UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-23319

Carlyle Tactical Private Credit Fund

(Exact Name of Registrant as Specified In Its Charter)

One Vanderbilt Avenue, Suite 3400

New York, New York 10017

(Address of principal executive offices) (Zip Code)

Joshua Lefkowitz, Esq.

Chief Legal Officer, Carlyle Tactical Private Credit Fund

One Vanderbilt Avenue, Suite 3400

New York, New York 10017

(Name and address of agent for service)

Registrant’s telephone number, including area code: (833) 677-3646

Date of fiscal year end: December 31

Date of reporting period: December 31, 2024

Item 1. Reports to Stockholders

CARLYLE TACTICAL PRIVATE CREDIT FUND

ANNUAL REPORT

DECEMBER 31, 2024

Table of Contents

| | | | | |

| Section | Page |

| Annual 2024 Shareholder Letter | |

| Top Holdings and Industries | |

| Consolidated Schedule of Investments | |

| Consolidated Statement of Assets and Liabilities | |

| Consolidated Statement of Operations | |

| Consolidated Statements of Changes in Net Assets | |

| Consolidated Statement of Cash Flows | |

| Consolidated Financial Highlights | |

| Notes to Consolidated Financial Statements | |

| Report of Independent Registered Public Accounting Firm | |

| Federal Income Tax Information | |

| Other Information | |

| Portfolio Proxy Voting Policies and Procedures; Updates to Schedules of Investments | |

| Management of the Fund | |

| Privacy Notice | |

We are pleased to present the Carlyle Tactical Private Credit Fund (the “Fund”) 2024 Annual Review.

ANNUAL 2024 SHAREHOLDER LETTER

The Fund’s Class N shares returned 10.77% for the year ended December 31, 2024. The 2024 dividends for Class A, I, L, M, N, U, and Y shares were $0.82, $0.86, $0.81, $0.80, $0.86, $0.80, and $0.81, respectively. The weighted average total yield of the Fund’s portfolio at fair value was 10.4% and the annualized distribution rates1 for the various classes were: Class A (without sales charge) 9.5%, Class I 10.0%, Class L (without sales charge) 9.5%, Class M 9.3%, Class N 10.0%, Class U 9.3%, and Class Y 9.7%.

FUND REVIEW & DISCUSSION OF PERFORMANCE

The Fund’s investment objective is to produce current income. The Fund seeks to achieve its investment objective by opportunistically allocating its assets across a wide range of credit strategies.

As of December 31, 2024, the Fund had $3,995 million of net assets and, by utilizing leverage, total assets (including cash and other assets) of $5,374 million. The Fund maintained a consistent approach to its use of leverage, aiming to improve shareholder returns, while taking on minimal incremental risk. The total asset coverage ratio for the Fund as of December 31, 2024 was 425%. As a percentage of total assets, the Fund’s portfolio consisted of 60.2% first-lien debt investments, 3.0% second-lien debt investments, 5.0% asset-backed securities, 16.2% Structured Credit investments, 5.2% Corporate Bond investments and 4.6% unlisted equity (including preferred equity and warrants). These levels are in line with concentration limits disclosed to the Fund’s shareholders. As of December 31, 2024, 90% of the Fund’s debt investments were floating rate in nature. The Fund had debt investments across over 430 portfolio companies with an average investment size of less than 1% of the total portfolio. Approximately 80% of the portfolio represented investments in companies located in the United States. As of December 31, 2024, there were six portfolio companies on non-accrual representing 33 bps of exposure on a cost basis.

The Fund also notably increased the number of positions in its portfolio from approximately 700 at the end of 2023 to over 800 as of December 31, 2024, as the Fund continued to diversify in position size and across industries. Given the diversification of the portfolio across issuers, industries, and positions, the Fund is not overly dependent on any one specific credit outcome. We continue to believe that the overall portfolio is of high credit quality and is well

positioned to perform over the duration of an economic cycle.

The largest industries in the Fund’s portfolio were Software, Banking, Finance, Insurance & Real Estate and Diversified Investment Vehicles, which collectively represented 35.1% of net assets. No single industry exceeds 17% of net assets and the top ten industries represent 70.0% of net assets.

As of December 31, 2024, the Fund’s total assets were allocated 33.9% to Direct Lending, 27.2% to Opportunistic Credit, 13.3% to Liquid Credit, 16.2% to Structured Credit, 3.7% to Real Assets Credit, 0.0% to Special Situations, 2.4% to cash & equivalents and 3.3% to other assets.

Through 2024, Opportunistic Credit, Direct Lending, Structured Credit, Liquid Credit and Real Assets Credit contributed positively to the Fund’s total return. Notably, Opportunistic Credit and Direct Lending were the highest contributors to total returns driven by higher base rates and lender friendly terms.

MARKET REVIEW

2024 was defined by record-breaking CLO issuance and the Federal Reserve’s first rate cuts since 2020. Credit markets remained resilient in 2024, delivering strong performance despite a rise in defaults.

Elevated yields supported returns while investor appetite remained robust across the sector. The fourth quarter saw activity levels nearly match the multi-year high of Q2, driven by investor optimism following the U.S. presidential election and additional Fed rate cuts. While leveraged buyout and M&A activity remained subdued throughout 2024, the removal of election uncertainty and improving rate environment are expected to drive a rebound in 2025.

Private credit continues to expand its role in capital markets, having established a healthy dynamic with broadly syndicated markets. In 2024, $26.0 billion of

1 Distribution rates are calculated by annualizing the respective distributions per share announced on December 31, 2024 and dividing these amounts by the respective net asset price as of December 31, 2024.

broadly syndicated loans were refinanced through private credit. Annual institutional loan volume dramatically outpaced prior levels at $1,362 billion, reflecting a decade high spurred by rate cuts. Repricing and refinancing activity accounted for $757 billion and $259 billion in 2024, respectively. High-yield bond issuance fell 37.4% quarter-over-quarter to $46.2 billion but reached $281.6 billion for the year, the highest since 2021, reflecting stabilizing investor sentiment.

Strong demand also drove CLO issuance to record levels, reinforcing the market’s resilience. Q4 issuance hit $59.5 billion, bringing full-year volume to $202.0 billion, while full-year refinancing and reset activity reached $305.9 billion. Private credit continued to gain market share, particularly among sub-$50 million EBITDA borrowers, where broadly syndicated loan market participation has declined. Asset-backed finance also expanded, with non-bank lenders filling gaps left by retreating traditional banks, further broadening private credit investment opportunities.

As macroeconomic conditions improve, private credit is well-positioned to capture more deal flow. While M&A-driven issuance remained muted in Q4, refinancing and repricing activity has seen an uptick in private credit as spreads tighten. As macro conditions improve and spreads remain at tighter levels, borrower demand for private capital is likely to rise.

Carlyle believes the Fund is well-positioned to capitalize on these trends, leveraging its flexible capital approach to take advantage of market dislocations and evolving borrower needs.

STRATEGY & OUTLOOK

Since the inception of the Fund in June 2018, we have been able to create our desired portfolio across

industries and issuers, consisting primarily of floating rate, senior secured loans. Throughout 2024, we saw increased opportunities in direct lending and asset-backed finance as investors sought to manage capital costs amid ongoing bank disintermediation. Regulatory constraints continue to limit banks' ability to originate and hold asset-backed exposure, creating further demand for private credit solutions. In Europe, private credit is finding strong relative value due to reduced competition in the region. Meanwhile, in the U.S., investors continue to favor private markets for their certainty of execution and holistic, partnership-oriented solutions.

From a top-down view, the Adviser’s Portfolio Allocation Advisory Committee (“PAAC”), which oversees the allocation among the different credit sectors for the Fund, continuously evaluated targeted exposures to the Fund’s underlying strategies in response to the evolving market environment. The PAAC did not revise allocations in 2024, focusing on private credit and structured credit allocations within the existing parameters. In 2025, we will look to rotate more heavily into private credit with the expected increase in M&A activity. Further, we will look to deploy in the asset-backed finance space as we see continued opportunity there.

Looking to 2025, we are optimistic as we expect private credit activity to pick up. We believe our existing portfolio remains healthy, and we believe we are well positioned to take advantage of opportunities in the near, medium and long term. The Fund has been constructed to be a diversified and defensive portfolio that we believe is situated well to sustain volatility and any market volatility that may arise.

