Exhibit 99.1

1 November 2019 Investor Presentation

2 No Offer or Solicitation This announcement is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to s ell , subscribe for or buy any securities or the solicitation of any vote in any jurisdiction pursuant to the proposed transactions or otherwise, nor shall there be any sale, issuance or transfer or securit ies in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the “S ecurities Act”), or pursuant to an exemption from the registration requirements of the Securities Act. Use of Projections This presentation contains, and the proxy statement to be delivered to Twelve Seas‘s shareholders will contain, financial for eca sts with respect to BPGIC’s projected revenues, EBITDA, and net capital expenditures for BPGIC’s fiscal 2019 and 2020. Neither Twelve Seas’s independent auditors, nor the independent registered pub lic accounting firm of BPGIC, audited, reviewed, compiled, or performed any procedures with respect to the projections for the purpose of their inclusion in this presentation and their anticipated incl usi on in the proxy statement, and accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this presentation or the proxy statement. The se projections should not be relied upon as being necessarily indicative of future results. In this presentation, certain of the above - mentioned projected information has been repeated (in each case, with an ind ication that the information is an estimate and is subject to the qualifications presented herein), for purposes of providing comparisons with historical data. The assumptions and estimates underlying the p ros pective financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to dif fer materially from those contained in the prospective financial information. Accordingly, there can be no assurance that the prospective results are indicative of the future performance of Twelve Seas, BPG IC, or the combined company after completion of the proposed business combination, or that actual results will not differ materially from those presented in the prospective financial information. In clusion of the prospective financial information in this presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achiev ed. Note on Going Concern As of June 30, 2019 and December 31, 2018, BPGIC had not paid $6,277,709 and $3,747,537 respectively of principal and accrued in terest that was due under the secured Shari’a compliant financing arrangement of USD 84.6 million entered into by BPGIC with First Abu Dhabi Bank PJSC (“FAB”) to fund a portion of the constru cti on costs of Phase I (the “Phase I Construction Facility”), the secured Shari’a compliant financing arrangement of USD 11.1 million entered into by BPGIC with FAB to fund a portion of the construct ion costs of Phase I (the “Phase I Admin Building Facility” and together with the Phase I Construction Facility, the “Phase I Construction Facilities”), and the Shari’a compliant financing arrangement of US D 3.5 million entered into by BPGIC with FAB to settle certain amounts due under the Phase I Construction Facilities (the “Phase I Short Term Financing Facility” and together with the Phase I Construc tio n Facilities, the “Phase I Financing Facilities”). Also, as of June 30, 2019 and December 31, 2018, BPGIC was not in compliance with its debt covenants, including the debt service coverage ratio contained i n i ts Phase I Financing Facilities. Even though the lender did not declare an event of default under the loan agreements, these breaches constituted events of default and could have resulted in the lende r r equiring immediate repayment of the loans. Accordingly, as of June 30, 2019 and December 31, 2018, BPGIC has classified its debt balance of $92,559,028 and $94,792,088 as a current liability. As of Jun e 3 0, 2019 and December 31, 2018, BPGIC’s current liabilities exceeded its current assets by $101,547,022 and $108,536,113, respectively. All of the above represents a material uncertainty that casts sig nificant doubt upon BPGIC’s ability to continue as a going concern. On September 10, 2019, BPGIC entered into an agreement with its lender to amend the Phase I Construction Facility. The princi pal and accrued interest of $5,494,063 outstanding under this facility as of July 31, 2019 as per the original repayment schedule will now be due on November 30, 2019. The Phase I Construction Facility is now payable in 45 instalments starting October 31, 2019 with final maturity on July 30, 2030. The Phase I Admin Building Facility and the Phase I Short Term Financing Facility were not amended as part of the September 10, 2019 agreement to amend the Phase I Construction Facility. Subsequent to the period end, BPGIC had repaid $5,646,206 due under the Phase I Admin Building Facility and the Pha se I Short Term Financing Facility. As such, all instalments related to Phase I Admin Building Facility and the Phase I Short Term Financing Facility due under the original repayment schedules up to Sept emb er 10, 2019 were repaid. In addition, BPGIC agreed to assign to the lender all proceeds from the operation of the tanks and to pre - settle by December 31, 2019 AED 100,000,000 ($27,225,701 translated usin g the exchange rate as of June 30, 2019) of principal under the Phase I Construction Facilities from the proceeds received from the Business Combination. A payment of principal and interest due on Oct ober 31, 2019 under the Phase I Financing Facilities was not in full as a result of recent discussions between the Company and the lender pertaining to more favorable financing terms. This partial no n - p ayment was an event of default, but, as in the past, the lender has not declared an event of default. During 2018, BPGIC signed a five - year lease and service agreement to provide storage and ancillary services to the Phase II end user, an international commodity trading company. Phase II operations are scheduled to start in the second quarter of 2020. Further, in 2019, BPGIC entered into a five - year refinery and services agreeme nt with Sahara Energy Resources DMCC (“Sahara Energy”) to develop and operate a modular refinery at the BPGIC terminal. BPGIC expects to provide operation, storage and ancillary services to Sahar a E nergy. Refinery operations are scheduled to start in the first quarter of 2020. Based on the above, management expects BPGIC will generate sufficient cash flows from its operations to meet its liabil iti es as and when the loan instalments fall due. Further, the owners intend to provide further financial support to enable BPGIC to meet its financial obligations as and when required. The annual and interim condensed financial statements have been prepared assuming that BPGIC will continue as a going concern . A ccordingly, the annual and interim condensed financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts, the amounts and clas sif ication of liabilities, or any other adjustments that might result in the event BPGIC is unable to continue as a going concern. Disclaimer

