Supplemental Operating & Financial Data First Quarter Ended March 31, 2019 Exhibit 99.2

Table of Contents 242, 242, 242 Financial Summary Consolidated Statements of Operations 2 Funds from Operations and Adjusted Funds from Operations 3 Consolidated Balance Sheets 4 GAAP Reconciliations to EBITDAre, GAAP NOI and Cash NOI 5 Market Capitalization, Debt Summary and Leverage Metrics 6 Net Investment Activity Investment Summary 7 Disposition Summary 8 Portfolio Summary Portfolio Highlights 9 Tenant and Industry Diversification 10 Portfolio Health 11 Leasing Summary Leasing Expiration Schedule, Leasing Activity and Statistics 12 Same-Store Analysis 13 Lease Escalations 14 Glossary 15-17

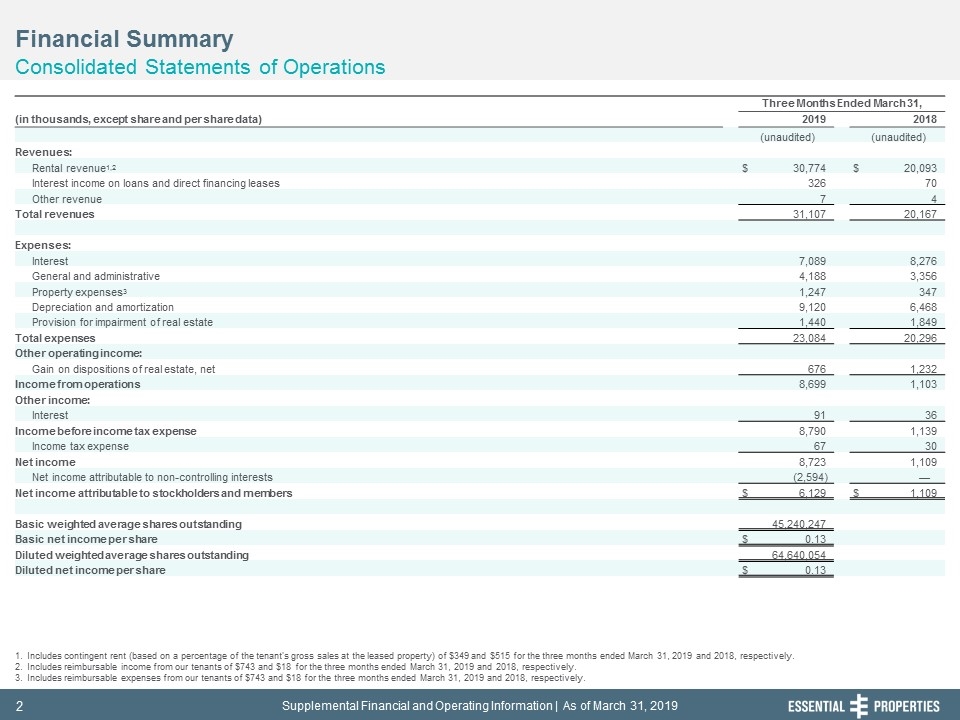

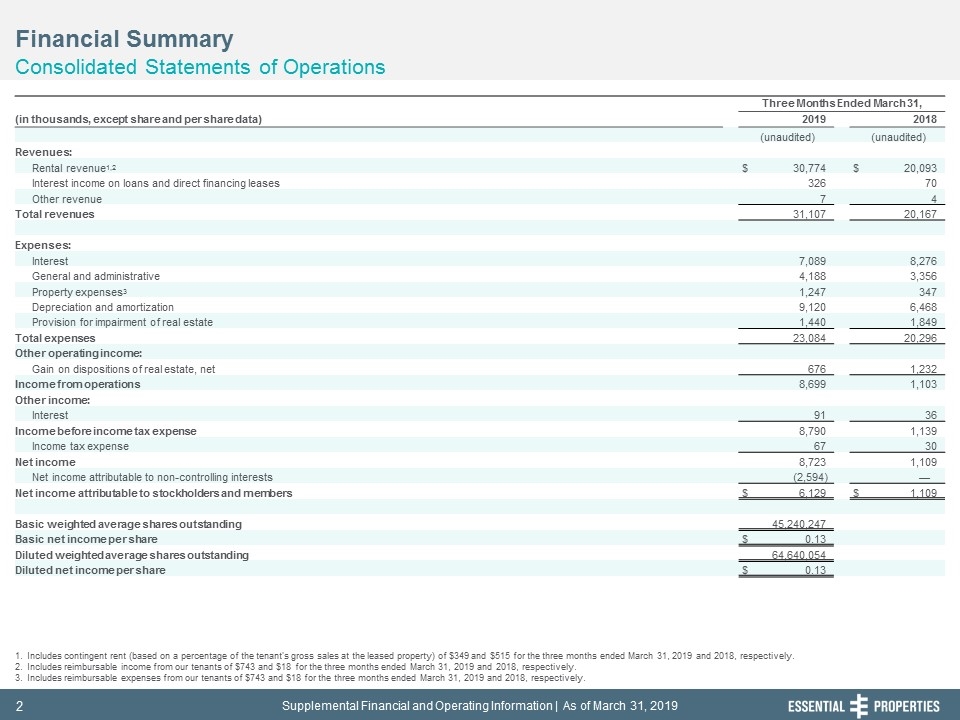

Financial Summary Consolidated Statements of Operations 242, 242, 242 Includes contingent rent (based on a percentage of the tenant's gross sales at the leased property) of $349 and $515 for the three months ended March 31, 2019 and 2018, respectively. Includes reimbursable income from our tenants of $743 and $18 for the three months ended March 31, 2019 and 2018, respectively. Includes reimbursable expenses from our tenants of $743 and $18 for the three months ended March 31, 2019 and 2018, respectively. Three Months Ended March 31, (in thousands, except share and per share data) 2019 2018 (unaudited) (unaudited) Revenues: Rental revenue1,2 $ 30,774 $ 20,093 Interest income on loans and direct financing leases 326 70 Other revenue 7 4 Total revenues 31,107 20,167 Expenses: Interest 7,089 8,276 General and administrative 4,188 3,356 Property expenses3 1,247 347 Depreciation and amortization 9,120 6,468 Provision for impairment of real estate 1,440 1,849 Total expenses 23,084 20,296 Other operating income: Gain on dispositions of real estate, net 676 1,232 Income from operations 8,699 1,103 Other income: Interest 91 36 Income before income tax expense 8,790 1,139 Income tax expense 67 30 Net income 8,723 1,109 Net income attributable to non-controlling interests (2,594) — Net income attributable to stockholders and members $ 6,129 $ 1,109 Basic weighted average shares outstanding 45,240,247 Basic net income per share $ 0.13 Diluted weighted average shares outstanding 64,640,054 Diluted net income per share $ 0.13

