Q4 Fiscal 2022 Supplemental Information

2 Revenue Composition ($ in thousands) Quarter Ended September 30, 2022 June 30, 2022 March 31, 2022 December 31, 2021 September 30, 2021 June 30, 2021 March 31, 2021 Software and related service revenue SaaS(1) $ 8,833 $ 8,450 $ 7,899 $ 6,310 $ 6,173 $ 6,107 $ 5,632 Transaction-based(2) 3,137 3,253 2,642 2,325 2,081 2,144 1,393 Maintenance(3) 5,600 5,720 5,672 5,897 5,776 5,644 2,849 Recurring software services(4) 10,945 10,768 11,107 10,311 3,237 3,587 3,952 Professional services(5) 8,492 8,743 8,251 9,386 9,086 7,630 3,371 Software licenses 3,485 2,072 3,401 2,109 2,375 1,707 561 Total $ 40,492 $ 39,006 $ 38,972 $ 36,338 $ 28,728 $ 26,819 $ 17,758 Year-over-year growth 41 % 45 % 119 % Payments revenue $ 39,775 $ 36,683 $ 34,528 $ 33,466 $ 33,510 $ 32,223 $ 28,337 Year-over-year growth 19 % 14 % Other revenue Recurring(6) $ 2,001 $ 1,792 $ 1,780 $ 1,802 $ 1,923 $ 1,516 $ 1,166 Other 2,982 3,072 2,840 2,333 3,016 2,571 1,936 Total $ 4,983 $ 4,864 $ 4,620 $ 4,135 $ 4,939 $ 4,087 $ 3,102 Year-over-year growth 1 % 19 % 49 % Total revenue $ 85,250 $ 80,553 $ 78,120 $ 73,939 $ 67,177 $ 63,129 $ 49,197 Recurring revenue(7) $ 70,291 $ 66,666 $ 63,628 $ 60,111 $ 52,700 $ 51,221 $ 43,329 Annualized Recurring Revenue “ARR”(8) Software and related service revenue $ 114,060 $ 112,764 $ 109,280 $ 99,372 $ 69,068 $ 69,928 $ 55,304 Payments revenue 159,100 146,732 138,112 133,864 134,040 128,892 113,348 Other revenue 8,004 7,168 7,120 7,208 7,692 6,064 4,664 Total ARR $ 281,164 $ 266,664 $ 254,512 $ 240,444 $ 210,800 $ 204,884 $ 173,316 Year-over-year growth 33 % 30 % 47 %

3 Annualized Recurring Revenue (“ARR”) 1. SaaS revenue is earned when we provide, as a service to our customers over time, the right to access our software, generally hosted in a cloud environment. 2. Transaction-based software revenue is earned when we provide services through our software and charge a per-transaction fee. For example, when we provide electronic filing services for courts and charge fees per filing, or when we stand-ready to process and bill utility customers and charge the utility a fee per bill electronically presented. 3. Software maintenance revenue is earned when, following the implementation of our software systems, we provide ongoing software support services to assist our customers in operating the systems and to periodically update the software. 4. Recurring software services are earned when we provide long-term, usually evergreen, contracted services to our customers through our software. The services provided, such as healthcare revenue cycle management, or automated collections management, are integrated into one of our software solutions. 5. Professional services are earned when we provide customized services to our customers who utilize our software products. Many of our customers contract with us for installation, configuration, training, and data conversion projects, which do not necessarily recur, and as such are excluded from our calculation of ARR. 6. Recurring other revenue primarily consists of recurring long-term contracts that are not specific to software, such as hardware maintenance plans or field service plans. 7. Recurring revenue consists of software-as-a-service (“SaaS”) arrangements, transaction-based software-revenue, software maintenance revenue, recurring software-based services, payments revenue and other recurring revenue sources. This excludes contracts that are not recurring or are one-time in nature. 8. Annualized Recurring Revenue (ARR) is the quarterly recurring revenue multiplied by 4. The Company focuses on ARR because it helps to assess the health and trajectory of the business. ARR does not have a standardized definition and is therefore unlikely to be comparable to similarly titled measures presented by other companies. It should be reviewed independently of revenue and it is not a forecast. It does not contemplate seasonality. The active contracts at the end of a reporting period used in calculating ARR may or may not be extended or renewed by the Company’s customers.

