RISK FACTORS

Investing in the Shares involves a high degree of risk. In evaluating Lykuid and investing in the Shares, careful consideration should be given to the following risk factors, in addition to the other information included in this Offering Circular. Each of these risk factors could materially adversely affect Lykuid’s business, software, operating results or financial condition, as well as adversely affect the value of an investment in our Shares. The following is a summary of the most significant factors that make this Offering speculative or substantially risky. The Company is still subject to all the same risks that all companies in its industry, and all companies in the economy, are exposed to. These include risks relating to economic downturns, political and economic events and technological developments (such as variations of technologies). You should consider general risks as well as specific risks when deciding whether to invest.

Risks Related to Our Business and Industry

Since we are a development stage company, have generated no revenues and lack an operating history, an investment in the Shares offered herein is highly risky and could result in a complete loss of your investment if we are unsuccessful in our business plans.

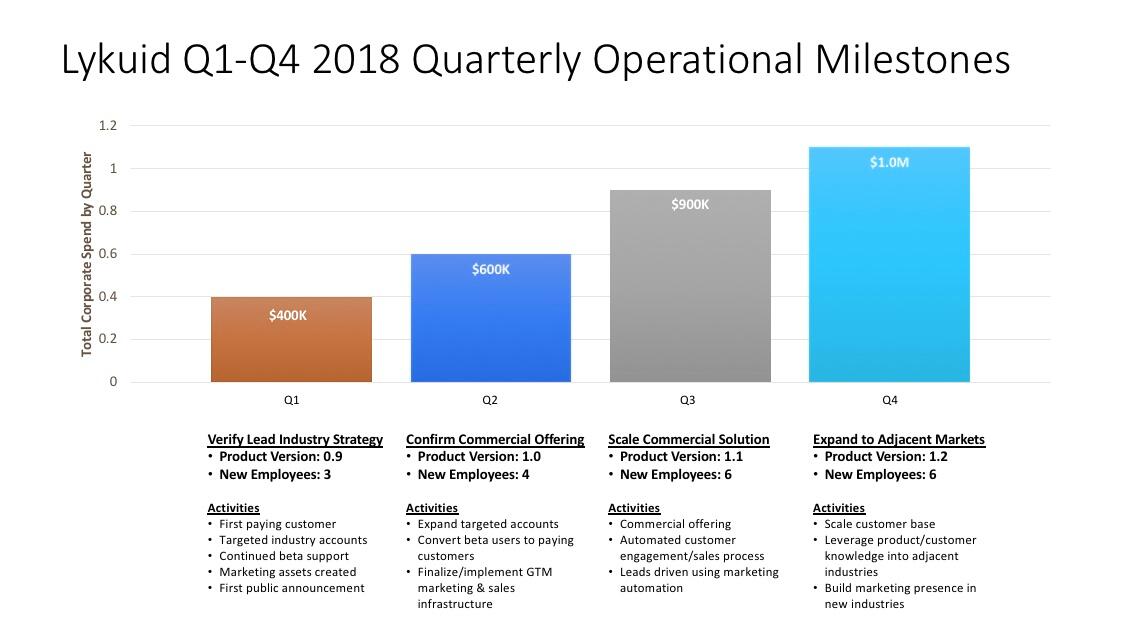

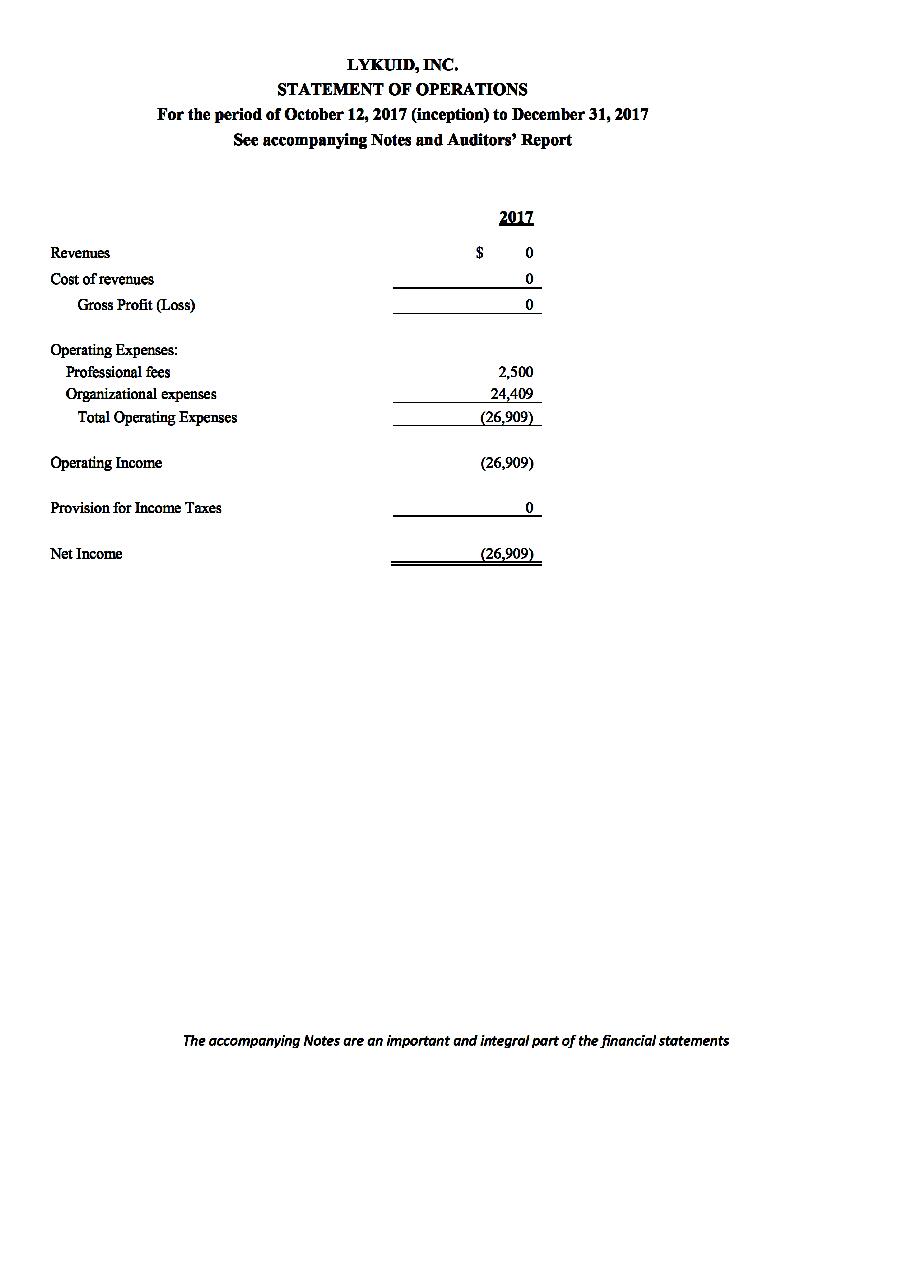

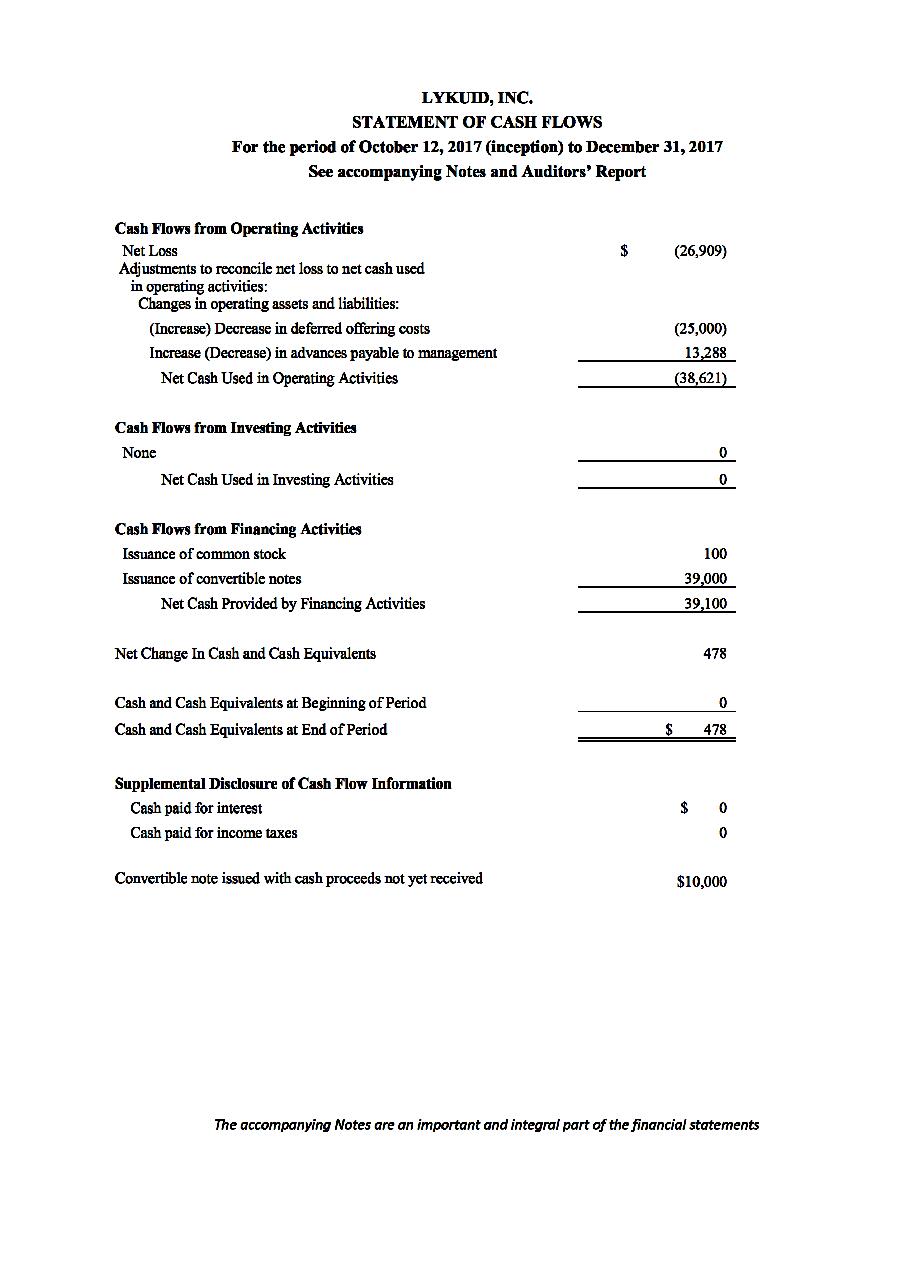

Lykuid, Inc. is a development stage company incorporated in October 2017. Since our inception, we have been primarily focused on building a team, designing our software and user interface, gathering a large informational database, and developing a pricing strategy and have not generated any revenues. As a result of our lack of operating history, our ability to forecast our future operating results is limited and subject to a number of uncertainties, including our ability to plan for and model future growth. Based upon current plans, we expect to incur operating losses in future periods as we incur significant expenses associated with the initial startup of our business. Further, we cannot guarantee that we will be successful in realizing sufficient revenues or in achieving or sustaining positive cash flow at any time in the future.

