SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant o

Filed by a Party other than the Registrant x

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| x | Soliciting Material Under Rule 14a-12 |

Anika Therapeutics, Inc.

(Name of Registrant as Specified in Its Charter)

Caligan Partners LP

Caligan Partners Master Fund LP

David Johnson

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| x | No fee required. |

| | |

| o | Fee paid previously with preliminary materials. |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

On February 21, 2023, Caligan Partners LP (“Caligan”) issued a press release regarding Anika Therapeutics, Inc. (the “Company”) in the form provided in Exhibit 1. Certain information related to the anticipated participants in a future proxy solicitation with respect to the 2023 annual meeting of stockholders of the Company and a description of such anticipated participants’ direct or indirect interests, by security holdings or otherwise, is attached as Exhibit 2.

Exhibit 1

Caligan Partners Issues Open Letter to Anika Board

Believes Current Board’s Strategic Missteps and Poor Capital Allocation Has Led to Significant Underperformance

Offers Three Actions for Significant Change, Including Strategic Review

NEW YORK, Feb. 21, 2023/PRNewswire/--Caligan Partners LP (“Caligan”), one of the largest shareholders of Anika Therapeutics, Inc. (NASDAQ: ANIK) (“Anika” or the “Company”), today issued an open letter to the board of directors of Anika in connection with Anika’s poor share performance, caused by the heavy losses it is incurring in its joint preservation segment, and its failure to maximize the value of Anika's viscosupplement portfolio.

The full text of the letter is in the attached PDF.

----

February 21, 2023

The Board of Directors

Anika Therapeutics, Inc.

32 Wiggins Avenue

Bedford, MA 01730

Attn: Jeff Thompson, Chairman

c/o Dr. Cheryl Blanchard, CEO

Dear Mr. Thompson and Members of the Board of Directors,

As you know, Caligan Partners LP (“Caligan,” “we” or “us”) is a major shareholder of Anika Therapeutics, Inc. (the “Company” or “Anika”), with beneficial ownership of ~4% of Anika's outstanding shares of common stock.

After months of diligence, analysis, and engagement with you, we strongly believe that Anika’s current strategy of incurring heavy losses in the joint preservation segment it acquired impairs the intrinsic value of Anika’s market-leading viscosupplement portfolio, Monovisc and Orthovisc[1].

After patiently engaging with Anika's board of directors (the “Board”) and management team over the past five months, we believe now is the time for a public discussion about Anika's future. We believe that:

[1] See Appendix 1 for a discussion on the viscosupplement market and the competitive positioning and value of Monovisc and Orthovisc.

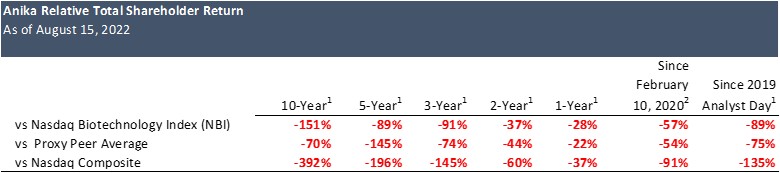

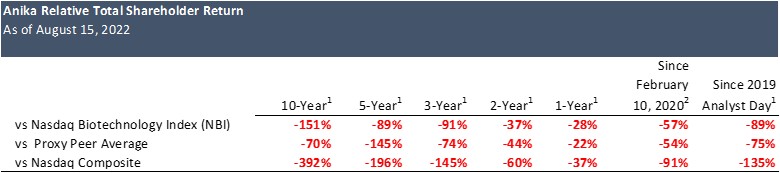

| 1) | Anika Has Materially Underperformed its Peer Group & Broader Indices: Despite Anika's well-capitalized balance sheet with ~$90MM in cash, no debt, and positive adjusted EBITDA, Anika’s total shareholder return (TSR) has underperformed both its self-selected peer group[2] and broader indices over all relevant time horizons. |

| 2) | Anika’s Underperformance Can Be Attributed to Two Key Issues: |

| a. | Investor concern on the product differentiation and losses in the Company’s Joint Preservation and Restoration (“JP”) segment; and |

| b. | A loss of investor confidence in management after consistently missing JP segment guidance and withdrawing 2024 financial targets. |

| 3) | Anika’s Viscosupplement Portfolio Will Not Be Appropriately Valued by Public Markets: Anika’s viscosupplement portfolio, with established, market-leading positions in osteoarthritis and an efficient commercialization strategy, is characterized by low market growth and high profitability, attributes that are more highly valued by private markets than public markets. |

