FORM 51-102F3

MATERIAL CHANGE REPORT

Item 1 Name and Address of Company

State the full name of your company and the address of its principal office in Canada.

Metalla Royalty & Streaming Ltd. ("Metalla" or the "Company")

Suite 501 - 543 Granville Street

Vancouver, BC

V6C 1X8

Item 2 Date of Material Change

April 24, 2020

Item 3 News Release

A news release was disseminated on April 27, 2020 to the TSX Venture Exchange and various approved public media and was filed on SEDAR with the securities commissions of British Columbia, Alberta, Manitoba, Ontario, Nova Scotia, and Newfoundland and Labrador.

Item 4 Summary of Material Change(s)

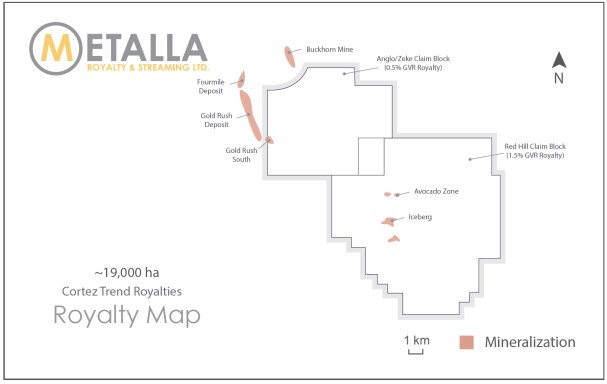

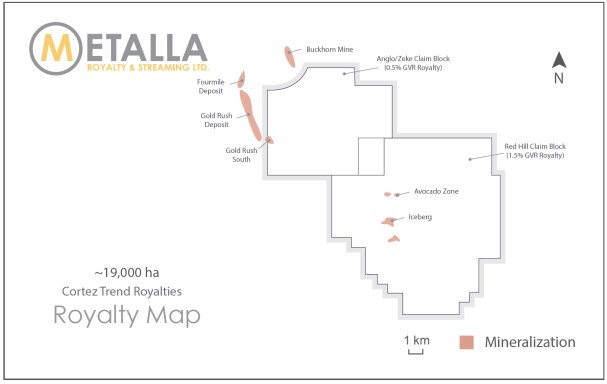

Metalla entered into a share purchase agreement ("SPA") dated April 24, 2020 with Idaho Resources Corporation ("IRC"), a privately held Nevada corporation, whereby a wholly-owned U.S. subsidiary of Metalla will acquire 100% of the issued and outstanding shares of IRC for $4.0 million in cash and shares. IRC holds a 0.5% gross overriding royalty ("GOR") on the Anglo/Zeke claim block in Eureka County, Nevada, which is located on trend to the southeast of the Cortez Operations and Goldrush project owned by Nevada Gold Mines ("NGM").

Item 5 Full Description of Material Change

5.1 Full Description of Material Change

Metalla entered into the SPA dated April 24, 2020 with IRC, a privately held Nevada corporation, whereby a wholly-owned U.S. subsidiary of Metalla will acquire 100% of the issued and outstanding shares of IRC for US$4.0 million in cash and shares. IRC holds a 0.5% GOR on the Anglo/Zeke claim block in Eureka County, Nevada, which is located on trend to the southeast of the Cortez Operations and Goldrush project owned by NGM. NGM is a joint venture between Barrick Gold Corporation ("Barrick") (61.5%) and Newmont Corporation ("Newmont") (38.5%), which was created in July 2019 to combine Barrick and Newmont's significant assets across Nevada to create the single largest gold producer in the world. IRC also holds a 1.5% GOR covering NuLegacy Gold Corporation's ("NuLegacy") Red Hill project ("Red Hill") in Eureka County, Nevada, which is contiguous to the southeast of the Anglo/Zeke claims.

The consideration for the SPA will be satisfied by Metalla issuing US$2.0 million in common shares based on the ten-day volume-weighted average price of shares traded on the TSXV exchange at a price of C$7.88, and US$2.0 million in cash. The transaction is subject to customary closing conditions and exchange approvals and is expected to close on or around June 1, 2020.

ANGLO/ZEKE (0.5% GOR)

The Anglo/Zeke claims cover more than 7,500 hectares of exploration land owned by NGM east and southeast of the Goldrush deposit along the Battle Mountain-Eureka trend. Barrick has previously stated the Goldrush deposit is a large Carlin-type gold development project with initial production projected for 2021, which will progress toward a steady-state production of 450,000 ounces of gold per annum during its first full five years of operation(1). Goldrush's end of 2019 reserve estimate is 2 million ounces at 9.7 g/t gold with a measured and indicated resource estimate of 9.4 million ounces at 9.4 g/t gold(2). Barrick previously has disclosed that mineralization at Goldrush is open along strike towards the north and east where the royalty property continues with the favorable stratigraphic host of the Goldrush, Cortez Hills, and Pipeline deposits, and has identified a mineral potential area known as Goldrush South(3) on the Anglo/Zeke claims.

