1 Supplemental Information Q1 FISCAL YEAR 2024

2 ($ in thousands) Quarter Ended December 31, 2023 September 30, 2023 June 30, 2023 March 31, 2023 December 31, 2022 September 30, 2022 June 30, 2022 March 31, 2022 December 31, 2021 Software and related service revenue SaaS(1) $ 10,453 $ 10,864 $ 10,170 $ 9,901 $ 9,230 $ 8,833 $ 8,450 $ 7,899 $ 6,310 Transaction-based(2) 3,776 3,827 3,461 3,319 3,331 3,137 3,253 2,642 2,325 Maintenance(3) 8,257 7,986 8,478 8,140 7,417 5,600 5,720 5,672 5,897 Recurring software services(4) 10,859 10,966 11,804 11,266 10,164 10,945 10,768 11,107 10,311 Professional services(5) 9,622 11,443 10,600 11,202 9,775 8,492 8,743 8,251 9,386 Software licenses 655 3,256 2,755 3,479 1,197 3,485 2,072 3,401 2,109 Total $ 43,622 $ 48,342 $ 47,268 $ 47,307 $ 41,114 $ 40,492 $ 39,006 $ 38,972 $ 36,338 Year-over-year growth 6 % 19 % 21 % 21 % 13 % Payments revenue $ 43,995 $ 42,601 $ 41,990 $ 41,909 $ 40,354 $ 39,775 $ 36,683 $ 34,528 $ 33,466 Year-over-year growth 9 % 7 % 14 % 21 % 21 % Other revenue Recurring(6) $ 1,890 $ 1,992 $ 1,956 $ 1,880 $ 2,045 $ 2,001 $ 1,792 $ 1,780 $ 1,802 Other 2,483 3,472 2,717 2,776 2,516 2,982 3,072 2,840 2,333 Total $ 4,373 $ 5,464 $ 4,673 $ 4,656 $ 4,561 $ 4,983 $ 4,864 $ 4,620 $ 4,135 Year-over-year growth (4) % 10 % (4) % 1 % 10 % Total revenue $ 91,990 $ 96,407 $ 93,931 $ 93,872 $ 86,029 $ 85,250 $ 80,553 $ 78,120 $ 73,939 Recurring revenue(7) $ 79,230 $ 78,236 $ 77,859 $ 76,415 $ 72,541 $ 70,291 $ 66,666 $ 63,628 $ 60,111 Annualized Recurring Revenue “ARR”(8) Software and related service revenue $ 133,380 $ 134,572 $ 135,652 $ 130,504 $ 120,568 $ 114,060 $ 112,764 $ 109,280 $ 99,372 Payments revenue 175,980 170,404 167,960 167,636 161,416 159,100 146,732 138,112 133,864 Other revenue 7,560 7,968 7,824 7,520 8,180 8,004 7,168 7,120 7,208 Total ARR $ 316,920 $ 312,944 $ 311,436 $ 305,660 $ 290,164 $ 281,164 $ 266,664 $ 254,512 $ 240,444 Year-over-year growth 9 % 11 % 17 % 20 % 21 % Revenue Composition See footnotes continued on the next slide.

3 1.) SaaS revenue is earned when we provide, as a service to our customers over time, the right to access our software, generally hosted in a cloud environment. 2.) Transaction-based software revenue is earned when we provide services through our software and charge a per-transaction fee. For example, when we provide electronic filing services for courts and charge fees per filing, or when we stand-ready to process and bill utility customers and charge the utility a fee per bill electronically presented. 3.) Software maintenance revenue is earned when, following the implementation of our software systems, we provide ongoing software support services to assist our customers in operating the systems and to periodically update the software. 4.) Recurring software services are earned when we provide long-term, usually evergreen, contracted services to our customers through our software. The services provided, such as healthcare revenue cycle management, or automated collections management, are integrated into one of our software solutions. 5.) Professional services are earned when we provide customized services to our customers who utilize our software products. Many of our customers contract with us for installation, configuration, training, and data conversion projects, which do not necessarily recur, and as such are excluded from our calculation of ARR. 6.) Recurring other revenue primarily consists of recurring long-term contracts that are not specific to software, such as hardware maintenance plans or field service plans. 7.) Recurring revenue consists of software-as-a-service (“SaaS”) arrangements, transaction-based software-revenue, software maintenance revenue, recurring software-based services, payments revenue and other recurring revenue sources. This excludes contracts that are not recurring or are one-time in nature. 8.) Annualized Recurring Revenue (“ARR”) is the quarterly recurring revenue multiplied by 4. The Company focuses on ARR because it helps to assess the health and trajectory of the business. ARR does not have a standardized definition and is therefore unlikely to be comparable to similarly titled measures presented by other companies. It should be reviewed independently of revenue and it is not a forecast. It does not contemplate seasonality. The active contracts at the end of a reporting period used in calculating ARR may or may not be extended or renewed by the Company’s customers. Annualized Recurring Revenue (“ARR”)

