| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-206361-13 |

| | | |

| February 5, 2018 | Benchmark 2018-B2 |

Free Writing Prospectus

Structural and Collateral Term Sheet |

| | | |

| BENCHMARK 2018-B2 |

| |

|

| | | |

| $1,507,013,899 |

| | (Approximate Mortgage Pool Balance) | |

| | | |

| $1,341,242,000 |

| | (Approximate Offered Certificates) | |

| | | |

| J.P. Morgan Chase Commercial Mortgage Securities Corp. |

| | Depositor | |

| | | |

| |

BENCHMARK 2018 MORTGAGE TRUST,

COMMERCIAL MORTGAGE PASS-THROUGH CERTIFICATES

SERIES 2018-B2 |

| |

JPMorgan Chase Bank, National Association

German American Capital Corporation

Citi Real Estate Funding Inc. |

| Sponsors and Mortgage Loan Sellers |

| | | |

| J.P. Morgan | Deutsche Bank Securities | Citigroup |

| | Co-Lead Managers and Joint Bookrunners | |

| | | |

| Drexel Hamilton | | Academy Securities |

| | | |

| | Co-Managers | |

| | | |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED

| February 5, 2018 | Benchmark 2018-B2 |

This material is for your information, and none of J.P. Morgan Securities LLC (“JPMS”), Deutsche Bank Securities Inc. (“DBSI”), Citigroup Global Markets Inc. (“CGMI”), Drexel Hamilton, LLC (“Drexel”) or Academy Securities, Inc. (“Academy Securities”) (each individually, an “Underwriter”, and together, the ’’Underwriters’’) are soliciting any action based upon it. This material is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

The Depositor has filed a registration statement (including a prospectus) with the SEC (SEC File no. 333-206361) for the offering to which this free writing prospectus relates. Before you invest, you should read the prospectus in the registration statement and other documents the Depositor has filed with the SEC for more complete information about the Depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Website at www.sec.gov. Alternatively, the Depositor or any Underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request itby calling (800) 408-1016 or by emailing the ABS Syndicate Desk at abs_synd@jpmorgan.com.

Neither this document nor anything contained in this document shall form the basis for any contract or commitment whatsoever. The information contained in this document is preliminary as of the date of this document, supersedes any previous such information delivered to you and will be superseded by any such information subsequently delivered prior to the time of sale. These materials are subject to change, completion or amendment from time to time.

This document has been prepared by the Underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Directive 2003/71/EC (as amended) and/or Part VI of the Financial Services and Markets Act 2000 (as amended) or other offering document.

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) that have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected in this document. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these certificates. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the Computational Materials. The specific characteristics of the certificates may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any certificate described in the Computational Materials are subject to change prior to issuance. None of the Underwriters nor any of their respective affiliates make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the certificates.

This information is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change.

This document contains forward-looking statements. Those statements are subject to certain risks and uncertainties that could cause the success of collections and the actual cash flow generated to differ materially from the information set forth in this document. While such information reflects projections prepared in good faith based upon methods and data that are believed to be reasonable and accurate as of their dates, the Depositor undertakes no obligation to revise these forward-looking statements to reflect subsequent events or circumstances. Investors should not place undue reliance on forward-looking statements and are advised to make their own independent analysis and determination with respect to the forecasted periods, which reflect the Depositor’s view only as of the date of this document.

J.P. Morgan is the marketing name for the investment banking businesses of JPMorgan Chase & Co. and its subsidiaries worldwide. Securities, syndicated loan arranging, financial advisory and other investment banking activities are performed by JPMS and its securities affiliates, and lending, derivatives and other commercial banking activities are performed by JPMorgan Chase Bank, National Association and its banking affiliates. JPMS is a member of SIPC and the NYSE. Securities and investment banking activities in the United States are performed by Deutsche Bank Securities Inc., a member of NYSE, FINRA and SIPC, and its broker-dealer affiliates. Lending and other commercial banking activities in the United States are performed by Deutsche Bank AG, acting through its New York Branch.

Capitalized terms used in this material but not defined herein shall have the meanings ascribed to them in the Preliminary Prospectus (as defined below).

THE CERTIFICATES REFERRED TO IN THESE MATERIALS ARE SUBJECT TO MODIFICATION OR REVISION (INCLUDING THE POSSIBILITY THAT ONE OR MORE CLASSES OF CERTIFICATES MAY BE SPLIT, COMBINED OR ELIMINATED AT ANY TIME PRIOR TO ISSUANCE OR AVAILABILITY OF A FINAL PROSPECTUS) AND ARE OFFERED ON A “WHEN, AS AND IF ISSUED” BASIS.

THE UNDERWRITERS MAY FROM TIME TO TIME PERFORM INVESTMENT BANKING SERVICES FOR, OR SOLICIT INVESTMENT BANKING BUSINESS FROM, ANY COMPANY NAMED IN THESE MATERIALS. THE UNDERWRITERS AND/OR THEIR AFFILIATES OR RESPECTIVE EMPLOYEES MAY FROM TIME TO TIME HAVE A LONG OR SHORT POSITION IN ANY CERTIFICATE OR CONTRACT DISCUSSED IN THESE MATERIALS.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

2 of 151

| Structural and Collateral Term Sheet | | Benchmark 2018-B2 |

| |

| Indicative Capital Structure |

Publicly Offered Certificates

| Class | Expected Ratings

(S&P / Fitch / KBRA) | Approximate Initial Certificate Balance

or Notional

Amount(1) | | Approximate Initial Credit Support(2) | | Expected Weighted

Avg. Life

(years)(3) | | Expected Principal Window(3) | | Certificate Principal to

Value

Ratio(4) | | Underwritten

NOI Debt Yield(5) |

| A-1 | AAA(sf) / AAAsf / AAA(sf) | $29,604,000 | | | 30.000% | | 2.52 | | 3/18 – 6/22 | | 40.0% | | 16.0% |

| A-2 | AAA(sf) / AAAsf / AAA(sf) | $341,798,000 | | | 30.000% | | 4.82 | | 6/22 – 2/23 | | 40.0% | | 16.0% |

| A-3 | AAA(sf) / AAAsf / AAA(sf) | $60,000,000 | | | 30.000% | | 6.80 | | 12/24 – 12/24 | | 40.0% | | 16.0% |

| A-4 | AAA(sf) / AAAsf / AAA(sf) | $125,000,000 | | | 30.000% | | 9.58 | | 3/27 – 11/27 | | 40.0% | | 16.0% |

| A-5 | AAA(sf) / AAAsf / AAA(sf) | $444,175,000 | | | 30.000% | | 9.83 | | 11/27 – 1/28 | | 40.0% | | 16.0% |

| A-SB | AAA(sf) / AAAsf / AAA(sf) | $54,333,000 | | | 30.000% | | 7.11 | | 2/23 – 3/27 | | 40.0% | | 16.0% |

| X-A | NR / AAAsf / AAA(sf) | $1,220,681,000 | (6) | | N/A | | 7.96 | | N/A | | N/A | | N/A |

| X-B | NR / AA-sf / AAA(sf) | $60,281,000 | (6) | | N/A | | 9.88 | | N/A | | N/A | | N/A |

| A-S | NR / AAAsf / AAA(sf) | $165,771,000 | | | 19.0000% | | 9.88 | | 1/28 – 1/28 | | 46.3% | | 13.8% |

| B | NR / AA-sf / AA-(sf) | $60,281,000 | | | 15.0000% | | 9.88 | | 1/28 – 2/28 | | 48.6% | | 13.2% |

| C | NR / A-sf / A-(sf) | $60,280,000 | | | 11.0000% | | 9.97 | | 2/28 – 2/28 | | 50.9% | | 12.6% |

Privately Offered Certificates(7)

| Class | Expected Ratings

(S&P / Fitch / KBRA) | Approximate Initial Certificate Balance

or Notional

Amount(1) | | Approximate

Initial Credit Support | | Expected Weighted

Avg. Life

(years)(3) | | Expected Principal Window(3) | | Certificate Principal to

Value Ratio(4) | | Underwritten

NOI Debt Yield(5) |

| X-D | NR / BBB+sf / BBB+(sf) | $18,838,000 | (6)(8) | | N/A | | 9.97 | | N/A | | N/A | | N/A |

| D | NR / BBB+sf / BBB+(sf) | $18,838,000 | (8) | | 9.750% | | 9.97 | | 2/28 – 2/28 | | 51.6% | | 12.4% |

| E-RR | NR / BBB-sf / BBB-(sf) | $52,746,000 | (8) | | 6.250% | | 9.97 | | 2/28 – 2/28 | | 53.6% | | 11.9% |

| F-RR | NR / BBsf / BB(sf) | $18,837,000 | | | 5.000% | | 9.97 | | 2/28 – 2/28 | | 54.3% | | 11.8% |

| G-RR | NR / Bsf / B(sf) | $18,838,000 | | | 3.750% | | 9.97 | | 2/28 – 2/28 | | 55.1% | | 11.6% |

| NR-RR | NR / NR / NR | $56,512,898 | | | 0.000% | | 9.97 | | 2/28 – 2/28 | | 57.2% | | 11.2% |

| (1) | In the case of each such Class, subject to a permitted variance of plus or minus 5%. In addition, the notional amounts of the Class X-A, Class X-B and Class X-D Certificates may vary depending upon the final pricing of the Classes of Principal Balance Certificates whose Certificate Balances comprise such notional amounts, and, if as a result of such pricing the pass-through rate of any Class of the Class X-A, Class X-B or Class X-D Certificates, as applicable, would be equal to zero at all times, such Class of Certificates will not be issued on the closing date of this securitization. |

| (2) | The credit support percentages set forth for Class A-1, Class A-2, Class A-3, Class A-4, Class A-5 and Class A-SB Certificates represent the approximate initial credit support for the Class A-1, Class A-2, Class A-3, Class A-4, Class A-5 and Class A-SB Certificates in the aggregate. |

| (3) | Assumes 0% CPR / 0% CDR and a February 27, 2018 closing date. Based on modeling assumptions as described in the Preliminary Prospectus dated February 5, 2018 (the “Preliminary Prospectus”). |

| (4) | The “Certificate Principal to Value Ratio” for any Class of Principal Balance Certificates (other than the Class A-1, Class A-2, Class A-3, Class A-4, Class A-5 and Class A-SB Certificates) is calculated as the product of (a) the weighted average Cut-off Date LTV for the mortgage loans, multiplied by (b) a fraction, the numerator of which is the total initial Certificate Balance of such Class of Certificates and all Classes of Principal Balance Certificates senior to such Class of Certificates and the denominator of which is the total initial Certificate Balance of all of the Principal Balance Certificates. The Class A-1, Class A-2, Class A-3, Class A-4, Class A-5 and Class A-SB Certificate Principal to Value Ratios are calculated in the aggregate for those Classes as if they were a single Class. Investors should note, however, that excess mortgaged property value associated with a mortgage loan will not be available to offset losses on any other mortgage loan. |

| (5) | The “Underwritten NOI Debt Yield” for any Class of Principal Balance Certificates (other than the Class A-1, Class A-2, Class A-3, Class A-4, Class A-5 and Class A-SB Certificates) is calculated as the product of (a) the weighted average UW NOI Debt Yield for the mortgage loans and (b) the total initial Certificate Balance of all of the Classes of Principal Balance Certificates divided by the total initial Certificate Balance for such Class and all Classes of Principal Balance Certificates senior to such Class of Certificates. The Underwritten NOI Debt Yield for each of the Class A-1, Class A-2, Class A-3, Class A-4, Class A-5 and Class A-SB Certificates is calculated in the aggregate for those Classes as if they were a single Class. Investors should note, however, that net operating income from any mortgaged property supports only the related mortgage loan and will not be available to support any other mortgage loan. |

| (6) | The Class X-A, Class X-B and Class X-D Notional Amounts are defined in the Preliminary Prospectus. |

| (7) | The Class X-D, Class D, Class E-RR, Class F-RR, Class G-RR and Class NR-RR Certificates are not being offered by the Preliminary Prospectus or this Term Sheet. The Class S and Class R Certificates are not shown above. |

| (8) | The approximate initial Notional Amount and Certificate Balances of the Class X-D, Class D and Class E-RR Certificates are estimated based in part on the estimated ranges of Notional Amounts, Certificate Balances and estimated fair values described in “Credit Risk Retention” in the Preliminary Prospectus. The Class X-D and Class D Notional Amount and Certificate Balances are expected to fall within a range of $15,071,000 and $26,373,000, with the ultimate Notional Amount and Certificate Balance determined, such that the aggregate fair value of the Yield-Priced Principal Balance Certificates will equal at least 5% of the estimated fair value of all of the classes of certificates (other than the Class R Certificates) issued by the issuing entity. The Class E-RR Certificate Balances are expected to fall within a range of $45,211,000 and $56,513,000, with the ultimate Certificate Balance determined such that the aggregate fair value of the Yield-Priced Principal Balance Certificates will equal at least 5% of the estimated fair value of all the classes of certificates (other than the Class R Certificates) issued by the issuing entity. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

3 of 151

| Structural and Collateral Term Sheet | | Benchmark 2018-B2 |

| |

| Summary of Transaction Terms |

| Securities Offered: | $1,341,242,000 monthly pay, multi-class, commercial mortgage REMIC Pass-Through Certificates. |

| Co-Lead Managers and Joint Bookrunners: | J.P. Morgan Securities LLC, Deutsche Bank Securities Inc. and Citigroup Global Markets Inc. |

| Co-Managers: | Drexel Hamilton, LLC and Academy Securities, Inc. |

| Mortgage Loan Sellers: | JPMorgan Chase Bank, National Association (“JPMCB”) (31.1%), German American Capital Corporation (“GACC”) (38.8%) and Citi Real Estate Funding Inc. (“CREFI”) (30.2%). |

| Master Servicer: | KeyBank National Association. |

| Special Servicer: | CWCapital Asset Management LLC. |

| Directing Certificateholder: | Barings LLC. |

| Trustee: | Wells Fargo Bank, National Association. |

| Certificate Administrator: | Wells Fargo Bank, National Association. |

| Operating Advisor: | Pentalpha Surveillance LLC. |

| Asset Representations Reviewer: | Pentalpha Surveillance LLC. |

| Rating Agencies: | S&P Global Ratings, acting through Standard and Poor’s Financial Services LLC (“S&P”), Fitch Ratings, Inc. (“Fitch”) and Kroll Bond Rating Agency (“KBRA”). |

| U.S. Credit Risk Retention: | JPMCB is expected to act as the “retaining sponsor” for this securitization and intends to satisfy the U.S. credit risk retention requirement through the purchase by Massachusetts Mutual Life Insurance Company, as a third-party purchaser (as defined in Regulation RR), from the depositor, on the Closing Date, of an “eligible horizontal residual interest”, which will be comprised of the Class E-RR, Class F-RR, Class G-RR and Class NR-RR Certificates. The aggregate estimated fair value of the Class E-RR, Class F-RR, Class G-RR and Class NR-RR Certificates will be at least equal to 5% of the estimated fair value of all of the Certificates (other than the Class R Certificates) issued by the issuing entity. Massachusetts Mutual Life Insurance Company, in its capacity as the “third-party purchaser” for this transaction, will be required to comply with the hedging, transfer and financing restrictions applicable to a “third-party purchaser” under the credit risk retention rules in effect on the Closing Date, which generally prohibit the transfer of the applicable Certificates, other than to a majority owned affiliate of Massachusetts Mutual Life Insurance Company, until February 27, 2023. After that date, transfers are permitted under certain circumstances, in accordance with the credit risk retention rules, to another “third-party purchaser”. The restrictions on hedging and transfer under the credit risk retention rules as in effect on the closing date of this transaction will expire on and after the date that is the earliest of (A) the date that is the latest of (i) the date on which the aggregate principal balance of the mortgage loans has been reduced to 33% of the aggregate principal balance of the mortgage loans as of the Cut-off Date; (ii) the date on which the total unpaid principal obligations under the Certificates has been reduced to 33% of the aggregate total unpaid principal obligations under the Certificates as of the Closing Date; or (iii) two years after the Closing Date and (B) the date on which all of the mortgage loans have been defeased in accordance with §244.7(b)(8)(i) of Regulation RR. The Pooling and Servicing Agreement (as defined below) will include the required provisions applicable to an operating advisor necessary for the securitization to comply with the credit risk retention rules utilizing the “third-party purchaser” option. See “Operating Advisor” below. Notwithstanding any references in this term sheet to the credit risk retention rules, the Regulation RR, the retaining sponsor, the third-party purchaser and other risk retention related matters, in the event the credit risk retention rules and/or Regulation RR (or any relevant portion thereof) are repealed or determined by applicable regulatory agencies to be no longer applicable to this securitization transaction, none of the retaining sponsor, the third-party purchaser or any other party will be required to comply with or act in accordance with the credit risk retention rules and/or Regulation RR (or such relevant portion thereof). For additional information, see “Credit Risk Retention” in the Preliminary Prospectus. |

| EU Credit Risk Retention: | The transaction is not structured to satisfy the EU risk retention and due diligence requirements. |

| Pricing Date: | On or about February 9, 2018. |

| Closing Date: | On or about February 27, 2018. |

| Cut-off Date: | With respect to each mortgage loan, the related due date in February 2018, or with respect to any mortgage loan that has its first due date in March 2018, the date that would otherwise have been the related due date in February 2018. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

