- AMRX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Amneal Pharmaceuticals (AMRX) 8-KAmneal and Impax Complete Business Combination

Filed: 7 May 18, 7:06am

Amneal & Impax Complete Combination A Strategic Combination for Long-Term Growth May 7, 2018 “We make healthy possible” Exhibit 99.2

Safe Harbor Statement Certain statements contained herein, regarding matters that are not historical facts, may be forward-looking statements (as defined in Section 27A of the United States Securities Act of 1933, as amended, and Section 21E of the United States Securities Exchange Act of 1934, as amended). We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and include this statement for purposes of complying with the safe harbor provisions. Such forward-looking statements include statements regarding management’s intentions, plans, beliefs, expectations or forecasts for the future. The words such as “may,” “will,” “could,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “continue,” and similar words are intended to identify estimates and forward-looking statements. Such forward-looking statements are based on the expectations of Amneal Pharmaceuticals, Inc. (“our” or the “Company”) and involve risks and uncertainties; consequently, actual results may differ materially from those expressed or implied in the statements. Such risks and uncertainties include, but are not limited to (i) our ability to integrate the operations of Amneal Pharmaceuticals LLC (“Amneal”) and Impax Laboratories, Inc. (“Impax”) pursuant to the transactions (the “Combination”) contemplated by that certain Business Combination Agreement dated as of October 17, 2017 by and among the Company, Amneal, Impax and K2 Merger Sub Corporation as amended by Amendment No. 1, dated November 21, 2017 and Amendment No. 2 dated December 16, 2017 and our ability to realize the anticipated synergies and other benefits of the Combination, (ii) the fact that certain of our stockholders holding over a majority of our shares (the “Amneal Group Members”) may have interests different from those of our other stockholders, (iii) the transaction costs related to the Combination, (iv) results from the public unaudited financial information of Impax and Amneal may not be indicative of the Company’s future operating performance, (v) business issues faced by either Amneal or Impax may be imputed to the operations of the Company, (vi) the impact of a separation of Impax or Amneal as a subsidiary of the Company, (vii) the change of control or early termination rights in certain of Impax’s or Amneal’s contracts that may be implicated by the Combination, (viii) payments required by the Company’s Tax Receivables Agreement, (ix) the impact of global economic conditions, (x) our ability to successfully develop or commercialize new products, (xi) our ability to obtain exclusive marketing rights for our products or to introduce products on a timely basis, (xii) the competition we face in the pharmaceutical industry from brand and generic drug product companies, (xiii) our ability to manage our growth, (xiv) the impact of competition, (xv) the illegal distribution and sale by third parties of counterfeit versions of our products or of stolen products, (xvi) market perceptions of us and the safety and quality of our products, (xvii) the substantial portion of our total revenues derived from sales of a limited number of products, (xviii) our ability to develop, license or acquire and introduce new products on a timely basis, (xix) the ability of our approved products to achieve expected levels of market acceptance, (xx) the risk that we may discontinue the manufacture and distribution of certain existing products, (xxi) the impact of manufacturing or quality control problems, (xxii) product liability risks, (xxiii) risks related to changes in the regulatory environment, including United States federal and state laws related to healthcare fraud abuse and health information privacy and security and changes in such laws, (xxiv) changes to FDA product approval requirements, (xxv) risks related to federal regulation of arrangements between manufacturers of branded and generic products, (xxvi) the impact of healthcare reform, (xxvii) business interruptions at one of our few locations that produce the majority of our products, (xxviii) relationships with our major customers, (xxix) the continuing trend of consolidation of certain customer groups, (xxx) our reliance on certain licenses to proprietary technologies, (xxxi) our dependence on third party suppliers and distributors for raw materials for our products, (xxxii) the time necessary to develop generic and branded drug products, (xxxiii) our dependence on third parties for testing required for regulatory approval of our products, (xxxiv) our dependence on third party agreements for a portion of our product offerings, (xxxv) our ability to make acquisitions of or investments in complementary businesses and products, (xxvi) regulatory oversight in international markets, (xxxvii) our increased exposure to tax liabilities and the impact of recent United State tax legislation, (xxxviii) third parties’ infringement of our intellectual property rights, (xxxix) our involvement in various legal proceedings, (xl) increased government scrutiny related to our agreements to settle patent litigation, (xli) the impact of legal, regulatory and legislative strategies by our brand competitors, (xlii) the significant amount of resources we expend on research and development, (xliii) our substantial amount of indebtedness, (xliv) risks inherent in conducting clinical trials, (xlv) our reporting and payment obligations under the Medicaid and other government rebate programs, (xlvi) fluctuations in our operating results, (xlvii) adjustments to our reserves based on price adjustments and sales allowances, (xlviii) impact of impairment on our goodwill and other intangible assets, (xlix) investigations and litigation concerning the calculation of average wholesale prices, (l) cybersecurity and data leakage risks, (li) our ability to attract and retain talented employees and consultants, (lii) uncertainties involved in the preparation of our financial statements, (liii) impact of terrorist attacks and other acts of violence, (liv) expansion of social media platforms, (lv) our need to raise additional funds in the future, (lvi) the restrictions imposed by the terms of our credit agreement, (lvii) our ability to generate sufficient cash to service our indebtedness in the future and (lviii) such other factors as may be set forth in the Company’s public filings with the Securities and Exchange Commission. Forward-looking statements included herein speak only as of the date hereof and we undertake no obligation to revise or update such statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events or circumstances. Trademarks referenced herein are the property of their respective owners. ©2018 Amneal Pharmaceuticals, Inc. All Rights Reserved.

Agenda Strong Foundation for Growth • Paul Bisaro, Executive Chairman The New Amneal • Rob Stewart, President & CEO Financial Update & Capital Structure • Bryan Reasons, CFO Closing Remarks • Rob Stewart Questions & Answers 1 2 3 4 5

