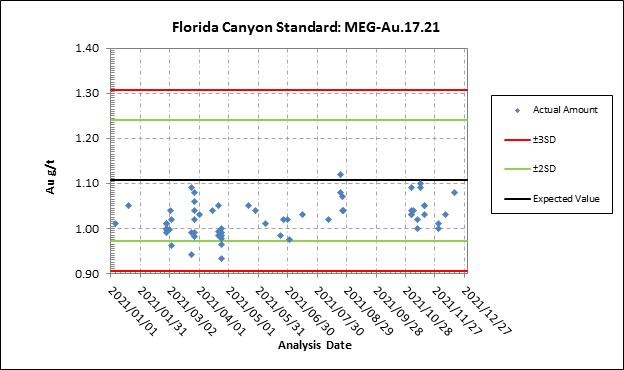

| Figure 12-29: CRM MEG-Au.17.21 from the 2021 Drilling Campaign | 89 |

| Florida Canyon Gold Mine | Page x |

| Florida Canyon Gold Inc. | NI 43-101 Technical Report |

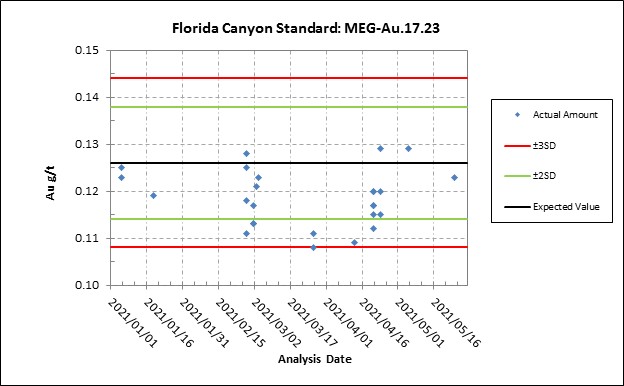

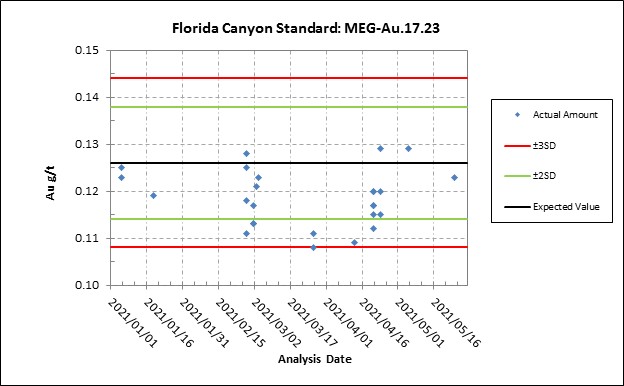

| Figure 12-30: CRM MEG-Au.17.23 from the 2021 Drilling Campaign | 89 |

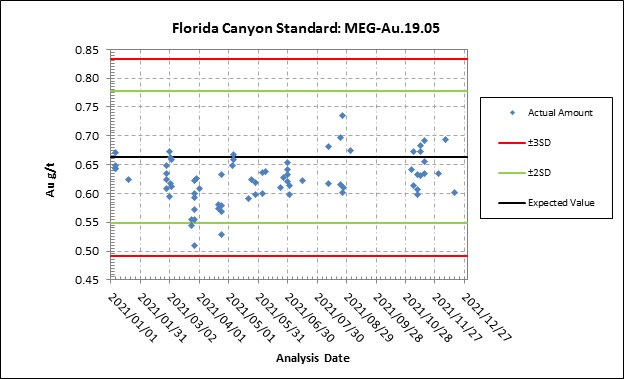

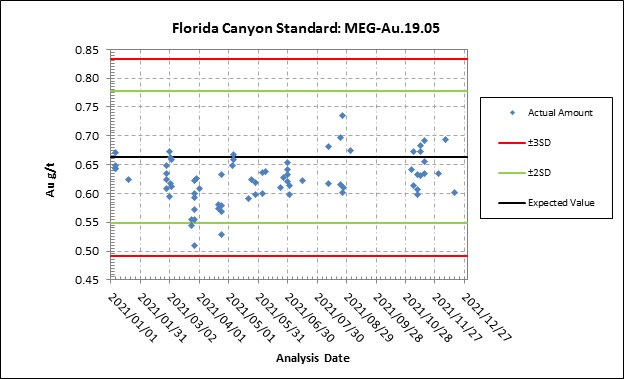

| Figure 12-31: CRM MEG-Au.19.05 from the 2021 Drilling Campaign | 90 |

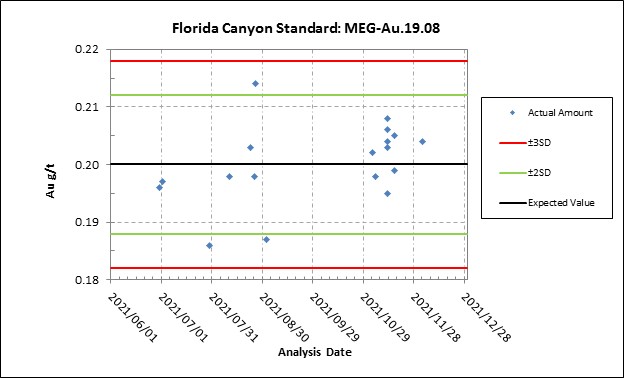

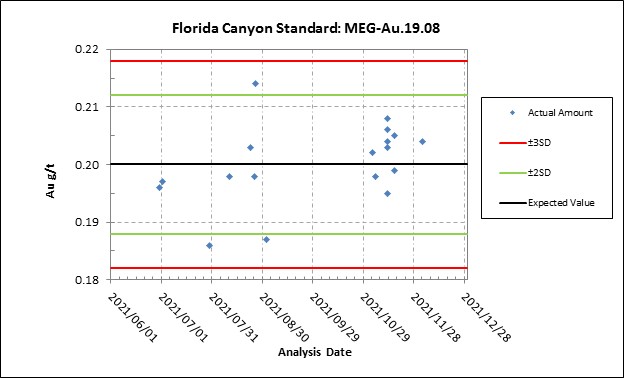

| Figure 12-32: CRM MEG-Au.19.08 from the 2021 Drilling Campaign | 90 |

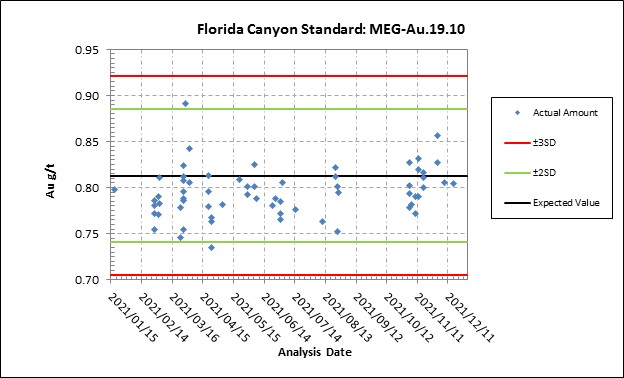

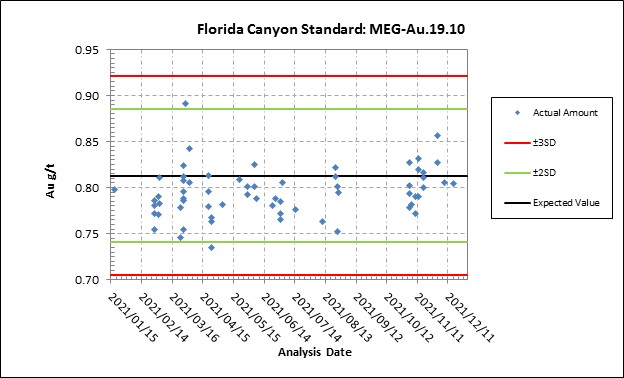

| Figure 12-33: CRM MEG-Au.19.10 from the 2021 Drilling Campaign | 91 |

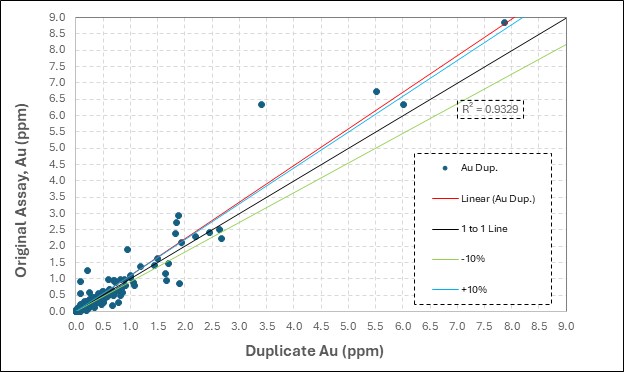

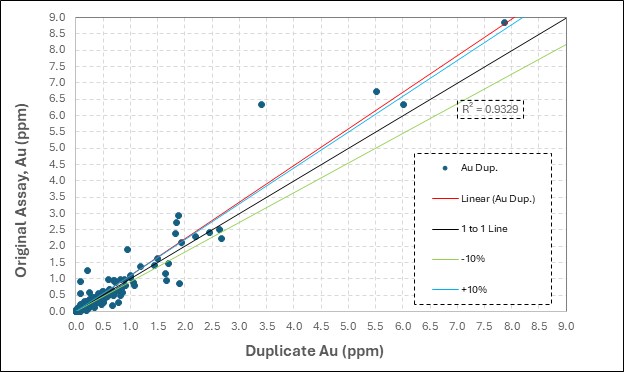

| Figure 12-34: Field Duplicate Samples from the 2021 Drilling Campaign | 92 |

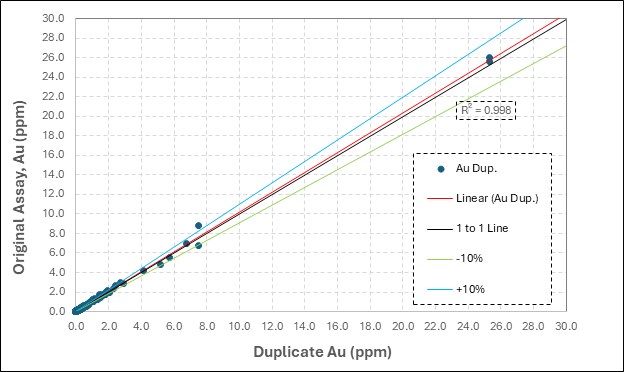

| Figure 12-35: Pulp Duplicate Samples from the 2021 Drilling Campaign | 92 |

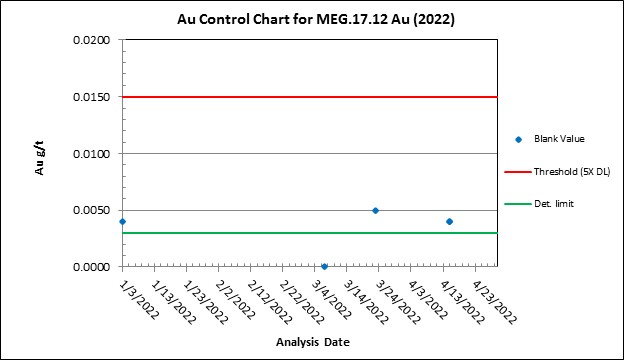

| Figure 12-36: 2022 Drilling Campaign, Blank Results | 93 |

| Figure 12-37: 2022 Drilling Campaign, Blank Results | 94 |

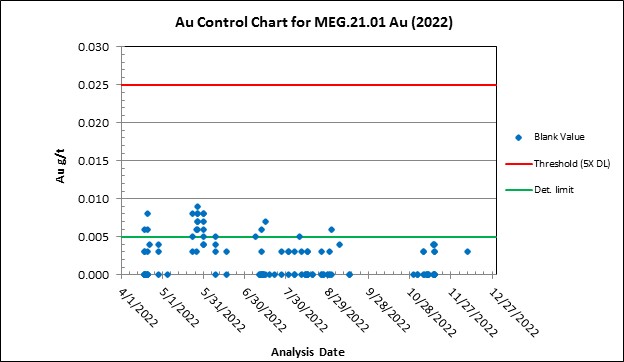

| Figure 12-38: CRM MEG-Au.17.04 from the 2022 Drilling Campaign | 95 |

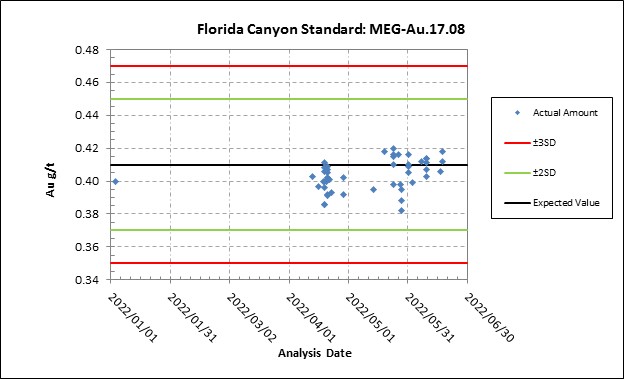

| Figure 12-39: CRM MEG-Au.17.08 from the 2022 Drilling Campaign | 95 |

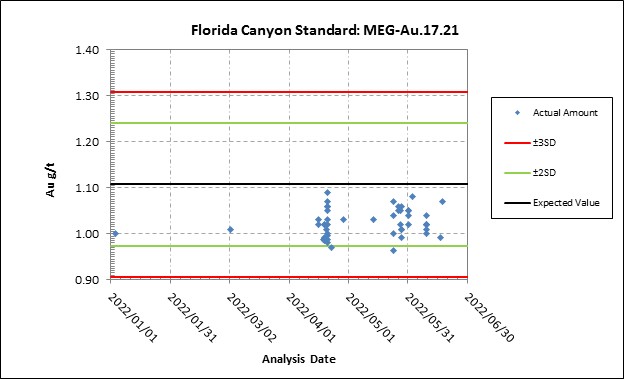

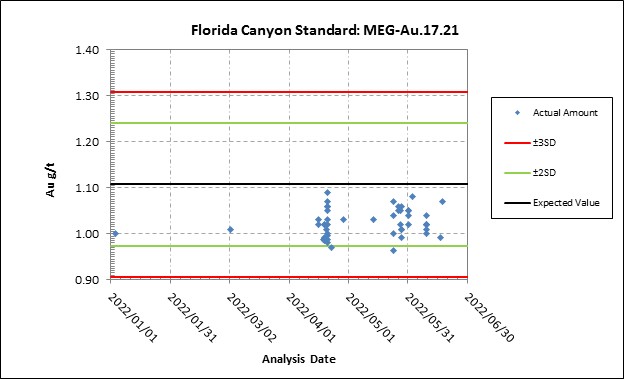

| Figure 12-40: CRM MEG-Au.17.21 from the 2022 Drilling Campaign | 96 |

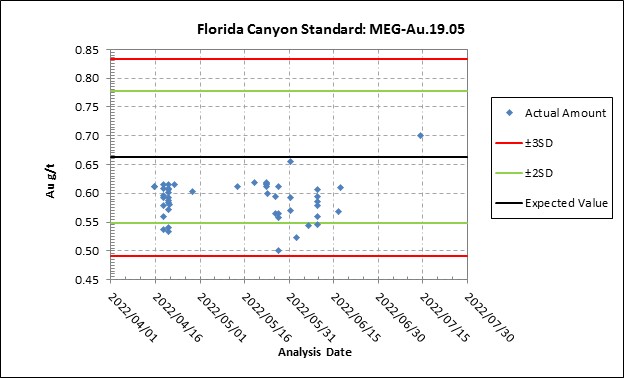

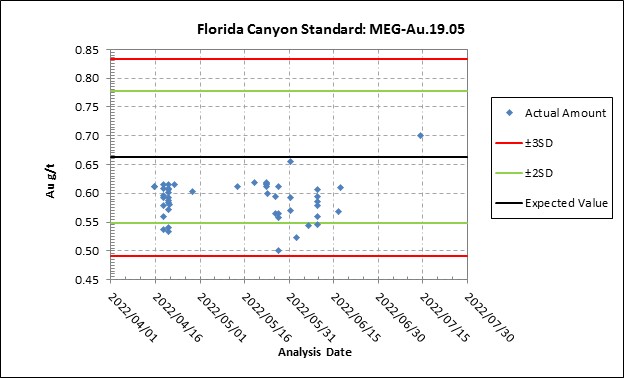

| Figure 12-41: CRM MEG-Au.19.05 from the 2022 Drilling Campaign | 96 |

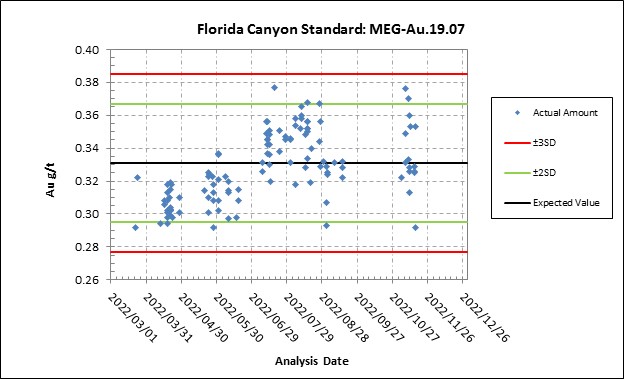

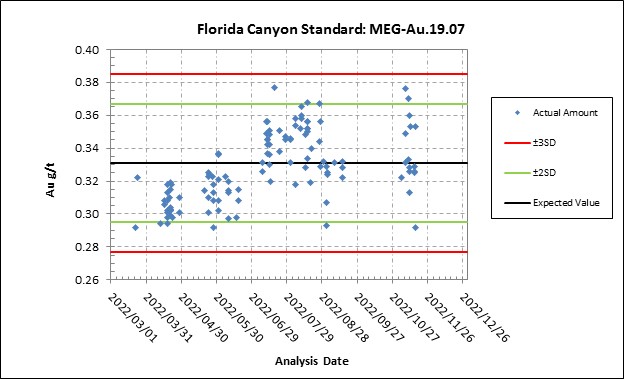

| Figure 12-42: CRM MEG-Au.19.07 from the 2022 Drilling Campaign | 97 |

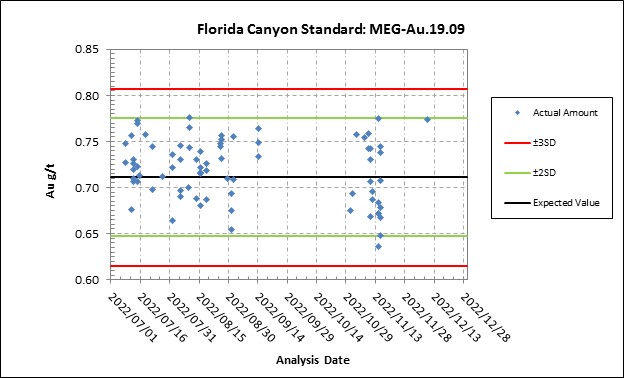

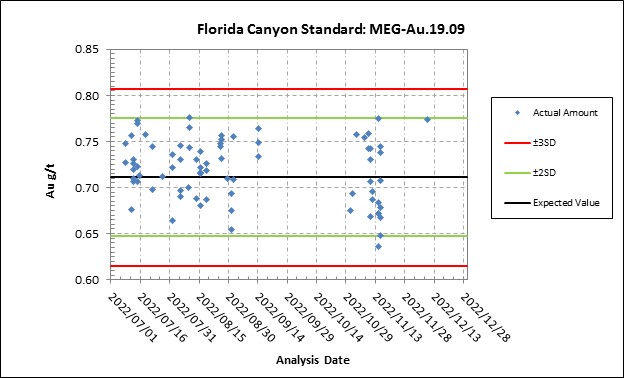

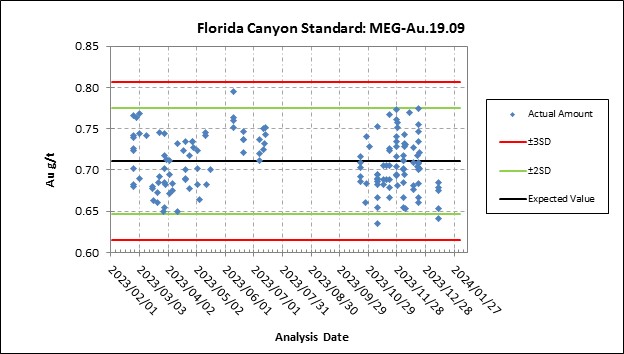

| Figure 12-43: CRM MEG-Au.19.09 from the 2022 Drilling Campaign | 97 |

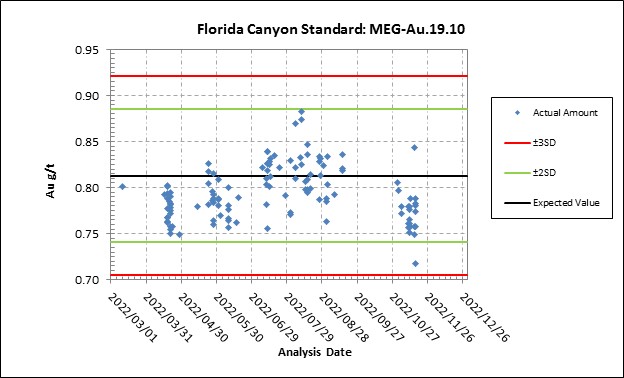

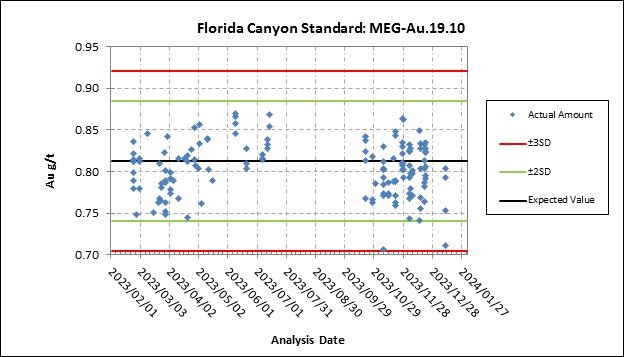

| Figure 12-44: CRM MEG-Au.19.10 from the 2022 Drilling Campaign | 98 |

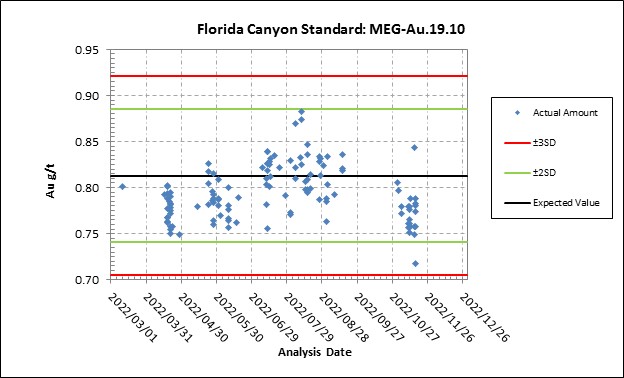

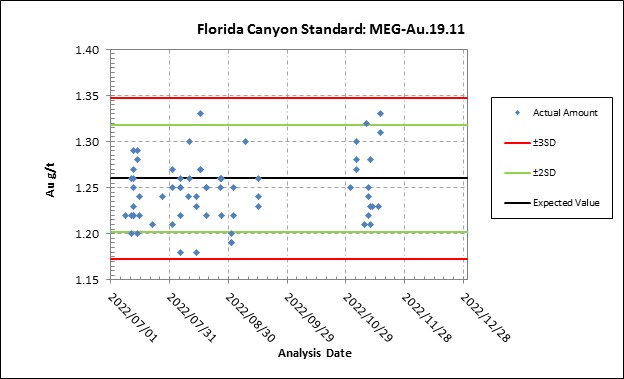

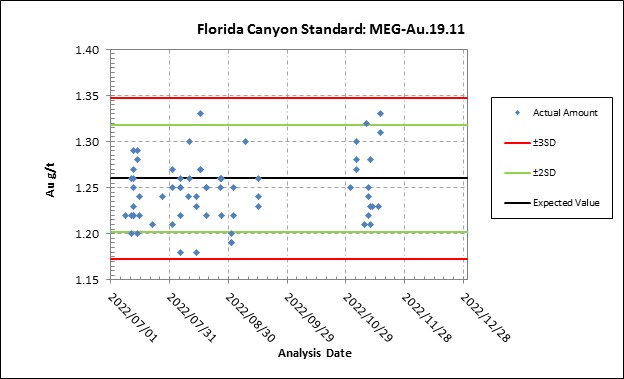

| Figure 12-45: CRM MEG-Au.19.11 from the 2022 Drilling Campaign | 98 |

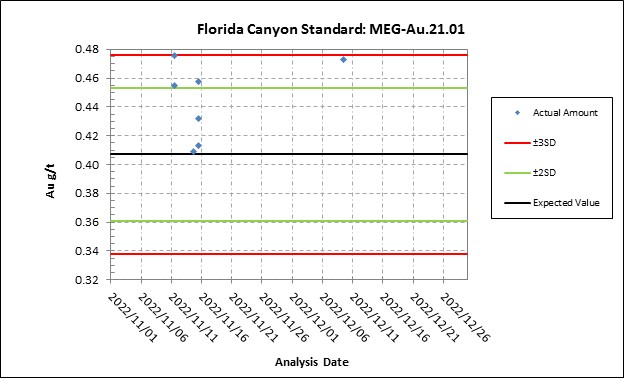

