Exhibit 99.2

Opes Acquisition Corp|BurgerFi Merger Investor Presentation June 2020

Disclaimer 2 Opes Acquisition Corp . , a Delaware corporation (“OPES”), and BurgerFi International LLC, a Delaware limited liability company (“BurgerFi”) and their respective directors, executive officers, members, managers, employees and other persons may be deemed to be participants in the solicitation of proxies from the holders of OPES’s common stock in respect of the proposed transaction described herein . Information about OPES’s directors and executive officers and their ownership of OPES’s common stock is set forth in OPES’s Annual Report on Form 10 - K, dated March 30 , 2020 and the proxy statement on Definitive Schedule 14 A dated June 5 , 2020 , filed with the Securities and Exchange Commission (the “SEC”), as modified or supplemented by any Form 3 or Form 4 filed with the SEC since the date of such filing . Other information regarding the interests of the participants in the proxy solicitation will be included in the proxy statement pertaining to the proposed transaction when it becomes available . These documents can be obtained free of charge from the sources indicated below . In connection with the transaction between OPES and BurgerFi, OPES will file relevant materials with the SEC, including a proxy statement on Schedule 14 A . Promptly after filing its definitive proxy statement with the SEC, OPES will mail the definitive proxy statement and a proxy card to each stockholder entitled to vote at the special meeting relating to the transaction . INVESTORS AND SECURITY HOLDERS OF THE PURCHASER ARE URGED TO READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE TRANSACTION THAT THE PURCHASER WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT OPES, BURGERFI AND THE TRANSACTION . The definitive proxy statement, the preliminary proxy statement and other relevant materials in connection with the transaction (when they become available), and any other documents filed by OPES with the SEC, may be obtained free of charge at the SEC’s website (www . sec . gov) or by writing to OPES at : 4218 NE 2 nd Avenue, Miami, FL 33137 . This presentation contains certain “forward - looking statements” within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934 , both as amended by the Private Securities Litigation Reform Act of 1995 . The words “expect,” “believe,” “estimate,” “intend,” “plan,” and similar expressions indicate forward - looking statements . Statements that are not historical facts, including statements about the pending transaction between OPES and BurgerFi and the transactions contemplated thereby, and the parties’ perspectives and expectations, are forward - looking statements . Such statements include, but are not limited to, statements regarding the proposed transaction, including the anticipated initial enterprise value and post - closing equity value, the benefits of the proposed transaction, integration plans, expected synergies and revenue opportunities, anticipated future financial and operating performance and results, including estimates for growth, the expected management and governance of the combined company, and the expected timing of the transactions contemplated by the membership interest purchase agreement between OPES and BurgerFi, dated June 30 , 2020 (the “Acquisition Agreement”) . These forward - looking statements are not guarantees of future performance and are subject to various risks and uncertainties, assumptions (including assumptions about general economic, market, industry and operational factors), known or unknown, which could cause the actual results to vary materially from those indicated or anticipated . Such risks and uncertainties include, but are not limited to : (i) risks related to the expected timing and likelihood of the pending transaction, including the risk that the transaction may not close due to one or more closing conditions to the transaction not being satisfied or waived, such as certain required conditions, limitations or restrictions in connection with such approvals, or that the required approval of the Acquisition Agreement by the stockholders of OPES ; (ii) the occurrence of any event, change or other circumstances that could give rise to the termination of the Acquisition Agreement ; (iii) the risk that there may be a material adverse effect on the business, properties, assets, liabilities, results of operations or condition (financial or otherwise), of OPES, BurgerFi or its subsidiaries or franchisees, taken as a whole ; (iv) risks related to disruption of management time from ongoing business operations due to the proposed Business Combination ; (v) the risk that the proposed transaction and its announcement could have an adverse effect on the ability of BurgerFi to retain customers and retain and hire key personnel and maintain relationships with their suppliers, franchisees and customers and on their operating results and businesses generally ; (vi) risks related to successfully integrating the companies, which may result in the combined company not operating as effectively and efficiently as expected ; (vii) any announcements relating to the proposed Business Combination could have adverse effects on the market price of OPES’s common stock ; and (viii) other risks and uncertainties and other factors identified in OPES’s prior and future filings with the SEC, available at www . sec . gov . A further list and description of risks and uncertainties can be found in OPES’s Annual Report on Form 10 - K, dated March 30 , 2020 and in the proxy statement on Schedule 14 A that will be filed with the SEC by OPES in connection with the proposed transaction, and other documents that the parties may file or furnish with the SEC, which you are encouraged to read . Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward - looking statements . Important factors that could cause the combined company’s actual results or outcomes to differ materially from those discussed in the forward - looking statements include : (i) BurgerFi’s ability to manage growth ; (ii) BurgerFi’s ability to execute its business plan ; (iii) BurgerFi’s estimates of the size of the markets for its products ; (iv) potential litigation involving BurgerFi ; (v) the validity or enforceability of BurgerFi’s intellectual property ; and (vi) the demand for BurgerFi’s products . Accordingly, you are cautioned not to place undue reliance on these forward - looking statements . Forward - looking statements relate only to the date they were made, and OPES and BurgerFi, and their respective subsidiaries, if any, undertake no obligation to update forward - looking statements to reflect events or circumstances after the date they were made except as required by law or applicable regulation .

BurgerFi is a fast - casual “better burger” concept with approximately 125 franchised and corporate - owned units, delivering an all - natural premium burger experience in a refined, contemporary environment. BurgerFi is committed to uncompromising and rewarding dining that appeals to an informed consumer base – those placing a high value on quality ingredients, transparency and a desire to avoid antibiotics, steroids, chemicals and additives. 3

Table of Contents 4 Section I Company Overview Section II Growth Strategy Section III Company Financials Section IV Transaction Details Section V A pp e nd ix 5 11 17 19 22

Section 1 Company Overview

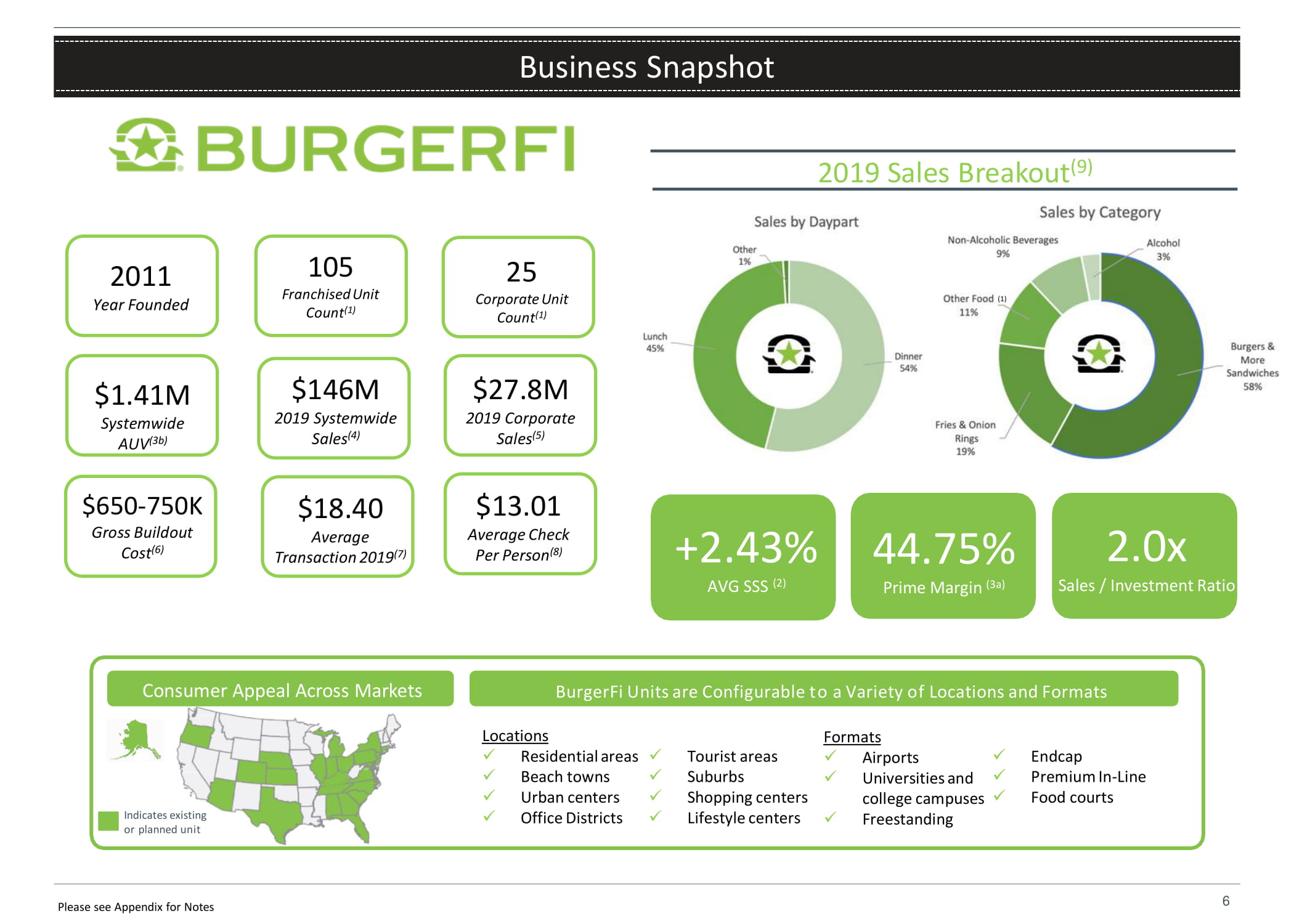

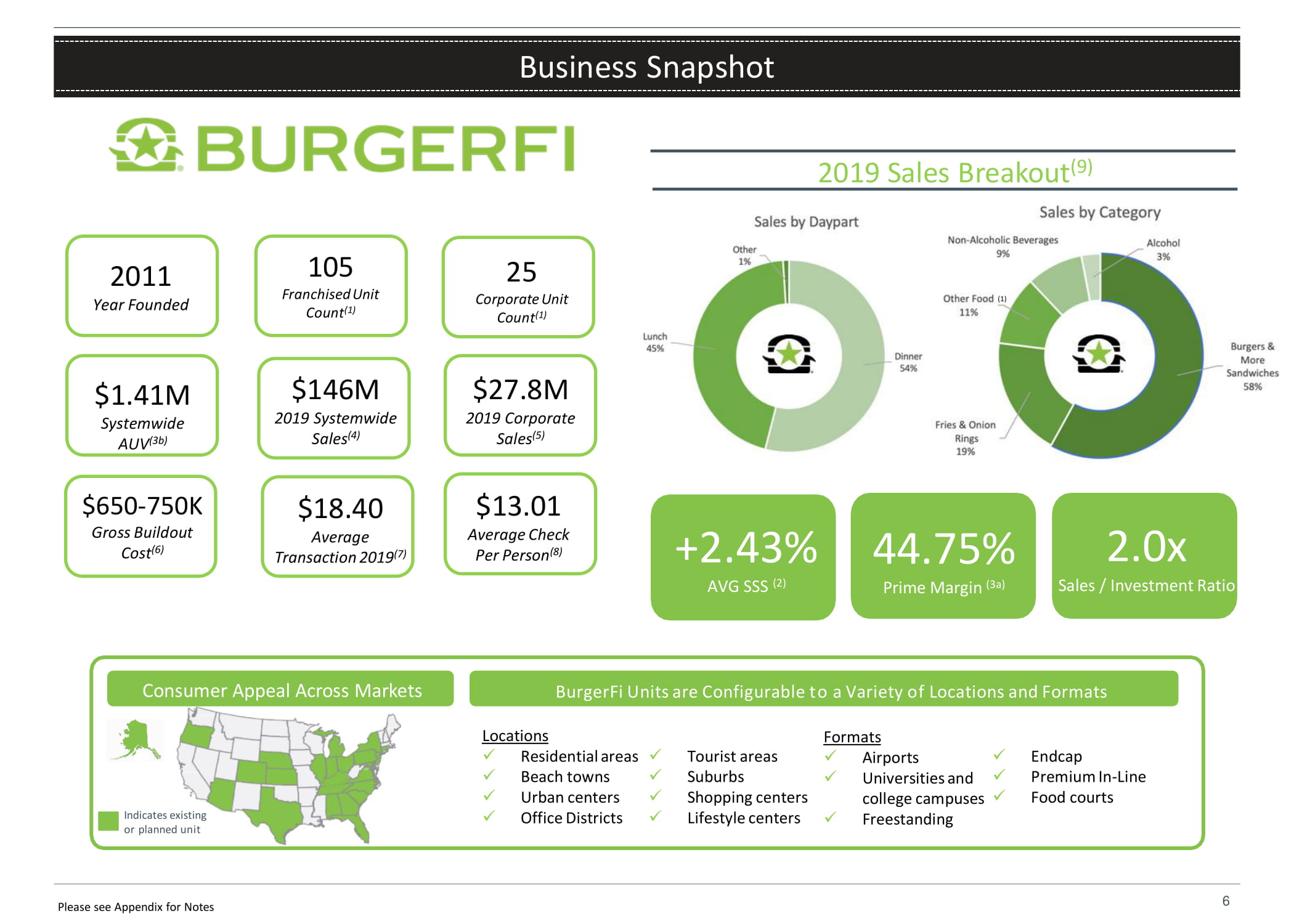

6 Business Snapshot 2011 Year Founded $1.41M S y s t em wid e AUV (3b) 105 F r an chi se d U ni t Count (1) $146M 2019 Systemwide Sales (4) $650 - 750K Gross Buildout Cost (6) $27.8M 2019 Corporate Sales (5) $18.40 Average Transaction 2019 (7) $13.01 Average Check Per Person (8) 2019 Sales Breakout (9) (1 ) BurgerFi Units are Configurable to a Variety of Locations and Formats Indicates existing or planned unit Locations x Residential areas x Beach towns x Urban centers x Office Districts x Tourist areas x Suburbs x Shopping centers x Lifestyle centers F o r m a t s x Airports x Universities and college campuses x x Freestanding x Endcap x Premium In - Line Food courts Consumer Appeal Across Markets +2.43% AVG SSS (2) 44.75% Prime Margin (3a) 2.0x Sales / Investment Ratio 25 Corporate Unit Count (1) Please see Appendix for Notes

