Exhibit 99.1

FOR IMMEDIATE RELEASE

ADAPTHEALTH CORP. ANNOUNCES SECOND QUARTER 2020 FINANCIAL RESULTS

Plymouth Meeting, PA – August 4, 2020 – AdaptHealth Corp. (NASDAQ: AHCO) (“AdaptHealth” or the “Company”), a leading provider of home healthcare equipment, medical supplies to the home and related services in the United States, announced today financial results for the three- and six-month periods ended June 30, 2020.

Highlights

| · | AdaptHealth recorded record revenue and profitability during the second quarter of 2020 aided by its ability to supply critically needed equipment and medical supplies to referral partners during the COVID-19 pandemic. |

| · | On July 1, 2020, the Company closed the acquisitions of Solara Medical Supplies and ActivStyle. These acquisitions bolster the Company’s recurring resupply business and expand AdaptHealth’s presence in the fast-growing continuous glucose monitoring business. |

| · | In July 2020, the Company completed $1.2 billion of financing transactions, consisting of $134 million in net proceeds from a primary equity issuance, $225 million from a PIPE issuance, $343 million in net proceeds from an unsecured senior note issuance and a $450 million senior bank facility refinancing, resulting in significant liquidity to advance the Company’s strategic priorities. As a result of these transactions, the Company funded the July acquisitions and has significant cash on hand, a debt structure balanced between secured bank debt and unsecured bonds, and a net leverage ratio under 3X EBITDA. |

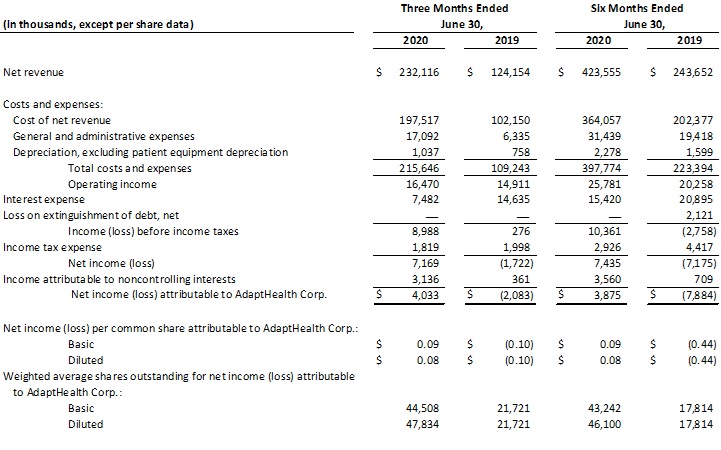

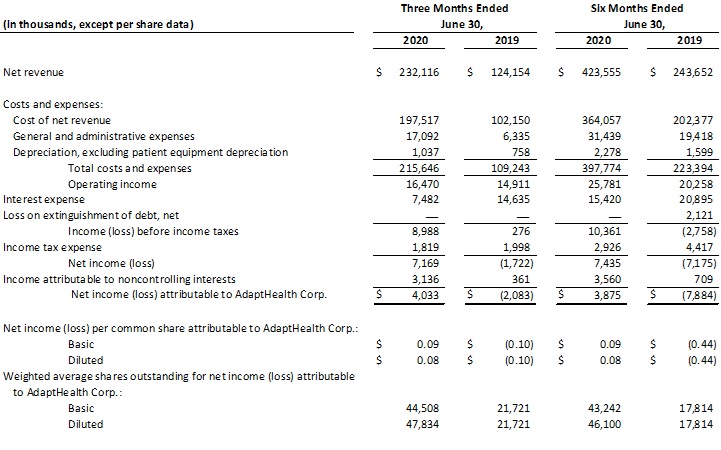

Second Quarter Results

| · | Net revenue was $232.1 million, an 87% increase from the second quarter of 2019 and 21% higher than the first quarter of 2020; Patient Care Solutions (PCS), acquired in January 2020, generated net revenue of $33.0 million. The Company also recorded $28.4 million of net revenue to referral partners and healthcare facilities in support of their urgent needs for ventilator and respiratory equipment for COVID-19 patients. |

| · | Net income attributable to AdaptHealth Corp. was $4.0 million, or $0.08 per diluted share, compared to a net loss of $2.1 million, or $0.10 per diluted share, in the second quarter of 2019. |