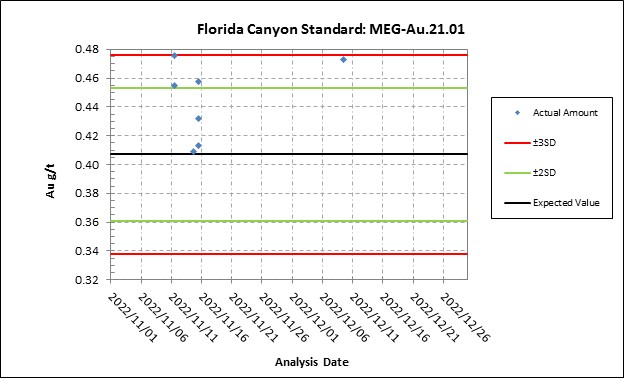

| Figure 12-46: CRM MEG-Au.21.01 from the 2022 Drilling Campaign | 99 |

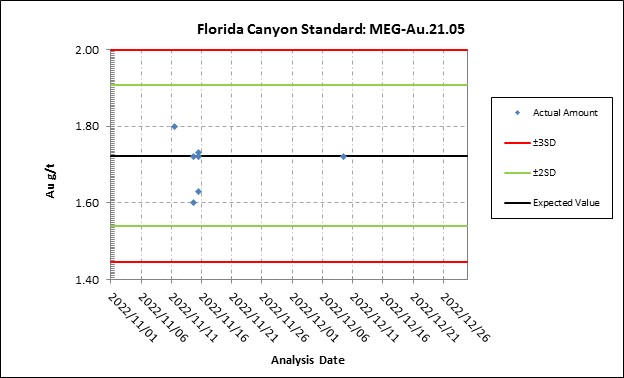

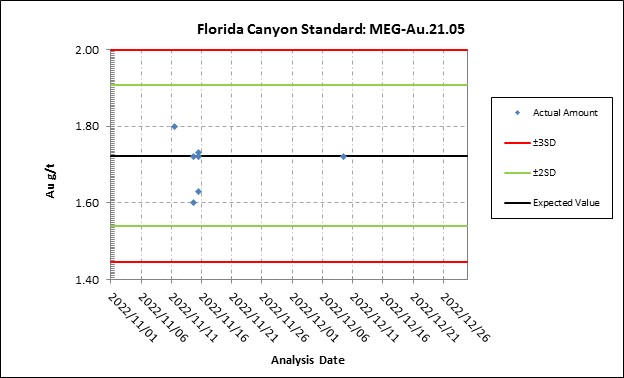

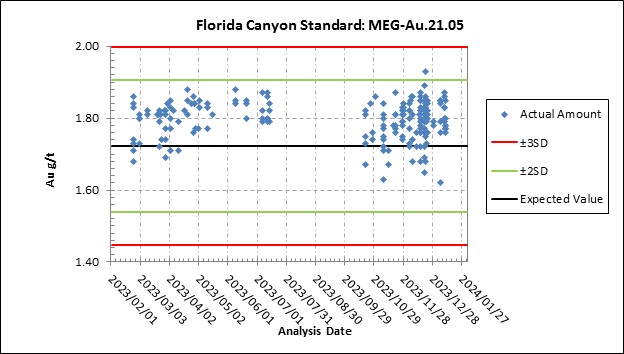

| Figure 12-47: CRM MEG-Au.21.05 from the 2022 Drilling Campaign | 99 |

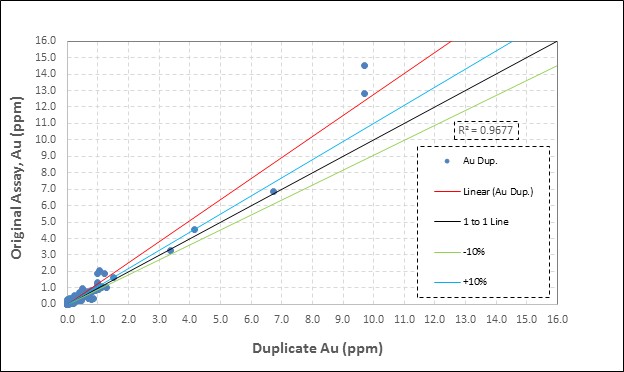

| Figure 12-48: Field Duplicate Samples from the 2022 Drilling Campaign | 100 |

| Figure 12-49: Pulp Duplicate Samples from the 2022 Drilling Campaign | 101 |

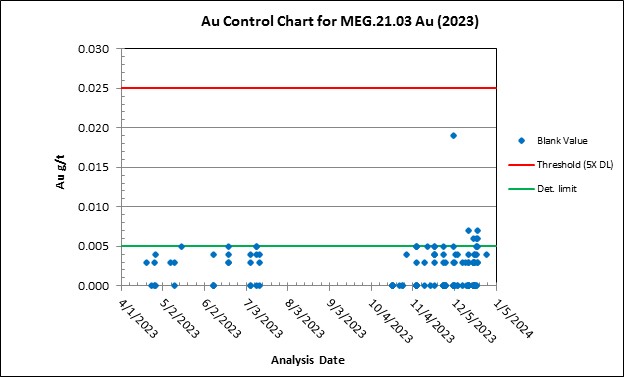

| Figure 12-50: 2023 Drilling Campaign, Blank Results | 102 |

| Figure 12-51: 2023 Drilling Campaign, Blank Results | 102 |

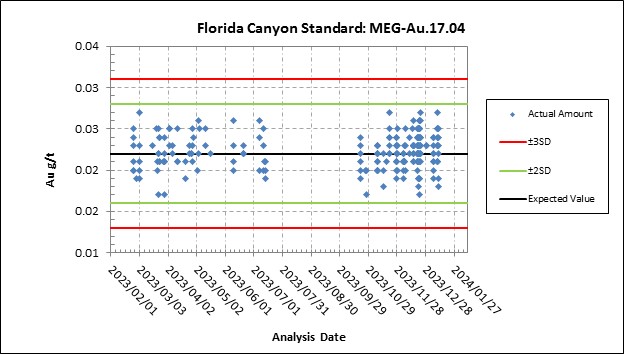

| Figure 12-52: CRM MEG-Au.17.04 from the 2023 Drilling Campaign | 103 |

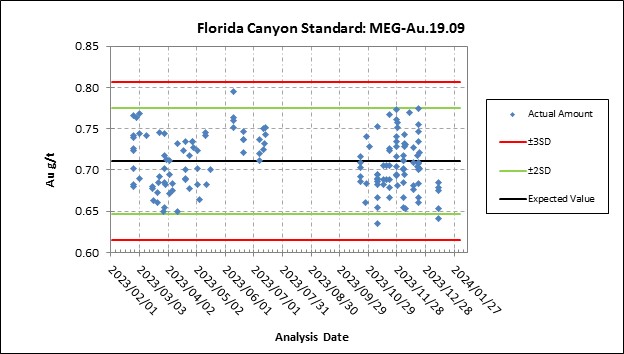

| Figure 12-53: CRM MEG-Au.19.09 from the 2023 Drilling Campaign | 104 |

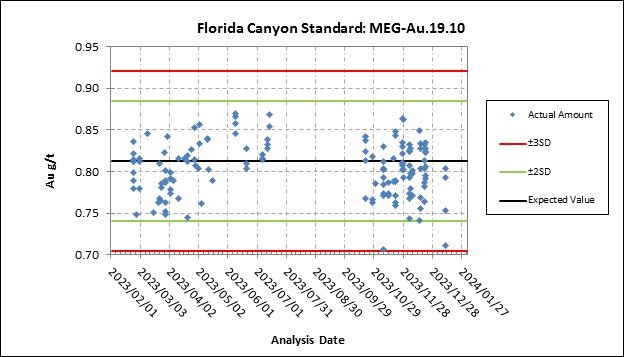

| Figure 12-54: CRM MEG-Au.19.10 from the 2023 Drilling Campaign | 104 |

| Figure 12-55: CRM MEG-Au.21.01 from the 2023 Drilling Campaign | 105 |

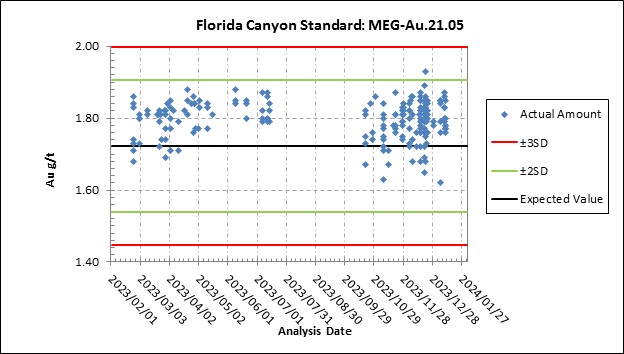

| Figure 12-56: CRM MEG-Au.21.05 from the 2023 Drilling Campaign | 105 |

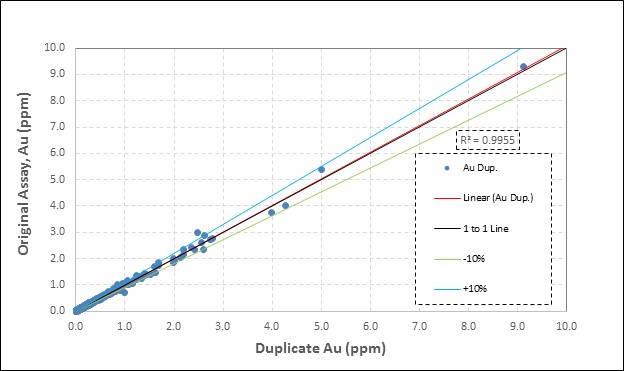

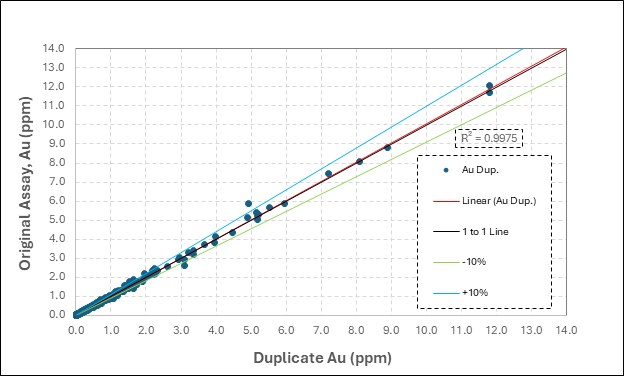

| Figure 12-57: Pulp Duplicate Samples from the 2023 Drilling Campaign | 106 |

| Figure 12-58: Inspection of the Collar Coordinates | 108 |

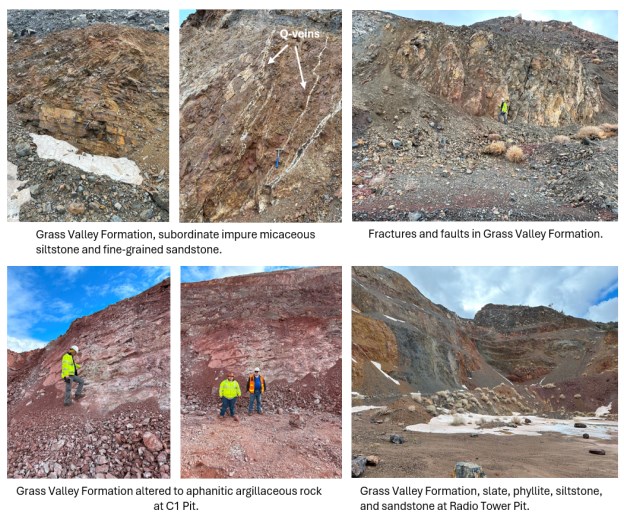

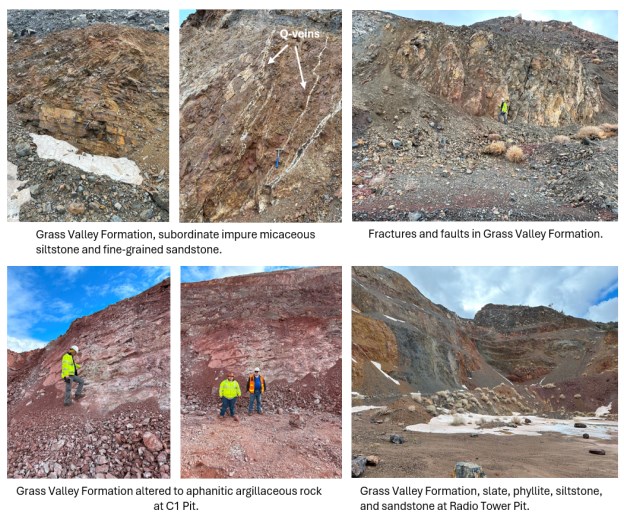

| Figure 12-59: GRE's QP Geological Inspections in 2024, different views of Grass Valley Formation | 109 |

| Figure 12-60: GRE's QP Geological Inspections in 2024, Fault and Q-Veins in Grass Valley Formation | 110 |

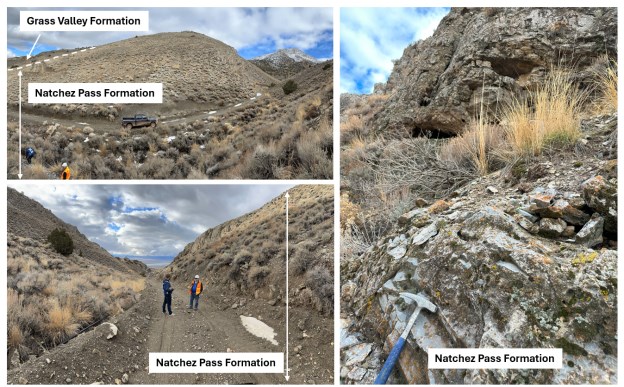

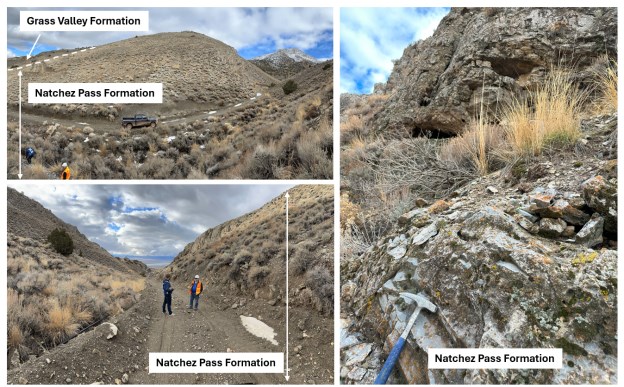

| Figure 12-61: GRE's QP Geological Inspections in 2024, Grass Valley and Natchez Pass Formations | 110 |

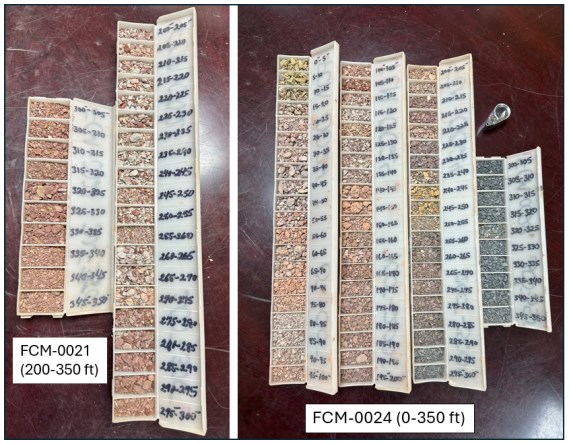

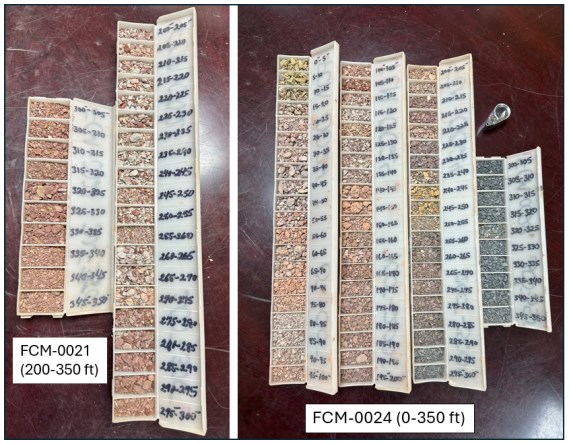

| Figure 12-62: Visual Inspection of RC Holes FCM-0021 and FCM-0024 | 111 |

| Figure 12-63: Core Storage and Core Logging in FCM's Facility at Lovelock, NV | 112 |

| Figure 12-64: Visual Inspection of Selected Intervals from Hole FCM-0500 | 114 |

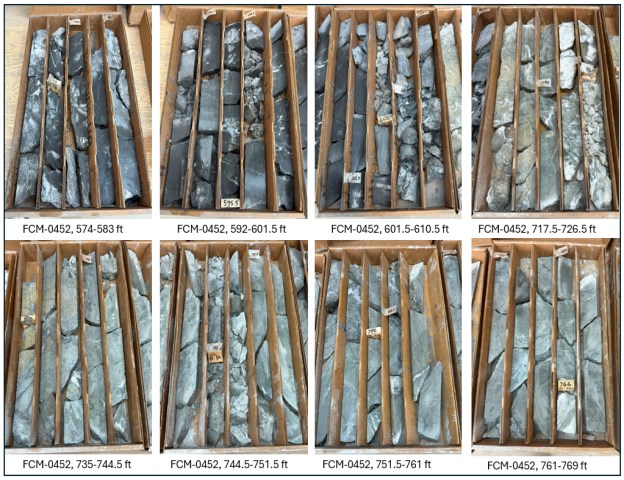

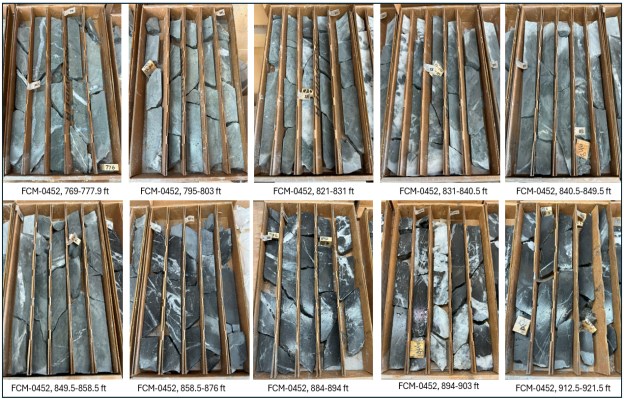

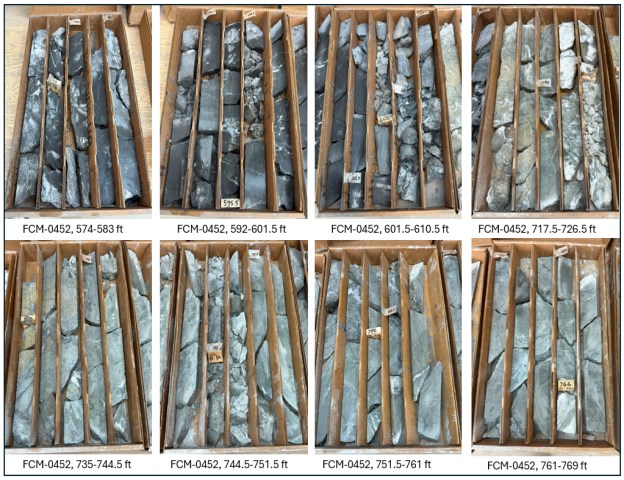

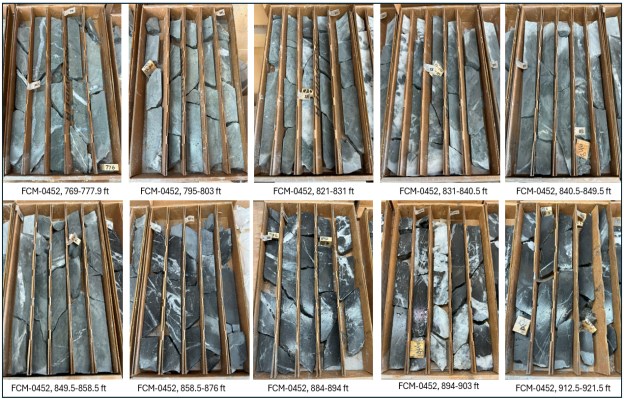

| Figure 12-65: Visual Inspection of Selected Intervals from Hole FCM-0452 | 115 |

| Figure 12-66: Visual Inspection of Selected Intervals from Hole FCM-0438 | 118 |