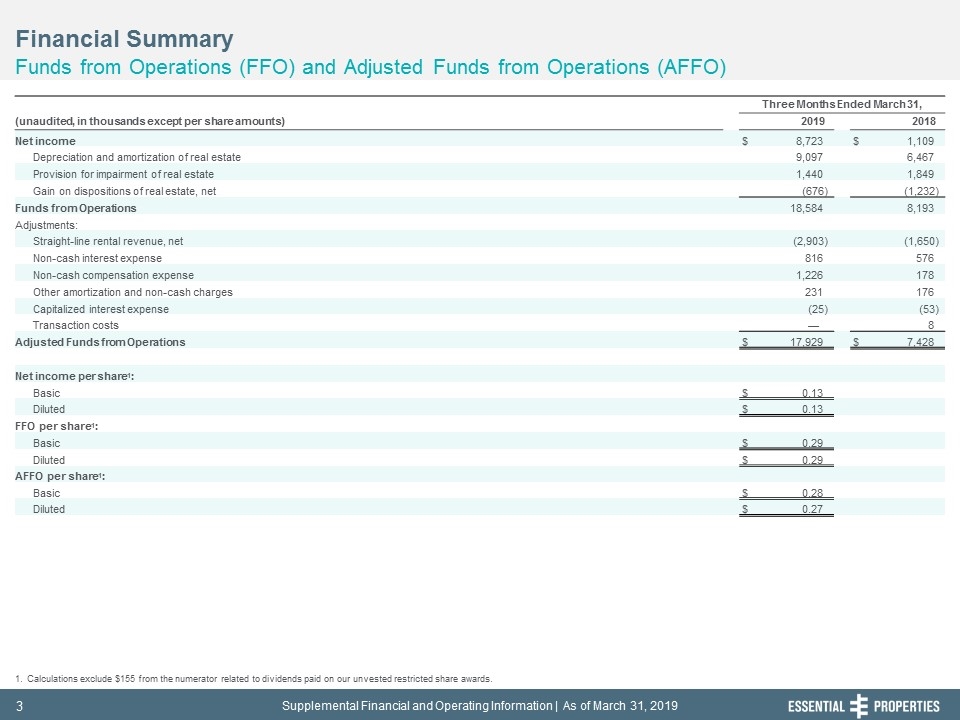

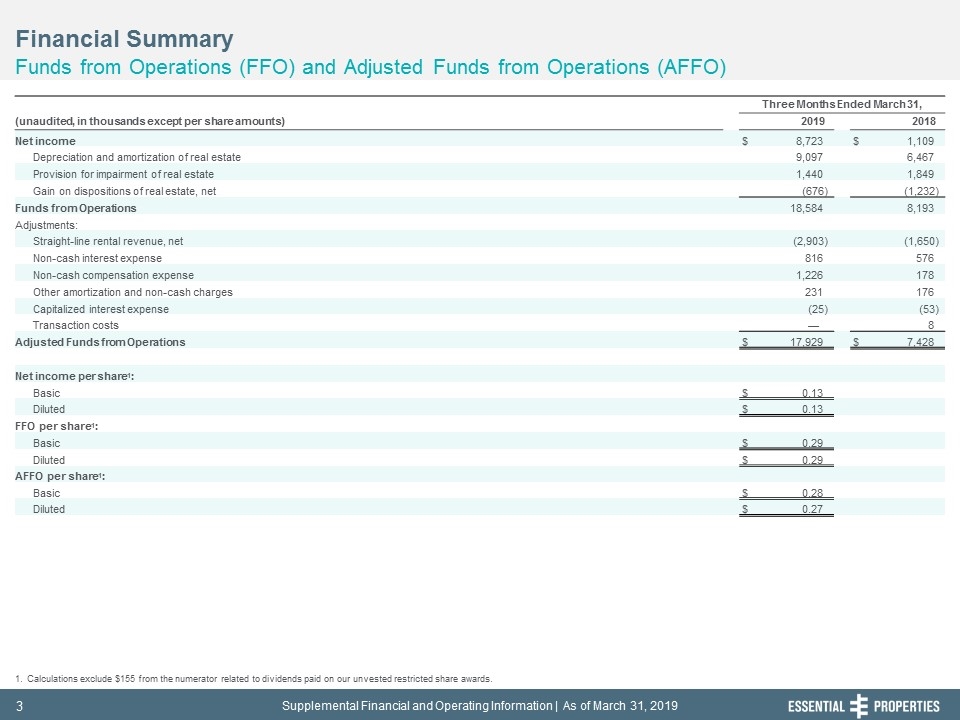

Financial Summary Funds from Operations (FFO) and Adjusted Funds from Operations (AFFO) 242, 242, 242 Calculations exclude $155 from the numerator related to dividends paid on our unvested restricted share awards. Three Months Ended March 31, (unaudited, in thousands except per share amounts) 2019 2018 Net income $ 8,723 $ 1,109 Depreciation and amortization of real estate 9,097 6,467 Provision for impairment of real estate 1,440 1,849 Gain on dispositions of real estate, net (676) (1,232) Funds from Operations 18,584 8,193 Adjustments: Straight-line rental revenue, net (2,903) (1,650) Non-cash interest expense 816 576 Non-cash compensation expense 1,226 178 Other amortization and non-cash charges 231 176 Capitalized interest expense (25) (53) Transaction costs — 8 Adjusted Funds from Operations $ 17,929 $ 7,428 Net income per share1: Basic $ 0.13 Diluted $ 0.13 FFO per share1: Basic $ 0.29 Diluted $ 0.29 AFFO per share1: Basic $ 0.28 Diluted $ 0.27

