UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

or

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 000-56270

Bitwise 10 Crypto Index Fund

(Exact Name of Registrant as Specified in Its Charter)

| |

|

|

Delaware | 82-3002349 |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

250 Montgomery Street, Suite 200

San Francisco, CA 94104

(Address of Principal Executive Offices, including zip code)

(415) 707-3663

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

| | |

|

|

|

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

None | N/A | N/A |

|

|

|

Securities registered pursuant to Section 12(g) of the Act: Bitwise 10 Crypto Index Fund (BITW) Shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | |

Large accelerated filer | ☐ |

| Accelerated filer | ☐ |

|

|

|

|

|

Non-accelerated filer | ☒ |

| Smaller reporting company | ☐ |

|

|

|

|

|

|

|

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity stock held by non-affiliates of the registrant was approximately $682,936,133, computed by reference to the closing sale price of the registrant’s common stock on the OTCQX, on June 28, 2024, the last business day of the registrant’s most recently completed second fiscal quarter.

Number of shares of the registrant’s common stock outstanding as of February 20, 2025: 20,241,947.

Table of Contents

Statement Regarding Forward-Looking Statements

This Annual Report on Form 10-K contains “forward-looking statements” with respect to the financial conditions, results of operations, plans, objectives, future performance and business of Bitwise 10 Crypto Index Fund (BITW) (the “Trust”). Statements preceded by, followed by or that include words such as “may,” “might,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or “continue,” the negative of these terms and other similar expressions are intended to identify some of the forward-looking statements. All statements (other than statements of historical fact) included in this Annual Report on Form 10-K that address activities, events or developments that will or may occur in the future, including such matters as changes in market prices and conditions, the Trust’s operations, the plans of Bitwise Investment Advisers, LLC (the “Sponsor”) and references to the Trust’s future success and other similar matters are forward-looking statements. These statements are only predictions. Actual events or results may differ materially from such statements. These statements are based upon certain assumptions and analyses the Sponsor made based on its perception of historical trends, current conditions and expected future developments, as well as other factors appropriate in the circumstances. Whether or not actual results and developments will conform to the Sponsor’s expectations and predictions, however, is subject to a number of risks and uncertainties, including, but not limited to, those described in “Item 1A. Risk Factors.” Forward-looking statements are made based on the Sponsor’s beliefs, estimates and opinions on the date the statements are made and neither the Trust nor the Sponsor is under a duty or undertakes an obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, other than as required by applicable laws. Investors are therefore cautioned against relying on forward-looking statements. Factors which could have a material adverse effect on the Trust's business, financial condition or results of operations and future prospects or which could cause actual results to differ materially from the Trust's expectations include, but are not limited to:

•the extreme volatility of trading prices that many Crypto Assets, including Bitcoin, have experienced in recent periods and may continue to experience, which could have a material adverse effect on the value of the Shares of the Trust;

•the recentness of the development of Crypto Assets and the uncertain medium-to-long term value of the Shares due to a number of factors relating to the capabilities and development of Blockchain technologies and to the fundamental investment characteristics of Crypto Assets;

•the value of the Shares depending on the acceptance of Crypto Assets and Blockchain technology, a new and rapidly evolving industry;

•the unregulated nature and lack of transparency surrounding the operations of Blockchain technologies and crypto assets, which may adversely affect the value of Portfolio Crypto Assets and the Shares;

•the limited history of the Index;

•the possibility that the Shares may trade at a price that is at, above or below the Trust’s NAV Per Share;

•regulatory changes or actions by the United States (“U.S.”) Congress or any U.S. federal or state agencies that may affect the value of the Shares or restrict the use of one or more Crypto Assets, Mining activity or the operation of their networks or the markets for the Portfolio Crypto Assets in a manner that adversely affects the value of the Shares;

•changes in the policies of the U.S. Securities and Exchange Commission (the “SEC”) that could adversely impact the value of the Shares;

•the possibility that the Trust or the Sponsor could be subject to regulation as a money service business or money transmitter, which could result in extraordinary expenses to the Trust or the Sponsor and also result in decreased liquidity for the Shares;

•regulatory changes or interpretations that could obligate the Trust or the Sponsor to register and comply with new regulations, resulting in potentially extraordinary, nonrecurring expenses to the Trust;

•potential delays in mail reaching the Sponsor when sent to the Trust at its registered office;

•possible requirements for the Trust to disclose information, including information relating to investors, to regulators;

•potential conflicts of interest that may arise among the Sponsor or its affiliates and the Trust;

•the potential discontinuance of the Sponsor’s continued services, which could be detrimental to the Trust;

•the Custodian’s possible resignation or removal by the Sponsor; and

•additional risk factors discussed in “Item 1A. Risk Factors” and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Annual Report on Form 10-K, as well as those described from time to time in our future reports filed with the SEC.

Unless otherwise stated or the context otherwise requires, the terms “we,” “our” and “us” in this Annual Report on Form 10-K refer to the Sponsor acting on behalf of the Trust.

Glossary

This glossary highlights some of the industry and other terms used elsewhere in this Annual Report on Form 10-K but is not a complete list of all the terms used herein. Each of the following terms has the meaning set forth below:

“Airdrops” – mean a method to promote the launch and use of new Crypto Assets by providing a small amount of such new Crypto Assets to the private wallets or exchange accounts that support the new Crypto Asset and that hold existing related Crypto Assets.

“Bitcoin” or “BTC” – means a type of Crypto Asset based on an open-source cryptographic protocol existing on the Bitcoin network, comprising one type of the Crypto Assets underlying the Trust's Shares. The native Crypto Asset for the Bitcoin network is Bitcoin.

“Blockchain” – means the public transaction ledger of a Crypto Asset’s network on which transactions are recorded.

“Consensus Algorithm” – means the algorithm at the heart of the Blockchain system that enforces the convergence of all ledgers over time.

“Crypto Assets” – means a Crypto Asset designed to work as a store of value and/or medium of exchange wherein individual Crypto Asset ownership records are stored in a ledger, a computerized database using cryptography to secure transaction records, to control the creation of additional Crypto Assets and to verify the transfer of Crypto Asset ownership.

“Crypto Asset Network” – means the online, end user to end user network hosting the public transaction ledger, known as the Blockchain, and the source code comprising the basis for the cryptographic and algorithmic protocols governing the Crypto Asset’s network.

“Crypto Asset Exchanges” – means a dealer market, a brokered market, principal to principal market or exchange market on which Crypto Assets are bought, sold, and traded.

“Custodial Account” – means a segregated custody account to store private keys, which allow for the transfer of ownership or control of the Trust’s Portfolio Crypto Assets, on the Trust’s behalf. Under the Custodian Agreement, the Custodian controls and secures the Trust’s Custodial Account.

“Custodian Fee” – means an annualized fee charged monthly that is a percentage of the Trust’s monthly assets under custody.

“Custodial Services” – means the services provided by the Custodian including, (i) allowing Portfolio Crypto Assets to be deposited from a public Blockchain address to the Trust’s Custodial Account and (ii) allowing the Trust or Sponsor to withdraw Portfolio Crypto Assets from the Trust’s Custodial Account to a public Blockchain address the Trust or Sponsor controls.

“Custodian” – means Coinbase Custody Trust Company, LLC. On behalf of the Trust, the Custodian holds the Portfolio Crypto Assets.

“DEX” – means “decentralized” exchange, where there is no central facilitator of trade and trading rules.

“Eligible Crypto Assets” – means those Crypto Assets that passed required considerations for inclusion in the Bitwise 10 Large Cap Crypto Index.

“Emissions” – mean regular awards provided to holders of Crypto Assets in the form of Crypto Asset grants, and often in the form of the “gas” that powers transactions on the relevant Crypto Asset Network.

“Extraordinary Expenses” – means expenses outside of the Trust’s normal business operations which include, but are not limited to, any non-customary costs and expenses including indemnification and extraordinary costs of the

Administrator and Auditor, costs of any litigation or investigation involving Trust activities, financial distress and restructuring and indemnification expenses.

“Hard Fork” – occurs when there is a change in the set of rules governing a Blockchain that makes it more restrictive than the previous set of rules in place.

“Index” – means the Bitwise 10 Large Cap Crypto Index, the benchmark index for the Trust.

“Index Components” – mean the top 10 Crypto Assets weighted by float adjusted market capitalization and selected in accordance with the Index Methodology.

“Index Provider” – means Bitwise Index Services, LLC, an affiliate of the Trust that is controlled by the same parent entity as the Sponsor. The Index Provider administers the Index.

“Market-Capitalization Weighted” – means the top 10 Crypto Assets in the Bitwise 10 Crypto Index selected and held in proportion to their valuation.

“Miners” – means stakeholders who help process transactions and ensure that the distributed ledgers that make up a proof of work Blockchain network stay consistent with one another.

“Mining” – means the act of solving computational puzzles through which transactions with Crypto Assets are verified and added to a proof of work Blockchain digital ledger in exchange for a Crypto Asset as a reward.

“NAV” – means net asset value.

"NAV of the Trust" – means the sum of the assets and liabilities of the Trust.

“NAV Per Share” – means the NAV of the Trust calculated on a per share basis.

"Network Distribution Event" – means an event that offers additional opportunities to engage with a blockchain network and general additional capital.

“Oracles” – means the reliable data source used by a Blockchain application whenever it needs to interact with external data.

“Portfolio Crypto Assets” – means the group of selected Crypto Assets held by the Trust.

“PoS” – means proof of stake and is a structure wherein entities can provide network verification services for the Blockchain network and, in turn, receive rewards in the form of Crypto Assets. PoS systems require entities to lock up and put at risk (aka, “stake”) a certain amount of the Crypto Asset associated with the relevant Blockchain in order to process transactions. These staked assets are lost if a network verifier processes a transaction in a way that is fraudulent or violates the rules of the underlying Blockchain. PoS is a newer structure that, among other things, seeks to avoid the heavy energy consumption that PoW systems typically require.

“PoW” – means proof of work and is a structure in which Miners provide a Mining service for the Blockchain network and receive payment. PoW is the first and most established scheme and involves computers competing to solve complicated cryptographic puzzles that require a substantial amount of energy as a way of securing the network and processing transactions.

“Shareholders” – means holders of common units of fractional undivided beneficial interest of the Trust.

