- TALO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

Talos Energy (TALO) 425Business combination disclosure

Filed: 22 Sep 22, 5:22pm

Exhibit 99.1 September 2022 Acquisition of EnVen Energy

Important Information for Investors and Shareholders Important Information for Investors and Shareholders This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed Merger, Talos will file with the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4, which will include a proxy statement/prospectus of Talos and a consent solicitation statement of EnVen. Talos also plans to file other documents with the SEC regarding the proposed transaction. After the registration statement has been declared effective by the SEC, a definitive proxy statement/prospectus will be mailed to Talos shareholders and a definitive consent solicitation statement will be mailed to EnVen shareholders. INVESTORS AND SHAREHOLDERS OF TALOS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER DOCUMENTS RELATING TO THE PROPOSED MERGER THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. Investors and shareholders will be able to obtain free copies of the proxy statement/prospectus/consent solicitation statement and other documents containing important information about Talos and EnVen once such documents are filed with the SEC, through the website maintained by the SEC at http://www.sec.gov. Participants in the Solicitation Talos, EnVen and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Talos shareholders in connection with the proposed transaction. Information about the directors and executive officers of Talos is set forth in Talos’s Definitive Proxy Statement on Schedule 14A for its 2022 Annual Meeting of Stockholders, which was filed with the SEC on April 6, 2022. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus/consent solicitation and other relevant materials to be filed with the SEC when they become available. 2

Cautionary Statement Cautionary Statement Regarding Forward-Looking Statements This presentation contains “forward-looking statements” for purposes of the federal securities laws. All statements, other than statements of historical fact included in this presentation, regarding the proposed transaction with EnVen, including our ability to satisfy the conditions to closing and the expected timing and benefits of the transaction, our strategy, future operations, the impact of regulatory changes, financial position, estimated capital expenditures, production, revenues and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. When used in this presentation, the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on our current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. We caution you that these forward-looking statements are subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond our control. These risks include, but are not limited to, the success of our carbon capture and sequestration projects; commodity price volatility due to the continued impact of the coronavirus disease 2019 (“COVID-19), including any new strains or variants, and governmental measures related thereto on global demand for oil and natural gas and on the operations of our business; the lack of a resolution to the war in Ukraine and its impact on certain commodity markets; the ability or willingness of the Organization of Petroleum Exporting Countries (“OPEC”) and non-OPEC countries, such as Saudi Arabia and Russia, to set and maintain oil production levels and the impact of any such actions, lack of transportation and storage capacity as a result of oversupply, government regulations and actions or other factors, sustained inflation and the impact of central bank policy responses thereto, lack of availability of drilling and production equipment and services, environmental risks, drilling and other operating risks, regulatory changes, the uncertainty inherent in estimating reserves and in projecting future rates of production, cash flow and access to capital, the timing of development expenditures, the possibility that the anticipated benefits of recent or proposed acquisitions (including the proposed transaction discussed herein) are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of such acquisitions, our ability to satisfy the conditions to closing to the proposed EnVen transaction as well as other factors discussed under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2021, Quarterly Report on Form 10-Q for the period ended June 30, 2022 and other filings with the SEC. Should one or more of these risks or uncertainties occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements. All forward-looking statements, expressed or implied, are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue. All forward-looking statements speak only as of the date hereof. Except as otherwise required by applicable law, we disclaim any duty to update any forward-looking statements, to reflect events or circumstances after the date of this presentation. Reserve Information Reserve engineering is a process of estimating underground accumulations of oil, natural gas and NGLs. The accuracy of any reserve estimate depends on the quality of available data, the interpretation of such data and price and cost assumptions made by reserve engineers. In addition, the results of drilling, testing and production activities may justify revisions upward or downward of estimates that were made previously. If significant, such revisions would change the schedule of any further production and development drilling. Accordingly, reserve estimates may differ significantly from the quantities of oil, natural gas and NGLs that are ultimately recovered. Investors are urged to consider closely the disclosures and risk factors in the reports we file with the SEC. Estimates for our future production volumes are based on assumptions of capital expenditure levels and the assumption that market demand and prices for oil and gas will continue at levels that allow for economic production of these products. The production, transportation and marketing of oil and gas are subject to disruption due to transportation and processing availability, mechanical failure, human error, hurricanes, global political and macroeconomic events and numerous other factors. Our estimates are based on certain other assumptions, such as well performance, which may vary significantly from those assumed. Therefore, we can give no assurance that our future production volumes will be as estimated. Use of Non-GAAP Financial Measures This presentation includes the use of certain measures that have not been calculated in accordance with U.S. generally acceptable accounting principles (GAAP), including EBITDA, Adjusted EBITDA, Net Debt, Free Cash Flow and Leverage. Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. Use of Projections This presentation contains projections, including production volumes, capital expenditures, Adjusted EBITDA, Free Cash Flow and cost-savings via synergies. Our independent auditors have not audited, reviewed, compiled, or performed any procedures with respect to the projections for the purpose of their inclusion in this presentation, and accordingly, have not expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this presentation. These projections are for illustrative purposes only and should not be relied upon as being indicative of future results. The assumptions and estimates underlying the projected information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the projected information. Even if our assumptions and estimates are correct, projections are inherently uncertain due to a number of factors outside our control. Accordingly, there can be no assurance that the projected results are indicative of our future performance after completion of the transaction or that actual results will not differ materially from those presented in the projected information. Inclusion of the projected information in this presentation should not be regarded as a representation by any person that the results contained in the projected information will be achieved. Industry and Market Data; Trademarks and Trade Names This presentation has been prepared by us and includes market data and other statistical information from sources we believe to be reliable, including independent industry publications, governmental publications or other published independent sources. Some data is also based on our good faith estimates, which are derived from our review of internal sources as well as the independent sources described above. Although we believe these sources are reliable, we have not independently verified the information and cannot guarantee its accuracy and completeness. We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our businesses. This presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this presentation is not intended to, and does not imply, a relationship with us or an endorsement or sponsorship by us. Solely for convenience, the trademarks, service marks and trade names referred to in this presentation may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names. 3

