Q3 2022 Earnings Supplement November 16, 2022

Disclaimer FORWARD-LOOKING STATEMENTS This press release may contain “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995, including statements relating to BurgerFi's estimates of its future business outlook, liquidity, prospects or financial results, long-term opportunities for asset-light expansion, executing on growth strategy for the Anthony’s brand, remaining focused on sales driving initiatives and on operational excellence, a new brand campaign to further strengthen BurgerFi’s position in the better burger category, improvement in guest satisfaction surveys that will translate to stronger financial performance, confidence in the recovery of BurgerFi’s margin profile, store opening plans, opening of additional GoPuff Fresh Food Halls, cobranding, expectations regarding adjusted EBITDA in 2022 and the continued presence of labor and supply chain pressures and elevated uncertainty from a consumer perspective, as well as statements set forth under the section entitled “2022 Outlook” above. Forward-looking statements generally can be identified by words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “projects,” “will be,” “will continue,” “will likely result,” and similar expressions. These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results to differ materially from those reflected in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in our Annual Report on Form 10-K for the year ended December 31, 2021, and those discussed in other documents we file with the Securities and Exchange Commission, including our ability to continue to access liquidity from our credit agreement and remain compliant with financial covenants therein, as well as to successfully realize the expected benefits of the acquisition of Anthony’s as a result of the impact of COVID-19 or any other factors. All subsequent written and oral forward-looking statements attributable to BurgerFi or persons acting on BurgerFi’s behalf are expressly qualified in their entirety by the cautionary statements included in this press release. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. NON-U.S. GAAP FINANCIAL MEASURES For discussion and reconciliation of non-U.S. GAAP financial measures, see pages 11-13 of this presentation. 22

3 Award-winning, fast casual “better burger” concept, delivering a delicious, all-natural burger experience ordered through our digital platforms or in our cool, modern, eco-friendly restaurants served by our passionate team members. 33

Anthony’s Coal Fired Pizza & Wings prides itself on serving fresh, never frozen, high-quality ingredients. Anthony's menu offers “well-done” pizza, coal fired chicken wings, homemade meatballs, and a variety of handcrafted sandwiches and salads. 4

Third Quarter 2022 Financial Results & Recent Highlights 5

Q3 2022 Highlights 6 1) Includes BurgerFi and Anthony’s in consolidated financials 2) See slide 11 for definition of key metrics and non-U.S. GAAP financial measures. 3) See slides 12-13 for consolidated and by brand reconciliation of non-U.S. GAAP financial measures. 6 First Anthony’s Multi- Unit Development Agreement Executed BurgerFi systemwide sales2 of $39.1M (-5% YOY) Restaurant-level operating profit improved 250 bps points vs. PYQ Adjusted EBITDA1,2,3 of $1.6M (+755% YOY) Opened nine new BurgerFi restaurants year-to-date Anthony’s systemwide sales of $31.5M (+4% YOY) Total revenue1 of $43.3M (+290% YOY)

Q3 2022 Key Metrics1 7 1) See slide 11 for definition of key metrics and non-U.S. GAAP financial measures. 7 $41.4 $39.1 $31.5 Q3 2021 Q3 2022 Systemwide Sales BurgerFi Anthony's $0.2 -$0.1 $1.7 Q3 2021 Q3 2022 Adjusted EBITDA BurgerFI Anthony's 116 117 61 Q3 2021 Q3 2022 Systemwide Unit Count BurgerFi Anthony's $11.1 $11.8 $31.5 Q3 2021 Q3 2022 Total Revenue BurgerFi Anthony's $1.6million 178 Restaurants $70.6 million$43.3 million

Historical Performance 8 $39.8 $44.2 $41.4 $40.7 $40.5 $42.4 $39.1 $22.4 $32.5 $31.8 $31.5 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Systemwide Sales BurgerFi Anthony's $0.7 $0.3 $0.2 $0.6 -$0.2 $0.2 -$0.1 $2.0 $2.5 $2.4 $1.7 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Adjusted EBITDA43 BurgerFi Anthony's $2.3 1) See slide 11 for definition of key metrics and non-U.S. GAAP financial measures. 2) See slides 12-13 for reconciliation of non-U.S. GAAP financial measures. 3) Q4 Anthony’s Systemwide sales from November 3, 2021 $63.13 $73.0 $74.2 $2.6 $2.6$70.6 $1.6 4) BurgerFi Adjusted EBITDA includes approximately $3m annually of public company costs that are not directly associated with operating the brand