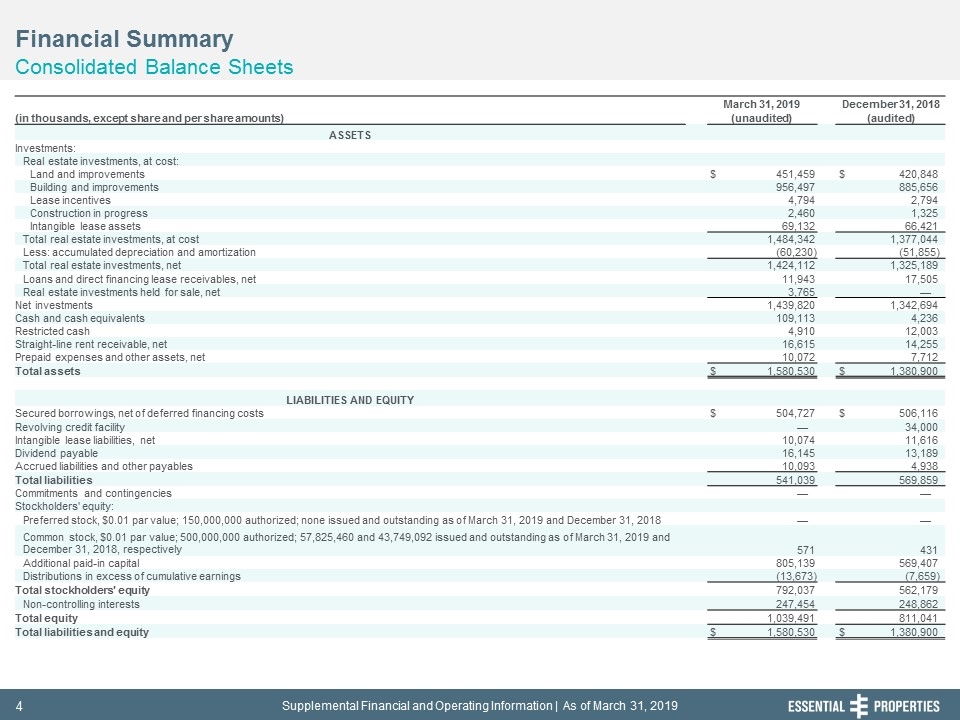

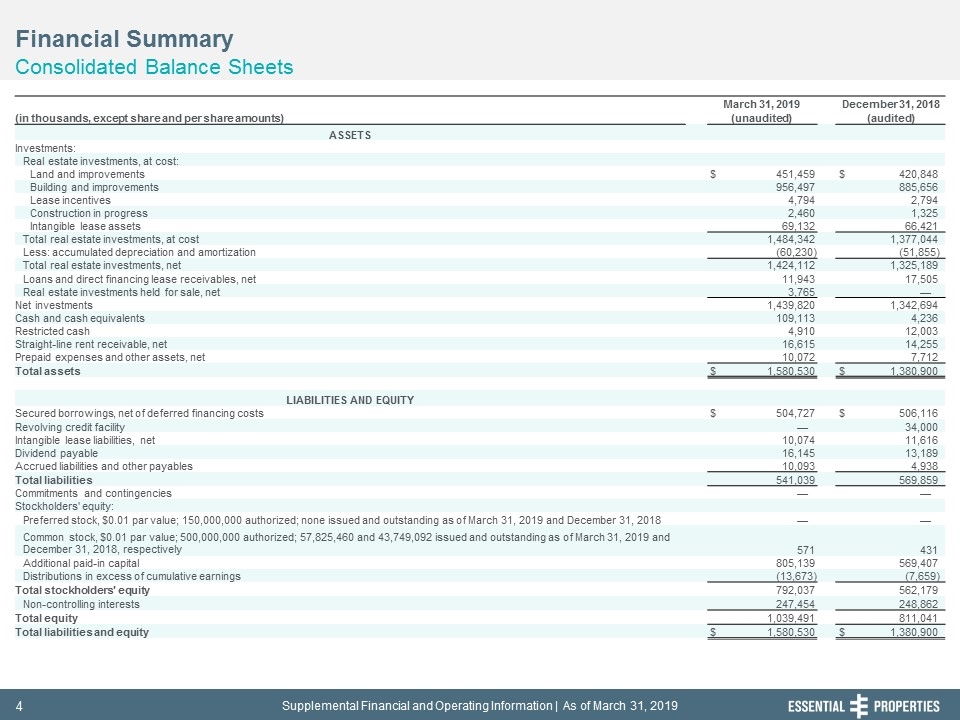

Financial Summary Consolidated Balance Sheets 242, 242, 242 March 31, 2019 December 31, 2018 (in thousands, except share and per share amounts) (unaudited) (audited) ASSETS Investments: Real estate investments, at cost: Land and improvements $ 451,459 $ 420,848 Building and improvements 956,497 885,656 Lease incentives 4,794 2,794 Construction in progress 2,460 1,325 Intangible lease assets 69,132 66,421 Total real estate investments, at cost 1,484,342 1,377,044 Less: accumulated depreciation and amortization (60,230) (51,855) Total real estate investments, net 1,424,112 1,325,189 Loans and direct financing lease receivables, net 11,943 17,505 Real estate investments held for sale, net 3,765 — Net investments 1,439,820 1,342,694 Cash and cash equivalents 109,113 4,236 Restricted cash 4,910 12,003 Straight-line rent receivable, net 16,615 14,255 Prepaid expenses and other assets, net 10,072 7,712 Total assets $ 1,580,530 $ 1,380,900 LIABILITIES AND EQUITY Secured borrowings, net of deferred financing costs $ 504,727 $ 506,116 Revolving credit facility — 34,000 Intangible lease liabilities, net 10,074 11,616 Dividend payable 16,145 13,189 Accrued liabilities and other payables 10,093 4,938 Total liabilities 541,039 569,859 Commitments and contingencies — — Stockholders' equity: Preferred stock, $0.01 par value; 150,000,000 authorized; none issued and outstanding as of March 31, 2019 and December 31, 2018 — — Common stock, $0.01 par value; 500,000,000 authorized; 57,825,460 and 43,749,092 issued and outstanding as of March 31, 2019 and December 31, 2018, respectively 571 431 Additional paid-in capital 805,139 569,407 Distributions in excess of cumulative earnings (13,673) (7,659) Total stockholders' equity 792,037 562,179 Non-controlling interests 247,454 248,862 Total equity 1,039,491 811,041 Total liabilities and equity $ 1,580,530 $ 1,380,900