4 ($ in thousands) Three months ended September 30, 2022 Three months ended September 30, 2021 Merchant Services Software and Services Other Total Merchant Services Software and Services Other Total Income (loss) from operations $ 6,746 $ 12,923 $ (12,450) $ 7,219 $ 6,546 $ 5,958 $ (11,877) $ 627 ($ in thousands) Year ended September 30, 2022 Year ended September 30, 2021 Merchant Services Software and Services Other Total Merchant Services Software and Services Other Total Income (loss) from operations $ 24,595 $ 20,003 $ (47,042) $ (2,444) $ 21,652 $ 16,207 $ (37,871) $ (12) The following is our Income (loss) from operations for the three and twelve months ended September 30, 2022 and 2021 calculated in accordance with GAAP. The presentation also includes references to the Company’s non-GAAP financials measures. The Company believes that, in addition to the financial measures calculated in accordance with GAAP, adjusted EBITDA and adjusted net income (loss) are appropriate indicators to assist in the evaluation of its operating performance on a period-to-period basis. The Company also uses adjusted EBITDA internally as a performance measure for planning purposes, including forecasting and for calculations of earnout liabilities. Adjusted EBITDA is also used to evaluate the Company’s ability to service debt.These non-GAAP financial measures presented throughout should be considered as a supplement to, not a substitute for, revenue, income from operations, net income, or other financial performance and liquidity measures prepared in accordance with GAAP. Q4 Fiscal 2022 GAAP Measures

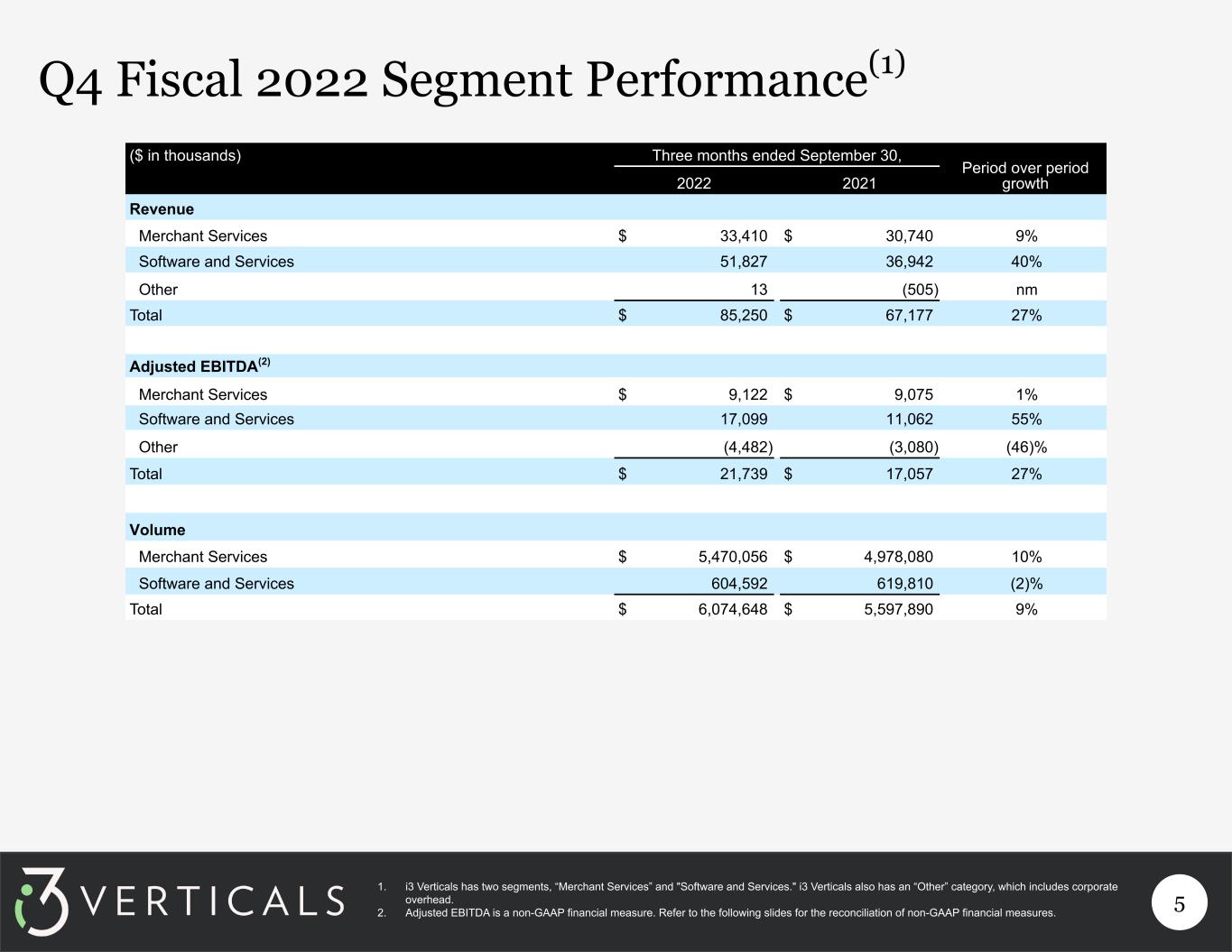

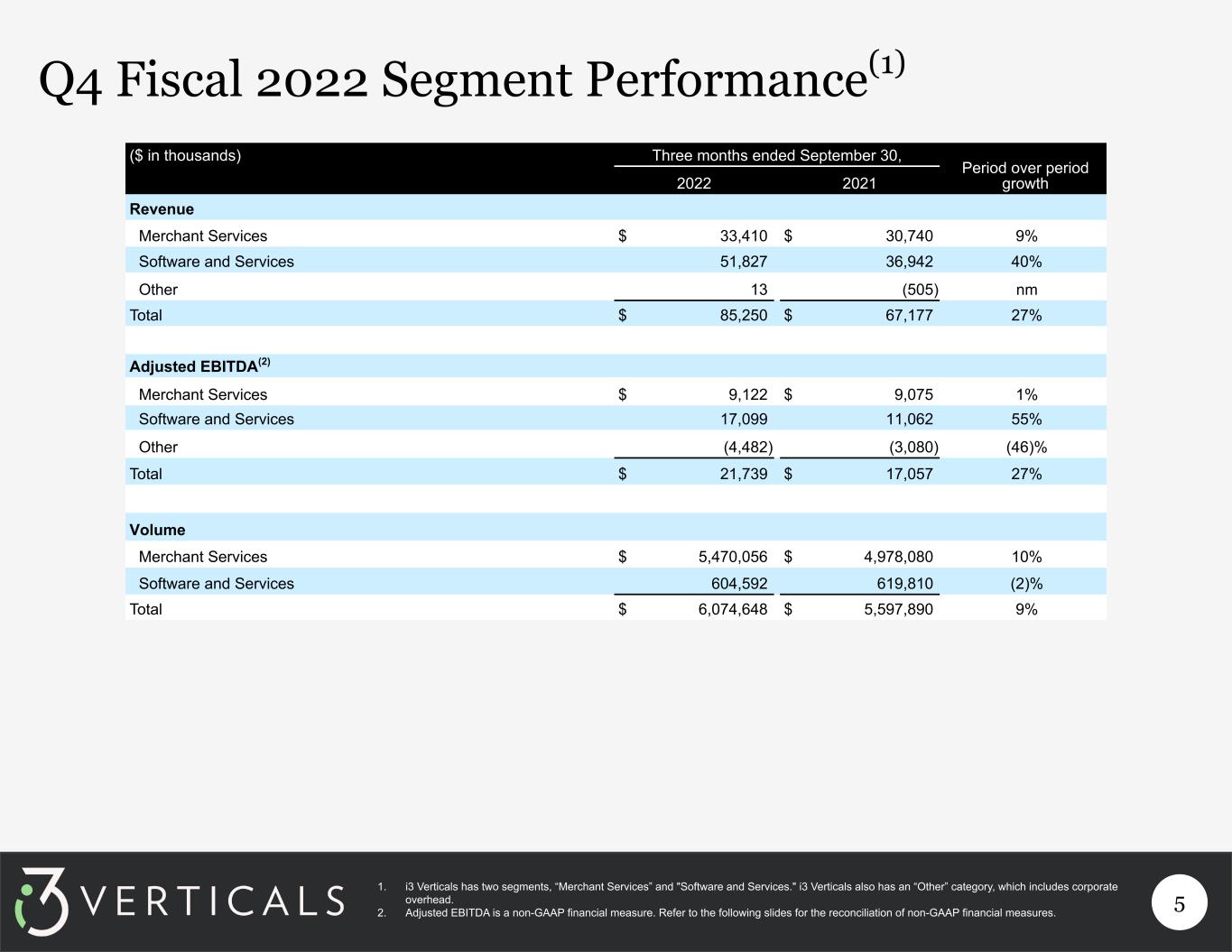

5 Q4 Fiscal 2022 Segment Performance(1) ($ in thousands) Three months ended September 30, Period over period growth2022 2021 Revenue Merchant Services $ 33,410 $ 30,740 9% Software and Services 51,827 36,942 40% Other 13 (505) nm Total $ 85,250 $ 67,177 27% Adjusted EBITDA(2) Merchant Services $ 9,122 $ 9,075 1% Software and Services 17,099 11,062 55% Other (4,482) (3,080) (46)% Total $ 21,739 $ 17,057 27% Volume Merchant Services $ 5,470,056 $ 4,978,080 10% Software and Services 604,592 619,810 (2)% Total $ 6,074,648 $ 5,597,890 9% 1. i3 Verticals has two segments, “Merchant Services” and "Software and Services." i3 Verticals also has an “Other” category, which includes corporate overhead. 2. Adjusted EBITDA is a non-GAAP financial measure. Refer to the following slides for the reconciliation of non-GAAP financial measures.

