| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-206677-21 |

| | | |

Free Writing Prospectus

Collateral Term Sheet

$744,811,779

(Approximate Aggregate Cut-off Date Balance of Mortgage Pool)

Wells Fargo Commercial Mortgage Trust 2017-C42

as Issuing Entity

Wells Fargo Commercial Mortgage Securities, Inc.

as Depositor

Barclays Bank PLC

Starwood Mortgage Funding II LLC

Wells Fargo Bank, National Association

Rialto Mortgage Finance, LLC

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2017-C42

December 1, 2017

WELLS FARGO SECURITIES Co-Lead Manager and Joint Bookrunner | | BARCLAYS Co-Lead Manager and Joint Bookrunner |

| | | |

| | Academy Securities Co-Manager | |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (‘‘SEC’’) (SEC File No. 333-206677) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-745-2063 (8 a.m. – 5 p.m. EST) or by emailing wfs.cmbs@wellsfargo.com.

Nothing in this document constitutes an offer of securities for sale in any jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

This free writing prospectus has been prepared by the underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Directive 2003/71/EC (as amended) and/or Part VI of the Financial Services and Markets Act 2000, as amended, or other offering document.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of Wells Fargo Securities, LLC, Barclays Capital Inc., Academy Securities, Inc., or any of their respective affiliates, make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including but not limited to Wells Fargo Securities, LLC, a member of NYSE, FINRA, NFA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC, and Wells Fargo Bank, N.A. Wells Fargo Securities, LLC and Wells Fargo Prime Services, LLC are distinct entities from affiliated banks and thrifts.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The information herein is preliminary and may be supplemented or amended prior to the time of sale. In addition, the Offered Certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis.

The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) any representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Wells Fargo Commercial Mortgage Trust 2017-C42 | Certain Loan Information |

A. Summary of the Whole Loans

Property Name | Mortgage Loan Seller in WFCM 2017-C42 | Note(s) | Original Balance | Holder of Note(1) | Lead Servicer for Whole Loan | Master Servicer Under Lead Securitization Servicing Agreement | Special Servicer Under Lead Securitization Servicing Agreement |

| One Ally Center | SMF II | A-1 | $70,000,000 | WFCM 2017-C42 | Yes | Wells Fargo Bank, National Association | LNR Partners, LLC |

| A-2 | $32,000,000 | Starwood Mortgage Funding III LLC | No |

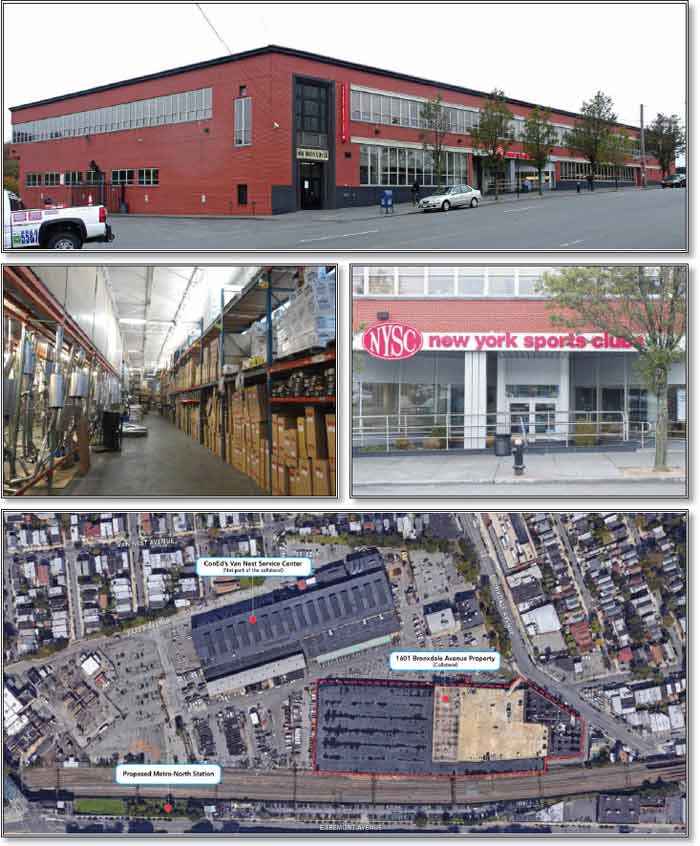

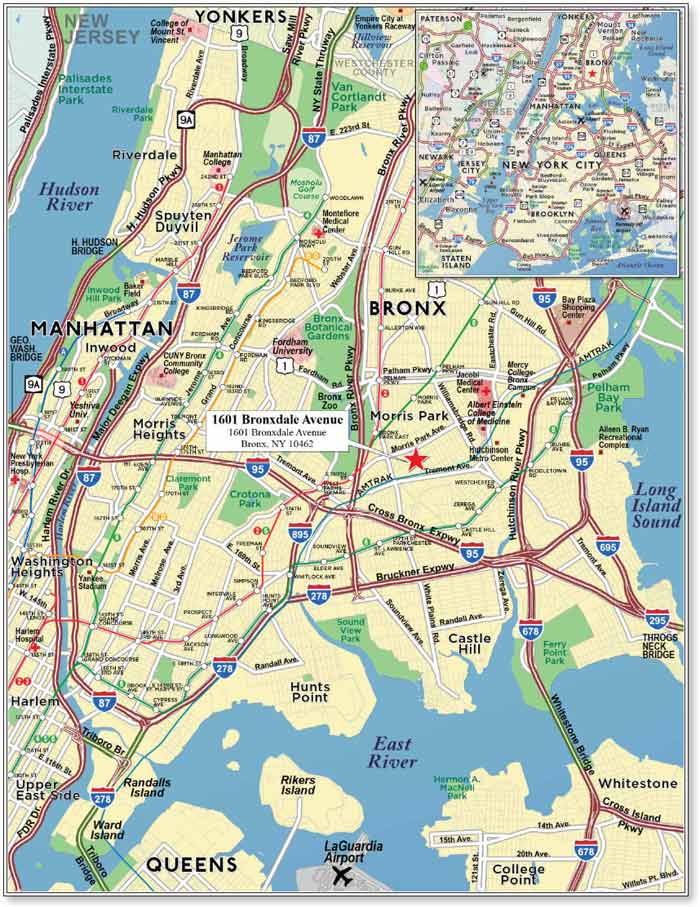

| 16 Court Street | Barclays | A-1 | $66,600,000 | WFCM 2017-C42 | Yes | Wells Fargo Bank, National Association | LNR Partners, LLC |

| A-2 | $44,400,000 | CCUBS 2017-C1 | No |

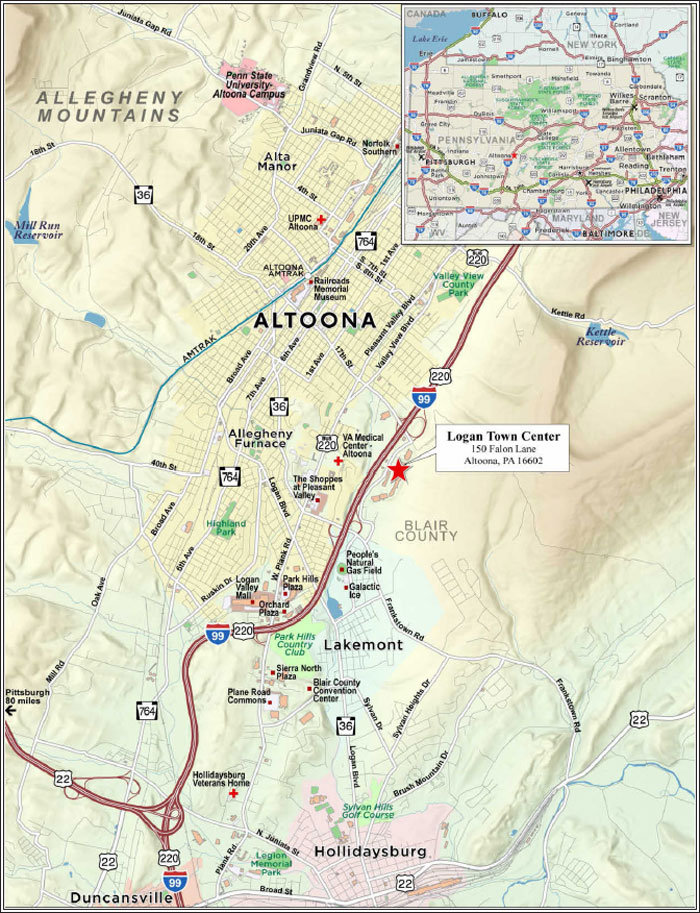

| Logan Town Center | RMF | A-1 | $55,000,000 | WFCM 2017-C42 | Yes | Wells Fargo Bank, National Association | LNR Partners, LLC |

| A-2 | $22,000,000 | UBS 2017-C6(2) | No |

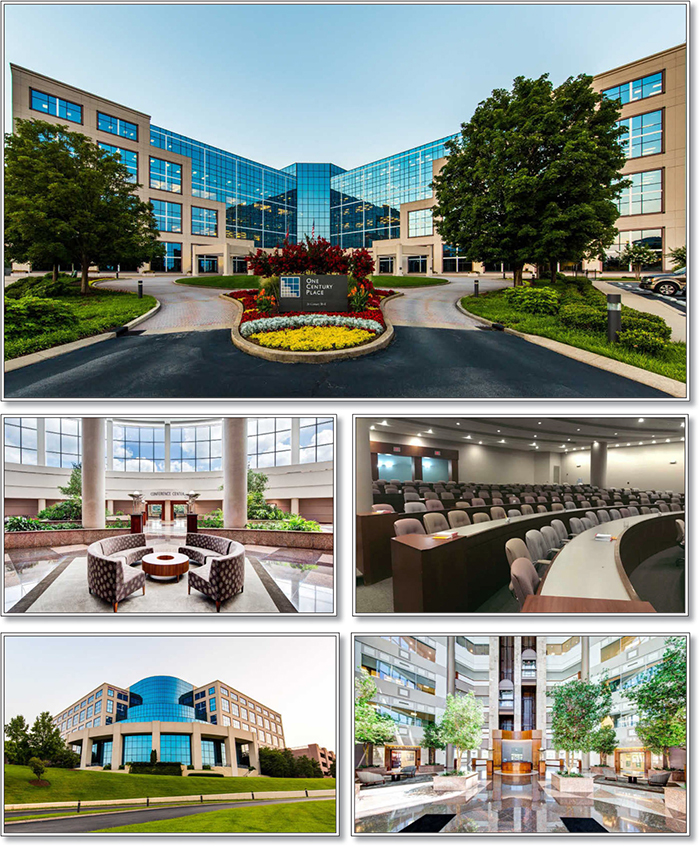

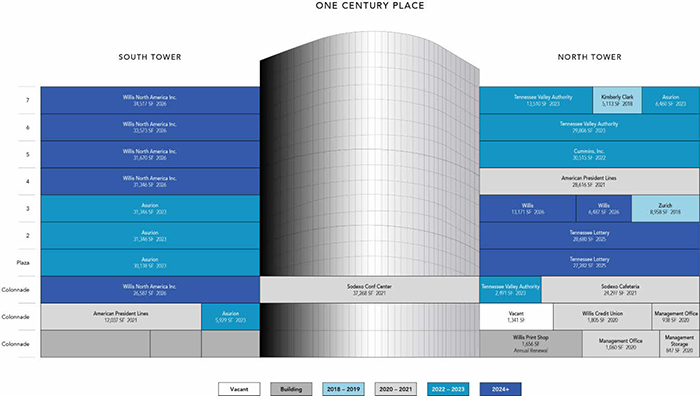

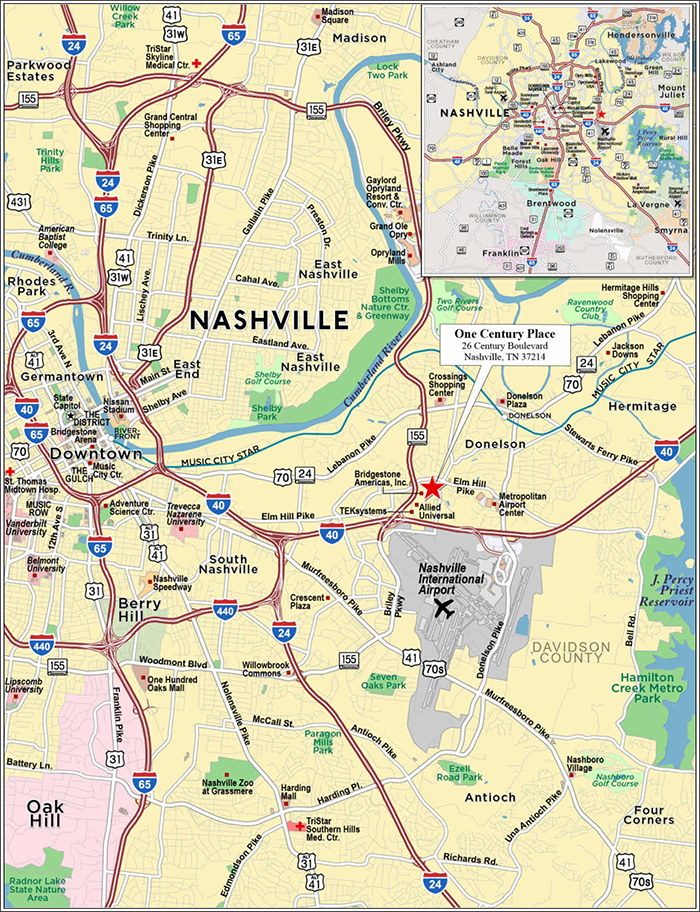

| One Century Place | Barclays | A-1 | $44,000,000 | WFCM 2017-C42 | Yes | Wells Fargo Bank, National Association | LNR Partners, LLC |