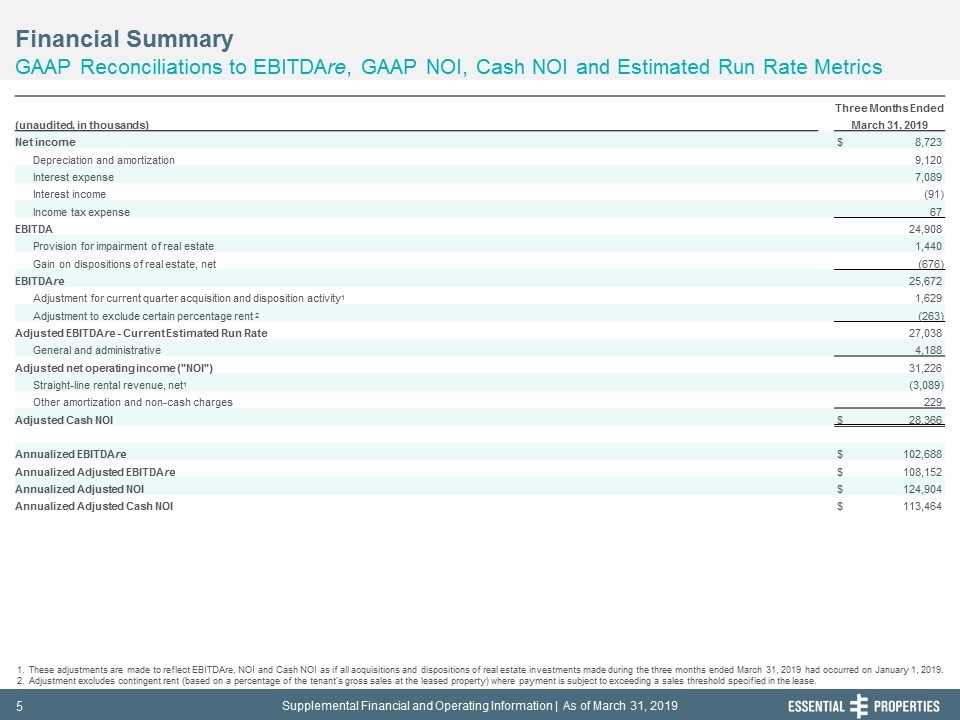

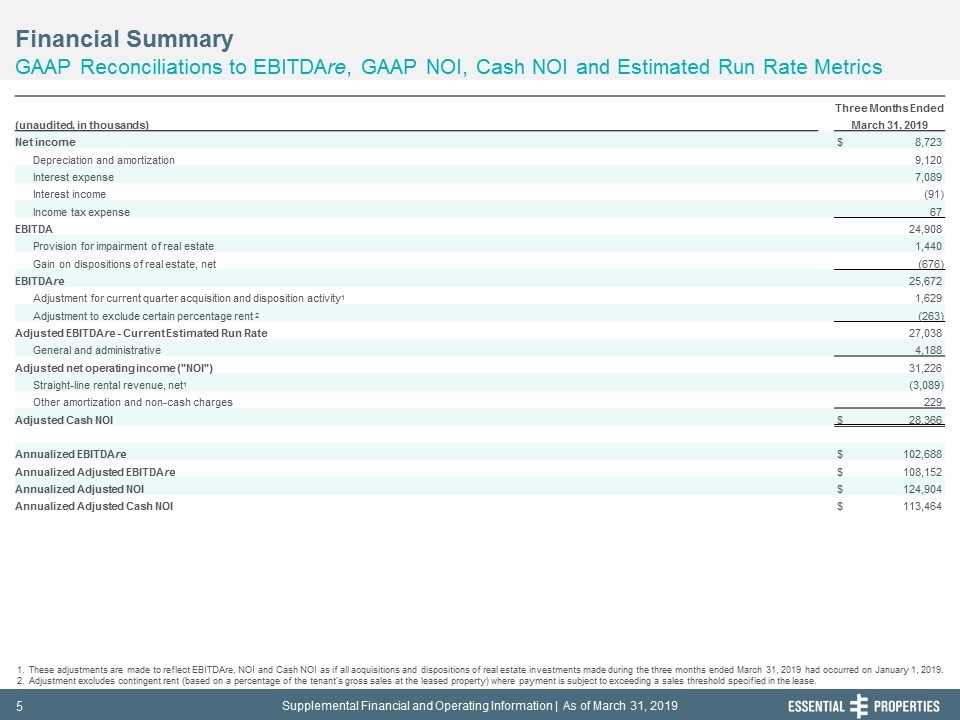

Financial Summary GAAP Reconciliations to EBITDAre, GAAP NOI, Cash NOI and Estimated Run Rate Metrics 242, 242, 242 These adjustments are made to reflect EBITDAre, NOI and Cash NOI as if all acquisitions and dispositions of real estate investments made during the three months ended March 31, 2019 had occurred on January 1, 2019. Adjustment excludes contingent rent (based on a percentage of the tenant's gross sales at the leased property) where payment is subject to exceeding a sales threshold specified in the lease. Three Months Ended (unaudited, in thousands) March 31, 2019 Net income $ 8,723 Depreciation and amortization 9,120 Interest expense 7,089 Interest income (91) Income tax expense 67 EBITDA 24,908 Provision for impairment of real estate 1,440 Gain on dispositions of real estate, net (676) EBITDAre 25,672 Adjustment for current quarter acquisition and disposition activity1 1,629 Adjustment to exclude certain percentage rent 2 (263) Adjusted EBITDAre - Current Estimated Run Rate 27,038 General and administrative 4,188 Adjusted net operating income ("NOI") 31,226 Straight-line rental revenue, net1 (3,089) Other amortization and non-cash charges 229 Adjusted Cash NOI $ 28,366 Annualized EBITDAre $ 102,688 Annualized Adjusted EBITDAre $ 108,152 Annualized Adjusted NOI $ 124,904 Annualized Adjusted Cash NOI $ 113,464

