NASDAQ: CLBK Sandler O'Neill East Coast Financial Services Conference Thomas K. Kemly President and CEO Dennis E. Gibney EVP, Chief Financial Officer November 7, 2018

Safe Harbor Statement THIS PRESENTATION CONTAINS FORWARD‐LOOKING STATEMENTS WITHIN THE MEANING OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 REGARDING COLUMBIA FINANCIAL INC.’S EXPECTATIONS OR PREDICTIONS OF FUTURE FINANCIAL OR BUSINESS PERFORMANCE OR CONDITIONS. FORWARD‐LOOKING STATEMENTS ARE TYPICALLY IDENTIFIED BY WORDS SUCH AS “BELIEVE,” “EXPECT,” “ANTICIPATE,” “INTEND,” “TARGET,” “ESTIMATE,” “CONTINUE,” “POSITIONS,” “PROSPECTS” OR “POTENTIAL,” BY FUTURE CONDITIONAL VERBS “WILL,” “WOULD,” “SHOULD,” “COULD” OR SUCH AS WILL, WOULD, SHOULD, COULD “MAY”, OR BY VARIATIONS OF SUCH WORDS OR BY SIMILAR EXPRESSIONS. THESE FORWARD‐LOOKING STATEMENTS ARE SUBJECT TO NUMEROUS ASSUMPTIONS, RISKS AND UNCERTAINTIES, WHICH CHANGE OVER TIME. FORWARD‐LOOKING STATEMENTS SPEAK ONLY AS OF THE DATE THEY ARE MADE AND WE ASSUME NO DUTY TO UPDATE FORWARD‐LOOKING STATEMENTS. ACTUAL RESULTS MAY DIFFER MATERIALLY FROM CURRENT PROJECTIONS. IN ADDITION TO FACTORS PREVIOUSLY DISCLOSED IN COLUMBIA FINANCIAL’S REPORTS FILED WITH THE U.S. SECURITIES AND EXCHANGE COMMISSION AND THOSE IDENTIFIED ELSEWHERE IN THIS PRESENTATION, THE FOLLOWING FACTORS AMONG OTHERS, COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM FORWARD‐LOOKING STATEMENTS OR HISTORICAL PERFORMANCE: CHANGES IN ASSET QUALITY AND CREDIT RISK; THE INABILITY TO SUSTAIN REVENUE AND EARNINGS GROWTH; OUR ABILITY TO CONTROL COSTS AND EXPENSES; CHANGES IN INTEREST RATES AND CAPITAL MARKETS; LOAN DELINQUENCY RATES; INFLATION; CUSTOMER ACCEPTANCE OF COLUMBIA BANK PRODUCTS AND SERVICES; CUSTOMER BORROWING, REPAYMENT, INVESTMENT AND DEPOSIT PRACTICES; CUSTOMER DISINTERMEDIATION; THE INTRODUCTION, WITHDRAWAL, SUCCESS AND TIMING OF BUSINESS INITIATIVES; COMPETITIVE CONDITIONS AND OUR ABILITY TO OFFER COMPETITIVE PRODUCTS AND PRICING; THE INABILITY TO REALIZE COST SAVINGS OR REVENUES OR TO IMPLEMENT INTEGRATION PLANS AND OTHER CONSEQUENCES ASSOCIATED WITH MERGERS, ACQUISITIONS AND DIVESTITURES; NATIONAL, REGIONAL AND LOCAL ECONOMIC CONDITIONS; AND THE IMPACT, EXTENT AND TIMING OF TECHNOLOGICAL CHANGES, CAPITAL MANAGEMENT ACTIVITIES, AND OTHER ACTIONS OF THE FEDERAL RESERVE BOARD AND OTHER LEGISLATIVE AND REGULATORY ACTIONS AND REFORMS. THESE FACTORS SHOULD BE CONSIDERED IN EVALUATING THE FORWARD‐LOOKING STATEMENTS AND UNDUE RELIANCE SHOULD NOT BE PLACED ON SUCH STATEMENTS. THIS PRESENTATION ALSO INCLUDES INTERIM AND UNAUDITED FINANCIAL INFORMATION THAT IS SUBJECT TO FURTHER REVIEW BY COLUMBIA FINANCIAL’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM. 1.