“Staking” – means the act of committing capital in the form of the PoS Blockchain’s native Crypto Asset to participate in verifying and adding transactions to the Blockchain digital ledger, and in securing the network in exchange for a Crypto Asset as a reward.

“Validators” – means stakeholders that help process transactions and ensure that the distributed ledgers that make up a PoS Blockchain network stay consistent with one another.

“51% Attacks” – occur when an attacker controls a majority of the computing power (for PoW Blockchains) or staked Crypto Assets (for PoS Blockchains) necessary to validate transactions on a Blockchain, giving the attacker a majority of the validation power on the network. Miners or Validators on Blockchains who successfully obtain this validation power may block other users’ transactions or make it appear as though they still have Crypto Assets that have been spent, which is known as a “double-spend attack,” or otherwise change the order of transactions. A 51% attack may also allow an attacker to use its monopoly over new blocks to “censor” other user transactions by actively preventing them from being written sustainably to the Blockchain.

part i.

Item 1. Business.

History of the Trust and the Shares

The Bitwise 10 Crypto Index Fund (the “Trust”) is a Delaware Statutory Trust that issues common units of fractional undivided beneficial interest (“Shares”), which represent ownership in the Trust. The Trust’s current standing in Delaware is active. The Trust was formed by the filing of a Certificate of Trust with the Delaware Secretary of State in accordance with the provisions of the Delaware Statutory Trust Act (the “DSTA”) and the adoption of a Trust Agreement (the “Trust Agreement”). The Trust operates pursuant to the Trust Agreement.

Bitwise Investment Advisers, LLC is the Sponsor of the Trust (the “Sponsor”). Bitwise Asset Management, Inc. (“Bitwise”), the parent company of the Sponsor, maintains a corporate website, www.bitwiseinvestments.com, which contains general information about the Trust and the Sponsor. The reference to the Bitwise website is an interactive textual reference only, and the information contained on the Bitwise website shall not be deemed incorporated by reference herein. Additional information regarding the Trust may also be found on the SEC's EDGAR database at www.sec.gov.

The Trust had previously issued Shares, which represented common units of fractional undivided beneficial interest in, and ownership of, the Trust, on a periodic basis to certain “accredited investors” within the meaning of Rule 501(a) of Regulation D under the Securities Act of 1933, as amended (the "Securities Act"). On November 18, 2021, the Sponsor closed sales of Shares directly from the Trust, pursuant to its rights under Sections 5 and 6 of the Trust Agreement. The Sponsor has no plans to reopen such sales. The Shares are quoted on OTCQX Best market (the "OTCQX") under the ticker symbol “BITW.”

Shares purchased directly from the Trust prior to November 18, 2021 were restricted securities ("Restricted Shares") that could not be resold except in transactions exempt from registration under the Securities Act and state securities laws and any transaction in Restricted Shares required approval in advance by the Sponsor. In determining whether to grant such approval, the Sponsor specifically looked at whether the conditions of Rule 144 under the Securities Act and any other applicable laws were met. Shares that have become unrestricted in accordance with Rule 144 under the Securities Act may trade on OTCQX.

The Trust’s principal investment objective is to invest in a portfolio (“Portfolio”) of Crypto Assets (each, a “Portfolio Crypto Asset” and collectively, “Portfolio Crypto Assets”) that tracks the Bitwise 10 Large Cap Crypto Index (the “Index”) as closely as possible with certain exceptions determined by the Sponsor in its sole discretion, as described more fully below in the section entitled “—Business of the Trust.” In addition, in the event the Portfolio Crypto Assets being held by the Trust present opportunities to generate returns in excess of the Index (for example, Airdrops, Emissions, forks, or similar network events) the Sponsor may also pursue these incidental opportunities on behalf of the Trust as part of the investment objective if in its sole discretion the Sponsor deems such activities to be possible and prudent.

The Trust believes that it has met its principal investment objective, however, because the Trust does not operate a redemption program for the Shares, because of the holding period required under Rule 144 for the sale of the Shares purchased from the Trust, and because the Trust may from time to time halt Share subscriptions, there can be no assurance that the value of the Shares will reflect the value of the Trust’s NAV Per Share, and the Shares may trade at a substantial premium over, or a substantial discount to, the value of the Trust’s NAV Per Share, and as such, there can be no assurance that an investor will achieve a return on investment that tracks the performance of the Index. As of December 31, 2024, there was a correlation of 99.99% between the Portfolio Crypto Assets and the assets included in the Index. The Trust is aware that the market price of the Trust’s shares may deviate from the net asset value (“NAV”) of the Shares, that to date the Shares traded on the secondary market have not closely tracked the NAV of the Shares, and that the market price of the Shares has been and may continue to be significantly above or below the net asset value per share (“NAV Per Share”). However, the Trust does not have control over an investor’s ability to achieve a return on investment that tracks the performance of the Index. The trading price of the Shares is determined by the market, and at times the Shares will trade at a premium or a discount to the NAV Per Share. Regardless of the Trust or Sponsor’s methods of managing the underlying portfolio, the price an investor will pay on the secondary market could differ significantly from the NAV Per Share. The Trust does not seek to track the

performance of the trading of Shares on the secondary market and the trading price for those Shares. The price an investor will pay on the secondary market may be significantly different from the NAV Per Share. Furthermore, under Regulation M, the Trust, as the issuer of the Shares, is not legally permitted to take the types of actions that might help to reconcile the NAV Per Share and the market price per Share.

The Shares may also trade at a substantial premium over, or a substantial discount to, the NAV Per Share as a result of price volatility, trading volume and closings of the exchanges on which the Sponsor purchases Portfolio Crypto Assets on behalf of the Trust due to fraud, failure, security breaches or otherwise. As a result of the foregoing, the price of the Shares as quoted on OTCQX has varied significantly from the value of the Trust’s Portfolio Crypto Assets Per Share since the Shares were approved for quotation on December 9, 2020.