Strong Foundation for Growth Paul Bisaro Executive Chairman

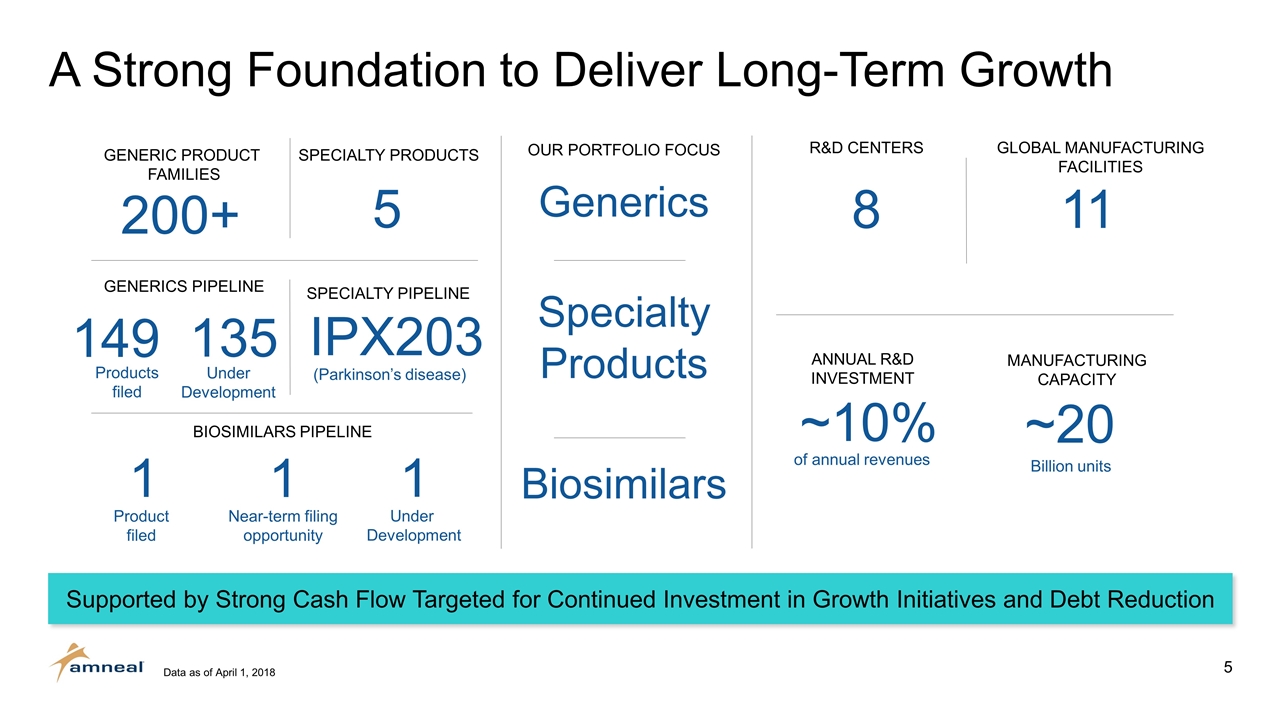

A Strong Foundation to Deliver Long-Term Growth 200+ 149 5 IPX203 1 1 ~20 ~10% Generics Biosimilars Specialty Products OUR PORTFOLIO FOCUS BIOSIMILARS PIPELINE MANUFACTURING CAPACITY ANNUAL R&D INVESTMENT GENERIC PRODUCT FAMILIES SPECIALTY PRODUCTS GENERICS PIPELINE SPECIALTY PIPELINE (Parkinson’s disease) Billion units of annual revenues Product filed Near-term filing opportunity 8 11 R&D CENTERS GLOBAL MANUFACTURING FACILITIES Supported by Strong Cash Flow Targeted for Continued Investment in Growth Initiatives and Debt Reduction Data as of April 1, 2018 1 Under Development 135 Products filed Under Development

The New Amneal Robert Stewart President and CEO

Well-Positioned Generic Pipeline to Drive Growth With one of the largest U.S. generic products pipelines, we are positioned to be a leader in an evolving market and meet the ever-changing needs of tomorrow Amneal data as of April1, 2018. Includes products on file with the FDA and tentative approvals not yet launched. 1Publicly disclosed data as of date listed: Teva – Dec. 31, 2017, Mylan – Apr. 11, 2018, Endo – Feb. 27, 2018, Akorn – Jan. 8, 2018, Lannett – Mar. 20, 2018. Excludes Indian Gx players. U.S. GENERICS PLAYERS: FILED ANDAs 1

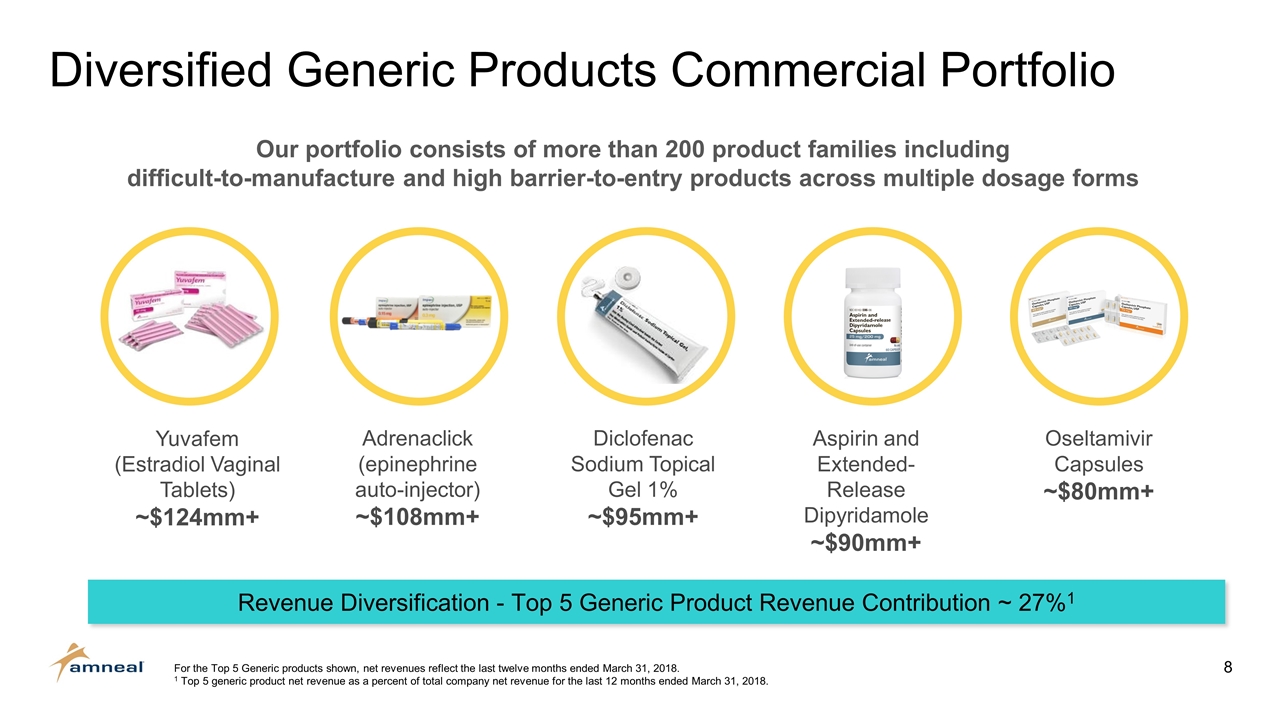

Oseltamivir Capsules ~$80mm+ Aspirin and Extended-Release Dipyridamole ~$90mm+ Adrenaclick (epinephrine auto-injector) ~$108mm+ Diclofenac Sodium Topical Gel 1% ~$95mm+ Yuvafem (Estradiol Vaginal Tablets) ~$124mm+ Diversified Generic Products Commercial Portfolio For the Top 5 Generic products shown, net revenues reflect the last twelve months ended March 31, 2018. 1 Top 5 generic product net revenue as a percent of total company net revenue for the last 12 months ended March 31, 2018. Our portfolio consists of more than 200 product families including difficult-to-manufacture and high barrier-to-entry products across multiple dosage forms Revenue Diversification - Top 5 Generic Product Revenue Contribution ~ 27%1

Stable Cash Flow from Specialty Franchise Proprietary marketed products Central nervous system disorders Parasitic infections Other therapeutic areas Established U.S. sales and marketing function 130 sales reps Primarily targeting neurologists, movement disorder specialists and other high-prescribing physicians in key markets Committed to Investing in Organic and External Opportunities to Create Long-Term Growth

Broad R&D Capabilities ORAL SOLIDS & LIQUIDS • IR/ER tablets • Hard Gelatin Capsules • Softgel Capsules • Hormonals • Controlled Substances • Suspensions/Solutions TOPICALS • Gels • Creams • Ointments & Devices • Hormonals INJECTABLES & STERILE • Peptides • Microspheres • Liposomes • Hormonals • General Injectables • Oncology Injectables • Ophthalmics • Otics TRANSDERMALS • Matrix • Hydrogel • Form Fill Seal • Hormonals RESPIRATORY • Metered Dose • Dry Powder • Nasal Spray Pumps • BFS Inhalation 8 Global R&D Facilities Offering a Full Suite of In-House Capabilities

