Exhibit 99.2

David Ossip Leagh Turner Chair and Co-CEO Co-CEO Dear Fellow Stockholders, We delivered strong performance in the first quarter of 2022 in terms of both revenue growth and profitability. Dayforce recurring revenue, excluding float revenue, grew by 31% and total revenue grew by 25%. Adjusted EBITDA of $57.4 million exceeded expectations and drove Adjusted EBITDA margin 347 basis points ahead of the high end of guidance. Based on our strong performance in the first quarter, we are raising our guidance for our fiscal year 2022. We are now expecting total revenue in the range of $1,208 million to $1,230 million, representing an increase of 18% to 20%, and Adjusted EBITDA of $190 million to $205 million. We were pleased with our sales performance in the first quarter, which was characterized by robust customer demand and very solid growth in the North America region. More than 35% of new Dayforce customers purchased the comprehensive product suite. This was driven by our continued investment in the Dayforce platform, as we build our differentiated and innovative full-suite capabilities to address the changing dynamics in the new world of work. Our pipeline is strong, and we expect solid sales performance to continue into the year. Our community of customers continues to grow, and we were pleased to add 175 customers in the first quarter. We now have 5,609 customers live, further validating our commitment to customer success. As we look further into 2022, we believe that our customers are more ready than ever to partner with Ceridian on their critical digital transformations and redesigns of their workforce experiences. The last two years have proven these initiatives are no longer an option but a necessity. Our strategic levers continue to guide our focus. We are executing against them simultaneously to strengthen our competitive advantage and unlock substantial growth opportunities. The five levers are: Acquiring new customers in the markets where we have seen success to date; Extending the Dayforce platform, allowing us to deliver more value to our current and prospective customers; Expanding within the enterprise segment; Accelerating our global expansion both by serving local customers in new geographies, and by extending our scope to service global multinational customers; and Driving incremental revenue from our customers by innovating in adjacent markets around our core HCM suite, such as Dayforce Wallet. Every organization faces a new world of work, and our vision to be the always-on people platform for the global workforce is resonating deeply with customers, prospects, and partners across all our major markets and industries around the world. As a recent example, we spent time in our Asia Pacific and Japan (APJ) region on the final two stops of the Ceridian World Tour in Melbourne and Singapore. The energy and engagement among our customers, prospects, partners, and our local teams were palpable. During the many customer and prospect conversations we had throughout the visit, it is clear that our customers see Ceridian as a strategic partner that can help create a differentiated workforce experience and deliver quantifiable value back to their organizations.

Last quarter, we discussed actions we took to take full operational advantage of our footprint in the APJ region and leverage key markets in Asia. We are very pleased with the newly expanded service and support center in Manila, where many new talented employees are working directly with our customers, upholding our high standard of delivery and support, which remain best in class. We will continue to apply this disciplined approach to create greater efficiency and scale in our organization as we drive global growth and quantifiable value for our customers. Financial highlights As noted, we had strong financial and operating performance in the first quarter. We maintained strong topline growth driven by Dayforce recurring revenue, which grew by 31% excluding float revenue, and total revenue, including Powerpay and Bureau revenue, grew by 25%. Adjusted cloud recurring gross margin was 75.5%, up 220 basis points compared to the first quarter of 2021. We exceeded our guidance on Adjusted EBITDA, which was $57.4 million, or 19.6% of revenue. Customer highlights We are focused on delivering value to our customers throughout their lifecycle, and thereby earning customers for life. Our modern cloud platform in combination with our services team and partner ecosystem enable us to take customers live quickly, predictably, and on-time at a consistent pace. Our go-live performance was strong, and we took 175 net customers live in the first quarter. We ended the quarter with 5,609 customers live on the Dayforce platform1, an 11% increase compared to the first quarter of 2021. We are successfully selling the broader HCM suite, and 35% of new customers purchased the comprehensive suite. Our trailing twelve-month Dayforce recurring revenue per customer for the same period was $110,947 up 10%3 year-over-year.

During the quarter, we took some notable companies live on Dayforce with key customers including: A large American discount supermarket chain with 900 locations in 32 states went live with Dayforce. Ceridian worked as a unified team with the grocer and delivered recruiting, performance, compensation, engagement, dashboards and managed benefits and managed payroll. A North American manufacturer of automotive parts with over 3,000 employees in the U.S., Canada, and Mexico went live with Dayforce talent management, benefits, payroll, and time. This implementation allowed the company to bring all regions under a single platform, streamline processes, and attract and retain top talent to fuel future expansion. A US-based health food chain went live with the full suite of Dayforce. Customer engagement, team collaboration, a solution-oriented approach, and strong executive leadership on both sides allowed the Ceridian team to deliver this project successfully. A leading business information company that provides commercial and professional services went live with Dayforce. The project initially kicked off in February 2021 and delivered Dayforce managed payroll, managed benefits, and time. The company completed its first pay run for 3,000 North American employees in January 2022. One of the UK’s leading holiday park operators with 66 parks and 8,000 employees went live with Dayforce, resulting in a significant HCM transformation. Dayforce is now helping the company efficiently manage seasonal hiring of 500 new employees per week, while ensuring that payroll is completed accurately and on time. In addition, the company will now also benefit from real-time insights and data to track labor budgeting and scheduling. A leading Australian tourism and leisure company went live with Dayforce for workforce management, recruiting, and payroll. Dayforce will help the company remain compliant and set the stage for growth on a global scale.

Partner ecosystem We are seeing strong momentum in our partner ecosystem where we are executing very well against our strategy to broaden our global reach, expand further into the enterprise segment, and deepen our industry expertise to create more value for Dayforce customers. While our SI partners provide a valuable complement to our implementation and services teams, we also utilize their capabilities as a demand generation engine. During the first quarter, our SI-primed deals continued to grow, and our partner-referred pipeline is strong, further demonstrating a healthy and robust partner ecosystem. Sales highlights Our focus on helping our customers adapt and evolve their workforce with our modern platform is driving strong demand for Dayforce. In North America during the first quarter, we had continued success across enterprise and large enterprise markets: The Government of Canada amended its current contract to include additional work to further test Ceridian’s cloud solution for the HR and pay business needs of the federal public service. The second-largest professional services network in the world selected Dayforce for its 52,000 U.S. employees. The company was looking for a partner whose technology could address complex payroll and tax requirements, and who could provide a comprehensive outsourcing service. Ceridian’s modern technology and continuous innovation were key differentiators in this win,

along with our proven ability to deliver on rapid implementation. A U.S. real estate development, construction, and property management leader with 3,000 employees selected Dayforce as its full-suite HCM solution. The company is looking to streamline people operations and reporting, while also leveraging modern technology to drive key talent initiatives. The company chose Dayforce for its ease of use, suitability for a complex operational model, and robust workforce management technology. A travel company with over 2,000 employees across Canada and the U.S. selected Dayforce as a unified solution to align processes, improve efficiency, and boost its bottom line. The company operates multiple lines of business, resulting in complex and cumbersome processes. Dayforce meets the company's need for a compliant, always on, people empowered system, that can scale to meet both current and future requirements. A large, regional long-term care provider with more than 2,200 employees selected Dayforce for talent management, workforce management, benefits, and payroll to increase efficiency, attract new talent, and promote employee engagement. A manufacturer and distributor of paper and forest products with 2,000 employees in the U.S. chose to partner with Ceridian to better manage its decentralized workforce. Dayforce will provide modern technology to consolidate recruiting, engagement, pay, and time in a single system. We continue to execute on the strategic growth lever of expanding globally in both the APJ region as well as in Europe Middle East and Africa (EMEA). Our key global wins during the first quarter included: A family entertainment company with 5,000 employees across seven countries selected Dayforce to manage its workforce in Australia and New Zealand. The company chose to partner with Ceridian due to the single platform architecture of Dayforce, and the depth of functionality in pay, time, and scheduling.

A global online gaming and hospitality group selected Dayforce for UK payroll, in addition to global HR and time for 7,000 employees across 10 worldwide territories. Ceridian demonstrated capabilities that surpassed those of several industry-specific time and scheduling tools, while providing an enhanced user experience across both time and HR. A British media company with over 3,000 employees globally selected Dayforce as a unified solution across the seven countries in which it operates. By partnering with Ceridian, the company will be able to consolidate over 60 separate solutions into approximately five, creating an integrated global architecture for its people operations. Product innovation Our vision to be the always-on people platform for the global workforce guides our innovation agenda, shaping how we strive to deliver value to our customers. As the leading provider in global pay, we continued to expand our global footprint with the delivery of localized Singapore payroll to charter customers, providing continuous calculation of data, analytics, and a modern user experience in a single system. We also are expanding our localized payroll capabilities to Taiwan, Indonesia, Philippines, Thailand, South Korea, Hong Kong, and Malaysia in APJ.

In workforce management, we continue to focus on the extensibility of Dayforce platform which enables us to open our gross pay, schedule, work contract, and entitlement engines. Our customers can now react in real-time to the ever-changing global compliance environment through easily personalized Excel-like macros as part of our core compliance capabilities in Dayforce. Additionally, with our investments in gross pay extensibility, our customers can now manage complex union rates, project and task premiums, minimum wages, and rate progression all in Dayforce, further expanding our compliance advantage. We also continued to invest in our talent intelligence capabilities. Two new areas of innovation in talent intelligence that we delivered in the first quarter are: Screening and Matching Intelligence: Uses AI to instantly screen, match and shortlist thousands of candidates, in real-time, and with incredible accuracy. Screening and matching also helps reduce bias which leads to a more diverse workforce. Candidate Job Alerts: Candidates now can save searches and receive email alerts when new opportunities match their search criteria. In addition to job alerts, candidates can now view job recommendations based on their profile and view the status of their applied jobs. Every organization is focused on talent and having greater ability to screen, match, and shortlist candidates can significantly accelerate searches to get the right people on board faster. As we continue to invest in our talent capabilities along with our other key products like our recently delivered Dayforce People Intelligence to help drive data-informed decisions, it further strengthens our ability to cross-sell to our customer base and deepen the value that customers gain with Ceridian. Dayforce Wallet We now have more than 1,100 customers signed onto Dayforce Wallet with over 530 customers live on the product. The attach rate remains very strong

for Dayforce Wallet at more than 80% of new sales. We continue to see solid evidence that the Dayforce Card is top of wallet: Average registration rates increased to 36% of all eligible employees. The Dayforce Card continues to be used approximately 23 times per month by individual users on spending for groceries, convenience stores, fast food, restaurants, gas, and ATM withdrawals. In the first quarter, we announced Dayforce Wallet Rewards, a new cash back rewards program that automatically give users cash back when they shop at thousands of local and national retail stores across the U.S. using their Dayforce Card. In addition, we delivered product enhancements including faster direct deposit into the Wallet application and ability for younger workers aged 14-17 years old to use to the Dayforce Wallet, with parental consent. Dayforce Wallet showcases what modern pay should look like. We are enabling more ways for workers to get paid and take full control of their financial wellbeing, while providing employers a critical acquisition and retention tool in the new world of work. Summary Our first quarter performance was a great start to our fiscal year. We remain focused on driving strong execution, investing in our business, and generating operating momentum to deliver long-term, durable growth. As we continue to execute in 2022, our vision to be the always-on people platform for the global workforce, coupled with our customer focus, scale, and geographic reach give us great confidence to accelerate our leadership position in the HCM market. We will continue to invest in the Dayforce platform, our people, and our partner ecosystem to strengthen the quantifiable value our customers have come to expect from us and to deliver value to you, our fellow stockholders.

