MANAGEMENT'S DISCUSSION & ANALYSIS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2022

GENERAL

This management's discussion and analysis ("MD&A") for Metalla Royalty & Streaming Ltd. (the "Company" or "Metalla") is intended to help the reader understand the significant factors that have affected Metalla and its subsidiaries performance and such factors that may affect its future performance. This MD&A, which has been prepared as of August 11, 2022, should be read in conjunction with the Company's condensed interim consolidated financial statements for the three and six months ended June 30, 2022, and the related notes contained therewith. The Company reports its financial position, financial performance, and cash flows in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB").

Additional information relevant to the Company are available for viewing on SEDAR at www.sedar.com and on the EDGAR section of the SEC website at www.sec.gov.

INDEX

COMPANY OVERVIEW

Metalla Royalty & Streaming Ltd. ("Metalla" or the "Company") is a precious metals royalty and streaming company that is focused on acquiring gold and silver metal purchase agreements, Net Smelter Return ("NSR") royalties, Gross Value Return ("GVR") royalties, Net Profit Interests ("NPIs"), Gross Proceeds Royalties ("GPRs"), Gross Overriding Return ("GOR") royalties, Price Participation Royalties ("PPRs"), and non-operating interests in mining projects that provide the right to the holder of a percentage of the gross revenue from metals produced from the project or a percentage of the gross revenue from metals produced from the project after deducting specified costs, if any, respectively. The Company's common shares are listed on the TSX Venture Exchange ("TSX-V") under the symbol "MTA" and on the NYSE American ("NYSE") under the symbol "MTA". The head office and principal address is 501 - 543 Granville Street, Vancouver, British Columbia, Canada.

Since March 2020, several measures have been implemented in Canada, Australia, Argentina, Mexico, the United States, and in other jurisdictions where we hold royalties and streams in response to the increased impact from the coronavirus (“COVID-19”). These measures, which include the implementation of travel bans, self-imposed quarantine periods, social distancing, vaccine or testing mandates, and in some cases mine closures or suspensions, have caused material disruption to business globally. Global financial markets have experienced significant volatility. There are significant uncertainties with respect to future developments and impact to the Company related to the COVID-19 pandemic, including the duration, severity and scope of the outbreak and the measures taken by governments and businesses to contain the pandemic. While the impact of COVID-19 is expected to be temporary, the current circumstances are dynamic and the impact of COVID-19 on our business operations cannot be reasonably estimated at this time, such as the duration and impact on future production for our partner operators at their respective mining operations. However, the current situation has improved and is expected to have less of an adverse impact on the Company’s business, results of operations, financial position and cash flows going forward.

COMPANY HIGHLIGHTS

During the six months ended June 30, 2022, and subsequent period the Company:

- Noted the following key milestones announced by operators of certain properties in its portfolio of royalties and streams (please see the 'Portfolio of Royalties and Streams' section of this MD&A for the details of these announcements):

- Monarch Mining Corporation (“Monarch”) announced that new production has started at the Beaufor Mine (1.0% NSR royalty) to bring the total number of producing assets in which the Company has an interest in to six, with the first royalty payment from Beaufor expected in the second half of 2022;

- G Mining Ventures Corp. (“G Mining”) announced a $481 million financing package to fully fund the construction of the Tocantinzinho (“TZ”) Gold Project (0.75% GVR royalty), targeting production for the second half of 2024;

- Yamana Gold Inc. (“Yamana”) announced its second increase in the projected annual output from its Wasamac Mine (1.5% NSR royalty) since acquiring the project in 2021. Originally slated to produce 169 Koz annually when acquired by Yamana, the projected output has subsequently been raised to 250 Koz annually until at least 2030 and over 200 Koz annually over the initial 15 years. Bulk sample permit approvals are expected in early 2023 and ramp development could begin in spring 2023;

- Moneta Gold Inc. (“Moneta”) announced a new discovery at the Garrison project (2.0% NSR royalty), where drilling to the west of the Garrcon Starter pit hit 50.09 g/t gold over 5.05 meters, highlighting the continued potential to significantly expand the Garrcon resource base and support an underground operation at the mine. Moneta expects to release an updated Preliminary Economic Assessment in the second half of 2022; and

- Yamana recently reported that the Canadian Malartic partnership had identified a porphyry-hosted gold mineralization that could potentially be mined via an open pit from the Camflo property (1.0% NSR royalty).

- Closed the following notable transaction:

- amended an existing 1.0% NSR royalty on Monarch's Beaufor Mine. In consideration for $1.0 million paid in cash to Monarch, Monarch agreed to waive a clause stipulating that payments under the NSR royalty were only payable after 100 Koz of gold have been produced by Monarch following its acquisition of Beaufor. Payments under this NSR royalty will commence shortly as Monarch announced the start of production during July 2022 (see below).

- On May 12, 2022, the Company filed a new final short form base shelf prospectus and a corresponding registration statement on Form F-10 that replaced the base shelf prospectus and Form F-10 registration statement previously filed by the Company in 2020, and to enhance the Company’s financial flexibility. In connection with this transition, the Company terminated its 2021 ATM Program (as defined below). From inception on May 14, 2021, to the termination on May 12, 2022, the Company distributed 1,990,778 common shares under the 2021 ATM Program at an average price of $8.18 per share for gross proceeds of $16.3 million, of which 20,170 common shares were sold during the three months ended June 30, 2022, at an average price of $7.13 per common share for gross proceeds of $0.1 million;

- On May 27, 2022, the Company announced that it had entered into a new equity distribution agreement with a syndicate of agents to establish an At-The-Market equity program under which the Company may distribute up to $50.0 million (or the equivalent in Canadian Dollars) in common shares of the Company. From inception to the date of the MD&A, the Company did not distribute any common shares under this program;

- for the three months ended June 30, 2022, received or accrued payments on 560 (three months ended June 30, 2021 - 646) attributable Gold Equivalent Ounces (“GEOs”) at an average realized price of $1,844 (three months ended June 30, 2021 - $1,778) and an average cash cost of $9 (three months ended June 30, 2021 - $8) per attributable GEO (see non-IFRS Financial Measures). For the six months ended June 30, 2022, received or accrued payments on 1,284 (six months ended June 30, 2021 – 1,377) attributable GEOs at an average realized price of $1,839 (six months ended June 30, 2021 - $1,764) and an average cash cost of $7 (six months ended June 30, 2021 - $10) per attributable GEO (see non-IFRS Financial Measures);

- For the three months ended June 30, 2022, recognized revenue from royalty and stream interests, including fixed royalty payments, of $0.5 million (three months ended June 30, 2021 – $0.7 million), net loss of $1.4 million (three months ended June 30, 2021 - $2.7 million), and adjusted EBITDA of negative $0.2 million (three months ended June 30, 2021 - negative $0.5 million) (see non-IFRS Financial Measures). For the six months ended June 30, 2022, recognized revenue from royalty and stream interests, including fixed royalty payments, of $1.1 million (six months ended June 30, 2021 – $1.4 million), net loss of $3.6 million (six months ended June 30, 2021 - $5.1 million), and adjusted EBITDA of negative $0.2 million (six months ended June 30, 2021 - negative $1.0 million) (see non-IFRS Financial Measures);

- For the three months ended June 30, 2022, generated operating cash margin of $1,835 (three months ended June 30, 2021 - $1,770) per attributable GEO, and for the six months ended June 30, 2022, generate operating cash margin of $1,832 (six months ended June 30, 2022 - $1,754) per attributable GEO, from the Wharf, Joaquin, and COSE royalties, the New Luika Gold Mine (“NLGM”) stream held by Silverback Ltd. (“Silverback”), the Higginsville derivative royalty asset, and other royalty interests (see non-IFRS Financial Measures); and

- For the three months ended June 30, 2022, recognized payments due or received (not included in revenue) from the Higginsville derivative royalty asset of $0.6 million (three months ended June 30, 2021 - $0.5 million), and for the six months ended June 30, 2022, recognized payments due or received (not included in revenue) from the Higginsville derivative royalty asset of $1.2 million (six months ended June 30, 2021 - $1.0 million) (see non-IFRS Financial Measures).

PORTFOLIO OF ROYALTIES AND STREAMS

As at the date of this MD&A, the Company owned 70 royalties, streams, and other interests. Six of the royalties and streams are in the production stage, twenty-four of the royalties are in the development stage, and the remainder are in the exploration stage.

Notes:

(1) Au: gold; Ag: silver; Cu: copper; Zn: zinc; and Pb: lead.

(2) Kt: kilotonnes; Mt: million tonnes; g/t: grams per tonne; oz: ounces; Koz: kilo ounces; Moz: million ounces; Ktpa: kilotonnes per annum; Mtpa: million tonnes per annum; and tpd: tonnes per day.

(3) See the Company's website at https://www.metallaroyalty.com/ for the complete list and further details.

