As filed with the Securities and Exchange Commission on April 3 , 2018

Registration No. 333-222585

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

TAL CONSOLIDATED INC.

(Exact name of registrant as specified in its charter)

| New York | 2000 | 82-3343404 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

377B Pearsall Avenue

Cedarhurst, New York 11516

(516) 415-7850

(Address, including zip code, and telephone number including

area code, of Registrant’s principal executive offices)

Jeremy J. Reichmann

Chief Executive Officer

377B Pearsall Avenue

Cedarhurst, New York 11516

(516) 415-7850

(Name, address, including zip code, and telephone number including area code, of agent for service)

With copies to:

Arnold Gulkowitz, Esq. Shaya M. Berger, Esq. Gulkowitz Berger LLP 4205 Avenue M Brooklyn, NY 11234 Tel. No.: (212) 208-0006 Fax No.: (917) 791-9612 | Oded Har-Even, Esq. Robert V. Condon III, Esq. Zysman, Aharoni, Gayer and Sullivan &Worcester LLP 1633 Broadway New York, NY 10019 Tel. No.: (212) 660-5000 Fax No.: (212) 660-3001 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. [ ]

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. Large Accelerated Filer [ ]

| Accelerated Filer [ ] | Smaller Reporting Company [X] | |

| Non-Accelerated Filer [ ] | Emerging Growth Company[X] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. [ ]

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price(1) | Amount of Registration Fee | ||||||

| Common stock, no par value per share(2)(3) | $ | 17,250,000 | $ | 2,147.63 | ||||

| Representative’s Warrants(4) | ||||||||

| Common stock underlying Representative’s Warrants(2)(5) | $ | 1,078,125 | $ | 134.22 | ||||

| Total | $ | 18,328,125 | $ | 2,281.85 | (6) | |||

| (1) | Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) of the Securities Act of 1933, as amended (“Securities Act”). |

| (2) | Pursuant to Rule 416 of the Securities Act, the securities registered hereby also includes an indeterminable number of additional shares of common stock as may from time to time become issuable by reason of stock splits, stock dividends, recapitalizations or other similar transactions. |

| (3) | Includes securities which may be issued upon exercise of the 45-day option granted to the underwriters to cover over-allotments, if any, up to 15% of the offering amount. |

| (4) | No separate registration fee is required pursuant to Rule 457(g) under the Securities Act. |

| (5) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) of the Securities Act based on an estimate of the proposed maximum aggregate offering price. The Representative’s Warrants are exercisable at a per share exercise price equal to 125% of the public offering price. As estimated solely for the purposes of calculating the registration fee pursuant to Rule 457(g) of the Securities Act, the proposed maximum offering price of the Representative’s Warrants is equal to 125% of $862,500(5% of $17,250,000). |

| (6) | Previously paid. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED APRIL 3 , 2018 |

2,143,000 Shares

Common Stock

TAL CONSOLIDATED INC.

This is a firm commitment initial public offering of shares of 2,143,000 common stock of Tal Consolidated Inc. No public market currently exists for our shares. We anticipate that the initial public offering price of our shares of common stock will be between $6.00 and $8.00 per share.

We have applied to list our common stock on the NASDAQ Capital Market under the symbol “TCL”. No assurance can be given that our application will be approved.

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 and, as such, we have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 7 of this prospectus for a discussion of information that should be considered in connection with an investment in our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public Offering Price | $ | $ | ||||||

| Underwriting discounts and commissions(1) | $ | $ | ||||||

| Proceeds, before expenses, to us | $ | $ | ||||||

| (1) | Does not include a non-accountable expense allowance equal to 1% of the gross proceeds of this offering payable to Joseph Gunnar & Co., LLC, the representative of the underwriters. We have agreed to reimburse the underwriters for other out-of-pocket expenses relating to this offering. See “Underwriting” for a description of compensation payable to the underwriters. |

We have granted a 45-day option to the representative of the underwriters to purchase up to 321,450 additional shares of common stock solely to cover over-allotments, if any.

The underwriters expect to deliver our shares to purchasers in the offering on or about , 2018.

Joseph Gunnar & Co.

, 2018

TABLE OF CONTENTS

Neither we nor the underwriters have authorized anyone to provide you with any information or to make any representation, other than those contained in this prospectus or any free writing prospectus we have prepared. The underwriters and we take no responsibility for, and provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell our common stock, and seeking offers to buy our common stock, only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of its date, regardless of the time of delivery of this prospectus or of any sale of our common stock.

Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than the United States. You are required to inform yourself about, and to observe any restrictions relating to, this offering and the distribution of this prospectus.

This prospectus includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe these industry publications and third-party research, surveys and studies are reliable, we have not independently verified such data.

Unless the context suggests otherwise, references in this prospectus to “Tal Consolidated,” “company,” “we,” “us” and “our” refer to Tal Consolidated Inc., a New York corporation, and, where appropriate, our wholly-owned subsidiaries. References to “Tal Depot” refer to Ram Distribution Group LLC d/b/a Tal Depot, a New York limited liability company and our wholly-owned subsidiary, and Lady Shipper LLC, a New York limited liability company that is wholly-owned by Ram Distribution Group LLC.

| I |

This summary highlights selected information appearing elsewhere in this prospectus. While this summary highlights what we consider to be important information about us, you should carefully read this entire prospectus before investing in our common stock, especially the risks and other information we discuss under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operation” and our financial statements and related notes beginning on page 62. Our fiscal year end is December 31. Some of the statements made in this prospectus discuss future events and developments, including our future strategy and our ability to generate revenue, income and cash flow. These forward-looking statements involve risks and uncertainties which could cause actual results to differ materially from those contemplated in these forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements”.

Our Business

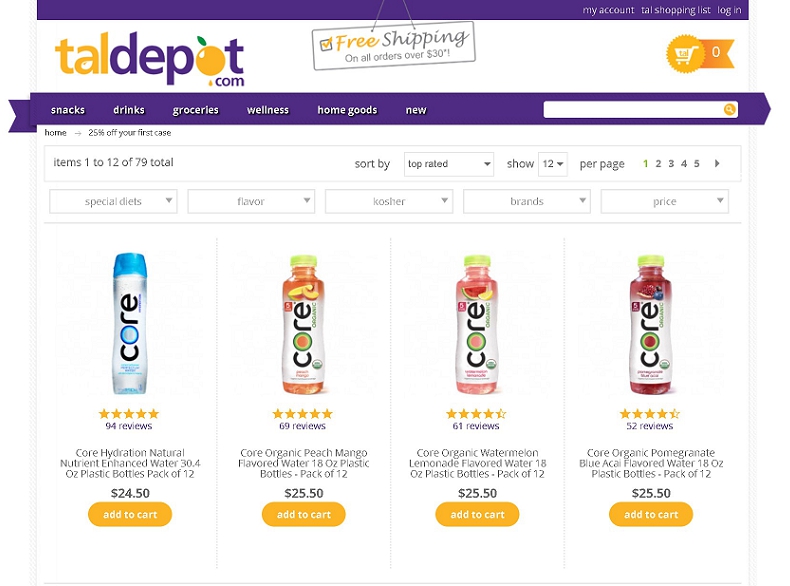

Tal Consolidated will serve as the holding company for its wholly-owned operating subsidiary, Tal Depot. Tal Depot primarily sells non-perishable grocery products and home goods online, comprising a vast array of products targeted at both retail and business customers in various geographical regions in the continental United States. The grocery items we currently sell are snacks, biscuits, pastries, k-cups and other coffee and tea products, spreads, dips, breakfast foods, pasta, rice, canned foods, dried fruit and vegetables, spices, vitamin supplements, milk, juices, sodas, water and other drinks. The home goods we currently sell are cleaning supplies, paper towels, toiletries, diapers and pet supplies. We purchase our products and goods directly from the manufacturers and from distributors. We strive to increase our offerings so that we can present our customers with a catalog of items that meets as many of their grocery and home good needs as possible. To do so, we work directly with manufacturers and with distributors. We serve our clients through our website, taldepot.com, and various third party online platforms to provide a seamless and enjoyable online shopping experience. We have developed a computerized inventory management process that reviews orders made and fulfilled. Through such review we keep track of our outgoing inventory and any notable changes in customer demands, and thereby maintain optimal levels of inventory to increase inventory turnover and product freshness. We currently distribute products to customers by taking orders and arranging shipments at our facility. Once an order is received, the products ordered are properly packaged, marked with an identification number, and shipped. For more information on our business please see the section entitled “Our Business.”

