DESCRIPTION OF THE NOTES

Our predecessor, Baker Hughes Incorporated, a Delaware corporation (“BHI”), entered into an indenture, dated as of October 28, 2008 (the “Original Indenture”), between BHI and The Bank of New York Mellon Trust Company, N.A., as trustee (herein called the “Trustee”). In connection with the combination of BHI and the oil and gas business of General Electric Company (“GE”), BHI converted into a Delaware limited liability company and changed its name to Baker Hughes, a GE company, LLC and succeeded to the obligations of BHI under the indenture. In addition, on July 3, 2017, Baker Hughes, a GE company, LLC, Baker Hughes Co-Obligor, Inc., a Delaware corporation and a wholly owned subsidiary of Baker Hughes, a GE company, LLC, and the Trustee entered into the Second Supplemental Indenture pursuant to which Baker Hughes, a GE company, LLC and Baker Hughes Co-Obligor, Inc. agreed to be jointly and severally liable with respect to the obligations of the Company under the indenture. The Company further changed its name from Baker Hughes, a GE company, LLC to Baker Hughes Holdings LLC on April 15, 2020. We refer to the Original Indenture, as previously supplemented, as the “Base Indenture.”

The 1.231% Notes due 2023 (the “2023 notes”) and the 2.061% Notes due 2026 (the “2026 notes” and, together with the 2023 notes, the “notes”) offered hereby will be issued under the Base Indenture, as supplemented by a supplemental indenture to be dated December 9, 2021 establishing the terms of the notes (as so supplemented, together with the Base Indenture, the “Indenture”). The terms of the notes will be those stated in the Indenture and those made part of the Indenture by reference to the Trust Indenture Act of 1939, as amended (the “TIA”). The following is a summary of the material provisions of the notes and the Indenture and is qualified in its entirety by the provisions of the Indenture and the notes, including definitions of terms used therein. Because this description is only a summary, you should refer to the Base Indenture and the supplemental indenture for a complete description of our obligations and your rights. A copy of the Indenture may be obtained from us and is available for inspection during normal business hours at the office of the Trustee. The Base Indenture was also filed as an exhibit to BHI’s Current Report on Form 8-K dated October 29, 2008, which is on file with the SEC and can be reviewed on the SEC’s website by going to www.sec.gov. Certain terms used but not defined herein shall have the meanings given to them in the Indenture or the notes, as the case may be.

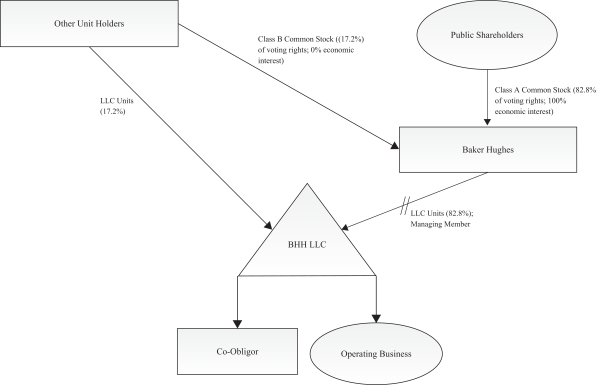

As used in this description of the notes, (i) the terms “Company,” “we,” “us” and “our” refer solely to Baker Hughes Holdings LLC and not to any of its subsidiaries or affiliates, (ii) the term “Co-Obligor” refers to Baker Hughes Co-Obligor, Inc. and (iii) the term “Issuers” refers collectively to the Company and the Co-Obligor.

General

The 2023 notes will mature on December 15, 2023 and the 2026 notes will mature on December 15, 2026. Each series of notes will constitute part of the senior debt of each of the Issuers. The Indenture and the notes do not limit the Issuers’ ability to incur other indebtedness or to issue other securities. Also, other than to the limited extent set forth below, the Issuers are not subject to financial or similar restrictions by the terms of the notes.

The notes will be issued under the Indenture. The Indenture provides for the issuance by the Company from time to time of one or more series of debt securities with varying maturities and other terms. Each of the 2023 notes and the 2026 notes will constitute a separate series of notes under the Indenture. As of September 30, 2021, there were six series of debt securities outstanding under the Base Indenture aggregating $6,121 million in principal amount. The Co-Obligor is jointly and severally liable, as a primary obligor and not as a guarantor or surety, with respect to all payment obligations on the notes, including the due and punctual payment of principal (and premium, if any) and interest on the notes and all other obligations of the Company under the Indenture.

We may, without the consent of the holders of the notes of a series, issue additional notes having the same ranking and the same interest rate, maturity and other terms as the notes of such series, except for the issue date, public offering price and, in certain cases, interest accrual date. Any additional notes having such similar terms, together with the previously issued notes of the applicable series, will constitute a single series of notes under the Indenture.

S-12