Justin Plouffe Brian Marcus

Portfolio Manager Portfolio Manager

PERFORMANCE

Average Annual Total Returns through December 31, 2024*

| | | | | | | | | | | | | | | | | |

| Class | Ticker | Inception Date | 1-Year | 5-Year(1) | Since Inception(1) |

| A Share | TAKAX | 6/4/2018 | 10.23% | 6.76% | 5.53% |

A Share with 3.0% Sales Load(2) | TAKAX | 6/4/2018 | 6.92% | 6.00% | 4.96% |

| I Share | TAKIX | 9/4/2018 | 10.80% | 7.36% | 6.40% |

| L Share | TAKLX | 9/4/2018 | 10.05% | 6.74% | 5.78% |

| L Share with 3.5% Sales Load | TAKLX | 9/4/2018 | 6.20% | 5.98% | 5.19% |

| M Share | TAKMX | 5/15/2020 | 9.96% | N/A | 11.07% |

| N Share | TAKNX | 4/18/2019 | 10.77% | 7.35% | 6.76% |

| U Share | TAKUX | 9/1/2022 | 9.96% | N/A | 10.04% |

| Y Share | TAKYX | 9/4/2018 | 10.16% | 7.05% | 6.08% |

| | | | | |

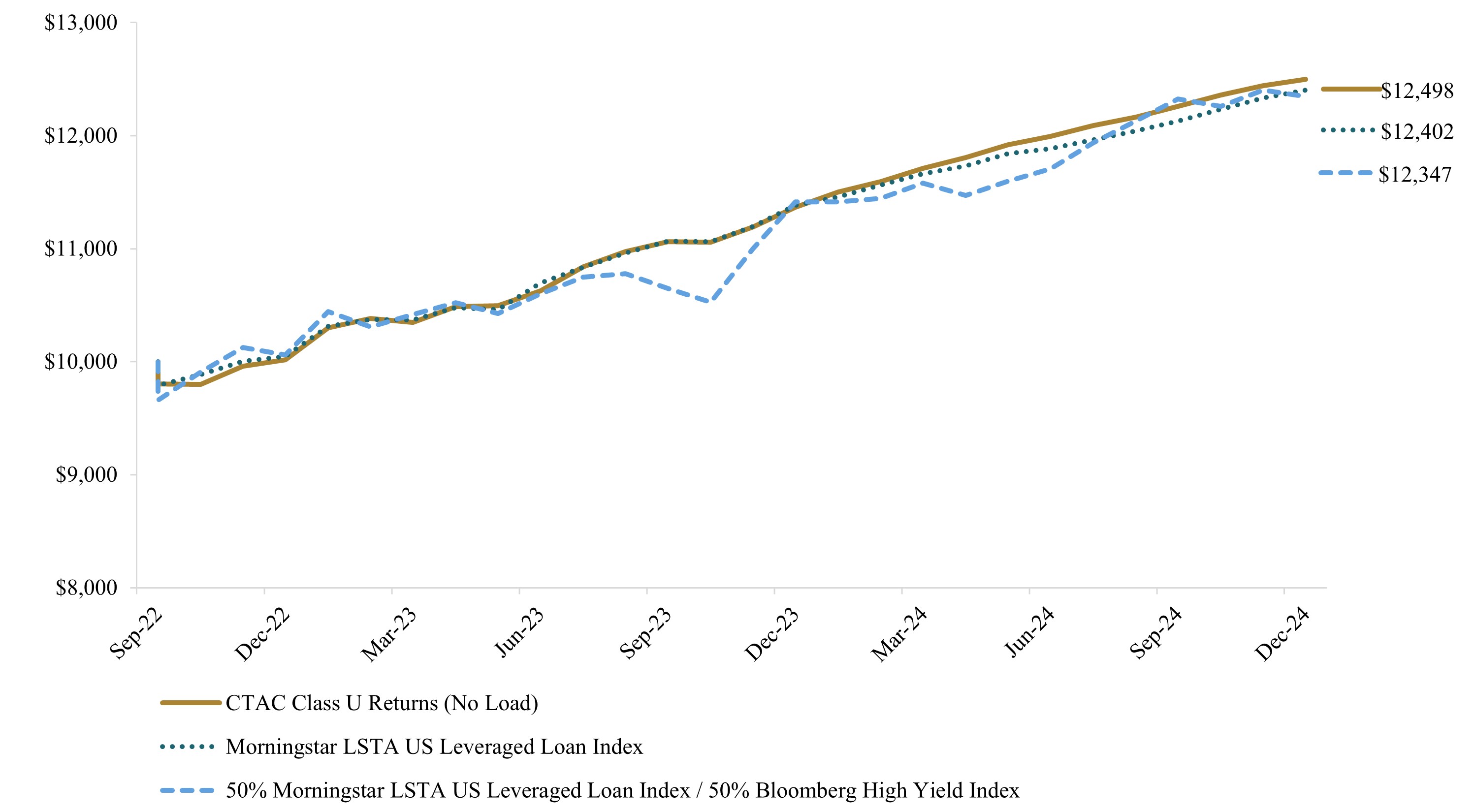

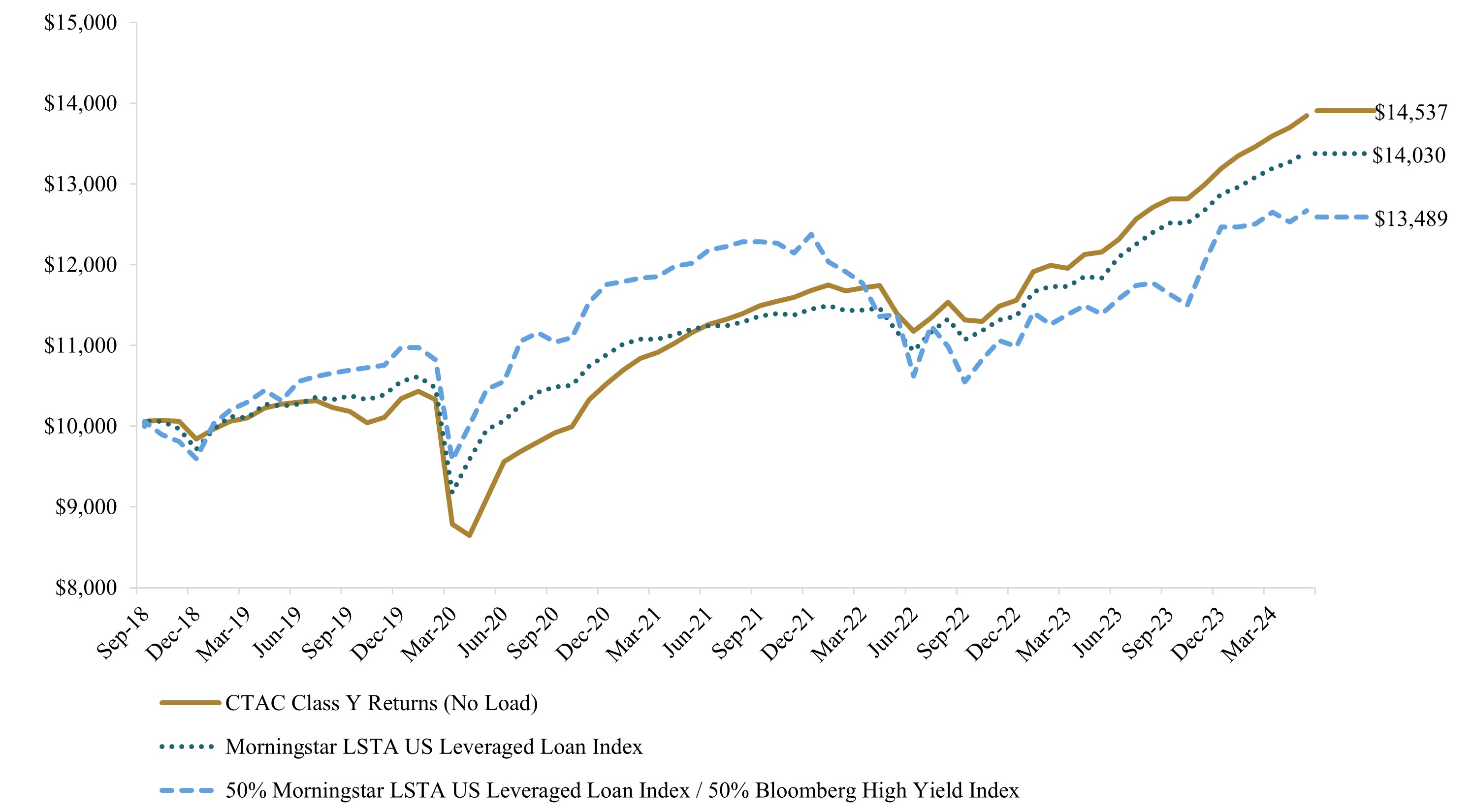

* These returns assume reinvestments of all distributions at net asset value and reflect a maximum sales load of 3.0% for Class A shares and 3.5% for Class L shares. Because Class I, Class M, Class N, Class U, and Class Y Shares do not involve a sales load, such a charge is not applied to their Average Annual Total Returns.

(1) 5-Year and Since Inception are annualized total returns.

(2) The average annual total return figures for the Fund’s Class A Shares reflect a maximum initial sales charge of 3.00%, the maximum rate currently in effect. Prior to September 1, 2020, the maximum initial sales charge applicable to sales of Class A Shares of the Fund was 3.50%, which is not reflected in the average annual total return figures shown.

