WHO KNOWLES INTELLIGENT AUDIO? APRIL 3, 2019 WWW.THEFUTUREOFKNOWLES.COM

Additional Information 2 • THIS PRESENTATION AND THE VIEWS EXPRESSED HEREIN ARE ONLY TO BE USED TO PROVIDE GENERAL INFORMATION REGARDING KNOWLES CORPORATION (“KNOWLES” OR THE “COMPANY”) . THIS PRESENTATION AND THE VIEWS EXPRESSED HEREIN DO NOT HAVE REGARD TO THE SPECIFIC INVESTMENT OBJECTIVE, FINANCIAL SITUATION, SUITABILITY, OR THE PARTICULAR NEED OF ANY SPECIFIC PERSON WHO MAY RECEIVE THIS PRESENTATION, AND SHOULD NOT BE TAKEN AS ADVICE ON THE MERITS OF ANY INVESTMENT DECISION . THE VIEWS EXPRESSED HEREIN REPRESENT THE CURRENT OPINIONS AS OF THE DATE HEREOF OF CALIGAN AND FALCON EDGE AND ARE DERIVED FROM PUBLICLY AVAILABLE INFORMATION AND THE ANALYSIS OF CALIGAN AND FALCON EDGE REGARDING THE COMPANY . CERTAIN FINANCIAL INFORMATION AND DATA USED HEREIN HAVE BEEN DERIVED OR OBTAINED FROM, WITHOUT INDEPENDENT VERIFICATION, FROM PUBLIC FILINGS, INCLUDING FILINGS MADE BY THE COMPANY WITH THE SECURITIES AND EXCHANGE COMMISSION (“SEC”), AND OTHER SOURCES . • THIS PRESENTATION DOES NOT CONSTITUTE AN OFFER TO SELL OR A SOLICITATION OF AN OFFER TO BUY ANY SECURITY DESCRIBED HEREIN IN ANY JURISDICTION TO ANY PERSON, NOR DOES IT CONSTITUTE A FINANCIAL PROMOTION, INVESTMENT ADVICE OR AN INDUCEMENT OR AN INCITEMENT TO PARTICIPATE IN ANY PRODUCT, OFFERING OR INVESTMENT . THIS PRESENTATION IS INFORMATIONAL ONLY AND SHOULD NOT BE USED AS THE BASIS FOR ANY INVESTMENT DECISION, NOR SHOULD IT BE RELIED UPON FOR LEGAL, ACCOUNTING OR TAX ADVICE OR INVESTMENT RECOMMENDATIONS OR FOR ANY OTHER PURPOSE . NO REPRESENTATION OR WARRANTY IS MADE THAT CALIGAN’S INVESTMENT PROCESSES OR INVESTMENT OBJECTIVES WILL OR ARE LIKELY TO BE ACHIEVED OR SUCCESSFUL OR THAT CALIGAN’S INVESTMENT WILL MAKE ANY PROFIT OR WILL NOT SUSTAIN LOSSES . PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS . • CALIGAN AND FALCON EDGE HAVE NOT SOUGHT OR OBTAINED CONSENT FROM ANY THIRD PARTY TO USE ANY STATEMENTS OR INFORMATION INDICATED HEREIN AS HAVING BEEN OBTAINED OR DERIVED FROM STATEMENTS MADE OR PUBLISHED BY THIRD PARTIES . ANY SUCH STATEMENTS OR INFORMATION SHOULD NOT BE VIEWED AS INDICATING THE SUPPORT OF SUCH THIRD PARTY FOR THE VIEWS EXPRESSED HEREIN . NO WARRANTY IS MADE THAT DATA OR INFORMATION, WHETHER DERIVED OR OBTAINED FROM FILINGS MADE WITH THE SEC OR FROM ANY THIRD PARTY, ARE ACCURATE . • EXCEPT FOR THE HISTORICAL INFORMATION CONTAINED HEREIN, THE MATTERS ADDRESSED IN THIS PRESENTATION, INCLUDING PROJECTIONS, MARKET OUTLOOKS, ASSUMPTIONS AND ESTIMATES, ARE FORWARD - LOOKING STATEMENTS THAT ARE BASED ON CERTAIN ASSUMPTIONS, AND INVOLVE CERTAIN RISKS AND UNCERTAINTIES, INCLUDING RISKS AND CHANGES AFFECTING INDUSTRIES GENERALLY AND THE COMPANY SPECIFICALLY . YOU SHOULD BE AWARE THAT PROJECTIONS AND OTHER FORWARD - LOOKING STATEMENTS ARE INHERENTLY UNCERTAIN, AND ACTUAL RESULTS MAY DIFFER FROM THE PROJECTIONS AND OTHER FORWARD LOOKING STATEMENTS CONTAINED HEREIN DUE TO REASONS THAT MAY OR MAY NOT BE FORESEEABLE . NO REPRESENTATION, WARRANTY OR UNDERTAKING, EXPRESS OR IMPLIED, IS MADE AS TO THE ACCURACY OR REASONABLENESS OF THE ASSUMPTIONS UNDERLYING THE PROJECTIONS AND OTHER FORWARD LOOKING STATEMENTS CONTAINED HEREIN OR TO THE ACCURACY OR COMPLETENESS OF THE INFORMATION OR VIEWS CONTAINED HEREIN . • NEITHER CALIGAN NOR FALCON EDGE SHALL NOT BE RESPONSIBLE OR HAVE ANY LIABILITY FOR ANY MISINFORMATION CONTAINED IN ANY SEC FILING, ANY THIRD PARTY REPORT OR THIS PRESENTATION . ALL AMOUNTS, MARKET VALUE INFORMATION AND ESTIMATES INCLUDED IN THIS PRESENTATION HAVE BEEN OBTAINED FROM OUTSIDE SOURCES THAT CALIGAN AND FALCON EDGE BELIEVE TO BE RELIABLE OR REPRESENT THE BEST JUDGMENT OF CALIGAN AND FALCON EDGE AS OF THE DATE OF THIS PRESENTATION . • CALIGAN AND FALCON EDGE RESERVE THE RIGHT TO CHANGE OR MODIFY ANY OF ITS OPINIONS EXPRESSED HEREIN AT ANY TIME AS IT DEEMS APPROPRIATE . CALIGAN AND FALCON EDGE DISCLAIM ANY OBLIGATION TO UPDATE THE INFORMATION CONTAINED HEREIN .