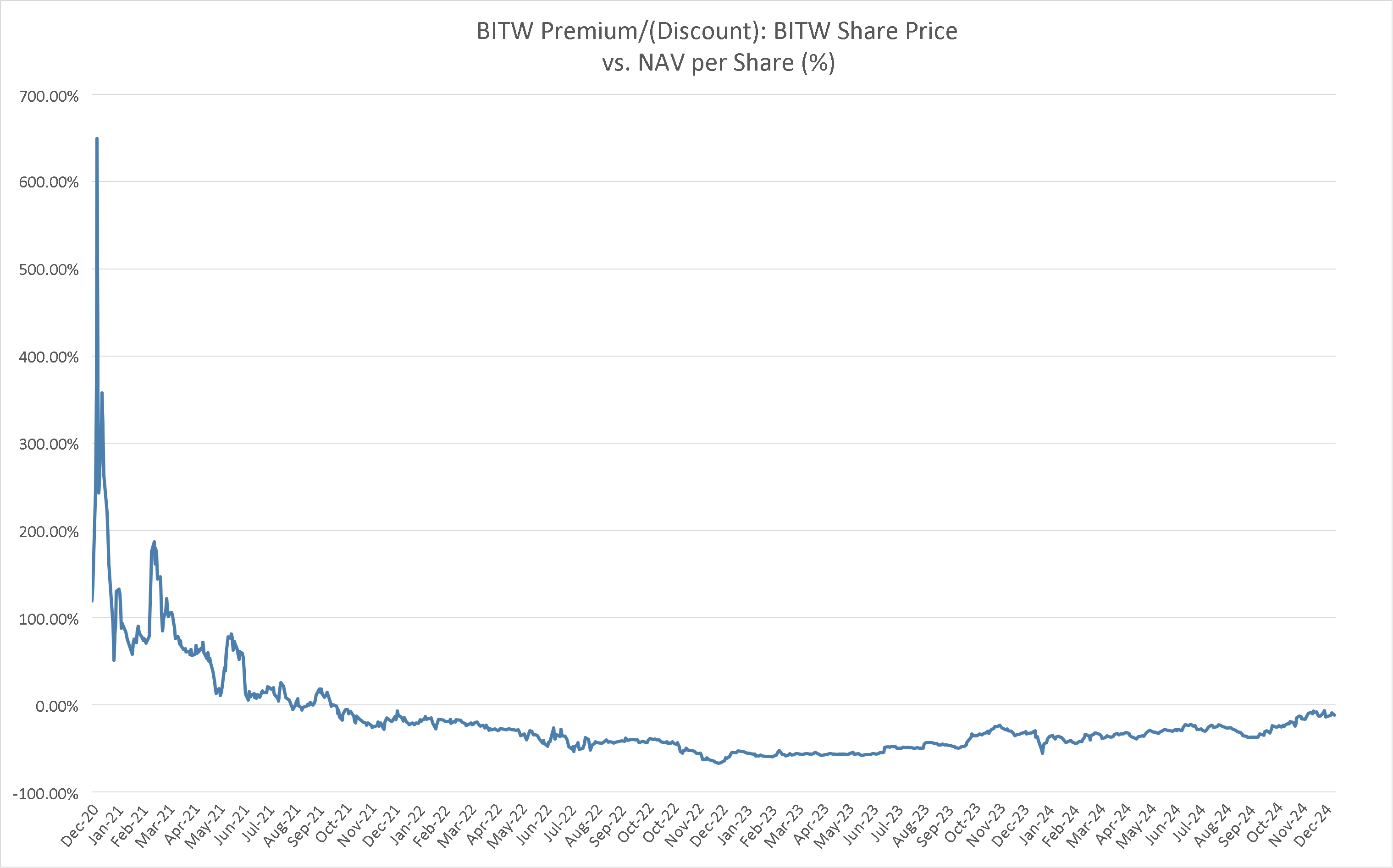

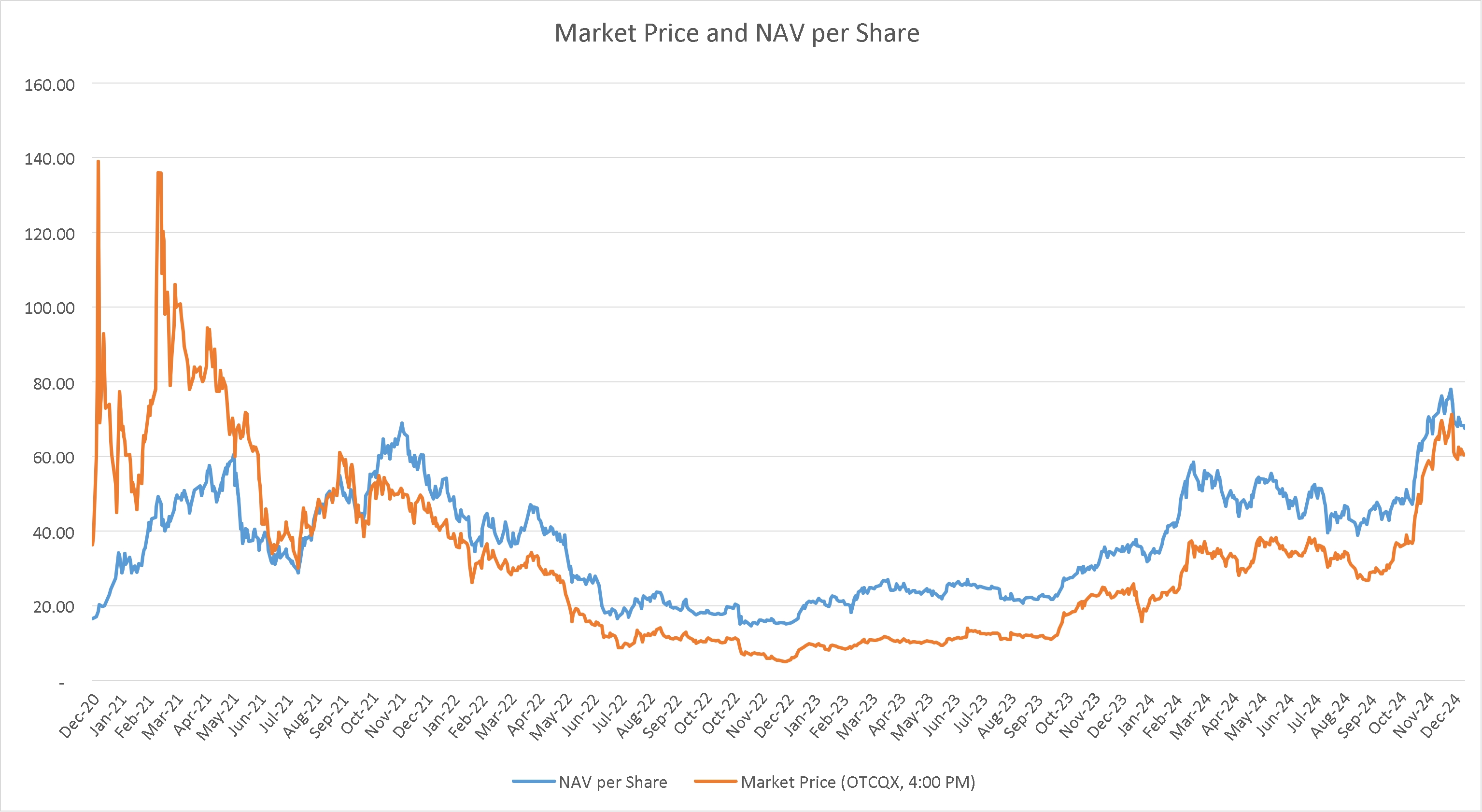

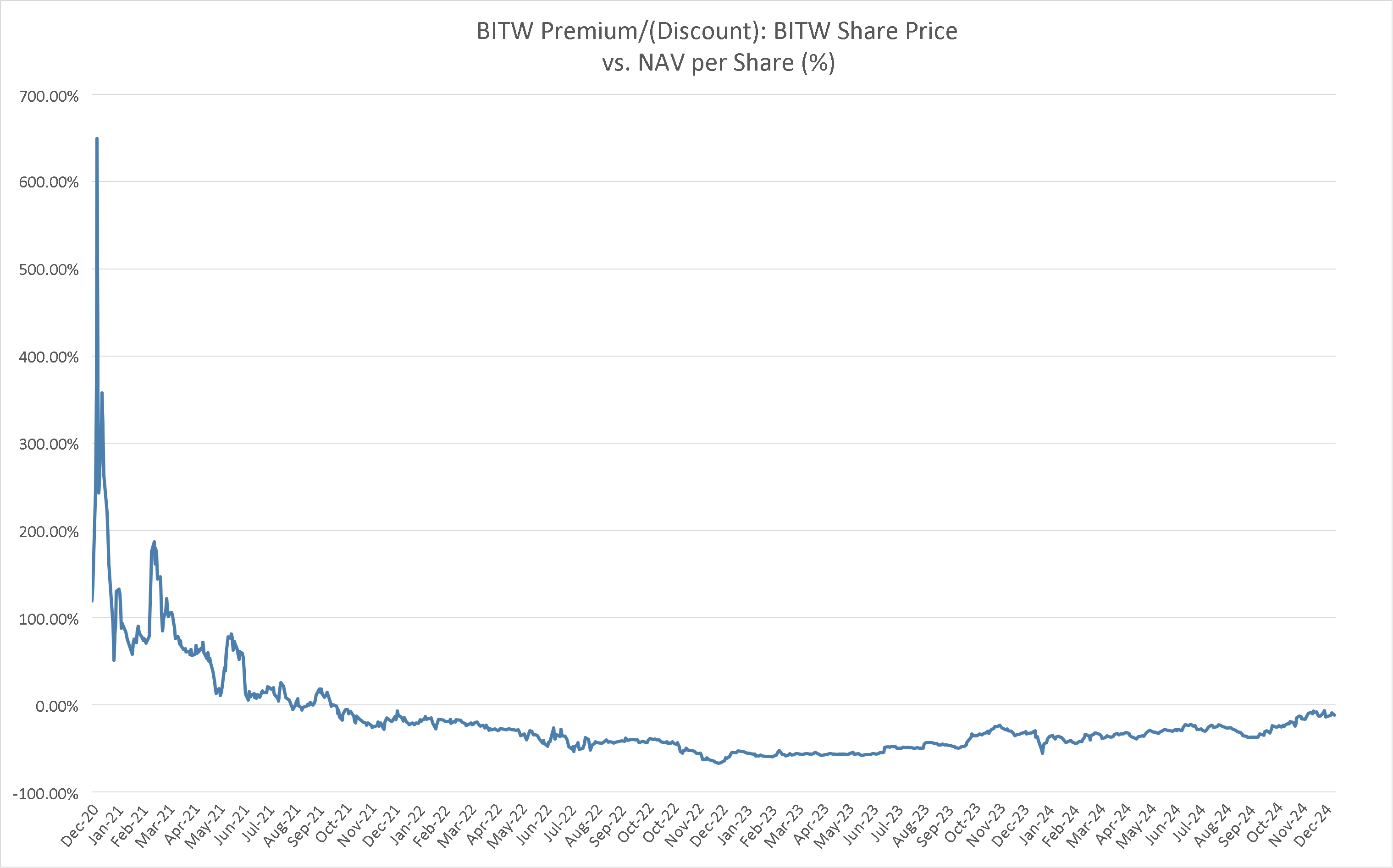

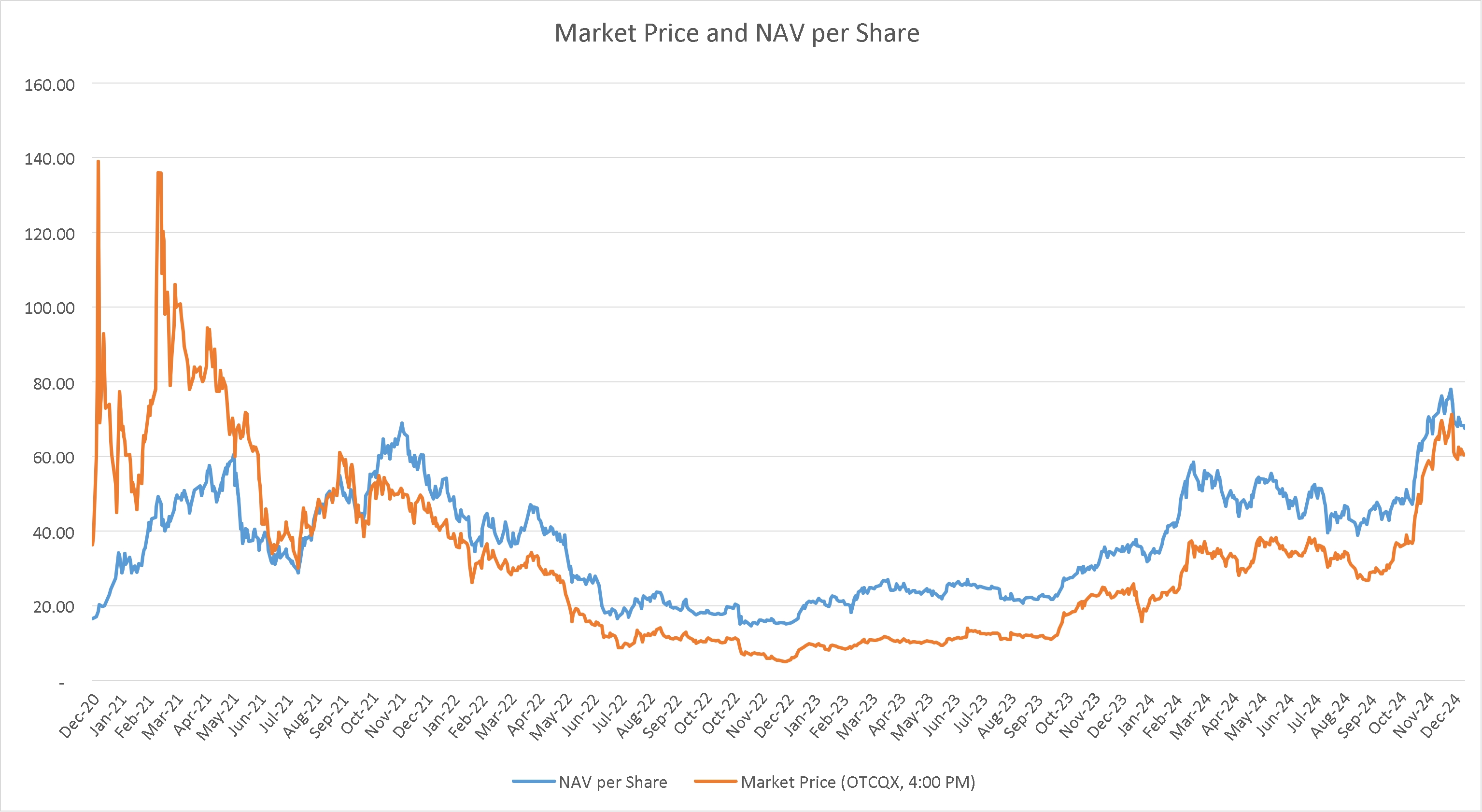

The following charts show the percentage of Premium/(Discount) of the Shares as quoted on OTCQX and the Trust’s NAV and a comparison of the NAV of the Trust vs the market price as quoted on OTCQX for the period December 10, 2020 through December 31, 2024:

From December 10, 2020 to December 31, 2024, the Shares of BITW traded at an average discount, based on closing prices at 4:00 pm ET, and estimated, un-audited, NAV Per Share of 16.72%. During that same period, the highest premium was 649.38% on December 16, 2020, and the lowest premium was 0.27% on August 4, 2021. During that same period, the highest discount was 67.80% on December 28, 2022, and the lowest discount was 0.09% on September 24, 2021. Given the lack of an ongoing redemption program and the holding period under Rule 144, there is no arbitrage mechanism to keep the Shares closely linked to the value of the Trust’s underlying holdings that may continue to have an adverse impact on investments in the Shares.