Producing Assets

As at the date of this MD&A, the Company owned an interest in the following properties that are in the production stage:

Property | | Operator | | Location | | Metal | | Terms |

Wharf | | Coeur Mining | | South Dakota, USA | | Au | | 1.0% GVR |

Higginsville (1) | | Karora Resources | | Higginsville, Australia | | Au | | 27.5% PPR |

COSE | | Pan American | | Santa Cruz, Argentina | | Au, Ag | | 1.5% NSR |

Joaquin | | Pan American | | Santa Cruz, Argentina | | Au, Ag | | 2.0% NSR |

New Luika | | Shanta Gold | | Tanzania | | Au, Ag | | 15% Ag Stream |

Beaufor | | Monarch Mining | | Val d'Or, Quebec | | Au | | 1.0% NSR |

(1) The Higginsville PPR royalty is designated as a derivate royalty asset on the Company's statement of financial position.

Below are updates during the three months ended June 30, 2022, and subsequent period to certain production stage assets and is based on information publicly filed by the applicable project owner:

Beaufor Mine

On July 5, 2022, Monarch announced that it had begun processing ore from its Beaufor Mine at its wholly-owned Beacon Mill, it reported it had stockpiled a total of 30,549 tonnes of ore averaging 4.76 g/t gold and would start feeding the mill with that ore and expected to pour its first bar of gold in July 2022. On July 27, 2022, Monarch further announced the production of its first gold bar from the Beaufor Mine, and announced it expects to reach commercial production in the coming months.

On June 16, 2022, Monarch reported results from recent drilling at the Q Zone where significant intercepts include 122 g/t over 1.4 meters, 20.74 g/t over 3.3 meters, 83.2 g/t gold over 0.5 meters and 18.87 g/t gold over 1.2 meters. On July 25, 2022, Monarch reported high grade results from drilling at the Q Zone that included 37.59 g/t gold over 2.5 meters, 29.79 g/t gold over 2.45 meters and 418 g/t gold over 0.63 meters, highlighting the potential to expand the Q Zone at depth.

Metalla holds a 1.0% NSR royalty on the Beaufor mine.

Wharf Royalty

On August 3, 2022, Coeur Mining Inc. ("Coeur") reported second quarter production of 20.4 Koz gold at 0.47 g/t gold, in line with the 70-80 Koz full year guidance for Wharf disclosed by Wharf on February 16, 2022. During the quarter, one reverse circulation ("RC") drill rig had completed a resource conversion program at the Portland-Ridge-Boston claim group and at the Flossie area.

On February 16, 2022, Coeur reported that Wharf's updated Proven and Probable Reserves totaled 852 Koz at 0.73 g/t. Total Measured and Indicated Resources were reported at 412 Koz at 0.63g/t with an Inferred Resource estimate of 90 Koz at 0.75 g/t. In addition, Coeur reported in their Q4 2021 financial statements, an updated mine life of 8 years for Wharf. Additionally, Coeur reported the continued exploration success at Wharf where a total of 6,625 meters of drilling was completed in the Portland Ridge - Boston claim group, Flossie and Juno areas. Coeur spent $4 million on exploration at the mine in 2021, its largest since acquiring the asset in 2015.

Metalla holds a 1.0% GVR royalty on the Wharf mine.

New Luika Silver Stream

On July 21, 2022, Shanta Gold Limited (“Shanta”) reported that it produced 17.5 Koz of gold at its NLGM in Tanzania in the second quarter of 2022, in line with full year production guidance of 68-76 Koz gold. On July 19, 2021, Shanta announced a new mine plan for NLGM, where average annual production is expected to be 73.6 Koz gold with the potential to extend mine life beyond 2026 through conversion of significant known resources and the expanded 2,450 tpd mill throughput. Shanta expects total gold production from NLGM for the five-year plan to total 368 Koz from both open pit and underground mine sources from the mining license.

Metalla holds a 15% interest in Silverback Ltd., whose sole business is receipt and distribution of a 100% silver stream on NLGM at an ongoing cost of 10% of the spot silver price.

Development Stage Assets

As at the date of this MD&A, the Company owned an interest in the following properties that are in the development stage:

Property | | Operator | | Location | | Metal | | Terms |

Akasaba West | | Agnico Eagle | | Val d'Or, Quebec | | Au, Cu | | 2.0% NSR(1) |

Amalgamated Kirkland | | Agnico Eagle | | Kirkland Lake, Ontario | | Au | | 0.45% NSR |

Aureus East | | Aurelius Minerals | | Halifax, Nova Scotia | | Au | | 1.0% NSR |

Big Springs | | Anova Metals | | Nevada, USA | | Au | | 2.0% NSR(2) |

Castle Mountain | | Equinox Gold | | California, USA | | Au | | 5.0% NSR |

CentroGold | | Oz Minerals | | Maranhao, Brazil | | Au | | 1.0%-2.0% NSR(3) |

Côté and Gosselin | | IAMGOLD/Sumitomo | | Gogama, Ontario | | Au | | 1.35% NSR |

Del Carmen | | Barrick Gold | | San Juan, Argentina | | Au, Ag | | 0.5% NSR |

El Realito | | Agnico Eagle | | Sonora, Mexico | | Au, Ag | | 2.0% NSR(1) |

Endeavor (5) | | CBH Resources | | NSW, Australia | | Zn, Pb, Ag | | 100% Ag Stream |

Fifteen Mile Stream ("FMS") | | St. Barbara | | Halifax, Nova Scotia | | Au | | 1.0% NSR |

FMS (Plenty Deposit) | | St. Barbara | | Halifax, Nova Scotia | | Au | | 3.0% NSR(1) |

Fosterville | | Agnico Eagle | | Victoria, Australia | | Au | | 2.5% GVR |

Garrison | | Moneta Gold | | Kirkland Lake, Ontario | | Au | | 2.0% NSR |

Hoyle Pond Extension | | Newmont | | Timmins, Ontario | | Au | | 2.0% NSR(1) |

La Fortuna | | Minera Alamos | | Durango, Mexico | | Au, Ag, Cu | | 3.5% NSR(4) |

North AK | | Agnico Eagle | | Kirkland Lake, Ontario | | Au | | 0.45% NSR |

NuevaUnión | | Newmont and Teck | | Chile | | Au | | 2.0% NSR |

San Luis | | SSR Mining | | Peru | | Au, Ag | | 1.0% NSR |

Santa Gertrudis | | Agnico Eagle | | Sonora, Mexico | | Au | | 2.0% NSR(1) |

Tocantinzinho | | G Mining | | Para, Brazil | | Au | | 0.75% GVR |

Wasamac | | Yamana Gold | | Rouyn-Noranda, Quebec | | Au | | 1.5% NSR(1) |

Timmins West Extension | | Pan American | | Timmins, Ontario | | Au | | 1.5% NSR(1) |

Zaruma | | Pelorus Minerals | | Ecuador | | Au | | 1.5% NSR |

(1) Subject to partial buy-back and/or exemption

(2) Subject to fixed royalty payments

(3) 1.0% NSR royalty on the first 500 Koz, 2.0% NSR royalty on next 1Moz, and 1.0% NSR royalty thereafter in perpetuity

(4) 2.5% NSR royalty capped at $4.5 million, 1.0% NSR royalty uncapped

(5) The Endeavor mine was previously classified as production, however it was placed on care and maintenance in December 2019 and has not since restarted, as such the Company has reclassified it to development stage properties

Below are updates during the three months ended June 30, 2022, and subsequent period to certain development stage assets and is based on information publicly filed by the applicable project owner:

Côté-Gosselin

On August 3, 2022, IAMGOLD Corporation ("IAMGOLD") reported that construction had reached 57% completion at the Côté Gold Project. It also reported completion in the second quarter of 2022 of approximately 10,500 meters of the 16,000 meter drill program is planned in 2022 to further delineate and expand the Gosselin mineral resources and test selected targets along the deposit corridor. In addition, IAMGOLD completed a project update to the Côté life-of-mine plans where the update proposes an 18-year mine life with initial production expected in early 2024. Average annual production during the first six years is expected to be 495 Koz gold and 365 Koz over the life-of-mine.

Figure 1: Table showing updating Gold Production Profile for the Côté Gold Project. (Source: IAMGOLD Corporation. Announces Results of Côté Gold Project Update, issued August 3, 2022)

Metalla holds a 1.35% NSR royalty that covers less than 10% of the Côté reserves and resources estimate and covers all of the Gosselin resource estimate.

Castle Mountain

Castle Mountain is slated to become one of Equinox Gold's ("Equinox") largest assets. Metalla's 5.0% NSR royalty covers the South Domes portion of the deposit which will be part of the Phase 2 expansion slated to begin in 2026.

On August 3, 2022, Equinox reported production in the second quarter of 6.7 Koz gold and exploration expenditure in the second quarter of $0.5 million at the Castle Mountain property. This was in addition to the exploration announced on May 3, 2022, where drilling in the first quarter included 7,948 meters of RC drilling across the South dump area to assess the continuity and distribution of grade. Equinox also completed 1,448 meters of RC drilling in the area between the JSLA and South Domes pits.

Equinox also announced that in March 2022 it had submitted applications to amend existing permits to accommodate the Phase 2 expansion. On February 24, 2022, Equinox announced they expect to spend $7 million for Phase 2 permitting, optimization studies and metallurgical test work and nearly $2 million for exploration. As of August 3, 2022, the Phase 2 permitting timeline was on schedule with the San Bernardino County having determined the application was complete. Equinox expects the U.S. Bureau of Land management to complete its completeness review by the end of July with the application reviews to run through to the end of 2022. Both agencies will determine the appropriate level of state and federal environmental review required with the resulting review process anticipated to begin by early 2023.