| A-2 | $22,300,000 | WFCM 2017-C41 | No |

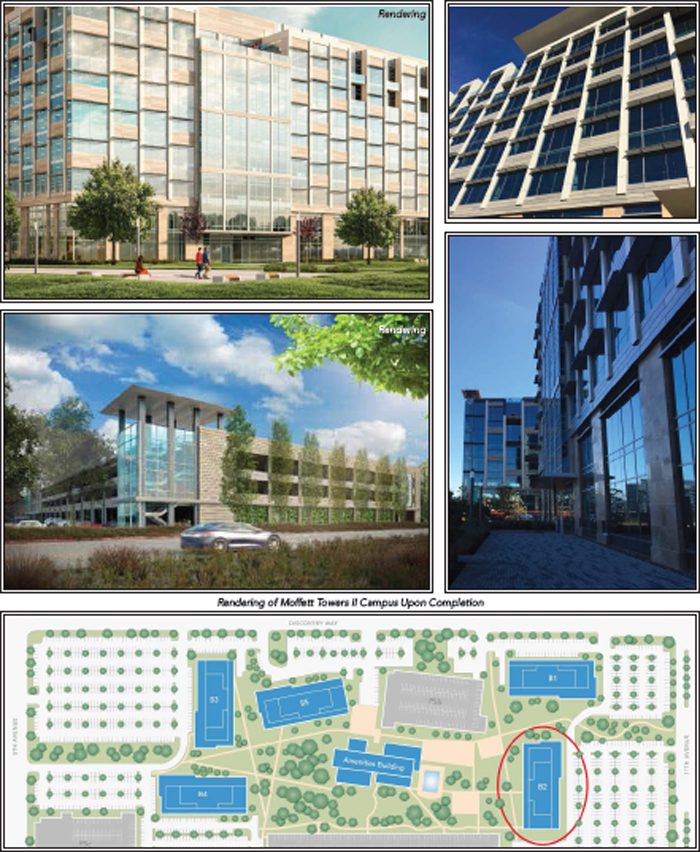

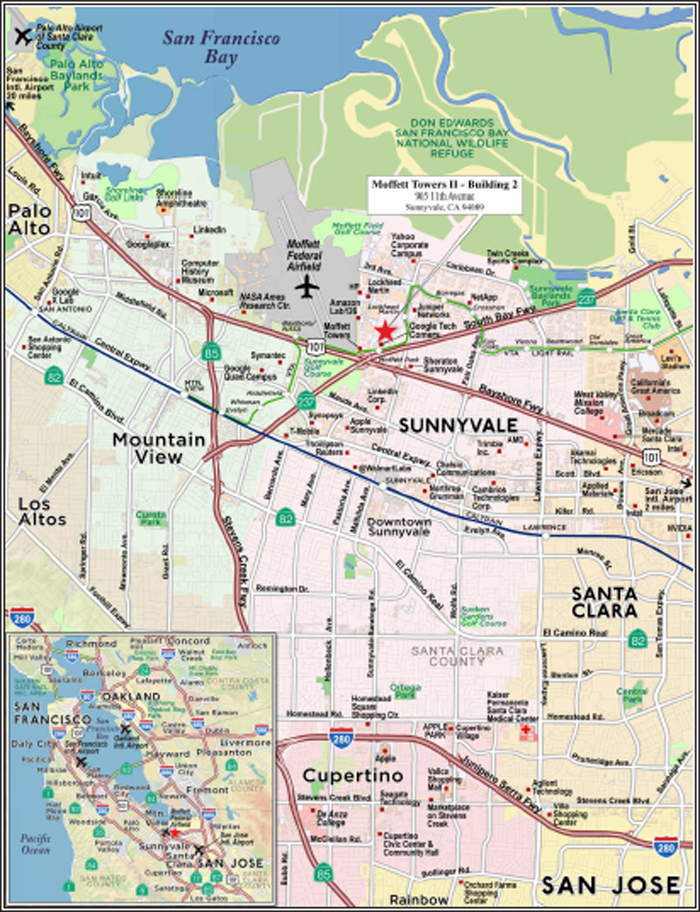

| Moffett Towers II – Building 2 | Barclays | A-1 | $43,000,000 | Barclays Bank PLC | Yes(4) | Wells Fargo Bank, National Association(4) | LNR Partners, LLC(4) |

| A-2 | $40,750,000 | Barclays Bank PLC | No |

| A-3 | $40,000,000 | WFCM 2017-C42 | No |

| A-4 | $41,250,000 | Morgan Stanley Bank, N.A. | No |

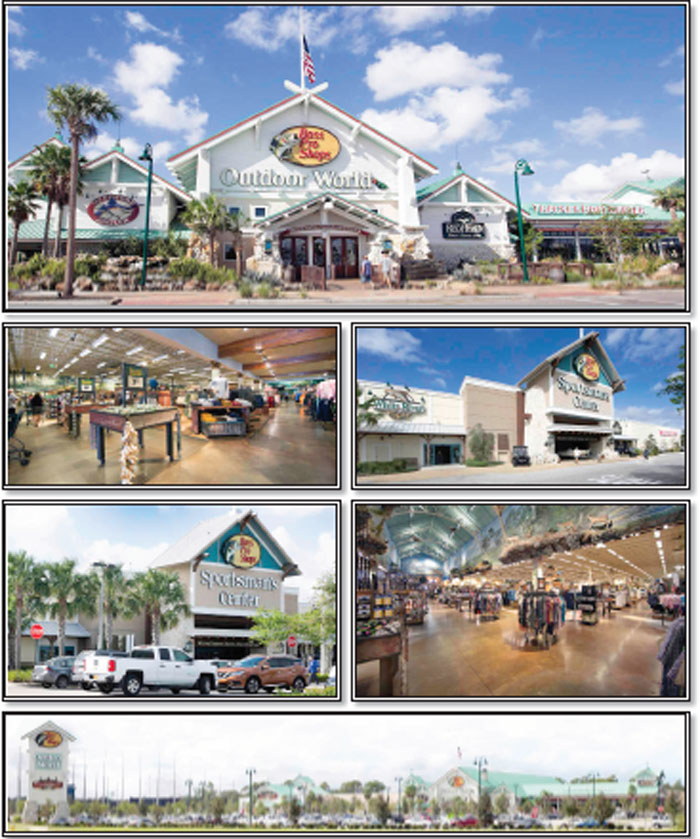

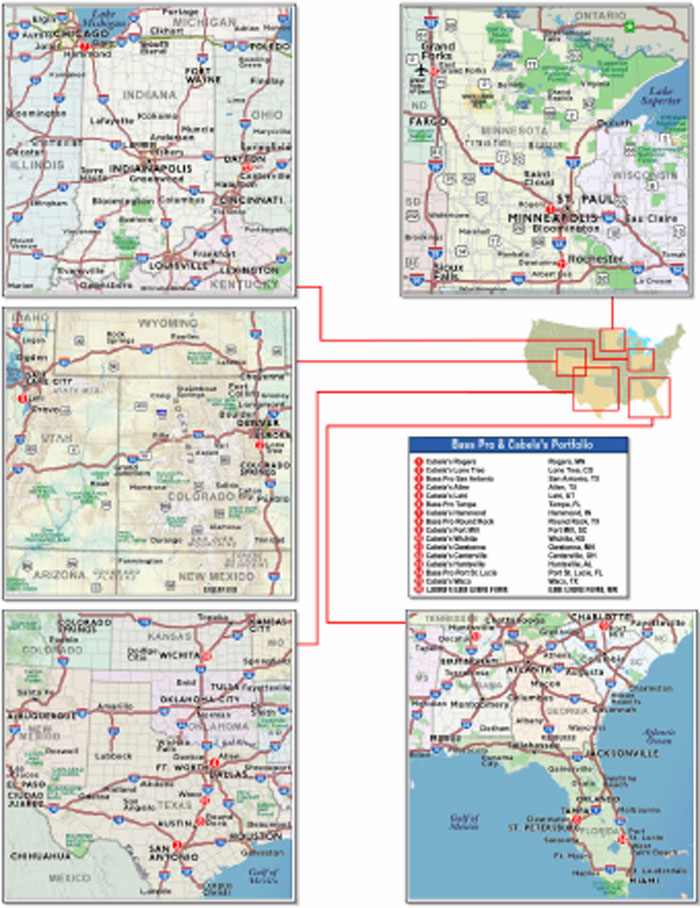

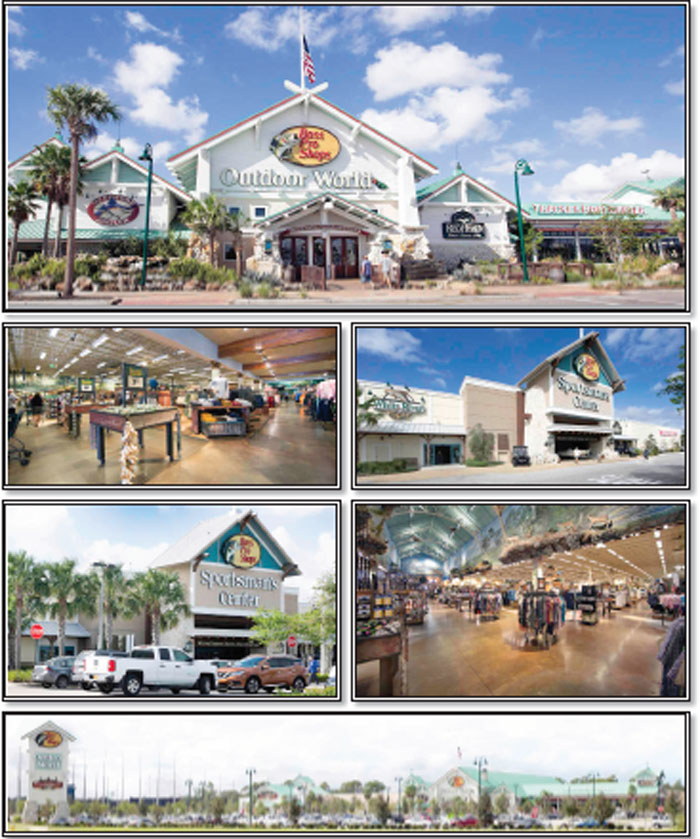

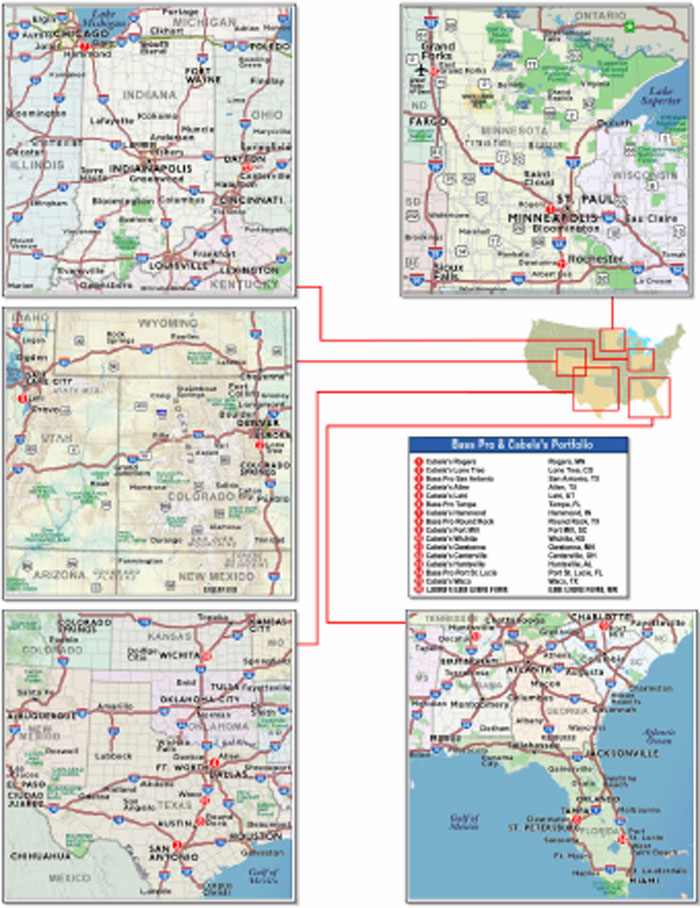

| Bass Pro & Cabela’s Portfolio | WFB | A-1(A-CP) | $37,500,000 | GSMS 2017-GS8 | Yes | Wells Fargo Bank, National Association | Midland Loan Services, a Division of PNC Bank, National Association |

| A-1(A-NCP) | $10,000,000 | GSMS 2017-GS8 | No |

| A-1-2 | $30,460,000 | Goldman Sachs Mortgage Company | No |

| A-2(A) | $7,500,000 | WFCM 2017-C42 | No |

| A-2(B)(1) | $27,470,000 | WFCM 2017-C42 | No |

| A-2(B)(2) | $23,500,000 | BANK 2017-BNK9(3) | No |

| A-3(A-CP) | $20,000,000 | UBS 2017-C5 | No |

| A-3(B-CP) | $24,750,000 | CCUBS 2017-C1 | No |

| A-3(C-CP) | $6,220,000 | UBS 2017-C6(2) | No |

| A-3(D-NCP) | $2,500,000 | UBS 2017-C6(2) | No |

| A-3(E-NCP) | $2,500,000 | UBS 2017-C6(2) | No |

| A-3(F-NCP) | $2,500,000 | UBS 2017-C6(2) | No |

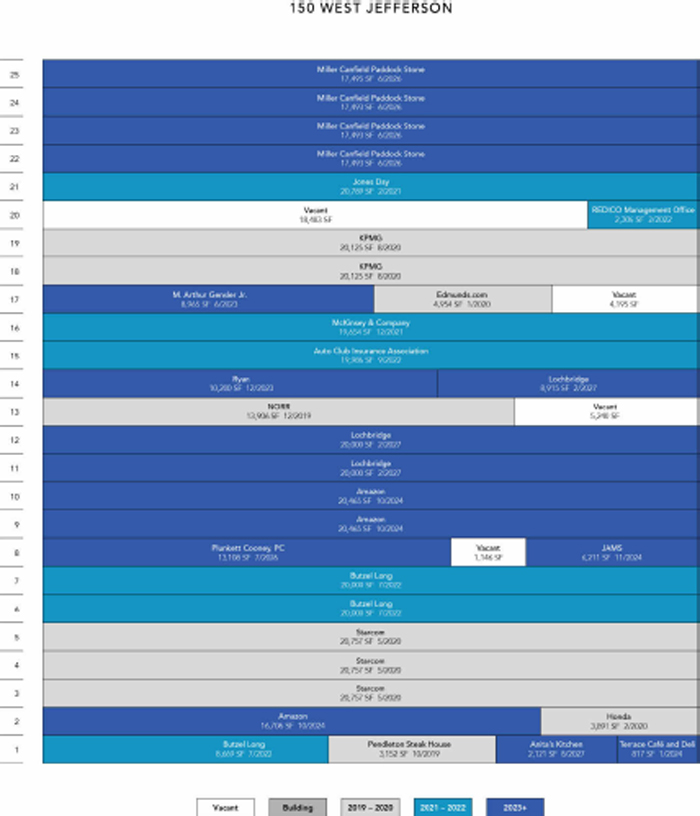

| 150 West Jefferson | SMF II | A-1 | $35,000,000 | Starwood Mortgage Funding III LLC | Yes(4) | Wells Fargo Bank, National Association(4) | LNR Partners, LLC(4) |