6 Q4 Fiscal 2022 Segment Performance(1) ($ in thousands) Years ended September 30, Period over period growth2022 2021 Revenue Merchant Services $ 124,481 $ 111,870 11% Software and Services 193,402 114,433 69% Other (21) (2,179) nm Total $ 317,862 $ 224,124 42% Adjusted EBITDA(2) Merchant Services $ 34,651 $ 33,162 4% Software and Services 62,691 35,600 76% Other (17,798) (13,355) (33)% Total $ 79,544 $ 55,407 44% Volume Merchant Services $ 20,488,530 $ 17,138,214 20% Software and Services 2,148,795 1,659,693 29% Total $ 22,637,325 $ 18,797,907 20% 1. i3 Verticals has two segments, “Merchant Services” and "Software and Services." i3 Verticals also has an “Other” category, which includes corporate overhead. 2. Adjusted EBITDA is a non-GAAP financial measure. Refer to the following slides for the reconciliation of non-GAAP financial measures.

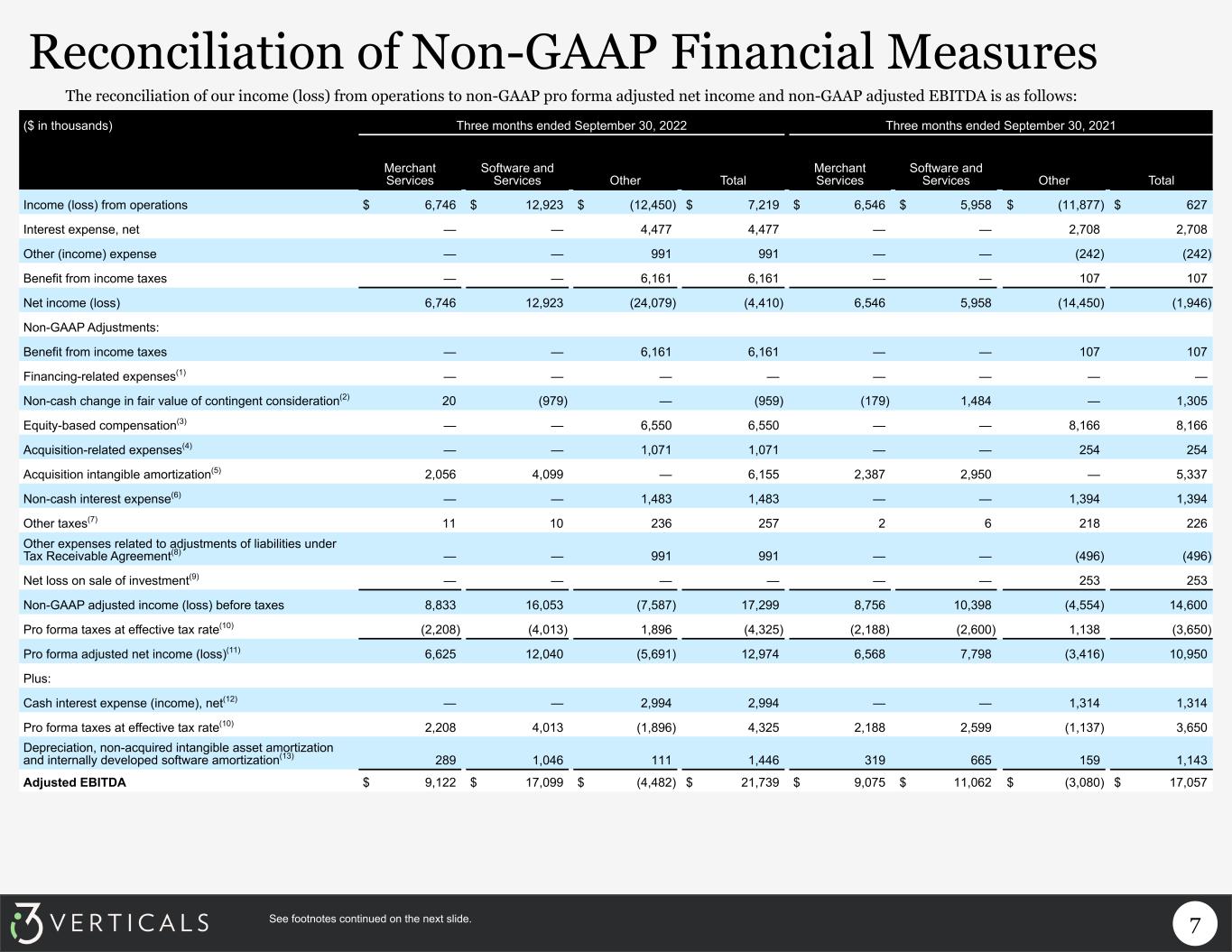

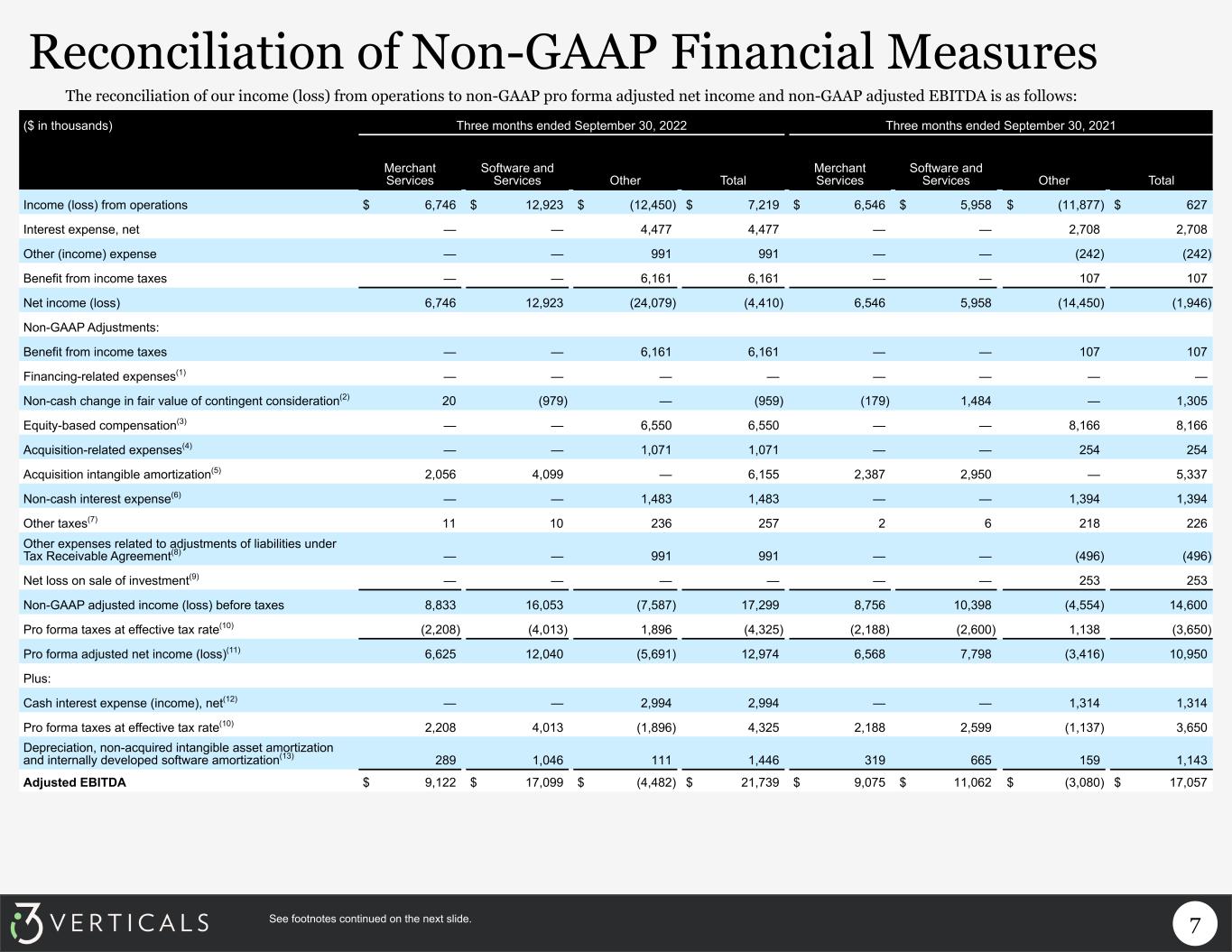

7 ($ in thousands) Three months ended September 30, 2022 Three months ended September 30, 2021 Merchant Services Software and Services Other Total Merchant Services Software and Services Other Total Income (loss) from operations $ 6,746 $ 12,923 $ (12,450) $ 7,219 $ 6,546 $ 5,958 $ (11,877) $ 627 Interest expense, net — — 4,477 4,477 — — 2,708 2,708 Other (income) expense — — 991 991 — — (242) (242) Benefit from income taxes — — 6,161 6,161 — — 107 107 Net income (loss) 6,746 12,923 (24,079) (4,410) 6,546 5,958 (14,450) (1,946) Non-GAAP Adjustments: Benefit from income taxes — — 6,161 6,161 — — 107 107 Financing-related expenses(1) — — — — — — — — Non-cash change in fair value of contingent consideration(2) 20 (979) — (959) (179) 1,484 — 1,305 Equity-based compensation(3) — — 6,550 6,550 — — 8,166 8,166 Acquisition-related expenses(4) — — 1,071 1,071 — — 254 254 Acquisition intangible amortization(5) 2,056 4,099 — 6,155 2,387 2,950 — 5,337 Non-cash interest expense(6) — — 1,483 1,483 — — 1,394 1,394 Other taxes(7) 11 10 236 257 2 6 218 226 Other expenses related to adjustments of liabilities under Tax Receivable Agreement(8) — — 991 991 — — (496) (496) Net loss on sale of investment(9) — — — — — — 253 253 Non-GAAP adjusted income (loss) before taxes 8,833 16,053 (7,587) 17,299 8,756 10,398 (4,554) 14,600 Pro forma taxes at effective tax rate(10) (2,208) (4,013) 1,896 (4,325) (2,188) (2,600) 1,138 (3,650) Pro forma adjusted net income (loss)(11) 6,625 12,040 (5,691) 12,974 6,568 7,798 (3,416) 10,950 Plus: Cash interest expense (income), net(12) — — 2,994 2,994 — — 1,314 1,314 Pro forma taxes at effective tax rate(10) 2,208 4,013 (1,896) 4,325 2,188 2,599 (1,137) 3,650 Depreciation, non-acquired intangible asset amortization