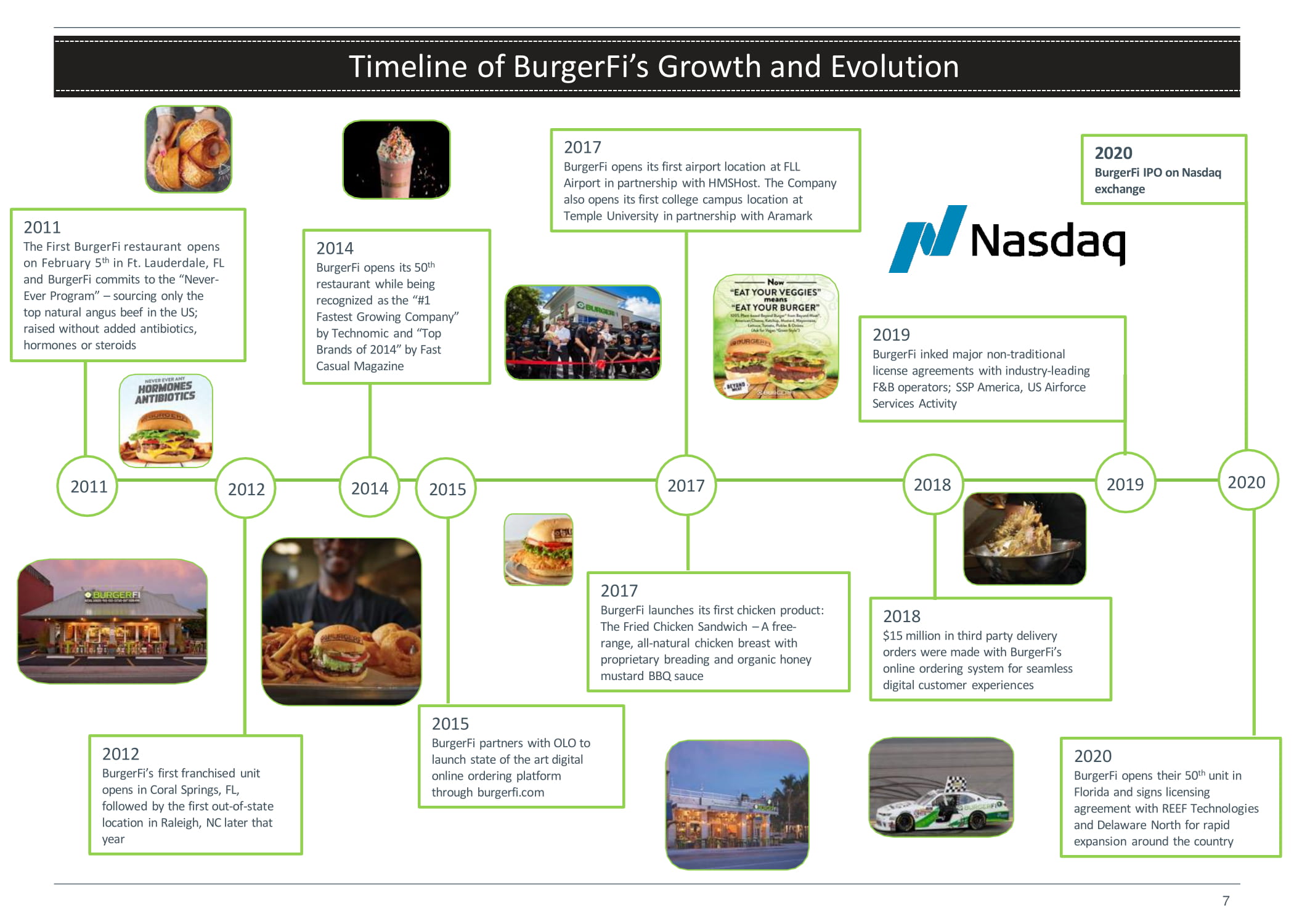

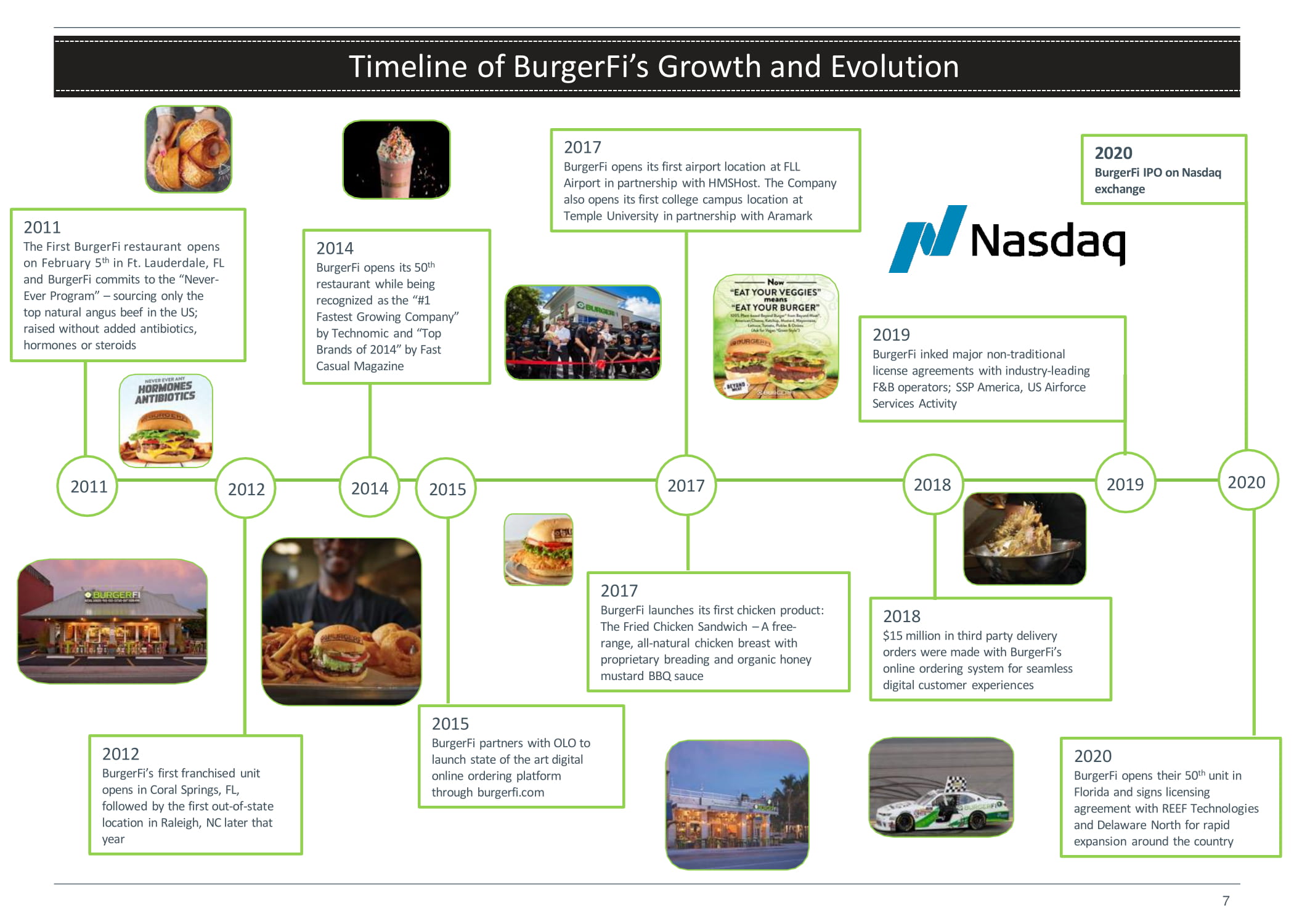

2011 The First BurgerFi restaurant opens on February 5 th in Ft. Lauderdale, FL and BurgerFi commits to the “Never - Ever Program” – sourcing only the top natural angus beef in the US; raised without added antibiotics, hormones or steroids 201 1 7 2012 BurgerFi’s first franchised unit opens in Coral Springs, FL, followed by the first out - of - state location in Raleigh, NC later that year 201 2 2014 BurgerFi opens its 50 th restaurant while being recognized as the “#1 Fastest Growing Company” by Technomic and “Top Brands of 2014” by Fast Casual Magazine 20 1 4 201 5 2015 BurgerFi partners with OLO to launch state of the art digital online ordering platform through burgerfi.com 201 7 2017 BurgerFi opens its first airport location at FLL Airport in partnership with HMSHost. The Company also opens its first college campus location at Temple University in partnership with Aramark 2017 BurgerFi launches its first chicken product: The Fried Chicken Sandwich – A free - range, all - natural chicken breast with proprietary breading and organic honey mustard BBQ sauce 201 8 201 9 2019 BurgerFi inked major non - traditional license agreements with industry - leading F&B operators; SSP America, US Airforce Services Activity 2018 $15 million in third party delivery orders were made with BurgerFi’s online ordering system for seamless digital customer experiences Timeline of BurgerFi’s Growth and Evolution 2020 2020 BurgerFi opens their 50 th unit in Florida and signs licensing agreement with REEF Technologies and Delaware North for rapid expansion around the country 2020 BurgerFi IPO on Nasdaq exchange

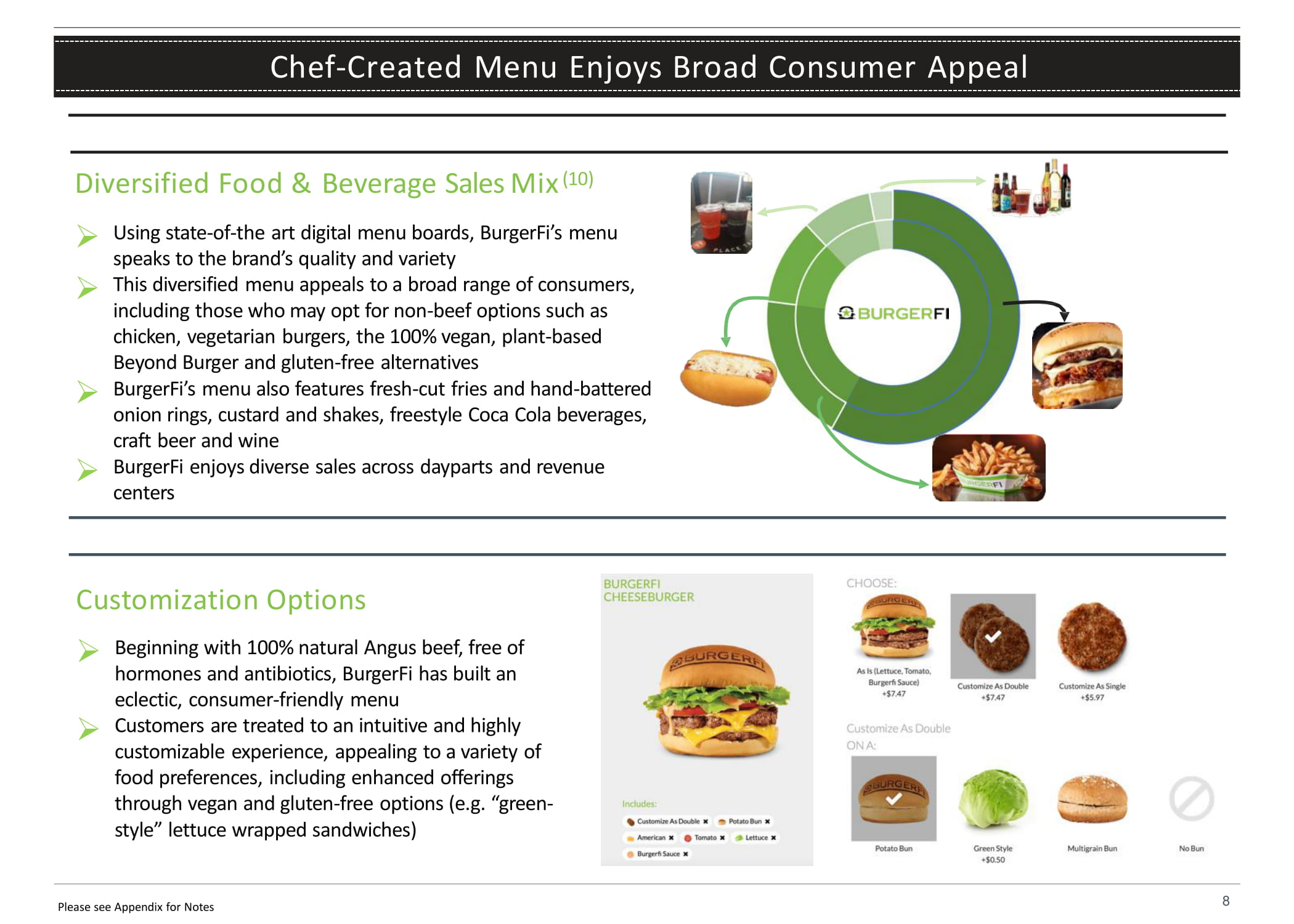

Chef - Created Menu Enjoys Broad Consumer Appeal Diversified Food & Beverage Sales Mix (10) » » » » Using state - of - the art digital menu boards, BurgerFi’s menu speaks to the brand’s quality and variety This diversified menu appeals to a broad range of consumers, including those who may opt for non - beef options such as chicken, vegetarian burgers, the 100 % vegan, plant - based Beyond Burger and gluten - free alternatives BurgerFi’s menu also features fresh - cut fries and hand - battered onion rings, custard and shakes, freestyle Coca Cola beverages, craft beer and wine BurgerFi enjoys diverse sales across dayparts and revenue centers Customization Options » Beginning with 100% natural Angus beef, free of hormones and antibiotics, BurgerFi has built an eclectic, consumer - friendly menu » Customers are treated to an intuitive and highly customizable experience, appealing to a variety of food preferences, including enhanced offerings through vegan and gluten - free options (e.g. “green - style” lettuce wrapped sandwiches) 8 Please see Appendix for Notes