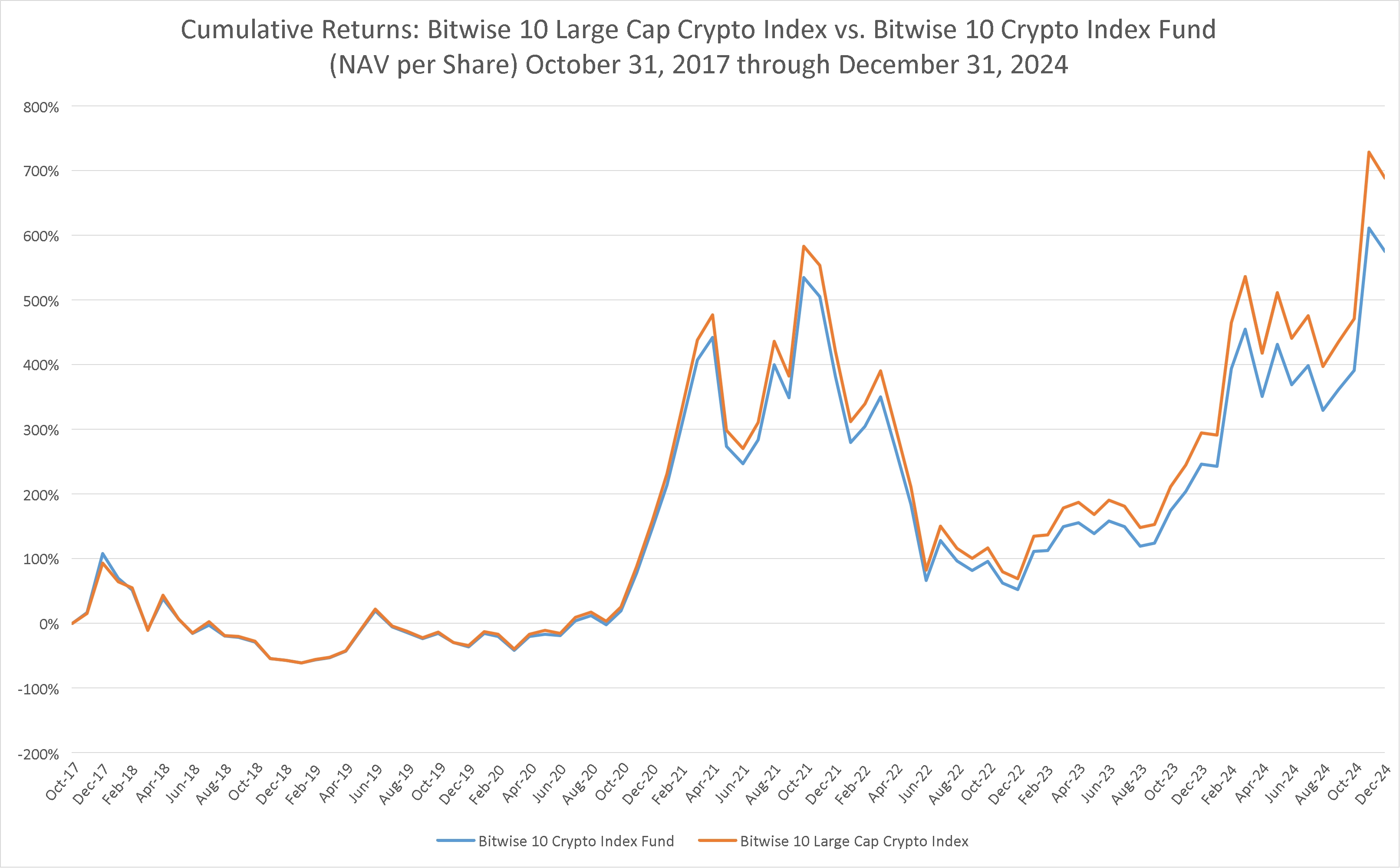

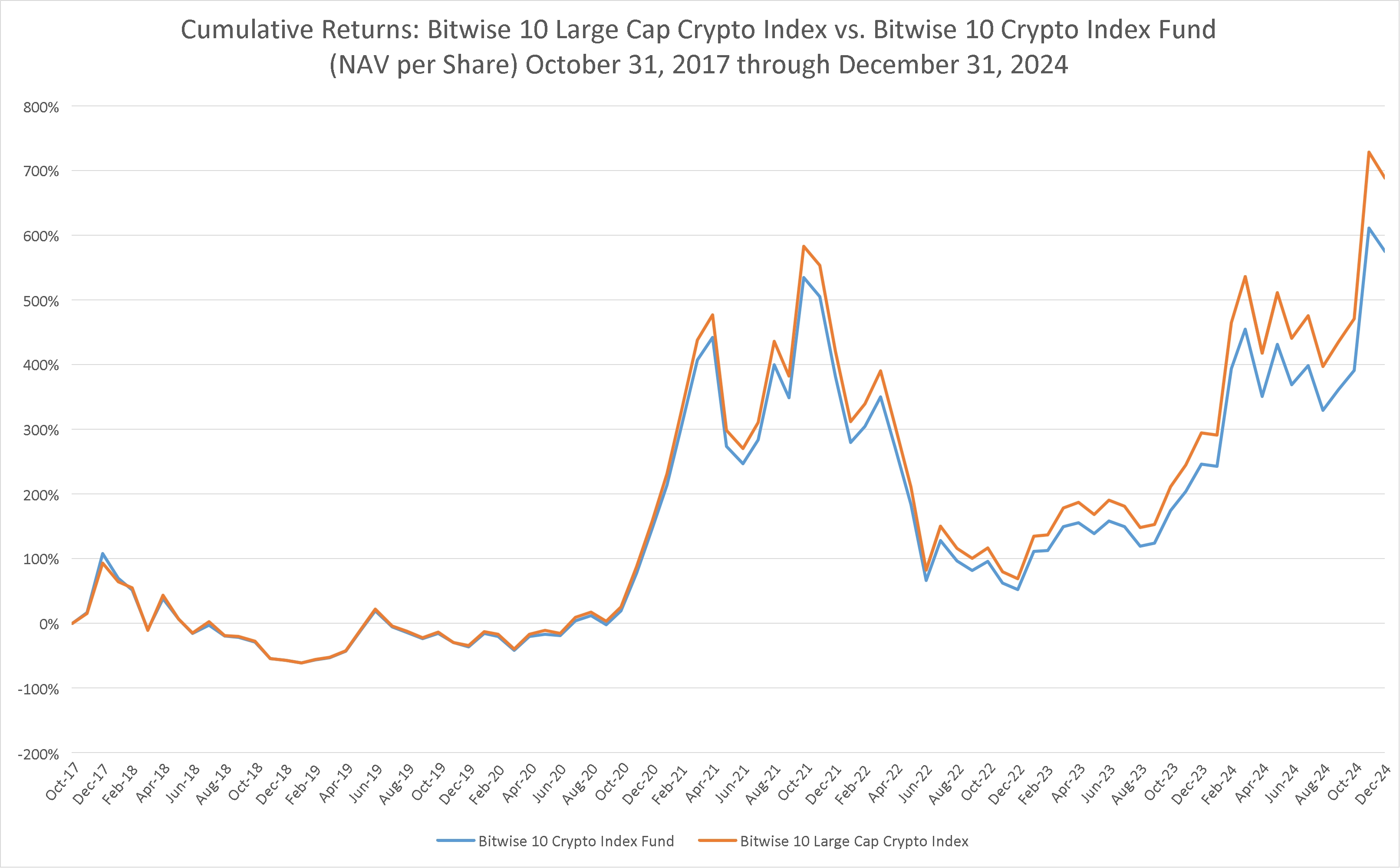

The following chart shows a comparison of the cumulative returns of the Index compared to the NAV of the Trust:

Emerging Growth Company Status

The Trust is an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). For as long as the Trust is an emerging growth company, unlike other public companies, it will not be required to, among other things:

•provide an auditor’s attestation report on management’s assessment of the effectiveness of our system of internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002; or

•comply with any new audit rules adopted by the PCAOB after April 5, 2012, unless the SEC determines otherwise.

The Trust will cease to be an “emerging growth company” upon the earliest of (i) it having $1.235 billion or more in annual revenues, (ii) it becoming a “large accelerated filer,” as defined in Rule 12b-2 of the Exchange Act, (iii) it issuing more than $1.0 billion of non-convertible debt over a three-year period or (iv) the last day of the fiscal year following the fifth anniversary of its initial public offering.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. The Trust has chosen not to “opt out” of such extended transition period, and as a result, the Trust will take advantage of such extended transition period.

Business Development

The Trust has not been in, and is not in the process of, any bankruptcy, receivership or any similar proceeding since its inception.