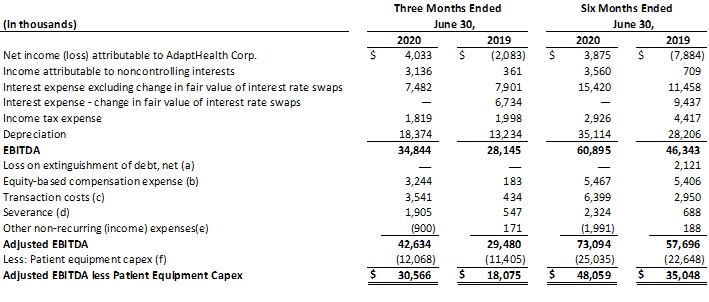

| · | Adjusted EBITDA less Patient Equipment Capex was $30.6 million compared to $18.1 million in the second quarter of 2019. Excluding PCS, which incurred a quarterly loss of $3.6 million, Adjusted EBITDA less Patient Equipment Capex was $34.2 million, an 89% increase compared to the second quarter of 2019. |

| · | Adjusted EBITDA was $42.6 million compared to $29.5 million in the second quarter of 2019. Excluding PCS, which incurred a quarterly loss of $3.6 million, Adjusted EBITDA was $46.2 million, a 57% increase compared to the second quarter of 2019. |

Six Month Results

| · | Net revenue was $423.6 million, a 74% increase from the first six months of 2019; PCS generated net revenue of $66.9 million. |

| · | Net income attributable to AdaptHealth Corp. was $3.9 million, or $0.08 per diluted share, compared to a net loss of $7.9 million, or $0.44 per diluted share, in the first six months of 2019. |

| · | Adjusted EBITDA less Patient Equipment Capex was $48.1 million compared to $35.0 million in the first half of 2019. Excluding PCS, which incurred a six-month loss of $8.1 million, Adjusted EBITDA less Patient Equipment Capex was $56.2 million, a 60% increase compared to the first half of 2019. |

| · | Adjusted EBITDA was $73.1 million compared to $57.7 million in the first half of 2019. Excluding PCS, which incurred a six-month loss of $8.1 million, Adjusted EBITDA was $81.2 million, a 41% increase compared to the first half of 2019. |

Luke McGee, Chief Executive Officer of AdaptHealth, commented, “Our strong year-to-date 2020 performance reflects the extraordinary hard work, resilience and dedication of our outstanding AdaptHealth team and their support of our patients and healthcare partners. We are continuing to successfully deploy a scalable growth model focused on organic sales, acquisitions, accretive capital deployment, and cash generation. The COVID-19 pandemic has presented unique challenges, but we’ve been able to offset certain headwinds with new business opportunities and growth in other product categories. More specifically, PAP new starts, orthotics and other business lines closely linked to discretionary hospital and long-term care facility discharges were significantly down and our costs were higher in the second quarter of 2020. Offsetting these negative trends, new respiratory starts increased, and our teams successfully focused on our resupply businesses. Additionally, we were able to supply critical products needed to meet the emergency needs of non-traditional and new customers. We generated approximately $28 million of business-to-business (B2B) revenues in the quarter and opened new channels and customers which we expect to have future positive impacts. In the aggregate, the improvements in our resupply business and the B2B revenue growth more than offset the weakness in our traditional businesses. While volumes in several of the impacted products have begun to stabilize since the end of the second quarter of 2020, the Company does not expect volumes in those product categories to return to pre-pandemic levels in 2020.

“PCS, our home medical supplies business, generated net revenue of $33.0 million for the quarter and negative EBITDA of $3.6 million. As previously disclosed, PCS is a turn-around situation and as part of our investment we expect $15 million in one-time restructuring and operational losses in 2020. We are pleased with our progress in addressing and curing various issues at PCS in the first half of the year and continue to believe PCS will be profitable in the fourth quarter of 2020.

“We are very excited about our July 1, 2020 acquisition of Solara Medical Supplies (Solara). Solara is a large national distributor of continuous glucose monitors (CGM) as part of its comprehensive suite of direct-to-patient diabetes supplies. The company maintains relationships with leading national manufacturers and managed care plans and is registered as a pharmacy in all 50 states. Diabetes is among the most costly and pervasive chronic diseases in the United States and the numbers of diagnosed cases continues to increase. We believe we will continue to see rapid adoption of CGM technology which has the potential to provide patients with better outcomes and better quality of life.