FY 2022 Outlook1 9 1) These projections assume the current economic environment does not change materially 2) See slide 11 for definition of key metrics and non-U.S. GAAP financial measures 3) See slides 12-13 for reconciliation of non-U.S. GAAP financial measures 9 Management’s outlook for the full year 2022 is as follows: Annual revenues of $175-$180 million Low single-digit same store sales2 growth for corporate locations 12-13 new BurgerFi brand restaurant openings (3 corporate-owned 9-10 franchises) as well as up to 30 BurgerFi GoPuff ghost kitchen locations Adjusted EBITDA3 of $9-$10 million Capital expenditures of approximately $2 million

INVESTMENT HIGHLIGHTS 1010 Early stage growth company with long-term growth opportunity Highly capable management team with decades of relevant industry expertise Organic growth primarily through asset-light franchising Two leading, differentiated brands with strong foothold in the Florida market L Catterton, is one of the largest shareholders and has board representation Franchising both brands provides the opportunity to foster attractive, multi-unit, multi-concept franchise deals Ability to leverage technology to drive revenue growth, efficiencies, and data analytics Ability to foster co-branded agreements combining two of the fastest growing categories

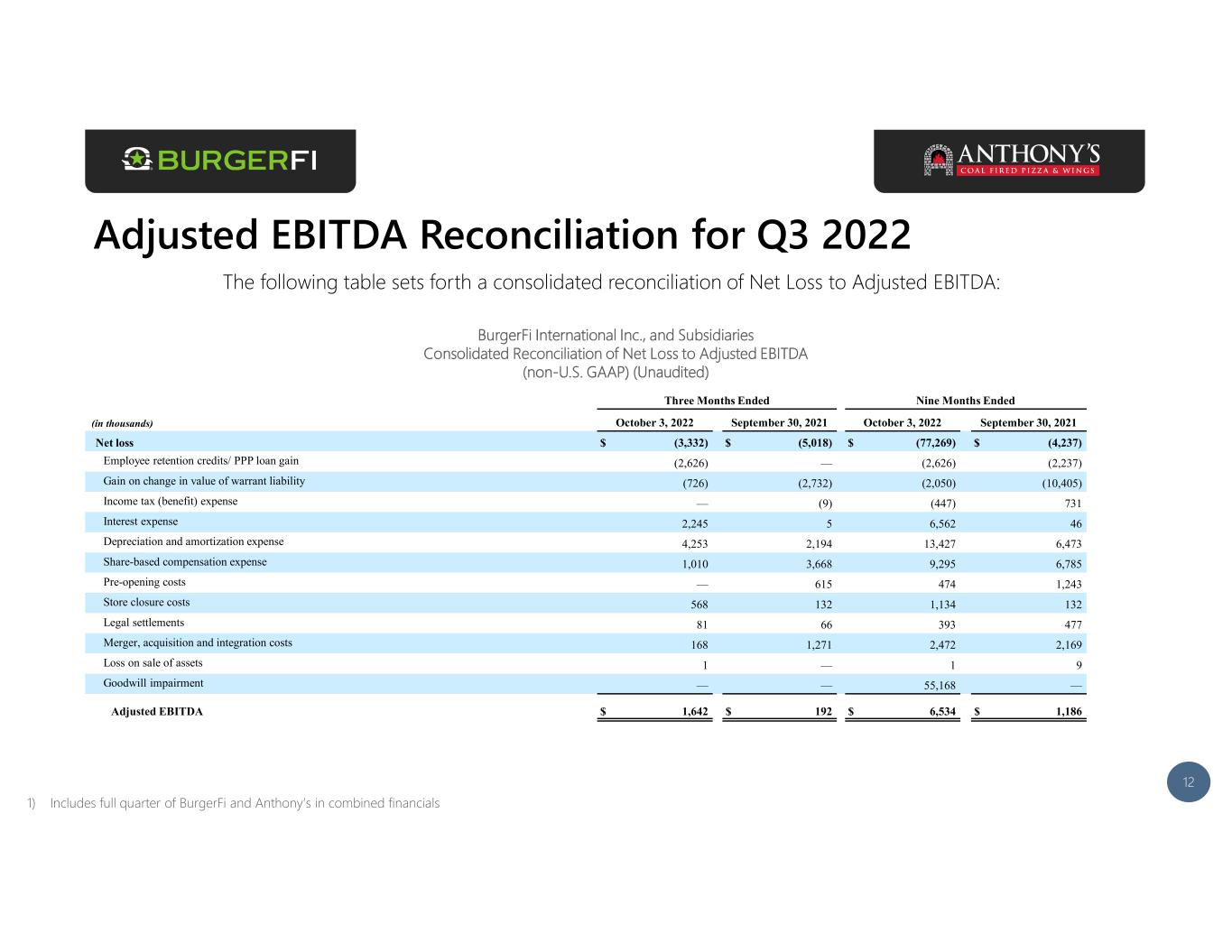

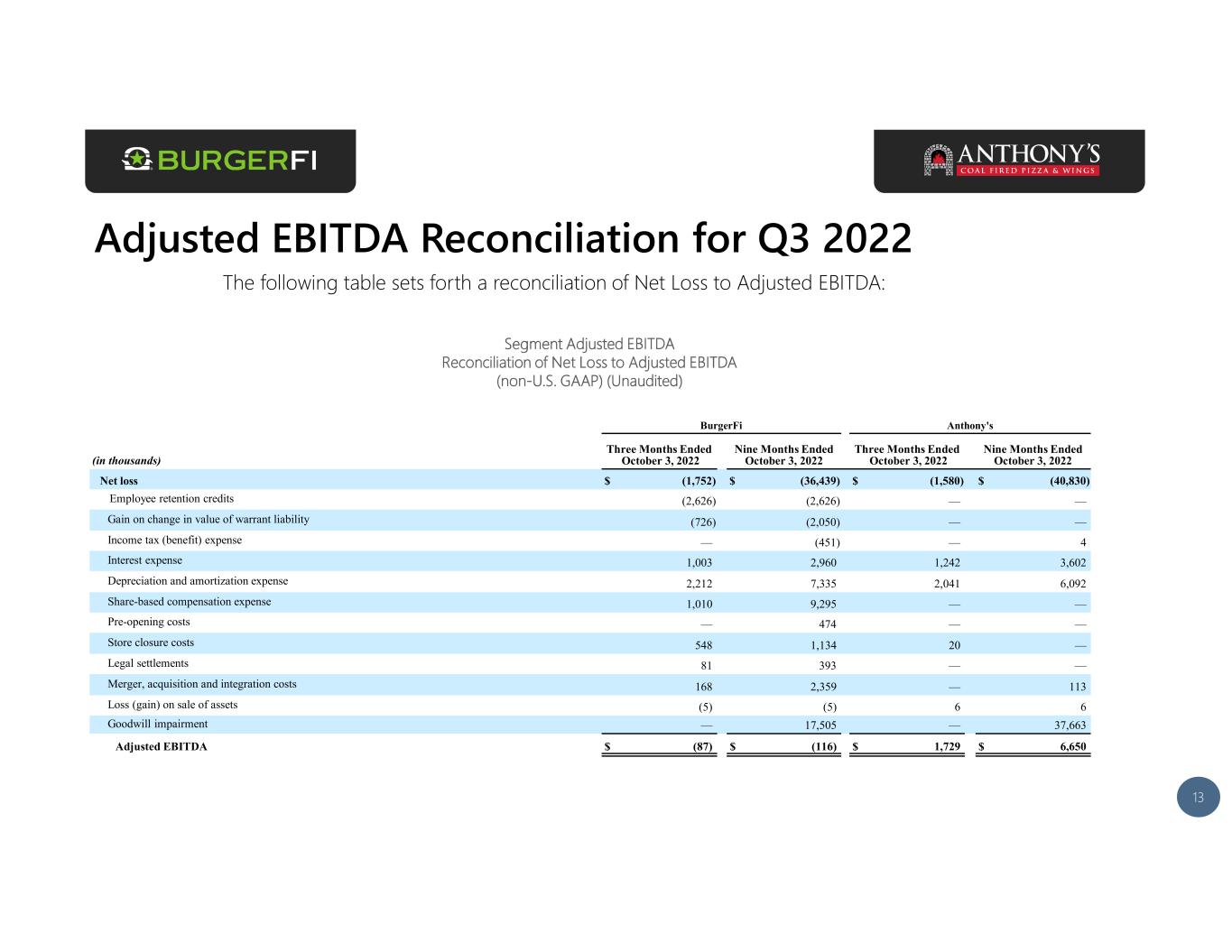

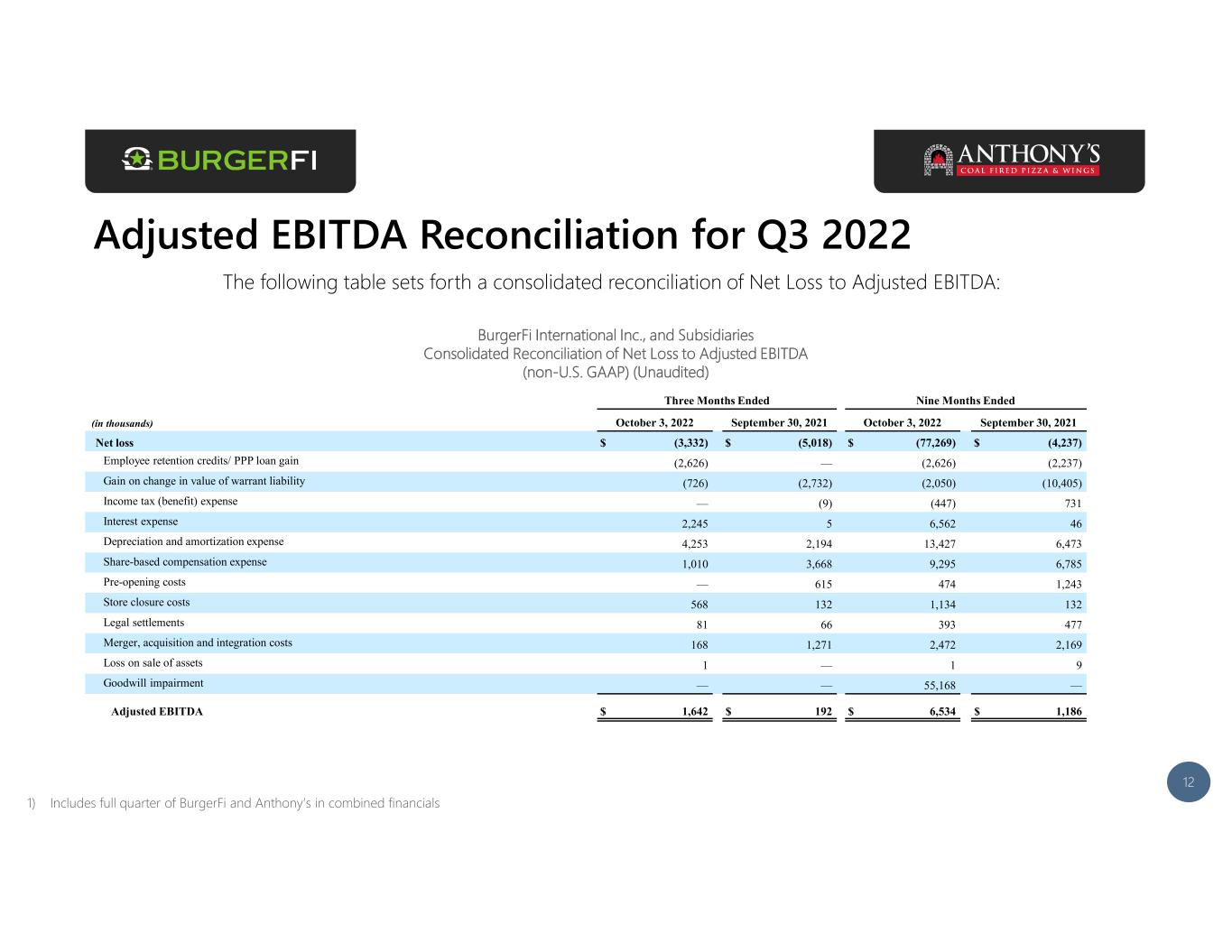

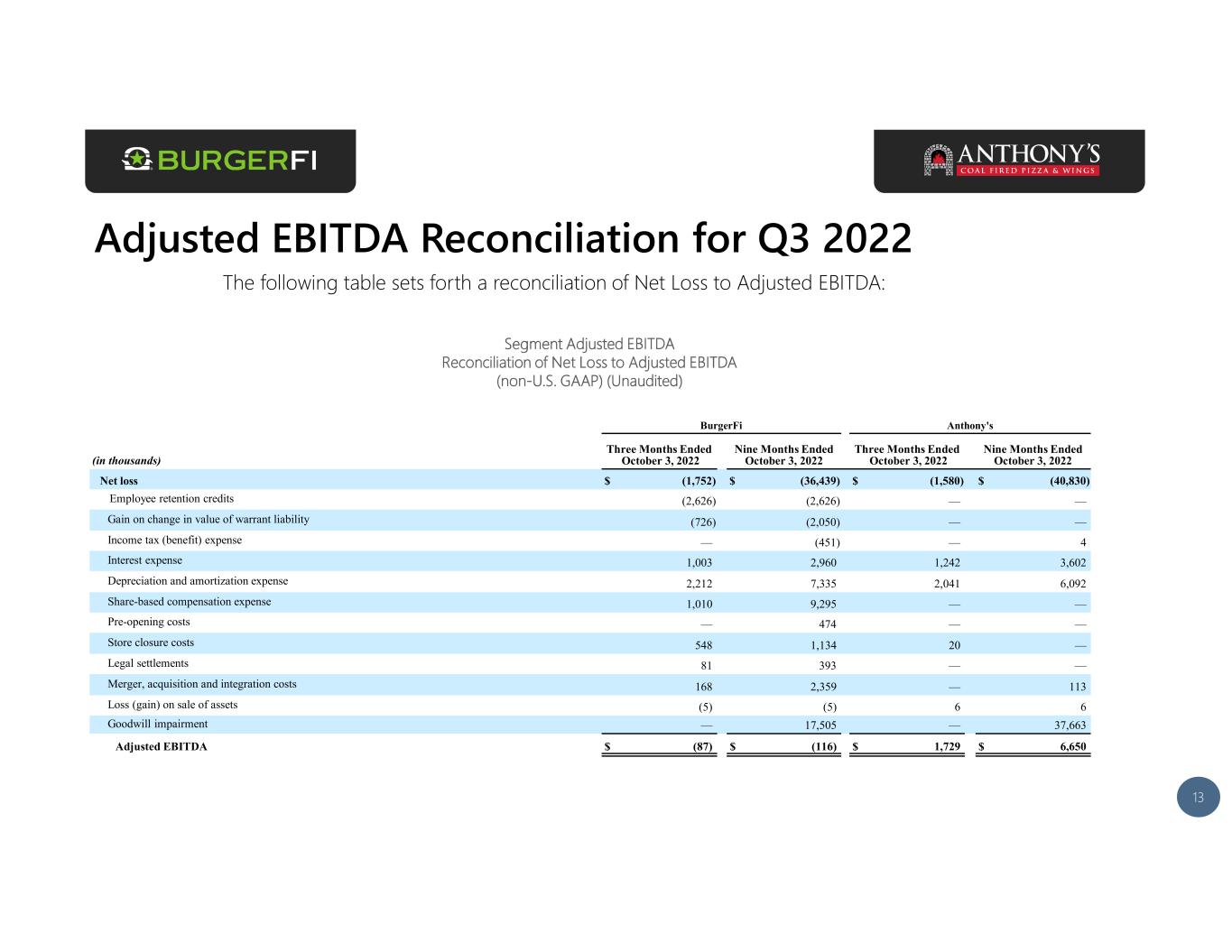

Adjusted EBITDA Reconciliation & Key Metrics Definitions 1111 Adjusted EBITDA Reconciliation • To supplement our consolidated financial statements, which are prepared and presented in accordance with GAAP, we use the measure Adjusted EBITDA. The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. • We use this non-GAAP financial measure for financial and operational decision-making and as a means to evaluate period-to-period