Current Limitations of Online Shopping

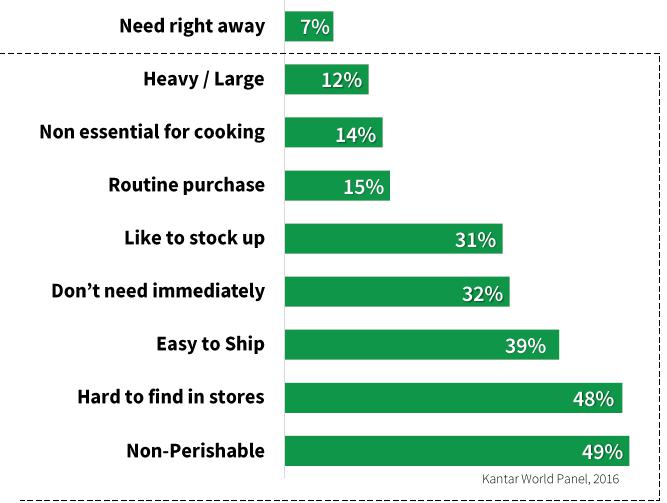

Tal Depot’s business is based on the realization that while retail customers seem to have little spare time to purchase bare essentials such as groceries, they often avoid e-commerce for such items because of the higher costs associated with purchasing such items online, the limited selection online, a lack of comfort with the online shopping experience, and a general concern of buying non-perishable and perishable items online because the shelf life is unknown. Additionally, business customers who have a need to purchase food for their businesses face similar challenges.

Our Solution

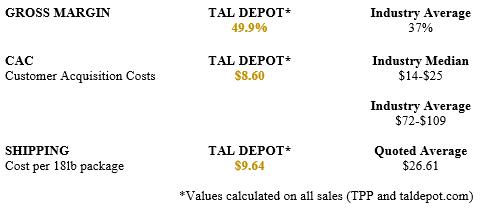

Tal Depot has grown its business by focusing on, and striving to solve, the current limitations of online shopping facing most retail and business customers of groceries and foodstuffs. With our strategically located distribution facility, and plans to expand existing infrastructure and our current product line while adding new facilities throughout the continental United States, we believe we are well positioned to decrease our already competitive costs, provide more selections online, enhance our brand to make customers more comfortable with shopping for groceries and foodstuffs online, and to alleviate shelf life concerns by having local supply of goods close to potential customers.

Our Strategy

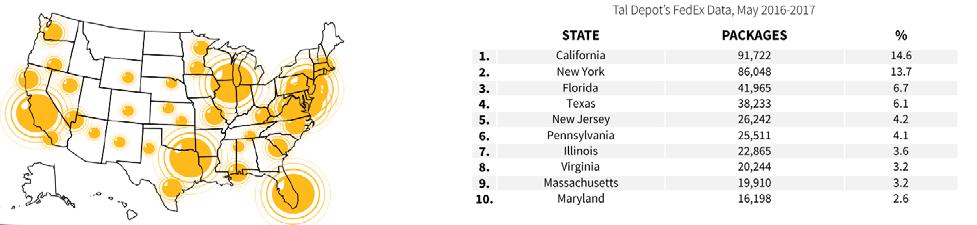

Since its formation, Tal Depot has more than one million customers all throughout the United States, but its highest concentration of orders are shipped to customers located in the northeastern United States, where approximately 31% of Tal Depot’s shipments are delivered. Our plan for growth includes opening warehouses and shipping centers in other areas of the country to better serve current Tal Depot customers that are in other regions, notably the west coast and mid-west, and further expand that geographic customer base. In addition to being able to attract more localized business, such facilities will enable us to attract local suppliers and have better inventory control to provide constantly fresh non-perishable, perishable and other goods, which we believe will enhance our brand and contribute to increasing market share.

Our sales are made either directly through our website, taldepot.com, or on third party platforms (“TPPs”). Our primary focus is generating as many direct sales as possible, which is one of its greatest challenges. Direct sales have increased from year to year, and continuing that trend remains our goal. The availability of TPPs is what has enabled us to build up the Tal Depot brand and its business to what it is today, and position us to concentrate on continued growth of direct sales. Indeed, TPPs are becoming increasingly more difficult to sell on due to the fees they charge and difficult benchmarks placed on third party sellers, thereby restricting them from freely making use of TPPs. By taking advantage of the TPP market over the past five years, Tal Depot has leveraged that market to its advantage, and its business model going forward is to continue to increase its direct sales, making them its primary revenue source.

| 1 |

We believe certain factors can give Tal Depot a competitive advantage over its competitors. These include:

| ● | pricing; | |

| ● | offering hard to find items; | |

| ● | offering a variety of products; | |

| ● | the freshness of the products offered; | |

| ● | ease of use of our website to place orders; | |

| ● | brand relationships; | |

| ● | experience in the food industry in general and specifically dedicated to the online part of it; | |

| ● | the market share we have in the online food industry market; and | |

| ● | having leveraged the TPP market for grocery items and household goods for the past five years to build its brand name. |

We will strive to leverage these advantages to grow Tal Depot’s business and expand into related services. Our growth strategy for Tal Depot involves increasing direct sales, improving and expanding infrastructure, opening new facilities in strategic locations, expanding our product offering including through acquiring or otherwise integrating with strategic suppliers and distributors, increasing marketing efforts, and hiring additional proven and experienced executives and operational personnel to complement our current management and personnel to drive our vision for growth.

Our Risks and Challenges

An investment in our common stock involves a high degree of risk, including risks related to the following:

| ● | Tal Depot was not profitable during the 2016 and 2017 fiscal years. At December 31, 2016 and December 31, 2017, Tal Depot had an accumulated deficit approximating $3.6 million and $7.7 million, respectively, and has incurred negative cash flows from operations, which according to our auditors, raise substantial doubt about our ability to continue as a going concern. | |

| ● | Tal Depot is currently dependent on sales through TPPs for a large majority of its revenues, and is reliant on these platforms continuing to authorize Tal Depot to sell on their websites. Historically, the Company has generated most of its sales from one TPP, Amazon.com. The TPPs may revoke Tal Depot’s authorization immediately and even for no reason, and have done so. | |

| ● | Our ability to meet our capital spending requirements to expand and grow our business. | |

| ● | We may be required to reduce our capital expenditures and investments or take other measures in order to meet our cash requirements. | |

| ● | We may need to seek additional funds from liquidity-generating transactions and other conventional sources of external financing (which may include a variety of debt, convertible debt and/or equity financings) to meet our cash and capital spending requirements. | |

| ● | Maintaining and enhancing the Tal Depot brand is critical to expanding our business, and maintaining and enhancing the Tal Depot brand may require substantial investments, and these investments may not be successful. |

| ● | Issues that may arise with some of our suppliers and manufacturers and any of their ability to meet customers’ standards are beyond our control. | |

| ● | Our competitors may have more extensive experience or more specialized products and capabilities than we do in some areas. |

We are subject to a number of additional risks, including general business risks and risks that are specific to the online and grocery/home goods industry, and you should be aware of such risks before you buy our common stock. These risks are discussed more fully in the section entitled “Risk Factors” following this prospectus summary.