“Taken together with our focus on patients with obstructive sleep apnea, our recent acquisitions, which make us a national leader in distribution of CGMs and other diabetes supplies, add to our expanding suite of products and will generate cross selling opportunities due to the co-morbidities. We believe these acquisitions will further our goal to enhance care for our patients with chronic conditions and become a leading provider of connected health solutions for care in the home.”

2020 Outlook Increased

While it is impossible to predict the duration of the COVID-19 crisis or the full impact on the Company’s business, based on current business and market trends (and taking into consideration the recent acquisitions of Solara and ActivStyle on July 1, 2020), the Company is offering financial guidance for fiscal year 2020 of net revenue between $935 million to $983 million, Adjusted EBITDA of $169 million to $178 million, and Adjusted EBITDA less Patient Equipment Capex of $120 million to $127 million. This outlook includes anticipated Adjusted EBITDA losses for PCS. The Company’s previous guidance excluded expected PCS losses of approximately $7 million.

Mr. McGee concluded, “I am very proud of our financial performance so far this this year but even more proud of how our AdaptHealth employees have responded to this unprecedented crisis by supporting our patients and healthcare partners. Our employees on the front line in patient-facing roles have continued to serve with professionalism and courage. I’m also very proud of our company’s role in delivering life-saving equipment to our referral partners. “

Redemption of Public Warrants

The Company also announced today that it will redeem all of its outstanding public warrants (the “Public Warrants”) to purchase shares of the Company’s Class A Common Stock, par value $0.0001 per share (the “Common Stock”), that were issued under the Warrant Agreement , dated February 15, 2018 (the “Warrant Agreement”), by and between the Company and Continental Stock Transfer & Trust Company, as warrant agent (the “Warrant Agent”), as part of the units sold in the Company’s initial public offering (the “IPO”), for a redemption price of $0.01 per Public Warrant (the “Redemption Price”), that remain outstanding at 5:00 p.m. New York City time on September 2, 2020 (the “Redemption Date”). Warrants to purchase Common Stock that were issued under the Warrant Agreement in a private placement simultaneously with the IPO and still held by the initial holders thereof or their permitted transferees are not subject to this redemption.

Under the terms of the Warrant Agreement, the Company is entitled to redeem all of the outstanding Public Warrants if the last sales price of the Common Stock is at least $18.00 per share on each of twenty trading days within any thirty-day trading period ending on the third trading day prior to the date on which a notice of redemption is given. At the direction of the Company, the Warrant Agent has delivered a notice of redemption to each of the registered holders of the outstanding Public Warrants.

In addition, in accordance with the Warrant Agreement, the Company’s board of directors has elected to require that, upon delivery of the notice of redemption, all Public Warrants are to be exercised only on a “cashless basis.” Accordingly, holders may no longer exercise Public Warrants and receive Common Stock in exchange for payment in cash of the $11.50 per warrant exercise price. Instead, a holder exercising a Public Warrant will be deemed to pay the $11.50 per warrant exercise price by the surrender of 0.6144 of a share of Common Stock (such fraction determined as described below) that such holder would have been entitled to receive upon a cash exercise of a Public Warrant. Accordingly, by virtue of the cashless exercise of the Public Warrants, exercising warrant holders will receive 0.3856 of a share of Common Stock for each Public Warrant surrendered for exercise. Any Public Warrants that remain unexercised at 5:00 p.m. New York City time on the Redemption Date will be void and no longer exercisable, and the holders will have no rights with respect to those Public Warrants, except to receive the Redemption Price (or as otherwise described in the redemption notice for holders who hold their Public Warrants in “street name”).

The number of shares of Common Stock that each exercising warrant holder will receive by virtue of the cashless exercise (instead of paying the $11.50 per Public Warrant cash exercise price) was calculated in accordance with the terms of the Warrant Agreement and is equal to the quotient obtained by dividing (x) the product of the number of shares underlying the Public Warrants held by such warrant holder, multiplied by the difference between $18.7175, the average last sale price of the Common Stock for the ten trading days ending on July 29, 2020, the third trading day prior to the date of the redemption notice (the “Fair Market Value”) and $11.50, by (y) the Fair Market Value. If any holder of Public Warrants would, after taking into account all of such holder’s Public Warrants exercised at one time, be entitled to receive a fractional interest in a share of Common Stock, the number of shares the holder will be entitled to receive will be rounded down to the nearest whole number of shares.