| A-2 | $32,500,000 | WFCM 2017-C42 | No |

| Courtyard Los Angeles Sherman Oaks | WFB | A-1 | $28,000,000 | WFB | Yes(4) | Wells Fargo Bank, National Association(4) | LNR Partners, LLC(4) |

| A-2 | $27,000,000 | WFCM 2017-C42 | No |

| Lakeside Shopping Center | Barclays | A-1 | $59,000,000 | CGCMT 2017-B1 | Yes | Wells Fargo Bank, National Association | LNR Partners, LLC |

| A-2 | $58,000,000 | WFCM 2017-C39 | No |

| A-3-1 | $33,000,000 | CGCMT 2017-P8 | No |

| A-3-2 | $25,000,000 | WFCM 2017-C42 | No |

| Laguna Cliffs Marriott | WFB | A-1 | $85,000,000 | BANK 2017-BNK9(3) | Yes | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| A-2 | $25,000,000 | WFCM 2017-C42 | No |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Wells Fargo Commercial Mortgage Trust 2017-C42 | Certain Loan Information |

| One Cleveland Center | RMF | A-1 | $39,000,000 | UBS 2017-C6(2) | Yes | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| A-2 | $18,000,000 | WFCM 2017-C42 | No |

| (1) | Unless otherwise indicated, each note not currently held by a securitization trust is expected to be contributed to a future securitization. No assurance can be provided that any such note will not be split further. |

| (2) | The UBS 2017-C6 transaction is expected to close on December 13, 2017. |

| (3) | The BANK 2017-BNK9 transaction is expected to close on December 20, 2017. |

| (4) | The related whole loan is expected to initially be serviced under the WFCM 2017-C42 pooling and servicing agreement until the securitization of the related “lead” pari passu note (namely, the related pari passu note marked “Yes” in the column entitled “Lead Servicer for Whole Loan”), after which the related whole loan will be serviced under the pooling and servicing agreement governing such securitization of the related “lead” pari passu note. The master servicer and special servicer for such securitization will be identified in a notice, report or statement to holders of the WFCM 2017-C42 certificates after the closing of such securitization. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Wells Fargo Commercial Mortgage Trust 2017-C42 | Certain Loan Information |

B. Large Loan Summaries

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

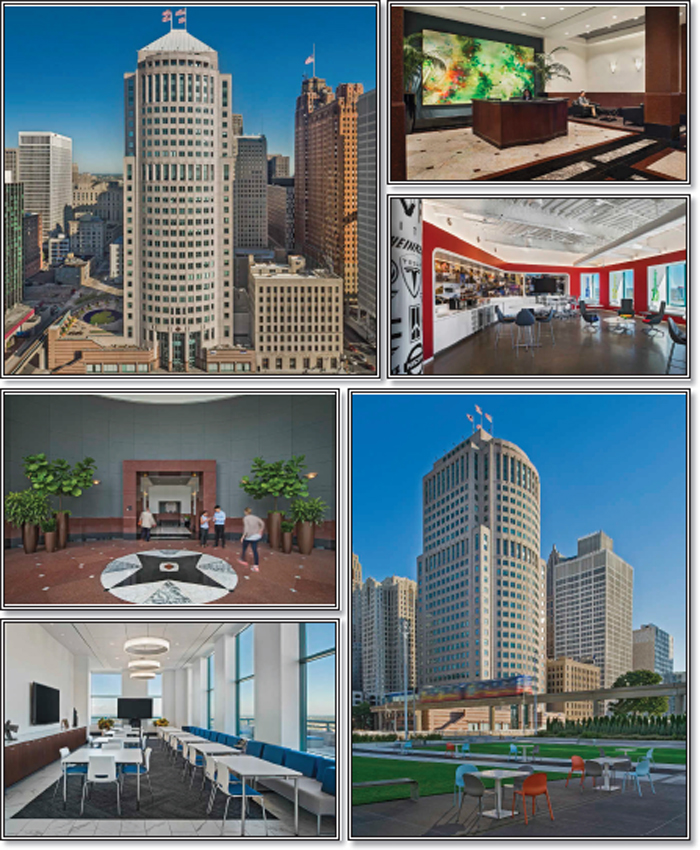

ONE ALLY CENTER

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

ONE ALLY CENTER

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

ONE ALLY CENTER

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

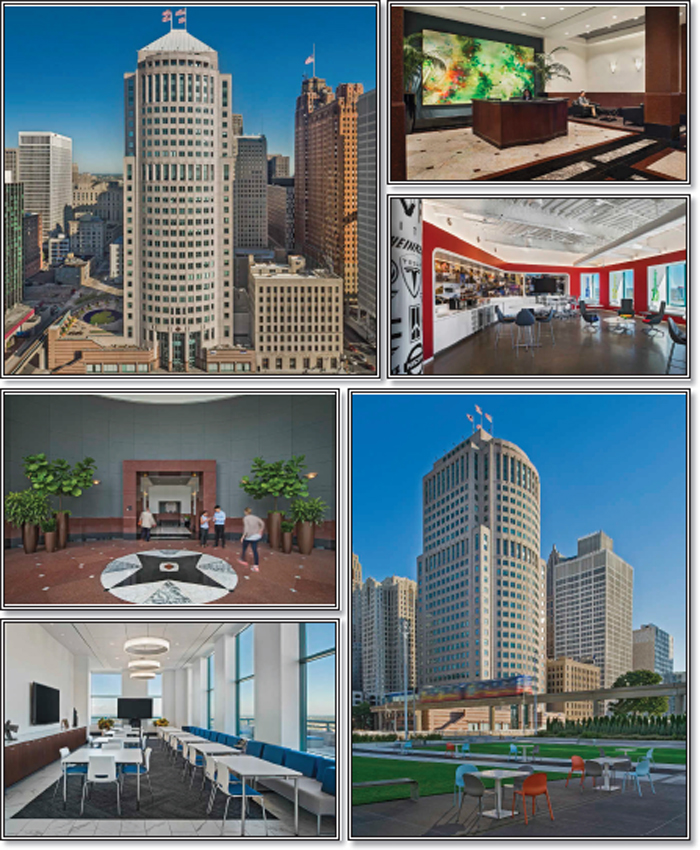

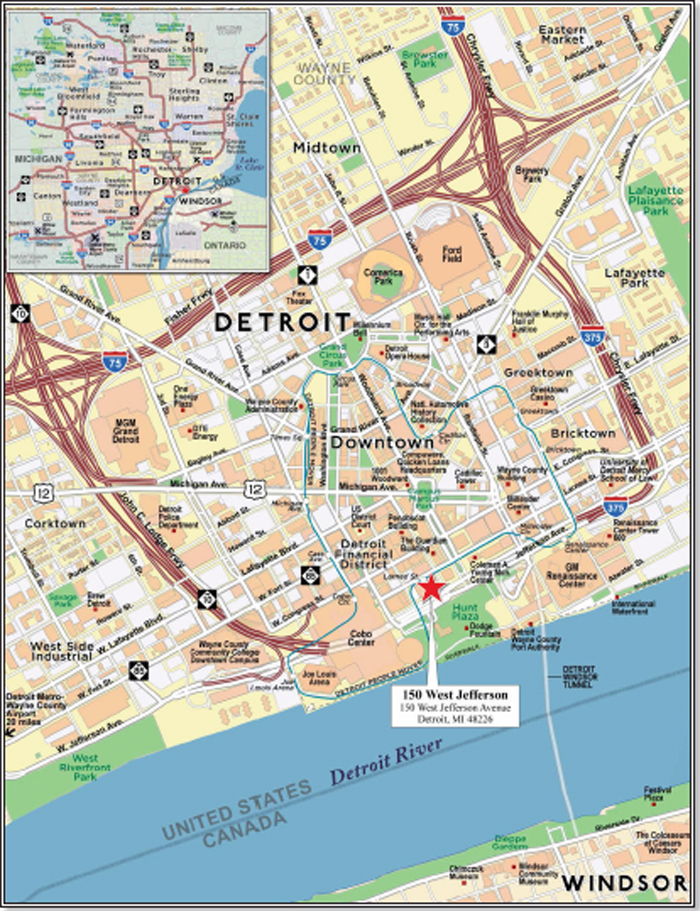

| No. 1 – One Ally Center |

| |

| Loan Information | | Property Information |

| Mortgage Loan Seller: | Starwood Mortgage Funding II LLC | | Single Asset/Portfolio: | Single Asset |

| Credit Assessment (Fitch/KBRA/Moody’s): | NR/NR/NR | | Property Type: | Office |

| Original Principal Balance(1): | $70,000,000 | | Specific Property Type: | CBD |

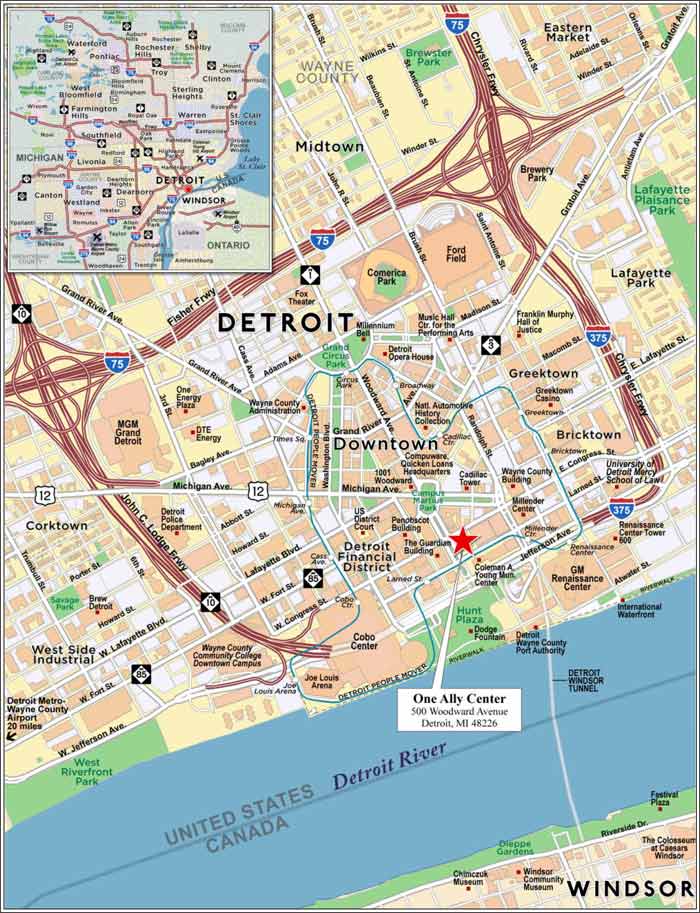

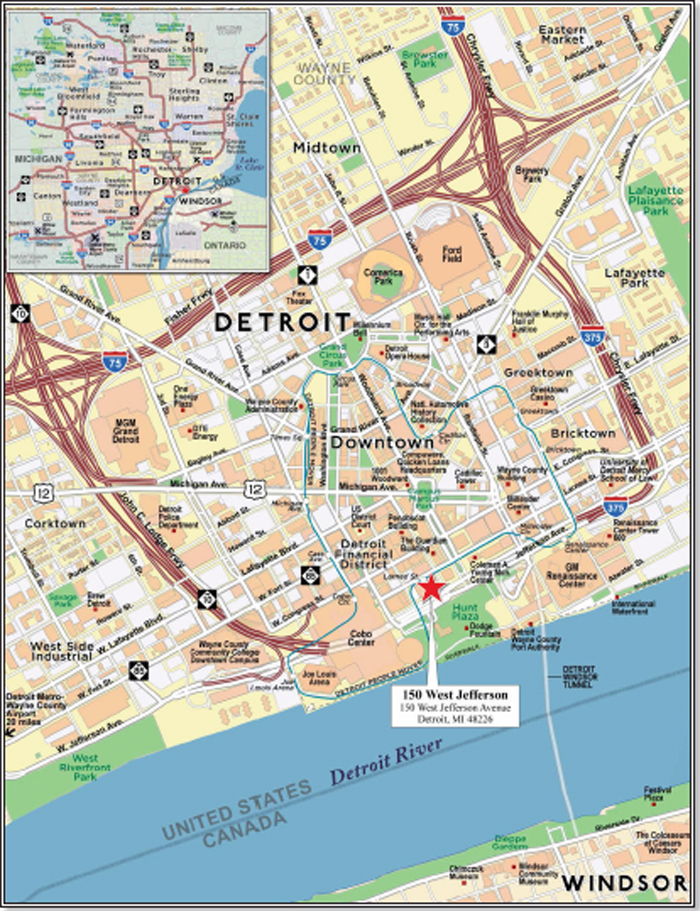

| Cut-off Date Balance(1): | $70,000,000 | | Location: | Detroit, MI |

| % of Initial Pool Balance: | 9.4% | | Size: | 976,095 SF |

| Loan Purpose: | Refinance | | Cut-off Date Balance Per SF(1): | $104.50 |

| Borrower: | 500 Webward LLC | | Year Built/Renovated: | 1992/NAP |

| Borrower Sponsor: | Bedrock Real Estate Services | | Title Vesting: | Leasehold |

| Mortgage Rate: | 4.516% | | Property Manager: | Self-managed |

| Note Date: | November 20, 2017 | | 4thMost Recent Occupancy(4): | NAV |

| Anticipated Repayment Date: | NAP | | 3rdMost Recent Occupancy(4): | NAV |

| Maturity Date: | December 6, 2027 | | 2ndMost Recent Occupancy: | 79.5% (12/31/2015) |

| IO Period: | 120 months | | Most Recent Occupancy (As of): | 96.6% (12/31/2016) |

| Loan Term (Original): | 120 months | | Current Occupancy (As of): | 94.3% (10/18/2017) |

| Seasoning: | 0 months | | |

| Amortization Term (Original): | NAP | | Underwriting and Financial Information: |

| Loan Amortization Type: | Interest-only, Balloon | | | |

| Interest Accrual Method: | Actual/360 | | 4thMost Recent NOI(4): | NAV |

| Call Protection(2): | L(24),D(92),O(4) | | 3rdMost Recent NOI(4): | NAV |

| Lockbox Type: | Hard/Upfront Cash Management | | 2ndMost Recent NOI(5): | $7,207,373 (12/31/2016) |

| Additional Debt(1): | Yes | | Most Recent NOI(5): | $10,088,481 (TTM 9/30/2017) |

| Additional Debt Type(1): | Pari Passu | | |

| | | | | |

| | | | U/W Revenues: | $30,714,612 |

| | | | U/W Expenses: | $17,866,862 |

| | | | | | U/W NOI(5): | $12,847,750 |

| Escrows and Reserves(3): | | | | | U/W NCF: | $11,371,879 |

| | | | | | U/W NOI DSCR(1): | 2.75x |

| Type: | Initial | Monthly | Cap (If Any) | | U/W NCF DSCR(1): | 2.43x |

| Taxes | $500,000 | $347,042 | NAP | | U/W NOI Debt Yield(1): | 12.6% |

| Insurance | $332,498 | $26,499 | NAP | | U/W NCF Debt Yield(1): | 11.1% |

| Replacement Reserves | $0 | $16,325 | $500,000 | | As-Is Appraised Value: | $185,000,000 |

| TI/LC Reserve | $0 | Springing | NAP | | As-Is Appraisal Valuation Date: | October 17, 2017 |

| Deferred Maintenance | $752,123 | $0 | NAP | | Cut-off Date LTV Ratio(1): | 55.1% |

| Ground Rent Reserve | $214,630 | $214,630 | NAP | | LTV Ratio at Maturity or ARD(1): | 55.1% |

| | | | | | | |

| (1) | See “The Mortgage Loan” section. All statistical information related to balances per square foot, loan-to-value ratios, debt service coverage ratios and debt yields are based on the One Ally Center Whole Loan (as defined below). |

| (2) | The lockout period will be at least 24 payments, beginning with and including the first payment date of January 6, 2018. Defeasance of the One Ally Center Mortgage Loan is permitted at any time after the earlier to occur of (i) November 20, 2020 or (ii) two years after the closing date of the securitization that includes the last note to be securitized. The assumed lockout period of 24 payments is based on the expected WFCM 2017-C42 securitization trust closing date in December 2017. |

| (3) | See “Escrows” section. |

| (4) | Full year NOI prior to 2016 and historical occupancy prior to December 31, 2015 is unavailable due to the Borrower sponsor acquiring the property in March 2015. |

| (5) | Ally Financial Inc. (“Ally”) executed a lease in 2015 for 316,997 square feet and approximately $7.1 million in underwritten base rent. Ally began taking occupancy in April 2016 and took full occupancy by October 2016. Ally’s free rent period ended July 2017. |