4 Q1 Fiscal 2024 GAAP Measures ($ in thousands) Three Months Ended December 31, 2023 Three Months Ended December 31, 2022 Software and Services Merchant Services Other Total Software and Services Merchant Services Other Total Income (loss) from operations $ 13,340 $ 8,133 $ (12,941) $ 8,532 $ 11,214 $ 7,017 $ (12,393) $ 5,838 The following is our income (loss) from operations for the three months ended December 31, 2023 and 2022 calculated in accordance with GAAP. The presentation also includes references to non-GAAP financial measures presented by the Company. The Company believes that the non-GAAP financial measures presented by the Company provide useful information to investors in understanding and evaluating the Company's ongoing operating results. Accordingly, the Company includes such non-GAAP financial measures when reporting its financial results to shareholders and potential investors in order to provide them with an additional tool to evaluate the Company’s ongoing business operations. The Company believes that these non-GAAP financial measures are representative of comparative financial performance that reflects the economic substance of the Company’s current and ongoing business operations. Although these non-GAAP financial measures assist in measuring the Company's operating results and assessing its financial performance, they are not necessarily comparable to similarly titled measures of other companies due to potential inconsistencies in the method of calculation. The Company believes that the disclosure of these non-GAAP financial measures provides investors with important key financial performance indicators that are utilized by management to assess the Company's operating results, evaluate the business and make operational decisions on a prospective, going-forward basis. Hence, management provides disclosure of these non-GAAP financial measures to give shareholders and potential investors an opportunity to see the Company as viewed by management, to assess the Company with some of the same tools that management utilizes internally and to be able to compare such information with prior periods. The Company believes that disclosure of these non-GAAP financial measures provides investors with additional information to help them better understand its financial statements just as management utilizes these non-GAAP financial measures to better understand the business, manage budgets and allocate resources.

