UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-23323)

Procure ETF Trust II

(Exact name of registrant as specified in charter)

16 Firebush Road

Levittown, PA 19056

(Address of principal executive offices) (Zip code)

Andrew Chanin

16 Firebush Road, Levittown, PA 19056

(Name and address of agent for service)

1-866-690-3837

Registrant’s telephone number, including area code

Date of fiscal year end: October 31

Date of reporting period: October 31, 2024

Item 1. Reports to Stockholders.

| (a) | A copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (“Act”), is filed herewith. |

| | |

| Procure Space ETF | |

| UFO (Principal U.S. Listing Exchange: NASDAQ) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Procure Space ETF for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at https://procureetfs.com/. You can also request this information by contacting us at 1-866-690-3837.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Procure Space ETF | $84 | 0.75% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The fund is a pure play space investment and is not a space and defense fund. Henced has a concentration in satellite communication and imagining equipment, launchvehicle production, and global positioning software and equipment. The weighting of major defense companies in the index is limited to the percentage of their gross revenue derived from space projects.

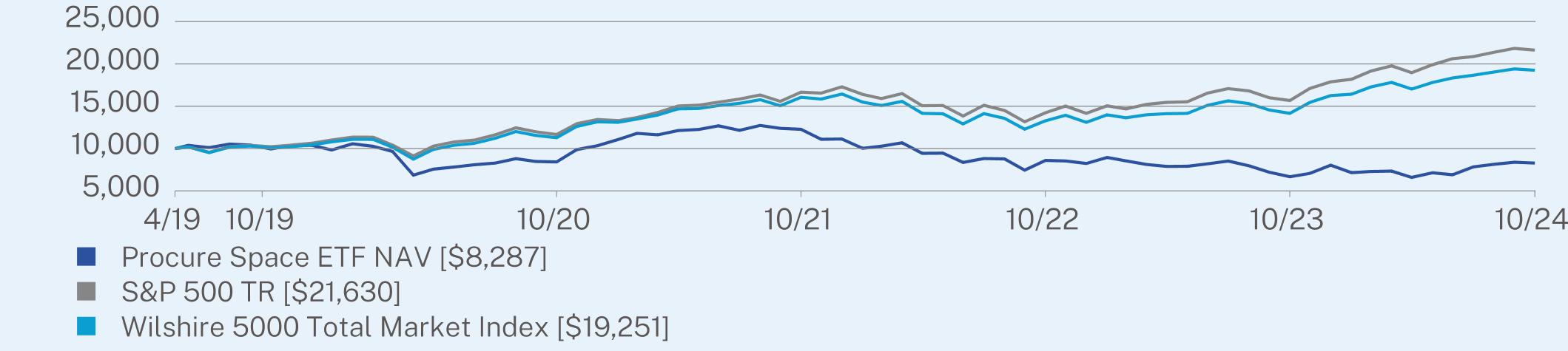

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | Since Inception

(04/10/2019) |

Procure Space ETF NAV | 24.19 | -4.42 | -3.32 |

S&P 500 TR | 38.02 | 15.27 | 14.89 |

Wilshire 5000 Total Market Index | 35.97 | 13.04 | 12.51 |

Visit https://procureetfs.com/ for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Procure Space ETF | PAGE 1 | TSR-AR-74280R205 |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $34,712,570 |

Number of Holdings | 36 |

Net Advisory Fee | $256,998 |

Portfolio Turnover | 47% |

Visit https://procureetfs.com/ for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)*

| |

Top 10 Issuers | (%) |

Rocket Lab USA, Inc. | 7.1% |

MDA Space Ltd. | 6.1% |

EchoStar Corp. | 5.1% |

Iridium Communications, Inc. | 5.1% |

Trimble, Inc. | 4.9% |

Garmin, Ltd. | 4.9% |

Sirius XM Holdings, Inc. | 4.8% |

Sky Perfect JSAT Holdings, Inc. | 4.5% |

Globalstar, Inc. | 4.1% |

AST SpaceMobile, Inc. | 4.1% |

| |

Top Sectors | (%) |

Industrials | 48.3% |

Communication Services | 33.6% |

Information Technology | 11.8% |

Consumer Discretionary | 4.9% |

Materials | 0.6% |

Cash & Other | 0.8% |

| * | Pecentages are stated as a percent of net assets. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://procureetfs.com/.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your ProcureAM, LLC documents not be householded, please contact ProcureAM, LLC at 1-866-690-3837, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by ProcureAM, LLC or your financial intermediary.

| Procure Space ETF | PAGE 2 | TSR-AR-74280R205 |

10391842412274859966738287106281166016664142291567221630104321128116057132781415819251

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any substantive amendments to its code of ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report.

A copy of the registrant’s Code of Ethics is filed herewith.

Item 3. Audit Committee Financial Expert.

The registrant’s board of Trustees has determined that there is at least one audit committee financial expert serving on its audit committee. John L. Jacobs is the “audit committee financial expert” and is considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant, Cohen & Company, Ltd, to perform audit services, audit-related services, tax services and/or other services during the past two fiscal years. “Audit services” refer to performing an audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. “Other services” refer to other services rendered by the Registrant’s principal accountant to the Registrant other than those reported under the “audit services”, “audit-related services”, and “tax services”. The following table details the aggregate fees billed or expected to be billed for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| | FYE 10/31/24 | FYE 10/31/23 |

| (a) Audit Fees | $15,250 | $30,500 |

| (b) Audit-Related Fees | None | None |

| (c) Tax Fees | $3,700 | $7,400 |

| (d) All Other Fees (Seed Audit) | None | None |

(e)(1) The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre-approve all audit and non-audit services of the registrant, including services provided to any entity affiliated with the registrant.

(e)(2) The percentage of fees billed by Cohen & Company, Ltd applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows:

| | FYE 10/31/24 | FYE 10/31/23 |

| Audit-Related Fees | 0% | 0% |

| Tax Fees | 0% | 0% |

| All Other Fees | 0% | 0% |

(f) Not Applicable.

(g) The following table indicates the non-audit fees billed or expected to be billed by the registrant’s accountant for services to the registrant and to the registrant’s investment adviser (and any other controlling entity, etc.—not sub-adviser) for the last two years.

| Non-Audit Related Fees | FYE 10/31/24 | FYE 10/31/23 |

| Registrant | None | None |

| Registrant’s Investment Adviser | None | None |

(h) Because no non-audit services were rendered, the audit committee of the registrant’s board of trustees did not consider whether the provision of non-audit services that were rendered to the registrant’s investment adviser is compatible with maintaining the principal accountant’s independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

(a) Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

(b) Not applicable.