Emerging Growth Company under the JOBS Act

As a company with less than $1.07 billion in revenues during our last fiscal year, we qualify as an “emerging growth company” under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we have elected to take advantage of reduced reporting requirements and are relieved of certain other significant requirements that are otherwise generally applicable to public companies. As an emerging growth company:

| ● | we are required to present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations; | |

| ● | we are exempt from the requirement to obtain an attestation and report from our auditors on whether we maintained effective internal control over financial reporting under the Sarbanes-Oxley Act; | |

| ● | we are permitted to provide less extensive disclosure about our executive compensation arrangements; and | |

| ● | we are not required to give our stockholders non-binding advisory votes on executive compensation or golden parachute arrangements. |

We have elected to take advantage of these provisions for up to five years so long as we continue to qualify as an emerging growth company. We would cease to be an emerging growth company if we have more than $1.07 billion in annual revenues, have more than $700 million in market value of our shares held by non-affiliates or issue more than $1.0 billion of non-convertible debt over a three-year period. We have chosen to take advantage of some but not all of these reduced burdens. We have elected to provide two years of audited consolidated financial statements.

| 2 |

Additionally, we have elected to take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”), for complying with new or revised accounting standards that have different effective dates for public and private companies until the earlier of the date we (i) are no longer an emerging growth company or (ii) affirmatively and irrevocably opt out of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act.

Our Corporate Information

Tal Consolidated was formed in 2017 and is a New York corporation. Tal Depot, the operating subsidiary that Tal Consolidated will wholly-own upon the effective date of the registration statement of which this prospectus forms a part (the “Effective Date”), is a New York limited liability company that has been in business since 2012. The owners of Tal Depot, which include Jeremy Reichmann, our Chief Executive Officer, who owns 85.2% of Tal Depot, will have, as of the Effective Date, exchanged their ownership in Tal Depot for shares in Tal Consolidated. Following this offering Mr. Reichmann will hold a substantial interest in Tal Consolidated, equal to approximately 53.2% of Tal Consolidated’s issued and outstanding equity. Tal Depot wholly owns Taldepot.com LLC (formed in 2014), which currently conducts no business, and Lady Shipper LLC (formed in 2017), which at times, processes some of our customer orders on TPPs, and each of which we may use in the future to conduct some of our current or new business enterprises, at the discretion of our management. Our executive offices are located at 377B Pearsall Avenue, Cedarhurst, New York 11516 and our telephone number is (516) 415-7850. Our warehouse from which we conduct our operations is located at 120 Adams Blvd., Farmingdale, NY 11734. Our web site is located atwww.talconsolidatedinc.com. The information contained on our website is not incorporated by reference into this prospectus, and the reference to our website in this prospectus is an inactive textual reference only.

| 3 |

THE OFFERING

| Common stock offered by us | 2,143,000 shares (or 2,464,450 shares if the representative of the underwriters exercises its over-allotment option in full). | |

| Common stock to be outstanding immediately after the offering | 5,714,429 shares (or 6,035,879 shares if the representative of the underwriters exercises its over-allotment option in full). | |

| Over-allotment option | We have granted the representative of the underwriters an option, exercisable for 45 days after the date of this prospectus, to purchase up to an additional 321,450 shares of common stock from us, less underwriting discounts and commissions, to cover over-allotments. | |

| Use of proceeds | We currently intend to use the net proceeds received from this offering to fund our future growth projects, for other general corporate purposes and to pay off certain of Tal Depot’s current debts. See “Use of Proceeds” on page 21. | |

| Risk factors | Investing in our common stock involves substantial risks. You should carefully review and consider the “Risk Factors” section of this prospectus beginning on page and the other information in this prospectus for a discussion of the factors you should consider before you decide to invest in this offering. | |

| Proposed trading symbol | Our common stock is presently not traded or quoted on any quotation system or national securities exchange. We have applied to the NASDAQ Capital Market to list our common stock under the symbol “TCL.” No assurance can be given that our application will be approved. |

The number of shares of our common stock to be outstanding after this offering is based on 3,571,429 shares outstanding as of the Effective Date and excludes:

● the exercise of the underwriters’ option to purchase up to an additional 321,450 shares of common stock to cover over-allotments, if any;

● the exercise of the warrants to purchase up to shares of common stock to be issued to the representative of the underwriters, or its designees, or the “Representative’s Warrants”; and

● the awarding of any stock and options to eligible officers, directors and employees under the Tal Consolidated Inc. Equity Incentive Plan.

| 4 |

SUMMARY FINANCIAL INFORMATION

We were formed on November 8, 2017, in contemplation of wholly-owning Tal Depot, and have not engaged in any other business. As a result, we have no historical or current financial data. The following summary statements are from the operations data of Tal Depot for the years ended December 31, 2016 and 2017 have been derived from Tal Depot’s audited consolidated financial statements included elsewhere in this prospectus.

The historical financial data presented below is not necessarily indicative of our financial results in future periods, You should read the summary consolidated financial data in conjunction with those financial statements and the accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Tal Depot’s consolidated financial statements are prepared and presented in accordance with United States generally accepted accounting principles (“U.S. GAAP”).

The following unaudited pro forma condensed consolidated financial information was prepared using the using the as-if method as though the transactions occurred as of the beginning of the period. The following unaudited pro forma condensed consolidated financial statements are based on the historical financial statements of the Company as adjusted to give effect to contemplated transactions in this initial public offering. The unaudited pro forma condensed consolidated statements of operations for the year ended December 31, 2017 give effect to these transactions as if they had occurred on January 1, 2017. The unaudited pro forma condensed consolidated balance sheet as of December 31, 2017 gives effect to these transactions as if they had occurred on December 31, 2017.

The pro forma financial information is presented for informational purposes only and does not purport to represent what the Company’s results of operations or financial condition would have been had the initial public offering actually occurred on the dates indicated, and does not purport to project the Company’s results of operations or financial condition for any future period or as of any future date.

The pro forma financial statements are based on the assumptions and adjustments that are described in the accompanying notes. The pro forma adjustments are preliminary, subject to further revision as additional information becomes available and additional analyses are performed, and have been made solely for providing the pro forma financial data. Differences between these preliminary estimates and the final accounting, expected to be completed after the closing of the initial public offering, will occur and these differences could have a material impact on the accompanying pro forma financial statements and the Company’s future results of operations and financial position. In addition, differences between the preliminary and final amounts will likely occur as a result of the amount of cash used for the Company’s operations, changes in the fair value of the Company’s preferred and common stock and other changes in the Company’s assets and liabilities.

The pro forma financial information is preliminary and has been prepared for illustrative purposes only. The actual results reported in periods following the initial public offering may differ significantly from those reflected in this pro forma financial information presented herein for a number of reasons, including, but not limited to, differences between the assumptions used to prepare this pro forma financial information.

The assumptions and estimates underlying the pro forma financial statements are described in the accompanying notes, which should be read together with the pro forma financial statements.

The unaudited pro forma condensed consolidated financial statements should be read together with the historical financial statements of the Company, included herein.

The pro forma and pro forma as adjusted information set forth below is illustrative only and will be adjusted based on the actual public offering price and other terms of this offering determined at pricing.