Questions concerning redemption and exercise of the Public Warrants can be directed to Continental Stock Transfer & Trust Company, 1 State Street, 30th Floor, New York, New York 10004, Attention: Compliance Department, telephone number (212) 509-4000.

Conference Call

Management will host a conference at 8:30 am ET today to discuss the results and business activities. Interested parties may participate in the call by dialing:

| · | (877) 423-9820 (Domestic) or |

| · | (201) 493-6749 (International) |

Webcast registration: Click Here

Following the live call, a replay will be available for six months on the Company's website, www.adapthealth.com under "Investor Relations."

About AdaptHealth Corp.

AdaptHealth Corp. (“AdaptHealth”) is a leading provider of home healthcare equipment, medical supplies to the home and related services in the United States. AdaptHealth provides a full suite of medical products and solutions designed to help patients manage chronic conditions in the home, adapt to life and thrive. Product and services offerings include (i) sleep therapy equipment, supplies and related services (including CPAP and bi PAP services) to individuals suffering from obstructive sleep apnea, (ii) home medical equipment (HME) to patients discharged from acute care and other facilities, (iii) oxygen and related chronic therapy services in the home, and (iv) other HME medical devices and supplies on behalf of chronically ill patients with diabetes care, wound care, urological, ostomy and nutritional supply needs. The company is proud to partner with an extensive and highly diversified network of referral sources, including acute care hospitals, sleep labs, pulmonologists, skilled nursing facilities, and clinics. AdaptHealth services beneficiaries of Medicare, Medicaid and commercial insurance payors. AdaptHealth services over approximately 1.7 million patients annually in all 50 states through its network of 251 locations in 40 states. Learn more at www.adapthealth.com.

Forward-Looking Statements

This press release includes certain statements that are not historical facts but are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding projections, estimates and forecasts of revenue and other financial and performance metrics and projections of market opportunity and expectations and the Company’s acquisition pipeline. These statements are based on various assumptions and on the current expectations of AdaptHealth management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on, by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of the Company.

These forward-looking statements are subject to a number of risks and uncertainties, including the outcome of judicial and administrative proceedings to which the Company may become a party or governmental investigations to which the Company may become subject that could interrupt or limit the Company’s operations, result in adverse judgments, settlements or fines and create negative publicity; changes in the Company’s clients’ preferences, prospects and the competitive conditions prevailing in the healthcare sector; and the impact of the recent coronavirus (COVID-19) pandemic and the Company’s response to it. A further description of such risks and uncertainties can be found in the Company’s filings with the Securities and Exchange Commission. If the risks materialize or assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that the Company presently knows or that the Company currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect the Company’s expectations, plans or forecasts of future events and views as of the date of this press release. The Company anticipates that subsequent events and developments will cause the Company’s assessments to change. However, while the Company may elect to update these forward-looking statements at some point in the future, the Company specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing the Company’s assessments as of any date subsequent to the date of this press release. Accordingly, undue reliance should not be placed upon the forward-looking statements.

No Offer or Solicitation

This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any offer of any of the Company’s securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction.