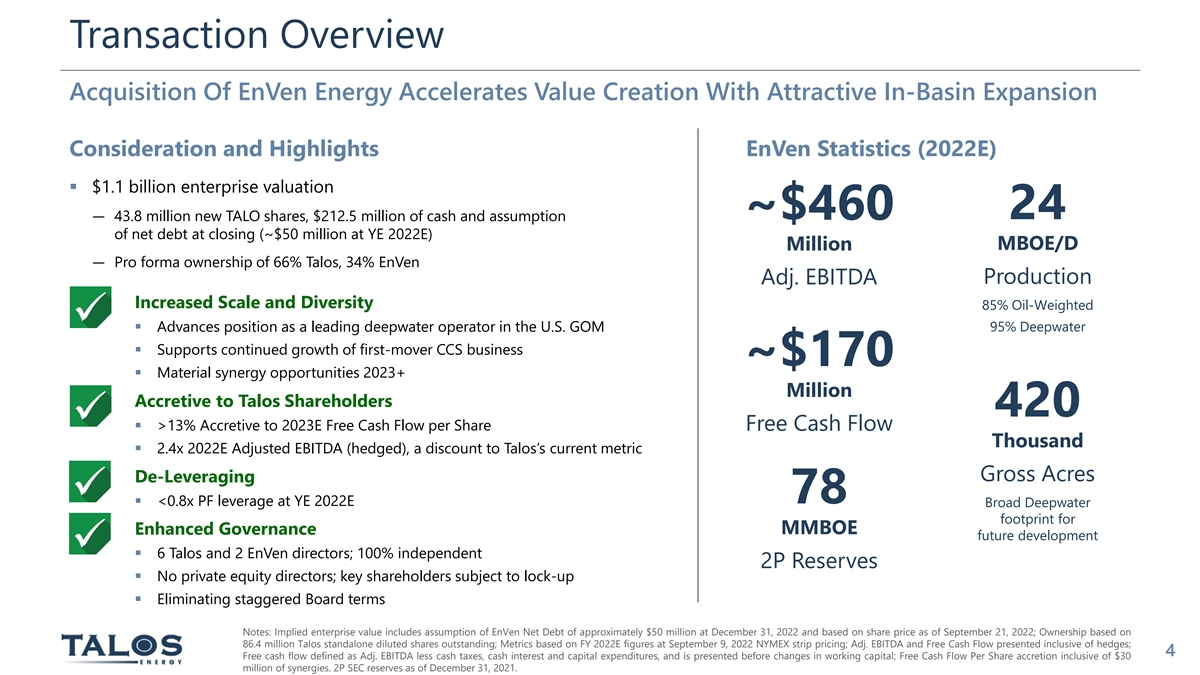

Transaction Overview Acquisition Of EnVen Energy Accelerates Value Creation With Attractive In-Basin Expansion Consideration and Highlights EnVen Statistics (2022E) § $1.1 billion enterprise valuation ~$460 24 ― 43.8 million new TALO shares, $212.5 million of cash and assumption of net debt at closing (~$50 million at YE 2022E) MBOE/D Million ― Pro forma ownership of 66% Talos, 34% EnVen Production Adj. EBITDA Increased Scale and Diversity 85% Oil-Weighted 95% Deepwater § Advances position as a leading deepwater operator in the U.S. GOM § Supports continued growth of first-mover CCS business ~$170 § Material synergy opportunities 2023+ Million Accretive to Talos Shareholders 420 § >13% Accretive to 2023E Free Cash Flow per Share Free Cash Flow Thousand § 2.4x 2022E Adjusted EBITDA (hedged), a discount to Talos’s current metric Gross Acres De-Leveraging 78 § <0.8x PF leverage at YE 2022E Broad Deepwater footprint for Enhanced Governance MMBOE future development § 6 Talos and 2 EnVen directors; 100% independent 2P Reserves § No private equity directors; key shareholders subject to lock-up § Eliminating staggered Board terms Notes: Implied enterprise value includes assumption of EnVen Net Debt of approximately $50 million at December 31, 2022 and based on share price as of September 21, 2022; Ownership based on 86.4 million Talos standalone diluted shares outstanding; Metrics based on FY 2022E figures at September 9, 2022 NYMEX strip pricing; Adj. EBITDA and Free Cash Flow presented inclusive of hedges; 4 Free cash flow defined as Adj. EBITDA less cash taxes, cash interest and capital expenditures, and is presented before changes in working capital; Free Cash Flow Per Share accretion inclusive of $30 million of synergies. 2P SEC reserves as of December 31, 2021.

Strategic Rationale Acquisition Further Solidifies Talos As A Leading Independent In The Gulf of Mexico § 40% increase in production; increased diversity of key producing fields § ~$30mm annual synergies Scale and Diversity § Improves optionality for Upstream reinvestment, CCS growth, de-leveraging or return of capital § Operated, oil-weighted asset base in prolific deepwater regions § Numerous operated facilities with existing PHA partners enhances future capital allocation Asset Mix § 35% increase in gross acreage § ~$460mm of 2022E Adj. EBITDA (~$630mm unhedged) and ~$170mm of Free Cash Flow § Adds high-margin production – Adj. EBITDA margins >$70/boe (2Q 2022 unhedged) Financial Profile § <0.8x pro forma leverage at year-end 2022 § Favorable to Talos GHG Emissions Intensity § Increases production in Deepwater GOM – a globally leading ESG-friendly basin ESG § Enhances governance practices and increases Board diversity and technical expertise Notes: Financial profile metrics and pro forma leverage based on FY 2022E figures at September 9, 2022 NYMEX strip pricing. Free cash flow defined as Adj. EBITDA less cash taxes, cash interest and 5 capital expenditures, and is presented before changes in working capital. Synergies expected to be achieved by year-end 2023.