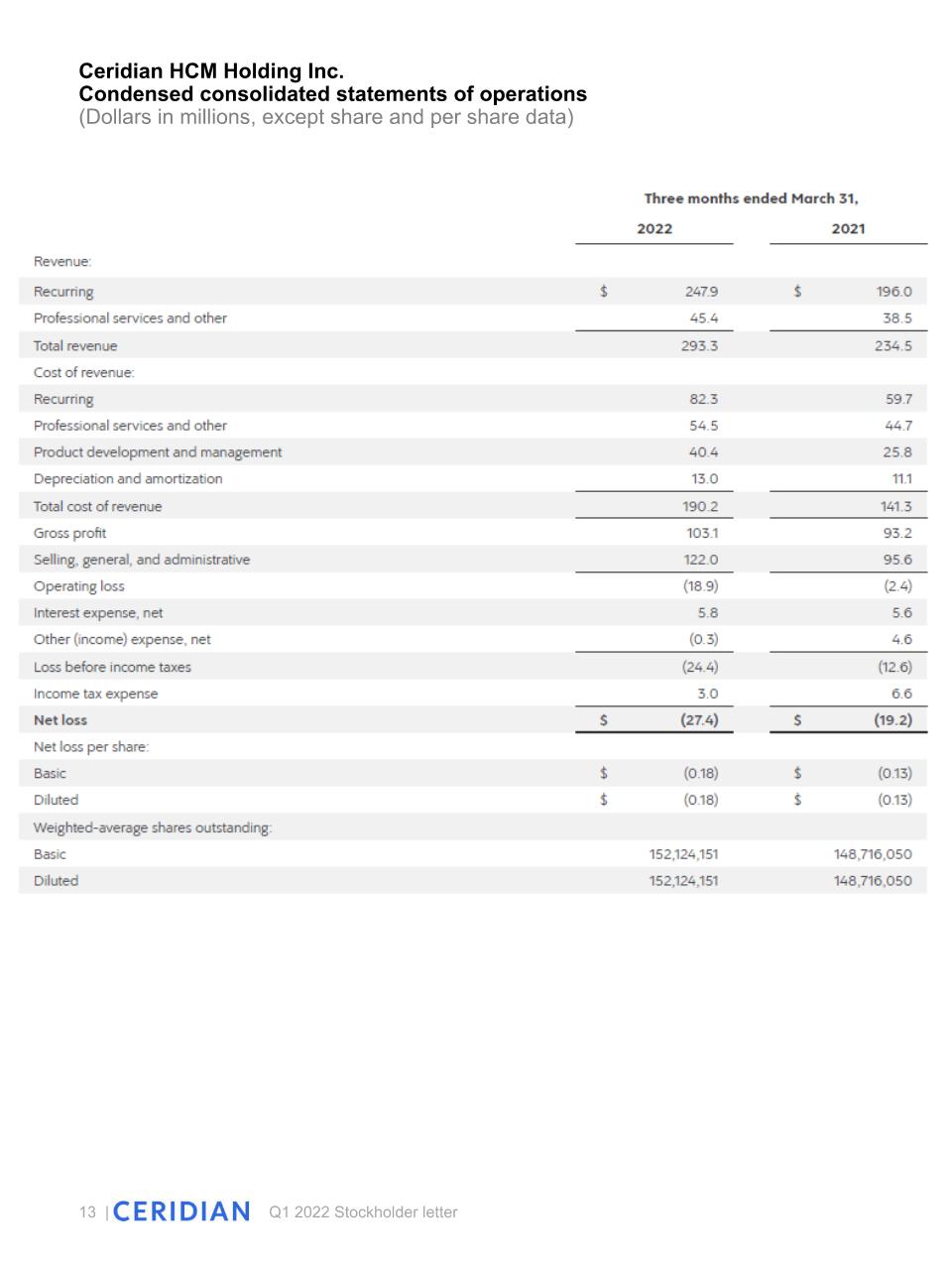

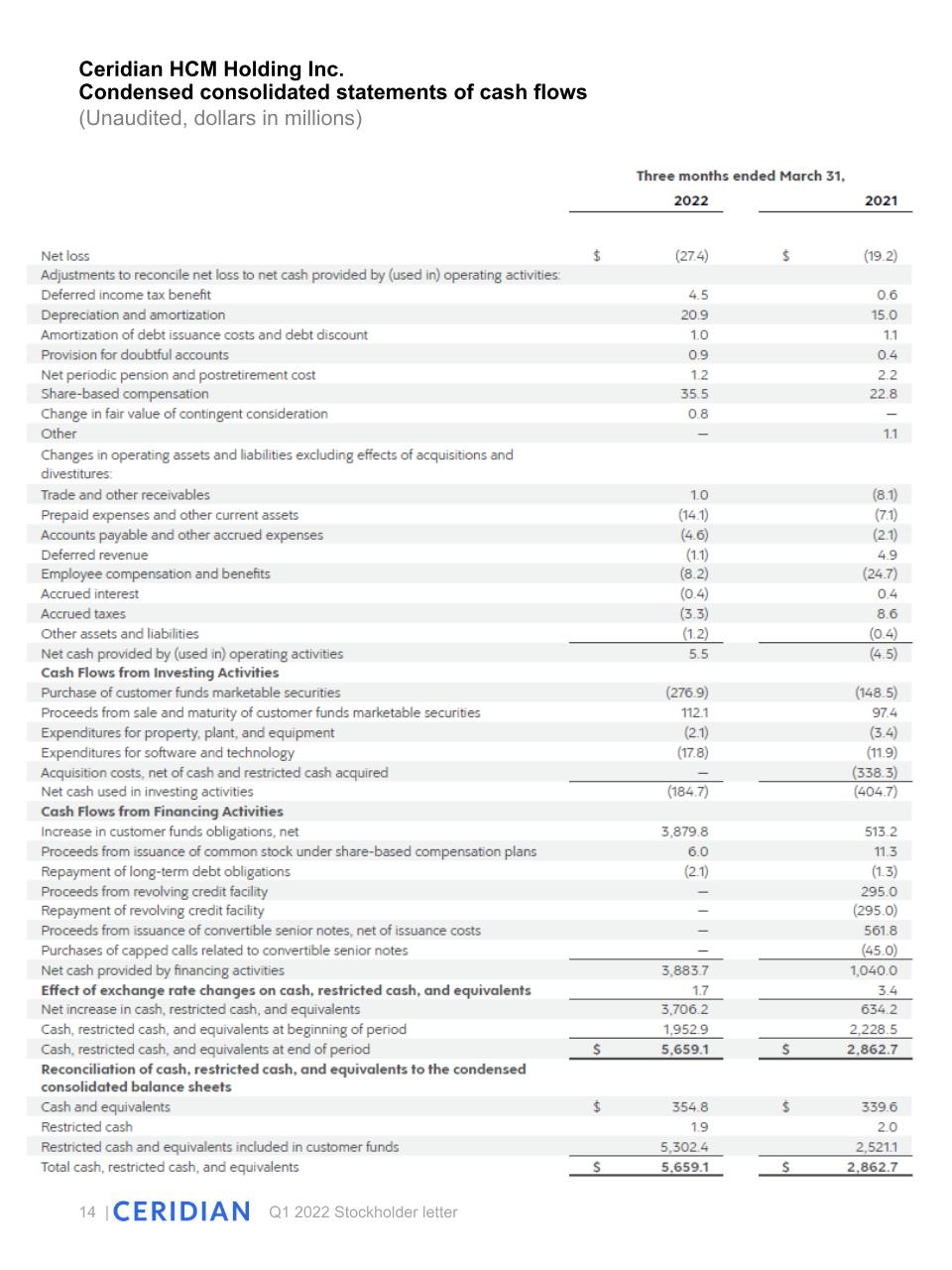

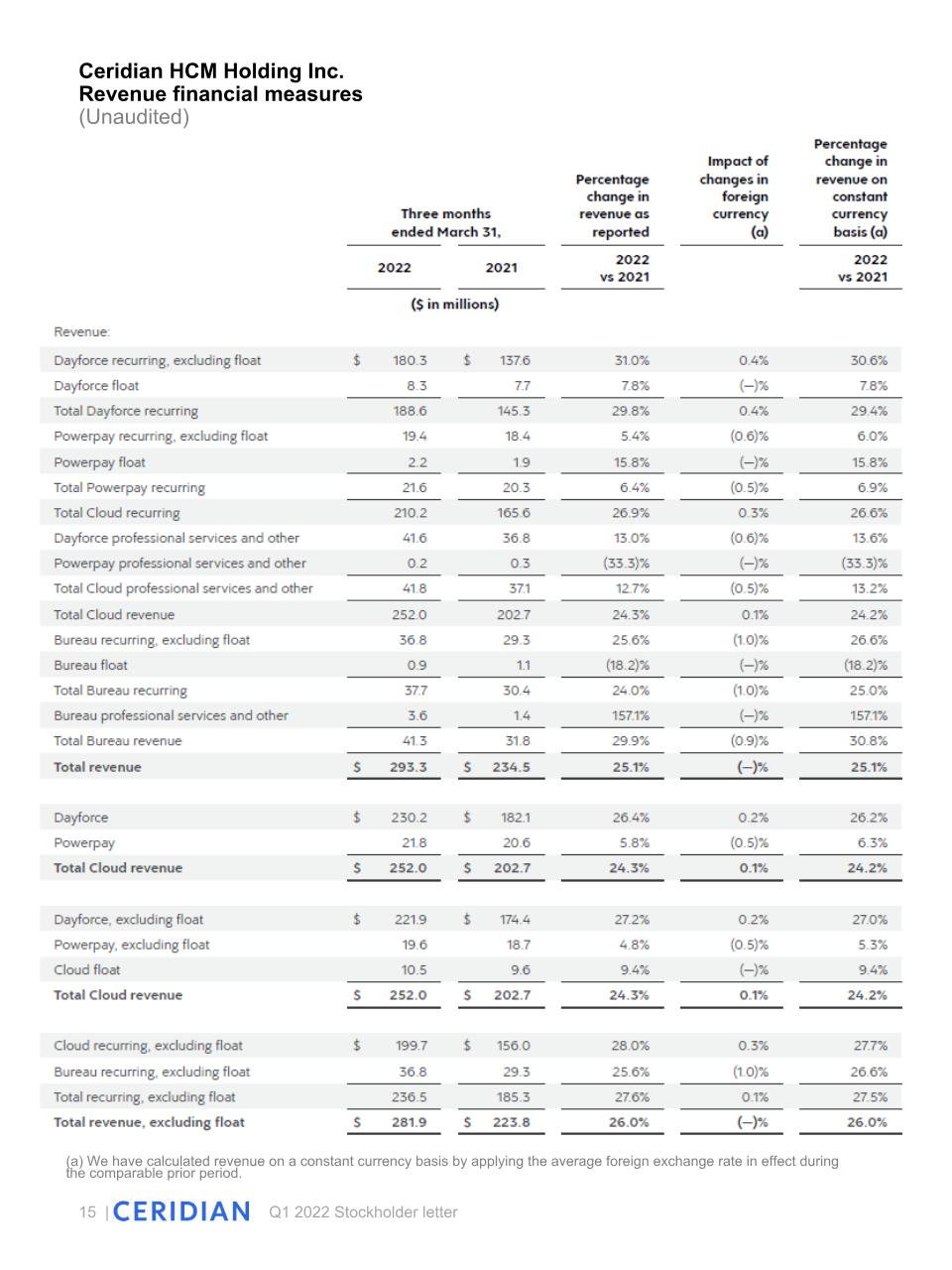

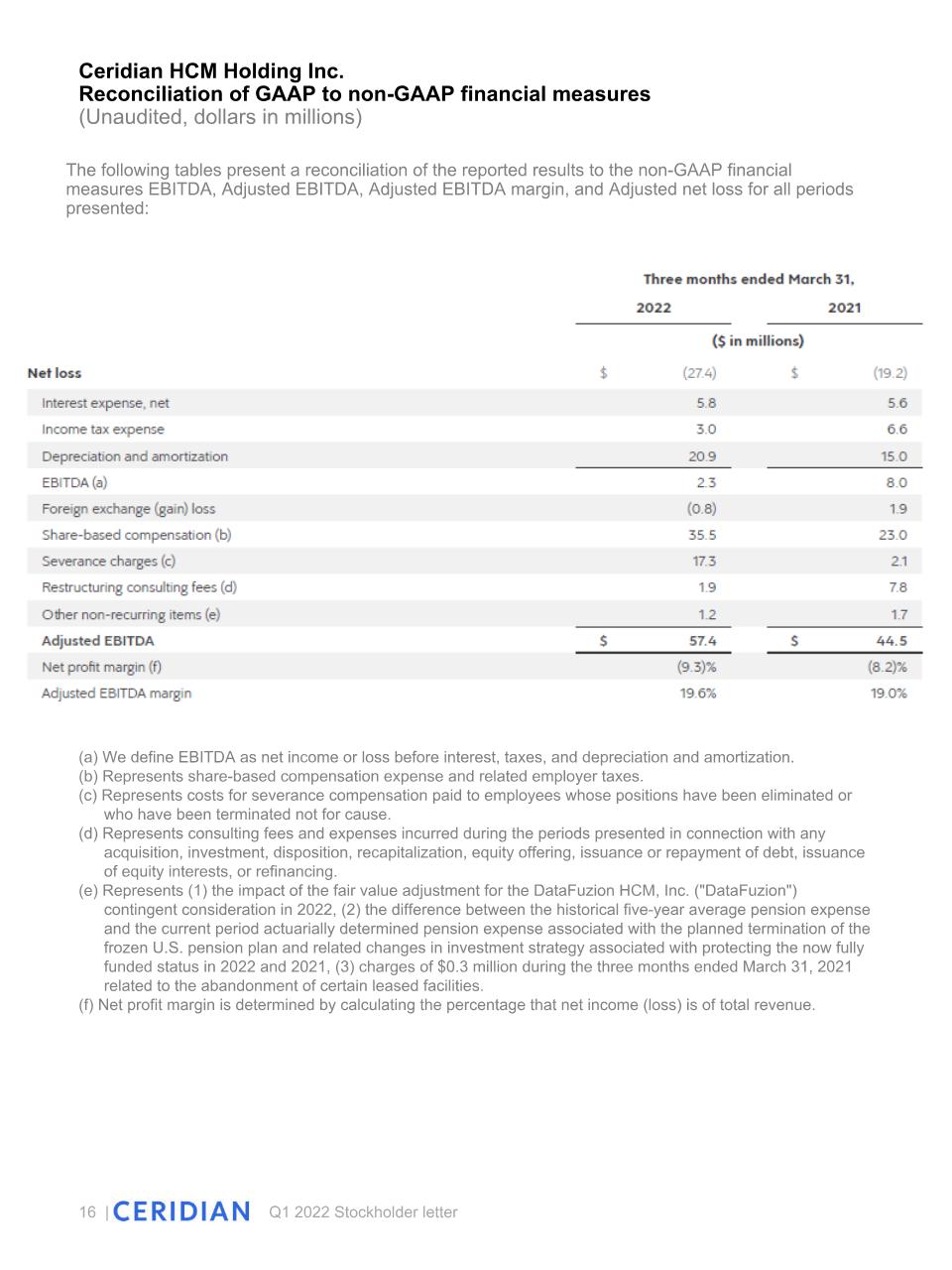

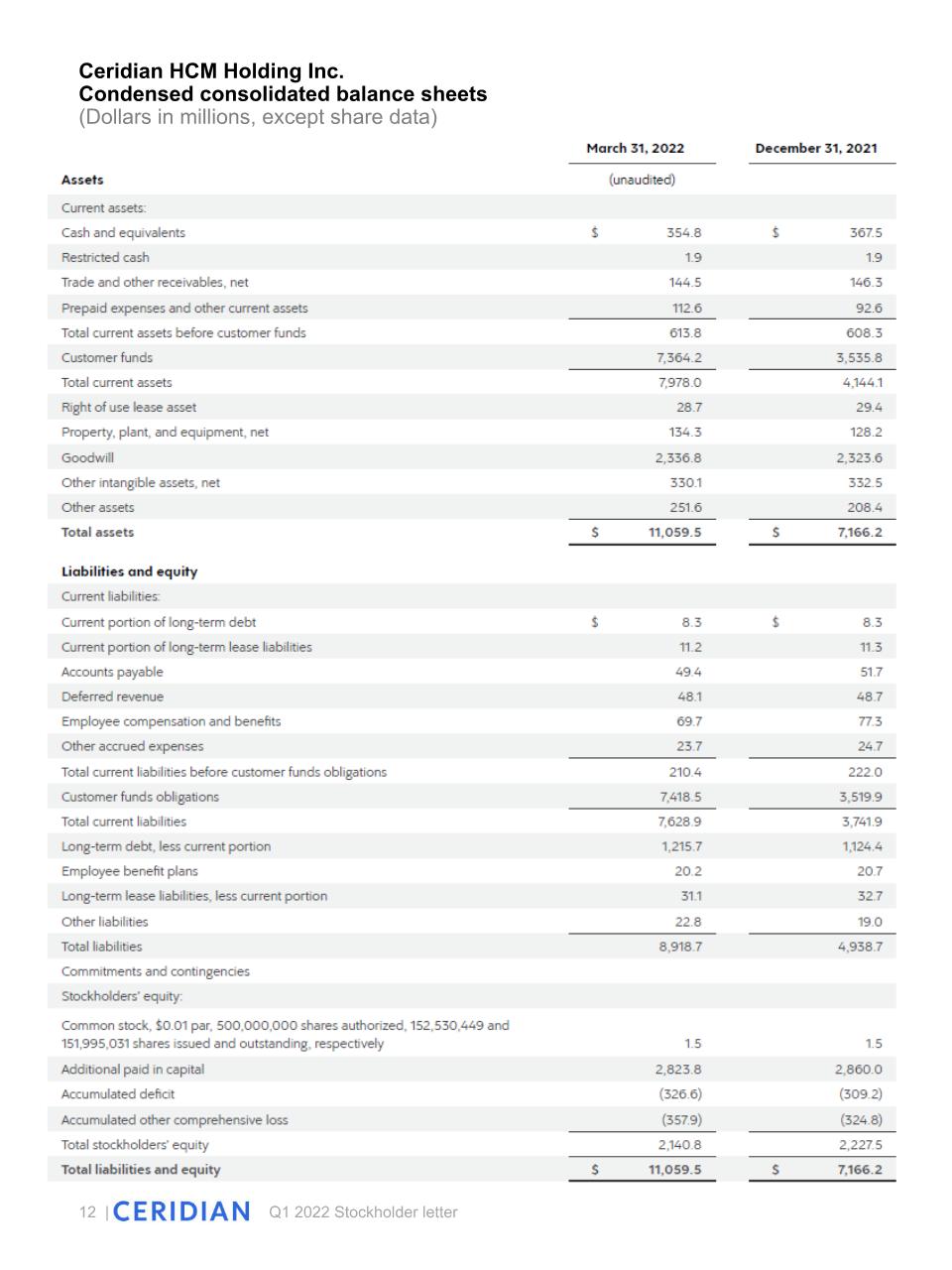

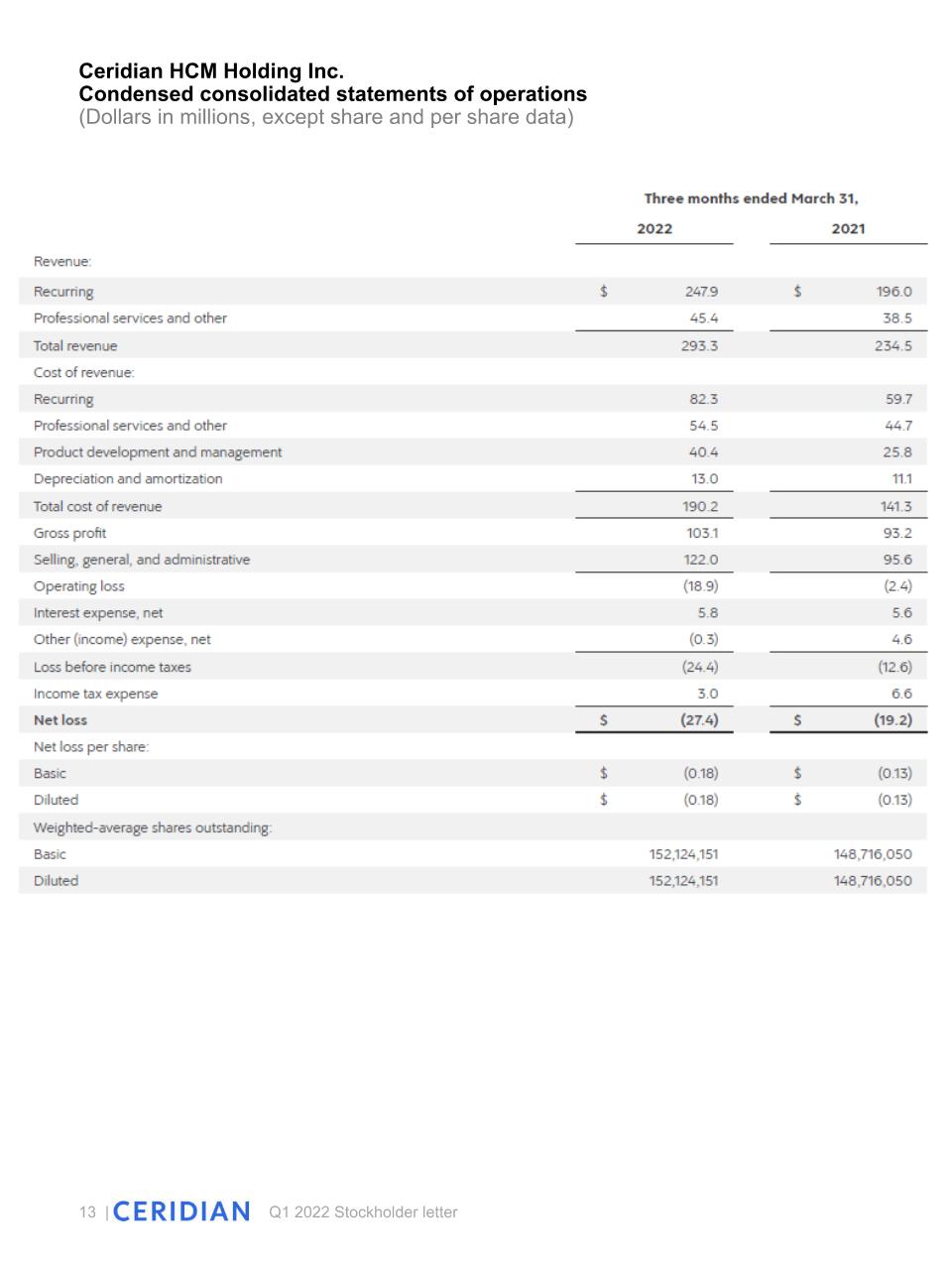

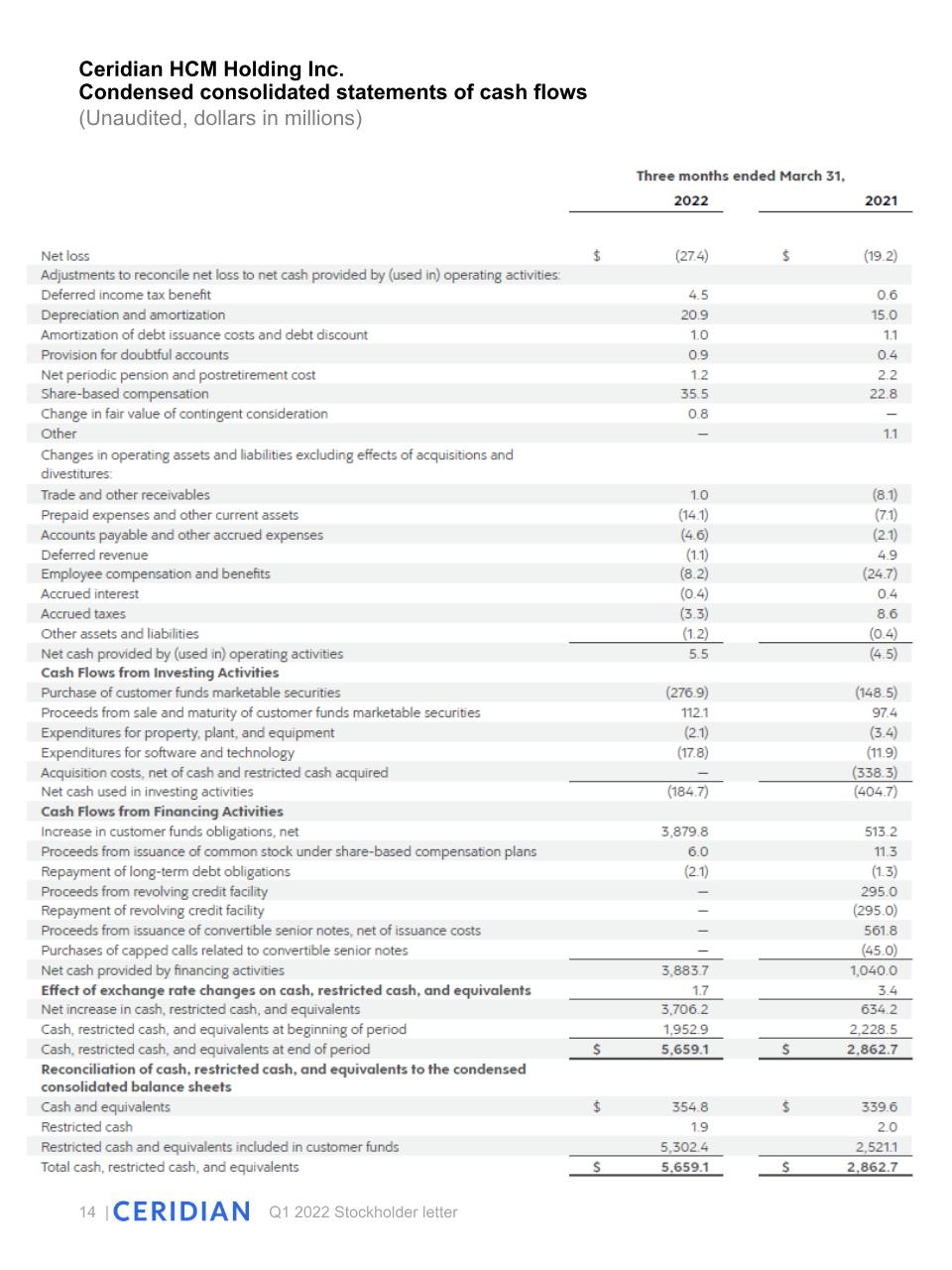

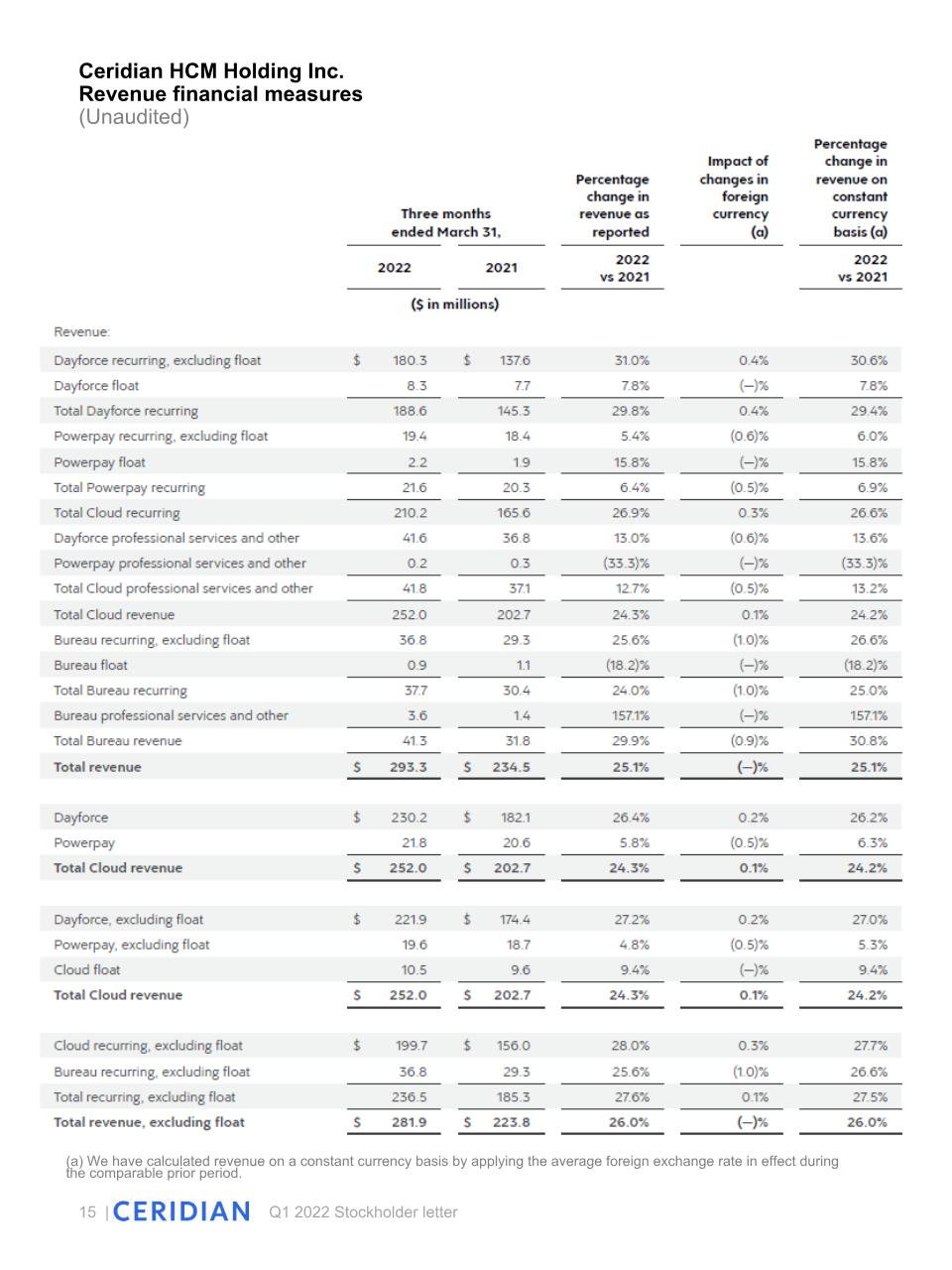

Noémie Heuland EVP and Chief Financial Officer The quarterly and annual financial highlights and business outlook below are on a year-over-year basis and reported in U.S. dollars, unless otherwise stated. Revenue Our revenue performance in the first quarter of 2022 was strong: Dayforce recurring revenue increased by $43.3 million, or 30%, to $188.6 million. Excluding float revenue, Dayforce recurring revenue increased by 31% on a GAAP and constant currency basis. Dayforce revenue increased by $48.1 million, or 26%, to $230.2 million. Excluding float revenue, Dayforce revenue increased by 27% on a GAAP and constant currency basis. Cloud revenue, which includes both Dayforce and Powerpay, increased by $49.3 