UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 9, 2020

i3 Verticals, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 001-38532 | | 82-4052852 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | |

40 Burton Hills Blvd., Suite 415 Nashville, TN | | | | 37215 |

| (Address of principal executive offices) | | | | (Zip Code) |

(615) 465-4487

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d- 2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e- 4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, $0.0001 Par Value | IIIV | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company. ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

In connection with a proposed underwritten public offering of 3,250,000 shares of Class A common stock, i3 Verticals, Inc. (the “Company,” “we” and “our”) provided potential investors with the following additional disclosures concerning recent developments in its acquisition activity, weekly payment volumes and software and related services revenue:

Recent Developments

Recent Acquisition Activity

A core component of our growth strategy includes a disciplined approach to acquisitions of companies and technology, evidenced by numerous platform acquisitions and tuck-in acquisitions since our inception in 2012. Our acquisitions have opened new strategic vertical markets, expanded our offerings in existing vertical markets, increased the number of businesses and organizations to whom we provide solutions and augmented our existing payment and software solutions and capabilities.

During the nine months ended June 30, 2020, we continued to actively pursue our acquisition strategy, though we did not complete any acquisitions during this period. This was primarily the result of the uncertainty from the COVID-19 pandemic and our desire to maintain liquidity and monitor the impact of the pandemic. Subsequent to June 30, 2020, we have completed the acquisition of three businesses, with two expanding our geographic reach and software capabilities in the public sector vertical and the other adding text-to-pay capabilities and other software solutions in our non-profit vertical. Total purchase consideration for these three completed acquisitions was $27.5 million, funded with cash and revolving line of credit proceeds, and an amount of contingent consideration, which is still being valued. In connection with these three acquisitions, we also granted an aggregate of approximately 100,000 stock options under our 2018 Equity Incentive Plan to certain key employees of the acquired companies. In addition, we currently have finalized separate non-binding term sheets for four acquisitions with an aggregate purchase price of approximately $50-60 million and an amount of contingent consideration. If completed, we would also expect to grant approximately 250,000-450,000 stock options to certain key employees of the acquired businesses under our newly adopted 2020 Acquisition Equity Incentive Plan, as described below. Each of the term sheets relate to an acquisition in one of our existing vertical markets. Assuming satisfactory completion of our due diligence review and negotiation and execution of definitive agreements, we would expect these four acquisitions to close in the fourth fiscal quarter of 2020 or the first fiscal quarter of 2021. Our negotiations for these potential acquisitions are ongoing and there is no assurance that we will be able to successfully negotiate and execute the definitive documents for or consummate any of these acquisitions.

2020 Acquisition Equity Incentive Plan

In connection with our acquisitions and as discussed above, we have historically granted stock options to certain key employees of the acquired companies to induce them to join us subsequent to an acquisition and to align their interests with those of our stockholders. In order to help facilitate this practice, on September 8, 2020, the Board of Directors of the Company, upon recommendation of the Compensation Committee, adopted the i3 Verticals, Inc. 2020 Acquisition Equity Incentive Plan (the “Acquisition Plan”) and reserved 1.5 million shares of the Company’s Class A common stock to be used exclusively for grants of awards to individuals that were not previously employees of the Company or its subsidiaries in connection with acquisitions, as a material inducement to the individual’s entry into employment with the Company or its subsidiaries within the meaning of Rule 5635(c)(4) of the Nasdaq Listing Rules. Under the Acquisition Plan, the Company may grant these eligible recipients stock options, stock appreciation rights, restricted stock awards, restricted stock unit awards, performance awards, and other stock-based awards. The Board of Directors also adopted a form of stock option agreement and form of restricted stock agreement (the “Form Agreements”) for use with the Acquisition Plan.

It is our current expectation that the shares reserved under the Acquisition Plan will be sufficient to meet our grant needs in connection with acquisitions for at least the next twelve months, but the actual number will

depend on the acquisitions consummated and the employees of those acquired companies who become employees of the Company.

The foregoing description of the Acquisition Plan and Form Agreements is not complete and is qualified in its entirety by reference to the text of the Acquisition Plan and Related Agreements, which are filed as Exhibits 10.1, 10.2 and 10.3, respectively, to this Current Report on Form 8-K.