Item 6. Investments.

| (a) | Schedule of Investments is included within the financial statements filed under Item 7 (a) of this Form. |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

(a)

PROCURE SPACE ETF TICKER: UFO

Annual Report

October 31, 2024

TABLE OF CONTENTS

PROCURE SPACE ETF

SCHEDULE OF INVESTMENTS

October 31, 2024

| | | | | | | |

COMMON STOCKS - 99.2%

| | | | | | |

Canada - 6%

| | | | | | |

Aerospace & Defense - 6.1%

| | | | | | |

MDA Space Ltd.(a) | | | 137,241 | | | $2,097,086 |

France - 2.3%

| | | | | | |

Aerospace & Defense - 2.3%

| | | | | | |

Airbus SE | | | 4,463 | | | 679,109 |

Thales SA | | | 693 | | | 111,461 |

| | | | | | 790,570 |

Total France | | | | | | 790,570 |

Italy - 1.5%

| | | | | | |

Aerospace & Defense - 1.5%

| | | | | | |

Avio SpA | | | 35,601 | | | 459,163 |

Leonardo SpA | | | 2,707 | | | 64,567 |

| | | | | | 523,730 |

Total Italy | | | | | | 523,730 |

Japan - 10.2%

| | | | | | |

Aerospace & Defense - 3.7%

| | | | | | |

Institute for Q-shu Pioneers of Space, Inc.(a)(b) | | | 50,800 | | | 546,269 |

Ispace, Inc.(a) | | | 165,651 | | | 744,927 |

| | | | | | 1,291,196 |

Media - 4.5%

| | | | | | |

Sky Perfect JSAT Holdings, Inc. | | | 267,767 | | | 1,552,196 |

Professional Services - 2.0%

| | | | | | |

Weathernews, Inc. | | | 17,566 | | | 697,681 |

Total Japan | | | | | | 3,541,073 |

Luxembourg - 3.5%

| | | | | | |

Media - 3.5%

| | | | | | |

SES SA | | | 301,423 | | | 1,200,312 |

Netherlands - 3.4%

| | | | | | |

Software - 3.4%

| | | | | | |

TomTom NV(a)(b) | | | 217,940 | | | 1,186,578 |

Switzerland - 4.9%

| | | | | | |

Household Durables - 4.9%

| | | | | | |

Garmin, Ltd. | | | 8,638 | | | 1,713,347 |

United States - 67.3%(c)

| | | | | | |

Aerospace & Defense - 25.0%(e)

| | | | | | |

Boeing Co.(a) | | | 4,850 | | | 724,154 |

Intuitive Machines, Inc.(a)(b) | | | 149,154 | | | 1,163,401 |

L3Harris Technologies, Inc. | | | 3,460 | | | 856,246 |

Lockheed Martin Corp. | | | 1,619 | | | 884,055 |

Northrop Grumman Corp. | | | 1,523 | | | 775,237 |

Redwire Corp.(a) | | | 75,281 | | | 578,911 |

Rocket Lab USA, Inc.(a)(b) | | | 230,127 | | | 2,462,359 |

RTX Corp. | | | 6,573 | | | 795,267 |

Virgin Galactic Holdings, Inc.(a)(b) | | | 62,180 | | | 408,523 |

| | | | | | 8,648,153 |

| | | | | | | |

| | | | | | | |

Communications Equipment - 3.5%

| | | | | | |

Comtech Telecommunications Corp.(a) | | | 55,157 | | | $205,184 |

ViaSat, Inc.(a) | | | 105,105 | | | 1,009,008 |

| | | | | | 1,214,192 |

Containers & Packaging - 0.6%

| | | | | | |

Ball Corp. | | | 3,645 | | | 215,966 |

Diversified Telecommunication Services - 13.2%

| | | | | | |

AST SpaceMobile, Inc.(a)(b) | | | 58,930 | | | 1,403,124 |

Globalstar, Inc.(a) | | | 1,337,842 | | | 1,404,734 |

Iridium Communications, Inc. | | | 60,164 | | | 1,764,610 |

| | | | | | 4,572,468 |

Electronic Equipment, Instruments & Components - 4.9%

| | | | | | |

Trimble, Inc.(a) | | | 28,354 | | | 1,715,417 |

Industrial Conglomerates - 2.3%

| | | | | | |

Honeywell International, Inc. | | | 3,844 | | | 790,634 |

Media - 12.4%

| | | | | | |

Comcast Corp. - Class A | | | 20,081 | | | 876,937 |

EchoStar Corp. - Class A(a) | | | 70,890 | | | 1,776,503 |

Sirius XM Holdings, Inc. | | | 61,863 | | | 1,649,268 |

| | | | | | 4,302,708 |

Professional Services - 5.4%

| | | | | | |

Planet Labs PBC(a) | | | 559,187 | | | 1,235,803 |

Spire Global, Inc.(a)(b) | | | 65,231 | | | 645,787 |

| | | | | | 1,881,590 |

Total United States | | | | | | 23,341,128 |

TOTAL COMMON STOCKS

(Cost $41,403,667) | | | | | | 34,393,824 |

| | | Units | | | |

SHORT-TERM INVESTMENTS - 13.5%

| | | | | | |

Investments Purchased with Proceeds from Securities Lending - 12.4%

| | | | | | |

Mount Vernon Liquid Assets Portfolio, LLC, 4.93%(d) | | | 4,284,023 | | | 4,284,023 |

| | | Shares | | | |

Money Market Funds - 1.1%

| | | | | | |

First American Government Obligations Fund - Class X, 4.78%(d) | | | 392,705 | | | 392,705 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $4,676,728) | | | | | | 4,676,728 |

TOTAL INVESTMENTS - 112.7%

(Cost $46,080,395) | | | | | | $39,070,552 |

Liabilities in Excess of Other

Assets - (12.7)% | | | | | | (4,357,982) |

TOTAL NET ASSETS - 100.0% | | | | | | $34,712,570 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

PROCURE SPACE ETF

SCHEDULE OF INVESTMENTS

October 31, 2024(Continued)

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services.

NV - Naamloze Vennootschap

SA - Sociedad Anónima

SE - Societas Europeae

SpA - Societa per Azioni

(a)

| Non-income producing security. |

(b)

| All or a portion of this security is on loan as of October 31, 2024. The total market value of these securities was $4,063,690 which represented 11.7% of net assets. |

(c)

| To the extent that the Fund invests a significant portion of its assets in the securities of companies of a single country or region, it is more likely to be impacted by events or conditions affecting the country or region. |

(d)

| The rate shown represents the 7-day annualized effective yield as of October 31, 2024. |

(e)

| As of October 31, 2024, the Fund had a significant portion of its asset involved in the Aerospace & Defense industry. (see Note 3)

|

(f)

| As of October 31, 2024, the Fund had a significant portion of its assets involved in Industrials and Communication Services sectors. (see Note 3). |

| | | | | | | |

Allocation of Portfolio Holdings by Country as of October 31, 2024

| | | | | | |

(% of Net Assets)

| | | | | | |

Japan | | | $3,541,073 | | | 10.2% |

Canada | | | 2,097,086 | | | 6.0 |

Switzerland | | | 1,713,347 | | | 4.9 |

Luxembourg | | | 1,200,312 | | | 3.5 |

Netherlands | | | 1,186,578 | | | 3.4 |

France | | | 790,570 | | | 2.3 |

Italy | | | 523,730 | | | 1.5 |

United States | | | 28,017,856 | | | 80.8 |

Liabilities in Excess of Other Assets | | | (4,357,982) | | | (12.6) |

| | | $34,712,570 | | | 100.0% |

| | | | | | | |

| | | | | | | |

Sector Classification as of October 31, 2024

| | | | | | |

(% of Net Assets)

| | | | | | |

Industrials(f) | | | $16,720,640 | | | 48.2% |

Communication Services(f) | | | 11,627,684 | | | 33.5 |

Information Technology | | | 4,116,187 | | | 11.9 |

Consumer Discretionary | | | 1,713,347 | | | 4.9 |

Materials | | | 215,966 | | | 0.6 |

Investments Purchased with Proceeds from Securities Lending | | | 4,284,023 | | | 12.3 |

Money Market Funds | | | 392,705 | | | 1.1 |

Liabilities in Excess of Other Assets | | | (4,357,982) | | | (12.5) |

| | | $34,712,570 | | | 100.0% |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Procure Space ETF