3 Disclaimer Forward Looking Statements This presentation contains "forward - looking statements" within the meaning of the "safe harbor" provisions of the United States Private Securities Litigation Reform Act of 1995. Forward - looking statements may be identified by words such as: "forecast," "intend," "seek," "target," "anticipate," "believe," "expect," "estimate," "p lan ," "future," "likely," "outlook," "project," "will" and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward looking statements in clude projected financial information. Examples of forward - looking statements include, among others, statements we make regarding: (i) projected completion, start of operations, operating capacity and ca pab ilities, and operating results, such as revenue growth, earnings, and EBITDA, at facilities that are not yet constructed; (ii) our future market position and growth prospects; (iii) expected cond iti ons in the local, regional and global oil markets; (iv) expected operating results, such as revenue growth, earnings, and EBITDA; (v) anticipated levels of capital expenditures and uses of capital for fiscal y ear s 2019 and 2020; (vi) expected future supply and demand of oil; (vii) the future execution of a final lease agreement that allows us to develop additional facilities on the 450,000 m 2 plot of additional land in the Port of Fujairah; and (viii) strategies for customer retention, growth, product development, market position, financial results and reserves, and risk management. Such forward looking statements with respe ct to revenues, earnings, performance, strategies, prospects and other aspects of the businesses of Twelve Seas, BPGIC and the combined company after completion of the proposed business combinatio n a re neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of the business, futur e p lans and strategies, projections, anticipated events and trends, the economy and other future conditions that are subject to risks and uncertainties. A number of factors could cause actual results or ou tco mes to differ materially from those indicated by such forward looking statements. These factors include, but are not limited to: (1) non - payment or non - performance by BPGIC's principal customers or end users; (2) the loss of any end - users as customers; (3) the continued concentration of revenues from two or three end - users; (4) changes in customer demand with respect to ancillary services provide d by BPGIC including throughput, blending, heating, and intertank transfers; (5) changes in expectations of future prices for refined petroleum products; (6) a decline or disruption of supply or demand of oil and gas; (7) higher fuel taxes or other governmental or regulatory actions that increase the price of gasoline or diesel; (8) changes to applicable regulations or new regulations, including th ose affecting the refined petroleum products serviced by BPGIC such as climate change legislation and regulations restricting the emission of greenhouse gases; (9) the extent to which BPGIC is successful in developing new long - term relationships with customers or retaining existing ones in the competitive oil storage market in the Port of Fujairah and other ports; (10) BPGIC's ability to effectively manag e t he risks and expenses associated with the construction of Phase II and other growth and expansion projects; (11) BPGIC’s ability to obtain additional land on which it can develop additional facilities o n c ommercially attractive terms, including its ability to enter into a final lease agreement for the 450,000 m 2 plot of land in the Port of Fujairah where BPGIC currently plans to locate its Phase III facilities; (12) accidents involving t he handling of oil products at BPGIC's terminal; (13) disruptions to BPGIC's technology network including computer systems and software; (14) natural events such as severe weather , f ires, floods and earthquakes or man - made or other disruptions of BPGIC's operating systems, structures, or equipment or of the Port of Fujairah's facilities; (15) political and economic cond iti ons in Fujairah and the United Arab Emirates, as well as the occurrence of hostilities, political instability or catastrophic events in Fujairah, the United Arab Emirates and the Middle East and North Af rica region; (16) changes in labor costs; (17) unlawful or arbitrary governmental action; (18) the failure of the parties to consummate the transactions contemplated by the business combination agreement rel ati ng to the proposed business combination (the "Business Combination Agreement"), including as a result of the occurrence of any event, change or other circumstances that could give rise to the ter mination of the Business Combination Agreement; (19) the outcome of any legal proceedings that may be instituted against BPGIC or Twelve Seas arising from the announcement of the proposed business com bination and transactions contemplated thereby; (20) the inability to complete the transactions contemplated by the proposed business combination due to the failure to obtain approval of the stoc kho lders of Twelve Seas, or the failure to satisfy other conditions to closing in the Business Combination Agreement; (21) the ability of the combined company to meet the Nasdaq Capital Market's listing stan dar ds, including having the requisite number of stockholders; (22) the risk that the proposed business combination disrupts current plans and operations as a result of the announcement and consummation of the transactions described herein; (23) the inability to recognize the anticipated benefits of the business combination, which may be affected by, among other things, competition, inability of BPG IC to meet anticipated construction timelines and the ability of the combined business to grow and manage growth profitably; (24) costs related to the business combination; (25) the possibility that BPGI C o r Twelve Seas may be adversely affected by other economic, business, and/or competitive factors; and (26) such other risks, factors, and uncertainties that will be indicated from time to time in th e proxy statement including those under "Risk Factors" therein, and other documents filed or to be filed with the Securities and Exchange Commission ("SEC") and delivered to Twelve Seas's stockholder s. Investors are cautioned not to place undue reliance upon any forward - looking statements, which speak only as of the date made. Twelve Seas and BPGIC undertake no commitment to update or revise t he forward - looking statements whether as a result of new information, future events or otherwise. In most instances, where third party sources are identified in this presentation, the information ha s been derived by BPGIC management from the source data. Use of IHS Markit Data IHS Markit reports, data and information referenced herein (the "IHS Markit Materials") are the copyrighted property of IHS M ark it Ltd. and its subsidiaries (“IHS Markit”). The IHS Markit Materials are from sources considered reliable; however, the accuracy and completeness thereof are not warranted, nor are the opinions and analy ses published by IHS Markit representations of fact. The IHS Markit Materials speak as of the original publication date thereof and are subject to change without notice. IHS Markit and other trademarks a ppe aring in the IHS Markit Materials are the property of IHS Markit or their respective owners. The IHS data used in the report is from a June 2018 study and has not been updated since then. Forecasts are inherently uncer tai n because of events or combinations of events that cannot reasonably be foreseen including the actions of government, individuals, third parties and competitors. The IHS Markit Materials speak as o f t he original publication date thereof (and not as of the date of this document). The information and opinions expressed in the IHS Markit Materials are subject to change without notice and IHS Markit has no du ty or responsibility to update the IHS Markit Materials. The IHS Markit Materials were commissioned by BPGIC and/or an affiliate of BPGIC.

4 Disclaimer Important Information About IFRS And Non - IFRS Financial Measures BPGIC’s financial statements are prepared in accordance with International Financial Reporting Standards as issued by the Int ern ational Accounting Standards Board and referred to in this proxy statement/prospectus as “IFRS.” BPGIC’s interim financial statements are prepared in accordance with “IAS 34 : Interim Financ ial Reporting” as issued by the International Accounting Standards Board. BPGIC refers in various places within this proxy statement/prospectus to EBITDA, Adjusted EBITDA, and Adjusted EBITDA margin which are non - IFRS measures that are calculated as earnings before interest, tax and depreciation and amortization, earnings before interest, tax and depreciation and amortization adjusted for selected items th at BPGIC’s management believes impact the comparability of financial results between reporting periods respectively, and Adjusted EBITDA as a percentage of revenue and more fully explained in “BPGIC’s Managemen t’s Discussion and Analysis of Financial condition and Results of Operations of BPGIC — Certain Non - IFRS Measures.” The presentation of this non - IFRS information is not meant to be considered in isolation or as a substitute for BPGIC’s financial results prepared in accordance with IFRS. Use of Non - GAAP Financial Measures This presentation includes non - GAAP financial measures, including EBITDA, EBITDA Margin, Annualized Run - Rate Revenue, Annualized Run - Rate EBITDA, Annualized Run - Rate EBITDA Margins, and Free Cash Flow. BPGIC defines EBITDA as total comprehensive income (loss) plus ( i ) depreciation, (ii) finance costs, (iii) changes in fair value of derivative financial instruments. EBITDA Margin is define d a s EBITDA divided by total revenues. Annualized Run - Rate Revenue is defined as the revenue of a specified quarter multiplied by four. Ann ualized Run - Rate EBITDA is defined as the EBITDA of a specified quarter multiplied by four. Annualized Run - Rate EBITDA Margins is defined as Annualized Run - Rate EBITDA divided by Annualized Run - Rate R evenue of a specified quarter. Investors can find the reconciliation of these measures to the nearest comparable GAAP measures elsewhere in this presentation. Free Cash Flow is defined as EBITDA minus ( i ) changes in working capital, (ii) capital expenditures. Except as otherwise noted, all references herein to full - year periods refer to BPGIC’s fiscal year, which ends on December 31. BPGIC believes that t hese non - GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to BPGIC’s financial condition and results of operations. BPGIC’s management uses these non - GAAP measures to compare BPGIC’s performance to that of prior periods for trend analyses and for budgeting and planning purposes. BPGIC believes that the use of these non - GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends. Management of BPGIC does not consider these non - GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. We have not reconciled the non - GAAP forward looking information to their corresponding GAAP measures because we do not provide guidance for the various reconciling items such as provision for income taxes and dep rec iation and amortization, as certain items that impact these measures are out of our control or cannot be reasonably predicted without unreasonable efforts. Investors should review BPGIC’s audited financ ial statements, which will be included in Twelve Seas’s filings with the SEC, including the proxy statement to be delivered to Twelve Seas’s stockholders, and not rely on any single financial measure to evaluate B PGI C’s business. Other companies may calculate EBITDA, EBITDA Margin, Annualized Run - Rate Revenue, Annualized Run - Rate EBITDA, Annualized Run - Rat e EBITDA Margin, and other non - GAAP measures differently, and therefore BPGIC’s EBITDA, EBITDA Margin, Run - Rate Revenue, Run - Rate EBITDA, and other non - GAAP measures may not be directly comp arable to similarly titled measures of other companies. BPGIC defines Adjusted EBITDA as profit (loss) before finance costs, income tax expense (currently not applicable in the UAE but included here for reference purposes), depreciation and adjusted for selected items that we believe impact the comparability of financial results between reporting periods. In addition to non - cash items, BP GIC has selected items for adjustment to EBITDA which management feels decrease the comparability of our results among periods. These items are identified as those which are generally outside of the result s o f day - to - day operations of the business. These items are not considered non - recurring, infrequent or unusual, but do erode comparability among periods in which they occur with periods in which they do not occur or occur to a greater or lesser degree. Historically, BPGIC has selected items such as Lease rental finance cost recognized in accordance with IFRS16, and changes in fair value of derivative financi al instruments. Management believes these types of items can make comparability of the results of day to day operations among periods difficult and have chosen to add back these items to profit (loss) to arri ve at the Adjusted EBITDA. BPGIC expects to adjust for similar types of items in the future. Although we present selected items that we consider in evaluating our performance, investors should be aware that the it ems presented do not represent all items that affect comparability between the periods presented. Additional Information For purposes of clarity and convenience, in certain instances, this presentation describes BPGIC’s business and operations wi th reference to the end users of its services, rather than its immediate customers. Additional information regarding BPGIC’s immediate customers and end users, as well as the relationship amongst them, is and/ or will be included in the proxy statement, and other documents filed or to be filed with SEC and delivered to Twelve Seas’s stockholders. In connection with the proposed business combination, Twelve Seas and Brooge Holdings Limited have filed, and will continue t o f ile, relevant materials with the SEC, including an effective Brooge Holdings Limited registration statement on Form F - 4, which included a preliminary proxy statement of Twelve Seas, and a prospectus in con nection with the proposed business combination, as well as a final prospectus. The proposed business combination will be submitted to stockholders of Twelve Seas for their consideration. Stockholders of T wel ve Seas and other interested persons are urged to read the proxy statement, the registration statement, and any other relevant documents that are or will be filed with the SEC carefully and in their entire ty when they become available because they contain or will contain important information about Twelve Seas, BPGIC, Brooge Holdings Limited and the proposed business combination. Stockholders and other interested pe rso ns are and will be able to obtain a free copy of the proxy statement, the registration statement, as well as other filings containing information about Twelve Seas, BPGIC and the proposed business co mbi nation, without charge, at the SEC’s website located at www.sec.gov or by directing a request to Stephen N. Cannon, Chief Financial Officer, Twelve Seas Investment Company, 135E 57th St. 18th Floor, New York, New York, +1 650 560 4753.