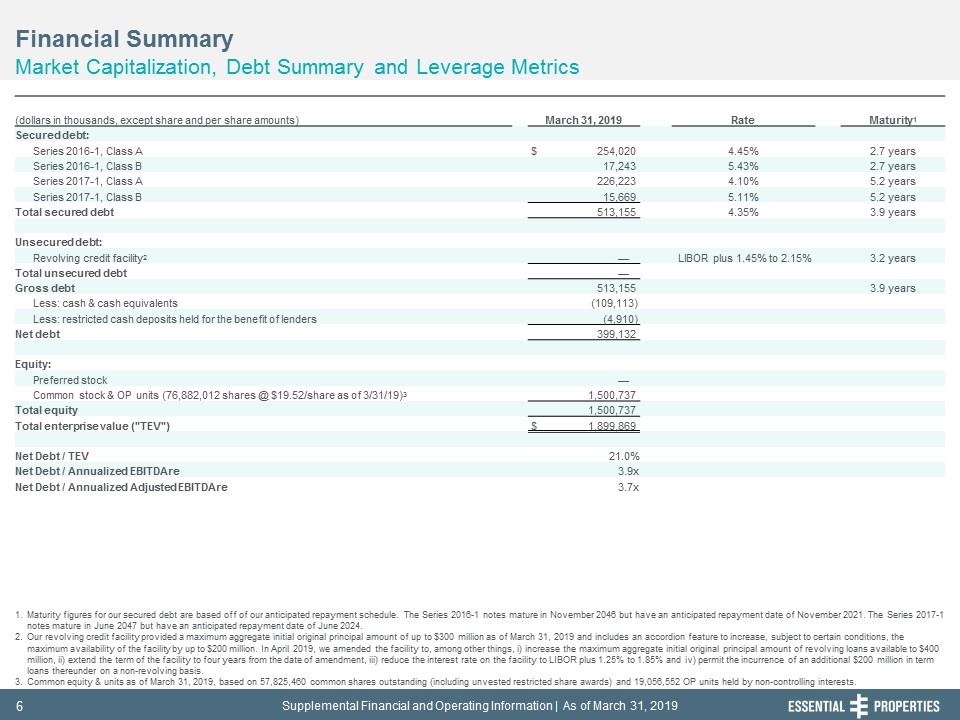

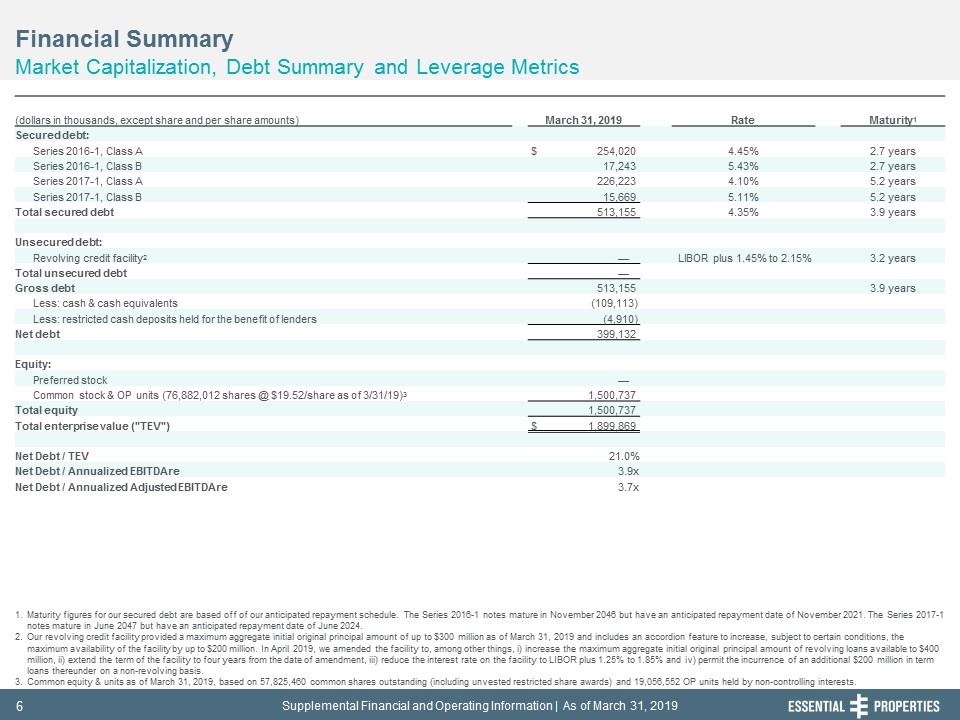

Financial Summary Market Capitalization, Debt Summary and Leverage Metrics 242, 242, 242 Maturity figures for our secured debt are based off of our anticipated repayment schedule. The Series 2016-1 notes mature in November 2046 but have an anticipated repayment date of November 2021. The Series 2017-1 notes mature in June 2047 but have an anticipated repayment date of June 2024. Our revolving credit facility provided a maximum aggregate initial original principal amount of up to $300 million as of March 31, 2019 and includes an accordion feature to increase, subject to certain conditions, the maximum availability of the facility by up to $200 million. In April 2019, we amended the facility to, among other things, i) increase the maximum aggregate initial original principal amount of revolving loans available to $400 million, ii) extend the term of the facility to four years from the date of amendment, iii) reduce the interest rate on the facility to LIBOR plus 1.25% to 1.85% and iv) permit the incurrence of an additional $200 million in term loans thereunder on a non-revolving basis. Common equity & units as of March 31, 2019, based on 57,825,460 common shares outstanding (including unvested restricted share awards) and 19,056,552 OP units held by non-controlling interests. (dollars in thousands, except share and per share amounts) March 31, 2019 Rate Maturity1 Secured debt: Series 2016-1, Class A $ 254,020 4.45% 2.7 years Series 2016-1, Class B 17,243 5.43% 2.7 years Series 2017-1, Class A 226,223 4.10% 5.2 years Series 2017-1, Class B 15,669 5.11% 5.2 years Total secured debt 513,155 4.35% 3.9 years Unsecured debt: Revolving credit facility2 — LIBOR plus 1.45% to 2.15% 3.2 years Total unsecured debt — Gross debt 513,155 3.9 years Less: cash & cash equivalents (109,113) Less: restricted cash deposits held for the benefit of lenders (4,910) Net debt 399,132 Equity: Preferred stock — Common stock & OP units (76,882,012 shares @ $19.52/share as of 3/31/19)3 1,500,737 Total equity 1,500,737 Total enterprise value ("TEV") $ 1,899,869 Net Debt / TEV 21.0% Net Debt / Annualized EBITDAre 3.9x Net Debt / Annualized Adjusted EBITDAre 3.7x