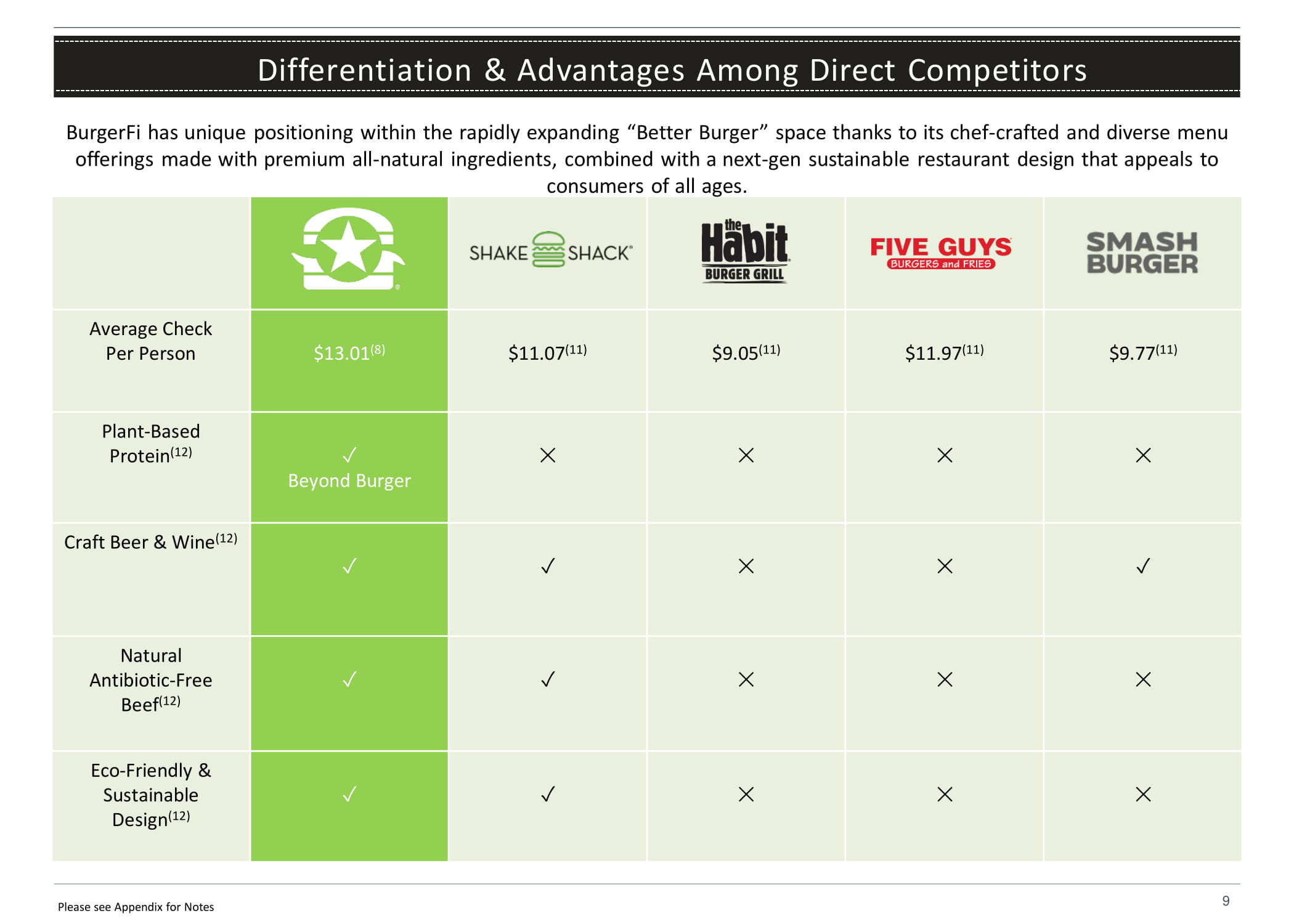

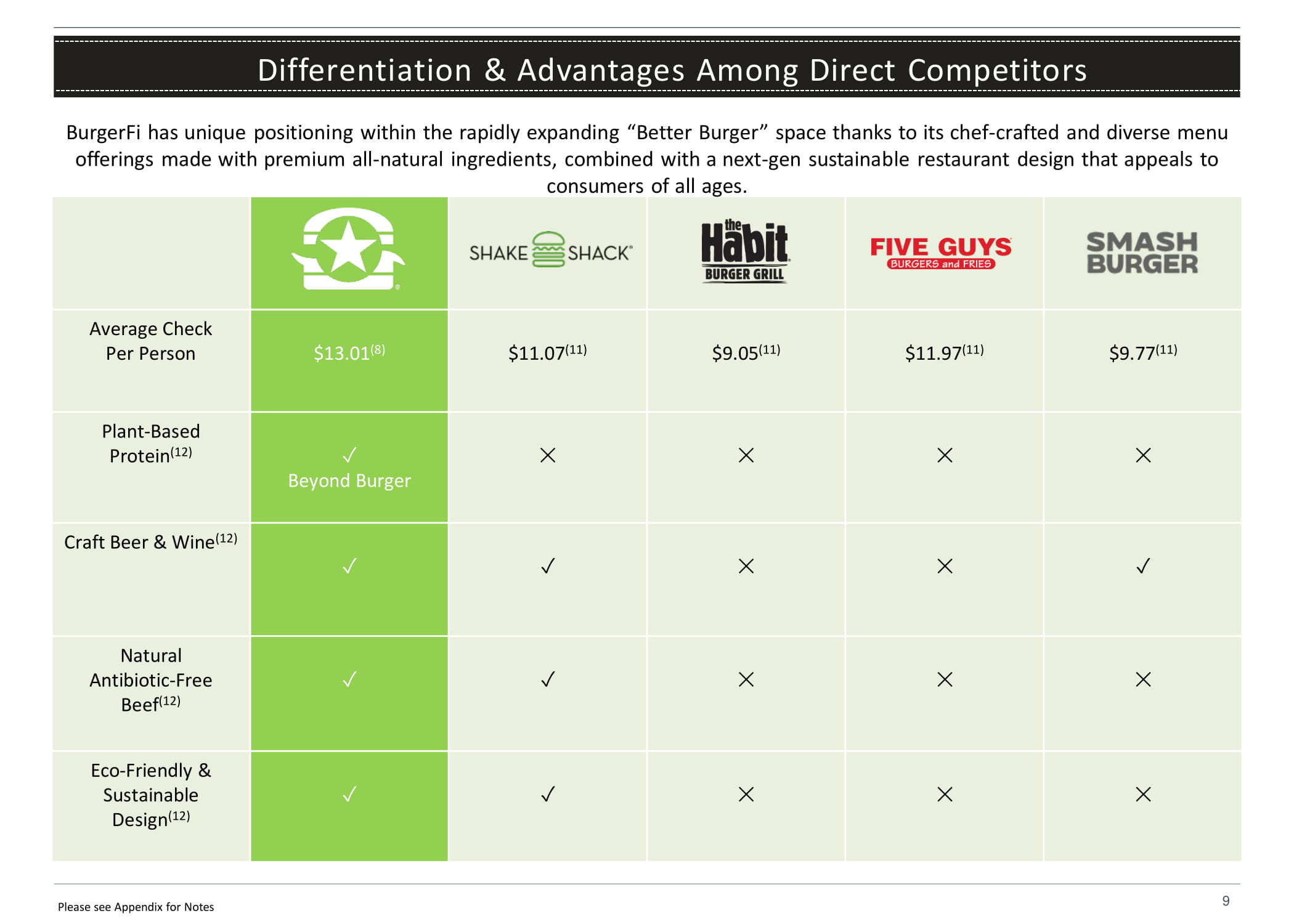

Differentiation & Advantages Among Direct Competitors Average Check Per Person $13.01 (8) $11.07 (11) $9.05 (11) $11.97 (11) $9.77 (11) P l a n t - B a s ed Protein (12) ض Beyond Burger ظ ظ ظ ظ Craft Beer & Wine (12) ض ض ظ ظ ض Natural A n t i b i o t i c - F r ee Beef (12) ض ض ظ ظ ظ Eco - Friendly & Sustainable Design (12) ض ض ظ ظ ظ BurgerFi has unique positioning within the rapidly expanding “Better Burger” space thanks to its chef - crafted and diverse menu offerings made with premium all - natural ingredients, combined with a next - gen sustainable restaurant design that appeals to consumers of all ages. 9 Please see Appendix for Notes

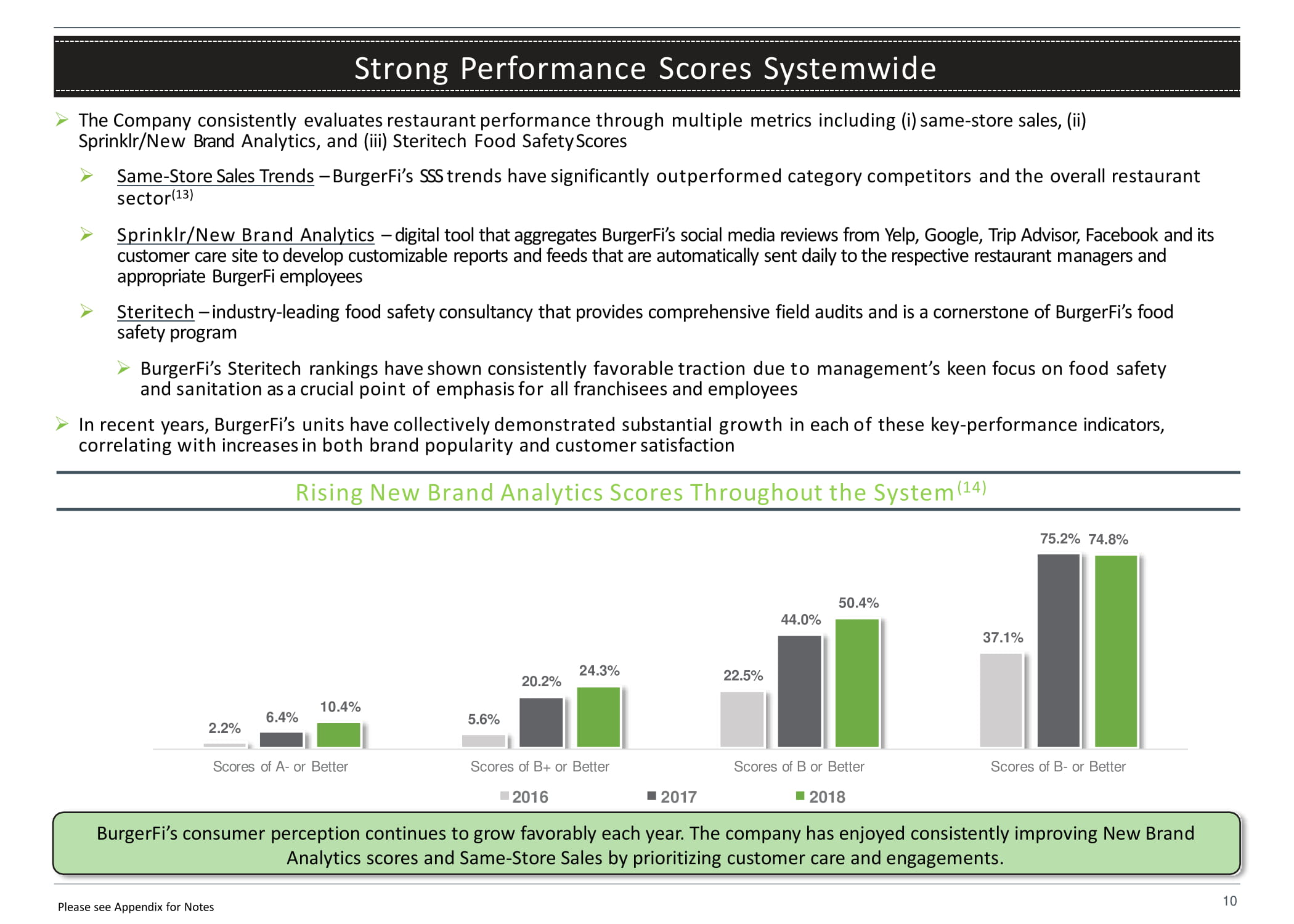

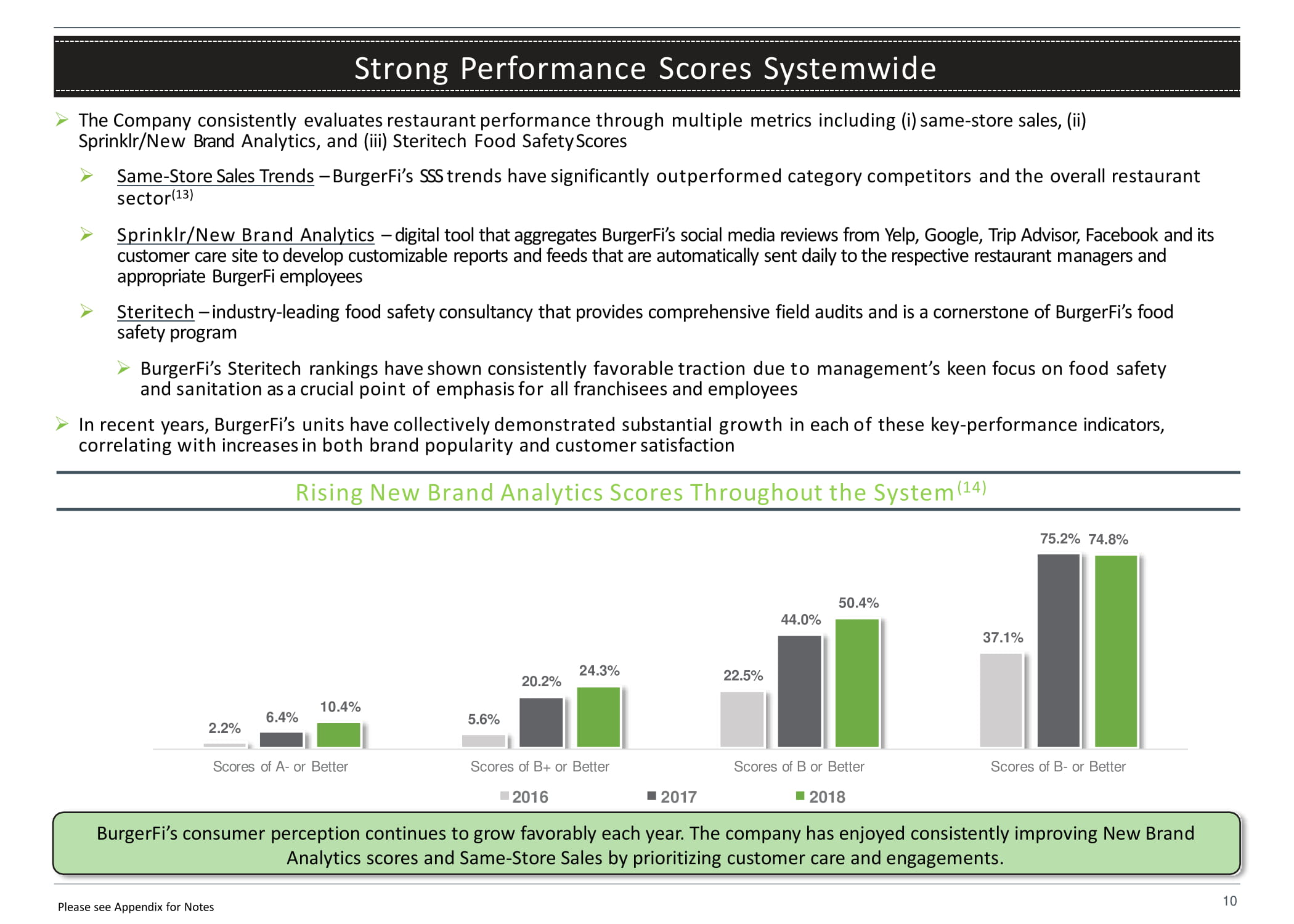

2 .2% 5 .6% 22.5% 37 .1% 6 .4% 20.2% 10 . 4% 24 .3% 50 .4% 44.0% Scores of A - or Better Scores of B - or Better Scores of B+ or Better 201 6 20 1 7 Scores of B or Better 2018 Strong Performance Scores Systemwide 10 Please see Appendix for Notes » The Company consistently evaluates restaurant performance through multiple metrics including (i) same - store sales, (ii) Sprinklr/New Brand Analytics, and (iii) Steritech Food Safety Scores » Same - Store Sales Trends – BurgerFi’s SSS trends have significantly outperformed category competitors and the overall restaurant sector (13) » Sprinklr/New Brand Analytics – digital tool that aggregates BurgerFi’s social media reviews from Yelp, Google, Trip Advisor, Facebook and its customer care site to develop customizable reports and feeds that are automatically sent daily to the respective restaurant managers and appropriate BurgerFi employees » Steritech – industry - leading food safety consultancy that provides comprehensive field audits and is a cornerstone of BurgerFi’s food safety program » BurgerFi’s Steritech rankings have shown consistently favorable traction due to management’s keen focus on food safety and sanitation as a crucial point of emphasis for all franchisees and employees » In recent years, BurgerFi’s units have collectively demonstrated substantial growth in each of these key - performance indicators, correlating with increases in both brand popularity and customer satisfaction Rising New Brand Analytics Scores Throughout the System (14) 75.2% 74.8% BurgerFi’s consumer perception continues to grow favorably each year. The company has enjoyed consistently improving New Brand Analytics scores and Same - Store Sales by prioritizing customer care and engagements.