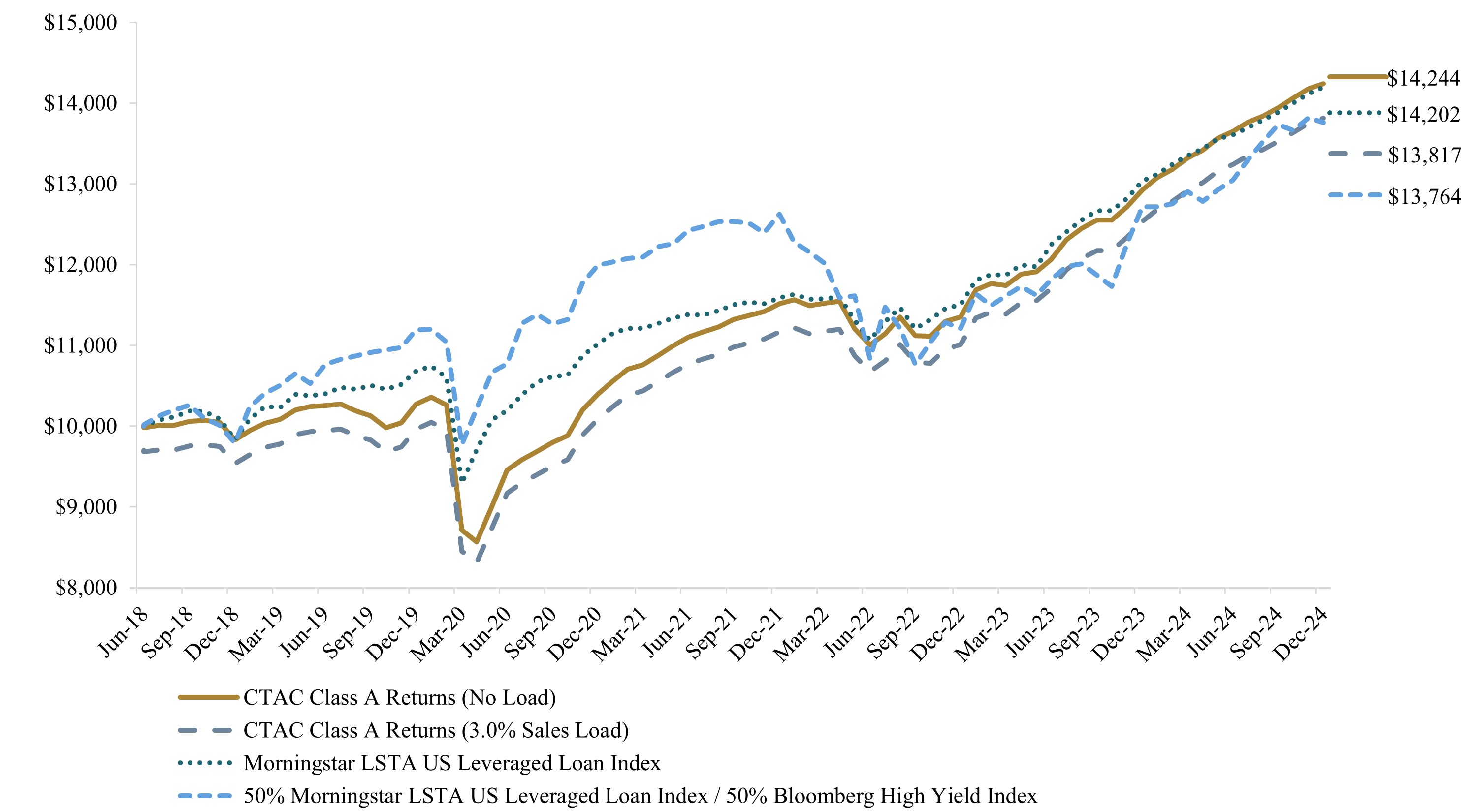

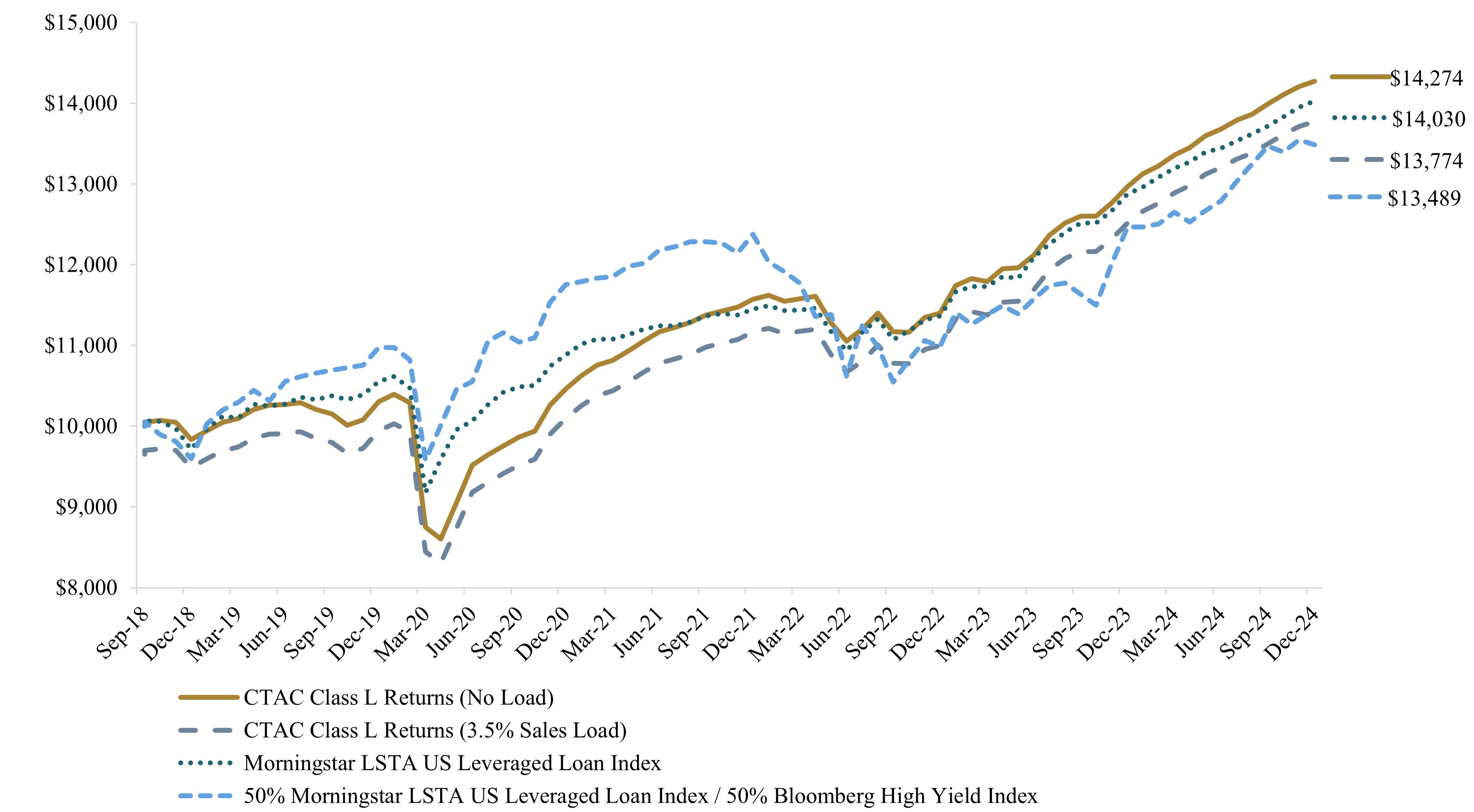

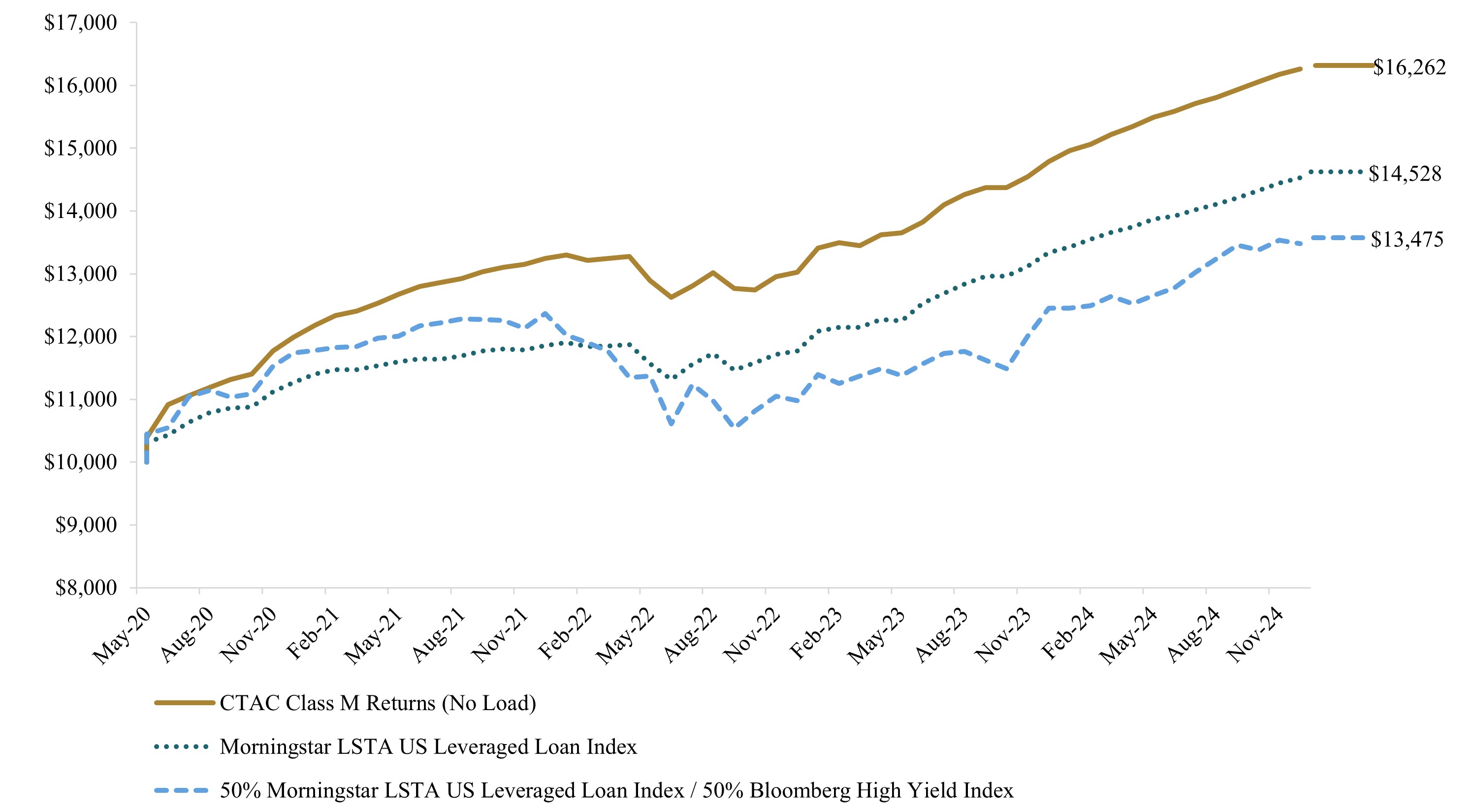

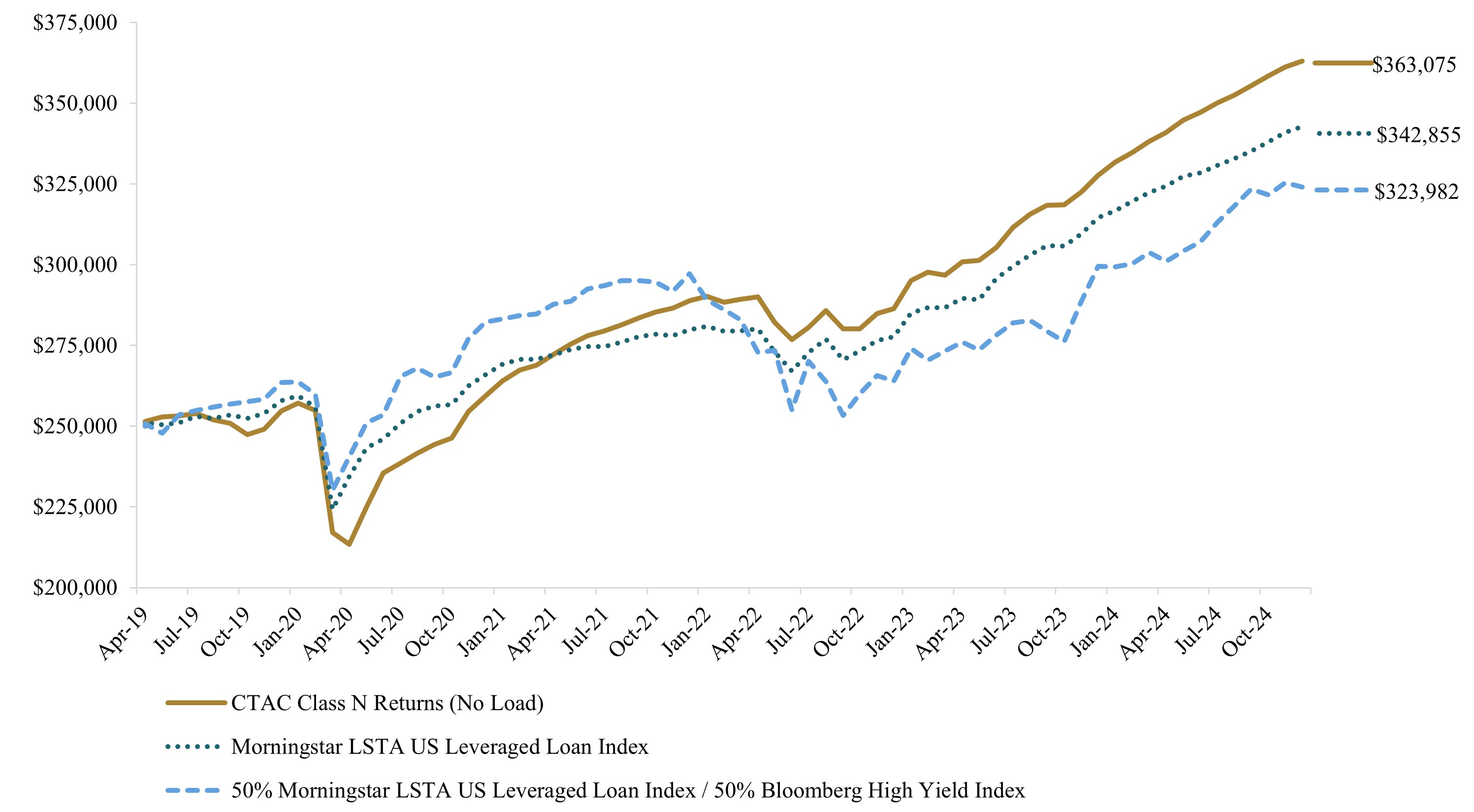

Returns shown in the charts below include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the repurchase of fund shares. In the absence of fee waivers and reimbursements, returns for the Fund would have been lower. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when repurchased, may be worth more or less than the original cost.

The Morningstar LSTA US Leveraged Loan Index is a market value-weighted index designed to measure the performance of the U.S. leveraged loan market based upon market weightings, spreads and interest payments.

The Bloomberg US High-Yield Corporate Bond Index is a rules-based, market-value-weighted index engineered to measure publicly issued non-investment grade USD fixed-rate, taxable and corporate bonds. To be included in the index, a security must have a minimum par amount of $250 million and have a minimum maturity of 1 year at rebalancing. Emerging market debt is excluded.

The Fund has chosen to benchmark against the Morningstar LSTA US Leveraged Loan Index. In addition, the performance charts below include a blended benchmark of 50% Morningstar LSTA US Leveraged Loan Index and 50% Bloomberg US High-Yield Corporate Bond Index to align with target portfolio asset allocation.

CTAC Class A Performance Data (Unaudited)

Total Return Based on a $10,000 Investment

The chart above assumes an initial gross investment of $10,000 made on June 4, 2018 (inception of Class A offering).

CTAC Class I Performance Data (Unaudited)

Total Return Based on a $250,000 Investment

The chart above assumes an initial gross investment of $250,000 on September 4, 2018 (inception of Class I offering).

CTAC Class L Performance Data (Unaudited)

Total Return Based on a $10,000 Investment

The chart above assumes an initial gross investment of $10,000 on September 4, 2018 (inception of Class L offering).

CTAC Class M Performance Data (Unaudited)

Total Return Based on a $10,000 Investment

The chart above assumes an initial gross investment of $10,000 on May 15, 2020 (inception of Class M offering).

CTAC Class N Performance Data (Unaudited)

Total Return Based on a $250,000 Investment

The chart above assumes an initial gross investment of $250,000 on April 18, 2019 (inception of Class N offering).

CTAC Class U Performance Data (Unaudited)

Total Return Based on a $10,000 Investment

The chart above assumes an initial gross investment of $10,000 on September 1, 2022 (inception of Class U offering).

CTAC Class Y Performance Data (Unaudited)

Total Return Based on a $10,000 Investment

The chart above assumes an initial gross investment of $10,000 on September 4, 2018 (inception of Class Y offering).

Past Performance is no guarantee of future results. Represents income only and does not include return of capital. Represents annualized distribution rate, which is calculated by taking the current quarter’s distribution rate divided by the current quarter-end NAV and annualizing, without compounding. NAV = NAV Per Share, MTD = Month to Date, QTD = Quarter to Date, YTD = Year to Date and ITD = Inception to Date (calculated on a cumulative basis). Annual Expense Ratios: Gross: Class A shares 5.90% / Class I shares 5.40% / Class L shares 5.90% / Class M shares 6.15%/ Class N shares 5.40%/ Class U shares 6.15%/ Class Y shares 5.65%. Net: Class A shares 5.90% / Class I shares 5.50% / Class L shares 6.08% / Class M shares 6.15% / Class N shares 5.40% / Class U shares 6.15%/ Class Y shares 5.98%. The Net Annual Expense Ratios exceed the Gross Annual Expense Ratios for certain share classes as a result of recoupment of previously reimbursed expense waivers. The performance data quoted represents past performance, which does not guarantee future results. Current performance and expense ratios may be lower or higher than the performance data quoted. The investment return and principal value of an investment in the fund will fluctuate so that an investor’s shares, when repurchased, may be worth more or less than the original cost. For performance data current to the most recent month-end, visit www.CarlyleTacticalCredit.com or call 833-677-3646. Class I, M, N, U and Y shares are not subject to a sales charge. The net expense ratio takes into account contractual fee waivers and/ or reimbursements, without which net performance would have been lower. These undertakings may not be amended or withdrawn for one year from the date of the current prospectus, unless approved by the Board. Generally, Class A, L, M and U shares are offered through Financial Intermediaries on brokerage or transactional platforms. Class I, N and Y shares are generally available through fee-based programs, registered investment advisers and other institutional accounts. Generally, Class I shares and Class N shares can only be purchased with a $250,000 initial investment. See prospectus for details.

Investors should consult with their financial advisor about the suitability of this fund in their portfolio.

INVESTING IN THE FUND INVOLVES A HIGH DEGREE OF RISK, INCLUDING THE RISK THAT YOU MAY RECEIVE LITTLE OR NO RETURN ON YOUR INVESTMENT OR THAT YOU MAY LOSE PART OR ALL OF YOUR INVESTMENT. THIS IS A CLOSED-END INTERVAL FUND AND IS NOT INTENDED TO BE A TYPICAL TRADED INVESTMENT. THE FUND WILL NOT BE LISTED OR TRADED ON ANY STOCK EXCHANGE. LIMITED LIQUIDITY IS PROVIDED TO SHAREHOLDERS ONLY THROUGH THE FUND’S QUARTERLY REPURCHASE OFFERS FOR NO LESS THAN 5% OF THE FUND’S SHARES OUTSTANDING AT NET ASSET VALUE. REGARDLESS OF HOW THE FUND PERFORMS, THERE IS NO GUARANTEE THAT SHAREHOLDERS WILL BE ABLE TO SELL ALL OF THE SHARES THEY DESIRE IN A QUARTERLY REPURCHASE OFFER.

THERE CURRENTLY IS NO SECONDARY MARKET FOR THE FUND'S SHARES AND THE FUND EXPECTS THAT NO SECONDARY MARKET WILL DEVELOP. SHARES OF THE FUND WILL NOT BE LISTED ON ANY SECURITIES EXCHANGE, WHICH MAKES THEM INHERENTLY ILLIQUID. LIMITED LIQUIDITY IS PROVIDED TO SHAREHOLDERS ONLY THROUGH THE FUND'S QUARTERLY REPURCHASE OFFERS, REGARDLESS OF HOW THE FUND PERFORMS.

There is no assurance that quarterly distributions paid by the Fund will be maintained at the targeted level or that dividends will be paid at all. The Fund's distributions may be funded from unlimited amounts of offering proceeds or borrowings, which may constitute a return of capital and reduce the amount of capital available to the Fund for investment. A return of capital to shareholders is a return of a portion of their original investment in the Fund, thereby reducing the tax basis of their investment.

This material is provided for general and educational purposes only, is not intended to provide legal or tax advice, and is not for use to avoid penalties that may be imposed under U.S. federal tax laws. Contact your attorney or other advisor regarding your specific legal, investment or tax situation.

Investing involves risk. Investment return and principal value of an investment will fluctuate, and an investor's shares, when repurchased, may be worth more or less than their original cost. Fixed income investing entails credit and interest rate risks. When interest rates rise, bond prices generally fall, and the Fund's share prices can fall. Below-investment-grade (“high yield” or “junk”) bonds are more at risk of default and are subject to liquidity risk. Credit instruments that are rated below investment grade (commonly referred to as “high yield” securities or “junk bonds”) are regarded as having predominantly speculative characteristics with respect to the issuer's capacity to pay interest and repay principal. Collateralized loan obligations (CLOs) are debt instruments but also carry additional risks related to the complexity and leverage inherent in the CLO structure. Because of the risks associated with investing in high yield securities, an investment in the Fund should be considered speculative. Some of the credit instruments will have no credit rating at all. The Fund may invest in loans and the value of those loans may be detrimentally affected to the extent a borrower defaults on its obligations. Senior loans are typically lower rated and may be illiquid investments, which may not have a ready market. Investments in lesser-known and middle market companies may be more vulnerable than larger, more established organizations. Distressed credit investments are inherently speculative and are subject to a high degree of risk. Leverage (borrowing) involves transaction and interest costs on amounts borrowed, which may reduce performance. Foreign investments may be volatile and involve additional expenses and special risks, including currency fluctuations, foreign taxes, regulatory and geopolitical risks.

The mention of specific currencies, securities, issuers or sectors does not constitute a recommendation on behalf of the Fund or Carlyle.

Shares are not FDIC insured, may lose value and not have bank guarantee. Investors should carefully consider the investment objective, risks, charges and expenses of the Fund before investing. This and other important information about the Fund is in the prospectus, which can be obtained by contacting your financial advisor or visiting www.CarlyleTacticalCredit.com. The prospectus should be read carefully before investing.

The Fund is distributed by Foreside Fund Services, LLC.

Top Holdings and Industries

Portfolio holdings and industries are subject to change. Percentages are as of December 31, 2024, and are based on net assets.

| | | | | |

Top Ten Industries(1) | |

| Software | 16.3 | % |

| Banking, Finance, Insurance & Real Estate | 10.6 | % |

| Diversified Investment Vehicles | 8.2 | % |

| Health Care Providers & Services | 7.8 | % |

| Consumer Services | 6.6 | % |

| Hotels, Restaurants & Leisure | 5.6 | % |

| Professional Services | 5.5 | % |

| Capital Equipment | 3.3 | % |

| Electronic Equipment, Instruments & Components | 3.3 | % |

| Commercial Services & Supplies | 2.8 | % |

(1) Although not an industry, Collateralized Loan Obligations, which are well-diversified pools of loans in varying industries, represent 21.8% of net assets.

| | | | | |

| Top Ten Holdings | |

| Santiago Holdings, LP | 1.9 | % |

| Vensure Employer Services, Inc., Term Loan | 1.5 | % |

| Park County Holdings, LLC, Term Loan | 1.4 | % |

| Nader Upside 2 S.a.r.l., Term Loan, Tranche B | 1.3 | % |

| NPA 2023 Holdco, LLC, Corporate Bond | 1.3 | % |

| Excelitas Technologies Corp., Term Loan | 1.2 | % |

| Monroe Capital CFO I Ltd., Class A | 1.2 | % |

| Rome Bidco Ltd., Term Loan | 1.2 | % |

| Galileo Parent, Inc., Term Loan | 1.1 | % |

| Tank Holding Corp., Term Loan | 1.1 | % |

CARLYLE TACTICAL PRIVATE CREDIT FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS

