NASDAQ: CLBK May 22, 2020

SAFE HARBOR STATEMENT THIS PRESENTATION CONTAINS FORWARD‐LOOKING STATEMENTS WITHIN THE MEANING OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 REGARDING COLUMBIA FINANCIAL INC.’S EXPECTATIONS OR PREDICTIONS OF FUTURE FINANCIAL OR BUSINESS PERFORMANCE OR CONDITIONS. FORWARD‐LOOKING STATEMENTS ARE TYPICALLY IDENTIFIED BY WORDS SUCH AS “BELIEVE,” “EXPECT,” “ANTICIPATE,” “INTEND,” “TARGET,” “ESTIMATE,” “CONTINUE,” “POSITIONS,” “PROSPECTS” OR “POTENTIAL,” BY FUTURE CONDITIONAL VERBS “WILL,” “WOULD,” “SHOULD,” “COULD” OR SUCH AS “WILL”, “WOULD”, “SHOULD”, “COULD”, “MAY”, OR BY VARIATIONS OF SUCH WORDS OR BY SIMILAR EXPRESSIONS. THESE FORWARD‐LOOKING STATEMENTS ARE SUBJECT TO NUMEROUS ASSUMPTIONS, RISKS AND UNCERTAINTIES, WHICH CHANGE OVER TIME. FORWARD‐LOOKING STATEMENTS SPEAK ONLY AS OF THE DATE THEY ARE MADE AND WE ASSUME NO DUTY TO UPDATE FORWARD‐LOOKING STATEMENTS. ACTUAL RESULTS MAY DIFFER MATERIALLY FROM CURRENT PROJECTIONS. IN ADDITION TO FACTORS PREVIOUSLY DISCLOSED IN COLUMBIA FINANCIAL’S REPORTS FILED WITH THE U.S. SECURITIES AND EXCHANGE COMMISSION AND THOSE IDENTIFIED ELSEWHERE IN THIS PRESENTATION, THE FOLLOWING FACTORS AMONG OTHERS, COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM FORWARD‐LOOKING STATEMENTS OR HISTORICAL PERFORMANCE: THE EFFECT OF THE COVID-19 PANDEMIC INCLUDING ITS IMPACT ON OUR BORROWERS AND THEIR ABILITY TO REPAY THEIR LOANS, AND ON THE LOCAL AND NATIONAL ECONOMIES; CHANGES IN ASSET QUALITY AND CREDIT RISK; THE INABILITY TO SUSTAIN REVENUE AND EARNINGS GROWTH; OUR ABILITY TO CONTROL COSTS AND EXPENSES; CHANGES IN INTEREST RATES AND CAPITAL MARKETS; LOAN DELINQUENCY RATES; INFLATION; CUSTOMER ACCEPTANCE OF COLUMBIA BANK PRODUCTS AND SERVICES; CUSTOMER BORROWING, REPAYMENT, INVESTMENT AND DEPOSIT PRACTICES; CUSTOMER DISINTERMEDIATION; THE INTRODUCTION, WITHDRAWAL, SUCCESS AND TIMING OF BUSINESS INITIATIVES; COMPETITIVE CONDITIONS AND OUR ABILITY TO OFFER COMPETITIVE PRODUCTS AND PRICING; THE INABILITY TO REALIZE COST SAVINGS OR REVENUES OR TO IMPLEMENT INTEGRATION PLANS AND OTHER CONSEQUENCES ASSOCIATED WITH MERGERS, ACQUISITIONS AND DIVESTITURES; NATIONAL, REGIONAL AND LOCAL ECONOMIC CONDITIONS; AND THE IMPACT, EXTENT AND TIMING OF TECHNOLOGICAL CHANGES, CAPITAL MANAGEMENT ACTIVITIES, AND OTHER ACTIONS OF THE FEDERAL RESERVE BOARD AND OTHER LEGISLATIVE AND REGULATORY ACTIONS AND REFORMS. THESE FACTORS SHOULD BE CONSIDERED IN EVALUATING THE FORWARD‐LOOKING STATEMENTS AND UNDUE RELIANCE SHOULD NOT BE PLACED ON SUCH STATEMENTS. TRADEMARKS REFERRED TO IN THIS PRESENTATION ARE THE PROPERTY OF THEIR RESPECTIVE OWNERS, ALTHOUGH FOR PRESENTATION CONVENIENCE WE MAY NOT USE THE ® OR THE ™ SYMBOLS TO IDENTIFY SUCH TRADEMARKS. THIS PRESENTATION ALSO INCLUDES INTERIM AND UNAUDITED FINANCIAL INFORMATION THAT IS SUBJECT TO FURTHER REVIEW BY COLUMBIA FINANCIAL’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM. 2