Statement of Assets and Liabilities

October 31, 2024

| | | | |

ASSETS:

| | | |

Investments, at value | | | $39,070,552 |

Foreign currency, at value | | | 40,958 |

Dividends and interest receivable | | | 18,174 |

Security lending income receivable | | | 14,712 |

Total assets | | | 39,144,396 |

LIABILITIES:

| | | |

Payable upon return of securities loaned | | | 4,284,023 |

Payable for investments purchased | | | 125,594 |

Payable to adviser | | | 22,209 |

Total liabilities | | | 4,431,826 |

NET ASSETS | | | $34,712,570 |

NET ASSETS CONSISTS OF:

| | | |

Paid-in capital | | | $78,388,321 |

Total accumulated losses | | | (43,675,751) |

Total net assets | | | $34,712,570 |

Net assets | | | $34,712,570 |

Shares issued and outstanding(a) | | | 1,825,000 |

Net asset value per share | | | $19.02 |

COST:

| | | |

Investments, at cost | | | $46,080,395 |

Foreign currency, at cost | | | $41,045 |

LOANED SECURITIES:

| | | |

at value (included in investments) | | | $4,063,690 |

| | | | |

(a)

| Unlimited shares authorized without par value. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Procure Space ETF

Statement of Operations

For the Year Ended October 31, 2024

| | | | |

INVESTMENT INCOME:

| | | |

Dividend income | | | $493,928 |

Less: Dividend withholding taxes | | | (39,275) |

Dividend reclaim income – foreign securities | | | 52,561 |

Interest income | | | 6,645 |

Securities lending income | | | 433,650 |

Total investment income | | | 947,509 |

EXPENSES:

| | | |

Investment advisory fee | | | 256,998 |

Trustees’ fees | | | 39,000 |

Compliance fees | | | 27,000 |

Total expenses | | | 322,998 |

Expense reimbursement by Adviser | | | (66,000) |

Net expenses | | | 256,998 |

NET INVESTMENT INCOME | | | 690,511 |

REALIZED AND UNREALIZED GAINS/(LOSSES)

| | | |

Net realized gain/loss from:

| | | |

Investments (see Note 6) | | | (9,729,207) |

Foreign currency transactions | | | (8,897) |

Net realized loss | | | (9,738,104) |

Net change in unrealized appreciation on:

| | | |

Investments | | | 16,338,084 |

Foreign currency translation | | | (706) |

Net change in unrealized appreciation | | | 16,337,378 |

Net realized and unrealized gain | | | 6,599,274 |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | | $7,289,785 |

| | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Procure Space ETF

Statements of Changes in Net Assets

| | | | |

OPERATIONS:

| | | | | | |

Net investment income | | | $690,511 | | | $1,161,108 |

Net realized loss | | | (9,738,104) | | | (9,199,922) |

Net change in unrealized appreciation/(depreciation) | | | 16,337,378 | | | (2,995,673) |

Net increase/(decrease) in net assets from operations | | | 7,289,785 | | | (11,034,487) |

DISTRIBUTIONS TO SHAREHOLDERS:

| | | | | | |

Distributions to shareholders | | | (505,948) | | | (1,154,486) |

Total distributions to shareholders | | | (505,948) | | | (1,154,486) |

CAPITAL TRANSACTIONS:

| | | | | | |

Redemptions | | | (6,635,988) | | | (14,274,200) |

Net decrease in net assets from capital transactions | | | (6,635,988) | | | (14,274,200) |

NET INCREASE (DECREASE) IN NET ASSETS | | | 147,849 | | | (26,463,173) |

NET ASSETS:

| | | | | | |

Beginning of the year | | | 34,564,721 | | | 61,027,894 |

End of the year | | | $34,712,570 | | | $34,564,721 |

CHANGES IN SHARES OUTSTANDING

| | | | | | |

Shares outstanding, beginning of period | | | 2,225,000 | | | 2,975,000 |

Shares sold | | | — | | | — |

Shares repurchased | | | (400,000) | | | (750,000) |

Shares outstanding, end of period | | | 1,825,000 | | | 2,225,000 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Procure Space ETF

Financial Highlights

| | | | |

PER SHARE DATA:

| | | | | | | | | | | | | | | |

Net asset value, beginning of year | | | $15.53 | | | $20.51 | | | $30.05 | | | $20.85 | | | $25.93 |

INVESTMENT OPERATIONS:

| | | | | | | | | | | | | | | |

Net investment income(a) | | | 0.34 | | | 0.45 | | | 0.64 | | | 0.25 | | | 0.16 |

Net realized and unrealized gain (loss) on investments(b) | | | 3.42 | | | (4.98) | | | (9.57) | | | 9.25 | | | (5.06) |

Total from investment operations | | | 3.76 | | | (4.53) | | | (8.93) | | | 9.50 | | | (4.90) |

LESS DISTRIBUTIONS FROM:

| | | | | | | | | | | | | | | |

Net investment income | | | (0.27) | | | (0.45) | | | (0.61) | | | (0.28) | | | (0.15) |

Return of capital | | | — | | | — | | | — | | | (0.02) | | | (0.03) |

Total distributions | | | (0.27) | | | (0.45) | | | (0.61) | | | (0.30) | | | (0.18) |

Net asset value, end of year | | | $19.02(d) | | | $15.53 | | | $20.51 | | | $30.05 | | | $20.85 |

TOTAL RETURN | | | 24.19% | | | −22.40% | | | −29.94% | | | 45.69% | | | −18.93% |

SUPPLEMENTAL DATA AND RATIOS:

| | | | | | | | | | | | | | | |

Net assets, end of year (in thousands) | | | $34,713 | | | $34,565 | | | $61,028 | | | $115,710 | | | $28,675 |

Ratio of expenses to average net assets:

| | | | | | | | | | | | | | | |

Before expense reimbursement | | | 0.94% | | | 0.82% | | | 0.81% | | | 0.81% | | | 1.12% |

After expense reimbursement | | | 0.75% | | | 0.75% | | | 0.75% | | | 0.75% | | | 0.75% |

Ratio of net investment income to average net assets | | | 2.02% | | | 2.32% | | | 2.69% | | | 0.85% | | | 0.72% |

Portfolio turnover rate(c) | | | 47% | | | 43% | | | 53% | | | 52% | | | 44% |

| | | | | | | | | | | | | | | | |

(a)

| Net investment income per share has been calculated based on average shares outstanding during the year. |

(b)

| Realized and unrealized gains and losses per share in the caption are balancing amounts necessary to reconcile the change in net asset value per share for the years, and may not reconcile with the aggregate gains and losses in the Statement of Operations due to share transactions for the year. |

(c)

| Portfolio turnover rate excludes in-kind transactions. |

(d)

| Includes adjustments made for GAAP Financial Statements. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

ProcureAM ETFs

NOTES TO FINANCIAL STATEMENTS

October 31, 2024

NOTE 1 – ORGANIZATION

Procure Space ETF (“UFO”) (the “Fund”) is a non-diversified series of Procure ETF Trust II (the “Trust”), an open-end management investment company consisting of multiple investment series, organized as a Delaware statutory trust on December 19, 2017. The Trust is registered with the SEC under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company and the offering of the Fund’s shares (“Shares”) is registered under the Securities Act of 1933, as amended (the “Securities Act”). UFO seeks investment results that correspond generally to the performance, before UFO’s fees and expenses, of an equity index called the “S-Network Space Index” (the “Underlying Index”) developed by S-Network Global Indexes (the “Index Provider”). UFO commenced operations on April 10, 2019.

The Fund currently offers one class of Shares, which has no front-end sales load, no deferred sales charges, and no redemption fees. The Fund may issue an unlimited number of Shares of beneficial interest, with no par value. All Shares of the Fund have equal rights and privileges.

