- HPR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

HighPoint Resources (HPR) 425Business combination disclosure

Filed: 9 Nov 20, 9:17am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (date of earliest event reported): November 9, 2020

Bonanza Creek Energy, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 001-35371 | 61-1630631 | ||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| 410 17th Street, Suite 1400 | ||||

| Denver, Colorado | 80202 | |||

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (720) 440-6100

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

x Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common stock, par value $0.01 per share | BCEI | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01. Regulation FD Disclosure.

On November 9, 2020, Bonanza Creek Energy, Inc., a Delaware corporation (“BCEI”), Boron Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of BCEI, and HighPoint Resources Corporation, a Delaware corporation (“HPR”), entered into an Agreement and Plan of Merger (the “Merger Agreement”), providing for BCEI’s acquisition of HPR.

On November 9, 2020, BCEI and HPR issued a joint press release announcing the execution of the Merger Agreement and a conference call with investors to be held by BCEI to discuss the proposed Merger (as defined below). A copy of each of the press release and the presentation to be used in connection with the investor conference call are attached hereto as Exhibit 99.1 and Exhibit 99.2, respectively, and each are incorporated by reference into this Item 7.01.

Item 8.01. Other Events.

To the extent required, the information included in Item 7.01 of this Current Report on Form 8-K is incorporated into this Item 8.01.

No Offer or Solicitation

This communication relates to a proposed business combination transaction (the “Merger”) between BCEI and HPR, which includes the commencement by BCEI and HPR of an exchange offer (the “Exchange Offer”) and the solicitation of a prepackaged plan of reorganization for HPR and its subsidiaries (the “Prepackaged Plan” and, together with the Exchange Offer and the Merger, the “Transaction”) to effect the exchange of unsecured senior notes of HPR for shares of BCEI common stock, par value $0.01 per share (the “BCEI common stock”), or unsecured senior notes to be issued by BCEI in connection with the Exchange Offer.

Communications in this document do not constitute an offer to sell or the solicitation of an offer to subscribe for or buy any securities or a solicitation of any vote or approval with respect to the Transaction, the Exchange Offer or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Important Additional Information

In connection with the Transaction, BCEI and HPR intend to file materials with the SEC, including (1) a joint proxy statement in preliminary and definitive form (the “Joint Proxy Statement”), (2) a consent solicitation and prospectus with respect to the Exchange Offer (the “Exchange Prospectus”), of which the Prepackaged Plan will be a part, (3) a Registration Statement on Form S-4 with respect to the Merger (the “Merger Registration Statement”), of which the Joint Proxy Statement will be a part, and (4) a Registration Statement on Form S-4 with respect to the Exchange Offer (together with the Merger Registration Statement, the “Registration Statements”), of which the Exchange Prospectus will be a part. After the Registration Statements are declared effective by the SEC, BCEI and HPR intend to send the definitive form of the Joint Proxy Statement to the shareholders of BCEI and the shareholders of HPR, and BCEI and HPR intend to send the definitive form of the Exchange Prospectus to the debt holders of HPR. These documents are not substitutes for the Joint Proxy Statement, Exchange Prospectus or Registration Statements or for any other document that BCEI or HPR may file with the SEC and send to BCEI’s shareholders or HPR’s shareholders or debt holders in connection with the Transaction. INVESTORS AND SECURITY HOLDERS OF BCEI AND HPR ARE URGED TO CAREFULLY AND THOROUGHLY READ THE JOINT PROXY STATEMENT, REGISTRATION STATEMENTS AND EXCHANGE PROSPECTUS, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AND OTHER RELEVANT DOCUMENTS FILED BY BCEI AND HPR WITH THE SEC, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT BCEI, HPR, THE TRANSACTION, THE RISKS RELATED THERETO AND RELATED MATTERS.

2

Investors will be able to obtain free copies of the Registration Statements, Joint Proxy Statement and Exchange Prospectus, as each may be amended from time to time, and other relevant documents filed by BCEI and HPR with the SEC (when they become available) through the website maintained by the SEC at www.sec.gov. Copies of documents filed with the SEC by BCEI will be available free of charge from BCEI’s website at www.bonanzacrk.com under the “For Investors” tab or by contacting BCEI’s Investor Relations Department at (720) 225-6679 or slandreth@bonanzacrk.com. Copies of documents filed with the SEC by HPR will be available free of charge from HPR’s website at www.hpres.com under the “Investors” tab or by contacting HPR’s Investor Relations Department at (303) 312-8514 or lbusnardo@hpres.com.

Participants in the Solicitation

BCEI, HPR and their respective directors and certain of their executive officers and other members of management and employees may be deemed, under SEC rules, to be participants in the solicitation of proxies from BCEI’s shareholders and HPR’s shareholders in connection with the Transaction. Information regarding the executive officers and directors of BCEI is included in its definitive proxy statement for its 2020 annual meeting filed with the SEC on April 24, 2020. Information regarding the executive officers and directors of HPR is included in its definitive proxy statement for its 2020 annual meeting filed with the SEC on March 18, 2020. Additional information regarding the persons who may be deemed participants and their direct and indirect interests, by security holdings or otherwise, will be set forth in the Registration Statements, Joint Proxy Statement and other materials when they are filed with the SEC in connection with the Transaction. Free copies of these documents may be obtained as described in the paragraphs above.

Forward-Looking Statements and Cautionary Statements

Certain statements in this document concerning the Transaction, including any statements regarding the expected timetable for completing the Transaction, the results, effects, benefits and synergies of the Transaction, future opportunities for the combined company, future financial performance and condition, guidance and any other statements regarding BCEI’s or HPR’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts are “forward-looking” statements based on assumptions currently believed to be valid. Forward-looking statements are all statements other than statements of historical facts. The words “anticipate,” “believe,” “ensure,” “expect,” “if,” “intend,” “estimate,” “probable,” “project,” “forecasts,” “predict,” “outlook,” “aim,” “will,” “could,” “should,” “would,” “potential,” “may,” “might,” “anticipate,” “likely” “plan,” “positioned,” “strategy,” and similar expressions or other words of similar meaning, and the negatives thereof, are intended to identify forward-looking statements. Specific forward-looking statements include statements regarding BCEI and HPR’s plans and expectations with respect to the Transaction and the anticipated impact of the Transaction on the combined company’s results of operations, financial position, growth opportunities and competitive position. The forward-looking statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995.

These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from those anticipated, including, but not limited to, the possibility that shareholders of BCEI may not approve the issuance of new shares of BCEI common stock in the Transactions or that shareholders of HPR may not approve the Merger Agreement; the risk that a condition to closing of the Transaction may not be satisfied, that either party may terminate the Merger Agreement or that the closing of the Transaction might be delayed or not occur at all; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the transaction; the diversion of management time on transaction-related issues; the ultimate timing, outcome and results of integrating the operations of BCEI and HPR; the effects of the business combination of BCEI and HPR, including the combined company’s future financial condition, results of operations, strategy and plans; the ability of the combined company to realize anticipated synergies in the timeframe expected or at all; changes in capital markets and the ability of the combined company to finance operations in the manner expected; regulatory approval of the transaction; the effects of commodity prices; the risks of oil and gas activities; the risk that the requisite amount of HPR debt does not participate in the Exchange Offer and that HPR may need to reorganize in bankruptcy as a result; the risks and unpredictability inherent in the bankruptcy process; and the fact that operating costs and business disruption may be greater than expected following the public announcement or consummation of the Transaction. Expectations regarding business outlook, including changes in revenue, pricing, capital expenditures, cash flow generation, strategies for our operations, oil and natural gas market conditions, legal, economic and regulatory conditions, and environmental matters are only forecasts regarding these matters.

3

Additional factors that could cause results to differ materially from those described above can be found in BCEI’s Annual Report on Form 10-K for the year ended December 31, 2019 and in its subsequently filed Quarterly Reports on Form 10-Q, each of which is on file with the SEC and available from BCEI’s website at www.bonanzacrk.com under the “For Investors” tab, and in other documents BCEI files with the SEC, and in HPR’s Annual Report on Form 10-K for the year ended December 31, 2019 and in its subsequently filed Quarterly Reports on Form 10-Q, each of which is on file with the SEC and available from HPR’s website at www.hpres.com under the “Investors” tab, and in other documents HPR files with the SEC.

All forward-looking statements speak only as of the date they are made and are based on information available at that time. Neither BCEI nor HPR assumes any obligation to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements were made or to reflect the occurrence of unanticipated events except as required by federal securities laws. As forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit No. | Description | |

| 99.1 | Joint Press Release issued by Bonanza Creek Energy, Inc. and HighPoint Resources Corporation, dated November 9, 2020. | |

| 99.2 | Presentation for Investor Conference Call to be held by Bonanza Creek Energy, Inc. on November 9, 2020. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Schedules and similar attachments have been omitted pursuant to Item 601(b)(2) of Regulation S-K. BCEI agrees to furnish a supplemental copy of any omitted schedule or attachment to the SEC upon request.