5 Management Team Over 8 years of finance experience ▪ Vice President, Finance & Administration at the Rochester Institute of Technology, Dubai ▪ PriceWaterhouseCoopers (PwC), Capital Projects & Infrastructure ▪ Al Hilal Bank Saleh Yammout Chief Finance Officer ▪ Spearheads the expansion and future growth of BPGIC both locally and internationally ▪ Bachelor’s Degree in Software Engineering ▪ Pursuing a Master’s Degree in International Business Law at Paris - Sorbonne University Abu Dhabi, UAE Lina S. Saheb Chief Strategy Officer Over 13 years in various business development roles Over 30 years of storage industry experience ▪ Terminal Manager, Oiltanking Odfjell Terminal, Oman ▪ Emirates National Oil Company ▪ Vopak Nico Paardenkooper Chief Executive Officer

6 Transaction Overview Nasdaq listed SPAC raised $207MM in June 2018 with focus on Eastern European and Middle East companies Premier independent midstream oil storage player in the UAE Only U.S. Listed Middle East Energy Infrastructure Company ▪ Transaction value: $1.08B ▪ Implied valuation: 8.4x annualized 2020 run - rate EBITDA ▪ Consideration mix: $800MM of equity + $200MM of Escrow shares (80MM shares + 20MM shares) to BPGIC’s ownership ▪ Pro forma Twelve Seas ownership: ~20% (1) ▪ Minimum cash required to close: $125MM (2) ▪ Expected close: Q4 2019 Projected $213.7MM in trust as of Closing Date: December 17, 2019 Newly - built, award - winning facilities driving industry - leading Adjusted EBITDA margins Experienced SPAC management team with global credentials Highly - strategic location in Fujairah provides natural barriers to entry and strategic growth opportunities (1) See assumptions under “Ownership at close” on slides 32 and 33. (2) Net of expenses and liabilities.

7 Attractive Investment Opportunity ▪ Compelling Entry Valuation: EV/EBITDA of 8.4x 1 vs closest publicly listed comp of 11.3x 2 ▪ Revenue Visibility: " take - or - pay" contracts for 100% of storage capacity, >50% of Revenue and >40% of EBITDA from fixed storage fees ▪ Upside Potential: EBITDA projected to increase to $550mm by 2023 with completion of Phase III ▪ High Free Cash Flow: over 97% of EBITDA is FCF ▪ Attractive yield: Brooge Holdings intends to target initial annual dividend of $1.00 per share ▪ 9.7% yield at estimated Closing share value of $10.32 per share ▪ Existing BPGIC shareholders, Underwriter, and holders of Twelve Seas Founder shares to waive dividend rights for two years ▪ Two years of dividend payments to be reserved ▪ Award Winning: 2019 Outstanding Port/Terminal Design of the Year, 2019 Excellence in Terminal Optimization and Logistics Service Provider of the Year awards from leading industry groups ▪ Top Market: Port of Fujairah (UAE) significant growth to second largest hub in World ▪ Highly Desirable End - Users: Top global physical traders with high service needs (Resulting in a consistent ~46% of Revenues from value - added ancillary services) ▪ High Profile Stakeholders: Prominent Emirate businessmen, Members of UAE ruling family, & ASMA Capital, preeminent private equity firm in the region ▪ Committed Shareholders: Rolling over 100% 3 of equity with 20% tied to meaningful earnout (1) Implied valuation based on BPGIC’s projected annualized 2020 run - rate EBITDA (2) Koninklijke Vopak N.V. 2020E projected valuation, data sourced from Capital IQ as of November 7, 2019 (3) Assuming no Cash Election by BPGIC Shareholders Attractive Risk - Reward High Quality Business World Class Customers & Shareholders 1 2 3

8 Overview of Brooge Petroleum and Gas Investment Company FZE ▪ Brooge Petroleum and Gas Investment Company FZE (“BPGIC”) is a premier midstream oil storage company located in the United Arab Emirates, formed in 2013 ▪ BPGIC owns state - of - the - art crude, fuel and clean oil storage terminals in Fujairah, a highly active oil export center in the Middle East ▪ Run by experienced management team with over 30 years in the industry ▪ Anchored by a select group of esteemed investors from the UAE (1) Company Overview Key Highlights BPGIC Today (Phase I) BPGIC in 2020 (Post Phase II Completion) Status Tanks Products Flow Rate 399,324 m 3 (2.5 MMBbls) 1,000,585 m 3 (6.3 MMBbls) Fuel Oil, Clean Products Fuel Oil, Clean Products, Crude Oil 14 22 4,500 m 3 / Hr (28,305 Bbls / Hr) 16,000 m 3 / Hr (100,640 Bbls / Hr) BPGIC in 2022 (Projected Post Phase III Completion) Up to 4,500,000 m 3 (28.3 MMBbls) Fuel Oil, Clean Products, Crude Oil 16,000 m 3 / Hr (100,640 Bbls / Hr) Expected to be the largest storage provider in Fujairah Total Land TBD (2) 153,917 m 2 153,917 m 2 603,917 m 2 (1) BPGIC’s high quality shareholders include His Highness Sheikh Mohammad bin Khalifa bin Zayed Al Nayhan . (2) To be determined based on FEED study and customer discussions. Storage Operational One End User Under Construction Contracted by an Additional End User Initial Land Lease Potential for Additional End User(s)

9 Significant Financial Upside from New Phase III Commencing Now (1) Assumes construction cost of storage capacity for Phase III is the same as Phase I & II (which was ~$310mm for 1mm m3). (2) Incremental EBITDA assuming 3.5mm m 3 incremental Storage Capacity with similar pricing and ancillary services utilization as Phase I and II (~$120mm EBITDA per 1mm m 3 ); no assumptions made for additional Refinery Capacity. Key Highlights Assumptions Current Operations Existing & Under Construction (Phase I, Refinery & Phase II) 1,000,585 m 3 Storage (6.3 MMBbls ) Scale of Phase III Additional… +3,500,000 m 3 Storage (+22.0 MMBbls ) 24,000 bbls / day Refinery Capacities TBD Phase I: Q1’18 Refinery: Q1’20 Phase II: Q2’20 Phase III: Late 2022 to Early 2023 Operational Dates EBITDA $128mm Annually Additional… +$422mm Annually 2 Est. Free Cash Flow > 97% of EBITDA >97% of EBITDA Anticipated Capital Expenditure 1 $310m Additional… +$1,085mm

10 BPGIC History Overview 2010 2013 2014 2015 2016 2017 2018 2020 Beyond Phase I Phase II 2010 Market study & analysis 2013 ▪ Incorporated ▪ Initial land lease and development rights 2014 Port facility agreement entered with Port of Fujairah 2015 ▪ Phase I financing committed ▪ Plans finalized for Phase I construction start date Phase II 2018 ▪ Off take contract for Phase II signed with end - user ▪ September : EPC Contract signed and started construction for Phase II ▪ October : Phase II financing committed Phase I 2018 ▪ January : Commenced ▪ August : ISO and OHSAS certifications received Phase II 2020 Q2 2020 : Expected operations start date Future Vision ▪ Phase III Launch ▪ Local and international growth Phase III Q3 2019 Initial land lease agreement reserving additional 450,000 m 2 in Port of Fujairah, almost 3 times the size of, and near to, Phase I and II land ▪ Phase I was completed and fully operational on schedule ▪ Phase II construction is underway with 100% of capacity already contracted ▪ Phase III initial land lease and discussions with potential customers underway 2019 Phase I 2020 Q1 2020 : Sahara refinery expected start of operations Q4 2019 Expected Nasdaq listing via Business Combination with Twelve Seas Phase III & Beyond