The Mortgage Loan.The mortgage loan (the “One Ally Center Mortgage Loan”) is part of a whole loan (the “One Ally Center Whole Loan”) evidenced by twopari passu notes secured by a first mortgage encumbering the leasehold interest in a 976,095 square-foot office building located in Detroit, Michigan (the “One Ally Center Property”). The One Ally Center Whole Loan was originated on November 20, 2017 by Starwood Mortgage Capital LLC. The One Ally Center Whole Loan had an original principal balance of $102,000,000, has an outstanding principal balance as of the Cut-off Date of $102,000,000 and accrues interest at an interest rate of 4.516%per annum. The One Ally Center Whole Loan had an initial term of 120 months, has a remaining term of 120 months as of the Cut-off Date and requires payments of interest-only through its term. The One Ally Center Whole Loan has a maturity date on December 6, 2027.

Note A-1, which will be contributed to the WFCM 2017-C42 Trust, had an original principal balance of $70,000,000, has an outstanding principal balance as of the Cut-off Date of $70,000,000 and represents the controlling interest in the One Ally Center Whole Loan. The non-controlling Note A-2, had an original principal balance of $32,000,000, has an outstanding principal balance as of the Cut-off Date of $32,000,000, is currently held by Starwood Mortgage Funding III LLC and is expected to be contributed to one or more future securitizations. The mortgage loan seller provides no assurances that any non-securitized notes will not be split further. See

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

ONE ALLY CENTER

“Description of the Mortgage Pool—The Whole Loans—The Serviced Pari Passu Whole Loans”in the preliminary prospectus. The following table presents a summary of the promissory notes comprising the One Ally Center Whole Loan.

Note Summary

| Notes | Original Balance | | Note Holder | Controlling Interest |

| A-1 | $70,000,000 | | WFCM 2017-C42 | Yes |

| A-2 | $32,000,000 | | Starwood Mortgage Funding III LLC | No |

| Total | $102,000,000 | | | |

Following the lockout period, the One Ally Center Borrower (as defined below) has the right to defease the One Ally Center Whole Loan in whole, but not in part. In addition, the One Ally Center Whole Loan is prepayable without penalty on or after September 6, 2027. The lockout period will expire on the earlier of (i) two years after the closing date of the last note to be securitized and (ii) November 20, 2020.

Sources and Uses

| Sources | | | | Uses | | |

| Original whole loan amount | $102,000,000 | 99.3% | | Loan payoff | $98,405,549 | 95.8% |

| Borrower sponsor equity contribution | 740,401 | 0.7 | | Closing costs | 2,535,601 | 2.5 |

| | | | | Reserves | 1,799,251 | 1.8 |

| | | | | | | |

| Total Sources | $102,740,401 | 100.0% | | Total Uses | $102,740,401 | 100.0% |

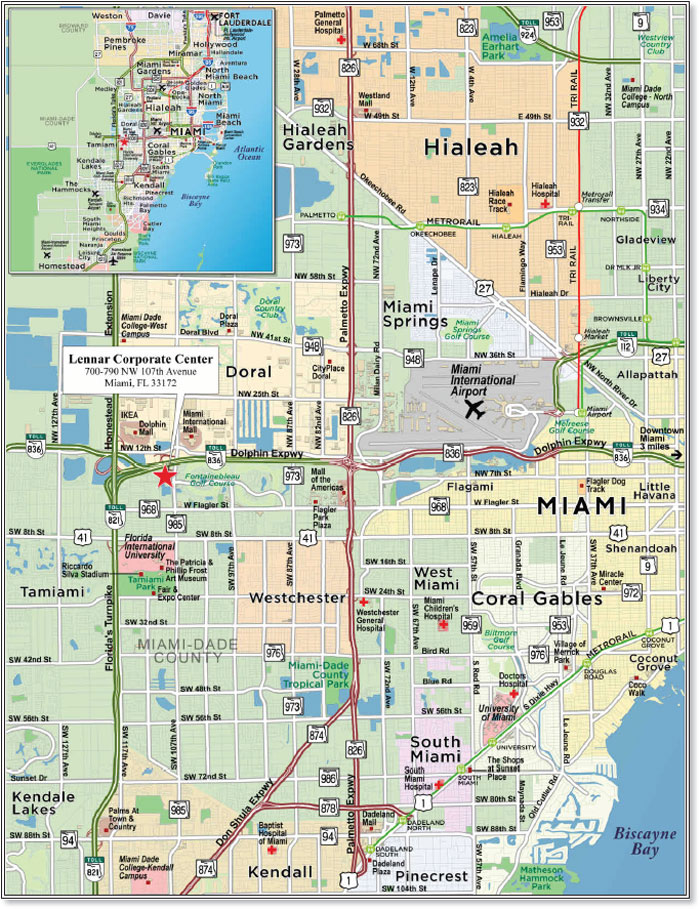

The Property. The One Ally Center Property consists of a 976,095 square-foot, Class A office building and an adjacent seven-level parking garage (the “One Ally Center Parking Garage”) located in Detroit, Michigan. The One Ally Center Property is located along Woodward Avenue in Detroit. Serving as the main thoroughfare between the central business district (“CBD”) and midtown Detroit, Woodward Avenue has direct access to the regional highway network and featuring a new streetcar line known as the QLine which opened in early 2017 and stops directly in front of the One Ally Center Property. Constructed in 1992, the One Ally Center Property sits on an approximately 2.9-acre site within the heart of the Detroit CBD. The One Ally Center Property includes an adjacent seven-level parking garage (2,070 spaces, 2.12 per 1000 square feet), 24-hour manned security and tenant amenities including two restaurants, a 10,078 square-foot Pulse fitness center and proximity to the Detroit People Mover. The One Ally Center Property struggled during the early 2000’s recession and was foreclosed on in 2007 by iStar Financial, Inc., which retained the fee simple interest in the One Ally Center Property. See “Description of the Mortgage Pool-Loan Purpose, Default History, Bankruptcy Issues and Other Proceedings” in the preliminary prospectus.

As of October 18, 2017, the One Ally Center Property was 94.3% leased to 20 tenants across a variety of industries, including Ally (32.5% NRA), Clark Hill PLC (7.9% NRA), Dickinson Wright PLLC (7.7% NRA), the Internal Revenue Service (7.2% NRA), PricewaterhouseCoopers LLP (7.2% NRA), McCann-Erickson USA, Inc. (5.1% NRA) and Foley & Lardner LLP (4.1% NRA).

Ally (formerly known as General Motors Acceptance Corporation) is a bank holding company founded by General Motors Corporation in 1919. The company provides financial services including auto financing, corporate financing, insurance, mortgages, stock brokerage, and online banking. Ally has been headquartered in Detroit since the company’s inception and is currently headquartered at the One Ally Center Property. Ally has consolidated approximately 1,500 employees in Southeast Michigan into the One Ally Center Property from five locations around greater Detroit, including Renaissance Center, Southfield Town Center, the Galleria Officentre in Southfield, the Auburn Hills Corporate Center and Troy Technology Park. Ally had an original lease commencement date in April 2016.

Clark Hill PLC (“Clark Hill”) is a legal firm which employs over 450 attorneys and professionals across 17 offices in Arizona, Delaware, Illinois, Michigan, New Jersey, Pennsylvania, Washington, DC, and West Virginia, among other states, and in Ireland, making it the second largest Michigan-based law firm according to a business publication. The firm’s practice areas include administrative and behavioral healthcare law, corporate restructuring and bankruptcy, estate planning and probate, government and public affairs, insurance and reinsurance, municipal finance, litigation, white collar criminal defense, economic development services, commercial and real estate finance transactions, product liability, intellectual property, and appellate. Clark Hill is headquartered at the One Ally Center Property.

Dickinson Wright PLLC (“Dickinson Wright”) is a general practice business law firm with over 425 attorneys among more than 40 practice areas and 19 industry groups and was founded in Detroit in 1878. The firm’s headquarters have been located at the One Ally Center Property since 1992. The firm has 18 offices, including six in Michigan, 11 other domestic offices, and one office in Canada.

PricewaterhouseCoopers LLP (“PWC”) is a multinational professional services firm headquartered in London, United Kingdom. PWC’s professional services include audit and assurance, tax and consulting that covers such areas as cybersecurity and privacy and human resources. The One Ally Center Property serves as PWC’s regional office for all clients in Michigan and northwest Ohio and is home to more than 700 consultants. PWC relocated from a building downtown to the One Ally Center Property in 2012.

The Internal Revenue Service’s (“IRS”) office at the One Ally Center is the largest of six offices with public-facing services that the IRS maintains in Michigan, and the only public-facing Taxpayer Assistance Center in the Detroit metropolitan area. The IRS’ improvements to its premises at the One Ally Center Property included significant structural work to support large volume document storage as well as extensive access control and security systems.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

ONE ALLY CENTER

The following table presents certain information relating to the tenancy at the One Ally Center Property:

Major Tenants

| Tenant Name | | Credit Rating (Fitch/Moody’s/ S&P)(1) | | Tenant NRSF | | % of

NRSF | | Annual U/W Base Rent PSF(2) | | Annual

U/W Base Rent(2) | | % of Total Annual U/W Base Rent | | Lease

Expiration

Date |

| | | | | | | | | | | | | | | |

| Major Tenant | | | | | | | | | | | | | | |

| Ally | | BB+/Ba3/BB+ | | 316,997 | | 32.5% | | $22.50 | | $7,132,433 | | 39.1% | | 12/31/2028(3) |

| Clark Hill | | NR/NR/NR | | 76,869 | | 7.9% | | $12.91 | | $992,355 | | 5.4% | | 12/31/2029(4) |

| Dickinson Wright | | NR/NR/NR | | 75,177 | | 7.7% | | $17.00 | | $1,278,009 | | 7.0% | | 9/7/2022(5) |

| PWC | | NR/NR/NR | | 70,184 | | 7.2% | | $22.00 | | $1,544,048 | | 8.5% | | 10/31/2023(6) |

| IRS | | AAA/Aaa/AA+u | | 69,920 | | 7.2% | | $15.31 | | $1,070,705 | | 5.9% | | 4/30/2021(7) |

| Total Major Tenants | | | | 609,147 | | 62.4% | | $19.73 | | $12,017,550 | | 65.9% | | |

| | | | | | | | | | | | | | | |

| Non-Major Tenants | | | | 311,265 | | 31.9% | | $19.95 | | $6,210,595 | | 34.1% | | |

| | | | | | | | | | | | | | | |

| Occupied Collateral Total | | | | 920,412 | | 94.3% | | $19.80 | | $18,228,145 | | 100.0% | | |

| | | | | | | | | | | | | | | |

| Vacant Space | | | | 55,683 | | 5.7% | | | | | | | | |

| | | | | | | | | | | | | | | |

| Collateral Total | | | | 976,095 | | 100.0% | | | | | | | | |

| | | | | | | | | | | | | | | |

| (1) | Certain ratings are those of the parent company whether or not the parent guarantees the lease. |

| (2) | Annual U/W Base Rent PSF and Annual U/W Base Rent include contractual rent steps through April 2018 and investment grade tenant leases underwritten to average rent over the remaining terms of its respective lease through the maturity of the One Ally Center Whole Loan, totaling approximately $430,310. |

| (3) | Ally has three, five-year lease renewal options. |

| (4) | Clark Hill has two, five-year lease renewal options. Clark Hill has a one-time right to terminate its lease effective January 2025 by providing 12 months’ notice and payment of unamortized leasing costs. Additionally, Clark Hill has a one-time right to contract by 25,480 square feet effective January 2025 with six months’ notice and payment of unamortized leasing costs. |

| (5) | Dickinson Wright has one, ten-year lease renewal option. |

| (6) | PWC has two, five-year lease renewal options. PWC has a one-time right to terminate its lease effective December 2019 with ten months’ notice and payment of a termination fee equal to three months’ rent and unamortized leasing costs. Additionally, PWC has an ongoing right to contract by up to 25% of its leased space until January 2021 with nine months’ notice and payment of unamortized leasing costs. |

| (7) | The IRS has an ongoing right to terminate its lease with three months’ notice and no termination fee. |

The following table presents certain information relating to the lease rollover schedule at the One Ally Center Property:

Lease Expiration Schedule(1)(2)

Year Ending

December 31, | No. of Leases Expiring | Expiring NRSF | % of Total NRSF | Cumulative Expiring NRSF | Cumulative % of Total NRSF | Annual