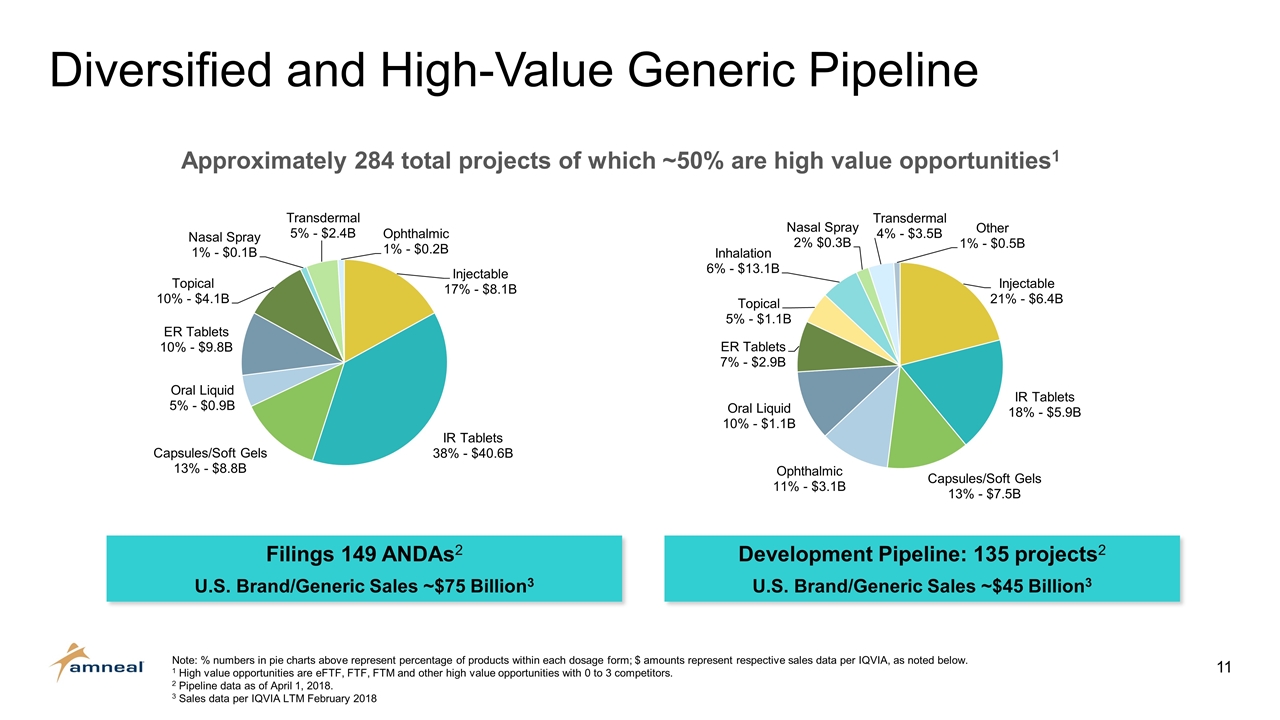

Diversified and High-Value Generic Pipeline Approximately 284 total projects of which ~50% are high value opportunities1 Note: % numbers in pie charts above represent percentage of products within each dosage form; $ amounts represent respective sales data per IQVIA, as noted below. 1 High value opportunities are eFTF, FTF, FTM and other high value opportunities with 0 to 3 competitors. 2 Pipeline data as of April 1, 2018. 3 Sales data per IQVIA LTM February 2018 Filings 149 ANDAs2 U.S. Brand/Generic Sales ~$75 Billion3 Development Pipeline: 135 projects2 U.S. Brand/Generic Sales ~$45 Billion3

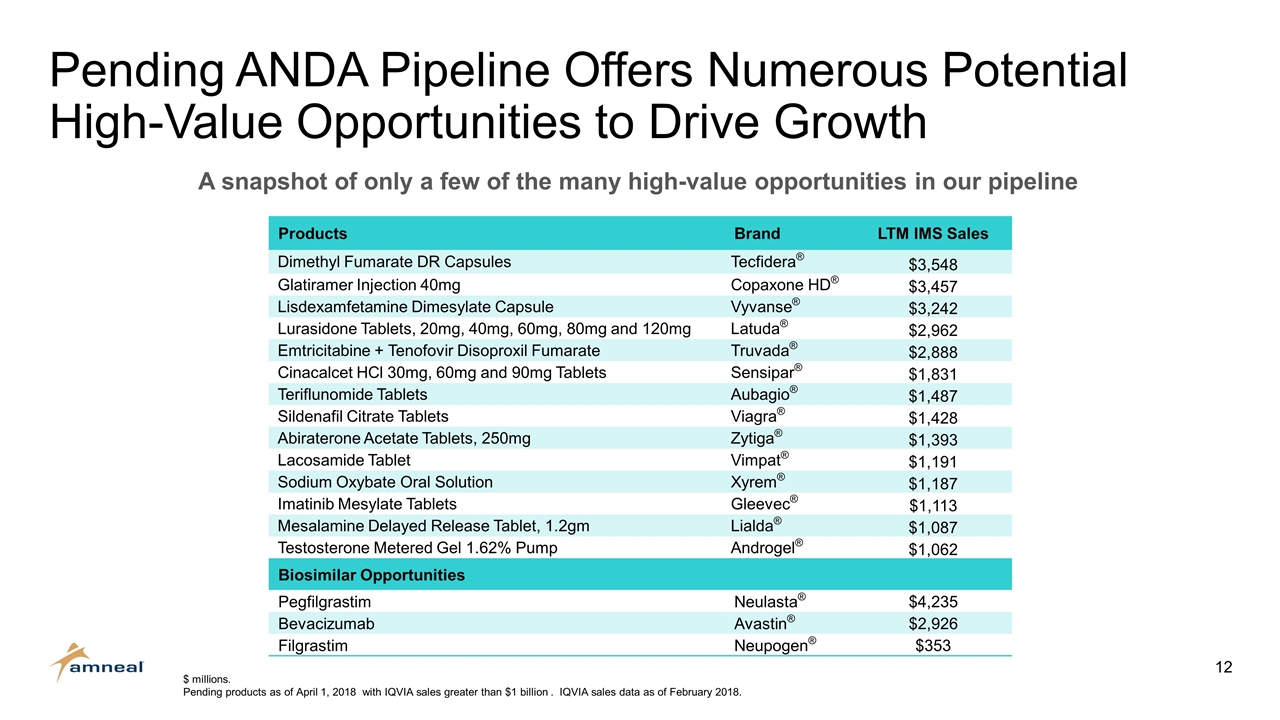

Pending ANDA Pipeline Offers Numerous Potential High-Value Opportunities to Drive Growth $ millions. Pending products as of April 1, 2018 with IQVIA sales greater than $1 billion . IQVIA sales data as of February 2018. Products Brand LTM IMS Sales Dimethyl Fumarate DR Capsules Tecfidera® $3,548 Glatiramer Injection 40mg Copaxone HD® $3,457 Lisdexamfetamine Dimesylate Capsule Vyvanse® $3,242 Lurasidone Tablets, 20mg, 40mg, 60mg, 80mg and 120mg Latuda® $2,962 Emtricitabine + Tenofovir Disoproxil Fumarate Truvada® $2,888 Cinacalcet HCl 30mg, 60mg and 90mg Tablets Sensipar® $1,831 Teriflunomide Tablets Aubagio® $1,487 Sildenafil Citrate Tablets Viagra® $1,428 Abiraterone Acetate Tablets, 250mg Zytiga® $1,393 Lacosamide Tablet Vimpat® $1,191 Sodium Oxybate Oral Solution Xyrem® $1,187 Imatinib Mesylate Tablets Gleevec® $1,113 Mesalamine Delayed Release Tablet, 1.2gm Lialda® $1,087 Testosterone Metered Gel 1.62% Pump Androgel® $1,062 Biosimilar Opportunities Pegfilgrastim Neulasta® $4,235 Bevacizumab Avastin® $2,926 Filgrastim Neupogen® $353 A snapshot of only a few of the many high-value opportunities in our pipeline

Ongoing Commitment to Invest in Biosimilar Pipeline Amneal entered into a licensing and supply agreement for biosimilar candidate Avastin® (bevacizumab) Amneal will be the exclusive partner for the bevacizumab product in the US market Amneal will pay up-front, development and regulatory milestone payments to mAbxience as well as one-time commercial milestone payments on reaching pre-agreed sales targets in the market Product Filed Expected to be Filed 2H 2018 Existing Partnership New Partnership