Background . Columbia Financial Inc. (“CLBK”) is the mid-tier holding company for Columbia Bank (the “Bank”), a community bank with 49 branches. . CLBK is in the mutual holding company (“MHC”) structure and completed its minority stock offering of 46% of the total shares outstanding (43% to depositors and 3% to a charitable foundation) on April 20, 2018, raising $498.3 million in gross proceeds. The remaining 54% of the total shares outstanding is owned by Columbia Bank, MHC. . Established in 1927, the Bank is headquartered in Fair Lawn, NJ and operates branches in 10 New Jersey counties. . The Bank attracts deposits from businesses and the general public and uses those funds to originate a variety of loans including commercial real estate and multifamily loans, residential mortgages, commercial business loans, construction loans, home equity loans and other consumer loans. . In addition to deposit and loan fees, the Bank offers title insurance through First Jersey Title Services, the Bank’s wholly owned subsidiary and insurance and investment advisory services through a third party relationship. 2.

Strategy . Increasing earnings through the growth of our balance sheet . Expanding our commercial business relationships . Continuing to emphasize the origination of 1-4 family residential mortgage loans . Increasing fee income through continued growth of fee-based activities . Expanding our franchise through de novo branching, branch acquisitions and the possible acquisition of other financial institutions and/or financial service companies . Maintaining asset quality through the application of a prudent, disciplined approach to credit risk as part of an overall risk management program . Expanding our technology infrastructure to broaden our product capabilities and improve product delivery and efficiency . Focusing on enhanced customer experience and continued customer satisfaction . Employing a shareholder-focused management of capital 3.

Vested Interest . Directors and Executive Officers have individually purchased approximately 785 thousand shares as of November 1, 2018. . The IPO purchase limitation for individuals and groups was 55 thousand shares. Insiders did not receive any preference in the IPO and some Executive Officers and Directors had their orders cut back due to the level of oversubscription. . In total, Directors and employees subscribed for 3.0 million shares and were allocated 2.3 million shares (5% of the shares sold) in the IPO. . A ESOP plan was established as part of the IPO and presently holds 4.5 million shares (9% of the shares sold). . All Directors, Executive Officers and Senior Vice Presidents have share holding requirements to meet by the fifth anniversary of the IPO equal to: CEO = 5x salary, Directors = 3x fees, Sr. EVP/EVPs = 3x salary and SVPs = 1.5x salary. Common Stock Percent of Shares Percent of Minority Market Value Holder Position Equivalent Held Outstanding Shares Outstanding ($000) Position Date Source Directors Noel R. Holland Chairman of the Board 55,000 0.05% 0.10%$ 857 4/19/2018 13D Thomas J. Kemly President, CEO and Director 122,575 0.11% 0.23% 1,910 11/1/2018 Form 4 Frank Czerwinski Director 55,000 0.05% 0.10% 857 4/19/2018 13D Raymond G. Hallock Director 55,000 0.05% 0.10% 857 4/19/2018 13D Henry Kuiken Director 85,775 0.07% 0.16% 1,336 8/29/2018 Form 4 Michael Massood Jr. Director 48,030 0.04% 0.09% 748 5/24/2018 Form 4 Elizabeth E. Randall Director 24,942 0.02% 0.05% 389 4/19/2018 13D John R. Salvetti Director 18,000 0.02% 0.03% 280 8/14/2018 Form 4 Robert Van Dyk Director 55,000 0.05% 0.10% 857 4/19/2018 13D Executive Officers Edward Thomas Allen Jr. SEVP and Chief Operating Officer 56,351 0.05% 0.11% 878 9/4/2018 Form 4 Joseph Francis Dempsey Jr. EVP and Head of Commercial Banking 3,000 0.00% 0.01% 47 10/30/2018 Form 4 Dennis E. Gibney EVP and Chief Financial Officer 65,000 0.06% 0.12% 1,013 10/30/2018 Form 4 Geri M. Kelly EVP and Human Resources Officer 55,385 0.05% 0.10% 863 9/10/2018 Form 4 John Klimowich EVP and Chief Risk Officer 16,890 0.01% 0.03% 263 8/2/2018 Form 4 Mark S. Krukar EVP and Chief Credit Officer 32,800 0.03% 0.06% 511 4/19/2018 13D Brian W. Murphy EVP and Operations Officers 31,100 0.03% 0.06% 485 4/19/2018 13D Allyson Katz Schlesinger EVP and Head of Consumer Banking 4,876 0.00% 0.01% 76 10/31/2018 Form 4 $ 12,226 Market value is calculated using the closing price 15.58 USD as of 11/2/2018. 4.