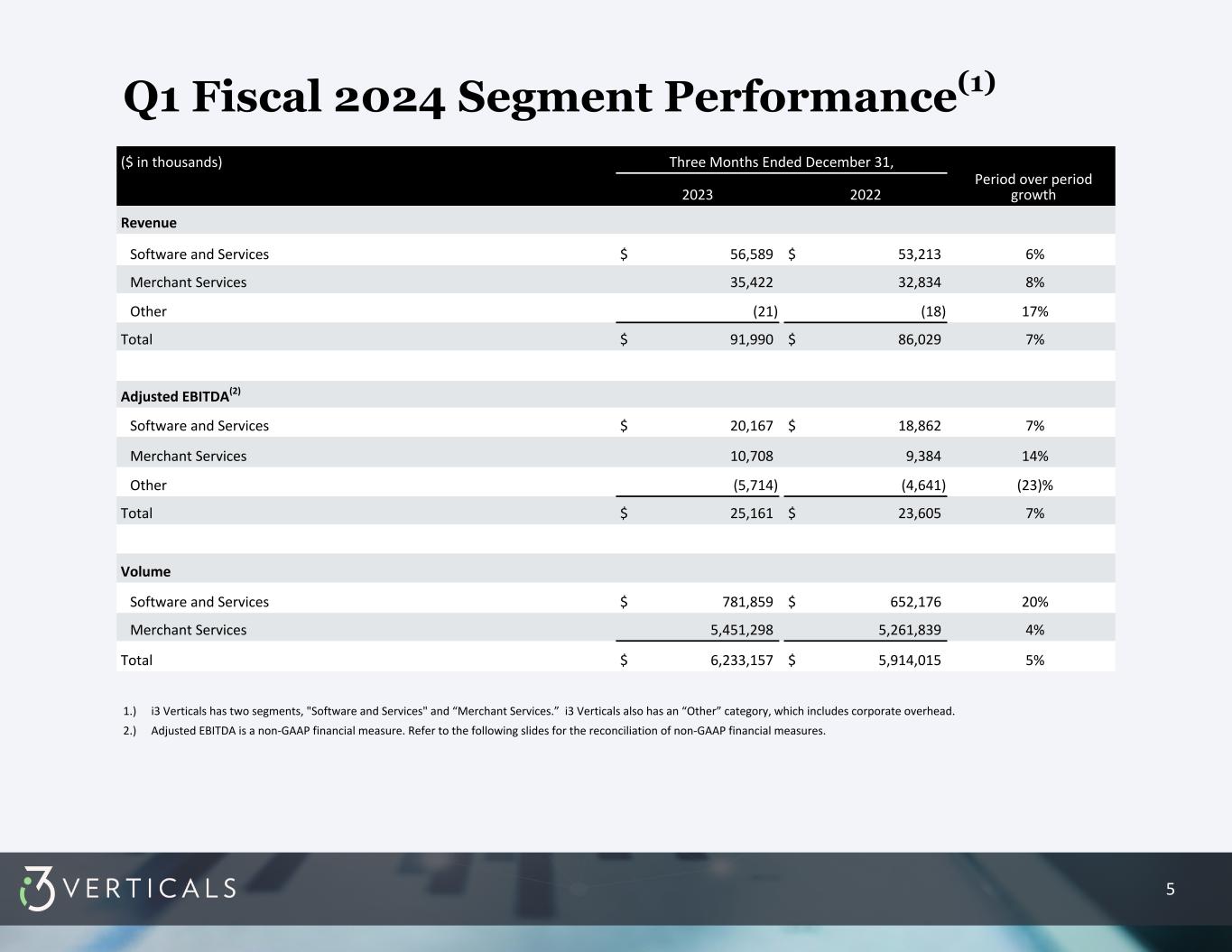

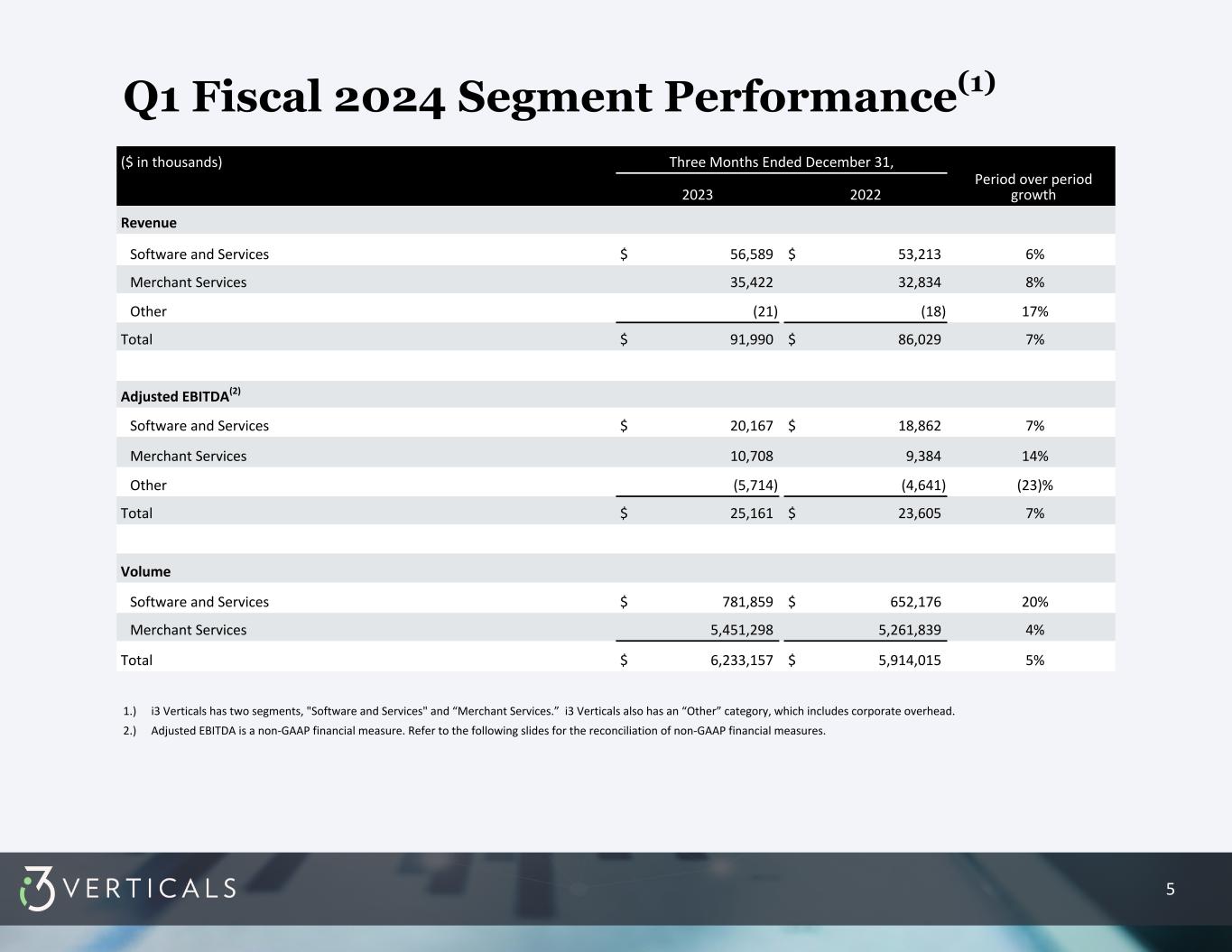

5 Q1 Fiscal 2024 Segment Performance(1) ($ in thousands) Three Months Ended December 31, Period over period growth2023 2022 Revenue Software and Services $ 56,589 $ 53,213 6% Merchant Services 35,422 32,834 8% Other (21) (18) 17% Total $ 91,990 $ 86,029 7% Adjusted EBITDA(2) Software and Services $ 20,167 $ 18,862 7% Merchant Services 10,708 9,384 14% Other (5,714) (4,641) (23)% Total $ 25,161 $ 23,605 7% Volume Software and Services $ 781,859 $ 652,176 20% Merchant Services 5,451,298 5,261,839 4% Total $ 6,233,157 $ 5,914,015 5% 1.) i3 Verticals has two segments, "Software and Services" and “Merchant Services.” i3 Verticals also has an “Other” category, which includes corporate overhead. 2.) Adjusted EBITDA is a non-GAAP financial measure. Refer to the following slides for the reconciliation of non-GAAP financial measures.

6 ($ in thousands) Three Months Ended December 31, 2023 Three Months Ended December 31, 2022 Software and Services Merchant Services Other Total Software and Services Merchant Services Other Total Income (loss) from operations $ 13,340 $ 8,133 $ (12,941) $ 8,532 $ 11,214 $ 7,017 $ (12,393) $ 5,838 Interest expense, net 7 20 6,680 6,707 — — 5,490 5,490 Provision for income taxes 5 — 177 182 — — 382 382 Net income (loss) 13,221 8,113 (19,798) 1,536 11,214 7,017 (18,062) 169 Non-GAAP Adjustments: Provision for income