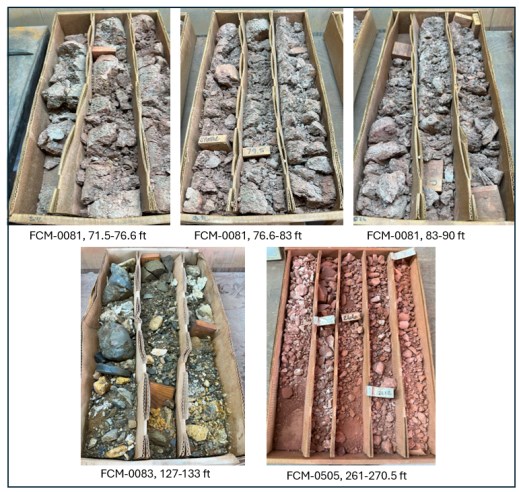

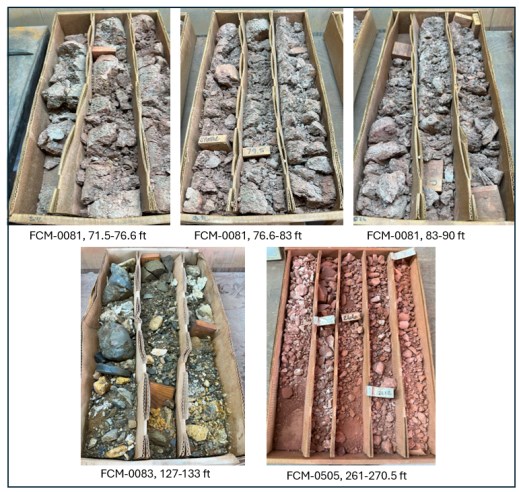

| Figure 12-67: Visual Inspection of Selected Intervals from Holes FCM-0081, FCM-0083, and FCM-0505 | 120 |

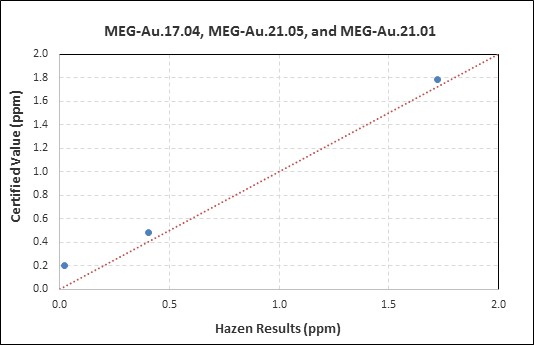

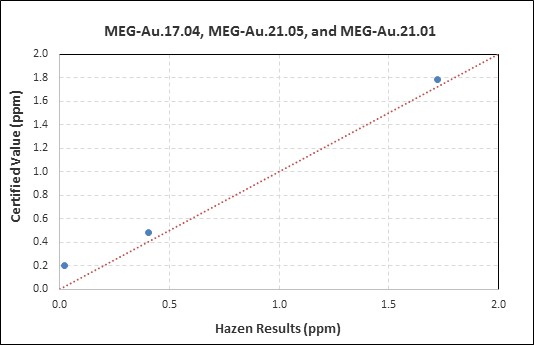

| Figure 12-68: Hazen Assay Results on CRMs (Au) | 123 |

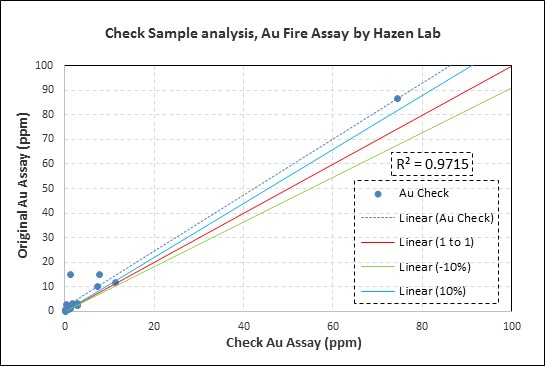

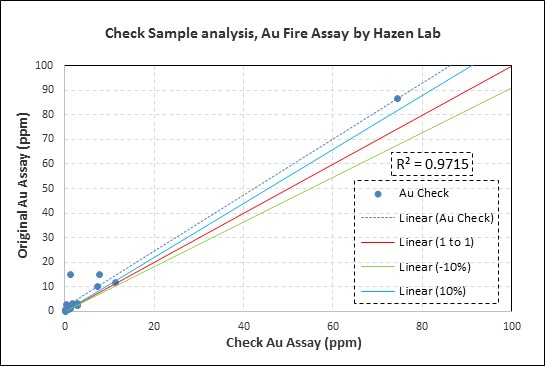

| Figure 12-69: Hazen Core Check Assay Results (Au) | 124 |

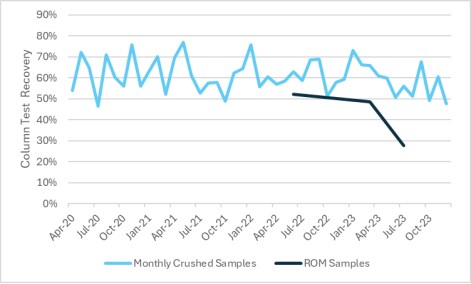

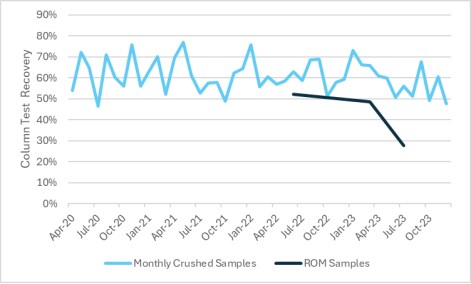

| Figure 13-1: Column Testing on Monthly Composites of Crushed Material and Column Testing of ROM Material Collected on a Quarterly Basis | 126 |

| Florida Canyon Gold Mine | Page xi |

| Florida Canyon Gold Inc. | NI 43-101 Technical Report |

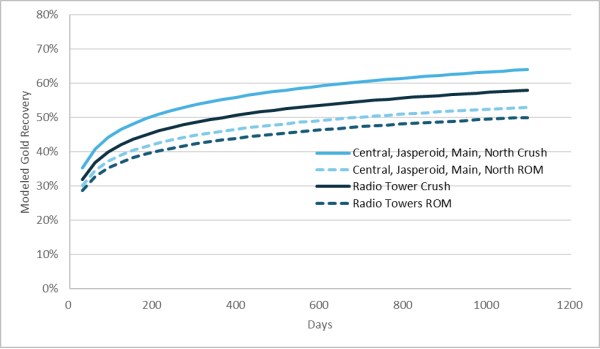

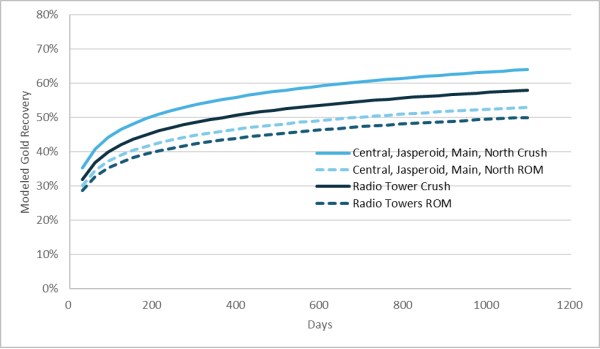

| Figure 13-2: Gold Recovery by Ore Source and Particle Size Over a Three-Year Period | 129 |

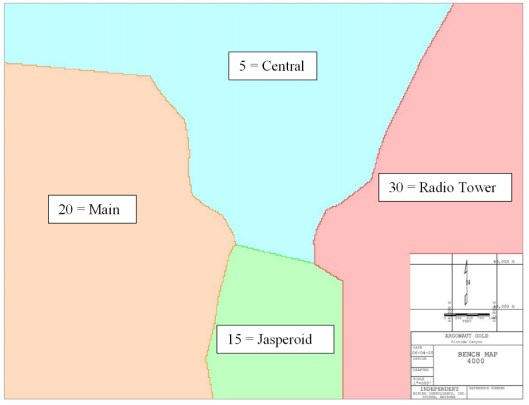

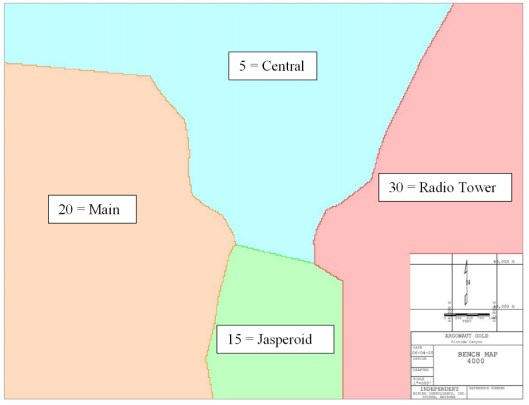

| Figure 14-1: Domain Codes and Locations | 134 |

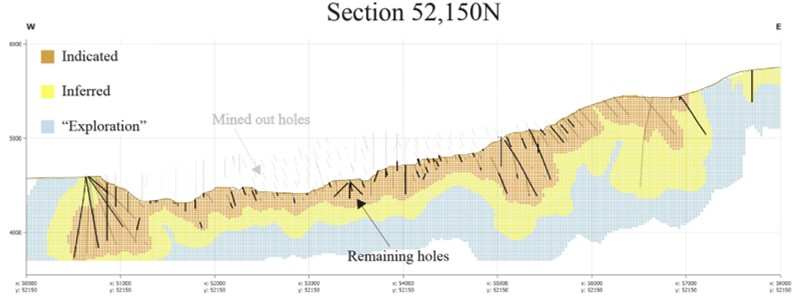

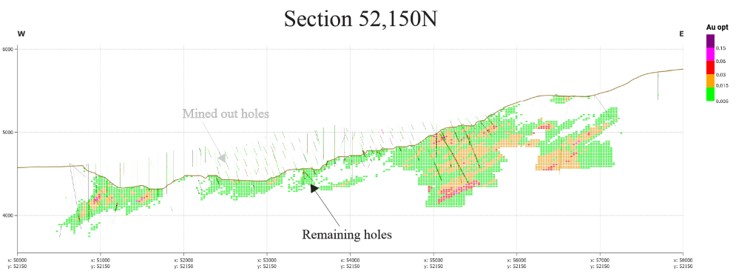

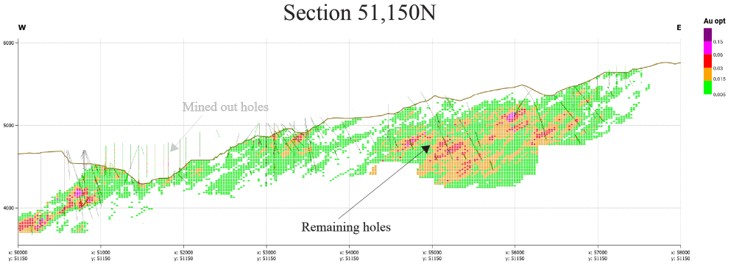

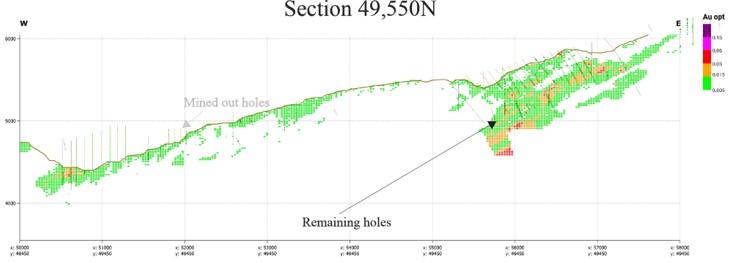

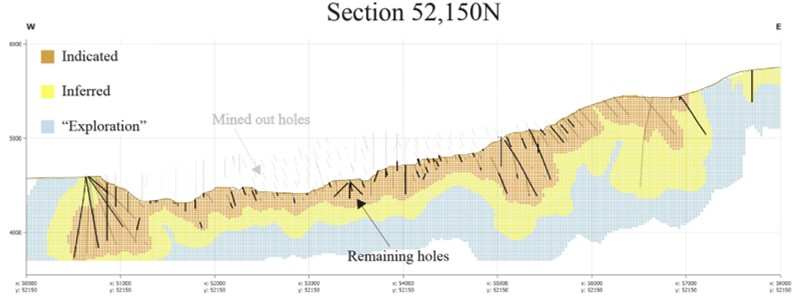

| Figure 14-2: Cross Section Looking North Showing Classification of Block Model | 137 |

| Figure 14-3: Cross Section Looking North Showing Gold Grade Estimation in Block Model | 138 |

| Figure 14-4: Cross Section Looking North Showing Gold Grade Estimation in Block Model | 139 |

| Figure 14-5: Cross Section Looking North Showing Gold Grade Estimation in Block Model | 140 |

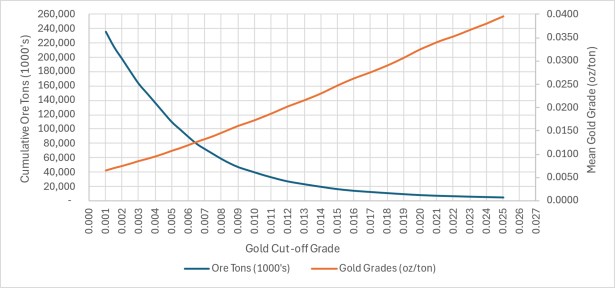

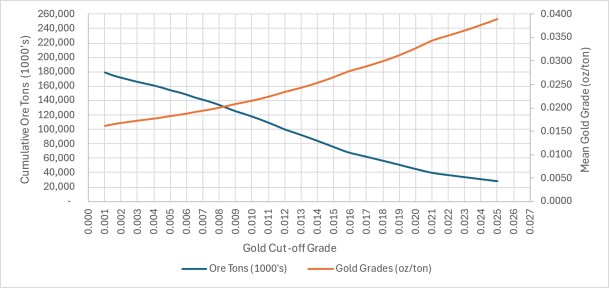

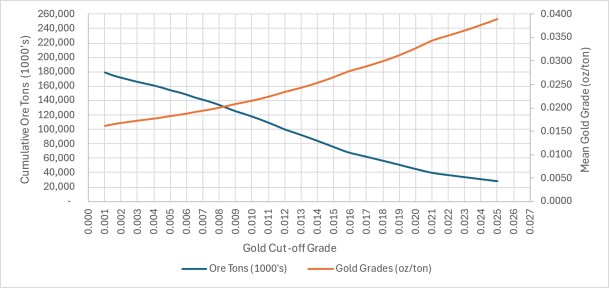

| Figure 14-6: Grade-Tonnage Sensitivity Curve for the Oxides | 148 |

| Figure 14-7: Grade-Tonnage Sensitivity Curve for the Sulfides | 148 |

| Figure 15-1: Open Pit Optimization Results at Incremental Gold Metal Price | 152 |