11 21% 18% 13% 8% 5% 5% 5% 4% 4% 4% 4% 2% 2% 2% 1% 1% 17% 14% 10% 28% 4% 4% 4% 3% 3% 3% 3% 2% 2% 1% 1% 1% 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 5,000 M 3 Post Phase III, BPGIC is Expected to be Largest Storage Provider in Fujairah Existing Capacity (2,3) Capacity expansion projects (2,3) Market share based on storage capacity Post - Phase II (1) Captive Demand represents strategic storage capacity, not used by trading firms / marketers and is not a competitive threat to BPGIC ▪ Post Phase II, BPGIC is expected to be the 4th largest storage player in Fujairah in terms of overall capacity ▪ Excluding captive demand, BPGIC is expected to be the 2nd largest independent storage player in Fujairah Phase I & II Phase I, II & III Market share based on storage capacity Post - Phase III (1) Source: IHS Markit data as of June 2018. Please see the disclaimer on page 3 for a full description. (1) Only expansions that are under construction and planned are considered. (2) Excludes the captive storage capacity of ADNOC terminal. (3) Excludes dedicated LPG and LNG terminals. (4) Phase III assumes up to 3,500,000 m 3 of additional storage capacity added. Post Phase III (4) , BPGIC is expected to become the largest storage player in Fujairah

12 Company Highlights & Strategy

13 Investment Highlights ▪ The Middle East is expected to continue to be the dominant crude oil exporter in the world with over 2,941,177 m 3 /d (~18.5 MMBbls/d) exported each year ▪ Increased energy trading activity in the region has driven the need for energy infrastructure ▪ Storage continues to play a critical role in managing supply disruptions and demand surges ▪ BPGIC terminals are strategically located in the Port of Fujairah, one of the largest global oil export hubs ▪ 60 - year lease of prime real estate , strategically located adjacent to VLCC jetties in the Port, allowing for fast customer turnaround time ▪ Limited remaining land available for other independent storage players to build out in Fujairah gives BPGIC an advantage ▪ One of the largest crude oil, clean oil, and fuel oil storage facilities in the region with 1,000,585 m 3 ( 6.3 MMBbls of capacity by mid - 2020) ‒ Expected to be the largest with up to 4,500,000 m 3 (28.3 MMBbls) of storage capacity post Phase III expansion ▪ Award - winning facilities with superior technological capabilities offering highly sought - after ancillary services ▪ 4.5 - year (1) weighted average renewable take - or - pay contract life for 100% of available and in - construction storage capacity (Phases I & II) ▪ Industry - leading Adjusted EBITDA margins driven by upfront investment in infrastructure and automation ▪ Diverse mix of fixed - fee and ancillary revenue provides combination of stability and growth potential ▪ Phase II expansion is expected to more than double EBITDA to $128 million by Q3 2020, on an annualized basis ▪ Modular refinery contract with Sahara Energy Resources to provide an additional $25 million in EBITDA at minimal capital cost to BPGIC ▪ Additional upside from ancillary revenue growth ▪ Seasoned management team with over 30 years of experience in the oil and gas industry ▪ Additional shares held in escrow, post transaction, act as an incentive for driving EBITDA growth Favorable Industry Trends Driving Storage Demand Strategic Location at the Epicenter of Global Crude Oil Trading Activity Newly - Built, World - Class Facilities Strong Fee - Based Cash Flow Profile with Meaningful Upside Visible Near - Term Growth Trajectory Experienced Management Team 1 2 3 4 5 6 (1) Weighted average contract life calculated based on proportional storage capacity per contract.

14 The UAE’s Business Friendly Policies Have Attracted Foreign Capital 1 ADNOC (Abu Dhabi National Oil Company) 2030 Initiatives ▪ Create partnerships that deliver expertise, capital and technology and bring market access More Profitable Upstream ▪ Increase gasoline production to 10.2 mtpa by 2022 ▪ Grow petrochemicals production from 4.5 mtpa in 2016 to 11.4 mtpa by 2025 More Valuable Downstream ▪ Ensure security of the gas supply ▪ Invest in developing various fields to maximize value from natural gas and gas products More Sustainable and Economic Gas Supply Over $45 billion to be invested in expanding downstream opportunities Expanding Partnerships ▪ ADNOC is evolving its approach to partnerships, spanning across its entire oil and gas value chain to secure access to target markets and new centers of global demand ▪ In February 2019, Blackrock and KKR led the first foreign investment in UAE national infrastructure - Blackrock and KKR invested $4 billion for a 40% ownership in a new entity called ADNOC Oil Pipelines ▪ Exxon Mobil and ADNOC continue to explore new opportunities in the upstream and downstream sector ▪ ADNOC continues to leverage mutually beneficial partnerships to drive new commercial opportunities Source: www.adnoc.ae/en/strategy2030.

15 0 20 40 60 80 100 120 140 160 2010 2011 2012 2013 2014 2015 2016 2017 2018E 2019E 2020E 2021E 2022E 2023E 2024E 2025E Millions of Metric Tons of Throughput per Year Dirty Product Clean Product Crude Favorable Industry Trends 1 Fujairah Port Traffic Has Seen Rapid Growth, and is Expected to Continue Growing into 2025 Storage plays a critical role in the management of supply disruptions and demand surges, providing a stable infrastructure for crude oil and products trade ▪ Completion of ADNOC terminals to export crude from Fujairah ▪ Increased storage capacity allowing more bunkering, build - bulk and blending opportunities ▪ IMO regulation is driving blending needs Recent Drivers of Growth in Fujairah Source: IHS Markit data as of June 2018. Please see the disclaimer on page 3 for a full description.

16 2017 2030 m 3 /d 1,350,874 1,171,065 MBbl/d 8,497 7,366 The World is Expected to Rely on Middle East Crude to Meet Long - Term Demand Crude Oil Flows From the Middle East Geographical Europe North Asia Europe Canada / USA Latin America Africa India Southeast Asia Middle East 2017 2030 m 3 /d 252,782 228,935 MBbl/d 1,590 1,440 ▪ 2,941,177 m 3 /d (18.5 MMbls/d) of Middle East crude exported currently ▪ Middle Eastern crude supplies virtually every region ▪ Africa, India and Southeast Asia represent the fastest growing regions 2017 2030 m 3 /d 403,975 425,596 MBbl/d 2,541 2,677 2017 2030 m 3 /d 289,348 350,874 MBbl/d 1,820 2,207 2017 2030 m 3 /d 477,425 593,482 MBbl/d 3,003 3,733 2017 2030 m 3 /d 60,890 131,161 MBbl/d 383 825 2017 2030 m 3 /d 34,181 47,854 MBbl/d 215 301 2 Source: IHS Markit data as of June 2018. Please see the disclaimer on page 3 for a full description.

17 Saudi Arabia United Arab Emirates Strategic Location ▪ Adjacent to major shipping routes, supplying major markets Political Stability ▪ Strong support for port development from local authorities Refining Center ▪ Significant refining capacity located nearby Port Infrastructure ▪ Large ports designed to minimize customer waiting times Significant Crude Flows ▪ Ample pipeline infrastructure supplying to terminal points Pricing Center ▪ Physical presence of major trading houses The UAE Meets Every Key Criteria For Crude Oil Infrastructure Investment Fujairah is a Trading, Refining and Export Hub Fujairah’s port is located outside the Strait of Hormuz − Major crude flows to all regions − 2 nd largest bunker trading hub − $45bn downstream expansion plan announced by ADNOC 2 Strait of Hormuz Fujairah Port Fujairah Port Source: IHS Markit data as of June 2018. Please see the disclaimer on page 3 for a full description.