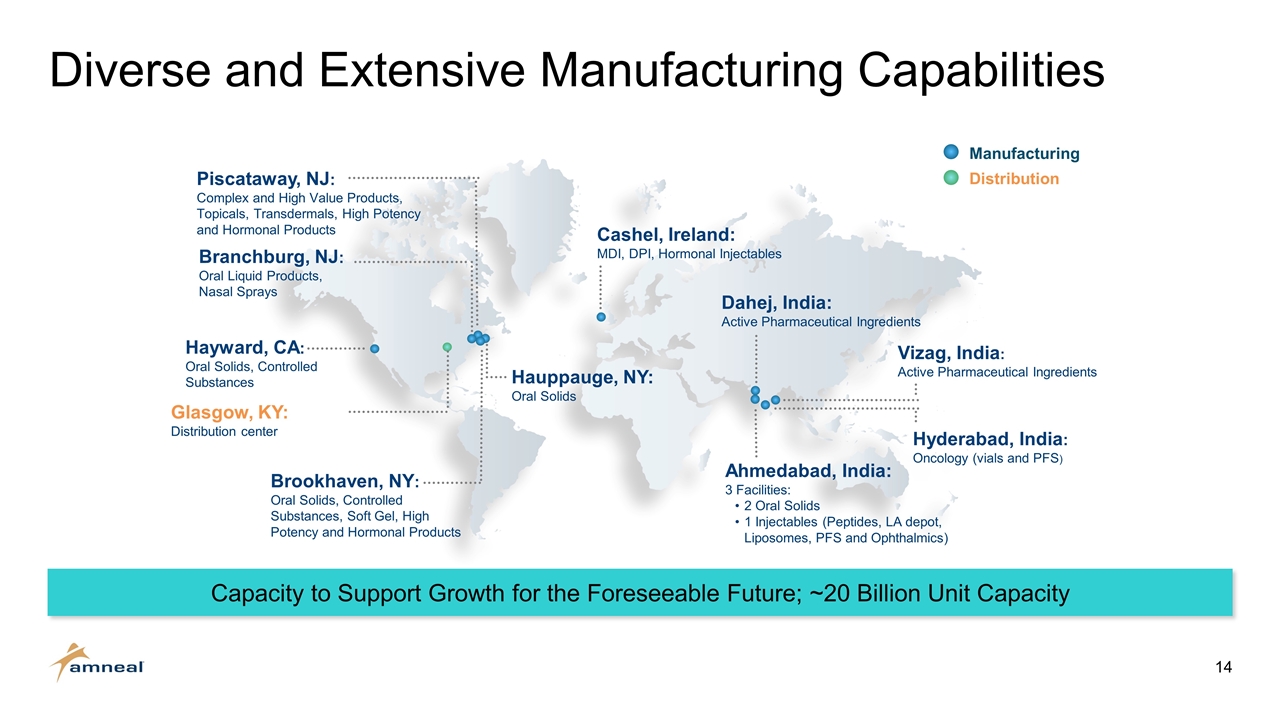

Diverse and Extensive Manufacturing Capabilities Dahej, India: Active Pharmaceutical Ingredients Vizag, India: Active Pharmaceutical Ingredients Hyderabad, India: Oncology (vials and PFS) Ahmedabad, India: 3 Facilities: 2 Oral Solids 1 Injectables (Peptides, LA depot, Liposomes, PFS and Ophthalmics) Cashel, Ireland: MDI, DPI, Hormonal Injectables Glasgow, KY: Distribution center Brookhaven, NY: Oral Solids, Controlled Substances, Soft Gel, High Potency and Hormonal Products Piscataway, NJ: Complex and High Value Products, Topicals, Transdermals, High Potency and Hormonal Products Hauppauge, NY: Oral Solids Hayward, CA: Oral Solids, Controlled Substances Manufacturing Distribution Branchburg, NJ: Oral Liquid Products, Nasal Sprays Capacity to Support Growth for the Foreseeable Future; ~20 Billion Unit Capacity

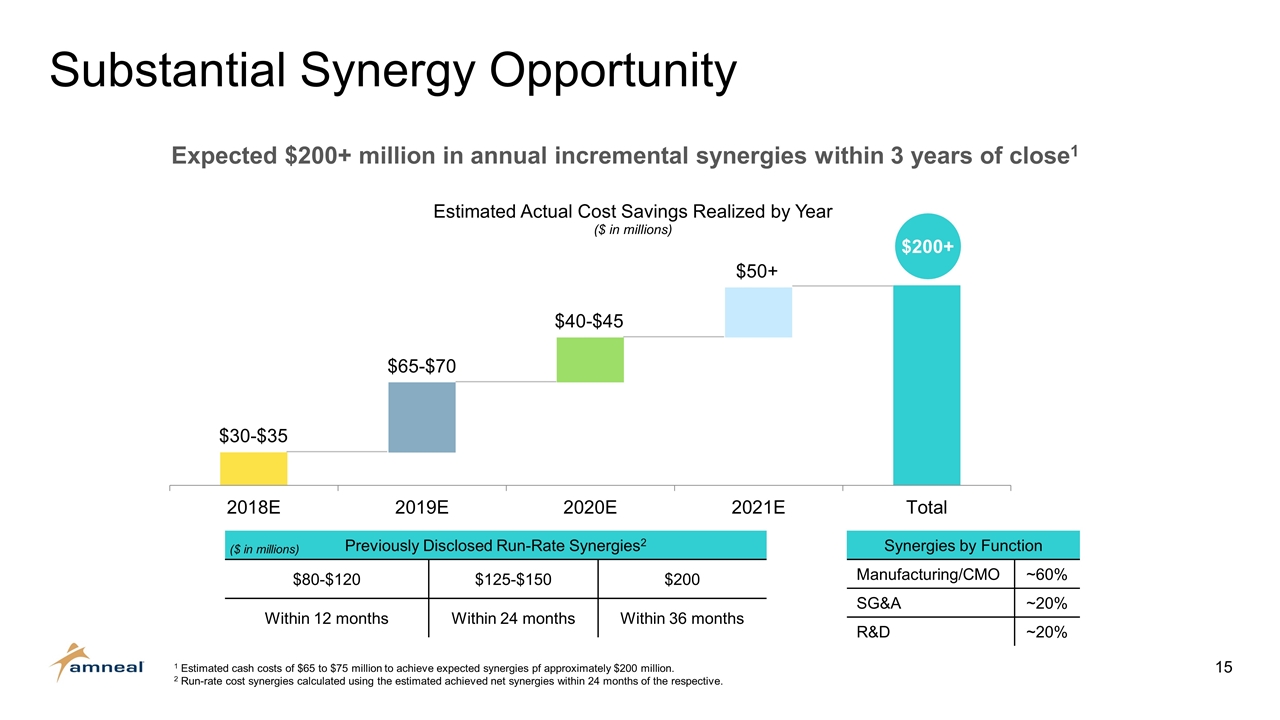

Substantial Synergy Opportunity Expected $200+ million in annual incremental synergies within 3 years of close1 $30-$35 $40-$45 Synergies by Function Manufacturing/CMO ~60% SG&A ~20% R&D ~20% Previously Disclosed Run-Rate Synergies2 $80-$120 $125-$150 $200 Within 12 months Within 24 months Within 36 months $65-$70 $50+ 1 Estimated cash costs of $65 to $75 million to achieve expected synergies pf approximately $200 million. 2 Run-rate cost synergies calculated using the estimated achieved net synergies within 24 months of the respective. ($ in millions) $200+