4 of 151

| Structural and Collateral Term Sheet | | Benchmark 2018-B2 |

| |

| Summary of Transaction Terms |

| Distribution Date: | The 4th business day after the Determination Date in each month, commencing in March 2018. |

| Determination Date: | 11thday of each month, or if the 11th day is not a business day, the next succeeding business day, commencing in March 2018. |

| Assumed Final Distribution Date: | The Distribution Date in February 2028, which is the latest anticipated repayment date of the Certificates. |

| Rated Final Distribution Date: | The Distribution Date in February 2051. |

| Tax Treatment: | The Publicly Offered Certificates are expected to be treated as REMIC “regular interests” for U.S. federal income tax purposes. |

| Form of Offering: | The Class A-1, Class A-2, Class A-3, Class A-4, Class A-5, Class A-SB, Class X-A, Class X-B, Class A-S, Class B and Class C Certificates (the “Publicly Offered Certificates”) will be offered publicly. The Class X-D, Class D, Class E-RR, Class F-RR, Class G-RR, Class NR-RR, Class S and Class R Certificates (the “Privately Offered Certificates”) will be offered domestically to Qualified Institutional Buyers and to Institutional Accredited Investors (other than the Class R Certificates) and to institutions that are not U.S. Persons pursuant to Regulation S. |

| SMMEA Status: | The Certificates will not constitute “mortgage related securities” for purposes of SMMEA. |

| ERISA: | The Publicly Offered Certificates are expected to be ERISA eligible. |

| Optional Termination: | On any Distribution Date on which the aggregate principal balance of the pool of mortgage loans is less than 1% of the aggregate principal balance of the mortgage loans as of the Cut-off Date, certain entities specified in the Preliminary Prospectus will have the option to purchase all of the remaining mortgage loans (and all property acquired through exercise of remedies in respect of any mortgage loan) at the price specified in the Preliminary Prospectus. Refer to “Pooling and Servicing Agreement—Termination; Retirement of Certificates” in the Preliminary Prospectus. |

| Minimum Denominations: | The Publicly Offered Certificates (other than the Class X-A and Class X-B Certificates) will be issued in minimum denominations of $10,000 and integral multiples of $1 in excess of $10,000. The Class X-A and Class X-B Certificates will be issued in minimum denominations of $1,000,000 and in integral multiples of $1 in excess of $1,000,000. |

| Settlement Terms: | DTC, Euroclear and Clearstream Banking. |

| Analytics: | The transaction is expected to be modeled by Intex Solutions, Inc. and Trepp, LLC and is expected to be available on Bloomberg L.P., Blackrock Financial Management, Inc., Interactive Data Corporation, CMBS.com, Inc., Markit Group Limited, Moody’s Analytics, RealInsight and Thomson Reuters Corporation. |

| Risk Factors: | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. REFER TO “RISK FACTORS” IN THE PRELIMINARY PROSPECTUS. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

5 of 151

| Structural and Collateral Term Sheet | | Benchmark 2018-B2 |

| |

| Collateral Characteristics |

| Loan Pool | |

| | Initial Pool Balance (“IPB”): | $1,507,013,899 |

| | Number of Mortgage Loans: | 57 |

| | Number of Mortgaged Properties: | 67 |

| | Average Cut-off Date Balance per Mortgage Loan: | $26,438,840 |

| | Weighted Average Current Mortgage Rate: | 4.21894% |

| | 10 Largest Mortgage Loans as % of IPB: | 40.9% |

| | Weighted Average Remaining Term to Maturity(1): | 104 months |

| | Weighted Average Seasoning: | 2 months |

| | | |

| Credit Statistics | |

| | Weighted Average UW NCF DSCR(2)(3): | 2.29x |

| | Weighted Average UW NOI Debt Yield(2): | 11.2% |

| | Weighted Average Cut-off Date Loan-to-Value Ratio (“LTV”)(2)(4): | 57.2% |

| | Weighted Average Maturity Date LTV(1)(2)(4): | 53.0% |

| | | |

| Other Statistics | |

| | % of Mortgage Loans with Additional Debt: | 22.0% |

| | % of Mortgaged Properties with Single Tenants: | 16.9% |

| | | |

| Amortization | |

| | Weighted Average Original Amortization Term(5): | 353 months |

| | Weighted Average Remaining Amortization Term(5): | 352 months |

| | % of Mortgage Loans with Interest-Only: | 47.6% |

| | % of Mortgage Loans with Partial Interest-Only followed by Amortizing Balloon: | 25.3% |

| | % of Mortgage Loans with Amortizing Balloon: | 19.8% |

| | % of Mortgage Loans with Interest-Only followed by ARD structure: | 7.2% |

| | | |

| Lockbox / Cash Management(6) | |

| | % of Mortgage Loans with In-Place, Hard Lockboxes: | 66.5% |

| | % of Mortgage Loans with Springing Lockboxes: | 20.9% |

| | % of Mortgage Loans with In-Place, Soft Lockboxes: | 12.6% |

| | % of Mortgage Loans with Springing Cash Management: | 79.8% |

| | % of Mortgage Loans with In-Place Cash Management: | 20.2% |

| | | |

| Reserves | |

| | % of Mortgage Loans Requiring Monthly Tax Reserves: | 57.6% |

| | % of Mortgage Loans Requiring Monthly Insurance Reserves: | 29.4% |

| | % of Mortgage Loans Requiring Monthly CapEx Reserves(7): | 56.2% |

| | % of Mortgage Loans Requiring Monthly TI/LC Reserves(8): | 41.1% |

| | | |

| (1) | In the case of Loan Nos. 3 and 15, each with an anticipated repayment date, Remaining Term to Maturity and Maturity Date LTV are calculated as of the related anticipated repayment date. |

| (2) | In the case of Loan Nos. 3, 4, 5, 6, 7, 8, 10, 13, 14, 15, 16, 17, 18, 19, 21, 22, 23, 32, 35, 39, 42, 46, 49 and 53, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 10, 16, 35, 39, 42, 46, 49 and 53, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s). |

| (3) | In the case of Loan No. 33, the UW NCF DSCR is calculated using the sum of principal and interest payments over the first 12 months based on the assumed principal payment schedule provided on Annex H to the Preliminary Prospectus. |

| (4) | In the case of Loan Nos. 3, 7, 9, 12, 19, 25, 29, 33, 36, 43 and 54, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| (5) | Excludes 24 mortgage loans that are interest-only for the entire term or until the related anticipated repayment date. |

| (6) | For a more detailed description of Lockbox / Cash Management, refer to “Description of the Mortgage Pool—Certain Terms of the Mortgage Loans—Mortgaged Property Accounts” in the Preliminary Prospectus. |

| (7) | CapEx Reserves include FF&E reserves for hotel properties. |

| (8) | Calculated only with respect to the Cut-off Date Balance of mortgage loans secured or partially secured by office, retail, mixed use and industrial properties. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

6 of 151

| Structural and Collateral Term Sheet | Benchmark 2018-B2 |

| |

| Collateral Characteristics |

Mortgage Loan Seller | Number of

Mortgage Loans | Number of

Mortgaged

Properties | Aggregate

Cut-off Date

Balance | |

| GACC(1) | 21 | 26 | $584,161,017 | 38.8% |

| JPMCB(2) | 19 | 19 | 468,409,651 | 31.1 |

| CREFI(3) | 17 | 22 | 454,443,230 | 30.2 |

| Total: | 57 | 67 | $1,507,013,899 | 100.0% |

| (1) | With the exception of Loan Nos. 3, 10, 15, 23 and 47, all of the loans for which GACC is the Mortgage Loan Seller were originated by Deutsche Bank, AG, New York Branch (“DBNY”) (an affiliate of GACC). In the case of Loan No. 3, the whole loan was co-originated by Wells Fargo Bank, National Association, Goldman Sachs Mortgage Company (“GSMC”) and DBNY. In the case of Loan Nos. 10 and 15, the whole loans were originated by GSMC, which sold certain notes, including the Worldwide Plaza mortgage loan and the Marina Heights State Farm mortgage loan, to DBNY. In the case of Loan No. 23, the whole loan was originated by CREFI, which sold certain notes, including the Two Harbor Point Square mortgage loan, to DBNY. In the case of Loan No. 47, the whole loan was originated by Cantor Commercial Real Estate Lending, L.P. |

| (2) | In the case of Loan No. 18, the whole loan was co-originated by JPMorgan Chase Bank, National Association, Column Financial, Inc. and Cantor Commercial Real Estate, L.P. |

| (3) | In the case of Loan No. 14, the whole loan was co-originated by Citi Real Estate Funding Inc. (“CREFI”) and Société Générale. |

| Ten Largest Mortgage Loans |

| |

|

| No. | Loan Name | Mortgage Loan Seller | No.

of Prop. | Cut-off Date Balance | % of IPB | SF/Units/ Rooms | Property Type | UW

