| Item 1.01. | Entry into a Material Definitive Agreement. |

On February 1, 2022, Grayscale Investments, LLC, the sponsor (the “Sponsor”) of Grayscale Ethereum Trust (ETH) (the “Trust”), and CoinDesk Indices, Inc., formerly known as TradeBlock Inc. (the “Index Provider”), entered into an Index License Agreement (the “Index License Agreement“) governing the Sponsor’s use of the CoinDesk Ether Price Index (ETX) (the “Index”) to calculate the Index Price (as defined below), among other things.

The foregoing description is a summary, does not purport to be a complete description of the Index License Agreement, and is qualified in its entirety by reference to the Index License Agreement, which is filed as Exhibit 10.1 hereto and is incorporated by reference herein.

| Item 1.02. | Termination of a Material Definitive Agreement. |

On January 31, 2022, in connection with the entry into the Index License Agreement, the Sponsor and the Index Provider agreed to terminate that certain Index License Agreement, dated February 28, 2019, between the Sponsor and the Index Provider, that governed the Sponsor’s use of the Index to calculate the Old Index Price (as defined below).

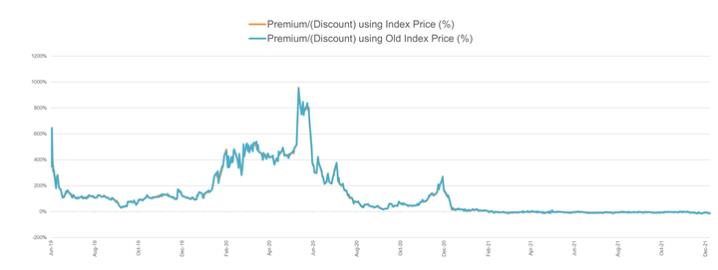

Grayscale Ethereum Trust (ETH) (the “Trust”) has historically valued its Ethereum (“ETH”) for operational purposes by reference to a volume-weighted average index price (the “Old Index Price”) of an ETH in U.S. dollars calculated by applying a weighting algorithm to the price and trading volume data for the immediately preceding 24-hour period as of 4:00 p.m., New York time derived from the selected digital asset exchanges that are reflected in the Index on such trade date. The methodology used exclusively by Grayscale and calculated by the Index Provider to calculate the Old Index Price overlaid an additional averaging mechanism to the price produced, resulting in the Old Index Price reflecting an average price for the 24-hour period. The Old Index Price was provided to the Sponsor once per day at 4:00 p.m., New York time.

Effective February 1, 2022, the Trust will value its ETH for operational purposes by reference to the index price (the “Index Price”) of a ETH in U.S. dollars calculated by applying the same methodology to the price and trading volume data for the immediately preceding 24-hour period as of 4:00 p.m., New York time derived from the selected digital asset exchanges that are reflected in the Index on such trade date without the additional averaging mechanism being applied to the Index Price. The methodology used to calculate the Index Price is consistent with the publicly available ETH price that is published by the Index Provider continuously throughout the day, and as a result the Sponsor believes that using the Index Price will provide more transparency to investors. There will be no change to the Index used to determine the Index Price or the criteria used to select the digital asset exchanges included in the Index. The Index Price is calculated using non-GAAP methodology and is not used in the Trust’s financial statements.

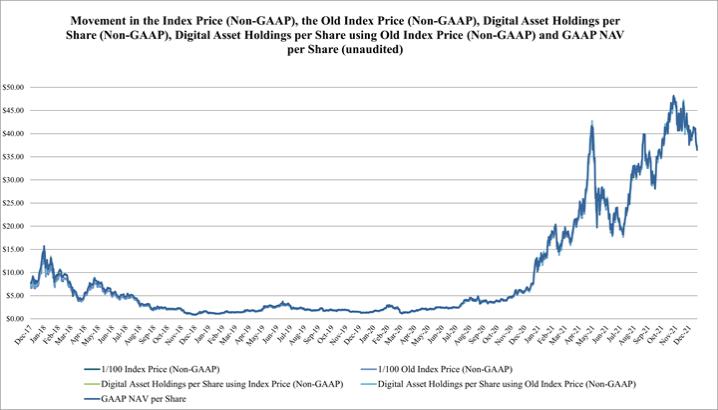

Historical Digital Asset Holdings and ETH Prices

For the period from January 1, 2019 and December 31, 2021, the average difference in price between the Old Index Price and the Index Price and the average difference in Digital Asset Holdings of the Trust as calculated using the Old Index Price and the Index Price of was 0.40%.

The following chart illustrates the movement in the Index Price, the Old Index Price, the Trust’s Digital Asset Holdings per Share based on the Old Index Price and the Index Price and the Trust’s net asset value per share as calculated in accordance with GAAP from December 14, 2017 to December 31, 2021. For more information on the determination of the Trust’s Digital Asset Holdings, see “Item 1. Business—Overview of the ETH Industry and Market—ETH Value—The Index and the Index Price” in the Trust’s Annual Report on Form 10-K for the year ended December 31, 2020, as filed with the Securities and Exchange Commission on March 5, 2021 (the “Annual Report”).