Section 1: Anika Has Underperformed Peers and Benchmarks Over Relevant Time Periods

Unlike most public life sciences companies, Anika has a fortress balance sheet and significant profitability from its viscosupplement portfolio. Despite these inherent advantages, the Company’s stock price has significantly underperformed both its self-selected proxy peer group and relevant benchmarks, including the NBI, over all time periods.

Source: S&P Capital IQ, Bloomberg

1 As of August 15, 2022, the day which Caligan began accumulating shares of Anika

2 Dr. Blanchard became CEO on February 10, 2020

Anika's EV/Revenue Multiples are Significantly Below Proxy Peers

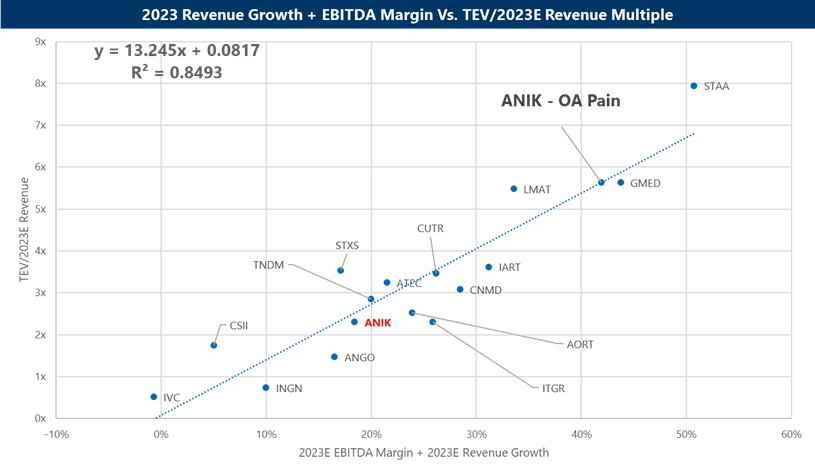

Anika trades at one of the lowest EV/Revenue multiple of any of its proxy peers—just 1.6x FY2023 consensus revenue estimates[3]—reflecting what we interpret is the public markets’ deeply cautious view of Anika’s present and future prospects. Four years ago, when Johnson & Johnson (J&J) represented more than 70% of Anika’s total revenues, Anika traded at a 3% valuation premium to its medical device peer group[4]:

[2] As disclosed on page 33 of Anika's proxy statement for its 2022 annual meeting of shareholders.

[3] S&P Capital IQ, as of August 15, 2022, the day which Caligan began acquiring shares of Anika

[4] ANIK’s medical device proxy peers defined as GKOS, ORGO, SRDX, VCEL, OFIX, AXGN, ATRC, AORT.

However, after the Company announced a new strategy of using cash flows from J&J to fund a strategic pivot into JP at its September 2019 Investor Day, Anika’s forward revenue trading multiple started to collapse, dropping ~68%. Now the Company trades at a ~60% discount to its peers.[5] Due to the low quality and high resource intensity of the assets Anika acquired, investors have punished Anika’s attempts to diversify with a lower trading multiple.

Section 2: Our Observed Reasons For Anika’s Underperformance

Investor Concern Regarding Company’s Losses In Joint Preservation And Negative Returns on Capital

Analysts and investors have noted that the Joint Preservation segment’s products are predominantly made up of less innovative 510k products[6] and have highlighted the segment’s material drag on overall profitability post-acquisitions.[7]

[5] Figures as of August 15, 2022.