4

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| BONANZA CREEK ENERGY, INC. | ||

| Dated: November 9, 2020 | By: | /s/ Cyrus D. Marter IV |

| Cyrus D. Marter IV | ||

| Executive Vice President, General Counsel and Secretary | ||

5

|  |

Bonanza Creek Announces Transformative Agreement to Acquire Restructured HighPoint Resources

| · | Creates a company of scale in the rural DJ Basin with production of 50,000 Boe/d and a consolidated, contiguous leasehold position of approximately 206,000 net acres | |

| · | Accretive on all key financial metrics with a transformative impact on sustainable free cash flow generation |

Denver, Colorado, November 9, 2020 – Bonanza Creek Energy, Inc. (“Bonanza Creek” or the “Company”) (NYSE: BCEI) and HighPoint Resources Corporation (“HighPoint”) (NYSE: HPR) today announced that they have entered into a definitive merger agreement to combine Bonanza Creek and HighPoint in a transaction valued at approximately $3761 million as of November 6, 2020. The transaction value is based on the equity to be issued to HighPoint equity holders, the equity and debt to be issued to HighPoint debt holders in connection with the Exchange Offer (as defined below) and the remaining debt to be assumed. Bonanza Creek will issue 9.8 million shares of common stock and up to $100 million in senior unsecured notes in the transaction. The transaction has been unanimously approved by the board of directors of each company.

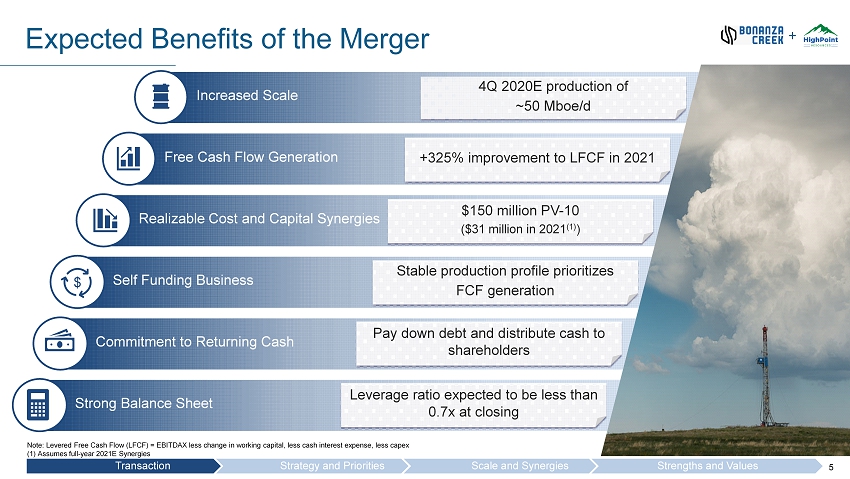

The strategic combination is expected to create the leading unconventional oil producer in rural Weld County and to significantly increase free cash flow and economic resilience. With its enhanced operating scale and significant increase in free cash flow, the Company plans to pursue a business model focused on strong capital returns to its shareholders. Highlights of the transaction include:

| · | Materially increases Bonanza Creek’s scale based on expected pro forma fourth quarter production of 50,000 Boe/d (53% oil) and a rural Weld County leasehold position of 206,000 net acres | |

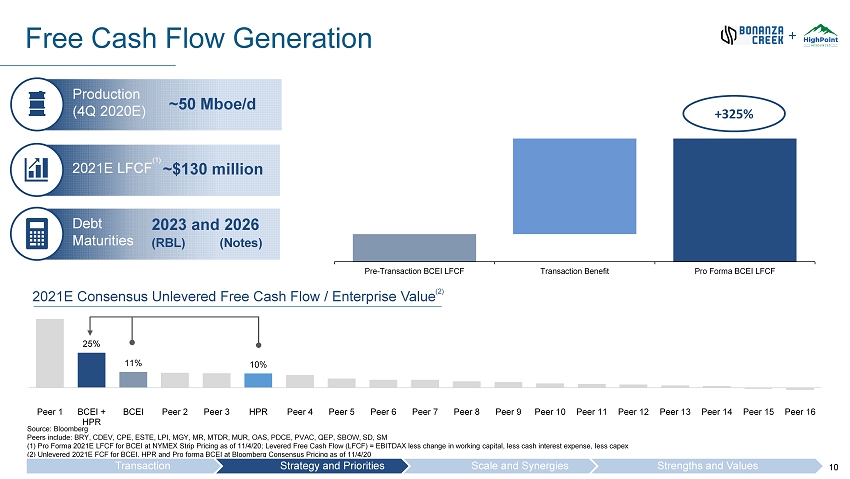

| · | Significantly increases expected pro forma 2021 levered free cash flow2 to ~$130 million. | |

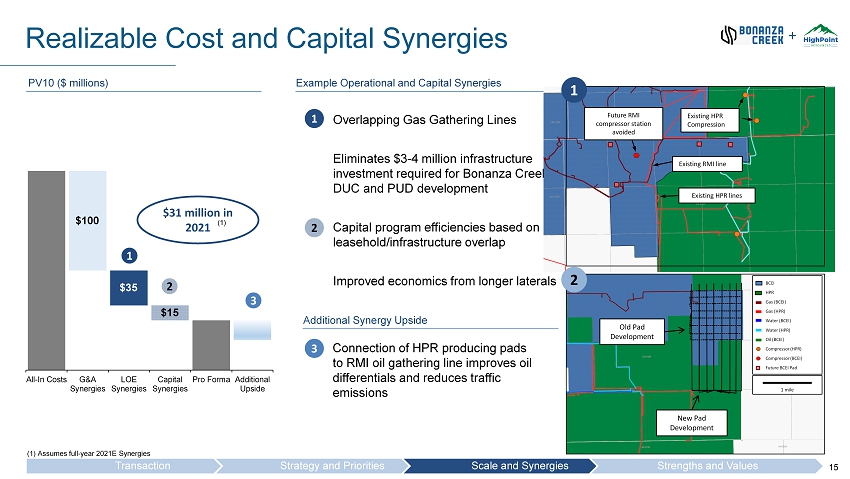

| · | Expected to result in approximately $31 million in 2021 synergies on a pro forma basis, with $150 million of PV10 synergies total, which represents nearly 45% of Bonanza Creek’s market capitalization at announcement | |

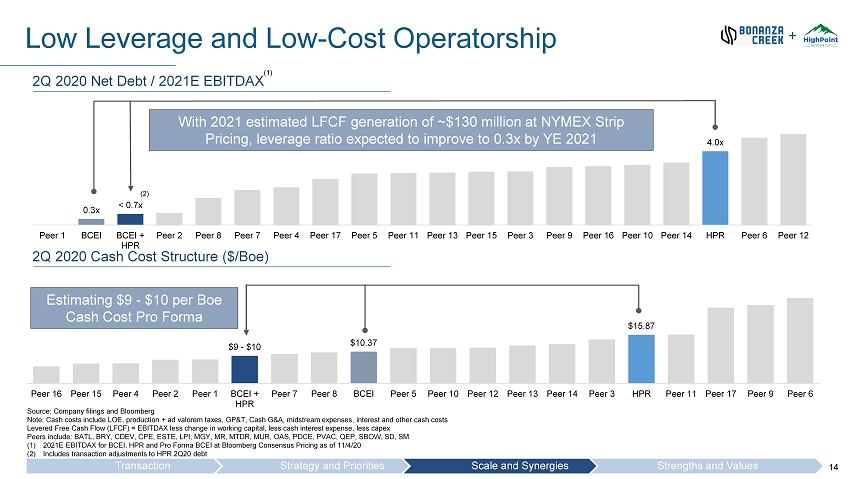

| · | Maintains strong balance sheet with an estimated pro forma leverage ratio less than 0.7x at the estimated closing date | |

| · | Low cost operations with anticipated pro forma cash costs3 between $9.00 and $10.00 per Boe |

1 Reflects HighPoint projected balance sheet at transaction close

2 Levered Free Cash Flow = EBITDAX less change in working capital, less cash interest expense, less capex

3 Cash costs include LOE, production + ad valorem taxes, GP&T, Cash G&A, midstream expenses, interest and other cash costs