comparisons. We believe that this non-GAAP financial measure provides meaningful supplemental information regarding our performance and liquidity by excluding certain items that may not be indicative of our recurring core business operating results. We believe that both management and investors benefit from referring to this non-GAAP financial measure in assessing our performance and when planning, forecasting, and analyzing future periods. This non-GAAP financial measure also facilitates management’s internal comparisons to our historical performance and liquidity as well as comparisons to our competitors’ operating results. We believe this non-GAAP financial measure is useful to investors both because (1) it allows for greater transparency with respect to key metrics used by management in its financial and operational decision-making and (2) it is used by our institutional investors and the analyst community to help them analyze the health of our business. • There are a number of limitations related to the use of this non-GAAP financial measure. We compensate for these limitations by providing specific information regarding the GAAP amounts excluded from this non-GAAP financial measure and evaluating this non-GAAP financial measure together with its relevant financial measures in accordance with GAAP. • A reconciliation of Adjusted EBITDA guidance is not being provided due to the nature of this forward-looking non-GAAP measure containing certain elements that are impractical to predict given their market-based nature, such as share-based compensation expense and gain and losses on change in value of warrant liabilities, without unreasonable efforts. For the same reasons, we are unable to address the probable significance of the unavailable information, nor can we accurately predict all of the components of the applicable non-GAAP financial measure and reconciling adjustments