Shares of the Fund are listed and traded on Nasdaq, Inc. Market prices for the Shares may be different from their net asset value (“NAV”). The Fund issues and redeems Shares on a continuous basis at NAV only in blocks of 25,000 shares, called “Creation Units.” Creation Units are issued and redeemed principally in-kind for securities included in a specified Index. Once created, Shares generally trade in the secondary market at market prices that change throughout the day in quantities less than a Creation Unit. Except when aggregated in Creation Units, Shares are not redeemable securities of the Fund. Shares of the Fund may only be purchased or redeemed by certain financial institutions (“Authorized Participants”). An Authorized Participant is either (i) a broker dealer or other participant in the clearing process through the Continuous Net Settlement System of the National Securities Clearing Corporation or (ii) a DTC participant and, in each case, must have executed a Participant Agreement with the Distributor. Most retail investors do not qualify as Authorized Participants nor have the resources to buy and sell whole Creation Units. Therefore, they are unable to purchase or redeem the Shares directly from the Fund. Rather, most retail investors may purchase Shares in the secondary market with the assistance of a broker and are subject to customary brokerage commissions or fees.

Authorized Participants pay fixed transaction fees to offset the transfer and other transaction costs associated with the issuance and redemption of Creation Units. The fixed transaction fee will be the same regardless of the number of Creation Units issued or redeemed by an investor. The fixed transaction fee charged by the Fund for each creation and redemption order is $500. Fixed transaction fees may be waived when the Advisor or Sub-Advisor believes that waiver of the fee is in the best interest of the Fund. An additional variable fee of up to four (4) times the fixed transaction fee (expressed as a percentage of the value of the Deposit Securities) for creations or (expressed as a percentage value of the Fund’s Securities) for redemptions may be imposed for (1) creations/redemption effected outside the Clearing Process and (2) cash creations/redemptions (to offset the Fund’s brokerage and other transaction costs associated with using cash to purchase the requisite Deposit/Fund’s Securities). Investors are responsible for the costs of transferring the securities constituting the Deposit/Fund’s Securities to the account of the Fund or on its order. Such variable charges, if any, are included in “Transaction Fees” in the Statements of Changes in Net Assets.

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund. These policies are in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

The Fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946 Financial Services – Investment Companies.

A.

| Security Valuation. Securities listed on a securities exchange, market or automated quotation system for which quotations are readily available (except for securities traded on NASDAQ), including securities traded over the counter, are valued at the last quoted sale price on the primary exchange or market (foreign or domestic) on which they are traded on the valuation date (or at approximately 4:00 PM Eastern Time if a security’s primary exchange is normally open at that time), or, if there is no such reported sale on the valuation date, at the most recent quoted bid price. For securities traded on NASDAQ, the NASDAQ Official Closing Price will be used. |

Money market funds are valued at NAV.

TABLE OF CONTENTS

ProcureAM ETFs

NOTES TO FINANCIAL STATEMENTS

October 31, 2024(Continued)

Securities for which quotations are not readily available are valued at their respective fair values as determined in good faith by the valuation designee in accordance with rule 2a-5. When a security is “fair valued,” consideration is given to the facts and circumstances relevant to the particular situation, including a review of various factors set forth in the pricing procedures adopted by the Fund’s designee. The use of fair value pricing by the Fund may cause the net asset value of its shares to differ significantly from the net asset value that would be calculated without regard to such considerations. As of October 31, 2024, the Fund held no Level 3 securities.

As described above, the Fund utilize various methods to measure the fair value of their investments on a recurring basis. U.S. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of inputs are:

Level 1 –

| Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

Level 2 –

| Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

Level 3 –

| Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available; representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability and would be based on the best information available. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The following table presents a summary of the Fund’s investments in securities, at fair value, as of October 31, 2024:

| | | | | | | | | | | | | |

Investments:

| | | | | | | | | | | | |

Common Stocks | | | $34,393,824 | | | $ — | | | $ — | | | $34,393,824 |

Investments Purchased with Proceeds from Securities Lending(a) | | | — | | | — | | | — | | | 4,284,023 |

Money Market Funds | | | 392,705 | | | — | | | — | | | 392,705 |

Total Investments | | | $34,786,530 | | | $— | | | $— | | | $39,070,552 |

| | | | | | | | | | | | | |

Refer to the Schedule of Investments for classifications by country and industry.

(a)

| Certain investments that are measured at fair value using the net asset value per share (or its equivalent) practical expedient have not been categorized in the fair value hierarchy. The fair value amount of $4,284,023 presented in the table are intended to permit reconciliation of the fair value hierarchy to the amounts listed in the Schedule of Investments. |

B.

| Federal Income Taxes. The Fund has elected to be taxed as a “regulated investment company” and intends to distribute substantially all taxable income to its shareholders and otherwise comply with the provisions of the Internal Revenue Code applicable to regulated investment companies. Therefore, no provisions for federal income taxes or excise taxes have been made. |

TABLE OF CONTENTS

ProcureAM ETFs

NOTES TO FINANCIAL STATEMENTS

October 31, 2024(Continued)

To avoid imposition of the excise tax applicable to regulated investment companies, the Fund intends to declare each year as dividends, in each calendar year, at least 98.0% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts, if any, from prior years.

The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. The Fund has analyzed its tax position and have concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions expected to be taken in the Fund’s 2021, 2022 and 2023 tax returns. The Fund identifies its major tax jurisdictions as U.S. Federal, the State of Pennsylvania, and the State of Delaware; however the Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

As of October 31, 2024, management has reviewed the tax positions for open years (for Federal purposes, three years from the date of filing and for state purposes, four years from the date of filing), as applicable to the Fund, and has determined that no provision for income tax is required in the Fund’s financial statements.

C .

| Security Transactions and Investment Income. Investment securities transactions are accounted for on the trade date. Gains and losses realized on sales of securities are determined on a specific identification basis. Discounts/premiums on debt securities purchased are accreted/amortized over the life of the respective securities using the effective interest method. Dividend income is recorded on the ex-dividend date or, in the case of foreign securities, as soon as the Fund is informed of the ex-dividend date. Interest income is recorded on an accrual basis. Income, including gains, from investments in foreign securities received by the Fund may be subject to withholding or other taxes imposed by foreign countries. |

D.

| Foreign Currency Translations and Transactions. The Fund may engage in foreign currency transactions. Foreign currency transactions are translated into U.S. dollars on the following basis: (i) market value of investment securities, assets and liabilities at the daily rates of exchange, and (ii) purchases and sales of investment securities, dividend and interest income and certain expenses at the rates of exchange prevailing on the respective dates of such transactions. For financial reporting purposes, the Fund does not isolate changes in the exchange rate of investment securities from the fluctuations arising from changes in the market prices of securities for unrealized gains and losses. However, for federal income tax purposes, the Fund does isolate and treat as ordinary income the effect of changes in foreign exchange rates on realized gains or losses from the sale of investment securities and payables and receivables arising from trade-date and settlement-date differences. |

E.

| Distributions to Shareholders. Distributions to shareholders from net investment income are typically declared and paid for the Fund on a quarterly basis. Net realized gains on securities for the Fund is normally declared and paid on an annual basis. Distributions are recorded on the ex-dividend date. |

F.

| Use of Estimates. The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of revenues and expenses during the year. Actual results could differ from those estimates. |

G.

| Share Valuation. NAV per share of the Fund is calculated by dividing the sum of the value of the securities held by the Fund, plus cash and other assets, minus all liabilities (including estimated accrued expenses) by the total number of Shares outstanding for the Fund, rounded to the nearest cent. The Fund’s Shares will not be priced on the days on which the NYSE is closed for trading. |

H.

| Guarantees and Indemnifications. In the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote. |

TABLE OF CONTENTS

ProcureAM ETFs

NOTES TO FINANCIAL STATEMENTS

October 31, 2024(Continued)

NOTE 3 – PRINCIPAL RISKS

Investors should consider the principal risks associated with investing in the Fund, which are summarized below. The value of an investment in the Fund will fluctuate and you could lose money by investing in the Fund. The Fund may not achieve their investment objective.