Summary Operating Data:

| 2016 | 2017 | Pro Forma (1) | Pro Forma as adjusted | Pro Forma as adjusted (2) | ||||||||||||||||

| Actual | Actual | 2017 | Adjustments | 2017 | ||||||||||||||||

| Unaudited | ||||||||||||||||||||

| NET REVENUES | $ | 23,913,571 | $ | 26,215,032 | $ | 26,215,032 | $ | 26,215,032 | ||||||||||||

| COST OF GOODS SOLD | 12,975,208 | 13,392,429 | 13,392,429 | 13,392,429 | ||||||||||||||||

| GROSS PROFIT | 10,938,363 | 12,822,603 | 12,822,603 | 12,822,603 | ||||||||||||||||

| SELLING, GENERAL AND ADMINISTRATIVE: | ||||||||||||||||||||

| Payroll and related expenses | 2,017,108 | 2,612,665 | 2,612,665 | 2,612,665 | ||||||||||||||||

| Shipping | 7,378,722 | 8,654,796 | 8,654,796 | 8,654,796 | ||||||||||||||||

| Professional fees | 302,759 | 623,488 | 623,488 | 623,488 | ||||||||||||||||

| General and administrative expenses | 4,322,267 | 4,563,748 | 4,563,748 | 4,563,748 | ||||||||||||||||

| Depreciation | 41,244 | 47,292 | 47,292 | 47,292 | ||||||||||||||||

| TOTAL SELLING, GENERAL AND ADMINISTRATIVE | 14,062,100 | 16,501,989 | 16,501,989 | 16,501,989 | ||||||||||||||||

| LOSS FROM OPERATIONS | (3,123,737 | ) | (3,679,386 | ) | (3,679,386 | ) | (3,679,386 | ) | ||||||||||||

| OTHER INCOME (EXPENSE): | ||||||||||||||||||||

| Other income | 4,310 | 2,856 | 2,856 | 2,856 | ||||||||||||||||

| Interest expense, net | (37,976 | ) | (291,742 | ) | (291,742 | ) | 101,599 | 7 | (190,143 | ) | ||||||||||

| TOTAL OTHER INCOME (EXPENSE) | (33,666 | ) | (288,886 | ) | (288,886 | ) | (187,287 | ) | ||||||||||||

| LOSS BEFORE INCOME TAXES | (3,157,403 | ) | (3,968,272 | ) | (3,968,272 | ) | (3,866,673 | ) | ||||||||||||

| Income tax | - | - | - | - | ||||||||||||||||

| NET LOSS | $ | (3,157,403 | ) | $ | (3,968,272 | ) | $ | (3,968,272 | ) | $ | (3,866,673 | ) | ||||||||

| Pro forma basic and diluted net loss per common share (unaudited) (1) | $ | (1.11 | ) | $ | (1.08 | ) | ||||||||||||||

| Pro forma basic and diluted weighted average number of common shares outstanding (unaudited) (1) | 3,571,429 | 3,571,429 | ||||||||||||||||||

| (1) | Pro forma basic and diluted net loss per common share were computed to give effect to the transactions set forth in the Share Exchange Agreement dated March 8, 2018, between Tal Consolidated, Tal Depot, Jeremy J. Reichmann, Albert Reichmann, Seth Yanofsky and Rambamm LLC (the “Share Exchange Agreement”), which would result in an aggregate of 3,571,429 shares of common stock issued as of December 31, 2017, assuming 2,143,000 shares are issued in this offering, using the as-if converted method as though the conversion had occurred as of the beginning of the period. |

| 5 |

The pro forma as adjusted information set forth below is illustrative only and will be adjusted based on the actual public offering price and other terms of this offering determined at pricing.

| Consolidated Balance Sheet Data | Year Ended December 31, 2016 | Year Ended December 31, 2017 | |||||||||||||||||||

| Actual | Actual | Pro Forma (1) | Pro Forma as adjusted adjustments | Pro Forma as adjusted (2) | |||||||||||||||||

| Unaudited | |||||||||||||||||||||

| ASSETS | |||||||||||||||||||||

| CURRENT ASSETS: | |||||||||||||||||||||

| Cash | $ | 196,716 | $ | 11,971 | $ | 11,971 | 13,200,920 | 3 | $ | 10,362,711 | |||||||||||

| (2,850,180 | ) | 4,5,6 | |||||||||||||||||||

| Accounts receivable, net | 110,398 | 241,435 | 241,435 | 241,435 | |||||||||||||||||

| Inventory | 382,278 | 373,872 | 373,872 | 373,872 | |||||||||||||||||

| Other current assets | - | 9,271 | 9,271 | 9,271 | |||||||||||||||||

| Total current assets | 689,392 | 636,549 | 636,549 | 10,987,289 | |||||||||||||||||

| Property and equipment, net | 162,112 | 152,491 | 152,491 | 152,491 | |||||||||||||||||

| Other assets | 30,333 | 30,333 | 30,333 | 30,333 | |||||||||||||||||

| TOTAL ASSETS | $ | 881,837 | $ | 819,373 | $ | 819,373 | $ | 11,170,113 | |||||||||||||

| LIABILITIES AND MEMBERS’/STOCKHOLDERS’S EQUITY (DEFICIT) | |||||||||||||||||||||

| CURRENT LIABILITIES: | |||||||||||||||||||||

| Accounts payable | $ | 1,385,930 | $ | 3,868,868 | $ | 3,868,868 | $ | 3,868,868 | |||||||||||||

| Accrued expenses | 820,626 | 114,264 | 114,264 | 114,264 | |||||||||||||||||

| Cash overdraft | 94,425 | 298,424 | 298,424 | 298,424 | |||||||||||||||||

| Accrued payroll | 19,136 | 35,201 | 35,201 | 35,201 | |||||||||||||||||

| Current portion of term loans, net of discount of $6,241, $6,241, $6,241 Pro Forma, $0 Pro Forma as adjusted | 120,212 | 692,199 | 692,199 | (692,199 | ) | 4 | - | ||||||||||||||

| Current portion of notes payable, net of discount of $0, $138,838, $138,838 Pro Forma and Pro Forma as adjsuted | 430,164 | 567,414 | 567,414 | 567,414 | |||||||||||||||||

| Current portion of capital lease obligations | - | 8,277 | 8,277 | 8,277 | |||||||||||||||||

| Current portion of bank line of credit | - | 10,046 | 10,046 | 10,046 | |||||||||||||||||

| Due to related parties | 1,073,372 | 1,836,047 | 1,836,047 | (1,100,000 | ) | 6 | 736,047 | ||||||||||||||

| Total current liabilities | 3,943,865 | 7,430,740 | 7,430,740 | 5,638,541 | |||||||||||||||||

| LONG TERM LIABILITIES: | |||||||||||||||||||||

| Term loans - long term portion, net of discount of $46,096 and $39,855, $39,855 Pro Forma, and $0 Pro Forma as adjusted | 549,256 | 1,011,885 | 1,011,885 | (1,011,885 | ) | 5 | - | ||||||||||||||

| Notes payable - long term portion, net of discount of $0 and $975, $975 Pro Forma and Pro Forma as adjusted | 20,510 | 22,423 | 22,423 | 22,423 | |||||||||||||||||

| Capital lease obligation - long term portion | - | 26,647 | 26,647 | 26,647 | |||||||||||||||||

| Bank line of credit - long term portion | - | 70,400 | 70,400 | 70,400 | |||||||||||||||||

| Total long term liabilities | 569,766 | 1,131,354 | 1,131,354 | 119,470 | |||||||||||||||||

| TOTAL LIABILITIES | 4,513,631 | 8,562,095 | 8,562,095 | 5,758,012 | |||||||||||||||||

| Commitments and contingencies | |||||||||||||||||||||

| MEMBERS’/STOCKHOLDERS’ EQUITY (DEFICIT): | |||||||||||||||||||||

| Blank Check Preferred Stock; 10,000,000 shares authorized, 0 shares issued and outstanding pro forma | |||||||||||||||||||||

| Common Stock, no par value;150,000,000 shares of common stock authorized; 2,143,000 shares issued and outstanding pro forma and 5,714,429 shares issued and outstanding pro forma as adjusted | - | 13,200,920 | 3 | 13,200,920 | |||||||||||||||||

| Accumulated deficit | (3,631,794 | ) | (7,742,722 | ) | (7,742,722 | ) | (46,096 | ) | 4,5 | (7,788,818 | ) | ||||||||||

| TOTAL MEMBERS’/STOCKHOLDERS” EQUITY (DEFICIT) | (3,631,794 | ) | (7,742,722 | ) | (7,742,722 | ) | 5,412,102 | ||||||||||||||