Compelling Overlap in Core Deepwater Areas Contiguous operated asset portfolio Petronius Pompano provides hand-in-glove fit in deepwater Amberjack Gulf of Mexico core areas Ram Powell Cognac Transaction Impact Lobster Prince Talos Acreage/Facility GC18 40% 35% EnVen Acreage/Facility CCS Opportunity Region Phoenix HP-1 Production Gross Acreage Talos Seismic Neptune Increase Increase Pro Forma Operating Profile Brutus / Glider Greater Than Greater Than Greater Than Strong Fit with Talos seismic, 80% 75% 70% enhancing upside potential % Deepwater % Operated % Oil Notes: Gross acreage as of June 30, 2022; Production figures and pro forma percentage oil and percentage deepwater based on FY 2022E production data based on Talos management estimates. 6

Key EnVen Deepwater Facilities Neptune Brutus / Glider (Operator, 100% WI) (Operator, 65% WI) § Gross oil capacity: 120,000 bbl/d § Gross oil capacity: 50,000 bbl/d § Water depth: 2,900’ / 3,243’ § Water depth: 4,250’ Prince Lobster (Operator, 100% WI) (Operator, 67% WI) § Gross oil capacity: 50,000 bbl/d § Gross oil capacity: 80,000 bbl/d § Water depth: 775’§ Water depth: 1,500’ Cognac Petronius (Operator, 63% WI) (Operator: Chevron, 50% WI) § Gross oil capacity: 30,000 bbl/d§ Gross oil capacity: 60,000 bbl/d § Water depth: 1,023’§ Water depth: 1,754’ 7

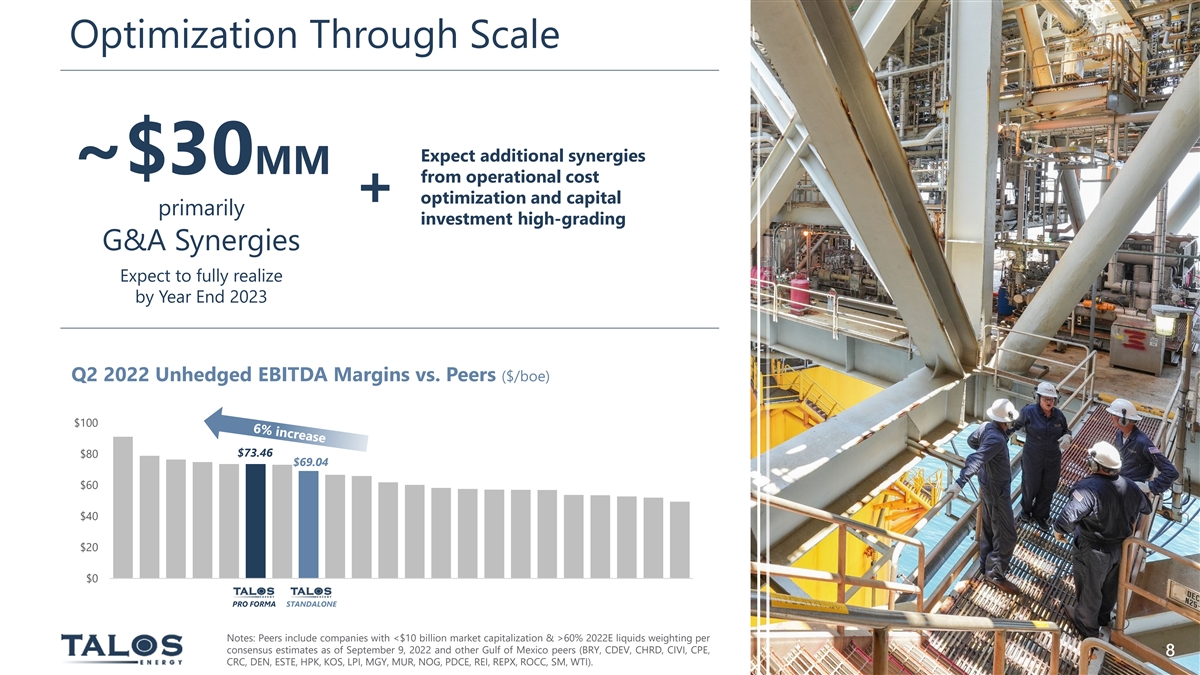

Optimization Through Scale Expect additional synergies ~$30MM from operational cost optimization and capital + primarily investment high-grading G&A Synergies Expect to fully realize by Year End 2023 Q2 2022 Unhedged EBITDA Margins vs. Peers ($/boe) $100 $73.46 $80 $69.04 $60 $40 $20 $0 PRO FORMA STANDALONE Notes: Peers include companies with <$10 billion market capitalization & >60% 2022E liquids weighting per consensus estimates as of September 9, 2022 and other Gulf of Mexico peers (BRY, CDEV, CHRD, CIVI, CPE, 8 CRC, DEN, ESTE, HPK, KOS, LPI, MGY, MUR, NOG, PDCE, REI, REPX, ROCC, SM, WTI).