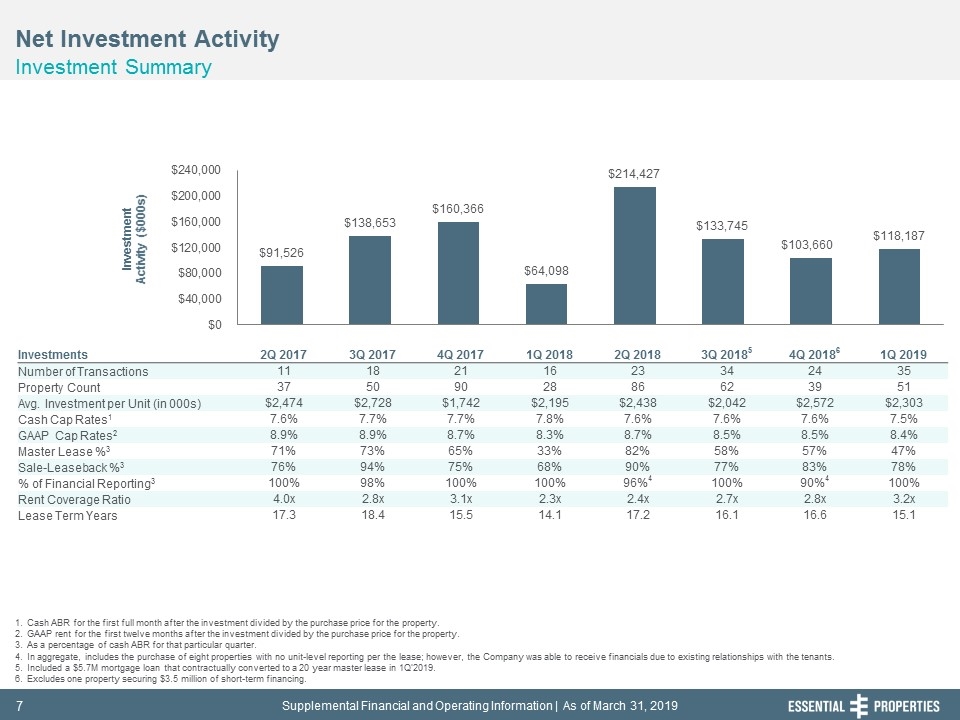

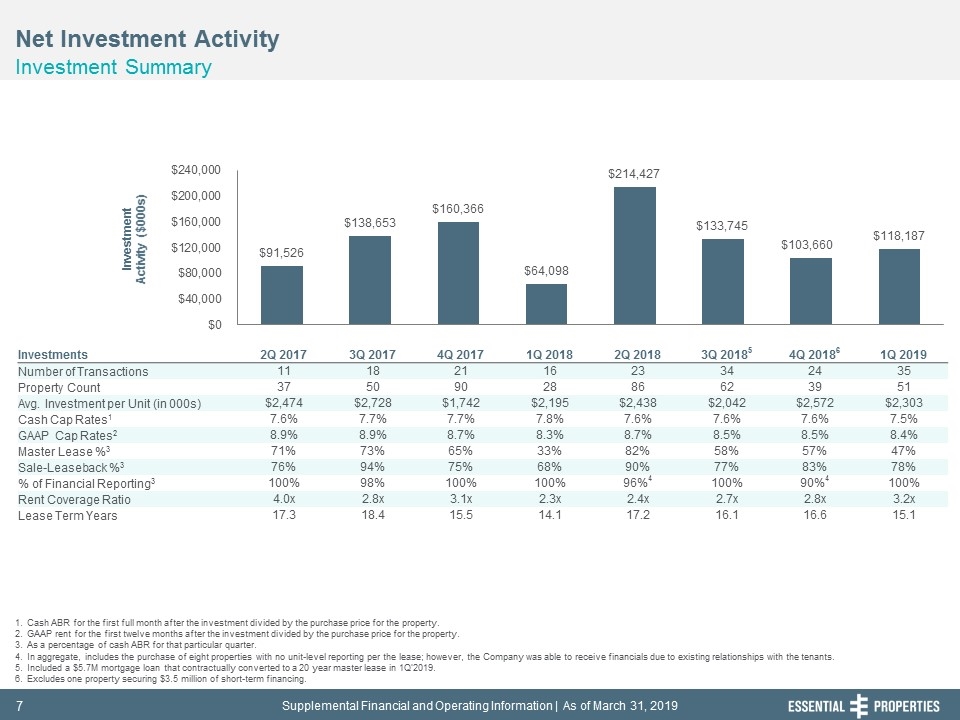

Net Investment Activity Investment Summary 242, 242, 242 Cash ABR for the first full month after the investment divided by the purchase price for the property. GAAP rent for the first twelve months after the investment divided by the purchase price for the property. As a percentage of cash ABR for that particular quarter. In aggregate, includes the purchase of eight properties with no unit-level reporting per the lease; however, the Company was able to receive financials due to existing relationships with the tenants. Included a $5.7M mortgage loan that contractually converted to a 20 year master lease in 1Q’2019. Excludes one property securing $3.5 million of short-term financing. Investments 2Q 2017 3Q 2017 4Q 2017 1Q 2018 2Q 2018 3Q 20185 4Q 20186 1Q 2019 Number of Transactions 11 18 21 16 23 34 24 35 Property Count 37 50 90 28 86 62 39 51 Avg. Investment per Unit (in 000s) $2,474 $2,728 $1,742 $2,195 $2,438 $2,042 $2,572 $2,303 Cash Cap Rates1 7.6% 7.7% 7.7% 7.8% 7.6% 7.6% 7.6% 7.5% GAAP Cap Rates2 8.9% 8.9% 8.7% 8.3% 8.7% 8.5% 8.5% 8.4% Master Lease %3 71% 73% 65% 33% 82% 58% 57% 47% Sale-Leaseback %3 76% 94% 75% 68% 90% 77% 83% 78% % of Financial Reporting3 100% 98% 100% 100% 96%4 100% 90%4 100% Rent Coverage Ratio 4.0x 2.8x 3.1x 2.3x 2.4x 2.7x 2.8x 3.2x Lease Term Years 17.3 18.4 15.5 14.1 17.2 16.1 16.6 15.1