taxes 5 — 177 182 — — 382 382 Non-cash change in fair value of contingent consideration(1) (237) — — (237) 1,430 13 — 1,443 Equity-based compensation(2) — — 6,508 6,508 — — 6,846 6,846 M&A-related expenses(3) — — 244 244 — — 727 727 Acquisition intangible amortization(4) 4,968 1,939 238 7,145 4,701 2,031 — 6,732 Non-cash interest(5) — — 414 414 — — 361 361 Other taxes(6) 38 294 43 375 9 5 61 75 Gain on investment(7) — — — — — — (203) (203) Loss on disposal of property and equipment(8) 107 — — 107 — — — — Non-GAAP adjusted income (loss) before taxes 17,995 10,346 (12,174) 16,167 — 17,354 9,066 (9,888) 16,532 Pro forma taxes at effective tax rate(9) (4,526) (2,587) 3,044 (4,069) (4,339) (2,267) 2,473 (4,133) Pro forma adjusted net income (loss)(10) 13,576 7,759 (9,130) 12,205 13,015 6,799 (7,415) 12,399 Plus: Cash interest expense, net(11) 7 20 6,266 6,293 — — 5,129 5,129 Pro forma taxes at effective tax rate(9) 4,526 2,587 (3,044) 4,069 4,339 2,267 (2,473) 4,133 Depreciation and internally developed software amortization(12) 2,058 342 194 2,594 1,508 318 118 1,944 Adjusted EBITDA(13) $ 20,167 $ 10,708 $ (5,714) $ 25,161 $ 18,862 $ 9,384 $ (4,641) $ 23,605 Reconciliation of Non-GAAP Financial Measures The reconciliation of our income (loss) from operations to non-GAAP pro forma adjusted net income and non-GAAP adjusted EBITDA excluding acquisition revenue adjustments is as follows: See footnotes continued on the next slide.