NCF

DSCR(1) | UW NOI

Debt

Yield(1) | Cut-off Date LTV(1)(2) | Maturity Date LTV(1)(2) |

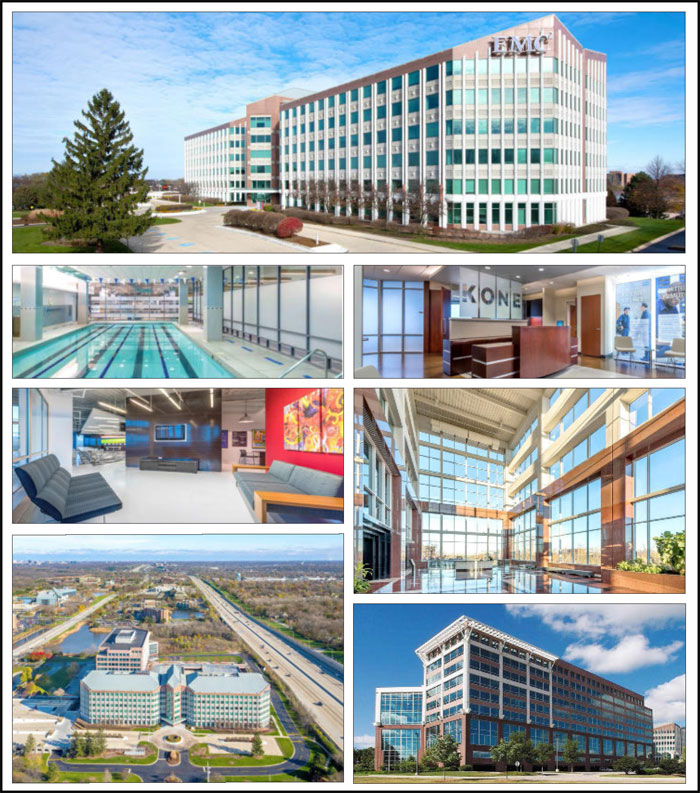

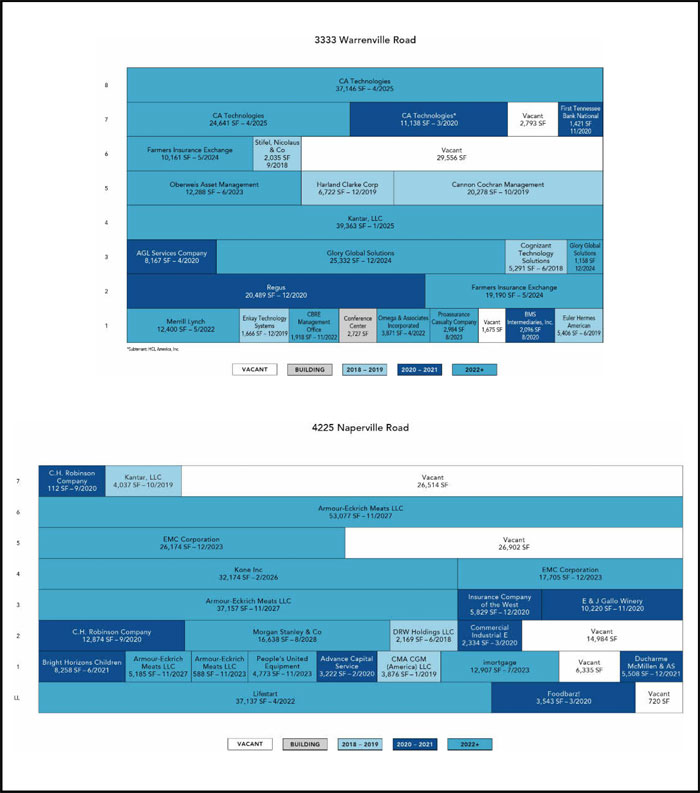

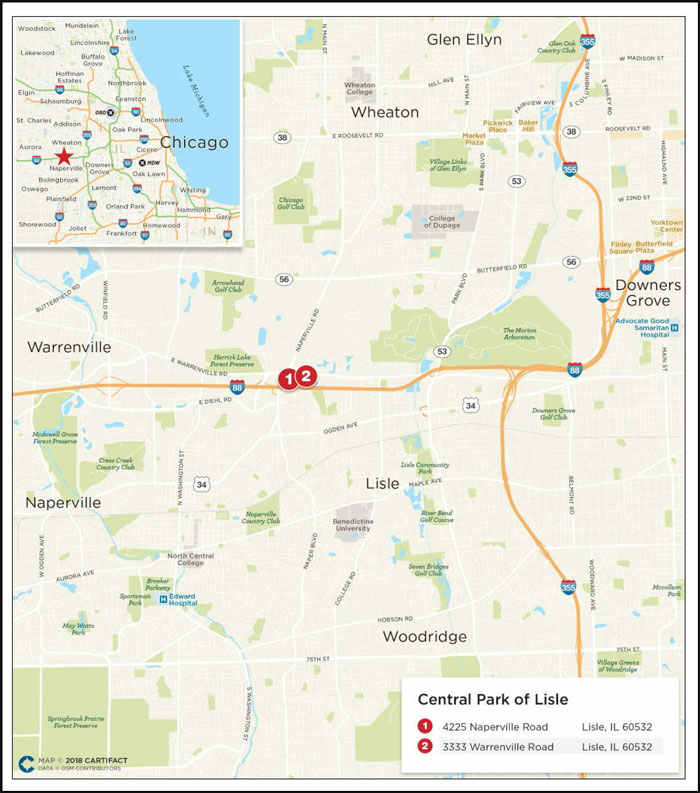

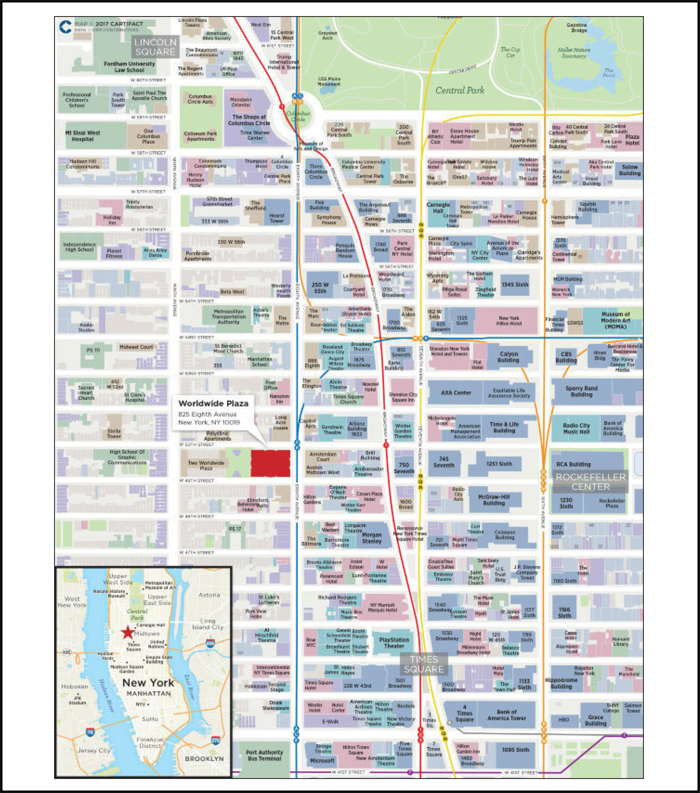

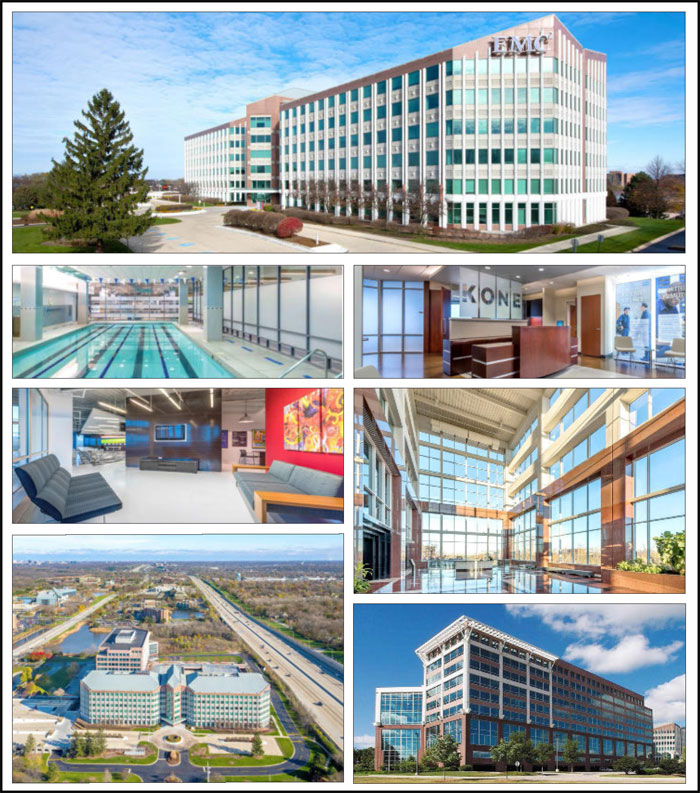

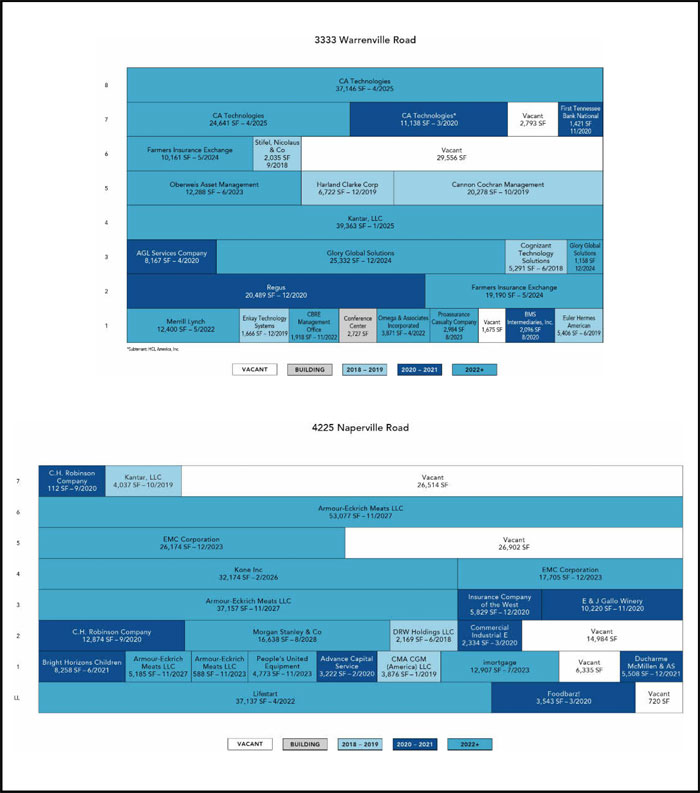

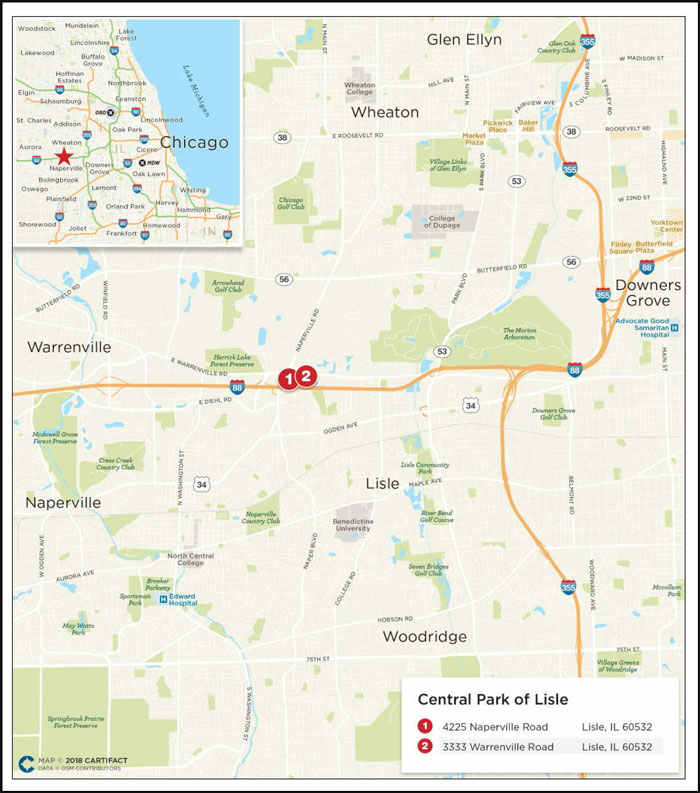

| 1 | Central Park of Lisle | CREFI | 1 | $79,500,000 | 5.3% | 693,606 | Office | 2.58x | 12.6% | 58.9% | 58.9% |

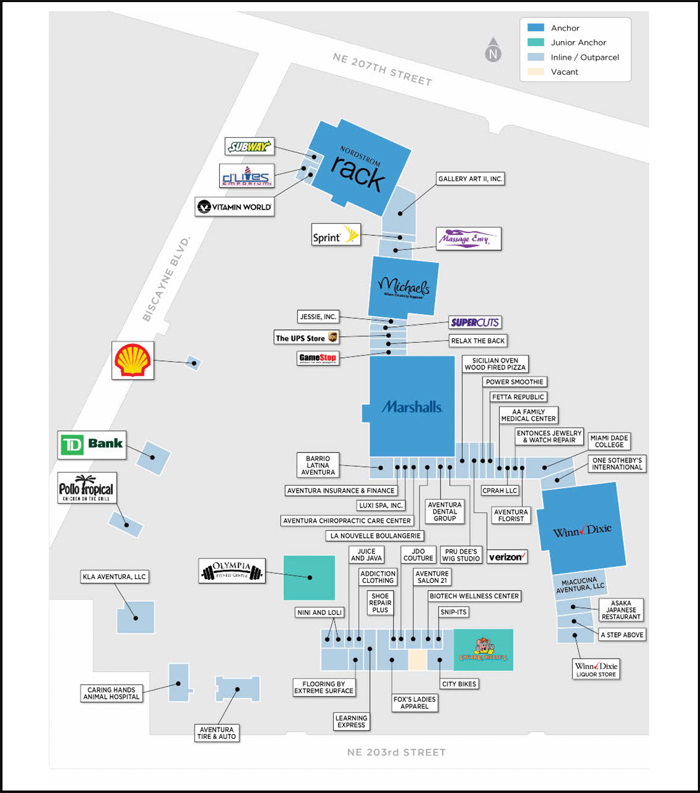

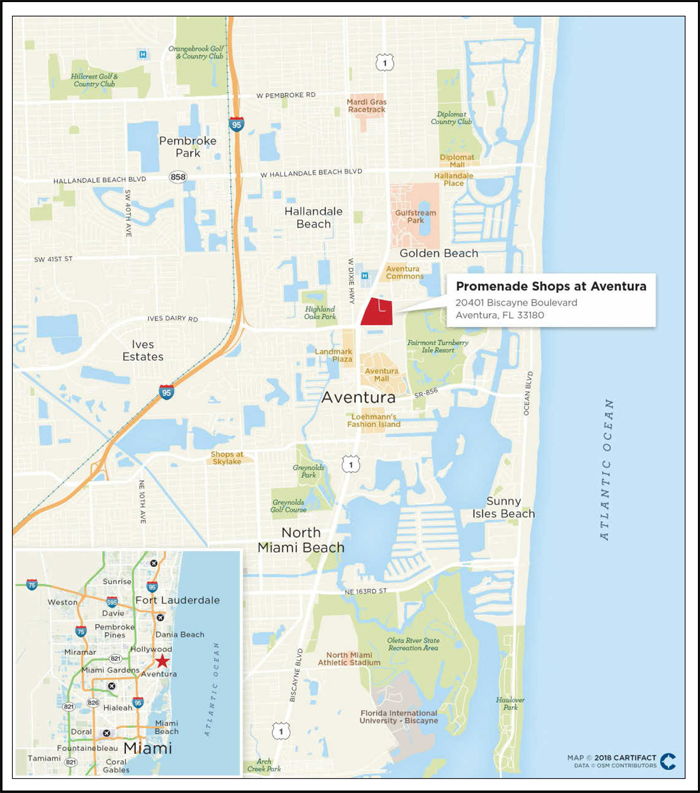

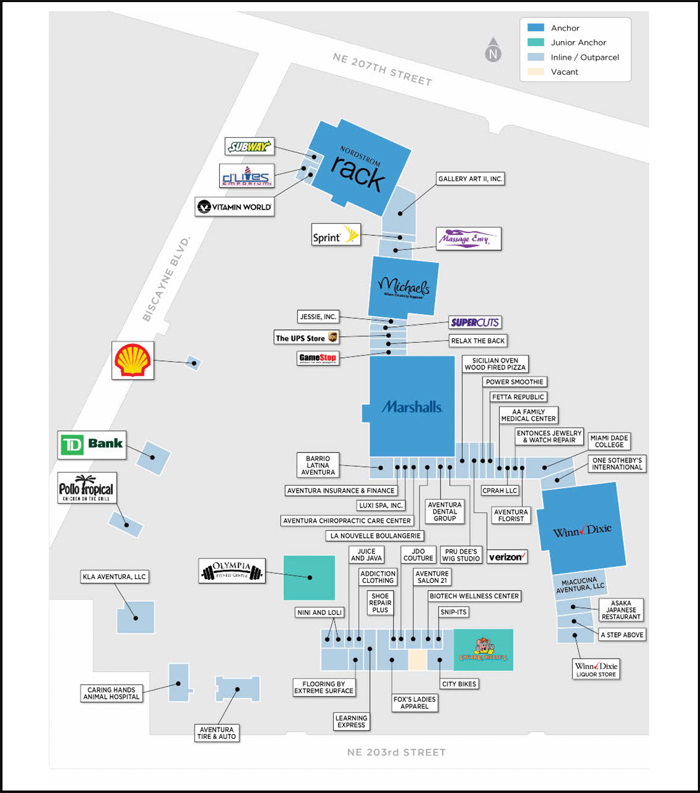

| 2 | Promenade Shops at Aventura | JPMCB | 1 | $70,000,000 | 4.6% | 291,834 | Retail | 1.29x | 8.6% | 64.7% | 52.6% |

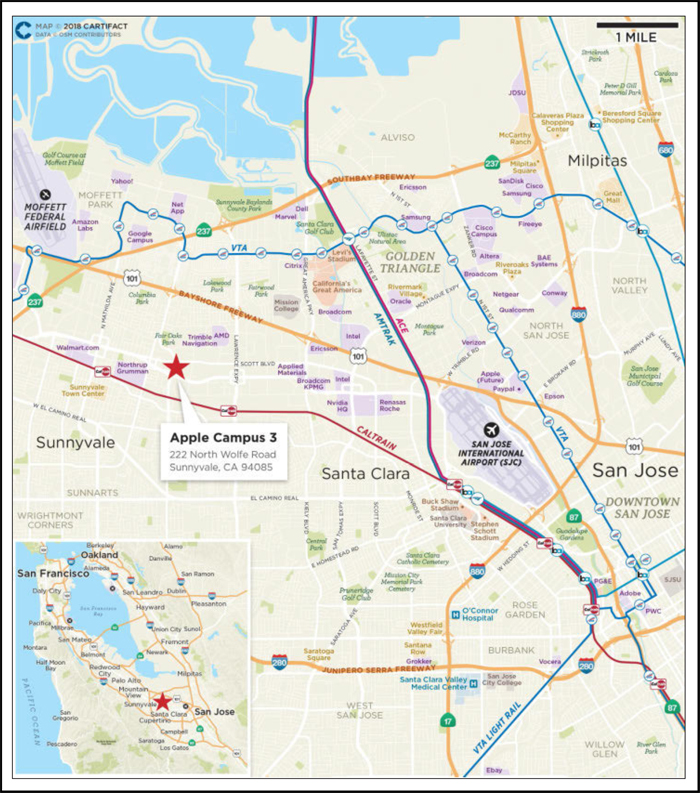

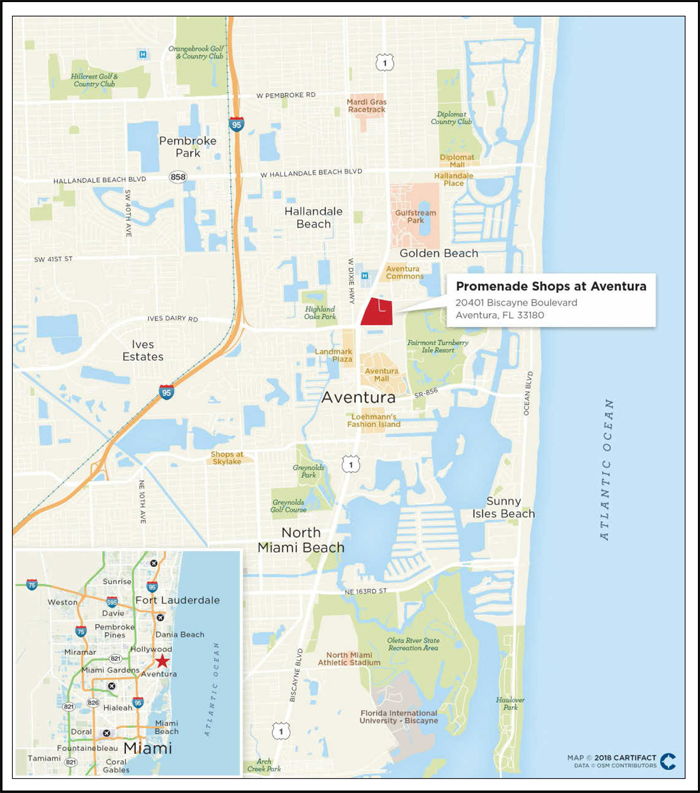

| 3 | Apple Campus 3 | GACC | 1 | $68,000,000 | 4.5% | 882,657 | Office | 3.55x | 12.2% | 44.0% | 44.0% |

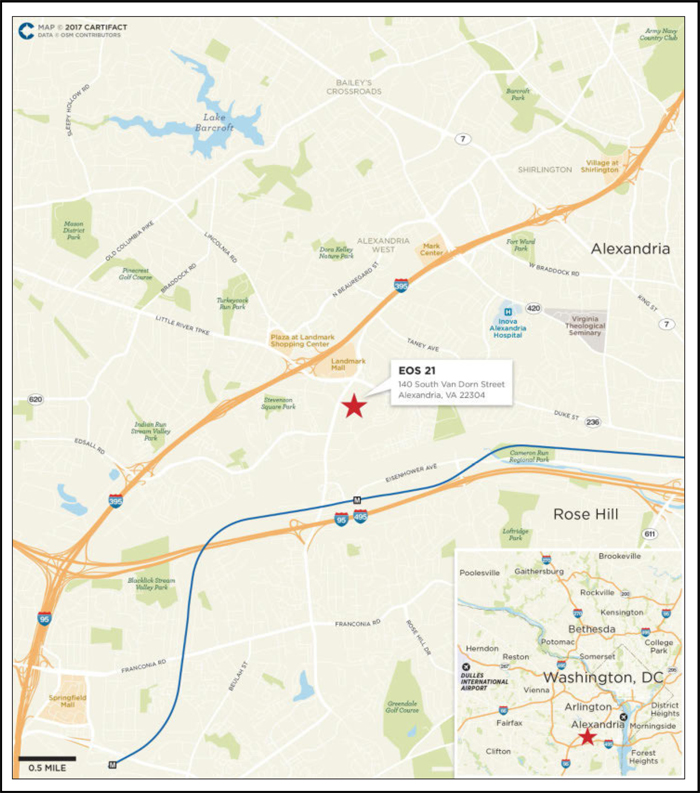

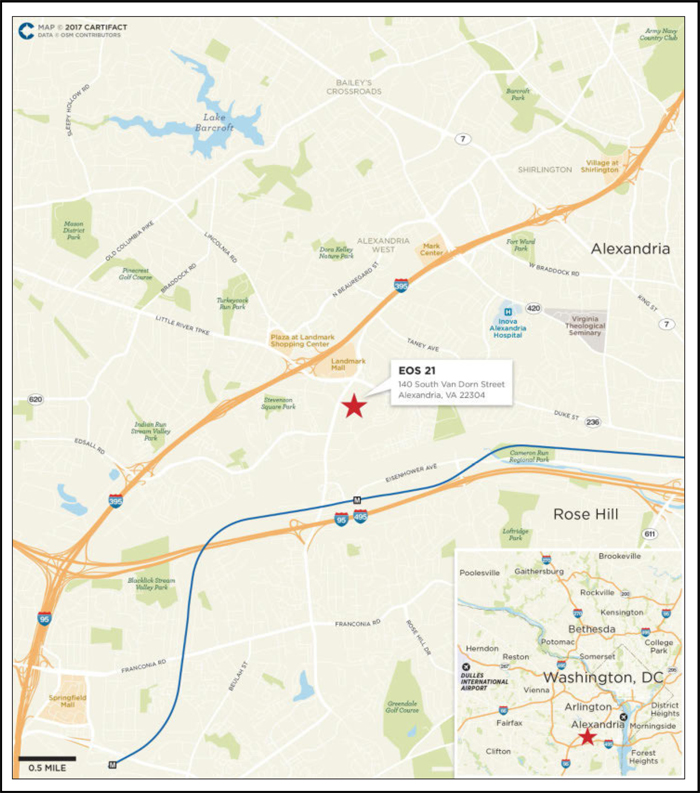

| 4 | EOS 21 | JPMCB | 1 | $60,000,000 | 4.0% | 1,180 | Multifamily | 1.87x | 7.5% | 64.8% | 64.8% |