million, or 24%, to $252 million. Excluding float revenue, Cloud revenue increased by 25% on a GAAP and constant currency basis. Total revenue increased by $58.8 million, or 25%, to $293.3 million. Excluding float revenue, total revenue increased by 26% on a GAAP and constant currency basis. We completed the acquisition of Ascender and ADAM HCM as of March 1, 2021 and December 3, 2021 respectively. As such, the incremental revenue contribution from these acquisitions in the first quarter of 2022 reflects two months of Ascender ownership and a full quarter of ADAM HCM ownership, and amounts to: $5.1 million in Dayforce recurring revenue, $0.3 million in Dayforce professional services revenue and $9.6 million in Bureau revenue. The average float balance for our customer funds during the first quarter increased 17.5% to $5,089 million. The average yield on our float balance was 0.91% during the first quarter, a decline of 11 basis points year over year. As a result, float revenue from invested customer funds was $11.4 million in the first quarter. The allocation of first quarter 2022 float revenue to Dayforce and Cloud revenue was $8.3 million and $10.5 million, respectively. Profitability In the first quarter of 2022, Cloud recurring gross margin was 69.3%, compared to 72.2%. On an adjusted basis, Cloud recurring gross margin was 75.5%, compared to 73.3%, an expansion of 220 basis points. Net loss in the first quarter of 2022 was ($27.4) million, or ($0.18) per diluted share, compared to ($19.2) million, or ($0.13) per diluted share. Adjusted net income in the first quarter of 2022 was $20.5 million, or $0.13 per diluted share, compared to $15.7 million, or $0.10 per diluted share. Adjusted EBITDA was $57.4 million in the first quarter of 2022 compared to $44.5 million in the first quarter of 2021. Adjusted EBITDA margin was 19.6% of total revenue in the first quarter of 2022 compared to 19.0% of total revenue in the first quarter of 2021. Balance sheet and liquidity As of March 31, 2022, we had cash and equivalents of $354.8 million, and our total debt balance was $1,240.5 million.