| TOTAL LIABILITIES AND MEMBERS’/STOCKHOLDERS’ EQUITY (DEFICIT) | $ | 881,837 | $ | 819,373 | $ | 819,373 | $ | 11,170,113 | |||||||||||||

| (1) | Gives effect to the transactions set forth in the Share Exchange Agreement. Pro forma basic and diluted net loss per common share were computed to give effect to the transactions set forth in the Share Exchange Agreement dated March 8, 2018, between Tal Consolidated, Tal Depot, Jeremy J. Reichmann, Albert Reichmann, Seth Yanofsky and Rambamm LLC (the “Share Exchange Agreement”), which would result in an aggregate of 3,571,429 shares of common stock issued as of December 31, 2017, assuming 2,143,000 shares are issued in this offering, using the as-if converted method as though the conversion had occurred as of the beginning of the period. | |

| (2) | Gives effect to the sale by us of shares of common stock in this offering at an initial public offering price of $7.00 per share, the midpoint of the public offering price range set forth on the cover page of this prospectus, after deducting underwriting discounts and commissions and estimated offering expenses, in addition to the payoff of debt disclosed in the use of proceeds. | |

| (3) | Assumes the closing of $15,001,000 in financing from the initial public offering, less $1,200,080 and $600,000 of underwriting discounts and commissions and estimated offering expenses, respectively. | |

| (4) | Assumes the cash payment of $698,440 to repay the short-term debts owed to Key Bank and acceleration of $6,241 of debt discount amortization. | |

| (5) | Assumes the cash payment of $1,051,740 to repay the long-term debts owed to Key Bank and acceleration of $39,855 of debt discount amortization. | |

| (6) | Assumes the cash payment of $1,100,000 to repay the short-term debt due to a related party. | |

| (7) | Assumes the repayment of certain debt had occurred on January 1, 2017 and gives effect to the to the elimination of interest expense related to the repayment of certain debt. |

| 6 |

As of the Effective Date, Tal Depot will be the only operating subsidiary that we own and our financial strength will depend on the success or failure of Tal Depot’s business. Therefore, all of the business operational risks described below are attributed specifically to Tal Depot in this prospectus. Given the dependence of our success on Tal Depot’s success, all such risks should be understood to pose risks to us. Additionally, in the future, we may form or acquire additional operating subsidiaries as part of our plan for strategic growth (see the section below entitled “Our Business” for a more detailed discussion). The risks described below that relate and have been ascribed specifically to Tal Depot’s operations will exist and should likewise be attributed to any such new operating subsidiaries that we form or acquire after the Effective Date.

Investing in our common stock involves a great deal of risk. Careful consideration should be made of the following factors as well as other information included in this prospectus before deciding to purchase our common stock. There are many risks that affect Tal Depot’s business and results of operations, some of which are beyond our control, and its business, financial condition or operating results could be materially harmed by any of these risks. This could cause the trading price of our common stock to decline, and you may lose all or part of your investment. Additional risks that we do not yet know of or that we currently think are immaterial may also affect our business and results of operations.

Risks Related To Our Financial Condition

Tal Depot has a history of losses and its and our future profitability on a quarterly or annual basis is uncertain, which could have a harmful effect on our business and the value of our common stock.

During the last three fiscal years, Tal Depot incurred losses from operations. These losses are attributable primarily to (i) Tal Depot expanding rapidly while still in its old facility, which was not equipped with the infrastructure to handle the increased volumes of products sold; (ii) a fire in Tal Depot’s old facility that destroyed significant inventory, shut down a portion of Tal Depot’s facility and caused significant delays in delivery and refund requests; and (iii) an inexperienced and understaffed employee team. As of December 31, 2016, Tal Depot had an accumulated deficit and total members’ deficit of $3,631,794. We moved into a new warehouse facility better suited to Tal Depot’s business operations on January 3, 2017, which in the long term we anticipate will improve Tal Depot’s financial performance, but there can be no assurance that will be the case or that occurrences that negatively impact Tal Depot’s financial performance, such as a fire or other disaster, will not occur again in the future. As of December 31, 2017, Tal Depot had an accumulated deficit and total members’ deficit of $7,742,722. Although access to the public financial markets could increase our ability to raise capital and properly fund Tal Depot, no assurances can be given that a significant liquid market will develop for our common stock, and we may not be, therefore, provided with greater access to capital.

Our future profitability depends upon the success of Tal Depot, and its success depends on many factors, including several that are beyond our control. These factors include, without limitation: (i) changes in the demand for Tal Depot’s products; (ii) loss of key customers and vendors; (iii) loss or limitation of access to TPPs for the sale of Tal Depot’s products; (iv) introduction of competitive online distributors of the products Tal Depot sells; and (v) the failure to successfully and cost effectively develop, introduce and market new products in a timely manner. In addition, we will incur significant legal, accounting, and other expenses related to being a public company. As a result of these expenditures, Tal Depot will have to generate and sustain increased revenue to achieve and maintain future profitability.

Although our consolidated financial statements have been prepared on a going concern basis, we must raise additional capital to fund our operations in order to continue as a going concern.

Friedman LLP, our independent registered public accounting firm for the fiscal years ending December 31, 2016 and 2017, has included an explanatory paragraph in their opinions that accompanies our consolidated audited financial statements as of and for the years ending December 31, 2016 and 2017, indicating that Tal Depot’s accumulated deficit and negative cash flows from operations raises substantial doubt about Tal Depot’s ability to continue as a going concern. Based on Tal Depot’s cash balance at December 31, 2017, and projected cash needs for 2018, management estimates that it will need to increase sales revenue and/or raise additional capital to cover operating and capital requirements for the 2018 year. Although management has been successful to date in raising necessary funding, there can be no assurance that sales revenue will substantially increase or that any required future financing can be successfully completed on a timely basis, or on terms acceptable to Tal Depot. If we are unable to improve Tal Depot’s liquidity position, we may not be able to continue as a going concern. The accompanying financial statements do not include any adjustments that might result if we are unable to continue as a going concern and, therefore, be required to realize our assets and discharge our liabilities other than in the normal course of business which could cause investors to suffer the loss of all or a substantial portion of their investment.

A number of factors could negatively impact Tal Depot’s gross margins, which in turn would negatively affect its operating results.

Tal Depot’s gross margins may be negatively affected by a result of a number of factors, including: (i) increased price competition; (ii) customer dissatisfaction; (ii) higher product, material or labor costs; (iii) introduction of new products and costs of entering new markets; (iv) increased levels of customer service; (v) changes in distribution channels; and (vi) changes in product and geographic mix.

Tal Depot’s future cash flow fluctuations may affect our ability to fund our working capital requirements or achieve business objectives in a timely manner.

Tal Depot’s working capital requirements and cash flows historically have been, and are expected to continue to be, subject to quarterly and yearly fluctuations, as described above. However, a substantial slow-down in capital spending by its customers may require us to adjust our current business model. As a result, Tal Depot’s revenues and cash flows may be materially lower than we expect and we may be required to reduce our capital expenditures and investments or take other measures in order to meet our cash requirements. We may seek additional funds from liquidity-generating transactions and other conventional sources of external financing (which may include a variety of debt, convertible debt and/or equity financings). We cannot provide any assurance that our net cash requirements will be as we currently expect. Our inability to manage cash flow fluctuations resulting from the above factors could have a material adverse effect on our ability to fund our working capital requirements from operating cash flows from Tal Depot and other sources of liquidity or to achieve our business objectives in a timely manner.

| 7 |

Our business may be adversely affected by increased levels of debt.