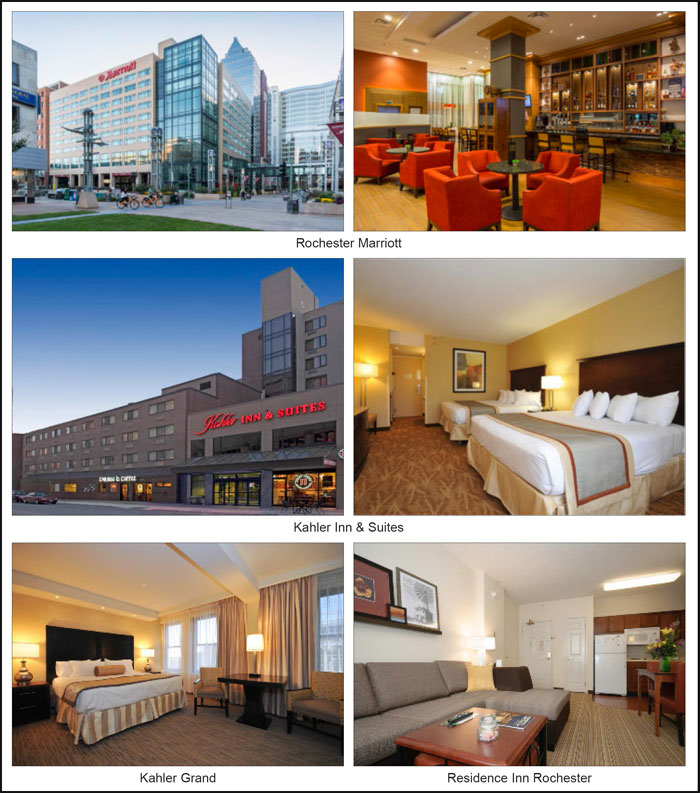

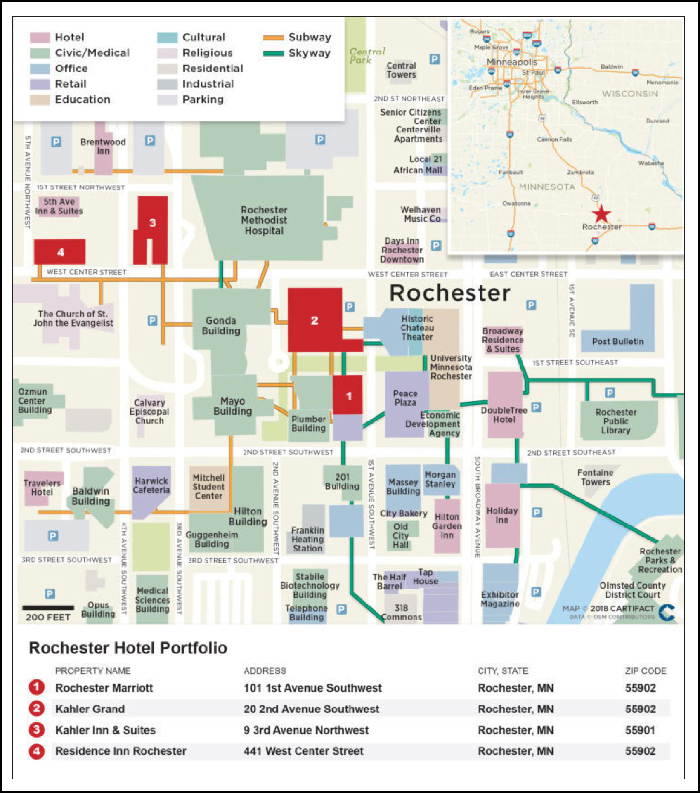

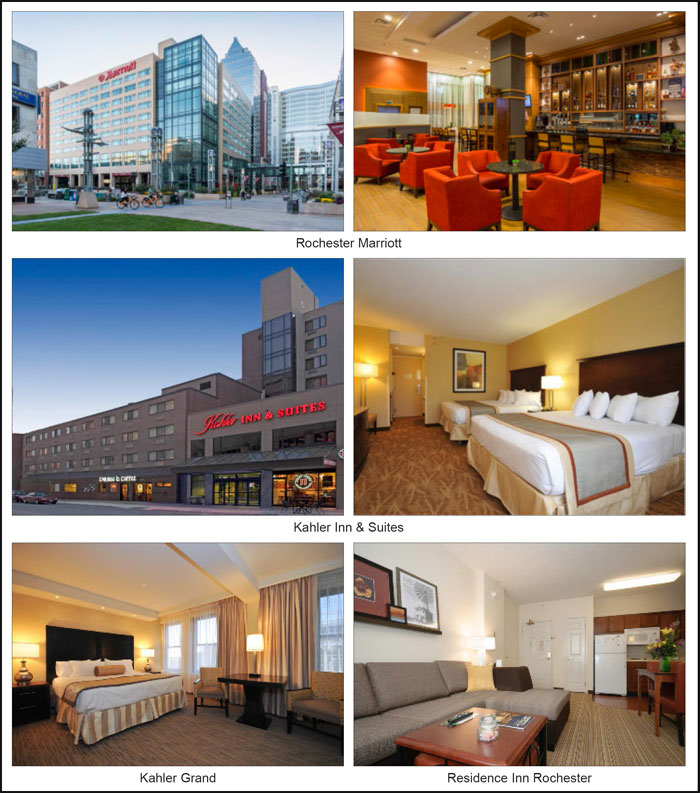

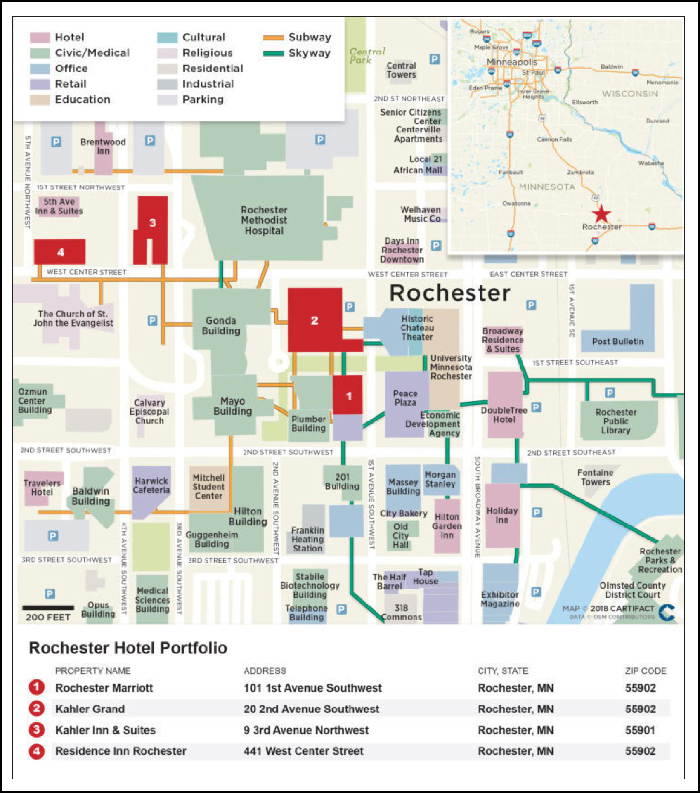

| 5 | Rochester Hotel Portfolio | GACC | 4 | $60,000,000 | 4.0% | 1,222 | Hotel | 1.50x | 12.2% | 66.7% | 55.4% |

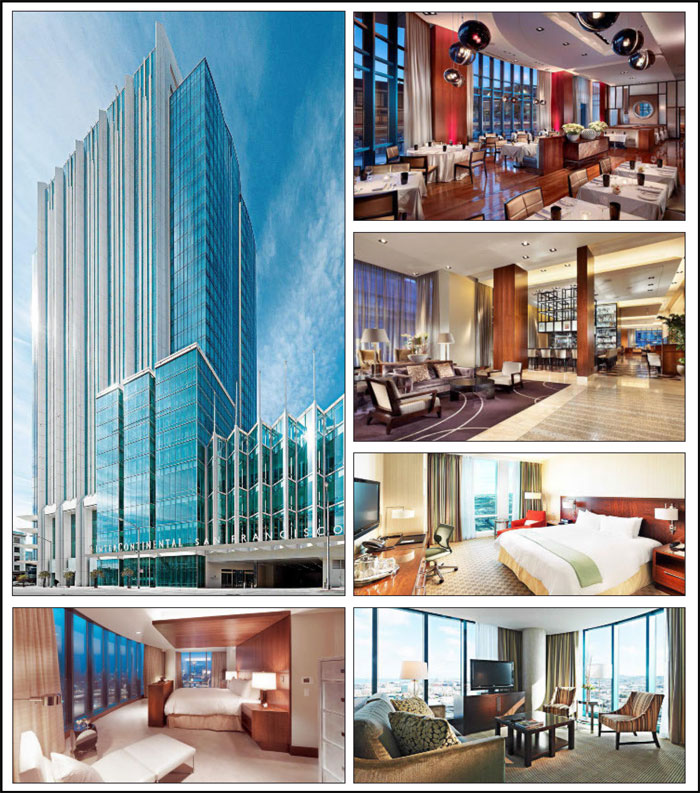

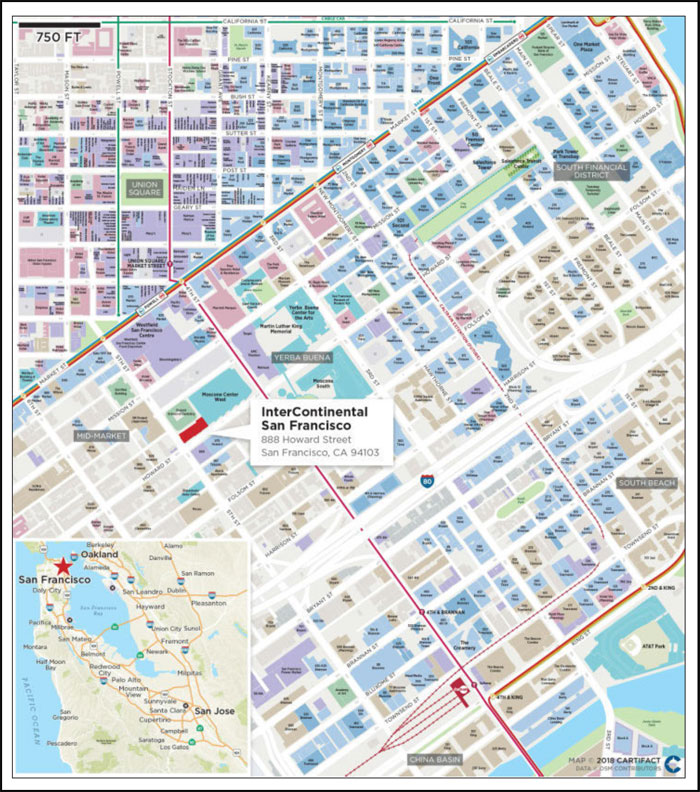

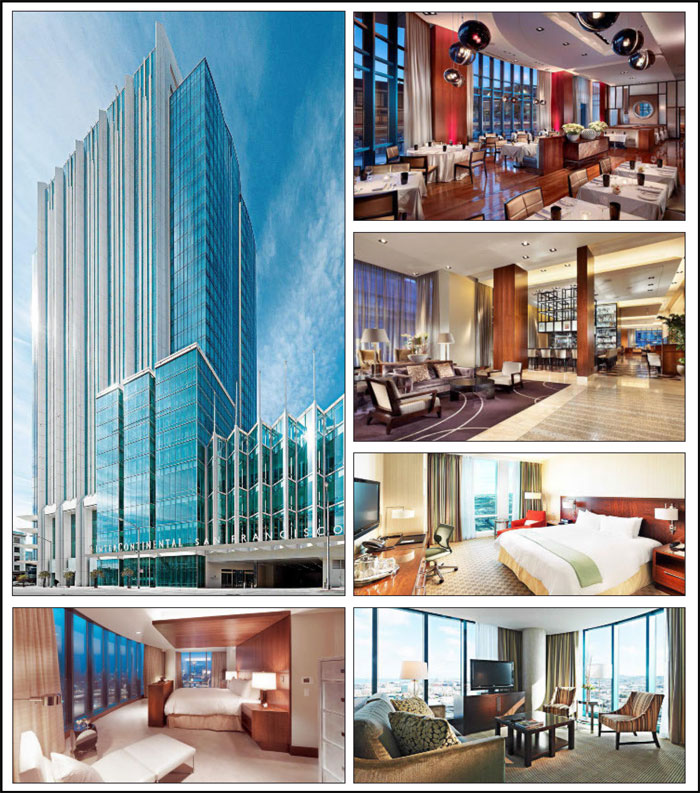

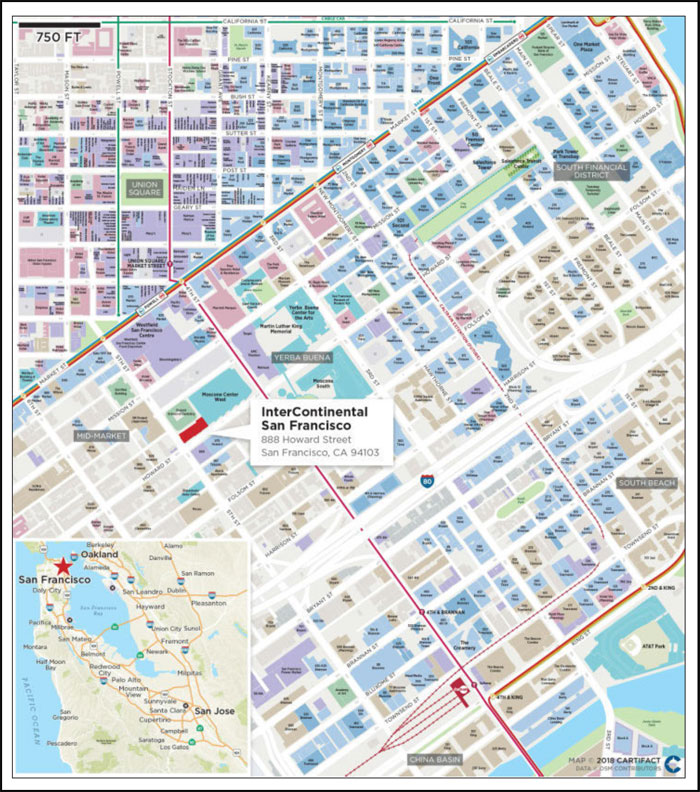

| 6 | InterContinental San Francisco | GACC | 1 | $59,922,671 | 4.0% | 550 | Hotel | 2.29x | 16.0% | 41.9% | 33.5% |