As of December 31, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments—Corporate Loans (85.1% of Net Assets) | Footnotes | Industry | Reference Rate & Spread | Interest Rate | Maturity Date | Par / Principal Amount * | Amortized Cost | Fair Value |

| First Lien Debt (81.0% of Net Assets) | | | | | | | | |

| 222 North Miami, LLC | Term Loan, Tranche B | (4) (5) (6) (14) | Real Estate Management & Development | SOFR + 1318 | 17.85 | % | 12/1/2025 | $ | 10,318,275 | | $ | 10,282,792 | | $ | 10,318,267 | |

| AAdvantage Loyalty IP Ltd. | Term Loan | (2) (3) (4) (13) (14) | Aerospace & Defense | SOFR + 475 | 9.63 | % | 4/20/2028 | 3,500,000 | | 3,481,157 | | 3,588,690 | |

| Accession Risk Management Group, Inc. | Delayed Draw Term Loan, 2022 Tranche 2 | (2) (3) (4) (5) (14) | Trading Companies & Distributors | SOFR + 475 | 9.35 | % | 11/1/2029 | 2,141,639 | | 2,135,017 | | 2,162,283 | |

| Accession Risk Management Group, Inc. | Delayed Draw Term Loan, 2023 Tranche 2 | (2) (3) (4) (5) (14) | Trading Companies & Distributors | SOFR + 475 | 9.35 | % | 11/1/2029 | 11,346,886 | | 11,331,163 | | 11,456,259 | |

| Accession Risk Management Group, Inc. | Term Loan, Tranche B | (3) (4) (5) (14) | Trading Companies & Distributors | SOFR + 475 | 9.28 | % | 11/1/2029 | 3,524,182 | | 3,524,259 | | 3,558,151 | |

| Accession Risk Management Group, Inc. | Term Loan | (3) (4) (5) (14) | Trading Companies & Distributors | SOFR + 475 | 9.28 | % | 11/1/2029 | 19,470,728 | | 19,504,141 | | 19,658,408 | |

| Accession Risk Management Group, Inc. | Term Loan, Tranche C | (3) (4) (5) (14) | Trading Companies & Distributors | SOFR + 475 | 9.28 | % | 11/1/2029 | 11,837,684 | | 11,792,099 | | 11,951,788 | |

| ACR Group Borrower, LLC | Delayed Draw Term Loan | (2) (3) (4) (5) (6) (14) | Aerospace & Defense | SOFR + 475 | 9.08 | % | 3/31/2028 | 550,024 | | 544,753 | | 550,024 | |

| ACR Group Borrower, LLC | Term Loan, Incremental | (2) (3) (4) (5) (14) | Aerospace & Defense | SOFR + 475 | 9.08 | % | 3/31/2028 | 870,778 | | 863,291 | | 870,778 | |

| Acrisure, LLC | Term Loan, Tranche B6 | (3) (4) (14) | Insurance | SOFR + 300 | 7.36 | % | 11/6/2030 | 8,229,375 | | 8,229,375 | | 8,226,824 | |

| ADPD Holdings, LLC | Revolver | (4) (5) (6) (13) (14) | Consumer Services | SOFR + 600 | 10.70 | % | 8/16/2028 | 603,550 | | 592,131 | | 527,751 | |

| ADPD Holdings, LLC | Term Loan | (2) (3) (4) (5) (6) (13) (14) | Consumer Services | SOFR + 600 | 10.70 | % | 8/16/2028 | 10,950,814 | | 10,757,694 | | 9,869,667 | |

| Advanced Web Technologies Holding Company | Delayed Draw Term Loan 2 | (3) (4) (5) (8) (14) | Containers, Packaging & Glass | SOFR + 400, 2.25% PIK | 10.58 | % | 12/17/2027 | 1,051,911 | | 1,043,380 | | 1,051,471 | |

| Advanced Web Technologies Holding Company | Term Loan, 2024 4th Amendment | (3) (4) (5) (8) (14) | Containers, Packaging & Glass | SOFR + 400, 2.25% PIK | 10.58 | % | 12/17/2027 | 1,027,217 | | 1,011,529 | | 1,026,788 | |

| Advanced Web Technologies Holding Company | Term Loan, 3rd Amendment Incremental | (4) (5) (8) (14) | Containers, Packaging & Glass | SOFR + 400, 2.25% PIK | 10.58 | % | 12/17/2027 | 397,043 | | 389,928 | | 396,877 | |

| Advanced Web Technologies Holding Company | Delayed Draw Term Loan | (3) (4) (5) (8) (14) | Containers, Packaging & Glass | SOFR + 400, 2.25% PIK | 10.58 | % | 12/17/2027 | 1,429,875 | | 1,420,205 | | 1,429,278 | |

| Advanced Web Technologies Holding Company | Delayed Draw Term Loan | (3) (4) (5) (8) (14) | Containers, Packaging & Glass | SOFR + 400, 2.25% PIK | 10.58 | % | 12/17/2027 | 727,510 | | 721,544 | | 727,206 | |

| Advanced Web Technologies Holding Company | Revolver | (3) (4) (5) (6) (8) (14) | Containers, Packaging & Glass | SOFR + 400, 2.25% PIK | 10.58 | % | 12/17/2027 | 113,716 | | 107,457 | | 113,384 | |

| Advanced Web Technologies Holding Company | Term Loan | (2) (3) (4) (5) (6) (8) (14) | Containers, Packaging & Glass | SOFR + 400, 2.25% PIK | 10.58 | % | 12/17/2027 | 3,893,470 | | 3,843,833 | | 3,891,129 | |

| Advisor Group, Inc. | Term Loan | (3) (4) (14) | Banking, Finance, Insurance & Real Estate | SOFR + 350 | 8.01 | % | 8/17/2028 | 9,950,063 | | 9,906,658 | | 9,906,650 | |

| AI Aqua Merger Sub, Inc. | Term Loan, Tranche B | (3) (4) (7) (14) | Consumer Services | SOFR + 350 | 8.05 | % | 7/31/2028 | 11,094,593 | | 10,962,395 | | 11,094,593 | |

| AI Grace AUS Bidco Pty. Ltd. | Term Loan, Tranche B | (3) (4) (5) (14) | Specialty Retail | SOFR + 525 | 9.62 | % | 12/17/2029 | 18,285,714 | | 18,285,714 | | 18,285,714 | |

| Alliance Laundry Systems, LLC | Term Loan, Tranche B | (3) (4) (14) | Machinery | SOFR + 350 | 7.84 | % | 8/9/2031 | 5,000,000 | | 4,975,976 | | 5,027,250 | |

CARLYLE TACTICAL PRIVATE CREDIT FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS (continued)

As of December 31, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments—Corporate Loans (85.1% of Net Assets) | Footnotes | Industry | Reference Rate & Spread | Interest Rate | Maturity Date | Par / Principal Amount * | Amortized Cost | Fair Value |

| Alliant Holdings Intermediate, LLC | Term Loan, Tranche B6 | (3) (4) (14) | Insurance | SOFR + 275 | 7.11 | % | 9/19/2031 | 4,987,500 | | 4,975,364 | | 4,995,281 | |

| Allied Benefit Systems Intermediate, LLC | Delayed Draw Term Loan | (2) (4) (5) (14) | Health Care Providers & Services | SOFR + 525 | 9.63 | % | 10/31/2030 | 3,144,706 | | 3,103,282 | | 3,176,153 | |

| Allied Benefit Systems Intermediate, LLC | Term Loan | (2) (3) (4) (5) (14) | Health Care Providers & Services | SOFR + 525 | 9.63 | % | 10/31/2030 | 17,147,867 | | 16,922,268 | | 17,319,345 | |

| Allied Universal Holdco, LLC | Term Loan, Tranche B Incremental | (2) (3) (4) (13) (14) | Professional Services | SOFR + 375 | 8.42 | % | 5/12/2028 | 9,840,779 | | 9,798,420 | | 9,864,495 | |

| Alpine Acquisition Corp. II | Revolver | (4) (5) (6) (8) (13) (14) | Transportation | SOFR + 200, 4.00% PIK | 10.70 | % | 11/30/2029 | 1,482,212 | | 1,451,786 | | 802,470 | |

| Alpine Acquisition Corp. II | Term Loan | (3) (4) (5) (8) (13) (14) | Transportation | SOFR + 200, 4.00% PIK | 10.70 | % | 11/30/2029 | 20,384,417 | | 20,196,602 | | 16,364,653 | |

| Alterra Mountain Co. | Term Loan, Tranche B | (3) (4) (14) | Hotels, Restaurants & Leisure | SOFR + 275 | 7.11 | % | 8/17/2028 | 3,944,493 | | 3,928,801 | | 3,966,701 | |

| Amperscap, LLC | Delayed Draw Term Loan | (3) (4) (5) (6) (14) | Banking, Finance, Insurance & Real Estate | SOFR + 525 | 9.54 | % | 12/17/2032 | 4,945,055 | | 4,648,580 | | 4,648,580 | |

| Amynta Agency Borrower, Inc. | Term Loan, Tranche B | (3) (4) (14) | Banking, Finance, Insurance & Real Estate | SOFR + 300 | 7.34 | % | 2/28/2028 | 3,675,812 | | 3,675,812 | | 3,675,812 | |

| Anticimex International AB | Term Loan, Tranche B1 | (2) (3) (4) (14) | Commercial Services & Supplies | SOFR + 315 | 7.72 | % | 11/16/2028 | 4,921,390 | | 4,868,256 | | 4,951,115 | |

| Apex Companies Holdings, LLC | Delayed Draw Term Loan, 3rd Amendment | (4) (5) (6) (14) | Commercial Services & Supplies | SOFR + 525 | 9.78 | % | 1/31/2028 | 1,829,006 | | 1,755,180 | | 1,792,818 | |

| Apex Companies Holdings, LLC | Delayed Draw Term Loan | (4) (5) (14) | Commercial Services & Supplies | SOFR + 525 | 9.60 | % | 1/31/2028 | 762,188 | | 747,897 | | 757,513 | |

| Apex Companies Holdings, LLC | Delayed Draw Term Loan, Tranche A | (4) (5) (14) | Commercial Services & Supplies | SOFR + 525 | 9.60 | % | 1/31/2028 | 1,221,841 | | 1,202,919 | | 1,214,347 | |

| Apex Companies Holdings, LLC | Delayed Draw Term Loan, Tranche B | (4) (5) (14) | Commercial Services & Supplies | SOFR + 525 | 9.76 | % | 1/31/2028 | 2,489,971 | | 2,451,824 | | 2,474,699 | |

| Apex Companies Holdings, LLC | Term Loan, Incremental | (3) (4) (5) (14) | Commercial Services & Supplies | SOFR + 525 | 9.76 | % | 1/31/2028 | 509,768 | | 502,780 | | 506,641 | |

| Apex Companies Holdings, LLC | Delayed Draw Term Loan, Specified | (4) (5) (14) | Commercial Services & Supplies | SOFR + 525 | 9.60 | % | 1/31/2028 | 147,541 | | 144,792 | | 146,636 | |

| Apex Companies Holdings, LLC | Delayed Draw Term Loan, Specified | (4) (5) (14) | Commercial Services & Supplies | SOFR + 525 | 9.76 | % | 1/31/2028 | 1,667,604 | | 1,644,734 | | 1,657,376 | |

| Apex Companies Holdings, LLC | Term Loan | (2) (3) (4) (5) (14) | Commercial Services & Supplies | SOFR + 525 | 9.60 | % | 1/31/2028 | 3,190,574 | | 3,130,967 | | 3,171,005 | |

| Applied Systems, Inc. | Term Loan | (2) (3) (4) (14) | Software | SOFR + 300 | 7.33 | % | 2/24/2031 | 2,587,000 | | 2,584,021 | | 2,610,231 | |

| Applied Technical Services, LLC | Delayed Draw Term Loan, 1st Amendment, Tranche A | (4) (5) (13) (14) | Professional Services | SOFR + 575 | 10.23 | % | 12/29/2026 | 2,699,478 | | 2,673,271 | | 2,662,331 | |

| Applied Technical Services, LLC | Delayed Draw Term Loan, 1st Amendment, Tranche B | (4) (5) (13) (14) | Professional Services | SOFR + 575 | 10.23 | % | 12/29/2026 | 2,759,694 | | 2,733,448 | | 2,721,718 | |

| Applied Technical Services, LLC | Delayed Draw Term Loan, 4th Amendment | (3) (4) (5) (13) (14) | Professional Services | SOFR + 600 | 10.52 | % | 12/29/2026 | 1,057,560 | | 1,043,844 | | 1,047,963 | |

| Applied Technical Services, LLC | Term Loan, 4th Amendment | (3) (4) (5) (13) (14) | Professional Services | SOFR + 600 | 10.52 | % | 12/29/2026 | 1,057,560 | | 1,043,844 | | 1,047,963 | |

CARLYLE TACTICAL PRIVATE CREDIT FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS (continued)

As of December 31, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments—Corporate Loans (85.1% of Net Assets) | Footnotes | Industry | Reference Rate & Spread | Interest Rate | Maturity Date | Par / Principal Amount * | Amortized Cost | Fair Value |

| Applied Technical Services, LLC | Delayed Draw Term Loan | (4) (5) (13) (14) | Professional Services | SOFR + 575 | 10.23 | % | 12/29/2026 | 956,769 | | 948,544 | | 943,603 | |

| Applied Technical Services, LLC | Delayed Draw Term Loan | (4) (5) (6) (13) (14) | Professional Services | SOFR + 575 | 10.27 | % | 12/29/2026 | 1,139,948 | | 1,089,127 | | 1,089,082 | |

| Applied Technical Services, LLC | Revolver | (4) (5) (6) (13) (14) | Professional Services | SOFR + 575 | 10.23 | % | 12/29/2026 | 842,326 | | 831,464 | | 829,239 | |

| Applied Technical Services, LLC | Term Loan | (2) (3) (4) (5) (13) (14) | Professional Services | SOFR + 575 | 10.23 | % | 12/29/2026 | 2,845,850 | | 2,820,744 | | 2,806,689 | |

| Applied Technical Services, LLC | Term Loan | (3) (4) (5) (13) (14) | Professional Services | SOFR + 575 | 10.27 | % | 12/29/2026 | 1,952,620 | | 1,924,968 | | 1,925,751 | |

| Appriss Health, LLC | Term Loan | (2) (3) (4) (5) (6) (13) (14) | Health Care Providers & Services | SOFR + 700 | 12.08 | % | 5/6/2027 | 13,033,333 | | 12,899,669 | | 12,941,790 | |

| Ardonagh Midco 3 PLC | Term Loan, Tranche B | (2) (4) (5) (14) | Insurance | SOFR + 475 | 9.90 | % | 2/15/2031 | 7,055,422 | | 6,958,835 | | 7,119,608 | |

| Aretec Group, Inc. | Term Loan, Tranche B | (4) (14) | Banking, Finance, Insurance & Real Estate | SOFR + 350 | 7.80 | % | 8/9/2030 | 1,500,000 | | 1,500,000 | | 1,501,170 | |

| Armor Holding II, LLC | Term Loan, Tranche B | (2) (3) (4) (5) (14) | Professional Services | SOFR + 375 | 8.05 | % | 12/11/2028 | 1,940,138 | | 1,926,789 | | 1,926,789 | |

| Artifact Bidco, Inc. | Term Loan | (2) (3) (4) (5) (6) (14) | Software | SOFR + 450 | 8.83 | % | 7/28/2031 | 17,610,837 | | 17,373,708 | | 17,431,715 | |

| Ascend Buyer, LLC | Revolver | (4) (5) (6) (13) (14) | Containers, Packaging & Glass | SOFR + 575 | 10.23 | % | 9/30/2027 | 570,562 | | 554,387 | | 568,245 | |

| Ascend Buyer, LLC | Term Loan | (2) (3) (4) (5) (13) (14) | Containers, Packaging & Glass | SOFR + 575 | 10.23 | % | 9/30/2028 | 16,326,641 | | 16,125,057 | | 16,304,540 | |

| Ascensus Holdings, Inc. | Term Loan | (3) (4) (14) | Banking, Finance, Insurance & Real Estate | SOFR + 300 | 7.44 | % | 8/2/2028 | 4,934,755 | | 4,906,161 | | 4,971,766 | |

| Associations, Inc. | Revolver, 2nd Amendment | (4) (5) (6) (14) | Construction & Engineering | SOFR + 650 | 11.05 | % | 7/2/2028 | 1,220,675 | | 1,218,614 | | 1,220,675 | |

| Associations, Inc. | Term Loan, Tranche A, 2nd Amendment | (2) (3) (4) (5) (14) | Construction & Engineering | SOFR + 650 | 11.05 | % | 7/2/2028 | 39,215,506 | | 39,179,467 | | 39,573,254 | |

| Associations, Inc. | Delayed Draw Term Loan, Special Purpose | (4) (5) (6) (14) | Construction & Engineering | SOFR + 650 | 11.05 | % | 7/2/2028 | 508,454 | | 505,885 | | 536,249 | |

| Associations, Inc. | Term Loan, Tranche A | (5) (8) | Construction & Engineering | 14.25% PIK | 14.25 | % | 5/3/2030 | 11,927,408 | | 11,876,331 | | 11,873,109 | |

| Associations, Inc. | Term Loan, Tranche B | (5) (8) | Construction & Engineering | 14.25% PIK | 14.25 | % | 5/3/2030 | 4,554,723 | | 4,535,218 | | 4,533,988 | |

| AssuredPartners, Inc. | Term Loan, Tranche B5 Incremental | (3) (4) (14) | Insurance | SOFR + 350 | 7.86 | % | 2/13/2031 | 3,970,000 | | 3,965,396 | | 3,975,201 | |

| Astra Acquisition Corp. | Term Loan, Tranche B | (3) (4) (5) (14) (15) | Software | SOFR + 525 | 9.58 | % | 10/25/2028 | 20,067,992 | | 5,873,164 | | 1,003,400 | |

| Asurion, LLC | Term Loan, Tranche B10 | (2) (3) (4) (13) (14) | Insurance | SOFR + 400 | 8.46 | % | 8/19/2028 | 967,676 | | 935,215 | | 964,250 | |

| Athenahealth Group, Inc. | Term Loan, Tranche B | (2) (3) (4) (7) (14) | Software | SOFR + 325 | 7.61 | % | 2/15/2029 | 9,063,294 | | 9,000,948 | | 9,072,992 | |

| Athlete Buyer, LLC | Delayed Draw Term Loan A, 3rd Amendment | (3) (4) (5) (13) (14) | Consumer Services | SOFR + 575 | 10.18 | % | 4/26/2029 | 4,422,030 | | 4,343,941 | | 4,351,685 | |

| Athlete Buyer, LLC | Delayed Draw Term Loan B, 3rd Amendment | (4) (5) (6) (13) (14) | Consumer Services | SOFR + 575 | 10.18 | % | 4/26/2029 | 13,501,285 | | 13,141,267 | | 13,171,956 | |