Recent Additions to the Team Allyson Schlesinger was appointed as Executive Vice President, Head of Consumer Banking in September 2018. In that role, Ms. Schlesinger is responsible for the Retail Banking, Retail Lending, Wealth Management and Marketing Divisions of Columbia Bank. Ms. Schlesinger was previously with Citigroup, Inc. for 25 years, most recently as its Managing Director, U.S. Retail and Division Manager for Citi’s New York City and New Jersey markets. In this role she led their largest branch market globally, and helped to implement the “Big Apple” strategy by deploying next generation banking centers, and championing new digital strategies. Ms. Schlesinger holds a Bachelor’s Degree from the University of Michigan. Joseph Dempsey was appointed as Executive Vice President, Head of Commercial Banking in September 2018. In that role, Mr. Dempsey is responsible for Columbia Bank's Commercial Lending functions, including C&I, SBA, Middle Market Lending, Commercial Real Estate and Construction financing, as well as the Bank's Business Development Division. Mr. Dempsey previously served as New Jersey Market President and Chair of Market Leadership Team at JP Morgan Chase, where he directed Chase's middle market operations for the State of New Jersey before moving to Capital One as its Senior Regional Commercial Credit Officer. In that role, he was responsible for Middle Market lending activities in New Jersey, New York, Long Island and Pennsylvania. Mr. Dempsey holds a Bachelor's Degree from Dartmouth College and an M.B.A. in Finance from New York University. In addition to Ms. Schlesinger and Mr. Dempsey, we have hired Elizabeth De Laney, formerly of Valley National Bank, as SVP, Retail Lending and Linda LeMond, formerly of Orange Bank and Trust Co., as SVP, Treasury Management to implement and support treasury management services for commercial customers. 5.

Lending . In September 2018, the Bank segregated its lending function from its credit function to provide more independence and enhance credit oversight. . Mark Krukar assumed the role of Chief Credit Officer and Joseph Dempsey was hired as EVP, Head of Commercial Banking. . The Bank intends to continue to grow all segments of its loan portfolio, but will have a greater emphasis on commercial segments. . The Bank is currently increasing its commercial lending team in order to source new relationships and loans. . Historically, the Bank had limited its lending to % properties or borrowers located in New Jersey. More Loan Type 9/30/2013 9/30/2018 Change $ in thousands recently, the Bank has followed existing commercial borrowers outside the state thereby expanding the Residential Real Estate$ 1,450,431 $ 1,823,266 25.7% market area for new borrowers to the neighboring Home Equity / Consumer 537,727 405,056 ‐24.7% States of Pennsylvania, New York and Connecticut. Commercial Real Estate 1,129,381 2,089,130 85.0% . Residential mortgage lending has expanded to Construction 128,262 269,729 110.3% Commercial 117,400 304,221 159.1% Pennsylvania and New York counties contiguous to Total Loans 3,363,201 4,891,402 45.4% our market area. Net Deferred Loan Costs 2,874 15,301 . The Bank will seek to sell a portion of its residential Allowance for Loan Losses (61,292) (63,406) originations to support the growth of servicing fee Loans Receivable, Net$ 3,304,783 $ 4,843,297 income. 6.

Asset Quality . NPAs to assets have declined from 1.68% of assets at September 30, 2013 to 0.06% of assets at September 30, 2018. . While credit quality is strong, the Company operates in a judicial state with consumer friendly foreclosure and eviction laws and practices which elongate the collection process for mortgages. The Company periodically elects to sell delinquent loans to shorten the collection process. . ALLL to loans was 1.30% at September 30, 2018. . As previously noted, in order to further strengthen credit oversight as we grow, the Company has segregated its Credit Department from Commercial Lending to improve independence and enhance credit oversight. 7.

Deposits . The Company’s primary source of funds is deposits, which are comprised of transaction accounts, money market accounts, savings accounts and certificates of deposit. . Deposit growth is sourced through our retail branch network in conjunction with the efforts of our business development and commercial lending teams. . The Company will seek to add de novo branches to enter new markets and expand market penetration. . The Company does not currently use brokered deposits or on-line listing services to attract deposits. 8.