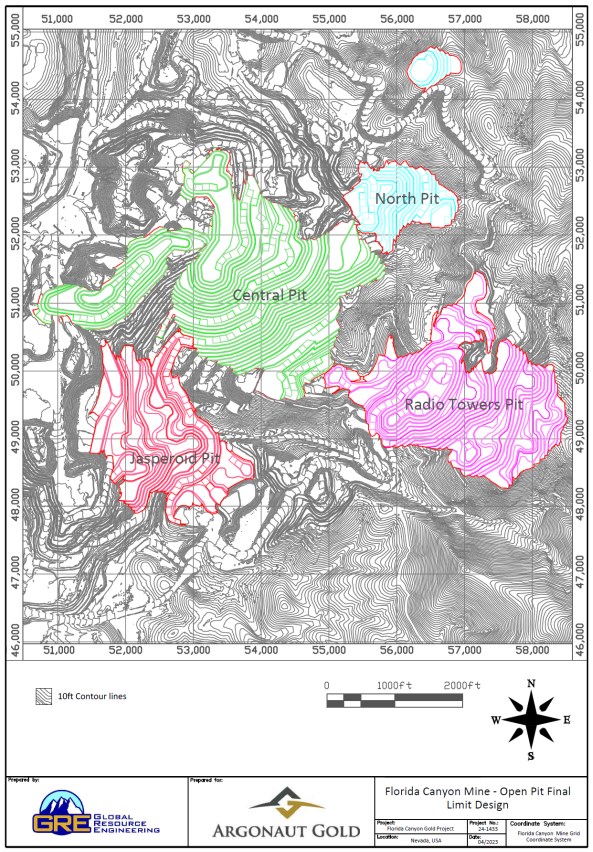

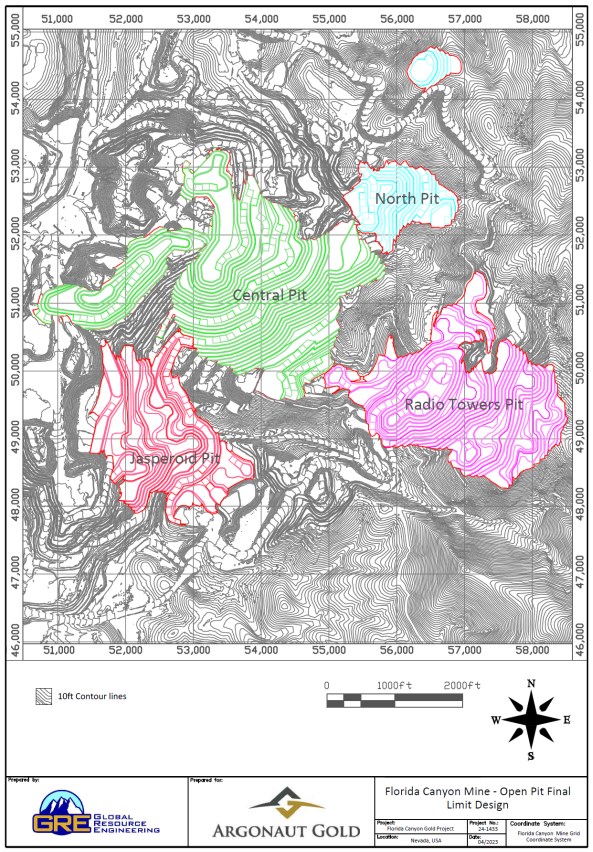

| Figure 15-2: Open Pit Final Limit Design | 154 |

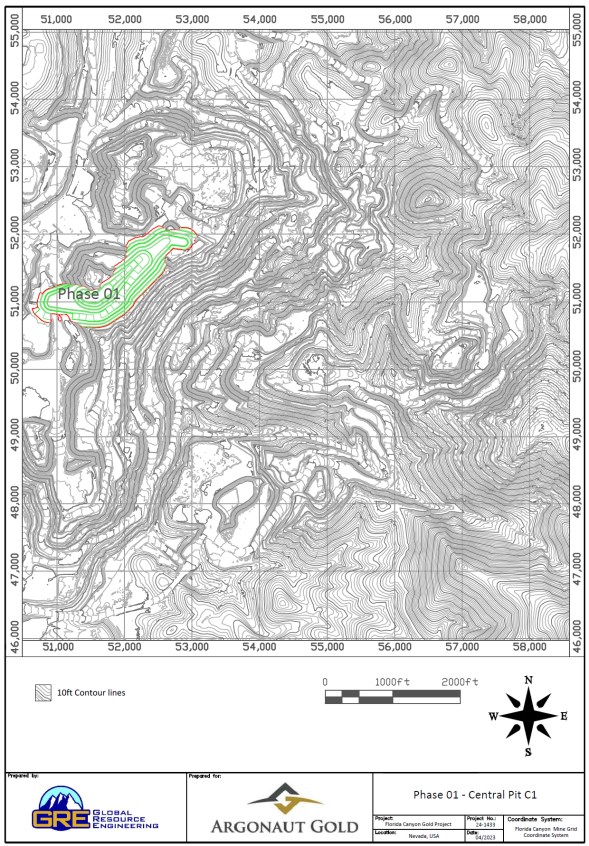

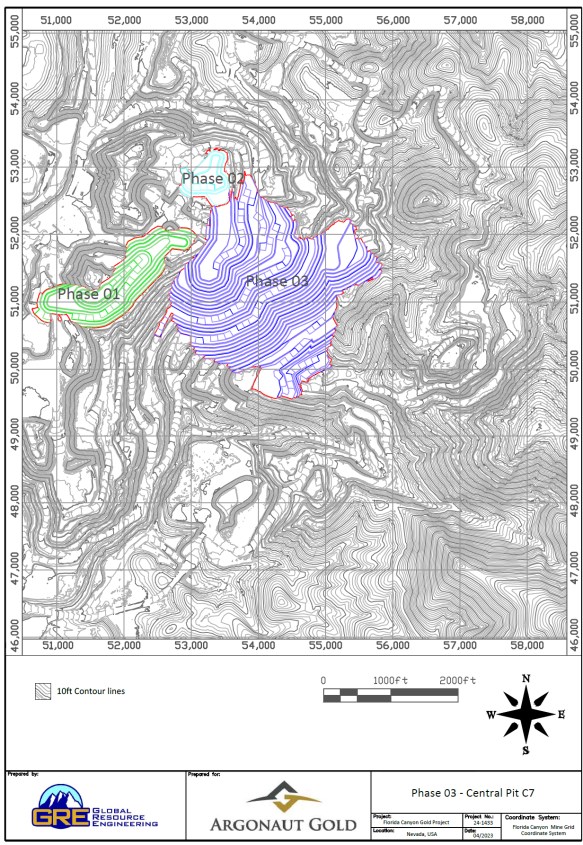

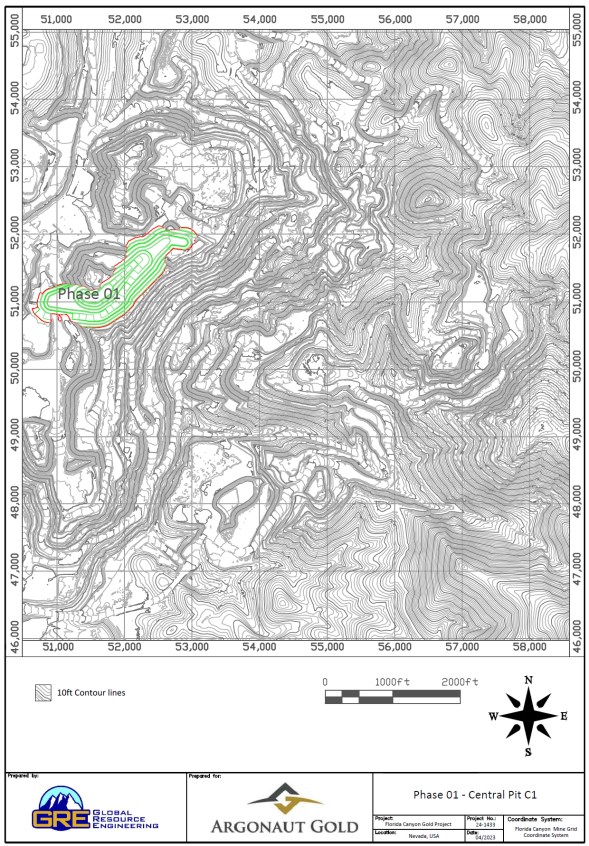

| Figure 16-1: Phase 01 - Central Pit C1 | 159 |

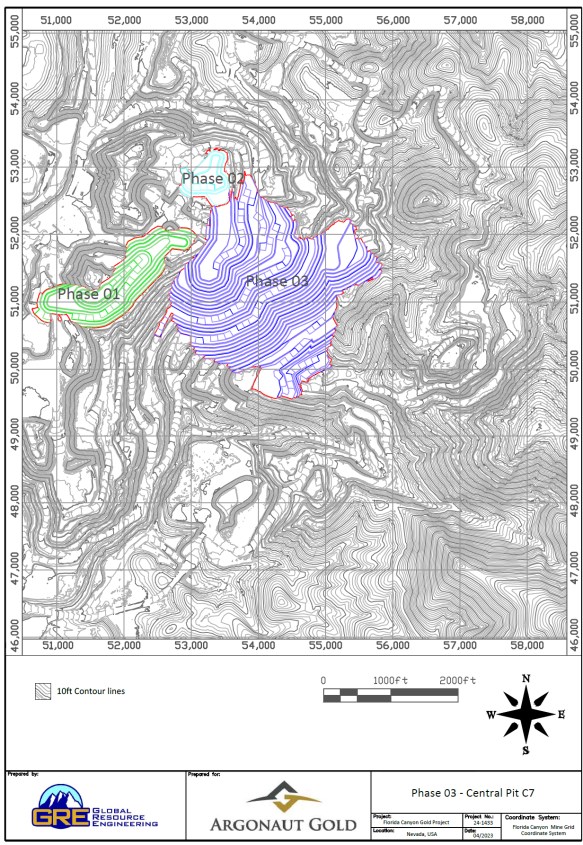

| Figure 16-2: Phase 02 - Central Pit C6 | 160 |

| Figure 16-3: Phase 03 - Central Pit C7 | 161 |

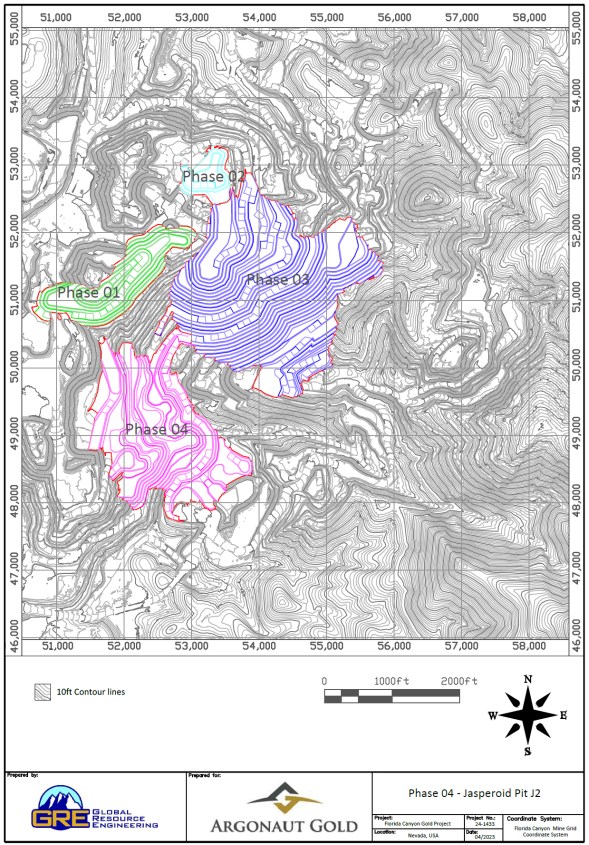

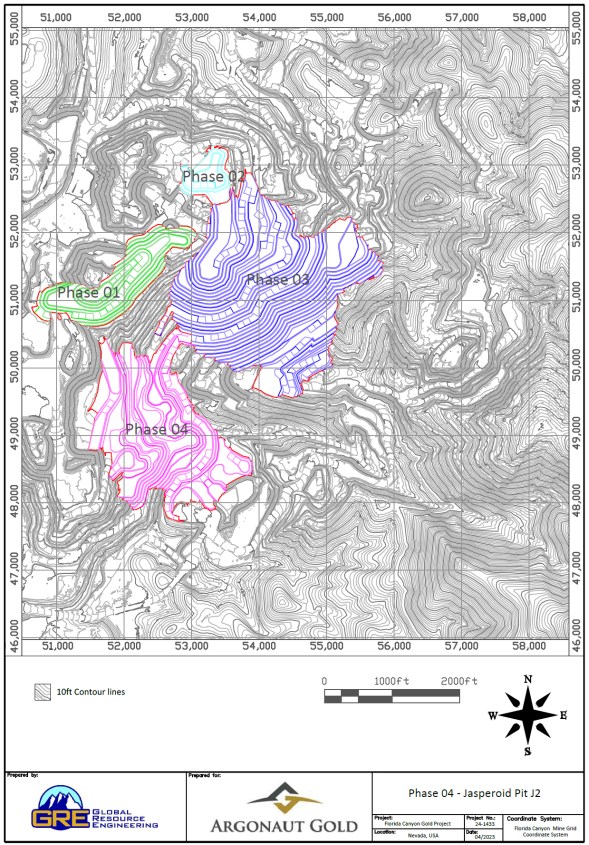

| Figure 16-4: Phase 04 - Jasperoid Pit J2 | 162 |

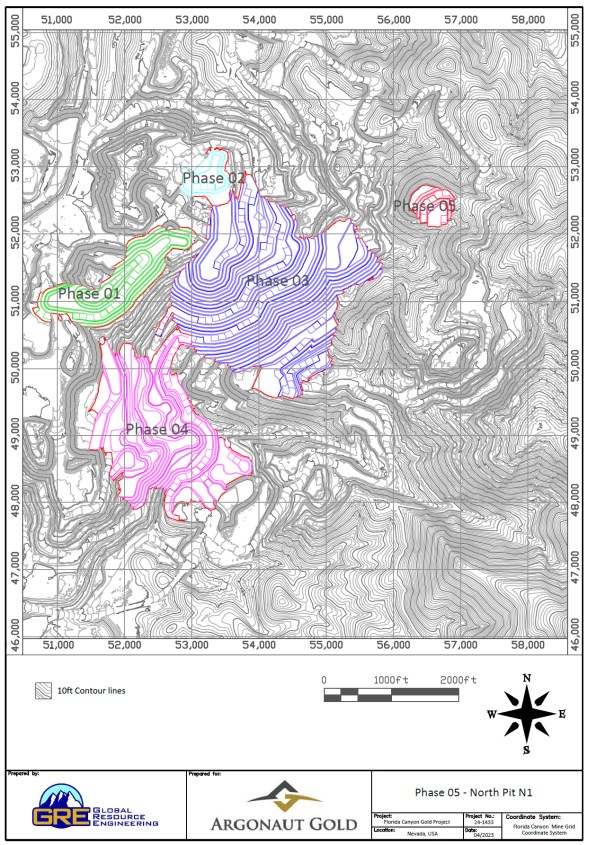

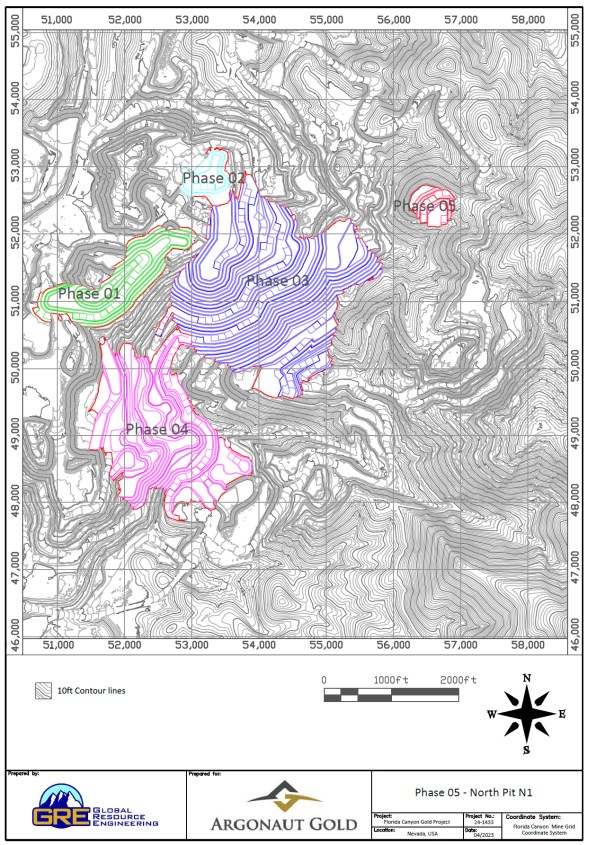

| Figure 16-5: Phase 05 - North Pit N1 | 163 |

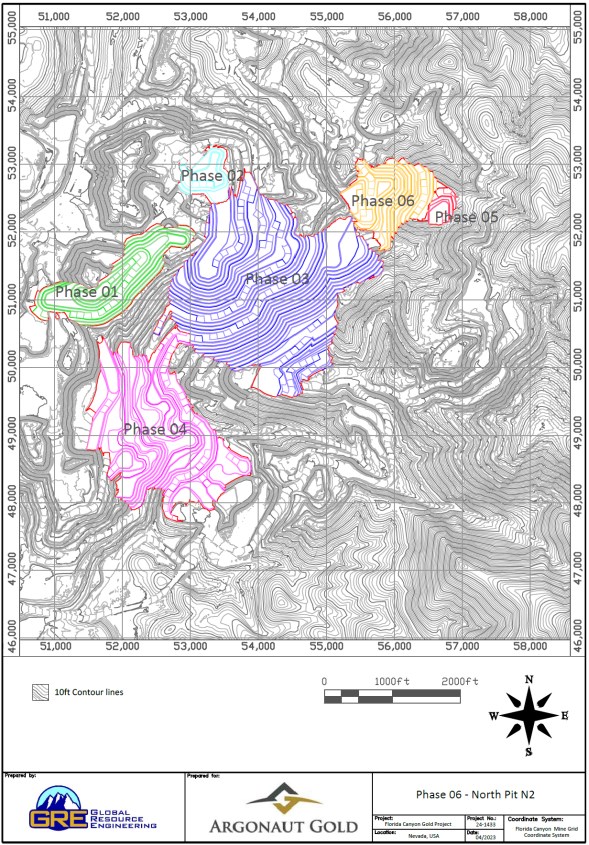

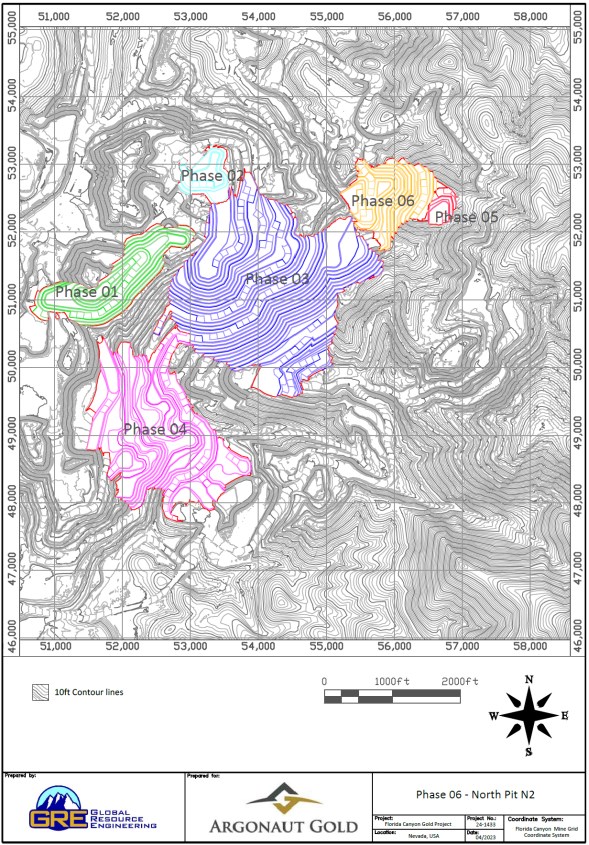

| Figure 16-6: Phase 06 - North Pit N2 | 164 |

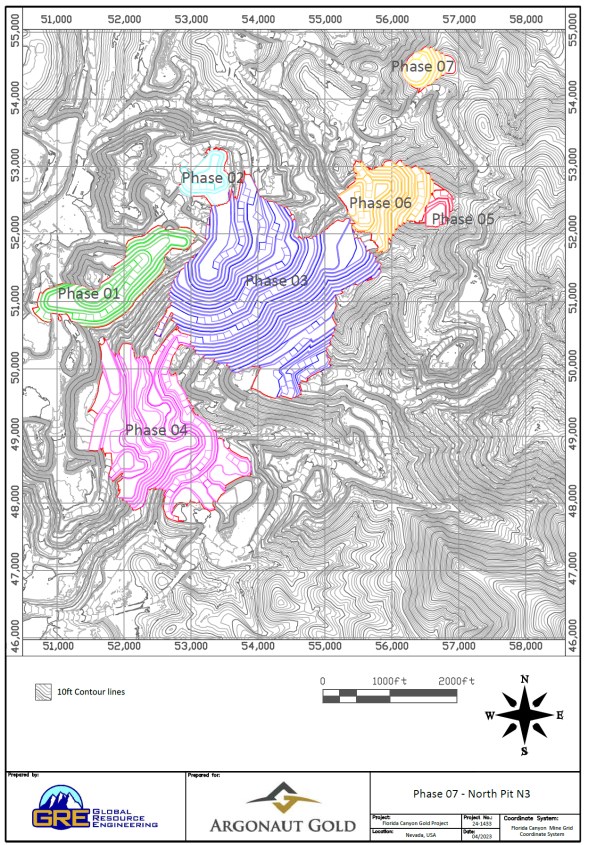

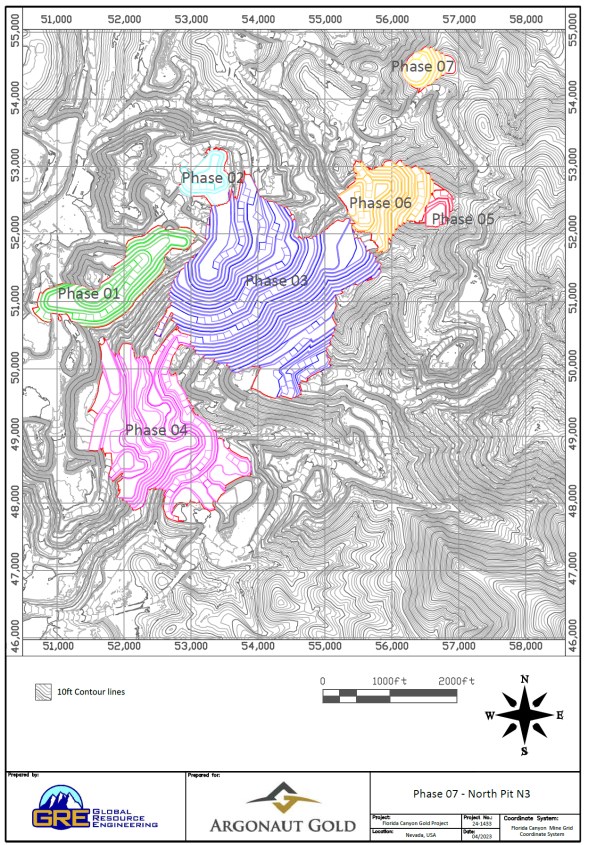

| Figure 16-7: Phase 07 - North Pit N3 | 165 |

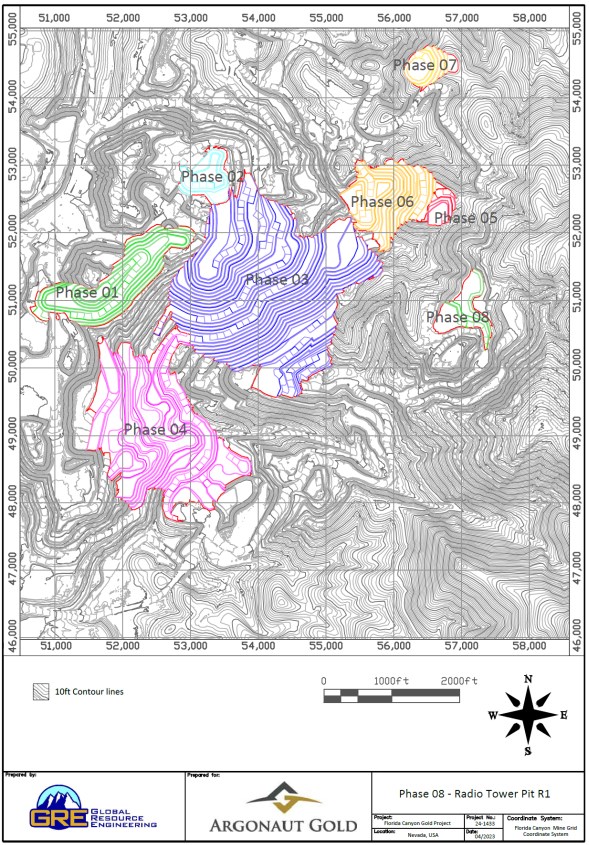

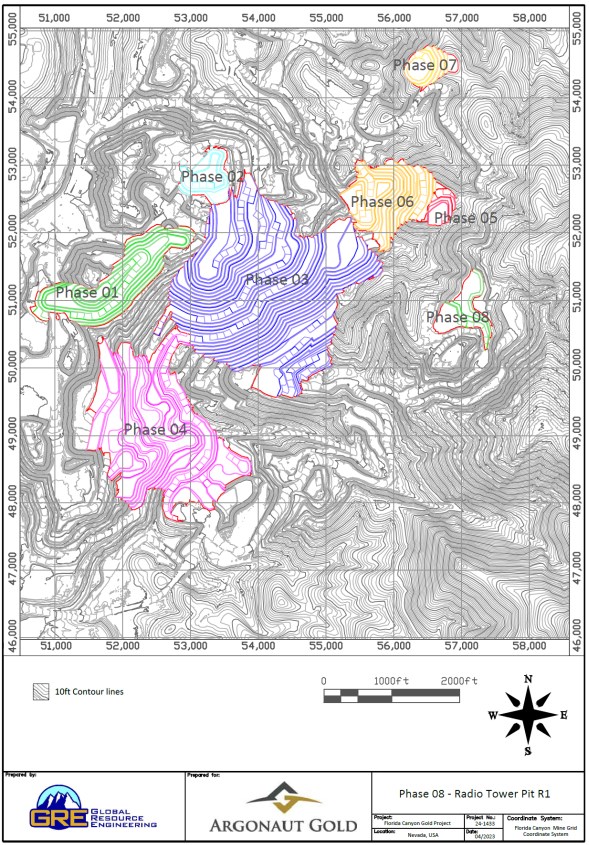

| Figure 16-8: Phase 08 - Radio Tower Pit R1 | 166 |

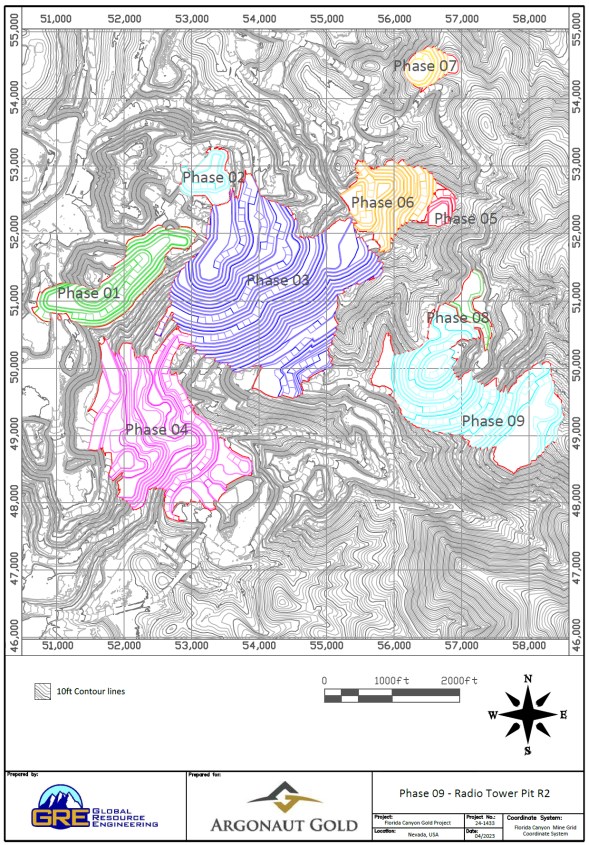

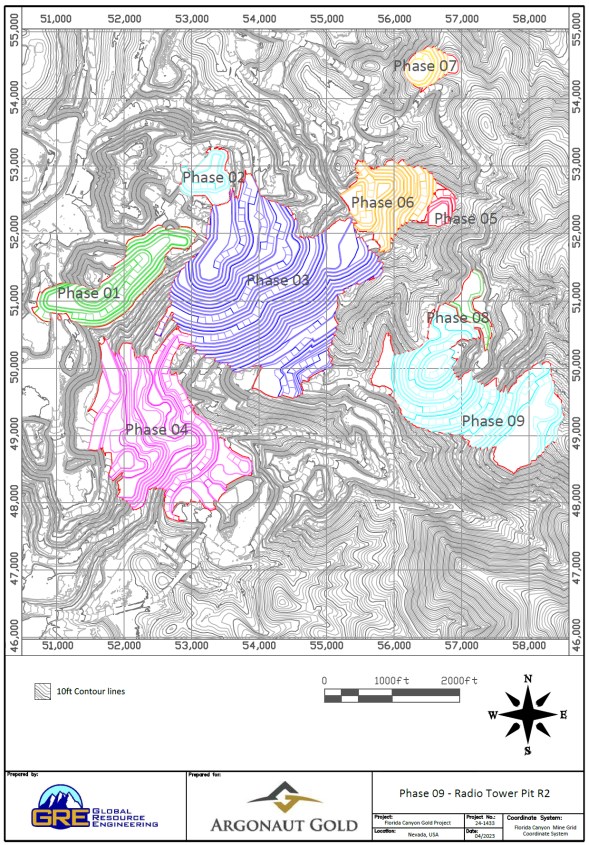

| Figure 16-9: Phase 09 - Radio Tower Pit R2 | 167 |

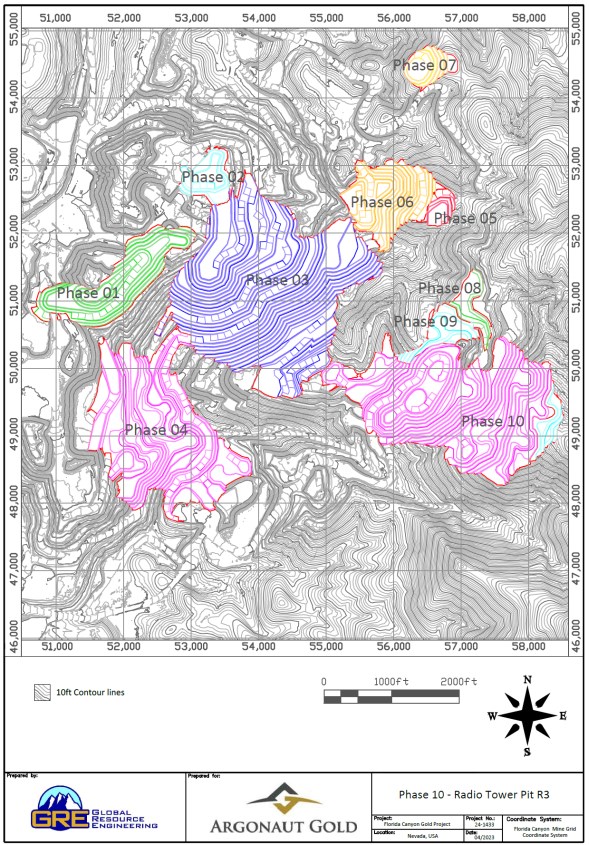

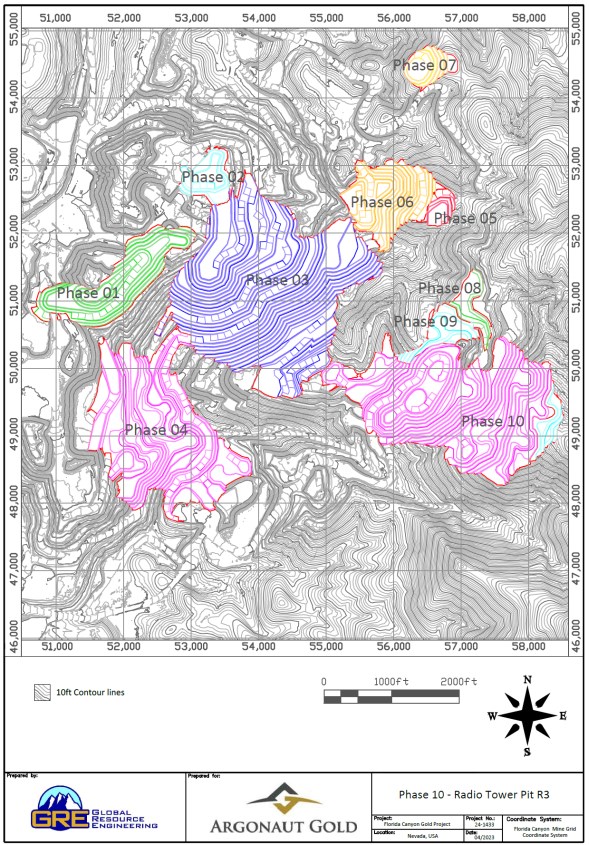

| Figure 16-10: Phase 10 - Radio Tower Pit R3 | 168 |

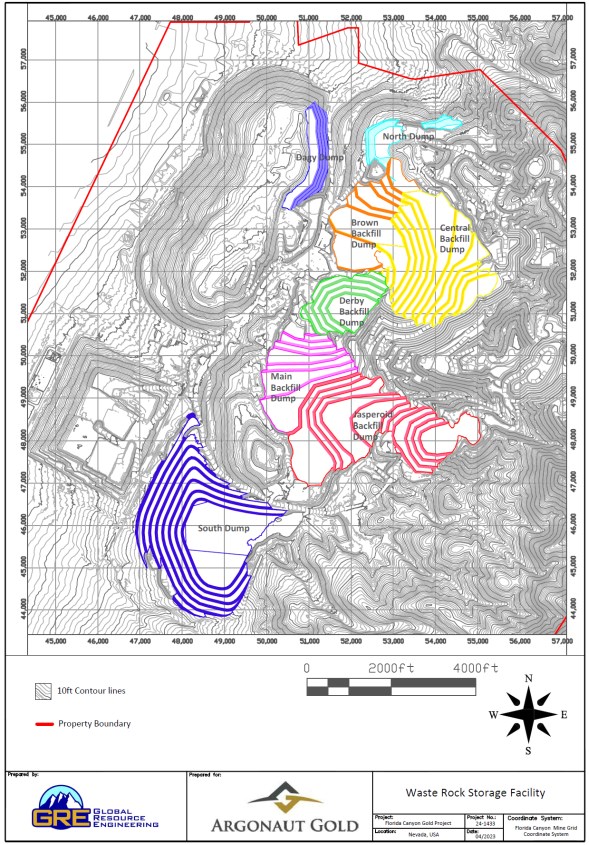

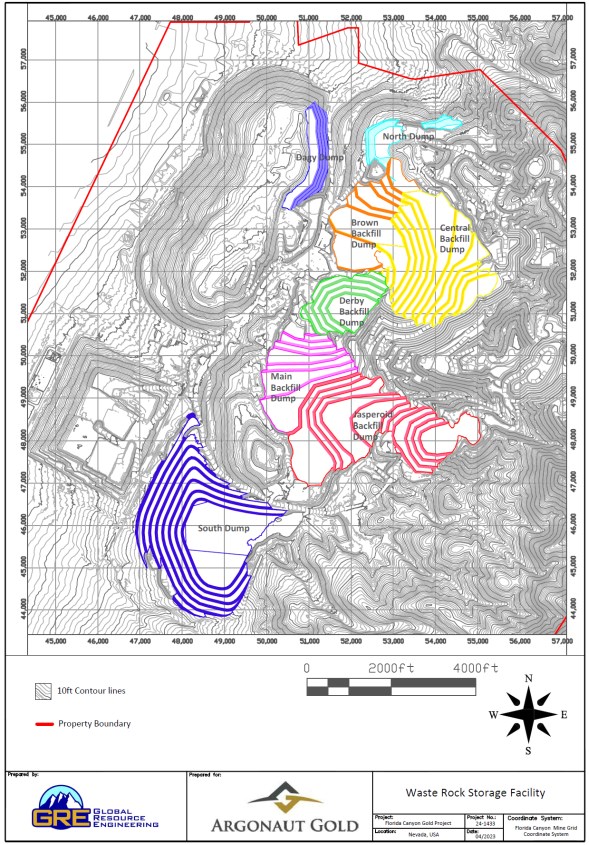

| Figure 16-11: Waste Rock Storage Facility | 172 |

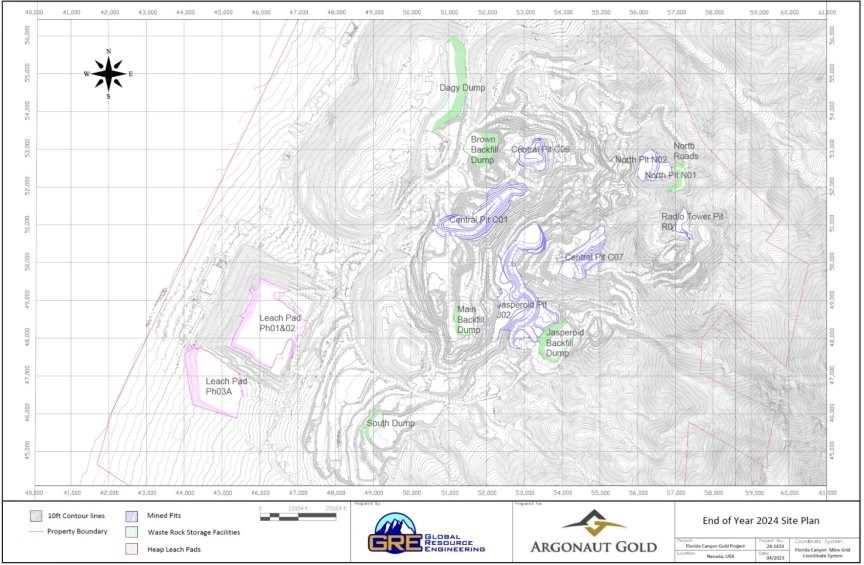

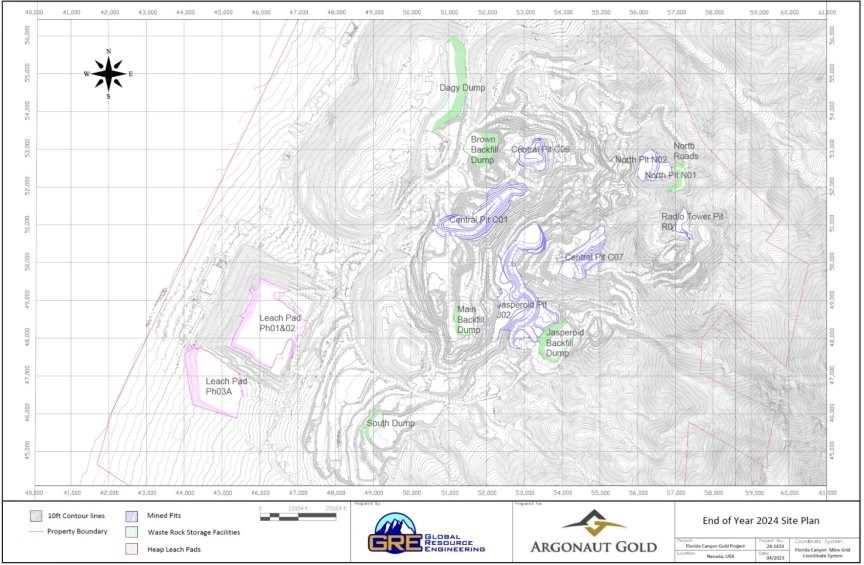

| Figure 16-12: End of Year 2024 Site Plan | 173 |

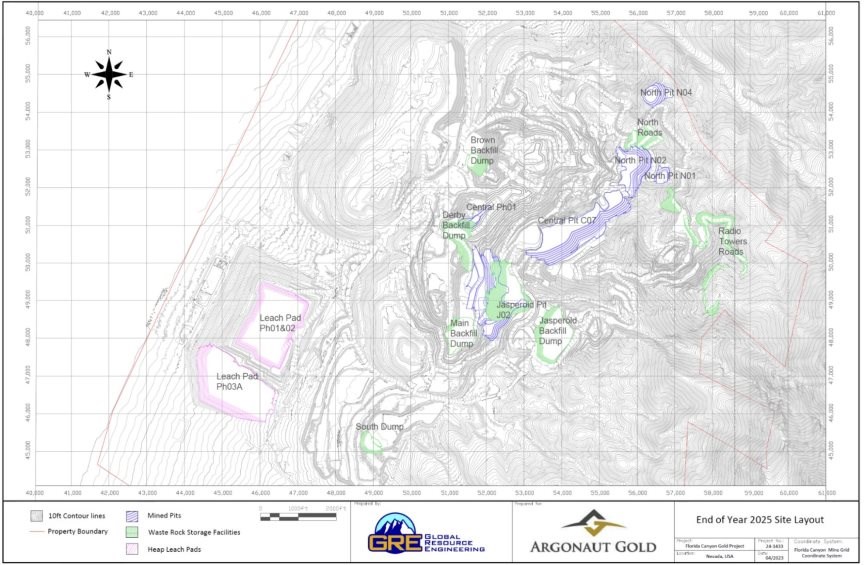

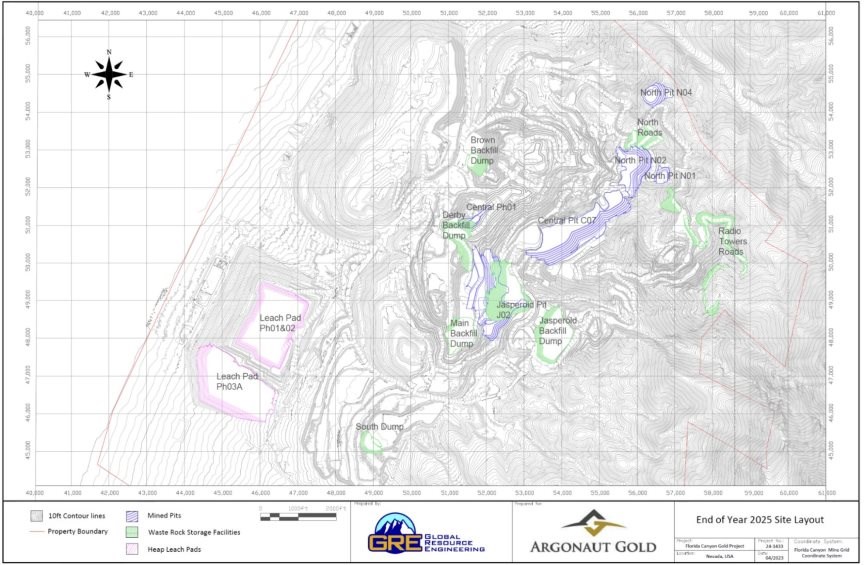

| Figure 16-13: End of Year 2025 Site Plan | 174 |

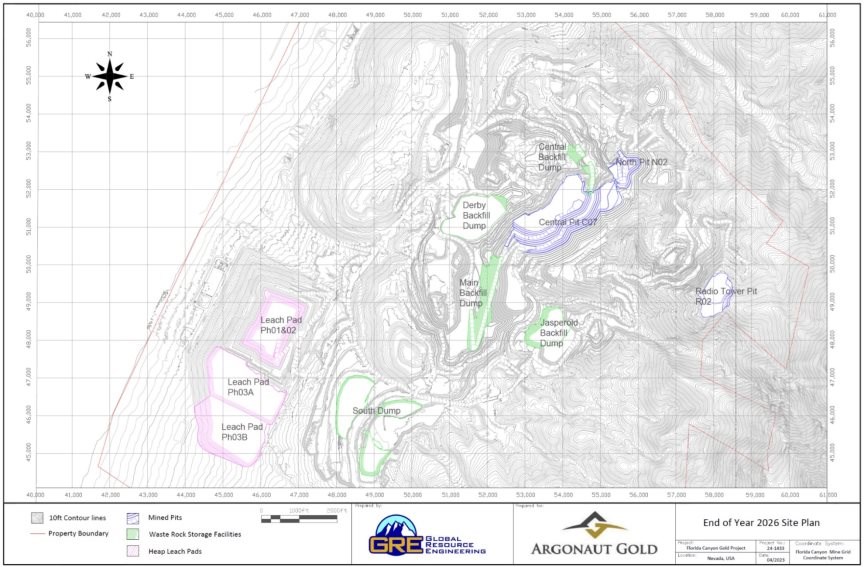