U/W

Base Rent | % of Total Annual U/W Base Rent | Annual

U/W

Base Rent

PSF(3) |

| MTM | 1 | 7,901 | 0.8% | 7,901 | 0.8% | $150,119 | 0.8% | $19.00 |

| 2017 | 0 | 0 | 0.0% | 7,901 | 0.8% | $0 | 0.0% | $0.00 |

| 2018 | 1 | 12,702 | 1.3% | 20,603 | 2.1% | $270,644 | 1.5% | $21.31 |

| 2019 | 1 | 8,547 | 0.9% | 29,150 | 3.0% | $190,171 | 1.0% | $22.25 |

| 2020 | 2 | 48,902 | 5.0% | 78,052 | 8.0% | $1,028,155 | 5.6% | $21.02 |

| 2021 | 5 | 171,505 | 17.6% | 249,557 | 25.6% | $3,042,821 | 16.7% | $17.74 |

| 2022 | 4 | 92,447 | 9.5% | 342,004 | 35.0% | $1,708,999 | 9.4% | $18.49 |

| 2023 | 1 | 70,184 | 7.2% | 412,188 | 42.2% | $1,544,048 | 8.5% | $22.00 |

| 2024 | 1 | 39,560 | 4.1% | 451,748 | 46.3% | $483,475 | 2.7% | $12.22 |

| 2025 | 0 | 0 | 0.0% | 451,748 | 46.3% | $0 | 0.0% | $0.00 |

| 2026 | 1 | 49,730 | 5.1% | 501,478 | 51.4% | $1,192,924 | 6.5% | $23.99 |

| 2027 | 0 | 0 | 0.0% | 501,478 | 51.4% | $0 | 0.0% | $0.00 |

| Thereafter | 3 | 418,934 | 42.9% | 920,412 | 94.3% | $8,616,789 | 47.3% | $20.57 |

| Vacant | 0 | 55,683 | 5.7% | 976,095 | 100.0% | $0 | 0.0% | $0.00 |

| Total/Weighted Average | 20 | 976,095 | 100.0% | | | $18,228,145 | 100.0% | $19.80 |

| (1) | Information obtained from the underwritten rent roll. |

| (2) | Certain tenants may have lease termination options that are exercisable prior to the originally stated expiration date of the subject lease and that are not considered in the Lease Expiration Schedule. |

| (3) | Weighted Average U/W Base Rent PSF excludes vacant space. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

ONE ALLY CENTER

The following table presents historical occupancy percentages at the One Ally Center Property:

Historical Occupancy

12/31/2013(1) | | 12/31/2014(1) | | 12/31/2015(2) | | 12/31/2016(2) | | 10/18/2017(3) |

| NAV | | NAV | | 79.5% | | 96.6% | | 94.3% |

| (1) | Historical occupancy prior to December 31, 2015 is unavailable due to the Borrower sponsor acquiring the property in March 2015. |

| (2) | Information obtained from the One Ally Center Borrower. |

| (3) | Information obtained from the underwritten rent roll. |

Operating History and Underwritten Net Cash Flow. The following table presents certain information relating to the underwritten net cash flow at the One Ally Center Property:

Cash Flow Analysis(1)

| | | 2016 | | TTM 9/30/2017 | | U/W | | % of U/W Effective Gross Income | | U/W $ per SF |

| Base Rent | | $11,402,810 | | | $13,725,555 | | | $18,228,145 | (2) | | 59.3 | % | | $18.67 | |

| Grossed Up Vacant Space | | 0 | | | 0 | | | 973,492 | | | 3.2 | | | 1.00 | |

| Total Reimbursables | | 4,431,513 | | | 4,528,196 | | | 3,781,943 | | | 12.3 | | | 3.87 | |

| Tenant Bill Backs | | 881,728 | | | 1,329,664 | | | 1,329,664 | | | 4.3 | | | 1.36 | |

| Parking Income | | 7,730,698 | | | 8,529,329 | | | 7,753,829 | | | 25.2 | | | 7.94 | |

| Other Income | | 93,720 | | | 78,181 | | | 78,181 | | | 0.3 | | | 0.08 | |

| Less Vacancy & Credit Loss | | 0 | | | 0 | | | (1,430,641 | )(3) | | (4.7 | ) | | (1.47 | ) |

| Effective Gross Income | | $24,540,469 | | | $28,190,925 | | | $30,714,612 | | | 100.0 | % | | $31.47 | |

| | | | | | | | | | | | | | | | |

| Total Operating Expenses | | $17,333,096 | | | $18,102,444 | | | $17,866,862 | | | 58.2 | % | | $18.30 | |

| | | | | | | | | | | | | | | | |

| Net Operating Income | | $7,207,373 | | | $10,088,481 | | | $12,847,750 | | | 41.8 | % | | $13.16 | |

| TI/LC | | 0 | | | 0 | | | 1,279,976 | | | 4.2 | | | 1.31 | |

| Capital Expenditures | | 0 | | | 0 | | | 195,895 | | | 0.6 | | | 0.20 | |

| Net Cash Flow | | $7,207,373 | | | $10,088,481 | | | $11,371,879 | | | 37.0 | % | | $11.65 | |

| | | | | | | | | | | | | | | | |

| NOI DSCR(4) | | 1.54 | x | | 2.16 | x | | 2.75 | x | | | | | | |

| NCF DSCR(4) | | 1.54 | x | | 2.16 | x | | 2.43 | x | | | | | | |

| NOI DY(4) | | 7.1 | % | | 9.9 | % | | 12.6 | % | | | | | | |

| NCF DY(4) | | 7.1 | % | | 9.9 | % | | 11.1 | % | | | | | | |

| (1) | Ally executed a lease for 316,997 square feet and approximately $7.1 million in base rent in 2015. Ally began taking occupancy in April 2016 and took full occupancy by September 2016. Ally’s free rent period ended June 2017. |

| (2) | U/W Base Rent includes contractual rent steps through June 2018 and investment grade tenant leases underwritten to average rent over the remaining terms of its respective lease through the maturity of the One Ally Center Whole Loan, totaling approximately $430,310. |

| (3) | The underwritten economic vacancy is 4.5%. The One Ally Center Property was 94.3% leased as of October 18, 2017. |

| (4) | Debt service coverage ratios and debt yields are based on the One Ally Center Whole Loan. |

Appraisal.As of the appraisal valuation date of October 17, 2017 the One Ally Center Property had an “as-is” appraised value of $185,000,000.

Environmental Matters. According to a Phase I environmental site assessment dated October 30, 2017, there was no evidence of any recognized environmental conditions at the One Ally Center Property.

Market Overview and Competition.The One Ally Center Property is located in the Detroit CBD submarket of the Detroit market. According to a market report, the Detroit CBD submarket had approximately 7.5 million square feet of Class A office inventory. According to the appraisal as of October 2017, the Detroit CBD submarket had average asking rents of $23.67 per square foot and a vacancy rate of 7.5%. According to the appraisal, the 2017 estimated population within a one-mile radius of the One Ally Center Property was 7,355, while the 2017 estimated median household income within the same radius was $34,866. Within the city of Detroit, the 2017 estimated population was 658,250, while the 2017 estimated median household income was $27,134.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

ONE ALLY CENTER

The following table presents certain information relating to comparable office leases for the One Ally Center Property:

Comparable Leases(1)

| Property Name/Location | Year Built | Occupancy | Distance from Subject | Tenant Name | Lease Date/Term | Lease Area (SF) | Annual Base Rent PSF | Lease Type |

One Campus Martius Detroit, MI | 2003 | 100% | 0.2 miles | Microsoft | Dec. 2017 / 7.7 Yrs. | 43,119 | $25.75 | MG |

One Kennedy Square Detroit, MI | 2006 | 100% | 0.2 miles | Ernst & Young | Oct. 2016 / 10 Yrs. | 37,277 | $16.75 | NNN |

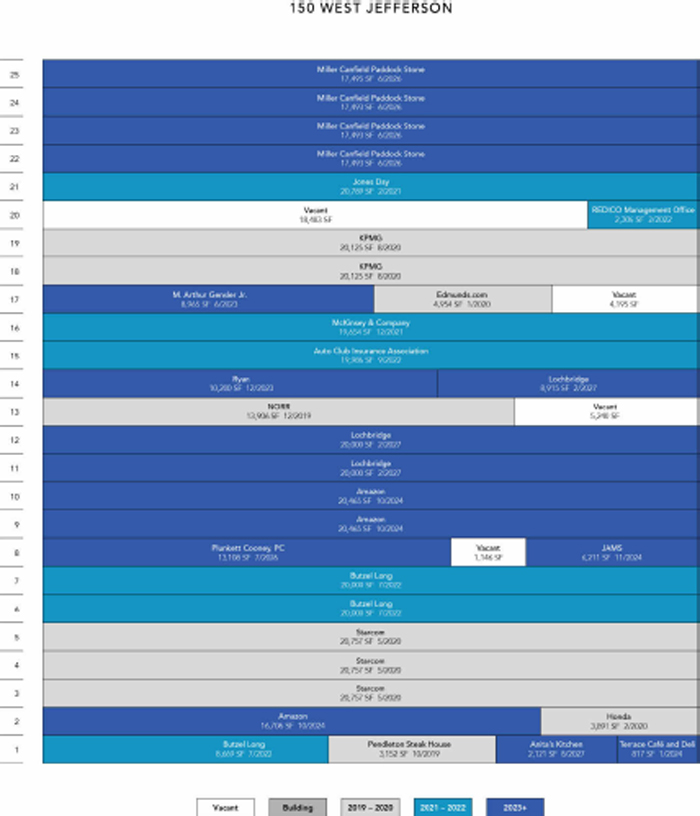

150 West Jefferson Detroit, MI | 1989 | 93% | 0.2 miles | Amazon | Jul. 2017 / 7.3 Yrs. | 20,465 | $25.50 | MG |

150 West Jefferson Detroit, MI | 1989 | 93% | 0.2 miles | Jams, Inc. | Jun. 2017 / 7.5 Yrs. | 6,211 | $25.00 | MG |

| (1) | Information obtained from the appraisal and third party reports. |

The Borrower.The One Ally Center Borrower for the One Ally Center Whole Loan is 500 Webward LLC (the “One Ally Center Borrower”), a recycled Michigan limited liability company and a special purpose entity with two independent directors. Legal counsel to the One Ally Center Borrower delivered a non-consolidation opinion in connection with the origination of the One Ally Center Whole Loan. Zup Ventures LLC is the guarantor of certain non-recourse carveouts under the One Ally Center Whole Loan. The loan documents require that, during any period commencing when a claim is made under any of the guaranties and ending once such claim has been fully resolved or paid, the guarantor maintain a net worth of at least $40,000,000 and liquid assets of at least $8,000,000.

The Borrower Sponsor. The borrower sponsor is Bedrock Real Estate Services (“Bedrock”). Bedrock and the One Ally Center Borrower are both ultimately owned by the Daniel B. Gilbert Trust UAD 12/23/96, as amended, a trust controlled by Mr. Daniel Gilbert and managed by an affiliate of Bedrock. Bedrock is the real estate investment company owned by Mr. Gilbert. Mr. Gilbert is the Chairman and founder of Quicken Loans, Inc. Detroit-based Bedrock is a real estate firm specializing in acquiring, developing, leasing, financing, and managing commercial and residential buildings. Since its founding in 2011, Bedrock and its affiliates have acquired and developed more than 100 properties in downtown Detroit and Cleveland totaling more than 16 million square feet. Bedrock’s current portfolio consists of more than 90 commercial properties totaling more than 15 million square feet throughout downtown Detroit.

Escrows.The One Ally Center Whole Loan documents provide for upfront escrows in the amount of $500,000 for real estate taxes, $332,498 for insurance premiums, $752,123 for deferred maintenance and $214,630 for a ground rent reserve. The loan documents also provide for ongoing monthly escrow deposits of $347,042 for real estate taxes, $26,499 for insurance premiums, $16,325 for replacement reserves (subject to a cap of $500,000) and $214,630 for ground rent.

If (i) an event of default occurs under the One Ally Center Whole Loan or (ii) the debt service coverage ratio at the One Ally Center Property falls below 2.00x calculated based on the trailing twelve months, the One Ally Center Borrower is required to make monthly deposits of $102,029 (approximately $1.25 per square foot annually) for TI/LCs. Upon the One Ally Center Property achieving a debt service coverage ratio of 2.00x or greater calculated based on the trailing twelve months for two consecutive calendar quarters, the ongoing TI/LC collections will be suspended and funds on deposit in the TI/LC reserve will be disbursed to the One Ally Center Borrower.

Lockbox and Cash Management.The One Ally Center Whole Loan is structured with a hard lockbox and upfront cash management. The One Ally Center Borrower was required at origination to deliver letters to all tenants at the One Ally Center Property directing them to pay all rents directly into a lender-controlled lockbox account. All funds received by the One Ally Center Borrower or manager are required to be deposited in the lockbox account within one business day following receipt. All funds in the lockbox account are required to be swept each business day into the cash management account controlled by the lender and disbursed on each payment date in accordance with the loan documents, with all excess cash flow required to be deposited to an excess cash reserve to be held as additional security during the existence of certain events for the One Ally Center Whole Loan.

Property Management. The One Ally Center Property is managed by Bedrock Management Services LLC, an affiliate of the One Ally Center Borrower.

Assumption.Commencing on November 20, 2018, the One Ally Center Borrower has the right to transfer the One Ally Center Property, provided that certain conditions are satisfied, including: (i) no event of default has occurred and is continuing, (ii) the One Ally Center Borrower has provided the lender with 60 days’ prior written notice, (iii) the proposed transferee qualifies as a qualified transferee under the loan documents and (iv) the lender has received rating agency confirmation that such assumption will not result in a downgrade of the respective ratings assigned to the Series 2017-C42 certificates and similar confirmations from each rating agency rating any securities backed by any of the One Ally Center companion loans.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

ONE ALLY CENTER

Future Expansion. During the term of the One Ally Center Mortgage Loan, the One Ally Center Borrower will be permitted to expand the One Ally Center Parking Garage by adding additional stories and/or building additional improvements on top of the One Ally Center Parking Garage structure, provided that the construction complies with the requirements contained in the One Ally Center Whole Loan documents. The One Ally Center Borrower will have the option to structure such expansion either (a) as part of the One Ally Center Mortgage Loan’s collateral, or (b) by converting the One Ally Center Property to condominium ownership with the One Ally Center Borrower’s condominium unit being comprised of the current One Ally Center Property and the One Ally Center Parking Garage structure and a second condominium unit being comprised of the air rights over the current One Ally Center Parking Garage structure in which an affiliate of the One Ally Center Borrower would construct the expansion, subject in either case to the compliance with the requirements contained in the One Ally Center Mortgage Loan documents. The construction of an office property under either structure is not permitted under the One Ally Center Whole Loan.