1 1 Section 2 Growth Strategy

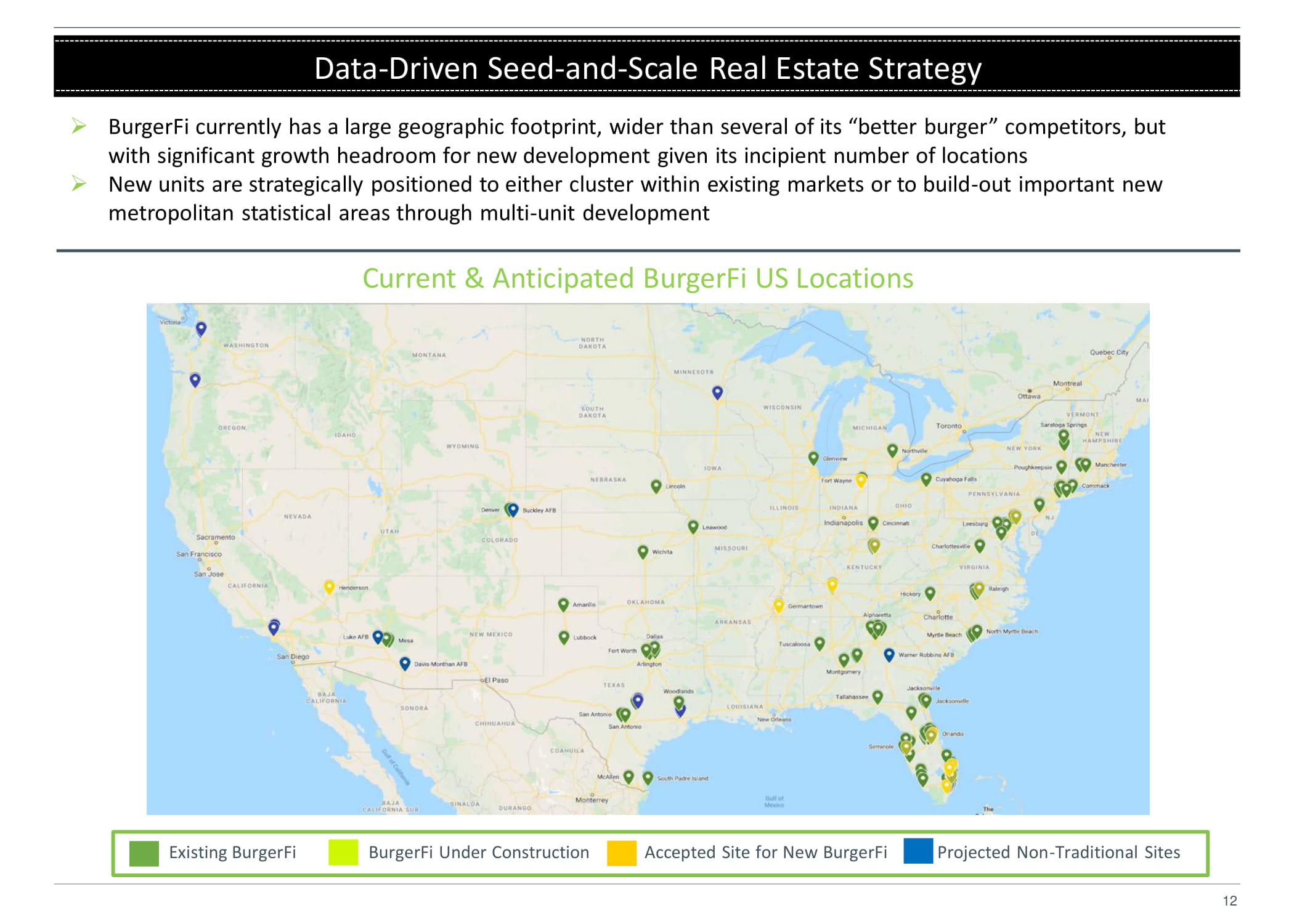

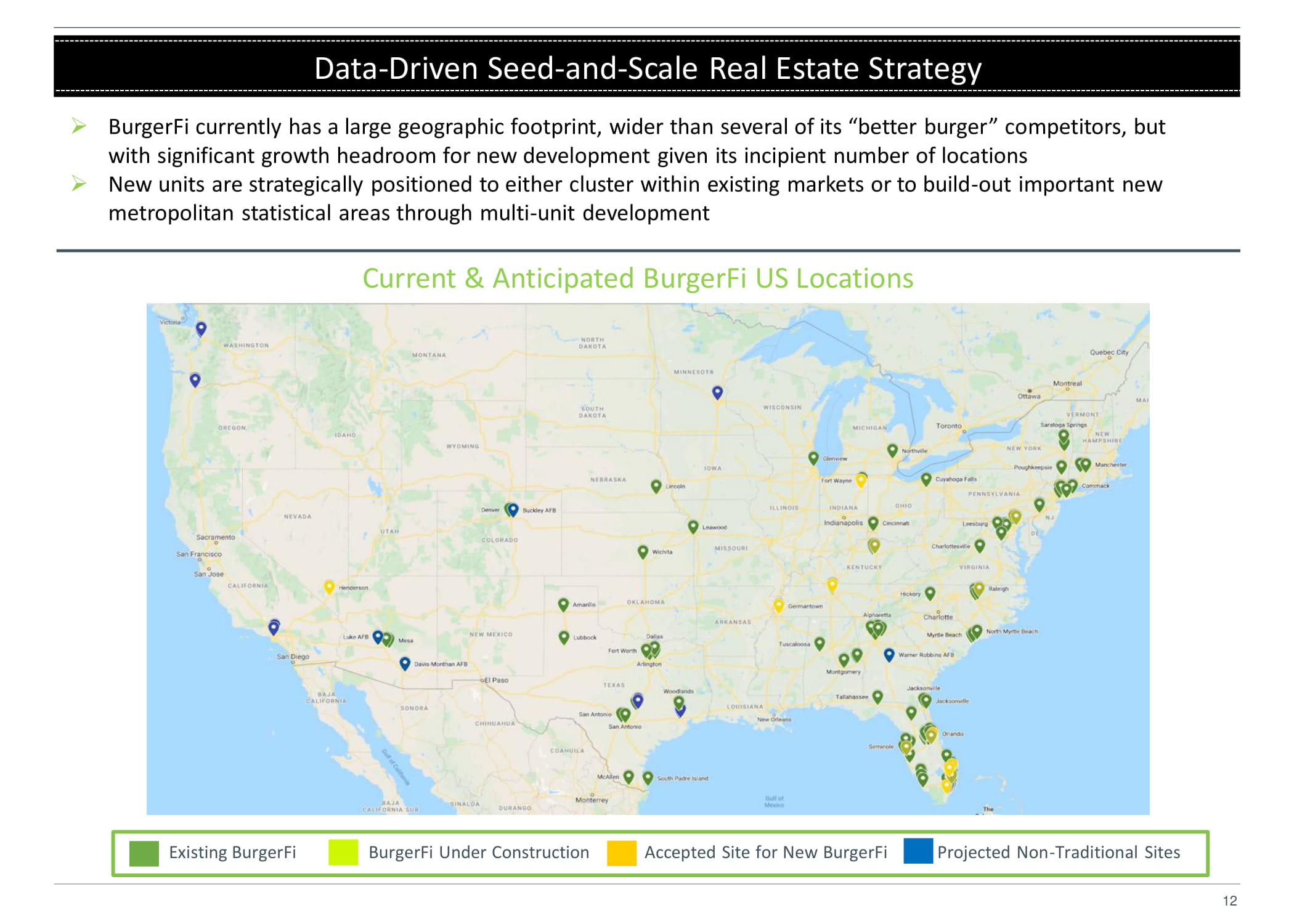

Existing BurgerFi BurgerFi Under Construction Accepted Site for New BurgerFi Projected Non - Traditional Sites Data - Driven Seed - and - Scale Real Estate Strategy » BurgerFi currently has a large geographic footprint, wider than several of its “better burger” competitors, but with significant growth headroom for new development given its incipient number of locations » New units are strategically positioned to either cluster within existing markets or to build - out important new metropolitan statistical areas through multi - unit development Current & Anticipated BurgerFi US Locations 12

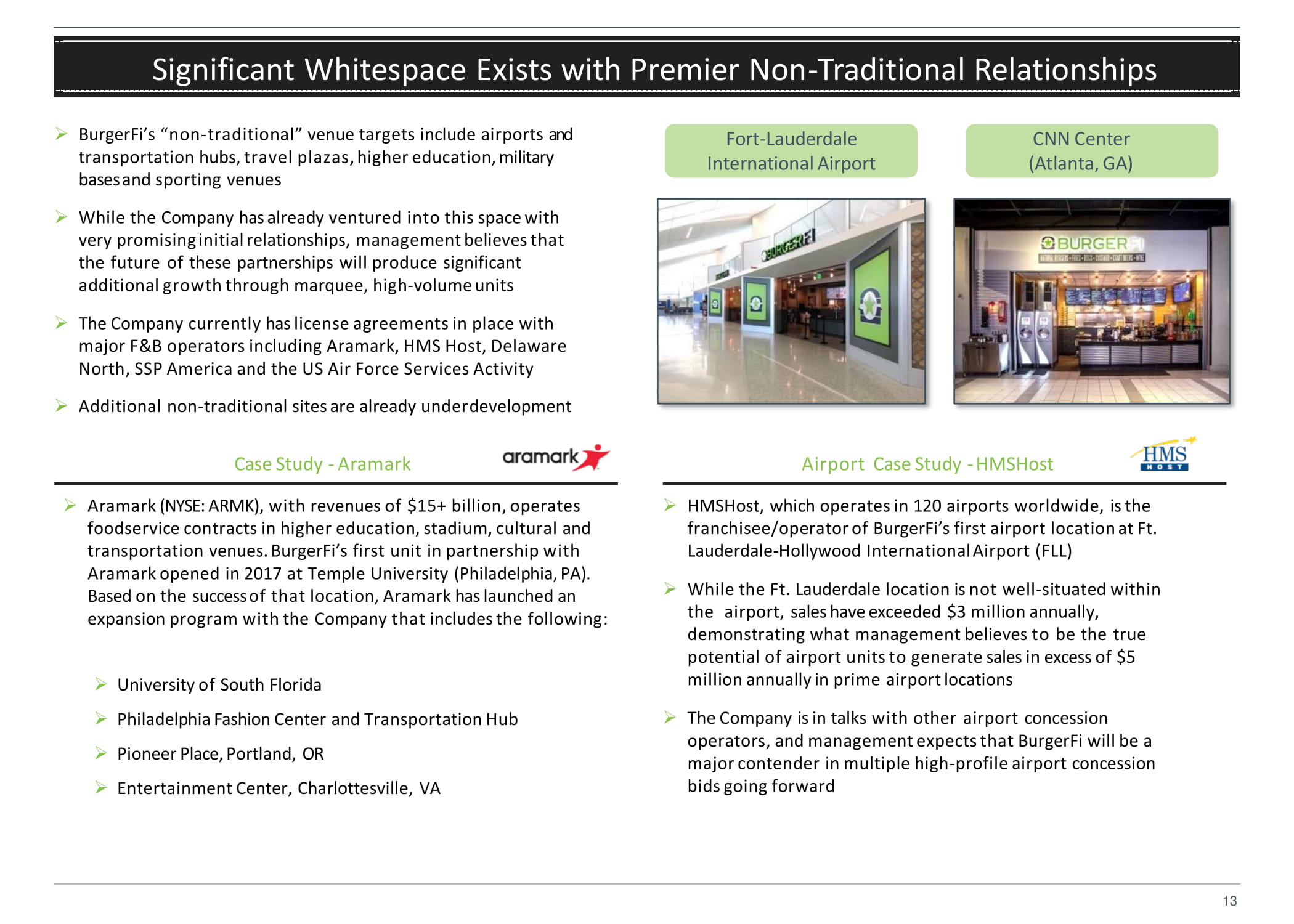

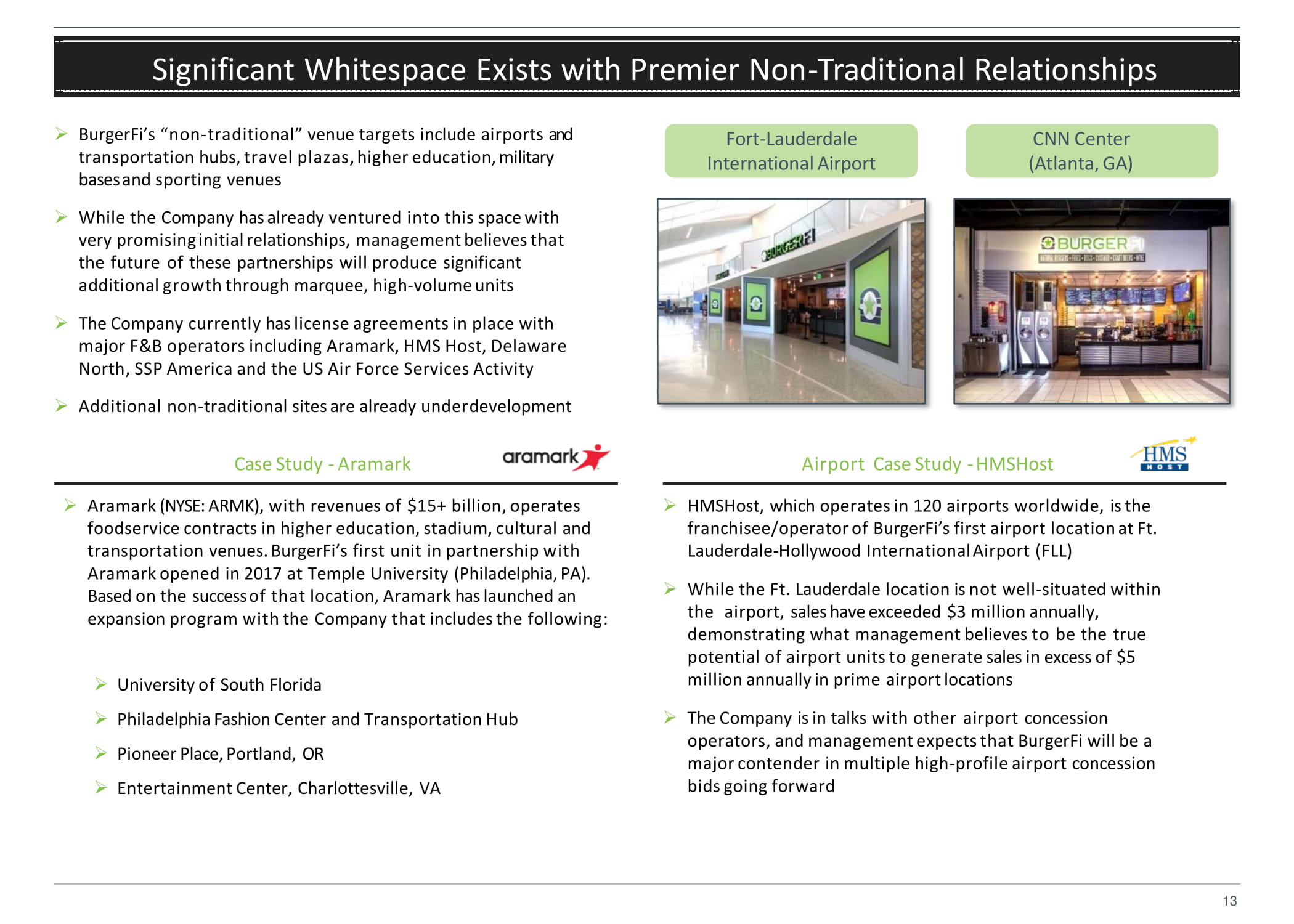

Fort - Lauderdale International Airport CNN Center (Atlanta, GA) » BurgerFi’s “non - traditional” venue targets include airports and transportation hubs, travel plazas, higher education, military bases and sporting venues » While the Company has already ventured into this space with very promising initial relationships, management believes that the future of these partnerships will produce significant additional growth through marquee, high - volume units » The Company currently has license agreements in place with major F&B operators including Aramark, HMS Host, Delaware North, SSP America and the US Air Force Services Activity » Additional non - traditional sites are already underdevelopment Case Study - Aramark » Aramark (NYSE: ARMK), with revenues of $15+ billion, operates foodservice contracts in higher education, stadium, cultural and transportation venues. BurgerFi’s first unit in partnership with Aramark opened in 2017 at Temple University (Philadelphia, PA). Based on the success of that location, Aramark has launched an expansion program with the Company that includes the following: » University of South Florida » Philadelphia Fashion Center and Transportation Hub » Pioneer Place, Portland, OR » Entertainment Center, Charlottesville, VA Airport Case Study - HMSHost » HMSHost, which operates in 120 airports worldwide, is the franchisee/operator of BurgerFi’s first airport location at Ft. Lauderdale - Hollywood International Airport (FLL) » While the Ft. Lauderdale location is not well - situated within the airport, sales have exceeded $3 million annually, demonstrating what management believes to be the true potential of airport units to generate sales in excess of $5 million annually in prime airport locations » The Company is in talks with other airport concession operators, and management expects that BurgerFi will be a major contender in multiple high - profile airport concession bids going forward Significant Whitespace Exists with Premier Non - Traditional Relationships 13

Prime margin defined as Corporate restaurant sales net of COGS and Labor divided by Revenue. Delivery - Only Expansion » BurgerFi signed a license agreement with REEF Technology in April 2020 » REEF Technology is the ecosystem that connects the world to your block. With a distributed real estate network of more than 5,000 locations and 10,000 logistics and real estate professionals across 50 cities, REEF is the largest operator of logistics hubs, and neighborhood kitchens in the United States. REEF develops ecosystems that connect people to the goods, services, and experiences that neighborhoods need to thrive » REEF Technology is valued at +$1B and is backed by SoftBank » New market expansion – Los Angeles, Seattle, Chicago, Houston, Nashville and Minneapolis » Penetration into markets that have been cost prohibitive for traditional brick and mortar restaurants » BurgerFi launched its first kitchen with REEF on June 15 in Miami » REEF is committed to having 25 operating kitchens by December 31, 2021 14

Prime margin defined as Corporate restaurant sales net of COGS and Labor divided by Revenue. US Air Force Partnership » BurgerFi signed a license agreement with the US Air Force Activity Services in October 2019 » Air Force Services chose BurgerFi to be part of a global initiative to enhance food quality, variety and availability on Air Force bases throughout the U.S. and abroad » Millennial and Gen - Z generations, who are largely represented in new recruits enlisting in military divisions, are more likely to demand high quality, natural food offerings. The military is turning to brands like BurgerFi to meet these preferences » Locations planned for development in 2020/2021 (AF = Air Force) » Luke AF Base – Phoenix, AZ » David Monson AF Base – Tucson, AZ » Buckley AF Base – Aurora, CO » Joint Base Elmendorf – Anchorage, AK » Robins AF Base – Warner Robins, GA » Offutt AF Base – Omaha, NE “ Our focus is on the changing lifestyles, needs and expectations of Airmen by adding recognizable, popular brands like BurgerFi to Air Force installations as we begin to redefine the food experience for our Airmen and their families. ” – Mike Baker, Chief Strategy and Innovation at Air Force Services Center 15