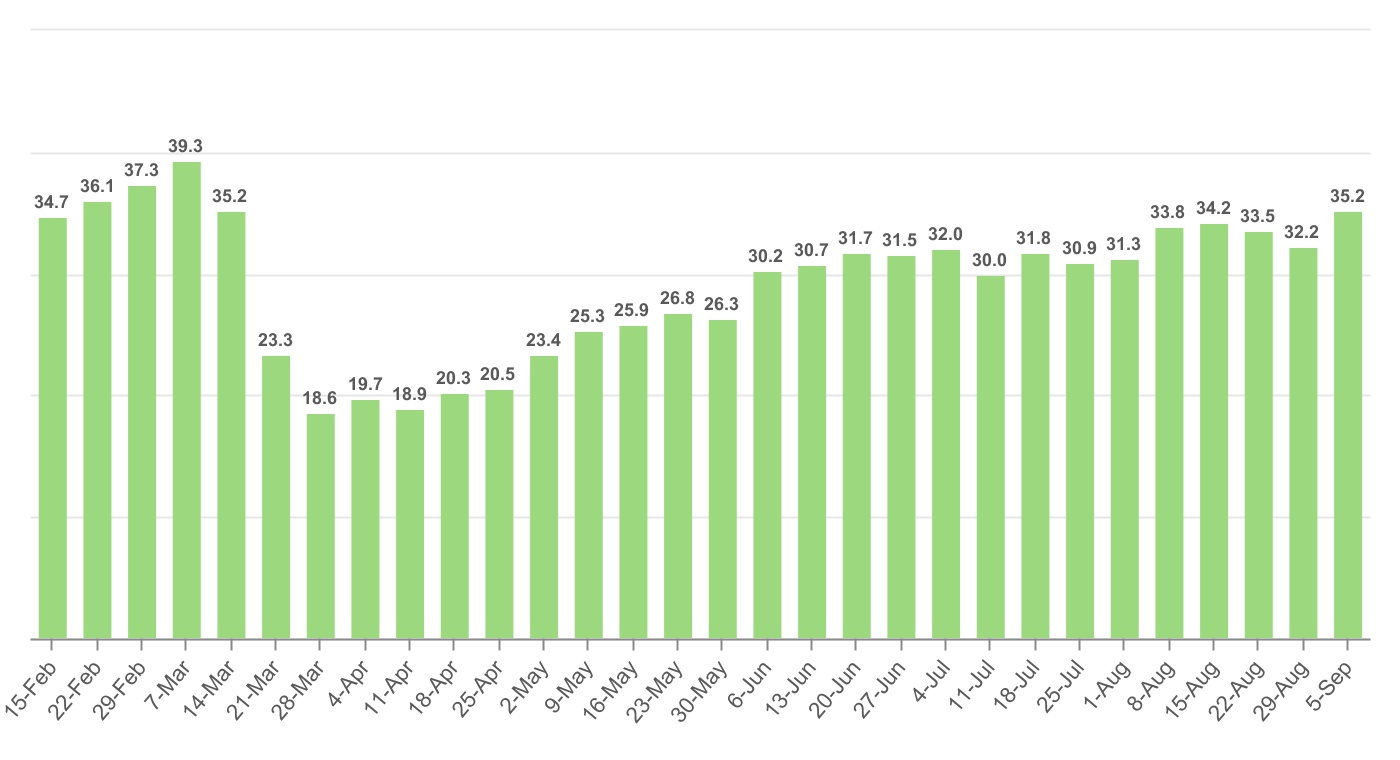

Payment Volumes

The COVID-19 pandemic is significantly affecting overall economic conditions in the United States. The economic impact of these conditions is materially impacting our business and is expected to continue to adversely impact our strategic verticals and our business in general. For example, beginning in the second half of March 2020 and continuing into the third quarter of fiscal 2020, we and our clients have experienced a decline and subsequent partial recovery in payment volume and the number of transactions processed, and therefore, a decline and subsequent partial recovery in revenue in our strategic verticals. However, as the table below demonstrates, our average daily payment volume has recovered 82% from the COVID-19 lows we experienced during the week of March 28, 2020. The impact of the COVID-19 pandemic is fluid and continues to evolve, and therefore, we cannot currently predict with certainty the extent to which our business, results of operations, financial condition or liquidity will ultimately be impacted.

