“Digital Asset Account”— A segregated custody account controlled and secured by the Custodian to store private keys, which allow for the transfer of ownership or control of the Trust’s Ether on the Trust’s behalf.

“Digital Asset Market”— A “Brokered Market,” “Dealer Market,” “Principal-to-Principal Market” or “Exchange Market” (referred to as “Trading Platform Market” in this Quarterly Report), as each such term is defined in the Financial Accounting Standards Board Accounting Standards Codification Master Glossary.

“Digital Asset Trading Platform”— An electronic marketplace where trading platform participants may trade, buy and sell Ether based on bid-ask trading. The largest Digital Asset Trading Platforms are online and typically trade on a 24-hour basis, publishing transaction price and volume data.

“Digital Asset Trading Platform Market”— The global trading platform market for the trading of Ether, which consists of transactions on electronic Digital Asset Trading Platforms.

“DSTA”— The Delaware Statutory Trust Act, as amended.

“DTC”— The Depository Trust Company. DTC is a limited purpose trust company organized under New York law, a member of the U.S. Federal Reserve System and a clearing agency registered with the SEC. DTC will act as the securities depository for the Shares.

“Ether”— Ethereum tokens, which are a type of digital asset based on an open source cryptographic protocol existing on the Ethereum Network, comprising units that constitute the assets underlying the Trust’s Shares.

“Ethereum Network”— The online, end-user-to-end-user network hosting the public transaction ledger, known as the Ethereum Blockchain, and the source code comprising the basis for the cryptographic and algorithmic protocols governing the Ethereum Network. See “Item 1. Business—Overview of the ETH Industry and Market” in our Annual Report.

“Ethereum Proof-of-Work” or “ETHPoW”— A type of digital currency based on an open source cryptographic protocol existing on the Ethereum Proof-of-Work network, which came into existence following the Ethereum hard fork on September 15, 2022.

“Exchange Act”— The Securities Exchange Act of 1934, as amended.

“FINRA”— The Financial Industry Regulatory Authority, Inc., which is the primary regulator in the United States for broker-dealers, including Authorized Participants.

“GAAP”— United States generally accepted accounting principles.

“Genesis”— Genesis Global Trading, Inc., a wholly owned subsidiary of Digital Currency Group, Inc., which served as a Liquidity Provider from October 3, 2022 to September 12, 2023.

“Grayscale Securities”— Grayscale Securities, LLC, a wholly owned subsidiary of the Sponsor, which as of the date of this Quarterly Report, is the only acting Authorized Participant.

“Incidental Rights”— Rights to acquire, or otherwise establish dominion and control over, any virtual currency or other asset or right, which rights are incident to the Trust’s ownership of Ether and arise without any action of the Trust, or of the Sponsor or Trustee on behalf of the Trust.

“Index”— The CoinDesk Ether Price Index (ETX).

“Index License Agreement”— The license agreement, dated as of February 1, 2022, between the Index Provider and the Sponsor governing the Sponsor’s use of the Index for calculation of the Index Price, as amended by Amendment No. 1 thereto and as the same may be amended from time to time.

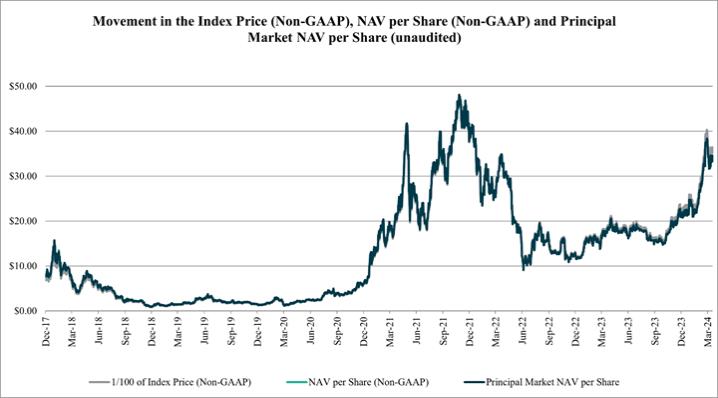

“Index Price”— The U.S. dollar value of an Ether derived from the Digital Asset Trading Platforms that are reflected in the Index, calculated at 4:00 p.m., New York time, on each business day. See “Item 1. Business—Overview of the ETH Industry and Market—ETH Value—The Index and the Index Price” in our Annual Report for a description of how the Index Price is calculated. For purposes of the Trust Agreement, the term Ether Index Price shall mean the Index Price as defined herein.

“Index Provider”— CoinDesk Indices, Inc., a Delaware corporation that publishes the Index. Prior to its sale to an unaffiliated third party on November 20, 2023, DCG was the indirect parent company of CoinDesk Indices, Inc. As a result, CoinDesk Indices, Inc. was an affiliate of the Sponsor and the Trust and was considered a related party of the Trust.

26