CARLYLE TACTICAL PRIVATE CREDIT FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS (continued)

As of December 31, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments—Corporate Loans (85.1% of Net Assets) | Footnotes | Industry | Reference Rate & Spread | Interest Rate | Maturity Date | Par / Principal Amount * | Amortized Cost | Fair Value |

| Athlete Buyer, LLC | Delayed Draw Term Loan, Tranche A | (2) (3) (4) (5) (6) (13) (14) | Consumer Services | SOFR + 575 | 10.18 | % | 4/26/2029 | 3,069,015 | | 2,760,924 | | 2,783,938 | |

| Athlete Buyer, LLC | Delayed Draw Term Loan, Tranche D | (3) (4) (5) (13) (14) | Consumer Services | SOFR + 575 | 10.18 | % | 4/26/2029 | 1,494,587 | | 1,468,161 | | 1,470,812 | |

| Atlas AU Bidco Pty Ltd. | Term Loan | (2) (3) (4) (5) (6) (14) | Software | SOFR + 500 | 9.63 | % | 12/9/2029 | 2,883,051 | | 2,810,261 | | 2,887,366 | |

| Atlas US Finco, Inc. | Term Loan, Incremental | (3) (4) (5) (14) | Software | SOFR + 500 | 9.63 | % | 12/9/2029 | 1,334,746 | | 1,311,562 | | 1,336,744 | |

| AuditBoard, Inc. | Term Loan | (3) (4) (5) (6) (14) | Software | SOFR + 475 | 9.07 | % | 7/12/2031 | 15,000,000 | | 14,763,805 | | 14,853,838 | |

| Avalara, Inc. | Revolver | (4) (5) (6) (14) | Banking, Finance, Insurance & Real Estate | SOFR + 625 | 10.58 | % | 10/19/2028 | 53,183 | | 38,801 | | 53,183 | |

| Avalara, Inc. | Term Loan | (2) (3) (4) (5) (14) | Banking, Finance, Insurance & Real Estate | SOFR + 625 | 10.58 | % | 10/19/2028 | 9,531,827 | | 9,372,054 | | 9,531,827 | |

| Azurite Intermediate Holdings, Inc. | Delayed Draw Term Loan | (2) (3) (4) (5) (14) | Software | SOFR + 650 | 10.86 | % | 3/19/2031 | 14,905,858 | | 14,682,270 | | 15,192,216 | |

| Azurite Intermediate Holdings, Inc. | Term Loan | (2) (3) (4) (5) (6) (14) | Software | SOFR + 650 | 10.86 | % | 3/19/2031 | 6,558,577 | | 6,436,047 | | 6,684,575 | |

| Banff Merger Sub, Inc. | Term Loan, Tranche B | (3) (4) (14) | Software | SOFR + 375 | 8.34 | % | 7/3/2031 | 5,000,000 | | 4,988,039 | | 5,036,950 | |

| Barnes & Noble, Inc. | Term Loan | (2) (3) (4) (5) (11) (13) (14) | Specialty Retail | SOFR + 881 | 13.27 | % | 12/20/2026 | 2,006,505 | | 1,969,853 | | 1,993,291 | |

| Barracuda Networks, Inc. | Term Loan | (3) (4) (7) (14) | Software | SOFR + 450 | 9.09 | % | 8/15/2029 | 3,934,762 | | 3,866,836 | | 3,630,329 | |

| Bausch & Lomb Corp. | Term Loan | (3) (4) (5) (14) | Health Care Providers & Services | SOFR + 400 | 8.33 | % | 9/29/2028 | 4,937,500 | | 4,898,353 | | 4,956,016 | |

| BCPE Empire Holdings, Inc. | Term Loan | (3) (4) (14) | Trading Companies & Distributors | SOFR + 350 | 7.86 | % | 12/11/2028 | 1,492,500 | | 1,489,334 | | 1,498,724 | |

| BCPE Pequod Buyer, Inc. | Term Loan, Tranche B | (3) (4) (14) | Banking, Finance, Insurance & Real Estate | SOFR + 350 | 7.86 | % | 9/19/2031 | 7,250,000 | | 7,213,750 | | 7,303,070 | |

| Bedford Beverly B, LLC | Term Loan, Land | (4) (5) (20) | Real Estate Management & Development | SOFR + 775 | 12.31 | % | 9/2/2026 | 9,719,189 | | 9,677,606 | | 9,670,593 | |

| Bedford Beverly B, LLC | Term Loan, Project | (4) (5) (6) (20) | Real Estate Management & Development | SOFR + 775 | 12.31 | % | 9/2/2026 | 1,984,659 | | 1,953,844 | | 1,947,402 | |

| Bedford Beverly B, LLC | Term Loan, Building | (4) (5) (6) (20) | Real Estate Management & Development | SOFR + 775 | 12.31 | % | 9/2/2026 | 11,354,203 | | 11,237,552 | | 11,213,276 | |

| Berlin Packaging, LLC | Term Loan, Tranche B7 | (3) (4) (14) | Containers, Packaging & Glass | SOFR + 350 | 7.83 | % | 6/7/2031 | 3,954,530 | | 3,893,767 | | 3,893,767 | |

| Big Bus Tours Bidco Ltd. | Term Loan, Tranche B | (2) (3) (4) (5) (14) | Hotels, Restaurants & Leisure | EURIBOR + 825 | 11.21 | % | 6/4/2031 | € | 16,515,636 | | 17,460,313 | | 16,637,254 | |

| Big Bus Tours Bidco Ltd. | Term Loan, Tranche B | (2) (3) (4) (5) (6) (14) | Hotels, Restaurants & Leisure | SOFR + 825 | 12.75 | % | 6/4/2031 | 26,706,231 | | 25,820,650 | | 25,846,268 | |

| Bingo Group Buyer, Inc. | Revolver | (4) (5) (6) (14) | Commercial Services & Supplies | SOFR + 500 | 9.33 | % | 7/10/2031 | 31,148 | | 19,184 | | 31,148 | |

| Bingo Group Buyer, Inc. | Term Loan | (3) (4) (5) (6) (14) | Commercial Services & Supplies | SOFR + 500 | 9.33 | % | 7/10/2031 | 8,585,041 | | 8,451,867 | | 8,696,181 | |

CARLYLE TACTICAL PRIVATE CREDIT FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS (continued)

As of December 31, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments—Corporate Loans (85.1% of Net Assets) | Footnotes | Industry | Reference Rate & Spread | Interest Rate | Maturity Date | Par / Principal Amount * | Amortized Cost | Fair Value |

| BlueCat Networks, Inc. | Delayed Draw Term Loan, Tranche A | (4) (5) (8) (14) | High Tech Industries | SOFR + 500, 1.00% PIK | 10.39 | % | 8/8/2028 | 451,731 | | 445,978 | | 444,539 | |

| BlueCat Networks, Inc. | Delayed Draw Term Loan, Tranche B | (4) (5) (8) (14) | High Tech Industries | SOFR + 500, 1.00% PIK | 10.39 | % | 8/8/2028 | 167,160 | | 165,078 | | 164,499 | |

| BlueCat Networks, Inc. | Term Loan | (2) (3) (4) (5) (8) (14) | High Tech Industries | SOFR + 500, 1.00% PIK | 10.39 | % | 8/8/2028 | 8,977,480 | | 8,848,496 | | 8,834,554 | |

| BlueCat Networks, Inc. | Term Loan, Tranche A | (2) (3) (4) (5) (8) (14) | High Tech Industries | SOFR + 500, 1.00% PIK | 10.39 | % | 8/8/2028 | 3,209,713 | | 3,168,161 | | 3,158,613 | |

| BradyPLUS Holdings, LLC | Delayed Draw Term Loan | (4) (5) (6) (14) | Distributors | SOFR + 500 | 9.52 | % | 10/31/2029 | 167,746 | | 154,853 | | 170,372 | |

| BradyPLUS Holdings, LLC | Term Loan, Tranche B | (2) (3) (4) (5) (14) | Distributors | SOFR + 500 | 9.52 | % | 10/31/2029 | 26,504,474 | | 26,053,921 | | 26,593,735 | |

| Broadstreet Partners, Inc. | Term Loan, Tranche B4 | (3) (4) (14) | Insurance | SOFR + 300 | 7.36 | % | 6/13/2031 | 4,955,119 | | 4,915,189 | | 4,967,259 | |

| Bullhorn, Inc. | Delayed Draw Term Loan, 8th Amendment | (2) (4) (5) (6) (14) | Software | SOFR + 500 | 9.36 | % | 10/1/2029 | 14,971,292 | | 14,884,837 | | 14,949,273 | |

| Bullhorn, Inc. | Term Loan | (2) (3) (4) (5) (14) | Software | SOFR + 500 | 9.36 | % | 10/1/2029 | 5,755,608 | | 5,742,563 | | 5,749,098 | |

| Bullhorn, Inc. | Term Loan | (2) (3) (4) (5) (14) | Software | SONIA + 500 | 9.70 | % | 10/1/2029 | £ | 10,422,070 | | 13,021,096 | | 13,032,631 | |

| Cambrex Corp. | Term Loan | (3) (4) (13) (14) | Health Care Providers & Services | SOFR + 350 | 7.96 | % | 12/4/2026 | 2,646,220 | | 2,646,220 | | 2,642,436 | |

| CD&R Hydra Buyer, Inc. | Term Loan, Tranche B | (3) (4) (14) | Trading Companies & Distributors | SOFR + 400 | 8.46 | % | 3/25/2031 | 4,974,937 | | 4,962,815 | | 4,984,887 | |

| Celerion Buyer, Inc. | Term Loan | (2) (3) (4) (5) (6) (14) | Health Care Providers & Services | SOFR + 500 | 9.52 | % | 11/5/2029 | 1,544,440 | | 1,508,315 | | 1,530,030 | |

| Celerion Buyer, Inc. | Term Loan, 2nd Amendment | (3) (4) (5) (14) | Health Care Providers & Services | SOFR + 500 | 9.53 | % | 11/5/2029 | 855,164 | | 846,765 | | 848,741 | |

| Central Parent, Inc. | Term Loan, Tranche B | (3) (4) (14) | Software | SOFR + 325 | 7.61 | % | 7/6/2029 | 7,742,071 | | 7,635,476 | | 7,626,947 | |

| Ceva Sante Animale S.A. | Term Loan, Tranche B | (3) (4) (14) | Health Care Providers & Services | SOFR + 325 | 7.77 | % | 11/1/2030 | 1,985,000 | | 1,967,526 | | 1,994,925 | |

| Chamberlain Group, Inc. | Term Loan, Tranche B | (3) (4) (14) | Construction & Engineering | SOFR + 325 | 7.66 | % | 11/3/2028 | 2,977,326 | | 2,958,662 | | 2,958,662 | |

| Chartis Group, LLC | Term Loan | (3) (4) (5) (6) (14) | Health Care Providers & Services | SOFR + 450 | 8.85 | % | 9/17/2031 | 31,229,530 | | 30,789,147 | | 30,964,789 | |

| Chemical Computing Group ULC | Term Loan, Tranche A | (2) (3) (4) (5) (6) (13) (14) | Software | SOFR + 450 | 9.06 | % | 8/25/2025 | 1,758,750 | | 1,758,121 | | 1,758,750 | |

| City Football Group Ltd. | Term Loan | (3) (4) (13) (14) | Hotels, Restaurants & Leisure | SOFR + 300 | 7.47 | % | 7/22/2030 | 6,917,560 | | 6,898,161 | | 6,885,877 | |

| Cloud Software Group, Inc. | Term Loan | (3) (4) (13) (14) | Software | SOFR + 375 | 8.08 | % | 3/22/2031 | 5,000,000 | | 4,965,551 | | 5,010,700 | |

| Cloud Software Group, Inc. | Term Loan, Tranche B | (3) (4) (14) | Software | SOFR + 350 | 7.83 | % | 3/30/2029 | 7,335,760 | | 6,853,413 | | 7,351,605 | |

| Cobham Ultra SeniorCo S.a.r.l. | Term Loan, Tranche B | (2) (3) (4) (14) | Electronic Equipment, Instruments & Components | SOFR + 375 | 8.82 | % | 8/3/2029 | 2,933,171 | | 2,933,171 | | 2,919,561 | |

| ConnectWise, LLC | Term Loan, Tranche B | (3) (4) (13) (14) | Software | SOFR + 350 | 8.09 | % | 9/29/2028 | 11,938,462 | | 11,910,012 | | 12,000,661 | |

| Cordstrap Holding B.V. | Term Loan, Facility B | (2) (3) (4) (5) (8) (14) | Transportation | EURIBOR + 558, 2.06% PIK | 10.42 | % | 5/11/2028 | € | 24,906,985 | | 25,546,147 | | 26,960,888 | |

CARLYLE TACTICAL PRIVATE CREDIT FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS (continued)