RED HILL (1.5% GOR)

Red Hill project owned by NuLegacy covers an area of interest of more than 11,500 hectares southeast of the Anglo-Zeke Claim block along the Battle Mountain-Eureka trend that hosts the NGM's Cortez Operations. Within the area of interest is the Red Hill property package encompassing the Avocado, Serena, and Iceberg gold deposits. Past drilling in the Serena and Iceberg deposits has intersected high-grade intercepts, including 22 meters at 6.59 g/t gold and 31.2 meters at 3.9 g/t gold(4). Recently, NuLegacy completed geophysical surveys on their land package, which identified an interesting untested anticline structure under cover to the west called the Rift Anticline, which is explained by NuLegacy to be an analogue to Nevada Gold Mine's Goldrush deposit to the northwest. NuLegacy expects to receive an expanded drill permit to test the Rift Anticline target by the end of 2020 with a preliminary drill program of 12 to 15 holes.

CORTEZ CLAIM REVERSIONARY RIGHTS

The IRC acquisition will also provide Metalla the opportunity to acquire the mineral claims under the Cortez Joint Venture plan of operations should NGM choose to relinquish their mineral claim interests. The claim reversionary rights cover the Cortez, Cortez Hills, Goldrush, Fourmile, Hilltop, Gold Acres, and Pipeline deposit mineral claims in Lander & Eureka County, Nevada.

QUALIFIED PERSON

The technical information contained in this material change report has been reviewed and approved by Charles Beaudry, geologist M.Sc., member of the Association of Professional Geoscientists of Ontario and the Ordre des Géologues du Québec and a consultant to Metalla. Mr. Beaudry is a Qualified Person as defined in National Instrument 43-101 Standards of disclosure for mineral projects.

TECHNICAL AND THIRD-PARTY INFORMATION

Except where otherwise stated, the disclosure in this material change report relating to the Anglo/Zeke and Red Hill claims and Project Goldrush is based on information publicly disclosed by the owners or operators of these properties and information/data available in the public domain as at the date hereof and none of this information has been independently verified by Metalla. Specifically, Metalla has limited, if any, access to these properties. Although Metalla does not have any knowledge that such information may not be accurate, there can be no assurance that such third party information is complete or accurate. Metalla's royalty interests often cover less than 100% and sometimes only a portion of the publicly reported mineral reserves, mineral resources, and production of a property.

The disclosure was prepared in accordance with Canadian National Instrument 43-101 ("NI 43-101"), which differs significantly from the current requirements of the U.S. Securities and Exchange Commission (the "SEC") set out in Industry Guide 7. Accordingly, such disclosure may not be comparable to similar information made public by companies that report in accordance with Industry Guide 7. In particular, this material change report may refer to "mineral resources", "measured mineral resources", "indicated mineral resources" or "inferred mineral resources". While these categories of mineralization are recognized and required by Canadian securities laws, they are not recognized by Industry Guide 7 and are not normally permitted to be disclosed in SEC filings by U.S. companies that are subject to Industry Guide 7. U.S. investors are cautioned not to assume that any part of a "mineral resource", "measured mineral resource", "indicated mineral resource", or "inferred mineral resource" will ever be converted into a "reserve." In addition, "reserves" reported by the Company under Canadian standards may not qualify as reserves under Industry Guide 7. Under Industry Guide 7, mineralization may not be classified as a "reserve" unless the mineralization can be economically and legally extracted or produced at the time the "reserve" determination is made. Accordingly, information contained or referenced in this material change report containing descriptions of mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of Industry Guide 7.

"Inferred mineral resources" have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Further, while NI 43-101 permits companies to disclose economic projections contained in preliminary economic assessments and pre-feasibility studies, which are not based on "reserves", U.S. companies have not generally been permitted under Industry Guide 7 to disclose economic projections for a mineral property in their SEC filings prior to the establishment of "reserves". Disclosure of "contained ounces" in a resource is permitted disclosure under Canadian reporting standards; however, Industry Guide 7 normally only permits issuers to report mineralization that does not constitute "reserves" by Industry Guide 7 standards as in-place tonnage and grade without reference to unit measures. Historical results or feasibility models presented herein are not guarantees or expectations of future performance.

5.2 Disclosure for Restructuring Transactions

Not applicable.

Item 6 Reliance on subsection 7.1(2) of National Instrument 51-102

Not applicable.

Item 7 Omitted Information

State whether any information has been omitted on the basis that it is confidential information.

Not applicable.

Item 8 Executive Officer

Give the name and business telephone number of an executive officer of your company who is knowledgeable about the material change and the Report, or the name of an officer through whom such executive officer may be contacted.

Brett Heath

President and Chief Executive Officer

Tel: 604-696-0741

Item 9 Date of Report

April 27, 2020