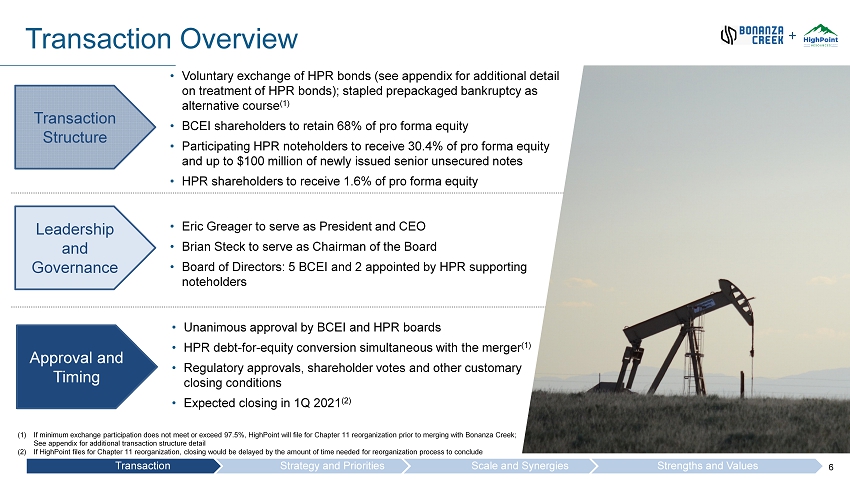

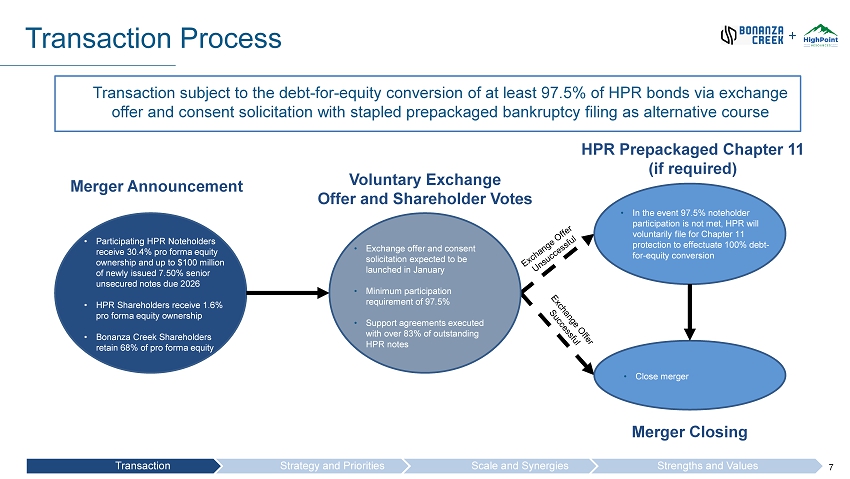

Transaction Details

Under the terms of the definitive merger agreement, Bonanza Creek and HighPoint have agreed to commence a registered exchange offer and consent solicitation (the “Exchange Offer and Consent Solicitation”) and simultaneous solicitation of a prepackaged plan of reorganization under Chapter 11 of the United States Bankruptcy Code (the “Prepackaged Plan”). The Exchange Offer and Consent Solicitation will be conditioned on a minimum participation of not less than 97.5% of the aggregate outstanding principal amount of HighPoint senior unsecured notes (the “HighPoint Notes”) (the “Minimum Participation Condition”).

If the Minimum Participation Condition is met, and if certain customary closing conditions are satisfied (including approval by each company’s shareholders), the companies will effect the Exchange Offer and Consent Solicitation, and Bonanza Creek will acquire HighPoint at closing outside of chapter 11.

Upon a successful Exchange Offer and Consent Solicitation, the HighPoint Notes will be stripped of substantially all protective covenants, including covenants restricting incurrence of secured debt and asset dispositions, which could result in the incurrence of secured debt by, or the transfer of assets, from HighPoint. The HighPoint Notes will also be amended to eliminate certain events of default. Prior to the Exchange Offer and Consent Solicitation, the HighPoint Notes will be amended to permit transactions described herein without triggering a change of control and, as a result, no change of control offer will be made upon consummation of the transactions. Upon a successful out-of-court Exchange Offer and Consent Solicitation, tendered HighPoint Notes shall receive cash in the amount of any accrued and unpaid interest on such HighPoint Notes from the most recent payment date to, but excluding the closing date.

If the Minimum Participation Condition is not met, HighPoint intends to file voluntary petitions under Chapter 11 with the United States Bankruptcy Court for the District of Delaware (the “Court”) to effectuate the solicited Prepackaged Plan and consummate the transaction. The consummation of the Prepackaged Plan will be subject to confirmation by the Court in addition to other conditions to be set forth in the Prepackaged Plan, a transaction support agreement (the “TSA”) and related transaction documents, but approval of the transaction by HighPoint shareholders will not be required.

The transaction is expected to close in the first quarter of 2021 under the Exchange Offer and Consent Solicitation or no later than the second quarter of 2021 under the Prepackaged Plan.

Upon completion of the transaction, Bonanza Creek shareholders will own approximately 68% of the combined company and HighPoint’s stakeholders will own approximately 32%. Existing HighPoint shareholders will own approximately 1.6% of the combined company while participating HighPoint noteholders will receive in the aggregate shares representing approximately 30.4% of the combined company and up to $100 million of newly issued 7.50% senior unsecured notes due 2026. Based on the number of shares of HighPoint common stock outstanding and those subject to equity-based awards, the transaction implies an exchange ratio of 0.114 shares of Bonanza Creek common stock for each share of HighPoint common stock.

Upon closing, Bonanza Creek’s balance sheet is expected to consist of approximately $50 million of cash, $100 million of senior unsecured notes, and approximately $150 million of reserve based lending (“RBL”) debt. We expect that the RBL for the combined company will be determined in the coming weeks. The combined asset base will likely support a borrowing base well in excess of Bonanza’s current $260 million borrowing base, near our existing level.

2

The Company and Fifth Creek Energy Company LLC (“Fifth Creek”), which owns approximately 46.5% of the outstanding shares of HighPoint, have entered into a support agreement whereby Fifth Creek will vote in favor of the Merger (as defined below), subject to certain customary termination rights. Additionally, HighPoint, Fifth Creek, and holders of (x) 73% of the 7.0% Senior Notes of HighPoint due October 15, 2022 and (y) 97% of the 8.75% Senior Notes of HighPoint due June 15, 2025 have entered into the TSA, which obligates Fifth Creek and the noteholder parties to support and vote in favor of the transaction, subject to specified termination rights.

Stakeholder Commentary

“The combination of Bonanza Creek and HighPoint creates significant scale in the rural DJ Basin, which will immediately increase free cash flow generation,” said Eric Greager, President and Chief Executive Officer of Bonanza Creek. “The combination of our complementary asset bases will yield significant synergies and represents a transformative transaction for Bonanza Creek.”

Scot Woodall, Chief Executive Officer and President of HighPoint, stated, “This transaction will create a premier DJ Basin player with a peer leading cost structure and a large, attractive rural footprint. The transaction provides HighPoint stakeholders with the opportunity to participate in a larger DJ Basin producer with both an attractive balance sheet and free cash flow profile.”

Brendan Circle, SVP/Portfolio Manager at Franklin Advisers, HighPoint’s largest noteholder, commented, “We are excited to become a shareholder of the new Bonanza Creek. Bonanza Creek exhibits a number of the qualities that we look for in investment opportunities: strong management, an excellent balance sheet, attractive free cash flow profile, and an ability to return significant cash flow to its shareholders. We look forward to forging this new relationship with the Bonanza Creek team.��

Strategic Rationale

| · | Creates the Leading Rural DJ Producer – On a pro forma basis, Bonanza Creek will have approximately 206,000 net acres in Weld County. Approximately 100% of the pro forma acreage will be unincorporated acreage not subject to regulation by municipalities, and only approximately 8% of the acreage will be subject to Federal mineral or surface regulations. Bonanza Creek remains committed to engaging community stakeholders to ensure safe, thoughtful, and responsible development. | |

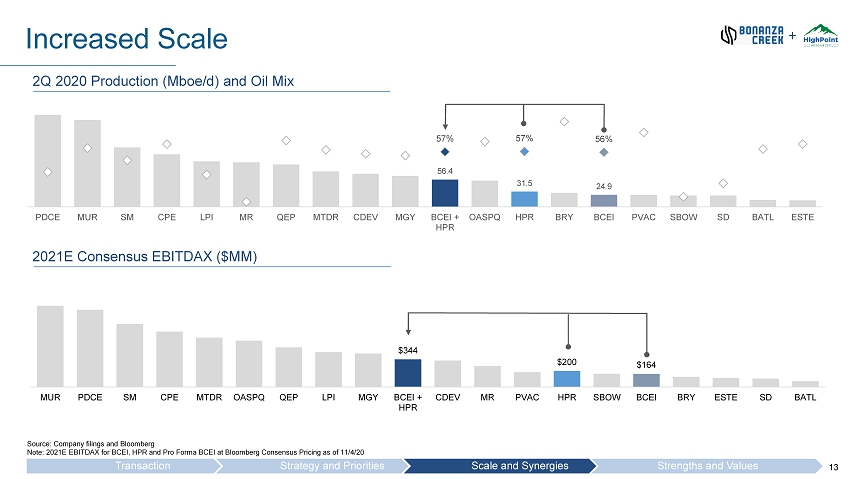

| · | Enhances Size and Scale – On a pro forma basis, fourth quarter 2020 production is expected to be approximately 50,000 Boe/d, with oil representing ~53%. | |

| · | Disciplined Capital Allocation – The transaction is expected to accelerate Bonanza Creek’s transition to a business model that focuses on free cash flow generation by increasing projected free cash flow to approximately $130 million in 2021, assuming NYMEX strip pricing. The Company will use excess free cash flow to reduce debt, return capital to shareholders, reinvest in the business, and pursue additional value-driven consolidation opportunities. |