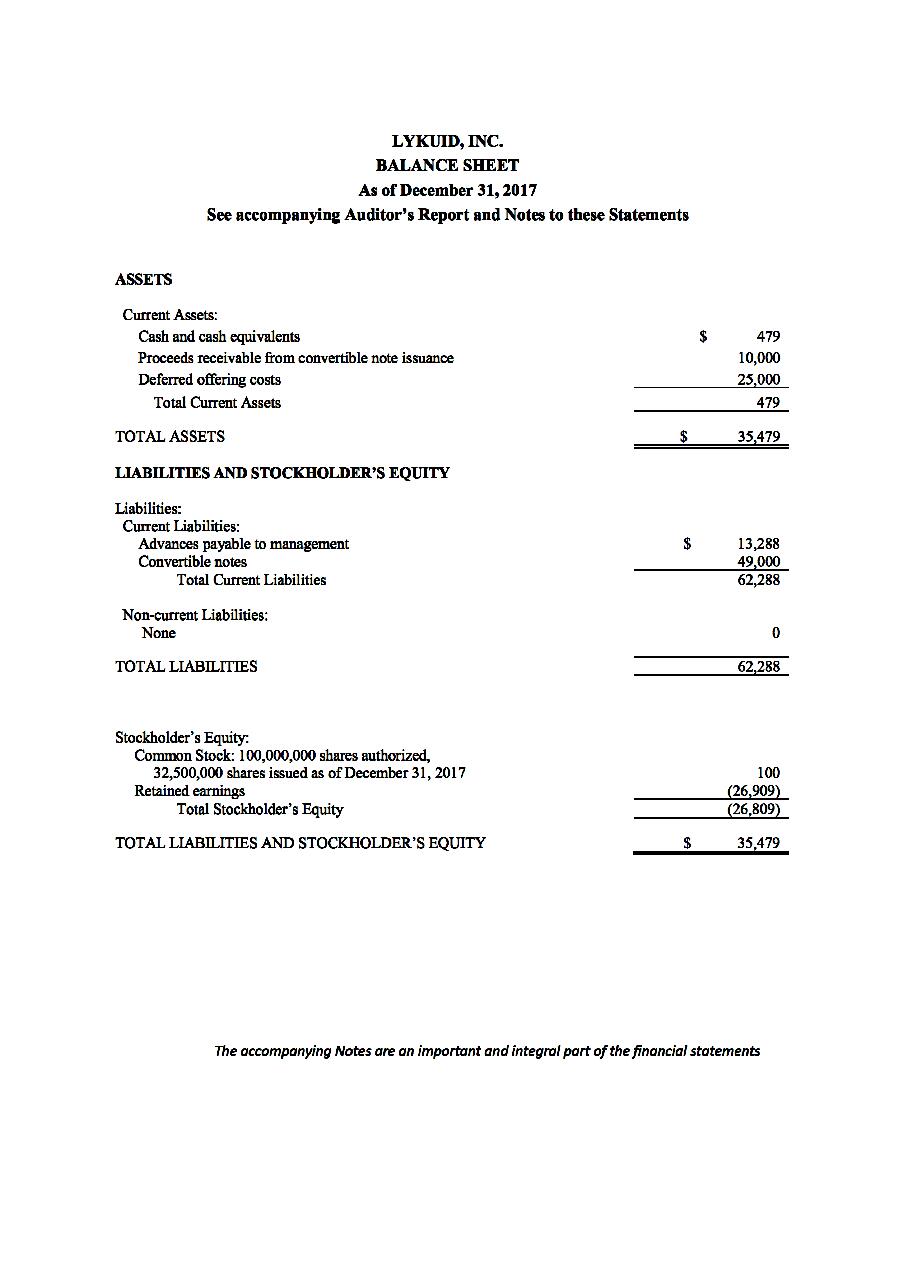

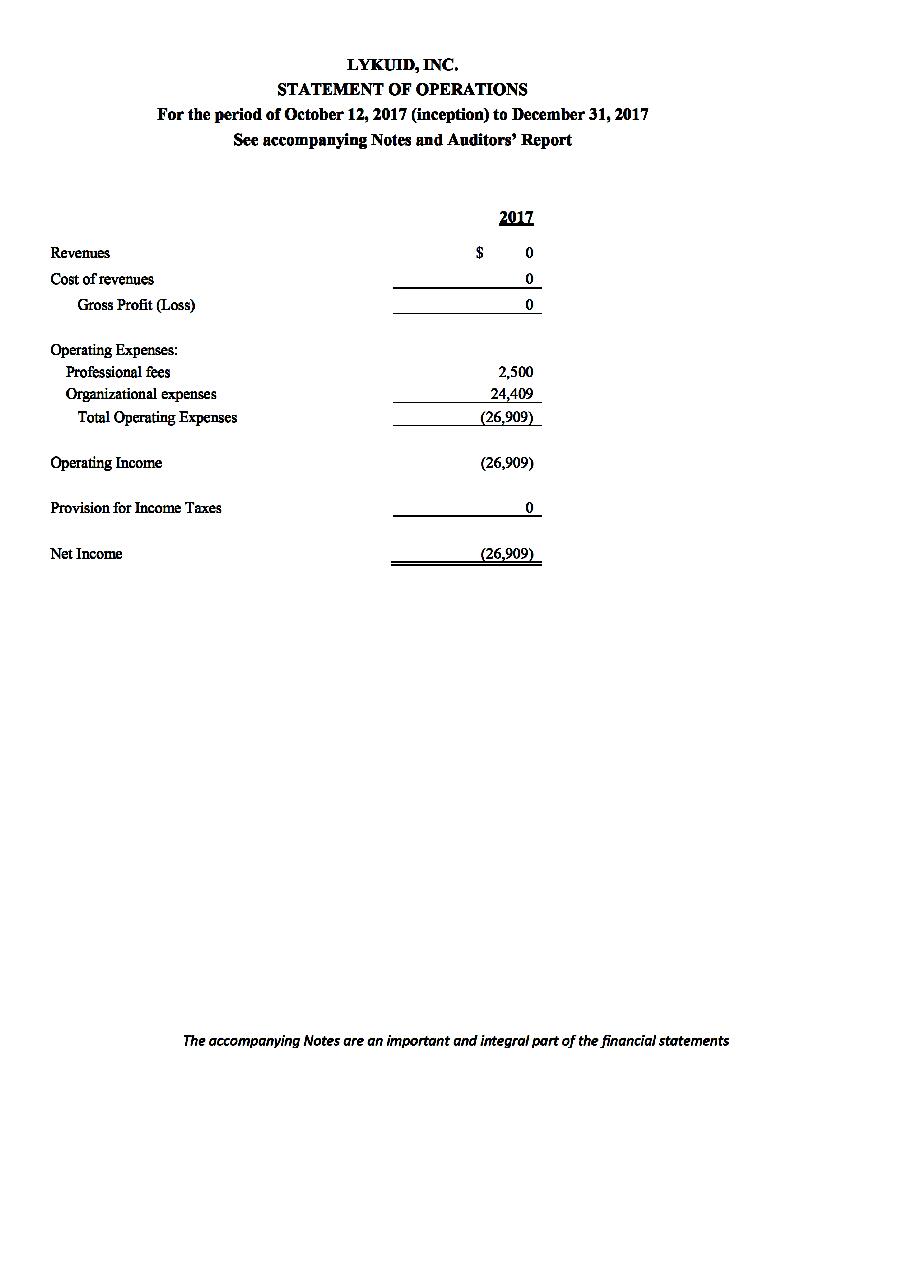

Our auditors have issued a “going concern” audit opinion.

Our independent auditors have indicated in their report on our December 31, 2017 financial statements that there is substantial doubt about our ability to continue as a going concern. A “going concern” opinion indicates that the financial statements have been prepared assuming we will continue as a going concern and do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets, or the amounts and classification of liabilities that may result if we do not continue as a going concern. Therefore, you should not rely on our consolidated balance sheet as an indication of the amount of proceeds that would be available to satisfy claims of creditors, and potentially be available for distribution to shareholders, in the event of liquidation.

We are a startup company and face challenges often encountered by startups.

We have encountered and will encounter risks and uncertainties frequently experienced by growing companies in rapidly changing industries, such as the risks and uncertainties described herein. If our assumptions regarding these risks and uncertainties (which we use to plan our business) are incorrect or change due to changes in our markets, or if we do not address these risks successfully, our operating and financial results could differ materially from our expectations and our business could suffer.

Failure to manage our growth may adversely affect our business or operations.

12

We expect to complete the development phase and then begin operations to grow our business rapidly over the next several years. This growth will place a significant strain on our management team and employees and on our operating and financial systems. To manage our future growth, we must continue to scale our business functions, improve our financial and management controls and our reporting systems and procedures and expand and train our work force. We anticipate that additional investments in sales personnel, technology and research and development spending will be required to:

scale our operations and increase productivity;

address the needs of our clients and partners;

further develop and enhance our existing technologies and solutions;

develop new technology; and

expand our markets and opportunity under management, including into innovative solutions and geographic areas.

We cannot assure you that our controls, systems and procedures will be adequate to support our future operations or that we will be able to manage our growth effectively. We also cannot assure you that we will be able to continue to establish and expand our market presence. Failure to effectively manage growth could result in difficulty or delays in deploying clients, declines in quality or satisfaction of service, increases in costs, difficulties in introducing new features or other operational difficulties, and any of these difficulties could adversely impact our business performance and results of operations.

Our efforts to increase use of our platform and services may not succeed and may negatively affect our revenue growth rate.

The success of sales and marketing for our software platform, which is a B2B software solution for revenue generating internet businesses, is unpredictable. Future level of market acceptance is unpredictable. Further, the introduction of new solutions may not be successful, which would adversely affect potential of growth. We are unable to determine with any certainty the satisfactory level from clients using our platform and may not be able to determine with certainty the extent to which our innovative solutions are being embraced by customers. Any factor adversely affecting sales of our platform or solutions, including release cycles, market acceptance, competition, performance and reliability, reputation and economic and market conditions, could adversely affect our business and operating results.

Our solutions face competition in the marketplace. If we are unable to compete effectively, our operating results could be adversely affected.

We compete with many types of companies, including diversified software solutions. Many of our existing competitors, as well as a number of potential new competitors, have longer operating histories, greater name recognition, more established customer bases and significantly greater financial, technical, marketing and other resources than we do. As a result, our competitors may be able to respond more quickly and effectively than we can to new or changing opportunities, technologies, standards or customer requirements. We could lose customers if our competitors introduce new competitive products and technologies, add new features, acquire competitive products, reduce prices, form strategic alliances with other companies or are acquired by third parties with greater available resources. We also face competition from a variety of vendors of software applications that address only a portion of one of our solutions. We may also face increasing competition from open source software initiatives, in which competitors may provide software and intellectual property for free. In addition, if a prospective customer is currently using a competing solution, the customer may be unwilling to switch to our solutions without access to setup support services. If we are unable to provide those services on terms attractive to the customer, the prospective customer may be unwilling to utilize our solutions. If our competitors’

13

products, services or technologies become more accepted than our solutions, if they are successful in bringing their products or services to market earlier than ours, or if their products or services are more technologically capable than ours, then our revenue could be adversely affected. In addition, some of our competitors may offer their products and services at a lower price. If we are unable to achieve our target pricing levels, our operating results would be negatively affected. Pricing pressures and increased competition could result in reduced sales, reduced margins, losses or a failure to maintain or improve our competitive market position, any of which would adversely affect our business.