7 1.) Non-cash change in fair value of contingent consideration reflects the changes in management’s estimates of future cash consideration to be paid in connection with prior acquisitions from the amount estimated as of the later of the most recent balance sheet date forming the beginning of the income statement period or the original estimates made at the closing of the applicable acquisition. 2.) Equity-based compensation expense related to stock options and restricted stock units issued under the Company's 2018 Equity Incentive Plan and 2020 Acquisition Equity Incentive Plan. 3.) M&A-related expenses are the professional service and related costs directly related to any merger, acquisition and disposition activity of the Company which the Company believes are not reflective of its underlying operational performance. 4.) Acquisition intangible amortization reflects amortization of intangible assets and software acquired through business combinations, acquired customer portfolios, acquired referral agreements and related asset acquisitions. 5.) Non-cash interest expense reflects amortization of debt discount and debt issuance costs and any write-offs of debt issuance costs. 6.) Other taxes consist of franchise taxes, commercial activity taxes, reserves for ongoing tax audit matters, the employer portion of payroll taxes related to stock option exercises and other non-income based taxes. Taxes related to salaries are not included. 7.) Gain on investment reflects $203k related to continent consideration received for an investment that was sold in a prior year for the three months ended December 31, 2022. 8.) Loss on disposal of property and equipment is related to the sale of a building purchased through an acquisition. 9.) Pro forma corporate income tax expense is based on Non-GAAP adjusted income before taxes and is calculated using a tax rate of 25.0% for both 2023 and 2022, based on blended federal and state tax rates. 10.) Pro forma adjusted net income represents a non-GAAP financial measure, and assumes that all net income during the period is available to the holders of the Company’s Class A common stock. 11.) Cash interest expense, net represents all interest expense net of interest income recorded on the Company's statement of operations other than non-cash interest expense, which represents amortization of debt discount and debt issuance costs and any write-offs of debt issuance costs. 12.) Depreciation and internally developed software amortization reflects depreciation on the Company's property, plant and equipment, net, and amortization expense on its internally developed capitalized software. 13.) Represents a non-GAAP financial measure. Reconciliation of Non-GAAP Financial Measures

8 ($ in millions) As of December 31, 2023 Revolving lines of credit to banks under the 2023 Senior Secured Credit Facility $ 265.5 1% Exchangeable Senior Notes due 2025 117.0 Less: Cash and Cash Equivalents (4.2) Total long-term debt for use in our Total Leverage Ratio $ 378.3 Reconciliation Between GAAP Debt and Covenant Debt The reconciliation of our GAAP Long-term debt, before issuance costs, and the debt balance used in our Total Leverage Ratio is as follows: ($ in millions) Pro forma adjusted Revolving lines of credit to banks under the 2023 Senior Secured Credit Facility $ 352.5 1% Exchangeable Senior Notes due 2025 26.2 Less: Cash and Cash Equivalents (4.2) Total long-term debt for use in our Total Leverage Ratio $ 374.5