3

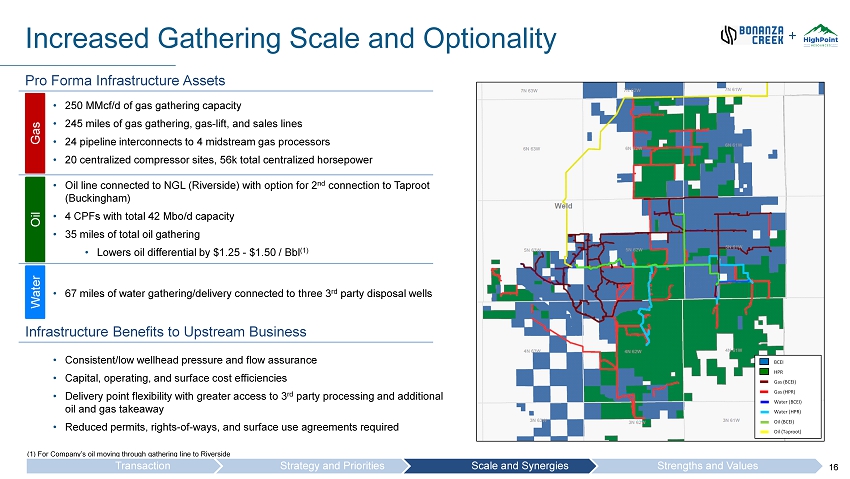

| · | Drives Significant Synergies – Bonanza Creek expects the strategic combination to generate significant synergies of $150 million in present value, including $15 million of near-term capital expenditures savings. In 2021, the Company expects synergies to be $31 million consisting of savings from general and administrative expenses, lease operating expenses and capital expenditures. Additionally, the integration of HighPoint’s midstream infrastructure into Bonanza Creek’s Rocky Mountain Infrastructure should provide additional flow assurance, operating and surface cost efficiencies and greater flexibility to third-party processing and takeaway. | |

| · | Maintains Strong Balance Sheet and Liquidity – Bonanza Creek expects to maintain its strong financial position with an estimated pro forma net debt-to-EBITDAX ratio at the estimated closing date under the Exchange Offer and Consent Solicitation of less than 0.7x on 2021 EBITDAX. | |

| · | Accretive to Financial Metrics – The transaction is expected to be immediately accretive in the first year to all relevant per-share-metrics, including cash flow, free cash flow, and net asset value. The transaction is also expected to be accretive to general and administrative expenses per Boe and lease operating expenses per Boe. |

Governance and Leadership

Following the completion of the transaction, the board of directors of the combined company will consist of 7 members: 5 directors from Bonanza Creek and 2 selected by HighPoint’s supporting noteholders. Eric Greager will serve as the CEO of the combined company and Brian Steck will serve as chairman of the board.

Preliminary Pro Forma 2021 Outlook

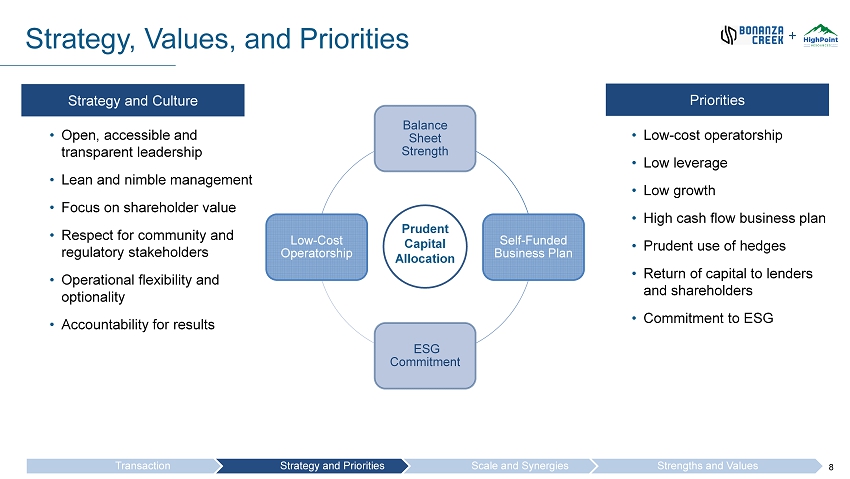

Bonanza Creek’s long-term strategy is to be a low-cost operator focused on generating free cash flow and returning cash to shareholders. In 2021, the Company is expected to generate approximately $130 million of free cash flow assuming NYMEX strip pricing. Full year production is expected to average between 45,000 and 50,000 Boe/d. Bonanza Creek expects its combined cash costs to be between $9.00 and $10.00 per Boe.

Tax Plan

In connection with the transaction, Bonanza Creek has entered into a tax benefits preservation plan designed to protect the availability of the Company’s existing net operating loss carryforwards and other tax attributes (collectively, the “Tax Benefits”). The Company’s ability to use its Tax Benefits would be substantially limited if it were to experience an “ownership change,” as defined under Section 382 of the Internal Revenue Code. Further details of the tax benefits preservation plan are provided in a separate Bonanza Creek announcement issued today.

Advisors

Evercore is serving as financial advisor and Vinson & Elkins LLP is serving as legal advisor to Bonanza Creek. Tudor, Pickering, Holt & Co. / Perella Weinberg Partners are serving as financial advisor, Kirkland & Ellis LLP is serving as legal advisor, and AlixPartners, LLP is serving as restructuring advisor to HighPoint. Akin Gump LLP is serving as legal advisor to an informal group of HighPoint Noteholders that have signed the TSA. J.P. Morgan Securities LLC also served as an advisor to HighPoint.

4

Conference Call Information

The Company invites you to join senior management from Bonanza Creek for an investor call on Monday, November 9, 2020 at 8:30 a.m. Eastern (6:30 a.m. Mountain), to discuss the key details and benefits of this transaction.

Conference Call and Webcast:

Date / Time: Monday, November 9, 2020, 8:30 a.m. ET / 6:30 a.m. MT

Domestic (Toll Free): (877) 793-4362

International: (615) 247-0186

Conference ID: 6789828

A live webcast and replay of this event will be available under the “For Investors - Events” page on the Investor Relations section of the Company’s website at www.bonanzacrk.com. This replay will be available through November 23, 2020.

About the Companies

Bonanza Creek Energy, Inc. is an independent oil and natural gas company engaged in the acquisition, exploration, development, and production of oil and associated liquids-rich natural gas in the Rocky Mountain region of the United States. The Company’s assets and operations are concentrated in rural, unincorporated Weld County, Colorado, within the Wattenberg Field, focused on the Niobrara and Codell formations. The Company’s common shares are listed for trading on the NYSE under the symbol: “BCEI.” For more information about the Company, please visit www.bonanzacrk.com.

HighPoint Resources Corporation (NYSE: HPR) is a Denver, Colorado based company focused on the development of oil and natural gas assets located in the Denver-Julesburg Basin of Colorado. Additional information about HighPoint may be found on its website at www.hpres.com.

No Offer or Solicitation

This communication relates to a proposed business combination transaction (the “Merger”) between Bonanza Creek and HighPoint, which includes the commencement of the Exchange Offer and Consent Solicitation and the solicitation of the Prepackaged Plan (together with the Merger and the Exchange Offer and Consent Solicitation, the “Transaction”). Communications in this document do not constitute an offer to sell or the solicitation of an offer to subscribe for or buy any securities or a solicitation of any vote or approval with respect to the Transaction, the Exchange Offer and Consent Solicitation or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

5

Important Additional Information

In connection with the Transaction, Bonanza Creek and HighPoint intend to file materials with the U.S. Securities and Exchange Commission (the “SEC”), including (1) a joint proxy statement in preliminary and definitive form (the “Joint Proxy Statement”), (2) a consent solicitation and prospectus with respect to the Exchange Offer and Consent Solicitation (the “Exchange Prospectus”), of which the Prepackaged Plan will be a part, (3) a Registration Statement on Form S-4 with respect to the Merger (the “Merger Registration Statement”), of which the Joint Proxy Statement will be a part, and (4) a Registration Statement on Form S-4 with respect to the Exchange Offer and Consent Solicitation (together with the Merger Registration Statement, the “Registration Statements”), of which the Exchange Prospectus will be a part. After the Registration Statements are declared effective by the SEC, Bonanza Creek and HighPoint intend to send the definitive form of the Joint Proxy Statement to the shareholders of Bonanza Creek and the shareholders of HighPoint, and Bonanza Creek and HighPoint intend to send the definitive form of the Exchange Prospectus to the debt holders of HighPoint. These documents are not substitutes for the Joint Proxy Statement, Exchange Prospectus or Registration Statements or for any other document that Bonanza Creek or HighPoint may file with the SEC and send to Bonanza Creek’s shareholders or HighPoint’s shareholders or debt holders in connection with the Transaction. INVESTORS AND SECURITY HOLDERS OF BONANZA CREEK AND HIGHPOINT ARE URGED TO CAREFULLY AND THOROUGHLY READ THE JOINT PROXY STATEMENT, REGISTRATION STATEMENTS AND EXCHANGE PROSPECTUS, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AND OTHER RELEVANT DOCUMENTS FILED BY BONANZA CREEK AND HIGHPOINT WITH THE SEC, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT BONANZA CREEK, HIGHPOINT, THE TRANSACTION, THE RISKS RELATED THERETO AND RELATED MATTERS.