Some of the proceeds from this offering will be used to pay down Tal Depot’s outstanding debt. While this may be an immediate boost to Tal Depot’s cash flow, due the uncertainty of Tal Depot’s cash flow from quarter to quarter, as discussed above, we may incur significant levels of debt in the future in order to finance Tal Depot’s business or to finance possible acquisitions and expansions. We may incur significant levels of debt that are higher than what Tal Depot has carried historically. A high level of debt, arduous or restrictive terms and conditions relating to accessing certain sources of funding, failure to provide certain financial information and certification of no adverse condition (as required in our current largest credit facility) and any significant reduction in, or access to, such facilities, poor business performance or lower than expected cash inflows could have adverse consequences on our ability to fund Tal Depot’s business and the operation of other subsidiaries that we may form.

Other effects of a high level of debt include the following: (i) we may have difficulty borrowing money in the future or accessing sources of funding; (ii) we may need to use a large portion of our cash flow from Tal Depot’s operations to pay principal and interest on our indebtedness, which would reduce the amount of cash available to finance our other planned business activities; (iii) a high debt level, arduous or restrictive terms and conditions, or lower than expected cash flows from Tal Depot would make us more vulnerable to economic downturns and adverse developments in our business; and (iv) if Tal Depot’s operating cash flows are not sufficient to meet its operating expenses, capital expenditures and debt service requirements as they become due, we may be required, in order to meet our debt service obligations, to delay or reduce capital expenditures or the introduction of new products, sell assets and/or forego business opportunities including acquisitions we may consider as strategic opportunities.

Risks Related To Our Business

Tal Depot depends on running an efficient operation to deliver products to its customers, and any significant disruption to its operation will materially adversely affect financial results.

Tal Depot currently distributes products to its customers by taking orders and arranging shipments at its facility. Once an order is received, the products ordered are properly packaged, marked with an identification number, and shipped. Tal Depot may not be able to respond rapidly to a disruption to any step in the process, which could take time to properly resolve, result in delayed shipments, customer dissatisfaction, loss of sales and damage to its reputation. Disruptions in the process can occur for many reasons, including natural disasters, accidents or intentional criminal acts that can damage Tal Depot’s facilities and inventory and interrupt Tal Depot’s ability to process orders. If there is any interruption in Tal Depot’s ability to process orders, it can have a drastic effect on our profits, as a large backlog of unfilled customer orders results in shipments being made containing damaged product, “mispicks” (selecting and sending items customers did not order) and “mispacks” (packing items for delivery in a faulty manner). If this were to occur, it could lead to an increase in returns, decreases in sales and decreases in revenue.

If Tal Depot cannot establish and maintain relationships with product manufacturers or local product distributors, it may not be able to increase revenue.

In order to maintain and increase revenues, Tal Depot must establish and maintain relationships with manufacturers of the products it sells, and for many products, the local wholesale distributors of the product or sales representatives. Any breakdown in these relationships, or reduction, delay or cancellation of orders from one or more of these parties could significantly reduce Tal Depot’s product variety and availability to its customers, which could hurt revenues and could damage Tal Depot’s reputation.

Competition within our markets may reduce our revenues and market share.

Tal Depot operates in a highly competitive market and our competitors may have more extensive experience or more specialized products and capabilities than we do in some areas. If Tal Depot is unable to continue to compete successfully against its current or future competitors, it may experience declines in revenues and market share which could negatively impact its results of operations, and Tal Depot’s and our financial condition or liquidity.

Tal Depot’s competitors include direct competitors that are other companies that sell online grocery and home goods, such as Boxed.com; big box and online retailers such as WalMart, Jet.com and Amazon that sell, among many other items and products, grocery and home goods (and Jet.com and Amazon even serve as our TPPs to sell our own products); and brick and mortar groceries that are establishing an online presence. Each of these types of competitors bring their own unique expertise and functions that may take away our business and hinder our growth and expansion goals. The TPPs’ sites in particular may specifically discontinue doing business with us if our business is deemed as a threat to their businesses.

| 8 |

Tal Depot’s business depends on its ability to build and maintain the Tal Depot brand. Tal Depot may not be able to maintain and enhance its existing brand if it fails to live up to customers’ expectations, which could materially adversely affect Tal Depot’s business, results of operations and growth prospects.

Tal Depot currently offers products to its customers under the Tal Depot brand. Maintaining and enhancing the Tal Depot brand is critical to expanding our business. However, a significant portion of Tal Depot’s customers’ experience depends on third parties outside of our control, including suppliers and logistics providers such as FedEx, UPS and the U.S. Postal Service. If these third parties do not meet Tal Depot’s or its customers’ expectations, the Tal Depot brand may suffer irreparable damage. In addition, maintaining and enhancing the Tal Depot brand may require substantial investments, and these investments may not be successful. If we fail to promote and maintain the Tal Depot brand, or if we incur excessive expenses in this effort, Tal Depot’s business, operating results and financial condition may be materially adversely affected. We anticipate that, as the online grocery and home goods market becomes increasingly competitive, maintaining and enhancing the Tal Depot brand may become increasingly difficult and expensive. Maintaining and enhancing the Tal Depot brand will depend largely on its ability to provide high quality products to its customers and a reliable, trustworthy and profitable sales channel to our suppliers, which we may not do successfully.

Tal Depot is currently exposed, and will continue to be exposed, potentially at an increased rate, to negative publicity and customer reviews, which may materially adversely affect Tal Depot’s business, results of operations and growth prospects.

The customer ratings and reviews of Tal Depot and its products and services that we receive through feedback on our website and on TPP websites are mostly positive. However, from time to time, Tal Depot is exposed to negative customer reviews, customer complaints or negative publicity about customers’ web experiences, Tal Depot’s products, product delivery times, customer data handling and security practices or customer support, either on the Tal Depot’s website, on the web sites of TPPs that offer Tal Depot products for sale, or on blogs and social media websites. For customer reviews and complaints on TPPs websites, TPPs enable our management to address and resolve certain customer review and complaints with the TPPs rather than directly with the customer, and our management has utilized these methods to address and resolve such negative reviews and complaints through TPPs, not through the customer that was the source of the review or complaint. Any TPP may change their policies in this regard and limit or entirely prevent our management’s ability to address and resolve such negative reviews and complaints with the TPPs, thereby increasing such negative reviews and complaints. In July 2017, Amazon, one of the TPPs Tal Depot sells on, implemented such a limitation. The negative customer reviews, customer complaints or negative publicity described above could rapidly and severely diminish consumer use of Tal Depot’s website, consumer and supplier confidence in Tal Depot, purchases of Tal Depot’s goods on its website and on the websites of TPPs and result in harm to our brands. Any increase in such negative reviews, customer complaints or negative publicity, whether as the result of a change in a TPP’s policies or otherwise, will increase such risks.

Our efforts to launch new brands and expand the existing Tal Depot brand may not be successful.

Our growth prospects depend on our ability to expand Tal Depot customer offerings by launching new brands relating to specialized product offering and expanding our existing Tal Depot brand into existing and new geographies. Launching new brands or expanding our existing brand requires significant upfront investments, including investments in marketing, information technology and additional personnel. We may not be able to generate satisfactory revenue from these efforts to offset these upfront costs. Any lack of market acceptance of our efforts to launch new brands or expand our existing brand could have a material adverse effect on our business, prospects, financial condition and results of operations.

Purchasers of Tal Depot’s products may not choose to shop online, which would prevent us from growing our business.