Metalla holds a 5.0% NSR royalty on the South Domes area of the Castle Mountain mine.

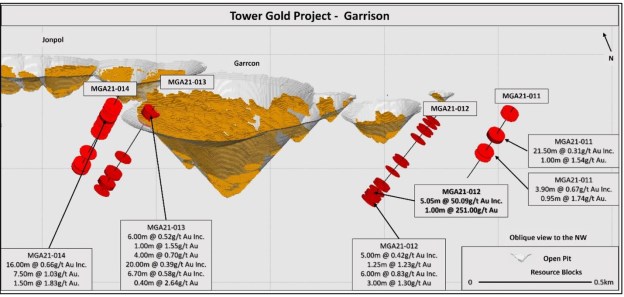

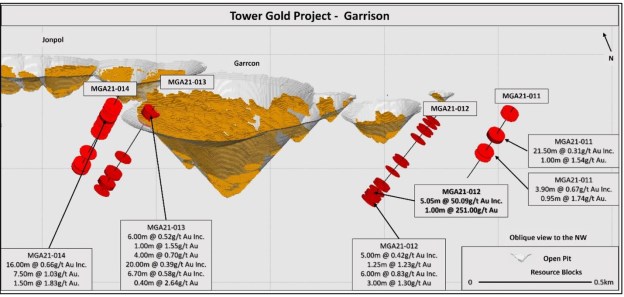

Garrison

On July 7, 2022, Moneta released the results of exploration drilling at the Garrison deposit in their Tower Gold project. Drilling results tested new areas all within the Tower Gold project, including east and west of the Garrcon resource, south of the Westaway resource at South Basin, east of the Windjammer South resource at Halfway, and west of the 55 deposit. Drilling has confirmed significant gold mineralization beyond the current resource. Highlights include a drill hole that intercepted significant mineralization with 50.09 g/t gold over 5.05 meters and 0.66 g/t gold over 16 meters. The holes highlight the potential to expand the Garrcon resource pit shells and open new targets for future exploration drilling.

On May 11, 2022, Moneta released an updated resource estimate for the Tower Gold project, including 4.27 Moz gold in the Indicated category and 7.5 Moz gold in the Inferred category. Moneta plans to complete a Preliminary Economic Assessment on the project scheduled for completion later in the second quarter of 2022. The Garrison deposit forms part of the Tower project and is comprised of three zones, Garrcon, Jonpol, and 903. At Garrcon, the open pit Indicated Resource is 841 Koz at 1.02 g/t gold with an Inferred Resource of 15Koz at 0.67 g/t gold, the underground portion has an Indicated Resource of 87 Koz at 5.08 g/t gold with an Inferred Resource of 120 Koz at 4.98 g/t gold. The Jonpol zone has an Indicated Resource of 297 Koz at 1.4 g/t gold and an Inferred Resource of 114 Koz at 0.99 g/t gold. The 903 zone has an Indicated Resource of 610 Koz at 1.01 g/t gold and an Inferred Resource of 600 Koz at 0.74 g/t gold. The Garrison starter pit now has an Indicated Resource of 1.75 Moz at 1.07 g/t gold. Moneta is slated to release a PEA in the second half of 2022.

Figure 2: Cross Section showing high grade intervals below the Garrcon resource pits (Source: Moneta Gold Inc. press release on Step-out drilling at Garrcon, Tower Gold Project, issued July 7, 2022)

Metalla holds a 2.0% NSR royalty on the Garrison project.

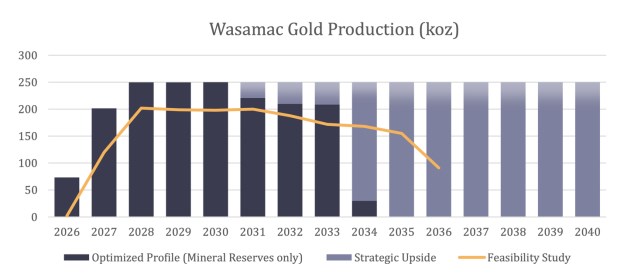

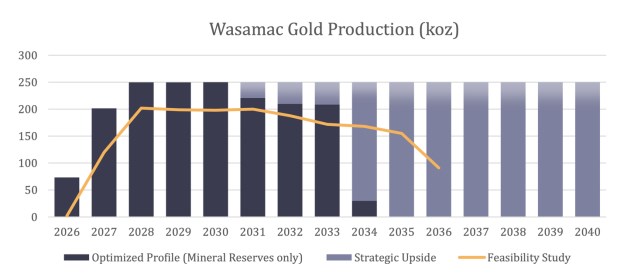

Wasamac

On July 7, 2022, Yamana announced the approval of the Wasamac bulk sample program, providing for earlier access to the deposit and to increase the level of confidence in the future mining of the project. Permit approvals are expected in early 2023 with ramp development potentially beginning in Spring 2023. A reassessment of the Wasamac project highlighted an improved gold production profile compared to the feasibility study with new projections of ramp-up to 200 Koz in 2027 and up to 250 Koz in 2028. Ongoing mine design and sequence optimizations could position Wasamac with the option for future incremental expansion of the mill to 9,000 tpd from 7,000 tpd in year 3 of operations which will extend the gold production profile of 250 Koz per year until at least 2030. Yamana also highlighted additional opportunities not included in the strategic plan which include processing flow sheet optimization to increase metallurgical recoveries by approximately 3%, optimized configuration of the tailings filter plant and paste backfill plant. Yamana also announced that bulk sample permits are scheduled for submission in the third quarter of 2022, with the approval expected in early 2023 and ramp development could begin in spring 2023.

On July 27, 2022, Yamana announced positive results from infill drilling at the Wasamac project where grades continue to exceed expectations with significant results include 5.05 g/t gold over 54.06 meters and 5.45 g/t gold over 16.8 meters. Exploration drilling at the Wildcat South target continued to expand on the discovery with a significant intercept of 7.31 g/t gold over 3.37 meters and 1.46 g/t gold over 12.3 meters.

Figure 3: Chart showing projected production profile of the Wasamac project (Source: Yamana Gold Inc. Second Quarter Operating Results, issued July 7, 2022)

Metalla holds a 1.5% NSR royalty on the Wasamac project subject to a buy back of 0.5% for C$7.5 million.

Amalgamated Kirkland Property

On July 27, 2022, Agnico Eagle Mines Limited ("Agnico") reported that an assessment was ongoing at the Amalgamated Kirkland deposit to provide incremental ore feed to the Macassa mill with annual production of 40 Koz as soon as 2024. The Macassa underground ramp had been extended by 615 meters and twenty-four drill holes had been completed in the higher-grade portion of the deposit. Significant intercepts from the underground drill program include 14.1 g/t gold over 6.5 meters, 23.9 g/t gold over 2.0 meters and 14.9 g/t gold over 3.0 meters. Drilling from the surface drill program designed to infill near surface mineralization proves to be successful in confirming grade thicknesses with significant intercepts of 6.9 g/t gold over 6.7 meters, 5.9 g/t gold over 6 meters and 9 g/t gold over 9.2 meters.

In 2022, Agnico plans to spend $8.6 million on a 1.3 kilometre exploration ramp from the Macassa near surface zones, designed to carry out infill drilling and a bulk sample of the higher-grade regions of the Amalgamated Kirkland deposit. On April 28, 2022, Agnico reported that the Amalgamated Kirkland deposit hosts an Indicated Resource estimate of 265 Koz gold at 6.51 g/t gold and an Inferred Resource of 406 Koz at 5.32 g/t gold. The deposit remains open at depth and extends laterally.

Metalla holds a 0.45% NSR royalty on the Amalgamated Kirkland property.

El Realito

On July 27, 2022, Agnico reported that pre-stripping of the El Realito pit was approximately 81% compete. Pre-stripping activities at El Realito pit are in line with forecast are expected to be completed in the third quarter of 2022. The production guidance in Agnico's February 23, 2022, press release for the La India mine which hosts the El Realito pit were positively revised to 82.5 Koz gold in 2022, 70 Koz gold in 2023 and 22.5 Koz gold in 2024. The increase in the production guidance was due to pit optimization and increase in mineral reserves at the El Realito deposit.

Metalla holds a 2.0% NSR royalty on the El Realito deposit which is subject to a 1.0% buyback right for $4.0 million.

Del Carmen

On May 4, 2022, Barrick Gold Corporation reported that drilling at Del Carmen resumed in the second quarter of 2022, drilling will continue until the winter season. Results received at Carmen Norte, located to the north of the Rojo Grande target, confirmed gold mineralization with an intercept of 0.5 g/t gold over 39 meters, which opens up a new area with upside potential to add resources to Del Carmen. In addition, all geological models grade estimates and geometallurgical models with be updated and rebuilding in the second quarter to inform future steps for the project.

Metalla holds a 0.5% NSR royalty on the Del Carmen project which is the Argentine portion of the Alturas-Del Carmen project in the prolific El Indio belt.