and internally developed software amortization(13) 289 1,046 111 1,446 319 665 159 1,143 Adjusted EBITDA $ 9,122 $ 17,099 $ (4,482) $ 21,739 $ 9,075 $ 11,062 $ (3,080) $ 17,057 See footnotes continued on the next slide. The reconciliation of our income (loss) from operations to non-GAAP pro forma adjusted net income and non-GAAP adjusted EBITDA is as follows: Reconciliation of Non-GAAP Financial Measures

8 Reconciliation of Non-GAAP Financial Measures 1. Financing-related expenses includes expenses directly related to certain transactions as part of financing transactions. 2. Non-cash change in fair value of contingent consideration reflects the changes in management’s estimates of future cash consideration to be paid in connection with prior acquisitions from the amount estimated as of the later of the most recent balance sheet date forming the beginning of the income statement period or the original estimates made at the closing of the applicable acquisition. 3. Equity-based compensation expense consisted of $6,550 related to stock options issued under the Company's 2018 Equity Incentive Plan and 2020 Acquisition Equity Incentive Plan and $8,166 related to stock options issued under the Company's 2018 Equity Incentive Plan during the three months ended September 30, 2022 and 2021, respectively. 4. Acquisition-related expenses are the professional service and related costs directly related to our acquisitions and are not part of our core performance. 5. Acquisition intangible amortization reflects amortization of intangible assets and software acquired through business combinations, acquired customer portfolios, acquired referral agreements and related asset acquisitions. 6. Non-cash interest expense reflects amortization of debt discount and debt issuance costs and any write-offs of debt issuance costs. 7. Other taxes consist of franchise taxes, commercial activity taxes, the employer portion of payroll taxes related to stock option exercises and other non-income based taxes. Taxes related to salaries are not included. 8. Under our Tax Receivable Agreement we have a liability equal to 85% of certain deferred tax assets resulting from an increase in the tax basis of our investment in i3 Verticals, LLC. Other expenses related to adjustments of liabilities under our Tax Receivable Agreement relate to the remeasurement of the underlying deferred tax asset for changes in estimated income tax rates. 9. When the Company becomes aware of an observable price change in an investment, such as a planned third party acquisition of the entity underlying the investment, we will adjust the carry value of the investment, which the Company recognizes in other income. 