[6] “510k Approved Devices are Lower Risk but also Less Differentiated.” – UBS, July 15, 2021

[7] “incremental investments to drive sustainable growth longer term continue to pressure the near-term outlook.” – Stephens, March 18, 2022

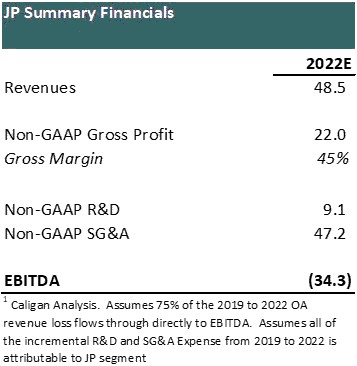

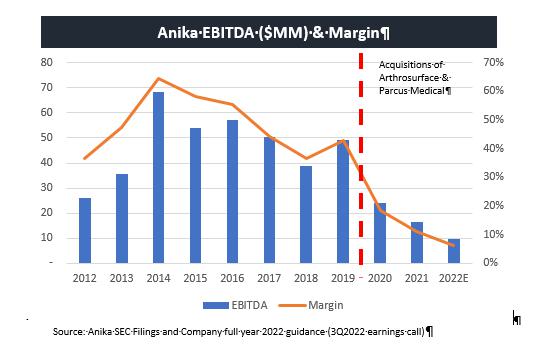

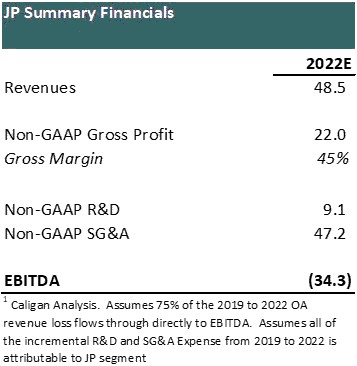

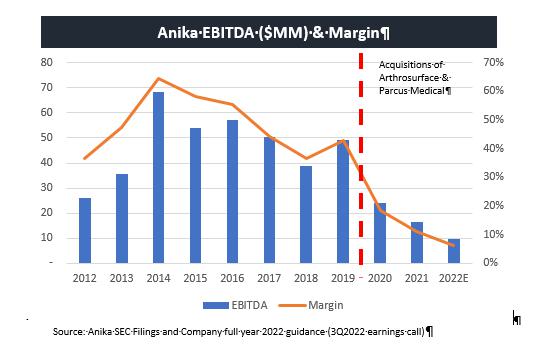

A basic examination of Anika’s financials demonstrates that, even assuming the OA pain management revenue loss post-COVID flowed through to Anika’s bottom line, Anika’s Joint Preservation Segment is operating at a ~$35MM loss annually. We calculate that, just for the segment to break even, Anika would need to grow JP revenue by 150%, with no incremental operating expense. This implies losses for more than a decade for a segment that the Company has guided to grow “low- to mid- single digits” in 2022.[8]

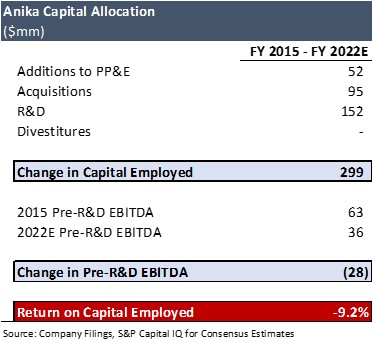

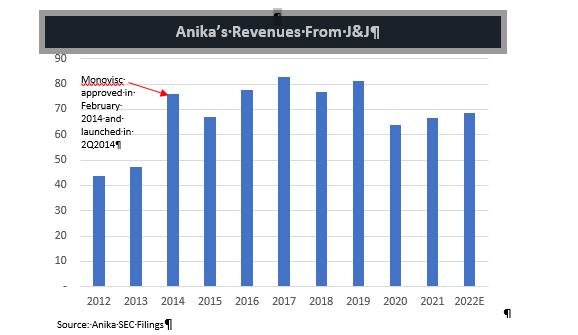

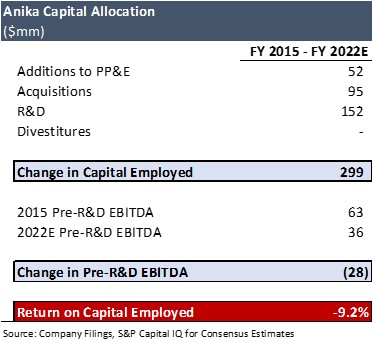

Since FY2015 (when Anika’s revenues from J&J were ~$67MM), Anika has invested ~$300MM of shareholder capital in R&D, acquisitions, and capital expenditures. In FY2022, consensus estimates for Anika’s revenues from J&J are ~$68MM and Anika’s Pre-R&D EBITDA is $28MM less than it was in FY 2015. In other words, Anika’s ~$300MM of investment has resulted in a -9.2% return for shareholders. All while Anika’s most profitable assets—revenues from Monovisc and Orthovisc—haven't changed.