2019 YEAR IN REVIEW The Company completed another successful year in 2019. Below are some of the highlights of our financial and operational performance for fiscal 2019 in support of our strategic plan: . Achieved asset growth of 22%, loan growth of 24%, and deposit growth of 28% through a combination of organic growth and an acquisition . Acquired Stewardship Financial Corporation - approximately $1.0 billion in assets . Agreed to acquire Roselle Bank, an institution in a mutual form of organization with approximately $435 million in assets . Added four de novo branches . Increased net income to $54.7 million, or $0.49 per basic and diluted share . Grew net interest income 5.1% and noninterest income 45.9% . Maintained strong asset quality - nonperforming assets to assets totaled 0.08% at December 31, 2019 . Furthered our digital strategy with the hiring of a Chief Information and Digital Officer . Repurchased 3.5 million shares of our common stock 3

COVID-19 IMPACT AND RESPONSE SAFELY PROVIDING BANKING SERVICES IN A CHALLENGING ENVIRONMENT . Implemented nearly 100% back office remote work environment at the time of the New Jersey stay at home order on March 21, 2020 . Branch banking through drive-up and appointment banking with enhanced sanitary protocols . Expanded digital banking offerings including Zelle SUPPORTING OUR CUSTOMERS . Relief programs for borrowers experiencing hardships . At May 7, 2020, loan deferments and short term loan modifications granted or under consideration totaled: . $840 million of commercial loans . $155 million of residential and consumer loans . Waived late fees . No credit reporting impact 4

COVID-19 IMPACT AND RESPONSE SUPPORTING OUR CUSTOMERS . Huge effort to support SBA Payroll Protection Program Loans . Originated 2,200 loans for $475 million. Average loan size was $216,000 . Supported the retention of over 40,000 local jobs . All applications accepted for qualified borrowers were approved SUPPORTING THE COMMUNITY . Funded the emergency field hospital at the New Jersey Convention Center in Edison . Columbia Bank Foundation pledged $600,000 to non-profit organizations and medical facilities 5

FINANCIAL PERFORMANCE FOR THE THREE MONTHS ENDED FOR THE YEARS ENDED DECEMBER 31, Operating Data MARCH 31, ($ in thousands) 2020 2019 2019 2018 2017 Interest Income $ 74,690 $ 62,887 $ 261,083 $ 226,290 $ 189,274 Interest Expense 23,988 20,503 88,712 62,256 45,965 Net Interest Income 50,702 42,384 172,371 164,034 143,309 Provision for Loan Losses 9,568 436 4,224 6,677 9,826 Non-Interest Income 6,391 6,037 31,636 21,688 16,818 Non-Interest Expense 38,508 29,559 128,701 145,386 105,421 Pre-Tax Income 9,017 18,426 71,082 33,659 44,880 Income Tax Expense 2,252 3,507 16,365 10,923 20,123 Net Income $ 6,765 $ 14,919 $ 54,717 $ 22,736 $ 24,757 6

FINANCIAL PERFORMANCE FOR THE THREE MONTHS ENDED FOR THE YEARS ENDED DECEMBER 31, Performance Ratios MARCH 31, 2020 1 2019 1 2019 2018 2017 Return on Average Assets 0.33% 0.90% 0.77% 0.36% 0.46% Core Return on 0.40% 0.89% 0.77% 0.79% 0.55% Avg. Assets Return on Average Equity 2.78% 6.18% 5.50% 2.87% 5.37% Core Return on 3.35% 6.14% 5.51% 6.12% 6.27% Avg. Equity Interest Rate Spread 2.33% 2.31% 2.20% 2.45% 2.62% Net Interest Margin 2.65% 2.70% 2.58% 2.74% 2.82% Non-Interest Expense to 1.88% 1.78% 1.82% 2.30% 1.97% Average Assets Efficiency Ratio 67.45% 61.05% 63.09% 78.28% 65.84% Core Efficiency Ratio 63.93% 61.21% 62.54% 59.60% 62.80% Basic and Diluted Earnings $ 0.06 $ 0.13 $ 0.49 $ 0.20 N/A Per Share 1 Ratios for the three months ended March 31, 2020 and March 31, 2019 are annualized. 7