Investors will be able to obtain free copies of the Registration Statements, Joint Proxy Statement and Exchange Prospectus, as each may be amended from time to time, and other relevant documents filed by Bonanza Creek and HighPoint with the SEC (when they become available) through the website maintained by the SEC at www.sec.gov. Copies of documents filed with the SEC by Bonanza Creek will be available free of charge from Bonanza Creek’s website at www.bonanzacrk.com under the “For Investors” tab or by contacting Bonanza Creek’s Investor Relations Department at (720) 225-6679 or slandreth@bonanzacrk.com. Copies of documents filed with the SEC by HighPoint will be available free of charge from HighPoint’s website at www.hpres.com under the “Investors” tab or by contacting HighPoint’s Investor Relations Department at (303) 312-8514 or lbusnardo@hpres.com.

Participants in the Solicitation

Bonanza Creek, HighPoint and their respective directors and certain of their executive officers and other members of management and employees may be deemed, under SEC rules, to be participants in the solicitation of proxies from Bonanza Creek’s shareholders and HighPoint’s shareholders in connection with the Transaction. Information regarding the executive officers and directors of Bonanza Creek is included in its definitive proxy statement for its 2020 annual meeting filed with the SEC on April 24, 2020. Information regarding the executive officers and directors of HighPoint is included in its definitive proxy statement for its 2020 annual meeting filed with the SEC on March 18, 2020. Additional information regarding the persons who may be deemed participants and their direct and indirect interests, by security holdings or otherwise, will be set forth in the Registration Statements, Joint Proxy Statement and other materials when they are filed with the SEC in connection with the Transaction. Free copies of these documents may be obtained as described in the paragraphs above.

6

Forward-Looking Statements and Cautionary Statements

Certain statements in this document concerning the Transaction, including any statements regarding the expected timetable for completing the Transaction, the results, effects, benefits and synergies of the Transaction, future opportunities for the combined company, future financial performance and condition, guidance and any other statements regarding Bonanza Creek’s or HighPoint’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts are “forward-looking” statements based on assumptions currently believed to be valid. Forward-looking statements are all statements other than statements of historical facts. The words “anticipate,” “believe,” “ensure,” “expect,” “if,” “intend,” “estimate,” “probable,” “project,” “forecasts,” “predict,” “outlook,” “aim,” “will,” “could,” “should,” “would,” “potential,” “may,” “might,” “anticipate,” “likely” “plan,” “positioned,” “strategy,” and similar expressions or other words of similar meaning, and the negatives thereof, are intended to identify forward-looking statements. Specific forward-looking statements include statements regarding Bonanza Creek and HighPoint’s plans and expectations with respect to the Transaction and the anticipated impact of the Transaction on the combined company’s results of operations, financial position, growth opportunities and competitive position. The forward-looking statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995.

These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from those anticipated, including, but not limited to, the possibility that shareholders of Bonanza Creek may not approve the issuance of new shares of Bonanza Creek common stock in the Transactions or that shareholders of HighPoint may not approve the Merger Agreement; the risk that a condition to closing of the Transaction may not be satisfied, that either party may terminate the Merger Agreement or that the closing of the Transaction might be delayed or not occur at all; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the transaction; the diversion of management time on transaction-related issues; the ultimate timing, outcome and results of integrating the operations of Bonanza Creek and HighPoint; the effects of the business combination of Bonanza Creek and HighPoint, including the combined company’s future financial condition, results of operations, strategy and plans; the ability of the combined company to realize anticipated synergies in the timeframe expected or at all; changes in capital markets and the ability of the combined company to finance operations in the manner expected; regulatory approval of the transaction; the effects of commodity prices; the risks of oil and gas activities; the risk that the requisite amount of HighPoint debt does not participate in the Exchange Offer and Consent Solicitation and that HighPoint may need to reorganize in bankruptcy as a result; the risks and unpredictability inherent in the bankruptcy process; and the fact that operating costs and business disruption may be greater than expected following the public announcement or consummation of the Transaction. Expectations regarding business outlook, including changes in revenue, pricing, capital expenditures, cash flow generation, strategies for our operations, oil and natural gas market conditions, legal, economic and regulatory conditions, and environmental matters are only forecasts regarding these matters.

Additional factors that could cause results to differ materially from those described above can be found in Bonanza Creek’s Annual Report on Form 10-K for the year ended December 31, 2019 and in its subsequently filed Quarterly Reports on Form 10-Q, each of which is on file with the SEC and available from Bonanza Creek’s website at www.bonanzacrk.com under the “For Investors” tab, and in other documents Bonanza Creek files with the SEC, and in HighPoint’s Annual Report on Form 10-K for the year ended December 31, 2019 and in its subsequently filed Quarterly Reports on Form 10-Q, each of which is on file with the SEC and available from HighPoint’s website at www.hpres.com under the “Investors” tab, and in other documents HighPoint files with the SEC.

7

All forward-looking statements speak only as of the date they are made and are based on information available at that time. Neither Bonanza Creek nor HighPoint assumes any obligation to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements were made or to reflect the occurrence of unanticipated events except as required by federal securities laws. As forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements.

Investor Contacts

Scott Landreth

Senior Director, Finance & Investor Relations and Treasurer

720-225-6679

slandreth@bonanzacrk.com

Larry C. Busnardo

Vice President, Investor Relations

303-312-8514

lbusnardo@hpres.com

8

BCEI + HPR: CONSOLIDATING THE RURAL DJ BASIN November 9, 2020

2 2 Important Disclosures No Offer or Solicitation This communication relates to a proposed business combination transaction (the “Merger”) between Bonanza Creek Energy, Inc. ( “ BCEI ”) and HighPoint Resources Corporation (“ HPR ”), which includes the commencement by BCEI and HPR of an exchange offer (the “Exchange Offer”) and the solicitation of a prepackaged plan of reorganization for HPR and its subsidiaries (the “Prepackaged Plan” and, together with the Exchange Offer and the Merger, the “Transaction”) to effect the exchange of unsecured senior notes of HPR for shares of BCEI common stock, par value $0.01 per share (the “ BCEI common stock”), or unsecured senior notes to be issued by BCEI in connection with the Exchange Offer. Communications in this presentation do not constitute an offer to sell or the solicita ti on of an offer to subscribe for or buy any securities or a solicitation of any vote or approval with respect to the Transaction, the Exchange Offer or otherwise, nor sh all there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such ju ris diction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Important Additional Information In connection with the Transaction, BCEI and HPR intend to file materials with the U.S. Securities and Exchange Commission (the “SEC”), including (1) a joint proxy statement in preliminary and definitive form (the “Joint Proxy Statement”), (2) a consent solicitation and prospectus with respect to the Exchange Offer (the “Exchange Pr osp ectus”), of which the Prepackaged Plan will be a part, (3) a Registration Statement on Form S - 4 with respect to the Merger (the “Merger Registration Statement”), of which the Joint Proxy Statement will be a part, and (4) a Registration Statement on Form S - 4 with respect to the Exchange Offer (together with the Merger Registration Statement, the “Registration Statements”), of which the Exchange Prospectus will be a par t. After the Registration Statements are declared effective by the SEC, BCEI and HPR intend to send the definitive form of the Joint Proxy Statement to the shareholders of BCEI and the shareholders of HPR , and BCEI and HPR intend to send the definitive form of the Exchange Prospectus to the debt holders of HPR . These documents are not substitutes for the Joint Proxy Statement, Exchange Prospectus or Registration Statements or for an y o ther document that BCEI or HPR may file with the SEC and send to BCEI’s shareholders or HPR’s shareholders or debt holders in connection with the Transaction. INVESTORS AND SECURITY HOLDERS OF BCEI AND HPR ARE URGED TO CAREFULLY AND THOROUGHLY READ THE JOINT PROXY STATEMENT, REGISTRATION STATEMENTS AND EXCHANGE PROSPECTUS, AS EACH MAY BE AMENDED OR SUPPLEM ENT ED FROM TIME TO TIME, AND OTHER RELEVANT DOCUMENTS FILED BY BCEI AND HPR WITH THE SEC, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT BCEI , HPR , THE TRANSACTION, THE RISKS RELATED THERETO AND RELATED MATTERS. Investors will be able to obtain free copies of the Registration Statements, Joint Proxy Statement and Exchange Prospectus, a s e ach may be amended from time to time, and other relevant documents filed by BCEI and HPR with the SEC (when they become available) through the website maintained by the SEC at www.sec.gov. Copies of documents filed w ith the SEC by BCEI will be available free of charge from BCEI’s website at www.bonanzacrk.com under the “For Investors” tab or by contacting BCEI’s Investor Relations Department at (720) 225 - 6679 or slandreth@bonanzacrk.com. Copies of documents filed with the SEC by HPR will be available free of charge from HPR’s website at www.hpres.com under the “Investors” tab or by contacting HPR’s Investor Relations Department at (303) 312 - 8514 or lbusnardo@hpres.com. Participants in the Solicitation BCEI , HPR and their respective directors and certain of their executive officers and other members of management and employees may be d ee med, under SEC rules, to be participants in the solicitation of proxies from BCEI’s shareholders and HPR’s shareholders in connection with the Transaction. Information regarding the executive officers and directors of BCEI is included in its definitive proxy statement for its 2020 annual meeting filed with the SEC on April 24, 2020. Information regarding the executive officers and directors of HPR is included in its definitive proxy statement for its 2020 annual meeting filed with the SEC on March 18, 2020. Additional information regarding the persons who may be deemed participants and their direct and indir ect interests, by security holdings or otherwise, will be set forth in the Registration Statements, Joint Proxy Statement and other materials when they are filed with the SEC in connection with the Transaction. Fr ee copies of these documents may be obtained as described in the paragraphs above.