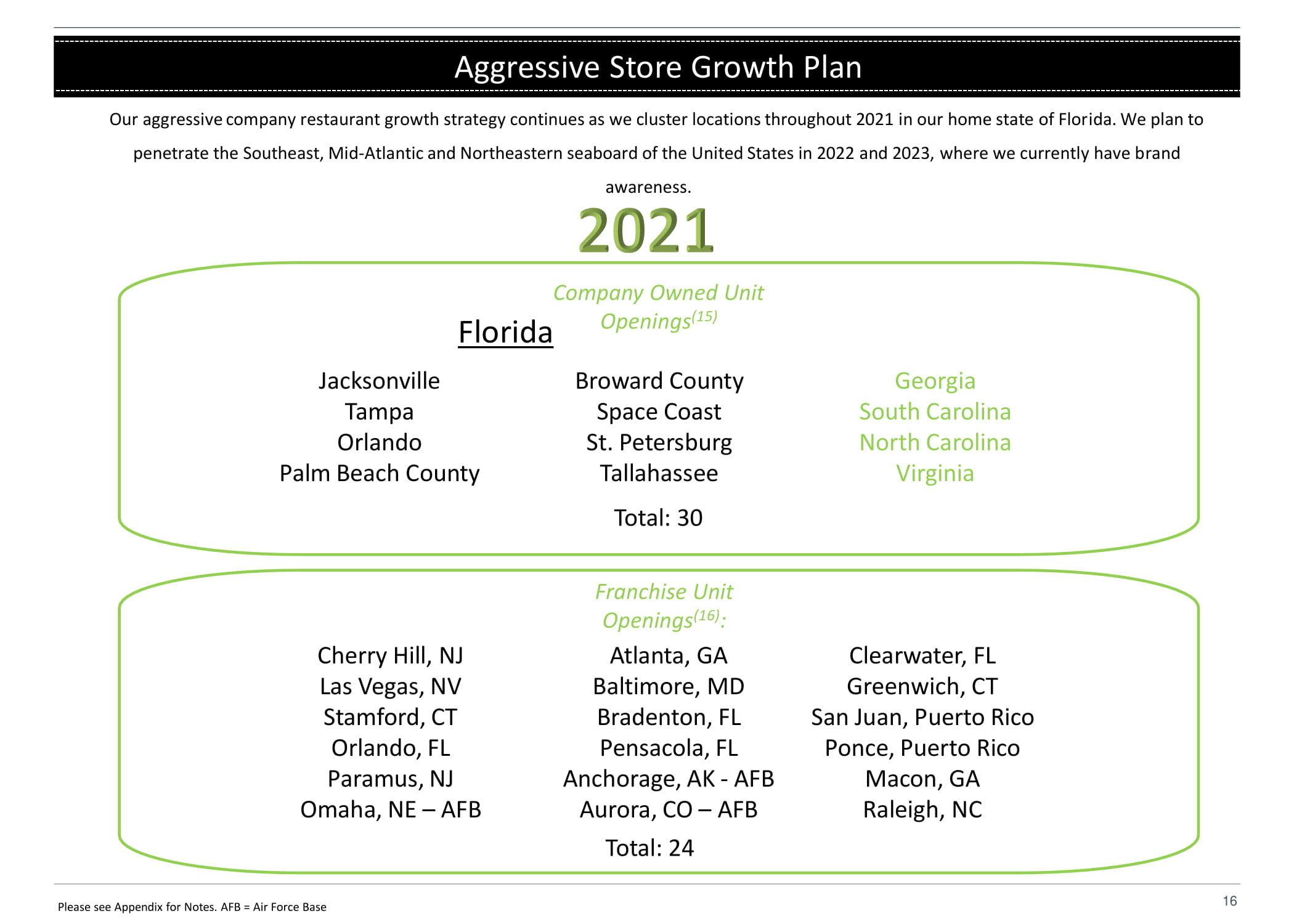

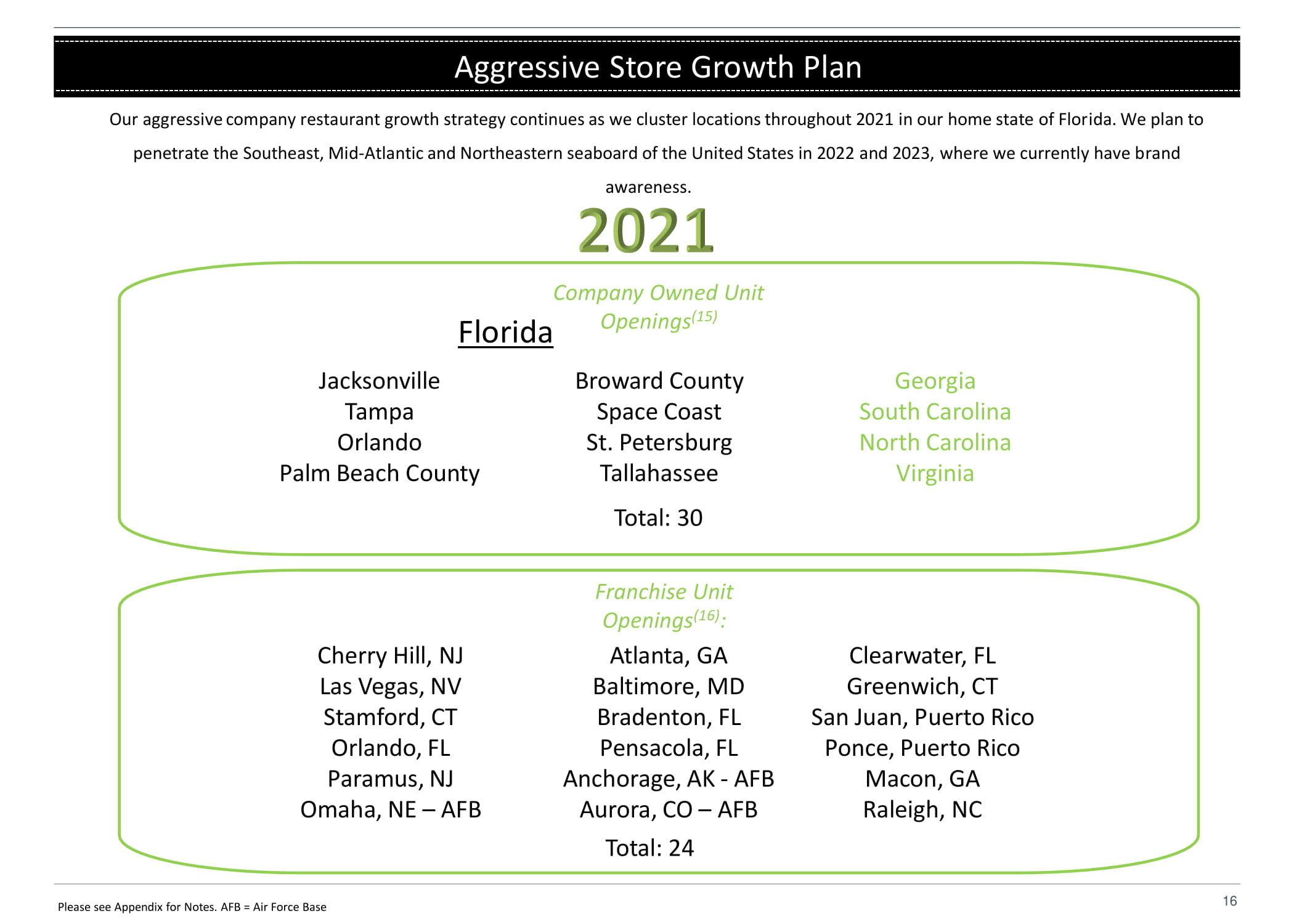

Our aggressive company restaurant growth strategy continues as we cluster locations throughout 2021 in our home state of Florida. We plan to penetrate the Southeast, Mid - Atlantic and Northeastern seaboard of the United States in 2022 and 2023, where we currently have brand awareness. 16 Aggressive Store Growth Plan J a c k s o n vill e Tampa Orlando Palm Beach County Company Owned Unit Openings (15) Broward County Space Coast St. Petersburg Tallahassee Total: 30 Florida Please see Appendix for Notes. AFB = Air Force Base Cherry Hill, NJ Las Vegas, NV Stamford, CT Orlando, FL Paramus, NJ Omaha, NE – AFB Clearwater, FL Greenwich, CT San Juan, Puerto Rico Ponce, Puerto Rico Macon, GA Raleigh, NC Franchise Unit Openings (16) : Atlanta, GA Baltimore, MD Bradenton, FL Pensacola, FL Anchorage, AK - AFB Aurora, CO – AFB Total: 24 Georgia South Carolina North Carolina Virginia

Section 3 Company Financials

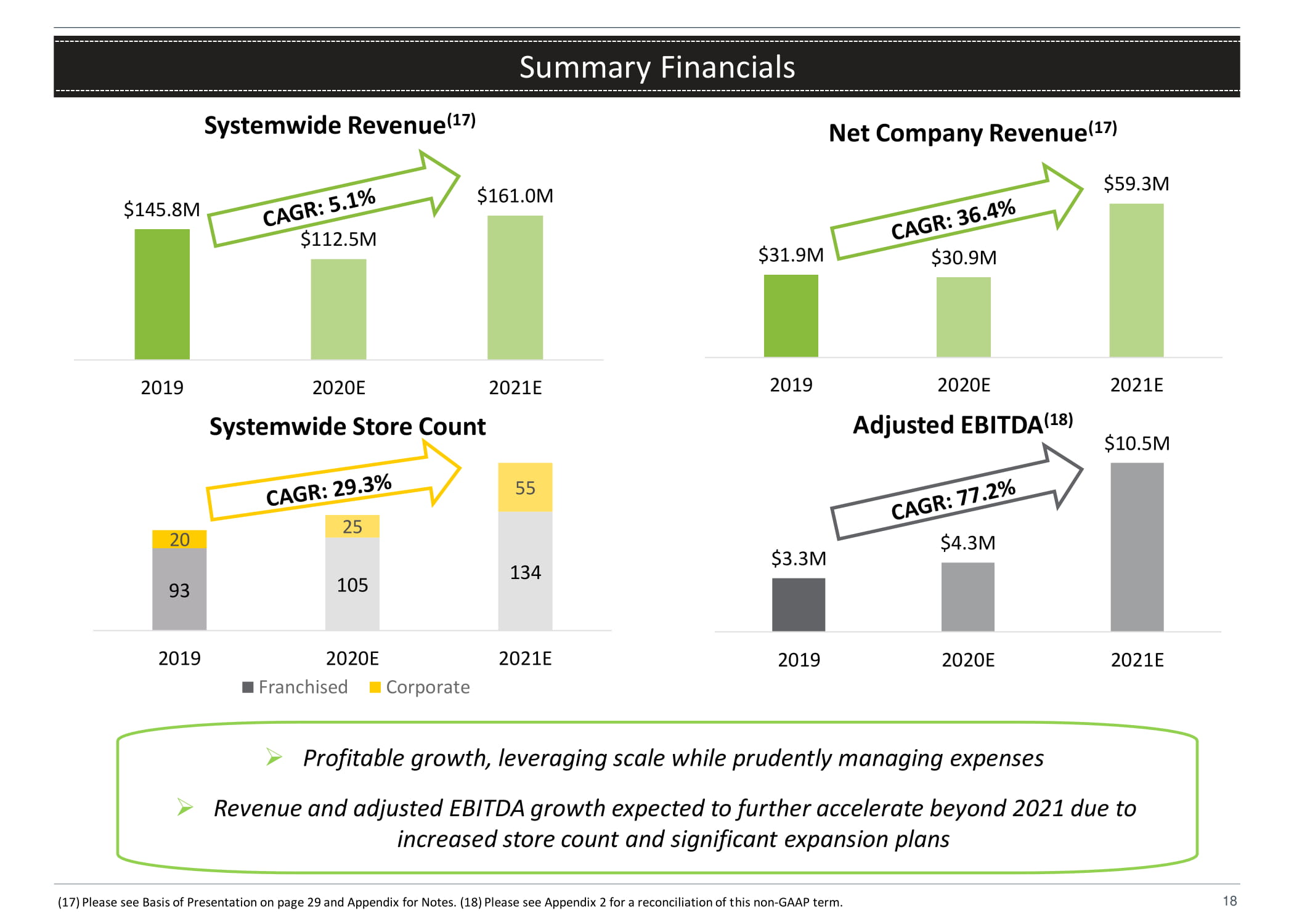

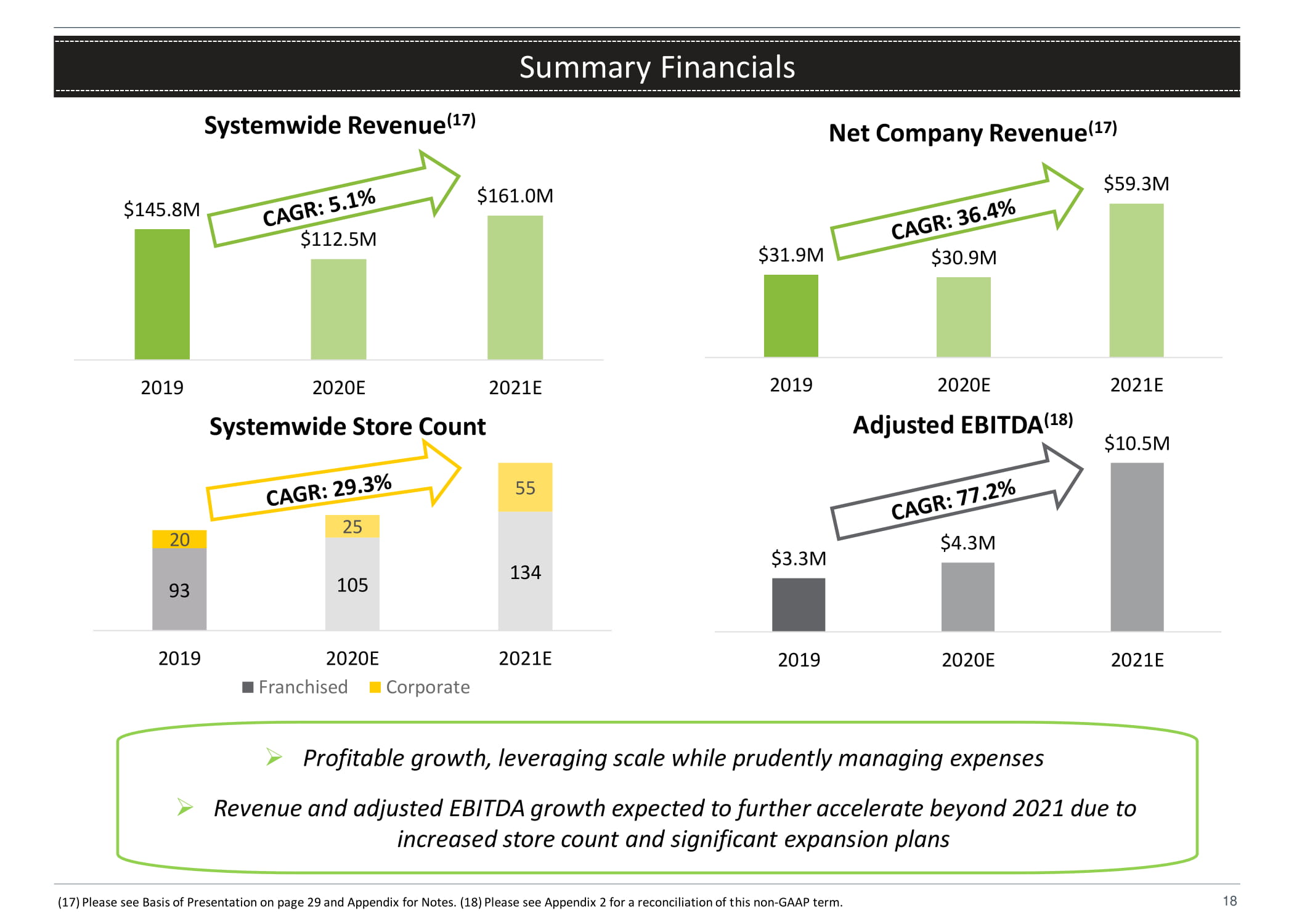

$31 . 9 M $30 . 9 M $59 . 3 M 2 0 1 9 2 0 2 1 E Net Company Revenue (17) 18 Summary Financials $145 . 8 M $112 . 5 M $161 . 0 M 2 0 1 9 2 0 2 1 E Systemwide Revenue (17) $3 . 3 M $4 . 3 M $10 . 5 M 2 0 1 9 2 0 2 0 E 2 0 2 1 E 2020E Adjusted EBITDA (18) » Profitable growth, leveraging scale while prudently managing expenses » Revenue and adjusted EBITDA growth expected to further accelerate beyond 2021 due to increased store count and significant expansion plans 93 105 134 20 25 55 2 0 1 9 2 0 2 1 E 2020E Systemwide Store Count 2 0 2 0 E Franchised C o r p o r a t e (17) Please see Basis of Presentation on page 29 and Appendix for Notes. (18) Please see Appendix 2 for a reconciliation of this non - GAAP term.