Real Estate Substitution.Not permitted.

Subordinate and Mezzanine Indebtedness.Not Permitted.

Ground Lease. The Borrower’s interest in the One Ally Center Property is pursuant to a ground lease with an affiliate of iStar Financial Inc. as the landlord. The ground lease commenced on March 31, 2015 and has an initial lease expiration of March 31, 2114 with two 30-year extension options at the lessee’s option, making the final expiration date March 31, 2174. The annual ground rent is currently $2.58 million and increases annually by 1.5%; however, at the end of each tenth lease year, the rent increases by the greater of (i) 1.5% over the prior year or (ii) the cumulative CPI increase over the prior ten-year period capped at 1.2x the rent paid at the beginning of the applicable 10-year period. The Borrower is required to make monthly deposits for ground rental payments.

Terrorism Insurance. The One Ally Center Borrower is required to obtain insurance for domestic and foreign acts of terrorism (as defined in the Terrorism Risk Insurance Program Reauthorization Act of 2007 as amended or replaced) in an amount equal to the full replacement cost of the One Ally Center Property and business interruption insurance of at least 18 months required under the One Ally Center Whole Loan documents; provided that, if the Terrorism Risk Insurance Program Reauthorization Act of 2007 (or a subsequent statute, extension or reauthorization) is not in effect, the One Ally Borrower will not be required to pay annual premiums for terrorism insurance in excess of an amount equal to two times the premium for a separate “Special Form” or “All Risks” policy or equivalent policy insuring only the One Ally Center Property on a stand-alone basis at the time that any terrorism coverage is excluded from any applicable policy (but the One Ally Borrower will be obligated to purchase the maximum amount of terrorism coverage available with funds equal to such amount).

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

16 COURT STREET

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

16 COURT STREET

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

16 COURT STREET

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| No. 2 – 16 Court Street |

| |

| Loan Information | | Property Information |

| Mortgage Loan Seller: | Barclays Bank PLC | | Single Asset/Portfolio: | Single Asset |

Credit Assessment

(Fitch/KBRA/Moody’s): | NR/NR/NR | | Property Type: | Office |

| Original Principal Balance(1): | $66,600,000 | | Specific Property Type: | CBD |

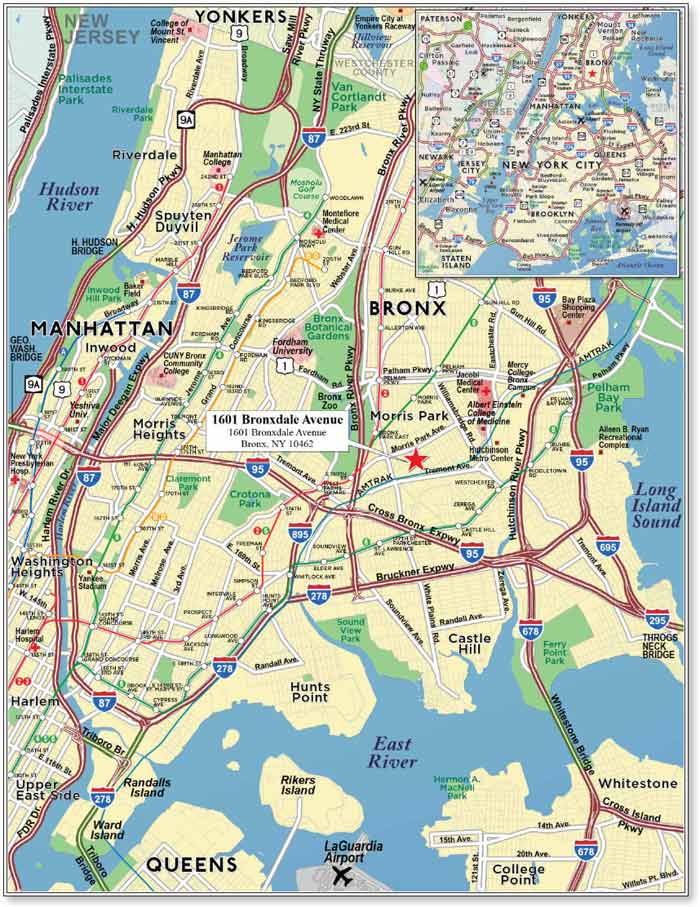

| Cut-off Date Balance(1): | $66,600,000 | | Location: | Brooklyn, NY |

| % of Initial Pool Balance: | 8.9% | | Size: | 325,510 SF |

| Loan Purpose: | Acquisition | | Cut-off Date Balance Per SF: | $341.00 |

| Borrower Name: | 16 Court St Brooklyn Owner, LLC | | Year Built/Renovated: | 1928/2016 |

| Borrower Sponsor: | CIM SMA I Investments, LLC | | Title Vesting: | Fee |

| Mortgage Rate: | 4.171% | | Property Manager: | Self-Managed |

| Note Date: | October 10, 2017 | | 4thMost Recent Occupancy (As of)(4): | 87.2% (12/31/2013) |

| Anticipated Repayment Date: | NAP | | 3rdMost Recent Occupancy (As of)(4): | 94.7% (12/31/2014) |

| Maturity Date: | November 1, 2027 | | 2ndMost Recent Occupancy (As of)(4): | 95.5% (12/31/2015) |

| IO Period: | 120 months | | Most Recent Occupancy (As of)(4): | 95.2% (12/31/2016) |

| Loan Term (Original): | 120 months | | Current Occupancy (As of)(4): | 92.7% (9/13/2017) |

| Seasoning: | 1 month | | |

| Amortization Term (Original): | NAP | | Underwriting and Financial Information: |

| Loan Amortization Type: | Interest-only, Balloon | | 4thMost Recent NOI (As of)(5): | $6,144,429 (12/31/2014) |

| Interest Accrual Method: | Actual/360 | | 3rdMost Recent NOI (As of)(5): | $7,631,247 (12/31/2015) |

| Call Protection: | L(25),D(89),O(6) | | 2ndMost Recent NOI (As of)(5): | $8,052,969 (12/31/2016) |

| Lockbox Type: | Hard/Springing Cash Management | | Most Recent NOI (As of)(5): | $8,434,282 (TTM 8/31/2017) |

| Additional Debt(1): | Yes | | | |

| Additional Debt Type(1)(2): | Pari Passu; Future Mezzanine | | |

| | | | U/W Revenues: | $15,919,171 |

| | | | U/W Expenses: | $6,484,958 |

| | | | U/W NOI(5): | $9,434,213 |

| Escrows and Reserves(3): | | | U/W NCF: | $8,586,140 |

| | | | U/W NOI DSCR(1): | 2.01x |

| Type: | Initial | Monthly | Cap (If Any) | | U/W NCF DSCR(1): | 1.83x |

| Taxes | $0 | Springing | NAP | | U/W NOI Debt Yield(1): | 8.5% |

| Insurance | $0 | Springing | NAP | | U/W NCF Debt Yield(1): | 7.7% |

| Replacement Reserves | $0 | $5,438 | NAP | | As-Is Appraised Value: | $175,000,000 |

| TI/LC Reserve | $0 | $27,190 | NAP | | As-Is Appraisal Valuation Date: | September 25, 2017 |

| Sprinkler Work Reserve | $3,347,154 | $0 | NAP | | Cut-off Date LTV Ratio(1): | 63.4% |

| Free Rent Reserve | $485,028 | $0 | NAP | | LTV Ratio at Maturity or ARD(1): | 63.4% |

| Outstanding TI/LC Reserve | $141,392 | $0 | NAP | | | |

| | | | | | | |

| | | | | | | | | |

| (1) | See “The Mortgage Loan” section. All statistical information related to balances per square foot, loan-to-value ratios, debt service coverage ratios and debt yields are based on the 16 Court Street Whole Loan (as defined below). |

| (2) | See “Subordinate and Mezzanine Indebtedness” section. |

| (3) | See “Escrows” section. |

| (4) | See “Historical Occupancy” section. |

| (5) | See “Cash Flow Analysis” section. |

The Mortgage Loan.The mortgage loan (the “16 Court Street Mortgage Loan”) is part of a whole loan (the “16 Court Street Whole Loan”) evidenced by twopari passu notes secured by a first mortgage encumbering the fee interest in a 36-story, Class A office tower located on the corner of Montague Street and Court Street in the Brooklyn Heights neighborhood of Brooklyn, New York (the “16 Court Street Property”). The 16 Court Street Whole Loan was originated on October 10, 2017 by Barclays Bank PLC and Citi Real Estate Funding Inc. The 16 Court Street Whole Loan had an original principal balance of $111,000,000, has an outstanding principal balance as of the Cut-off Date of $111,000,000 and accrues interest at an interest rate of 4.171%per annum. The 16 Court Street Whole Loan had an initial term of 120 months, has a remaining term of 119 months as of the Cut-off Date and requires payments of interest-only through the term of the 16 Court Street Whole Loan. The 16 Court Street Whole Loan matures on November 1, 2027.

Note A-1, which will be contributed to the WFCM 2017-C42 Trust, had an original principal balance of $66,600,000, has an outstanding principal balance as of the Cut-off Date of $66,600,000 and represents the controlling interest in the 16 Court Street Whole Loan. The non-controlling Note A-2, had an original principal balance of $44,400,000, has an outstanding principal balance as of the Cut-off Date of $44,400,000 and was contributed to the CCUBS 2017-C1 Trust. See“Description of the Mortgage Pool—The Whole Loans—The Serviced Pari Passu Whole Loans” in the Preliminary Prospectus.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

16 COURT STREET

The following table presents a summary of the promissory notes comprising the 16 Court Street Whole Loan:

Note Summary

| Notes | Original Balance | | Note Holder | Controlling Interest |

| A-1 | $66,600,000 | | WFCM 2017-C42 | Yes |

| A-2 | $44,400,000 | | CCUBS 2017-C1 | No |

| Total | $111,000,000 | | | |

Following the lockout period, the 16 Court Street Borrower (as defined below) has the right to defease the 16 Court Street Whole Loan in whole, but not in part. In addition, the 16 Court Street Whole Loan is prepayable without penalty on any business day after May 1, 2027. The lockout period will expire two years after the closing date of the WFCM 2017-C42 Trust.

Sources and Uses

| Sources | | | | | Uses | | | |

| Original whole loan amount | $111,000,000 | | 62.1% | | Purchase price | $171,000,000 | | 95.7% |

| Borrower sponsors’ new cash contribution | 67,686,414 | | 37.9 | | Reserves | 3,973,573 | | 2.2 |

| | | | | | Closing costs | 3,712,841 | | 2.1 |

| | | | | | | | | |

| Total Sources | $178,686,414 | | 100.0% | | Total Uses | $178,686,414 | | 100.0% |

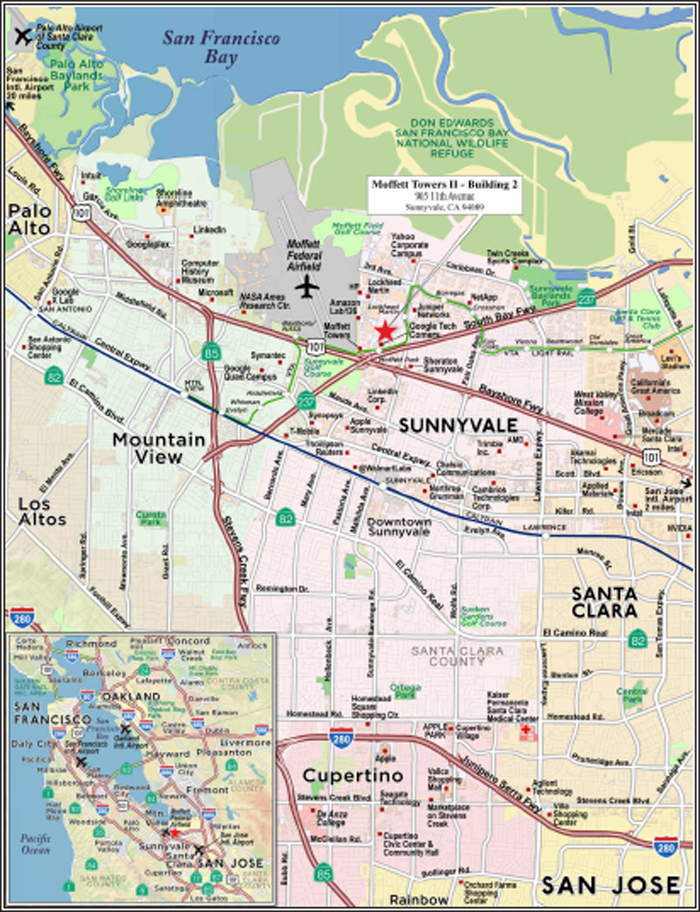

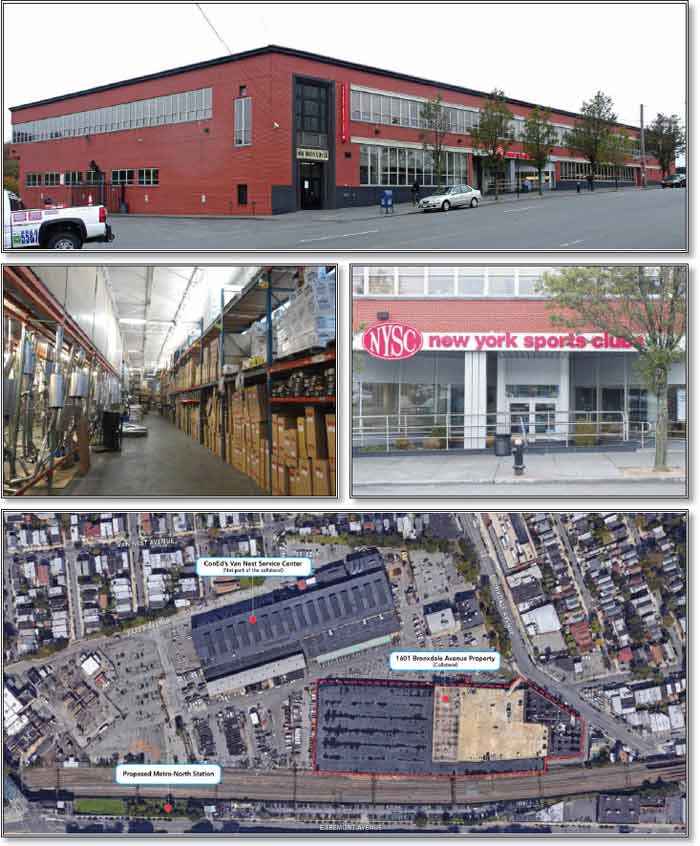

The Property.The 16 Court Street Property is a 36-story, Class A office tower located in an area of downtown Brooklyn, New York that is known as the “Tech Triangle.” Constructed in 1928 and most recently renovated in 2016, the 16 Court Street Property totals 325,510 square feet and is comprised of 309,455 square feet of office space (95.1% of net rentable area) and 16,055 square feet of retail space (4.9% of net rentable area). According to the sponsor, since 2007, the 16 Court Street Property has had a total of $33.7 million (approximately $103.53 per square foot) in capital improvements. A $15.0 million renovation was completed in 2016, including a renovated lobby featuring a cafe and bike storage, renovated elevators cabs and building corridors. Additionally, renovations at the 16 Court Street Property include the installation of fiber optics, a key feature for technology, advertising, media and information tenants. With 36 stories, the 16 Court Street Property is one of the tallest commercial towers in Brooklyn with floor plates ranging from approximately 13,500 square feet on the lower floors to approximately 4,000 square feet on the top four floors. The typical ceiling heights range from approximately 10 to 14 feet.