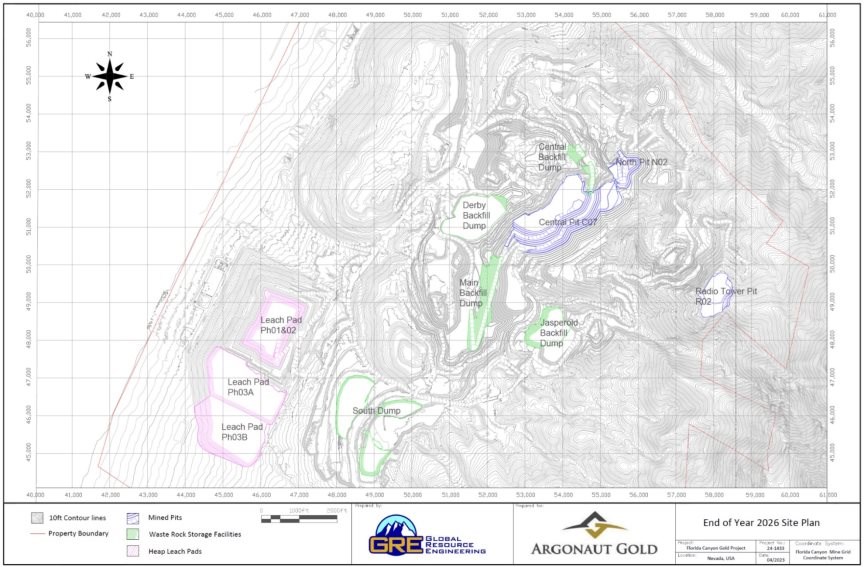

| Figure 16-14: End of Year 2026 Site Plan | 175 |

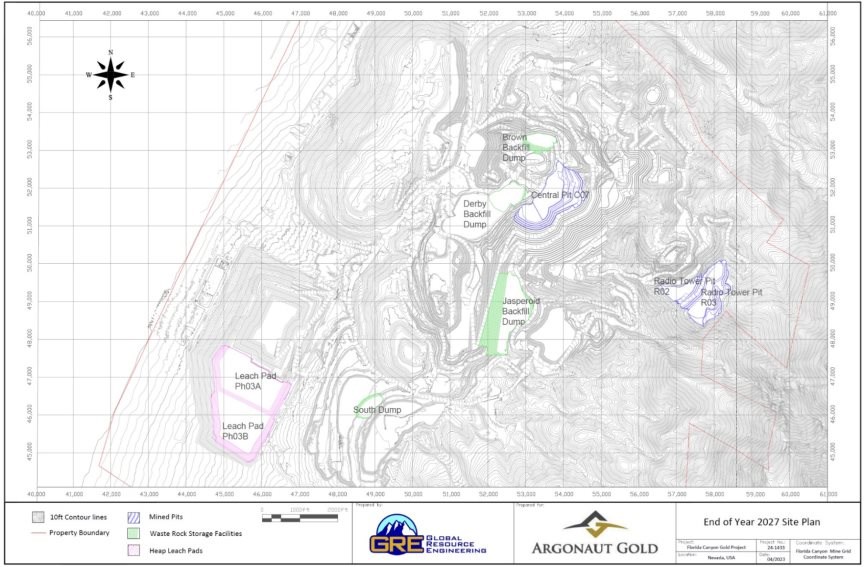

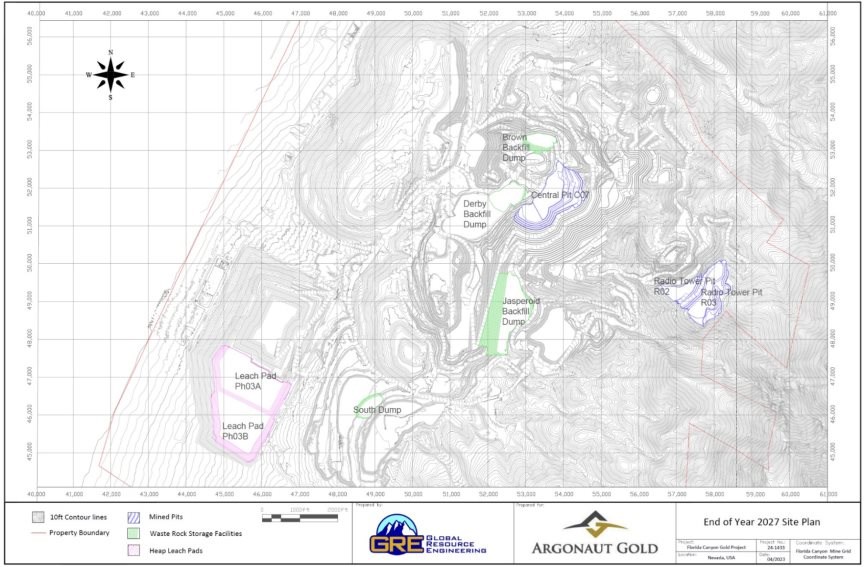

| Figure 16-15: End of Year 2027 Site Plan | 176 |

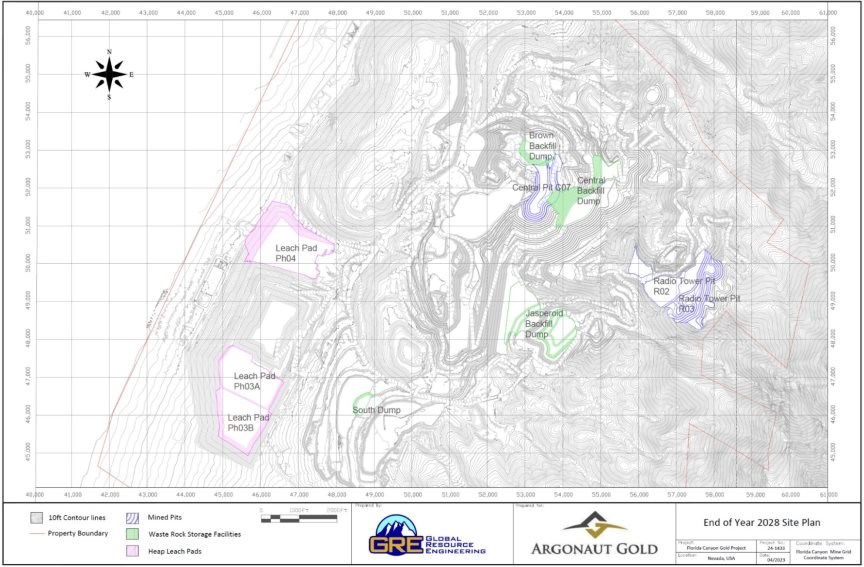

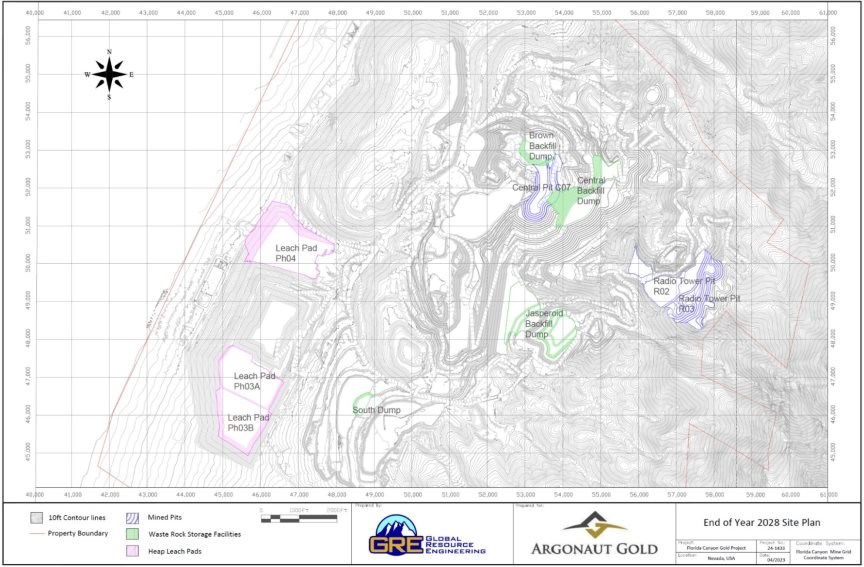

| Figure 16-16: End of Year 2028 Site Plan | 177 |

| Figure 16-17: End of Year 2029 Site Plan | 178 |

| Figure 16-18: End of Year 2030 Site Plan | 179 |

| Figure 17-1: Gold Recovery Trend | 184 |

| Figure 18-1: Site General Arrangement | 186 |

| Figure 19-1: LBMA AM Fix gold price (daily) | 191 |

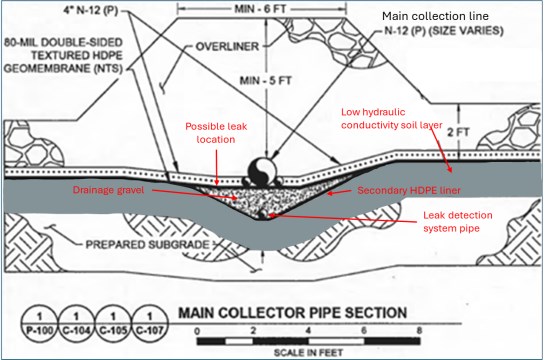

| Figure 20-1: Phase 2 Heap Leach Leak Detection System | 197 |

| Figure 22-1: Sensitivity Analysis | 214 |

LIST OF TABLES

| Table 1-1: Mineral Resource Statement - effective 31 December 2023 | 21 |

| Table 1-2: Mineral Reserve Statement - effective 31 December 2023 | 22 |

| Table 1-3: Capital Cost Estimate | 25 |

| Table 1-4: Operating Cost Estimates | 25 |

| Table 2-1: Contributing Authors | 29 |

| Table 6-1: Historic Mineral Resource Statements for Florida Canyon | 39 |

| Table 6-2: Historic Mineral Reserve Statements for Florida Canyon | 40 |

| Table 9-1: Summary of Exploration Sampling Exclusive of Drilling | 48 |

| Florida Canyon Gold Mine | Page xii |

| Florida Canyon Gold Inc. | NI 43-101 Technical Report |

| Table 10-1: Drill Hole Database - Florida Canyon Mine | 52 |

| Table 10-2: Core Recovery from 2020 to 2023 | 57 |

| Table 10-3: Down-Hole Surveys (1981-2016) | 58 |

| Table 10-4: Down Hole Surveys (2017) | 58 |

| Table 10-5: Down-Hole Surveys (2020-2023) | 59 |

| Table 11-1: Pre Argonaut (QA/QC Programs Prior to 2017) | 62 |

| Table 11-2: Pre Argonaut (QA/QC Programs in 2017) | 63 |

| Table 11-3: List of Certified Reference Materials Used in the 2017 Drilling Program | 63 |