Other than the conversion of the Trust from a Delaware limited liability company into a Delaware Statutory Trust, the Trust has not undergone any material reclassification, merger, consolidation, or purchase or sale of a significant amount of assets since its inception.

The Trust has not experienced any default of the terms of any note, loan, lease, or other indebtedness or financing arrangement requiring the Trust to make payments since its inception.

The Trust has not experienced any change of control since its inception.

The Trust has only one class of outstanding equity securities. The Trust has experienced increases of more than 10% of the Shares since inception of the Trust (September 18, 2017). The Trust is a Delaware statutory trust that has no limit on the number of Shares that can be issued.

Other than the conversion of the Trust from a Delaware limited liability company into a Delaware Statutory Trust and an associated share split, there are no past or pending share splits, dividends, recapitalizations, mergers, acquisitions, spin-offs, or reorganizations since the Trust’s inception.

There has not been any delisting of the Shares by any securities exchange or deletion from the OTC Bulletin Board.

Competitive Business Conditions

The Crypto Asset industry is rapidly developing, and there are significant uncertainties with respect to the development, acceptance, and success of the digital networks underlying the Portfolio Crypto Assets. See “Item 1A. Risk Factors—Risks Related to Crypto Assets—The long-term viability and technological evolution of Crypto Assets and Blockchain technology are uncertain, and their development, acceptance, and adoption face significant industry-wide challenges, which could negatively impact the value of the Portfolio Crypto Assets and the Shares” and "Item 1A. Risk Factors—Risks Related to Crypto Assets—The Blockchain technology underlying the Crypto Asset is subject to a number of known and unknown technological challenges and risks that may prevent wide adoption and use of the Crypto Assets, which may negatively affect the value of Portfolio Crypto Assets and the value of the Shares" for additional information. While the Crypto Assets that are Portfolio Crypto Assets have enjoyed some acceptance and use in their limited history, it is possible that other Crypto Assets may grow more rapidly in acceptance and adoption for use as compared to Portfolio Crypto Assets, and while the Index may, over time, change to include more successful Crypto Assets, the Index may not capture the growth in value of more rapidly growing Crypto Assets.

Business of the Trust

The Sponsor expects the market price of the Shares to fluctuate over time in response to the market prices of Portfolio Crypto Assets. In addition, because the Shares reflect the estimated accrued but unpaid expenses of the Trust, the number of Portfolio Crypto Assets represented by a Share will gradually decrease over time as the Trust’s Portfolio Crypto Assets are used to pay the Trust’s expenses.

The Trust’s Portfolio Crypto Assets are held by Coinbase Custody Trust Company, LLC (the “Custodian“) on behalf of the Trust. The Trust’s Portfolio Crypto Assets are transferred only in the following circumstances: (i) sales made in connection with monthly rebalancing in order to more closely track the Index, (ii) sales to pay expenses of the Trust, (iii) sales on behalf of the Trust in the event the Trust terminates and liquidates its assets or as otherwise required by law or regulation, and (iv) transfers to pursue Airdrops, forks, Emissions, or other similar network events as deemed necessary by the Sponsor. Each delivery or sale of Portfolio Crypto Assets for purposes of rebalancing the Trust’s Portfolio Crypto Assets to track the Index will be a taxable event for Shareholders. See “Certain U.S. Federal Income Tax Considerations.,” and “Item 1A. Risk Factors—Risks Related to Crypto Assets—The Sponsor may experience loss or theft of its Portfolio Crypto Assets during the transfer of Portfolio Crypto Assets from the Custodian to the Sponsor or to Crypto Asset trading venues, which could adversely affect the value of the Shares.” In addition, each sale of Portfolio Crypto Assets by the Trust to pay the expenses of the Trust will be a taxable event for Shareholders.

The Trust is not registered as an investment company under the Investment Company Act of 1940, as amended (the “Investment Company Act”) and the Sponsor believes that the Trust is not required to register under the Investment Company Act. See “Item 1A. Risk Factors—Risks Related to Regulatory and Compliance” and “—Overview of Government Regulation” for additional information. In addition, the Trust will not hold or trade in commodity futures contracts or other derivative contracts regulated by the Commodity Exchange Act (the “CEA”), as administered by the Commodities Future Trading Commission (the “CFTC”). The Sponsor believes that the Trust is not a commodity pool for purposes of the CEA, and that neither the Sponsor nor the Trustee is subject to regulation as a commodity pool operator or a commodity trading adviser in connection with the operation of the Trust.

The Trust has no fixed termination date. The Trust is a passive entity with no operations, and no employees. The Sponsor administers and manages the Trust as described below. The Trust has not at any time been a “shell company.” The Trust and the Sponsor have entered into a limited, non-exclusive, revocable license agreement with Bitwise Index Services, LLC (the “Index Provider”), an affiliate of the Trust that is controlled by the same parent entity as the Sponsor, at no cost to the Trust or the Sponsor allowing the Trust to use the Index for the purpose of using as the benchmark index for the Trust (the “License Agreement”).

Activities of the Trust

The Trust seeks to make it easier for an investor to invest in the Crypto Asset market as a whole, without having to pick specific tokens, manage a portfolio, or constantly monitor ongoing news and developments. Although the Shares will not be the exact equivalent of a direct investment in Crypto Assets, they provide investors with an alternative that constitutes a relatively cost-effective, professionally managed way to participate in Crypto Asset markets.

The Trust notes that an indirect investment in Crypto Assets through Shares may operate and perform differently from a direct investment in Crypto Assets, and such differences may include, among other things: the holding period under Rule 144 for the resale of the Shares purchased from the Trust, the risk that the Shares may trade at a substantial premium over or a substantial discount to the NAV Per Share, the risk that over time the number of Portfolio Crypto Assets represented by a Share will gradually decrease as the Portfolio Crypto Assets are used to pay the Trust’s expenses, the ability to invest in Shares via an investor’s equity retirement accounts such as a 401(k) or individual retirement account, which do not provide the ability to invest directly in Crypto Assets; the convenience of not having to open and maintain a Crypto Asset wallet; the potential ability to participate in decentralized finance (“DeFi”) protocols including governance, voting, staking assets and lending assets; and the ability of an investor to rely on the Bitwise Crypto Index Committee (the “Committee”) to choose the Portfolio Crypto Asset composition and balance of the assets. To date, the only DeFi protocol the Trust has participated in, including governance, voting, staking assets, lending assets and liquidity provisions, was in staking Tezos in 2020. The Index has not participated in any other DeFi protocols, including governance, voting and lending assets. To the extent that the Trust participates in any decentralized finance protocols, the Trust anticipates only participating in such protocols where the Trust has made a direct investment in the relevant decentralized finance Crypto Asset. While the Trust currently does not participate in any staking activities, it may in the future engage in staking activities if the Trust deems such activity to be in the best interest of shareholders. The Trust will determine whether engaging in staking activities is in the best interest of the Shareholders on a case-by-case basis. In making such a determination, the Trust will consider whether the staking activities present possible and prudent opportunities to generate additional returns for Shareholders in excess of the Index, the risks associated with the staking activities, the potential for the loss of all or part of the staked amounts, and whether or not the activity is supported by the Trust’s custodian.

In addition, the Trust must pay certain expenses which would not be charged for a direct investment in Crypto Assets, including a Management Fee payable monthly, in arrears, in an amount equal to 2.5% per annum (1/12th of 2.5% per month) of the net asset value of the Trust’s assets at the end of each month.

In furtherance of its objective, the activities of the Trust include: (i) issuing Shares in exchange for subscriptions, (ii) selling or buying Portfolio Crypto Assets in connection with monthly rebalancing, (iii) selling Portfolio Crypto Assets as necessary to cover the Management Fee (as defined below) and/or any Organizational Expenses (as

defined below), (iv) causing the Sponsor to sell Portfolio Crypto Assets upon any potential future termination of the Trust, and (v) engaging in all administrative and security procedures necessary to accomplish such activities in accordance with the provisions of the Trust Agreement, and the Custodian Agreement (as defined below). In addition, the Trust may engage in any lawful activity necessary or desirable in order to facilitate these activities, provided that such activities do not conflict with the terms of the Trust Agreement.

Crypto Assets are purchased from approved counterparties that include exchanges, electronic trading systems that seek liquidity from multiple trading venues, and market making firms known as “over the counter” or “OTC” desks ("OTC Desks") with the goal of purchasing Crypto Assets at or near the prices used to calculate the Trust's NAV Per Share and used to calculate the Index while also seeking to minimize execution slippage compared to the benchmark price (the "Benchmark Price") while simultaneously promoting operational risk management and efficient management of the Trust’s assets.

The Trust does not utilize a single principal market to convert Crypto Assets to U.S. dollars and to purchase Crypto Assets. The Sponsor evaluates counterparties, trading venues, and execution tools on an ongoing basis. The Trust utilizes multiple venues to acquire and dispose of Crypto Assets, including trading venues (known as exchanges), OTC Desks, and trading technology solutions that aggregate liquidity from multiple trading venues. The Sponsor exercises judgment to determine on which venue to trade.

Calculation of Valuation

For all periods through the quarterly period ended June 30, 2021, the NAV Per Share, the NAV of the Trust, and the fair valuations for each Portfolio Crypto Asset were calculated by the Trust's Administrator in reliance on the fair value of each Portfolio Crypto Asset based on a blended average approach for calculating the price of a Crypto Asset (the "Blended Bitwise Crypto Asset Price"), which the Sponsor was responsible for calculating. The Sponsor provided this price to the Administrator, and the Administrator used this price (multiplied by the Trust’s holdings) for each asset to determine the fair value of the Trust’s assets. The Administrator then subtracted the Trust’s liabilities to determine the NAV of the Trust. The Administrator then divided this value by the Trust’s shares outstanding in order to determine the NAV Per Share. As a result of the Sponsor’s responsibility in this regard, any errors, discontinuance or changes in such valuation calculations may have had an adverse effect on the value of the Shares. The Sponsor instituted this valuation policy in order to generate fair value estimates because it determined that such policy was in the best interest of Shareholders, as it would avoid misstatements in valuation of the assets potentially arising from deviations in pricing across the Crypto Asset market, and because of the fragmented nature of the Crypto Asset trading ecosystem. As a result, management applied this valuation technique which it determined to be appropriate given the circumstances.