18 Limited Available Land in Fujairah Suitable for Infrastructure 2 BPGIC Phase III Initial Lease BPGIC is well positioned in the Port of Fujairah as demand for storage capacity increases Fujairah

19 Scarcity of Remaining Land in Fujairah Gives BPGIC a Competitive Advantage 2 Strategic storage facilities do not provide storage and ancillary service facilities to traders and do not represent a competitive threat to BPGIC Limited remaining suitable land available in Fujairah makes BPGIC well situated to capitalize on growing infrastructure needs in the area BPGIC expected to be the 2 nd largest storage operator in Fujairah post Phase II and the largest post Phase III. With limited land to build, there are few competitive threats Matrix Manifold 2

20 Premier Location, Giving End Users Fastest Turnaround Time Competitors have limited access to Matrix Manifold 2 which connects to the VLCC jetty – VLCC jetty provides access to very large crude carriers loading and discharging points with higher flow rates BPGIC is closest to Matrix Manifold 2 – allowing for quick vessel turnaround time at a lower cost compared to competitors 6 Total Jetty Lines: 4 existing and 2 more to be added in Phase II BPGIC 2 Phase II Phase I Phase III Initial Lease

21 Long - Term Contracts Servicing Global End Users Phase I Overview ▪ Fully - operational ▪ Clean oil and fuel oil terminals ▪ 14 oil tanks ▪ 399,324 m 3 (2.5 MMBbls) of capacity ▪ 4,500 m 3 (28 MBbls) / Hr flow rate Phase I End User ▪ Via a 3.5 year remaining take - or - pay contract for 100% of Phase I capacity 399,324 m 3 (2.5 MMBbls) ▪ Fixed fee storage fees and ancillary services Phase II End User ▪ Via a 5 year take - or - pay contract for 100% of Phase II capacity 601,261 m 3 (3.8 MMBbls) ▪ Fixed fee storage fees and ancillary services ▪ Beginning in 2020 with Phase II completion Phase II Overview ▪ Expected to begin operations in 2Q 2020 ▪ 8 oil tanks ▪ 601,261 m 3 (3.8 MMBbls) of capacity ▪ 16,000 m 3 / Hr (100 MBbls / Hr) flow rate 3 * Phase I is fully constructed. Phase II is under construction. Phase III is under FEED evaluation and discussions with poten tia l customers. Note: Phase I and Phase II facilities have one end user each, respectively. The addition of a modular refinery in 2020 will a dd a third end user(s). Phase III Overview ▪ Initial Land Lease ▪ Up to 3,500,000 m 3 (22.0 MMBbls ) of capacity Phase III End User(s) ▪ Refinery expansion ▪ Storage expansion * Artist rendered picture * Artist rendered picture * Artist rendered picture

22 Well - Constructed Facilities Best - in - Class Flow - Rates Industry Leading Loss Ratios 11 Simultaneous Operations Barriers to Entry Award - Winning Storage Facilities ▪ Construction using high quality materials ▪ All tank bottoms coated and 2 tanks fully coated ▪ HDPE coating on the land to avoid contamination from any spillage ▪ Equipped with high capacity pumping system capable of moving 4,500 m 3 / Hr (28 MBbls / Hr ) in Phase I tanks and 16,000 m 3 / Hr (100 MBbls / Hr) in Phase II tanks post - completion ▪ Currently able to fill vessels in 60% of time versus other terminals in Port of Fujairah ▪ Post Phase II completion, will have ability to handle VLCCs in 32 hours (mooring to unmooring) ▪ Superior facility design generates direct savings for customers by reducing typical oil loss ratios by over 80% ▪ Dedicated lines connecting each tank with the pump station are installed for efficient blending, inter - tank transfer, and recirculation operations − BPGIC can perform blending, heating, inter - tank transfer services simultaneously, which maximizes efficient use of facilities ▪ BPGIC is closest to MM 2, allowing for quick vessel turnaround time ▪ BPGIC can operate through 8 out of 9 berths in the Port and VLCC jetty post Phase II completion − Competitors have limited access to VLCC jetty, which means they have to travel a further distance to transport crude import and for export 3

23 Ancillary Revenue Sources Drives EBITDA Diversification 2020P Revenue Mix Fixed Revenue Sources (~54% of Current Revenue (1) ) Fixed Fee Storage ▪ Contracted capacity, take - or - pay structures Ancillary Revenue Sources (~46% of Current Revenue (1) ) Blending ▪ Blending of two or more batches of product at customer’s request ▪ Product is exported after blending occurs Throughput Transfer ▪ Performed during loading / unloading of product ▪ BPGIC collects additional revenue on throughput that is above the monthly storage capacity Inter - tank Transfer ▪ Additional fees occurring during blending, product consolidation and when customers trade from one terminal to another Heating ▪ BPGIC earns incremental revenue by controlling the temperature for fuel oil Refinery ▪ BPGIC earns incremental revenue associated with Sahara Energy Resources’ refinery use 4 Fixed Refinery Fees ▪ Sahara Energy Resources will pay BPGIC fixed fees associated with its refinery Fixed Revenue Ancillary Revenue 39% Refinery - Fixed 14% 40% Refinery - Ancillary 7% (1) As of June 30, 2019.

24 Modular Refinery Diversifies EBITDA Growth With Minimal Capital Investment 4 Overview Highlights Q1 2020 Expected to be Operational ~$25MM Expected Annual EBITDA 5 - Year Renewable Contract ~$0 Investment by BPGIC ▪ To be built on existing BPGIC land with no expected negative impact on Phase II construction ▪ 5 - year contract with Sahara Energy Resources DMCC ▪ Expected to generate $25 million in annual Adjusted EBITDA , resulting in an incremental $9 million per year - Sahara will utilize a portion of Phase I capacity currently occupied by the Phase I end user ▪ Refinery to produce IMO 2020 compliant refined products

25 Phase II Expansion Will More Than Double BPGIC EBITDA by 2020 Phase II Build Out at Attractive Costs Phase II End User ▪ Contracted for 100% of Phase II capacity ▪ Storage fee contracted per Bbl / month ▪ Ancillary fees vary on service per cbm / month 4 (1) EBITDA divided by construction cost. ▪ Phase II expansion will add an additional 601,261 m 3 (3.8 MMBls) of crude oil storage capacity > Doubling Capacity ▪ $161 million in total capital expenditures ▪ Funded with a $91 million loan, repayable over 10 years Attractive Cost ▪ 2 - year payback period (1) ▪ Construction scheduled to be complete by 2Q 2020 Near Term Payback ▪ 5 - year, renewable contract beginning in 2020 Fully Contracted * Artist rendered picture

26 1 st Quarter 2020 Expected completion date of Modular Refinery Construction Status Update on Phase II Expansion and Modular Refinery 4 (1) Capex spent to date includes capex spent before June 30, 2019 and remaining capex as of June 30, 2019. 2019: ~$9 million spent to date and ~$135 million remaining capex (1) 2020: ~$17 million estimated capex April/May 2019 Funds wired to EPC, construction on Phase II commences March/April 2019 Steel for Phase II construction ordered 2 nd Quarter 2020 Expected completion date of Phase II July/August 2019 Phase II Construction and Modular Refinery development underway

27 Projected 3Q 2020 Annualized Run - rate EBITDA of $128 million ▪ Mix of fixed - fee and ancillary revenue provides combination of stability and growth potential ▪ The low - risk Phase II expansion is expected to more than double the existing capacity by 2Q 2020 ▪ The modular refinery targeted to become operational in 2020 is expected to contribute approximately $9 million of incremental Adjusted EBITDA per year ($25 million of Adjusted EBITDA less $16 million that partially displaces existing Phase I end user) Annualized Adjusted EBITDA ($mm) Actual (1) & Projected (2) Strong Fee - Based Cash Flow Profile with Industry - Leading EBITDA Margins 4 $21 $38 $9 $25 $82 $128 $46 6/30 '19A Annualized Incremental Adjusted EBITDA from Modular Refinery (Fully Operational 1Q 2020) 1Q '20P Annualized (Upon Refinery Completion) Phase II Fully Operational End of 2Q 2020 Annualized 3Q '20P Annualized (Upon Phase II Completion) 85% Adj. EBITDA Margin 87% EBITDA Margin 94% EBITDA Margin Existing End User Refinery End User Existing Capacity (1) Estimates based on auditor - reviewed financial results through June 2019. (2) Projected storage revenue based on contract terms. Ancillary services revenue price/cbm is contracted but volumes are project ed based on historical activity and discussions with the two current end users.