[8] S&P Capital IQ. 3Q2022 earnings transcript.

Loss of Credibility

Setting appropriate long-term targets and executing against those targets is essential for any company to build trust with the investment community. At its 2021 Investor Day, more than a year after the COVID-19 pandemic’s impact to its business were well-known, Dr. Cheryl Blanchard, CEO, conveyed management's revenue and EBITDA targets, which implied doubling FY2019's revenue and a 20% adjusted EBITDA margin by 2024.[9]

By March 2022, not even 9 months later, management withdrew these 2024 targets. The reaction from sell-side analysts was predictable with one analyst writing “no sense of an alternative timetable or even a reasonable basis for why the targets remained achievable was provided. Given how often and how confidently the 2024 targets had been discussed and defended by Anika leadership, we think the mere two sentences utilized during the conference call to communicate that the 2024 targets were no longer valid left much to be desired.”[10]

Anika’s shares fell -14.3% on March 9, 2022, the day after withdrawing the 2024 guidance, underperforming the XBI by -19.2%.

Similarly damaging to management credibility and a further indictment of the quality of the JP segment and management’s ability to accurately forecast it, since the Company acquired Arthrosurface and Parcus, Anika has had to cut its initial guidance every single year in the JP segment.[11]

Section 3: Anika’s Viscosupplement Business Will Struggle To Be Valued Appropriately By Public Markets

Anika’s public disclosure surrounding its viscosupplement products is opaque, which we believe causes the public markets to struggle to appropriately value the OA segment. We believe this is because Anika commingles its financial reporting of a high margin royalty stream from the osteoarthritis pain management segment (OA Segment) with the revenues, development, and commercial infrastructure costs of the JP segment. And though Anika mandatorily discloses its total revenue from J&J, the form of that revenue—product sales versus royalty—and associated costs are not specifically enumerated.

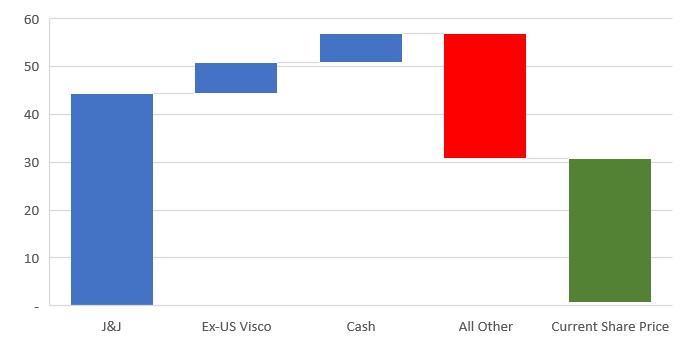

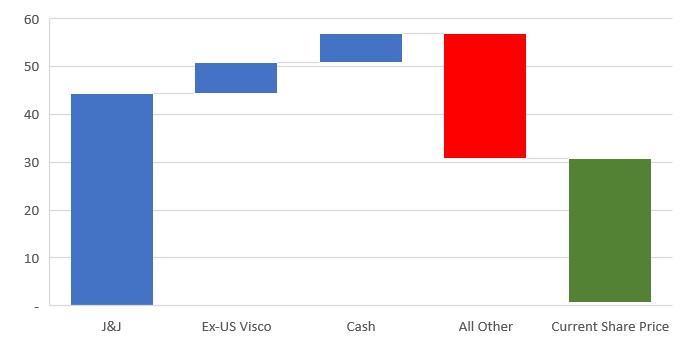

Either the public markets are placing an unreasonably high discount rate on the revenue stream from Monovisc and Orthovisc or, contrarily, assuming a reasonable discount rate on Anika’s revenues from J&J, we believe the public markets are currently implying Anika’s JP segment represents NEGATIVE VALUE of ~$400MM (~$26/share).