Fifteen Mile Stream

On July 27, 2022, St. Barbara Limited reported that the Fifteen Mile Stream project has been extended to include all four identified resource open pits and enable development of the full potential of the project. Permitting application for Fifteen Mile Stream under the Canadian Federal protocol have been made and will be determined in August 2022.

Metalla holds a 1.0% NSR royalty on the Fifteen Mile Stream project, and 3.0% NSR royalty on the Plenty and Seloam Brook deposits.

Tocantinzinho

On July 18, 2022, G Mining announced a $481 million financing package, which included a gold stream, term-loan, and equity placement from Franco-Nevada Corporation for $353 million, for the development of the TZ Gold Project located in Para State, Brazil, providing for full financing required for the project. In addition, Eldorado Gold and La Mancha participated for $89 million in equity placements. Project financing is now in place for full construction to begin in Q3 2023 and targeting production for the second half of 2024.

G Mining had previously announced a feasibility study for the TZ Gold Project was completed in the previous quarter, which confirmed a 10.5-year mine life producing 1.8 Moz of gold in total resulting in an average annual gold production profile of 174,700 ounces at an all-in sustaining cost of $681/oz.

Economics were favourable, at a $1,600/oz gold price the study demonstrated an after-tax NPV5% of $622 million and generated an after-tax IRR of 24%. Also of note, G Mining increased the reserves at TZ by 12% to 2.0 Moz and saw an increase in the capital cost at the project of only 7% since the last study was conducted. Project optimization and detailed engineering is expected to occur from Q4 2021 through to Q4 2022. G Mining also expects to complete two drilling campaigns totaling 10,000 meters beginning in Q4 2021 through to Q1 2022, these include a grade control drilling program to de-risk early years of production and an exploration drilling program to test for potential extensions of the known mineralization at depth and below the current pit.

G Mining is a precious metals development company with a leadership team which has built four mines in South America, including the Merian mine for Newmont Corporation and Fruta Del Norte for Lundin Gold.

Metalla holds a 0.75% GVR royalty on the Tocantinzinho project.

Fosterville

On July 27, 2022, Agnico reported that gold production from Fosterville for the first six months of the operation was 168 Koz gold. During the quarter, the Robbins Hill and Phoenix exploration declines were completed allowing for the advancement of exploration drilling in the prospective areas.

On February 23, 2022, Agnico reported that they expect to spend $34.6 million for 121,400 metres of drilling and development to replace mineral reserve depletion and to add mineral resources at the Fosterville mine. Agnico announced that another $19.7 million will be spent on underground and surface exploration with the aim to discover additional high-grade mineralization, with $2.9 million to be spent on regional exploration drilling on the land package surrounding the mine.

Metalla holds a 2.5% GVR royalty on the Northern and Southern extensions of the Fosterville mining license and other areas in the land package.

CentroGold

On July 25, 2022, Oz Minerals stated that the relocation plan required for progressing the court injunction removal for CentroGold was still in review with the National Institute of Colonization and Agrarian Reform (INCRA). In addition, exploration expenses of $0.9 million were spent on the project for the quarter.

Metalla holds a 1.0-2.0% NSR royalty on the CentroGold project.

Exploration Stage Assets

As at the date of this MD&A, the Company owned a large portfolio of royalties on exploration stage assets including:

Property | | Operator | | Location | | Metal | | Terms |

Anglo/Zeke | | Nevada Gold Mines | | Nevada, USA | | Au | | 0.5% GOR |

Beaudoin | | Explor Resources | | Timmins, Ontario | | Au, Ag | | 0.4% NSR |

Big Island | | Voyageur Mineral Expl. | | Flin Flon, Manitoba | | Au | | 2.0% NSR |

Bint Property | | Glencore | | Timmins, Ontario | | Au | | 2.0% NSR |

Biricu | | Minaurum Gold | | Guerrero, Mexico | | Au, Ag | | 2.0% NSR |

Boulevard | | Independence Gold | | Dawson Range, Yukon | | Au | | 1.0% NSR |

Caldera | | Discovery Harbour Res. | | Nevada, USA | | Au | | 1.0% NSR (4) |

Camflo Mine | | Yamana Gold/Agnico Eagle | | Val d'Or, Quebec | | Au | | 1.0% NSR |

Capricho | | Solaris Resources | | Peru | | Au, Ag | | 1.0% NSR |

Colbert/Anglo | | Newmont | | Timmins, Ontario | | Au | | 2.0% NSR |

Carlin East | | Ridgeline Minerals | | Nevada, USA | | Au | | 0.5% NSR (4) |

DeSantis Mine | | Canadian Gold Miner | | Timmins, Ontario | | Au | | 1.5% NSR |

Detour DNA | | Agnico Eagle | | Cochrane, Ontario | | Au | | 2.0% NSR |

Edwards Mine | | Alamos Gold | | Wawa, Ontario | | Au | | 1.25% NSR |

Fortuity 89 | | Newcrest Mining | | Nevada, USA | | Au | | 2.0% NSR |

Golden Brew | | Highway 50 Gold | | Nevada, USA | | Au | | 0.5% NSR |

Golden Dome | | Anova Metals | | Nevada, USA | | Au | | 2.0% NSR (4) |

Goodfish Kirana | | Warrior Gold | | Kirkland Lake, Ontario | | Au | | 1.0% NSR |

Green Springs | | Contact Gold | | Nevada, USA | | Au | | 2.0% NSR |

Guadalupe/Pararin | | Black Swan Minerals | | Peru | | Au | | 1.0% NSR |

Hot Pot/Kelly Creek | | Nevada Exp./Austin Gold | | Nevada, USA | | Au | | 1.5% NSR (2)(4) |

Island Mountain | | Tuvera Exploration | | Nevada, USA | | Au | | 2.0% NSR (4) |

Jersey Valley | | Abacus Mining | | Nevada, USA | | Au | | 2.0% NSR (4) |

Kings Canyon | | Pine Cliff Energy | | Utah, USA | | Au | | 2.0% NSR |

Kirkland-Hudson | | Agnico Eagle | | Kirkland Lake, Ontario | | Au | | 2.0% NSR |

Los Patos | | Private | | Venezuela | | Au | | 1.5% NSR |

Los Tambo | | IAMGOLD | | Peru | | Au | | 1.0% NSR |

Lourdes | | Pucara Resources | | Peru | | Au, Ag | | 1.0% NSR |

Mirado Mine | | Orefinders/Kirkland Lake JV | | Kirkland Lake, Ontario | | Au | | 1.0% NSR(1) |

Montclerg | | GFG Resources | | Timmins, Ontario | | Au | | 1.0% NSR |

Orion | | Minera Frisco | | Nayarit, Mexico | | Au, Ag | | 2.75% NSR(3) |

Pelangio Poirier | | Pelangio Exploration | | Timmins, Ontario | | Au | | 1.0% NSR |

Pine Valley | | Nevada Gold Mines | | Nevada, USA | | Au | | 3.0% NSR (2)(4) |

Pucarana | | Buenaventura | | Peru | | Au | | 1.8% NSR(1) |

Puchildiza | | Metalla | | Chile | | Au | | 1.5% NSR(5) |

Red Hill | | NuLegacy Gold Corp. | | Nevada, USA | | Au | | 1.5% GOR |

Sirola Grenfell | | Pelangio Exploration | | Kirkland Lake, Ontario | | Au | | 0.25% NSR |

Solomon's Pillar | | Private | | Greenstone, Ontario | | Au | | 1.0% NSR |

Tower Stock | | White Metal Res. | | Thunder Bay, Ontario | | Au | | 2.0% NSR |

TVZ Zone | | Newmont | | Timmins, Ontario | | Au | | 2.0% NSR |

(1) Option to acquire the underlying and/or additional royalty

(2) Subject to partial buy-back and/or exemption

(3) Subject to closing conditions

(4) Subject to fixed royalty payments

(5) Option available

Below are updates during the three months ended June 30, 2022, and subsequent period to certain exploration assets and is based on information publicly filed by the applicable project owner:

Camflo

On July 27, 2022, Yamana reported the Canadian Malartic partnership has identified porphyry hosted gold mineralization that could potentially be mined via an open pit at the Camflo property and provide tonnage to the Canadian Malartic operation. Additional studies are underway to fully evaluate the mineralization and additional potential in adjacent rock types. An aggressive drill program is planned in 2023. The Camflo property covers the past producing Camflo mine which had historical production of approximately 1.6 Moz of gold.

Metalla holds a 1.0% NSR royalty on the Camflo mine, located ~1km northeast of the Canadian Malartic operation.

Montclerg

Through press releases dated July 20, 2022, and June 23, 2022, GFG Resources Inc. ("GFG") reported high grade intervals at the Montclerg Gold Project located 48 km east of the Timmins Gold District. Significant intercepts include 1.32 g/t gold over 33.5 meters, 1.6 g/t gold over 70.4 meters and a 4.95 g/t gold over 8.3 meters. Step-out drilling has demonstrated the Montclerg deposit continues for 530 meters to the east and remains open. GFG are planning to complete a 8,000-10,000 meter drill program in 2022.