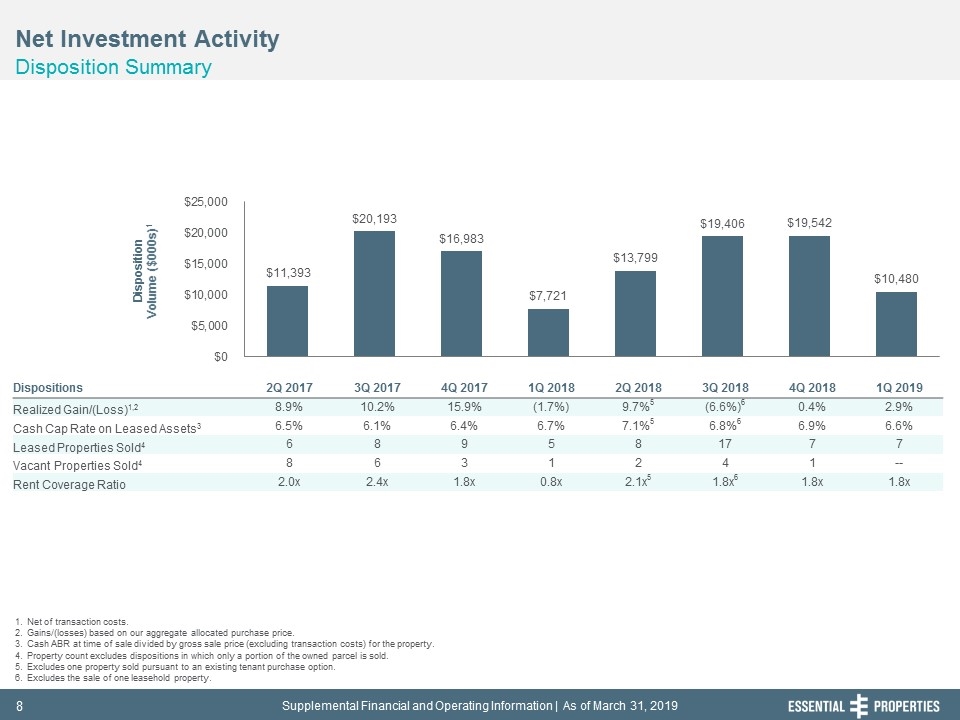

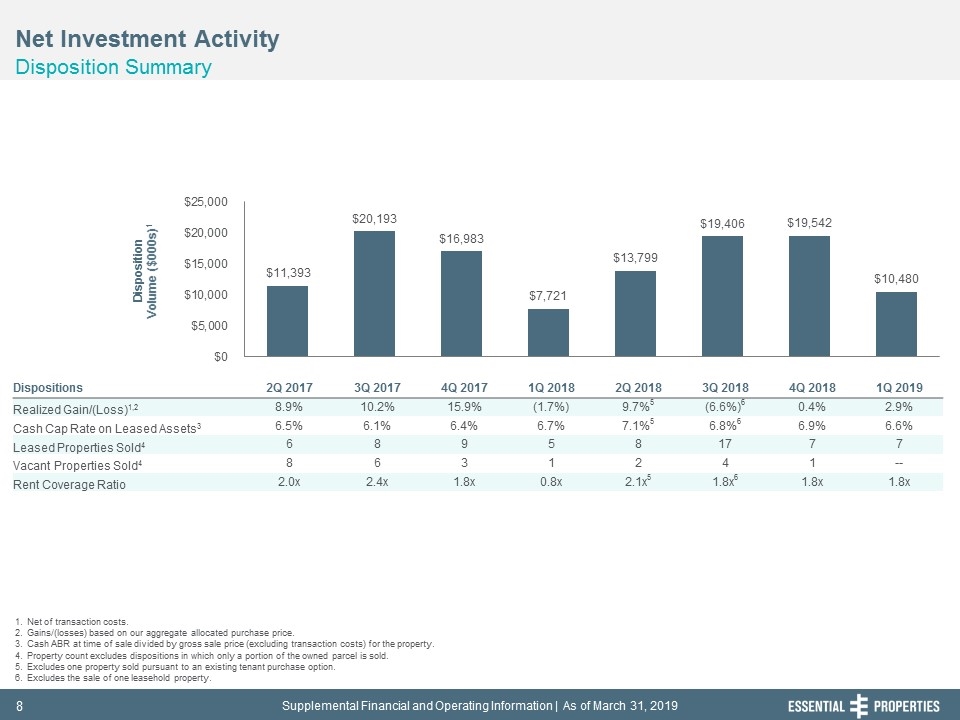

Net Investment Activity Disposition Summary 242, 242, 242 Net of transaction costs. Gains/(losses) based on our aggregate allocated purchase price. Cash ABR at time of sale divided by gross sale price (excluding transaction costs) for the property. Property count excludes dispositions in which only a portion of the owned parcel is sold. Excludes one property sold pursuant to an existing tenant purchase option. Excludes the sale of one leasehold property. Dispositions 2Q 2017 3Q 2017 4Q 2017 1Q 2018 2Q 2018 3Q 2018 4Q 2018 1Q 2019 Realized Gain/(Loss)1,2 8.9% 10.2% 15.9% (1.7%) 9.7%5 (6.6%)6 0.4% 2.9% Cash Cap Rate on Leased Assets3 6.5% 6.1% 6.4% 6.7% 7.1%5 6.8%6 6.9% 6.6% Leased Properties Sold4 6 8 9 5 8 17 7 7 Vacant Properties Sold4 8 6 3 1 2 4 1 -- Rent Coverage Ratio 2.0x 2.4x 1.8x 0.8x 2.1x5 1.8x6 1.8x 1.8x