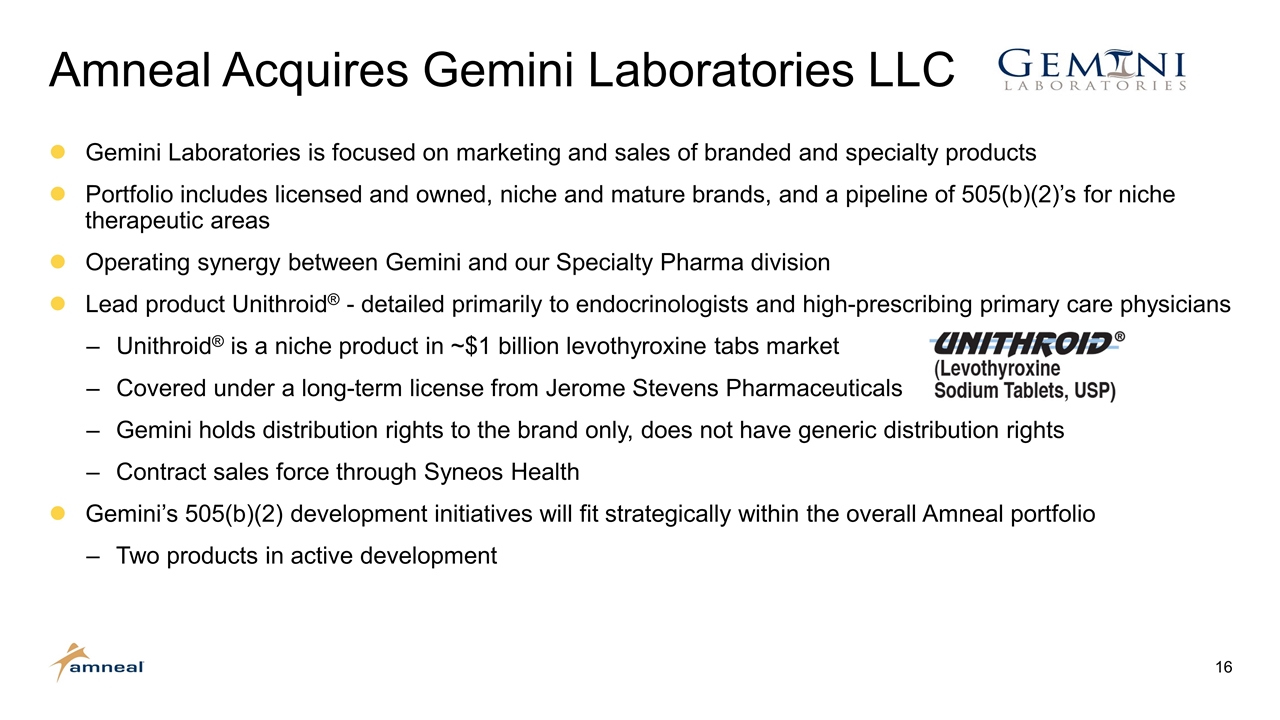

Amneal Acquires Gemini Laboratories LLC Gemini Laboratories is focused on marketing and sales of branded and specialty products Portfolio includes licensed and owned, niche and mature brands, and a pipeline of 505(b)(2)’s for niche therapeutic areas Operating synergy between Gemini and our Specialty Pharma division Lead product Unithroid® - detailed primarily to endocrinologists and high-prescribing primary care physicians Unithroid® is a niche product in ~$1 billion levothyroxine tabs market Covered under a long-term license from Jerome Stevens Pharmaceuticals Gemini holds distribution rights to the brand only, does not have generic distribution rights Contract sales force through Syneos Health Gemini’s 505(b)(2) development initiatives will fit strategically within the overall Amneal portfolio Two products in active development

Financial Update & Capital Structure Bryan Reasons SVP, Chief Financial Officer

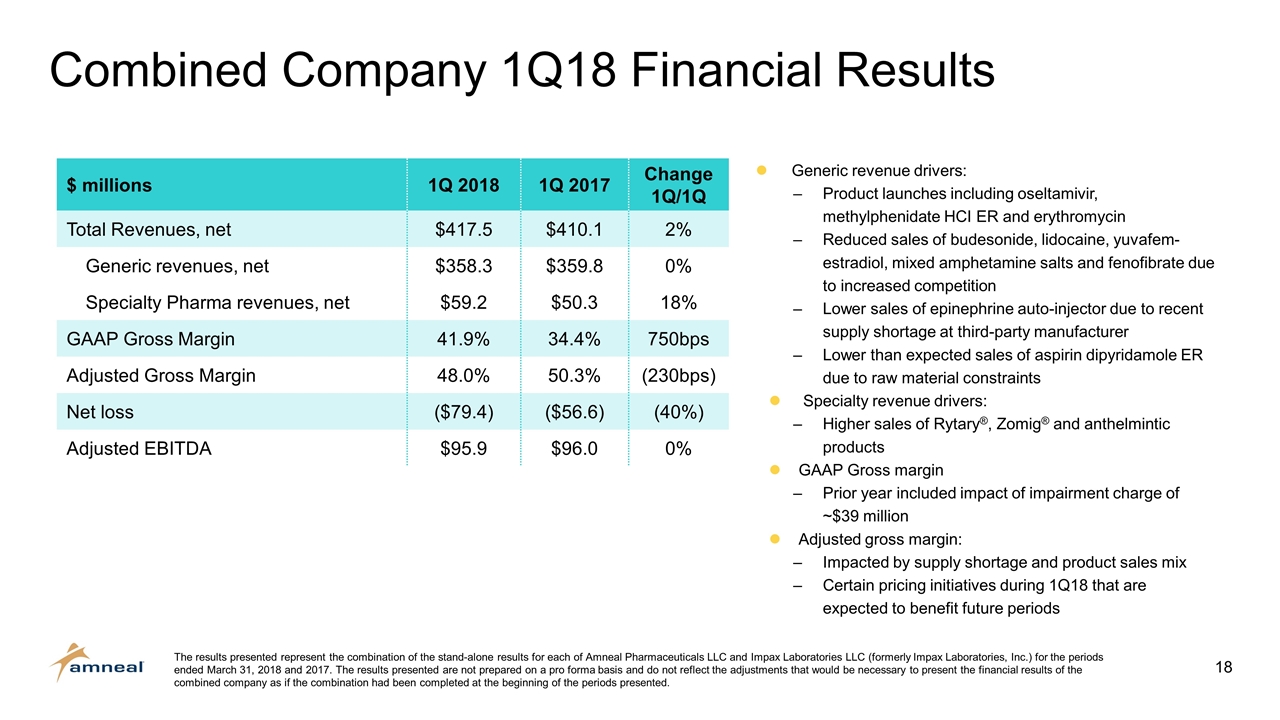

$ millions 1Q 2018 1Q 2017 Change 1Q/1Q Total Revenues, net $417.5 $410.1 2% Generic revenues, net $358.3 $359.8 0% Specialty Pharma revenues, net $59.2 $50.3 18% GAAP Gross Margin 41.9% 34.4% 750bps Adjusted Gross Margin 48.0% 50.3% (230bps) Net loss ($79.4) ($56.6) (40%) Adjusted EBITDA $95.9 $96.0 0% Combined Company 1Q18 Financial Results The results presented represent the combination of the stand-alone results for each of Amneal Pharmaceuticals LLC and Impax Laboratories LLC (formerly Impax Laboratories, Inc.) for the periods ended March 31, 2018 and 2017. The results presented are not prepared on a pro forma basis and do not reflect the adjustments that would be necessary to present the financial results of the combined company as if the combination had been completed at the beginning of the periods presented. Generic revenue drivers: Product launches including oseltamivir, methylphenidate HCI ER and erythromycin Reduced sales of budesonide, lidocaine, yuvafem-estradiol, mixed amphetamine salts and fenofibrate due to increased competition Lower sales of epinephrine auto-injector due to recent supply shortage at third-party manufacturer Lower than expected sales of aspirin dipyridamole ER due to raw material constraints Specialty revenue drivers: Higher sales of Rytary®, Zomig® and anthelmintic products GAAP Gross margin Prior year included impact of impairment charge of ~$39 million Adjusted gross margin: Impacted by supply shortage and product sales mix Certain pricing initiatives during 1Q18 that are expected to benefit future periods

