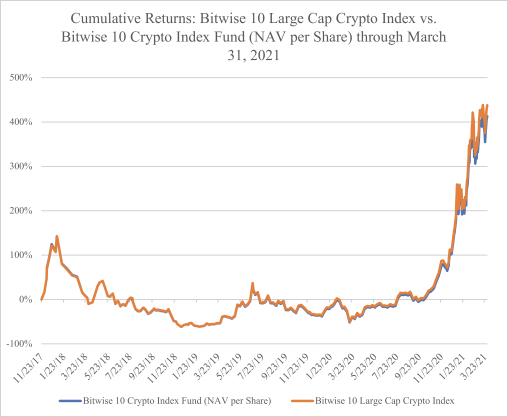

are new and, in most cases, largely unregulated” and “Overview of the Digital Asset Industry,” the prices of the various Portfolio Crypto Assets held by the Trust are subject to extreme volatility. This volatility had a significant impact on the value of the Portfolio Crypto Assets as of the three months ended March 31, 2021 compared to March 31. 2020 and year-end 2020 compared to year end 2019.

As shown below in the “Schedules of Investments,” aside from the change in value of Portfolio Crypto Assets, the increase in total investments in digital assets from January 1, 2021 to March 31, 2021 was due primarily to an increase of approximately 2,837.65 units of Bitcoin and an increase of approximately 23,842.82 units of Ethereum, in addition to the number of units invested in the additional cryptocurrencies that comprise the Portfolio Crypto Assets, purchased in connection with Shareholder subscriptions for Shares, partially offset by the sale of various Portfolio Crypto Assets to pay the Management Fee.

The increase in total investments in digital assets from December 31, 2019 to December 31, 2020 was due primarily to an increase of approximately 8,373.092 units of Bitcoin and an increase of approximately 46,773.289 units of Ethereum, in addition to the number of units invested in the additional cryptocurrencies that comprise the Portfolio Crypto Assets, purchased in connection with Shareholder subscriptions for Shares, partially offset by the sale of various Portfolio Crypto Assets to pay the Management Fee and to fund redemptions.

Shareholder Subscriptions and Redemptions6

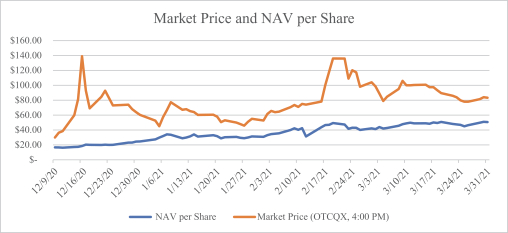

During the period from January 1, 2021 to March 31, 2021, Shareholders subscribed for approximately 4,647,510 Shares with an average net asset value as of March 31, 2021 of $50.68. During the same period, Shareholders redeemed zero Shares. As a result, there were approximately 19,779,750 Shares outstanding as of March 31, 2021.

During the period from January 1, 2019 to December 31, 2019, Shareholders subscribed for 746,509.27 Shares with an average net asset value as of December 31, 2019 of $7.52. During the same period, Shareholders redeemed 239,486.17 Shares. As a result, there were 3,416,265.31 Shares outstanding as of December 31, 2019. The Trust ceased its redemption program on October 7, 2020.

During the period from January 1, 2020 to December 31, 2020, Shareholders subscribed for 11,985,739.55 Shares with an average net asset value as of December 31, 2020 of $17.2764. During the same period, Shareholders redeemed 269,912.45 Shares. As a result, there were approximately 15,132,240 Shares outstanding as of December 31, 2020.

From January 1, 2021 to March 31, 2021, the Trust took in $161,036,568 of subscriptions. From January 1, 2020 through December 31, 2020, the Trust took in $199,474,452 of subscriptions and processed $2,277,884 of redemptions. From January 1, 2019 through December 31, 2019, the Trust took in $5,522,177 of subscriptions and processed $1,833,801 of redemptions.

| 6 | The Share and average net asset value numbers presented in this section have been adjusted to reflect an approximately 10:1 stock split that occurred on May 1, 2020 in connection with the conversion of the Trust from a Delaware limited liability company to a Delaware statutory trust. |

90