Aerospace and Defense Companies Risk – Aerospace and defense companies can be significantly affected by government aerospace and defense regulation and spending policies because companies involved in this industry rely to a significant extent on U.S. (and other) government demand for their products and services. Thus, the financial condition of, and investor interest in, aerospace and defense companies are heavily influenced by governmental defense spending policies which are typically under pressure from efforts to control the U.S. (and other) government budgets.

Communication Services Risk – Companies in the communications sector may be affected by industry competition, substantial capital requirements, government regulation, cyclicality of revenues and earnings, obsolescence of communications products and services due to technological advancement, a potential decrease in the discretionary income of targeted individuals and changing consumer tastes and interests.

Equity Securities Risk – The prices of equity securities generally fluctuate in value more than fixed-income investments, may rise or fall rapidly or unpredictably and may reflect real or perceived changes in the issuing company’s financial condition and changes in the overall market or economy. A decline in the value of equity securities held by the Fund will adversely affect the value of your investment in the Fund. Common stocks generally represent the riskiest investment in a company and dividend payments (if declared) to preferred stockholders generally rank junior to payments due to a company’s debtholders. The Fund may lose a substantial part, or even all, of its investment in a company’s stock.

Index Risk – Although the Fund follows a defined index rebalance schedule, the Index Provider could determine to suspend or delay a rebalance to a market event, during which time the Fund’s index tracking risk may be heightened and could negatively impact investors.

Foreign Securities Risk – The Underlying Indices contain equities listed in foreign markets. These securities markets are subject to various regulations, market trading times and contractual settlement dates. Market liquidity may also differ from the U.S. equity markets as many foreign market shares trade OTC and prices are not published to the official exchanges until after the trades are completed. In addition, where all or a portion of the Fund’s underlying securities trade in a market that is closed when the market in which the Fund’s shares are listed and trading in that market is open, there may be changes between the last quote from its closed foreign market and the value of such security during the Fund’s domestic trading day. Consequently, this could lead to differences between the market price of the Fund’s shares and the value of the shares of its underlying portfolio holdings.

Index Construction Risk – A stock included in the Underlying Index may not exhibit the factor trait or provide specific factor exposure for which it was selected and consequently the Fund’s holdings may not exhibit returns consistent with that factor trait.

Issuer-Specific Changes Risk – The value of an individual security or type of security can be more volatile than the total market and can perform differently from the value of the total market. The value of securities of smaller issuers can be more volatile than that of larger issuers.

Large-Capitalization Securities Risk – The Fund is subject to the risk that large-capitalization securities may underperform other segments of the equity market or the total equity market. Larger, more established companies may be unable to respond quickly to new competitive challenges such as changes in technology and may not be able to attain the high growth rate of smaller companies, especially during extended years of economic expansion.

Liquidity Risk – The Fund’s shares are subject to liquidity risk, which means that, in stressed market conditions, the market for the Fund’s shares may become less liquid in response to deteriorating liquidity in the markets for the Fund’s underlying portfolio holdings. Please also note that this adverse effect on liquidity for the Fund’s shares in turn could lead to differences between the market price of the Fund’s shares and the underlying value of those shares. Further, the Underlying Index’s screening process requires that each component security have a three-month average

TABLE OF CONTENTS

ProcureAM ETFs

NOTES TO FINANCIAL STATEMENTS

October 31, 2024(Continued)

trading volume minimum of $1,000,000 on the date of the Underlying Index’s semi-annual reconstitution date, therefore the number of stocks available to the Underlying Index may be negatively affected during stressed market conditions.

Market Price Risk – Shares are listed for trading on Nasdaq, Inc. and are bought and sold in the secondary market at market prices. The market prices of Shares may fluctuate continuously during trading hours, in some cases materially, in response to changes in the net asset value (“NAV”) and supply and demand for Shares, among other factors. Although it is expected that the market price of Shares typically will remain closely correlated to the NAV, the market price will generally differ from the NAV because of timing reasons, supply and demand imbalances and other factors. As a result, the trading prices of Shares may deviate significantly from NAV during certain years, especially those of market volatility. The Investment Advisor cannot predict whether Shares will trade above (premium), below (discount) or at their NAV prices. Thus, an investor may pay more than NAV when buying Shares in the secondary market and receive less than NAV when selling Shares in the secondary market.

Natural Disaster/Epidemic Risk – Natural or environmental disasters, such as earthquakes, fires, floods, hurricanes, tsunamis and other severe weather-related phenomena generally, and widespread disease, including pandemics and epidemics, have been and may be highly disruptive to economies and markets, adversely impacting individual companies, sectors, industries, markets, currencies, interest and inflation rates, credit ratings, investor sentiment, and other factors affecting the value of the Fund’s investments. Given the increasing interdependence among global economies and markets, conditions in one country, market, or region are increasingly likely to adversely affect markets, issuers, and/or foreign exchange rates in other countries, including the U.S. Any such events could have a significant adverse impact on the value of the Fund’s investments.

Any public health emergency, including any emerging or reemergent epidemics (including, without limitation, outbreaks of coronavirus, influenza virus and ebola virus), or the threat thereof, could have a significant adverse impact on the Fund and the securities it holds, and could adversely affect the Fund’s ability to fulfill its investment objectives. Beginning in late 2019, a novel and highly contagious form of coronavirus known as SARS-CoV-2 emerged, causing a disease referred to as COVID-19 or “coronavirus.” In March 2020, the World Health Organization declared the COVID-19 epidemic a “global pandemic,” meaning the disease was prevalent and spreading in multiple geographies. The COVID-19 pandemic has resulted in numerous deaths, adversely impacted global commercial activity and contributed to significant volatility in certain equity and debt markets. The global impact of the outbreak is rapidly evolving, and many countries have reacted to reduce or mitigate the spread of COVID-19 by implementing nonpharmaceutical intervention measures (“NPIs”), such as quarantines, prohibitions on travel and the closure of offices, businesses, schools, retail stores and other public venues. Businesses are also implementing similar NPIs, such as closures, contactless delivery and remote work. Such measures, as well as the general uncertainty surrounding the dangers and impact of COVID-19, are creating significant disruption in supply chains and economic activity and are having a particularly adverse impact on transportation, hospitality, tourism, entertainment and other industries. As COVID-19 continues to mutate globally and vaccines will continue to be developed to meet the mutating strains of the COVID virus, the Board of the fund has chosen to operate under the SEC guidance and hold virtual meetings until the SEC rescinds this relief for in person meetings granted during the pandemic.

In addition, the operations of the Fund, the Advisor and the Fund’s other service providers may be significantly impacted, or even temporarily or permanently halted, because of government quarantine measures, voluntary and precautionary restrictions on travel or meetings and other factors related to a public health emergency, including its potential adverse impact on the health of any such entity’s personnel.

Non-Correlation Risk – The Fund’s return may not match the return of the Underlying Index. For example, the Fund incurs operating expenses not applicable to the Underlying Index, and incurs costs in buying and selling securities, especially when rebalancing the Fund’s securities holdings to reflect changes in the composition of the Underlying Index. In addition, the performance of the Fund and the Underlying Index may vary due to asset valuation differences and differences between the Fund’s portfolio and the Underlying Index resulting from legal restrictions, cash flows or operational inefficiencies.

TABLE OF CONTENTS

ProcureAM ETFs

NOTES TO FINANCIAL STATEMENTS

October 31, 2024(Continued)

Non-Diversification Risk – The Fund is classified as “non-diversified.” This means that the Fund may invest in a large percentage of its assets in securities issued by or representing a small number of issuers. As a result, the Fund may be more susceptible to the risks associated with these particular issuers or to a single economic, political or regulatory occurrence affecting these issuers.