| Table 11-4: Argonaut (QA/QC Programs 2020-2023) | 64 |

| Table 11-5: List of Certified Reference Materials Used in the 2020-2023 Drilling Program | 64 |

| Table 12-1: Nearest Neighbor Test of 2017 Data vs All Previous Data | 69 |

| Table 12-2: DDH to RC Nearest Neighbor Comparison | 70 |

| Table 12-3: Collar Coordinates Inspections | 107 |

| Table 12-4: Visual Inspection of RC Sample Intervals | 111 |

| Table 12-5: Visual Inspection of Core Sample Intervals | 112 |

| Table 12-6: Check Samples Submitted to Hazen Labs | 121 |

| Table 12-7: Summary Table of Hazen Results with Original Assays | 121 |

| Table 13-1: Gold Recovery Equations by Source and Particle Size | 128 |

| Table 13-2: Annual summary of Ore and Ounces Placed, Modeled and Produced Ounces | 129 |

| Table 14-1: Basic Statistics of Fire Assays and 20-foot Composites Used for the LIK Estimation | 131 |

| Table 14-2: Model Location and Block Size | 132 |

| Table 14-3: Conversion Parameters for Florida Canyon Local Mine Grid to NAD 83 Zone 11 | 132 |

| Table 14-4: Assay Intervals with Cyanide Soluble Assays Remaining as of Year End 2023 | 133 |

| Table 14-5: Bulk Density Assignment | 133 |

| Table 14-6: Grade Estimation Parameters for OK Localizer Model | 135 |

| Table 14-7: Comparison of LIK Models to the Blasthole Block Model Showing Various FA/CN Conversion Ratios | 141 |

| Table 14-8: Comparison of LIK Model to the Ore Control Production Model for Ore Polygons Mined in 2023 | 143 |

| Table 14-9: Comparison of LIK Model to the Ore Control Production Model for Ore Polygons Mined in 2024 | 144 |

| Table 14-10: Pit Optimization Parameters for Determination of Mineral Resource | 146 |

| Table 14-11: Summary of Mineral Resources, Inclusive of Mineral Reserves - effective 31 December 2023 | 147 |

| Table 15-1: Summary of Predictive Gold Recovery | 151 |

| Table 15-2:Open Pit COG Calculation Parameters | 151 |

| Table 15-3: Summary of Mineral Reserves - effective 31 December 2023 | 155 |

| Table 16-1: Inter-Ramp Slope Design Criteria | 157 |

| Table 16-2: Open Pit Mine Ore Production Schedule | 170 |

| Table 16-3: Open Pit Mine Material Movement Schedule | 170 |

| Table 16-4: Mine Waste Rock Storage Facility Requirements and Capacities | 171 |

| Table 16-5: Current and Peak Principal Open Pit Mining Equipment Requirements | 180 |

| Table 17-1: Processing Equipment Used at FCM | 183 |

| Florida Canyon Gold Mine | Page xiii |

| Florida Canyon Gold Inc. | NI 43-101 Technical Report |

| Table 17-2: Primary Reagent Consumptions and Rate for 2023. | 183 |

| Table 17-3: Consolidated Production Data for SHLP | 184 |

| Table 20-1: Current Permits for Florida Canyon | 197 |

| Table 20-2: FCM Water Rights | 202 |

| Table 21-1: Capital Costs Summary | 208 |

| Table 21-2: Operating Cost Summary | 209 |

| Table 21-3: Unit Operating Cost Summary | 209 |

| Table 22-1: Financial Analysis Summary | 212 |

| Table 22-2: Sensitivity Analysis | 213 |

| Table 25-1: Capital Cost Estimate | 220 |

| Table 25-2: Operating Cost Estimates | 220 |

LIST OF ACRONYMS AND ABBREVIATIONS

| Argonaut | Argonaut Gold Inc. |

| FCGI | Florida Canyon Gold Inc. |

| FCM | Florida Canyon Mine |

| GRE | Global Resource Engineering, Ltd |

| NI-43101 | Canadian Securities Administrators' National Instrument 43-101 |

| CIM | Canadian Institute of Mining, Metallurgy and Petroleum |

| QP | Qualified Person |

| ROM | Run-of-Mine |

| WRSF | Waste Rock Storage Facility |

| BLM | U.S. Bureau of Land Management |

| RAB | Rotary Air Blast |

| RC | Reverse Circulation |

| CIC | Carbon-in-Column |

| AA | Atomic Adsorption Spectrometer |

| LIK | Localized Indicator Kriging |

| MIK | Mixed Indicator Kriging |

| Ok | Ordinary Kriging |

| VRF | Variance Reduction Factor |

| COG | Cut-off-Grade |

| FEL | Front-End Loaders |

| tpd | Tons per day (short) |

| tpa | Tons per year (short) |

| HLP | Heap Leach Pad |

| SHLP | South Heap Leach Pad |

| NHLP | North Heap Leach Pad |

| Asahi | Asahi Refining USA Inc. |

| NPV | Net Present Value |

| I-80 | Interstate Highway I-80 |

| StdM | Standard Mine |

| Alio | Alio Gold, Inc. |

| Florida Canyon Gold Mine | Page xiv |

| Florida Canyon Gold Inc. | NI 43-101 Technical Report |

| MDA | Mine Development Associates |

| IMC | Independent Mine Consultants |

| Cordex | Cordilleran Explorations |

| Montoro | Montoro Gold Company |

| Pegasus | Pegasus Gold Corporation |

| Nevoro | Nevoro Gold, Inc. |

| Apollo | Apollo Gold Corporation |

| Admiral | Admiral Financial Group |

| Rye Patch | Rye Patch Gold Corp |

| Homestake | Homestake Mining Company |

| DDH | Diamond Drill Holes |

| lb | Pound |

| lb/ton | Pounds per ton (short) |

| oz/ton | Ounces per ton (short) |

| oz | Ounces |

| RQD | Rock Quality Designation |

| IRD | International Directional Services |

| SRG | Surface Recoding Gyro |

| AAL | American Assay Labs |

| NDEP | Nevada Department of Environmental Protection |

| ppm | Parts per million |

| QA/QC | Quality Assurance / Quality Control |

| MEG | Moment Exploration Geochemistry |

| CRM | Certified Reference Material |

| KS | Komologov-Smirnoff |

| Hazen | Hazen Research Inc. |

| CNAA | Cyanide-Leach Atomic Absorption |

| AuAA | Cyanide Soluble Gold assay |

| AuFA | Gold Fire Assay |

| SMU | Selective Mining Unit |

| LOM | Life-of-Mine |

| Golder | Golder Associates Inc. |

| Barr | Barr Engineering Co. |

| UDCF | Undiscounted Cash Flow |

| DTH | Down-the-Hole |

| ADR | Adsorption, Desorption and Regeneration |

| PAG | Potentially Acid Generating |

| LBMA | London Bullion Market Association |

| PoO | Mine Plan of Operations |

| APO | Amended Plan of Operations |

| NEPA | National Environmental Policy Act |

| FONSI | Finding of No Significant Impact |

| DR | Decision Record |

| Florida Canyon Gold Mine | Page xv |

| Florida Canyon Gold Inc. | NI 43-101 Technical Report |

| WPCP | Water Pollution Control Permit |

| BMRR | Bureau of Regulations and Reclamation |

| FOAV | Findings of Alleged Violation |

| LDS | Leak Detections System |

| GPD | Gallons per day |

| HDPE | High-Density Polyethylene |

| SWPPP | Stormwater Pollution Prevention Plan |

| NDWR | Nevada Division of Water Resources |

| EA | Environmental Assessment |

| EIS | Environmental Impact Statement |

| BAPC | Bureau of Air Pollution control |

| BWPC | Bureau of Water Pollution control |

| BWM | Bureau of Waste Management |

| BSDW | Bureau of Safe Drinking Water |

| NDOW | Nevada Department of Wildlife |

| HAP | Hazardous Pollutants |

| ROW | Right of Way |

| SRCE | Nevada Standardized Reclamation Cost Estimator |

| CDC | Closure Diversion Channel |

| EMS | Environmental Management System |

| IRR | Internal Rate of Return |

| SAG | Semi-Autogenous Grinding |

1.0 SUMMARY

1.1 Introduction

Dr. Todd Harvey (SME Registered Member), Ms. Terre Lane (MMSA QP), Dr. Hamid Samari (MMSA QP) and Larry Breckenridge (PE) were retained by Argonaut Gold Inc. (Argonaut) to prepare this technical report (the Report) on the Florida Canyon Gold Mine (FCM) in Nevada, USA for Florida Canyon Gold Inc. (FCGI) for the purpose of documenting the technical information available on the FCM in connection with the listing of FCGI on the TSX Venture Exchange (TSXV) as required by the policies of the TSXV.

On March 27, 2024, Argonaut and Alamos Gold Inc. (Alamos) entered into an arrangement agreement (the Arrangement Agreement), whereby Alamos will acquire all of the issued and outstanding shares of Argonaut pursuant to a court approved plan of arrangement (the Arrangement). As part of the Arrangement, Alamos will acquire Argonaut's Magino mine and Argonaut's assets in the United States and Mexico will be spun out to FCGI. As a result, FCGI will own the Florida Canyon mine.

This Report has been addressed to FCGI, as the Authors intend that FCGI be entitled to rely on it in connection with the Arrangement and the transactions contemplated thereby. The authors also intend for this Report to be filed on SEDAR+ by FCGI.

Prior to the completion of the Arrangement, Argonaut wholly-owned the FCM. Argonaut acquired the property through a merger with Alio Gold Inc. (Alio) that closed on July 1, 2020. Following the completion of the Arrangement, the FCM will be wholly-owned by FCGI.

Mineral Resources and Mineral Reserves are reported for the FCM assuming open pit mining methods. The mine was in continuous operation from 1986 through 2011 and then intermittently until 2015. It was reopened in mid-2016 and has been in operation since that time.

1.2 Terms of Reference

Mineral Resources and Mineral Reserves are reported in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves (May 2014; the 2014 CIM Definition Standards) and the CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines (November 2019; the 2019 CIM Best Practice Guidelines).

Units used in the report are imperial units unless otherwise noted. Monetary units are in US dollars ($) unless otherwise stated. The Report uses US English.

FCM uses the term "run-of-mine" (ROM) which is material that is placed directly on the heap leach pad (HLP) without crushing and "waste rock storage facility" (WRSF) for the area where waste rock will be stored.

1.3 Project Setting

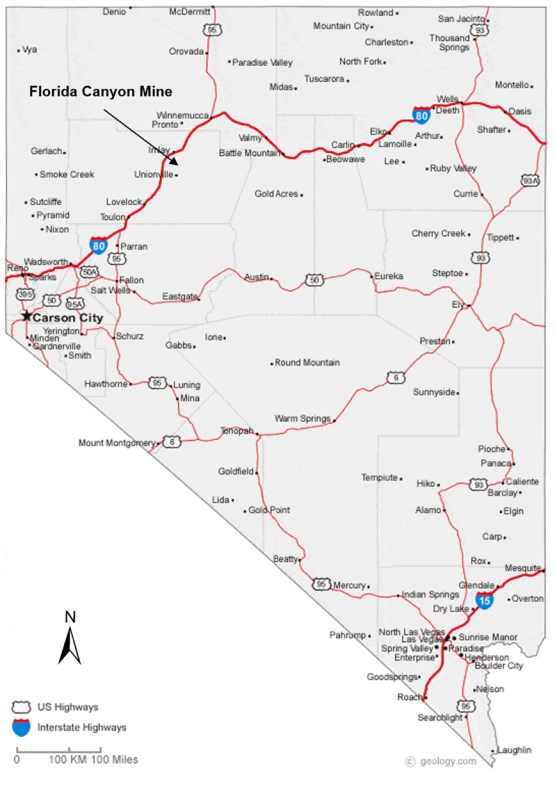

FCM is located just off Interstate Highway I-80 (I-80), 125 miles northeast of Reno, Nevada. The nearest towns are Winnemucca, 40 miles northeast with a population of 8,388 (2022) and Lovelock, 33 miles southwest, with a population of 1,854 (2022). The highway exit for the FCM from I-80 is at Imlay, Nevada. The property location is 40.586088 degrees north latitude by 118.257365 degrees west longitude. Access is reliable via the Interstate Highway year around.

1.4 Mineral Tenure, Royalties, Environmental Liabilities and Permitting

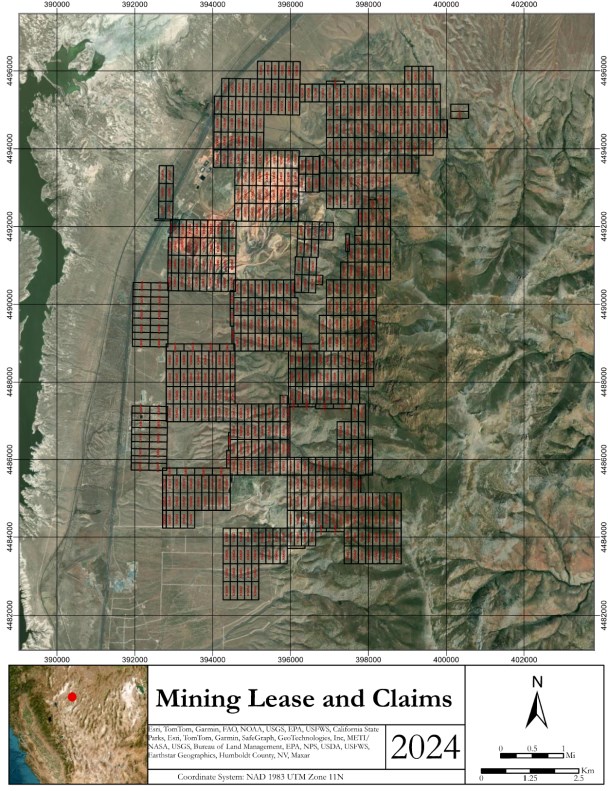

The land package owned or leased by FCM covers a total of 18,630.8 acres. Fee lands total 5,520.4 acres and unpatented claims total 13,110.4 acres. Contained within the fee lands are 19 patented claims totaling 359.9 acres. This land position includes both FCM and the Standard Mine (StdM) which is located south of FCM. This report addresses FCM only and does not include any Mineral Resources within the StdM property holdings.

Royalty interests at FCM have been consolidated since publications in 2019 and are reported by FCM accounting personnel to be:

• Top Hat Partnership 2.5% NSR

• Maverix Metals, Inc. 3.0% NSR

The Maverix Metals Inc. (Maverix) royalty historically changed at different locations across the property. Alio negotiated a fixed 3% royalty with Maverix on 22 November 2019.

FCM reports that all environmental and operational permits are in place to continue operations. Specifics of environmental permitting will be summarized in Section 20. The U.S. Bureau of Land Management (BLM) and the State of Nevada regulations require closure and reclamation of mineral projects, and a reclamation permit must include a financial surety to ensure that the reclamation will be completed. FCM has a reclamation surety to fund closure and reclamation of the mine operations disturbance and is currently permitted for reclamation.

1.5 Geology, Mineralization, and Deposit Type

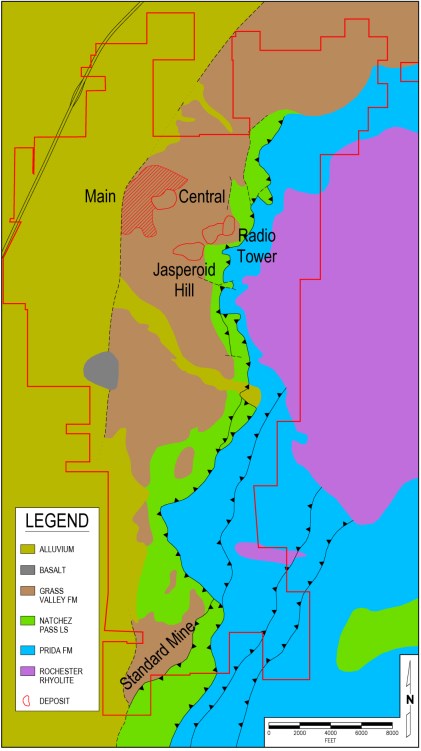

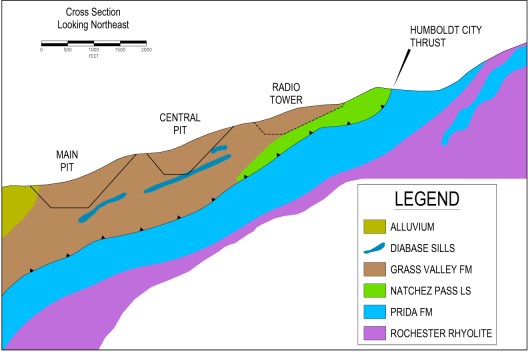

FCM and StdM are situated in northwestern Nevada within the Great Basin and Humboldt Range physiographic province, which is typified by a series of northward-trending elongate mountain ranges separated by alluvial valleys. Rocks exposed in the region range in age from Cambrian to Holocene and comprise thick sequences of sedimentary, volcanic, intrusive and metamorphic rocks in a complex structural environment (Johnson, 1977). Rocks of the Rochester Rhyolite, Prida Formation, Natchez Pass Limestone, and Grass Valley Formation are exposed in the FCM area. All of these units are of Triassic age. The Humboldt City Thrust Fault separated the Natchez Pass and Grass Valley formations from the underlying Prida Formation, and much of the middle and lower units of the Natchez Pass Limestone have been cut out above the thrust fault. FCM gold deposits are hosted by the Grass Valley Formation and Natchez Pass Limestone along with sill/limestone contact zones within Prida Formation. The general strike of the stratigraphy at FCM is N30oE with a 30- to 40-degree dip to the west.

The location and geometry of the mineralized bodies at FCM are a result of structure; the presence of favorable silty argillite, quartzite, and limestone host rocks; and the position of the host rocks relative to structural conduits. The higher-grade zones of mineralization tend, in general, to follow the high-angle, northeast- and northwest-trending fault and shear zones. The more moderate- or lower-grade zones are controlled by favorable host rocks more distal to feeder structures.

Rock units that are more favorable hosts to mineralization include silty argillite, hornfels contact zones with mafic sills, karsted limestone, and platy, silty limestone with interbeds of calcareous shale. Local factors that influence the occurrence and geometry of mineralized bodies include variations in folds, foliation, and bedding in favorable units, intersecting structural fabrics, and proximity to low-angle structures (Taylor, 2001). Hypogene mineralization at FCM consists of native gold and electrum associated with quartz, iron oxides, pyrite, marcasite, and arsenopyrite (Hastings, et al., 1987). Quartz is the major gangue material.

FCM is a large, relatively young epithermal gold deposit adjacent to an active geothermal system. The close spatial association with the geothermal system has led to a general belief that FCM is a hot spring-style, epithermal gold deposit. Hydrothermal alteration assemblages and the mineralogy of both oxidized and unoxidized gold mineralization at FCM have been described and interpreted by Fifarek et al. (2011) as having formed in a low-sulfidation, epithermal environment.

1.6 History

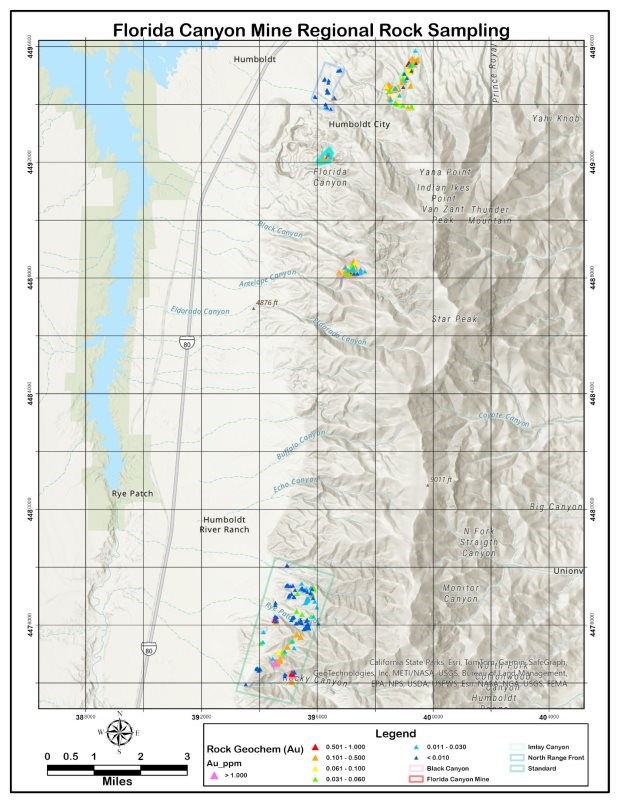

Prior to Argonaut acquiring its project interest, companies involved in the project area included Pegasus Gold Corporation (Pegasus), Apollo Gold Inc. (Apollo), Jipangu Inc.(Jipangu), and Rye Patch Gold Corp (Rye Patch). Work completed included prospecting, geological mapping and reconnaissance, rock, stream, sediment, and soil geochemical sampling, trenching, RC and core drilling, open pit development, and mining studies.