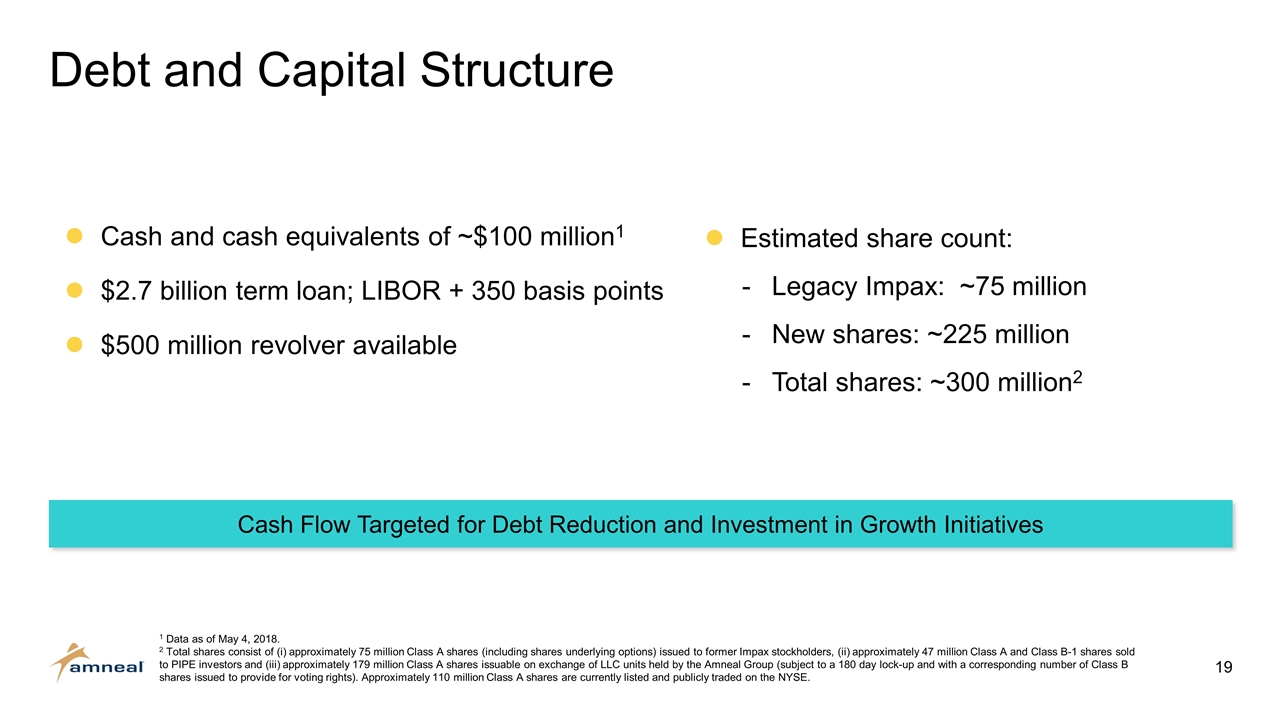

Debt and Capital Structure Cash and cash equivalents of ~$100 million1 $2.7 billion term loan; LIBOR + 350 basis points $500 million revolver available Cash Flow Targeted for Debt Reduction and Investment in Growth Initiatives Estimated share count: Legacy Impax: ~75 million New shares: ~225 million Total shares: ~300 million2 1 Data as of May 4, 2018. 2 Total shares consist of (i) approximately 75 million Class A shares (including shares underlying options) issued to former Impax stockholders, (ii) approximately 47 million Class A and Class B-1 shares sold to PIPE investors and (iii) approximately 179 million Class A shares issuable on exchange of LLC units held by the Amneal Group (subject to a 180 day lock-up and with a corresponding number of Class B shares issued to provide for voting rights). Approximately 110 million Class A shares are currently listed and publicly traded on the NYSE.

Closing Remarks Robert Stewart President and CEO

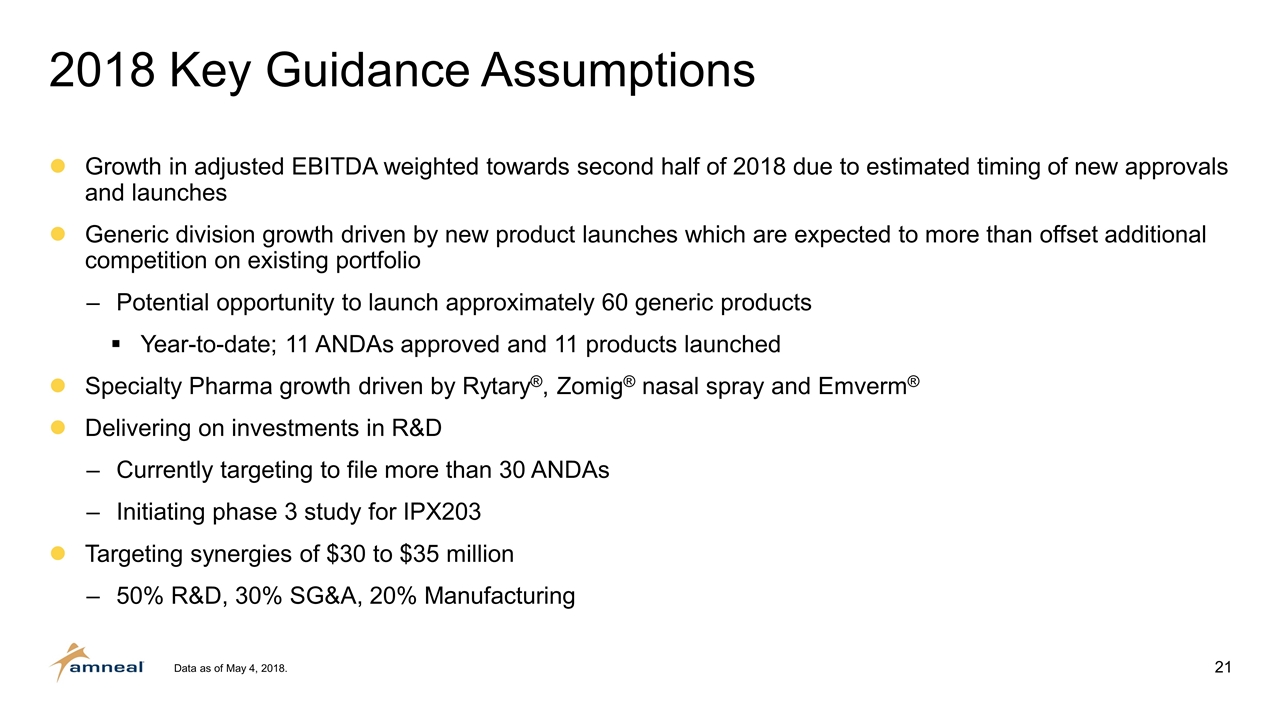

2018 Key Guidance Assumptions Growth in adjusted EBITDA weighted towards second half of 2018 due to estimated timing of new approvals and launches Generic division growth driven by new product launches which are expected to more than offset additional competition on existing portfolio Potential opportunity to launch approximately 60 generic products Year-to-date; 11 ANDAs approved and 11 products launched Specialty Pharma growth driven by Rytary®, Zomig® nasal spray and Emverm® Delivering on investments in R&D Currently targeting to file more than 30 ANDAs Initiating phase 3 study for IPX203 Targeting synergies of $30 to $35 million 50% R&D, 30% SG&A, 20% Manufacturing Data as of May 4, 2018.

