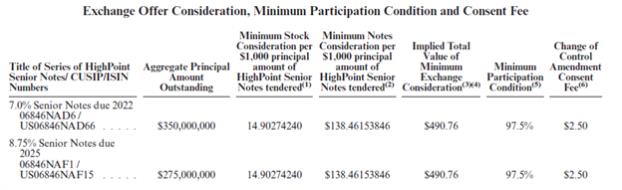

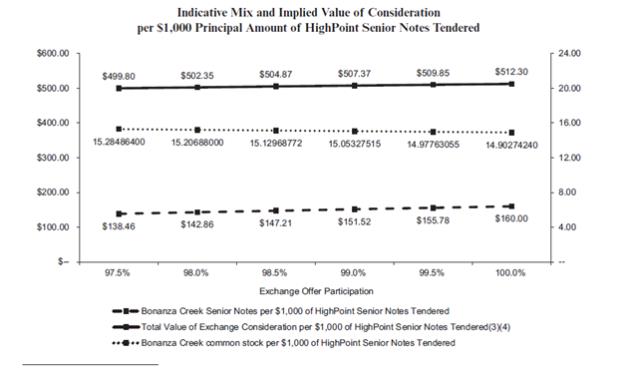

On February 10, 2021, HighPoint Resources Corporation (“HighPoint”) announced that a special meeting of stockholders of HighPoint (the “HighPoint special meeting”) is scheduled to take place on March 12, 2021 at 9:00 a.m., Mountain Time. The purpose of the HighPoint special meeting is to adopt (i) the proposal to approve the transaction pursuant to the Agreement and Plan of Merger, dated as of November 9, 2020, by and among Bonanza Creek Energy, Inc. (“Bonanza Creek”), HighPoint and Boron Merger Sub, Inc. (as amended from time to time, the “merger agreement”), (ii) the proposal to approve the compensation that may be paid to HighPoint’s named executive officers in connection therewith and (iii) the proposal to approve the Prepackaged Plan (as defined below) in the event that the merger agreement is not approved or less than 97.5% of the aggregate outstanding principal amount of each series of outstanding HighPoint Notes (as defined below) (the “Minimum Participation Condition”) participate in the Exchange Offers (as defined below). The record date for HighPoint stockholders entitled to vote at the HighPoint special meeting is the close of business on February 1, 2021.

A copy of HighPoint’s press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

Also on February 10, 2021, Bonanza Creek and HighPoint announced that Bonanza Creek has commenced offers to exchange (the “Exchange Offers”) shares of its common stock and newly issued 7.5% Senior Notes due 2026 for any and all of the 7.0% Senior Notes due October 15, 2022 (the “2022 Notes”) of HighPoint Operating Corporation (“HighPoint OpCo”) and the 8.75% Senior Notes due June 15, 2025 of HighPoint OpCo (the “2025 Notes” and, together with the 2022 Notes, the “HighPoint Notes”). The Exchange Offers are being commenced in connection with Bonanza Creek’s proposed acquisition of HighPoint pursuant to the Merger Agreement.

In connection with the Exchange Offers, HighPoint is soliciting, on behalf of HighPoint OpCo, consents (the “Consent Solicitations”) to certain proposed amendments to the indentures governing the HighPoint Notes from all eligible holders of the HighPoint Notes.

Concurrently with the Exchange Offers and Consent Solicitations, HighPoint is soliciting votes from the holders of the HighPoint Notes to accept or reject a prepackaged plan of reorganization under Chapter 11 of the United States Bankruptcy Code (the “Prepackaged Plan”).

A copy of Bonanza Creek and HighPoint’s press release is attached as Exhibit 99.2 to this Current Report on Form 8-K and incorporated herein by reference.

No Offer or Solicitation

This communication relates to a proposed business combination transaction (the “Merger”) between Bonanza Creek and HighPoint, which includes the commencement by Bonanza Creek and HighPoint of the Exchange Offers and Consent Solicitations and the simultaneous solicitation of the Prepackaged Plan (collectively, the “Transaction”). Communications in this document do not constitute an offer to sell or the solicitation of an offer to subscribe for or buy any securities or a solicitation of any vote or approval with respect to the Merger, the Exchange Offers and Consent Solicitations or other aspects of the Transaction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933 (the “Securities Act”).

Important Additional Information

In connection with the Transaction, Bonanza Creek and HighPoint have filed materials with the U.S. Securities and Exchange Commission (the “SEC”), including (1) a definitive joint proxy statement/prospectus (“Joint Proxy Statement/Prospectus”), (2) a consent solicitation and prospectus with respect to the Exchange Offers and Consent Solicitations (the “Exchange Prospectus”), of which the Prepackaged Plan is a part, (3) a Registration Statement on Form S-4, Registration No. 333-251401, with respect to the Merger (the “Merger Registration Statement”), of which the Joint Proxy Statement/ Prospectus forms a part, and (4) a Registration Statement on Form S-4, Registration No. 333-251402, with respect to the Exchange Offers