Consolidated average daily payments volume(1) ($ in millions)

__________________________

1.This includes credit and debit card volume from our processing portfolios for which daily volume figures are readily available. The volume of portfolios for which daily volume figures are unavailable and any volume for which we receive residual payments but do not control the merchant relationship are not included. Average daily volume above represents approximately 85% of the credit and debit volume we reported, or we expect to report in our consolidated financial statements.

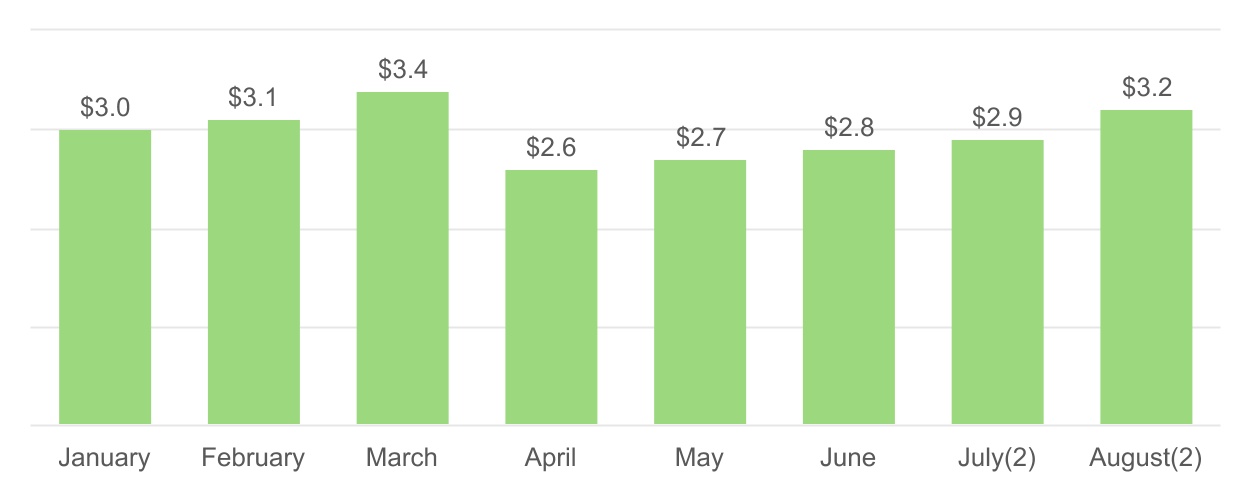

Software and Related Services Revenue

For the months ended July 31, 2020 and August 31, 2020, we estimate we had $2.9 million and $3.2 million, respectively, in software and related services revenue. Software and related services includes the sale of licenses, subscriptions, installation services, and ongoing support specific to software. While we currently expect that our final results will be consistent with the preliminary estimates set forth above, we note they are preliminary and have not been audited or reviewed and are thus inherently uncertain and subject to change as we complete our financial closing and review procedures for the three months and year ended September 30, 2020.

Software and Related Services Revenue Trends(1) (Monthly Adjusted Net Revenue - $ in millions)

_________________________

1.Software and related services includes the sale of licenses, subscriptions, installation services, and ongoing support specific to software.

2.Preliminary estimates for the months ended July 31, and August 31, 2020, respectively.

Forward-Looking Statements

This document contains forward-looking statements that are subject to risks and uncertainties. All statements other than statements of historical fact or relating to present facts or current conditions included in this release are forward-looking statements, including any statements regarding guidance and statements of a general economic or industry specific nature. Forward-looking statements give the Company’s current expectations and projections relating to its financial condition, results of operations, guidance, plans, objectives, future performance and business. You generally can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “will,” “should,” “could,” “likely” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. Forward-looking statements are not guarantees of future performance, and the Company’s actual results could differ materially from the expectations expressed or implied in any forward-looking statements. You should not put undue reliance on them. Examples of forward-looking statements contained in this document include statements about the Company’s expected timeline for certain acquisitions. Actual results may differ from those contained in any forward-looking statements made in this release for a variety of reasons, including those described in “Risk Factors” and “Note Regarding Forward-looking Statements” in the Company’s Annual Report on Form 10-K for the year ended September 30, 2019, and in its subsequent periodic reports.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: September 9, 2020

| | | | | | | | |

| | |

| i3 VERTICALS, INC. | | |

| | |

| By: | | /s/ Clay Whitson |

| Name: | | Clay Whitson |

| Title: | | Chief Financial Officer |