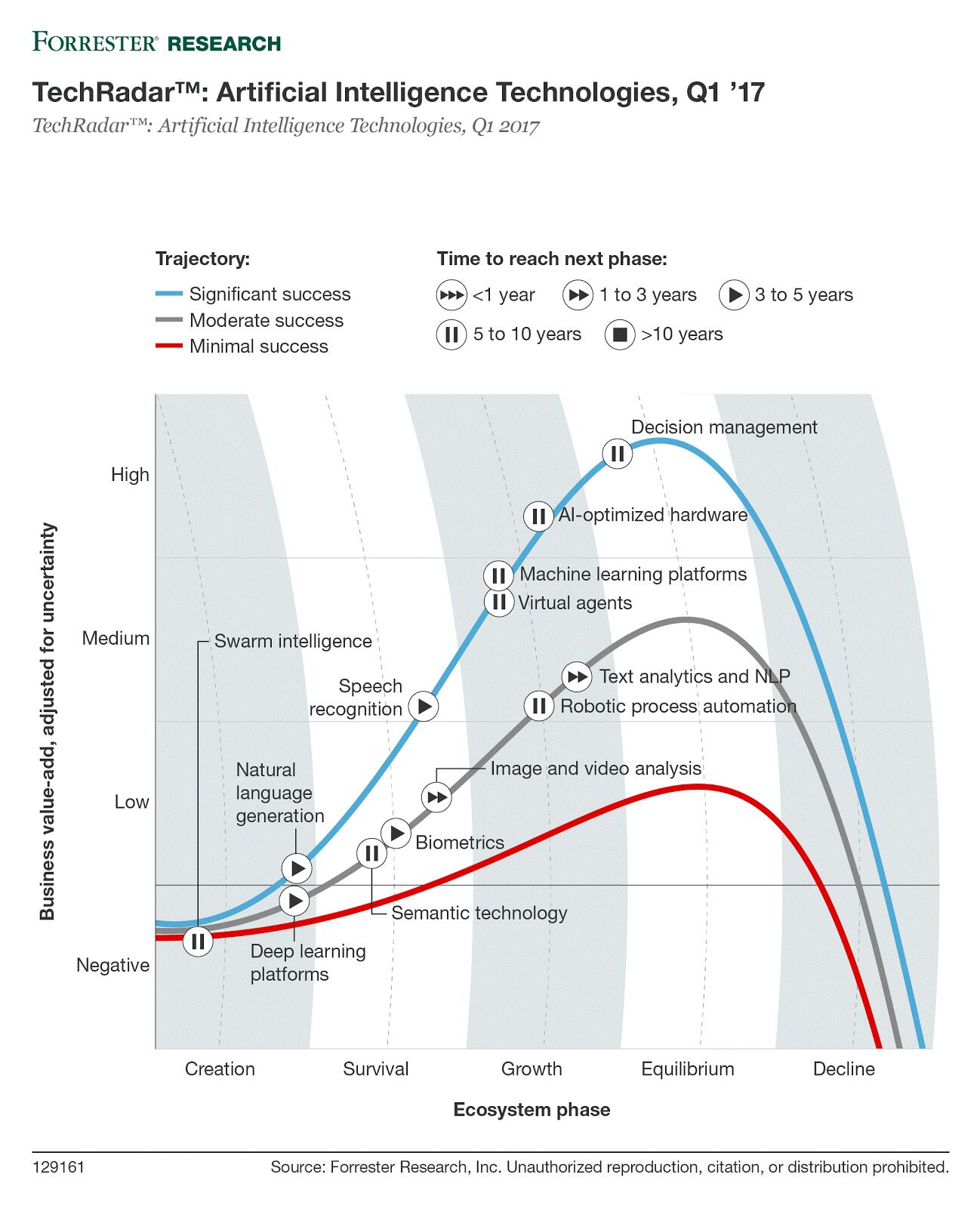

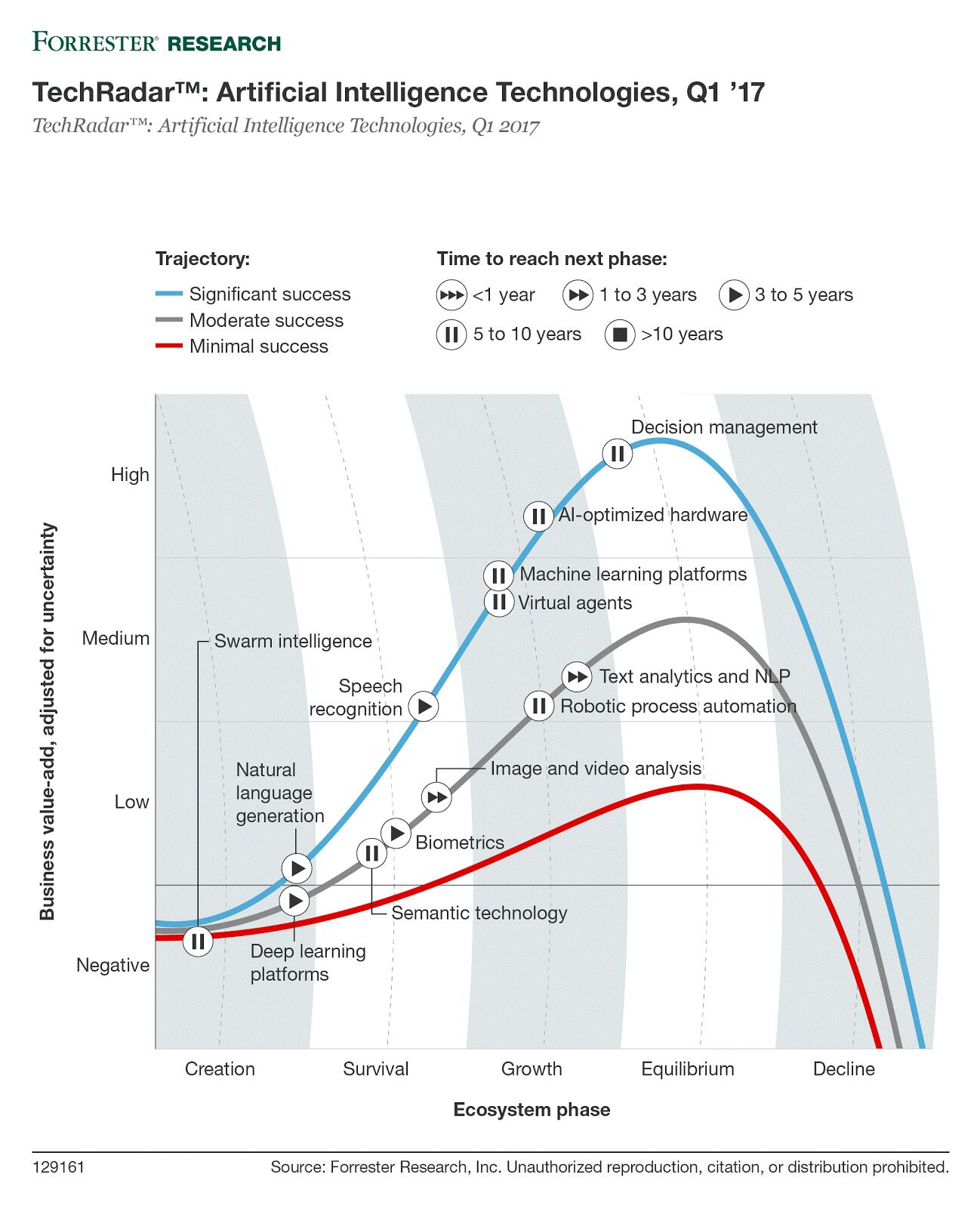

If we do not keep pace with technological changes, our solutions may become less competitive and our business may suffer.

Our market is characterized by rapid technological change, frequent product and service innovation and evolving industry standards. If we are unable to provide enhancements and new features for solutions that keep pace with these technological developments, our business could be adversely affected. The success of enhancements, new features and solutions depends on several factors, including the timely completion, introduction and market acceptance of the enhancements or new features or solutions. Failure in this regard may significantly impair our revenue growth. In addition, because our solutions are designed to operate on a variety of systems, we will need to continuously modify and enhance our solutions to keep pace with changes in internet-related hardware, software, communication, browser and database technologies. We may not be successful in either developing these modifications and enhancements or in bringing them to market in a timely fashion. Furthermore, uncertainties about the timing and nature of new network platforms or technologies, or modifications to existing platforms or technologies, could increase our research and development expenses. Any failure of our solutions to keep pace with technological changes or operate effectively with future network platforms and technologies could reduce the demand for our solutions, result in customer dissatisfaction and adversely affect our business.

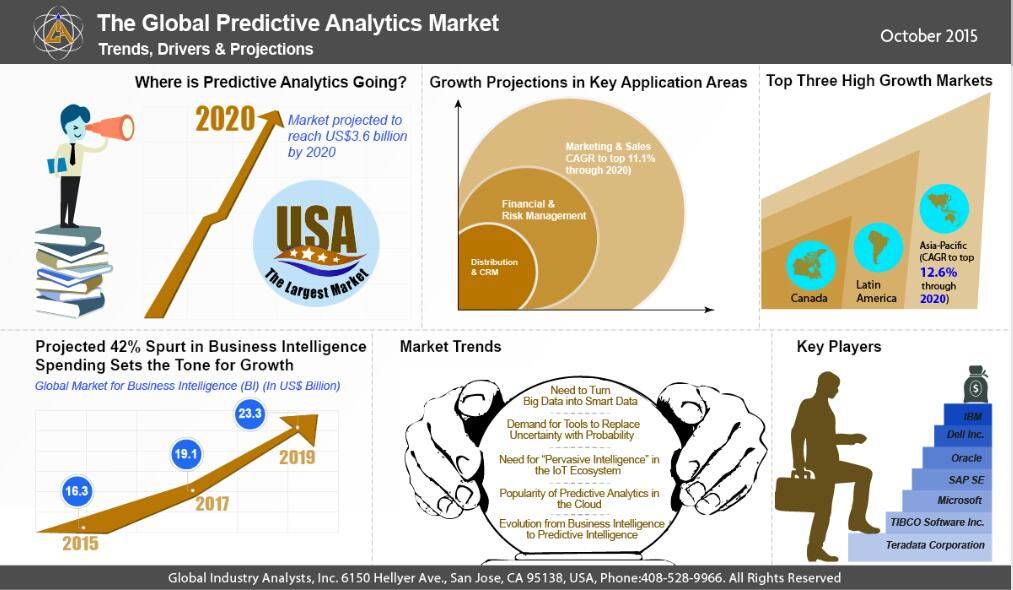

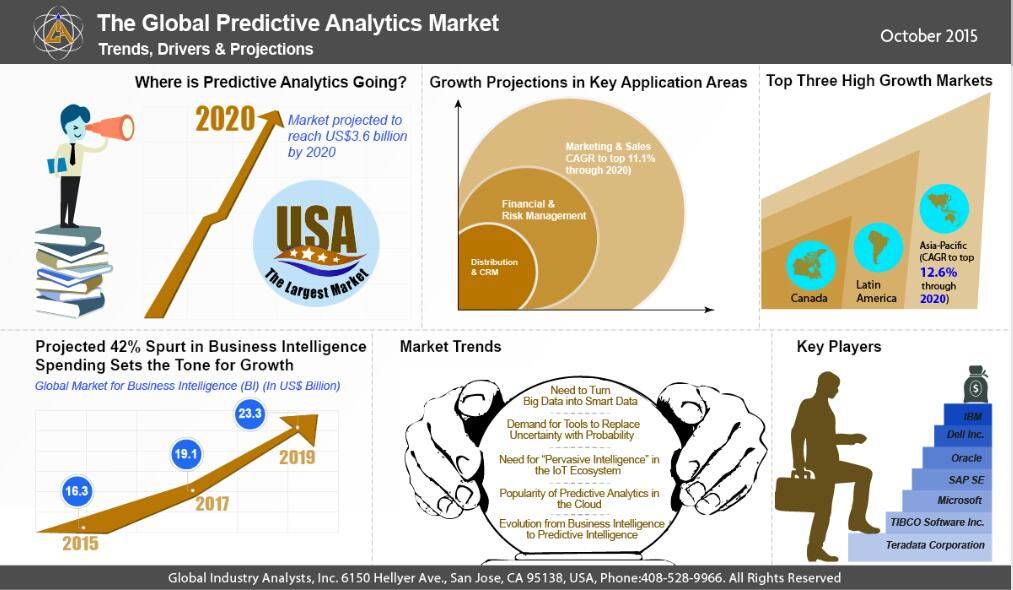

If the market for our technology delivery model and proprietary software develops more slowly than we expect, our business could be harmed.