LENDING • As part of our business plan, the Company intends to continue to grow all segments of its loan portfolio, but will place a greater emphasis on commercial segments. • However, near term growth will be limited as the impact of COVID-19 is monitored. LOAN TYPE ($ in thousands) 12/31/2017 3/31/2020 % CHANGE • In response to COVID-19, credit Residential Real Estate $ 1,615,000 $ 2,071,941 20.3% standards have been modified to Home Equity / Consumer 448,918 381,439 -15.0% make them more conservative while Commercial and Multifamily Real Estate 1,870,475 2,957,589 58.1% we evaluate the impact of the Construction 233,652 316,973 35.7% pandemic. Commercial Business 277,970 496,157 78.5% Total Loans 4,446,015 6,224,099 40.0% • The Company will seek to sell a portion Purchase Credit Impaired Loans - 7,021 of its residential originations to support Net Deferred Loan Costs 12,633 21,385 the growth of servicing fee income. Allowance for Loan Losses (58,178) (71,200) Loans Receivable, Net $ 4,400,470 $ 6,181,305 8

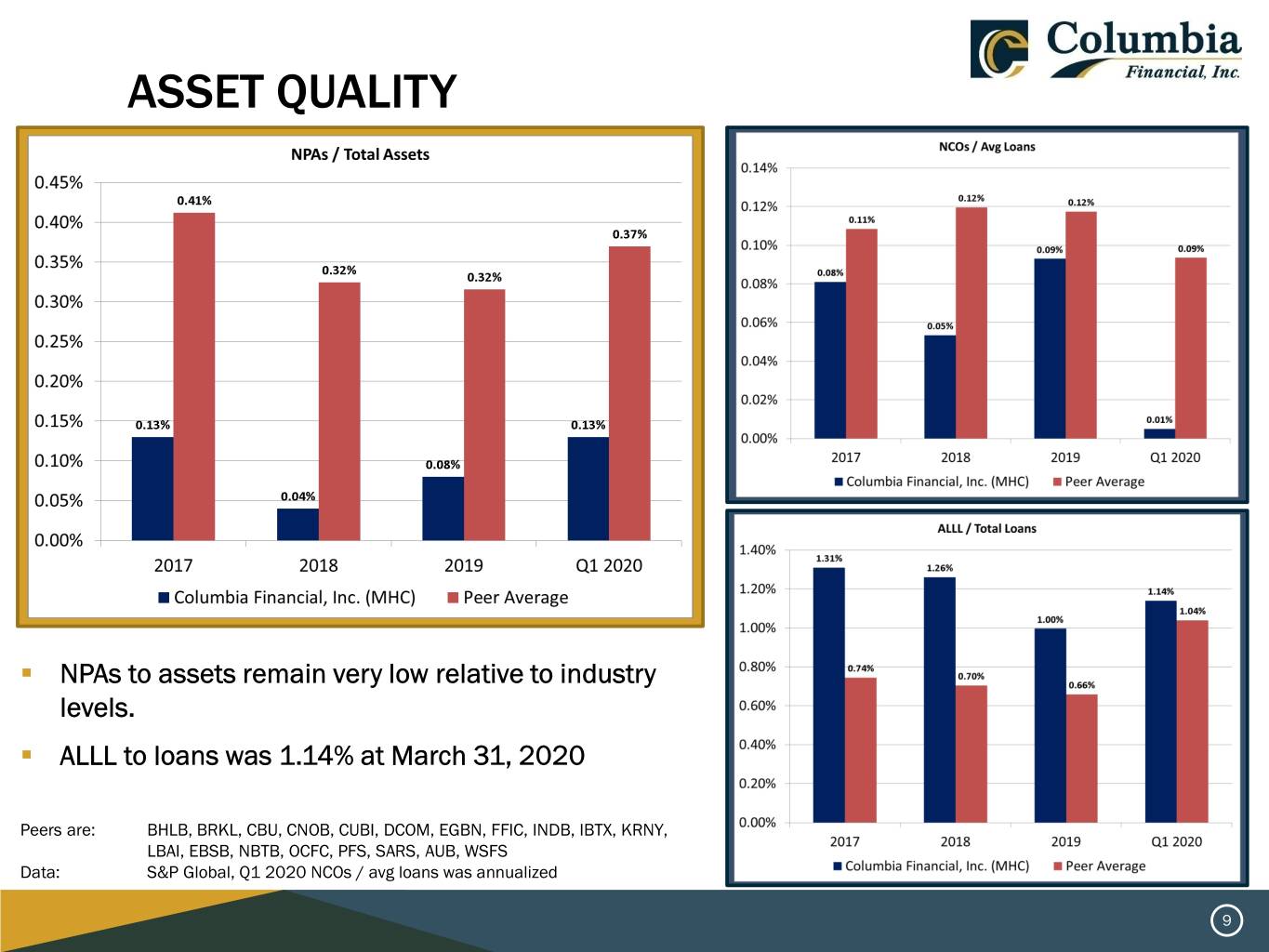

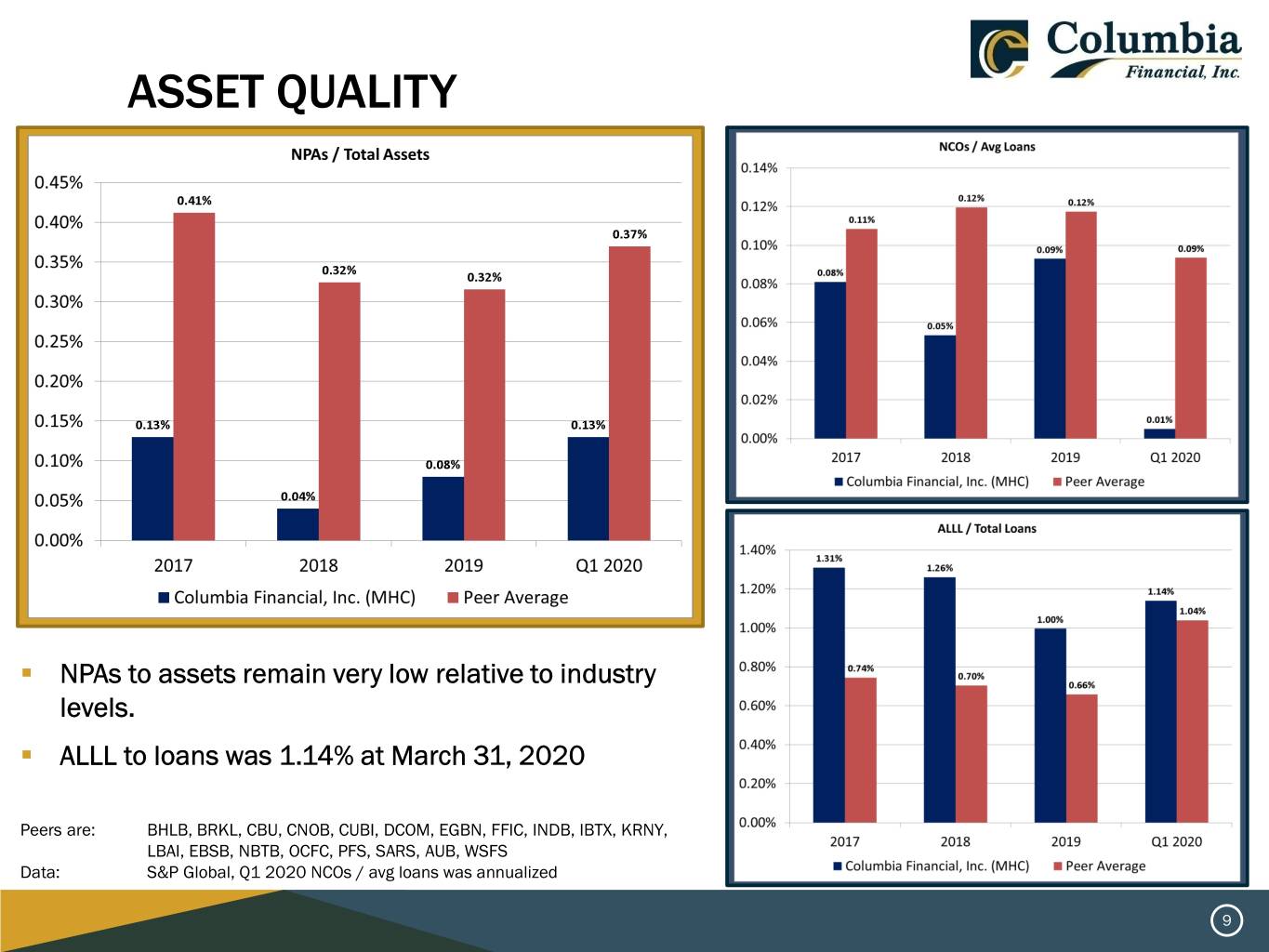

ASSET QUALITY . NPAs to assets remain very low relative to industry levels. . ALLL to loans was 1.14% at March 31, 2020 Peers are: BHLB, BRKL, CBU, CNOB, CUBI, DCOM, EGBN, FFIC, INDB, IBTX, KRNY, LBAI, EBSB, NBTB, OCFC, PFS, SARS, AUB, WSFS Data: S&P Global, Q1 2020 NCOs / avg loans was annualized 9