As of December 31, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments—Corporate Loans (85.1% of Net Assets) | Footnotes | Industry | Reference Rate & Spread | Interest Rate | Maturity Date | Par / Principal Amount * | Amortized Cost | Fair Value |

| CoreLogic, Inc. | Term Loan | (3) (4) (13) (14) | Commercial Services & Supplies | SOFR + 350 | 7.97 | % | 6/2/2028 | 2,104,006 | | 2,098,169 | | 2,074,697 | |

| CoreWeave Compute Acquisition Co., II, LLC | Delayed Draw Term Loan | (4) (5) (14) | Electronic Equipment, Instruments & Components | SOFR + 962 | 14.10 | % | 6/30/2028 | 3,547,297 | | 3,499,765 | | 3,582,770 | |

| CoreWeave Compute Acquisition Co., IV, LLC | Delayed Draw Term Loan | (4) (5) (6) (14) | Electronic Equipment, Instruments & Components | SOFR + 600 | 10.54 | % | 7/26/2029 | 3,333,193 | | 2,761,906 | | 2,756,936 | |

| CoreWeave Compute Acquisition Co., IV, LLC | Delayed Draw Term Loan | (4) (5) (14) | Electronic Equipment, Instruments & Components | SOFR + 600 | 10.54 | % | 8/27/2029 | 6,522,181 | | 6,434,349 | | 6,424,348 | |

| CoreWeave Compute Acquisition Co., IV, LLC | Delayed Draw Term Loan | (4) (5) (14) | Electronic Equipment, Instruments & Components | SOFR + 600 | 10.54 | % | 6/28/2029 | 2,226,262 | | 2,196,496 | | 2,192,868 | |

| CoreWeave Compute Acquisition Co., IV, LLC | Delayed Draw Term Loan | (4) (5) (14) | Electronic Equipment, Instruments & Components | SOFR + 600 | 10.54 | % | 10/11/2029 | 8,302,684 | | 8,191,502 | | 8,178,143 | |

| CoreWeave Compute Acquisition Co., IV, LLC | Delayed Draw Term Loan | (4) (5) (14) | Electronic Equipment, Instruments & Components | SOFR + 600 | 10.54 | % | 10/28/2029 | 4,264,024 | | 4,207,044 | | 4,200,064 | |

| CoreWeave Compute Acquisition Co., IV, LLC | Delayed Draw Term Loan | (4) (5) (14) | Electronic Equipment, Instruments & Components | SOFR + 600 | 10.54 | % | 11/25/2029 | 4,823,252 | | 4,759,073 | | 4,750,903 | |

| CoreWeave Compute Acquisition Co., IV, LLC | Delayed Draw Term Loan | (4) (5) (14) | Electronic Equipment, Instruments & Components | SOFR + 600 | 10.54 | % | 12/10/2029 | 2,351,040 | | 2,319,827 | | 2,315,774 | |

| CoreWeave Compute Acquisition Co., IV, LLC | Delayed Draw Term Loan | (4) (5) (14) | Electronic Equipment, Instruments & Components | SOFR + 600 | 10.54 | % | 12/31/2029 | 4,079,889 | | 4,025,922 | | 4,018,691 | |

| Cornerstone OnDemand, Inc. | Term Loan | (2) (3) (4) (7) (13) (14) | Software | SOFR + 375 | 8.22 | % | 10/16/2028 | 2,917,048 | | 2,834,816 | | 2,553,875 | |

| Cotiviti Corp. | Term Loan | (3) (4) (14) | Health Care Technology | SOFR + 300 | 7.55 | % | 2/22/2031 | 4,967,538 | | 4,953,624 | | 4,989,295 | |

| Coupa Holdings, LLC | Term Loan | (2) (3) (4) (5) (6) (14) | Software | SOFR + 550 | 10.09 | % | 2/27/2030 | 6,446,244 | | 6,297,801 | | 6,539,933 | |

| Covetrus, Inc. | Term Loan | (3) (4) (14) | Health Care Providers & Services | SOFR + 500 | 9.33 | % | 10/13/2029 | 1,974,874 | | 1,943,141 | | 1,894,773 | |

| CP Developer S.a.r.l. | Term Loan | (2) (3) (4) (5) (8) (14) | Banking, Finance, Insurance & Real Estate | EURIBOR + 800, 4.00% PIK | 15.02 | % | 5/21/2026 | € | 13,090,920 | | 13,599,545 | | 12,780,513 | |

| CST Holding Company | Term Loan | (2) (3) (4) (5) (6) (13) (14) | Consumer Goods: Non-Durable | SOFR + 500 | 9.46 | % | 11/1/2028 | 2,442,320 | | 2,385,677 | | 2,442,559 | |

| Da Vinci Purchaser Corp. | Term Loan | (3) (4) (14) | Software | SOFR + 350 | 7.86 | % | 1/8/2027 | 1,882,738 | | 1,884,972 | | 1,888,782 | |

| Daffodil Bidco Ltd. | Term Loan | (4) (5) (8) (14) | Banking, Finance, Insurance & Real Estate | SONIA + 12.50% PIK | 17.20 | % | 4/30/2031 | £ | 27,371,834 | | 34,139,391 | | 33,410,123 | |

| Daffodil Bidco Ltd. | Term Loan, Tranche B | (3) (4) (5) (14) | Banking, Finance, Insurance & Real Estate | SONIA + 800 | 12.70 | % | 4/30/2031 | £ | 30,015,358 | | 37,318,270 | | 36,636,814 | |

| Dance Midco S.a.r.l. | Delayed Draw Term Loan, Tranche B2 | (4) (5) (6) (14) | Hotels, Restaurants & Leisure | EURIBOR + 550 | 8.54 | % | 10/25/2031 | € | 6,536,302 | | 6,387,170 | | 6,447,234 | |

| Dance Midco S.a.r.l. | Term Loan, Tranche B1 | (2) (3) (4) (5) (14) | Hotels, Restaurants & Leisure | EURIBOR + 550 | 8.54 | % | 10/25/2031 | € | 38,383,072 | | 40,826,972 | | 39,162,709 | |

| Darktrace PLC | Term Loan | (3) (4) (14) | Software | SOFR + 325 | 7.89 | % | 7/2/2031 | 10,000,000 | | 9,951,193 | | 9,982,800 | |

| DCA Investment Holdings, LLC | Delayed Draw Term Loan, 3rd Amendment | (2) (4) (5) (14) | Health Care Providers & Services | SOFR + 650 | 10.83 | % | 4/3/2028 | 612,765 | | 600,433 | | 589,465 | |

CARLYLE TACTICAL PRIVATE CREDIT FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS (continued)

As of December 31, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments—Corporate Loans (85.1% of Net Assets) | Footnotes | Industry | Reference Rate & Spread | Interest Rate | Maturity Date | Par / Principal Amount * | Amortized Cost | Fair Value |

| DCA Investment Holdings, LLC | Delayed Draw Term Loan | (3) (4) (5) (14) | Health Care Providers & Services | SOFR + 641 | 10.73 | % | 4/3/2028 | 478,781 | | 476,583 | | 459,368 | |

| DCA Investment Holdings, LLC | Term Loan, Incremental | (3) (4) (5) (14) | Health Care Providers & Services | SOFR + 641 | 10.73 | % | 4/3/2028 | 1,442,358 | | 1,433,295 | | 1,383,874 | |

| DCA Investment Holdings, LLC | Term Loan | (3) (4) (5) (14) | Health Care Providers & Services | SOFR + 641 | 10.73 | % | 4/3/2028 | 3,186,959 | | 3,161,368 | | 3,057,735 | |

| Delta TopCo, Inc. | Term Loan | (2) (3) (4) (14) | Computers and Electronics Retail | SOFR + 350 | 7.88 | % | 10/30/2029 | 4,987,469 | | 4,976,067 | | 5,023,628 | |

| Deltatre Bidco Limited | Term Loan | (3) (4) (5) (14) | Entertainment | SOFR + 775 | 12.04 | % | 9/14/2028 | 5,475,972 | | 5,362,565 | | 5,256,933 | |

| Deltatre Bidco Limited | Term Loan, Tranche B Facility | (2) (3) (4) (5) (14) | Entertainment | EURIBOR + 775 | 11.03 | % | 9/14/2028 | € | 18,909,520 | | 20,268,508 | | 18,803,924 | |

| Denali Midco 2, LLC | Delayed Draw Term Loan, 2023 Incremental 1 | (4) (5) (14) | Consumer Services | SOFR + 525 | 9.69 | % | 12/22/2028 | 1,773,461 | | 1,745,589 | | 1,759,833 | |

| Denali Midco 2, LLC | Delayed Draw Term Loan, Incremental | (4) (5) (14) | Consumer Services | SOFR + 525 | 9.69 | % | 12/22/2028 | 1,307,955 | | 1,284,305 | | 1,297,904 | |

| Denali Midco 2, LLC | Delayed Draw Term Loan, Tranche 3 Incremental | (4) (5) (14) | Consumer Services | SOFR + 525 | 9.69 | % | 12/22/2028 | 957,034 | | 939,189 | | 949,679 | |

| Denali Midco 2, LLC | Delayed Draw Term Loan, Tranche 2 Incremental | (4) (5) (14) | Consumer Services | SOFR + 525 | 9.69 | % | 12/22/2028 | 280,766 | | 275,507 | | 278,608 | |

| Denali Midco 2, LLC | Delayed Draw Term Loan, Tranche 4 Incremental | (4) (5) (14) | Consumer Services | SOFR + 525 | 9.69 | % | 12/22/2028 | 1,131,637 | | 1,110,894 | | 1,122,941 | |

| Denali Midco 2, LLC | Delayed Draw Term Loan, Tranche 5 Incremental | (4) (5) (6) (14) | Consumer Services | SOFR + 525 | 9.69 | % | 12/22/2028 | 2,752,500 | | 2,512,148 | | 2,627,469 | |

| Denali Midco 2, LLC | Term Loan, Incremental | (2) (3) (4) (5) (14) | Consumer Services | SOFR + 525 | 9.69 | % | 12/22/2028 | 4,200,774 | | 4,121,092 | | 4,168,493 | |

| Denali Midco 2, LLC | Term Loan, Tranche 1 | (4) (5) (14) | Consumer Services | SOFR + 525 | 9.69 | % | 12/22/2028 | 561,532 | | 551,379 | | 557,217 | |

| DexKo Global, Inc. | Term Loan, Tranche B | (2) (3) (4) (14) | Automotives | SOFR + 375 | 8.34 | % | 10/4/2028 | 1,682,229 | | 1,678,885 | | 1,585,332 | |

| DG Investment Intermediate Holdings 2, Inc. | Term Loan | (2) (3) (4) (13) (14) | Software | SOFR + 375 | 8.22 | % | 3/31/2028 | 5,719,766 | | 5,687,791 | | 5,765,066 | |

| Digital Intelligence Systems, LLC | Term Loan | (2) (3) (5) | Consumer Services | 9.00% | 9.00 | % | 4/2/2026 | 11,340,448 | | 11,072,428 | | 11,340,448 | |

| Diligent Corporation | Term Loan, Tranche A1 | (2) (3) (4) (5) (6) (14) | Telecommunications | SOFR + 500 | 10.09 | % | 8/4/2030 | 32,102,892 | | 31,801,104 | | 32,469,363 | |

| Diligent Corporation | Term Loan, Tranche A1 | (2) (3) (4) (5) (14) | Telecommunications | SOFR + 500 | 10.09 | % | 8/4/2030 | 5,503,353 | | 5,461,509 | | 5,557,477 | |

| Dwyer Instruments, Inc. | Delayed Draw Term Loan, Upsize | (4) (5) (14) | Electronic Equipment, Instruments & Components | SOFR + 475 | 9.08 | % | 7/21/2029 | 1,400,780 | | 1,385,788 | | 1,400,780 | |

| Dwyer Instruments, Inc. | Term Loan, 4th Amendment | (3) (4) (5) (6) (14) | Electronic Equipment, Instruments & Components | SOFR + 475 | 9.14 | % | 7/21/2029 | 21,886,104 | | 21,643,858 | | 21,638,820 | |

| Dwyer Instruments, Inc. | Delayed Draw Term Loan | (4) (5) (14) | Electronic Equipment, Instruments & Components | SOFR + 475 | 9.08 | % | 7/21/2029 | 975,831 | | 966,480 | | 975,831 | |

| Dwyer Instruments, Inc. | Term Loan | (2) (3) (4) (5) (6) (14) | Electronic Equipment, Instruments & Components | SOFR + 475 | 9.08 | % | 7/21/2029 | 19,089,232 | | 18,837,998 | | 19,089,232 | |

| EAB Global, Inc. | Term Loan | (2) (3) (4) (14) | Professional Services | SOFR + 325 | 7.61 | % | 8/16/2028 | 4,929,727 | | 4,899,685 | | 4,940,819 | |

CARLYLE TACTICAL PRIVATE CREDIT FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS (continued)