Passive Management Risk – Unlike many investment companies, the Fund is not “actively” managed. Therefore, it would not necessarily sell a security because the security’s issuer was in financial trouble or defaulted on its obligations under the security, or whose credit rating was downgraded, unless that security is removed from the Underlying Index. In addition, the Fund will not otherwise take defensive positions in declining markets unless such positions are reflected in the Underlying Index.

Satellite Companies Concentration Risk – The Fund is considered to be concentrated in securities of companies that operate or utilize satellites which are subject to manufacturing delays, launch delays or failures, and operational and environmental risks (such as signal interference or space debris) that could limit their ability to utilize the satellites needed to deliver services to customers. Some companies that operate or utilize satellites do not carry commercial launch or in orbit insurance for the full value of their satellites and could face significant impairment charges if the satellites experience full or partial failures. Rapid and significant technological changes in the satellite communications industry or in competing terrestrial industries may impair a company’s competitive position and require significant additional capital expenditures. There are also regulatory risks associated with the allocation of orbital positions and spectrum under the International Telecommunication Union (“ITU”) and the regulatory bodies in each of the countries in which companies provide service. In addition, the ground facilities used for controlling satellites or relaying data between Earth and the satellites may be subject to operational and environmental risks (such as natural disasters) or licensing and regulatory risks. If a company does not obtain or maintain regulatory authorizations for its satellites and associated ground facilities, it may not be able to operate its existing satellites or expand its operations.

Securities Lending Risk – There are certain risks associated with securities lending, including the risk that the borrower may fail to return the securities on a timely basis or even the loss of rights in the collateral deposited by the borrower, if the borrower should fail financially. The Fund could also lose money in the event of a decline in the value of collateral provided for loaned securities or a decline in the value of any investments made with cash collateral. As a result, the Fund may lose money.

Small and Mid-Capitalization Securities Risk – The Fund may be subject to the risk that small and mid-capitalization securities may underperform other segments of the equity market or the equity market as a whole. Securities of small and mid-capitalization companies may experience much more price volatility, greater spreads between their bid and ask prices and significantly lower trading volumes than securities issued by large, more established companies. Accordingly, it may be difficult for the Fund to sell small and mid-capitalization securities at a desired time or price. Small and mid-capitalization companies tend to have inexperienced management as well as limited product and market diversification and financial resources. Small and mid-capitalization companies have more speculative prospects for future growth, sustained earnings and market share than large companies, and may be more vulnerable to adverse economic, market or industry developments than large capitalization companies.

Space Industry Risk – The exploration of space by private industry and the utilization of space assets is a business focused on the future and is witnessing new entrants into the market. This is a global event with a growing number of corporate participants looking to meet the future needs of a growing global population. Therefore, investments in the Fund will be riskier than traditional investments in established industry sectors and the growth of these companies may be slower and subject to setbacks as new technology advancements are made to expand into space.

Unidentified Aerial Phenomena (“UAP”) Risk – A UAP, formerly known as an “unidentified flying object” or “UFO”, is a flying object that looks or moves unlike any known aircraft used by the US or any foreign country. Recently, the US military has acknowledged the existence of UAPs and confirmed the authenticity of certain videos and images purporting to show UAPs. Given that currently there is no identification of these observed phenomena, it is possible that UAPs could create unintentional or deliberate operational, data security, “cyber” and other interference with the operation of satellites and other objects in space. Such activities could result in a significant adverse impact on the Fund’s securities, thereby causing the Fund’s investment in such portfolio securities to lose value and adversely affecting the Fund’s ability to fulfill its investment objectives.

TABLE OF CONTENTS

ProcureAM ETFs

NOTES TO FINANCIAL STATEMENTS

October 31, 2024(Continued)

NOTE 4 – COMMITMENTS AND OTHER RELATED PARTY TRANSACTIONS.

Pursuant to an Investment Advisory Agreement (“Advisory Agreement”) between the Trust, on behalf of the Fund, and ProcureAM, LLC (the “Advisor”), the Advisor provides investment advice to the Fund and oversees the day-to-day operations of the Fund, subject to the direction and control of the Board and the officers of the Trust.

Under the Advisory Agreement, the Advisor agrees to pay all expenses of the Trust, except brokerage and other transaction expenses including taxes; extraordinary legal fees or expenses, such as those for litigation or arbitration; compensation and expenses of the Independent Trustees, counsel to the Independent Trustees, and the Trust’s chief compliance officer; extraordinary expenses; distribution fees and expenses paid by the Trust under any distribution plan adopted pursuant to Rule 12b-1 under the 1940 Act; and the advisory fee payable to the Advisor hereunder. For services provided to the Fund, the Fund pays the Adviser 0.75% at an annual rate based on the Fund’s average daily net assets. Certain officers and an Interested Trustee of the Trust are affiliated with the Advisor. Those officers’ and Interested Trustee’s compensation is paid for by the Advisor. The Fund has an expense limitation agreement (ELA) in place limiting the Fund’s expenses to 0.75% of the daily net assets of the Fund with all expenses above 0.75% shall be paid for by the Advisor.

Penserra Capital Management, LLC serves as the Sub-Advisor (the “Sub-Advisor”) to the Fund. The Sub-Advisor has overall responsibility for selecting and continuously monitoring the Fund’s investments. The Advisor compensates the Sub-Advisor for these services under a sub-advisory agreement between the two entities. The Advisor has overall responsibility for overseeing the investment of the Fund’s assets, managing the Fund’s business affairs and providing certain clerical, bookkeeping and other administrative services for the Trust.

U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services (the “Administrator”), provides fund accounting, fund administration, and transfer agency services to the Fund. The Advisor compensates the Administrator for these services under an administration agreement between the two entities. U.S. Bank National Association, an affiliate of U.S. Bank Global Fund Services, serves as the Fund’s custodian pursuant to a custody agreement. Foreside Financial Services, LLC, serves as the Fund’s distributor pursuant to a distribution agreement.

The Fund pays, in the aggregate, each Independent Trustee an annual fee of $12,000. The Chairmen of the Audit Committee, the Valuation Committee and the Nominating and Governance Committee each receive an additional annual fee of $1,000. In addition, the Independent Trustees are reimbursed for all reasonable travel expenses relating to their attendance at Board Meetings. The Fund paid ACA Global Group $6,750 and paid Momentum57 $20,250 over the period November 1, 2023 to October 31, 2024. During the period ended October 31, 2024, the Advisor paid $66,000, in the aggregate, for Trustee and CCO fees on the Fund’s behalf, as a contractual waiver of its management fee. Such contractual waivers are not subject to recoupment by the Advisor. This Agreement with respect to the Fund shall continue in effect until February 28, 2025, and from year to year thereafter provided each such continuance is specifically approved by a majority of the Trustees of the Trust.

NOTE 5 – DISTRIBUTION PLAN

The Fund has adopted a Plan of Distribution pursuant to Rule 12b-1 under the 1940 Act. Under the Plan, the Fund may pay compensation to the Distributor or any other distributor or financial institution with which the Trust has an agreement with respect to the Fund, with the amount of such compensation not to exceed an annual rate of 0.25% of the Fund’s daily average net assets. For the period ended October 31, 2024 the Fund did not incur any 12b-1 expenses.