10. Pro forma corporate income tax expense is based on Non-GAAP adjusted income before taxes and is calculated using a tax rate of 25.0% for both 2022 and 2021, based on blended federal and state tax rates. 11. Pro forma adjusted net income assumes that all net income during the period is available to the holders of the Company’s Class A common stock. 12. Cash interest expense, net represents all interest expense net of interest income recorded on the Company's statement of operations other than non-cash interest expense, which represents amortization of debt discount and debt issuance costs and any write-offs of debt issuance costs. 13. Depreciation, non-acquired intangible asset amortization and internally developed software amortization reflects depreciation on the Company's property, plant and equipment, net, and amortization expense on its internally developed capitalized software.

9 ($ in thousands) Year ended September 30, 2022 Year ended September 30, 2021 Merchant Services Software and Services Other Total Merchant Services Software and Services Other Total Income (loss) from operations $ 24,595 $ 20,003 $ (47,042) $ (2,444) $ 21,652 $ 16,207 $ (37,871) $ (12) Interest expense, net — — 14,775 14,775 — — 9,799 9,799 Other expense — — 991 991 — — (2,595) (2,595) Benefit from income taxes — — 5,007 5,007 — — 623 623 Net income (loss) 24,595 20,003 (67,815) (23,217) 21,652 16,207 (45,698) (7,839) Non-GAAP Adjustments: Benefit from income taxes — — 5,007 5,007 — — 623 623 Financing-related expenses(1) — — 13 13 — — 152 152 Non-cash change in fair value of contingent consideration(2) 520 23,205 — 23,725 177 6,963 — 7,140 Equity-based compensation(3) — — 26,230 26,230 — — 20,860 20,860 Acquisition-related expenses(4) — — 2,088 2,088 — — 2,319 2,319 Acquisition intangible amortization(5) 8,333 15,796 — 24,129 10,115 9,839 — 19,954 Non-cash interest expense(6) — — 5,795 5,795 — — 5,450 5,450 Other taxes(7) 27 55 426 508 23 34 474 531 Other expenses related to adjustments of liabilities under Tax Receivable Agreement(8) — — 991 991 — — (496) (496) Net gain on sale of investments(9) — — — — — — (2,100) (2,100) Non-GAAP adjusted income (loss) before taxes 33,475 59,059 (27,265) 65,269 31,967 33,043 (18,416) 46,594 Pro forma taxes at effective tax rate(10) (8,369) (14,765) 6,816 (16,318) (7,992) (8,261) 4,604 (11,649) Pro forma adjusted net income (loss)(11) 25,106 44,294 (20,449) 48,951 23,975 24,782 (13,812) 34,945 Plus: Cash interest (income) expense, net(12) — — 8,980 8,980 — — 4,349 4,349 Pro forma taxes at effective tax rate(10) 8,369 14,765 (6,816) 16,318 7,992 8,261 (4,604) 11,649 Depreciation, non-acquired intangible asset