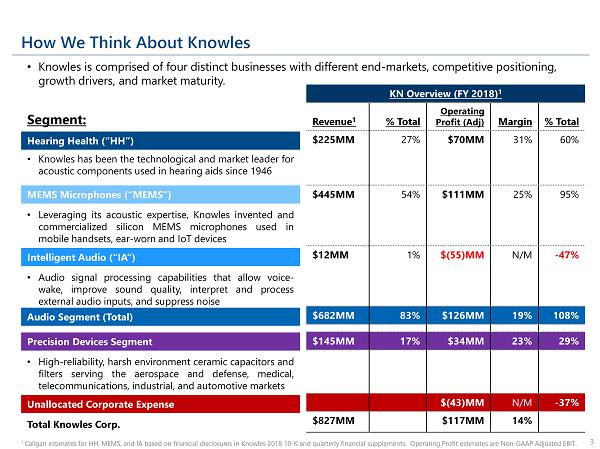

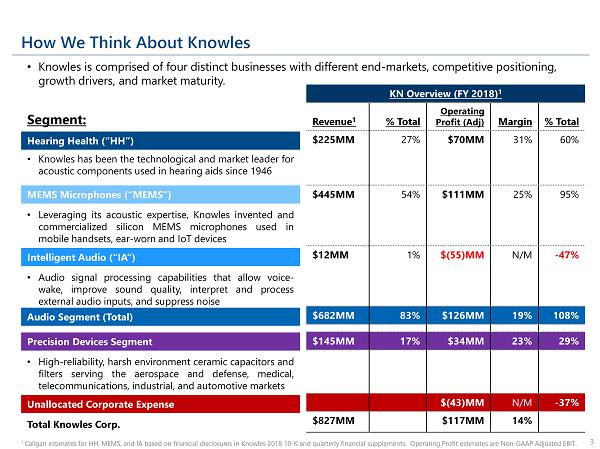

How We Think About Knowles 3 • Knowles is comprised of four distinct businesses with different end - markets, competitive positioning, growth drivers, and market maturity. Segment: 1 Caligan estimates for HH, MEMS, and IA based on financial disclosures in Knowles 2018 10 - K and quarterly financial supplements. Operating Profit estimates are Non - GAAP Adjusted EBIT. Hearing Health (“HH”) • Knowles has been the technological and market leader for acoustic components used in hearing aids since 1946 MEMS Microphones (“MEMS”) • Leveraging its acoustic expertise, Knowles invented and commercialized silicon MEMS microphones used in mobile handsets, ear - worn and IoT devices Intelligent Audio (“IA”) • Audio signal processing capabilities that allow voice - wake, improve sound quality, interpret and process external audio inputs, and suppress noise Precision Devices Segment • High - reliability, harsh environment ceramic capacitors and filters serving the aerospace and defense, medical, telecommunications, industrial, and automotive markets KN Overview (FY 2018) 1 Revenue 1 % Total Operating Profit (Adj) Margin % Total $225MM 27% $70MM 31% 60% $445MM 54% $111MM 25% 95% $12MM 1% $(55)MM N/M - 47% $682MM 83% $126MM 19% 108% $145MM 17% $34MM 23% 29% $(43)MM N/M - 37% $827MM $117MM 14% Audio Segment (Total) Unallocated Corporate Expense Total Knowles Corp.