Metalla holds a 1.0% NSR royalty on the Montclerg property.

Detour DNA

On July 28, 2022, Agnico reported that exploration plans will investigate the Sunday Lake deformation zone along strike to the west and east of the mine. In addition, step out drilling two kilometres west of the current pit out has encountered significant intersections including 32.3 g/t gold over 4.8 meters outlining the potential for an underground operation.

Metalla holds a 2.0% NSR royalty on the Detour DNA property which is ~7km west of the Detour West reserve pit margin.

Green Springs

On August 9, 2022, Contact Gold reported results from the first 3 drill holes from the 2022 step-out drill program at the Green Springs oxide gold project in the Cortez Trend, Nevada. Significant results from the X-Ray zone include 1.66 g/t gold over 28.96 meters and 0.82 g/t gold over 35.05 meters. Results from the remaining 20 holes are pending.

Metalla holds a 2.0% NSR royalty on the Green Springs project.

Red Hill

On June 21, 2022, NuLegacy Gold Corporation reported an updated exploration plan for Red Hill for 2022-2023 with a 29-hole program expected to have begun in July 2022.

Metalla holds a 1.5% GOR royalty on the Red Hill property which is in close proximity to Nevada Gold Mines Cortez operations.

Production and Sales from Royalties and Streams

The following table summarizes the attributable GEOs sold by the Company's royalty partners, including any amounts related to derivative royalty assets, for the three and six months ended June 30, 2022, and 2021:

| | | Three months ended | | | Six months ended | |

| | | June 30, | | | June 30, | |

| | | 2022 | | | 2021 | | | 2022 | | | 2021 | |

| Attributable GEOs(1) during the period from: | | | | | | | | | | | | |

| Higginsville(2) | | 332 | | | 289 | | | 664 | | | 580 | |

| Wharf | | 100 | | | 200 | | | 318 | | | 447 | |

| NLGM(3) | | 28 | | | 28 | | | 47 | | | 75 | |

| COSE | | 59 | | | 103 | | | 123 | | | 191 | |

| Joaquin | | 41 | | | 26 | | | 132 | | | 84 | |

| Total attributable GEOs(1) | | 560 | | | 646 | | | 1,284 | | | 1,377 | |

(1) For the methodology used to calculate attributable GEOs see Non-IFRS Financial Measures.

(2) The Higginsville PPR is accounted for as a derivative royalty asset, as such any payments received under this royalty are treated as a reduction in the carrying value of the asset on the statement of financial position and not shown as revenue on the Company's statement of profit and loss. However, operationally the Company is paid for the ounces sold similar to the Company's other royalty interests, therefore the results have been included here for more accurate comparability and to allow the reader to accurately analyze the operations of the Company. For additional details on the derivative royalty asset see Note 5 in the Company's condensed interim consolidated financial statements for the three and six months ended June 30, 2022.

(3) Adjusted for the Company's proportionate share of NLGM held by Silverback.

OUTLOOK

Primary sources of cash flows from royalties and streams for 2022 are expected to be Wharf, Higginsville, Joaquin, COSE, and NLGM, with the addition of Beaufor and El Realito expected to commence in the second half of 2022. In 2022, the Company expects 2,500 to 3,500 attributable GEOs (1).

(1) For the methodology used to calculated attributable GEOs see Non-IFRS Financial Measures.

SUMMARY OF QUARTERLY RESULTS

The following table provides selected financial information for the eight most recently completed financial quarters(1) up to June 30, 2022:

| | | | | | Three months ended | | | | |

| | | June 30, | | | March 31, | | December 31, | | September 30, | |

| | | 2022 | | | 2022 | | | 2021 | | | 2021 | |

| Revenue from royalty and stream interests | $ | 460,262 | | $ | 668,997 | | $ | 813,509 | | $ | 785,058 | |

| Net loss | | 1,370,500 | | | 2,232,219 | | | 3,131,180 | | | 2,187,472 | |

| Dividends declared and paid | | - | | | - | | | - | | | - | |

| Loss per share - basic and diluted | | 0.03 | | | 0.05 | | | 0.07 | | | 0.05 | |

| Weighted average shares outstanding - basic | | 44,583,515 | | | 44,271,600 | | | 43,953,837 | | | 43,287,763 | |

| | | | | | | | | | | |

| | | | | | | | | Four months | | | Three months | |

| | | Three months ended | | | ended | | | ended | |

| | | June 30, | | | March 31, | | December 31, | | | August 31, | |

| | | 2021 | | | 2021 | | | 2020 | | | 2020 | |

| Revenue from royalty and stream interests | $ | 696,605 | | $ | 674,585 | | $ | 962,783 | | $ | 346,869 | |

| Net loss | | 2,729,981 | | | 2,377,724 | | | 3,289,068 | | | 1,456,741 | |

| Dividends declared and paid | | - | | | - | | | - | | | - | |

| Loss per share - basic and diluted | | 0.06 | | | 0.06 | | | 0.08 | | | 0.04 | |

| Weighted average shares outstanding - basic | | 42,281,245 | | | 40,709,081 | | | 38,975,824 | | | 36,214,370 | |

(1) The Company changed its year-end from May 31 to December 31, beginning with December 31, 2020, as such the Company had a transition financial year which was for the seven months ended December 31, 2020, and a financial quarter which was for four months ended December 31, 2020.

Changes in revenues, net income (loss), and cash flows on a quarter-by-quarter basis are affected primarily by changes in production levels and the related commodity prices at producing mines, acquisitions of royalties and streams, as well as the commencement or cessation of mining operations at mines the Company has under royalty and stream agreements.

A summary of material changes impacting the Company's quarterly results are discussed below:

- For the three months ended June 30, 2022, March 31, 2022, December 31, 2021, September 30, 2021, and June 30, 2021, revenue was roughly consistent compared to the previous quarter as the primary sources of revenue remained unchanged being the Wharf, COSE and Joaquin royalties.

- For the three months ended March 31, 2021, revenue decreased compared to the previous quarter primarily due to the period being a three-month period compared to the comparative to four months in the previous quarter.

- For the four months ended December 31, 2020, and the three months ended August 31, 2020, revenue increased primarily as a result of acquiring the producing Wharf royalty.

RESULTS OF OPERATIONS

Three Months Ended June 30, 2022

The Company’s net loss totaled $1.4 million for the three months ended June 30, 2022 (“Q2 2022”), compared with a net loss of $2.7 million for the three months ended June 30, 2021 (“Q2 2021”).

Significant items impacting the change in net loss included the following:

- a decrease in share-based payments from $1.5 million for Q2 2021, to $0.5 million for Q2 2022, due to the Company having less unvested options outstanding during the current period, which lead to a corresponding lower share-based payment charge;

- an increase in mark-to-market gains on the derivative royalty asset from a loss of $0.4 million for Q2 2021, to a gain of $0.2 million for Q2 2022, driven primarily by changes in the estimates of future gold price and foreign exchange rates used in the Company’s derivative valuation model; and

- an increase in interest expense from $0.2 million for Q2 2021 to $0.3 million in Q2 2022, driven by an increase in the Company’s loans payable from $3.3 million as at June 30, 2021, to $10.8 million as at June 30, 2022.

Six Months Ended June 30, 2022

The Company’s net loss totaled $3.6 million for the six months ended June 30, 2022 (“Q2 2022 YTD”), compared with a net loss of $5.1 million for the six months ended June 30, 2021 (“Q2 2021 YTD”).

Significant items impacting the change in net loss included the following:

- a decrease in share-based payments from $2.5 million for the Q2 2021 YTD, to $1.7 million for Q2 2022 YTD, this decrease was due to the Company having less unvested options outstanding during the current period, which lead to a corresponding lower share-based payment charge;

- an increase in mark-to-market gains on the derivative royalty asset from a loss of $0.6 million for Q2 2021 YTD, to a gain of $0.4 million for Q2 2022 YTD, driven primarily by changes in the estimates of future gold price and foreign exchange rates used in the Company's derivative valuation model; and

- an increase in interest expense from $0.3 million for Q2 2021 YTD to $0.6 million in Q2 2022 YTD, driven by an increase in the Company's loans payable during the period.

LIQUIDITY AND CAPITAL RESOURCES

The Company considers items included in shareholders' equity and long-term debt as capital. The Company's objective when managing capital is to safeguard the Company's ability to continue as a going concern, so that it can continue to add value for shareholders and benefits for other stakeholders.

The Company’s cash balance as at June 30, 2022, was $3.4 million (December 31, 2021 - $2.3 million) and its working capital was negative $3.7 million (December 31, 2021 - $5.4 million). The main driver for the negative working capital was the classification of the Company’s Amended Loan Facility (as defined below) as a current liability. Subsequent to June 30, 2022, the Company and Beedie entered into an agreement to extend the due date of the Amended Loan Facility from April 21, 2023, to January 22, 2024. If the extension had been in place at June 30, 2022, $5.7 million would have moved from current labilities to non-current liabilities, increasing the working capital by a corresponding amount. The Company manages its capital structure and makes adjustments in light of changes in economic conditions and the risk characteristics of the underlying assets .