The 16 Court Street Property is leased to 65 tenants in a variety of industries occupying 85 spaces. The largest tenants include The City University of New York (11.8% of U/W base rent), NYC Department of Mental Health (6.3% of U/W base rent) and Michael Van Valkenburgh Associates, Inc. (5.6% U/W base rent). The City University of New York (“CUNY”) (rated AA/Aa2/AA by Fitch/Moody’s/S&P) occupies 47,162 square feet of office space at the 16 Court Street Property, with a lease that expires on August 31, 2024 and has been a tenant at the 16 Court Street Property since 2010. CUNY provides accessible education for more than 274,357 degree seeking students and 260,000 adults and continuing education students at 24 campuses across New York City. NYC Department of Mental Health (rated AA/Aa2/AA by Fitch/Moody’s/S&P) occupies 19,560 SF at the 16 Court Street Property, with a lease that expires on November 30, 2020 and has been a tenant at the 16 Court Street Property since 1994. The NYC Department of Mental Health is one of the largest public health agencies in the world, serving eight million New Yorkers with an annual budget of $1.6 billion and more than 6,000 employees throughout the five boroughs. Michael Van Valkenburgh Associates, Inc. occupies 19,071 square feet at the 16 Court Street Property, with a lease that expires on March 31, 2024 and has been a tenant at the 16 Court Street Property since 2008. Michael Van Valkenburgh Associates, Inc., founded in 1982, is a landscape architecture firm with over 80 staff members and is headquartered at the 16 Court Street Property. The 16 Court Street Property was 92.7% occupied as of September 13, 2017.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

16 COURT STREET

The following table presents certain information relating to the tenancy at the 16 Court Street Property:

Major Tenants

| Tenant Name | Credit Rating (Fitch/Moody’s /S&P)(1) | Tenant

NRSF | % of

NRSF | Annual U/W Base Rent PSF(2) | Annual

U/W Base

Rent(2) | % of Total

Annual

U/W Base

Rent | Lease

Expiration

Date |

| | | | | | | | |

| Major Tenants | | | | | | | |

| The City University of New York | AA/Aa2/AA | 47,162 | 14.5% | $35.06 | $1,653,500 | 11.8% | 8/31/2024(3) |

| NYC Department of Mental Health | AA/Aa2/AA | 19,560 | 6.0% | $45.00 | $880,200 | 6.3% | 11/30/2020 |

| Michael Van Valkenburgh Associates, Inc. | NR/NR/NR | 19,071 | 5.9% | $41.21 | $785,924 | 5.6% | 3/31/2024(4) |

| New York Department of Transportation | AA/Aa2/AA | 16,198 | 5.0% | $38.82 | $628,806 | 4.5% | 12/10/2017(5) |

| Diamond Reporting Services | NR/NR/NR | 14,143 | 4.3% | $33.95 | $480,155 | 3.4% | 2/29/2024(6) |

| HF Management Services, LLC | NR/NR/NR | 12,822 | 3.9% | $59.74 | $765,986 | 5.5% | 5/31/2019 |

| Blumberg Court LLC(7) | NR/NR/NR | 12,420 | 3.8% | $55.09 | $684,191 | 4.9% | 4/30/2023 |

| Duane Reade | BBB/Baa2/BBB | 11,644 | 3.6% | $76.91 | $895,516 | 6.4% | 2/28/2026(8) |

| Rubenstein & Rynecki(9) | NR/NR/NR | 7,903 | 2.4% | $52.27 | $413,129 | 3.0% | 7/31/2027(9) |

| FedEx Office and Print Services, Inc.(10) | NR/Baa2/BBB | 3,134 | 1.0% | $230.06 | $721,016 | 5.2% | 10/31/2024 |

| Total Major Tenants | 164,057 | 50.4% | $48.21 | $7,908,424 | 56.6% | |

| | | | | | | | |

| Non-Major Tenants | | 137,777 | 42.3% | $43.93 | $6,051,889 | 43.4% | |

| | | | | | | | |

| Occupied Collateral Total | 301,834 | 92.7% | $46.25 | $13,960,314 | 100.0% | |

| | | | | | | | |

| Vacant Space | | 23,676 | 7.3% | | | | |

| | | | | | | | |

| Collateral Total | 325,510 | 100.0% | | | | |

| | | | | | | | |

| (1) | Certain ratings are those of the parent company whether or not the parent guarantees the lease. |

| (2) | Annual U/W Base Rent PSF and Annual U/W Base Rent include contractual rent steps through November 2018, totaling $720,158. |

| (3) | The City University of New York has one, five-year lease renewal option. |

| (4) | Michael Van Valkenburgh Associates, Inc. has one, five-year lease renewal option and an option to terminate its lease for suite 1212-1214 only (1,825 SF) on April 1, 2020 and April 1, 2022, with notice required to be given by June 1, 2019 and June 1, 2021, respectively, prior to such date and the payment of a termination fee. |

| (5) | According to the sponsor, New York Department of Transportation is currently in discussion of renewing their lease as well as expanding into additional space at the 16 Court Street Property. |

| (6) | Diamond Reporting Services has one, five-year lease renewal option and has the right to terminate its lease any time after September 30, 2018 with 365 days’ notice and the payment of a termination fee. |

| (7) | Blumberg Court LLC has four months of free rent in 2018, which was reserved for upfront. |

| (8) | Duane Reade has one, five-year lease renewal option. |

| (9) | Rubenstein & Rynecki has the right to terminate its lease any time after August 1, 2022 with 10 months’ notice and the payment of a termination fee. Rubenstein & Rynecki has rent abatement one month a year from 2018 through 2021,which was reserved for upfront. |

| (10) | FedEx Office and Print Services, Inc. has a rent abatement period of four months in 2017, the remaining rent abatement was reserved for upfront. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

16 COURT STREET

The following table presents certain information relating to the lease rollover schedule at the 16 Court Street Property:

Lease Expiration Schedule(1)(2)

Year Ending

December 31, | No. of

Leases

Expiring(3) | Expiring

NRSF | % of

Total

NRSF | Cumulative Expiring NRSF | Cumulative % of Total NRSF | Annual

U/W

Base Rent | % of Annual

U/W

Base Rent | Annual

U/W

Base

Rent

PSF(4) |

| MTM | 1 | 8,579 | 2.6% | 8,579 | 2.6% | $243,895 | 1.7% | $28.43 |

| 2017 | 1 | 16,198 | 5.0% | 24,777 | 7.6% | $628,806 | 4.5% | $38.82 |

| 2018 | 9 | 14,580 | 4.5% | 39,357 | 12.1% | $669,490 | 4.8% | $45.92 |

| 2019 | 12 | 29,849 | 9.2% | 69,206 | 21.3% | $1,488,206 | 10.7% | $49.86 |

| 2020 | 3 | 24,186 | 7.4% | 93,392 | 28.7% | $1,089,527 | 7.8% | $45.05 |

| 2021 | 10 | 33,298 | 10.2% | 126,690 | 38.9% | $1,576,041 | 11.3% | $47.33 |

| 2022 | 8 | 12,623 | 3.9% | 139,313 | 42.8% | $532,570 | 3.8% | $42.19 |

| 2023 | 4 | 23,339 | 7.2% | 162,652 | 50.0% | $1,161,887 | 8.3% | $49.78 |

| 2024 | 10 | 108,410 | 33.3% | 271,062 | 83.3% | $4,629,272 | 33.2% | $42.70 |

| 2025 | 4 | 10,175 | 3.1% | 281,237 | 86.4% | $533,310 | 3.8% | $52.41 |

| 2026 | 1 | 11,644 | 3.6% | 292,881 | 90.0% | $895,516 | 6.4% | $76.91 |

| 2027 | 1 | 7,903 | 2.4% | 300,784 | 92.4% | $413,129 | 3.0% | $52.27 |

| Thereafter | 1 | 1,050 | 0.3% | 301,834 | 92.7% | $98,664 | 0.7% | $93.97 |

| Vacant | 0 | 23,676 | 7.3% | 325,510 | 100.0% | $0 | 0.0% | $0.00 |

| Total/Weighted Average | 65 | 325,510 | 100.0% | | | $13,960,314 | 100.0% | $46.25 |

| (1) | Information obtained from the underwritten rent roll and includes rent steps through November 2018. |

| (2) | Certain tenants may have lease termination or contraction options that are exercisable prior to the originally stated expiration date of the subject lease and that are not considered in the Lease Expiration Schedule. |

| (3) | Certain building office, elevator, cable and roof spaces were not considered for the purposes of the Lease Expiration Schedule. |

| (4) | Weighted Average Annual U/W Base Rent PSF excludes vacant space. |

The following table presents historical occupancy percentages at the 16 Court Street Property:

Historical Occupancy

12/31/2013(1) | 12/31/2014(1) | 12/31/2015(1) | 12/31/2016(1) | 9/13/2017(2) |

| | | | | |

| 87.2% | 94.7% | 95.5% | 95.2% | 92.7% |

| (1) | Information obtained from the borrower. |

| (2) | Information obtained from the underwritten rent roll. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

16 COURT STREET

Operating History and Underwritten Net Cash Flow. The following table presents certain information relating to the historical operating performance and the underwritten net cash flow at the 16 Court Street Property:

Cash Flow Analysis

| | 2014 | 2015 | 2016 | TTM 8/31/2017(1) | U/W(1) | % of U/W

Effective

Gross Income | U/W $ per SF |

| Base Rent | $10,247,089 | $11,503,819 | $12,118,568 | $12,530,658 | $14,174,889(2) | 89.0% | $43.55 |

| Grossed Up Vacant Space | 0 | 0 | 0 | 0 | 1,130,154 | 7.1 | 3.47 |

| Total Reimbursables | 1,158,008 | 1,222,544 | 1,239,467 | 1,191,394 | 1,721,529 | 10.8 | 5.29 |

| Other Income(3) | 287,885 | 335,342 | 263,091 | 161,682 | 22,753 | 0.1 | 0.07 |

| Less Vacancy & Credit Loss | 0 | 0 | 0 | 0 | (1,130,154) | (7.1) | (3.47) |

| Effective Gross Income | $11,692,983 | $13,061,704 | $13,621,126 | $13,883,734 | 15,919,171 | 100.0% | $48.91 |

| | | | | | | | |

| Total Operating Expenses(4) | $5,548,554 | $5,430,457 | $5,568,157 | $5,449,452 | $6,484,958 | 40.7% | $19.92 |

| | | | | | | | |

| Net Operating Income | $6,144,429 | $7,631,247 | $8,052,969 | $8,434,282 | $9,434,213 | 59.3% | $28.98 |

| TI/LC | 0 | 0 | 0 | 0 | 782,972 | 4.9 | 2.41 |

| Capital Expenditures | 0 | 0 | 0 | 0 | 65,102 | 0.4 | 0.20 |

| Net Cash Flow | $6,144,429 | $7,631,247 | $8,052,969 | $8,434,282 | $8,586,140 | 53.9% | $26.38 |

| | | | | | | | |

| NOI DSCR(5) | 1.31x | 1.63x | 1.72x | 1.80x | 2.01x | | |

| NCF DSCR(5) | 1.31x | 1.63x | 1.72x | 1.80x | 1.83x | | |

| NOI DY(5) | 5.5% | 6.9% | 7.3% | 7.6% | 8.5% | | |

| NCF DY(5) | 5.5% | 6.9% | 7.3% | 7.6% | 7.7% | | |

| (1) | The increase in Net Operating Income from TTM 8/31/2017 to U/W is primarily attributable to newly executed leases, lease renewals, straight-line rent for investment grade tenants and contractual rent steps through November 2018 and the exclusion of rent abatements from U/W Effective Gross Income as the 16 Court Street Borrower (as defined below) reserved $485,028 at origination for free rent. |

| (2) | Underwritten Base Rent is inclusive of contractual rent steps through November 2018 totaling $720,158, straight-line rent for investment grade tenants totaling $214,576 and signed but not occupied rent of $39,536 for C.A. Goldberg, PLLC who is expected to be in occupancy by December 1, 2017. |

| (3) | Other Income consists of storage rent, license rent, late fees and other miscellaneous income. |

| (4) | Total Operating Expenses is inclusive of real estate taxes which were underwritten to a 10-year average. The 16 Court Street Property has a 15-year industrial and commercial incentive plan that began in fiscal year 2010/11. The 15-year phase-in reflects 11 years of 100.0% abatement with real estate taxes phasing in 20.0% per year from years 12 through 15. The real estate taxes are projected to begin the phase-in starting in 2021-2022. Real estate taxes are based on the lower of the phased-in value or the market value. |

| (5) | Debt service coverage ratios and debt yields are based on the 16 Court Street Whole Loan. |

Appraisal.As of the appraisal valuation date of September 25, 2017 the 16 Court Street Property had an “as-is” appraised value of $175,000,000. The appraiser also concluded to a hypothetical value of the lower and upper floor components (Floors 26-36) of the 16 Court Street Property, assuming they are independent condominium units with a value conclusion of $150,000,000 for the lower condominium unit and $30,000,000 for the upper condominium unit.

Environmental Matters. According to a Phase I environmental site assessment dated June 13, 2017, there was no evidence of any recognized environmental conditions at the 16 Court Street Property.