Following the filing of the Trust's Form 10, the Sponsor conducted a complete review of its process for determining fair valuation in the presentation of its financial statements and calculation of NAV. In this process, the Sponsor evaluated whether or not the identification of a principal market for each of the Trust’s assets for valuation purposes, during each period for which the Trust created and had audited its financial statements, would have created a material difference in the Trust’s estimated fair value or assets. In conjunction, the Sponsor determined to undertake a change in valuation policy for the fair valuation of Crypto Assets held in the Trust. As a result, the Sponsor developed a revised process for the determination of a principal market for each asset based on this consideration and disclosed and implemented this change in valuation policy and accounting policy prior to the creation of financial statements for the period ending September 30, 2021. The Blended Bitwise Crypto Asset Price is no longer used for any calculations by the Trust, including NAV Per Share, NAV of the Trust or fair valuations for any Portfolio Crypto Asset.

Effective August 31, 2021, the process that the Sponsor developed for identifying a principal market, as described in Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 820-10, which outlines the application of fair value accounting, was to begin by identifying publicly available, well established and reputable Crypto Asset exchanges selected by the Sponsor and its affiliates in their sole discretion, and then calculating, on each valuation period, the highest volume exchange during the 60 minutes prior to 4:00 pm ET for each asset. In evaluating the markets that could be considered principal markets, the Trust considered whether or not the specific markets were accessible to the Trust, either directly or through an intermediary, at the end of each period.

Effective February 13, 2023, the Sponsor adapted a nearly identical principal market valuation process, with no material impact to the Trust, using a third-party valuation vendor, Lukka, Inc., to identify publicly available, well established and reputable Crypto Asset exchanges selected by Lukka, Inc. in their sole discretion, including Binance, Bitfinex, Bitflyer, Bitstamp, Bullish, Coinbase, Crypto.com, Gate.io, Gemini, HitBTC, Huobi, itBit, Kraken, KuCoin, LMAX, MEXC Global, OKX and Poloniex, and then calculating, on each valuation period, the highest volume exchange during the 60 minutes prior to 4:00 pm ET for each asset. In evaluating the markets that could be considered principal markets, the Trust considered whether the specific markets were accessible to the Trust, either directly or through an intermediary, at the end of each period.

In the process of its review, the Sponsor also retroactively applied this process for identifying a principal market to the prior periods of reported financial results, including the fiscal years 2019 and 2020, to determine whether or not any material or significant differences would have resulted from the application of a different valuation policy in the creation of each financial statement (e.g., comparing the fair value prices determined using the existing and previous valuation methodology to the hypothetical fair value prices using an identified principal market for each asset) and to consider whether management’s use of the existing valuation policy would have created any material departures from a valuation policy of identifying a principal market.

As set out in more detail in the tables in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Significant Accounting Policies—Investments and Valuation—Calculation of Valuation,” the Sponsor’s results concluded that there were no material or significant differences in valuation or the financial statements as presented when using the policy of identifying a principal market described above as compared to the existing valuation methodology for any period since the Trust commenced operations, as the average difference in valuation prices was in each case less than 0.05% or five one hundredths of one percent for each asset for each period measured, and such differences were deemed immaterial in all cases.

Statements, Filings, and Reports

The Trust endeavors to comply with all reporting obligations required of companies with a class of securities registered under the Exchange Act, including timely filing Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other customary filings.

Shareholders can expect to receive annual audited financial statements for the Trust and any applicable tax reports (e.g., Schedules K-1) from the Sponsor. The Sponsor or the Administrator (as defined below) expect to issue Schedules K-1 directly to Shareholders who hold Shares or the custodian of such Shares, as applicable, for each taxable year or portion thereof.

The Trustee will make elections, file tax returns and prepare, disseminate and file tax reports, as advised by the Sponsor, the Trust’s counsel or accountants or as required by any applicable statute, rule or regulation.

Investment Strategy

The Trust holds a Portfolio of Crypto Assets that generally tracks the Index. The Index is administered by Bitwise Index Services, LLC, an affiliate of the Sponsor (the “Index Provider”). The Trust rebalances monthly alongside the rebalance of the Index to stay current with changes. The Sponsor strives to minimize tracking error (e.g., divergence between the performance of the Trust and the Index) by managing costs and price slippage during trade execution, and holding the assets in the Index.

The Sponsor has the discretion, when possible and prudent, to take advantage of incidental opportunities to generate additional returns in excess of the Index that arise from the Portfolio Crypto Assets held by the Trust through, for example, Airdrops, Staking, Emissions, Hard Forks, lending or similar network events and activities, if the Sponsor determines that any such activities are in the best interest of the Trust and its Shareholders. The Sponsor does not consider these activities inconsistent with its investment objective to invest in a portfolio to track the Index or inconsistent with its disclosure that the Trust is managed as a passive investment vehicle. Accrual of additional returns through such activities may offset fees and fund expenses and allow the Trust to track the performance of the Index more closely. If the Sponsor accepts and liquidates Airdrops, Emissions, Hard Forks, or engages in Staking, it

will apply fair value to the assets received as described in the section “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Significant Accounting Policies—Investments and Valuation.”

The Trust seeks to track the Index, and, therefore, to the extent that a Network Distribution Event, defined as an event that offers additional opportunities to engage with a Blockchain network and generate additional capital, occurs and such Network Distribution Event impacts the composition of the Index, the Trust will undertake its usual rebalancing process. The policies of the Index in regard to Network Distribution Events are described below in “—Overview of the Index—Summary of the Index Methodology—Index Methodology.”

It is possible that a Network Distribution Event could occur that may result in an opportunity for the Trust to generate additional returns, such as if an asset the Trust already held were to do an Airdrop resulting in the Trust obtaining an additional, different asset. If this were to occur, the Trust might seek to utilize the Network Distribution Event in such a way as to benefit the Shareholders of the Trust. For example, the Sponsor of the Trust may choose to sell an airdropped asset and return the proceeds to the Shareholders.

Price and Cost Slippage

On days when the Sponsor accepts subscriptions, the Sponsor aggregates the dollar value of subscriptions into the Trust and uses quantitative portfolio management techniques to compare the Trust’s existing holdings and weightings to the constituents and weightings of the index in order to calculate the amounts and quantities of each Crypto Asset to purchase. On days when the Sponsor rebalances the Trust’s portfolio in order to pursue its investment objective of tracking the Index, the Sponsor uses quantitative portfolio management techniques to compare the Trust’s existing holdings and weightings to the new and updated constituents and weightings of the Index in order to calculate the amounts and quantities of each Crypto Asset to purchase so that the Trust’s holdings and weightings will, after trade execution, be closely aligned with the constituents and weightings of the Index. In each case, the Sponsor has at its disposal multiple venues on which to acquire and dispose of Crypto Assets, including trading venues (known as exchanges), OTC Desks, and trading technology solutions that aggregate liquidity from multiple trading venues.

Trade execution and portfolio management is dynamic and complex, and the Sponsor must exercise judgment, assess multiple factors including recent experience and market conditions, as well as the size of the trades, settlement procedures at each venue, types of assets that need to be executed, as well as their availability on such platforms, prior to determining the best venue on which to execute each trade. The Sponsor attempts to purchase or sell each asset in each instance at a price that is close to the price used for calculating the NAV of the Trust (and the Index’s daily price) at 4:00 pm ET, while also minimizing market impact and reducing operational and settlement risk. The Trust may choose to algorithmically execute a trade over time (for example, to execute a trade while only participating in a certain amount of volume), to execute a trade using a market order (e.g., purchasing or selling a Crypto Asset immediately at whatever price the entire order can be filled), or by putting multiple OTC Desks into competition to provide the best price possible for a given amount and quantity of a Crypto Asset. Often, OTC Desks may be able to provide better prices than trading venues, and can also streamline and minimize operational complexity and settlement risk. There is no guarantee that the Sponsor will be able to trade Crypto Assets at or near the Benchmark Price, as there are a number of other factors aside from price slippage that inform best practices in trade execution, and market conditions change rapidly. Such factors include, but are not limited to, reputation of the trading venue, availability and support of personnel and coverage at the trading venue, settlement consistency or procedures, availability of assets and Crypto Asset coverage, understanding of market dynamics, and perceived, disclosed, or reported regulatory compliance of the platform.

Staking Activities

The Index does not engage in Staking. To the extent the Trust participates in staking activity, such activity varies across protocols. If the Trust decides to pursue staking activities that require Portfolio Crypto Assets to be restricted within a protocol for a specific period of time, the Trust may be unable to rebalance its holdings in accordance with the monthly rebalancing of the Index. The inability of the Trust to rebalance in accordance with the Index could cause deviations between the Trust and the Index, and such deviations could create performance differences between the Trust and the Index. If the Trust was unable to rebalance its holdings in accordance with the monthly rebalancing

of the Index, the Trust would include this information on its website, as the current Portfolio Crypto Assets and any relevant information regarding the Portfolio Crypto Assets is always provided on the Trust's website. However, the Trust does not believe that at present its staking activities would affect its ability to rebalance its holdings on a monthly basis, as its staking activity is extremely limited, and the Trust does not currently have plans to significantly expand such activity.

Staking activity may require withdrawals of its Portfolio Crypto Assets by the Sponsor in order to make certain types of trades or to deposit certain Portfolio Crypto Assets within various protocols. While the ability to gain temporary control of even a portion of the Portfolio Crypto Assets is restricted to a limited number of authorized personnel of the Sponsor, once the Custodian processes the transaction, the Sponsor has the ability to send the withdrawn Portfolio Crypto Assets to the delivery address of trading counterparties or trading venues. During any such transfer, the Portfolio Crypto Assets may be vulnerable to security breaches, including hackings and other efforts to obtain the Portfolio Crypto Assets, as well as the risk that while Portfolio Crypto Assets are under the Sponsor’s control, an employee of the Sponsor could access and obtain the Portfolio Crypto Assets. Some of these attempts to obtain the Portfolio Crypto Assets may be successful, and the Sponsor may lose some or all of the transferred Portfolio Crypto Assets. In addition, Portfolio Crypto Assets transferred to exchanges or other trading venues or protocols, such as smart contracts that facilitate staking or other reward-generating activity, are subject to increased risk of loss or theft due to reliance on the security procedures of the trading venue or protocol (when the Portfolio Crypto Assets are no longer in the custody of the Custodian) or the risk of the smart-contract operating appropriately, and because the same withdrawal procedures required by the Custodian, which are designed to reduce the risk of error or theft, may not be required by trading venues. Portfolio Crypto Assets transferred for the purposes of lending, staking, or participating in other network activities are subject to increased risk of loss, theft, or technological complication that could result in the loss of Portfolio Crypto Assets in their entirety.

