ASLAN PHARMACEUTICALS LIMITED AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2018 AND 2019

(In U.S. Dollars, Unless Stated Otherwise)

(Unaudited)

Credit risk refers to the risk that a counterparty will default on its contractual obligations resulting in a financial loss to the Group. The Group adopted a policy of only dealing with creditworthy counterparties and financial institutions, where appropriate, as a means of mitigating the risk of financial loss from defaults.

The Group manages liquidity risk by monitoring and maintaining a level of cash and cash equivalents that are deemed adequate to finance the Group’s operations and mitigate the effects of fluctuations in cash flows. In addition, management monitors the utilization of long-term borrowings and ensures compliance with repayment conditions.

As the Company is in the clinical research and development phase, the Company will be seeking future funding based on the requirements of its business operations. The Company intends to explore various means of fundraising to meet its funding requirements to carry out its business operations, such as offerings of American Depositary Shares (“ADSs”), domestic follow-on offerings of ordinary shares, venture debt and shareholder loans. The Company may also use other means of financing such as out-licensing of its intangible assets to generate revenue and cash. The Company has the ability to exercise discretion and flexibility to deploy its capital resources used in research and development activities according to the amount and timing of its financing activities. Accordingly, the Company believes that its existing cash and cash equivalents will enable it to fund its operating expenses and capital expenditure requirements and meet its obligations for at least the next twelve months from September 30, 2019. However, the future viability of the Company depends on its ability to raise additional capital to finance its operations.

On September 30, 2019 and October 25, 2019, the Company entered into a series of loan facilities with certain of the Company’s directors, existing stockholders or affiliates thereof, and others, for an aggregate loan amount of $2.95 million. The loan facilities provide the Company with additional working capital to support its ongoing research and development programs and clinical studies. The two types of loan facilities are described below:

Convertible Loan Facility

On September 30, 2019, the Company entered into a loan facility with Bukwang Pharmaceutical Co., Ltd., for an amount of $1.0 million (the “September 2019 Loan Facility”). The September 2019 Loan Facility has a two-year term with a 10% interest rate per annum, commencing upon the date the Company draws down on such facility. The Company has the option to repay the amounts owed under the September 2019 Loan Facility at any time, subject to certain conditions.

The lender will have the right to convert, at their option, any outstanding principal amount plus accrued and unpaid interest under the loan into that number of the Company’s newly issued ADSs calculated by dividing (a) such outstanding principal amount and accrued and unpaid interest under the loan by (b) 90% of the volume-weighted average price of the Company’s ADS on the date of the conversion notice. Each ADS represents five ordinary shares of the Company. The ability to convert is subject to certain conditions, including that the Company’s ordinary shares will have been delisted from the TPEx, and expires at the expiry of the term of the loan.

October 2019 Loan Facility

On October 25, 2019, the Company entered into a loan facility with certain existing stockholders/directors, or affiliates thereof, for an aggregate amount of $1.95 million (collectively, the “October 2019 Loan Facility”). The October 2019 Loan Facility has a two-year term with a 10% interest rate per annum, commencing upon the date the Company draws down the facility, which must be drawn down in full. The Company has the option to repay not less than $1.0 million of the amounts owed under the October 2019 Loan Facilities at any time, subject to certain conditions. In the event that the Company raises net proceeds of more than $19.5 million in a financing transaction during the loan term, the Company will be obligated to repay any unpaid portion of the principal amount and accrued interest thereunder within 30 days of the receipt of the proceeds from such financing transaction.

The October 2019 Loan Facility provides that, during the time that any amount is outstanding thereunder, the Company will not (i) incur any finance debt which is secured by a security interest or (ii) carry out or implement any merger, consolidation, reorganization (other than the solvent reorganization of the Company), recapitalization, reincorporation, share dividend or other changes in the capital structure of the Company which may have a material adverse effect on the rights of the lenders, in each case except with the prior written consent of the lenders. In addition, upon an event of default (as defined in the October 2019 Loan Facility), the lenders may declare the principal amounts then outstanding and all interest thereon accrued and unpaid to be immediately due and payable to the lenders.