Section 4 Transaction Details

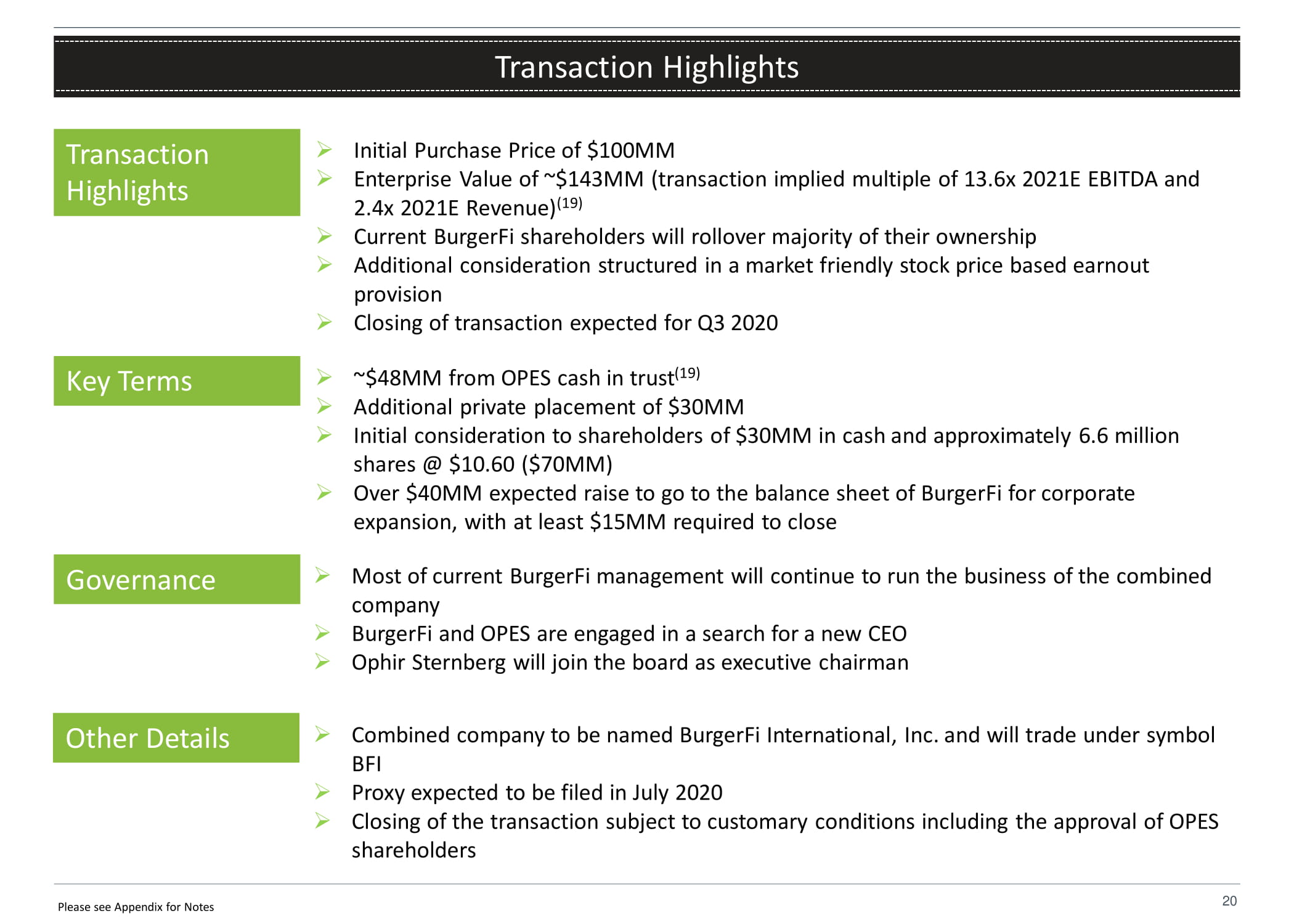

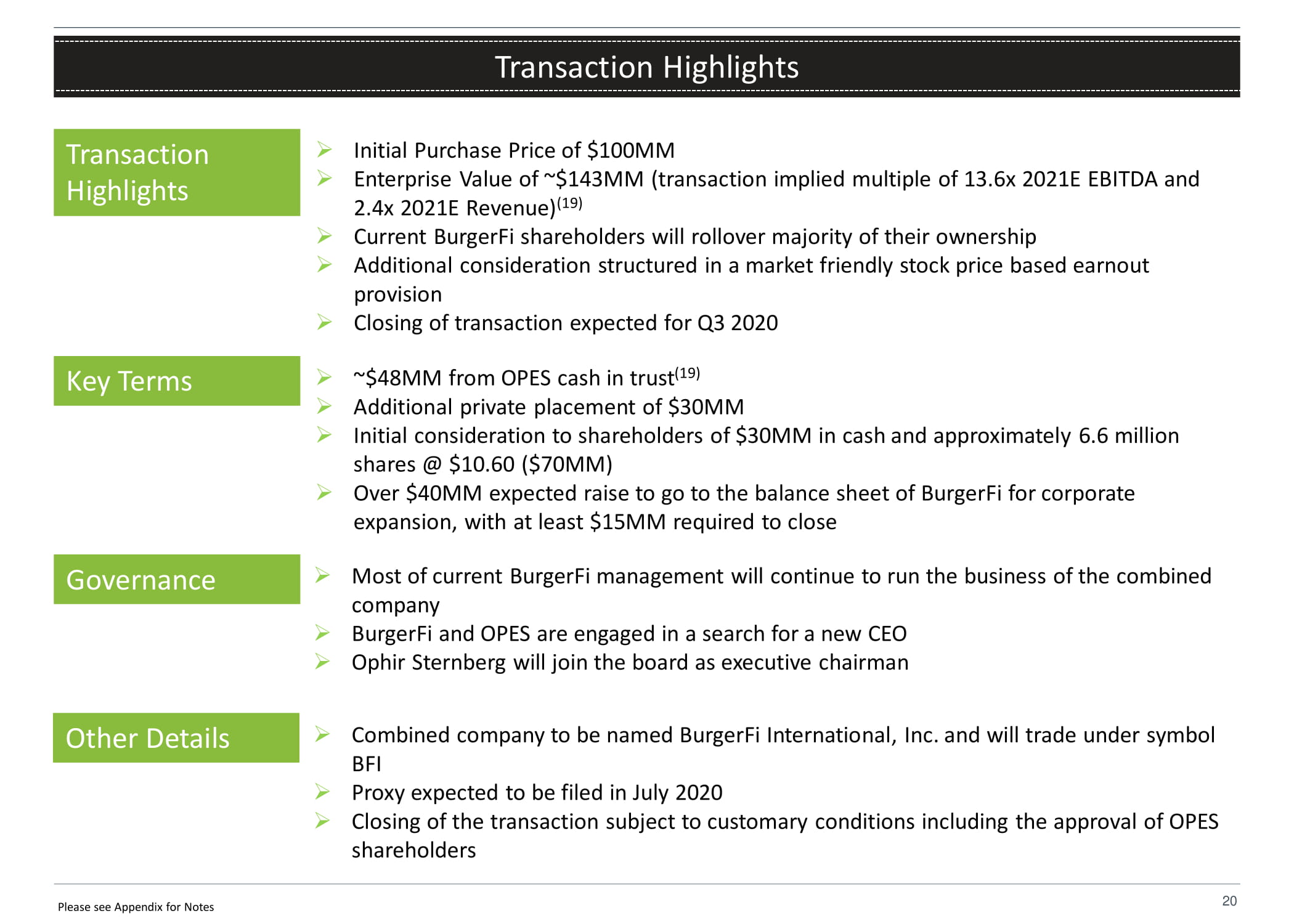

Prime margin defined as Corporate restaurant sales net of COGS and Labor divided by Revenue. 20 Transaction Highlights Transaction Highlights Governance Key Terms Other Details » Initial Purchase Price of $100MM » Enterprise Value of ~$143MM (transaction implied multiple of 13.6x 2021E EBITDA and 2.4x 2021E Revenue) (19) » Current BurgerFi shareholders will rollover majority of their ownership » Additional consideration structured in a market friendly stock price based earnout provision » Closing of transaction expected for Q3 2020 » ~$48MM from OPES cash in trust (19) » Additional private placement of $30MM » Initial consideration to shareholders of $30MM in cash and approximately 6.6 million shares @ $10.60 ($70MM) » Over $40MM expected raise to go to the balance sheet of BurgerFi for corporate expansion, with at least $15MM required to close » Most of current BurgerFi management will continue to run the business of the combined company » BurgerFi and OPES are engaged in a search for a new CEO » Ophir Sternberg will join the board as executive chairman » Combined company to be named BurgerFi International, Inc. and will trade under symbol BFI » Proxy expected to be filed in July 2020 » Closing of the transaction subject to customary conditions including the approval of OPES shareholders Please see Appendix for Notes

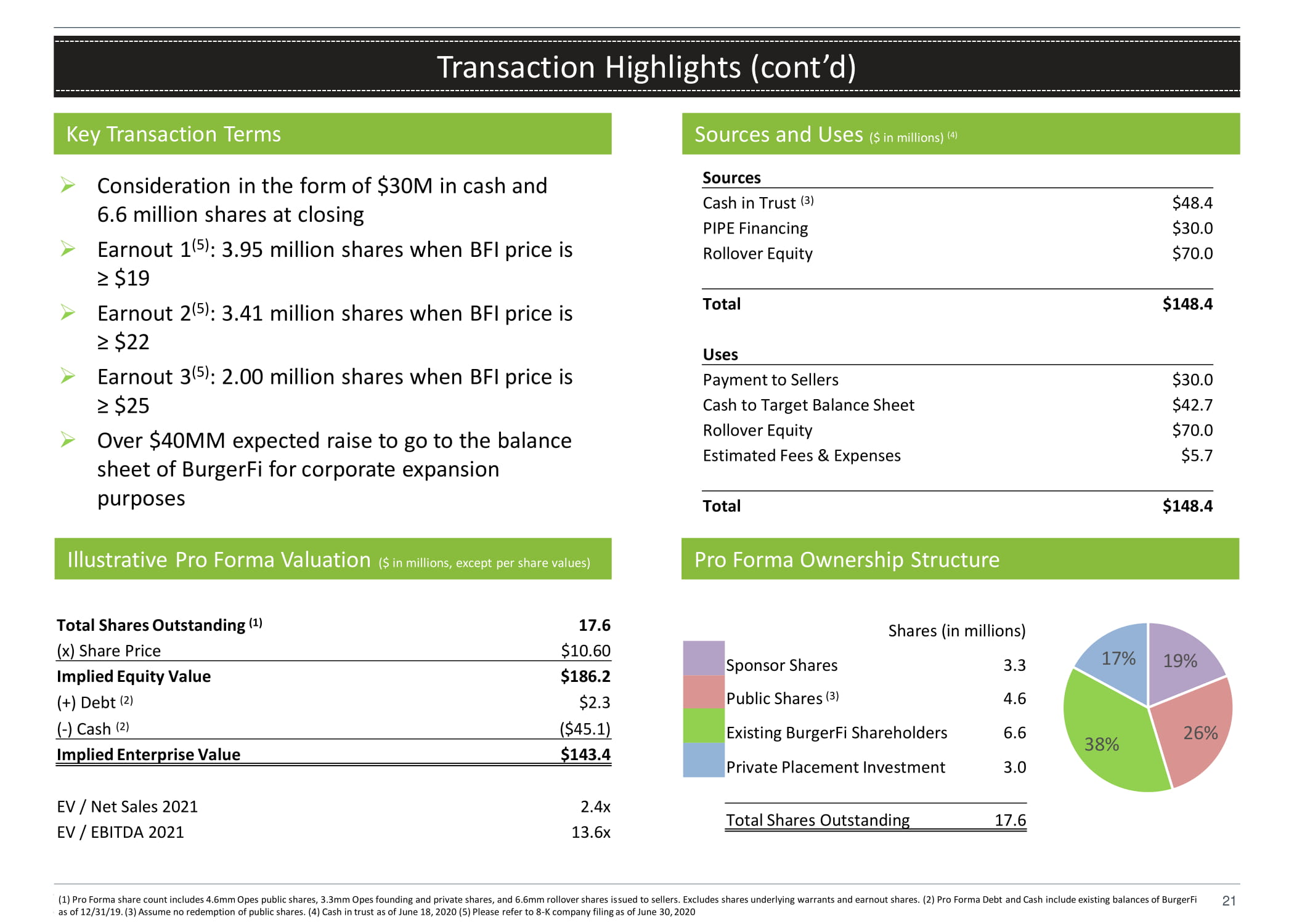

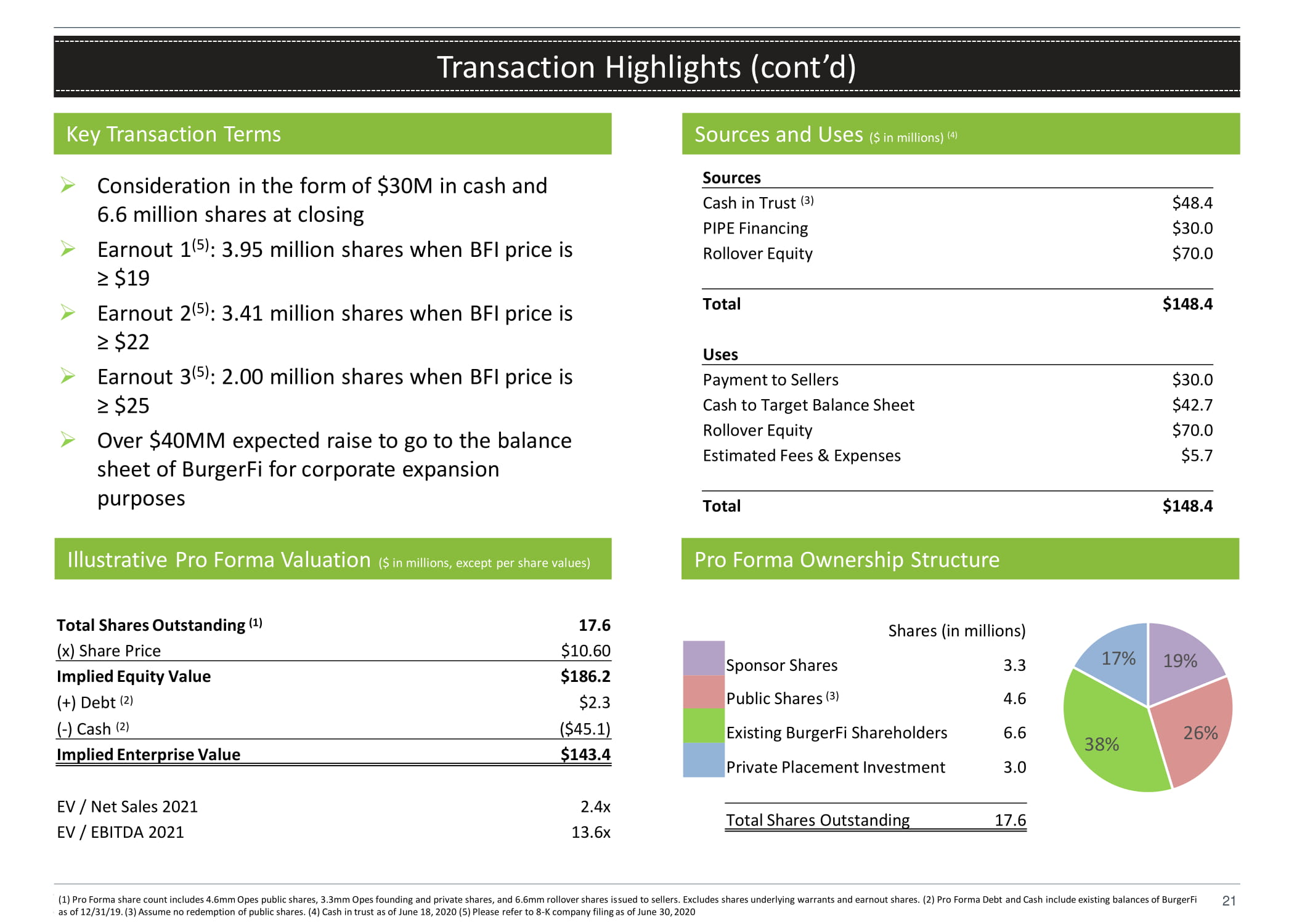

19% 26% 38% 17% Prime margin defined as Corporate restaurant sales net of COGS and Labor divided by Revenue. 21 Transaction Highlights (cont’d) » Consideration in the form of $30M in cash and 6.6 million shares at closing » Earnout 1 (5) : 3.95 million shares when BFI price is ≥ $19 » Earnout 2 (5) : 3.41 million shares when BFI price is ≥ $22 » Earnout 3 (5) : 2.00 million shares when BFI price is ≥ $25 » Over $40MM expected raise to go to the balance sheet of BurgerFi for corporate expansion purposes (1) Pro Forma share count includes 4.6mm Opes public shares, 3.3mm Opes founding and private shares, and 6.6mm rollover shares issued to sellers. Excludes shares underlying warrants and earnout shares. (2) Pro Forma Debt and Cash include existing balances of BurgerFi as of 12/31/19. (3) Assume no redemption of public shares. (4) Cash in trust as of June 18, 2020 (5) Please refer to 8 - K company filing as of June 30, 2020 Key Transaction Terms Illustrative Pro Forma Valuation ($ in millions, except per share values) Sources and Uses ($ in millions) (4) Pro Forma Ownership Structure Total Shares Outstanding (1) 17 . 6 (x) Share Price $10 . 6 0 Implied Equity Value $186 . 2 (+) Debt (2) $2 .3 ( - ) Cash (2) ($45 . 1 ) Implied Enterprise Value $143 . 4 EV / Net Sales 2021 2 . 4 x EV / EBITDA 2021 13 . 6 x Shares (in millions) Sponsor Shares 3 .3 Public Shares (3) 4 .6 Existing BurgerFi Shareholders 6 .6 Private Placement Investment 3 .0 Tot a l Shar e s Outstandi n g 17 .6 Sources Cash in Trust (3) PIPE Financing Rollover Equity Total Uses Payment to Sellers Cash to Target Balance Sheet Rollover Equity Estimated Fees & Expenses Total