thereto; accordingly, guidance for the corresponding GAAP measure may be materially different than guidance for the non-GAAP measure. Such forward looking information is also subject to uncertainty and various risks, and there can be no assurance that any forecasted results or conditions will actually be achieved. • For more information on this non-U.S. GAAP financial measures, please see the tables captioned Reconciliation of Net Loss to Adjusted EBITDA included on slides 12-13. Key Metrics Definitions • “Systemwide Restaurant Sales” is presented as informational data in order to understand the aggregation of franchised stores sales, ghost kitchen and corporate-owned store sales performance. Systemwide Restaurant Sales growth refers to the percentage change in sales at all franchised restaurants, ghost kitchens and corporate-owned restaurants in one period from the same period in the prior year. Systemwide Restaurant Same Store Sales growth refers to the percentage change in sales at all franchised restaurants, ghost kitchens, and corporate-owned restaurants after 14 months of operations. See definition below for “Same Store Sales”. • “Corporate-Owned Restaurant Sales” represent the sales generated only by corporate-owned restaurants. Corporate-Owned Restaurant Sales growth refers to the percentage change in sales at all corporate-owned restaurants in one period from the same period in the prior year. Corporate-Owned Restaurant Same Store Sales growth refers to the percentage change in sales at all corporate-owned restaurants after 14 months of operations. These measures highlight the performance of existing corporate-owned restaurants. • “Franchise Restaurant Sales” represent the sales generated only by franchisee-owned restaurants and are not recorded as revenue, however, the royalties based on a percentage of these franchise restaurant sales are recorded as revenue. Franchise