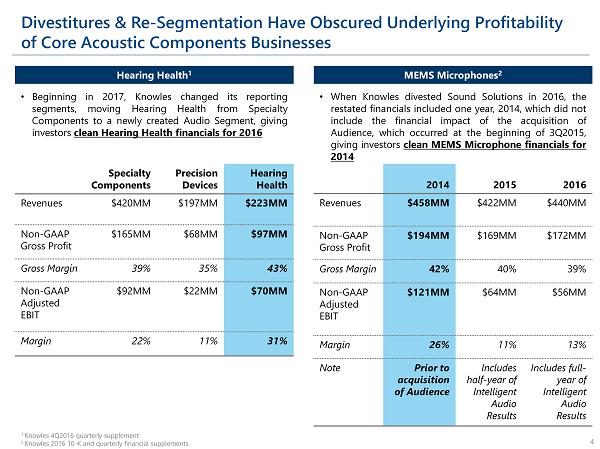

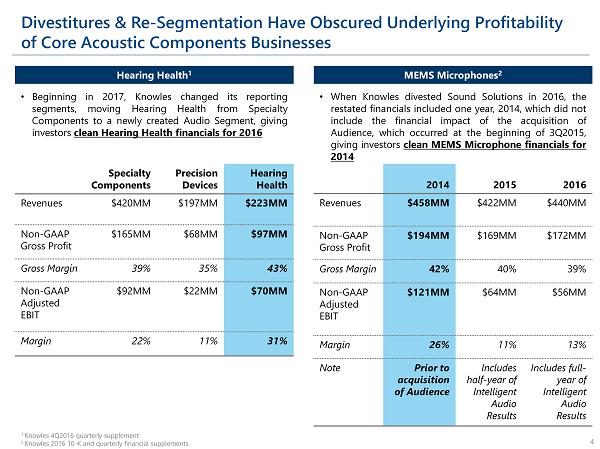

Divestitures & Re - Segmentation Have Obscured Underlying Profitability of Core Acoustic Components Businesses 4 Hearing Health 1 MEMS Microphones 2 • Beginning in 2017 , Knowles changed its reporting segments, moving Hearing Health from Specialty Components to a newly created Audio Segment, giving investors clean Hearing Health financials for 2016 Specialty Components Precision Devices Hearing Health Revenues $420MM $197MM $223MM Non - GAAP Gross Profit $165MM $68MM $97MM Gross Margin 39% 35% 43% Non - GAAP Adjusted EBIT $92MM $22MM $70MM Margin 22% 11% 31% • When Knowles divested Sound Solutions in 2016 , the restated financials included one year, 2014 , which did not include the financial impact of the acquisition of Audience, which occurred at the beginning of 3 Q 2015 , giving investors clean MEMS Microphone financials for 2014 2014 2015 2016 Revenues $458MM $422MM $440MM Non - GAAP Gross Profit $194MM $169MM $172MM Gross Margin 42% 40% 39% Non - GAAP Adjusted EBIT $121MM $64MM $56MM Margin 26% 11% 13% Note Prior to acquisition of Audience Includes half - year of Intelligent Audio Results Includes full - year of Intelligent Audio Results 1 Knowles 4Q2016 quarterly supplement 2 Knowles 2016 10 - K and quarterly financial supplements

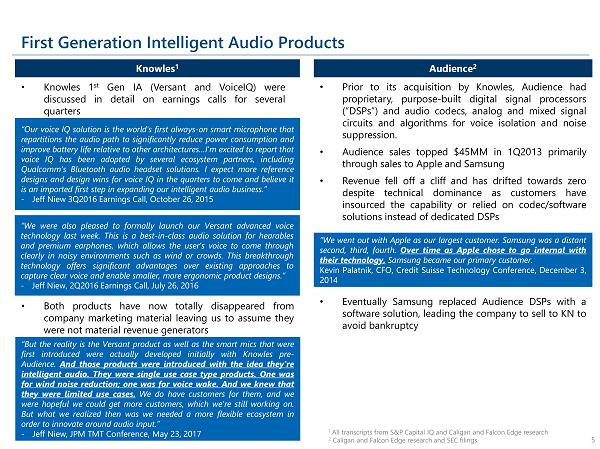

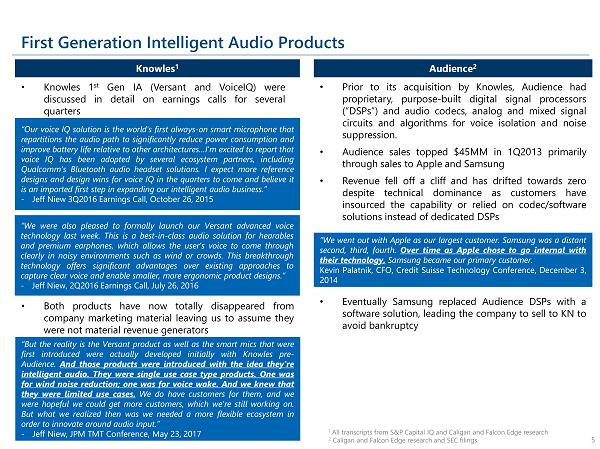

First Generation Intelligent Audio Products • Knowles 1 st Gen IA (Versant and VoiceIQ) were discussed in detail on earnings calls for several quarters • Prior to its acquisition by Knowles, Audience had proprietary, purpose - built digital signal processors (“DSPs”) and audio codecs, analog and mixed signal circuits and algorithms for voice isolation and noise suppression . • Audience sales topped $ 45 MM in 1 Q 2013 primarily through sales to Apple and Samsung • Revenue fell off a cliff and has drifted towards zero despite technical dominance as customers have insourced the capability or relied on codec/software solutions instead of dedicated DSPs • Eventually Samsung replaced Audience DSPs with a software solution, leading the company to sell to KN to avoid bankruptcy 5 “Our voice IQ solution is the world's first always - on smart microphone that repartitions the audio path to significantly reduce power consumption and improve battery life relative to other architectures … I'm excited to report that voice IQ has been adopted by several ecosystem partners, including Qualcomm's Bluetooth audio headset solutions . I expect more reference designs and design wins for voice IQ in the quarters to come and believe it is an imported first step in expanding our intelligent audio business . ” - Jeff Niew 3 Q 2016 Earnings Call, October 26 , 2015 “We were also pleased to formally launch our Versant advanced voice technology last week . This is a best - in - class audio solution for hearables and premium earphones, which allows the user's voice to come through clearly in noisy environments such as wind or crowds . This breakthrough technology offers significant advantages over existing approaches to capture clear voice and enable smaller, more ergonomic product designs . ” - Jeff Niew, 2 Q 2016 Earnings Call, July 26 , 2016 • Both products have now totally disappeared from company marketing material leaving us to assume they were not material revenue generators “We went out with Apple as our largest customer . Samsung was a distant second, third, fourth . Over time as Apple chose to go internal with their technology, Samsung became our primary customer . Kevin Palatnik, CFO, Credit Suisse Technology Conference, December 3 , 2014 Knowles 1 Audience 2 1 All transcripts from S&P Capital IQ and Caligan and Falcon Edge research 2 Caligan and Falcon Edge research and SEC filings “But the reality is the Versant product as well as the smart mics that were first introduced were actually developed initially with Knowles pre - Audience . And those products were introduced with the idea they're intelligent audio . They were single use case type products . One was for wind noise reduction ; one was for voice wake . And we knew that they were limited use cases . We do have customers for them, and we were hopeful we could get more customers, which we're still working on . But what we realized then was we needed a more flexible ecosystem in order to innovate around audio input . ” - Jeff Niew, JPM TMT Conference, May 23 , 2017