NOTE 6 – PURCHASES AND SALES OF SECURITIES

The costs of purchases and sales of securities, excluding short-term securities and in-kind transactions, for the period ended October 31, 2024:

| | | | | | | |

Procure Space ETF | | | $16,039,718 | | | $15,945,651 |

| | | | | | | |

TABLE OF CONTENTS

ProcureAM ETFs

NOTES TO FINANCIAL STATEMENTS

October 31, 2024(Continued)

The costs of purchases and sales of in-kind transactions associated with creations and redemptions for the period ended October 31, 2024:

| | | | | | | |

Procure Space ETF | | | $ — | | | $6,535,246 |

| | | | | | | |

For the fiscal year ended October 31, 2024, short-term and long-term gains on in-kind transactions were as follows.

| | | | | | | |

Procure Space ETF | | | $114,843 | | | $273,141 |

| | | | | | | |

There were no purchases or sales of U.S. Government obligations for the period ended October 31, 2024.

During the period ended October 31, 2024, the Fund paid $0 brokerage commissions on trades of securities to Penserra Securities, LLC, an affiliate of the Sub-Adviser.

NOTE 7 – SECURITIES LENDING

The Fund may lend up to 33 1∕3% of the value of the securities in its portfolio to brokers, dealers and financial institutions (but not individuals) under terms of participation in a securities lending program administered by U.S. Bank N.A. (the “Custodian”). The securities lending agreement requires that loans are collateralized at all times in an amount equal to at least 102% of the value of any domestic loaned securities or 105% of the value of any foreign securities at the time of the loan, plus accrued interest. The Fund receives compensation in the form of fees and earned interest on the cash collateral. The amount of fees depends on a number of factors including the type of security and length of the loan. The Fund continues to receive interest payments or dividends on the securities loaned during the borrowing period. Gain or loss in the fair value of securities loaned that may occur during the term of the loan will be for the account of the Fund. The Fund has the right under the terms of the securities lending agreement to recall the securities from the borrower on demand. The cash collateral is invested by the Custodian in accordance with approved investment guidelines. Those guidelines require the cash collateral to be invested in readily marketable, high quality, short-term obligations either directly on behalf of the Fund or through one or more joint accounts, money market funds, or short-term bond funds, including those advised by or affiliated with the Advisor; however, such investments are subject to risk of payment delays or default on the part of the issuer or counterparty or otherwise may not generate sufficient interest to support the costs associated with securities lending. Other investment companies, in which the Fund may invest cash collateral, can be expected to incur fees and expenses for operations, such as investment advisory and administration fees, which would be in addition to those incurred by the Fund, and which may be received in full or in part by the Advisor. Pursuant to guidance issued by the SEC staff, fees and expenses of money market funds used for cash collateral received in connection with loans of securities are not treated as Acquired Fund Fees and Expenses, which reflect a fund’s pro rata share of the fees and expenses incurred by other investment companies in which the Fund invests (as disclosed in the Prospectus, as applicable). The Fund could also experience delays in recovering its securities and possible loss of income or value if the borrower fails to return the borrowed securities, although the Fund is indemnified from this risk by contract with the securities lending agent. The Fund receives cash as collateral in return for securities lent as part of the securities lending program. The collateral is invested in the Mount Vernon Liquid Assets Portfolio, LLC of which the investment objective is to seek to maximize current income to the extent with the preservation of capital and liquidity and maintain a stable NAV of $1.00 per unit. The remaining contractual maturity of all securities lending transactions is overnight and continuous. The Fund manages credit exposure arising from these lending transactions by, in appropriate circumstances, entering into master netting agreements and collateral agreements with third party borrowers that provide the Fund, in the event of default (such as bankruptcy or a borrower’s failure to pay or perform), the right to net a third party borrower’s rights and obligations under such agreement and liquidate and set off collateral against the net amount owed by the counterparty. The net income earned by the Fund on investments of cash collateral received from borrowers for the securities loaned to them are reflected in the Fund’s Statements of Operations. Securities lending income, as disclosed in the Fund’s Statements of Operations, represents the income earned from the investment of cash collateral, net of fee rebates paid to the borrower and net of fees paid to the Custodian as lending agent.

TABLE OF CONTENTS

ProcureAM ETFs

NOTES TO FINANCIAL STATEMENTS

October 31, 2024(Continued)

As of October 31, 2024, the value of the securities on loan and payable for collateral due to broker were as follows:

Value of Securities on Loan Collateral Received

| | | | | | | |

Procure Space ETF | | | $4,063,690 | | | $4,284,023 |

| | | | | | | |

NOTE 8 – FEDERAL INCOME TAXES

The components of distributable earnings/(accumulated deficit) and cost basis of investments for federal income tax purposes at October 31, 2024 were as follows:

| | | | | | | | | | | | | |

Procure Space ETF | | | $48,189,571 | | | $7,030,869 | | | $(16,149,974) | | | $(9,119,105) |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Procure Space ETF | | | $416,879 | | | | | | $(34,973,525) | | | $(9,119,105) | | | $(43,675,751) |

| | | | | | | | | | | | | | | | |

The difference between the cost basis for financial statement and federal income tax purposes was primarily due to the tax deferral of losses from wash sales and Partnership adjustments.

As of October 31, 2024, the Fund had accumulated capital loss carryovers of:

| | | | | | | | | | |

Procure Space ETF | | | $15,442,805 | | | $19,529,824 | | | Indefinite |

| | | | | | | | | | |

Under current tax law, late-year ordinary losses realized after December 31 of a Fund’s fiscal year may be deferred and treated as occurring on the first business day of the following fiscal year for tax purposes. The Fund deferred $0 of late-year ordinary losses for the tax year ending October 31, 2024.

U.S. GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications relate to redemptions in-kind and have no effect on net assets or net asset value per share.

For the fiscal year ended October 31, 2024, the following table shows the reclassifications made:

| | | | | | | |

Procure Space ETF | | | $(93,094) | | | $93,094 |

| | | | | | | |

The tax character of distributions paid by the Fund during the fiscal year ended October 31, 2023, and the year ended October 31, 2024 as follows:

| | | | | | | |

Procure Space ETF | | | $505,948 | | | $1,154,486 |

| | | | | | | |

TABLE OF CONTENTS

ProcureAM ETFs

NOTES TO FINANCIAL STATEMENTS

October 31, 2024(Continued)

NOTE 9 – OTHER INFORMATION

Based on a recommendation by the Advisor, the Board of Trustees of Procure ETF Trust II approved the liquidation of the Procure Disaster Recovery Strategy ETF. The fund liquidated on October 24, 2024.

NOTE 10 – SUBSEQUENT EVENTS

In preparing these financial statements, management has evaluated events and transactions for potential recognition or disclosure through the date the financial statements were issued. There were no other events or transactions that occurred during the period subsequent to the end of the current period that materially impacted the amounts or disclosures in the Fund’s financial statements through the date the financial statements were issue.

TABLE OF CONTENTS

ProcureAM ETFs

REPORT OF independent REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders of Procure Space ETF and Board of Trustees of

Procure ETF Trust II

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Procure ETF Trust II comprising Procure Space ETF (the “Fund”) as of October 31, 2024, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of October 31, 2024, the results of its operations for the year then ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of October 31, 2024, by correspondence with the custodian and brokers. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor for one or more ProcureAM, LLC’s investment companies since 2018.

COHEN & COMPANY, LTD.

Philadelphia, Pennsylvania

December 23, 2024

TABLE OF CONTENTS

ProcureAM ETFs

SUPPLEMENTARY INFORMATION

October 31, 2024 (Unaudited)

NOTE 1 – FREQUENCY DISTRIBUTION OF PREMIUMS AND DISCOUNTS

Information regarding how often shares of the Fund traded on the Exchange at a price above (i.e., at a premium) or below (i.e., at a discount) the NAV is available on the Fund’s website at www.ProcureETFs.com.