In 2020, Argonaut acquired control of FCM through a merger with Alio.

FCM has completed geological mapping, soil and grab sampling, rotary air blast (RAB), reverse circulation (RC) drilling and diamond drill hole (DDH) core drilling, Mineral Resource and Mineral Reserve estimation, metallurgical test work, environmental test work as well as mining and supporting studies. A Technical Report, Preliminary Economic Assessment, was completed in 2016 and published in 2017 (Keech, 2017), a Technical Report on life of the Mine Plan and Mineral Reserves for the project was completed in 2018 and published in 2019 (SRK, 2019), and a Technical Report on Mineral Resources and Mineral Reserves was completed in 2020 (IMC, 2020). The current Technical Report was completed in 2024 and incorporates new drilling and updated information since the previous Technical Report (2020).

On March 27, 2024, Argonaut and Alamos announced they had entered into the Arrangement Agreement whereby Alamos will acquire all of the issued and outstanding shares of Argonaut pursuant to a court approved plan of arrangement. As part of the Arrangement, Alamos will acquire Argonaut's Magino mine and Argonaut's assets in the United States and Mexico (including the Florida Canyon mine) will be spun out to FCGI.

1.7 Drilling and Sampling

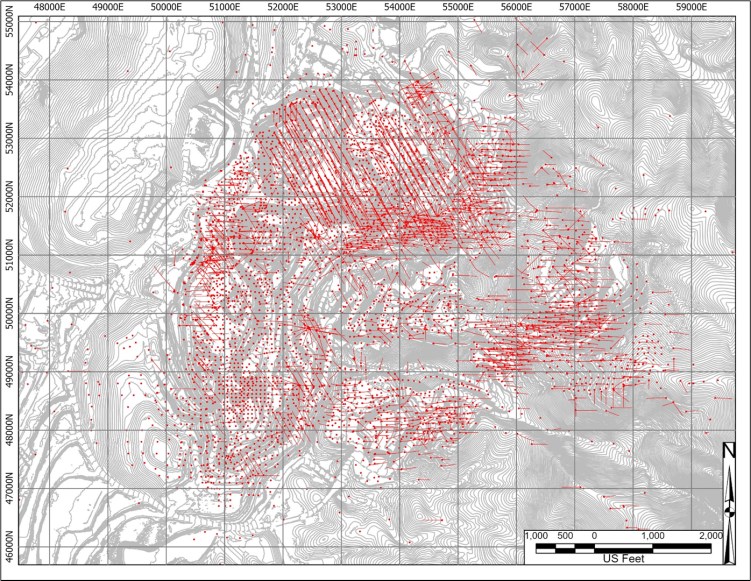

The drill hole database provided for modeling includes most of the historical drilling through the 2023 drill season. Some historical drilling that was either exploration drilling too distal to the deposit area to be used or could not be validated has been excluded. The current database has 4,821 holes amounting to 2,091,843 feet of drilling. Since 2020, FCM has added 32 core holes consisting of 19,341 feet of drilling and 510 RC holes consisting of 137,293 feet of drilling. The current database contains 384,919 assayed intervals for gold.

Before Argonaut, at FCM eighty five percent (85%) of the drilling was RC drilling which was completed by the operators Pegasus and/or Apollo, between the years 1981 and 2004. Jipangu drilled 15%, and Rye Patch drilled less than 0.5% of the total RC holes prior to 2018. RC drilling was completed using wet methods, where water was injected down-hole from the collar until ground water was intersected in the hole. The slurry of water and drill cuttings was directed to a rotating wet splitter, where the samples were reduced to approximately 10 to 15 lbs and collected in porous sample bags. Bags were pre-labeled with drill hole ID and sample interval. RC samples were collected at 5-foot intervals at the rig by the drill contractor. The 54 DDH core holes were a mix of 50% vertical and 50% angle drilling. Angled hole inclinations varied from 40 to 75 degrees.

Since 2020, FCM has added thirty-two 32 core holes, consisting of 19,341 feet of drilling and 510 holes totaling 137,293 feet of RC. Of the 384,919 assay intervals, 57,940 have been added by FCM. Since 2020, RC drill holes have been typically 5-1/4 inches in diameter, with some collars being drilled with a 7-5/8 tri-cone when in unconsolidated material at the hole collar, and some 6 inch diameter holes were also drilled.

Recovered cuttings were delivered to a rotary splitter for sample collection. The drill contractors collected a sample of the split at the rig during drilling using a pre-labeled bag. Samples were collected at 5-foot intervals and typically range from 10 to 15 pounds in weight.

Two diameters of core have been collected since 2020. The primary core size was HQ (2-1/2 inches), with PQ (3-1/2 inches) being utilized only at the top of the hole where casing was required. Core was collected from the drill using the standard wireline method with split core tubing sampling methods. All the core was washed and placed in core boxes.

1.8 Data Verification

Internal data verification by FCM personnel consisted of a review of database inputs. Data was manually checked for errors and gaps prior to database upload, and any identified issues were corrected.

A number of verification programs were completed on historical data and in support of Technical Reports regarding FCM by third parties in the period 2016 to 2024. No material issues were identified during these programs.

The QPs individually reviewed the information in their areas of expertise and concluded that the information supported Mineral Resource and Mineral Reserve estimation and could be used in mine planning and in the economic analysis that supports the Mineral Reserve estimates.

1.9 Metallurgical Test Work

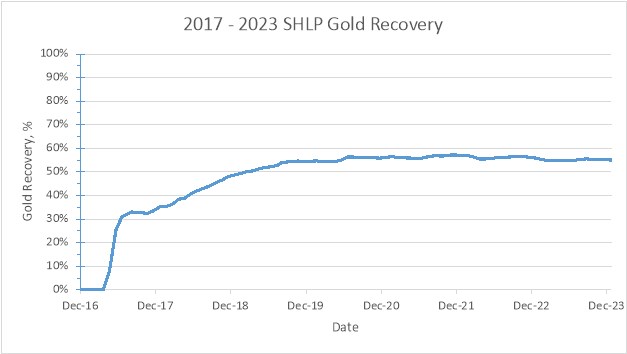

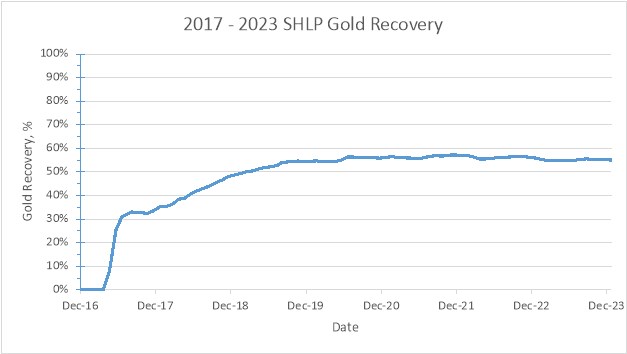

Routine metallurgical test work for ore placed on the South Heap Leach Pad (SHLP) is conducted on samples that are representative of the various types and styles of mineralization and the mineral deposit as a whole. These samples were sourced from either the Main, Central, Jasperoid and/or Radio Tower open pits. Test work consists of small (220 lb) and large (1,545 lb) test leach columns, bottle roll testing on daily crusher samples, and cyanide soluble (AuAA) analysis of blasthole samples and test column material. Carbon suite testing for carbon hardness, activity and attrition is conducted on new carbon supply options as needed. Carbon activity testing is done on every strip, acid wash and reactivated carbon batch, which informs the performance quality of both the Carbon-in-Column (CIC) and elution circuits. All metallurgical test work is supported on-site by an analytical lab equipped with atomic adsorption spectrometers (AA's), fire assay furnaces, LECO carbon/sulfur analyzer (commencing Q3-2024) and sample preparation equipment. The test work and analytical equipment are all typical of industry.

FCM leach pads have been in operation for more than 35 years. In that time, several hundred columns, countless bottle roll tests and continuous pad/solution and carbon sampling campaigns have been conducted to determine expected gold recovery. This testing has been conducted on ore and exploration samples from several different pits and areas covering many rock lithologies. Apart from Radio Towers ore, testing indicates all ores behave in a similar fashion, and as such, gold recoveries are also similar and predictable. These many years of operation and testing have provided a wealth of metallurgical information that forms the knowledge base behind the FCM heap leach performance predictions.

1.10 Mineral Resource Estimation

The grade estimate was constructed using a block size of 30 x 30 x 20 feet high.

An oxide-sulfide boundary surface was interpreted from independently modeled solids built on logging data collected from drill holes. The oxide-sulfide boundary surface was assigned to the block model and used in recovery and cutoff grade parameters when calculating Mineral Resources and Mineral Reserves.

Block grade estimation was accomplished using Localized Indicator Kriging (LIK), which combines the histograms from a panel-sized Multiple Indicator Kriging (MIK) with the locations of block values from an Ordinary Kriging model (OK), which is referred to as the localizer model. Block estimation was limited by distance using the average distance to the nearest three drillholes. No blocks were estimated that had an average distance greater than 300 feet.

LIK models use a Variance Reduction Factor (VRF) to control the final block distribution and that factor was established by comparing a series of LIK models with different VFRs to the blasthole block model. This was done in a previous update in the Main domain where a VRF of 0.2 was determined and used for all the domains. However, because of significant production in the Central domain a VRF of 0.1 was determined from the blasthole model and used in that domain. The selection of this lower factor allows the LIK model to reconcile the tons and grades in the blasthole model quite closely.

The OK localizer model used the same block definition as was used in previous models (see Table 14-2), and the MIK model used 120-foot by 120-foot panels that coincided spatially with the localizer blocks. This resulted in sixteen OK blocks inside each panel.

1.11 Mineral Resource Statement

Mineral Resources are reported in-situ, using the 2014 CIM Definition Standards. Mineral Resources are reported inclusive of those Mineral Resources converted to Mineral Reserves.

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Mineral Resources have an effective date of 31 December 2023.

The Qualified Person for the estimate is Ms. Terre Lane, MMSA QP, a GRE employee.

Table 1-1: Mineral Resource Statement - effective 31 December 2023

Material | Class | Cut-off Grade (Gold oz/ton) | Tonnage (tons x 1000) | Gold Grade (oz/ton) | Contained Au (oz x 1000) |

Oxides | Measured | 0.0039 - 0.0046 | - | - | - |

Indicated | 0.0039 - 0.0046 | 93,036 | 0.0100 | 933 |

Sulfides | Measured | 0.0162 | - | - | - |

Indicated | 0.0162 | - | - | - |

Sub-Total | Measured & indicated | 0.0039-0.0162 | 93,036 | 0.0100 | 933 |

Oxides | Inferred | 0.0039 - 0.0046 | 40,067 | 0.0091 | 366 |

Sulfides | Inferred | 0.0162 | 66,098 | 0.0281 | 1,854 |

Sub-Total | Inferred | 0.0039-0.0162 | 106,165 | 0.0209 | 2,220 |

1. Mineral Resources are reported, using the 2014 CIM Definition Standards, with an effective date of 31 December 2023. The Qualified Person for the estimate is Ms. Terre Lane, MMSA QP, a GRE employee. 2. Mineral Resources are reported inclusive of those Mineral Resources converted to Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. 3. Mineral Resources are constrained within a conceptual open pit shell that uses the following assumptions: gold price of US$1,800/oz; gold recoveries ranging from 45% to 64% for oxides and 80% for sulfides; reference mining cost of $2.49/ton mined in-situ and $1.89/ton mined fill; processing cost of $4.51/ton processed for oxide crushed material and $2.42/ton processed for oxide ROM material; processing cost of $21.00/ton processed for sulfide material; general and administrative costs of $1.09/ton processed; treatment and refining costs of $6.57/oz Au recoverable; royalty of $88.00/oz Au recoverable, and pit slope overall angles ranging from 30-36°. 4. Mineral Resources are reported at a cut-off grade ranging from 0.0039 oz/ton to 0.0057 oz/ton for oxides and is 0.0162 oz/ton for sulfides. 5. Mineral Resources include a stockpile inventory of 1,206.9 ktons at an average grade of 0.0052 oz/ton and total contained gold of 6.22 koz. 6. Mineral Resources include heap leach inventory of 3,928.7 ktons at an average grade of 0.0101 oz/ton and total contained gold of 39.64 koz. 7. Numbers have been rounded and may not sum. |

1.12 Mineral Reserve Estimation

Open pit Mineral Reserves were estimated by FCM through the application of a mine design, phasing sequence and subsequent mine plan to convert the Measured and Indicated Mineral Resources to Proven and Probable Mineral Reserves. Inferred Mineral Resources were not included and were assigned to waste. The estimate is based upon the application of a typical truck-loader open pit mining operation to excavate the Mineral Reserve followed by a conventional heap leaching process and by a CIC capture with loaded carbon pressure stripped. Gold is recovered by electrowinning and the precipitate melted into doré bars.

There are two principal ore type classifications used to identify Mineral Reserves at FCM: Crushed and ROM. Additionally, material is identified as being associated with the Radio Tower deposit or Central deposit (including both the Main and Jasperoid deposits). The Radio Tower deposit has been identified as having a different metallurgical recovery response than the Central deposit.

Both Crushed and ROM material meets the requirements of the breakeven cut-off grade (COG) definition as stated in the CIM Estimation of Mineral Resources and Reserves Best Practice Guidelines (2019), being "The lowest grade or value of material that can be mined and processed at an operating profit, considering all applicable costs".

1.13 Mineral Reserve Statement

Mineral Reserves are reported at the point of delivery to the process plant using the 2014 CIM Definition Standards and have an effective date of 31 December 2023.

The Qualified Person for the estimate is Ms. Terre Lane, MMSA QP, a GRE employee.

Table 1-2: Mineral Reserve Statement - effective 31 December 2023

Category | Tonnage (tons x 1000) | Gold Grade (oz/ton) | Contained Gold (oz x 1000) |

Proven | - | - | - |

Probable | 85,352 | 0.0101 | 861 |

Proven & Probable | 85,352 | 0.0101 | 861 |

1. Mineral Reserves are reported at the point of delivery to the process plant, using the 2014 CIM Definition Standards, with an effective date of 31 December 2023. The Qualified Person for the estimate is Ms. Terre Lane, MMSA QP, a GRE employee. 2. Mineral Reserves are constrained within an open pit design that uses the following assumptions: gold price of US$1,800/oz considering only oxide material; gold recoveries varied by deposit and ore type, ranging from 45% to 64%; reference mining cost of $2.49/ton mined in-situ and $1.89/ton mined fill; processing cost of $4.51/ton processed for oxide crushed material and $2.42/ton for oxide ROM material; G&A costs of $1.09/ton ore processed; treatment and refining costs of $6.57/oz gold recoverable; royalty costs of $88.00/oz gold recoverable; and pit slope inter-ramp angles ranged from 38-42° for rock and 30° for alluvium / fill. 3. Mineral Reserves are reported at a cut-off grade ranging from 0.0039 oz/ton to 0.0057 oz/ton. 4. Mineral Reserves include a stockpile of 1,206.9 ktons at an average grade of 0.0052 oz/ton and total contained gold of 6.22 koz. 5. Mineral Reserves include Heap Leach Inventory of 3,928.7 ktons at an average grade of 0.0101 oz/ton and total contained gold of 39.64 koz. 6. Numbers have been rounded and may not sum. |

1.14 Mining Method

1.14.1 Hydrologic Considerations

Groundwater is not considered to play a role in the slope stability at FCM based on the groundwater depths. However, snow melt and surface water runoff during spring can recharge open surface fractures and potentially trigger or reactivate slide areas and therefore measures should be taken to drain runoff away from the open pits and prevent / minimize pooling, seepage, etc.

1.14.2 Open Pit Geotechnical Considerations

Recent geotechnical studies focused particularly on the west to northwest facing highwalls of the Central, Main and / or Radio Tower open pits. These pit slopes form the highest pit slopes and have had past slope failures principally restricted to the northwest facing slopes, implying a structural control on the instability.

This structural control is considered to be related to the regional structural fabric that has been recognized at FCM as well as other mine sites in the Humboldt Range including StdM, Spring Valley Mine, and the Rochester Mine. The foliation generally dips northwest; however, it is expected that there is considerable localized variability in the dip orientation.

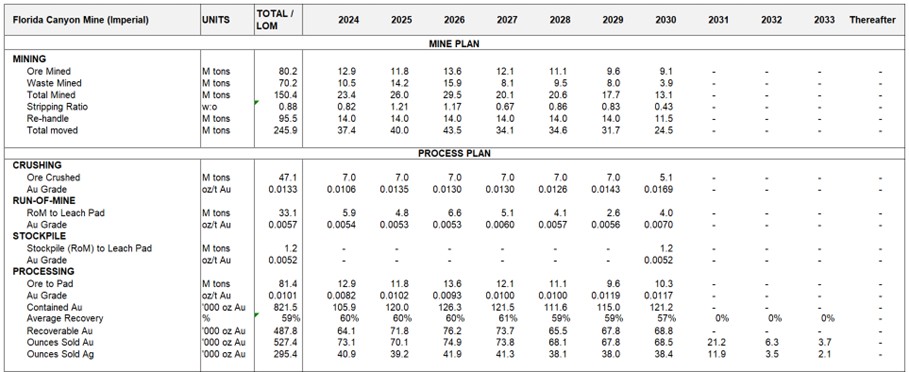

1.14.3 Mine Plan

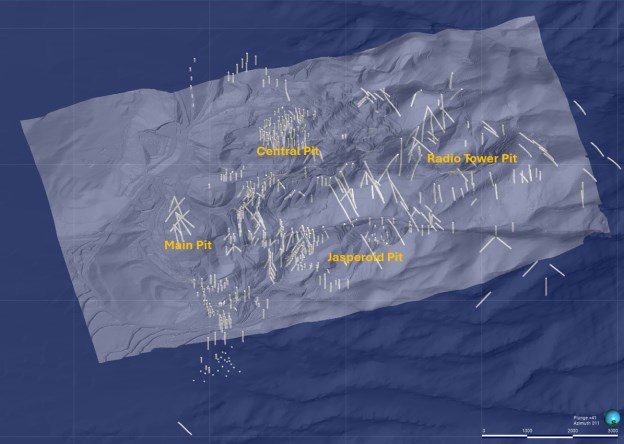

Mining at FCM is currently conducted using conventional truck and loader open pit mining methods. The mining operation is conducted with a fleet of 100 ton payload haul trucks combined with large front-end loaders (FELs) as primary loading units. The open pit operates at a peak mining rate of 81,000 tons per day (tpd) of ore and waste and has an overall strip ratio of 0.88:1 (waste:ore).

Waste and ore are drilled and blasted, loaded by FELs and transported by haul trucks to WRSFs, stockpiles, the primary crusher, or directly to the leach pad as ROM. Crushed ore is loaded into haul trucks and stacked on the HLP where both crushed and ROM ore are co-mingled and irrigated with a dilute cyanide solution and recovered with carbon columns.

The selection of the mining phases was based upon an incremental analysis of optimized pit solutions generated at increasing gold prices, as well as geometric considerations for safe and efficient mining and access to the WRSFs, primary crusher, ore stockpiles and HLP. FCM preferentially utilizes a minimum phase width of 200 feet but at times this does become smaller in areas of limited extent.

A total of 10 phases remain to be excavated across four open pits: 03-phases in the Central Pit (Phase 01-C1, Phase 02-C6 and Phase 03-C7), 01-phase in the Jasperoid Pit (Phase 04-J2), 03-phases in the North Pit (Phase 05-N1, Phase 06-N2 and Phase 07-N3) and 03-phases in the Radio Tower Pit (Phase 08-R1, Phase 09-R2 and Phase 10-R3).

1.15 Recovery Methods

Crushed ore passes through two stages of open circuit crushing to a final crush size of 80% minus 1½ inches. The current crushing circuit target is 21,000 tpd. Crushed ore is then agglomerated with a polymer binding agent to improve solution percolation through the HLP and is delivered to the HLP via haul truck. The ore can also be delivered to the pad through a series of mobile ramp conveyors and mobile grasshopper conveyors, or a combination of both. At present, the overland conveyor system is not being utilized due to operational issues and the potential for re-implementation in the future is being studied. Crushed and ROM ores are co-mingled at the pad dump face. Lime is added directly to haul trucks carrying ROM ore from a silo or via a separate lime silo for crushed ore as it is conveyed to the stockpile.

Barren solution (cyanide-bearing solution very low in gold grade) is applied selectively to different areas of the pad through drip irrigation tubing at an average application rate of 0.003 gallons per minute per square foot.

Pregnant solution (gold bearing) from the bottom of the pad reports to the pregnant solution pond and is then pumped to one of two trains of carbon columns where precious metals are adsorbed onto activated carbon.

Loaded carbon is transported to the plant by truck where gold is eluted (stripped or redissolved) under pressure and high temperature in a 3-ton vessel. The desorbed gold and silver are recovered from solution electrolytically by two electrowinning cells in series.

The plated material (sludge) from electrowinning is retorted for drying and mercury removal. Once retorted, the sludge is mixed with flux and smelted in a 150-kilowatt induction furnace. Doré bars are the final product at FCM and are shipped to a third-party refiner at 90-95% Au/Ag purity.

FCM has operated for over 35 years as a heap leach operation. Operational knowledge and experience gained during this period has allowed for the streamlined operations that exist today. As future ore types planned for the South Heap Leach Pad (SHLP) are expected to perform metallurgically like those leached in the past, it can be expected that the processing efficiencies reported in this section will continue.

1.16 Project Infrastructure

FCM has been in production intermittently since 1986 and all the infrastructure that is required to sustain production is in place. However, some infrastructure will need to be expanded or modified to complete the mine plan as developed in this Report.

1.17 Environmental, Permitting and Social Considerations

FCM has all permits in place to continue mine operations. Additional permits required for mine life extension are in progress to assure continuity of operation. Those are typically associated with the planned expansions of the SHLP. Final permitting is expected by the end of Q2-2024.

1.18 Markets and Contracts

Mineral Resources and Mineral Reserves have been assessed using the gold price of $1,800.00/oz provided by Argonaut.

Gold and silver markets are mature global markets with reputable refiners located throughout the world. Note that silver is not assayed at FCM due to its low economic impact on the operation and therefore not included in the declaration of Mineral Resources and Mineral Reserves.

Gold output from the FCM operation is in the form of doré containing approximately 55% gold and 45% silver on average. Silver credits are received from the Refiner. The doré is shipped to the Asahi Refining USA Inc. (Asahi) facility located in Salt Lake City.