As of December 31, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments—Corporate Loans (85.1% of Net Assets) | Footnotes | Industry | Reference Rate & Spread | Interest Rate | Maturity Date | Par / Principal Amount * | Amortized Cost | Fair Value |

| EFS Cogen Holdings I, LLC | Term Loan, Tranche B | (2) (3) (4) (7) (14) | Utilities | SOFR + 350 | 8.11 | % | 10/1/2027 | 8,589,853 | | 8,560,621 | | 8,614,936 | |

| Electronics for Imaging, Inc. | Term Loan | (2) (3) (4) (13) (14) | High Tech Industries | SOFR + 500 | 9.69 | % | 7/23/2026 | 5,849,546 | | 4,649,520 | | 4,724,444 | |

| Element Materials Technology Group US Holdings, Inc. | Term Loan | (2) (3) (4) (14) | Professional Services | SOFR + 375 | 8.08 | % | 7/6/2029 | 6,631,416 | | 6,618,278 | | 6,660,462 | |

| Eliassen Group, LLC | Delayed Draw Term Loan | (4) (5) (14) | Professional Services | SOFR + 575 | 10.08 | % | 4/14/2028 | 1,205,602 | | 1,195,110 | | 1,186,091 | |

| Eliassen Group, LLC | Term Loan | (2) (3) (4) (5) (14) | Professional Services | SOFR + 575 | 10.08 | % | 4/14/2028 | 19,964,363 | | 19,779,793 | | 19,641,270 | |

| Ellkay, LLC | Term Loan | (2) (3) (4) (5) (6) (8) (13) (14) | Health Care Providers & Services | SOFR + 550, 2.00% PIK | 12.70 | % | 9/14/2027 | 14,031,917 | | 13,878,222 | | 12,277,141 | |

| Engineered Machinery Holdings, Inc. | Term Loan, Incremental | (2) (3) (4) (7) (14) | Capital Equipment | SOFR + 375 | 8.34 | % | 5/21/2028 | 1,940,000 | | 1,934,565 | | 1,950,922 | |

| Enverus Holdings, Inc. | Revolver | (4) (5) (6) (14) | Software | SOFR + 550 | 9.86 | % | 12/22/2029 | 44,278 | | 25,715 | | 33,130 | |

| Enverus Holdings, Inc. | Term Loan | (2) (3) (4) (5) (6) (14) | Software | SOFR + 550 | 9.86 | % | 12/22/2029 | 19,390,154 | | 19,125,558 | | 19,237,402 | |

| Epicor Software Corp. | Term Loan | (3) (4) (14) | Software | SOFR + 325 | 7.61 | % | 5/23/2031 | 11,243,668 | | 11,207,155 | | 11,315,066 | |

| eResearchTechnology, Inc. | Term Loan | (3) (4) (14) | High Tech Industries | SOFR + 400 | 8.36 | % | 2/4/2027 | 1,924,433 | | 1,924,433 | | 1,934,652 | |

| Essential Services Holding Corp. | Term Loan | (2) (3) (4) (5) (6) (14) | Commercial Services & Supplies | SOFR + 500 | 9.65 | % | 6/17/2031 | 30,334,400 | | 29,958,953 | | 30,221,326 | |

| Excel Fitness Holdings, Inc. | Delayed Draw Term Loan | (2) (4) (5) (14) | Hotels, Restaurants & Leisure | SOFR + 550 | 9.83 | % | 4/27/2029 | 1,846,969 | | 1,811,025 | | 1,846,969 | |

| Excel Fitness Holdings, Inc. | Delayed Draw Term Loan, 4th Amendment | (4) (5) (6) (14) | Hotels, Restaurants & Leisure | SOFR + 550 | 9.83 | % | 4/29/2029 | 467,226 | | 437,507 | | 467,226 | |

| Excel Fitness Holdings, Inc. | Term Loan | (2) (3) (4) (5) (6) (13) (14) | Hotels, Restaurants & Leisure | SOFR + 525 | 9.73 | % | 4/27/2029 | 6,140,859 | | 6,045,629 | | 6,095,523 | |

| Excel Fitness Holdings, Inc. | Term Loan | (2) (3) (4) (5) (14) | Hotels, Restaurants & Leisure | SOFR + 550 | 9.83 | % | 4/27/2029 | 3,675,469 | | 3,601,452 | | 3,675,469 | |

| Excelitas Technologies Corp. | Term Loan | (2) (3) (4) (5) (6) (14) | Capital Equipment | SOFR + 525 | 9.61 | % | 8/13/2029 | 49,599,202 | | 49,554,668 | | 49,248,342 | |

| Excelitas Technologies Corp. | Term Loan | (2) (3) (4) (5) (14) | Capital Equipment | EURIBOR + 525 | 8.11 | % | 8/13/2029 | € | 3,887,330 | | 4,213,606 | | 3,997,550 | |

| FCG Acquisitions, Inc. | Term Loan | (2) (3) (4) (13) (14) | Commercial Services & Supplies | SOFR + 375 | 8.22 | % | 3/31/2028 | 4,839,633 | | 4,828,677 | | 4,866,251 | |

| Fertitta Entertainment, LLC | Term Loan, Tranche B | (2) (3) (4) (7) (14) | Hotels, Restaurants & Leisure | SOFR + 350 | 7.81 | % | 1/27/2029 | 7,869,579 | | 7,817,922 | | 7,892,244 | |

| Finastra USA, Inc. | Revolver | (4) (5) (6) (14) | Software | SOFR + 725 | 11.65 | % | 9/13/2029 | 2,338,309 | | 2,278,434 | | 2,404,098 | |

| Finastra USA, Inc. | Term Loan | (2) (3) (4) (5) (14) | Software | SOFR + 725 | 12.18 | % | 9/13/2029 | 35,968,797 | | 35,364,911 | | 36,598,251 | |

| First Advantage Holdings, LLC | Term Loan, Tranche B | (3) (4) (5) (14) | Professional Services | SOFR + 325 | 7.61 | % | 9/20/2031 | 4,500,000 | | 4,477,892 | | 4,543,605 | |

| Floating Infrastructure Holdings Finance, LLC | Term Loan, Tranche A | (2) (3) (5) | Transportation | 9.00% | 9.00 | % | 8/13/2027 | 13,551,466 | | 13,395,297 | | 13,551,466 | |

| Flynn Restaurant Group LP | Term Loan, Tranche B | (2) (3) (4) (13) (14) | Specialty Retail | SOFR + 425 | 8.72 | % | 12/1/2028 | 4,874,557 | | 4,829,382 | | 4,887,962 | |

CARLYLE TACTICAL PRIVATE CREDIT FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS (continued)

As of December 31, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments—Corporate Loans (85.1% of Net Assets) | Footnotes | Industry | Reference Rate & Spread | Interest Rate | Maturity Date | Par / Principal Amount * | Amortized Cost | Fair Value |

| Focus Financial Partners, LLC | Term Loan, Tranche B8 | (3) (4) (6) (14) | Banking, Finance, Insurance & Real Estate | SOFR + 325 | 7.61 | % | 9/11/2031 | 9,030,140 | | 9,008,163 | | 9,113,840 | |

| FPG Intermediate Holdco, LLC | Term Loan, 3rd Amendment | (4) (5) (8) (14) | Consumer Services | SOFR + 275, 4.00% PIK | 11.23 | % | 3/5/2027 | 75,535 | | 74,776 | | 49,217 | |

| FPG Intermediate Holdco, LLC | Delayed Draw Term Loan | (4) (5) (6) (8) (13) (14) | Consumer Services | SOFR + 100, 5.75% PIK | 11.25 | % | 3/5/2027 | 1,848 | | 1,848 | | 1,848 | |

| Gainwell Acquisition Corp. | Term Loan, Tranche B | (2) (3) (4) (13) (14) | Health Care Providers & Services | SOFR + 400 | 8.43 | % | 10/1/2027 | 3,355,816 | | 3,330,635 | | 3,243,027 | |

| Galileo Parent, Inc. | Revolver | (4) (5) (6) (14) | Aerospace & Defense | SOFR + 575 | 10.08 | % | 5/3/2029 | 3,299,297 | | 3,299,297 | | 3,299,297 | |

| Galileo Parent, Inc. | Term Loan | (3) (4) (5) (14) | Aerospace & Defense | SOFR + 575 | 10.08 | % | 5/3/2030 | 45,816,404 | | 45,816,404 | | 45,816,404 | |

| GEN II Fund Services, LLC | Term Loan, Tranche B | (2) (4) (5) (14) | Banking, Finance, Insurance & Real Estate | SOFR + 275 | 7.08 | % | 11/19/2031 | 5,000,000 | | 4,987,590 | | 5,018,750 | |

| Generator Buyer, Inc. | Delayed Draw Term Loan | (2) (4) (5) (6) (14) | Machinery | CORRA + 525 | 8.42 | % | 7/22/2030 | C$ | 659,689 | | 421,331 | | 411,423 | |

| Generator Buyer, Inc. | Term Loan, Tranche A | (2) (3) (4) (5) (6) (14) | Machinery | CORRA + 525 | 8.42 | % | 7/22/2030 | C$ | 19,395,833 | | 13,842,866 | | 13,303,554 | |

| Generator U.S. Buyer, Inc. | Term Loan | (2) (3) (4) (5) (14) | Machinery | SOFR + 525 | 9.58 | % | 7/22/2030 | 3,823,750 | | 3,759,012 | | 3,779,081 | |

| Genesys Cloud Services Holdings II, LLC | Term Loan, Tranche B | (3) (4) (14) | Software | SOFR + 300 | 7.36 | % | 12/1/2027 | 9,153,247 | | 9,125,990 | | 9,221,896 | |

| Greenhouse Software, Inc. | Term Loan, 2nd Amendment Incremental | (2) (3) (4) (5) (6) (14) | Software | SOFR + 625 | 10.58 | % | 9/1/2028 | 1,600,000 | | 1,565,407 | | 1,600,395 | |

| Greenhouse Software, Inc. | Term Loan | (2) (3) (4) (5) (14) | Software | SOFR + 625 | 10.58 | % | 9/1/2028 | 7,598,039 | | 7,524,853 | | 7,643,087 | |

| GS AcquisitionCo, Inc. | Delayed Draw Term Loan, 7th Supplemental | (4) (5) (6) (14) | Software | SOFR + 525 | 9.58 | % | 5/25/2028 | 104,209 | | 102,284 | | 107,201 | |

| GS AcquisitionCo, Inc. | Term Loan | (3) (4) (5) (6) (14) | Software | SOFR + 525 | 9.58 | % | 5/25/2028 | 13,767,444 | | 13,728,870 | | 13,855,130 | |

| Guidehouse LLP | Term Loan | (2) (3) (4) (5) (8) (14) | Sovereign & Public Finance | SOFR + 375, 2.00% PIK | 10.11 | % | 12/14/2030 | 39,992,827 | | 39,991,592 | | 40,392,755 | |

| Hadrian Acquisition Limited | Term Loan, Acquisition | (2) (3) (4) (5) (8) (11) (14) | Banking, Finance, Insurance & Real Estate | SONIA + 516, 3.20% PIK | 13.08 | % | 2/28/2029 | £ | 7,443,753 | | 9,761,129 | | 9,412,021 | |

| Hadrian Acquisition Limited | Delayed Draw Term Loan | (2) (3) (4) (5) (6) (8) (11) (14) | Banking, Finance, Insurance & Real Estate | SONIA + 516, 3.20% PIK | 13.08 | % | 2/28/2029 | £ | 4,160,892 | | 4,921,804 | | 5,360,951 | |

| Hadrian Acquisition Limited | Term Loan, Tranche B2 | (2) (3) (4) (5) (8) (11) (14) | Banking, Finance, Insurance & Real Estate | SONIA + 516, 3.20% PIK | 13.08 | % | 2/28/2029 | £ | 19,607,035 | | 25,629,922 | | 24,791,503 | |

| Heartland Home Services, Inc. | Delayed Draw Term Loan, 2nd Amendment | (4) (5) (14) | Consumer Services | SOFR + 575 | 10.08 | % | 12/15/2026 | 4,764,598 | | 4,743,366 | | 4,526,972 | |

| Heartland Home Services, Inc. | Delayed Draw Term Loan, 1st Amendment | (4) (5) (14) | Consumer Services | SOFR + 600 | 10.33 | % | 12/15/2026 | 8,498,168 | | 8,449,169 | | 8,110,771 | |

| Heartland Home Services, Inc. | Delayed Draw Term Loan | (2) (3) (4) (5) (14) | Consumer Services | SOFR + 600 | 10.33 | % | 12/15/2026 | 2,254,461 | | 2,237,480 | | 2,151,689 | |

| Heartland Home Services, Inc. | Revolver | (4) (5) (6) (14) | Consumer Services | SOFR + 600 | 10.33 | % | 12/15/2026 | 181,058 | | 176,401 | | 149,374 | |

CARLYLE TACTICAL PRIVATE CREDIT FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS (continued)

As of December 31, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments—Corporate Loans (85.1% of Net Assets) | Footnotes | Industry | Reference Rate & Spread | Interest Rate | Maturity Date | Par / Principal Amount * | Amortized Cost | Fair Value |

| Heartland Home Services, Inc. | Term Loan | (2) (3) (4) (5) (14) | Consumer Services | SOFR + 600 | 10.33 | % | 12/15/2026 | 6,787,339 | | 6,744,192 | | 6,477,932 | |

| Helios Software Holdings, Inc. | Term Loan, Tranche B | (3) (4) (14) | Banking, Finance, Insurance & Real Estate | SOFR + 350 | 7.83 | % | 7/18/2030 | 5,130,000 | | 5,026,458 | | 5,150,520 | |

| Hercules Borrower, LLC | Delayed Draw Term Loan | (2) (4) (5) (13) (14) | Environmental Industries | SOFR + 550 | 9.93 | % | 12/14/2026 | 2,026,184 | | 2,009,674 | | 2,026,184 | |

| Hercules Borrower, LLC | Term Loan | (2) (3) (4) (5) (6) (13) (14) | Environmental Industries | SOFR + 550 | 9.93 | % | 12/14/2026 | 5,964,961 | | 5,901,057 | | 5,964,961 | |

| Hercules Borrower, LLC | Term Loan | (3) (4) (5) (13) (14) | Environmental Industries | SOFR + 550 | 9.93 | % | 12/14/2026 | 339,153 | | 336,264 | | 339,153 | |

| Hoosier Intermediate, LLC | Term Loan | (2) (3) (4) (5) (6) (14) | Health Care Providers & Services | SOFR + 500 | 9.52 | % | 11/15/2028 | 12,020,100 | | 11,850,906 | | 12,020,100 | |

| Howden Group Holdings Ltd. | Term Loan, Tranche B | (2) (3) (4) (14) | Insurance | SOFR + 300 | 7.36 | % | 2/3/2031 | 9,925,125 | | 9,880,163 | | 9,880,163 | |

| Howden Group Holdings Ltd. | Term Loan, Tranche B | (3) (4) (14) | Insurance | SOFR + 350 | 7.86 | % | 4/18/2030 | 4,952,185 | | 4,932,911 | | 4,982,096 | |

| HS Spa Holdings Inc. | Delayed Draw Term Loan, 2nd Amendment | (4) (5) (6) (14) | Consumer Services | SOFR + 525 | 9.54 | % | 6/1/2029 | 313,372 | | 307,936 | | 313,372 | |

| HS Spa Holdings Inc. | Revolver | (4) (5) (6) (14) | Consumer Services | SOFR + 525 | 9.61 | % | 6/2/2028 | 247,093 | | 232,685 | | 247,093 | |

| HS Spa Holdings Inc. | Term Loan | (2) (3) (4) (5) (14) | Consumer Services | SOFR + 525 | 9.61 | % | 6/1/2029 | 8,432,050 | | 8,312,533 | | 8,483,200 | |

| HUB International Ltd. | Term Loan, Tranche B | (3) (4) (14) | Insurance | SOFR + 275 | 7.37 | % | 6/20/2030 | 9,942,884 | | 9,909,961 | | 9,909,953 | |

| Hunter Holdco 3 Ltd. | Term Loan, Tranche B | (2) (3) (4) (5) (7) (13) (14) | Health Care Providers & Services | SOFR + 425 | 8.68 | % | 8/19/2028 | 2,565,243 | | 2,555,376 | | 2,529,970 | |

| Icefall Parent, Inc. | Term Loan | (2) (3) (4) (5) (6) (14) | Software | SOFR + 650 | 10.86 | % | 1/26/2030 | 13,018,681 | | 12,767,312 | | 13,004,965 | |

| iCIMS, Inc. | Revolver | (4) (5) (6) (14) | Software | SOFR + 575 | 10.38 | % | 8/18/2028 | 487,682 | | 461,719 | | 443,567 | |

| iCIMS, Inc. | Term Loan | (2) (3) (4) (5) (6) (14) | Software | SOFR + 575 | 10.38 | % | 8/18/2028 | 27,543,982 | | 27,270,422 | | 26,963,586 | |