The online market for groceries and other home goods is less developed than the online market for apparel, consumer electronics and other consumer products. According to a Nielsen Global Connected Commerce Survey in the third quarter of 2016, 50% of people surveyed purchased books, music and other media products online and 58% purchased clothes accessories and shoes online. In contrast, only 24% of people surveyed purchased online packaged grocery food, 23% purchased household products, and 21% purchased fresh groceries. If the online market for groceries and other home goods does not gain more acceptance, our business may suffer. Our success will depend, in part, on our ability to attract consumers who have historically purchased these goods through traditional retailers. Furthermore, we may have to incur significantly higher and more sustained advertising and promotional expenditures in order to attract additional online consumers to Tal Depot’s sites and convert them into purchasing customers. Specific factors that could impact consumers’ willingness to purchase groceries and home goods online include:

| 9 |

| ● | concerns about buying products without a physical storefront and the ability to physically examine products; | |

| ● | delivery time associated with online orders; | |

| ● | actual or perceived lack of security of online transactions and concerns regarding the privacy of personal information; | |

| ● | delayed shipments or shipments of incorrect or damaged products; | |

| ● | inconvenience associated with returning or exchanging items purchased online; and | |

| ● | usability, functionality and features of websites. |

If the shopping experience Tal Depot provides does not appeal to potential new consumers or meet the expectations of existing customers, Tal Depot may not acquire new customers, may lose existing customers altogether or existing customers’ buying patterns and levels may be less than historical rates.

Tal Depot’s business may be adversely affected if it is unable to provide its customers with a cost-effective shopping platform that is able to respond and adapt to rapid changes in technology.

The number of people who access the internet through devices other than personal computers, including mobile phones, smartphones, handheld computers such as notebooks and tablets, video game consoles, and television set-top devices, has increased dramatically in the past few years. The smaller screen size, functionality, and memory associated with some alternative devices may make the use of Tal Depot’s website and purchasing its products more difficult. In addition, it is time consuming and costly to keep pace with rapidly changing and continuously evolving technology. As new mobile devices and platforms are released, it is difficult to predict the problems Tal Depot may encounter in developing applications for alternative devices and platforms, and we may need to devote significant resources to the creation, support and maintenance of such applications. If Tal Depot is unable to attract customers to its website through these devices or is slow to develop a version of its website that is more compatible with alternative devices or a mobile application, Tal Depot may fail to capture a significant share of customers in the grocery and home goods market, which could adversely affect its business. Further, upgrading existing technologies and business applications will be necessary for the foreseeable future and will require significant investment and expenditures. Tal Depot’s inability to adequately address these issues harm customer growth, and its business, financial condition and operating results may be materially adversely affected.

Tal Depot may be subject to product liability claims if people are harmed by the products it sells.

Some of the products Tal Depot sells may expose it to product liability claims and litigation or regulatory action relating to such claims including those related to personal injury or death. Some of Tal Depot’s agreements with its suppliers and manufacturers may not indemnify Tal Depot from product liability for a particular supplier’s or manufacturer’s products, or the suppliers or manufacturer may not have sufficient resources or insurance to satisfy their indemnity and defense obligations. Additionally, some of Tal Depot’s agreements with its TPPs require Tal Depot to indemnify these third parties from certain product liability claims and litigation or certain regulatory action relating to such claims, and at times TPPs have asked Tal Depot to confirm such agreements and/or asked it to take specific rectifying measures when these TPPs were threatened with such claims. Although Tal Depot maintains liability insurance, we cannot be certain that such coverage will be adequate for all liabilities actually incurred or that insurance will continue to be available on economically reasonable terms, or at all.

Significant merchandise returns could harm Tal Depot’s business.

Tal Depot allows its customers to return products, subject to its return policy. If product returns are significant, Tal Depot’s business, prospects, financial condition and results of operations could be harmed. Further, Tal Depot modifies its policies relating to returns from time to time, which may result in customer dissatisfaction or an increase in the number of product returns.

Risks associated with the suppliers and manufacturer from whom Tal Depot’s products are sourced could materially adversely affect Tal Depot’s financial performance as well as its reputation and brand.

Tal Depot depends on its ability to provide customers with a wide range of products from qualified suppliers and manufacturers in a timely and efficient manner. Political and economic instability, the financial stability of suppliers and manufacturers, their ability to meet customers’ standards, labor problems experienced by suppliers and manufacturers, the availability of raw materials, merchandise quality issues, currency exchange rates, transport availability and cost, transport security, inflation, and other factors relating to the suppliers are beyond our control.

| 10 |

Tal Depot’s agreement with most of its suppliers and manufactures do not provide for the long-term availability of merchandise or the continuation of particular pricing practices, nor do they restrict such suppliers from selling products to other buyers. There can be no assurance that Tal Depot’s current suppliers and manufactures will continue to seek to sell Tal Depot products on current terms or that it will be able to establish new or otherwise extend current supply and manufacturer relationships to ensure product acquisitions in a timely and efficient manner and on acceptable commercial terms. Tal Depot’s ability to develop and maintain relationships with reputable suppliers and manufacturers and offer high quality merchandise to its customers is critical to our success. If Tal Depot is unable to develop and maintain relationships with suppliers and manufactures that would allow it to offer a sufficient amount and variety of quality products on acceptable commercial terms, Tal Depot’s ability to satisfy its customers’ needs, and therefore our long-term growth prospects, would be materially adversely affected.

Tal Depot may be unable to source additional or strengthen its relationships with suppliers and manufacturers.

As of December 31, 2017, Tal Depot had relationships with over 50 suppliers and manufacturers. Tal Depot’s agreements with suppliers and manufactures are generally terminable at will by either party upon short notice. If Tal Depot does not maintain its existing relationships or build new relationships with suppliers and manufacturers on acceptable commercial terms, it may not be able to maintain a broad selection of products, and its business and would suffer severely.

Tal Depot depends on its agreements and relationships with TPPs, and changes in these agreements, cancellations of these agreements or changes in the relationships with these parties could adversely impact Tal Depot’s revenue and profits.

Currently, Tal Depot’s net revenue are primarily generated from sales on TPPs. Tal Depot’s agreement with TPPs allow customers to purchase Tal Depot products though TPP websites and mobile applications. TPPs require Tal Depot to abide by specific terms and conditions, reach and/or maintain certain benchmarks or metrics in order to sell products on their sites, such as metrics tied into TPPs customers’ satisfaction. TPPs also require Tal Depot to ensure even all inadvertent non-compliance with laws and regulations in states where Tal Depot’s products are sold, no matter the amount or frequency of sales in a given state. Because Tal Depot’s agreements with TPPs are generally terminable at will and because of the TPPs’ benchmarks, metric requirements and other requirements, these agreements may be terminated (either because of a violation under the agreement or for no reason), Tal Depot’s ability to make sales on TPPs may be limited, or Tal Depot may be unable to maintain these relationships, each of which would result in significantly reduced sales and have a material adverse effect on its business and results of operations, and our prospects and financial condition. This risk includes the fact that (i) TPPs may in the future determine they no longer wish to do business with Tal Depot or take other action that could harm Tal Depot’s business; and (ii) Tal Depot itself may determine that it no longer wants to do business with TPPs. TPPs may take such action because they are competitors or potential competitors in the grocery and home goods market, a violation of the agreements with the TPPs or for some other unknown reason, because, as stated above, Tal Depot’s agreements with TPPs are terminable at will. While we may take actions to repair any issues that may arise with any of our TPPs and incur costs in doing so, and we may also temporarily attempt to do business with TPPs through Tal Depot’s wholly owned subsidiaries to the extent any TPP will allow us to do so – and some may not – there can be no assurances that such actions will provide a remedy in the long terms, or even in the short term. In 2017 Amazon.com limited Tal Depot’s ability to make sales on its platform from February until April 2017, and Amazon.com and Walmart temporarily revoked Tal Depot’s authorization to do business on their platforms for one week in September 2017, and for approximately six weeks in September and October 2017, respectively. Other TPPs may to do so in the future. We could suffer substantial losses should Tal Depot’s ability to sell products on any one of our TPPs be eliminated or even limited and may not be able to continue operations.