DEPOSITS • The Company’s primary source of funds is deposits, which are comprised of demand accounts, money market accounts, savings accounts and certificates of deposit. • Deposit growth is sourced through our retail branch network in conjunction with the efforts of our business development and commercial lending teams. • The Company places a heavy emphasis on checking products which currently account for nearly half of all deposits. • The customer online account opening experience has been enhanced. • The Company does not currently use brokered deposits or on-line listing services to attract deposits. 10

ACQUISITION OF STEWARDSHIP FINANCIAL . Cash deal of $137 million to purchase a solid community bank with ~$1 billion in assets . Strengthened our northern franchise with the addition of seven branches after consolidation . Significant cost savings and earnings accretion . Manageable level of tangible book dilution . Improved loan and deposit mixes with a heavier commercial emphasis . Obtained talented staff with strong customer relationships Pro Forma Branch Map Columbia Financial, Inc. Stewardship Financial Corporation 11

ACQUISITION OF ROSELLE BANK . Merger of Mutual Holding Companies completed on April 1, 2020 . No actual consideration paid to a third party for additional capital . Roselle Bank depositors received the same rights in Columbia Bank, MHC (subscription and liquidation) as Columbia Bank depositors and maintain their account opening date . Accretive to fully converted tangible book value . Added four branches in attractive markets . Meaningful and achievable cost savings Columbia Financial, Inc. and the potential for revenue synergies Roselle Bank 12