1.19 Capital Cost Estimates

The capital cost estimate for the LOM is estimated as $144M and includes:

• Leach pad expansion costs, including CIC and pregnant solution pond expansions,

• Design development and quantity growth allowances, and

• Owner's costs

Total capital costs estimated are summarized in Table 1-3.

Table 1-3: Capital Cost Estimate

Description | Unit | Total |

Leach Pad | $M | 56.8 |

RT Relocation | $M | 3.0 |

Equipment Lease | $M | 21.2 |

| Salvage Value | $M | (10.0) |

Reclamation | $M | 37.82 |

Other | $M | 35.2 |

Total | $M | 144.1 |

1. Numbers have been rounded and may not sum.

1.20 Operating Cost Estimates

The operating cost estimate for the LOM is estimated as $736M or $9.03/ton processed and is summarized in Table 1-4.

Table 1-4: Operating Cost Estimates

Description | Life-of-Mine ($M) | Life-of-Mine ($/ton processed) |

Mining | 340.9 | 4.19 |

Crushing | 98.5 | 1.21 |

Processing | 139.9 | 1.72 |

G&A | 152.7 | 1.88 |

Refining | 3.5 | 0.04 |

Total | 735.5 | 9.03 |

1. Mining costs include capitalized stripping costs.

2. G&A costs include Nevada Gold & Silver Excise Tax, Nevada Net Proceeds Mining Tax and royalties.

3. Numbers have been rounded and may not sum.

1.21 Economic Analysis

A financial analysis for FCM was developed by FCM and Argonaut personnel using a discounted cash flow approach on a pre-tax and after-tax basis. The net present value (NPV) was calculated from the cash flow generated by FCM based on a discount rate of 5% utilizing gold metal selling prices of $2,200/oz for 2024, $2,150/oz for 2025/2026 and thereafter $1,900/oz. Gold metal prices are elevated in the first 03-years to reflect current metal price trends with latter years reverting to slightly above the 03-year trailing average. Silver metal selling price is assumed as $20/oz. Note that silver is included in the financial model based on historical recovery of silver metal equivalent to 56% of gold production and does not form part of the Mineral Reserve declared in this Report.

The resultant pre-tax NPV discounted at 5% is $141 M, with an internal rate of return (IRR) of 257%, and a payback period is 1.44 years. On an after-tax basis, the NPV 5% is $128 M with an IRR of 246%, and the payback period is 1.46 years.

An economic analysis of FCM using the financial model adjusted for Mineral Reserve reporting metal prices declared in this report of $1,800 per ounce gold was undertaken (note that silver credits were removed as silver is not part of the declared Mineral Reserve). The pre-tax Mineral Reserve price financial model resulted in an undiscounted cash flow of $81 M with an NPV 5% of $50 M. On an after‑tax basis, the Mineral Reserve financial model resulted in an undiscounted cash flow of $78 M with an NPV 5% of $47 M. The minimal change in value between pre-tax and after-tax cash flows is a result of the utilization of current and projected tax attributes.

Based on the Mineral Reserve financial analysis, on an NPV basis, FCM is most sensitive to changes in metal prices, and then to a lesser extent, to mining costs and processing costs. FCM is least sensitive to changes in the capital cost.

1.22 Interpretation and Conclusions

Under the assumptions in this Report, the Project shows a positive cash flow over the life-of-mine and supports the Mineral Resource and Mineral Reserve estimates. The projected mine plan is achievable under the set of assumptions and parameters used.

The sulfide component of Mineral Resources shows positive economic value. Historic and current metallurgical test work shows that an economic concentrate can be made from this material.

1.23 Recommendations

1.23.1 Geology

Drilling campaigns reveal great potential across the Project area, but there is significant remaining exploration potential in the principal FCM deposit and environs. Exploration targets include feeder structures at depth and along strike. Due to limited legacy exploratory drilling along the Humboldt City Thrust between FCM and StdM, additional opportunities exist to discover and delineate along this structure. Still, deep drilling needs to test areas along feeder structures and fault terminals on the western side of FCM deposits, which are covered by alluvium.

Geological and structural data is to be collected during this drilling program (and future drilling programs) and should continue to be used to increase geological understanding of the spatial correlation between mineralization and geological structures and inform the resource modeling process.

Results of the exploration RC drilling program proposed will be used to identify potential future drilling targets which will lead to potential future exploration activities to expand knowledge of mineralization and potentially expand future Mineral Resources outside of known, exploited deposits. Estimated cost associated with the exploration RC drilling - $950,000.

Oxide mining operations at FCM in addition to a potential future sulfides project would benefit from better knowledge of the oxide-sulfide boundary. There could be more leach amenable material just below the currently interpreted oxide-sulfide boundary that are not actually sulfides. As a result, more drilling is recommended within the known FCM deposit area to improve definition of the oxide-sulfide boundary, and to collect samples for process metallurgical testing. A complete metallurgical testing program should be completed on the fresh oxide, transitional and sulphide material samples obtained during the program and be used to support improved understanding of relationships between cyanide assays and fire assays results in addition to the metallurgical response of sulphide material related to a potential future development of a sulfide project. Estimated cost associated with the drilling program and assaying and metallurgical testing work - $1,300,000.

1.23.2 Mining

FCM should review the re-implementation of the overland conveyor and grasshopper conveying system to minimize truck haulage hours and minimize ore re-handle. This review should result in a go, no-go decision regarding re-implementation of the system. Estimated cost associated with this review - $50,000.

Sulfide tonnage, grade, and process options should be evaluated in a timely manner such that if a sulfide operation is warranted. If results of options are positive, permit applications can be started in advance to assure a transition from oxide to sulfide operations without a major hiatus to production.

1.23.3 Metallurgy and Processing

Should transitional sulfide mineralization be treated on the existing HLPs, test work should be conducted to examine the gold recovery as well as the reagent consumption, specifically lime. It may also be important to understand the long-term stability of this material so that the heap does not become acid generating. This work could be conducted on site by the existing staff.

Carbon testing and CIC modeling should be conducted to maximize gold recovery in the carbon circuit. This testing should also model carbon stripping and regeneration to determine if future bottlenecks will arise once the CIC expansion is completed. Estimated cost is $50,000.

Additional telemetry should be installed to allow operators to monitor remote equipment without traveling to the remote location. Some of the telemetry elements are still available onsite and need to be revived. A telemetry study would be necessary to determine what additional equipment is necessary to reestablish this network. This study, which would lead to a decision as to the feasibility and cost required to expand the telemetry system is estimated to cost $50,000. If a positive decision is made to expand the system, this cost may be absorbed by the vendor in exchange for providing the equipment and installation services for the upgraded / expanded telemetry system.

1.23.4 Environmental Studies

A new Environmental Management System (EMS) should be considered for implementation. Currently, FCM operates in compliance utilizing a system of plans and permitting requirements, with data collected to series of spreadsheets making both data and information difficult to query. However, a true EMS which includes training, data management and permit obligations charts would provide much clearer and quicker access to information. Field tablets should be incorporated to assist with data collection for the EMS. The estimated cost is $130,000.

A site weather station should be considered for implementation. Currently, FCM operates with several smaller portable weather reporting units that are cloud based and have no provision for downloading data. Being cloud based, this results in data loss occurring whenever internet service is lost. The estimated cost of installation of a fixed weather station at site is $20,000.

An auto sampling unit which would help with collecting the data during well sampling should be considered. The estimated cost is $2,000.

2.0 INTRODUCTION

Dr. Todd Harvey (SME Registered Member), Ms. Terre Lane (MMSA QP), Dr. Hamid Samari (MMSA QP) and Larry Breckenridge (PE) from Global Resource Engineering, Ltd. (GRE) were retained by Argonaut to prepare this Report on the FCM in Nevada, USA for FCGI for the purpose of documenting the technical information available on the FCM in connection with the listing of FCGI on the TSXV as required by the policies of the TSXV.

On March 27, 2024, Argonaut and Alamos entered into an Arrangement Agreement, whereby Alamos will acquire all of the issued and outstanding shares of Argonaut pursuant to a court approved plan of arrangement. As part of the Arrangement, Alamos will acquire Argonaut's Magino mine and Argonaut's assets in the United States and Mexico will be spun out to FCGI. As a result, FCGI will own the Florida Canyon mine.

This Report has been addressed to FCGI, as the Authors intend that FCGI be entitled to rely on it in connection with the Arrangement and the transactions contemplated thereby. The authors intend for this Report to be filed on SESAR+ by FCGI.

Prior to the completion of the Arrangement, Argonaut wholly-owned the FCM. Argonaut acquired the property through a merger with Alio Gold Inc. (Alio) that closed on July 1, 2020. Following the completion of the Arrangement, the FCM will be wholly-owned by FCGI.

This Report has been prepared in accordance with the disclosure and reporting requirements set forth in the Canadian Securities Administrators’ National Instrument 43-101 (“NI 43-101”), Companion Policy 43-101CP, and Form 43-101F1, as well as with the Canadian Institute of Mining, Metallurgy and Petroleum’s “CIM Definition Standards - For Mineral Resources and Reserves, Definitions and Guidelines” (“CIM Standards”) adopted by the CIM Council on November 29, 2019.

The Qualified Persons (QPs) responsible for the preparation of this Technical Report are:

Terre Lane, MMSA 01407QP, Society of Mining, Metallurgy, and Exploration (SME) Registered Member 4053005

Todd Harvey, PhD, PE, SME Registered Member 4144120

Hamid Samari, PhD, MMSA 01519QP

Larry Breckenridge, P.E.: No. 12694 in New Hampshire and No. 38048 in Colorado.

The QPs are collectively referred to as the "Authors" of this Report and none have an affiliation with Argonaut except for that of an independent consultant/client relationship.

Dr. Samari, Ms. Lane, and Dr. Harvey have visited the FCM property. Ms. Lane, Principal Mining Engineer for GRE, conducted a site visit to FCM in January 2023 and January 2024. Dr. Hamid Samari, Senior Geologist for GRE, conducted a site visit to FCM in January 2024. Dr. Todd Harvey, Director of Process Engineering for GRE, conducted a site visit to FCM in May 2023.

In addition to their own work, the Authors have made use of information from other sources and have listed these sources in this document under "References."

Table 2-1 shows the report sections and responsible QP.

Table 2-1: Contributing Authors

Section | Section Name | Responsibility | Author/ QP |

1.0 | Summary | | |

1.1 | Introduction | GRE | All |

1.2 | Terms of Reference | GRE | All |

1.3 | Project Setting | GRE | Terre Lane |

1.4 | Mineral Tenure, Royalties, Environmental Liabilities and Permitting | GRE | Terre Lane |

1.5 | Geology, Mineralization, and Deposit Type | GRE | Hamid Samari |

1.6 | History | GRE | Hamid Samari |

1.7 | Drilling and Sampling | GRE | Hamid Samari |

1.8 | Data Verification | GRE | Hamid Samari |

1.9 | Metallurgical Test Work | GRE | Todd Harvey |

1.10 | Mineral Resource Estimation | GRE | Terre Lane |

1.11 | Mineral Resource Statement | GRE | Terre Lane |

1.12 | Mineral Reserve Estimation | GRE | Terre Lane |

1.13 | Mineral Reserve Statement | GRE | Terre Lane |

1.14 | Mining Method | GRE | Terre Lane |

1.15 | Recovery Methods | GRE | Todd Harvey |

1.16 | Project Infrastructure | GRE | Lane and Harvey |

1.17 | Environmental, Permitting and Social Considerations | GRE | Larry Breckenridge |

1.18 | Markets and Contracts | GRE | Lane and Harvey |

1.19 | Capital Cost Estimates | GRE | Lane and Harvey |

1.20 | Operating Cost Estimates | GRE | Lane and Harvey |

1.21 | Economic Analysis | GRE | Lane and Harvey |

1.22 | Interpretation and Conclusions | GRE | All |

1.23 | Recommendations | GRE | All |

2 | Introduction | GRE | All |

3 | Reliance on Other Experts | GRE | Terre Lane |

4 | Property Description and Location | GRE | Terre Lane |

5 | Access, Climate, Local Resources, Infrastructure and Physiography | GRE | Terre Lane |

6 | History | GRE | Hamid Samari |

7 | Geology Setting and Mineralization | GRE | Hamid Samari |

8 | Deposit Types | GRE | Hamid Samari |

9 | Exploration | GRE | Hamid Samari |

10 | Drilling | GRE | Hamid Samari |

11 | Sample Preparation, Analyses and Security | GRE | Hamid Samari |

12 | Data Verification | GRE | Hamid Samari |

13 | Mineral Processing and Metallurgical Testing | GRE | Todd Harvey |

14 | Mineral Resource Estimates | GRE | Terre Lane |

15 | Mineral Reserve Estimates | GRE | Terre Lane |

16 | Mining Methods | GRE | Terre Lane |

17 | Recovery Methods | GRE | Todd Harvey |

18 | Project Infrastructure | GRE | Lane and Harvey |

19 | Market Studies and Contracts | GRE | Lane and Harvey |

Section | Section Name | Responsibility | Author/ QP |

20 | Environmental Studies, Permitting and Social or Community Impact | GRE | Larry Breckenridge |

21 | Capital and Operating Costs | GRE | Lane and Harvey |

22 | Economic Analysis | GRE | Lane and Harvey |

23 | Adjacent Properties | GRE | Terre Lane |

24 | Other Relevant Data and Information | GRE | Lane and Harvey |

25 | Interpretation and Conclusions | GRE | All |

26 | Recommendations | GRE | All |

27 | References | GRE | All |

The scope of this study included a review of pertinent technical reports and data provided to GRE by Argonaut and FCM relative to the general setting, geology, project history, exploration activities and results, methodology, quality assurance, interpretations, drilling programs, and metallurgy as cited throughout this report. The authors have reviewed much of the available data and made site visits and have made judgments about the general reliability of the underlying data. Where deemed either inadequate or unreliable, the data were either eliminated from use, or procedures were modified to account for lack of confidence in that specific information. The authors have made such independent investigations as deemed necessary in the professional judgment of the authors to reasonably present the conclusions discussed herein. The authors believe the data presented in this report are generally an accurate and reasonable representation of the project.

The Effective Date of this Technical Report is 28 June 2024.

In this report, measurements are generally reported in Imperial units. Unless otherwise indicated, all currency references to dollars ($) in this report refer to currency of the United States of America.

3.0 RELIANCE ON OTHER EXPERTS

The Authors are not experts in legal matters, such as the assessment of the legal validity of mining claims, private lands, mineral rights, and property agreements in the United States of America. The Authors did not conduct any investigations of the environmental, permitting, or social-economic issues associated with FCM, and the authors are not experts with respect to these issues. The Authors have relied fully on Argonaut and FCM for information concerning the legal status of Argonaut and related companies, as well as current legal title, material terms of all agreements, existence of all applicable royalty obligations, and material environmental and permitting information that pertain to FCM.

For environmental compliances, Authors relied on David Raynor, Environmental Superintendent at FCM and an expert on the subject.

The Authors are not experts to offer an opinion regarding taxation on mine operations in Nevada. Authors have relied on the input and calculations from Argonaut regarding taxation.

As of the date of this report, the Authors are not aware of any litigation that could potentially affect FCM.

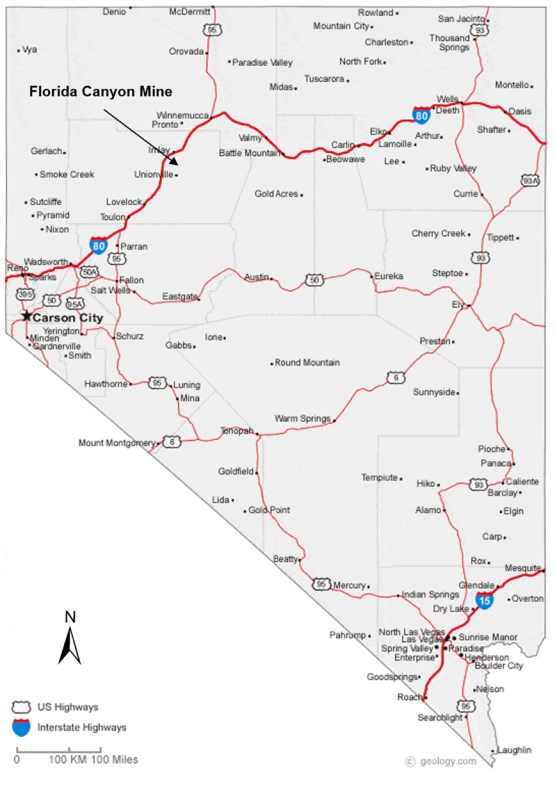

4.0 PROPERTY DESCRIPTION AND LOCATION

FCM is located adjacent to Interstate Highway I-80 (I-80), 125 miles northeast of Reno, Nevada. The nearest towns are Winnemucca, 40 miles northeast with a population of 8,388 (2022) and Lovelock, 33 miles southwest, with a population of 1,854 (2022). The highway exit for FCM from I-80 is Exit 138 at Imlay, Nevada onto Frontage Road. The property location is 40.586088 degrees north latitude by 118.257365 west longitude. Access is reliable via the Interstate year around.

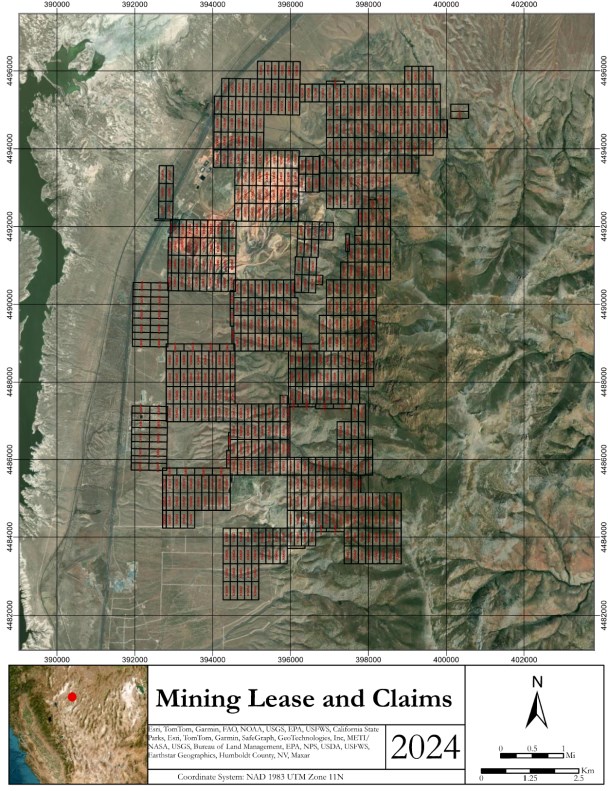

The land package owned or leased by FCM covers a total of 18,630.8 acres. Fee lands total 5,520.4 acres and unpatented claims total 13,110.4 acres. Contained within the fee lands are 19 patented claims totaling 359.9 acres. This land position includes both FCM and the Standard Mine (StdM) which is located south of FCM. This report addresses FCM only and does not include any Mineral Resources or Mineral Reserves within the StdM property holdings.

Royalty interests at FCM have been consolidated since publications in 2019 and are reported by FCM to be:

- Top Hat Partnership 2.5% NSR

- Maverix Metals, Inc. 3.0% NSR

The Maverix Metals Inc. (Maverix) royalty historically changed at different locations across the property. Alio Gold Inc. (Alio) negotiated a fixed 3.0% royalty with Maverix on 22 November 2019.

Figure 4-1 illustrates the location of FCM on the map of Nevada, USA, and Figure 4-2 illustrates the land map of FCM. Figure 4-3 illustrates a map of current mining leases and claims.

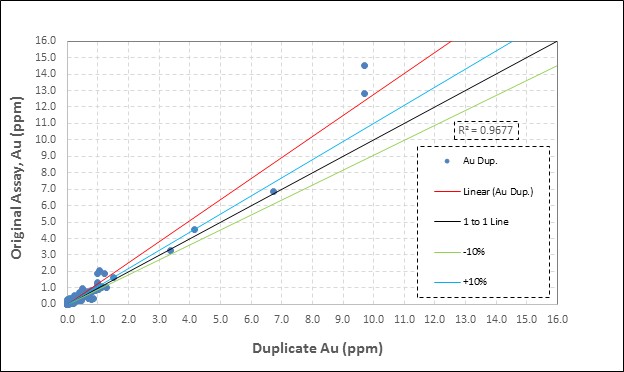

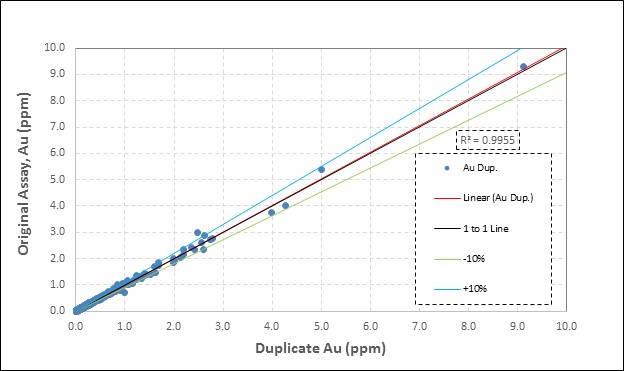

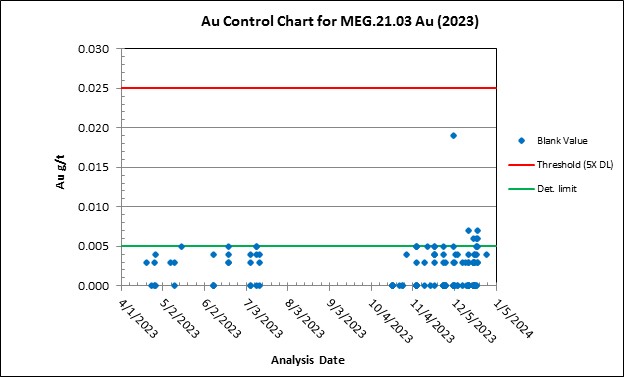

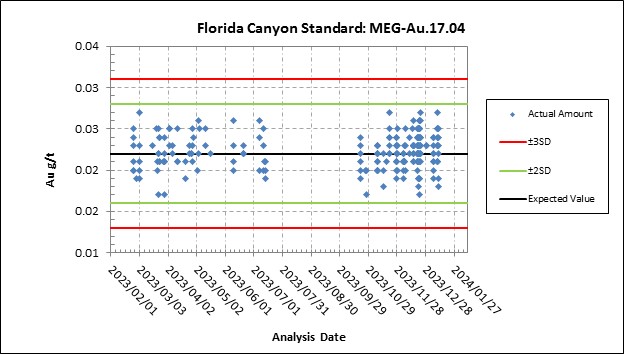

Argonaut acquired control of FCM through a merger with Alio Gold, Inc (Alio). The merger agreement between Alio and Argonaut was completed in 2020.