Appendix 22

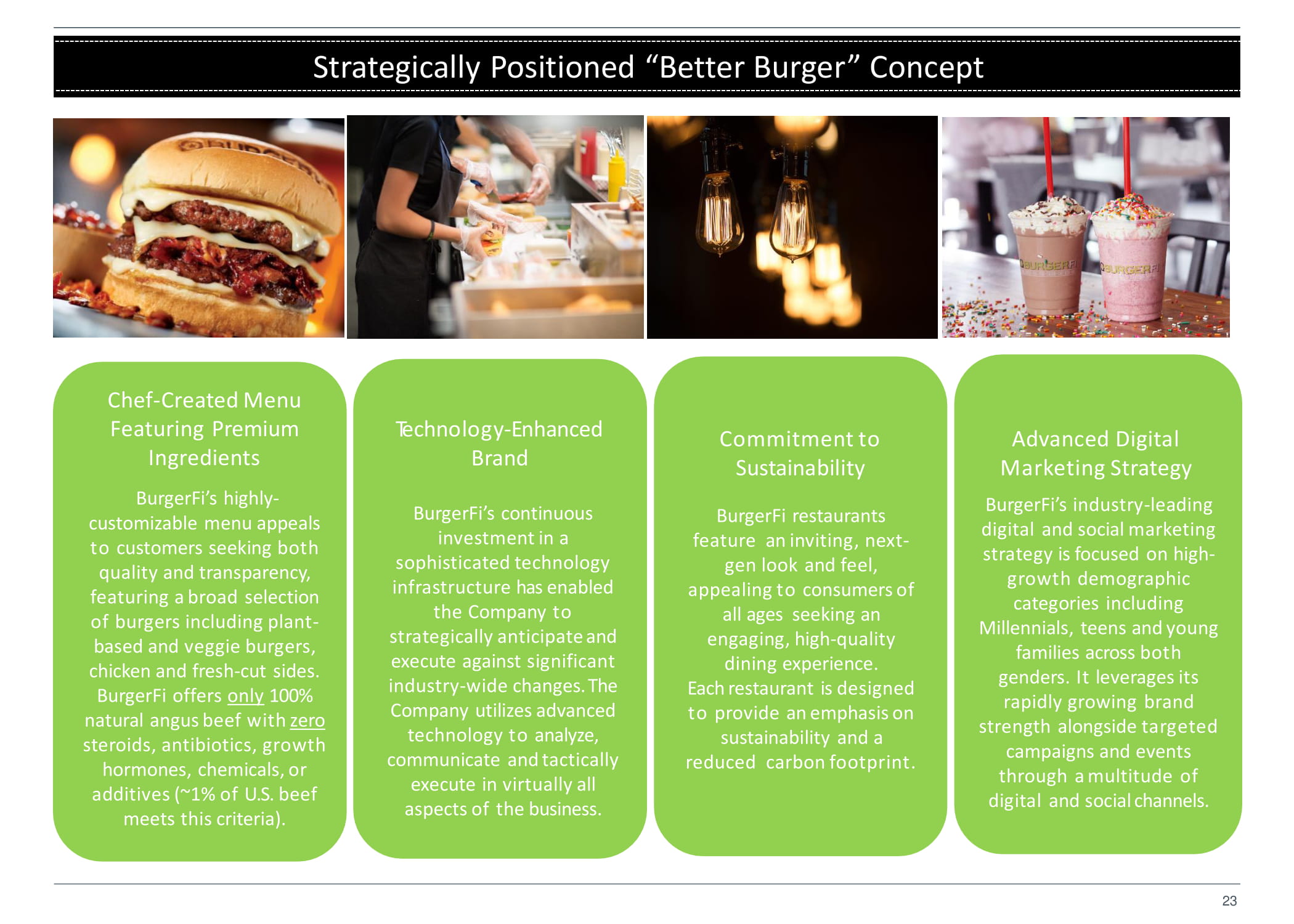

Commitment to Sustainability BurgerFi restaurants feature an inviting, next - gen look and feel, appealing to consumers of all ages seeking an engaging, high - quality dining experience. Each restaurant is designed to provide an emphasis on sustainability and a reduced carbon footprint. T e chn o l o g y - E n h a nc ed Brand BurgerFi’s continuous investment in a sophisticated technology infrastructure has enabled the Company to strategically anticipate and execute against significant industry - wide changes. The Company utilizes advanced technology to analyze, communicate and tactically execute in virtually all aspects of the business. Chef - Created Menu Featuring Premium Ingredients BurgerFi’s highly - customizable menu appeals to customers seeking both quality and transparency, featuring a broad selection of burgers including plant - based and veggie burgers, chicken and fresh - cut sides. BurgerFi offers only 100% natural angus beef with zero steroids, antibiotics, growth hormones, chemicals, or additives (~1% of U.S. beef meets this criteria). Advanced Digital Marketing Strategy BurgerFi’s industry - leading digital and social marketing strategy is focused on high - growth demographic categories including Millennials, teens and young families across both genders. It leverages its rapidly growing brand strength alongside targeted campaigns and events through a multitude of digital and social channels. Strategically Positioned “Better Burger” Concept 23

BurgerFi is Rapidly Becoming a Nationally Recognized Brand Critics’ Pick #3 Fastest Growing Limited Service Chain The Next 20 If you want a fast food burger experience, in many ways BurgerFi is a much better alternative than the traditional large chains. While those are scrambling to reinvent themselves as using less processed ingredients, BurgerFi is already there. And unlike other burger chains, the vegetarian options here are more than afterthoughts. Add on dense custards, seasonal craft beers, wines by the bottle, and outdoor seating to complete the happy, have - it - your - way ex p er i en c e. “ ” “ ” Widespread Industry Acclaim Top 500 Fastest Growing Private Companies Top 100 Movers & Shakers ’14 , ‘ 15, ’16, ‘17, ’18, ’19, ‘20 Top 500 Chains 24

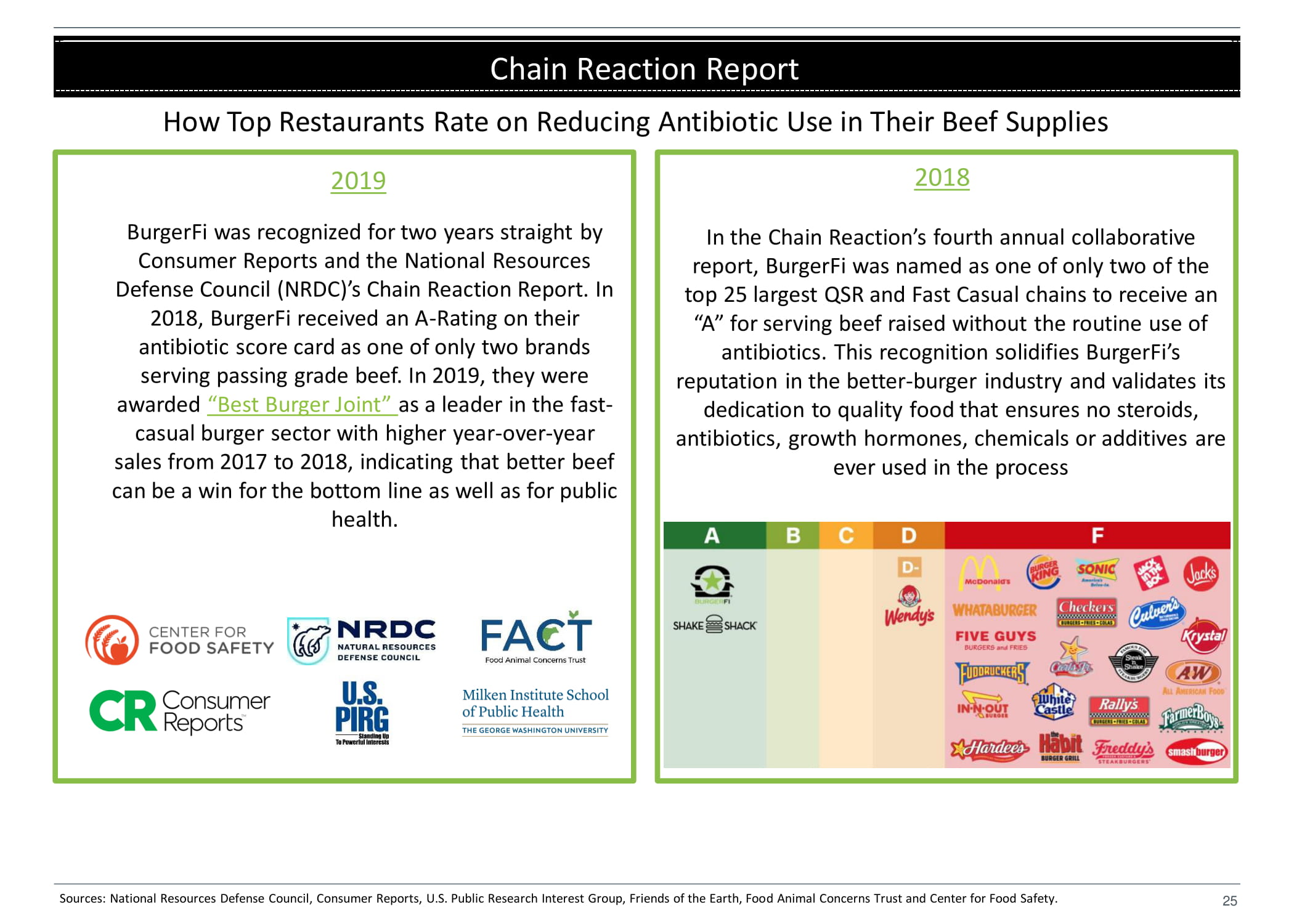

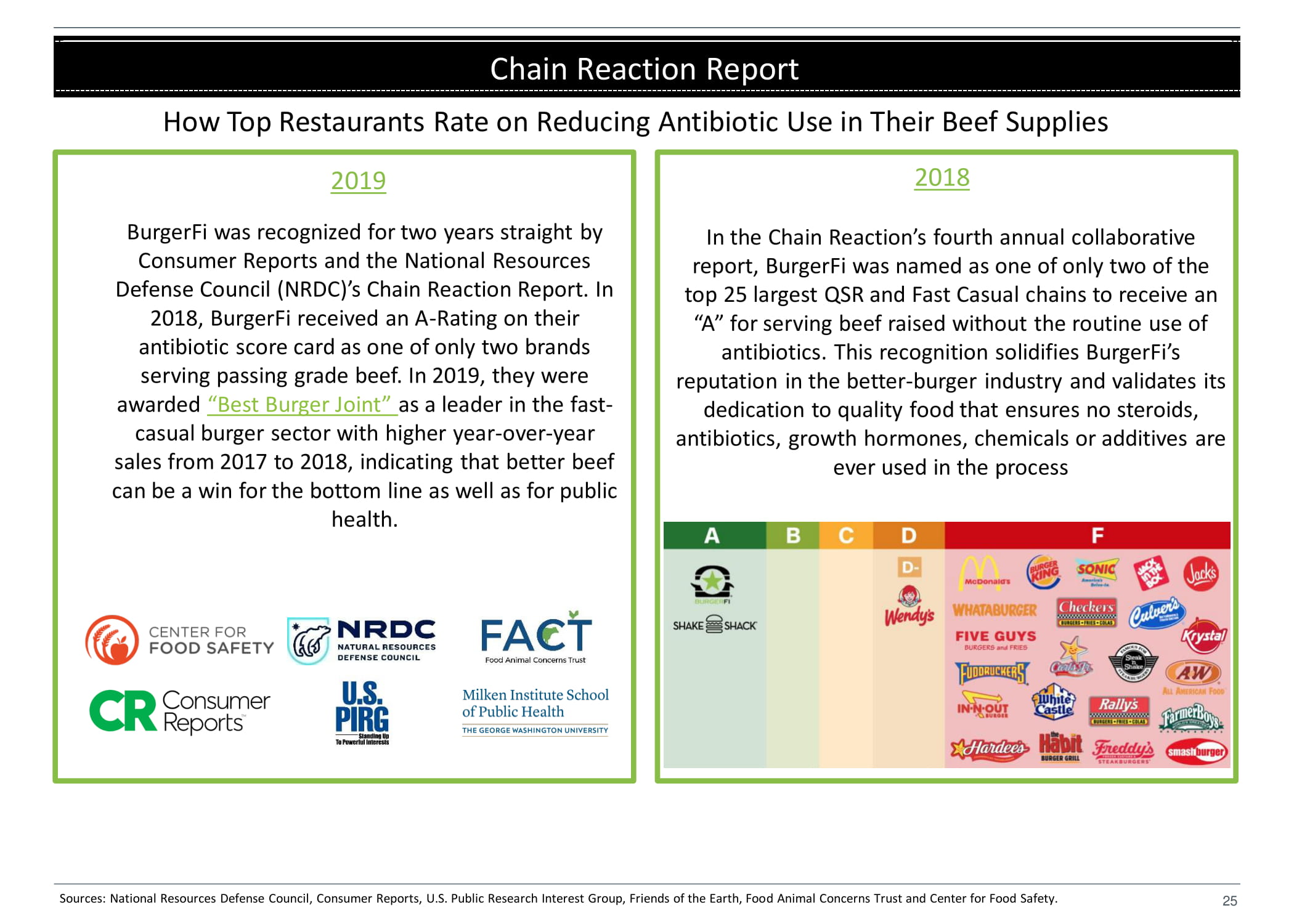

25 Chain Reaction Report 2019 BurgerFi was recognized for two years straight by Consumer Reports and the National Resources Defense Council (NRDC)’s Chain Reaction Report. In 2018, BurgerFi received an A - Rating on their antibiotic score card as one of only two brands serving passing grade beef. In 2019, they were awarded “Best Burger Joint” as a leader in the fast - casual burger sector with higher year - over - year sales from 2017 to 2018, indicating that better beef can be a win for the bottom line as well as for public health. How Top Restaurants Rate on Reducing Antibiotic Use in Their Beef Supplies 2018 In the Chain Reaction’s fourth annual collaborative report, BurgerFi was named as one of only two of the top 25 largest QSR and Fast Casual chains to receive an “A” for serving beef raised without the routine use of antibiotics. This recognition solidifies BurgerFi’s reputation in the better - burger industry and validates its dedication to quality food that ensures no steroids, antibiotics, growth hormones, chemicals or additives are ever used in the process Sources: National Resources Defense Council, Consumer Reports, U.S. Public Research Interest Group, Friends of the Earth, Food Animal Concerns Trust and Center for Food Safety.