In the event that the Company draws down on the October 2019 Loan Facility, the Company will issue the lenders warrants (the “Warrants”) to purchase an aggregate number of ADSs calculated by dividing (a) 50% of the aggregate principal amount provided to the Company by (b) the Warrant Exercise Price. The “Warrant Exercise Price” is equal to 120% of the volume-weighted average price per ADS on the draw down date, and will be the exercise price per ADS for the Warrants. The Warrants are exercisable only after the Company’s ordinary shares have been delisted from TPEx, and will expire on the earlier of (i) the first anniversary of such TPEx delisting or (ii) expiry of the term of the October 2019 Loan Facility. If, by expiry of the term of the October 2019 Loan Facility, (i) the Company’s shares have not been delisted from TPEx and (ii) the Warrants have not been exercised, the lenders shall be entitled to receive a further sum equal to 5% of the principal amount per annum, by way of additional interest, payable by the Company upon expiry of the loan term.

The Company’s board of directors has resolved to issue ordinary shares for cash sponsoring the issuance of ADSs in October 2019 as well.

The Company is currently in the process of finalizing its funding plans through public offerings in the United States and has submitted an application to Taiwan Securities and Futures Bureau for the required regulatory approval. If the Company is unable to obtain sufficient funds at acceptable terms when needed, the Company could be required to delay, limit or reduce certain of its research and development programs, which could have effects on the Company’s business prospects. Although management continues to pursue these plans, there can be no assurance that the Company will be successful in obtaining sufficient funding on terms acceptable to the Company to fund continuing operations.

| 22. | TRANSACTIONS WITH RELATED PARTIES |

Balances and transactions between the Company and its subsidiaries have been eliminated upon consolidation and are not disclosed in this note. Besides information disclosed elsewhere in the other notes, details of transactions between the Group and other related parties are disclosed below.

Compensation of Key Management Personnel

| | | | | | | | |

| | | For the nine months ended

September 30 | |

| | | 2018 | | | 2019 | |

Short-term employee benefits | | $ | 2,081,781 | | | $ | 1,643,168 | |

Post-employment benefits | | | 111,131 | | | | 80,762 | |

Share-based payments recognized (reversed) | | | 1,578,128 | | | | (227,159 | ) |

| | | | | | | | |

| | $ | 3,771,040 | | | $ | 1,496,771 | |

| | | | | | | | |

The remuneration of directors and key executives was determined by the remuneration committee based on the performance of individuals and market trends.

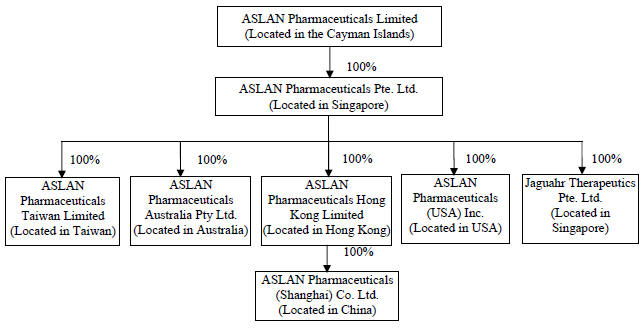

On September 30, 2019, the Company entered into an Investment and Joint Venture Agreement (“JV Agreement”) with Bukwang Pharmaceutical Co., Ltd., to establish a joint venture with the goal of developing preclinical AhR antagonists from the Company’s early stage pipeline. The joint venture will operate through a newly created, independent company based in Singapore, Jaguahr Therapeutics Pte. Ltd., and will focus on developing new immuno-oncology therapeutics for global markets targeting the AhR pathway.

Pursuant to the JV Agreement, the Company has transferred the global rights to all assets related to AhR technology into Jaguahr Therapeutics Pte. Ltd. Under the JV Agreement, Bukwang Pharmaceutical Co., Ltd. is obligated to invest $5,000,000 into Jaguahr Therapeutics Pte. Ltd., through two separate tranches, which will be used to fund development of the assets and identify a lead development compound, with the goal of filing an Investigational New Drug application. Bukwang Pharmaceutical Co., Ltd. made the first payment of $2,500,000 to Jaguahr Therapeutics Pte. Ltd. on October 15, 2019, and was subsequently issued 63,000 shares of Jaguahr Therapeutics Pte. Ltd. As of October 29, 2019, Bukwang Pharmaceutical Co., Ltd. and the Company hold 45% and 55% of the outstanding shares in Jaguahr Therapeutics Pte. Ltd., respectively.

F-34