The market for artificial intelligence-based software is not as mature as the market for current widely used software types, and it is uncertain whether our services will sustain high levels of demand and market acceptance. Our success will depend to a substantial extent on the willingness of companies to increase their use of artificial intelligence-based services in general, and of our solutions in particular. Many companies have invested substantial personnel and financial resources to integrate traditional software into their businesses, and therefore may be reluctant or unwilling to migrate to an artificial intelligent based service. Furthermore, some companies may be reluctant or unwilling to use artificial intelligent based services because they have concerns regarding the risks associated with security capabilities, among other things, of the technology delivery model associated with these services. If companies do not perceive the benefits of artificial intelligent based software, then the market for our solutions may develop more slowly than we expect, or the market for our new solutions may not develop at all, either of which would significantly adversely affect our operating results. We may not be able to adjust our spending quickly enough if market growth falls short of our expectations or we may make errors in predicting and reacting to relevant business trends, either of which could harm our business. If the market for our intelligent solutions does not evolve in the way we anticipate, or if customers do not recognize the benefits of our intelligent solutions over traditional on-premise enterprise software products, and as a result we are unable to increase sales of subscriptions to our solutions, then our revenue may not grow or may decline, and our operating results would be harmed.

The success of our artificial intelligence-based solutions largely depends on our ability to provide reliable solutions to our customers. If a customer were to experience a product defect, a disruption in

14

its ability to use our solutions or a security flaw, demand for our solutions could be diminished, we could be subject to substantial liability and our business could suffer.

Because our solutions are complex and we will continually evolve new features, our solutions could have errors, defects, viruses or security flaws that could result in unanticipated downtime for our clients and harm our reputation and our business. Internet-based software frequently contains undetected errors or security flaws when first introduced or when new versions or enhancements are released. We might from time to time find such defects in our solutions, the detection and correction of which could be time consuming and costly. Since our customers use our solutions for important aspects of their business, any errors, defects, disruptions in access, security flaws, viruses, data corruption or other performance problems with our solutions could hurt our reputation and may damage our customers’ businesses. If that occurs, customers could elect not to continue using our services or withhold payment to us or may make warranty or other claims against us, which could result in an increase in our provision for doubtful accounts, an increase in collection cycles for accounts receivable or the expense and risk of litigation. We could also lose future sales. In addition, if the public becomes aware of security breaches of our solutions, our future business prospects could be adversely impacted.

Any failure or interruptions in the internet infrastructure, bandwidth providers, data center providers, other third parties or our own systems for providing our solutions to customers could negatively impact our business.

Our ability to deliver our solutions is dependent on the development and maintenance of the internet and other telecommunications services by third parties. Such services include maintenance of a reliable network backbone with the necessary speed, data capacity and security for providing reliable internet access and services and reliable telecommunications systems that connect our operations. While our solutions are designed to operate without interruption, we may experience interruptions and delays in services and availability from time to time. We rely on systems as well as third-party vendors, including data center, bandwidth, and telecommunications equipment providers, to provide our solutions. We do not maintain redundant systems or facilities for some of these services. In the event of a catastrophic event with respect to one or more of these systems or facilities, we may experience an extended period of system unavailability, which could negatively impact our relationship with our customers.

Any failure to offer high-quality technical support services may adversely affect our relationships with our customers and our financial results.

Once our solutions are deployed, our customers depend on our customer success organization to resolve technical issues relating to our solutions. We may be unable to respond quickly enough to accommodate short-term increases in customer demand for support services. We also may be unable to modify the format of our support services to compete with changes in support services provided by our competitors. Increased customer demand for these services, without corresponding revenue, could increase costs and adversely affect our operating results. In addition, our sales process is highly dependent on our solutions and business reputation and on positive recommendations from our existing customers. Any failure to maintain high-quality technical support, or a market perception that we do not maintain high-quality support, could adversely affect our reputation, our ability to sell our solutions to existing and prospective customers, and our business, operating results and financial position.

Adverse economic conditions or reduced technology spending may adversely impact our business.

Our business depends on the overall demand for technology and on the economic health of our prospective customers. In general, worldwide economic conditions remain unstable, and these conditions make it difficult for our customers, prospective customers and us to forecast and plan future business

15

activities accurately, and they could cause our prospective customers to reevaluate their decision to purchase our solutions. Weak global economic conditions, or a reduction in technology spending even if economic conditions improve, could adversely impact our business, financial condition and results of operations in a number of ways, including longer sales cycles, lower prices for our solutions, reduced services and lower or no growth.

We depend on our senior management team and other key employees, and the loss of one or more key employees could adversely affect our business.

Our success depends largely upon the continued services of our executive officers and directors. We also rely on our leadership team and other mission-critical individuals in the areas of research and development, tech development and support, marketing, sales, services and general and administrative functions. From time to time, there may be changes in our management team resulting from the hiring or departure of executives or other key employees, which could disrupt our business. Our senior management and key employees are generally employed under employment agreements. The loss of one or more of our executive officers or key employees, could have a material adverse effect on our business. Also, we do not have any key person life insurance policies on officers and directors and we do not anticipate acquiring key man insurance in the foreseeable future.

Our ability to attract, train and retain qualified employees is crucial to our results of operations and any future growth.

To execute our growth plan, we must attract and retain highly qualified personnel. Competition for these individuals is intense, especially for engineers with high levels of experience in designing and developing software and internet-related services, senior sales executives and professional services personnel with appropriate financial reporting experience. We expect to experience difficulty in hiring and retaining employees with appropriate qualifications. Many of the companies with which we compete for experienced personnel have greater resources than we have. If we hire employees from competitors or other companies, their former employers may attempt to assert that these employees have breached their legal obligations or that we have induced such breaches, resulting in a diversion of our time and resources. If we fail to attract new personnel or fail to retain and motivate our current personnel, our business and future growth prospects could be adversely affected.

Our lack of adequate D&O insurance may also make it difficult for us to retain and attract talented and skilled directors and officers.

In the future we may be subject to additional litigation, including potential class action and stockholder derivative actions. Risks associated with legal liability are difficult to assess and quantify, and their existence and magnitude can remain unknown for significant periods of time. To date, we have not obtained directors and officers liability (“D&O”) insurance. Without adequate D&O insurance, the amounts we would pay to indemnify our officers and directors should they be subject to legal action based on their service to the Company could have a material adverse effect on our financial condition, results of operations and liquidity. Furthermore, our lack of adequate D&O insurance may make it difficult for us to retain and attract talented and skilled directors and officers, which could adversely affect our business

Data security concerns and laws or other domestic or foreign regulations may reduce the effectiveness of our solutions and adversely affect our business.

We manage private and confidential information and documentation related to our customers’ finances and transactions, often prior to public dissemination. The use of insider information is highly regulated in

16

the United States and abroad, and violations of securities laws and regulations may result in civil and criminal penalties. Privacy and data security are rapidly evolving areas of regulation, and additional regulation in those areas, some of it potentially difficult and costly for us to accommodate, is frequently proposed and occasionally adopted. Changes in laws restricting or otherwise governing data and transfer thereof could result in increased costs and delay operations.

In addition to government activity, the technology industry and other industries are considering various new, additional or different self-regulatory standards that may place additional burdens on us. If the processing of private and confidential information were to be curtailed in this manner, our software solutions may be less effective, which may reduce demand for our solutions and adversely affect our business. Furthermore, government agencies may seek to access sensitive information that our customers upload to our service providers or restrict customers’ access to our service providers. Laws and regulations relating to government access and restrictions are evolving, and compliance with such laws and regulations could limit adoption of our services by customers and create burdens on our business. Moreover, regulatory investigations into our compliance with privacy-related laws and regulations could increase our costs and divert management attention.

If we or our service providers fail to keep our customers’ information confidential or otherwise handle their information improperly, our business and reputation could be significantly and adversely affected.

If we fail to keep customers’ proprietary information and documentation confidential, we may lose existing customers and potential new customers and may expose them to significant loss of revenue based on the premature release of confidential information. While we have security measures in place to protect customer information and prevent data loss and other security breaches, these measures may be breached as a result of third-party action, employee error, malfeasance or otherwise. Because the techniques used to obtain unauthorized access or sabotage systems change frequently and generally are not identified until they are launched against a target, we may be unable to anticipate these techniques or to implement adequate preventative measures.

In addition, our service providers (including, without limitation, hosting facilities, disaster recovery providers and software providers) may have access to our customers’ data and could suffer security breaches or data losses that affect our customers’ information.

If an actual or perceived security breach or premature release occurs, our reputation could be damaged and we may lose future sales and customers. We may also become subject to civil claims, including indemnity or damage claims in certain customer contracts, or criminal investigations by appropriate authorities, any of which could harm our business and operating results. Furthermore, while our errors and omissions insurance policies include liability coverage for these matters, if we experienced a widespread security breach that impacted a significant number of our customers for whom we have these indemnity obligations, we could be subject to indemnity claims that exceed such coverage.

Any failure to protect our intellectual property rights could impair our ability to protect our proprietary technology and our brand.

We continue to develop our software and our success substantially depends and will continue to depend upon our proprietary methodologies and other intellectual property rights. Unauthorized use of our trade secret by third parties may damage our brand and our reputation. We also rely on a trade secret laws, employee and third-party non-disclosure and non-competition agreements and other methods to protect our intellectual property. However, unauthorized parties may attempt to copy or obtain and use our technology to develop products with the same functionality as our solutions. We cannot assure you that

17

the steps we take to protect our intellectual property will be adequate to deter misappropriation of our proprietary information or that we will be able to detect unauthorized use and take appropriate steps to protect our intellectual property. United States federal and state intellectual property laws offer limited protection, and the laws of some countries provide even less protection. Moreover, changes in intellectual property laws, such as changes in the law regarding the patentability of software, could also impact our ability to obtain protection for our solutions. In addition, patents may not be issued with respect to our pending or future patent applications. Those patents that are issued may not be upheld as valid, may be contested or circumvented, or may not prevent the development of competitive solutions.