3 3 Cautionary Statement Regarding Forward - Looking Statements Certain statements in this presentation concerning the Transaction, including any statements regarding the expected timetable fo r completing the Transaction, the results, effects, benefits and synergies of the Transaction, future opportunities for the combined company, future financial performance and condition, guid anc e and any other statements regarding BCEI’s or HPR’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not hist ori cal facts are “forward - looking” statements based on assumptions currently believed to be valid. Forward - looking statements are all statements other than statements of historical facts. The words “antici pate,” “believe,” “ensure,” “expect,” “if,” “intend,” “estimate,” “probable,” “project,” “forecasts,” “predict,” “outlook,” “aim,” “will,” “could,” “should,” “would,” “potential,” “may,” “might,” “antici pat e,” “likely” “plan,” “positioned,” “strategy,” and similar expressions or other words of similar meaning, and the negatives thereof, are intended to identify forward - looking statements. Specific forward - looking statem ents include statements regarding BCEI and HPR’s plans and expectations with respect to the Transaction and the anticipated impact of the Transaction on the combined company’s results of operations, financial position, growth opportunities and competitive position. The forward - looking statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. These forward - looking statements involve significant risks and uncertainties that could cause actual results to differ materiall y from those anticipated, including, but not limited to, the possibility that shareholders of BCEI may not approve the issuance of new shares of BCEI common stock in the Transactions or that shareholders of HPR may not approve the Merger Agreement; the risk that a condition to closing of the Transaction may not be satisfied, that either party may terminate the Merger Agreement or that th e c losing of the Transaction might be delayed or not occur at all; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or comple tio n of the transaction; the diversion of management time on transaction - related issues; the ultimate timing, outcome and results of integrating the operations of BCEI and HPR ; the effects of the business combination of BCEI and HPR , including the combined company’s future financial condition, results of operations, strategy and plans; the ability of the combined company to reali ze anticipated synergies in the timeframe expected or at all; changes in capital markets and the ability of the combined company to finance operations in the manner expected; regulatory approval of the transaction; the effects of commodity prices; the risks of oil and gas activities; the risk that the requisite amount of HPR debt does not participate in the Exchange Offer and that HPR may need to reorganize in bankruptcy as a result; the risks and unpredictability inherent in the bankruptcy process; and the fact that operating costs and business disruption may be greater than expected fo llo wing the public announcement or consummation of the Transaction. Expectations regarding business outlook, including changes in revenue, pricing, capital expenditures, cash flow generation, s tra tegies for our operations, oil and natural gas market conditions, legal, economic and regulatory conditions, and environmental matters are only forecasts regarding these matters. Additional factors that could cause results to differ materially from those described above can be found in BCEI’s Annual Report on Form 10 - K for the year ended December 31, 2019 and in its subsequently filed Quarterly Reports on Form 10 - Q, each of which is on file with the SEC and available from BCEI’s website at www.bonanzacrk.com under the “For Investors” tab, and in other documents BCEI files with the SEC, and in HPR’s Annual Report on Form 10 - K for the year ended December 31, 2019 and in its subsequently filed Quarterly Reports on Form 10 - Q, e ach of which is on file with the SEC and available from HPR’s website at www.hpres.com under the “Investors” tab, and in other documents HPR files with the SEC. All forward - looking statements speak only as of the date they are made and are based on information available at that time. Neit her BCEI nor HPR assumes any obligation to update forward - looking statements to reflect circumstances or events that occur after the date the forward - looking statements were made or to reflect t he occurrence of unanticipated events except as required by federal securities laws. As forward - looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements. Trademarks that appear in this presentation belong to their respective owners.

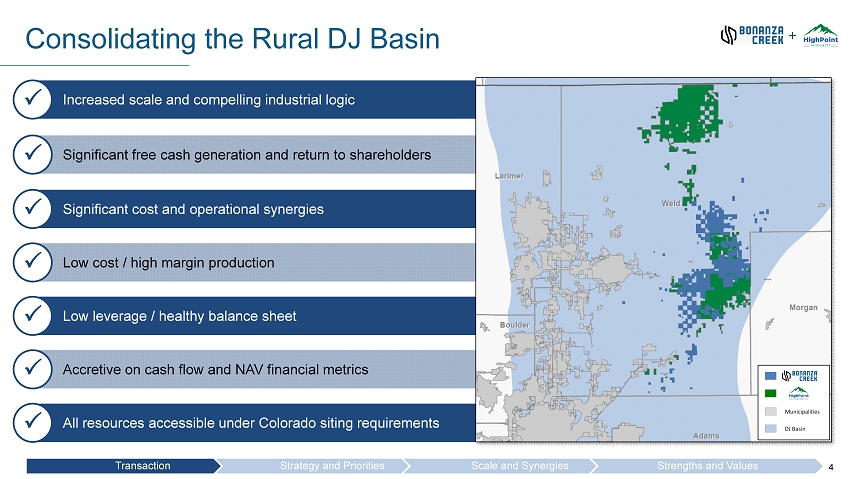

4 4 All resources accessible under Colorado siting requirements & Increased scale and compelling industrial logic & Consolidating the Rural DJ Basin + Transaction Strategy and Priorities Scale and Synergies Strengths and Values Significant free cash generation and return to shareholders & Significant cost and operational synergies & Low cost / high margin production & Low leverage / healthy balance sheet & Accretive on cash flow and NAV financial metrics & Municipalities DJ Basin

5 5 Commitment to Returning Cash Self Funding Business $ Increased Scale Expected Benefits of the Merger + Free Cash Flow Generation Realizable Cost and Capital Synergies Transaction Strategy and Priorities Scale and Synergies Strengths and Values Strong Balance Sheet 4Q 2020E production of ~50 Mboe /d +325% improvement to LFCF in 2021 $150 million PV - 10 ($31 million in 2021 (1) ) Stable production profile prioritizes FCF generation Pay down debt and distribute cash to shareholders Leverage ratio expected to be less than 0.7x at closing Note: Levered Free Cash Flow (LFCF) = EBITDAX less change in working capital, less cash interest expense, less capex (1) Assumes full - year 2021E Synergies

6 6 Transaction Overview Transaction Structure • Voluntary exchange of HPR bonds (see appendix for additional detail on treatment of HPR bonds); stapled prepackaged bankruptcy as alternative course (1) • BCEI shareholders to retain 68% of pro forma equity • Participating HPR noteholders to receive 30.4% of pro forma equity and up to $100 million of newly issued senior unsecured notes • HPR shareholders to receive 1.6% of pro forma equity Leadership and Governance • Eric Greager to serve as President and CEO • Brian Steck to serve as Chairman of the Board • Board of Directors: 5 BCEI and 2 appointed by HPR supporting noteholders Approval and Timing • Unanimous approval by BCEI and HPR boards • HPR debt - for - equity conversion simultaneous with the merger (1) • Regulatory approvals, shareholder votes and other customary closing conditions • Expected closing in 1Q 2021 (2) (1) If minimum exchange participation does not meet or exceed 97.5%, HighPoint will file for Chapter 11 reorganization prior to merging with Bonanza Creek; See appendix for additional transaction structure detail (2) If HighPoint files for Chapter 11 reorganization, closing would be delayed by the amount of time needed for reorganization process to conc lu de + Transaction Strategy and Priorities Scale and Synergies Strengths and Values

7 7 Transaction Process Transaction subject to the debt - for - equity conversion of at least 97.5% of HPR bonds via exchange offer and consent solicitation with stapled prepackaged bankruptcy filing as alternative course + Transaction Strategy and Priorities Scale and Synergies Strengths and Values • Participating HPR Noteholders receive 30.4% pro forma equity ownership and up to $100 million of newly issued 7.50% senior unsecured notes due 2026 • HPR Shareholders receive 1.6% pro forma equity ownership • Bonanza Creek Shareholders retain 68% of pro forma equity Merger Announcement Voluntary Exchange Offer and Shareholder Votes • Exchange offer and consent solicitation expected to be launched in January • Minimum participation requirement of 97.5% • Support agreements executed with over 83% of outstanding HPR notes HPR Prepackaged Chapter 11 (if required) • In the event 97.5% noteholder participation is not met, HPR will voluntarily file for Chapter 11 protection to effectuate 100% debt - for - equity conversion • Close merger Merger Closing