28 BPGIC is Expected to be the Leading Storage Provider in Fujairah Post Phase III 4 Phase III Summary Illustrative Phase III Blueprint ▪ Additional storage capacity of up to 3,500,000 m 3 , optimal product mix to be determined by FEED design ▪ Host 90% of planned Sahara refinery facilities and additional room to facilitate other refinery expansions ▪ Given scale of expansion and scarcity of additional land, BPGIC will have a competitive advantage in Fujairah ▪ Initial land lease for additional 450,000 m 2 land in the Port of Fujairah near the parcel used for Phase I and II ▪ Land provides expansion optionality allowing BPGIC to secure the most attractive contracts in the region ▪ Undergoing FEED design in parallel with customer discussions to determine value maximizing layout Note: Illustrative Phase III plan may vary. Blueprint subject to change based on further technical, financial and market studies. 27 Estimated Tanks Manifold Key Facilities

29 Visible Near - Term Growth Trajectory: Opportunities Available to BPGIC 5 Strategic Opportunities in Services ▪ Minimal Capital Expense investment ▪ Customer services under long - term contract ▪ Services will be recurring and scheduled ▪ Increases overhead infrastructure utilization/efficiency ▪ Profit - sharing model ▪ BPGIC provides operational expertise ▪ Capital Expense funded by Partner – minimal BPGIC capital required ▪ Additional expansions in Fujairah based on newly acquired initial land - lease ▪ Ongoing discussion with end - users for Phase III capacity Strategic JVs for Capacity Expansion Organic Expansion

30 Financial Overview

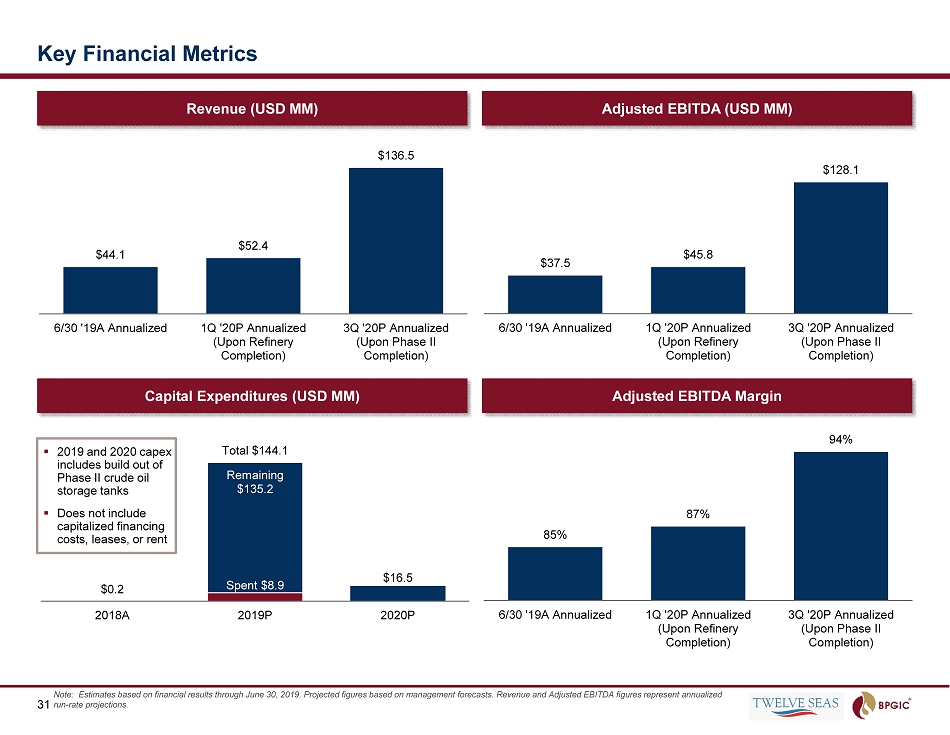

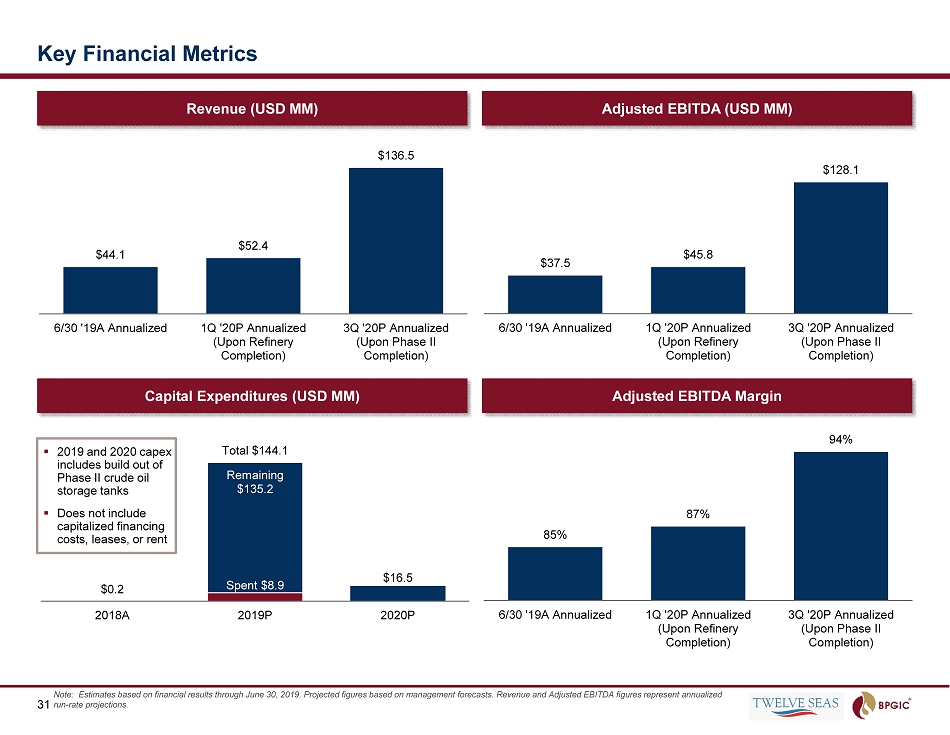

31 Key Financial Metrics $44.1 $52.4 $136.5 6/30 '19A Annualized 1Q '20P Annualized (Upon Refinery Completion) 3Q '20P Annualized (Upon Phase II Completion) $37.5 $45.8 $128.1 6/30 '19A Annualized 1Q '20P Annualized (Upon Refinery Completion) 3Q '20P Annualized (Upon Phase II Completion) Revenue (USD MM) Adjusted EBITDA (USD MM) Capital Expenditures (USD MM) Adjusted EBITDA Margin Spent $8.9 Remaining $135.2 $0.2 Total $144.1 $16.5 2018A 2019P 2020P 85% 87% 94% 6/30 '19A Annualized 1Q '20P Annualized (Upon Refinery Completion) 3Q '20P Annualized (Upon Phase II Completion) ▪ 2019 and 2020 capex includes build out of Phase II crude oil storage tanks ▪ Does not include capitalized financing costs, leases, or rent Note: Estimates based on financial results through June 30, 2019. Projected figures based on management forecasts. Revenue and Adju ste d EBITDA figures represent annualized run - rate projections.

32 Ownership at Close (1)(2)(3)(5) Uses (USD MM) Sources (USD MM) Pro Forma Valuation (1)(2)(4) Note: Transaction assumes no Twelve Seas shareholder redeems and an estimated Trust cash of $213.7 million at Closing. (1) Excludes 20,000,000 Escrowed Shares to be released to existing BPGIC shareholder and 1,552,500 Escrowed Shares to be rele ase d to Twelve Seas Sponsor upon meeting the release requirements as disclosed in the Investor Presentation (2) Assuming that existing BPGIC shareholder does not elect to receive any consideration in cash in lieu of shares pursuant t o i ts right under the business combination agreement (3) Assumes $1.00 annual dividend with the shares received by existing BPGIC shareholder, Founder Shares, and Underwriter Sha res waiving the right to the dividend for the first two years (4) SPAC Shareholders include outstanding rights that convert into 1/10th of a share at the closing and approximately 1.0mm founder shares that Twe lve Seas Sponsor agreed to forfeit. Excludes outstanding Twelve Seas warrants and shares reserved for issuance under any new equity incentive plan adopted by the post - closin g company. (5) BPGIC’s high quality indirect shareholders include His Highness Sheikh Mohammad bin Khalifa bin Zayed Al Nayhan Excluding Escrow Shares Shares % Existing BPGIC Shareholders (shares mm) 80.0 75.2% Twelve Seas Public Shareholders (shares mm) 22.8 21.4% Twelve Seas Sponsor (shares mm) 3.5 3.3% Total 106.3 100.0% Including Escrow Shares Shares % Existing BPGIC Shareholders (shares mm) 100.0 78.2% Twelve Seas Public Shareholders (shares mm) 22.8 17.8% Twelve Seas Sponsor (shares mm) 5.1 4.0% Total 127.9 100.0% Transaction Sources & Uses / Capitalization (Assumes No Redemption ) Existing BPGIC Shareholders (shares mm) 80.0 Plus: SPAC Shareholders (shares mm) 26.3 Total Shares 106.3 Share Price (USD) $10.32 Equity Value (USD mm) $1,097.4 Plus: Projected Debt (USD mm) $185.0 Less: Cash Reserved for Dividends (USD mm) $46.7 Less: Cash Freely Usable (USD mm) $156.4 Enterprise Value (USD mm) $1,079.3 Projected Annualized EBITDA (USD mm) $128 EV / Projected Annual EBITDA 8.4 x Existing BPGIC Shareholder Rollover Equity (1)(2) $ 800.0 Twelve Seas Cash in Trust 213.7 Total Sources $ 1,013.7 Existing Shareholder Rollover Equity (1)(2) $ 800.0 Estimated Transaction Fees & Expenses 10.6 Cash - Reserved for Two Years of Dividends (3) 46.7 Cash - Freely Usable by BPGIC 156.4 Total Uses $ 1,013.7