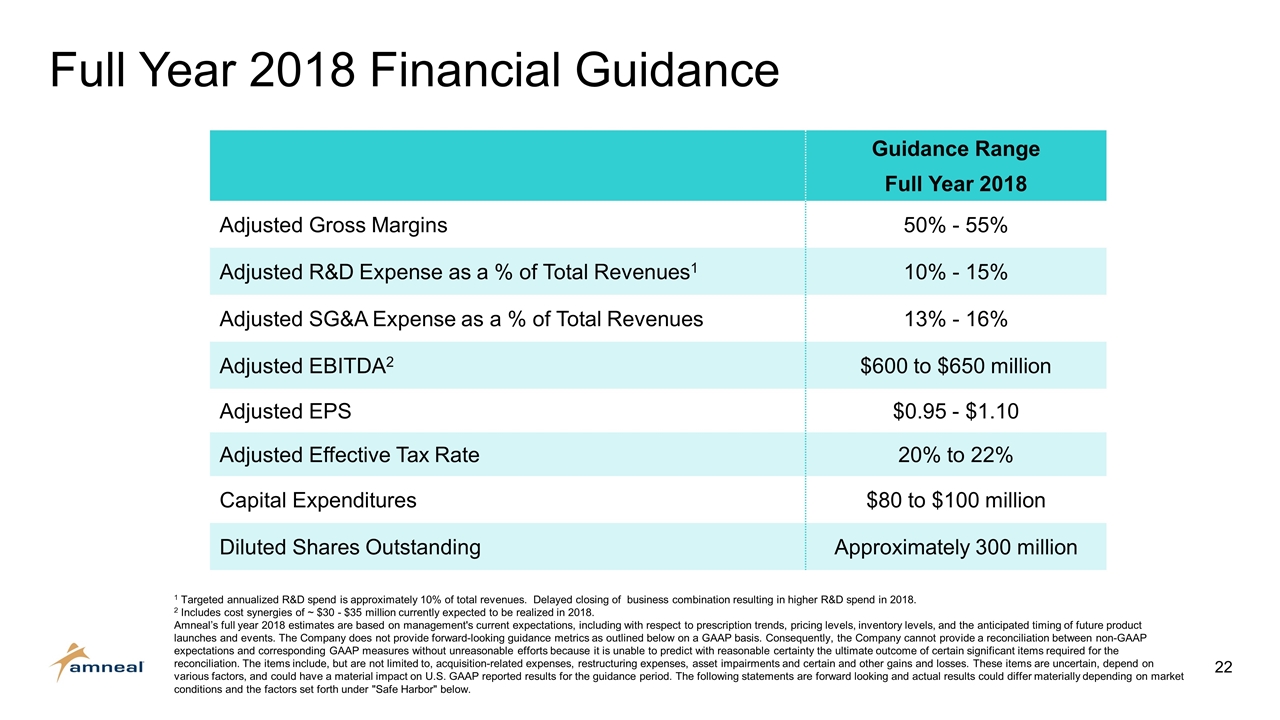

Full Year 2018 Financial Guidance Guidance Range Full Year 2018 Adjusted Gross Margins 50% - 55% Adjusted R&D Expense as a % of Total Revenues1 10% - 15% Adjusted SG&A Expense as a % of Total Revenues 13% - 16% Adjusted EBITDA2 $600 to $650 million Adjusted EPS $0.95 - $1.10 Adjusted Effective Tax Rate 20% to 22% Capital Expenditures $80 to $100 million Diluted Shares Outstanding Approximately 300 million 1 Targeted annualized R&D spend is approximately 10% of total revenues. Delayed closing of business combination resulting in higher R&D spend in 2018. 2 Includes cost synergies of ~ $30 - $35 million currently expected to be realized in 2018. Amneal’s full year 2018 estimates are based on management's current expectations, including with respect to prescription trends, pricing levels, inventory levels, and the anticipated timing of future product launches and events. The Company does not provide forward-looking guidance metrics as outlined below on a GAAP basis. Consequently, the Company cannot provide a reconciliation between non-GAAP expectations and corresponding GAAP measures without unreasonable efforts because it is unable to predict with reasonable certainty the ultimate outcome of certain significant items required for the reconciliation. The items include, but are not limited to, acquisition-related expenses, restructuring expenses, asset impairments and certain and other gains and losses. These items are uncertain, depend on various factors, and could have a material impact on U.S. GAAP reported results for the guidance period. The following statements are forward looking and actual results could differ materially depending on market conditions and the factors set forth under "Safe Harbor" below.

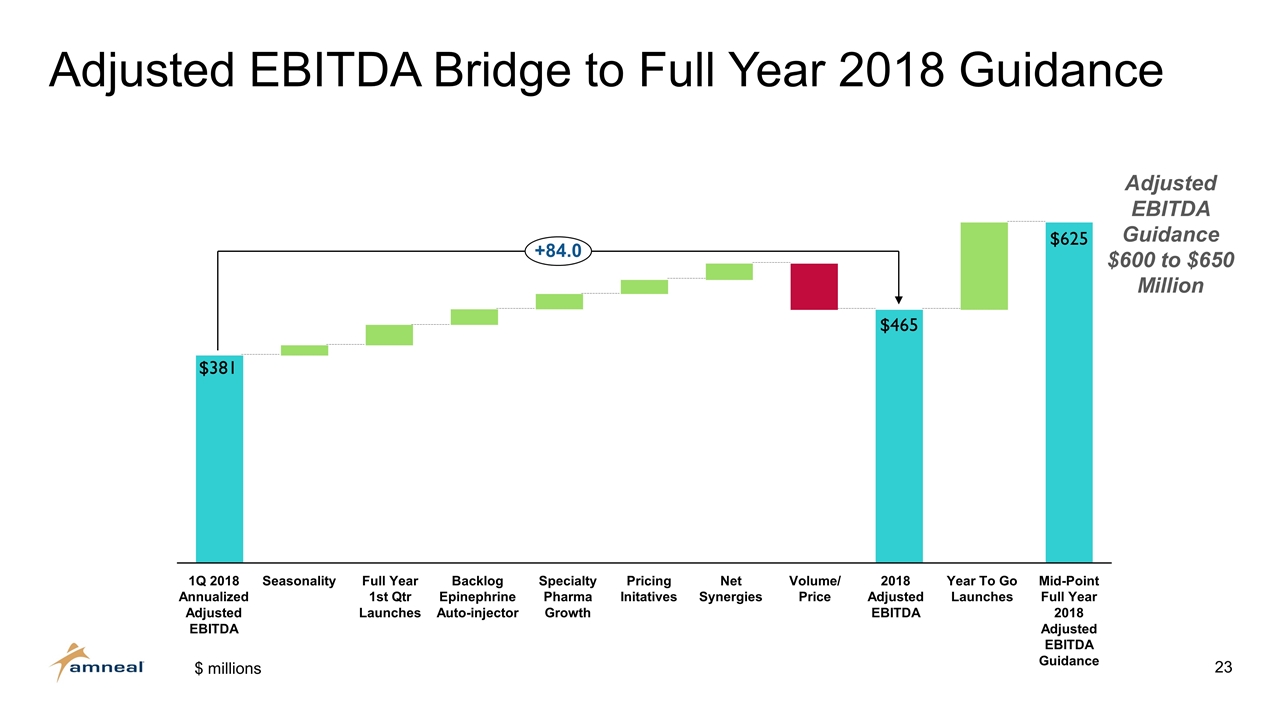

Adjusted EBITDA Bridge to Full Year 2018 Guidance 1Q 2018 Annualized Adjusted EBITDA Backlog Epinephrine Auto-injector Mid-Point Full Year 2018 Adjusted EBITDA Guidance Volume/ Price Specialty Pharma Growth EBITDA Adjusted EBITDA Guidance $600 to $650 Million $ millions

Focused on Operational Execution… Rapidly and seamlessly combine Amneal and Impax Focus on synergy capture and cost control Maintain high level of quality and compliance Continue to provide superior service to our customers Maximize value of enhanced commercial portfolio to grow revenue and profits

…And Continued Investment in Growth Initiatives Invest in organic growth through focused R&D Pursue creative business development to strengthen our franchises and other adjacencies Generics Biosimilars Specialty Products OUR PORTFOLIO FOCUS

Questions & Answers

Appendix & Non-GAAP Reconciliations

Disclosed ANDA Pending Pipeline $ millions. Source of sales data: IMS NPS February 2018; Pipeline data as of April 1, 2018. Product Brand LTM IMS Sales Product Brand LTM IMS Sales Pemetrexed injection Alimta® $1,053 Pitavastatin Calcium Tablet Livalo® $292 Lubiprostone Capsule Amitiza® $489 Guaifenesin Tablet Mucinex® $75 Testosterone Gel 1.62% Androgel® $1,062 Guaifenesin + Dextromethorphan HBr Mucinex® DM $61 Teriflunomide Tablet Aubagio® $1,487 Dronaderone Tablet Multaq® $450 Testosterone Topical Solution Axiron® $158 Ritonavir Tablet Norvir® $200 Risedronate Sodium DR tablet Atelvia® $18 Saxagliptin HCl Tablet Onglyza® $404 Ticagrelor Tablet Brilinta® $749 Doxycycline ER Capsule 40mg Oracea® $300 Exenatide Injection Byetta® $237 Oxycodone ER Tablet OxyContin® $1,875 Mesalamine Rectal Suppository Canasa® $245 Diclofenac Na Topical Solution 2% Pennsaid® 2% $953 Colchicine Tablet Colcrys® $574 Dexmedetomidine HCl Injection Precedex® $119 Glatiramer Injection Copaxone®HD $3,457 Asenapine Maleate Sublingual Tablet Saphris® $292 Carvedilol ER capsule Coreg CR® $192 Cinacalcet HCl Tablet Sensipar® $1,739 Prasugrel HCl Tablet Effient ® $516 Quetiapine Fumarate ER Tablet Seroquel® XR $629 Apixaban IR tablet Eliquis® $4,956 Dimethyl Fumarate DR Capsule Tecfidera® $3,548 Darifenacin HBr ER Tablet Enablex® $35 Fesoterodine Fumarate Tablet Toviaz® $200 Rivastigmine TDS Patch Exelon® $262 Emtricitabine + Tenofovir DF Tablet Truvada® $2,888 Fulvestrant Injection Faslodex® $503 Bortezomib Injection Velcade® $637 Fentanyl Buccal IR tablet Fentora® $103 Sildenafil Citrate Tablet Viagra® $1,428 Levomilnacipran HCl ER Capsule Fetzima® $118 Lacosamide Tablet Vimpat® $1,191 Imatinib Mesylate Tablet Gleevec® $1,113 Lisdexamfetamine Dimesylate Capsule Vyvanse® $3,242 Saxagliptin HCl + Metformin ER Tablet Kombiglyze® XR $194 Colesevelam IR tablet Welchol® $526 Lamotrigine ER Tablet Lamictal® XR $323 Sodium Oxybate Solution Xyrem® $1,187 Lurasidone HCl Tablet Latuda® $2,962 Azithromycin Powder for Suspension Zithromax® $74 Mesalamine DR Tablet Lialda® $1,087 Abiraterone Acetate Tablet Zytiga ® $1,393