A large majority of Tal Depot’s sales in 2016 and 2017 came from one TPP

Amazon.com, one of our TPPs, has accounted for 82% and 73% of Tal Depot’s revenue in 2016 and 2017, respectively. If our authorization to sell on Amazon.com is suspended temporarily or permanently, or even if our authorization to sell is limited for a significant of time, we could suffer substantial losses and may not be able to continue operations. In 2017 Amazon.com limited Tal Depot’s ability to make sales on its platform from February until April 2017, and Amazon.com and Walmart temporarily revoked Tal Depot’s authorization to do business on their platforms for one week in September 2017, and for approximately six weeks in September and October 2017, respectively. While Tal Depot had been able to regain full selling rights on Amazon.com and Walmart after each of these instances, there can be no assurances in that if any of these or similar actions were to be taken against us in the future that we would be able to resolve the situation and regain the ability to sell on this TPP.

System interruptions that impair customer access to the Tal Depot website or our TPPs that offer Tal Depot’s products, or other performance failures in Tal Depot’s or the TPPs’ technology infrastructure could damage Tal Depot’s business, reputation and brand, and substantially harm its business and results of operations.

The satisfactory performance, reliability and availability of Tal Depot’s website, transaction processing systems and technology infrastructure are critical to its reputation and its ability to acquire and retain customers, as well as maintain adequate customer service levels. The same applies to the websites and systems utilized by the TPPs that offer Tal Depot products for sale. If there are computer and communications hardware failures, or other types of interruptions or degradations of computer and network services, Tal Depot could lose customer data and miss order fulfillment deadlines, which could have a material adverse effect on its business, prospects, financial condition and results of operations.

| 11 |

Moreover, these systems are vulnerable to damage or interruption from fire, flood, power loss, telecommunications failure, terrorist attacks, cyber-attacks, data loss, acts of war, break-ins, earthquake and similar events. In the event of any failure described above, response and recovery could take substantial time, during which time Tal Depot’s website or the websites of the TPPs selling Tal Depot products could be completely shut down for significant time. Such occurrences will reduce order fulfillment performance, reduce the volume of goods sold, increase the amount of refund requests and returns and could also materially adversely affect consumer perception of the Tal Depot brand.

In addition, continued growth in Tal Depot transaction volume, as well as surges in online traffic and orders associated with promotional activities or seasonal trends in Tal Depot’s business, place additional demands on the technology Tal Depot relies on to facilitate sales and operate its business, which could cause or exacerbate slowdowns or interruptions. There can be no assurance that we or Tal Depot will be able to accurately project the rate or timing of increases in order traffic, if any, and Tal Depot may not be able to adapt, expand and upgrade any systems and infrastructures that would be required to accommodate such increases on a timely basis.

Tal Depot relies heavily on information technology to manage its inventory.

Tal Depot’s business is highly dependent upon inventory management software and procedures that we have internally developed and use in conjunction with third-party inventory management solutions. Any issues affecting our inventory management system, including system delay or failure, could adversely and materially affect our business operations and profitability if we are unable to address any such issues in a timely manner. To achieve our growth strategy, we will need to maintain our current level of inventory management while expanding our inventory management control over any new facilities. Should we experience difficulties in expanding or integrating our inventory management as we expand our facilities and operations, our business operations and profitability may be adversely and materially affected. Additionally, we may need to improve upon our existing inventory management to stay competitive, and if we are unable to keep pace with improvements implemented by our competitors, then our business operations and profitability could adversely and materially be affected.

Tal Depot relies heavily on email and other messaging services, and any restrictions on the sending of emails or messages or an inability to timely deliver such communications could materially adversely affect its business.

Tal Depot’s business is highly dependent upon email and other messaging services for not only accepting order, but also promoting and selling its products. Promotions are offered through emails and other messages, which generates a portion of Tal Depot’s revenue. If Tal Depot is unable to successfully deliver or receive emails or other messages to its customers and subscribers for any reason, or if customers or subscribers decline to open emails or other messages, Tal Depot’s net revenue and profitability would be materially adversely affected.

Tal Depot is subject to risks related to online payment methods.

Tal Depot accepts payments using a variety of methods, including credit card, debit card, PayPal and gift cards. As Tal Depot offers new payment options to consumers, it may be subject to additional regulations, compliance requirements and fraud. For certain payment methods, including credit and debit cards, Tal Depot pays interchange and other fees, which may increase over time and raise its operating costs and lower profitability. Tal Depot is also subject to payment card association operating rules and certification requirements, including the Payment Card Industry Data Security Standard and rules governing electronic funds transfers, which could change or be reinterpreted to make it difficult or impossible for us to comply. If Tal Depot fails to comply with the rules or requirements of any provider of a payment method it accepts, if the volume of fraud in transactions limits or terminates its rights to use payment methods it currently accept, or if a data breach occurs, Tal Depot may, among other things, be subject to fines or higher transaction fees and may lose, or face restrictions placed upon, the ability to accept credit card and debit card payments from customers or facilitate other types of online payments. Tal Depot has been, and may continue to be, victimized by the receipt of orders placed with fraudulent credit card data, and may suffer losses even if the associated financial institution approved payment. The occurrence if all these events may adversely affect Tal Depot’s business, financial condition and operating results.

Government regulation of the internet and e-commerce is evolving, and unfavorable changes or failure by Tal Depot to comply with these regulations could substantially harm its business and results of operations.

Tal Depot is subject to general business regulations and laws as well as regulations and laws specifically governing the Internet and e-commerce. Existing and future regulations and laws could impede the growth of the Internet, e-commerce or mobile commerce. These regulations and laws may involve taxes, tariffs, privacy and data security, anti-spam, content protection, electronic contracts and communications, consumer protection, Internet neutrality and gift cards. It is not clear how existing laws governing issues such as property ownership, sales and other taxes and consumer privacy apply to the Internet as the vast majority of these laws were adopted prior to the advent of the Internet and do not contemplate or address the unique issues raised by the Internet or e-commerce. It is possible that general business regulations and laws, or those specifically governing the Internet or e-commerce, may be interpreted and applied in a manner that is inconsistent from one jurisdiction to another and may conflict with other rules or our practices. We cannot be sure that Tal Depot’s practices have complied, comply or will comply fully with all such laws and regulations. Any failure, or perceived failure, by Tal Depot to comply with any of these laws or regulations could result in damage to its reputation, a loss in business and proceedings or actions against it by governmental entities or others. Any such proceeding or action could hurt Tal Depot’s reputation, force it to spend significant amounts in defense of these proceedings, distract our and Tal Depot’s management, increase Tal Depot’s costs of doing business, decrease the use of Tal Depot’s sites by its customers and may result in the imposition of monetary liability.

| 12 |

Failure to comply with federal, state and international laws and regulations relating to privacy, data protection and consumer protection, or the expansion of current or the enactment of new laws or regulations relating to privacy, data protection and consumer protection, could adversely affect Tal Depot’s business and financial condition.

A variety of federal, state and international laws and regulations govern the collection, use, retention, sharing and security of consumer data. Laws and regulations relating to privacy, data protection and consumer protection are evolving and subject to potentially differing interpretations. These requirements may be interpreted and applied in a manner that is inconsistent from one jurisdiction to another or may conflict with other rules or our practices. As a result, Tal Depot’s practices may not have complied or may not comply in the future with all such laws, regulations, requirements and obligations. Any failure, or perceived failure, by Tal Depot to comply with posted privacy policies or with any federal, state or international privacy or consumer protection-related laws, regulations, industry self-regulatory principles, industry standards or codes of conduct, regulatory guidance, orders to which it may be subject or other legal obligations relating to privacy or consumer protection could adversely affect Tal Depot’s reputation, brand and business, and may result in claims, proceedings or actions against it by governmental entities or others or other liabilities or require us to change its operations and/or cease using certain data sets. Any such claim, proceeding or action could hurt Tal Depot’s reputation, brand and business, force it to incur significant expenses in defense of such proceedings, distract our and Tal Depot’s management, increase Tal Depot’s costs of doing business, result in a loss of customers and may result in the imposition of monetary penalties.

Tal Depot’s failure or the failure of third-party service providers to protect its website, networks and systems against security breaches, or otherwise to protect confidential information, could damage Tal Depot’s reputation and brand and substantially harm its business and operating results.