Market Overview and Competition.The 16 Court Street Property is located in Downtown Brooklyn, on the corner of Court Street and Montague Street. According to a third party report, the Downtown Brooklyn office submarket, which contains approximately 27 million square feet of net rentable area, has a vacancy rate of 12.5%. According to the appraisal, there are 19 Class A and Class B office buildings located in Downtown Brooklyn that compete directly with the 16 Court Street Property and have a total of approximately 9.3 million square feet of net rentable area and a vacancy rate of 3.8%. The 16 Court Street Property is one subway stop from Manhattan. The Borough Hall subway station and the Jay Street subway station provide transportation connectivity via the A, C, F, M, R, Q, G, N, 2, 3, 4 and 5 trains, which provide access to multiple Manhattan and outer neighborhoods. According to a third party report, the population within a one- and three-mile radius of the 16 Court Street Property is 114,486 and 1,049,392, respectively, and the median household income within a one- and three-mile radius of the 16 Court Street Property is $105,677 and $76,527, respectively.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

16 COURT STREET

The following table presents certain information relating to comparable leases to the 16 Court Street Property:

Comparable Leases(1)

| Property Name/Location | Year Built / Renovated | Class | Stories | Total GLA (SF) | Tenant Name | Lease Date/Term | Lease

Area

(SF) | Annual

Base

Rent

PSF | Lease

Type |

Atlantic Terminal Brooklyn, NY | 2003/N/A | A | 14 | 399,700 | Confidential | May 2017 / 10 Yrs | 12,973 | $53.17 | Gross |

1 Pierrepont Plaza Brooklyn, NY | 1988/N/A | A | 19 | 770,000 | Law Department | Sept. 2017 / 10 Yrs | 39,808 | $47.50 | Gross |

| | | | | | Federal Defender | May 2017 / 10 Yrs | 17,273 | $50.50 | Gross |

| | | | | | FDNY-Pending | May 2017 / 15 Yrs | 42,107 | $49.00 | Gross |

| | | | | | SSRC-Pending | May 2017 / 10 Yrs | 27,241 | $47.50 | Gross |

| | | | | | Dime Savings Bank of Williamsburgh | May 2016 / 10 Yrs | 40,481 | $50.00 | Gross |

One Willoughby Street Brooklyn, NY | Proposed 2021 | A | 34 | 472,671 | Confidential | May 2017 / 10 Yrs | 38,612 | $60.82 | Gross |

32 Court Street Brooklyn, NY | 1908/N/A | B | 22 | 115,586 | Confidential | May 2017 / 12 Yrs | 1,975 | $50.00 | Gross |

185 Montague Street Brooklyn, NY | 1929/N/A | B | 12 | 55,000 | Lindamood-Bell Learning | April 2017 / 10 Yrs | 2,300 | $50.00 | Gross |

41 Flatbush Avenue Brooklyn, NY | 1920/2017 | B | 10 | 233,712 | Confidential | March 2017 / 10 Yrs | 26,970 | $60.00 | Gross |

| (1) | Information obtained from the appraisal. All listed properties are within 1.5 miles of the 16 Court Street Property. |

The Borrower.The borrower for the 16 Court Street Whole Loan is 16 Court St Brooklyn Owner, LLC, a Delaware limited liability company and a special purpose entity with two independent directors (the “16 Court Street Borrower”). Legal counsel to the 16 Court Street Borrower delivered a non-consolidation opinion in connection with the origination of the 16 Court Street Whole Loan. CIM SMA I Investments, LLC is the guarantor of certain nonrecourse carveouts under the 16 Court Street Whole Loan. The nonrecourse carve-out guarantor will be required to maintain a minimum net worth, excluding its interest in the 16 Court Street Property, of $111,000,000 and liquidity of at least $11,100,000.

The Borrower Sponsor.The borrower sponsor is CIM SMA I Investments, LLC, a subsidiary of CIM Group, LLC (“CIM”). CIM is a real estate investment firm that focuses on infrastructure investment, property management, leasing, asset management, development, acquisition and investment advisory services. CIM has approximately $19.7 billion of real estate assets under management across its various funds. CIM invests in major metropolitan markets in the United States, such as San Francisco, Los Angeles and New York City. CIM was founded in 1994 and is headquartered in Los Angeles, California. The company has additional offices in Oakland, California, Bethesda, Maryland, Dallas, Texas, and New York, New York.

Escrows.The loan documents provide for upfront reserves in the amount of $3,347,154 for sprinkler work, $485,028 for outstanding free rent and $141,392 for outstanding tenant improvements and leasing commissions.

The loan documents provide for ongoing monthly escrows of (a) $5,438 for capital expenditures and (b) $27,190 for tenant improvements and leasing commissions. During the continuance of a Cash Sweep Period (as defined below), the 16 Court Street Borrower is required to escrow monthly (i) 1/12 of the annual estimated tax payments and (ii) 1/12 of the annual insurance premiums (unless the 16 Court Street Property is insured via an acceptable blanket insurance policy and such policy is in full force and effect). Additionally, the 16 Court Street Borrower will be required to deposit all excess cash flow into the sprinkler work reserve during the continuance of a Cash Sweep Period. The 16 Court Street Borrower shall not be required to make deposits to the sprinkler work reserve to the extent that any such deposit would increase the amount on deposit in the sprinkler work reserve above the Sprinkler Work Reserve Cap (as defined below). The 16 Court Street Borrower is required to complete the sprinkler work to the lender’s satisfaction on or prior to June 30, 2019.

A “Cash Sweep Period” will commence (i) upon the occurrence of an event of default, (ii) upon the net operating income debt yield for the 16 Court Street Whole Loan falling below 6.75% for two consecutive calendar quarters or (iii) as of June 30, 2019 if the sprinkler work has not been completed. A Cash Sweep Period will continue until, in regard to clause (i) above, the cure of such event of default and acceptance of such cure by the lender, in regard to clause (ii) above, the net operating income debt yield for the 16 Court Street Whole Loan is equal to or greater than 6.75% for two consecutive calendar quarters, or in regard to clause (iii) above, (a) the date the lender determines, in its sole but reasonable discretion, that the aggregate amount of funds deposited into the sprinkler work reserve account is at least 110% of the estimated remaining costs required to complete the sprinkler work (the “Sprinkler Work Reserve Cap”) and (b) the completion of the sprinkler work to the lender’s sole but reasonable satisfaction (as evidenced by documentation provided by the 16 Court Street Borrower to the lender or such other documentation as the lender may reasonably request). If more than one event giving rise to a Cash Sweep Period has occurred and is continuing, then the Cash Sweep Period will not terminate unless a cure has occurred with respect to each such event.

Lockbox and Cash Management.The 16 Court Street Whole Loan is structured with a hard lockbox and springing cash management. The borrower was required at origination to deliver letters to all tenants at the 16 Court Street Property directing them to pay all rents directly into a lender-controlled lockbox account. All funds received by the borrower or manager are required to be deposited in the lockbox account within three business days following receipt. During the occurrence and continuance of a Cash Sweep Period, all funds

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

16 COURT STREET

are required to be swept each business day into the cash management account controlled by the lender and disbursed on each payment date in accordance with the loan documents, with all excess cash flow to be deposited to an excess cash reserve to be held as additional security for the 16 Court Street Whole Loan.

Property Management. The 16 Court Street Property is managed by an affiliate of the borrower.

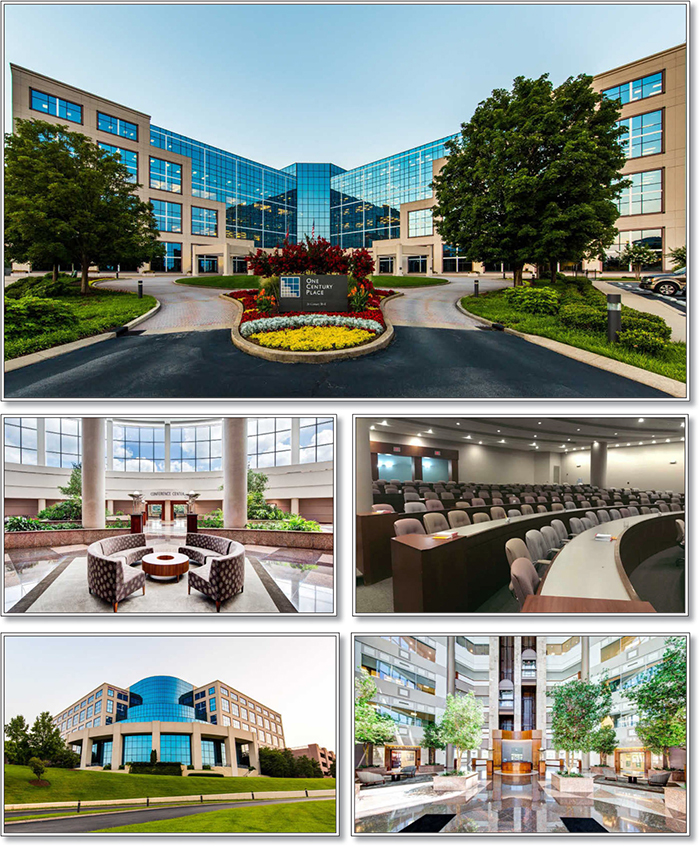

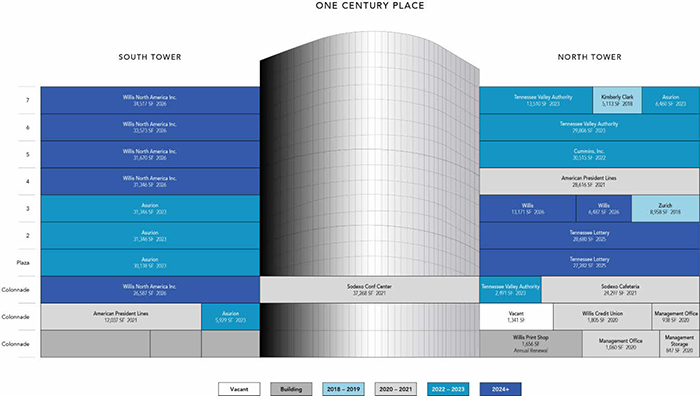

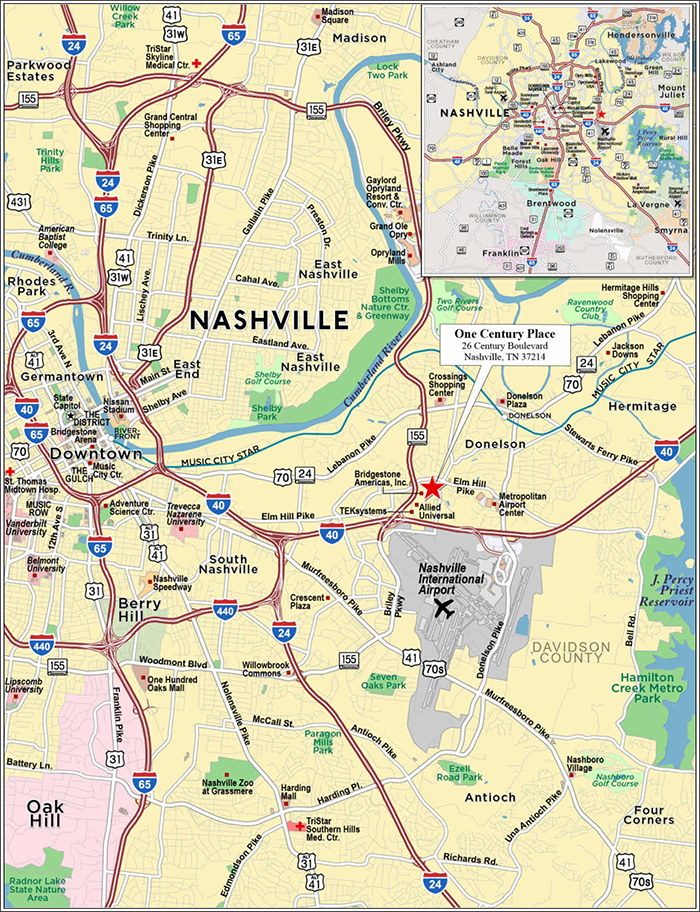

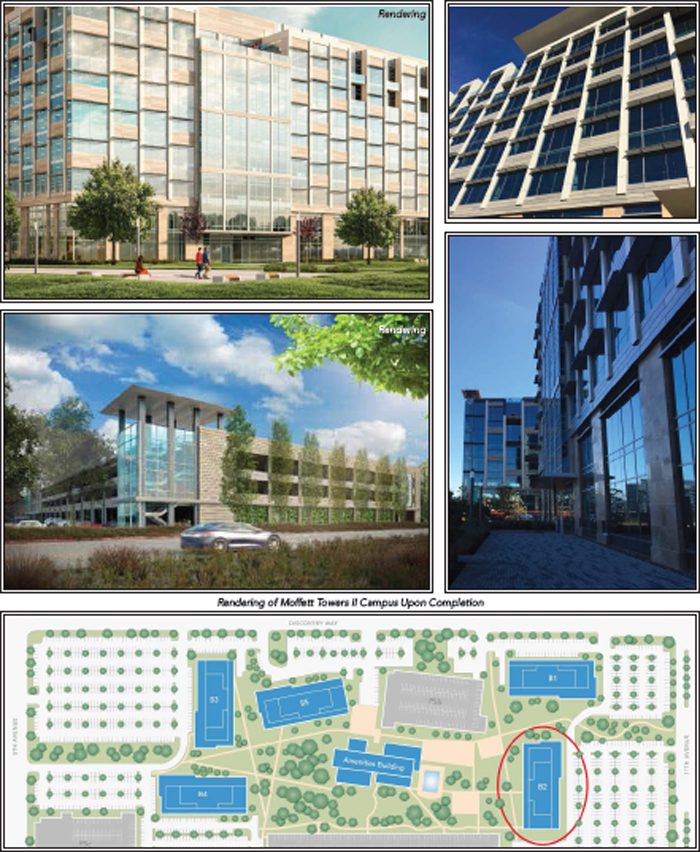

Assumption.The borrower has, at any time (other than the period 60 days after a securitization of a note) the one-time right to transfer the 16 Court Street Property, provided that certain conditions are satisfied, including: (i) no event of default has occurred and is continuing, (ii) the borrower has provided the lender with 30 days’ prior written notice, (iii) the proposed transferee qualifies as a qualified transferee under the 16 Court Street Whole Loan documents, (iv) the payment of a transfer fee of one percent of the then outstanding principal balance of the 16 Court Street Whole Loan, and (v) the lender has received confirmation from KBRA, Fitch and Moody’s that such assumption will not result in a downgrade of the respective ratings assigned to the Series 2017-C42 certificates and similar confirmations from each rating agency rating any securities backed by any of the 16 Court Street Companion Loans.