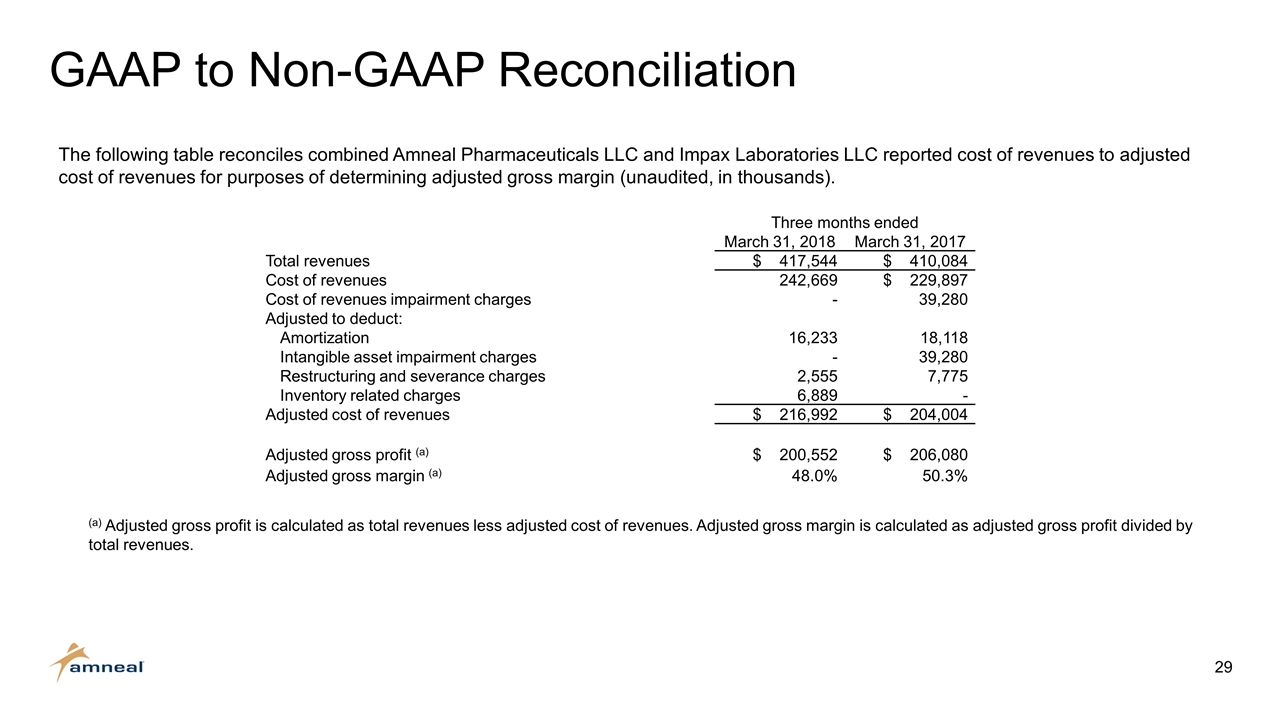

GAAP to Non-GAAP Reconciliation Three months ended March 31, 2018 March 31, 2017 Total revenues $ 417,544 $ 410,084 Cost of revenues 242,669 $ 229,897 Cost of revenues impairment charges - 39,280 Adjusted to deduct: Amortization 16,233 18,118 Intangible asset impairment charges - 39,280 Restructuring and severance charges 2,555 7,775 Inventory related charges 6,889 - Adjusted cost of revenues $ 216,992 $ 204,004 Adjusted gross profit (a) $ 200,552 $ 206,080 Adjusted gross margin (a) 48.0% 50.3% The following table reconciles combined Amneal Pharmaceuticals LLC and Impax Laboratories LLC reported cost of revenues to adjusted cost of revenues for purposes of determining adjusted gross margin (unaudited, in thousands). (a) Adjusted gross profit is calculated as total revenues less adjusted cost of revenues. Adjusted gross margin is calculated as adjusted gross profit divided by total revenues.

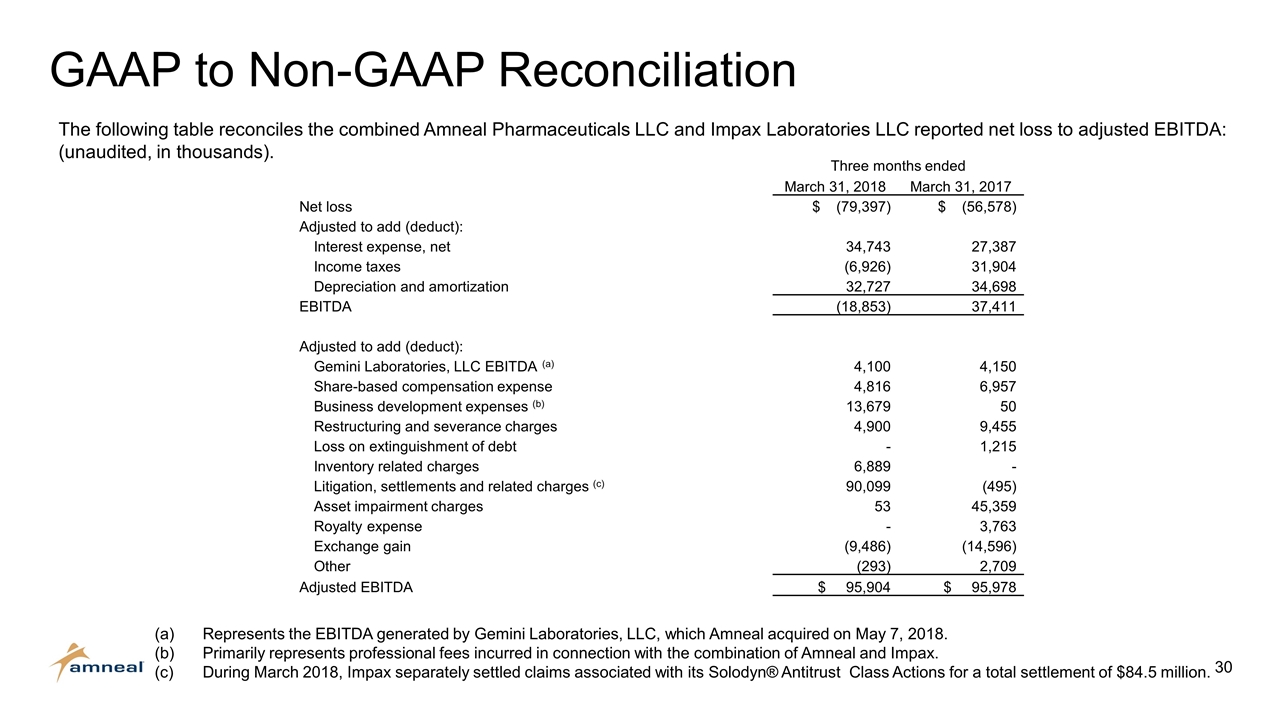

GAAP to Non-GAAP Reconciliation The following table reconciles the combined Amneal Pharmaceuticals LLC and Impax Laboratories LLC reported net loss to adjusted EBITDA: (unaudited, in thousands). (a)Represents the EBITDA generated by Gemini Laboratories, LLC, which Amneal acquired on May 7, 2018. (b)Primarily represents professional fees incurred in connection with the combination of Amneal and Impax. (c)During March 2018, Impax separately settled claims associated with its Solodyn® Antitrust Class Actions for a total settlement of $84.5 million. Three months ended March 31, 2018 March 31, 2017 Net loss $ (79,397) $ (56,578) Adjusted to add (deduct): Interest expense, net 34,743 27,387 Income taxes (6,926) 31,904 Depreciation and amortization 32,727 34,698 EBITDA (18,853) 37,411 Adjusted to add (deduct): Gemini Laboratories, LLC EBITDA (a) 4,100 4,150 Share-based compensation expense 4,816 6,957 Business development expenses (b) 13,679 50 Restructuring and severance charges 4,900 9,455 Loss on extinguishment of debt - 1,215 Inventory related charges 6,889 - Litigation, settlements and related charges (c) 90,099 (495) Asset impairment charges 53 45,359 Royalty expense - 3,763 Exchange gain (9,486) (14,596) Other (293) 2,709 Adjusted EBITDA $ 95,904 $ 95,978