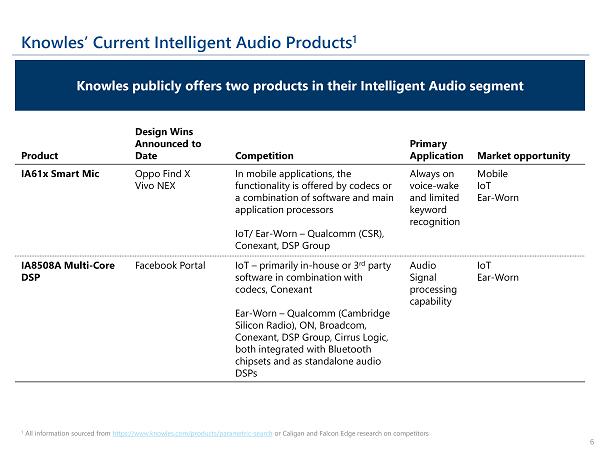

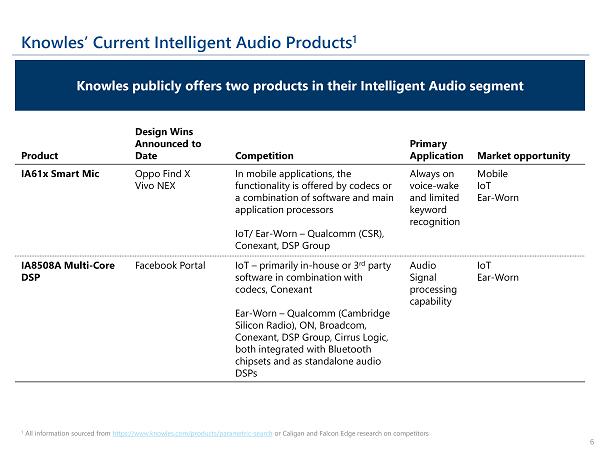

Knowles’ Current Intelligent Audio Products 1 Product Design Wins Announced to Date Competition Primary Application Market opportunity IA61x Smart Mic Oppo Find X Vivo NEX In mobile applications, the functionality is offered by codecs or a combination of software and main application processors IoT/ Ear - Worn – Qualcomm (CSR), Conexant, DSP Group Always on voice - wake and limited keyword recognition Mobile IoT Ear - Worn IA8508A Multi - Core DSP Facebook Portal IoT – primarily in - house or 3 rd party software in combination with codecs, Conexant Ear - Worn – Qualcomm (Cambridge Silicon Radio), ON, Broadcom, Conexant, DSP Group, Cirrus Logic, both integrated with Bluetooth chipsets and as standalone audio DSPs Audio Signal processing capability IoT Ear - Worn 1 All information sourced from https://www.knowles.com/products/parametric - search or Caligan and Falcon Edge research on competitors 6 Knowles publicly offers two products in their Intelligent Audio segment

