Exhibit 5.1

April 16, 2020

To:

Safe-T Group Ltd.

8 Abba Eban Ave.

Herzliya, 4672526

Israel

Re: Registration Statement on Form F-1

Ladies and Gentlemen:

We have acted as Israeli counsel to Safe-T Group Ltd., an Israeli company (the “Company”), in connection with a registration statement on Form F-1 (Registration Statement No. 333-237629) (as amended through the date hereof, the “Registration Statement”), filed by the Company with the United States Securities and Exchange Commission (the “SEC”) under the Securities Act of 1933, as amended (the “Securities Act”) for the registration (including in connection with an over-allotment option granted to the underwriters as set forth below) and proposed offering by the Company under the Registration Statement of up to an aggregate amount of $11,500,000 of (i) units, with each unit consisting of (a) one American Depositary Share (the “ADS”), each representing forty (40) ordinary shares, no par value, of the Company (the “Ordinary Shares”), and (b) one warrant to purchase one ADS (the “Regular Warrant” and together with the ADS, the “Unit”); (ii) units, with each unit consisting of (a) one pre-funded warrant to purchase one ADS at an exercise price of $0.001 per ADS (the “Pre-Funded Warrants”), and (ii) the Regular Warrant (together with the Pre-Funded Warrant, the “Pre-Funded Unit”), and (iii) at the option of the underwriters, additional ADSs (the “Option ADSs”) and/or additional Regular Warrants (the “Option Warrants” and, together with the Option ADSs, the “Option Securities”). The ADSs and the Option ADSs are collectively referred to herein as the “Offered ADSs”; the Regular Warrants, the Pre-Funded Warrants and the Option Warrants are collectively referred to herein as the “Warrants”; the Offered ADSs, the Option Securities, the Warrants, the Units, the Pre-Funded Units and the Ordinary Shares underlying all and any of them are collectively referred to herein as the “Securities”. The Securities are being registered by the Company in connection with an underwritten public offering of the Company (the “Offering”).

In connection herewith, we have examined the originals or copies, certified or otherwise identified to our satisfaction, of (i) the Registration Statement, to which this opinion is attached as an exhibit, (ii) a copy of the articles of association of the Company; (iii) resolutions of the board of directors (the “Board”) of the Company which have heretofore been approved and which relate to the Registration Statement and the actions to be taken in connection with the Offering; and (iv) such other corporate records, agreements, documents and other instruments, and such certificates or comparable documents of public officials and of officers and representatives of the Company, as we have deemed relevant and necessary as a basis for the opinions hereafter set forth. We have also made inquiries of such officers and representatives as we have deemed relevant and necessary as a basis for the opinions hereafter set forth.

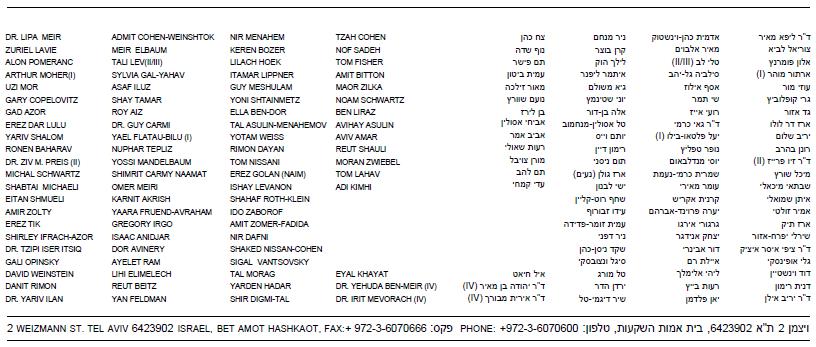

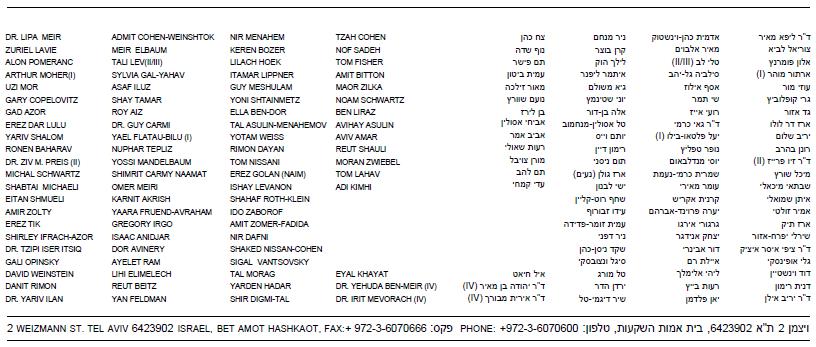

| WWW.LIPAMEIR.CO.IL | EMAIL: LAW@LIPAMEIR.CO.IL |

| (I) NOTARY (II) ADMITTED IN NY (III) ADMITTED IN ENGLAND (IV) OF COUNSEL | (I) נוטריון (II) רשיון עו"ד בניו יורק (III) רשיון עו"ד באנגליה (IV) יועץ |

In such examination, we have assumed: (i) the authenticity of original documents and the genuineness of all signatures; (ii) the conformity to the originals of all documents submitted to us as copies; (iii) the truth, accuracy and completeness of the information, representations and warranties contained in the corporate records, documents, certificates and instruments we have reviewed; (iv) the due execution and delivery of all documents where due execution and delivery are a prerequisite to the effectiveness thereof; and (v) the legal capacity of all natural persons. As to any facts material to such opinion, to the extent that we did not independently establish relevant facts, we have relied on certificates of public officials and certificates of officers or other representatives of the Company.

On the basis of the foregoing, and in reliance thereon, we are of the opinion that (i) the Ordinary Shares underlying the Offered ADSs have been duly authorized by the Company, and when issued and sold in the Offering as contemplated in the Registration Statement against payment to the Company of the consideration per Security and subject to final action by the Board of the Company or a pricing committee of the Board approving the precise number and the price of the Ordinary Shares, will be validly issued, fully paid and non-assessable and (ii) the Ordinary Shares underlying the Warrants, when issued and sold by the Company and delivered by the Company against receipt of the exercise price therefor, in accordance with and in the manner described in the Registration Statement and the Warrants, will be duly authorized and validly issued, fully paid and non-assessable.

We are members of the Israel Bar and we express no opinion as to any matter relating to the laws of any jurisdiction other than the laws of the State of Israel. This opinion is limited to the matters stated herein and no opinion is implied or may be inferred beyond the matters expressly stated.

We consent to the filing of this opinion as an exhibit to the Registration Statement and to the use of our name wherever it appears in the Registration Statement. In giving such consent, we do not thereby admit that we are “experts” within the meaning of such term as used in the Securities Act or the rules and regulations of the SEC issued thereunder with respect to any part of the Registration Statement, including this opinion as an exhibit or otherwise.

Zysman, Aharoni, Gayer and Sullivan & Worcester LLP, U.S. counsel to the Company, may rely on the opinions given herein in rendering their opinion of even date herewith in connection with the Registration Statement.

| Very truly yours, | |

| | |

| /s/ Lipa Meir & Co. | |

WWW.LIPAMEIR.CO.IL | EMAIL: LAW@LIPAMEIR.CO.IL |

- 2 -