STOCK PERFORMANCE The following graph illustrates CLBK’s stock performance relative to the industry and the MHC Index. Source: S&P Global with data through May 19, 2020 13

DIGITAL STRATEGY ROADMAP 2015-2019 2020 Strategic Area of Focus Drive Growth & Digital Mortgage Solutions Profitability Operational Excellence Small Business Lending Solutions Customer Experience AI/ML for Cyber Defense Security & Risk Controls Business Intelligence Tools to drive Employee Business Decisions Experience 14

CAPITAL MANAGEMENT . In light of the current uncertain economic environment, the Company will moderate growth, both organic and through acquisitions, and evaluate its capital position as it relates to repurchases. . Dividends . CLBK is not a “grandfathered” mutual holding company as defined in the Dodd Frank Act, which means that based upon current Federal Reserve current policy, cash dividends cannot be waived by Columbia Bank, MHC. For this reason, CLBK does not expect to pay cash dividends to shareholders. MINIMUM CAPITAL MINIMUM CAPITAL ADEQUACY REQUIREMENTS At March 31, 2020 ACTUAL 1 To Risk-Weighted Assets ADEQUACY REQUIREMENTS WITH CAPITAL 2 To Adjusted Total Assets CONSERVATION BUFFER Amount Ratio Amount Ratio Amount Ratio Total Capital 1 $ 1,041,024 15.94% $ 522,366 8.00% $ 685,605 10.50% Tier 1 Capital 1 957,952 14.67% 391,774 6.00% 555,014 8.50% Common Equity Tier 1 Capital 1 950,735 14.56% 293,831 4.50% 457,070 7.00% Tier 1 Capital 2 957,952 11.81% 324,322 4.00% 324,322 4.00% 15