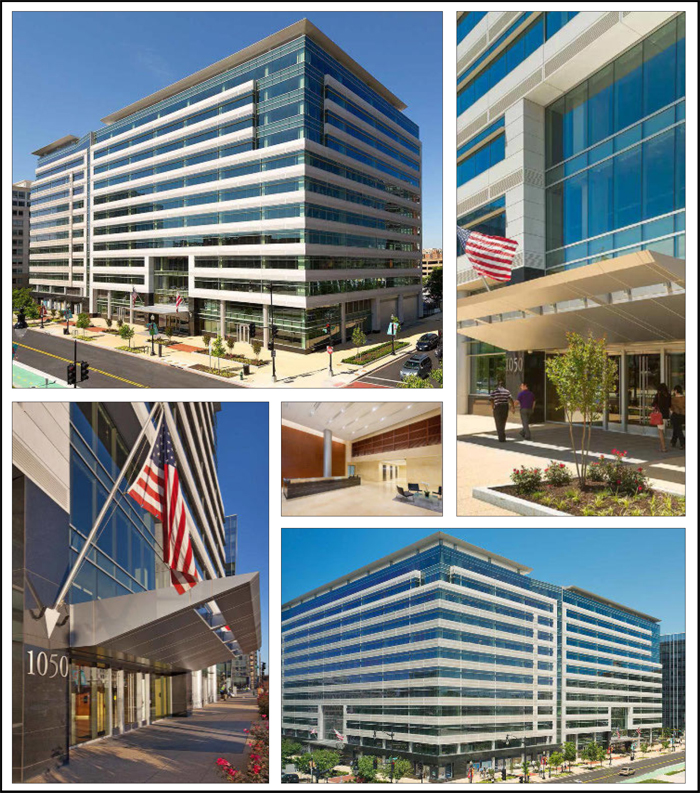

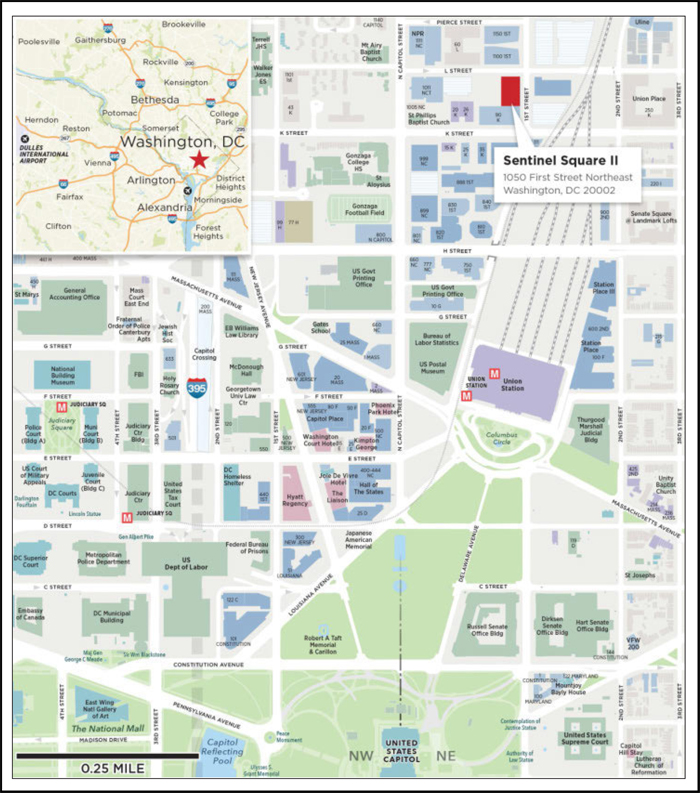

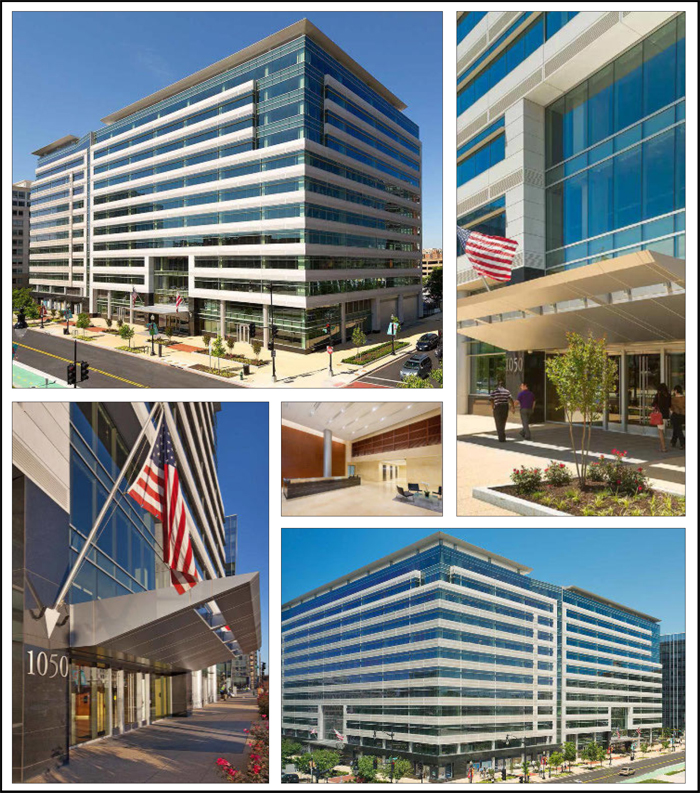

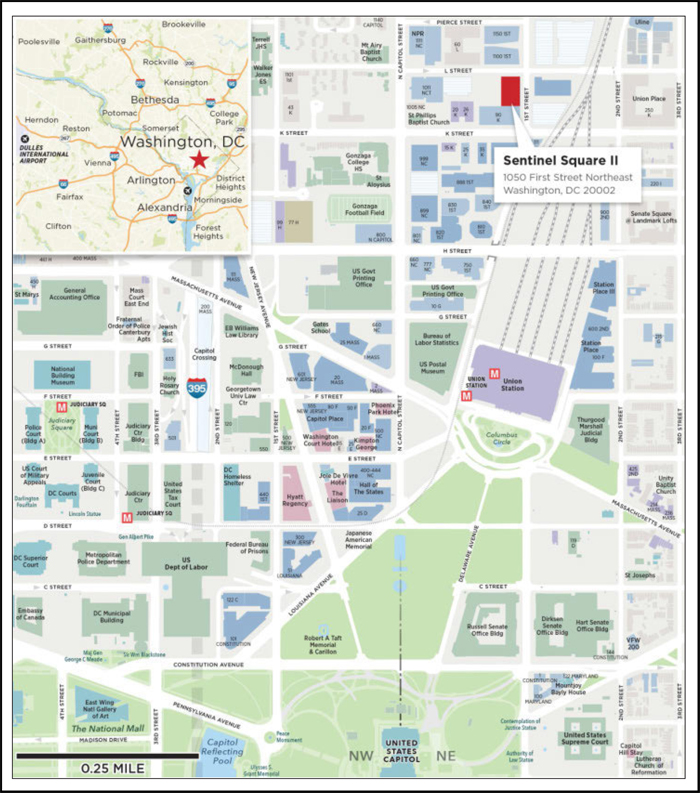

| 7 | Sentinel Square II | GACC | 1 | $57,660,000 | 3.8% | 280,363 | Office | 2.70x | 9.0% | 59.7% | 59.7% |

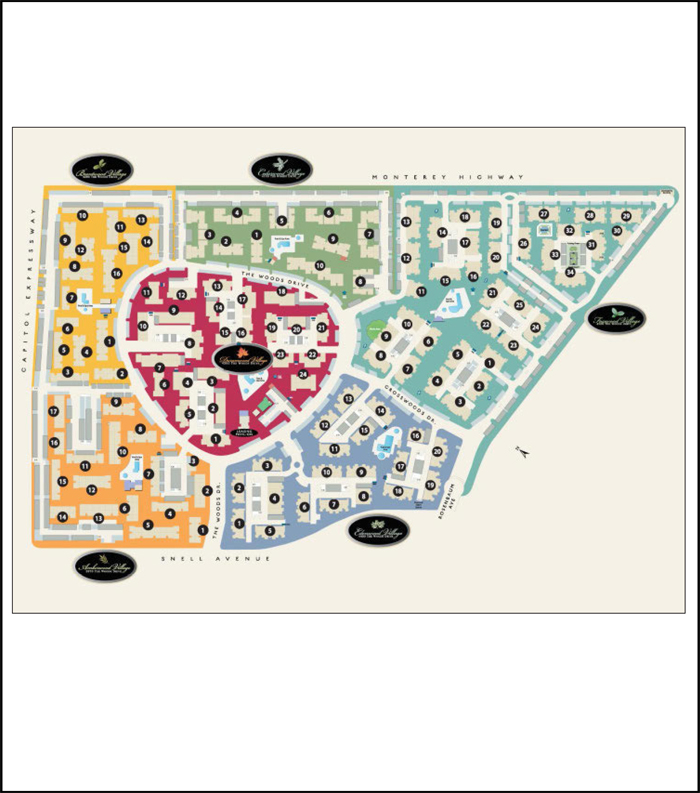

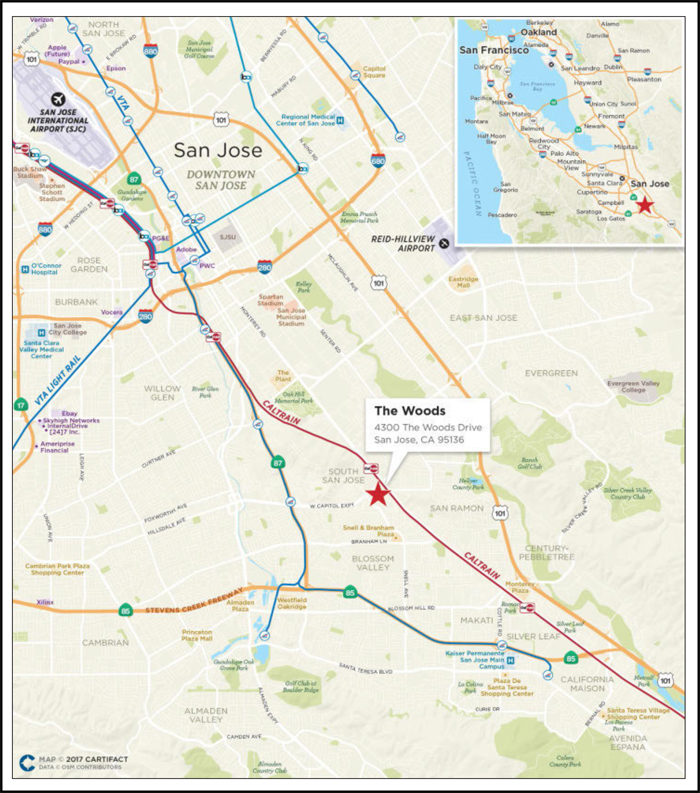

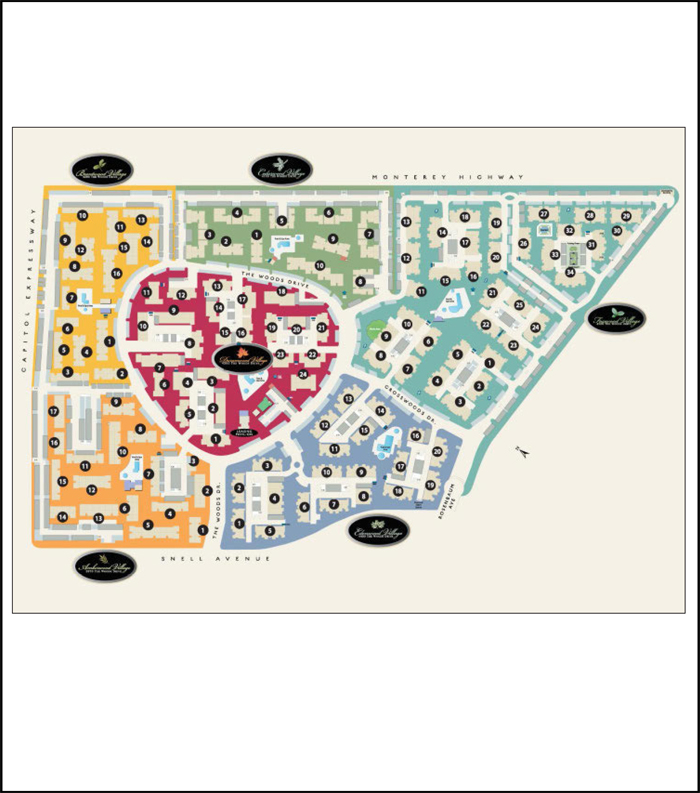

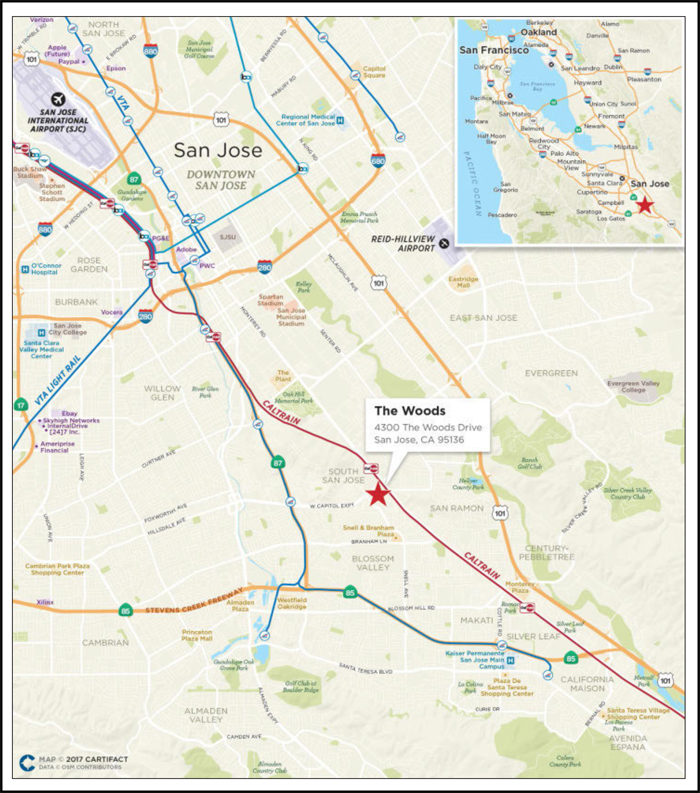

| 8 | The Woods | CREFI | 1 | $57,500,000 | 3.8% | 1,841 | Multifamily | 5.01x | 15.2% | 29.6% | 29.6% |

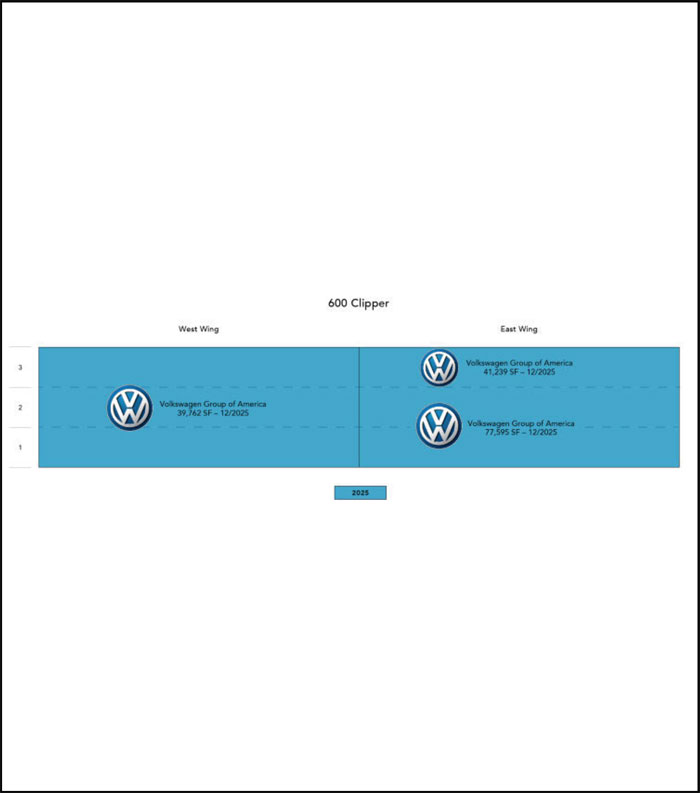

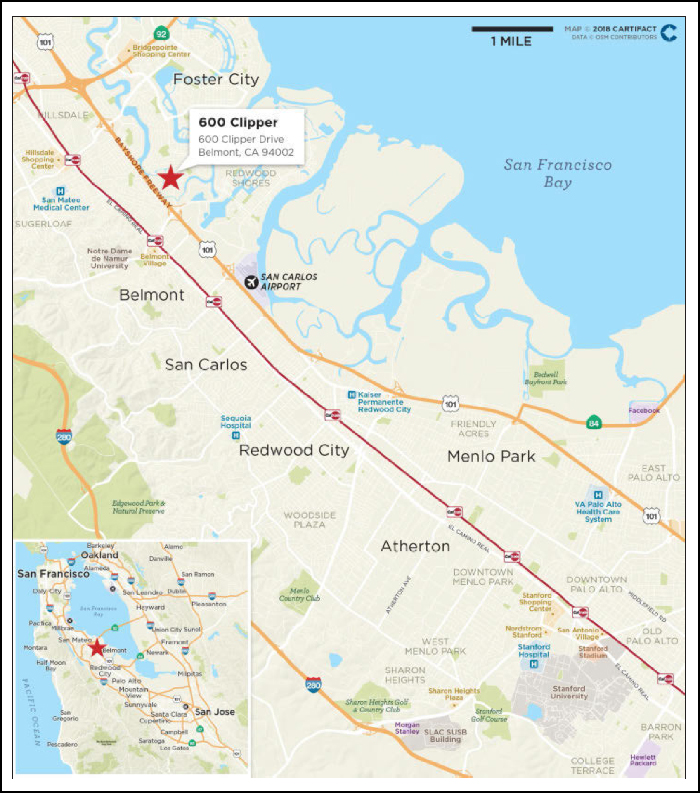

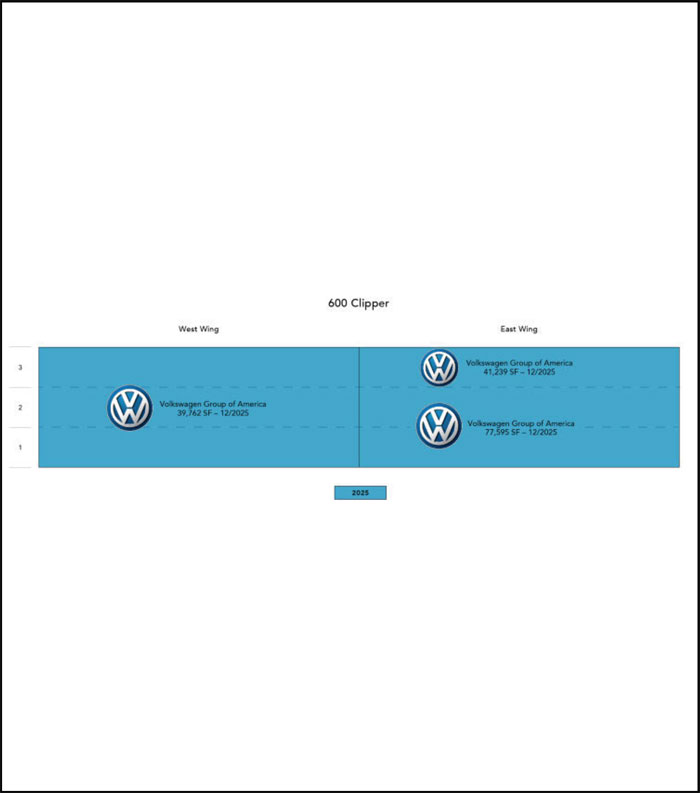

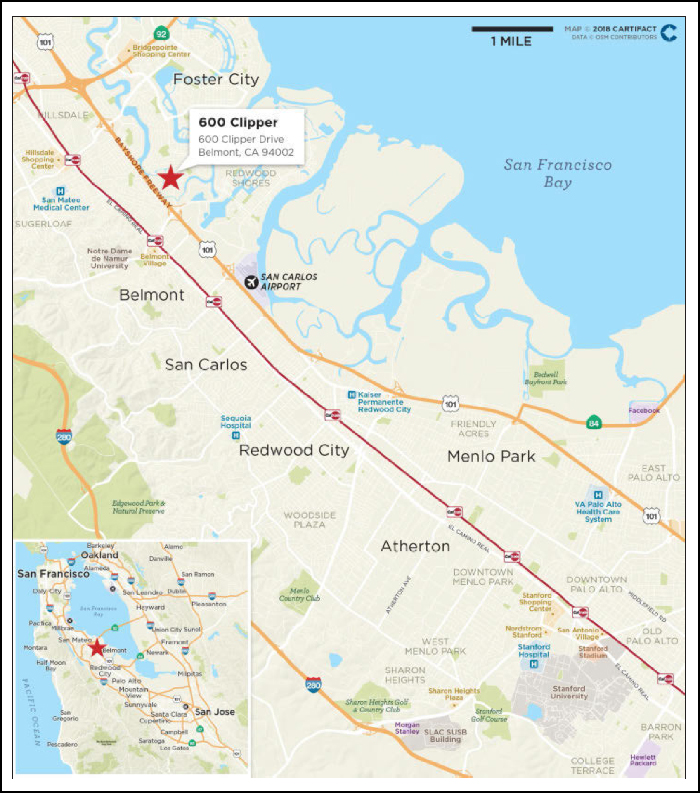

| 9 | 600 Clipper | JPMCB | 1 | $54,300,000 | 3.6% | 158,596 | Office | 3.17x | 12.7% | 57.8% | 57.8% |