We might be required to spend significant resources and divert the efforts of our technical and management personnel to monitor and protect our intellectual property. Litigation brought to protect and enforce our intellectual property rights could be costly, time-consuming and distracting to management and could result in the impairment or loss of portions of our intellectual property. Furthermore, our efforts to enforce our intellectual property rights may be met with defenses, counterclaims and countersuits attacking the validity and enforceability of our intellectual property rights. Any failure to secure, protect and enforce our intellectual property rights could seriously adversely affect our brand and adversely impact our business.

Assertions by third parties of infringement or other violations by us of their intellectual property rights could result in significant costs and harm our business and operating results.

Our success depends upon our ability to refrain from infringing upon the intellectual property rights of others. Some companies, including some of our competitors, own large numbers of patents, copyrights and trademarks, which they may use to assert claims against us. As we grow and enter new markets, we will face a growing number of competitors. As the number of competitors in our industry grows and the functionality of products in different industry segments overlaps, we expect that software and other solutions in our industry may be subject to such claims by third parties. Third parties may in the future assert claims of infringement, misappropriation or other violations of intellectual property rights against us. We cannot assure you that infringement claims will not be asserted against us in the future, or that, if asserted, any infringement claim will be successfully defended. A successful claim against us could require that we pay substantial damages or ongoing royalty payments, prevent us from Offering our services, or require that we comply with other unfavorable terms. We may also be obligated to indemnify our customers or business partners or pay substantial settlement costs, including royalty payments, in connection with any such claim or litigation and to obtain licenses, modify applications or refund fees, which could be costly. Even if we were to prevail in such a dispute, any litigation regarding our intellectual property could be costly and time-consuming and divert the attention of our management and key personnel from our business operations.

If we fail to continue to develop our brand, our business may suffer.

We believe that continuing to develop and maintain awareness of our brand is critical to achieving widespread acceptance of our solution and is an important element in attracting and retaining customers. Efforts to build our brand may involve significant expense and may not generate customer awareness or increase revenue at all, or in an amount sufficient to offset expenses we incur in building our brand.

Promotion and enhancement of our name and the brand names of our solutions depends largely on our success in being able to provide high quality, reliable and cost-effective solutions. If customers do not perceive our solutions as meeting their needs, or if we fail to market our solutions effectively, we will likely be unsuccessful in creating the brand awareness that is critical for broad customer adoption of our solutions. That failure could result in a material adverse effect on our business, financial condition and operating results.

18

We may need to raise additional capital, which may not be available to us.

We will require substantial funds to support the implementation of our business plan. Our future liquidity and capital requirements are difficult to predict as they depend upon many factors, including the success of our solutions and competing technological and market developments. In the future, we may require additional capital to respond to business opportunities, challenges, acquisitions, a decline in the level of customer prepayments or unforeseen circumstances and may determine to engage in equity or debt financings or enter into credit facilities for other reasons, and we may not be able to timely secure additional debt or equity financing on favorable terms, or at all. Any debt financing obtained by us in the future could involve restrictive covenants relating to our capital raising activities and other financial and operational matters, which may make it more difficult for us to obtain additional capital and to pursue business opportunities, including potential acquisitions. If we raise additional funds through further issuances of equity, convertible debt securities or other securities convertible into equity, our existing shareholders could suffer significant dilution in their percentage ownership of our company, and any new equity securities we issue could have rights, preferences and privileges senior to those of holders of Common Stock. If we are unable to obtain adequate financing or financing on terms satisfactory to us when we require it, our ability to continue to grow or support our business and to respond to business challenges could be significantly limited.

Changes in laws and regulations related to the internet or changes in the internet infrastructure itself may diminish the demand for our solutions and could have a negative impact on our business.

The future success of our business depends upon the continued use of the internet as a primary medium for commerce, communication and business solutions. Federal, state or foreign government bodies or agencies have in the past adopted, and may in the future adopt, laws or regulations affecting the use of the internet as a commercial medium. Changes in these laws or regulations could require us to modify our solutions in order to comply with these changes. They can also require our clients to modify their applications, which may have an influence on the Company. In addition, government agencies or private organizations may begin to impose taxes, fees or other charges for accessing the internet or commerce conducted via the internet. These laws or charges could limit the growth of internet-related companies generally or result in reductions in the demand for internet-based solutions such as ours.

In addition, the use of the internet as a business tool could be adversely affected due to delays in the development or adoption of new standards and protocols to handle increased demands of internet activity, security, reliability, cost, ease of use, accessibility and quality of service. The performance of the internet and its acceptance as a business tool has been adversely affected by “viruses,” “worms” and similar malicious programs, and the internet has experienced a variety of outages and other delays as a result of damage to portions of its infrastructure. If the use of the internet is adversely affected by these issues, demand for our solutions could suffer.

We operate and offer our services in many jurisdictions and, therefore, may be subject to federal, state, local and foreign taxes that could harm our business.

As an organization that operates in many jurisdictions in the United States and around the world, we may be subject to taxation in several jurisdictions with increasingly complex tax laws, the application of which can be uncertain. The authorities in these jurisdictions, including state and local taxing authorities in the United States, could successfully assert that we are obligated to pay additional taxes, interest and penalties. In addition, the amount of taxes we pay could increase substantially as a result of changes in the applicable tax principles, including increased tax rates, new tax laws or revised interpretations of existing tax laws and precedents, which could have a material adverse effect on our liquidity and operating results.

19

The authorities could also claim that various withholding requirements apply to us or assert that benefits of tax treaties are not available to us, any of which could have a material impact on us and the results of our operations. In addition, we may lose sales or incur significant costs should various tax jurisdictions impose taxes on either a broader range of services or services that we have performed in the past. We may be subject to audits of the taxing authorities in any such jurisdictions that would require us to incur costs in responding to such audits. Imposition of such taxes on our services could result in substantially unplanned costs, would effectively increase the cost of such services to our customers and could adversely affect our ability to gain new customers in the areas in which such taxes are imposed.

Some of the jurisdictions in which we operate may give us the benefit of either relatively low tax rates, tax holidays or government grants, in each case that are dependent on how we operate or how many jobs we create and employees we retain. We plan on utilizing such tax incentives in the future as opportunities are made available to us. Any failure on our part to operate in conformity with applicable requirements to remain qualified for any such tax incentives or grants may result in an increase in our taxes. In addition, jurisdictions may choose to increase rates at any time due to economic or other factors. Any such rate increase could harm our results of operations.

In addition, changes to U.S. tax laws that may be enacted in the future could impact the tax treatment of any possible foreign earnings. Due to the possibility of expansion of our business activities, any changes in the U.S. taxation of such activities could increase any potential worldwide effective tax rate and adversely affect our financial position and results of operations.

We are subject to general litigation that may materially adversely affect us.

From time to time, we may be involved in disputes or regulatory inquiries that arise in the ordinary course of business. We expect that the number and significance of these potential disputes may increase as our business expands and our Company grows larger. While our agreements with customers limit our liability for damages arising from our solutions, we cannot assure you that these contractual provisions will protect us from liability for damages in the event we are sued. Although we may carry general liability insurance coverage, our insurance may not cover all potential claims to which we are exposed or may not be adequate to indemnify us for all liability that may be imposed. Any claims against us, whether meritorious or not, could be time consuming, result in costly litigation, require significant amounts of management time, and result in the diversion of significant operational resources. Because litigation is inherently unpredictable, we cannot assure you that the results of any of these actions will not have a material adverse effect on our business, financial condition, results of operations and prospects.

The structure of our Common Stock has the effect of concentrating voting control with our officers and directors, and their affiliates; this will limit or preclude your ability to influence corporate matters.

Each share of our Common Stock is entitled to one vote on any matter brought forth to shareholders. Our officers and directors collectively own 19,255,500 shares or 59.24% of our currently outstanding Common Stock and therefore have control over general corporate matters, such as the election of directors, the sale of all or substantially all of the assets of the Company, amending the Corporation’s articles of incorporation. Following this Offering and assuming all 8,750,000 shares of Common Stock are sold, our officers and directors will own an aggregate 46.68% of the voting power of our voting capital stock. This concentrated control will limit or preclude your ability to influence corporate matters for the foreseeable future and could harm the market value of your Common Stock.

Risks Related to Our Securities

20

We expect to incur substantial expenses to meet our reporting obligations as a public company. In addition, failure to maintain adequate financial and management processes and controls could lead to errors in our financial reporting and could harm our ability to manage our expenses.

We estimate that it will cost approximately $50,000 annually to maintain the proper management and financial controls for our filings required as a public reporting company. In addition, if we do not maintain adequate financial and management personnel, processes and controls, we may not be able to accurately report our financial performance on a timely basis, which could cause a decline in our stock price and adversely affect our ability to raise capital. Wemay also incur additional expenses once a Form 8-A registration statement is declared effective, as this may require a re-audit of your financial statements since our independent auditors are not currently registered with the PCAOB.

Even if we satisfy NASDAQ’s initial listing standards, we may experience a delay in the initial trading of our Common Stock on NASDAQ.

We intend to apply to list our Common Stock on the NASDAQ Capital Market. Our Common Stock will not commence trading on NASDAQ until a number of conditions are met, including that we have raised the minimum amount of offering proceeds necessary for us to meet the initial listing requirements of NASDAQ. There is no guarantee that we will be able to sell a sufficient number of shares to raise the required minimum amount of offering proceeds. Assuming we sell a sufficient number of shares to list on NASDAQ, we expect trading to commence following the Termination Date of this offering. However, we may wait before terminating the offering and commencing the trading of our Common Stock on NASDAQ in order to raise additional proceeds. In addition, in order to list, we will be required to, among other things, file with the SEC a post-qualification amendment to the Offering Statement, and then file an SEC Form 8-A in order to register our Common Stock under the Exchange Act. The post-qualification amendment of the Offering Statement is subject to review by the SEC, and there is no guarantee that such amendment will be qualified quickly after filing. Any delay in the qualification of the post-qualification amendment may cause a delay in the initial trading of our Common Stock on NASDAQ. For all of the foregoing reasons, you may experience a delay between the closing of your purchase of our Common Stock and the commencement of exchange trading of our Common Stock.

If listed, NASDAQ could delist our securities from its exchange, which could limit investors’ ability to make transactions in our securities and subject us to additional trading restrictions.

In order to make a final determination of compliance with their listing criteria, NASDAQ may look to the first trading day’s activity and, particularly, the last bid price on such day. In the event the trading price for our Common Stock drops below NASDAQ’s minimum bid requirement, NASDAQ could rescind our initial listing approval. If that were to happen, the liquidity for our Common Stock would decrease, which may substantially decrease the trading price of our Common Stock.

In addition, we cannot assure you that, in the future, our securities will meet the continued listing requirements to be listed on NASDAQ. If NASDAQ delists our Common Stock, we could face significant material adverse consequences, including:

| ● | | a limited availability of market quotations for our securities; |

| ● | | a determination that our Common Stock is a “penny stock” which will require brokers trading in our Common Stock to adhere to more stringent rules and possibly resulting in a reduced level of trading activity in the secondary trading market for our Common Stock; |

| ● | | a limited amount of news and analyst coverage for our Company; and |

| ● | | a decreased ability to issue additional securities or obtain additional financing in the future. |

21

We cannot assure you that an active public market for our Common Stock will develop after this offering or if it does develop, it may not be sustained.