The Trust records receipt of staking rewards when they are received if there is value to the Trust in doing so. Crypto Assets received from staking rewards have no cost basis and the Trust recognizes unrealized gains equal to the fair value of the new Crypto Asset received. To date, the only Crypto Asset the Trust has staked was Tezos, which was part of the Index and the Trust’s Portfolio Crypto Assets from April 12, 2019 until February 26, 2021, when the Crypto Asset's market capitalization declined relative to other Crypto Assets and made it ineligible to be included in the Index. During 2020, the Trust participated in staking activities with Tezos which required the Trust to post certain Crypto Assets for a period of time to a “stakepool” and vote on certain items on the staking platform, in return for collecting the staking reward. The amount of rewards received from this activity was de minimis, and the Sponsor participated on behalf of the Trust due to the fact that the Trust’s Custodian was able to facilitate the process while retaining custody and safekeeping the Trust’s Tezos during the staking process. The Trust has not participated in any staking or reward generation activity other than in 2020 with respect to Tezos when the Trust received $2,139 in total staking rewards from its Tezos staking activities. While the Trust currently does not participate in any staking activities, it may in the future engage in further staking activities if the Trust deems such activity to be in the best interest of Shareholders. If the Sponsor makes material changes to the Trust's staking policy in the future, it will disclose such changes on Form 8-K.

Overview of the Crypto Asset Industry

Digital or Crypto Assets are bearer assets whose ownership is secured by cryptographic protocols and incentives that operate on a network of computers utilizing Blockchains, as defined below. Crypto Assets are intended to allow for storage and transfer without the need for a trusted intermediary. Well-known Blockchains that have their own native Crypto Assets include Bitcoin and Ethereum.

Crypto Assets are traded on trading venues around the world, as well as on over-the-counter and peer-to-peer markets. Crypto Assets can be converted to fiat currencies or into other Crypto Assets at rates determined by supply and demand on these markets. Derivative investment products, including futures, options, and swaps contracts, are also available that allow investors to build sophisticated investment and trading strategies focused around the most prominent Crypto Assets.

The number and diversity of market participants and companies operating in the Crypto Asset space has also increased dramatically over the past several years. Currently, there are a wide range of companies providing services related to Crypto Assets to retail and institutional investors. These include companies that provide trading venues,

custody solutions for institutional and retail investors, investment funds, payment services, trading services, lending and collateral management, and prime brokerage.

The ownership of Crypto Assets is recorded in a digital ledger or database, called a Blockchain. Blockchains differ from traditional databases in that they are designed not to be controlled by any single party, but rather, to be maintained by a distributed network of computers, each of which maintains and updates its own copy of the ledger. Each participant in this network is incentivized to process transactions according to a set of predetermined rules and to keep its ledger consistent with the rest of the network over time.

The exact method with which each Blockchain network processes and records transactions can, and usually does, vary from Blockchain to Blockchain. There are myriad architectural decisions participants either implicitly or explicitly agree to when they join a certain network, which includes the level of decentralization, privacy, throughput, and other features a network can provide. These decisions usually involve trade-offs and therefore each Blockchain network is typically optimized for specific capabilities, limitations, and target use cases. As a nascent and fast-changing area, the Crypto Asset market carries significant risks and uncertainty. See “Item 1A. Risk Factors—Risks Related to Crypto Assets" for further discussion of such risks and uncertainties.

Typical Stakeholders in Blockchain Networks

Designing a Blockchain network is similar to designing a digital economy, and the design of incentive systems that govern the relationship between different groups of stakeholders is sometimes referred to as crypto economics or token economics.

The following section provides an overview of the different groups of market participants which are present in most Blockchain networks and constitute much of the crypto economic system.

1.Stakeholders: Stakeholders help process transactions and ensure that the distributed ledgers that make up a Blockchain network stay consistent with one another. They fall under two categories: Miners, for PoW Blockchains, and Validators, for PoS Blockchains.

Stakeholders are typically compensated for providing this service in large part by algorithmic grants of the Crypto Asset associated with the Blockchain network they are helping to secure, although they may be compensated with transaction fees or by other means as well.

There are multiple schemes under which stakeholders can operate to provide this service and receive this payment, but the two most important are proof of work (“PoW”) and proof of stake (“PoS”).

•Proof of work is the first and most established scheme and involves computers solving cryptographic puzzles that require a substantial amount of energy as a way of securing the network and processing transactions. The more computing power a Miner dedicates to solving this puzzle the more likely it will be the first to solve the problem and collect the rewards of newly minted Crypto Assets and transaction fees. By piling up computing power over time, transactions become increasingly hard to reverse and eventually can be considered “settled.” PoW is the scheme used by Bitcoin, as well as many other assets. One criticism of PoW systems is the high amount of energy they consume, which may have negative downstream environmental consequences, among other issues.

•Proof of stake is a newer scheme that tries to avoid the heavy energy consumption that PoW systems typically require. PoS systems require Validators to lock up and put at risk (aka, “stake”) a certain amount of the Crypto Asset associated with a given Blockchain in order to process transactions. These staked assets are lost if a Validator processes a transaction in a way that is fraudulent or violates the rules of the underlying Blockchain. PoS is utilized by Blockchains such as Ethereum, Avalanche, Cardano and Solana. Concerns with PoS systems include the risk of lower security assurances and the potential for centralization of the network.

2.Users: Users are the stakeholders that hold or transfer Crypto Assets, either by participating directly in the network or by delegating this work to third-party service providers.

Users will typically buy and sell Crypto Assets for fiat currencies through dedicated trading venues. In recent years, a robust ecosystem of trading systems has emerged that cater to these investors.

Once in possession of a Crypto Asset, the interaction between users and the rest of the network can fall between two ends of a spectrum:

•On one end, users can opt to be completely sovereign over their asset holdings and transactions. Such users would typically host a local copy of the entire ledger of transactions and validate every single transaction that takes place in the network by running the protocol software in their own machines. They would also own the private keys that guarantee ownership of their Crypto Assets and embrace the responsibility of keeping them safe. This group tends to be technically savvy and/or attribute high value to holding Crypto Assets independently.

•On the other end, users can opt to delegate their participation in the network to third-party companies that provide specialized services. Examples of such users include individuals or institutions that delegate the responsibility of keeping their private keys safe to custodians or merchants that use payment processing companies to allow clients to make payments in Crypto Assets. This group tends to use third-party services either due to prioritization of convenience or due to external requirements (regulations, for example).

3.Developers: Developers are network contributors that build the protocols and software that both users and stakeholders (i.e. Miners and Validators) need to run to participate in the network. Developers are also generally split between two categories depending on the type of software they work in.

•Protocol developers are involved directly in building the core software that defines how a network works. Most projects adopt the free and open-source software ("FOSS") paradigm, which means that the software is free and openly shared so people can voluntarily contribute to its maintenance and improvement. Protocol developers can exert power over the network as they ultimately define which rules it will abide by. That is why having a high number of developers (i.e. decentralization) is important. Additionally, as the software is open-source, users can opt to run any version of the software they see more fit. This keeps the developers’ power over the network in check. Protocol developers are usually highly specialized experts with deep knowledge not only of software development but also in cryptography, computer networking or other subfields of computer science.

•Application developers use the software built by protocol developers to build applications that will ultimately reach end-users. Such projects might or might not be open-source software. Examples of such projects would include digital wallets, which are designed to allow users to hold Crypto Assets without the complexity of interacting with the underlying protocol.

Overview of the Index

The Index is designed to track the performance of the ten largest Crypto Assets, as selected and weighted by free-float market capitalization. These assets collectively account for more than approximately 75% of the total market capitalization of the Crypto Asset market as of December 31, 2024.

The Index uses a variety of rules to screen out assets that the Committee – the governing body for the Index – believes represent undesirable or uncompensated risks in the market. These rules require, among other things, that Crypto Assets included in the Index are available for custody at a third-party custodian regulated as a federally chartered bank or as a state trust company, and subject to additional screens for security practices, insurance requirements and business practice requirements as determined by the Committee; maintain a certain level of liquidity; are listed on multiple established Crypto Asset trading venues; and more. An additional rule excludes assets that are tethered or pegged to the price of other Crypto Assets.

The Index is reconstituted on a monthly basis at 4:00 pm Eastern Time on the last “business day” of each month. The Index considers a “business day” to be any day that the New York Stock Exchange is scheduled to be open for trading. The Index’s rules are designed and maintained specifically for the Crypto Asset market. For instance, the Index’s rules are designed to capture the value of significant “Hard Forks” of constituent assets, should they occur.

The Index rules govern how the newly forked asset is handled, including whether the asset is retained, liquidated or (if it is of de minimis market value) ignored by the Index.

Summary of the Index Methodology

The following is a materially complete description of the Index methodology (“Index Methodology”). The full Index Methodology is publicly available at https://app.bitwiseinvestments.com/indexes/methodology. Should any material change be made to the Index Methodology that results in a material change to the composition of the Index and, as part of the Trust’s monthly rebalancing process, results in a material change to the composition of the Trust the Sponsor will notify Shareholders of such material change by filing a Form 8-K with the SEC. The Trust defines a material change as any change of 10% or more to the composition of the Index, and that also results in a corresponding change to the Trust. If not required by applicable law, the Trust may or may not file a Form 8-K with the SEC to disclose changes to the Index Methodology that do not result in a material change. When deciding whether or not to file a Form 8-K to disclose changes to the Index Methodology that do not result in a material change, the Trust will consider whether the particular changes are required to be disclosed by one or more of the specific requirements of Form 8-K, and whether there is an independent legal obligation under the federal securities laws to make such a disclosure even in the absence of a specific requirement in Form 8-K. The Trust may have additional current or periodic reporting obligations under the Exchange Act due to other changes to the Index Methodology, such as to how the Index is calculated.