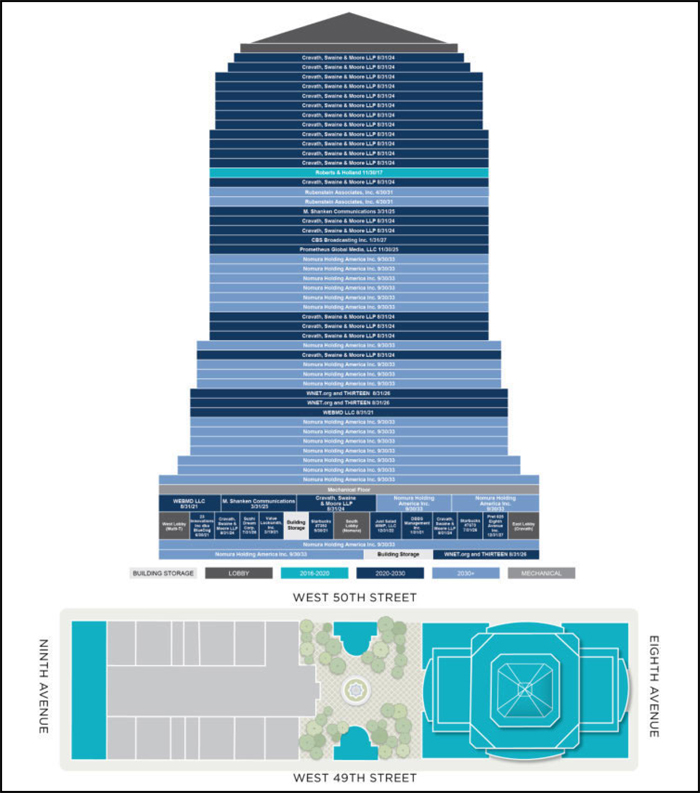

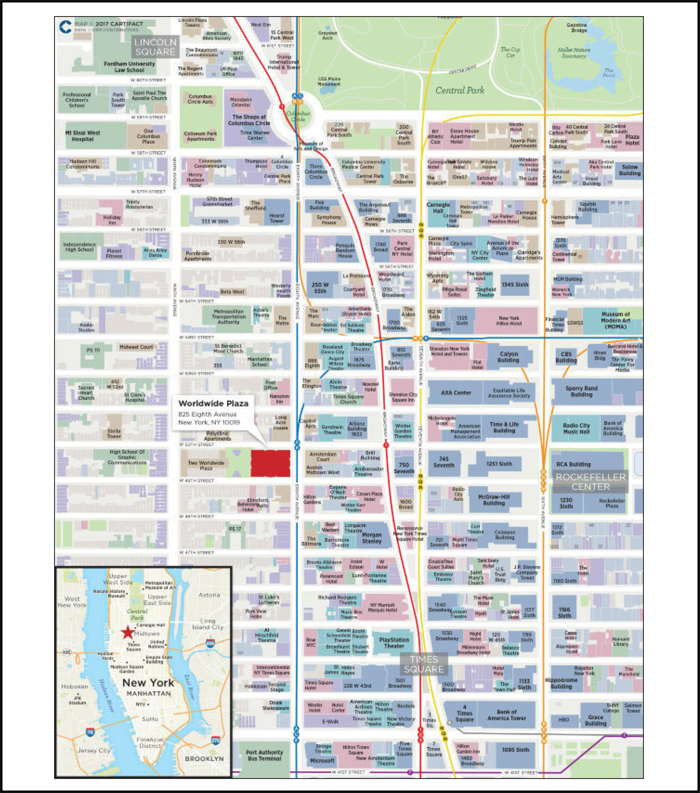

| 10 | Worldwide Plaza | GACC | 1 | $50,000,000 | 3.3% | 2,049,553 | Office | 3.77x | 14.2% | 35.4% | 35.4% |

| | | | | | | | | | | | |

| | Top 3 Total/Weighted Average | 3 | $217,500,000 | 14.4% | | | 2.47x | 11.2% | 56.1% | 52.2% |

| | Top 5 Total/Weighted Average | 8 | $337,500,000 | 22.4% | | | 2.19x | 10.7% | 59.5% | 55.0% |

| | Top 10 Total/Weighted Average | 13 | $616,882,671 | 40.9% | | | 2.72x | 11.9% | 52.9% | 49.7% |

| | | | | | | | | | | | | |

| (1) | In the case of Loan Nos. 3, 4, 5, 6, 7, 8 and 10, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1 and 10, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s). |

| (2) | In the case of Loan Nos. 3, 7 and 9, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

7 of 151

| Structural and Collateral Term Sheet | Benchmark 2018-B2 |

| |

| Collateral Characteristics |

| Pari Passu Companion Loan Summary |

| | |

No. | Loan Name | Trust Cut-off Date Balance | Pari Passu

Loan(s)

Cut-off Date

Balance | Total Mortgage

Loan Cut-off

Date

Balance(1) | Controlling Pooling & Servicing Agreement | Master Servicer | Special Servicer | Control Rights |

| 3 | Apple Campus 3 | $68,000,000 | $272,000,000 | $340,000,000 | BANK 2018-BNK10 | Wells Fargo | Torchlight | BANK 2018-BNK10 |

| 4 | EOS 21 | $60,000,000 | $90,000,000 | $150,000,000 | BMARK 2018-B2 | KeyBank | CWCapital | BMARK 2018-B2 |

| 5 | Rochester Hotel Portfolio | $60,000,000 | $80,000,000 | $140,000,000 | BMARK 2018-B2 | KeyBank | CWCapital | BMARK 2018-B2 |

| 6 | InterContinental San Francisco | $59,922,671 | $49,935,559 | $109,858,230 | BMARK 2018-B2 | KeyBank | CWCapital | BMARK 2018-B2 |

| 7 | Sentinel Square II | $57,660,000 | $45,000,000 | $102,660,000 | BMARK 2018-B2 | KeyBank | CWCapital | BMARK 2018-B2 |

| 8 | The Woods | $57,500,000 | $142,500,000 | $200,000,000 | MSC 2017-HR2 | Wells Fargo | LNR | MSC 2017-HR2 |

| 10 | Worldwide Plaza | $50,000,000 | $566,286,000 | $616,286,000 | WPT 2017-WWP | Wells Fargo | Cohen | WPT 2017-WWP |

| 13 | Braddock Metro Center | $44,200,000 | $30,000,000 | $74,200,000 | BMARK 2018-B2 | KeyBank | CWCapital | BMARK 2018-B2 |

| 14 | BlueLinx Portfolio | $42,900,000 | $28,600,000 | $71,500,000 | BMARK 2018-B2 | KeyBank | CWCapital | BMARK 2018-B2 |

| 15 | Marina Heights State Farm | $41,000,000 | $519,000,000 | $560,000,000 | GS 2017-FARM | KeyBank | AEGON | GS 2017-FARM |

| 16 | Red Building | $40,000,000 | $40,000,000 | $80,000,000 | BMARK 2018-B2 | KeyBank | CWCapital | (2) |

| 17 | 599 Broadway | $40,000,000 | $35,000,000 | $75,000,000 | BMARK 2018-B2 | KeyBank | CWCapital | BMARK 2018-B2 |

| 18 | Lehigh Valley Mall | $35,355,560 | $163,830,696 | $199,186,256 | BMARK 2018-B1 | Wells Fargo | Midland | BMARK 2018-B1 |

| 19 | Atrium Center | $35,000,000 | $80,000,000 | $115,000,000 | (3) | (3) | (3) | (3) |

| 21 | 90 Hudson | $30,000,000 | $100,000,000 | $130,000,000 | BMARK 2018-B1 | Wells Fargo | Midland | BMARK 2018-B1 |

| 22 | Marriott Charlotte City Center | $30,000,000 | $73,000,000 | $103,000,000 | (3) | (3) | (3) | (3) |

| 23 | Two Harbor Point Square | $24,750,000 | $24,750,000 | $49,500,000 | (3) | (3) | (3) | (3) |

| 32 | Towers at University Town Center | $15,000,000 | $31,000,000 | $46,000,000 | BMARK 2018-B2 | KeyBank | CWCapital | BMARK 2018-B2 |

| 35 | Beacon - Criterion | $13,305,255 | $24,675,200 | $37,980,455 | JPMCC 2017-BCON | KeyBank | Cohen | JPMCC 2017-BCON |

| 39 | Beacon - Hague | $11,420,588 | $21,180,000 | $32,600,588 | JPMCC 2017-BCON | KeyBank | Cohen | JPMCC 2017-BCON |

| 42 | Beacon - Paramount | $9,703,725 | $17,996,000 | $27,699,725 | JPMCC 2017-BCON | KeyBank | Cohen | JPMCC 2017-BCON |

| 46 | Beacon - Mercury / Garage | $7,968,529 | $14,778,000 | $22,746,529 | JPMCC 2017-BCON | KeyBank | Cohen | JPMCC 2017-BCON |

| 49 | Beacon - Orpheum | $7,417,020 | $13,755,200 | $21,172,220 | JPMCC 2017-BCON | KeyBank | Cohen | JPMCC 2017-BCON |

| 53 | Beacon - Tower | $5,184,882 | $9,615,600 | $14,800,482 | JPMCC 2017-BCON | KeyBank | Cohen | JPMCC 2017-BCON |

| | | | | | | | | | | | | | |

| (1) | In the case of Loan Nos. 10, 16, 35, 39, 42, 46, 49 and 53, the Total Mortgage Loan Cut-off Date Balance excludes the related Subordinate Companion Loan(s). |

| (2) | The initial controlling noteholder is a third party investor, as holder of the related controlling subordinate companion loan. Upon the occurrence and during the continuance of a control appraisal period, the trust governed by the related lead servicing agreement will be the controlling noteholder. |

| (3) | In the case of Loan Nos. 19, 22 and 23, the whole loan is serviced under the BMARK 2018-B1 Pooling and Servicing Agreement until such time that the controllingpari passu companion loan has been securitized, at which point the whole loan will be serviced under the related pooling and servicing agreement. With respect to Loan Nos. 19 and 22, JPMCB holds the related controllingpari passu companion loan and is entitled to exercise control rights until the securitization of such controllingpari passucompanion loan. With respect to Loan No. 23, CREFI holds the related controllingpari passucompanion loan and is entitled to exercise control rights until the securitization of such controllingpari passu companion loan. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

8 of 151

| Structural and Collateral Term Sheet | Benchmark 2018-B2 |

| |

| Collateral Characteristics |

No. | Loan Name | Trust

Cut-off Date Balance | Subordinate

Debt

Cut-off

Date

Balance(1) | Total Debt Cut-off Date Balance | Mortgage Loan UW NCF DSCR(2)(3) | Total Debt UW NCF DSCR(3) | Mortgage Loan

Cut-off

Date

LTV(2)(4) | Total Debt Cut-off Date LTV(4) | Mortgage Loan UW NOI Debt Yield(2) | Total Debt UW NOI Debt Yield |

| 1 | Central Park of Lisle | $79,500,000 | $14,350,000 | $93,850,000 | 2.58x | 1.96x | 58.9% | 69.5% | 12.6% | 10.7% |

| 3 | Apple Campus 3 | $68,000,000 | $235,000,000 | $575,000,000 | 3.55x | 1.70x | 44.0% | 74.3% | 12.2% | 7.2% |

| 10 | Worldwide Plaza | $50,000,000 | $583,714,000 | $1,200,000,000 | 3.77x | 1.75x | 35.4% | 69.0% | 14.2% | 7.3% |

| 16 | Red Building | $40,000,000 | $116,000,000 | $196,000,000 | 3.31x | 1.15x | 27.9% | 68.4% | 16.1% | 6.6% |

| 23 | Two Harbor Point Square | $24,750,000 | $11,500,000 | $61,000,000 | 1.78x | 1.28x | 61.9% | 76.3% | 11.3% | 9.2% |

| 33 | Fairfield Portfolio | $14,490,000 | $1,260,000 | $15,750,000 | 1.80x | 1.54x | 64.4% | 70.0% | 13.6% | 12.5% |

| 35 | Beacon - Criterion | $13,305,255 | $39,046,545 | $77,027,000 | 3.01x | 1.19x | 37.0% | 75.0% | 11.7% | 5.8% |

| 39 | Beacon - Hague | $11,420,588 | $32,308,412 | $64,909,000 | 2.87x | 1.17x | 37.1% | 73.9% | 11.2% | 5.6% |

| 42 | Beacon - Paramount | $9,703,725 | $31,976,275 | $59,676,000 | 3.37x | 1.20x | 33.0% | 71.0% | 13.1% | 6.1% |

| 46 | Beacon - Mercury / Garage | $7,968,529 | $25,948,471 | $48,695,000 | 3.36x | 1.21x | 33.9% | 72.6% | 13.2% | 6.1% |

| 49 | Beacon - Orpheum | $7,417,020 | $22,648,780 | $43,821,000 | 3.14x | 1.19x | 36.0% | 74.5% | 12.2% | 5.9% |

| 53 | Beacon - Tower | $5,184,882 | $16,071,518 | $30,872,000 | 3.22x | 1.21x | 36.6% | 76.4% | 12.5% | 6.0% |

| | | | | | | | | | | | |

| (1) | In the case of Loan No. 1, Subordinate Debt Cut-off Date Balance represents a Subordinate Companion Loan. In the case of Loan No. 3, Subordinate Debt Cut-off Date Balance represents two mezzanine loans. In the case of Loan No. 10, Subordinate Debt Cut-off Date Balance represents a Subordinate Companion Loan and a mezzanine loan. In the case of Loan No. 16, Subordinate Debt Cut-off Date Balance represents two Subordinate Companion Loans. In the case of Loan Nos. 23 and 33, Subordinate Debt Cut-off Date Balance represents a mezzanine loan. In the case of Loan Nos. 35, 39, 42, 46, 49 and 53, Subordinate Debt Cut-off Date Balance represents a Subordinate Companion Loan and a mezzanine loan. |

| (2) | In the case of Loan Nos. 10, 16, 23, 35, 39, 42, 46, 49 and 53, Mortgage Loan UW NCF DSCR, Mortgage Loan Cut-off Date LTV and Mortgage Loan UW NOI Debt Yield calculations include any related Pari Passu Companion Loans, where applicable, but exclude the related Subordinate Companion Loan(s) or mezzanine loan(s), as applicable. |

| (3) | In the case of Loan No. 33, the Mortgage Loan UW NCF DSCR and Total Debt UW NCF DSCR are calculated using the sum of principal and interest payments over the first 12 months based on the assumed principal payment schedule provided on Annex H to the Preliminary Prospectus. |

| (4) | In the case of Loan Nos. 3 and 33, the Mortgage Loan Cut-off Date LTV and the Total Debt Cut-off Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

9 of 151

| Structural and Collateral Term Sheet | Benchmark 2018-B2 |

| |

| Collateral Characteristics |

| Mortgaged Properties by Type(1) |

| | | | | | Weighted Average |

| Property Type | Property Subtype | Number of Properties | Cut-off Date Principal Balance | % of