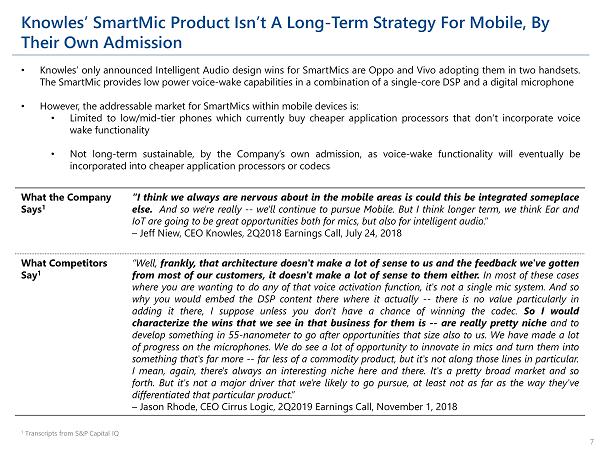

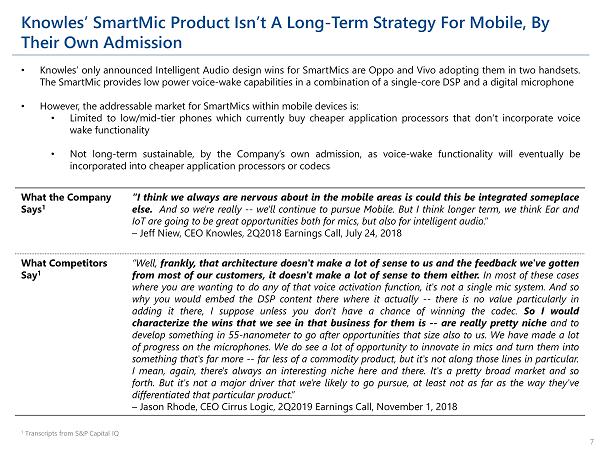

Knowles’ SmartMic Product Isn’t A Long - Term Strategy For Mobile, By Their Own Admission 7 1 Transcripts from S&P Capital IQ What the Company Says 1 “I think we always are nervous about in the mobile areas is could this be integrated someplace else . And so we're really -- we'll continue to pursue Mobile . But I think longer term, we think Ear and IoT are going to be great opportunities both for mics, but also for intelligent audio . ” – Jeff Niew , CEO Knowles, 2 Q 2018 Earnings Call, July 24 , 2018 What Competitors Say 1 “Well, frankly, that architecture doesn't make a lot of sense to us and the feedback we've gotten from most of our customers, it doesn't make a lot of sense to them either . In most of these cases where you are wanting to do any of that voice activation function, it's not a single mic system . And so why you would embed the DSP content there where it actually -- there is no value particularly in adding it there, I suppose unless you don't have a chance of winning the codec . So I would characterize the wins that we see in that business for them is -- are really pretty niche and to develop something in 55 - nanometer to go after opportunities that size also to us . We have made a lot of progress on the microphones . We do see a lot of opportunity to innovate in mics and turn them into something that's far more -- far less of a commodity product, but it's not along those lines in particular . I mean, again, there's always an interesting niche here and there . It's a pretty broad market and so forth . But it's not a major driver that we're likely to go pursue, at least not as far as the way they've differentiated that particular product . ” – Jason Rhode, CEO Cirrus Logic, 2 Q 2019 Earnings Call, November 1 , 2018 • Knowles’ only announced Intelligent Audio design wins for SmartMics are Oppo and Vivo adopting them in two handsets . The SmartMic provides low power voice - wake capabilities in a combination of a single - core DSP and a digital microphone • However, the addressable market for SmartMics within mobile devices is : • Limited to low/mid - tier phones which currently buy cheaper application processors that don’t incorporate voice wake functionality • Not long - term sustainable, by the Company’s own admission, as voice - wake functionality will eventually be incorporated into cheaper application processors or codecs

Sell - Side Research Has Publicly Questioned The Market Opportunity and Knowles’ Competitive Positioning In Intelligent Audio for Years 8 Issue JPM August 3, 2018 Research Report JPM April 2, 2019 Research Report Caligan/Falcon Edge Commentary Intelligent Audio Competes with Larger, Well - Resourced Competitors; Knowles Has Not Told Investors How it Plans to Differentiate Itself “Though KN has also discussed its long - term total available market (TAM) opportunity in smart audio potentially reaching ~ $ 1 billion over time, we think a significant portion of the TAM is at or driven by industry titans such as Apple, Google, Amazon and Samsung which have all chosen a different path to address the audio chain through competing processors and by applying homegrown software and algorithms . Moreover, as requirements for increased intelligence at the edge in audio will likely increase over time , it could curtail KN’s growth opportunity as we look beyond the next few years, especially as other competitors put additional emphasis on addressing the market (by addressing in the main processor and through software) . We also point out that as 5 G becomes more pervasive from 2020 (and beyond) any latency benefits of having smart audio at the edge currently could become less relevant in the 5 G era . As we look at the current direct competitive landscape, we see pockets of strength from established competitors such as Cirrus Logic (CRUS, not covered) in premium smartphones, CSR, part of Qualcomm (QCOM, not covered) in wireless earbuds and Synaptics (SYNA, covered by J . P . Morgan’s Paul Coster ) which acquired audio business segments from Conexant and Marvell . ” “ When we downgraded Knowles in August 2018 , we cautioned investors on the near - term growth potential of IA and pointed out the competitive threats in the business . ” Knowles should provide some explanation or guidance around the TAM/SAM and their relative strengths . How is Knowles competing against key incumbents and new entrants? All sourced from JP Morgan Equity Research on Knowles published on April 2 , 2019 and August 3 , 2018 • Longstanding questions regarding the market opportunity and Knowles’ strategy for Intelligent Audio remain unanswered