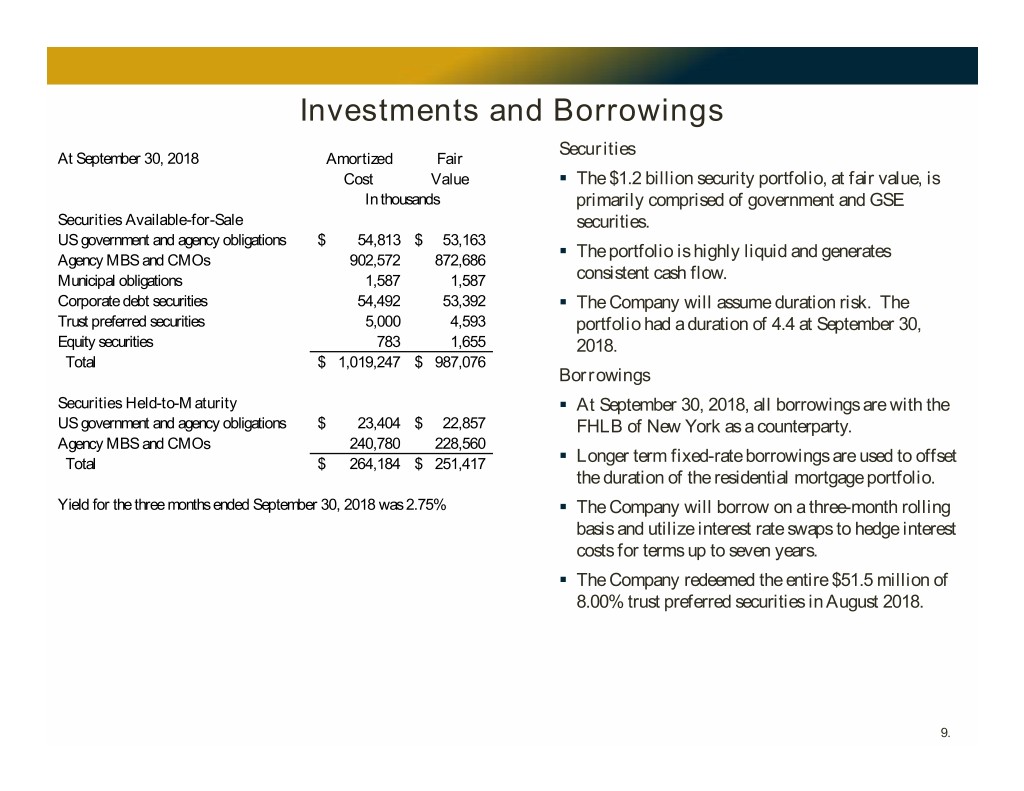

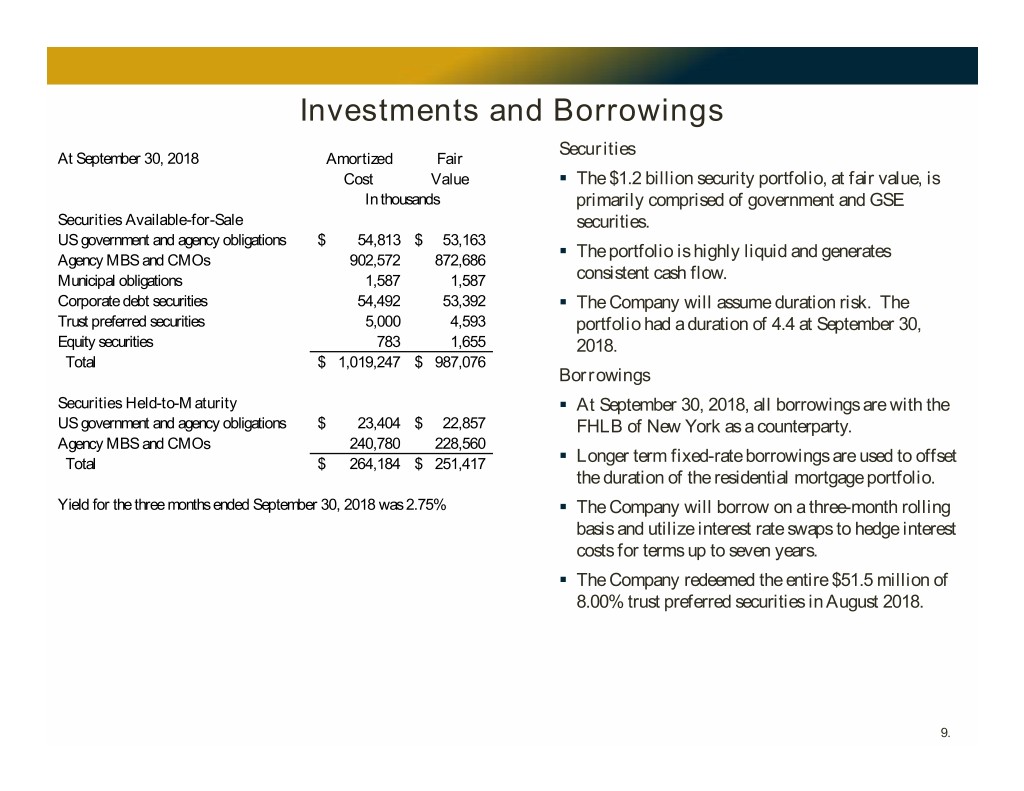

Investments and Borrowings Securities At September 30, 2018 Amortized Fair Cost Value . The $1.2 billion security portfolio, at fair value, is In thousands primarily comprised of government and GSE Securities Available-for-Sale securities. US government and agency obligations$ 54,813 $ 53,163 . The portfolio is highly liquid and generates Agency MBS and CMOs 902,572 872,686 Municipal obligations 1,587 1,587 consistent cash flow. Corporate debt securities 54,492 53,392 . The Company will assume duration risk. The Trust preferred securities 5,000 4,593 portfolio had a duration of 4.4 at September 30, Equity securities 783 1,655 2018. Total$ 1,019,247 $ 987,076 Borrowings Securities Held-to-Maturity . At September 30, 2018, all borrowings are with the US government and agency obligations$ 23,404 $ 22,857 FHLB of New York as a counterparty. Agency MBS and CMOs 240,780 228,560 Total$ 264,184 $ 251,417 . Longer term fixed-rate borrowings are used to offset the duration of the residential mortgage portfolio. Yield for the three months ended September 30, 2018 was 2.75% . The Company will borrow on a three-month rolling basis and utilize interest rate swaps to hedge interest costs for terms up to seven years. . The Company redeemed the entire $51.5 million of 8.00% trust preferred securities in August 2018. 9.

Earnings Columbia Financial, Inc. Summary Income State me nt ($ in thousands) For nine months ended 2018 2017 Interest and dividend income$ 164,508 $ 140,098 Interest expense 43,847 33,723 Net interest income 120,661 106,375 Provision for loan losses 5,900 6,426 Non-interest income 15,280 12,266 Non-interest expense 114,372 79,995 Pre-tax income 15,669 32,220 Income tax expense 7,800 11,140 Net income$ 7,869 $ 21,080 Core net income$ 35,251 $ 26,195 Reconciliation of GAAP to Non-GAAP Financial Measures Reconciliation to Core Net Income Net income$ 7,869 $ 21,080 Add: contribution to foundation, net of tax 27,466 2,281 Add: losses (gains) on sale of investment securities, net of tax (84) 2,834 Core net income$ 35,251 $ 26,195 10.