IPB | Occupancy | UW

NCF

DSCR(2)(3) | UW

NOI Debt Yield(2) | Cut-off Date LTV(2)(4) | Maturity

Date

LTV(2)(4) |

| Office | Suburban | 10 | $358,670,000 | 23.8% | 93.8% | 2.60x | 11.6% | 59.3% | 56.9% |

| | CBD | 7 | 230,910,000 | 15.3 | 92.8% | 2.74x | 11.7% | 49.7% | 48.6% |

| | Subtotal: | 17 | $589,580,000 | 39.1% | 93.4% | 2.65x | 11.7% | 55.5% | 53.6% |

| | | | | | | | | | |

| Hotel | Full Service | 5 | $154,354,509 | 10.2% | 75.8% | 2.06x | 13.7% | 55.9% | 47.1% |

| | Select Service(5) | 3 | 61,251,569 | 4.1 | 65.3% | 1.73x | 12.6% | 66.9% | 57.1% |

| | Limited Service | 5 | 41,144,091 | 2.7 | 73.7% | 1.74x | 12.6% | 62.5% | 54.7% |

| | Extended Stay | 2 | 23,928,571 | 1.6 | 77.5% | 1.61x | 11.6% | 66.8% | 55.9% |

| | Subtotal: | 15 | $280,678,740 | 18.6% | 73.3% | 1.90x | 13.1% | 60.2% | 51.2% |

| | | | | | | | | | |

| Multifamily | Garden | 4 | $123,362,093 | 8.2% | 95.4% | 3.07x | 11.9% | 50.4% | 45.8% |

| | Mid-rise | 1 | 60,000,000 | 4.0 | 97.3% | 1.87x | 7.5% | 64.8% | 64.8% |

| | High-rise(6) | 6 | 55,000,000 | 3.6 | 94.6% | 3.13x | 12.2% | 35.7% | 35.7% |

| | Student | 1 | 15,000,000 | 1.0 | 99.2% | 1.55x | 10.0% | 63.4% | 55.9% |

| | Subtotal: | 12 | $253,362,093 | 16.8% | 95.9% | 2.71x | 10.8% | 51.4% | 48.7% |

| | | | | | | | | | |

| Retail | Anchored | 6 | $125,606,828 | 8.3% | 98.5% | 1.51x | 10.1% | 67.3% | 55.7% |

| | Unanchored | 1 | 40,000,000 | 2.7 | 100.0% | 1.75x | 7.3% | 50.0% | 50.0% |

| | Super Regional Mall | 1 | 35,355,560 | 2.3 | 83.9% | 2.07x | 12.5% | 44.8% | 35.8% |

| | Freestanding | 3 | 17,230,677 | 1.1 | 100.0% | 1.60x | 10.4% | 67.0% | 55.6% |

| | Subtotal: | 11 | $218,193,066 | 14.5% | 96.5% | 1.65x | 10.0% | 60.5% | 51.4% |

| | | | | | | | | | |

| Mixed Use | Office/Retail | 2 | $83,000,000 | 5.5% | 100.0% | 1.70x | 7.4% | 57.3% | 57.3% |

| | Subtotal: | 2 | $83,000,000 | 5.5% | 100.0% | 1.70x | 7.4% | 57.3% | 57.3% |

| | | | | | | | | | |

| Industrial | Warehouse/Distribution | 4 | $42,900,000 | 2.8% | 100.0% | 2.46x | 12.1% | 64.2% | 64.2% |

| | Subtotal: | 4 | $42,900,000 | 2.8% | 100.0% | 2.46x | 12.1% | 64.2% | 64.2% |

| | | | | | | | | | |

| Other | Leased Fee | 1 | $24,500,000 | 1.6% | NAP | 1.69x | 7.4% | 74.2% | 74.2% |

| | Subtotal: | 1 | $24,500,000 | 1.6% | NAP | 1.69x | 7.4% | 74.2% | 74.2% |

| | | | | | | | | | |

| Self Storage | Self Storage | 3 | $7,700,000 | 0.5% | 82.4% | 1.26x | 8.4% | 74.8% | 66.1% |

| | Subtotal: | 3 | $7,700,000 | 0.5% | 82.4% | 1.26x | 8.4% | 74.8% | 66.1% |

| | | | | | | | | | |

| Manufactured Housing | Manufactured Housing | 2 | $7,100,000 | 0.5% | 95.4% | 1.41x | 9.0% | 74.6% | 61.0% |

| | Subtotal: | 2 | $7,100,000 | 0.5% | 95.4% | 1.41x | 9.0% | 74.6% | 61.0% |

| | | | | | | | | | | |

| | Total / Weighted Average: | 67 | 1,507,013,899 | 100.0% | 91.0% | 2.29x | 11.2% | 57.2% | 53.0% |

| | | | | | | | | | | | |

| (1) | Because this table presents information relating to the mortgaged properties and not mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts. |

| (2) | In the case of Loan Nos. 3, 4, 5, 6, 7, 8, 10, 13, 14, 15, 16, 17, 18, 19, 21, 22, 23, 32, 35, 39, 42, 46, 49 and 53, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 10, 16, 35, 39, 42, 46, 49 and 53, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s). |

| (3) | In the case of Loan No. 33, the UW NCF DSCR is calculated using the sum of principal and interest payments over the first 12 months based on the assumed principal payment schedule provided on Annex H to the Preliminary Prospectus. |

| (4) | In the case of Loan Nos. 3, 7, 9, 12, 19, 25, 29, 33, 36, 43 and 54, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| (5) | Select Service includes the Hotel Indigo & Austin property, which is a dual-branded hotel consisting of a 134-room select-service hotel and a 171-room limited-service hotel. |

| (6) | High-rise includes the Beacon – Mercury / Garage property, which consists of a 126-unit multifamily property and a 510-space parking garage. Occupancy is for the multifamily portion of the property only. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

10 of 151

| Structural and Collateral Term Sheet | Benchmark 2018-B2 |

| |

| Collateral Characteristics |

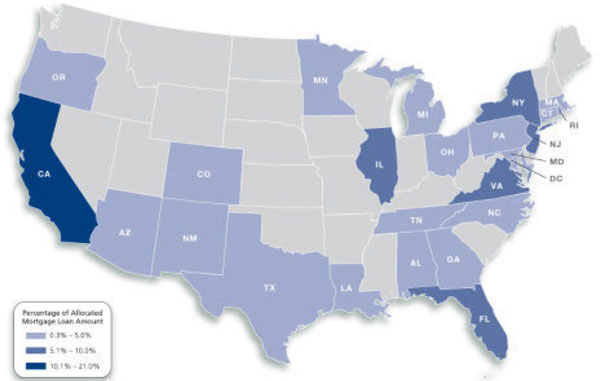

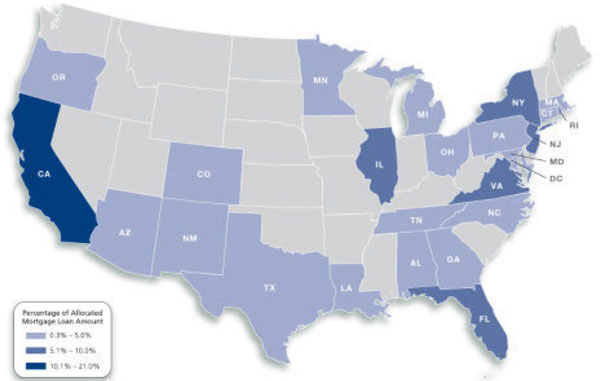

| Mortgaged Properties by Location(1) |

| |

| | | | | Weighted Average |

State | Number of Properties | Cut-off Date Principal Balance | % of IPB | Occupancy | UW

NCF DSCR(2)(3) | UW

NOI Debt Yield(2) | Cut-off Date

LTV(2)(4) | Maturity Date LTV(2)(4) |

| California | 8 | $316,392,671 | 21.0% | 92.7% | 3.26x | 13.7% | 44.1% | 42.0% |

| New York | 3 | 138,000,000 | 9.2 | 99.4% | 2.37x | 9.6% | 48.2% | 48.2% |

| Virginia | 2 | 104,200,000 | 6.9 | 95.2% | 1.71x | 8.3% | 65.6% | 63.3% |

| Illinois | 2 | 104,000,000 | 6.9 | 84.2% | 2.37x | 11.4% | 62.5% | 62.5% |

| Florida | 4 | 102,933,438 | 6.8 | 97.6% | 1.39x | 9.4% | 66.8% | 54.8% |

| New Jersey | 7 | 85,000,000 | 5.6 | 95.6% | 2.75x | 11.1% | 44.3% | 44.3% |

| Arizona | 2 | 71,500,000 | 4.7 | 97.7% | 2.34x | 9.9% | 60.5% | 57.7% |

| Georgia | 8 | 68,300,230 | 4.5 | 86.8% | 1.65x | 11.0% | 67.8% | 56.4% |

| Texas | 4 | 63,862,093 | 4.2 | 73.5% | 1.66x | 11.4% | 70.1% | 59.5% |

| Minnesota | 4 | 60,000,000 | 4.0 | 62.7% | 1.50x | 12.2% | 66.7% | 55.4% |

| North Carolina | 5 | 57,897,140 | 3.8 | 78.7% | 2.34x | 12.8% | 63.5% | 59.4% |

| District of Columbia | 1 | 57,660,000 | 3.8 | 94.1% | 2.70x | 9.0% | 59.7% | 59.7% |

| Massachusetts | 2 | 48,991,250 | 3.3 | 100.0% | 2.17x | 9.3% | 56.6% | 56.6% |

| Ohio | 2 | 39,500,000 | 2.6 | 93.8% | 1.82x | 11.9% | 72.8% | 62.2% |

| Pennsylvania | 2 | 38,033,560 | 2.5 | 85.0% | 2.05x | 12.4% | 45.5% | 36.8% |

| Maryland | 2 | 29,820,000 | 2.0 | 99.6% | 2.00x | 11.0% | 63.8% | 60.0% |

| Connecticut | 1 | 24,750,000 | 1.6 | 94.3% | 1.78x | 11.3% | 61.9% | 56.4% |

| Michigan | 1 | 23,600,000 | 1.6 | 96.8% | 1.45x | 9.9% | 72.0% | 63.7% |

| Oregon | 1 | 19,500,000 | 1.3 | 100.0% | 1.68x | 10.5% | 63.3% | 57.5% |

| Louisiana | 1 | 12,900,000 | 0.9 | 72.5% | 1.83x | 13.2% | 54.4% | 52.0% |

| Rhode Island | 1 | 10,775,000 | 0.7 | 95.4% | 2.04x | 13.4% | 68.2% | 59.5% |

| New Mexico | 1 | 9,482,984 | 0.6 | 80.9% | 1.48x | 10.4% | 71.8% | 60.5% |

| Alabama | 1 | 8,500,000 | 0.6 | 91.4% | 1.94x | 12.4% | 68.8% | 60.3% |

| Tennessee | 1 | 7,144,426 | 0.5 | 71.4% | 2.05x | 15.2% | 58.6% | 48.1% |

| Colorado | 1 | 4,271,107 | 0.3 | 67.9% | 1.89x | 12.3% | 59.7% | 49.4% |

| Total / Weighted Average: | 67 | $1,507,013,899 | 100.0% | 91.0% | 2.29x | 11.2% | 57.2% | 53.0% |

| | | | | | | | | | | | | | |

| (1) | Because this table presents information relating to the mortgaged properties and not mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts. |

| (2) | In the case of Loan Nos. 3, 4, 5, 6, 7, 8, 10, 13, 14, 15, 16, 17, 18, 19, 21, 22, 23, 32, 35, 39, 42, 46, 49 and 53, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 10, 16, 35, 39, 42, 46, 49 and 53, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s). |

| (3) | In the case of Loan No. 33, the UW NCF DSCR is calculated using the sum of principal and interest payments over the first 12 months based on the assumed principal payment schedule provided on Annex H to the Preliminary Prospectus. |

| (4) | In the case of Loan Nos. 3, 7, 9, 12, 19, 25, 29, 33, 36, 43 and 54, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

11 of 151

| Structural and Collateral Term Sheet | Benchmark 2018-B2 |

| Collateral Characteristics |

| Cut-off Date Principal Balance |

| | | | | Weighted Average |

Range of Cut-off Date

Principal Balances | Number

of Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan

Term(1) | UW

NCF

DSCR(2)(3) | UW

NOI

DY(2) | Cut-off

Date

LTV(2)(4) | Maturity

Date

LTV(1)(2)(4) |

| $2,678,000 | - | $9,999,999 | 16 | $108,867,342 | 7.2% | 4.55667% | 101 | 2.15x | 11.4% | 58.3% | 51.8% |

| $10,000,000 | - | $19,999,999 | 14 | 201,458,326 | 13.4 | 4.65740% | 108 | 1.85x | 11.6% | 63.5% | 54.6% |

| $20,000,000 | - | $24,999,999 | 5 | 117,850,000 | 7.8 | 4.50132% | 119 | 1.61x | 9.7% | 70.3% | 64.0% |

| $25,000,000 | - | $49,999,999 | 12 | 461,955,560 | 30.7 | 4.30279% | 109 | 2.11x | 10.5% | 56.7% | 54.1% |

| $50,000,000 | - | $79,500,000 | 10 | 616,882,671 | 40.9 | 3.89940% | 96 | 2.72x | 11.9% | 52.9% | 49.7% |

| Total / Weighted Average: | 57 | $1,507,013,899 | 100.0% | 4.21894% | 104 | 2.29x | 11.2% | 57.2% | 53.0% |

| | | | | Weighted Average |

Range of

Mortgage Interest Rates | Number

of Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan

Term(1) | UW

NCF

DSCR(2)(3) | UW

NOI

DY(2) | Cut-off

Date

LTV(2)(4) | Maturity

Date

LTV(1)(2)(4) |

| 2.94050% | - | 3.99999% | 14 | $478,460,000 | 31.7% | 3.53234% | 93 | 3.20x | 11.5% | 48.4% | 48.4% |

| 4.00000% | - | 4.49999% | 16 | 522,373,231 | 34.7 | 4.28369% | 105 | 2.09x | 11.2% | 55.6% | 52.8% |

| 4.50000% | - | 4.99999% | 22 | 436,836,576 | 29.0 | 4.70135% | 112 | 1.65x | 11.0% | 67.0% | 57.3% |

| 5.00000% | - | 5.71000% | 5 | 69,344,091 | 4.6 | 5.42948% | 120 | 1.60x | 11.3% | 68.3% | 58.6% |

| Total / Weighted Average: | 57 | $1,507,013,899 | 100.0% | 4.21894% | 104 | 2.29x | 11.2% | 57.2% | 53.0% |

| Original Term to Maturity in Months |

| | | | | Weighted Average |

Original Term to

Maturity in Months | Number

of Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan

Term(1) | UW

NCF

DSCR(2)(3) | UW

NOI

DY(2) | Cut-off

Date

LTV(2)(4) | Maturity

Date

LTV(1)(2)(4) |

| 60 | 12 | $335,460,000 | 22.3% | 3.87927% | 58 | 3.08x | 12.3% | 50.9% | 50.8% |

| 84 | 1 | 60,000,000 | 4.0 | 3.88000% | 82 | 1.87x | 7.5% | 64.8% | 64.8% |

| 120 | 44 | 1,111,553,899 | 73.8 | 4.33974% | 119 | 2.08x | 11.1% | 58.7% | 53.0% |

| Total / Weighted Average: | 57 | $1,507,013,899 | 100.0% | 4.21894% | 104 | 2.29x | 11.2% | 57.2% | 53.0% |

| | | | | | | | | | |

| Remaining Term to Maturity in Months |

| | | | | Weighted Average |

Range of Remaining Term to

Maturity in Months | Number

of Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan

Term(1) | UW

NCF

DSCR(2)(3) | UW

NOI

DY(2) | Cut-off

Date

LTV(2)(4) | Maturity

Date

LTV(1)(2)(4) |

| 52 | - | 84 | 13 | $395,460,000 | 26.2% | 3.87938% | 62 | 2.90x | 11.6% | 53.0% | 52.9% |

| 85 | - | 119 | 34 | 852,963,899 | 56.6 | 4.21966% | 118 | 2.25x | 11.6% | 56.8% | 51.9% |

| 120 | - | 120 | 10 | 258,590,000 | 17.2 | 4.73583% | 120 | 1.50x | 9.4% | 65.2% | 56.7% |

| Total / Weighted Average: | 57 | $1,507,013,899 | 100.0% | 4.21894% | 104 | 2.29x | 11.2% | 57.2% | 53.0% |

| (1) | In the case of Loan Nos. 3 and 15, each with an anticipated repayment date, Remaining Loan Term and Maturity Date LTV are calculated as of the related anticipated repayment date. |

| (2) | In the case of Loan Nos. 3, 4, 5, 6, 7, 8, 10, 13, 14, 15, 16, 17, 18, 19, 21, 22, 23, 32, 35, 39, 42, 46, 49 and 53, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 10, 16, 35, 39, 42, 46, 49 and 53, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s). |

| (3) | In the case of Loan No. 33, the UW NCF DSCR is calculated using the sum of principal and interest payments over the first 12 months based on the assumed principal payment schedule provided on Annex H to the Preliminary Prospectus. |

| (4) | In the case of Loan Nos. 3, 7, 9, 12, 19, 25, 29, 33, 36, 43 and 54, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