[9] Dr Cheryl Blanchard, 2021 Investor Day Transcript, S&P Capital IQ. Dr. Blanchard stated that the Company expects to “double our 2019 revenue in mid-teens revenue CAGR, driving to an adjusted gross margin that expands to greater than 70% and double-digit adjusted EBITDA growth run rate by 2024, which gets us to a greater than 20% adjusted EBITDA margin.”

[10] Barrington Research, March 9, 2022.

[11] S&P Capital IQ. Earnings transcripts 4Q2019, 1Q2020 withdrawing guidance altogether. 4Q2020, Company expected full year joint preservation revenue growth in “upper 20s to low 30s percent range”, in 3Q2021, guidance reduced to “upper teens”. In 4Q2021, guidance was for “mid-single digits to low teens” and in 3Q2022, guidance for JP was lowered to “low to mid -single digit.”

Note: Caligan analysis. J&J revenues valued at 10% discount rate and $68MM revenue run-rate. Ex-US Visco revenues valued at 20% discount rate.

As illustrated above in the sum-of-the parts chart, the upside in addressing the losses in the JP segment is considerable and indicates that Anika can be worth ~$60 per share, more than double the current share price, by exiting the JP segment and removing the associated losses.

Section 4: The Path Forward

Given Anika's perpetual underperformance and significant shareholder capital being wasted in JP, we believe the status quo is untenable and urgent changes are needed. Anika would benefit by evaluating the following options with the help of outside advisors:

| 1) | Exiting Joint Preservation and Returning Capital To Shareholders: Anika’s misguided foray in joint preservation has not generated the revenue growth necessary to justify the heavy losses incurred. Nor, given the repeated guidance cuts, does Anika have any reasonable basis to suggest they can accurately forecast the segment will grow at a level in the future that justifies the current losses. Anika’s shareholders would be better off making their own capital allocation decisions with the profits from the viscosupplement business via share buybacks. |

| 2) | Strategic Review: While Caligan strongly believes that public life sciences companies are bought—not sold—the public markets are not appropriately valuing the cash flow of Anika's viscosupplement portfolio. Given the nature of Anika’s most valuable assets, low growth and high profit, Anika may be better positioned as a private company or as part of a larger organization. |

| 3) | Fresh Perspectives: Given the current board’s lack of accountability for the shareholder value destruction that has occurred under their watch, we believe that in conjunction with a review of Anika’s strategic options, fresh perspectives are needed. Caligan believes Anika needs new directors on its Board; those who are willing to objectively look at the JP segment and appropriately assess its prospects amongst alternative uses of capital. |

Next Steps

We have attempted to engage in constructive discussions with Anika for the last five months, but Anika's Board and management have been reluctant to acknowledge that losses associated with the JP segment have resulted in substantial shareholder value destruction and remain unwilling to consider alternative solutions to improve share price performance.

Therefore, we intend to consider all available options to us, including nominating a slate of well-qualified directors for election to the Board at the Company's 2023 Annual Meeting of Shareholders, who we believe would be positioned to help reset Anika’s strategic direction and unlock significant value for shareholders.

David Johnson

Managing Partner

Caligan Partners LP

Appendix 1

Viscosupplement Market Overview

Hyaluronic acid (HA) is a naturally occurring polymer found throughout the body that facilitates joint health and tissue function. Anika manufactures a non-animal sourced cross-linked HA which allows for longer residence time and can support extended pain relief from osteoarthritis (OA). OA is a chronic, painful, degenerative joint disease and is the leading cause of disability.

There are an estimated 14 million individuals suffering from symptomatic knee OA in the US; predominantly older Americans. An aging population and higher proportion of obesity lead to market growth higher than overall population growth. While there are 31 million individuals with osteoarthritis in general (beyond the knee), HA is currently only indicated for the knee in the US, but in all joints in most ex-US countries. In 2019, 2.4 million HA viscosupplementation procedures were performed in the US, representing a $1BN+ market across all treatment regimens.12

In the current treatment paradigm for OA pain, HA injections are administered after a patient fails corticosteroid injections but before a patient receives a total knee replacement (TKR). Corticosteroids provide short-acting pain relief that wears off quickly while HA tends have a longer duration of effect with a delayed onset. For clinicians, a single injection regimen is favorable from an economic standpoint, increasing physician productivity and reducing the burden of multiple treatments for patients.