Purpose of the Index

The purpose of the Index is to track a basket of Crypto Assets that represents the majority of Crypto Assets by market capitalization. At its inception on October 1, 2017, the Crypto Assets in the Index represented about 83% of all Crypto Assets by market capitalization, and now represent approximately 75% as of December 31, 2024. The Index is comprised of the top 10 Crypto Assets selected and weighted by free-float-adjusted market capitalization. The Index is rebalanced monthly. Additional eligibility criteria are applied to screen Crypto Assets for investment feasibility (as defined below), to ensure the integrity of the Crypto Assets selected to comprise the Index, and to appropriately account for one-off events. As a result, the 10 Crypto Assets in the Index may not always completely match lists of the "top 10 Crypto Assets" that may be available on popular websites such as CoinMarketCap.com.

Index Methodology

The Index, designed by the Index Provider, an affiliate of the Sponsor, is comprised of the top ten largest Crypto Assets in the world based on free-float-adjusted market capitalizations. The market capitalizations of Crypto Assets are calculated using data sources from multiple publicly available, well-established and reputable Crypto Asset exchanges. The selection of Crypto Asset exchanges used to calculate market capitalization is made by the Committee, as defined below, in its sole discretion. Currently, the list of exchanges used to calculate the value of Crypto Assets in the Index include: BitFlyer, Binance, Bitstamp, Bittrex, Coinbase, itBit, Kraken, Gemini and Poloniex.

The market capitalization of a Crypto Asset is calculated by multiplying its price times its free-float-adjusted or “circulating” supply. The proportion of each Crypto Asset in the Index is based on this adjusted market capitalization. Public exchanges used for calculating the Index are selected using criteria which may include factors such as trading volume, availability, regulatory compliance, security, and reliability of real-time price and trade volume information and absence of abnormal withdrawal restrictions of crypto and fiat currencies. Regulatory compliance is defined as the exchange having no public evidence, such as statements by a relevant regulator, that it is not in compliance with the local regulations of the exchange’s domicile, and not being subject to publicly disclosed legal or regulatory action. The Committee monitors company websites, news flow, social media, and API-level data feeds to determine the regulatory compliance, security and reliability of real-time price and trade volume information and the absence of abnormal withdrawal restrictions of crypto and fiat currencies.

The Index is actively researched and evaluated and, therefore, the Index Methodology’s eligibility criteria, constituents and overall strategy may be adjusted over time. The Index is calculated by the Sponsor and its affiliates on a daily basis and published on the Sponsor’s website. Since the Trust’s investment strategy is to invest its assets to track the Index, a change in Index Methodology or composition will not automatically warrant a notice or consent

requirement to Shareholders. Should any material change be made to the Index Methodology that results in a material change to the composition of the Index and, as part of the Trust’s monthly rebalancing process, results in a material change to the composition of the Trust the Trust will notify Shareholders of such material change by filing a Form 8-K with the SEC. The Trust defines material change as any change of 10% or more to the composition of the Index.

To screen, select and weight the top 10 coins, the Index uses a free-float-adjusted market capitalization which is calculated as follows:

(composite price) x (free-float-adjusted or circulating supply)

A Crypto Asset's composite price is derived from the real-time price data pulled from multiple exchanges. The individual exchange price data is combined using a trade volume weighting technique. The price on the exchange with more trade volume has more influence on the composite price while the exchange with the price that deviates more from the prices of the other exchanges has less influence on the composite price. This normalization produces a more accurate composited price which is then used in the market capitalization calculation.

In calculating the available supply of a Crypto Asset, the Index looks at circulating supply. Circulating supply is the best approximation of the number of coins available on public markets. Circulating supply is derived by taking the total number of existing Crypto Assets native to a specific Blockchain and subtracting the number of coins verifiably burned, locked, or reserved (for example, by a foundation).

The top 10 Crypto Assets in the Index are selected and held in proportion to their valuation, often referred to as “Market-Capitalization Weighted.”

Composite Price Determination by the Index

Broadly speaking, the intent is to generate a price to reflect the price at which an institutionally oriented investor can trade any given Crypto Asset. This price is called the Index Crypto Asset Price (“Index CAP”). The Index CAP is used solely by the Index and is not used by the Trust or the Sponsor. The default denomination of an Index CAP is the U.S. dollar, and the methodology is as follows:

Calculating Crypto Asset Prices in U.S. Dollars: The Crypto Asset world has two modalities of trading: crypto-to-fiat trading and crypto-to-crypto trading. To create a single unified price for every Crypto Asset, all trading pairs must be standardized to price that asset in a single currency (for the Index, this currency is the U.S. dollar). The steps to do that are listed below in the order that they are followed:

1.Select Quote Crypto Assets: To avoid circular pricing when standardizing crypto-to-crypto trading pairs, the Committee must select a group of “Quote Crypto Assets.” Quote Crypto Assets are determined on an annual basis at the Committee meeting that precedes the start of a new calendar year.

a.Quote Crypto Assets are those that:

i.Have crypto-to-fiat trading on at least two Eligible Crypto Asset trading venues that allow for institutional deposits and withdrawals in a noncapital-controlled fiat currency (an “Eligible Fiat Currency”).

ii.Are the largest crypto trading pair (measured by trailing 30-day dollar trading volume) for at least one of the top 100 Eligible Crypto Assets in each of the past three months.

iii.As of December 31, 2024, Quote Crypto Assets were Bitcoin ("BTC") and Ethereum ("ETH").

2.Calculate Quote Crypto Assets Index CAPs: Quote Crypto Assets are unique in that the Index only considers fiat-to-crypto trades when calculating their Index CAPs, as the goal is to calculate the fiat-convertible price of Eligible Crypto Assets that have crypto-to-crypto trading pairs.

a.The Index CAP for a Quote Crypto Asset is calculated as follows:

i.Aggregate all crypto-to-fiat trading pairs for Eligible Fiat Currencies that take place on Eligible Crypto Asset trading venues, removing any pairs that face withdrawal issues.

ii.Transform all non-U.S.-dollar fiat trading pairs into U.S. dollar prices using synchronous data from an established foreign exchange reference data provider.

iii.Calculate the U.S. dollar volume over the previous hour for each crypto-to-fiat trading pair.

iv.Assign each trading pair a contribution weight based on its share of total dollar trading volume in a given asset over the previous hour.

v.Multiply the last traded price (adjusted into U.S. dollars) for each trading venue pair by its contribution weight. In the event that no trading price is pulled for a particular trading pair either due to technical reasons or to a lack of trading volume, the Committee may substitute a fair market value estimate for that price or eliminate that price from consideration.

vi.Sum to find the Index CAP.

3.Calculate the Index CAP for Non-Quote Crypto Assets: Many crypto assets trade (sometimes exclusively) in pairs with other crypto assets.

a.The process for translating these crypto-to-crypto pairs along with crypto-to-fiat pairs into an aggregate Index CAP is as follows:

i.Consider both crypto-to-fiat trading pairs and crypto-to-crypto trading pairs on Eligible Crypto Asset trading venues, excluding any trading venue pairs that have withdrawal issues.

ii.Exclude all trading pairs that are not denominated in either Eligible Fiat Currencies or Quote Crypto Assets.

iii.Transform all non-U.S.-dollar fiat trading pairs into U.S. dollars using synchronous foreign exchange data from an established foreign exchange data supplier.

iv.For Quote Crypto Assets, use the synchronous Index CAP to translate crypto-to-crypto pairs into a crypto-to-U.S.-dollar equivalent. The synchronous Index CAP is used to establish a conversion rate for non-fiat denominated crypto pairs. Non-quote crypto assets are usually priced relative to a Quote Crypto Asset; therefore, the price can be converted into a U.S. dollar price by multiplying by the U.S. dollar Index CAP of the Quote Crypto Asset. For example, a non-quote crypto asset can be priced in Bitcoin, which is a Quote Crypto Asset. Therefore, you would convert the price of the non-quote crypto asset to its price in Bitcoin, and then convert that price to U.S. dollars. In either scenario, the crypto-to-crypto price is converted or "translated" into a crypto-to-U.S. dollar equivalent. This process is similar to how a foreign exchange rate would be used to convert or “translate” a crypto-to-forex price into a crypto-to-U.S. dollar equivalent.

v.Calculate the U.S. dollar volume for each trading pair and assign each pair a contribution weight based on its share of total U.S. dollar trading volume in a given Crypto Asset over the past hour.

vi.Multiply the last traded price (adjusted into U.S. dollars) by its contribution weight. Note: In the event that no trading price is pulled for a particular trading pair either due to technical reasons or a lack of trading volume, the Committee may substitute a fair market value estimate for that price or eliminate that price from consideration.

vii.Sum to find the Index CAP.

Changes in Index Methodology

The Index Methodology is subject to change, though changes are expected to be infrequent and consistent with the Index’s goal of including the most valuable coins that cover the majority of the Crypto Asset market based on market capitalization, while meeting criteria relating to liquidity, access to markets, available pricing, available

custody options, and other criteria included within the Index’s rules, which we collectively refer to as meeting an “investment feasibility” standard. See “—Eligibility of Crypto Assets ” for additional information.

Given the speed at which the Crypto Asset market has been changing over the past few years, some adjustments to the methodology have been made in order for the Index to better reflect its target market. Examples of such changes include the method followed to determine which exchanges or custodians are needed to support a Crypto Asset in order to make it eligible, the method to calculate a Crypto Asset’s free-float-adjusted market capitalization, and the specifics of how to screen out assets for non-compensated regulatory or technical risks.

In fiscal year 2024, the Committee approved by unanimous vote the following changes to the methodology:

•to remove Bakkt as an eligible custodian under clause III.B.i.e of the Bitwise Crypto Asset Index Methodology, which allows for the removal of a custodian “at the discretion of the Bitwise Crypto Index Committee.”

Since the Trust’s principal investment objective is to invest in a portfolio of Crypto Assets that tracks the Index as closely as possible, the Trust relies on the Index Methodology when the Trust determines in which Crypto Assets it should invest. The Trust does not intend for its holdings to deviate from the Crypto Assets as determined by the Index, and the Trust anticipates that such deviation would likely occur only if the Trust was unable to hold a particular Crypto Asset that was included in the Index or if the Trust determined that holding a particular asset would result in significant harm to Shareholders.

Eligibility of Crypto Assets