33 Ownership at Close (1)(2)(3)(5) Uses (USD MM) Sources (USD MM) Pro Forma Valuation (1)(2)(4) Note: Transaction assumes max Twelve Seas shareholder redemptions while leaving Closing Net Cash of $125 million (approximate ly 7.6 million shares redeemed at estimated redemption price of $10.32 based on estimated Trust cash of $213.7 million at Closing and 20.7 million total outstanding Twelve Seas ordinary sha res .) (1) Excludes 20,000,000 Escrowed Shares to be released to existing BPGIC shareholder and 1,552,500 Escrowed Shares to be rele ase d to Twelve Seas Sponsor upon meeting the release requirements as disclosed in the Investor Presentation (2) Assuming that existing BPGIC shareholder does not elect to receive any consideration in cash in lieu of shares pursuant t o i ts right under the business combination agreement (3) Assumes $1.00 annual dividend with the shares received by existing BPGIC shareholder, Founder Shares, and Underwriter Sha res waiving the right to the dividend for the first two years (4) SPAC Shareholders include outstanding rights that convert into 1/10th of a share at the closing and approximately 1.0mm founder shares that Twe lve Seas Sponsor agreed to forfeit. Excludes outstanding Twelve Seas warrants and shares reserved for issuance under any new equity incentive plan adopted by the post - closin g company (5) BPGIC’s high quality indirect shareholders include His Highness Sheikh Mohammad bin Khalifa bin Zayed Al Nayhan Excluding Escrow Shares Shares % Existing BPGIC Shareholders (shares mm) 80.0 81.0% Twelve Seas Public Shareholders (shares mm) 15.2 15.4% Twelve Seas Sponsor (shares mm) 3.5 3.6% Total 98.7 100.0% Including Escrow Shares Shares % Existing BPGIC Shareholders (shares mm) 100.0 83.1% Twelve Seas Public Shareholders (shares mm) 15.2 12.6% Twelve Seas Sponsor (shares mm) 5.1 4.2% Total 120.3 100.0% Transaction Sources & Uses / Capitalization (Assumes M aximum Redemption with $125mm Closing Net Cash ) Existing BPGIC Shareholders (shares mm) 80.0 Plus: SPAC Shareholders (shares mm) 18.7 Total Shares 98.7 Share Price (USD) $10.32 Equity Value (USD mm) $1,019.3 Plus: Projected Debt (USD mm) $185.0 Less: Cash Reserved for Dividends (USD mm) $31.6 Less: Cash Freely Usable (USD mm) $93.4 Enterprise Value (USD mm) $1,079.3 Projected Annualized EBITDA (USD mm) $128 EV / Projected Annual EBITDA 8.4 x Existing BPGIC Shareholder Rollover Equity (1)(2) $ 800.0 Twelve Seas Cash in Trust 135.6 Total Sources $ 935.6 Existing Shareholder Rollover Equity (1)(2) $ 800.0 Estimated Transaction Fees & Expenses 10.6 Cash - Reserved for Two Years of Dividends (3) 31.6 Cash - Freely Usable by BPGIC 93.4 Total Uses $ 935.6

34 Half Release Escrow Requirements (1) Expiration Shares Annualized Run - Rate EBITDA Target (2) Stock Price Threshold (3) 5 Years (4) ▪ 10 million shares to BPGIC owners ▪ 0.8 million shares to Sponsor $175 MM USD $12.50 USD OR (1) Escrowed shares consist of (i) 20 million from existing BPGIC shareholder and (ii) 1.6 million from the Twelve Seas sponsor. Re lease if either annualized run - rate EBITDA OR share price targets is exceeded. (2) Annualized run - rate is the last quarter multiplied by four. EBITDA is subject to certain adjustments set forth in the escrow agr eement. (3) For any 10 trading days within any 20 trading day period during the escrow period. (4) 5 years from the start of the first full fiscal quarter after the closing. Description of Escrowed Shares – Aligned Shareholder Interest In addition to the 80 million shares issued at the closing to the existing BPGIC shareholder, the existing BPGIC shareholder can earn an additional 20 million shares if certain thresholds are met (the “Escrowed Shares”) Full Escrow Requirements Expiration Shares Annualized Run - Rate EBITDA Target (2) Stock Price Threshold (3) 5 Years (4) ▪ 20 million shares to BPGIC owners ▪ 1.6 million shares to Sponsor $250 MM USD $14.00 USD OR Any shares that are released in the half release will be deducted from the full escrow share count so that the maximum amount of shares that can be released will not exceed 20 million for the BPGIC owners and 1.6 million shares to the Sponsor

35 Illustrative Uses (USD MM) Illustrative Financial Impact from Phase III After Completion (Assumes No Redemptions and Phase III Completion at EOY 2022) Illustrative Sources (USD MM) Illustrative Pro Forma Valuation (USD MM) (1)(2)(3)(4) (5) Includes estimated loans to fund completion of Phase II and III (6) Illustrative scenarios presented for Post - Phase III Projected Annualized EBITDA: • ~$550mm: assuming similar pricing and profit from Phase III expansion as Phase I and II • ~$440 – 660 : assuming +/ - 20% range to the Post - Phase III Projected Annualized EBITDA • Illustrative Phase III plan may vary. Projections subject to change based on further technical, financial and market studies. (7) Assumes milestones for escrowed shares are satisfied resulting in full release of all shares escrowed Post - Phase III completion. Assumes no future equity offerings post - merger. (1) Assumes company generates $128mm of annual EBITDA (starting H2 2020), >97% of which is effectively free cash flow; 2020 p roj ected Free Cash Flow excludes Phase II capital expenditure due to assumption that Phase II is fully funded by Phase II Loan and already included in the Projected Debt at Me rge r (2) Assumes Existing BPGIC Shareholders, Underwriter, and Holders of Twelve Seas Founder shares to waive dividend rights for two years; assume annual dividend of $1.00 to be paid on all outstanding shares starting in 2022 (3) Assumes existing BPGIC shareholder, Underwriter, and Twelve Seas Founder shares continue to waive dividend rights in 2022 (4) Assumes construction cost of storage capacity for Phase III is the same as Phase I & II (which was ~$310mm for 1mm m 3 ) Note: Post - Phase III Projected Annualized EBITDA assumptions are only indicative and could change based on several factors, incl uding but not limited to entering into a final land lease, the ability to secure an end - user contract, commercial discussions, change in product mix, changes in crude prices and ma cro economic environment. Cash - Reserved for Two Years of Dividends(3) $ 46.7 Cash - Freely Usable by BPGIC 156.4 Projected Free Cash Flow (2020, 2021, 2022) (1) 310.2 Additional Loans 641.7 Total Sources $ 1,155.1 Target Dividend Payment to Public S/H (2020, 2021) (2) $ 46.7 Target Dividend Payment to Public S/H (2022) (3) 23.4 Construction of Phase 3 (3.5mm m3 incremental capacity) (4) 1,085.0 Total Uses $ 1,155.1 Pro Forma Valuation Post-Merger Post-Phase 3 (7) Existing BPGIC Shareholders (shares mm) 80.0 100.0 Plus: SPAC Shareholders (shares mm) 26.3 27.9 Total Shares (shares mm) 106.3 127.9 Share Price (USD) $10.32 $10.32 Equity Value (USD mm) $1,097.4 $1,319.8 Plus: Projected Debt (USD mm) (5) 185.0 826.7 Less: Cash Reserved for Dividends (USD mm) 46.7 46.7 Less: Cash Freely Usable (USD mm) 156.4 0.0 Enterprise Value (USD mm) $1,079.3 $2,099.8 Projected Annualized EBITDA (USD mm) (6) $128.1 $440.0 $550.0 $660.0 EV / Projected Annual EBITDA 8.4 x 4.8 x 3.8 x 3.2 x