Even if our Common Stock is listed on NASDAQ or other exchange or electronic quotation system, we cannot assure you that an active public market for our Common Stock will develop after this offering or if it does develop, it may not be sustained. In the absence of a public trading market, you may not be able to liquidate your investment in our Common Stock. In addition, the market price of our Common Stock could be subject to significant fluctuations after this offering. Among the factors that could affect our stock price are:

| ● | quarterly variations in our operating results; |

| ● | changes in contract revenue and earnings estimates or publication of research reports by analysts; |

| ● | speculation in the press or investment community; |

| ● | investor perception of us and our industry; |

| ● | strategic actions by us or our competitors, such as significant contracts, acquisitions or restructurings; |

| ● | actions by institutional shareholders or other large shareholders, including future sales; |

| ● | our relationship with Government agencies; |

| ● | changes in government spending; |

| ● | changes in accounting principles; and |

| ● | general economic market conditions. |

In particular, we cannot assure you that you will be able to resell your Shares at or above the Offering Price. The stock markets have experienced extreme volatility in recent years that has been unrelated to the operating performance of particular companies. These broad market fluctuations may adversely affect the trading price of our Common Stock. In the past, following periods of volatility in the market price of a company’s securities, class action litigation has often been instituted against the company. Any litigation of this type brought against us could result in substantial costs and a diversion of our management’s attention and resources, which would harm our business, operating results and financial condition.

If securities analysts do not publish research or reports about our business, or if they publish negative reports about our business, the price of the Common Stock could decline.

The trading market for the Common Stock, to some extent, will depend on the research and reports that securities or industry analysts publish about us or our business. We do not have any control over these analysts. If one or more of the analysts who cover us should downgrade our shares or change their opinion of the Common Stock, industry sector, or products, the trading price for the Common Stock would likely decline. If one or more of these analysts should cease coverage of our Company or fail to regularly publish reports on us, we could lose visibility in the financial markets, which could cause the price of our Common Stock or trading volume to decline.

If we fail to establish or maintain an effective system of internal controls, we may be unable to accurately report our financial results or prevent fraud, and investor confidence and the market price of the Common Stock may, therefore, be adversely affected.

Upon the effectiveness of our Form 8-A, we will be subject to the reporting requirements of the Exchange Act. As an Exchange Act reporting company, we will be required to maintain internal control over financial reporting and to report any material weaknesses in such internal control. In addition, beginning with our annual report for the year ending December 31, 2019, we will be required to submit a report by

22

management to the audit committee on the effectiveness of our internal control over financial reporting pursuant to Section 404 and to design and implement a process of testing the internal control over financial reporting required to comply with this obligation. This process is time-consuming, costly, and complicated. In addition, our independent registered public accounting firm will be required to attest to the effectiveness of our internal controls over financial reporting beginning with our annual report. If we identify material weaknesses in our internal controls over financial reporting, if we are unable to comply with the requirements of Section 404 in a timely manner or assert that our internal controls over financial reporting are effective, or if our independent registered public accounting firm is unable to express an opinion as to the effectiveness of our internal controls over financial reporting when required, investors may lose confidence in the accuracy and completeness of our financial reports and the market price of the Common Stock may be adversely affected, and we could become subject to investigations by the stock exchange on which our securities are listed, the SEC, or other regulatory authorities, which could require additional financial and management resources.

Because we are a “shell company” the holders of our restricted securities will not be able to sell their securities in reliance on Rule 144 and we cannot file registration statements under Section 5 of the Securities Act using a Form S-8, until we cease being a “shell company”.

We are a “shell company” as that term is defined by the applicable federal securities laws. Specifically, because of the nature and amount of our assets and our very limited operations, pursuant to applicable federal rules, we are considered a “shell company”. Applicable provisions of Rule 144 specify that during that time that we are a “shell company” and for a period of one year thereafter, holders of our restricted securities cannot sell those securities in reliance on Rule 144. This restriction may have potential adverse effects on future efforts to form additional capital through unregistered offerings. Another implication of us being a shell company is that we cannot file registration statements under Section 5 of the Securities Act using a Form S-8, a short form of registration to register securities issued to employees and consultants under an employee benefit plan. As result, one year after we cease being a shell company, assuming we are current in our reporting requirements with the Securities and Exchange Commission and have filed current “Form 10 information” with the SEC reflecting our status as an entity that is no longer a shell company for a period of not less than 12 months, holders of our restricted securities may then sell those securities in reliance on Rule 144 (provided, however, those holders satisfy all of the applicable requirements of that rule). For us to cease being a “shell company” we must have more than nominal operations and more that nominal assets or assets which do not consist solely of cash or cash equivalents. Shares purchased in this Offering, which will be immediately resalable, and sales of all of our other shares if and when applicable restrictions against resale expire, could have a depressive effect on the market price, if any, of our Common Stock and the shares we are Offering.

We may, in the future, issue additional shares, which would reduce investors’ percent of ownership and may dilute our share value.

Our Articles of Incorporation authorize the issuance of 100,000,000 shares of Common Stock. As of the date of this Offering Circular the Company had 32,500,000 shares of Common Stock outstanding. Accordingly, we may issue up to an additional 67,500,000 shares of Common Stock of Lykuid, Inc. The future issuance of Common Stock may result in substantial dilution in the percentage of our Common Stock held by our then existing shareholders. We may value any Common Stock issued in the future on an arbitrary basis. The issuance of Common Stock for future services or financing or other corporate actions may have the effect of diluting the value of the share held by our investors, and might have an adverse effect on any trading market for our Common Stock.

Anti-takeover effects of certain provisions of Florida state law hinder a potential takeover of the Company.

23

Though not now, we may be or in the future we may become subject to Florida’s control share law. The Florida Business Corporation Act (the "FBCA") prohibits the voting of shares in a publicly-held Florida corporation that are acquired in a "control share acquisition" unless the holders of a majority of the corporation's voting shares (exclusive of shares held by officers of the corporation, inside directors, or the acquiring party) approve the granting of voting rights as to the shares acquired in the control share acquisition. A "control share acquisition" is defined as an acquisition that immediately thereafter entitles the acquiring party to vote in the election of directors within each of the following ranges of voting power: (i) one-fifth or more but less than one-third of such voting power, (ii) one-third or more but less than a majority of such voting power, and (iii) more than a majority of such voting power. The Board of Directors may, however, exclude an acquisition from the reach of the prohibition on the voting of shares acquired in a control share acquisition.

The FBCA also contains an "affiliated transaction" provision that prohibits a publicly-held Florida corporation from engaging in a broad range of business combinations or other extraordinary corporate transactions with an "interested shareholder" unless (i) the transaction is approved by a majority of disinterested directors before the person becomes an interested shareholder, (ii) the interested shareholder has owned at least 80% of the corporation's outstanding voting shares for at least five years, or (iii) the transaction is approved by the holders of two-thirds of the corporation's voting shares other than those owned by the interested shareholder. An "interested shareholder" is defined as a person who together with affiliates and associates beneficially owns more than 10% of the corporation's outstanding voting shares.

The above-described provisions may have certain anti-takeover effects. Such provisions may make it more difficult for other persons, without the approval of the Company's Board of Directors, to make a tender offer or acquisitions of substantial amounts of the Common Stock or to launch other takeover attempts that might result in the payment of a premium over market price for the Common Stock held by such shareholder.

Risks Related to Our Common Stock

The Company arbitrarily determined the Offering Price and terms of the Shares offered through this Offering Circular.

The Offering Price of the Shares has been arbitrarily determined and bears no relationship to the assets or book value of the Company, or other customary investment criteria. No independent counsel or appraiser has been retained to value the Shares, and no assurance can be made that the Offering Price is in fact reflective of the underlying value of the Shares offered hereunder. Each prospective investor is therefore urged to consult with his or her own legal counsel and tax advisors as to the Offering Price and terms of the Shares offered hereunder.

There is no minimum raise required in this Offering.

There is no minimum number of Shares that must be sold in this offering other than each investor must invest at least $400 (100 Shares). As a result, we will retain the proceeds from any funds raised and the proceeds will not be returned to the investor. In the event that we fail to raise enough capital in this offering, we will utilize the proceeds for general working capital purposes only. We cannot guarantee that we will be able to raise adequate funds in this offering to implement our intended business plan.

We are not establishing as escrow to hold the proceeds of this Offering.

24

Since the funds are not being placed in an escrow account, a third party creditor may obtain a judgment or lien against us and satisfy the judgment or lien by executing on the bank account where the offering funds are being held, resulting in a loss of any investment you make in our securities.

Since this is a direct public offering and there is no underwriter, we may not be able to sell any Shares ourselves.

We have not retained an underwriter to sell these Shares. We will conduct this Offering as a direct public offering, meaning there is no guarantee as to how much money we will be able to raise through the sale of our stock. If we fail to sell all the Shares we are trying to sell, our ability to expand and complete our business plan will be materially affected, and you may lose all or substantially all of your investment.

Investors cannot withdraw funds once invested and will not receive a refund.

Investors do not have the right to withdraw invested funds. Subscription payments will be paid to Lykuid, Inc. and held in segregated bank account if the Subscription Agreements are in good order and the Company accepts the investor’s investment. Therefore, once an investment is made, investors will not have the use or right to return of such funds, and the funds raised will become immediately available to the company.

There has been no public market for our Common Stock and an active market may not develop or be sustained, which could limit your ability to sell your shares of Common Stock.

There currently is no public market for our Common Stock, and our Common Stock will not be traded in the open market prior to this offering. We intend to submit an application with The NASDAQ Stock Market LLC (“NASDAQ”) to list our Common Stock on The NASDAQ Capital Market. In order to list, the NASDAQ Capital Market requires that, among other criteria, at least 1,000,000 publicly-held shares of our Common Stock be outstanding, the shares be held in the aggregate by at least 300 round lot holders, the market value of the publicly-held shares of our Common Stock be at least $15.0 million, the bid price per share of our Common Stock be $4.00 or more, and there be at least three registered and active market makers for our Common Stock. There is no guarantee that we will be able to satisfy the NASDAQ listing requirements. In addition, in order to list, we will be required to, among other things, file with the SEC a post-qualification amendment to the offering statement and a registration statement on Form 8-A in order to register our shares under the Exchange Act. The post-qualification amendment of the offering statement is subject to review by the SEC, and there is no guarantee that such amendment will be qualified quickly after filing. Any delay in the qualification of the post-qualification amendment may cause a delay in the initial trading of our Common Stock on NASDAQ. For all of the foregoing reasons, you may experience a delay between the closing of your purchase of our Common Stock and the commencement of exchange trading of our Common Stock.

There has been no prior public market for our Common Stock, the stock price of our Common Stock may be volatile or may decline regardless of our operating performance, and you may not be able to resell your shares at or above the Offering Price.