12 of 151

| Structural and Collateral Term Sheet | Benchmark 2018-B2 |

| Collateral Characteristics |

| Original Amortization Term in Months |

| | | | | Weighted Average |

Original

Amortization

Term in Months | Number

of Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan

Term(1) | UW

NCF

DSCR(2)(3) | UW

NOI

DY(2) | Cut-off

Date

LTV(2)(4) | Maturity

Date

LTV(1)(2)(4) |

| Interest Only | 24 | $826,530,000 | 54.8% | 3.87451% | 92 | 2.81x | 11.2% | 51.8% | 51.8% |

| 300 | 2 | 79,967,553 | 5.3 | 4.73326% | 117 | 1.51x | 12.1% | 66.7% | 53.9% |

| 360 | 31 | 600,516,346 | 39.8 | 4.62450% | 117 | 1.68x | 11.2% | 63.4% | 54.4% |

| Total / Weighted Average: | 57 | $1,507,013,899 | 100.0% | 4.21894% | 104 | 2.29x | 11.2% | 57.2% | 53.0% |

| Remaining Amortization Term in Months |

| | | | | Weighted Average |

Range of Remaining

Amortization Term in Months | Number

of Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan

Term(1) | UW

NCF

DSCR(2)(3) | UW

NOI

DY(2) | Cut-off

Date

LTV(2)(4) | Maturity

Date

LTV(1)(2)(4) |

| Interest Only | 24 | 826,530,000 | 54.8% | 3.87451% | 92 | 2.81x | 11.2% | 51.8% | 51.8% |

| 299 | - | 356 | 3 | 87,865,942 | 5.8 | 4.75076% | 117 | 1.52x | 12.1% | 67.2% | 54.4% |

| 357 | - | 360 | 30 | 592,617,956 | 39.3 | 4.62045% | 117 | 1.68x | 11.2% | 63.3% | 54.3% |

| Total / Weighted Average: | 57 | $1,507,013,899 | 100.0% | 4.21894% | 104 | 2.29x | 11.2% | 57.2% | 53.0% |

| | | | | Weighted Average |

| Amortization Types | Number

of Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan

Term(1) | UW

NCF

DSCR(2)(3) | UW

NOI

DY(2) | Cut-off

Date

LTV(2)(4) | Maturity

Date

LTV(1)(2)(4) |

| Interest Only | 22 | $717,530,000 | 47.6% | 3.94080% | 88 | 2.72x | 11.1% | 52.2% | 52.2% |

| IO-Balloon | 17 | 381,603,000 | 25.3 | 4.62239% | 116 | 1.61x | 10.9% | 67.1% | 59.1% |

| Balloon | 16 | 298,880,899 | 19.8 | 4.65629% | 119 | 1.73x | 11.8% | 59.5% | 48.2% |

| ARD-Interest Only | 2 | 109,000,000 | 7.2 | 3.43815% | 119 | 3.39x | 11.9% | 49.4% | 49.4% |

| Total / Weighted Average: | 57 | $1,507,013,899 | 100.0% | 4.21894% | 104 | 2.29x | 11.2% | 57.2% | 53.0% |

| Underwritten Net Cash Flow Debt Service Coverage Ratios(2)(3) |

| | | | | Weighted Average |

Range of Underwritten Net

Cash Flow Debt Service

Coverage Ratios | Number

of Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan

Term(1) | UW

NCF

DSCR(2)(3) | UW

NOI

DY(2) | Cut-off

Date

LTV(2)(4) | Maturity

Date

LTV(1)(2)(4) |

| 1.26x | - | 1.49x | 11 | $280,297,824 | 18.6% | 4.63885% | 119 | 1.39x | 8.6% | 66.4% | 58.8% |

| 1.50x | - | 1.74x | 13 | 273,899,310 | 18.2 | 4.71259% | 117 | 1.62x | 11.2% | 68.6% | 58.6% |

| 1.75x | - | 1.99x | 8 | 167,589,107 | 11.1 | 4.30326% | 101 | 1.82x | 9.4% | 59.9% | 57.3% |

| 2.00x | - | 2.24x | 8 | 149,444,986 | 9.9 | 4.19826% | 118 | 2.05x | 10.8% | 57.2% | 52.8% |

| 2.25x | - | 5.01x | 17 | 635,782,671 | 42.2 | 3.80377% | 88 | 3.16x | 13.0% | 47.6% | 46.8% |

| Total / Weighted Average: | 57 | $1,507,013,899 | 100.0% | 4.21894% | 104 | 2.29x | 11.2% | 57.2% | 53.0% |

| (1) | In the case of Loan Nos. 3 and 15, each with an anticipated repayment date, Remaining Loan Term and Maturity Date LTV are calculated as of the related anticipated repayment date. |

| (2) | In the case of Loan Nos. 3, 4, 5, 6, 7, 8, 10, 13, 14, 15, 16, 17, 18, 19, 21, 22, 23, 32, 35, 39, 42, 46, 49 and 53, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 10, 16, 35, 39, 42, 46, 49 and 53, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s). |

| (3) | In the case of Loan No. 33, the UW NCF DSCR is calculated using the sum of principal and interest payments over the first based on the assumed principal payment schedule provided on Annex H to the Preliminary Prospectus. |

| (4) | In the case of Loan Nos. 3, 7, 9, 12, 19, 25, 29, 33, 36, 43 and 54, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

13 of 151

| Structural and Collateral Term Sheet | Benchmark 2018-B2 |

| Collateral Characteristics |

| LTV Ratios as of the Cut-off Date(2)(4) |

| | | | | Weighted Average |

Range of

Cut-off Date LTVs | Number

of Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan

Term(1) | UW

NCF

DSCR(2)(3) | UW

NOI

DY(2) | Cut-off

Date LTV(2)(4) | Maturity

Date

LTV(1)(2)(4) |

| 27.9% | - | 49.9% | 12 | $365,778,231 | 24.3% | 3.69977% | 100 | 3.37x | 14.0% | 37.3% | 35.0% |

| 50.0% | - | 59.9% | 10 | 334,453,533 | 22.2 | 3.93266% | 92 | 2.55x | 10.8% | 57.0% | 56.5% |

| 60.0% | - | 64.9% | 13 | 398,310,000 | 26.4 | 4.40280% | 102 | 1.79x | 9.4% | 63.0% | 59.1% |

| 65.0% | - | 69.9% | 10 | 227,428,668 | 15.1 | 4.78501% | 118 | 1.61x | 11.5% | 67.4% | 57.2% |

| 70.0% | - | 74.8% | 12 | 181,043,466 | 12.0 | 4.68109% | 119 | 1.59x | 10.0% | 72.7% | 64.0% |

| Total / Weighted Average: | 57 | $1,507,013,899 | 100.0% | 4.21894% | 104 | 2.29x | 11.2% | 57.2% | 53.0% |

| LTV Ratios as of the Maturity Date(1)(2)(4) |

| | | | | Weighted Average |

Range of

Maturity Date LTVs | Number

of Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan

Term(1) | UW

NCF

DSCR(2)(3) | UW

NOI

DY(2) | Cut-off

Date LTV(2)(4) | Maturity

Date

LTV(1)(2)(4) |

| 27.9% | - | 44.9% | 12 | $365,778,231 | 24.3% | 3.69977% | 100 | 3.37x | 14.0% | 37.3% | 35.0% |

| 45.0% | - | 49.9% | 3 | 31,383,086 | 2.1 | 4.80929% | 119 | 1.70x | 12.7% | 63.8% | 49.0% |

| 50.0% | - | 54.9% | 6 | 175,068,000 | 11.6 | 4.49422% | 115 | 1.64x | 9.0% | 58.2% | 52.3% |

| 55.0% | - | 59.9% | 17 | 497,369,505 | 33.0 | 4.26726% | 102 | 2.18x | 11.3% | 62.8% | 57.8% |

| 60.0% | - | 74.2% | 19 | 437,415,076 | 29.0 | 4.44560% | 104 | 1.82x | 9.6% | 66.7% | 63.0% |

| Total / Weighted Average: | 57 | $1,507,013,899 | 100.0% | 4.21894% | 104 | 2.29x | 11.2% | 57.2% | 53.0% |

| | | | | Weighted Average |

| Prepayment Protection | Number

of Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan

Term(1) | UW

NCF

DSCR(2)(3) | UW

NOI

DY(2) | Cut-off

Date LTV(2)(4) | Maturity

Date

LTV(1)(2)(4) |

| Defeasance(5) | 36 | $925,441,228 | 61.4% | 4.31105% | 102 | 2.21x | 11.2% | 58.6% | 54.3% |

| Yield Maintenance | 14 | 366,222,671 | 24.3 | 4.09830% | 110 | 2.31x | 11.3% | 54.4% | 49.5% |

| Defeasance or Yield Maintenance | 7 | 215,350,000 | 14.3 | 4.02822% | 99 | 2.60x | 11.3% | 56.1% | 53.0% |

| Total / Weighted Average: | 57 | $1,507,013,899 | 100.0% | 4.21894% | 104 | 2.29x | 11.2% | 57.2% | 53.0% |

| | | | | Weighted Average |

| Loan Purpose | Number

of Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan

Term(1) | UW

NCF

DSCR(2)(3) | UW

NOI

DY(2) | Cut-off

Date LTV(2)(4) | Maturity

Date

LTV(1)(2)(4) |

| Refinance | 31 | $818,256,561 | 54.3% | 4.18093% | 110 | 2.36x | 11.6% | 52.1% | 46.9% |

| Acquisition | 24 | 646,057,337 | 42.9 | 4.27563% | 94 | 2.22x | 11.0% | 63.7% | 60.5% |

| Recapitalization | 1 | 35,000,000 | 2.3 | 3.90000% | 119 | 2.05x | 8.2% | 53.5% | 53.5% |

| Acquisition/Recapitalization | 1 | 7,700,000 | 0.5 | 4.95000% | 120 | 1.26x | 8.4% | 74.8% | 66.1% |

| Total / Weighted Average: | 57 | $1,507,013,899 | 100.0% | 4.21894% | 104 | 2.29x | 11.2% | 57.2% | 53.0% |

| (1) | In the case of Loan Nos. 3 and 15, each with an anticipated repayment date, Remaining Loan Term and Maturity Date LTV are calculated as of the related anticipated repayment date. |

| (2) | In the case of Loan Nos. 3, 4, 5, 6, 7, 8, 10, 13, 14, 15, 16, 17, 18, 19, 21, 22, 23, 32, 35, 39, 42, 46, 49 and 53, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 10, 16, 35, 39, 42, 46, 49 and 53, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s). |

| (3) | In the case of Loan No. 33, the UW NCF DSCR is calculated using the sum of principal and interest payments over the first 12 months based on the assumed principal payment schedule provided on Annex H to the Preliminary Prospectus. |

| (4) | In the case of Loan Nos. 3, 7, 9, 12, 19, 25, 29, 33, 36, 43 and 54, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| (5) | In the case of Loan No. 4, 17, 18 and 22 the loan documents permit the borrowers to prepay the related loan with yield maintenance premium in the event the defeasance lockout period has not expired after certain dates. See the “Description of the Mortgage Pool—Certain Terms of the Mortgage Loans—Defeasance; Collateral Substitution” in the Preliminary Prospectus. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

14 of 151

| Structural and Collateral Term Sheet | Benchmark 2018-B2 |

| Collateral Characteristics |

| Previous Securitization History(1) |

| No. | Loan Name | Cut-off Date

Principal Balance | % of IPB | Location | Property

Type | Previous Securitization |

| 2 | Promenade Shops at Aventura | $70,000,000 | 4.6% | Aventura, FL | Retail | JPMCC 2010-C2 |

| 5 | Rochester Hotel Portfolio | 60,000,000 | 4.0 | Rochester, MN | Hotel | COMM 2013-CCRE6 |

| 10 | Worldwide Plaza | 50,000,000 | 3.3 | New York, NY | Office | COMM 2013-WWP |

| 14 | BlueLinx Portfolio | 42,900,000 | 2.8 | Various | Industrial | WBCMT 2006-C27; BACM 2006-4 |

| 17 | 599 Broadway | 40,000,000 | 2.7 | New York, NY | Retail | Prima 2011-1 |

| 25 | Village Green of Waterford | 23,600,000 | 1.6 | Waterford, MI | Multifamily | FREMF 2014-K40; FHMS K040 |

| 26 | Gateway Plaza | 23,500,000 | 1.6 | Santa Clarita, CA | Office | MSC 2008-T29 |

| 32 | Towers at University Town Center | 15,000,000 | 1.0 | Hyattsville, MD | Multifamily | MLCFC 2007-8 |

| 38 | Coral Club Apartments | 11,762,093 | 0.8 | Houston, TX | Multifamily | GSMS 2013-GC14 |

| 45 | Homewood Commons | 8,500,000 | 0.6 | Homewood, AL | Retail | WBCMT 2007-C32 |

| Total | | $345,262,093 | 22.9% | | | |

| (1) | The table above represents the properties for which the previously existing debt was securitized, based on information provided by the related borrower or obtained through searches of a third-party database. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

15 of 151

| Structural and Collateral Term Sheet | Benchmark 2018-B2 |

No. | Loan Name | Location | Cut-off Date

Balance |

% of

IPB | Maturity

Date

Balance | % of

Certificate

Class(2) | Original

Loan

Term | Remaining

Loan

Term | UW

NCF

DSCR(3) | UW

NOI

Debt

Yield(3) | Cut-off

Date

LTV(3)(4) | Maturity

Date

LTV(3)(4) |

| 1 | Central Park of Lisle | Lisle, IL | $79,500,000 | 5.3% | $79,500,000 | 23.3% | 60 | 59 | 2.58x | 12.6% | 58.9% | 58.9% |

| 7 | Sentinel Square II | Washington, DC | $57,660,000 | 3.8 | $57,660,000 | 16.9 | 60 | 59 | 2.70x | 9.0% | 59.7% | 59.7% |

| 8 | The Woods | San Jose, CA | $57,500,000 | 3.8 | $57,500,000 | 16.8 | 60 | 58 | 5.01x | 15.2% | 29.6% | 29.6% |

| 14 | BlueLinx Portfolio | Various, Various | $42,900,000 | 2.8 | $42,900,000 | 12.6 | 60 | 60 | 2.46x | 12.1% | 64.2% | 64.2% |

| 22 | Marriott Charlotte City Center | Charlotte, NC | $30,000,000 | 2.0 | $30,000,000 | 8.8 | 60 | 52 | 2.76x | 12.7% | 60.6% | 60.6% |

| 35 | Beacon - Criterion | Jersey City, NJ | $13,305,255 | 0.9 | $13,305,255 | 3.9 | 60 | 59 | 3.01x | 11.7% | 37.0% | 37.0% |

| 36 | Holiday Inn Express New Orleans | New Orleans, LA | $12,900,000 | 0.9 | $12,321,787 | 3.6 | 60 | 59 | 1.83x | 13.2% | 54.4% | 52.0% |

| 39 | Beacon - Hague | Jersey City, NJ | $11,420,588 | 0.8 | $11,420,588 | 3.3 | 60 | 59 | 2.87x | 11.2% | 37.1% | 37.1% |

| 42 | Beacon - Paramount | Jersey City, NJ | $9,703,725 | 0.6 | $9,703,725 | 2.8 | 60 | 59 | 3.37x | 13.1% | 33.0% | 33.0% |

| 46 | Beacon - Mercury / Garage | Jersey City, NJ | $7,968,529 | 0.5 | $7,968,529 | 2.3 | 60 | 59 | 3.36x | 13.2% | 33.9% | 33.9% |

| 49 | Beacon - Orpheum | Jersey City, NJ | $7,417,020 | 0.5 | $7,417,020 | 2.2 | 60 | 59 | 3.14x | 12.2% | 36.0% | 36.0% |

| 53 | Beacon - Tower | Jersey City, NJ | $5,184,882 | 0.3 | $5,184,882 | 1.5 | 60 | 59 | 3.22x | 12.5% | 36.6% | 36.6% |

| | Total / Weighted Average: | $335,460,000 | 22.3% | $334,881,787 | 98.0% | 60 | 58 | 3.08x | 12.3% | 50.9% | 50.8% |

| (1) | The table above presents the mortgage loans whose balloon payments would be applied to pay down the certificate balance of the Class A-2 Certificates, assuming a 0% CPR and applying the “Modeling Assumptions” described in the Preliminary Prospectus, including the assumptions that (i) none of the mortgage loans in the pool experience prepayments, defaults or losses; (ii) there are no extensions of maturity dates of any mortgage loans in the pool; and (iii) each mortgage loan in the pool is paid in full on its stated maturity date. Each Class of Certificates, including the Class A-2 Certificates, evidences undivided ownership interests in the entire pool of mortgage loans. Debt service coverage ratio, debt yield and loan-to-value ratio information does not take into account subordinate debt (whether or not secured by the mortgaged property), if any, that exists or is allowed under the terms of any mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

| (2) | Reflects the percentage equal to the Maturity Date Balance divided by the initial Class A-2 Certificate Balance. |

| (3) | In the case of Loan Nos. 7, 8, 14, 22, 35, 39, 42, 46, 49 and 53, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 35, 39, 42, 46, 49 and 53, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s). |

| (4) | In the case of Loan Nos. 7 and 36, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

16 of 151

| Structural and Collateral Term Sheet | Benchmark 2018-B2 |

No. | Loan Name | Location | Cut-off Date

Balance | % of

IPB | Maturity

Date

Balance | % of

Certificate

Class(2) | Original

Loan

Term | Remaining

Loan

Term | UW

NCF

DSCR | UW

NOI

Debt

Yield | Cut-off

Date

LTV | Maturity

Date

LTV |

| 4 | EOS 21 | Alexandria, VA | $60,000,000 | 4.0% | $60,000,000 | 100.0% | 84 | 82 | 1.87x | 7.5% | 64.8% | 64.8% |

| | Total / Weighted Average: | | $60,000,000 | 4.0% | $60,000,000 | 100.0% | 84 | 82 | 1.87x | 7.5% | 64.8% | 64.8% |

| (1) | The table above presents the mortgage loans whose balloon payments would be applied to pay down the certificate balance of the Class A-3 Certificates, assuming a 0% CPR and applying the “Modeling Assumptions” described in the Preliminary Prospectus, including the assumptions that (i) none of the mortgage loans in the pool experience prepayments, defaults or losses; (ii) there are no extensions of maturity dates of any mortgage loans in the pool; and (iii) each mortgage loan in the pool is paid in full on its stated maturity date. Each Class of Certificates, including the Class A-3 Certificates, evidences undivided ownership interests in the entire pool of mortgage loans. Debt service coverage ratio, debt yield and loan-to-value ratio information does not take into account subordinate debt (whether or not secured by the mortgaged property), if any, that is allowed under the terms of any mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

| (2) | Reflects the percentage equal to the Maturity Date Balance divided by the initial Class A-3 Certificate Balance. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

17 of 151

| Structural and Collateral Term Sheet | | Benchmark 2018-B2 |

| |

| Structural Overview |

| ■ Accrual: | | Each Class of Certificates (other than the Class S and Class R Certificates) will accrue interest on a 30/360 basis. The Class S and Class R Certificates will not accrue interest. On each Distribution Date, any excess interest collected in respect of any mortgage loan in the trust with an anticipated repayment date, solely to the extent received from the related borrower during the related collection period, will be distributed to the holders of the Class S Certificates. |

| | | |