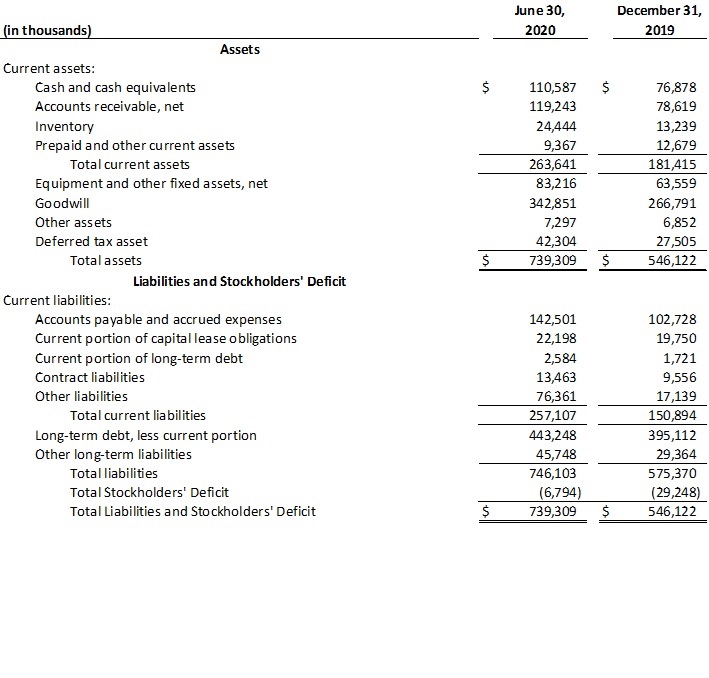

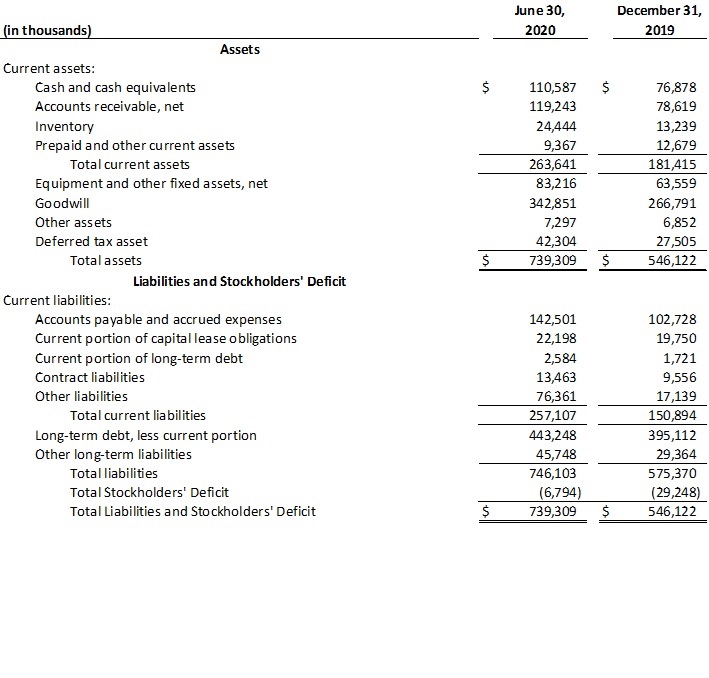

ADAPTHEALTH CORP.

Condensed Consolidated Balance Sheets (Unaudited)

ADAPTHEALTH CORP.

Condensed Consolidated Statements of Operations (Unaudited)

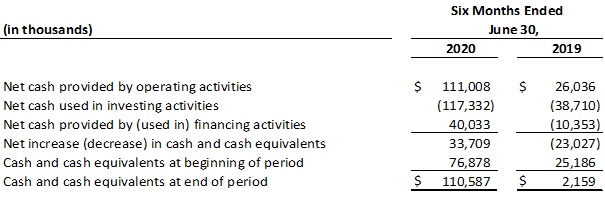

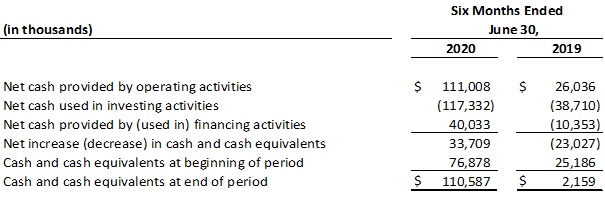

ADAPTHEALTH CORP.

Condensed Consolidated Statements of Cash Flows (Unaudited)

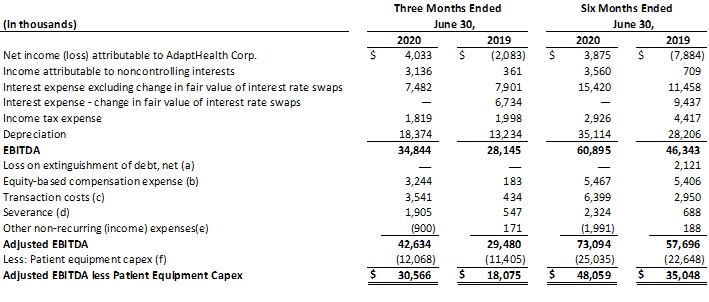

Non-GAAP Financial Measures

This press release presents AdaptHealth’s EBITDA, Adjusted EBITDA and Adjusted EBITDA less Patient Equipment Capex for the three and six months ended June 30, 2020 and 2019.