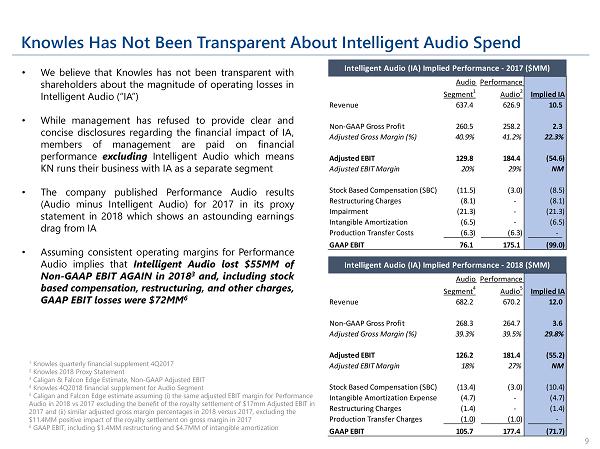

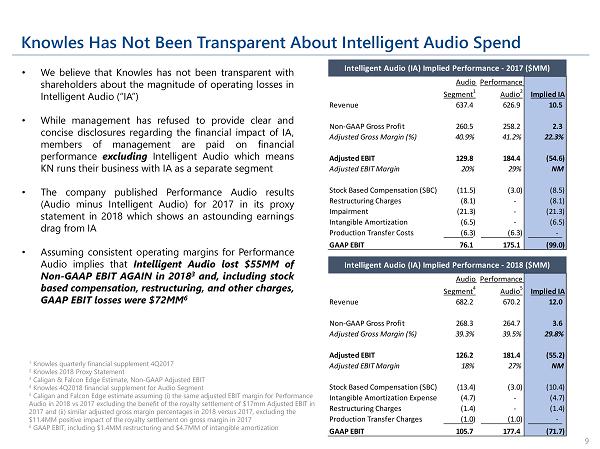

Knowles Has Not Been Transparent About Intelligent Audio Spend 9 • We believe that Knowles has not been transparent with shareholders about the magnitude of operating losses in Intelligent Audio (“IA”) • While management has refused to provide clear and concise disclosures regarding the financial impact of IA, members of management are paid on financial performance excluding Intelligent Audio which means KN runs their business with IA as a separate segment • The company published Performance Audio results (Audio minus Intelligent Audio) for 2017 in its proxy statement in 2018 which shows an astounding earnings drag from IA • Assuming consistent operating margins for Performance Audio implies that Intelligent Audio lost $ 55 MM of Non - GAAP EBIT AGAIN in 2018 3 and, including stock based compensation, restructuring, and other charges, GAAP EBIT losses were $ 72 MM 6 1 Knowles quarterly financial supplement 4Q2017 2 Knowles 2018 Proxy Statement 3 Caligan & Falcon Edge Estimate, Non - GAAP Adjusted EBIT 4 Knowles 4Q2018 financial supplement for Audio Segment 5 Caligan and Falcon Edge estimate assuming ( i ) the same adjusted EBIT margin for Performance Audio in 2018 vs 2017 excluding the benefit of the royalty settlement of $17mm Adjusted EBIT in 2017 and (ii) similar adjusted gross margin percentages in 2018 versus 2017, excluding the $11.4MM positive impact of the royalty settlement on gross margin in 2017 6 GAAP EBIT, including $1.4MM restructuring and $4.7MM of intangible amortization Audio Segment 4 Performance Audio 5 Implied IA Revenue 682.2 670.2 12.0 Non-GAAP Gross Profit 268.3 264.7 3.6 Adjusted Gross Margin (%) 39.3% 39.5% 29.8% Adjusted EBIT 126.2 181.4 (55.2) Adjusted EBIT Margin 18% 27% NM Stock Based Compensation (SBC) (13.4) (3.0) (10.4) Intangible Amortization Expense (4.7) - (4.7) Restructuring Charges (1.4) - (1.4) Production Transfer Charges (1.0) (1.0) - GAAP EBIT 105.7 177.4 (71.7) Intelligent Audio (IA) Implied Performance - 2018 ($MM) Audio Segment 1 Performance Audio 2 Implied IA Revenue 637.4 626.9 10.5 Non-GAAP Gross Profit 260.5 258.2 2.3 Adjusted Gross Margin (%) 40.9% 41.2% 22.3% Adjusted EBIT 129.8 184.4 (54.6) Adjusted EBIT Margin 20% 29% NM Stock Based Compensation (SBC) (11.5) (3.0) (8.5) Restructuring Charges (8.1) - (8.1) Impairment (21.3) - (21.3) Intangible Amortization (6.5) - (6.5) Production Transfer Costs (6.3) (6.3) - GAAP EBIT 76.1 175.1 (99.0) Intelligent Audio (IA) Implied Performance - 2017 ($MM)

15 20 25 30 35 40 45 50 55 1Q2015 2Q2015 3Q2015 4Q2015 1Q2016 2Q2016 3Q2016 4Q2016 1Q2017 2Q2017 3Q2017 4Q2017 1Q2018 2Q2018 3Q2018 4Q2018 Quarterly Non - GAAP Operating Expenses ($MM) ~$4MM quarterly opex increase Pre - Audience Acquisition: $25mm Quarterly Run - Rate Post - Audience Acquisition: $39mm Quarterly Run - Rate Audio Segment Shows Massive Expense Increase Post - Audience Acquisition 10 Source : SEC Filings, Caligan and Falcon Edge estimates of $ 27 . 6 MM of annualized HH non - GAAP operating expenses in 2017 and 2018 . 4 Q 2017 expenses adjusted upward by $ 5 . 6 MM by removing the positive expense impact of the royalty settlement Quarterly Non - GAAP Operating Expenses For Performance Audio, Intelligent Audio, & Unallocated Corporate ($MM) Acquisition of Audience “ Lastly, we achieved our goal of $ 25 million in annual cost savings associated with the integration of Audience by the end of Q 1 . ” – Jeff Niew ( 1 Q 2016 Earnings Call, 4 / 25 / 16 ) $10MM quarterly reduction