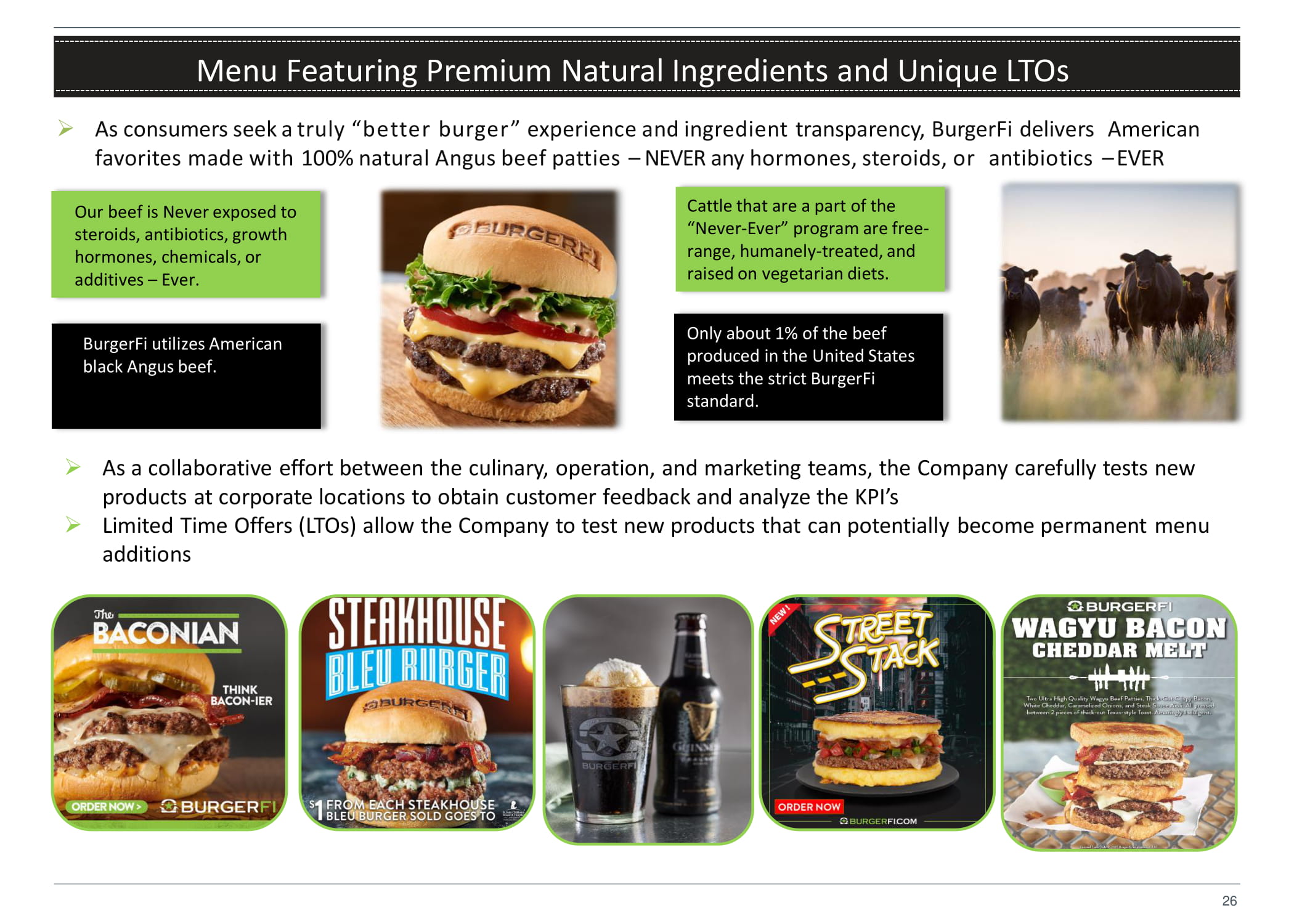

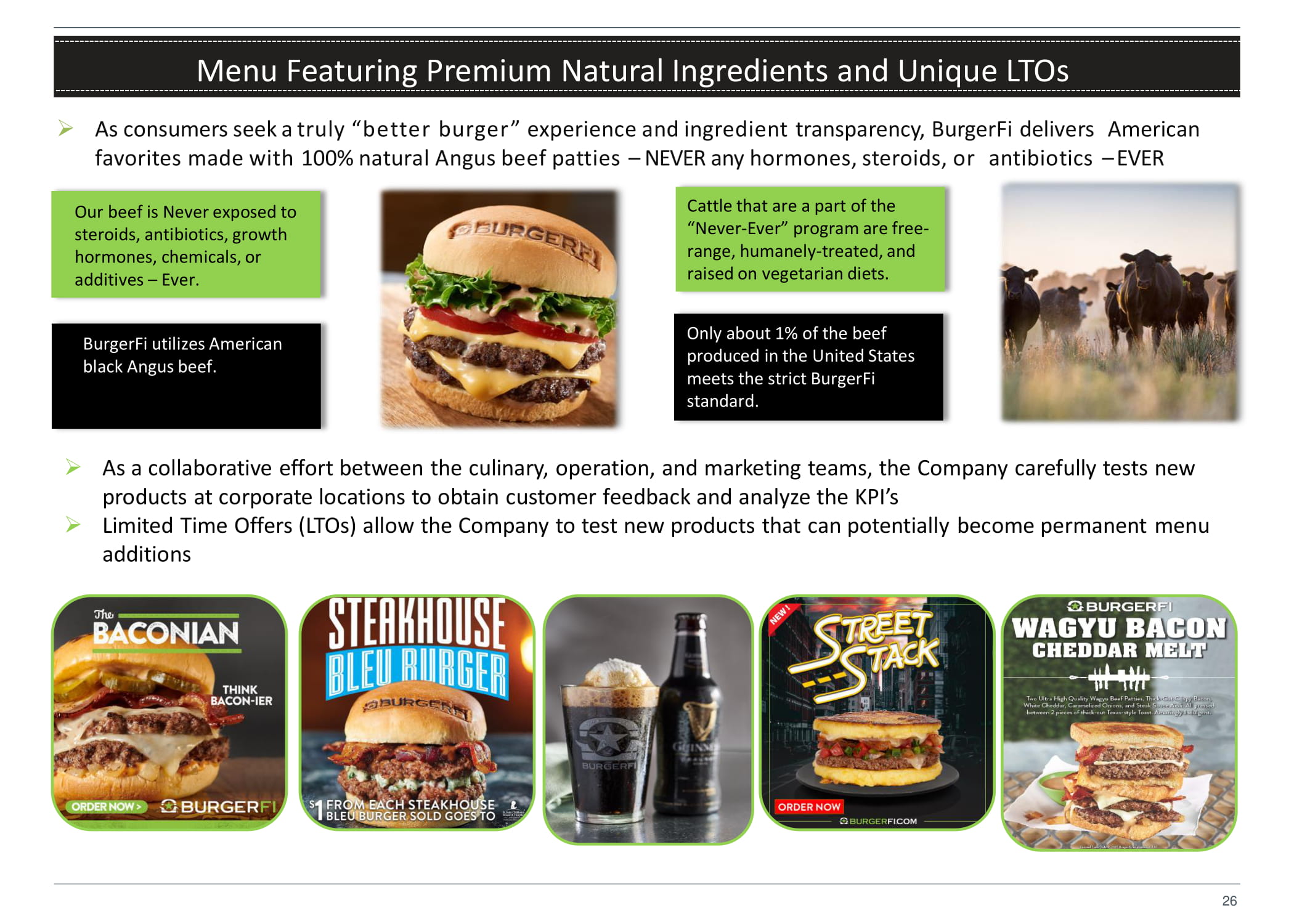

» As consumers seek a truly “better burger” experience and ingredient transparency, BurgerFi delivers American favorites made with 100% natural Angus beef patties – NEVER any hormones, steroids, or antibiotics – EVER Menu Featuring Premium Natural Ingredients and Unique LTOs Our beef is Never exposed to steroids, antibiotics, growth hormones, chemicals, or additives – Ever. BurgerFi utilizes American black Angus beef. Cattle that are a part of the “Never - Ever” program are free - range, humanely - treated, and raised on vegetarian diets. Only about 1% of the beef produced in the United States meets the strict BurgerFi standard. » As a collaborative effort between the culinary, operation, and marketing teams, the Company carefully tests new products at corporate locations to obtain customer feedback and analyze the KPI’s » Limited Time Offers (LTOs) allow the Company to test new products that can potentially become permanent menu additions 26

Select Training Initiatives Yoobic (Learning ManagementSystem) » Robust, technology - driven learning management system containing high quality, interactive training videos and courses In - store Training Program » An “in - store trainer” continually works to maintain an environment of ongoing training in the restaurant, while also participating in new store openings when called upon BurgerFi Boot Camp » Intense training taking management recruits through the BurgerFi system with a combination of classroom and on - the - job training in certified training restaurants . Upon boot camp graduation, new GMs and Assistant Managers are able to run their assigned BurgerFirestaurants BurgerFi Field CertificationProgram » Provides Assistant Managers with course curriculum and training modules for online study at their home restaurant . Upon completion and testing, the manager is certified to oversee a BurgerFi restaurant Steps to Success » Promotes employee development practices as the foundation for growth from within – employees master each milestone on a path to promotion while future leaders arecultivated within the Company 100 % Order Accuracy » Training department initiative focusing on training through a curriculum designed to ensure all critical elements of order accuracy Comprehensive Training Development and Culture Rooted in the Local Community BurgerFi Culture BurgerFi actively focuses on “Give Back Nights,” donations and sponsorships within local communities, helping to build meaningful relationships with both existing and potential new customers. Partnerships with local middle and high schools Local sponsorship of youth sports associations or other organizations Fundraisers to build awareness in tight - knit communities Select Local Charitable Partners National Partnerships 27

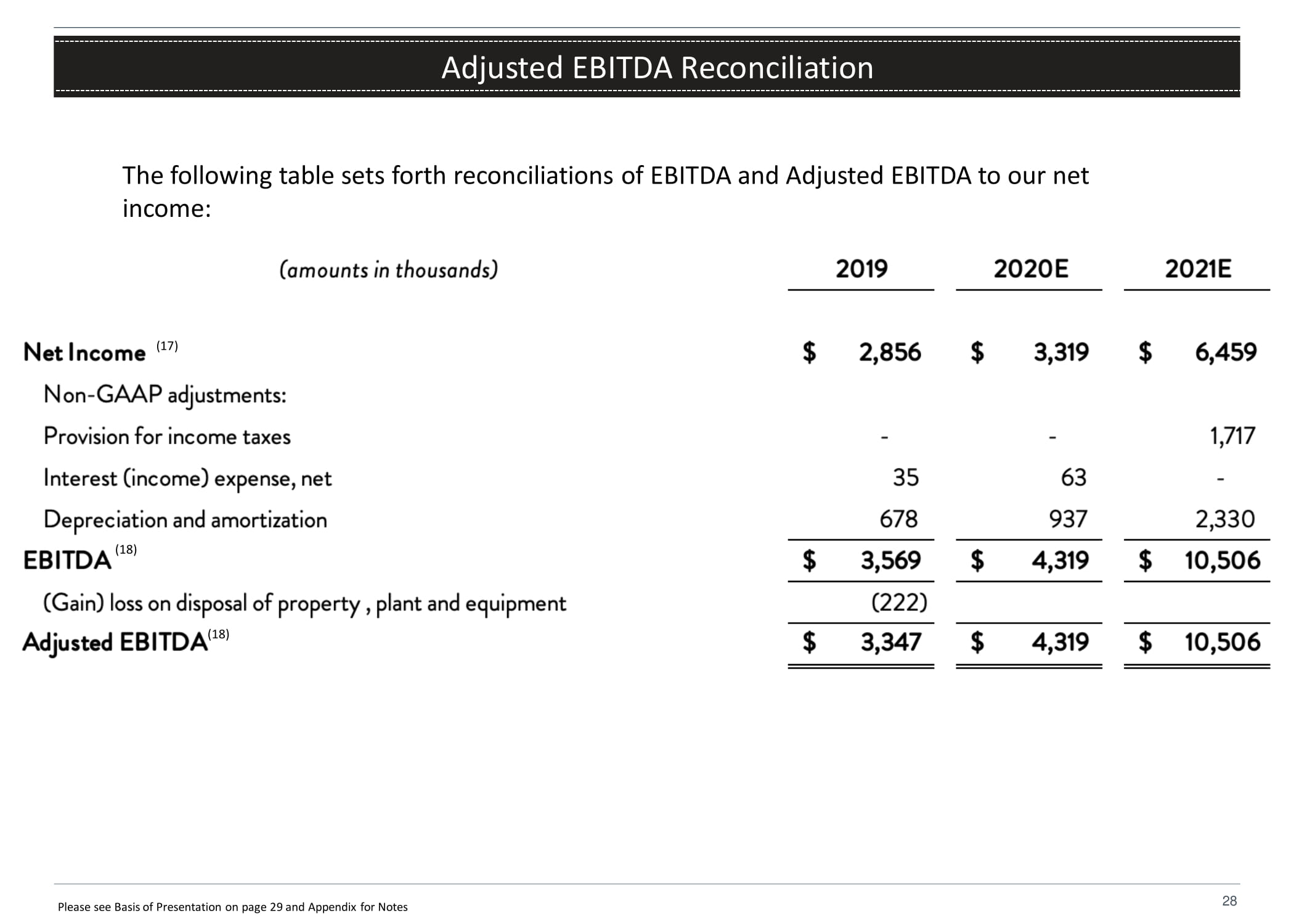

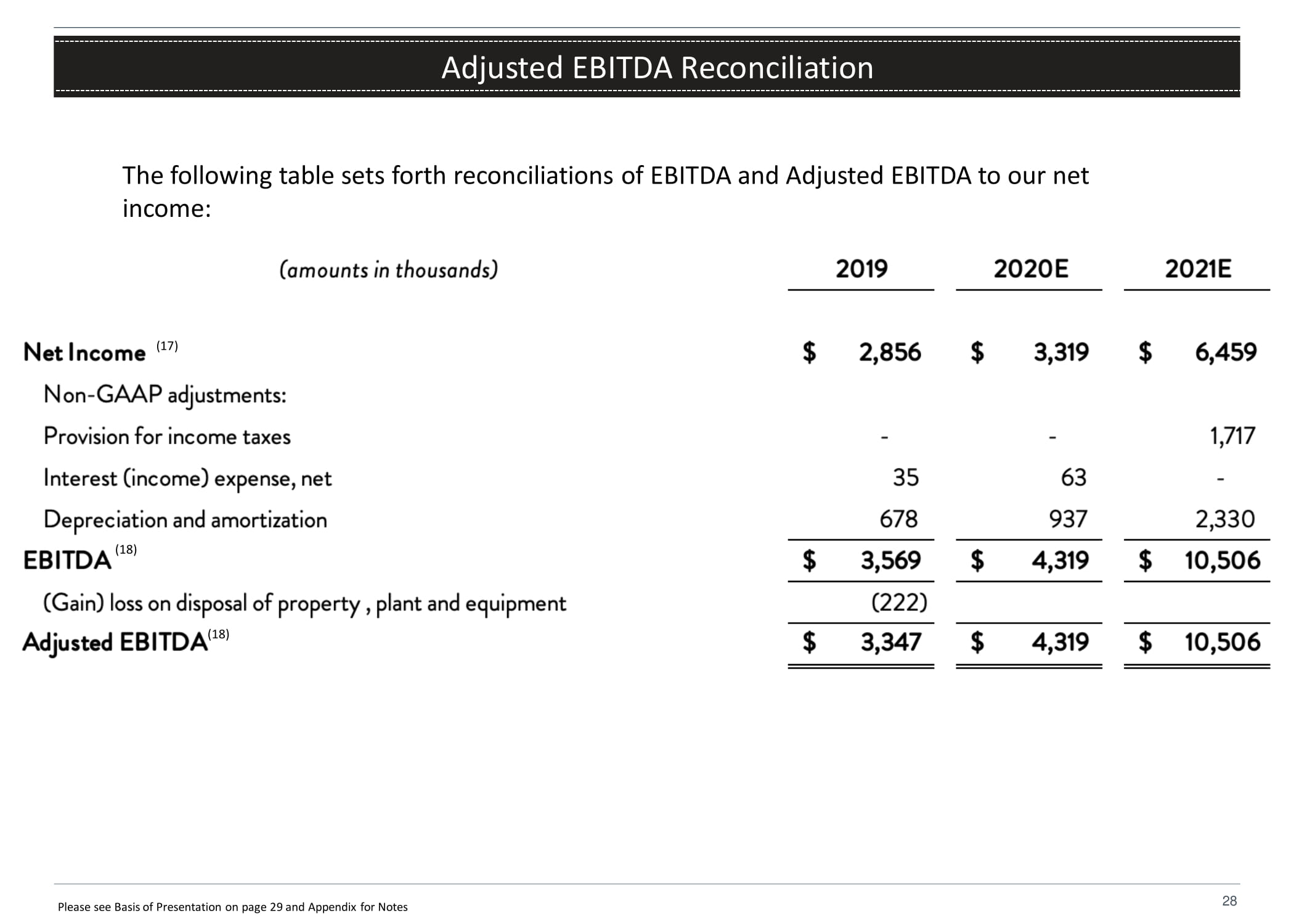

Prime margin defined as Corporate restaurant sales net of COGS and Labor divided by Revenue. Adjusted EBITDA Reconciliation The following table sets forth reconciliations of EBITDA and Adjusted EBITDA to our net income: 28 Please see Basis of Presentation on page 29 and Appendix for Notes ( 17 ) ( 18) ( 18 )

Prime margin defined as Corporate restaurant sales net of COGS and Labor divided by Revenue. Basis of Presentation and Adjusted EBITDA Reconciliation 29 Basis of Presentation – The historical financial information presented herein is from the Company’s unaudited financial statements for the years ended December 31, 2017, 2018 and 2019. These financial statements were prepared in accordance with accounting principles generally applied in the United States of America (“GAAP”) for privately held companies. Adjusted EBITDA Reconciliation – EBITDA and Adjusted EBITDA as presented in this report are supplemental measures of our performance that are neither required by, nor presented in accordance with, GAAP. Our presentation of EBITDA should not be construed as an inference that our future results will be unaffected by these or other unusual or nonrecurring items. EBITDA represents net income before net interest expense, provision for income taxes, depreciation and amortization. Adjusted EBITDA represents net income before net interest expense, provision for income taxes, depreciation and amortization and certain items associated with activities outside of normal course operations.

Prime margin defined as Corporate restaurant sales net of COGS and Labor divided by Revenue. Note (1) Note (2) Note (3a) Note (3b) Note (4) Note (5) Note (6) Note (7) Note (8) Note (9) Note (10) Note (11) Note (12) Note (13) Note (14) Note (15) Note (16) Note (17) Note (18) Note (19) Source: BurgerFi International LLC year - end forecast for 2020 Represents the 12 month average same store sales as compared to the previous 12 months, over a 3 - year timeframe Prime margin represents [total revenue – (costs of goods sold + total labor)] / total revenue Systemwide sales represents the 12 month average sales for both corporate and franchised locations Total 2019 corporate and franchise sales. Source: Audited 2019 financial statements As of year - end 2019. Source: Audited 2019 financial statements 2020 and 2021 projected build - out costs including construction, furniture, fixtures, kitchen equipment and computer equipment. Source: Internal company data 2019 actual total corporate sales divided by actual 2019 total transactions The sum of the actual menu prices of (i) BurgerFi Burger, (ii) regular fries and (iii) 16 ounce Freestyle drink 2019 actual internal corporate point of sales reports. Corporate stores only Other Food primarily consists of Shakes, Hot dogs, Custards and Breakfast. Pie chart based on 2019 actual internal corporate point of sales reports Raymond James Shake Shack Inc. Equity Report dated January 8, 2020 From referenced company websites Internal company data for BurgerFi and Raymond James Analyst report for restaurant sector Internal Company information from Sprinklr and Steritech reports for 2019 Internal Company forecast for the years ending 2020 and 2021 Internal Company forecast based on executed franchise agreements and commitments from franchisees for the year Source: audited 2019 financial statements, unaudited internal company forecasts for 2020 and 2021 Adjusted EBITDA represents net income before net interest expense, provision for income taxes, depreciation and amortization and certain items associated with activities outside of normal course operations Assumes no redemptions from the trust account Notes 30

Thank you!