Restaurant Sales growth refers to the percentage change in sales at all franchised restaurants in one period from the same period in the prior year. Franchise Restaurant Same Store Sales growth refers to the percentage change in sales at all franchised restaurants after 14 months of operations. These measures highlight the performance of existing franchised restaurants. • “Same Store Sales” is used to evaluate the performance of our store base, which excludes the impact of new stores and closed stores, in both periods under comparison. We include a restaurant in the calculation of Same Store Sales after 14 months of operations. A restaurant which is temporarily closed (including as a result of the COVID-19 pandemic), is included in the Same Store Sales computation. A restaurant which is closed permanently, such as upon termination of the lease, or other permanent closure, is immediately removed from the Same Store Sales computation. Our calculation of Same Store Sales may not be comparable to others in the industry. • “Digital Channel” % of systemwide sales is used to measure performance of our investments made in our digital platform and partnerships with third party delivery partners. We believe our digital platform capabilities are a vital element to continuing to serve our customers and will continue to be a differentiator for the Company as compared to some of our competitors. Digital Channel as percentages of Systemwide Restaurant Sales are indicative of the sales placed through our digital platforms and the percentage of those digital sales when compared to total sales at all our franchised and corporate-owned restaurants. • “Adjusted EBITDA,” a non-GAAP measure, is defined as net loss before employee retention credits and PPP loan gain, the gain on change in value of warrant liability, income tax (benefit) expense, interest expense (which includes non-cash interest on