8 8 Balance Sheet Strength Self - Funded Business Plan ESG Commitment Low - Cost Operatorship Prudent Capital Allocation Strategy, Values, and Priorities Strategy and Culture • Open, accessible and transparent leadership • Lean and nimble management • Focus on shareholder value • Respect for community and regulatory stakeholders • Operational flexibility and optionality • Accountability for results Priorities • Low - cost operatorship • Low leverage • Low growth • High cash flow business plan • Prudent use of hedges • Return of capital to lenders and shareholders • Commitment to ESG + Transaction Strategy and Priorities Scale and Synergies Strengths and Values

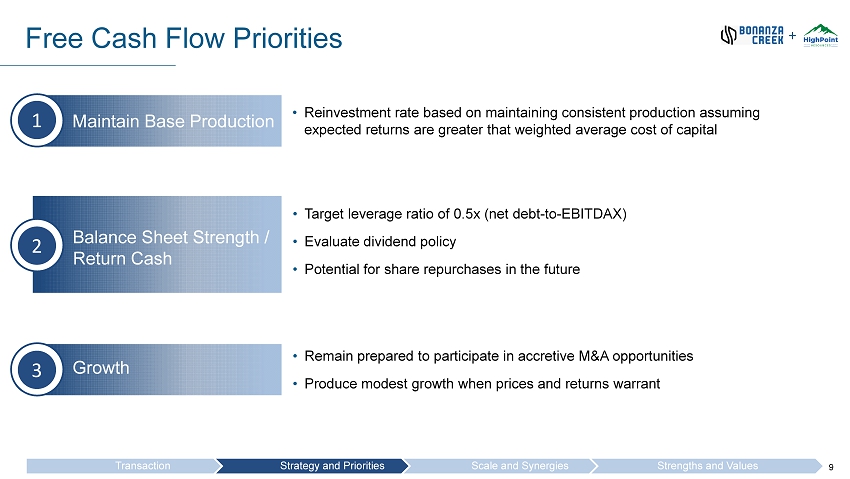

9 9 Free Cash Flow Priorities + Maintain Base Production 1 • Target leverage ratio of 0.5x (net debt - to - EBITDAX) • Evaluate dividend policy • Potential for share repurchases in the future Balance Sheet Strength / Return Cash 2 • Remain prepared to participate in accretive M&A opportunities • Produce modest growth when prices and returns warrant Growth 3 Transaction Strategy and Priorities Scale and Synergies Strengths and Values • Reinvestment rate based on maintaining consistent production assuming expected returns are greater that weighted average cost of capital

10 10 25% 11% 10% 0 0 0 0 0 0 1 1 Peer 1 BCEI + HPR BCEI Peer 2 Peer 3 HPR Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13 Peer 14 Peer 15 Peer 16 Pre-Transaction BCEI LFCF Transaction Benefit Pro Forma BCEI LFCF Free Cash Flow Generation + Production (4Q 2020E) 2021E LFCF ~50 Mboe/d ~$130 million Debt Maturities 2023 and 2026 Source: Bloomberg Peers include: BRY, CDEV, CPE, ESTE, LPI, MGY, MR, MTDR, MUR, OAS, PDCE, PVAC, QEP, SBOW, SD, SM (1) Pro Forma 2021E LFCF for BCEI at NYMEX Strip Pricing as of 11/4/20; Levered Free Cash Flow (LFCF) = EBITDAX less change i n w orking capital, less cash interest expense, less capex (2) Unlevered 2021E FCF for BCEI, HPR and Pro forma BCEI at Bloomberg Consensus Pricing as of 11/4/20 +325% 2021E Consensus Unlevered Free Cash Flow / Enterprise Value (RBL) (Notes) (1) (2) Transaction Strategy and Priorities Scale and Synergies Strengths and Values

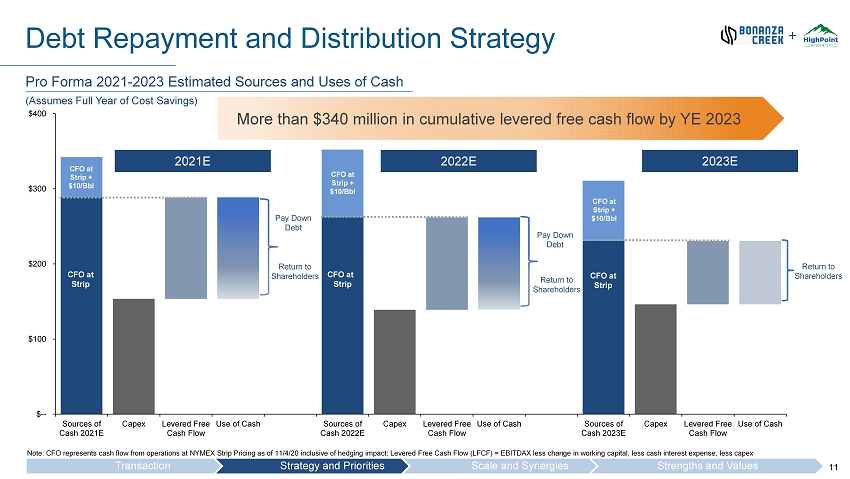

11 11 $-- $100 $200 $300 $400 Sources of Cash 2021E Capex Levered Free Cash Flow Use of Cash Sources of Cash 2022E Capex Levered Free Cash Flow Use of Cash Sources of Cash 2023E Capex Levered Free Cash Flow Use of Cash Debt Repayment and Distribution Strategy More than $340 million in cumulative levered free cash flow by YE 2023 CFO at Strip + $10/ Bbl CFO at Strip Return to Shareholders Pay Down Debt Return to Shareholders Pay Down Debt Return to Shareholders + Pro Forma 2021 - 2023 Estimated Sources and Uses of Cash (Assumes Full Year of Cost Savings) CFO at Strip + $10/ Bbl 2021E 2022E 2023E Note: CFO represents cash flow from operations at NYMEX Strip Pricing as of 11/4/20 inclusive of hedging impact; Levered Free Ca sh Flow (LFCF) = EBITDAX less change in working capital, less cash interest expense, less capex CFO at Strip CFO at Strip CFO at Strip + $10/ Bbl Transaction Strategy and Priorities Scale and Synergies Strengths and Values

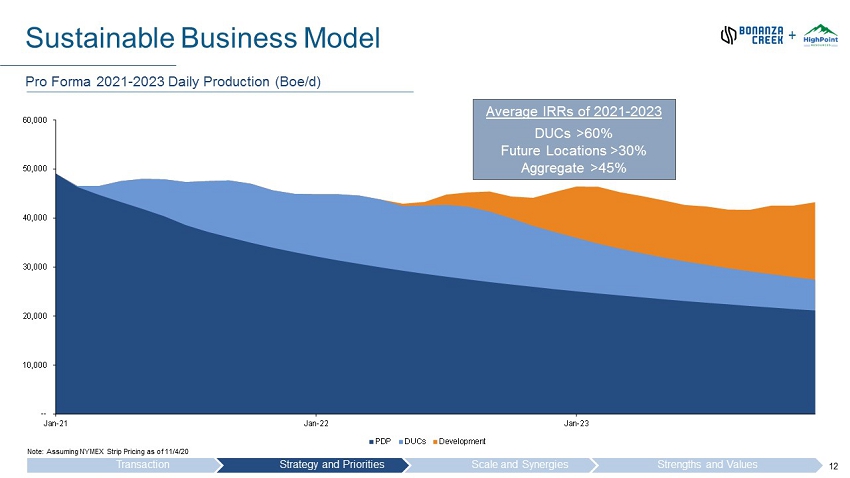

12 12 -- 10,000 20,000 30,000 40,000 50,000 60,000 Jan-21 Jan-22 Jan-23 Sustainable Business Model + Average IRRs of 2021 - 2023 DUCs >60% Future Locations >30% Aggregate >45% Pro Forma 2021 - 2023 Daily Production ( Boe /d) -- 10,000 20,000 30,000 40,000 50,000 60,000 1/1/21 4/1/21 7/1/21 10/1/21 1/1/22 4/1/22 7/1/22 10/1/22 1/1/23 4/1/23 7/1/23 10/1/23 PDP DUCs Development Note: Assuming NYMEX Strip Pricing as of 11/4/20 Transaction Strategy and Priorities Scale and Synergies Strengths and Values