The Company believes it has access to sufficient resources to undertake its current business plan for the foreseeable future. In order to meet is capital requirements the Company's primary sources of cash flows are expected to be from the Wharf, Higginsville, Joaquin, COSE, and NLGM royalties and streams. For any capital requirement not covered by the cash flows from royalties and streams, the Company may: seek additional funds through public and/or private placements, draw down additional funds under the Amended Loan Facility (as defined below), enter into new debt agreements, or sell assets.

During the six months ended June 30, 2022, cash increased by $1.0 million. The increase was due to cash provided by financing activities of $2.3 million, partially offset by cash used in operating and investing activities of $0.2 million and $0.9 million, respectively. Exchange rate changes had an impact on cash of $0.1 million.

Debt

Convertible Loan Facility

In March 2019, the Company entered into a convertible loan facility (the "Loan Facility") of C$12.0 million with Beedie to fund acquisitions of new royalties and streams. The Loan Facility consisted of an initial advance of C$7.0 million, with the remaining C$5.0 million available for subsequent advances in minimum tranches of C$1.25 million. The Loan Facility carried an interest rate of 8.0% on amount advanced and 2.5% on standby funds available, with the principal payment due April 21, 2023. At the option of Beedie, principal outstanding can be converted into common shares of the Company at a conversion price of C$5.56 per share. In August 2019, the Company drew down the initial advance of $5.4 million (C$7.0 million) (the "First Drawdown").

On August 6, 2020, the Company completed an amendment with Beedie on its Loan Facility (the "Loan Amendment"). As part of the Loan Amendment: (i) Beedie converted C$6.0 million of the First Drawdown; (ii) the Company drew down the remaining undrawn C$5.0 million available from the Loan Facility with a conversion price of C$9.90 per share; (iii) the Loan Facility was increased by an aggregate C$20.0 million. All future advances will have a minimum amount of C$2.5 million and each advance will have its own conversion price based on a 20% premium to the 30-day Volume Weighted Average Price ("VWAP") of the Company's shares on the date of such advance; (iv) if for a period of 30 consecutive trading days the 30-day VWAP is at a 50% premium above any or all of the conversion prices, the Company may elect to convert the principal amount outstanding under the Loan Facility at the respective conversion prices; and (v) the standby fee on all undrawn funds available under the Loan Facility will bear an interest rate of 1.5%.

In August 2020, as per the terms of the Loan Amendment, Beedie converted C$6.0 million of the First Drawdown at a conversion price of C$5.56 per share for a total of 1,079,136 common shares of the Company. In October 2020, Beedie converted the remaining C$1.0 million of the First Drawdown at a conversion price of C$5.56 per share for a total of 179,856 common shares of the Company.

In August 2020, as per the terms of the Loan Amendment, the Company drew down $3.8 million (C$5.0 million) (the "Second Drawdown"), at a conversion price of C$9.90 per share. In March 2021, Beedie converted the entire C$5.0 million from the Second Drawdown at a conversion price of C$9.90 per share for a total of 505,050 common shares of the Company.

Following the conversion of the First Drawdown and the Second Drawdown, under the Loan Facility and the Loan Amendment (together the "Amended Loan Facility") the Company had C$20.0 million available under the Amended Loan Facility with the conversion price to be determined on the date of any future advances.

In March 2021, the Company drew down $4.0 million (C$5.0 million) (the "Third Drawdown"), at a conversion price of C$14.30 per share, from the Amended Loan Facility of which $3.2 million was allocated to the liability portion and the residual value of $0.8 million was allocated to the conversion feature as equity reserves. A deferred tax liability of $0.2 million related to the taxable temporary difference arising from the equity portion of the convertible loan was recognized as an offset in equity reserves. The effective interest rate on the liability portion was 20.0% per annum, with an expected life of approximately two years.

In October 2021, the Company drew down $2.4 million (C$3.0 million) (the "Fourth Drawdown"), at a conversion price of C$11.16 per share, from the Amended Loan Facility of which $2.0 million was allocated to the liability portion and the residual value of $0.4 million was allocated to the conversion feature as equity reserves. A deferred tax liability of $0.1 million related to the taxable temporary difference arising from the equity portion of the convertible loan was recognized as an offset in equity reserves. The effective interest rate on the liability portion was 20.0% per annum, with an expected life of approximately one and a half years.

As at June 30, 2022, the Company had C$5.0 million outstanding with a conversion price of C$14.30 per share from the Third Drawdown, C$3.0 million outstanding with a conversion price of C$11.16 per share from the Fourth Drawdown, and had C$12.0 million available under the Amended Loan Facility with the conversion price to be determined on the date of any future advances.

For the three months ended June 30, 2022, the Company recognized finance charges of less than $0.1 million (three months ended June 30, 2021 - less than $0.1 million), and for the six months ended June 30, 2022, the Company recognized finance charges of $0.1 million (six months ended June 30 - $0.1 million), related to costs associated with the Amended Loan Facility, including standby fees on the undrawn portion of the Amended Loan Facility, as well as set up and other associated costs.

Subsequent to June 30, 2022, in August 2022, the Company and Beedie entered into an agreement to extend the maturity date of the Amended Loan Facility from April 21, 2023, to January 22, 2024 (the “Loan Extension”). In consideration for the Loan Extension the Company incurred a fee of 2.0% of the currently drawn amount of C$8.0 million, the C$160,000 fee will be convertible into common shares at a conversion price of C$7.34 per share, calculated based on a 20% premium to the 30-day Volume Weighted Average Price of the Company’s common shares on the close of trading on the trading day immediately prior to the effective date of the Loan Extension. The Loan Extension is subject to stock exchange approvals which are pending.

Other Loans

In connection with the Castle Mountain acquisition in October 2021, the Company entered into a $5.0 million loan agreement with the arm’s length seller bearing interest at a rate of 4.0% per annum until fully repaid. As per the terms of the agreement the principal amount and any accrued interest will be repaid no later than twenty months from the closing date of the acquisition. The loan is fully payable on June 1, 2023, as such it has been disclosed as a currently liability on the Company’s statement of financial position.

Cash Flows from Operating Activities

During the six months ended June 30, 2022, cash used in operating activities was $0.2 million and was primarily the result of a net loss of $3.6 million, partially offset by $2.8 million for items not affecting cash, and by a $0.6 million decrease in non-cash working capital items. During the six months ended June 30, 2021, net cash provided by operating activities was $0.4 million and was primarily as a result of a net loss of $5.1 million, partially offset by $4.4 million for items not affecting cash, and by a $1.1 million increase in non-cash working capital items.

Cash Flows from Investing Activities

During the six months ended June 30, 2022, cash used in the Company's investing activities was $0.9 million and was primarily related to the acquisition of royalties and streams. During the six months ended June 30, 2021, cash used in the Company's investing activities was $24.9 million and was primarily related to the acquisition of royalties and streams.

Cash Flows from Financing Activities

During the six months ended June 30, 2022, cash provided by the Company’s financing activities was $2.3 million, which was primarily comprised of $2.3 million in net proceeds from the 2021 ATM Program, $0.3 million from the exercise of stock options, partially offset by $0.3 million of finance charges and interest payments. During the six months ended June 30, 2021, cash provided by the Company’s financing activities was $22.6 million, which was primarily comprised of the drawdown of $4.0 million from the Amended Loan Facility, $0.2 million from the exercise of stock options, $18.6 million in proceeds from at-the-market offerings, partially offset by $0.3 million of finance charges and interest payments.

At-The-Market Equity Program

2022 ATM Program

On May 27, 2022, the Company announced that it had entered into an equity distribution agreement (the "2022 Distribution Agreement") with a syndicate of agents (collectively, the "Agents") to establish an At-The-Market equity program (the "2022 ATM Program"). Under the 2022 ATM Program, the Company may distribute up to $50.0 million (or the equivalent in Canadian Dollars) in common shares of the Company (the "Offered Shares"). The Offered Shares will be sold by the Company, through the Agents, to the public from time to time, at the Company's discretion, at the prevailing market price at the time of sale. The net proceeds from the 2022 ATM Program will be used to finance the future purchase of royalties and streams and for general working capital purposes. The 2022 Distribution Agreement may be terminated at any time by the Company or the Agents and if not so terminated will terminate upon the earlier of (a) the date that the aggregate gross sales proceeds of the Offered Shares sold under the 2022 ATM Program reaches the aggregate amount of $50.0 million (or the equivalent in Canadian Dollars); or (b) June 12, 2024. For additional details about the 2022 ATM Program please see the press release by the Company dated May 27, 2022, and available on SEDAR at www.sedar.com and EDGAR at www.sec.gov.

From inception to the date of this MD&A the Company has not distributed any shares under the 2022 ATM Program.

2021 ATM Program

On May 14, 2021, the Company announced that it had entered into an equity distribution agreement (the “2021 Distribution Agreement”) with a syndicate of agents (collectively, the “2021 Agents”) to establish an At-The-Market equity program (the “2021 ATM Program”). Under the 2021 ATM Program, the Company could distribute up to $35.0 million (or the equivalent in Canadian Dollars) in common shares of the Company (the “2021 Offered Shares”). The Offered Shares were sold by the Company, through the Agents, to the public from time to time, at the Company’s discretion, at the prevailing market price at the time of sale. The net proceeds from the 2021 ATM Program were used to finance the purchase of royalties and streams and for general working capital purposes.