There has been no public market for our Common Stock prior to this Offering. The Offering Price for our Common Stock may vary from the market price of our Common Stock following this Offering and you may not be able to resell those shares at or above the Offering Price. The market price of our Common Stock may fluctuate significantly in response to numerous factors, many of which are beyond our control, including:

| • | | overall performance of the equity markets; |

25

| • | | the development and sustainability of an active trading market for our Common Stock; |

| • | | our operating performance and the performance of other similar companies; |

| • | | changes in the estimates of our operating results that we provide to the public, our failure to meet these projections or changes in recommendations by securities analysts that elect to follow our Common Stock; |

| • | | press releases or other public announcements by us or others, including our filings with the SEC; |

| • | | changes in the market perception of all-electric and hybrid products and services generally or in the effectiveness of our products and services in particular; |

| • | | announcements of technological innovations, new applications, features, functionality or enhancements to products, services or products and services by us or by our competitors; |

| • | | announcements of acquisitions, strategic alliances or significant agreements by us or by our competitors; |

| • | | announcements of customer additions and customer cancellations or delays in customer purchases; |

| • | | announcements regarding litigation involving us; |

| • | | recruitment or departure of key personnel; |

| • | | changes in our capital structure, such as future issuances of debt or equity securities; |

| • | | our entry into new markets; |

| • | | regulatory developments in the United States or foreign countries; |

| • | | the economy as a whole, market conditions in our industry, and the industries of our customers; |

| • | | the expiration of market standoff or contractual lock-up agreements; |

| • | | the size of our market float; and |

| • | | any other factors discussed in this Offering Circular. |

In addition, the stock markets have experienced extreme price and volume fluctuations that have affected and continue to affect the market prices of equity securities of many technology companies. Stock prices of many technology companies have fluctuated in a manner unrelated or disproportionate to the operating performance of those companies. In the past, shareholders have filed securities class action litigation following periods of market volatility. If we were to become involved in securities litigation, it could subject us to substantial costs, divert resources and the attention of management from our business, and adversely affect our business.

26

Because the Offering Price of our Common Stock will be substantially higher than the pro forma net tangible book value per share of our outstanding Common Stock following this Offering, new investors will experience immediate and substantial dilution.

The Offering Price is substantially higher than the pro forma net tangible book value per share of our Common Stock immediately following this Offering based on the total value of our tangible assets less our total liabilities. Therefore, if you purchase shares of our Common Stock in this Offering, based on the Offering Price of $4.00 per share, assuming that we raise our full amount, you will experience immediate dilution to $0.85 per share, the difference between the price per share you pay for our Common Stock and its pro forma net tangible book value per share as of December 31, 2017, after giving effect to the issuance of shares of our Common Stock in this Offering. In addition, upon the completion of this Offering, there will be options to purchase shares of our Common Stock outstanding, based on the number of such awards outstanding on. To the extent shares of Common Stock are issued with respect to such awards in the future, there will be further dilution to new investors.

NASDAQ, or other securities exchange, may delist our Common Stock from trading on its exchange, which could limit shareholders’ ability to trade our Common Stock.

In the event we are able to list our Common Stock on the NASDAQ Capital Market or other national securities exchange, we will be required to meet continued listing standards on an ongoing basis in order to continue the listing of our Common Stock. If we fail to meet these continued listing requirements, our Common Stock may be subject to delisting. If our Common Stock is delisted and we are not able to list our Common Stock on another national securities exchange, we expect our securities would be quoted on an over-the-counter market. If this were to occur, our shareholders could face significant material adverse consequences, including limited availability of market quotations for our Common Stock and reduced liquidity for the trading of our securities. In addition, we could experience a decreased ability to issue additional securities and obtain additional financing in the future.

We have broad discretion in the use of the net proceeds from this Offering and may not use them effectively.

We cannot specify with any certainty the particular uses of the net proceeds that we will receive from this Offering. We will have broad discretion in the application of the net proceeds, including working capital, possible acquisitions, and other general corporate purposes, and we may spend or invest these proceeds in a way with which our shareholders disagree. The failure by our management to apply these funds effectively could adversely affect our business and financial condition. Pending their use, we may invest the net proceeds from this Offering in a manner that does not produce income or that loses value. These investments may not yield a favorable return to our investors.

We do not expect to pay dividends in the future; any return on investment may be limited to the value of our common stock.

We do not currently anticipate paying cash dividends in the foreseeable future. The payment of dividends on our Common Stock will depend on earnings, financial condition and other business and economic factors affecting it at such time as the board of directors may consider relevant. Our current intention is to apply net earnings, if any, in the foreseeable future to increasing our capital base and development and marketing efforts. There can be no assurance that the Company will ever have sufficient earnings to declare and pay dividends to the holders of our Common Stock, and in any event, a decision to declare and pay dividends is at the sole discretion of our board of directors. If we do not pay dividends, our Common Stock may be less valuable because a return on your investment will only occur if its stock price appreciates.

27

The elimination of monetary liability against our directors, officers and employees under our Articles of Incorporation and the existence of indemnification rights to our directors, officers and employees may result in substantial expenditures by our company and may discourage lawsuits against our directors, officers and employees.

Our Articles of Incorporation contains provisions that eliminate the liability of our directors for monetary damages to our company and shareholders. Our bylaws also require us to indemnify our officers and directors. We may also have contractual indemnification obligations under our agreements with our directors, officers and employees. The foregoing indemnification obligations could result in our company incurring substantial expenditures to cover the cost of settlement or damage awards against directors, officers and employees that we may be unable to recoup. These provisions and resulting costs may also discourage our company from bringing a lawsuit against directors, officers and employees for breaches of their fiduciary duties, and may similarly discourage the filing of derivative litigation by our shareholders against our directors, officers and employees even though such actions, if successful, might otherwise benefit our company and shareholders.

There are legal restrictions on the resale of the Shares offered that are penny stocks. These restrictions may adversely affect your ability to resell your Shares.

Our Common Stock may be subject to the penny stock rules under the Exchange Act. These rules regulate broker/dealer practices for transactions in “penny stocks.” Penny stocks are generally equity securities with a price of less than $5.00. The penny stock rules require broker/dealers to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker/dealer must also provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker/dealer and its salesperson and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations and the broker/dealer and salesperson compensation information must be given to the customer orally or in writing prior to completing the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction, the broker and/or dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. The transaction costs associated with penny stocks are high, reducing the number of broker-dealers who may be willing to engage in the trading of our shares. These additional penny stock disclosure requirements are burdensome and may reduce all of the trading activity in the market for our Common Stock. If our Common Stock is subject to the penny stock rules, our shareholders may find it more difficult to sell their shares.