13 13 $344 $200 $164 0 200 400 600 800 1,000 1,200 MUR PDCE SM CPE MTDR OASPQ QEP LPI MGY BCEI + HPR CDEV MR PVAC HPR SBOW BCEI BRY ESTE SD BATL 56.4 31.5 24.9 57% 57% 56% 0% 20% 40% 60% 80% 100% 0 20 40 60 80 100 120 140 160 180 200 PDCE MUR SM CPE LPI MR QEP MTDR CDEV MGY BCEI + HPR OASPQ HPR BRY BCEI PVAC SBOW SD BATL ESTE Increased Scale Source: Company filings and Bloomberg Note: 2021E EBITDAX for BCEI, HPR and Pro Forma BCEI at Bloomberg Consensus Pricing as of 11/4/20 2Q 2020 Production (Mboe/d) and Oil Mix 2021E Consensus EBITDAX ($MM) + Transaction Strategy and Priorities Scale and Synergies Strengths and Values

14 14 0.3x < 0.7x 4.0x 0.0x 1.0x 2.0x 3.0x 4.0x 5.0x 6.0x Peer 1 BCEI BCEI + HPR Peer 2 Peer 8 Peer 7 Peer 4 Peer 17 Peer 5 Peer 11 Peer 13 Peer 15 Peer 3 Peer 9 Peer 16 Peer 10 Peer 14 HPR Peer 6 Peer 12 $9 - $10 $10.37 $15.87 0 5 10 15 20 25 30 Peer 16 Peer 15 Peer 4 Peer 2 Peer 1 BCEI + HPR Peer 7 Peer 8 BCEI Peer 5 Peer 10 Peer 12 Peer 13 Peer 14 Peer 3 HPR Peer 11 Peer 17 Peer 9 Peer 6 Low Leverage and Low - Cost Operatorship Estimating $9 - $10 per Boe Cash Cost Pro Forma + 2Q 2020 Net Debt / 2021E EBITDAX 2Q 2020 Cash Cost Structure ($/ Boe ) With 2021 estimated LFCF generation of ~$130 million at NYMEX Strip Pricing, leverage ratio expected to improve to 0.3x by YE 2021 Source: Company filings and Bloomberg Note: Cash costs include LOE, production + ad valorem taxes, GP&T, Cash G&A, midstream expenses, interest and other cash cost s Levered Free Cash Flow (LFCF) = EBITDAX less change in working capital, less cash interest expense, less capex Peers include: BATL, BRY, CDEV, CPE, ESTE, LPI, MGY, MR, MTDR, MUR, OAS, PDCE, PVAC, QEP, SBOW, SD, SM (1) 2021E EBITDAX for BCEI, HPR and Pro Forma BCEI at Bloomberg Consensus Pricing as of 11/4/20 (2) Includes transaction adjustments to HPR 2Q20 debt (3) Reflects targeted 2021 cash costs (inclusive of expected synergies) (2) (1) Transaction Strategy and Priorities Scale and Synergies Strengths and Values

15 15 $100 $35 $15 All-In Costs G&A Synergies LOE Synergies Capital Synergies Pro Forma Additional Upside Realizable Cost and Capital Synergies + Example Operational and Capital Synergies Overlapping Gas Gathering Lines Eliminates $3 - 4 million infrastructure investment required for Bonanza Creek DUC and PUD development Capital program efficiencies based on leasehold/infrastructure overlap Improved economics from longer laterals Connection of HPR producing pads to RMI oil gathering line improves oil differentials and reduces traffic emissions 3 1 2 3 2 1 Additional Synergy Upside PV10 ($ millions) Old Pad Development New Pad Development Existing RMI line Existing HPR Compression Existing HPR lines Future RMI compressor station avoided 1 2 BCEI HPR Gas (BCEI) Gas (HPR) Water (BCEI) Water (HPR) Oil (BCEI) Compressor (HPR) Compressor (BCEI) Future BCEI Pad 1 mile Transaction Strategy and Priorities Scale and Synergies Strengths and Values $31 million in 2021 (1) Assumes full - year 2021E Synergies (1)

16 16 Increased Gathering Scale and Optionality • 250 MMcf/d of gas gathering capacity • 245 miles of gas gathering, gas - lift, and sales lines • 24 pipeline interconnects to 4 midstream gas processors • 20 centralized compressor sites, 56k total centralized horsepower + Pro Forma Infrastructure Assets • Consistent/low wellhead pressure and flow assurance • Capital, operating, and surface cost efficiencies • Delivery point flexibility with greater access to 3 rd party processing and additional oil and gas takeaway • Reduced permits, rights - of - ways, and surface use agreements required Infrastructure Benefits to Upstream Business (1) For Company’s oil moving through gathering line to Riverside Gas Oil • 67 miles of water gathering/delivery connected to three 3 rd party disposal wells • Oil line connected to NGL (Riverside) with option for 2 nd connection to Taproot (Buckingham) • 4 CPFs with total 42 Mbo /d capacity • 35 miles of total oil gathering • Lowers oil differential by $1.25 - $1.50 / Bbl (1) Water BCEI HPR Gas (BCEI) Gas (HPR) Water (BCEI) Water (HPR) Oil (BCEI) Oil (Taproot) Transaction Strategy and Priorities Scale and Synergies Strengths and Values

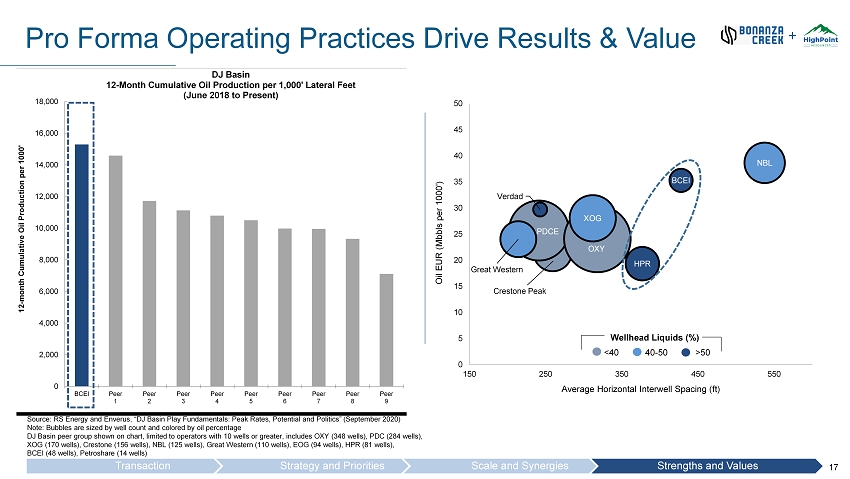

17 17 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 18,000 BCEI Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 12 - month Cumulative Oil Production per 1000' DJ Basin 12 - Month Cumulative Oil Production per 1,000' Lateral Feet (June 2018 to Present) Crestone Peak BCEI PDCE Great Western HPR NBL OXY Verdad XOG 0 5 10 15 20 25 30 35 40 45 50 150 250 350 450 550 Oil EUR ( Mbbls per 1000') Average Horizontal Interwell Spacing (ft) Wellhead Liquids (%) <40 40 - 50 >50 Pro Forma Operating Practices Drive Results & Value + Source: RS Energy and Enverus , “DJ Basin Play Fundamentals: Peak Rates, Potential and Politics” (September 2020) Note: Bubbles are sized by well count and colored by oil percentage DJ Basin peer group shown on chart, limited to operators with 10 wells or greater, includes OXY (348 wells), PDC (284 wells), XOG (170 wells), Crestone (156 wells), NBL (125 wells), Great Western (110 wells), EOG (94 wells), HPR (81 wells), BCEI (48 wells), Petroshare (14 wells) Transaction Strategy and Priorities Scale and Synergies Strengths and Values

18 18 ESG Commitment • M eeting /exceeding Colorado air emission standards and groundwater monitoring regulations • Reducing carbon footprint via pipeline infrastructure, reduced truck traffic, Leak Detection and Repair (LDAR), and Storage Tank Emissions Management (STEM) • Incorporating advanced vapor recovery, methane, and volatile organic compounds (VOC) controls at our Centralized Processing Facilities • Holding suppliers and service providers to same high standard • Committed to increasing employee and contractor diversity and inclusion • Value driven culture that encourages employees to volunteer and contribute to the betterment of their communities • Continually seeking opportunities to engage employees, local governments, and community leaders to protect people, land, air, and water • Engaged , independent, and diverse Board • Compensation program aligned with ESG commitment • Code of Business Conduct and Ethics not only for employees but also extends to suppliers • Transparent and proactive stakeholder engagement + Environment Social Governance Transaction Strategy and Priorities Scale and Synergies Strengths and Values

19 19 Transaction Structure – Additional Detail + • Upon a successful exchange, HPR bonds will be stripped of substantially all protective covenants, including covenants restricting incurrence of secured debt and asset dispositions, which could result in the incurrence of secured debt by, or the transfer of assets, from HPR • HPR bonds will also be amended to eliminate certain events of default • Prior to exchange, HPR bonds will be amended to permit transactions described herein without triggering a change of control and, as a result, no change of control offer will be made upon consummation of the transactions • Upon a successful out - of - court exchange, accrued and unpaid interest will be paid in cash to the exchanging holders

20 20 Company Contacts + Scott Landreth Senior Director, Finance, Investor Relations and Treasurer • Tel: (720) 225 - 6679 • Email: slandreth @bonanzacrk.com