preferred stock and interest accretion on related party notes), depreciation and amortization, share-based compensation expense, pre-opening costs, store closure costs, legal settlements, merger, acquisition and integration costs, loss (gain) on sale of assets and goodwill impairment. • Unless otherwise stated, Systemwide Restaurant Sales, Systemwide Sales growth, and Same Store Sales are presented on a systemwide basis, which means they include franchise restaurants and company-owned restaurants. Franchise restaurant sales represent sales at all franchise restaurants and are revenues to our franchisees. We do not record franchise sales as revenues; however, our royalty revenues and brand royalty revenues are calculated based on a percentage of franchise sales.

Adjusted EBITDA Reconciliation for Q3 2022 12 The following table sets forth a consolidated reconciliation of Net Loss to Adjusted EBITDA: BurgerFi International Inc., and Subsidiaries Consolidated Reconciliation of Net Loss to Adjusted EBITDA (non-U.S. GAAP) (Unaudited) 12 1) Includes full quarter of BurgerFi and Anthony’s in combined financials Three Months Ended Nine Months Ended (in thousands) October 3, 2022 September 30, 2021 October 3, 2022 September 30, 2021 Net loss $ (3,332) $ (5,018) $ (77,269) $ (4,237) Employee retention credits/ PPP loan gain (2,626) — (2,626) (2,237) Gain on change in value of warrant liability (726) (2,732) (2,050) (10,405) Income tax (benefit) expense — (9) (447) 731 Interest expense 2,245 5 6,562 46 Depreciation and amortization expense 4,253 2,194 13,427 6,473 Share-based compensation expense 1,010 3,668 9,295 6,785 Pre-opening costs — 615 474 1,243 Store closure costs 568 132 1,134 132 Legal settlements 81 66 393 477 Merger, acquisition and integration costs 168 1,271 2,472 2,169 Loss on sale of assets 1 — 1 9 Goodwill impairment — — 55,168 — Adjusted EBITDA $ 1,642 $ 192 $ 6,534 $ 1,186