| IG Investment Holdings, LLC | Term Loan, Refinancing | (2) (3) (4) (5) (6) (13) (14) | IT Services | SOFR + 500 | 9.67 | % | 9/22/2028 | 4,116,737 | | 4,116,348 | | 4,116,331 | |

| Infront Luxembourg Finance S.a.r.l. | Term Loan, Tranche B | (2) (3) (4) (5) (8) (14) | Hotels, Restaurants & Leisure | EURIBOR + 450, 5.50% PIK | 12.91 | % | 5/28/2027 | € | 21,382,376 | | 25,588,098 | | 22,148,928 | |

| Instructure Holdings, Inc. | Term Loan | (3) (4) (14) | Software | SOFR + 300 | 7.33 | % | 9/12/2031 | 4,800,000 | | 4,777,016 | | 4,813,488 | |

| ION Trading Technologies S.a.r.l. | Term Loan, Tranche B | (3) (4) (14) | Banking, Finance, Insurance & Real Estate | SOFR + 350 | 7.83 | % | 4/1/2028 | 8,603,751 | | 8,560,386 | | 8,560,386 | |

| IQN Holding Corp. | Term Loan | (2) (3) (4) (5) (14) | Professional Services | SOFR + 525 | 9.76 | % | 5/2/2029 | 6,835,334 | | 6,788,097 | | 6,835,334 | |

| iRobot Corporation | Term Loan | (2) (3) (4) (5) (8) (13) (14) | Consumer Goods: Durable | SOFR + 650, 2.50% PIK | 13.76 | % | 7/24/2026 | 26,421,640 | | 26,421,640 | | 25,562,937 | |

| iSolved, Inc. | Term Loan | (3) (4) (14) | Professional Services | SOFR + 325 | 7.61 | % | 10/15/2030 | 4,466,334 | | 4,447,048 | | 4,516,581 | |

| Janney Montgomery Scott, LLC | Term Loan | (3) (4) (6) (14) | Banking, Finance, Insurance & Real Estate | SOFR + 325 | 7.58 | % | 9/11/2031 | 5,571,429 | | 5,543,796 | | 5,636,429 | |

| Javelin Buyer, Inc. | Term Loan | (3) (4) (14) | Banking, Finance, Insurance & Real Estate | SOFR + 325 | 7.61 | % | 11/1/2031 | 10,000,000 | | 9,975,110 | | 10,068,800 | |

CARLYLE TACTICAL PRIVATE CREDIT FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS (continued)

As of December 31, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments—Corporate Loans (85.1% of Net Assets) | Footnotes | Industry | Reference Rate & Spread | Interest Rate | Maturity Date | Par / Principal Amount * | Amortized Cost | Fair Value |

| Jeg's Automotive, LLC | Revolver | (4) (5) (14) (15) | Automotives | SOFR + 700 | 11.33 | % | 12/22/2027 | 1,041,666 | | 1,044,339 | | 1,041,666 | |

| Jeg's Automotive, LLC | Term Loan | (3) (4) (5) (14) (15) | Automotives | SOFR + 700 | 11.33 | % | 12/22/2027 | 6,270,833 | | 6,270,987 | | 6,270,833 | |

| Jordanes Equity AS | Term Loan, Tranche A | (5) (6) (8) | Beverage, Food & Tobacco | 11.75% PIK | 11.75 | % | 12/27/2031 | kr | 291,278,474 | | 22,961,042 | | 22,791,893 | |

| Kaman Corp. | Term Loan | (3) (4) (14) | Distributors | SOFR + 350 | 7.83 | % | 4/21/2031 | 4,364,063 | | 4,353,742 | | 4,388,632 | |

| Kaseya, Inc. | Delayed Draw Term Loan | (4) (5) (6) (8) (14) | Software | SOFR + 550, 2.50% PIK | 12.33 | % | 6/25/2029 | 223,529 | | 209,683 | | 223,529 | |

| Kaseya, Inc. | Delayed Draw Term Loan | (4) (5) (8) (14) | Software | SOFR + 550, 2.50% PIK | 12.33 | % | 6/25/2029 | 70,978 | | 70,029 | | 70,978 | |

| Kaseya, Inc. | Revolver | (4) (5) (6) (14) | Software | SOFR + 550 | 10.08 | % | 6/25/2029 | 519,029 | | 492,256 | | 519,029 | |

| Kaseya, Inc. | Term Loan | (2) (3) (4) (5) (8) (14) | Software | SOFR + 550, 2.50% PIK | 12.33 | % | 6/25/2029 | 36,032,252 | | 35,533,823 | | 36,032,252 | |

| Kestra Advisor Services Holdings A, Inc. | Term Loan | (3) (4) (14) | Banking, Finance, Insurance & Real Estate | SOFR + 400 | 8.51 | % | 3/25/2031 | 2,493,750 | | 2,487,998 | | 2,493,750 | |

| Kingpin Intermediate Holdings, LLC | Term Loan, Tranche B | (4) (5) (14) | Hotels, Restaurants & Leisure | SOFR + 350 | 7.85 | % | 2/8/2028 | 1,333,333 | | 1,333,333 | | 1,335,000 | |

| KRE HYOD Owner, LLC | Term Loan, Tranche A1 | (4) (5) (14) | Banking, Finance, Insurance & Real Estate | SOFR + 421 | 8.92 | % | 9/13/2026 | 1,320,876 | | 1,320,876 | | 1,310,970 | |

| KRE HYOD Owner, LLC | Term Loan, Tranche A2 | (4) (5) (11) (14) | Banking, Finance, Insurance & Real Estate | SOFR + 1046 | 15.17 | % | 9/13/2026 | 3,719,970 | | 3,719,970 | | 3,710,670 | |

| LaserShip, Inc. | Term Loan | (4) (5) (14) | Transportation | SOFR + 450 | 9.09 | % | 5/7/2028 | 50,000 | | 24,500 | | 21,025 | |

| LaserShip, Inc. | Term Loan, Tranche A | (4) (14) | Transportation | SOFR + 625 | 10.55 | % | 1/2/2029 | 4,469,651 | | 4,195,671 | | 4,645,665 | |

| Legence Holdings, LLC | Term Loan | (2) (3) (4) (7) (13) (14) | Commercial Services & Supplies | SOFR + 350 | 7.96 | % | 12/16/2027 | 3,391,575 | | 3,384,268 | | 3,401,750 | |

| LSF12 Crown U.S. Commercial Bidco, LLC | Term Loan, Tranche B | (3) (4) (5) (14) | Commercial Services & Supplies | SOFR + 425 | 8.59 | % | 10/10/2031 | 5,000,000 | | 4,950,242 | | 4,978,150 | |

| LVF Holdings, Inc. | Delayed Draw Term Loan | (2) (3) (4) (5) (13) (14) | Beverage, Food & Tobacco | SOFR + 550 | 9.98 | % | 6/10/2027 | 5,658,700 | | 5,605,019 | | 5,658,700 | |

| LVF Holdings, Inc. | Term Loan, Initial | (2) (3) (4) (5) (13) (14) | Beverage, Food & Tobacco | SOFR + 550 | 9.98 | % | 6/10/2027 | 5,912,832 | | 5,856,824 | | 5,912,832 | |

| LVF Holdings, Inc. | Revolver | (4) (5) (6) (13) (14) | Beverage, Food & Tobacco | SOFR + 550 | 9.98 | % | 6/10/2027 | 355,699 | | 348,165 | | 355,699 | |

| Madison Safety & Flow, LLC | Term Loan, Tranche B | (3) (4) (14) | Machinery | SOFR + 325 | 7.61 | % | 9/19/2031 | 4,239,375 | | 4,229,087 | | 4,267,185 | |

| Magenta Security Holdings, LLC | Term Loan, Super Priority | (3) (4) (13) (14) | Software | SOFR + 625 | 10.84 | % | 7/27/2028 | 2,411,612 | | 2,320,613 | | 2,453,068 | |

| Material Holdings, LLC | Term Loan, Tranche A | (3) (4) (5) (6) (8) (13) (14) | Professional Services | SOFR + 135, 4.65% PIK | 10.43 | % | 8/19/2027 | 10,530,637 | | 10,530,637 | | 10,530,637 | |

| Material Holdings, LLC | Term Loan, Tranche B | (3) (4) (5) (8) (13) (14) (15) | Professional Services | SOFR + 6.00% PIK | 10.43 | % | 8/19/2027 | 2,524,099 | | 1,001,033 | | 655,147 | |

| Maverick Acquisition, Inc. | Delayed Draw Term Loan | (2) (4) (5) (14) | Aerospace & Defense | SOFR + 625 | 10.58 | % | 6/1/2027 | 2,380,869 | | 2,358,847 | | 1,732,279 | |

| Maverick Acquisition, Inc. | Term Loan, Initial | (3) (4) (5) (14) | Aerospace & Defense | SOFR + 625 | 10.58 | % | 6/1/2027 | 10,444,480 | | 10,346,339 | | 7,599,224 | |

| Mavis Tire Express Services Corp. | Term Loan | (3) (4) (14) | Specialty Retail | SOFR + 350 | 7.86 | % | 5/4/2028 | 3,378,460 | | 3,369,357 | | 3,397,481 | |

| McAfee, LLC | Term Loan, Tranche B | (3) (4) (14) | Software | SOFR + 325 | 7.37 | % | 3/1/2029 | 6,905,181 | | 6,747,570 | | 6,747,570 | |

CARLYLE TACTICAL PRIVATE CREDIT FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS (continued)

As of December 31, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments—Corporate Loans (85.1% of Net Assets) | Footnotes | Industry | Reference Rate & Spread | Interest Rate | Maturity Date | Par / Principal Amount * | Amortized Cost | Fair Value |

| Medical Manufacturing Technologies, LLC | Term Loan, 1st Amendment Incremental | (4) (5) (14) | Health Care Providers & Services | SOFR + 575 | 10.09 | % | 12/23/2027 | 9,249,450 | | 9,099,261 | | 9,107,046 | |

| Medical Manufacturing Technologies, LLC | Delayed Draw Term Loan | (4) (5) (13) (14) | Health Care Providers & Services | SOFR + 575 | 10.23 | % | 12/23/2027 | 5,047,829 | | 4,992,183 | | 4,970,112 | |

| Medical Manufacturing Technologies, LLC | Revolver | (2) (4) (5) (6) (13) (14) | Health Care Providers & Services | SOFR + 575 | 10.23 | % | 12/23/2027 | 1,781,000 | | 1,752,619 | | 1,745,619 | |

| Medical Manufacturing Technologies, LLC | Term Loan | (2) (3) (4) (5) (13) (14) | Health Care Providers & Services | SOFR + 575 | 10.23 | % | 12/23/2027 | 12,525,309 | | 12,383,523 | | 12,332,470 | |

| Minerva Bidco Ltd. | Term Loan | (3) (4) (5) (6) (14) | Utilities | SONIA + 625 | 10.95 | % | 11/7/2030 | £ | 21,761,116 | | 26,405,613 | | 26,268,284 | |

| Mitchell International, Inc. | Term Loan | (3) (4) (14) | Health Care Providers & Services | SOFR + 325 | 7.61 | % | 6/17/2031 | 6,877,687 | | 6,836,363 | | 6,872,047 | |

| Nader Upside 2 S.a.r.l. | Term Loan, Tranche B | (4) (5) (8) | Health Care Providers & Services | EURIBOR + 10.25% PIK | 12.93 | % | 3/28/2028 | € | 51,815,159 | | 54,829,395 | | 52,513,388 | |

| NEFCO Holding Company, LLC | Term Loan, 1st Amendment Incremental | (2) (3) (4) (5) (14) | Building Products | SOFR + 575 | 10.03 | % | 8/5/2028 | 552,800 | | 543,844 | | 551,534 | |

| NEFCO Holding Company, LLC | Delayed Draw Term Loan, Tranche A | (2) (3) (4) (5) (14) | Building Products | SOFR + 575 | 10.31 | % | 8/5/2028 | 845,535 | | 836,511 | | 843,598 | |

| NEFCO Holding Company, LLC | Delayed Draw Term Loan, Tranche B | (2) (3) (4) (5) (14) | Building Products | SOFR + 575 | 10.31 | % | 8/5/2028 | 638,314 | | 632,167 | | 636,852 | |

| NEFCO Holding Company, LLC | Delayed Draw Term Loan, Tranche C | (2) (3) (4) (5) (14) | Building Products | SOFR + 575 | 10.31 | % | 8/5/2028 | 1,130,653 | | 1,118,114 | | 1,128,063 | |

| NEFCO Holding Company, LLC | Delayed Draw Term Loan, Tranche D | (4) (5) (14) | Building Products | SOFR + 575 | 10.03 | % | 8/5/2028 | 2,995,655 | | 2,947,890 | | 2,988,794 | |

| NEFCO Holding Company, LLC | Revolver | (4) (5) (6) (14) | Building Products | SOFR + 575 | 10.31 | % | 8/5/2028 | 382,830 | | 346,251 | | 374,260 | |

| NEFCO Holding Company, LLC | Term Loan | (2) (3) (4) (5) (14) | Building Products | SOFR + 575 | 10.31 | % | 8/5/2028 | 6,246,438 | | 6,177,342 | | 6,232,131 | |

| NEFCO Holding Company, LLC | Term Loan, 4th Amendment | (3) (4) (5) (14) | Building Products | SOFR + 575 | 10.31 | % | 8/5/2028 | 3,071,379 | | 3,040,665 | | 3,064,344 | |

| NEFCO Holding Company, LLC | Delayed Draw Term Loan, Tranche E | (4) (5) (14) | Building Products | SOFR + 575 | 10.03 | % | 8/5/2028 | 3,424,006 | | 3,365,365 | | 3,416,163 | |

| NEFCO Holding Company, LLC | Delayed Draw Term Loan, Tranche F | (4) (5) (6) (14) | Building Products | SOFR + 575 | 10.31 | % | 8/5/2028 | 2,250,387 | | 2,213,897 | | 2,241,680 | |

| NEFCO Holding Company, LLC | Delayed Draw Term Loan, Tranche G | (4) (5) (14) | Building Products | SOFR + 575 | 10.31 | % | 8/5/2028 | 3,801,329 | | 3,764,747 | | 3,792,622 | |

| NEFCO Holding Company, LLC | Term Loan, Incremental | (2) (3) (4) (5) (14) | Building Products | SOFR + 575 | 10.31 | % | 8/5/2028 | 1,287,638 | | 1,274,761 | | 1,284,688 | |

| North Haven Fairway Buyer, LLC | Delayed Draw Term Loan, Tranche C1 | (4) (5) (14) | Consumer Services | SOFR + 650 | 10.90 | % | 5/17/2028 | 95,362 | | 93,139 | | 95,362 | |

| North Haven Fairway Buyer, LLC | Delayed Draw Term Loan, Tranche C2 | (4) (5) (14) | Consumer Services | SOFR + 650 | 10.90 | % | 5/17/2028 | 11,072,057 | | 10,822,734 | | 11,072,057 | |