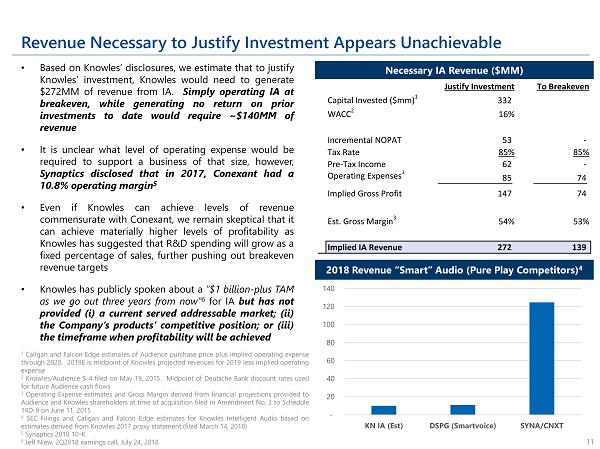

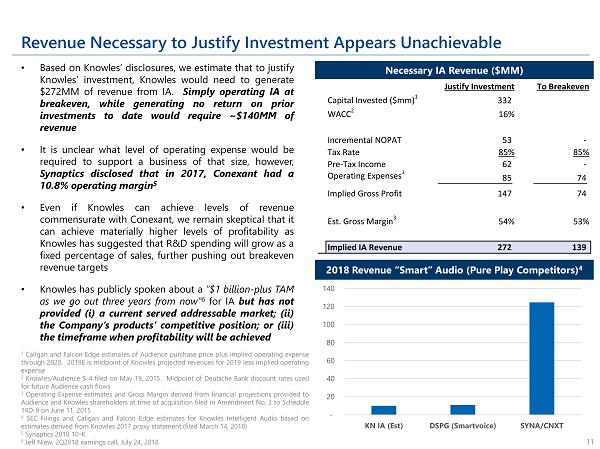

Revenue Necessary to Justify Investment Appears Unachievable 11 1 Caligan and Falcon Edge estimates of Audience purchase price plus implied operating expense through 2020 . 2019 E is midpoint of Knowles projected revenues for 2019 less implied operating expense 2 Knowles/Audience S - 4 filed on May 19 , 2015 . Midpoint of Deutsche Bank discount rates used for future Audience cash flows 3 Operating Expense estimates and Gross Margin derived from financial projections provided to Audience and Knowles shareholders at time of acquisition filed in Amendment No . 3 to Schedule 14 D - 9 on June 11 , 2015 4 SEC Filings and Caligan and Falcon Edge estimates for Knowles Intelligent Audio based on estimates derived from Knowles 2017 proxy statement (filed March 14 , 2018 ) 5 Synaptics 2018 10 - K 6 Jeff Niew, 2 Q 2018 earnings call, July 24 , 2018 2018 Revenue “Smart” Audio (Pure Play Competitors) 4 • Based on Knowles’ disclosures, we estimate that to justify Knowles’ investment, Knowles would need to generate $ 272 MM of revenue from IA . Simply operating IA at breakeven, while generating no return on prior investments to date would require ~ $ 140 MM of revenue • It is unclear what level of operating expense would be required to support a business of that size, however, Synaptics disclosed that in 2017 , Conexant had a 10 . 8 % operating margin 5 • Even if Knowles can achieve levels of revenue commensurate with Conexant, we remain skeptical that it can achieve materially higher levels of profitability as Knowles has suggested that R&D spending will grow as a fixed percentage of sales, further pushing out breakeven revenue targets • Knowles has publicly spoken about a “ $ 1 billion - plus TAM as we go out three years from now” 6 for IA but has not provided ( i ) a current served addressable market ; (ii) the Company’s products’ competitive position ; or (iii) the timeframe when profitability will be achieved - 20 40 60 80 100 120 140 KN IA (Est) DSPG (Smartvoice) SYNA/CNXT Justify Investment To Breakeven Capital Invested ($mm) 1 332 WACC 2 16% Incremental NOPAT 53 - Tax Rate 85% 85% Pre-Tax Income 62 - Operating Expenses 3 85 74 Implied Gross Profit 147 74 Est. Gross Margin 3 54% 53% Implied IA Revenue 272 139 Necessary IA Revenue ($MM)