Adjusted EBITDA Reconciliation for Q3 2022 13 The following table sets forth a reconciliation of Net Loss to Adjusted EBITDA: Segment Adjusted EBITDA Reconciliation of Net Loss to Adjusted EBITDA (non-U.S. GAAP) (Unaudited) 1 BurgerFi Anthony's (in thousands) Three Months Ended October 3, 2022 Nine Months Ended October 3, 2022 Three Months Ended October 3, 2022 Nine Months Ended October 3, 2022 Net loss $ (1,752) $ (36,439) $ (1,580) $ (40,830) Employee retention credits (2,626) (2,626) — — Gain on change in value of warrant liability (726) (2,050) — — Income tax (benefit) expense — (451) — 4 Interest expense 1,003 2,960 1,242 3,602 Depreciation and amortization expense 2,212 7,335 2,041 6,092 Share-based compensation expense 1,010 9,295 — — Pre-opening costs — 474 — — Store closure costs 548 1,134 20 — Legal settlements 81 393 — — Merger, acquisition and integration costs 168 2,359 — 113 Loss (gain) on sale of assets (5) (5) 6 6 Goodwill impairment — 17,505 — 37,663 Adjusted EBITDA $ (87) $ (116) $ 1,729 $ 6,650

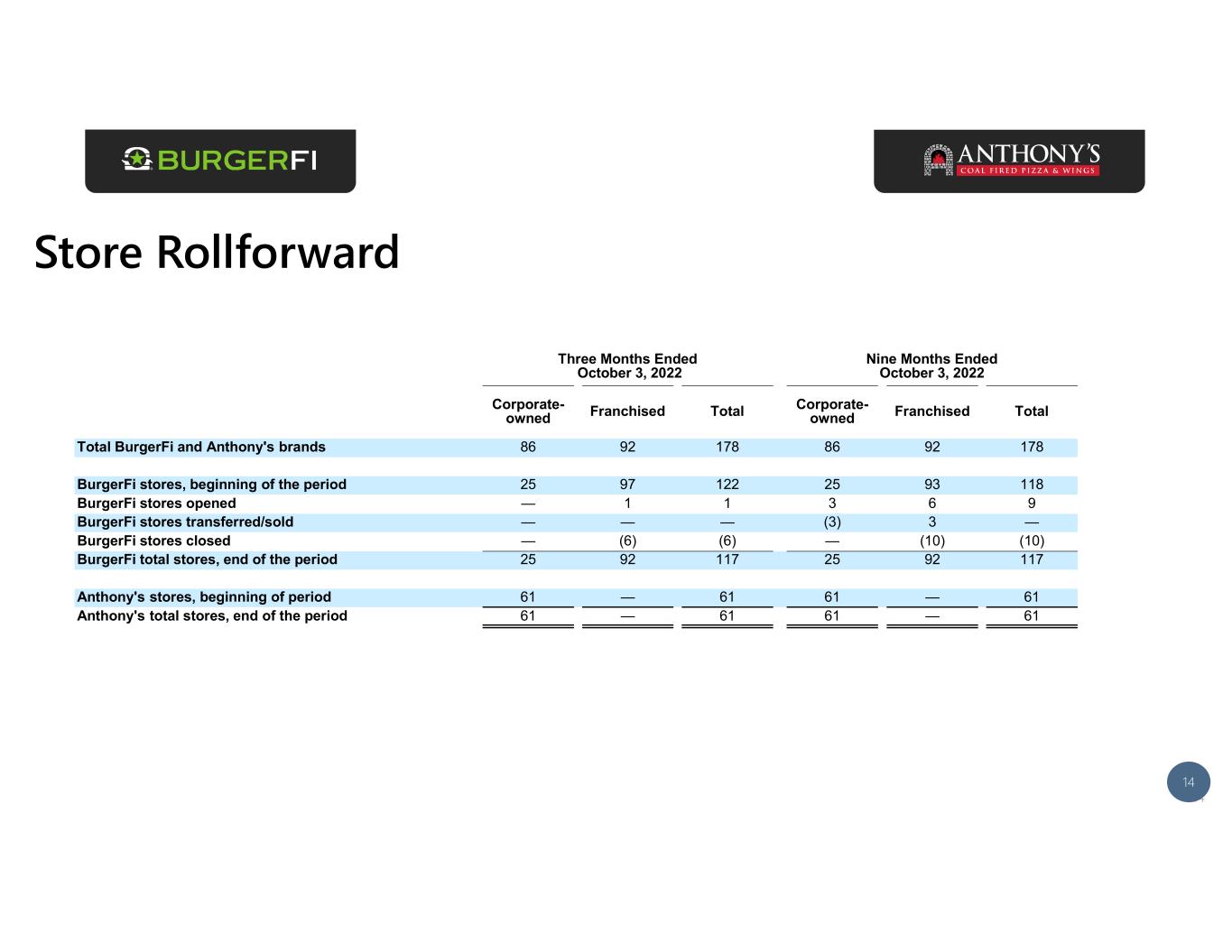

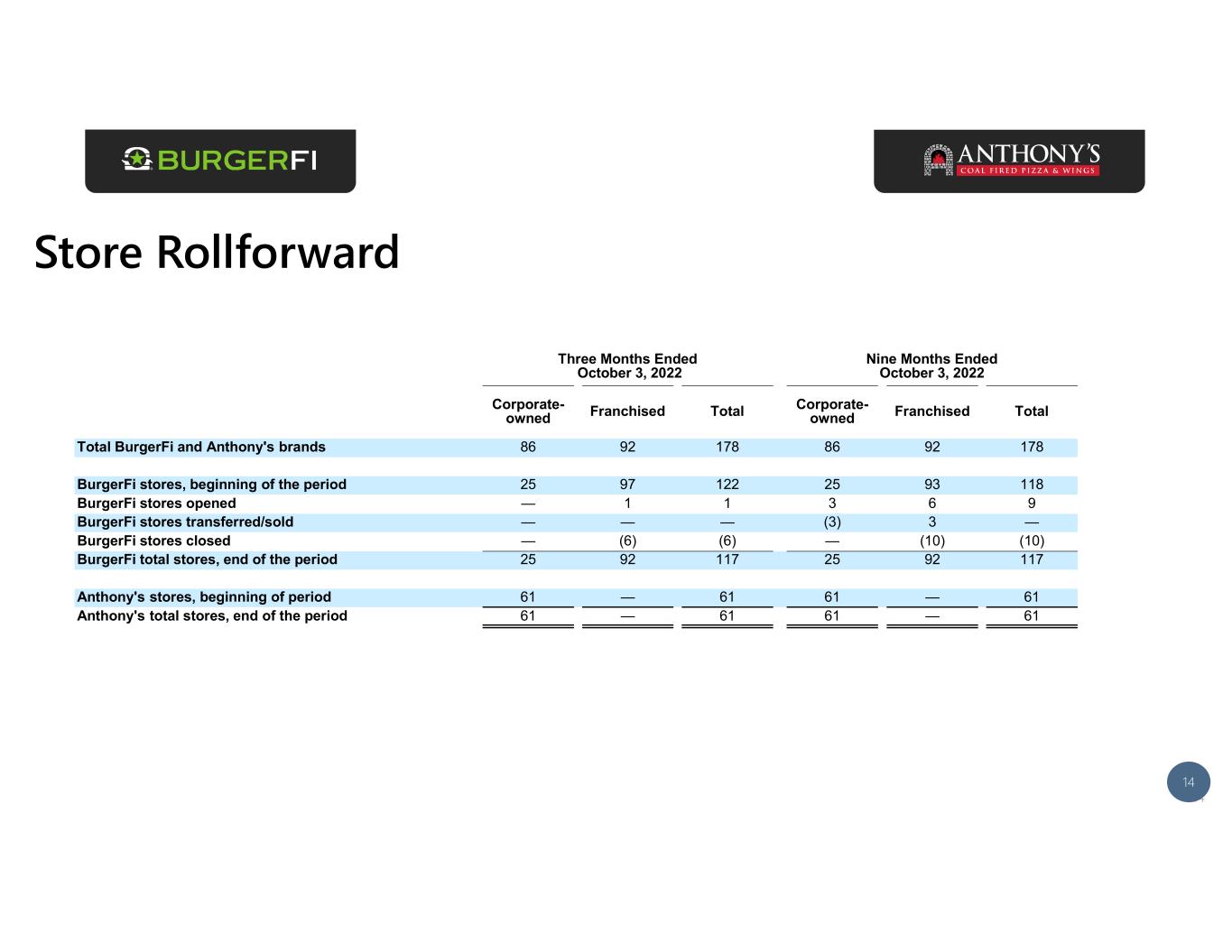

Store Rollforward 14 14 Three Months Ended October 3, 2022 Nine Months Ended October 3, 2022 Corporate- owned Franchised Total Corporate- owned Franchised Total Total BurgerFi and Anthony's brands 86 92 178 86 92 178 BurgerFi stores, beginning of the period 25 97 122 25 93 118 BurgerFi stores opened — 1 1 3 6 9 BurgerFi stores transferred/sold — — — (3) 3 — BurgerFi stores closed — (6) (6) — (10) (10) BurgerFi total stores, end of the period 25 92 117 25 92 117 Anthony's stores, beginning of period 61 — 61 61 — 61 Anthony's total stores, end of the period 61 — 61 61 — 61

Contact Us Investor Relations Contact Michelle Michalski 646-277-1224 IR-BFI@icrinc.com