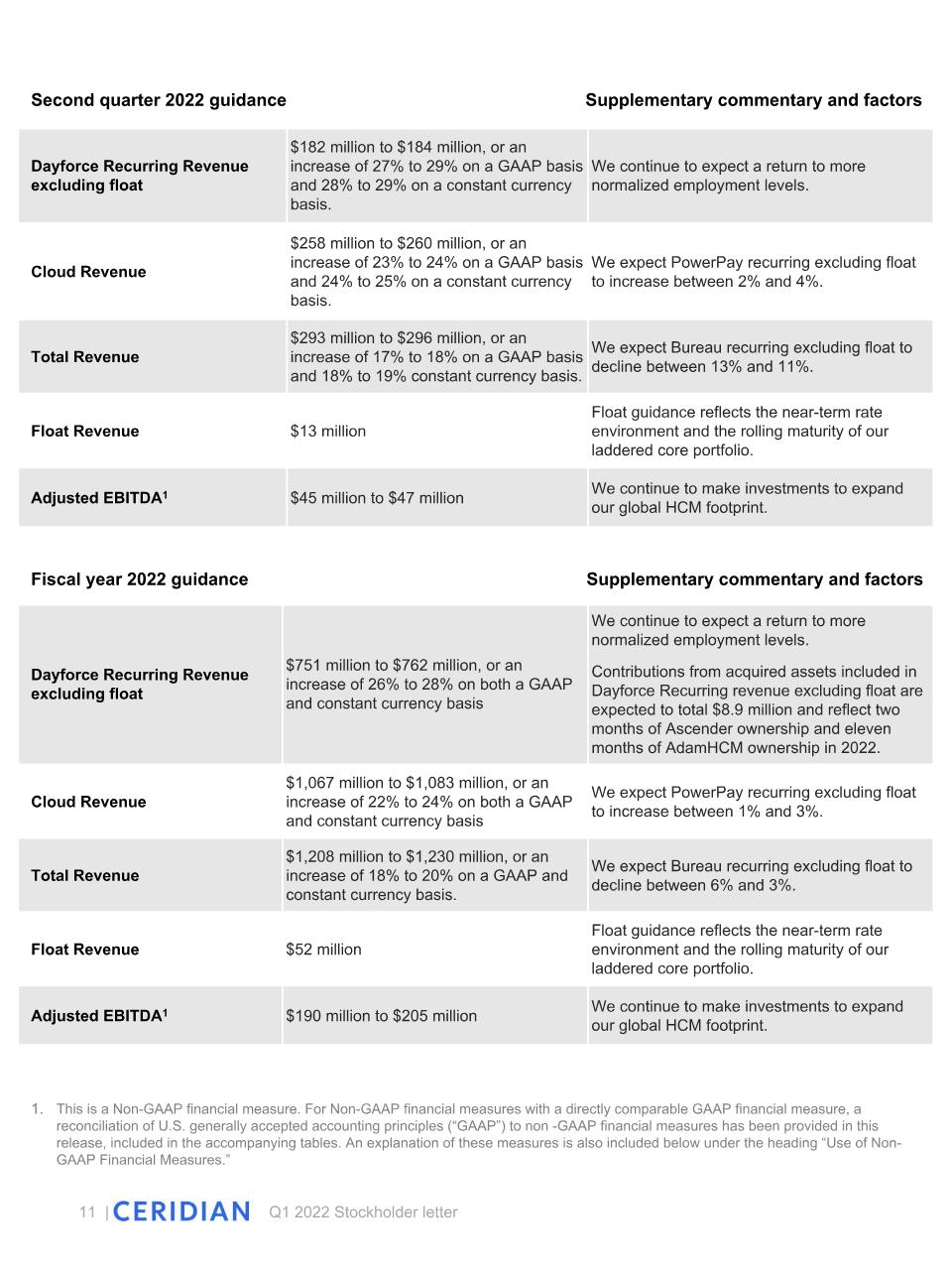

Business outlook Based on information available as of May 4, 2022, Ceridian is issuing guidance for the second quarter of 2022 and updating full year 2022 outlook as indicated below. Comparisons are on a year-over-year basis, unless stated otherwise. Second quarter 2022 guidance Dayforce recurring revenue, excluding float revenue, of $182 million to $184 million, or an increase of 27% to 29% on a GAAP basis and 28% to 29% on a constant currency basis. Cloud revenue of $258 million to $260 million, or an increase of 23% to 24% on a GAAP basis and 24% to 25% on a constant currency basis. Total revenue of $293 million to $296 million, or an increase of 17% to 18% on a GAAP basis and 18% to 19% on a constant currency basis. Float revenue of $13 million, an increase of 25% on a GAAP and constant currency basis. Adjusted EBITDA of $45 million to $47 million. Full year 2022 guidance Dayforce recurring revenue, excluding float revenue of $751 million to $762 million, or an increase of 26% to 28% on both a GAAP basis and a constant currency basis. Cloud revenue of $1,067 million to $1,083 million, or an increase of 22% to 24% on both a GAAP basis and a constant currency basis compared to previously issued guidance of $1,054 million to $1,075 million. Total revenue of $1,208 million to $1,230 million, or an increase of 18% to 20% on a GAAP basis and constant currency basis compared to previously issued guidance of $1,192 million to $1,217 million. Float revenue of $52 million, an increase of 27% on a GAAP and constant currency basis. Adjusted EBITDA of $190 million to $205 million compared to previously issued guidance of $180 million to $195 million. Supplemental guidance details Our guidance continues to assume productivity gains through further integration of the Excelity and Ascender acquisitions and specifically a re-balancing of resources across our global footprint. As expected, we incurred one-time severance and restructuring costs in the first quarter of 2022 in conjunction with our re-balancing of workforce across our global footprint. These costs amounted to $11 million in the first quarter of 2022 and were accounted for in cost of recurring revenue. We continue to expect an additional $14 million of costs associated with this re-balancing of the workforce. These remaining costs are expected to be incurred primarily in the second and third quarters, with the balance recognized in the fourth quarter of 2022. Excluding these one-time costs, we expect cloud recurring gross margin to continue to improve throughout 2022. The update to our float guidance reflects the near-term rate environment and the rolling maturity of our laddered core portfolio. We have not reconciled the Adjusted EBITDA range for the full year or second quarter of 2022 to the directly comparable GAAP financial measure because applicable information for the future period, on which this reconciliation would be based, is not readily available due to uncertainty regarding, and the potential variability of, depreciation and amortization, share-based compensation expense and related employer taxes, changes in foreign currency exchange rates, and other items. Foreign exchange impacts For the full year and second quarter of 2022, our guidance assumes an average U.S. dollar to Canadian dollar foreign exchange rate of $1.25, compared to an average rate of $1.25 for the full year of 2021.

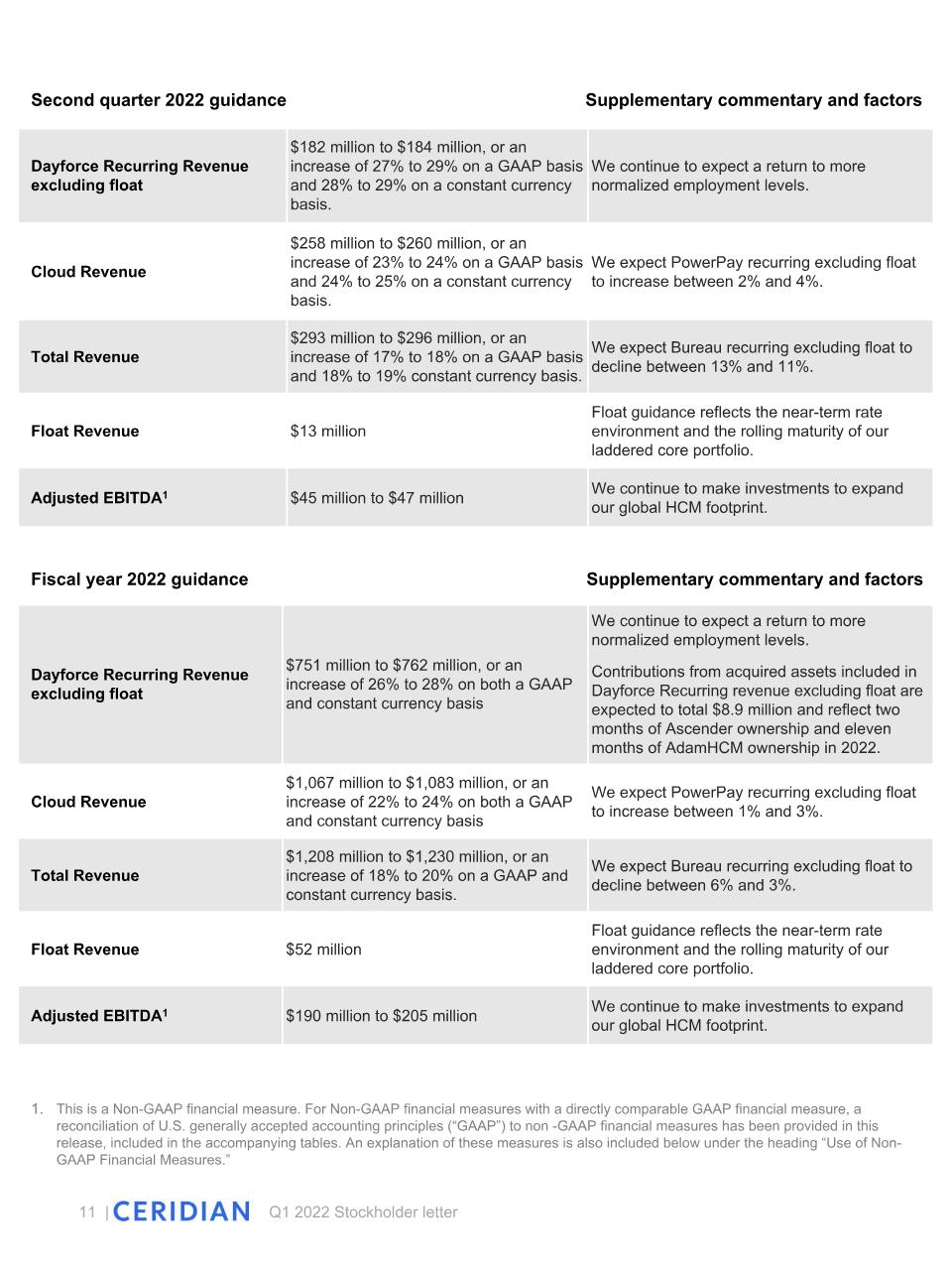

Second quarter 2022 guidance Supplementary commentary and factors Dayforce Recurring Revenue excluding float $182 million to $184 million, or an increase of 27% to 29% on a GAAP basis and 28% to 29% on a constant currency basis. We continue to expect a return to more normalized employment levels. Cloud Revenue $258 million to $260 million, or an increase of 23% to 24% on a GAAP basis and 24% to 25% on a constant currency basis. We expect PowerPay recurring excluding float to increase between 2% and 4%. Total Revenue $293 million to $296 million, or an increase of 17% to 18% on a GAAP basis and 18% to 19% constant currency basis. We expect Bureau recurring excluding float to decline between 13% and 11%. Float Revenue $13 million Float guidance reflects the near-term rate environment and the rolling maturity of our laddered core portfolio. Adjusted EBITDA1 $45 million to $47 million We continue to make investments to expand our global HCM footprint. Fiscal year 2022 guidance Supplementary commentary and factors Dayforce Recurring Revenue excluding float $751 million to $762 million, or an increase of 26% to 28% on both a GAAP and constant currency basis We continue to expect a return to more normalized employment levels. Contributions from acquired assets included in Dayforce Recurring revenue excluding float are expected to total $8.9 million and reflect two months of Ascender ownership and eleven months of AdamHCM ownership in 2022. Cloud Revenue $1,067 million to $1,083 million, or an increase of 22% to 24% on both a GAAP and constant currency basis We expect PowerPay recurring excluding float to increase between 1% and 3%. Total Revenue $1,208 million to $1,230 million, or an increase of 18% to 20% on a GAAP and constant currency basis. We expect Bureau recurring excluding float to decline between 6% and 3%. Float Revenue $52 million Float guidance reflects the near-term rate environment and the rolling maturity of our laddered core portfolio. Adjusted EBITDA1 $190 million to $205 million We continue to make investments to expand our global HCM footprint. 11 | Q1 2022 Stockholder letter This is a Non-GAAP financial measure. For Non-GAAP financial measures with a directly comparable GAAP financial measure, a reconciliation of U.S. generally accepted accounting principles (“GAAP”) to non -GAAP financial measures has been provided in this release, included in the accompanying tables. An explanation of these measures is also included below under the heading “Use of Non-GAAP Financial Measures.”