COLUMBIA BANK FOUNDATION . Current Funding: $47 million . 2019 Total Donations: $2.7 million . Pledged $600,000 to non-profit organizations impacted by COVID-19 and to medical facilities during 2020 16

NEAR TERM FOCUS The pandemic has materially impacted the Company’s growth pattern, interaction with customers / employees and the economic outlook. We will modify the Company’s financial and operating strategies to conform with the constraints of the pandemic and the new operating environment. Specifically, we will: . Moderate the growth of the balance sheet with new growth focused on lower risk assets . Work with our customers to reduce problem assets . Reduce cost of funds to protect net interest margin . Manage expense levels, including a pause of the de novo branch strategy . Increase our emphasis on digital strategy to address customer preferences and gain operating efficiencies . Evaluate our capital position based on the economic outlook 17

18

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES FOR THE THREE MONTHS ENDED FOR THE YEARS ENDED DECEMBER 31, Performance Ratios MARCH 31, 2020 2019 2019 2018 2017 Reconciliation to Core Net Income Net Income $6,765 $14,919 $54,717 $22,736 $24,757 Less: (Gain) loss on securities transactions, net (278) (100) (2,006) (88) 1,689 of tax Add: Charitable contribution -- -- -- 27,466 2,744 to foundation, net of tax Add: Merger-related 818 -- 2,162 -- -- expenses, net of tax Add: Branch closure 878 -- -- -- -- expenses, net of tax Core Net Income $8,183 $14,819 $54,873 $50,114 $29,190 19

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES (CONTINUED) FOR THE THREE MONTHS ENDED FOR THE YEARS ENDED DECEMBER 31, Performance Ratios MARCH 31, (1 Ratios are annualized) 2020 1 2019 1 2019 2018 2017 Return on Average Assets 0.33% 0.90% 0.77% 0.36% 0.46% Net Income $6,765 $14,919 $54,717 $22,736 $24,757 Average Assets $8,251,193 $6,739,828 $7,086,854 $6,319,249 $5,353,953 Core Return on Avg. Assets 0.40% 0.89% 0.77% 0.79% 0.55% Core Net Income $8,183 $14,819 $54,873 $50,114 $29,190 Return on Average Equity 2.78% 6.18% 5.50% 2.87% 5.37% Total Avg. Stockholders’ Equity $979,906 $979,578 $994,925 $791,889 $460,912 Less: (Gain) Loss on Securities Transactions, Net (278) (100) (2,006) (88) 1,689 of Tax Add: Charitable Contribution -- -- -- 27,466 2,744 to Foundation, Net of Tax Add: Merger-related 818 -- 2,162 -- -- Expenses, Net of Tax Add: Branch Closure 878 -- -- -- -- Expenses, Net of Tax Core Avg. Stockholders’ Equity $981,324 $979,478 $995,081 $819,267 $465,345 Core Return on Avg. Equity 3.35% 6.14% 5.51% 6.12% 6.27% 20

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES (CONTINUED) FOR THE THREE MONTHS ENDED FOR THE YEARS ENDED DECEMBER 31, Performance Ratios MARCH 31, (1 Ratios are annualized) 2020 1 2019 1 2019 2018 2017 Efficiency Ratio 67.45% 61.05% 63.09% 78.28% 65.84% Net Interest Income $50,702 $42,384 $172,371 $164,034 $143,309 Non-Interest Income 6,391 6,037 31,636 21,688 16,818 Total Income 57,093 48,421 204,007 185,722 160,127 Non-Interest Expense $38,508 $29,559 $128,701 $145,386 $105,421 Core Efficiency Ratio 63.93% 61.21% 62.54% 59.60% 62.80% Non-Interest Income $6,391 $6,037 $31,636 $21,688 16,818 Less: (Gain) Loss on (370) (126) (2,612) (116) 2,159 Securities Transactions Core Non-Interest Income $6,021 $5,911 $29,024 $21,572 $18,977 Non-Interest Expense $38,508 $29,559 $127,701 $145,386 $105,421 Less: Charitable Contribution -- -- -- (34,767) (3,509) to Foundation Less: Merger-related (1,075) -- (2,755) -- -- Expenses Less: Branch Closure (1,170) -- -- -- -- Expenses Core Non-Interest Expense $36,263 $29,559 $125,946 $110,619 $101,912 21