amortization and internally developed software amortization(13) 1,176 3,632 487 5,295 1,195 2,557 712 4,464 Adjusted EBITDA $ 34,651 $ 62,691 $ (17,798) $ 79,544 $ 33,162 $ 35,600 $ (13,355) $ 55,407 See footnotes continued on the next slide. The reconciliation of our income (loss) from operations to non-GAAP pro forma adjusted net income and non-GAAP adjusted EBITDA is as follows: Reconciliation of Non-GAAP Financial Measures

10 Reconciliation of Non-GAAP Financial Measures 1. Financing-related expenses includes expenses directly related to certain transactions as part of financing transactions. 2. Non-cash change in fair value of contingent consideration reflects the changes in management’s estimates of future cash consideration to be paid in connection with prior acquisitions from the amount estimated as of the later of the most recent balance sheet date forming the beginning of the income statement period or the original estimates made at the closing of the applicable acquisition. 3. Equity-based compensation expense consisted of $25,163 related to stock options issued under the Company's 2018 Equity Incentive Plan and 2020 Acquisition Equity Incentive Plan and $20,860 related to stock options issued under the Company's 2018 Equity Incentive Plan during the years ended September 30, 2022 and 2021, respectively. 4. Acquisition-related expenses are the professional service and related costs directly related to our acquisitions and are not part of our core performance. 5. Acquisition intangible amortization reflects amortization of intangible assets and software acquired through business combinations, acquired customer portfolios, acquired referral agreements and related asset acquisitions. 6. Non-cash interest expense reflects amortization of debt discount and debt issuance costs and any write-offs of debt issuance costs. 7. Other taxes consist of franchise taxes, commercial activity taxes, the employer portion of payroll taxes related to stock option exercises and other non-income based taxes. Taxes related to salaries are not included. 8. Under our Tax Receivable Agreement we have a liability equal to 85% of certain deferred tax assets resulting from an increase in the tax basis of our investment in i3 Verticals, LLC. Other expenses related to adjustments of liabilities under our Tax Receivable Agreement relate to the remeasurement of the underlying deferred tax asset for changes in estimated income tax rates. 9. When the Company becomes aware of an observable price change in an investment, such as a planned third party acquisition of the entity underlying the investment, we will adjust the carry value of the investment, which the Company recognizes in other income. 