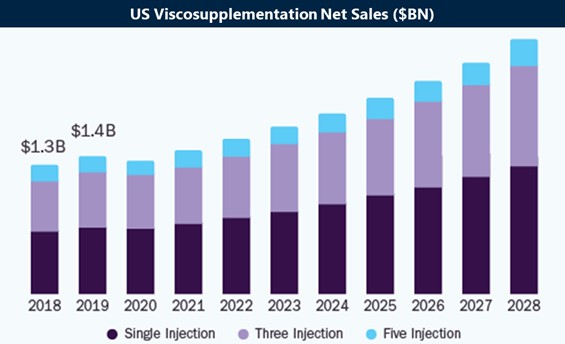

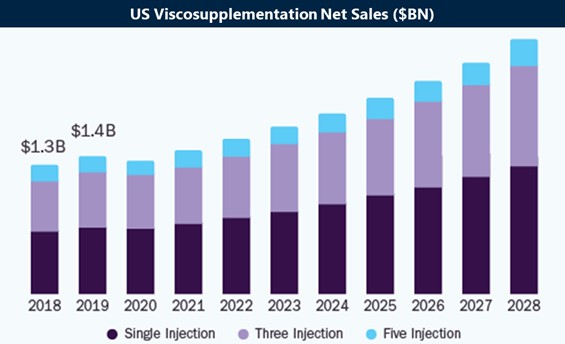

Grand View Research[12] projects that the US viscosupplement market will grow at an 8.4% CAGR from 2021-2028 driven by increasing demand for non-surgical treatments for OA, increased prevalence of poor lifestyle-caused disorders, and advancements in the development of HA-based therapies.

Source: Grand View Research

Viscosupplement injections are predominantly performed at ambulatory surgery centers (ASCs) and the patient is discharged within a few hours of the procedure. Japan is the 2nd largest market for viscosupplements globally, after the US.

[12] Grand View Research, Caligan Research

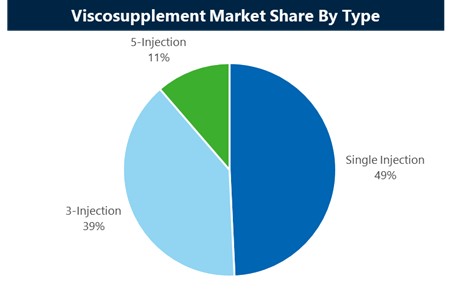

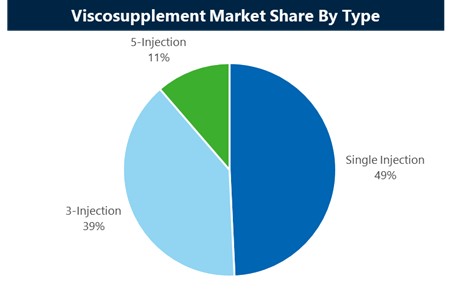

The convenience of a single injection drives growth in this category at the expense of declining utilization of the three- and five injection regimens. The single-injection market is projected to grow at a mid-single-digit CAGR and the three-injection market and five-injection markets are projected to decline in the low-single digits and low to mid-teens, respectively.12

Source: JP Morgan, Caligan Research

Monovisc & Orthovisc Market Positioning

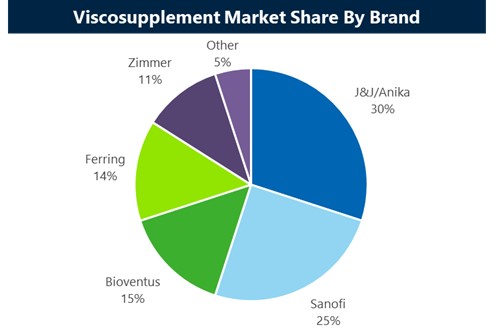

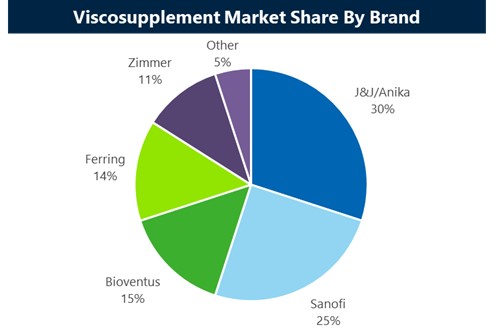

Anika’s key HA products, Monovisc (single-injection) and Orthovisc (three-injection), are marketed by J&J’s subsidiary, Depuy Synthes; a highly resource efficient go-to-market strategy for Anika. Through a combination of an excellent product profile (safety/efficacy) and the commercial expertise of J&J, Monovisc and Orthovisc have the largest combined market share of the viscosupplement market.