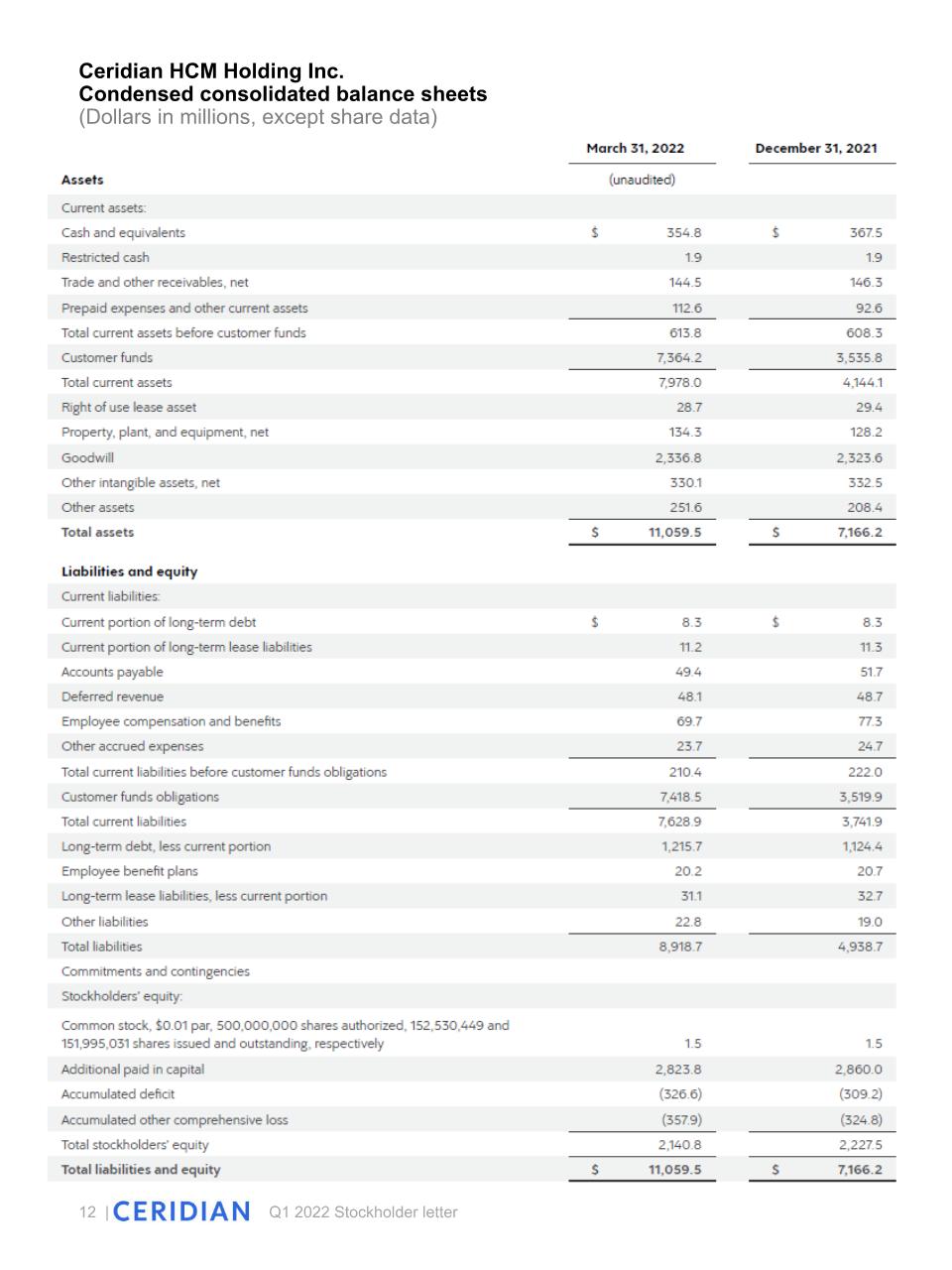

Ceridian HCM Holding Inc.�Condensed consolidated balance sheets�(Dollars in millions, except share data)

Ceridian HCM Holding Inc.�Condensed consolidated statements of operations�(Dollars in millions, except share and per share data)

Ceridian HCM Holding Inc.�Condensed consolidated statements of cash flows�(Unaudited, dollars in millions)

(a) We have calculated revenue on a constant currency basis by applying the average foreign exchange rate in effect during the comparable prior period. Ceridian HCM Holding Inc.�Revenue financial measures�(Unaudited)

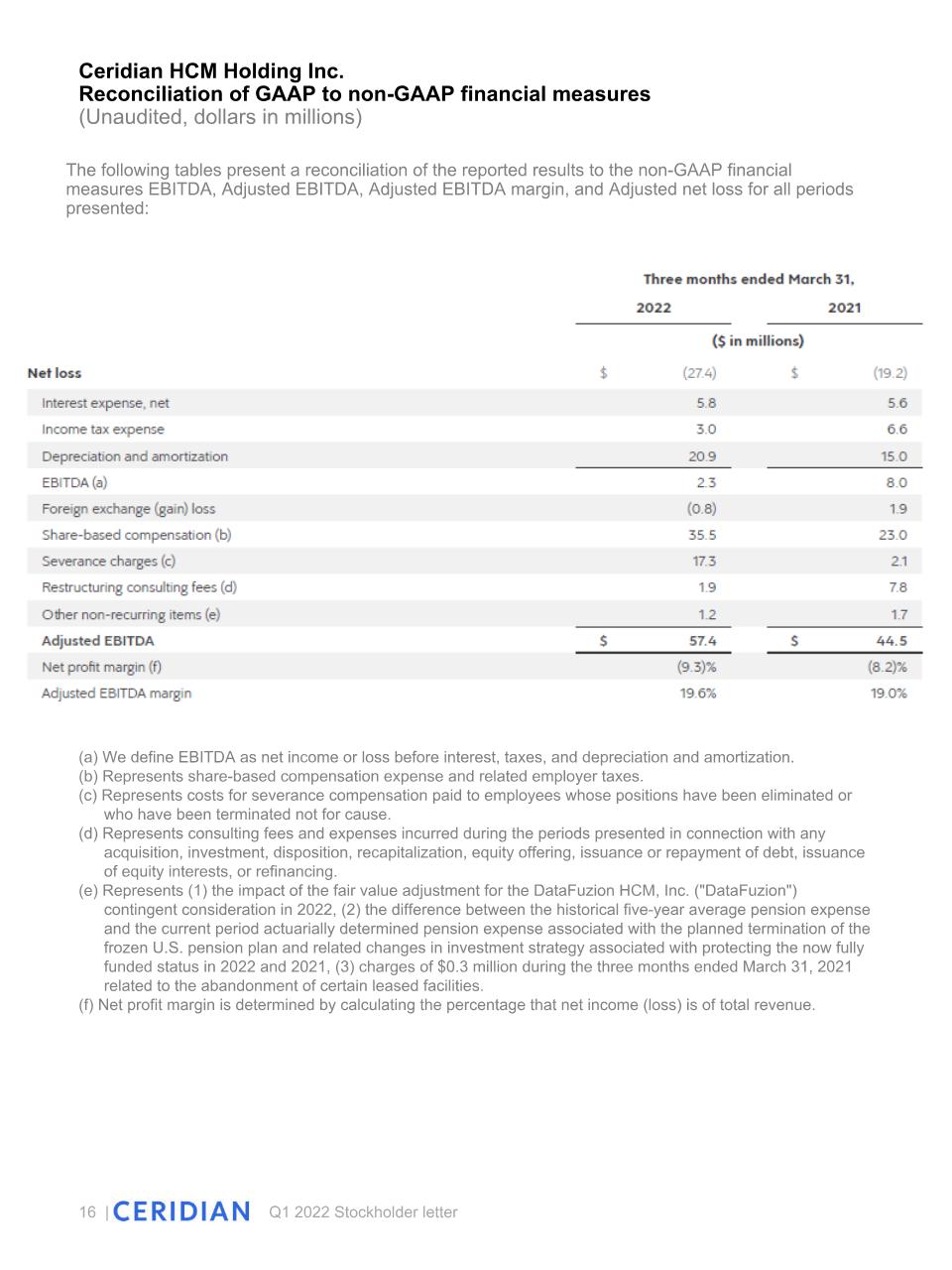

Ceridian HCM Holding Inc.�Reconciliation of GAAP to non-GAAP financial measures�(Unaudited, dollars in millions) (a) We define EBITDA as net income or loss before interest, taxes, and depreciation and amortization. (b) Represents share-based compensation expense and related employer taxes. (c) Represents costs for severance compensation paid to employees whose positions have been eliminated or who have been terminated not for cause. (d) Represents consulting fees and expenses incurred during the periods presented in connection with any acquisition, investment, disposition, recapitalization, equity offering, issuance or repayment of debt, issuance of equity interests, or refinancing. (e) Represents (1) the impact of the fair value adjustment for the DataFuzion HCM, Inc. ("DataFuzion") contingent consideration in 2022, (2) the difference between the historical five-year average pension expense and the current period actuarially determined pension expense associated with the planned termination of the frozen U.S. pension plan and related changes in investment strategy associated with protecting the now fully funded status in 2022 and 2021, (3) charges of $0.3 million during the three months ended March 31, 2021 related to the abandonment of certain leased facilities. (f) Net profit margin is determined by calculating the percentage that net income (loss) is of total revenue. The following tables present a reconciliation of the reported results to the non-GAAP financial measures EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, and Adjusted net loss for all periods presented:

