Contract No. CNH-R01-L01-A2/2015

“Self-Consumed Hydrocarbons” shall mean the Hydrocarbons used as fuel to carry out the Petroleum Activities, or flared, vented or reinjected into the reservoir, but only in the manner and amounts approved in accordance with the Applicable Laws.

“Social Impact Evaluation” shall mean the document that contains the identification of the communities and villages located in the influence area of a project regarding Hydrocarbons, as well as, the identification, characterization, prediction and valuation of the consequences towards the population that may be derived from itself and the mitigation measures and the correspondent social management plans.

“State Consideration” shall mean, for any Month beginning with the Month in which Regular Commercial Production commences, the share of Hydrocarbon production from the Contract Area and the other consideration that the Nation is entitled to in accordance with Article 16.2 and Annex 3.

“Storage” shall mean the deposit and safeguard of Hydrocarbons in enclosed deposits and facilities that may be located on the surface, at sea or in the subsoil.

“Subcontractors” shall mean those Persons that carry out Petroleum Activities at the request of the Contractor pursuant to Article 19.2.

“Sub-Products” shall mean those elements or components different from Hydrocarbons, such as, sulfur or any other mineral or substance contained in Crude Oil or Natural Gas that may be separated from Hydrocarbons.

“Sub-Salt Discovery” shall mean a Discovery by direct methods of an accumulation or accumulations of Subsoil Hydrocarbons, where prospective areas exist in sedimentary formations under salt domes.

“Surface Reconnaissance and Exploration” shall mean all Appraisal studies based solely on activities undertaken on the surface of the land or the ocean to assess the possible existence of Hydrocarbons in the Contract Area, including works for the acquisition, as well as the processing, reprocessing or interpretation of information.

“Tax Obligations” shall mean any and all federal, state or municipal taxes, contributions, government fees, government charges, tariffs or withholding taxes of any kind, together with any and all incidental taxes, surcharges, updates and fines, charged or determined at any time by any Governmental Authority.

“Technical Documents” shall mean all studies, reports, spreadsheets and databases, in any form, relating to the Contract Area or the Petroleum Activities.

“Technical Information” shall mean all of the data and information obtained as a result of the Petroleum Activities, including, without limitation: geological, geophysical, geochemical and engineering information; well logs, progress reports, Technical Documents and any other information related to the completion, production, maintenance or performance of Petroleum Activities.

16

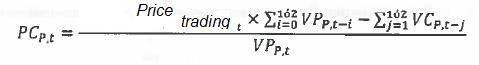

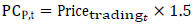

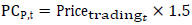

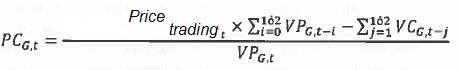

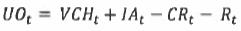

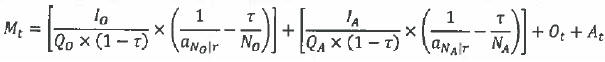

= Sum of volume of production of Crude Oil registered at Measurement Point during Periods t, t - 1 and if applicable, t - 2.

= Sum of volume of production of Crude Oil registered at Measurement Point during Periods t, t - 1 and if applicable, t - 2. =Sum of Contractual Value of Crude Oil during Period t - 1, and if applicable, t- 2.

=Sum of Contractual Value of Crude Oil during Period t - 1, and if applicable, t- 2.

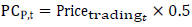

= Sum of Volume of Production of Condensates registered at Measurement Point during Periodst,t - 1, and if applicable, t - 2.

= Sum of Volume of Production of Condensates registered at Measurement Point during Periodst,t - 1, and if applicable, t - 2. = Sum of Contractual Value of Condensates during Period t - 1, and if applicable, t - 2.

= Sum of Contractual Value of Condensates during Period t - 1, and if applicable, t - 2.

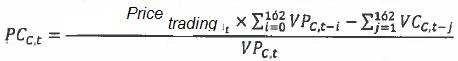

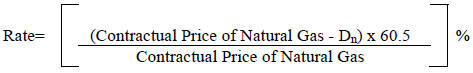

= Sum of the Volume of Production of Natural Gas registered at the Measurement Point during Periods t, t - 1 and if applicable, t - 2.

= Sum of the Volume of Production of Natural Gas registered at the Measurement Point during Periods t, t - 1 and if applicable, t - 2. = Sum of Contractual Value of Natural Gas during Period t - 1, and if applicable, t - 2.

= Sum of Contractual Value of Natural Gas during Period t - 1, and if applicable, t - 2.

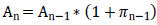

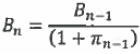

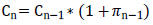

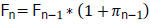

in the Base Year and n specifies the corresponding Year

in the Base Year and n specifies the corresponding Year

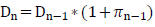

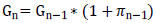

in the Base Year and n specifies the corresponding Year.

in the Base Year and n specifies the corresponding Year.

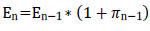

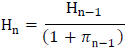

in the Base year and n specifies the corresponding year.

in the Base year and n specifies the corresponding year.

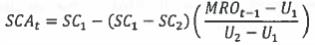

in the base Year and n indicates the corresponding Year.

in the base Year and n indicates the corresponding Year.

Tax rate equal to 30%

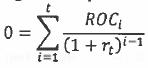

Tax rate equal to 30% =Formula of present value of the annuity of Ni periods with a yield r.

=Formula of present value of the annuity of Ni periods with a yield r.