Digital Platform and Strategy . The Company completed its core system conversion in 2015 to a state-of-the-art banking platform to facilitate real time transactions. . This real time platform allows the Company to support online account opening, mobile transactions and creates an enhanced user experience across our digital banking channels . The platform also facilitates P2P payments and advanced fraud monitoring applications . In 2016, the Company implemented a residential and consumer origination system to enhance productivity and customer experience. Online loan applications are fully supported. . The Q2 Business Treasury Management platform was implemented in 2018, enabling the Company to match the offerings of money center banks and far exceeding the capabilities of many of our regional peers. . A CRM and Commercial Loan Origination System will be implemented in 2019, which we believe will enhance the capability and efficiency of both our salesforce and back office. Mobile App Survey Taken the Week of September 17, 2018 Money Center Money Center Regional Regional Columbia Bank Bank 1 Bank 2 Competitor 1 Competitor 2 Touch IDXXXXX Account TransfersXXXXX Bill Pay XXXXX Remote Check DepositXXXXX P2P Payments X X X Loan Payments X X X ATM Preferences X X Online Statements X X X X Account Opening X Find a BranchXXXXX Credit Score X X Card Management X (Separate App) X X X (Separate App) Personal Financial Management X Apple Watch X X Money Center Banks are assumed to have assets >$100B and Regional Competitors have assets > $10B. 11.

What Differentiates CLBK? . We are fully invested in the success of the Company . We have a long tenured management team and have supplemented the team with strong outside hires. . We are further along in developing our commercial business line than our thrift counterparts . We source the overwhelming majority of our commercial loan originations . We invest where appropriate, but maintain a discipline of cost control . We have developed a robust enterprise risk management culture and maintain strong regulatory relationships . We have a strong interest rate risk management program . We are agile with the ability to adapt to changing market conditions . We offer a challenging and rewarding work environment with strong employee loyalty . We maintain a strong commitment to the communities we serve 12.