AdaptHealth defines EBITDA as net income (loss) attributable to AdaptHealth Corp., plus net income attributable to noncontrolling interests, interest expense (income), income tax expense (benefit), and depreciation.

AdaptHealth defines Adjusted EBITDA as EBITDA (as defined above), plus loss on extinguishment of debt, equity-based compensation expense, transaction costs, severance, and similar items of expense (income).

AdaptHealth defines Adjusted EBITDA less Patient Equipment Capex as Adjusted EBITDA (as defined above) less patient equipment acquired during the period without regard to whether the equipment was purchased or financed through lease transactions.

The following unaudited table presents the reconciliation of net income (loss) attributable to AdaptHealth Corp., to EBITDA, Adjusted EBITDA and Adjusted EBITDA less Patient Equipment Capex for the three and six months ended June 30, 2020 and 2019:

| (a) | Represents write offs of deferred financing costs related to refinancing of debt, net of income taxes. |

| (b) | Represents amortization of equity-based compensation to employees, including expense resulting from accelerated vesting and modification of certain awards incurred in 2019. |

| (c) | Represents transaction costs related to acquisitions and the 2019 Recapitalization. |

| (d) | Represents severance costs related to acquisition integration and internal AdaptHealth restructuring and workforce reduction activities. |

| (e) | The six months ended June 30, 2020 includes (1) $2.9 million of reductions in the fair value of earnout liabilities, (2) a $0.6 million gain in connection with the sale of a cost method investment, offset by (3) a $1.5 million expense associated with the PCS Transition Services Agreement. |

| (f) | Represents the value of the patient equipment obtained during the respective period without regard to whether the equipment is purchased or financed through lease transactions. |

AdaptHealth uses EBITDA, Adjusted EBITDA and Adjusted EBITDA less Patient Equipment Capex, which are financial measures that are not prepared in accordance with generally accepted accounting principles in the United States, or U.S. GAAP, to analyze its financial results and believes that they are useful to investors, as a supplement to U.S. GAAP measures. In addition, AdaptHealth’s ability to incur additional indebtedness and make investments under its existing credit agreement is governed, in part, by its ability to satisfy tests based on a variation of Adjusted EBITDA less Patient Equipment Capex.

AdaptHealth believes Adjusted EBITDA less Patient Equipment Capex is useful to investors in evaluating AdaptHealth’s financial performance. AdaptHealth’s business requires significant investment in equipment purchases to maintain its patient equipment inventory. Some equipment title transfers to patients’ ownership after a prescribed number of fixed monthly payments. Equipment that does not transfer wears out or oftentimes is not recovered after a patient’s use of the equipment terminates. AdaptHealth uses this metric as the profitability measure in its incentive compensation plans that have a profitability component and to evaluate acquisition opportunities, where it is most often used for purposes of contingent consideration arrangements. In addition, AdaptHealth’s debt agreements contain covenants that use a variation of Adjusted EBITDA less Patient Equipment Capex for purposes of determining debt covenant compliance. For purposes of this metric, patient equipment capital expenditure is measured as the value of the patient equipment obtained during the accounting period without regard to whether the equipment is purchased or financed through lease transactions.

EBITDA, Adjusted EBITDA and Adjusted EBITDA less Patient Equipment Capex should not be considered as measures of financial performance under U.S. GAAP, and the items excluded from EBITDA, Adjusted EBITDA and Adjusted EBITDA less Patient Equipment Capex are significant components in understanding and assessing financial performance. Accordingly, these key business metrics have limitations as an analytical tool. They should not be considered as an alternative to net income or any other performance measures derived in accordance with U.S. GAAP or as an alternative to cash flows from operating activities as a measure of AdaptHealth’s liquidity.

Contacts

AdaptHealth Corp.

Jason Clemens

Chief Financial Officer

(484) 301-6599

jclemens@adapthealth.com

Brittany Lett

Vice President, Marketing

(909) 915-4983

blett@adapthealth.com

The Equity Group Inc.

Devin Sullivan

Senior Vice President

(212) 836-9608

dsullivan@equityny.com

Kalle Ahl, CFA

Vice President

(212) 836-9614

kahl@equityny.com