10. Pro forma corporate income tax expense is based on Non-GAAP adjusted income before taxes and is calculated using a tax rate of 25.0% for both 2022 and 2021, based on blended federal and state tax rates. 11. Pro forma adjusted net income assumes that all net income during the period is available to the holders of the Company’s Class A common stock. 12. Cash interest expense, net represents all interest expense net of interest income recorded on the Company's statement of operations other than non-cash interest expense, which represents amortization of debt discount and debt issuance costs and any write-offs of debt issuance costs. 13. Depreciation, non-acquired intangible asset amortization and internally developed software amortization reflects depreciation on the Company's property, plant and equipment, net, and amortization expense on its internally developed capitalized software.

11 Reconciliation Between GAAP Debt and Covenant Debt ($ in millions) As of September 30, 2022 Revolving lines of credit to banks under the Senior Secured Credit Facility $ 185.0 Exchangeable Notes 104.6 Debt issuance costs, net (2.6) Total long-term debt, net of issuance costs $ 287.0 Non-GAAP Adjustments: Discount on Exchangeable Notes(1) $ 12.4 Exchangeable Notes 104.6 Exchangeable Notes Face Value $ 117.0 Revolving lines of credit to banks under the Senior Secured Credit Facility $ 185.0 Exchangeable Notes Face Value 117.0 Less: Cash and Cash Equivalents (3.5) Total long-term debt for use in our Total Leverage Ratio $ 298.5 The reconciliation of our GAAP Long-term debt, net of issuance costs and the debt balance used in our Total Leverage Ratio: 1. In accordance with Financial Accounting Standards Board Accounting Standards Codification 470-20, Debt with Conversion and Other Options (“ASC 470-20”), convertible debt that may be entirely or partially settled in cash (such as the notes) is required to be separated into a liability and an equity component, such that interest expense reflects the issuer’s non-convertible debt interest cost. On the issue date, the value of the exchange option of the notes, representing the equity component was recorded as additional paid-in capital within shareholders’ equity and as a discount to the notes, which reduces their initial carrying value. The carrying value of the notes, net of the discount recorded, was accrued up to the principal amount of such notes from the issue date until maturity. ASC 470-20 does not affect the actual amount that the Issuer is required to repay. The amount shown in the table above for the discount reflects the debt discount for the value of the exchange option.