36 Assumptions (1) BPGIC defines Free Cash Flow as EBITDA less change in working capital and capital expenditures (2) Assume 97% of Phase III EBITDA is Free Cash Flow (3) Assumes existing BPGIC, Founder, and Underwriter Shareholders waive dividend rights for two years (4) Phase II capital expenditures is assumed to be fully funded within BPGIC’s projected debt at merger and thus do not impact 20 20P Free Cash Flow Projection $65mm (4) 2020P 2021P 2022P 2023P Free Cash Flow (Phase I, Refinery, & II) (1) Free Cash Flow (including Phase III) (1)(2) Phase I & II Loan Repayment (Principal & Interest) $124mm $124mm $534mm Dividend Payment - Public and Private Placement Unit Shareholders Only (3) $32mm $23mm $32mm $23mm $31mm $23mm Phase III expected to ramp up to max capacity by end of 2022 Brooge Holdings intends to maintain a consistent dividend on public shares, and commence dividends on all shares once operating financial results support doing so Cash Flow From Operations Expected to Support Attractive $1.00 Annual Dividend (Assumes No Redemptions and Phase III Completion at EOY 2022)

37 Appendix

38 BPGIC is Well - Positioned to Benefit from IMO 2020 Implementation on Jan 1, 2020 for reduction in the sulfur level of bunker fuels used for ships Likely impact on the storage industry x Increased requirement for additional blending facilities and segregation of hydrocarbon cutter stocks to meet sulfur limit de man ds x Increased demand for floating storage tanks as there will be a likely shift in bunkering locations based on low - sulfur bunker fu el availability x Tank farms expected to have good interchangeability and flexibility 2020 Specifications Refining Shipping ▪ Increased demand for low sulfur bunker fuel ▪ High capex requirements by refining industry to reduce high sulfur bunker fuel oil ▪ Disposal of high sulfur bunker fuel/bottom of the barrel ▪ Shipping industry has been slow to adopt scrubber technology ▪ High overhead costs for effluent discharge from scrubbers Challenges Options for the Shipping Industry Installation of Exhaust Gas Cleaning Systems (EGCS or ‘scrubbers’) to remove sulfur on board Switching away from high sulfur grades used currently to low - sulfur bunker fuel Switch to alternate bunker fuel sources like LNG, which would need alternative ship design Source: IHS Markit data as of June 2018. Please see the disclaimer on page 3 for a full description.

39 Safety Performance Achievements – 2018 2018 No. Focus Area Objective Target Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Remarks Target Achieved 1 Fatalities Zero work related incidents 0 0 0 0 0 0 0 0 0 0 0 0 0 100% 2 LTI Zero work related incidents 0 0 0 0 0 0 0 0 0 0 0 0 0 100% 3 Product Spills Minimizing adverse environmental and socioeconomic impacts by coordinating all containment and removal activities to carry out a timely, effective response 0 0 0 0 0 0 0 0 0 0 0 0 0 100% 4 Fire Incidents Zero harm to personnel, property environment and company reputation 0 0 0 0 0 0 0 0 0 0 0 0 0 100% 5 Emergency Drills – Annual To check the readiness & effectiveness of ERP 5 1 0 0 1 1 0 0 0 0 1 0 1 100% 6 PTW Compliance with Procedure Safety control system aims to work together to maintain system that is safe and without risk to health, safety and environment 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100%

40 Safety Performance Achievements – 2019 2019 No. Focus Area Objective Target (Full Year) Jan Feb Mar Apr May Jun Jul Aug Sep Target Achieved (YTD) 1 Fatalities Zero work - related incidents 0 0 0 0 0 0 0 0 0 0 100% 2 LTI Zero work - related incidents 0 0 0 0 0 0 0 0 0 0 100% 3 Product Spills Minimizing adverse environmental and socioeconomic impacts by coordinating all containment and removal activities to carry out a timely, effective response 0 0 0 0 0 0 0 0 0 0 100% 4 Fire Incidents Zero harm to personnel, property, environment, and company reputation 0 0 0 0 0 0 0 0 0 0 100% 5 Emergency Drills – Annual To check the readiness & effectiveness of ERP 6 0 1 0 1 0 1 0 1 0 100% 6 PTW Compliance with Procedure Safety control system aims to work together to maintain system that is safe and without risk to health, safety and environment 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100%

41 Summary of Comprehensive Income (Values in USD million) 2017 (Restated) 2018 (Audited) 6/30/2018 (Unaudited) 6/30/2019 (Unaudited) Revenue 0.1 35.8 13.8 22.0 Storage fee 0.1 20.7 8.8 12.0 Ancillary services - 15.1 5.0 10.0 Direct costs (2.3) (9.6) (4.8) (5.0) Gross (loss) profit (2.2) 26.2 9.0 17.1 Gross profit (loss) margin (%) N/M 73.2% 65.5% 77.5% General and administrative expenses (0.6) (2.0) (1.0) (1.2) Finance costs (1.0) (7.0) (3.3) (3.4) Changes in fair value of derivative financial instruments - (1.2) - (0.5) (Loss) profit and total comprehensive (loss) income (3.7) 16.1 4.7 12.0 Total comprehensive income (loss) margin (%) N/M 44.8% 33.8% 54.2% (Values in USD million) 2017 2018 H1 2018 H1 2019 Total comprehensive income (loss) (3.7) 16.1 4.7 12.0 Depreciation 0.7 5.7 2.9 2.9 Finance costs 1.0 7.0 3.3 3.4 Changes in Fair Value of Derivative Financial Instruments - 1.2 - 0.5 Adjusted EBITDA (1) (2.0) 30.0 10.9 18.8 Adjusted EBITDA margin (%) N/M 83.5% 78.7% 85.1% (1) Adjusted EBITDA is defined as profit (loss) before finance costs, income tax expense (currently not applicable in the UAE but in cluded here for reference purposes), depreciation and adjusted for selected items that we believe impact the comparability of financial results between reporting periods. In addit ion to non - cash items, we have selected items for adjustment to EBITDA which management feels decrease the comparability of our results among periods.

42 Statement of Financial Position (Values in USD million) 31 Dec’ 2018 (Audited) 30 June 2019 (Unaudited) Non - current assets Property, plant and equipment 197.6 205.9 Advances to contractors - 29.4 Total non - current assets 197.6 235.3 Current assets Inventories 0.1 0.2 Trade and other receivables 2.1 4.6 Bank balances and cash (1) 0.0 6.7 Total current assets 2.3 11.5 Total assets 199.9 246.8 Equity Share Capital 1.4 1.4 Owners’ accounts 47.7 80.3 General reserve 0.7 0.7 Retained earnings (accumulated losses) 11.2 23.2 Total equity 61.0 105.6 Non - current liabilities Provisions (2) 0.0 0.0 Lease liability 28.1 28.2 Other liabilities - - Current liabilities Bank Overdraft 3.7 - Accounts payable, accruals and other payables 9.0 16.5 Term Loans 94.8 92.6 Derivative financial instruments 1.2 1.7 Lease liability 2.1 2.3 Total liabilities 139.0 141.2 Total equity and liabilities 199.9 246.8 (1) Bank balances and cash stood at $37,351 as of December 31, 2018. (2) Provisions balance was $9,485 and $6,267 as of June 30, 2019 and December 31, 2018, respectively.

43 Statement of Cash Flows (Values in USD million) 2017 (Restated) 2018 (Audited) 6/30/2018 (Unaudited) 6/30/2019 (Unaudited) Cash flow from operating activities (Loss) profit for the year / period (3.7) 16.1 4.7 12.0 Adjustments (1) 1.7 13.9 6.2 6.8 Working capital changes (0.2) (2.0) (1.8) 0.8 Net cash from (used in) operating activities (2.3) 27.9 9.0 19.5 Cash flow from investing activity Purchase of property, plant and equipment (21.9) (0.3) (0.1) (8.9) Advances paid to contractors - - - (29.4) Net cash from (used in) investing activity (21.9) (0.3) (0.1) (38.2) Cash flow from financing activities Proceeds from term loans 16.7 4.0 0.6 - Repayment of term loans - (3.5) - (2.3) Interest paid on term loans (3.4) (7.2) - (0.1) Payment of transaction costs on loans (0.1) - - - Net contribution from (distribution to) owners 11.2 (25.0) (8.4) 31.6 Net cash from (used in) financing activities 24.3 (31.6) (7.9) 29.1 Increase (decrease) in cash and cash equivalents 0.1 (4.0) 1.0 10.4 Cash and cash equivalents at the beginning of the year / period 0.1 0.3 0.3 (3.7) Cash and cash equivalents at the end of the year / period 0.3 (3.7) 1.3 6.7 (1) Depreciation, Finance costs, Net change in fair value of derivative instruments, and provisions for employees’ end of service be nefits.