The 2021 ATM Program and the 2021 Distribution Agreement were terminated on May 12, 2022. From inception on May 14, 2021, to termination on May 12, 2022, the Company distributed 1,990,778 common shares under the 2021 ATM Program at an average price of $8.18 per share for gross proceeds of $16.3 million, with aggregate commissions paid or payable to the 2021 Agents and other share issue costs of $1.0 million, resulting in aggregate net proceeds of $15.3 million. The remaining $18.7 million of common shares not sold under the 2021 ATM Program are no longer available for sale and will not be issued.

Outstanding Share Data

As at the date of this MD&A the Company had the following:

- 44,872,282 common shares issued and outstanding;

- 2,329,488 stock options outstanding with a weighted average exercise price of C$7.70; and

- 372,054 unvested restricted share units.

Dividends

The Company's long-term goal is to pay out dividends with a target rate of up to 50% of the annualized operating cash flow of the Company, however, the timing and amount of the payment of a dividend is determined by the board of directors by taking into account many factors, including (but not limited to), an increase and stabilization in operating cash flows, and the potential capital requirements related to acquisitions. Going forward, the board of directors of the Company will continually assess the Company's business requirements and projected cash flows to make a determination on whether to pay dividends in respect of a particular quarter during its financial year.

Requirement for additional financing

Management believes that the Company's current operational requirements and capital investments can be funded from existing cash, cash generated from operations, and funds available under the Amended Loan Facility. If future circumstances dictate an increased cash requirement and we elect not to delay, limit, or eliminate some of our plans, we may raise additional funds through debt financing, the issuance of hybrid debt-equity securities, or additional equity securities. The Company has relied on equity financings and loans for its acquisitions, capital expansions, and operations. Capital markets may not be receptive to offerings of new equity from treasury or debt, whether by way of private placements or public offerings. The Company's growth and success may be dependent on external sources of financing which may not be available on acceptable terms.

TRANSACTIONS WITH RELATED PARTIES

The aggregate value of transactions and outstanding balances relating to key management personnel were as follows:

Key management compensation for the Company consists of remuneration paid to management (which includes Brett Heath, the Chief Executive Officer, and Saurabh Handa, the Chief Financial Officer) for services rendered and compensation for members of the Board of Directors (which includes Lawrence Roulston, E.B. Tucker, Alexander Molyneux, James Beeby, Douglas Silver, and Terry Krepiakevich (ret. effective May 22, 2022)) in their capacity as directors of the Company. During the three and six months ended June 30, 2022, the Company's key management compensation was as follows:

| | | Three months ended | | | Six months ended | |

| | | June 30, | | | June 30, | |

| | | 2022 | | | 2021 | | | 2022 | | | 2021 | |

| Salaries and fees | $ | 254,312 | | $ | 227,903 | | $ | 506,562 | | $ | 447,450 | |

| Share-based payments | | 367,472 | | | 1,091,333 | | | 1,235,878 | | | 1,856,730 | |

| | $ | 621,784 | | $ | 1,319,236 | | $ | 1,742,440 | | $ | 2,304,180 | |

As at June 30, 2022, the Company had $Nil due to directors and management related to remuneration and expense reimbursements. As at June 30, 2022, the Company had $Nil due from directors and management related to the payment of withholding amounts.

OFF-BALANCE SHEET ARRANGEMENTS

As of the date of this MD&A, the Company does not have any off-balance sheet arrangements that have, or are reasonably likely to have, a current or future effect on the results of operations or financial condition of the Company, including, and without limitation, such considerations as liquidity and capital resources.

PROPOSED TRANSACTIONS

While the Company continues to pursue further transactions, there are no binding transactions of a material nature that have not already been disclosed publicly.

COMMITMENTS

Contractual Commitments

As at June 30, 2022, the Company had the following contractual commitments:

| | | Less than | | | Over | | | | |

| | | 1 year | | | 1 year | | | Total | |

| Trade and other payables | $ | 604,066 | | $ | - | | $ | 604,066 | |

| Loans payable principal and interest payments (1) | | 6,729,389 | | | - | | | 6,729,389 | |

| Payments related to acquisition of royalties and streams (2) | | 5,333,151 | | | - | | | 5,333,151 | |

| Total commitments | $ | 12,666,606 | | $ | - | | $ | 12,666,606 | |

(1) Payments required to be made on the Amended Loan Facility based on the closing balance as at June 30, 2022.

(2) Payments required for the completion of the Castle Mountain acquisition.

Contingent Commitments

In addition to the contractual commitments above, the Company could in the future have additional commitments payable in cash and/or shares related to the acquisition of royalty and stream interests. However, these payments are subject to certain triggers or milestone conditions that had not been met as of June 30, 2022.

As at June 30, 2022, the Company had the following contingent commitments:

- the Company is obligated to make additional potential payments in connection with its acquisition of its royalty on the CentroGold project of $7.0 million payable in common shares upon receipt of all project licenses, the lifting or extinguishment of the injunction imposed on the CentroGold project with no pending appeals and, if necessary, the completion of any and all community relocations, and $4.0 million in cash upon the achievement of commercial production at the project;

- the Company is obligated to make additional potential payments in connection with its acquisition of its royalty on the NuevaUnión copper-gold project of $0.5 million in cash and $0.5 million in common shares upon achievement of commercial production at the La Fortuna deposit in Chile; and

- the Company is obligated to make additional potential payments in connection with its acquisition of its royalty on the Hoyle Pond Extension property, the Timmins West Extension property, and the DeSantis Mine property totalling C$5.0 million in cash and common shares upon achievement of various production milestones.

FINANCIAL INSTRUMENTS

Classification

The Company classified its financial instruments as follows:

| | | As at | |

| | | June 30, | | | December 31, | |

| | | 2022 | | | 2021 | |

| Financial assets | | | | | | |

| Amortized cost: | | | | | | |

| Cash | $ | 3,370,370 | | $ | 2,344,246 | |

| Royalty, derivative royalty, and stream receivables | | 908,946 | | | 1,175,602 | |

| Other receivables | | 252,851 | | | 125,571 | |

| Fair value through profit or loss: | | | | | | |

| Derivative royalty asset | | 3,217,950 | | | 4,034,007 | |

| Marketable securities | | 36,122 | | | 34,027 | |

| Total financial assets | $ | 7,786,239 | | $ | 7,713,453 | |

| | | | | | | |

| Financial liabilities | | | | | | |

| Amortized cost: | | | | | | |

| Trade and other payables | $ | 604,066 | | $ | 1,089,219 | |

| Loans payable | | 10,811,206 | | | 10,514,644 | |

| Total financial liabilities | $ | 11,415,272 | | $ | 11,603,863 | |

Fair value

Financial instruments recorded at fair value on the statement of financial position are classified using a fair value hierarchy that reflects the significance of the inputs used in making the measurements. The fair value hierarchy has the following levels:

- Level 1 - Unadjusted quoted prices in active markets for identical assets or liabilities;

- Level 2 - Inputs other than quoted prices that are observable for assets or liabilities, either directly or indirectly; and

- Level 3 - Inputs for assets and liabilities that are not based on observable market data.

The fair value hierarchy requires the use of observable market inputs whenever such inputs exist. A financial instrument is classified to the lowest level of the hierarchy for which a significant input has been considered in measuring fair value.

The carrying value of cash, receivables, and accounts payable and accrued liabilities approximated their fair value because of the short-term nature of these instruments. Marketable securities are classified within Level 1 of the fair value hierarchy. Royalty, derivative royalty, and stream receivables that are receivable to the Company without further adjustments are classified as amortized cost. The fair value of the Company's loans payable is approximated by its carrying value as its interest rates are comparable to market interest rates. The derivative royalty asset was valued using certain inputs that are not based on observable market data, inputs used include a gold forward price curve, US$/A$ foreign exchange rates based on forward curves, and an estimated discount rate. Therefore, the derivate royalty asset is classified within Level 3 of the fair value hierarchy.

The Company's activities expose it to financial risks of varying degrees of significance which could affect its ability to achieve its strategic objectives for growth and shareholder returns. The principal financial risks to which the Company is exposed are credit risk and liquidity risk. The Board of Directors has overall responsibility for the establishment and oversight of the Company's risk management framework and reviews the Company's policies on an ongoing basis.

Credit risk

Credit risk arises from cash deposits, as well as credit exposures to counterparties of outstanding receivables and committed transactions. There is no significant concentration of credit risk other than cash deposits. The Company's cash deposits are primarily held with a Canadian chartered bank. Receivables include goods and service tax refunds due from the Canadian federal government. The carrying amount of financial assets recorded in the financial statements represents the Company's maximum exposure to credit risk. The Company believes it is not exposed to significant credit risk and overall, the Company's credit risk has not declined significantly from the prior year.