Enhanced Free Cash Flow Combined Profile Improves Capital Allocation Flexibility Cash Flow Priorities Remain Unchanged § Achieve standing leverage reduction target at year end § High-grade pro forma inventory for value-accelerating drilling opportunities § Accelerate ambition for return of capital to shareholders § Advance measured investments in CCS opportunities § Engage in accretive M&A and corporate development Transaction accelerates Talos’s optionality to build long-term value for shareholders EnVen Key Metrics ~$170MM ~65% Free Cash Flow Unhedged Production (2022E hedged) (2023E) Notes: Free cash flow defined as Adj. EBITDA less cash taxes, cash interest and capital expenditures, and is presented before changes in working 9 capital; ~$170 million free cash flow figure based on FY 2022E and NYMEX strip pricing as of September 9, 2022.

De-Leveraging Transaction Bolsters Conservative Balance Sheet Commentary Pro Forma Leverage Profile 2.0x 1.7x § Accelerates de-leveraging, maintains conservative strategy 1.5x 1.0x <0.8x ― PF leverage of <0.8x by YE 2022E; No near-term maturities 0.5x ― Hedging approach remains unchanged, but adds optionality from 0.0x 2023+ EnVen unhedged volumes Talos Standalone Year-End 2021A Pro Forma Year-End 2022E § Expect to optimize capital structure given credit improvement Leverage vs. Peers (YE22 proj. net debt / 2022E EBITDA) § Future P&A largely pre-funded with >$160mm in restricted cash 2.5x and receivables 2.0x 1.5x 0.8x 1.0x 0.5x 0.0x (0.5x) PRO FORMA Notes: Peers include companies with <$10 billion market capitalization & >60% 2022E liquids weighting per consensus estimates as of September 9, 2022 and other Gulf of Mexico peers (BRY, CDEV, CHRD, CIVI, CPE, CRC, DEN, ESTE, HPK, KOS, LPI, MGY, MUR, NOG, PDCE, REI, REPX, ROCC, SM); Talos YE 2021 leverage based on public disclosure, pro forma leverage based on September 9, 2022 NYMEX strip pricing for Talos, consensus estimates for peers; Pro Forma Capitalization includes deduction of cash consideration; Projected net debt for peer group calculated as net debt as of June 30, 2022 less 2022E remainder retained free 10 cash flow; retained free cash flow calculated as operating cash flow less capex, share repurchases and dividends.

Advancing ESG Commitments Growing in GOM Deepwater – A Global Leader for Cleaner, Environmentally Responsible Energy Supply Favorable to Scope 1 GHG Intensity Sustainability Initiatives (Gross Operated Production, MT CO Equivalent/MBoe) 2 ESG Reporting Assets moving to public ESG Reporting standard 30% Base Reduction Target Talos SEMS Bring assets under Talos 15.3 HSE best practices Supply Chain Optimize logistics 21.8 and transportation 18.2 17.4 15.9 Cold Venting 15.3 Eliminate cold venting 13.1 at acquired facilities 40% Stretch Reduction Target Solar and Wind Swap fuel gas to renewables for select systems 2018 2019 2020 2021 2021 2022 2023 2024 2025 PF Notes: Talos GHG Intensity based upon AQS/GOADS reporting methods utilizing Talos offshore operated production plus third-party operated 11 wells flowing through Talos production facilities. Scope 1 GHG Intensity reduction targets calculated from 2018 baseline.