NOTE 2 – FEDERAL TAX INFORMATION

Qualified Dividend Income/Dividends Received Deduction

For the fiscal period/year ended October 31, 2024, certain dividends paid by the Fund may be subject to a maximum tax rate of 23.8%, as provided for by the Jobs and Growth Tax Reconciliation Act of 2003. The percentage of dividends declared from ordinary income designated as qualified dividend income was as follows:

For corporate shareholders, the percent of ordinary income distributions qualifying for the corporate dividends received deduction for the fiscal period/year ended October 31, 2022 was as follows:

NOTE 3 – INFORMATION ABOUT PORTFOLIO HOLDINGS

The Fund filed their complete schedules of portfolio holdings for their first and third fiscal quarters with the Securities and Exchange Commission (“SEC”) on Part F of Form N-PORT. The Fund’s Part F of Form N-PORT is available on the website of the SEC at www.sec.gov. The Fund’s portfolio holdings are posted on its website at www.ProcureETFS.com daily.

NOTE 4 – INFORMATION ABOUT PROXY VOTING

A description of the policies and procedures the Fund uses to determine how to vote proxies relating to portfolio securities is provided in the Statement of Additional Information (“SAI”). The SAI is available without charge upon request by calling toll-free at 1-866-690-3837, by accessing the SEC’s website at www.sec.gov, or by accessing the Fund’s website at www.ProcureETFs.com.

Information regarding how the Fund voted proxies relating to portfolio securities during the period ending June 30 is available by calling toll-free at 1-866-690-3837 or by accessing the SEC’s website at www.sec.gov.

TABLE OF CONTENTS

ProcureAM, LLC Trust II

PRIVACY POLICY AND PROCEDURES

April 30, 2023

ProcureAM has adopted policies and procedures to protect the “nonpublic personal information” of natural person consumers and customers and to disclose to such persons, policies and procedures for protecting that information. Nonpublic personal information includes nonpublic “personally identifiable financial information” plus any list, description or grouping of customers that is derived from nonpublic personally identifiable financial information. Such information may include personal financial and account information, information relating to services performed for or transactions entered into on behalf of clients, advice provided by ProcureAM to clients, and data or analyses derived from such nonpublic personal information. ProcureAM must also comply with the California Financial Information Privacy Act (SB1) if the Firm does business with California consumers.

Regulation S-ID – Applicability of Identity Theft Red Flag Rules

An adviser registered or required to be registered with the SEC that falls within the scope of the SEC’s Identity Theft Red Flag Rules (the “Rules”) is required to adopt policies and procedures to detect and respond appropriately to identity theft red flags.

An adviser that is a “financial institution” or “creditor” that offers and maintains one or more “covered accounts” is required to adopt and implement a written Identity Theft Prevention Program with respect to all “covered accounts”. For purposes of the Rules, identity theft is referred to as a fraud committed or attempted using the identifying information of another person without authority.

The Managing Partners along with the CCO are responsible for reviewing, maintaining and enforcing these policies and procedures to ensure meeting ProcureAM’s client privacy goals and objectives while at a minimum ensuring compliance with applicable federal and state laws and regulations.

ProcureAM has adopted the following procedures to implement, review, monitor and ensure the Firm’s policy is observed, implemented properly and amended or updated, as appropriate:

ProcureAM maintains safeguards to comply with federal and state standards to guard each client’s nonpublic personal information. ProcureAM does not share any nonpublic personal or information on a consolidated basis with any nonaffiliated third parties, except in the following circumstances:

| • | As necessary to provide the service that the client has requested or authorized, or to maintain and service the client’s account; |

| • | As required by regulatory authorities or law enforcement officials who have jurisdiction over ProcureAM, or as otherwise required by any applicable law; |

| • | To the extent reasonably necessary to prevent fraud and unauthorized transactions. |

Employees are prohibited, either during or after termination of their employment, from disclosing nonpublic personal information to any person or entity outside ProcureAM, including family members, except under the circumstances described above. An employee is permitted to disclose nonpublic personal information only to such other employees who need to have access to such information to deliver our services to the client.

TABLE OF CONTENTS

Advisor

ProcureAM, LLC

16 Firebush Road

Levittown, PA 19056

Sub-Advisor

Penserra Capital Management, LLC

4 Orinda Way, Suite 100-A

Orinda, CA 94563

Distributor

Quasar Distributors, LLC

111 E. Kilbourn Ave, Suite 2200

Milwaukee, WI 53202

Custodian

U.S. Bank National Association

Custody Operations

1555 North River Center Drive, Suite 302

Milwaukee, WI 53212

Fund Accountant, Transfer Agent and Fund Administrator

U.S. Bank Global Fund Services

615 East Michigan Street

Milwaukee, WI 53202

Independent Registered Public Accounting Firm

Cohen & Company, Ltd.

1835 Market St., Suite 310

Philadelphia, PA 19103

Legal Counsel

K&L Gates

599 Lexington Avenue

New York, NY 10022

(b) Financial Highlights are included within the financial statements filed under Item 7(a) of this Form.

Item 8. Changes in and Disagreements with Accountants for Open-End Investment Companies.

None for the period contained within this report.

Item 9. Proxy Disclosure for Open-End Investment Companies.

None for the period contained within this report.

Item 10. Remuneration Paid to Directors, Officers, and Others of Open-End Investment Companies.

Each current Independent Trustee is paid an annual retainer of $13,000, $12,000 for serving as a trustee and $1 ,000 for serving as chair of a committee,for his or her services as a Board member to the Trust, together with out-of-pocket expenses in accordance with the Board’s policy on travel and other business expenses relating to attendance at meetings.

Independent Trustee fees are paid by the adviser to each series of the Trust through the applicable adviser’s unitary management fee, and not by the Fund. Annual Trustee fees may be reviewed periodically and changed by the Board.

The Trust does not have a bonus, profit sharing, pension or retirement plan.

Item 11. Statement Regarding Basis for Approval of Investment Advisory Contract.

APPROVAL OF ADVISORY AGREEMENTS AND BOARD CONSIDERATIONS

The Board (the members of which are referred to as “Trustees”) of the Trust met telephonically on December 15, 2023, to consider the UFO renewal and continuance of (1) the Advisory Agreement between the Trust, on behalf of the Fund, and the Advisor and (2) the investment sub-advisory agreement (the “Sub-Advisory Agreement”) between the Advisor and the Sub-Advisor. The Board considered the Advisory Agreement and the Sub-Advisory Agreement and the continued engagements of the Advisor and the Sub-Advisor separately.

In accordance with Section 15(c) of the 1940 Act, the Board requested, reviewed and considered materials furnished by the Advisor and the Sub-Advisor relevant to the Board’s consideration of whether to renew each of the Advisory Agreement and Sub-Advisory Agreement. In connection with considering approval of the Advisory Agreement and Sub-Advisory Agreement, the Trustees who are not “interested persons” of the Trust, as that term is defined in the 1940 Act (the “Independent Trustees”), met in executive session with counsel to the Trust, who provided assistance and advice. The consideration of the Advisory Agreement and Sub-Advisory Agreement was conducted by both the full Board and the Independent Trustees, who also voted separately.

During their review and consideration, the Board and the Independent Trustees focused on and analyzed the factors they deemed relevant, including: (1) the nature, extent and quality of the services provided by each of the Advisor and the Sub-Advisor; (2) the investment performance of each of the Advisor and the Sub-Advisor; (3) the costs of the services to be provided and profits to be realized by each of the Advisor and the Sub-Advisor and their affiliates from the relationship with the Trust; (4) the extent to which economies of scale would be realized as the Fund grows; (5) any benefits derived or to be derived by each of the Advisor and the Sub-Advisor from the relationship with the Trust; (6) potential conflicts of interest; and (7) other key information.