28

DILUTION

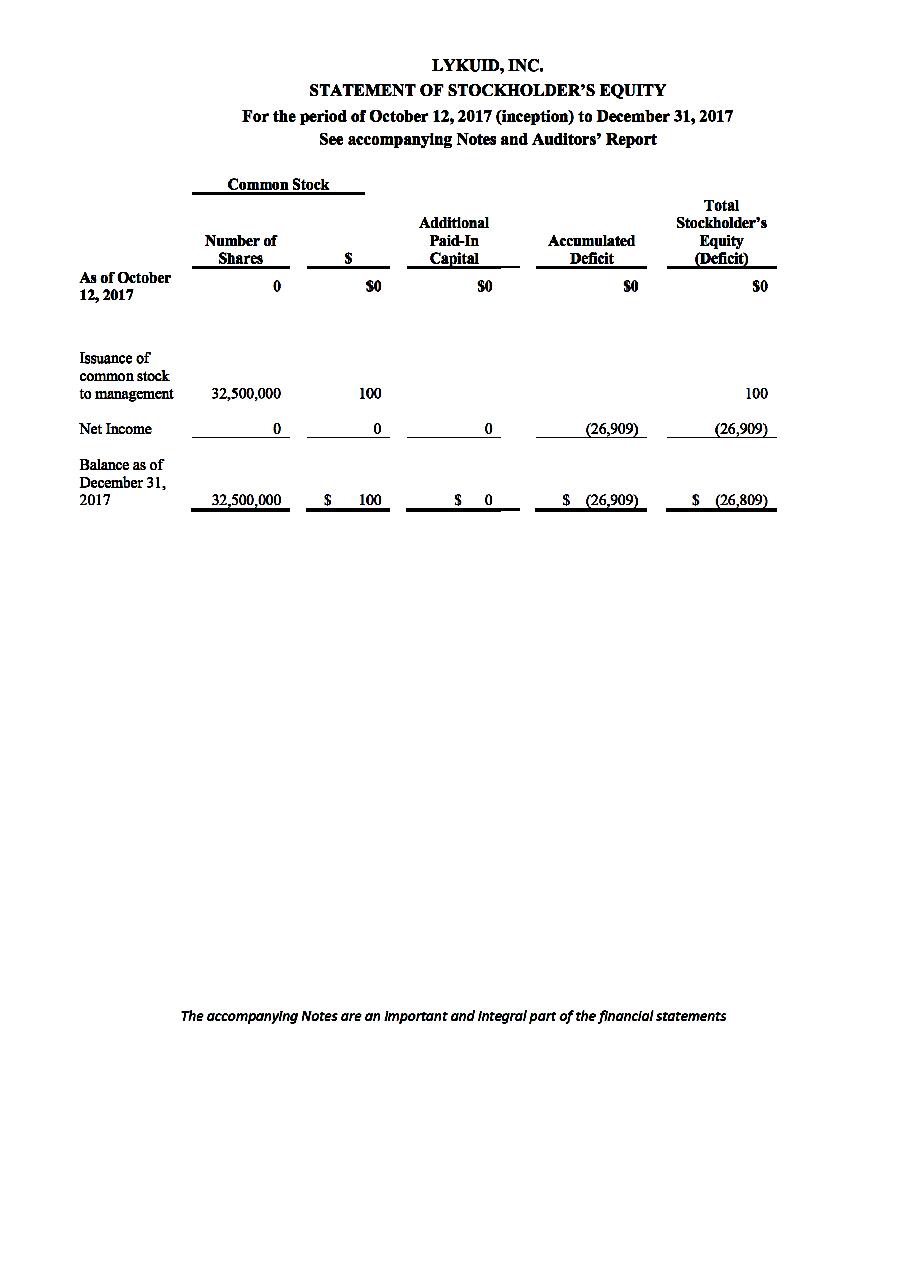

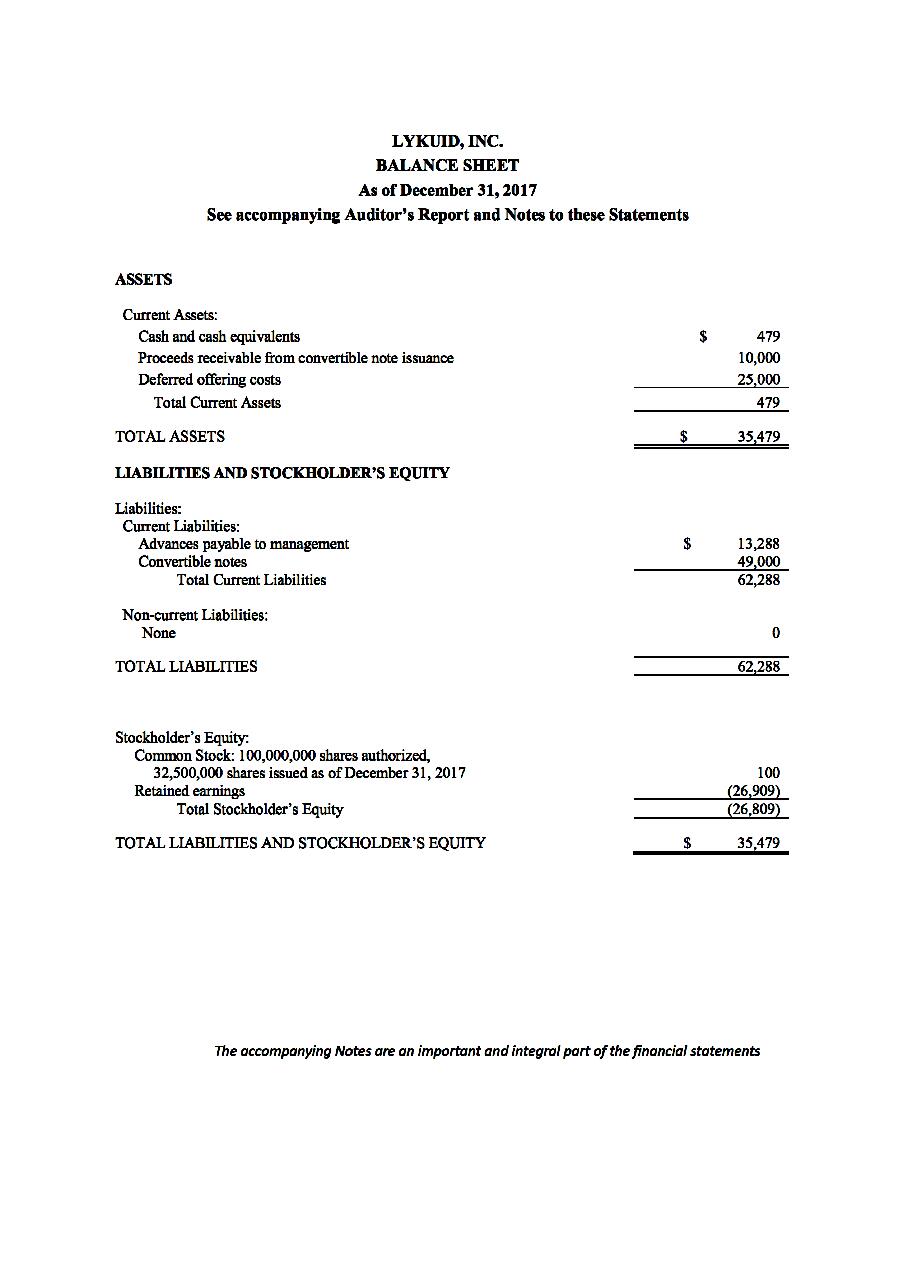

Purchasers of our Shares offered in this Offering will experience an immediate and substantial dilution of the net tangible book value of their Common Stock from the $4.00 offering price. Such dilution results from the Offering Price of the Shares by the Company. At December 31, 2017, we had a consolidated net tangible book value of $ -(26,809). Net tangible book value is the aggregate amount of the Lykuid tangible assets, less its total liabilities.

After giving effect to the sale of the Shares offered hereby, including the use of proceeds as described under “Use of Proceeds,” the pro forma net tangible book value at December 31, 2017 attributable to common shareholders would have been $35,000,000, or $0.85 per share of our Common Stock. This amount represents an immediate increase in net tangible book value of $0.85 per share to new investors and an immediate dilution in pro forma net tangible book value of $3.15 per share from the Offering Price of $4.00 per share of our Common Stock to new investors. The following table illustrates this per-share dilution:

Offering Price per Share | | $ | 4.00 | |

Net tangible book value per Share before this Offering (1) | | $ | 0.00 | |

Increase in net tangible book value per share attributable to new investors (2) | | $ | 0.85 | |

Pro forma net tangible book value per share after this offering | | $ | 0.85 | |

Dilution per share to new investors | | $ | 3.15 | |

(1) | Net tangible book value per share of our Common Stock before this offering is determined by dividing net tangible book value based as of December 31, 2017 (consisting of tangible assets less tangible liabilities) of the Company by the number of shares of our Common Stock issued. |

(2) | Net tangible book value after the offering divided by the number of outstanding shares after the offering minus the net tangible book value per share before the offering. |

Maximum Offering:

| | Shares Purchased | | | Total Consideration | | | Average Price | |

| | Number | | | Percent | | | Amount | | | Percent | | | Per Share | |

Current shareholders | | 32,500,000 | | | 73.08% | | | 0 | | | 0.0% | | $ | 0.0 | |

New Investors | | 8,750,000 | | | 26.92% | | | 35,000,000 | | | 100.0% | | $ | 4.00000 | |

Total | | 41,250,000 | | | 100.0% | | | 35,000,000 | | | 100.0% | | $ | 4.00000 | |

Another important way of assessing dilution is the dilution that happens due to future actions by the Company. The investor’s stake in a company could be diluted due to the company issuing additional shares. In other words, when the company issues more shares, the percentage of the company that you own will go down, even though the value of the company may go up. You will own a smaller piece of a larger company. This increase in number of shares outstanding could result from a stock offering (such as this Offering, another crowd funding round, a venture capital round, angel investment), employees exercising stock options, or by conversion of certain instruments (e.g. convertible bonds, preferred shares or warrants) into stock.

29

If the Company decides to issue more shares, an investor could experience value dilution, with each share being worth less than before, and control dilution, with the total percentage an investor owns being less than before. The Company has authorized and issued three classes of shares, Common Stock. However, all of the Company’s current shareholders and the investors in this Offering will experience the same dilution if the company decides to issue more shares in the future.

DIVIDEND POLICY

We have never paid a dividend on our Common Stock. Any future determination to pay dividends on our Common Stock is subject to the discretion of our Board and will depend upon various factors then existing, including our results of operations, financial condition, liquidity requirements, restrictions that may be imposed by applicable laws and our contracts, as well as economic and other factors deemed relevant by our Board. We do not currently expect to declare or pay dividends on our Common Stock for the foreseeable future. Instead, we anticipate that all of our earnings in the foreseeable future will be used for the operation and growth of our business.

30

PLAN OF DISTRIBUTION

The Company is offering an aggregate of 8,750,000 shares of its Common Stock for sale at the fixed price of $4.00 per share on a “best efforts” basis by our officers, directors. In connection with the Company’s selling efforts in the offering, our officers, directors will not register as a broker-dealer pursuant to Section 15 of the Exchange Act, but rather will rely upon the “safe harbor” provisions of SEC Rule 3a4-1, promulgated under the Exchange Act. Rule 3a4-1 provides an exemption from the broker-dealer registration requirements of the Exchange Act for persons associated with an issuer that participate in an offering of the issuer’s securities. Our officers and directors are not subject to any statutory disqualification, as that term is defined in Section 3(a)(39) of the Exchange Act nor will they be compensated in connection with their participation in the offering by the payment of commissions or other remuneration based either directly or indirectly on transactions in our securities. None of our officers and directors are currently, nor have they been within the past 12 months, a broker or dealer, and they are not, nor have they been within the past 12 months, associated persons of a broker or dealer.

We intend to market the shares in this offering through one or more third party marketing platforms. We have engaged IPOFLOW’s website, www.ipoflow.com, a third-party marketing platform owned by Adamson Brothers Corp., an entity of which Mr. Andy Altahawi has voting and dispositive control. We have entered into an agreement with Adamson Brothers Corp. October 16th, 2017 and it was amended on February 15th, 2018 pursuant to which Mr. Altahawi has provided the Company with legal and business development advisory services to the Company since inception and in connection with this offering in consideration for $25,000 and an aggregate amount of 2,500,000 unregistered Common Stock. Pursuant to the amendment dated February 15th, 2018, between Adamson Brothers Corp. and the Company, the parties memorialized the parties’ agreement that the Company would be listed on www.ipoflow.com for marketing purposes for no additional compensation to Adamson Brothers Corp. or Mr. Altahawi for such services, and we have issued and vested the 2,500,000 shares to Mr. Altahawi as of February 15th, 2018 for services rendered.

There is currently no underwriter or sales agents for the Shares; however, the Company reserves the right to retain the services of one or more FINRA registered broker-dealers to serve as an underwriter or selling agent of the Shares in consideration for customary fees and commissions not exceeding those imposed by FINRA. As of the date of this offering circular, no selling agreements had been entered into by us with any broker-dealer firms. We will indemnify participating broker-dealers and possibly other parties with respect to disclosures made in the Offering Circular. In the event we engage a broker-dealer, we will file an amendment to this Offering Circular to disclose the name of the underwriter and the terms of underwriting compensation.

Offering Period and Expiration Date

The Offering will commence within two calendar days after this offering circular has been qualified by the SEC. This Offering will terminate upon the earlier of (i) such time as all of the Shares have been sold pursuant to the offering statement; (ii) our board of directors determines to terminate the offering; or (iii) 365 days from the qualified date of this offering circular, unless extended by our directors for an additional 90 days.

Procedures and Requirements for Subscription

The Subscription Agreement includes a representation by the investor to the effect that, if the investor is not an “accredited investor” as defined under Securities Act, that such investor is investing an amount that does not exceed the greater of 10% of such investor’s annual income or 10% of such investor’s net worth

31

(excluding principal residence). The Subscription Agreement must be delivered to us and the investor may transfer funds for the subscribed amount in accordance with the instructions stated in the subscription agreement.Subscriptions, once received and accepted by the Company, are irrevocable. The minimum investment is 100 Shares ($400) but we reserve the right to accept a lesser amount. We have the sole discretion to reject any subscription. Any rejected subscriptions will be promptly returned without interest thereon or deduction therefrom.

Deposit of Offering Proceeds

This is a “best efforts” offering, so the Company is not required to sell any specific number or dollar amount of Shares but will use its best efforts to sell the Shares offered.There is no minimum number of Shares that we must sell in order to conduct a closing in this Offering and we intend to have multiple closings until the termination of the Offering Period. The Company may close on investments on a “rolling” basis (so not all investors will receive their Shares on the same date). The Company has made no arrangements to place subscription funds in an escrow, trust or similar account which means that all funds collected for subscriptions will be immediately available to the Company for use in the implementation of its business plan.The Company will hold all funds it receives in a segregated bank account. Upon each closing, the proceeds collected for such closing will be disbursed to the Company and the Shares for each closing will be issued to investors 30 days from the subscription agreement acceptance.

We have no creditors making claims against us at this time. Subsequent claims may be filed during the Offering Period which could cause you to lose all or part of your entire investment. If potential claims were perfected, the Company may not be able to return your funds or move the proceeds of the Offering into its business account. At this time no one is making any claims against the Company.

Please see the Risk Factor section to read the related risk to you as a purchaser of any Shares.

NASDAQ Listing Application

We intend to apply to have our Common Stock approved for listing on NASDAQ. In order to list, the NASDAQ Capital Market requires that, among other criteria, at least 1,000,000 publicly-held shares of our Common Stock be outstanding, the shares be held in the aggregate by at least 300 round lot holders, the market value of the publicly-held shares of our Common Stock be at least $15.0 million and the bid price per share of our Common Stock be $4.00 or more. We will not satisfy these requirements until we have a sufficient amount of subscriptions in this Offering.

Our Common Stock will not commence trading on NASDAQ until all of the following conditions are met: (i) we meet the initial listing requirements of NASDAQ; (ii) the offering is terminated; and (iii) we have filed a post-qualification amendment to the Offering Statement and a registration statement on Form 8-A (“Form 8-A”) under the Exchange Act, and such post-qualification amendment is qualified by the SEC and the Form 8-A has become effective. Pursuant to applicable rules under Regulation A, the Form 8-A will not become effective until the SEC qualifies the post-qualification amendment. We intend to file the post-qualification amendment and request its qualification immediately prior to the termination of the Offering in order that the Form 8-A may become effective as soon as practicable.

Even if we meet the minimum requirements for listing on NASDAQ, we may wait before terminating the offering and commencing the trading of our Common Stock on NASDAQ in order to raise additional proceeds. As a result, you may experience a delay between the closing of your purchase of shares of our Common Stock and the commencement of exchange trading of our Common Stock.

32

This Offering is not contingent upon receiving NASDAQ’s listing approval. In the event we do not meet NASDAQ’s initial listing qualification requirements, we intend to apply to have our Common Stock listed on another national securities exchange.