IF YOU HAVE SUBMITTED A WHITE PROXY CARD AND ARE A STOCKHOLDER AS OF THE RECORD DATE AND YOU DO NOT WISH TO CHANGE YOUR VOTE, THEN YOU DO NOT HAVE TO TAKE ANY FURTHER ACTION AND YOU DO NOT NEED TO SUBMIT THE ENCLOSED WHITE PROXY CARD. YOU SHOULD DISREGARD AND DISCARD, AND NOT VOTE, ANY GOLD PROXY CARD YOU RECEIVE FROM THE COMPANY. ONLY YOUR LAST DATED PROXY CARD WILL COUNT.

OTHER SUPPLEMENTAL DISCLOSURES

Stockholder Proposals

According to the Company’s definitive proxy statement, pursuant to Rule 14a-8 of the Exchange Act, the Company must receive stockholder proposals submitted pursuant to such Rule, in writing by December 16, 2022, to consider them for inclusion in the Company’s proxy materials for the 2023 Annual Meeting. For any proposal that is not submitted for inclusion in the Company’s proxy statement, but is instead sought to be presented directly at the 2023 Annual Meeting, the Company’s secretary must receive written notice of the proposal at the Company’s principal executive offices during the period beginning on November 16, 2022 and ending at 5:00 p.m. Eastern Time, on December 16, 2022.

Additional Participant Information

The Nominee, Comrit Investments 1, Comrit Manager, I.B.I., Ziv Sapir, Sharon Stern and Erez Shacham are participants in this solicitation. The principal business of Comrit Investments 1 is serving as a private investment fund. Comrit Manager manages the business and affairs of Comrit Investments 1. I.B.I. is an Israeli public company traded on the Tel Aviv Stock Exchange. Ziv Sapir is the Managing Partner and the CEO of Comrit Investments 1 and the CEO of Comrit Manager. Mr. Sapir is a citizen of Israel. The Nominee, Ms. Stern, is currently President of Eastmore Management and Metro Investments. Ms. Stern is a citizen of Canada. Mr. Shacham is currently CEO of NY Stone New Jersey and NY Stone Manhattan. Mr. Shacham is a citizen of the United States.

The address of the principal office of each of Comrit Investments 1, Comrit Manager, I.B.I., and Mr. Sapir is 9 A’had Ha’am Street, Floor 28th, Shalom Tower, Tel Aviv, Israel 6129109. The address of the principal office of the Nominee is 1822 Ste. Catherine W., Suite 100, Montreal, Quebec H3H 1M1. The address of the principal office of Mr. Shacham is 30 W. 21st Street, New York, New York 10010.

As of the date hereof, Comrit Investments 1 beneficially owns 267,520 shares of Common Stock. Comrit Manager, as the general partner of Comrit Investments 1, may be deemed the beneficial owner of the 267,520 shares owned by Comrit Investments 1. Mr. Sapir, as the investment manager of Comrit Manager, may be deemed the beneficial owner of the 267,520 shares owned by Comrit Investments 1. I.B.I, as the majority owner of Comrit Manager, may be deemed the beneficial owner of the 267,520 shares owned by Comrit Investments 1. Mr. Sapir, as the owner of the shares of Comrit Manager not owned by I.B.I., may be deemed the beneficial owner of the 267,520 shares owned by Comrit Investments 1. As of the date hereof, Mr. Stern does not own of record or beneficially any securities of the Company. As of the date hereof, Mr. Shacham beneficially owns 86 shares of Common Stock. For information regarding transactions in securities of the Company during the past two years by each participant, please see Schedule II.

Each participant in this solicitation, if deemed to be a member of a “group” with the other participants for the purposes of Section 13(d)(3) of the Exchange Act, may be deemed to beneficially own the 267,520 shares of Common Stock owned by Comrit Investments 1. Each participant in this solicitation disclaims beneficial ownership of the shares of Common Stock owned by Comrit Investments 1 except to the extent of their pecuniary interest therein. During the past two years, the participants in this solicitation have not purchased or sold any securities of the Company.

The shares of Common Stock owned directly by Comrit Investments 1 were purchased with working capital (which may, at any given time, include margin loans made by brokerage firms in the ordinary course of business).