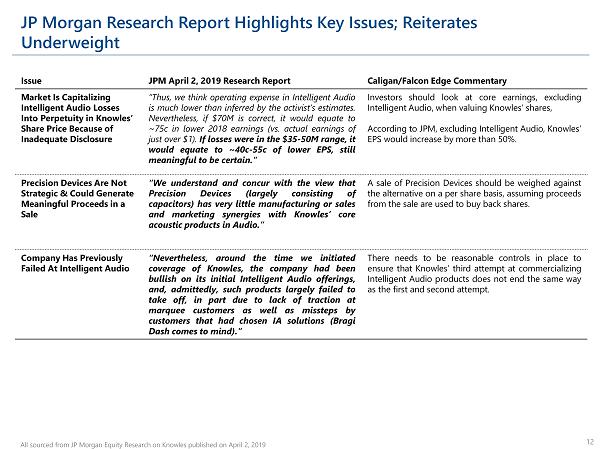

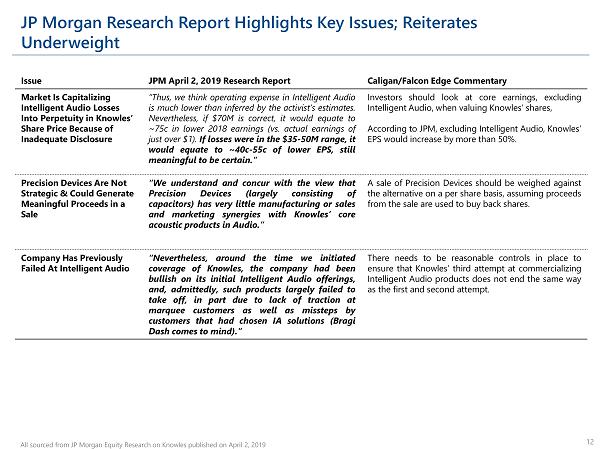

JP Morgan Research Report Highlights Key Issues; Reiterates Underweight 12 Issue JPM April 2, 2019 Research Report Caligan/Falcon Edge Commentary Market Is Capitalizing Intelligent Audio Losses Into Perpetuity in Knowles’ Share Price Because of Inadequate Disclosure “Thus, we think operating expense in Intelligent Audio is much lower than inferred by the activist’s estimates . Nevertheless, if $ 70 M is correct, it would equate to ~ 75 c in lower 2018 earnings (vs . actual earnings of just over $ 1 ) . If losses were in the $ 35 - 50 M range, it would equate to ~ 40 c - 55 c of lower EPS, still meaningful to be certain . ” Investors should look at core earnings, excluding Intelligent Audio, when valuing Knowles’ shares, According to JPM, excluding Intelligent Audio, Knowles’ EPS would increase by more than 50 % . Precision Devices Are Not Strategic & Could Generate Meaningful Proceeds in a Sale “We understand and concur with the view that Precision Devices (largely consisting of capacitors) has very little manufacturing or sales and marketing synergies with Knowles’ core acoustic products in Audio . ” A sale of Precision Devices should be weighed against the alternative on a per share basis, assuming proceeds from the sale are used to buy back shares . Company Has Previously Failed At Intelligent Audio “Nevertheless, around the time we initiated coverage of Knowles, the company had been bullish on its initial Intelligent Audio offerings, and, admittedly, such products largely failed to take off, in part due to lack of traction at marquee customers as well as missteps by customers that had chosen IA solutions ( Bragi Dash comes to mind) . ” There needs to be reasonable controls in place to ensure that Knowles’ third attempt at commercializing Intelligent Audio products does not end the same way as the first and second attempt . All sourced from JP Morgan Equity Research on Knowles published on April 2 , 2019

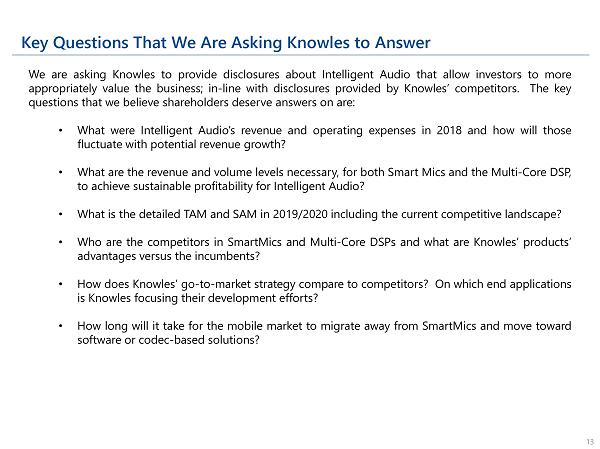

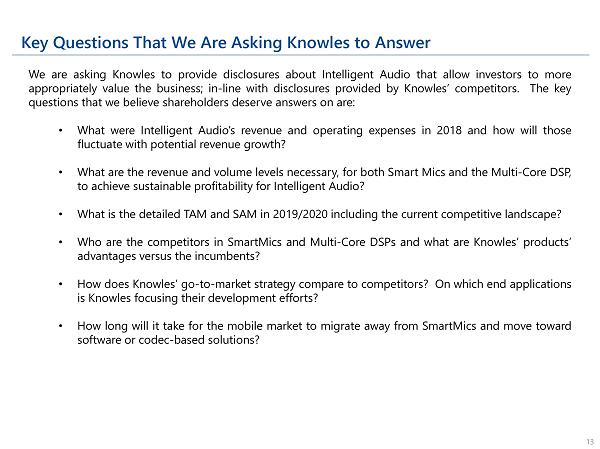

Key Questions That We Are Asking Knowles to Answer 13 We are asking Knowles to provide disclosures about Intelligent Audio that allow investors to more appropriately value the business ; in - line with disclosures provided by Knowles’ competitors . The key questions that we believe shareholders deserve answers on are : • What were Intelligent Audio’s revenue and operating expenses in 2018 and how will those fluctuate with potential revenue growth? • What are the revenue and volume levels necessary, for both Smart Mics and the Multi - Core DSP, to achieve sustainable profitability for Intelligent Audio? • What is the detailed TAM and SAM in 2019 / 2020 including the current competitive landscape? • Who are the competitors in SmartMics and Multi - Core DSPs and what are Knowles’ products’ advantages versus the incumbents? • How does Knowles’ go - to - market strategy compare to competitors? On which end applications is Knowles focusing their development efforts? • How long will it take for the mobile market to migrate away from SmartMics and move toward software or codec - based solutions?

Contacts & Additional Information 14 Investors Edward McCarthy / Geoffrey Weinberg / Peter Aymar D . F . King & Co . , Inc . ( 212 ) 269 - 5550 KN@dfking . com Press Robert Laman Mark Cho Caligan Partners, LP Falcon Edge Capital, LP + 1 ( 646 ) 859 - 8205 + 1 ( 212 ) 230 - 2295 rl@caliganpartners . com MCho@falconedgecap . com F or Additional Information IR@caliganpartners . com www . thefutureofknowles . com IMPORTANT INFORMATION ABOUT PROXY PARTICIPANTS Caligan , Caligan CV I LP, Samuel Merksamer, David Johnson, Falcon Edge, Falcon Edge Global Master Fund, LP, Moraine Master Fund, LP, Richard Gerson and Jonathan Christodoro (collectively, the “Participants”) intend to file with the SEC a definitive proxy statement and accompanying form of proxy to be used in connection with the solicitation of proxies from the stockholders of the Company . All stockholders of the Company are advised to read the definitive proxy statement and other documents related to the solicitation of proxies by the Participants when they become available, as they will contain important information, including additional information related to the Participants . The definitive proxy statement and an accompanying proxy card will be furnished to some or all of the Company’s stockholders and will be, along with other relevant documents, available at no charge on the SEC website at http : //www . sec . gov/ and from the Participants' proxy solicitor, D . F . King & Co . , Inc, by requesting a copy via email to KN@dfking . com . Information about the Participants and a description of its direct or indirect interests by security holdings is contained in the Schedule 14 A filed by Caligan with the SEC on March 29 , 2019 . This document is available free of charge from the sources indicated above .