Source: JP Morgan, Caligan Research

On each of Monovisc and Orthovisc, Anika receives:

| · | a transfer price calculated with reference to historical end-user prices in the market; and |

| · | a fixed royalty rate per product on net product sales |

The net result of this relationships is that Anika receives ~30% of the end sales of Monovisc and Orthovisc[13]. The blended gross margin on those revenues is ~75% with ~33% operating margins.

Source: Anika 2019 Investor Day Presentation, slide 176

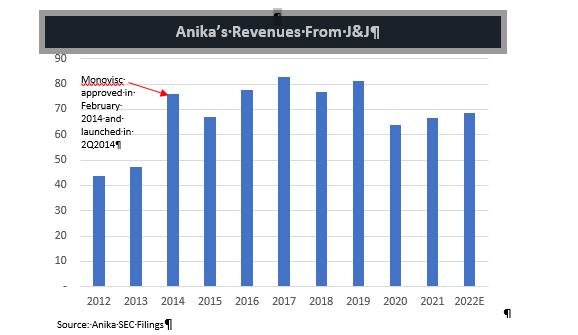

Anika’s revenues from the J&J partnership were relatively steady from 2017 – 2019 at ~$80MM; COVID impacted elective procedure volume and some competitive single injection regimens took market share in 2020 - 2021 though those headwinds have largely stabilized.

Prior to Anika’s strategic pivot into joint preservation, 71% of Anika’s revenues were from the J&J relationship and 21% of Anika’s revenues were from international distributors who sold Monovisc,

[13] Anika 2019 Investor Day, slide 176

Orthovisc, and Cingal (a steroid/HA combination not approved in the US) in non-US markets. Driven by this resource-efficient commercialization strategy, in 2019, Anika achieved 75% gross margins and 43% EBITDA margins. In 2022, Anika’s guidance for Adjusted EBITDA margins are now mid-single digits, reflecting the excessive losses in the JP segment.

Value of Anika’s Viscosupplement Portfolio

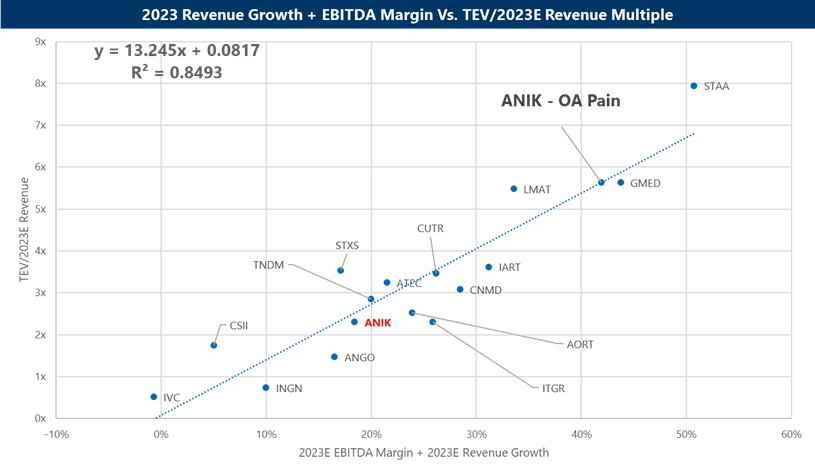

Public markets efficiently (near perfect correlation, see chart below) value small and mid-cap life sciences companies based on their profitability relative to their top-line growth profile. Caligan believes, based on the strong regression shown below, on a standalone basis (fully burdened by corporate costs and Cingal R&D), Anika’s OA pain management segment would be valued at ~5.8x 2023 revenue/14.2x 2023 EBITDA, which implies an EV of $580MM. For a potential acquirer that could easily eliminate Anika’s excessive corporate costs and decide the optimal path forward for Cingal, pro-forma EBITDA margins could be in the mid-50 percent range. Consistent with our earlier analysis, this implies that based on the existing, approved viscosupplement portfolio alone, Anika could be worth almost $60 per share, double the current share price.