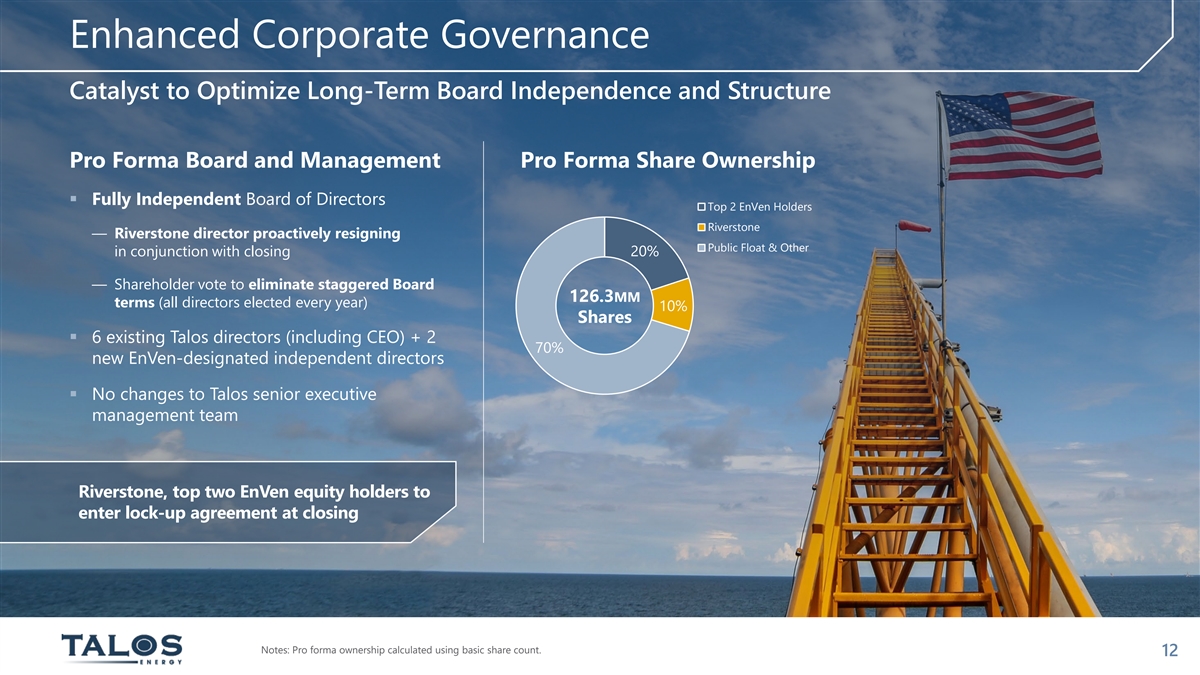

Enhanced Corporate Governance Catalyst to Optimize Long-Term Board Independence and Structure Pro Forma Board and Management Pro Forma Share Ownership § Fully Independent Board of Directors Top 2 EnVen Holders Riverstone ― Riverstone director proactively resigning Public Float & Other in conjunction with closing 20% ― Shareholder vote to eliminate staggered Board 126.3MM terms (all directors elected every year) 10% Shares § 6 existing Talos directors (including CEO) + 2 70% new EnVen-designated independent directors § No changes to Talos senior executive management team Riverstone, top two EnVen equity holders to enter lock-up agreement at closing Notes: Pro forma ownership calculated using basic share count. 12

A Highly Compelling Strategic Transaction Solid Transaction Satisfies All Company Criteria for Strategic M&A Strategic Fit Financial Merits Builds Scale Through Attractive In-Basin 2.4x 2022E hedged Adj. EBITDA Expansion 1.7x 2022E unhedged Adj. EBITDA Enhances Deepwater Focus FCFPS Accretive to Talos Shareholders Adds Significant Acreage and Facilities Footprint <0.8x YE 2022E Pro Forma Leverage Advances Emissions Intensity Objectives in ~$30MM+ Annual Run-Rate Synergies the ESG-leading Gulf of Mexico Notes: Implied enterprise value includes assumption of EnVen Net Debt of approximately $50 million at 12/31/22 and based on Talos share price as of September 21, 2022; Metrics based on FY 2022E figures at September 9, 2022 NYMEX strip pricing; Free cash flow defined as EBITDA less cash taxes, cash interest and capital expenditures, and is presented before changes in working capital; Free Cash 13 Flow Per Share accretion based on 2023E and inclusive of $30 million of synergies.

14