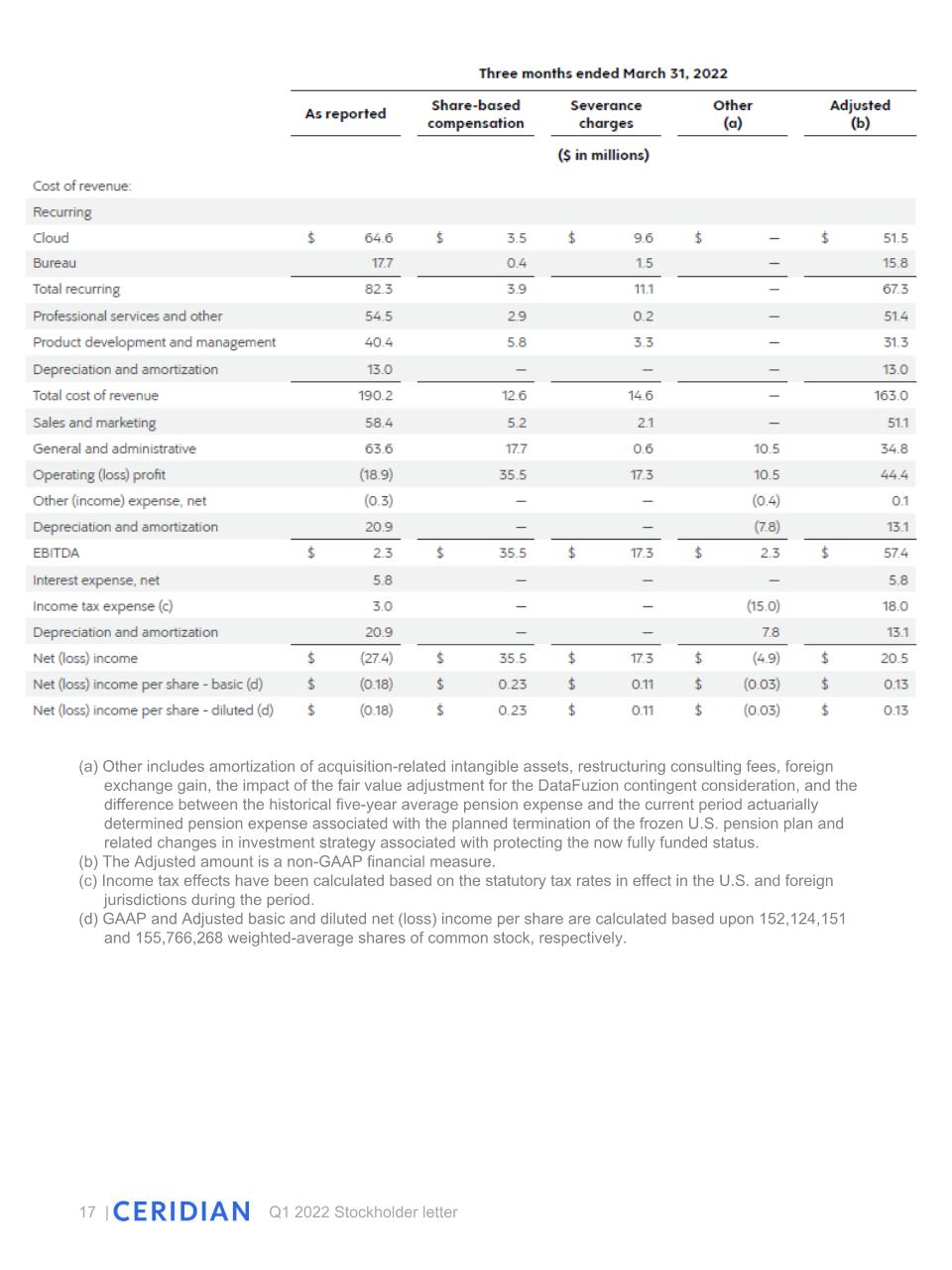

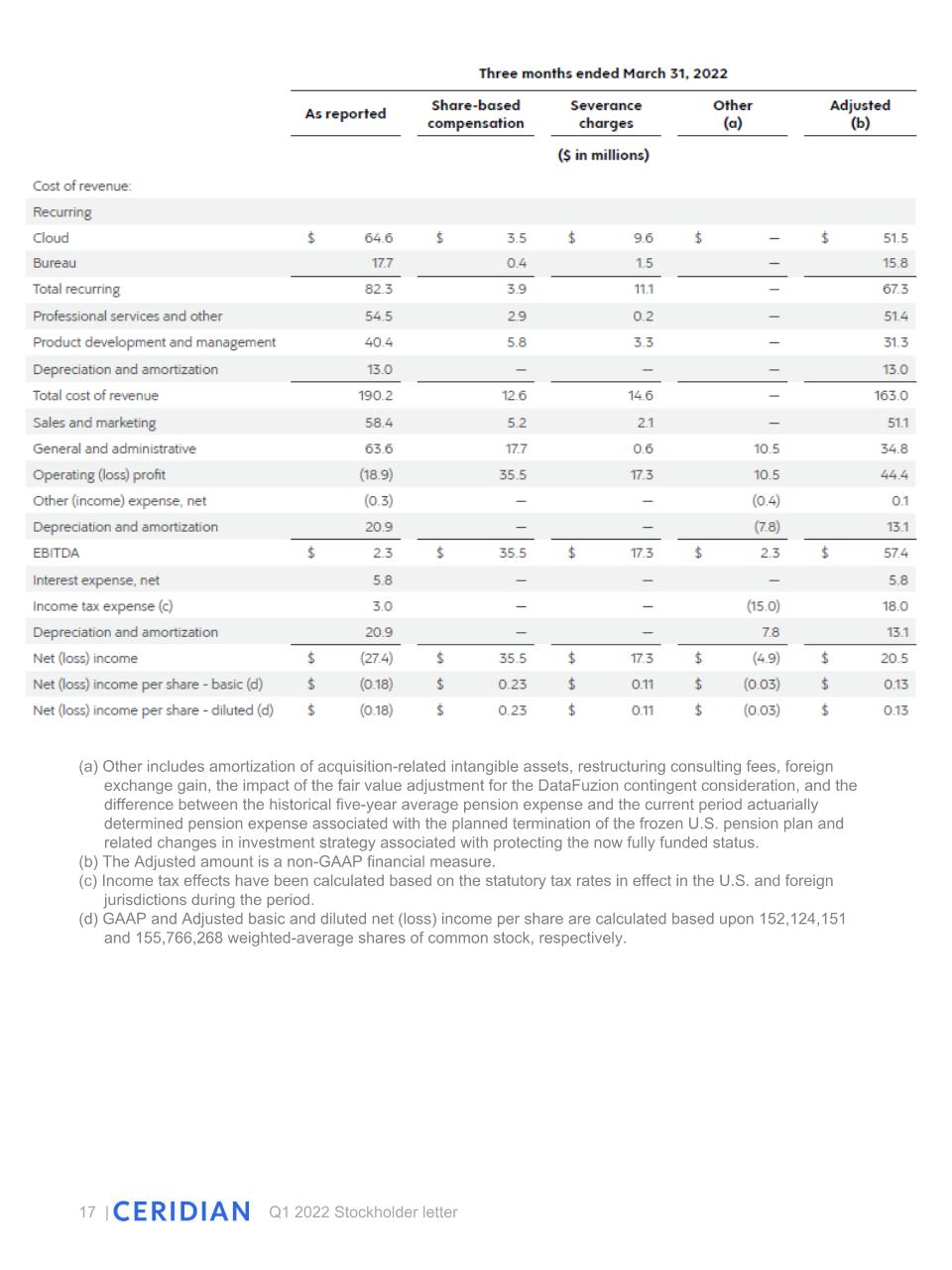

(a) Other includes amortization of acquisition-related intangible assets, restructuring consulting fees, foreign exchange gain, the impact of the fair value adjustment for the DataFuzion contingent consideration, and the difference between the historical five-year average pension expense and the current period actuarially determined pension expense associated with the planned termination of the frozen U.S. pension plan and related changes in investment strategy associated with protecting the now fully funded status. (b) The Adjusted amount is a non-GAAP financial measure. (c) Income tax effects have been calculated based on the statutory tax rates in effect in the U.S. and foreign jurisdictions during the period. (d) GAAP and Adjusted basic and diluted net (loss) income per share are calculated based upon 152,124,151 and 155,766,268 weighted-average shares of common stock, respectively.