Source: S&P CapitalIQ. As of December 5, 2022. Caligan Estimates Anika OA Pain 2023 Revenue of $100MM and $43MM of OA EBITDA. 2019 OA Revenue of $104MM and 2019 OA EBITDA of $49MM yielded a 43% OA EBITDA margin.

About Caligan Partners LP

Caligan Partners LP (“Caligan”) is an SEC-registered investment advisor focused on active engagement with small and midcap companies within life sciences.

No Offer or Solicitation

This letter is for informational purposes only and shall not constitute an offer to sell or the solicitation of an offer to buy any securities pursuant to the transaction or otherwise, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Forward-Looking Statements and Third-Party Statements

This letter contains a number of forward-looking statements. Words such as “plan,” “believe,” “anticipate,” “reflect,” “invest,” “see,” “make,” “expect,” “deliver,” “drive,” “improve,” “intend,” “assess,” “remain,” “evaluate,” “establish,” “focus,” “build,” “turn,” “expand,” “leverage,” “grow,” “will,” and variations of such words and similar future or conditional expressions are intended to identify forward-looking statements. Examples of forward-looking statements include, but are not limited to, statements regarding Caligan’s plans, impacts of accounting standards and guidance, growth, legal matters, taxes, costs and cost savings, impairments, dividends, expectations, investments, innovations, opportunities, capabilities, execution, initiatives, and pipeline. These forward-looking statements reflect management’s current expectations and are not guarantees of future performance and are subject to a number of risks and uncertainties, many of which are difficult to predict and beyond the Issuer’s control. Caligan disclaims and does not undertake any obligation to update, revise, or withdraw any forward-looking statement in this press release, except as required by applicable law or regulation.

Caligan has not sought or obtained consent from any third party to use any statements or information indicated herein as having been obtained or derived from statements made or published by third parties.

Important Information

Caligan, together with certain other affiliates who are expected to be participants (the “Participants”) in solicitation of shareholders of the Company in connection with its 2023 annual meeting of shareholders (the “2023 Annual Meeting”), intend to file a definitive proxy statement and accompanying proxy card with the Securities and Exchange Commission (the “SEC”) in anticipation of such solicitation. Shareholders are advised to read the definitive proxy statement and any other documents related to the 2023 Annual Meeting when they become available because they will contain important information.

Information about the Participants and a description of their direct or indirect interests by security holdings is contained in an exhibit to the Schedule 14A filed by Caligan on February 21, 2023, which is available free of charge on the SEC website at www.sec.gov. The definitive proxy statement, when filed, and other relevant documents, will also be available on the SEC website, free of charge.

Exhibit 2

CERTAIN INFORMATION REGARDING THE PARTICIPANTS

The potential participants in the proxy solicitation (the “Participants”) in connection with the 2023 Annual Meeting are anticipated to include Caligan Partners LP, a Delaware limited partnership (“Caligan”), David Johnson (“Mr. Johnson”), and Caligan Partners Master Fund LP, a Cayman Islands limited partnership (“Caligan Master Fund”).

Caligan Partners GP LLC (“Caligan GP”) is the general partner of Caligan, which serves as the management company for certain investment funds managed by Caligan (the “Caligan Funds”). Caligan GP is controlled by David Johnson. Each of Caligan and David Johnson, by virtue of their relationships to the Caligan Funds (collectively, the “Caligan Group”), may be deemed to have shared voting power and shared dispositive power with regard to, and therefore may be deemed to beneficially own (within the meaning of Rule 13d-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) the shares of common stock of the Company (the “Shares”) owned by the Caligan Funds.

As of the date of this filing, the Caligan Group beneficially owns (within the meaning of Rule 13d-3 under the Exchange Act), in the aggregate, 577,675 Shares, including 1,000 Shares held in record name by Caligan Master Fund.