Except as set forth in this Proxy Statement (including the Schedules hereto), (i) during the past 10 years, no participant in this solicitation has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors); (ii) no participant in this solicitation directly or indirectly beneficially owns any securities of the Company; (iii) no participant in this solicitation owns any securities of the Company which are owned of record but not beneficially; (iv) no participant in this solicitation has purchased or sold any securities of the Company during the past two years; (v) no part of the purchase price or market value of the securities of the Company owned by any participant in this solicitation is represented by funds borrowed or otherwise obtained for the purpose of acquiring or holding such securities; (vi) no participant in this solicitation is, or within the past year was, a party to any contract, arrangements or understandings with any person with respect to any securities of the Company, including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies; (vii) no associate of any participant in this solicitation owns beneficially, directly or indirectly, any securities of the Company; (viii) no participant in this solicitation owns beneficially, directly or indirectly, any securities of any parent or subsidiary of the Company; (ix) no participant in this solicitation or any of his or its associates was a party to any transaction, or series of similar transactions, since the beginning of the Company’s last fiscal year, or is a party to any currently proposed transaction, or series of similar transactions, to which the Company or any of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000; (x) no participant in this solicitation or any of his or its associates has any arrangement or understanding with any person with respect to any future employment by the Company or its affiliates, or with respect to any future transactions to which the Company or any of its affiliates will or may be a party; and (xi) no participant in this solicitation has a substantial interest, direct or indirect, by securities holdings or otherwise, in any matter to be acted on at the Annual Meeting.

There are no material proceedings to which any participant in this solicitation or any of his or her or its associates is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries. With respect to the Nominee, none of the events enumerated in Item 401(f)(1)-(8) of Regulation S-K of the Exchange Act occurred during the past 10 years.