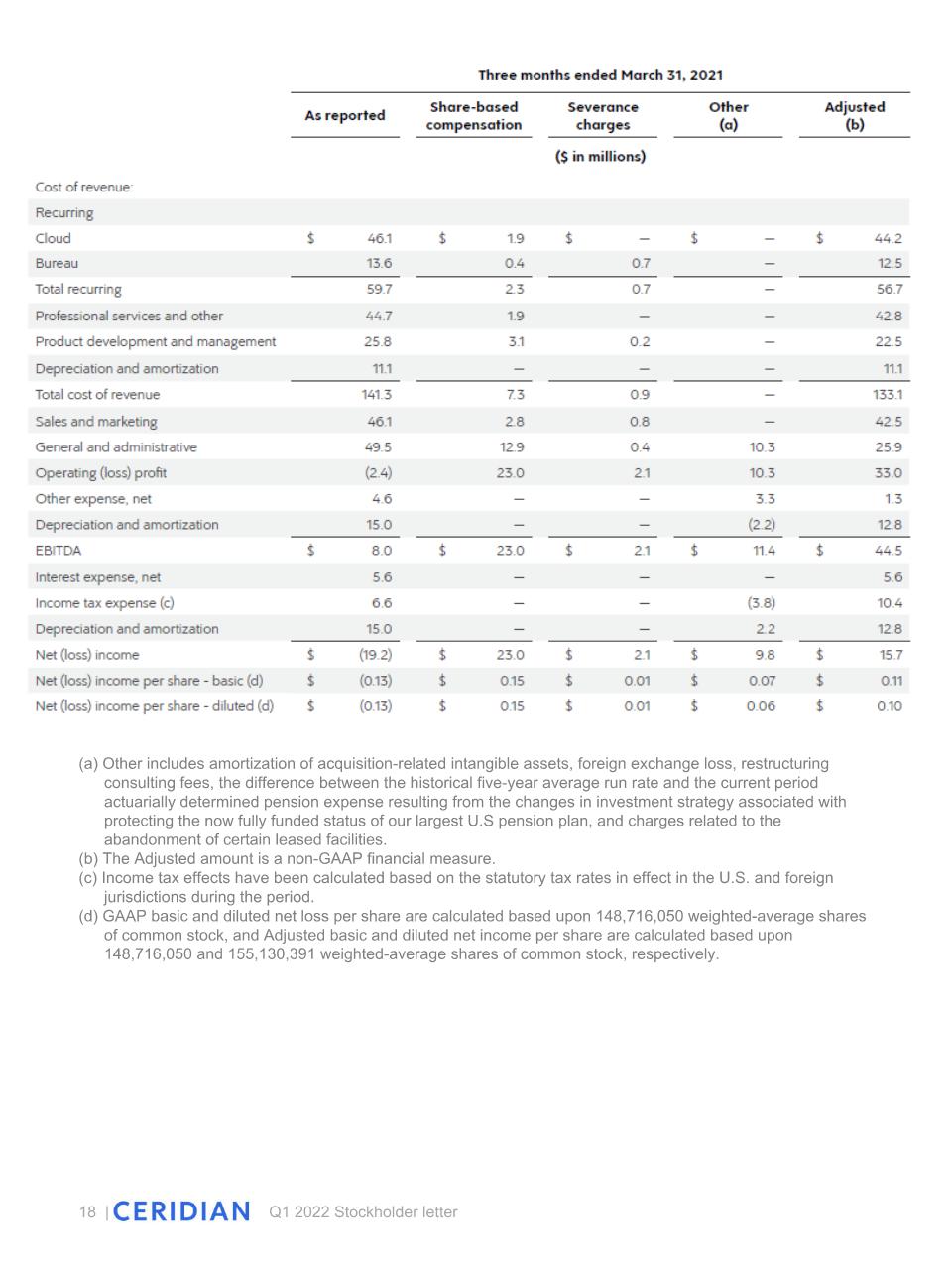

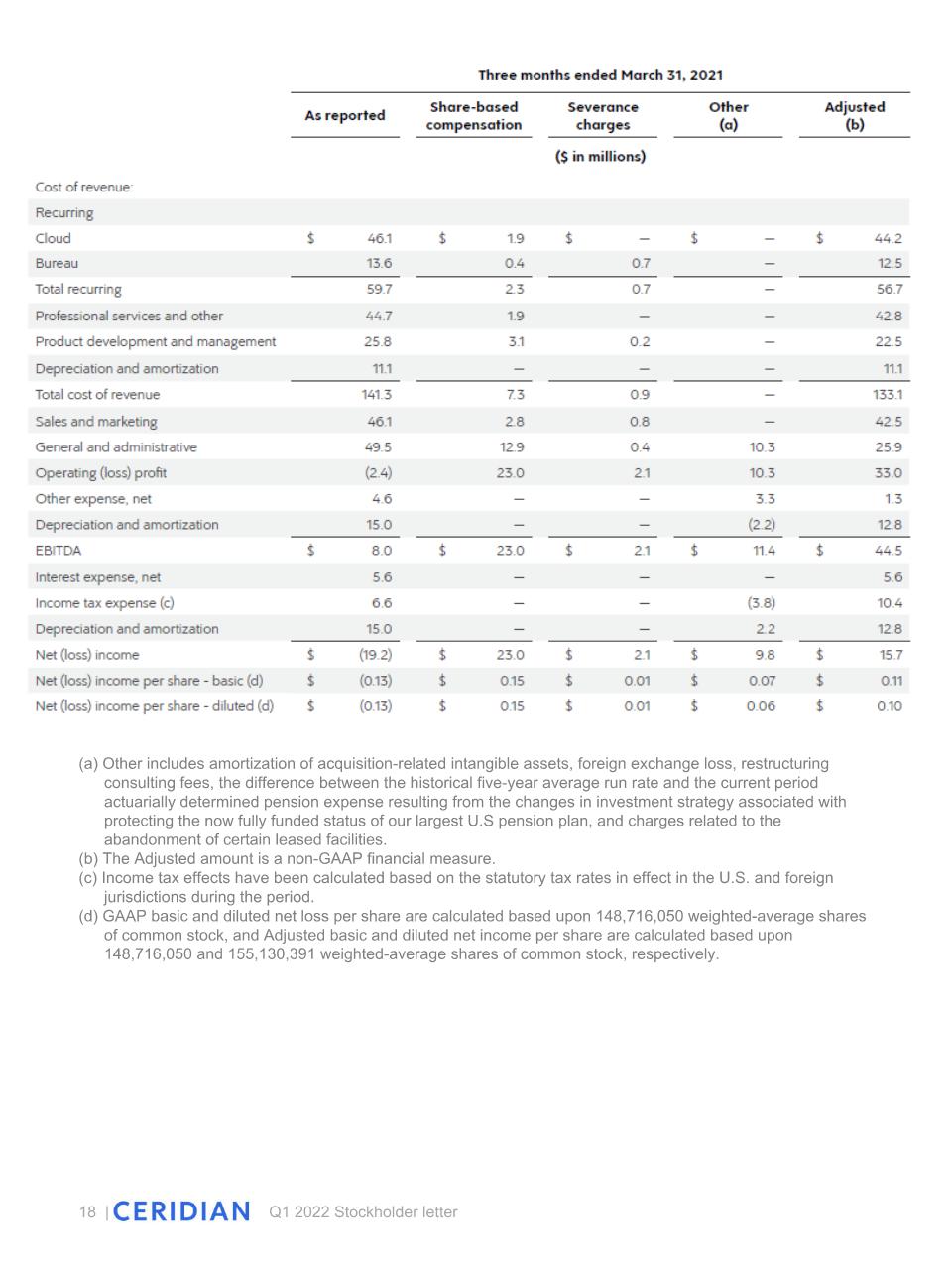

(a) Other includes amortization of acquisition-related intangible assets, foreign exchange loss, restructuring consulting fees, the difference between the historical five-year average run rate and the current period actuarially determined pension expense resulting from the changes in investment strategy associated with protecting the now fully funded status of our largest U.S pension plan, and charges related to the abandonment of certain leased facilities. (b) The Adjusted amount is a non-GAAP financial measure. (c) Income tax effects have been calculated based on the statutory tax rates in effect in the U.S. and foreign jurisdictions during the period. (d) GAAP basic and diluted net loss per share are calculated based upon 148,716,050 weighted-average shares of common stock, and Adjusted basic and diluted net income per share are calculated based upon 148,716,050 and 155,130,391 weighted-average shares of common stock, respectively.

Use of non-GAAP financial measures We use certain non-GAAP financial measures in this stockholder letter including EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted net income, Adjusted diluted net income per share, revenue on a constant currency basis, and Dayforce recurring revenue per customer. We believe that EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, and Adjusted net income, non-GAAP financial measures, are useful to management and investors as supplemental measures to evaluate our overall operating performance. Adjusted EBITDA and Adjusted EBITDA margin are components of our management incentive plan and are used by management to assess performance and to compare our operating performance to our competitors. We define EBITDA as net income (loss) before interest, taxes, depreciation, and amortization and Adjusted EBITDA as EBITDA, as adjusted to exclude foreign exchange gain (loss), share-based compensation expense and related employer taxes, severance charges, restructuring consulting fees, and other non-recurring items. Adjusted EBITDA margin is determined by calculating the percentage Adjusted EBITDA is of total revenue. Adjusted net income is defined as net income (loss), as adjusted to exclude foreign exchange gain (loss), share-based compensation expense and related employer taxes, severance charges, restructuring consulting fees, amortization of acquisition-related intangible assets, and other non-recurring items, all of which are adjusted for the effect of income taxes. Adjusted diluted net income per share is calculated by dividing adjusted net income by diluted weighted average common shares outstanding. When adjusted diluted net income per share is positive, diluted weighted average common shares outstanding incorporate the effect of dilutive equity instruments. Management believes that EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, and Adjusted net income are helpful in highlighting management performance trends because EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, and Adjusted net income exclude the results of decisions that are outside the normal course of our business operations. Our presentation of EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, and Adjusted net income are intended as supplemental measures of our performance that are not required by, or presented in accordance with, GAAP. EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, and Adjusted net income should not be considered as alternatives to net income (loss), earnings (loss) per share, or any other performance measures derived in accordance with GAAP, or as measures of operating cash flows or liquidity. Our presentation of EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, and Adjusted net income should not be construed to imply that our future results will be unaffected by similar items to those eliminated in this presentation. EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, and Adjusted net income are included in this discussion because they are key metrics used by management to assess our operating performance. EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, and Adjusted net income are not defined under GAAP, are not measures of net income (loss) or any other performance measures derived in accordance with GAAP, and are subject to important limitations. Our use of the terms EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, and Adjusted net income may not be comparable to similarly titled measures of other companies in our industry and are not measures of performance calculated in accordance with GAAP. EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, and Adjusted net income have important limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of our results as reported under GAAP. In evaluating EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, and Adjusted net income, you should be aware that in the future we may incur expenses similar to those eliminated in this presentation. We present revenue on a constant currency basis to assess how our underlying businesses performed, excluding the effect of foreign currency rate fluctuations, which we believe is useful to management and investors. We calculate revenue

on a constant currency basis by applying the average foreign exchange rate in effect during the comparable prior period. Our Dayforce recurring revenue per customer is an indicator of the average size of our Dayforce recurring customer. To calculate Dayforce recurring revenue per customer, we start with Dayforce recurring revenue, excluding Ascender and ADAM HCM, on a constant currency basis by applying the same exchange rate to all comparable periods for the trailing twelve months and exclude float revenue, the impact of lower employment levels in 2021 and 2020 due to the COVID-19 pandemic, and Ascender and ADAM HCM revenue. This amount is divided by the number of live Dayforce customers at the end of the trailing twelve month period. We calculate and monitor Dayforce recurring revenue per customer on a quarterly basis. Our Dayforce recurring revenue per customer may fluctuate as a result of a number of factors, including the number of live Dayforce customers and the number of customers purchasing the full HCM suite. We have not reconciled the Dayforce recurring revenue per customer because there is no directly comparable GAAP financial measure. Forward-looking statements This stockholder letter contains forward-looking statements that are subject to risks and uncertainties. All statements other than statements of historical fact or relating to present facts or current conditions included in this stockholder letter are forward-looking statements. Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. Forward-looking statements in this stockholder letter include statements relating to the fiscal year of 2022, as well as those relating to future growth initiatives. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “seek,” “plan,” “intend,” “believe,” “will,” “may,” “could,” “continue,” “likely,” “should,” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events but not all forward-looking statements contain these identifying words. The forward-looking statements contained in this stockholder are based on assumptions that we have made in light of our industry experience and our perceptions of historical trends, current conditions, expected future developments and other factors that we believe are appropriate under the circumstances. As you consider this stockholder letter, you should understand that these statements are not guarantees of performance or results. These assumptions and our future performance or results involve risks and uncertainties (many of which are beyond our control). These risks and uncertainties include, but are not limited to, the following: its inability to manage its growth effectively or execute on its growth strategy; its failure to provide new or enhanced functionality and features;

its inability to successfully compete in the market in which we operate and expand its current offerings into new markets or further penetrate existing markets due to competition; its inability to offer and deliver high-quality technical support, implementation and professional services; system breaches, interruptions or failures, including cyber-security breaches, identity theft, or other disruptions that could compromise customer information or sensitive company information; its failure to comply with applicable privacy, security, data, and financial services laws, regulations and standards, including its ongoing consent order with the Federal Trade Commission regarding data protection; its failure to properly update its solutions to enable its customers to comply with applicable laws; its failure to manage its aging technical operations infrastructure; its inability to maintain necessary third-party relationships, and third party software licenses, and identify errors in the software it licenses; its inability to attract and retain senior management employees and highly skilled employees; the impact of its outstanding debt obligations on its financial condition, results of operations, and value of its common stock; or the duration and scope of the COVID-19 pandemic, including the uncertainty around the surge of different variants and the actions that governmental authorities may take in all the jurisdictions where we operate. Additional factors or events that could cause our actual performance to differ from these forward-looking statements may emerge from time to time, and it is not possible for us to predict all of them. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, our actual financial condition, results of operations, future performance and business may vary in material respects from the performance projected in these forward-looking statements. In addition to any factors and assumptions set forth above in this stockholder letter, the material factors and assumptions used to develop the forward-looking information include, but are not limited to: the general economy remains stable; the competitive environment in the HCM market remains stable; the demand environment for HCM solutions remains stable; our implementation capabilities and cycle times remain stable; foreign exchange rates, both current and those used in developing forward-looking statements, specifically USD to CAD, remain stable at, or near, current rates; we will be able to maintain our relationships with our employees, customers and partners; we will continue to attract qualified personnel to support our development requirements and the support of our new and existing customers; and that the risk factors noted above, individually or collectively, do not have a material impact on the company. Any forward-looking statement made by us in this stockholder letter speaks only as of the date on which it is made. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

Ceridian is a global human capital management software company. Dayforce, our flagship cloud HCM platform, provides human resources, payroll, benefits, workforce management, and talent management functionality. Our platform is used to optimize management of the entire employee lifecycle, including attracting, engaging, paying, deploying, and developing people. Ceridian has solutions for organizations of all sizes. www.ceridian.com © 2022 Ceridian HCM, Inc. All Rights Reserved. 20220504 AC/C