Liquidity risk

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they fall due. The Company manages liquidity risk by continuing to monitor forecasted and actual cash flows. The Company has in place a planning and budgeting process to help determine the funds required to support the Company’s normal operating requirements on an ongoing basis and its development plans. The Company strives to maintain sufficient liquidity to meet its short-term business requirements, taking into account its anticipated cash flows from royalty interests, its holdings of cash, and its committed liabilities. The maturities of the Company’s loan liabilities are disclosed in Note 8 of the Company’s condensed interim consolidated financial statements for the three and six months ended June 30, 2022. All current liabilities are settled within one year. Subsequent to June 30, 2022, the Company and Beedie entered into an agreement to extend the maturity date of the Amended Loan Facility from April 21, 2023, to January 22, 2024. The Loan Extension is subject to stock exchange approvals which are pending.

Currency risk

The Company is exposed to the financial risk related to the fluctuation of foreign exchange rates. The Company primarily operates in Canada, Australia, Argentina, Mexico, and the United States and incurs expenditures in currencies other than United States dollars. Thereby, the Company is exposed to foreign exchange risk arising from currency exposure. The Company has not hedged its exposure to currency fluctuations. Based on the above net exposure, as at June 30, 2022, and assuming that all other variables remain constant, a 1% depreciation or appreciation of the United States dollar against the Canadian dollar, Australian dollar, Argentinian peso, and Mexican peso would result in an increase/decrease in the Company's pre-tax income or loss of $0.1 million.

NON-IFRS FINANCIAL MEASURES

The Company has included, in this document, certain performance measures, including (a) attributable GEOs, (b) average cash cost per attributable GEO, (c) average realized price per attributable GEO, (d) operating cash margin per attributable GEO, which is based on the two preceding measures, and (e) adjusted EBITDA. The presentation of these non-IFRS measures is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. These non-IFRS measures do not have any standardized meaning prescribed by IFRS, and other companies may calculate these measures differently.

Attributable Gold Equivalent Ounces (GEOs)

Attributable GEOs are composed of gold ounces attributable to the Company, plus an amount calculated by taking the revenue earned by the Company in the period from payable silver ounces attributable to the Company divided by the average London fix price of gold for the relevant period, plus an amount calculated by taking the cash received or accrued by the Company in the period from the derivative royalty asset divided by the average London fix gold price for the relevant period. Included in the calculation of attributable GEOs is any cash received from the Higginsville PPR royalty, which is accounted for as a derivative royalty asset, as such any payments received under this royalty are treated as a reduction in the carrying value of the asset on the Company's statement of financial position and not shown as revenue on the Company's statement of profit and loss. However, operationally as the Company receives payment similar to the Company's other royalty interests, the results have been included here for more accurate comparability and to allow the reader to accurately analyze the operations of the Company. For additional details on the derivative royalty asset see Note 5 of the Company's condensed interim consolidated financial statements for the three and six months ended June 30, 2022.

Attributable GEOs are composed of:

- payable gold ounces attributable to the Company; plus

- an amount calculated by taking the revenue earned by the Company in the period from payable silver ounces attributable to the Company divided by the average London fix price of gold for the relevant period; plus

- an amount calculated by taking the cash received or accrued by the Company in the period from the derivative royalty asset divided by the average London fix gold price for the relevant period.

The Company presents attributable GEOs as it believes that certain investors use this information to evaluate the Company's performance in comparison to other streaming companies in the precious metals mining industry who present results on a similar basis.

Average cash cost per attributable GEO

Average cash cost per attributable GEO is calculated by dividing the Company's total cash cost of sales, excluding depletion by the number of attributable GEOs. The Company presents average cash cost per attributable GEO as it believes that certain investors use this information to evaluate the Company's performance in comparison to other streaming companies in the precious metals mining industry who present results on a similar basis.

The Company's average cash cost per attributable GEO for the three and six months ended June 30, 2022, was:

| | | Three months ended | | | Six months ended | |

| | | June 30, | | | June 30, | |

| | | 2022 | | | 2021 | | | 2022 | | | 2021 | |

| Cost of sales for NLGM(1) | $ | 5,179 | | $ | 5,059 | | $ | 8,804 | | $ | 13,502 | |

| Total cash cost of sales | | 5,179 | | | 5,059 | | | 8,804 | | | 13,502 | |

| Total attributable GEOs | | 560 | | | 646 | | | 1,284 | | | 1,377 | |

| Average cash cost per att ribut able GEO | $ | 9 | | $ | 8 | | $ | 7 | | $ | 10 | |

(1) Adjusted for the Company's proportionate share of NLGM held by Silverback.

Average realized price per attributable GEO

Average realized price per attributable GEO is calculated by dividing the Company's revenue, excluding any revenue earned from fixed royalty payments, and including cash received or accrued in the period from derivative royalty assets, by the number of attributable GEOs sold.

The Company presents average realized price per attributable GEO as it believes that certain investors use this information to evaluate the Company's performance in comparison to other streaming companies in the precious metals mining industry that present results on a similar basis.

The Company's average realized price per attributable GEO for the three and six months ended June 30, 2022, was:

| | | Three months ended | | | Six months ended | |

| | | June 30, | | | June 30, | |

| | | 2022 | | | 2021 | | | 2022 | | | 2021 | |

| Royalty revenue (excluding fixed royalty payments) | $ | 360,262 | | $ | 571,605 | | $ | 1,029,259 | | $ | 1,246,190 | |

| Payments from derivative assets(3) | | 620,569 | | | 526,244 | | | 1,243,855 | | | 1,047,552 | |

| Revenue from NLGM(1) | | 51,787 | | | 50,595 | | | 88,035 | | | 135,024 | |

| Sales from stream and royalty interests | | 1,032,618 | | | 1,148,444 | | | 2,361,149 | | | 2,428,766 | |

| Total attributable GEOs sold | | 560 | | | 646 | | | 1,284 | | | 1,377 | |

| Average realized price per attributable GEO | $ | 1,844 | | $ | 1,778 | | $ | 1,839 | | $ | 1,764 | |

| | | | | | | | | | | | | |

| Operating cash margin per at tributable GEO(2) | $ | 1,835 | | $ | 1,770 | | $ | 1,832 | | $ | 1,754 | |

(1) Adjusted for the Company's proportionate share of NLGM held by Silverback.

(2) Operating cash margin per attributable GEO is calculated by subtracting from the average realized price per attributable GEO, the average cash cost per attributable GEO.

(3) The Higginsville PPR is accounted for as a derivative royalty asset, as such any payments received under this royalty are treated as a reduction in the carrying value of the asset on the statement of financial position and not shown as revenue on the Company's statement of profit and loss. However, operationally the Company is paid for the ounces sold similar to the Company's other royalty interests, therefore the results have been included here for more accurate comparability and to allow the reader to accurately analyze the operations of the Company. For additional details on the derivative royalty asset see Note 5 in the Company's condensed interim consolidated financial statements for the three and six months ended June 30, 2022.

Adjusted EBITDA

Management uses Adjusted EBITDA to evaluate the Company's operating performance, to plan and forecast its operations, and assess leverage levels and liquidity measures. The Company presents Adjusted EBITDA as it believes that certain investors use this information to evaluate the Company's performance in comparison to other streaming companies in the precious metals mining industry who present results on a similar basis. However, Adjusted EBITDA does not represent, and should not be considered an alternative to, net income (loss) or cash flow provided by operating activities as determined under IFRS.

The Company's adjusted EBITDA for the three and six months ended June 30, 2022, was:

| | | Three months ended | | | Six months ended | |

| | | June 30, | | | June 30, | |

| | | 2022 | | | 2021 | | | 2022 | | | 2021 | |

| Net loss | $ | (1,370,500 | ) | $ | (2,729,981 | ) | $ | (3,602,719 | ) | $ | (5,107,705 | ) |

| Adjusted for: | | | | | | | | | | | | |

| Interest expense | | 329,707 | | | 164,328 | | | 649,910 | | | 331,781 | |

| Finance charges | | 35,241 | | | 46,096 | | | 70,163 | | | 101,231 | |

| Income tax provision | | (32,687 | ) | | 55,983 | | | 57,583 | | | 108,335 | |

| Depletion | | 336,538 | | | 407,380 | | | 867,341 | | | 881,536 | |

| Foreign exchange loss (gain) | | (16,821 | ) | | 69,277 | | | 65,393 | | | 201,949 | |

| Share-based payments (1) | | 510,005 | | | 1,473,052 | | | 1,712,469 | | | 2,466,773 | |

| Adjusted EBITDA | $ | (208,517 | ) | $ | (513,865 | ) | $ | (179,860 | ) | $ | (1,016,100 | ) |

(1) Includes stock options and restricted share units.

CRITICAL ACCOUNTING ESTIMATES AND JUDGMENTS

The preparation of consolidated financial statements in conformance with IFRS requires management to make estimates, judgments and assumptions that affect the application of accounting policies and the reported amounts of assets, liabilities, income and expenses. Actual results may differ from these estimates. Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized in the period in which the estimates are revised and in any future periods affected. The Company's significant accounting policies and estimates are disclosed in Note 2 of the Company's consolidated financial statements for the year ended December 31, 2021.

DISCLOSURE CONTROLS AND INTERNAL CONTROLS OVER FINANCIAL REPORTING

Disclosure Controls and Procedures