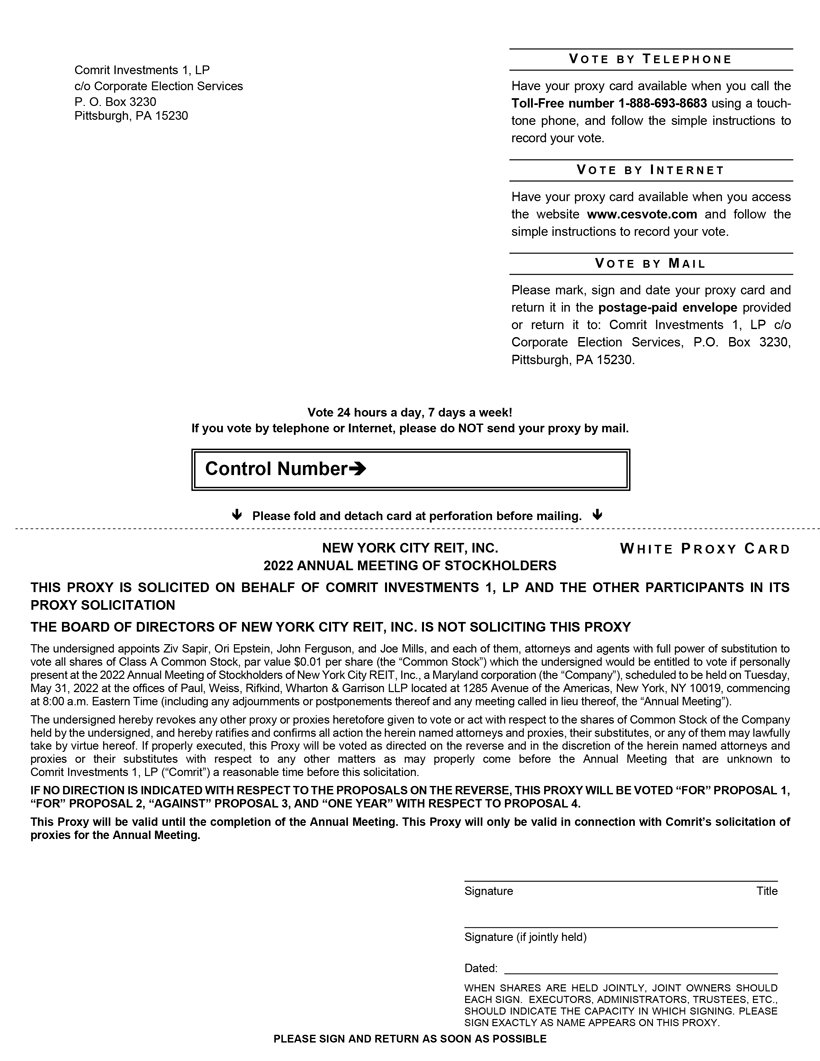

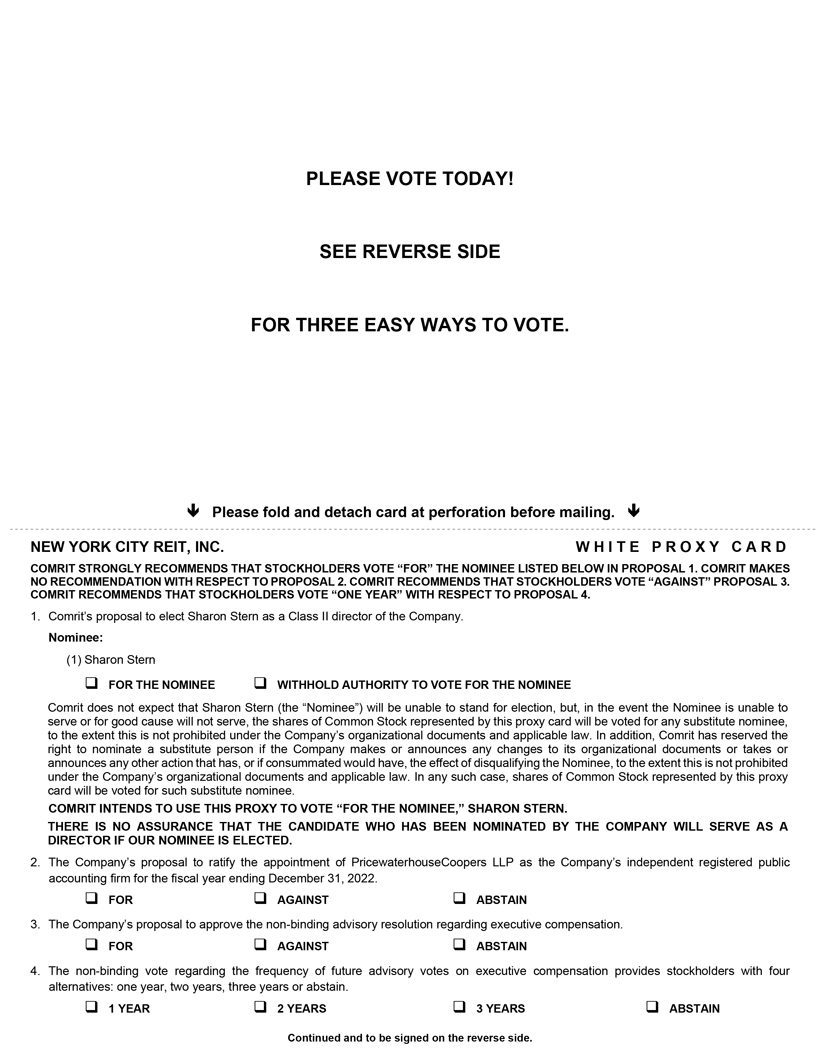

THIS SOLICITATION IS BEING MADE BY COMRIT AND NOT ON BEHALF OF THE BOARD OF DIRECTORS OR MANAGEMENT OF THE COMPANY. COMRIT URGES YOU TO SIGN, DATE AND RETURN THE WHITE PROXY CARD IN FAVOR OF THE ELECTION OF THE NOMINEE. IF YOU HAVE ALREADY SENT A GOLD PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS DESCRIBED IN OUR DEFINITIVE PROXY STATEMENT BY SIGNING, DATING, AND RETURNING THE ENCLOSED WHITE PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR THE ANNUAL MEETING OR BY VOTING IN PERSON AT THE ANNUAL MEETING.

2