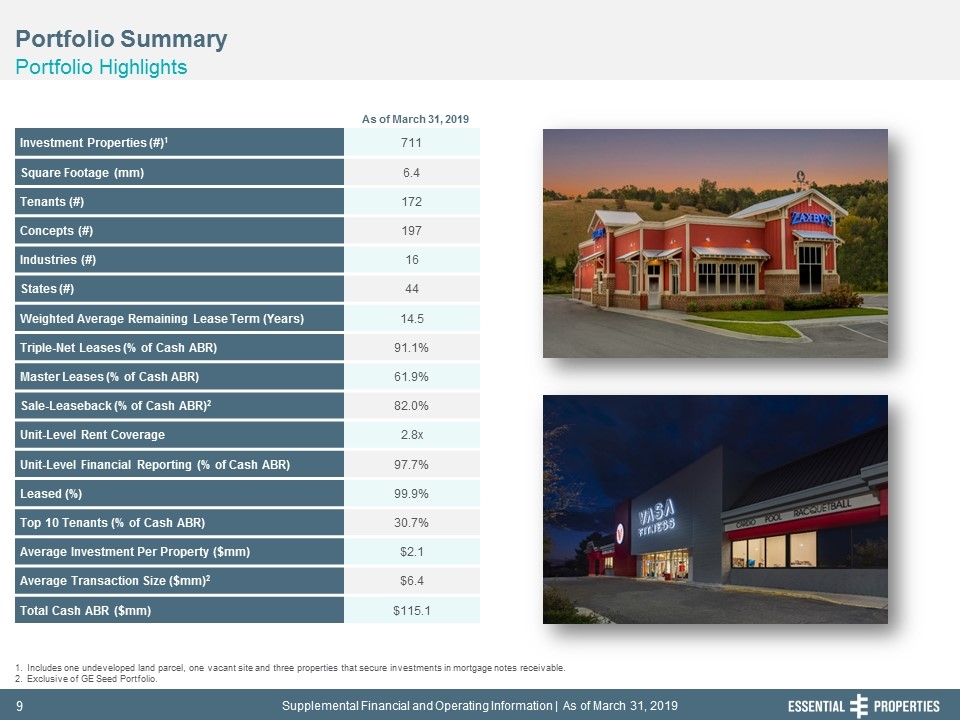

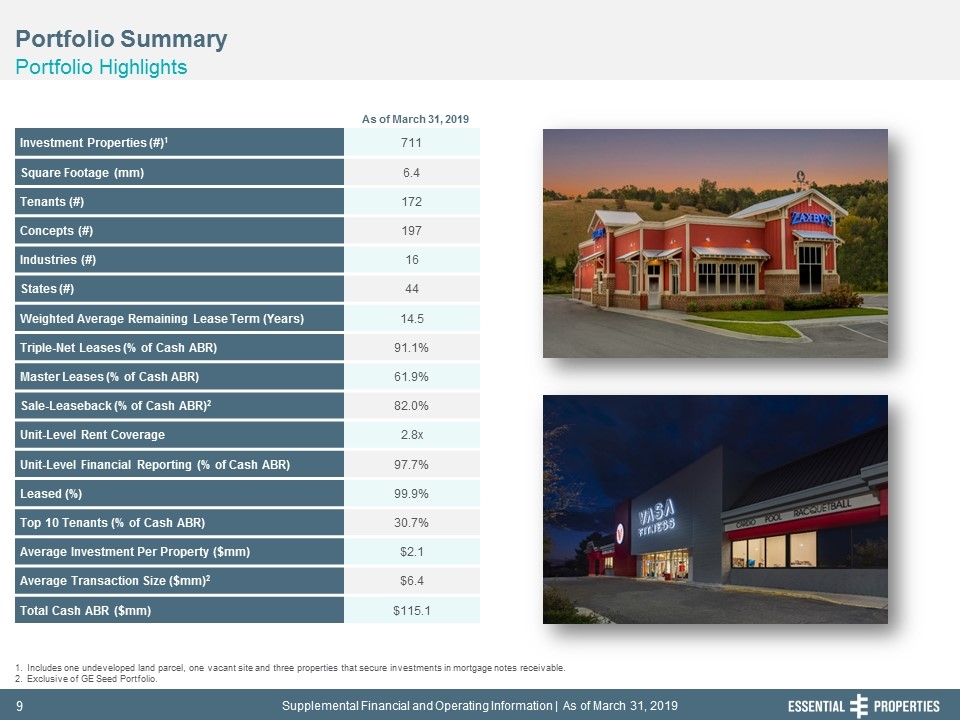

Portfolio Summary Portfolio Highlights 242, 242, 242 Investment Properties (#)1 711 Square Footage (mm) 6.4 Tenants (#) 172 Concepts (#) 197 Industries (#) 16 States (#) 44 Weighted Average Remaining Lease Term (Years) 14.5 Triple-Net Leases (% of Cash ABR) 91.1% Master Leases (% of Cash ABR) 61.9% Sale-Leaseback (% of Cash ABR)2 82.0% Unit-Level Rent Coverage 2.8x Unit-Level Financial Reporting (% of Cash ABR) 97.7% Leased (%) 99.9% Top 10 Tenants (% of Cash ABR) 30.7% Average Investment Per Property ($mm) $2.1 Average Transaction Size ($mm)2 $6.4 Total Cash ABR ($mm) $115.1 Includes one undeveloped land parcel, one vacant site and three properties that secure investments in mortgage notes receivable. Exclusive of GE Seed Portfolio. As of March 31, 2019

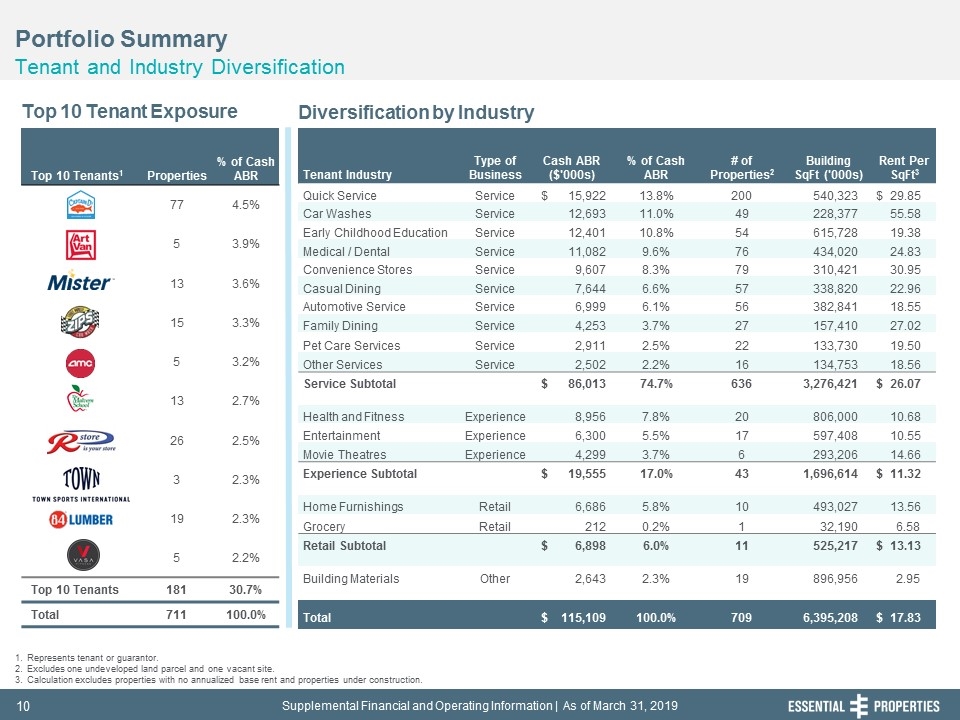

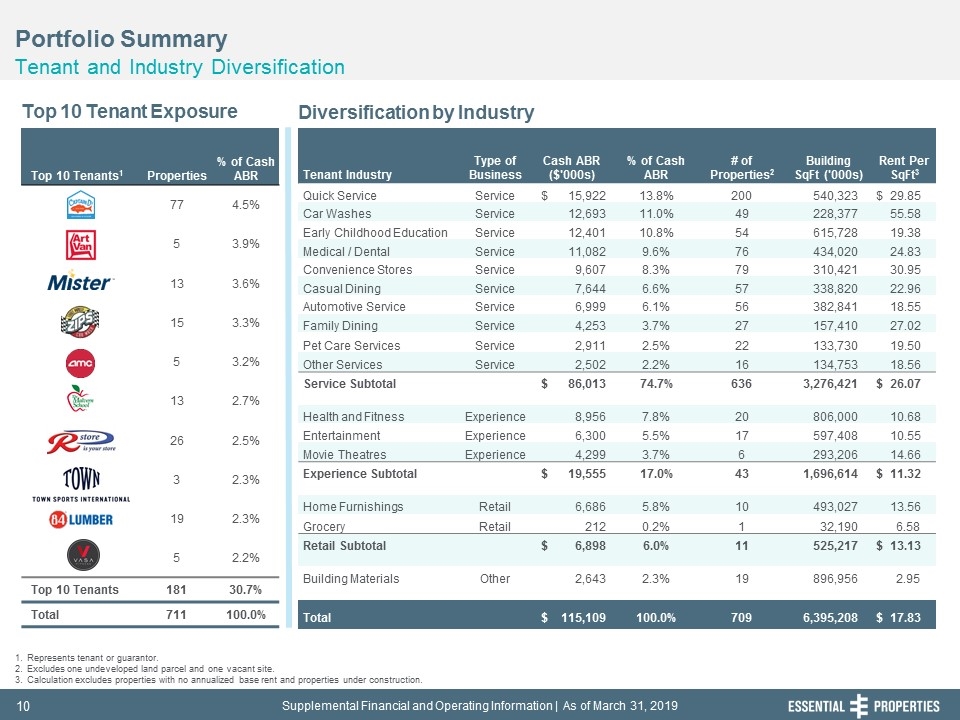

Portfolio Summary Tenant and Industry Diversification 242, 242, 242 Top 10 Tenants1 Properties % of Cash ABR 77 4.5% 5 3.9% 13 3.6% 15 3.3% 5 3.2% 13 2.7% 26 2.5% 3 2.3% 19 2.3% 5 2.2% Top 10 Tenants 181 30.7% Total 711 100.0% Top 10 Tenant Exposure Diversification by Industry Represents tenant or guarantor. Excludes one undeveloped land parcel and one vacant site. Calculation excludes properties with no annualized base rent and properties under construction. Tenant Industry Type of Business Cash ABR ($'000s) % of Cash ABR # of Properties2 Building SqFt ('000s) Rent Per SqFt3 Quick Service Service $ 15,922 13.8% 200 540,323 $ 29.85 Car Washes Service 12,693 11.0% 49 228,377 55.58 Early Childhood Education Service 12,401 10.8% 54 615,728 19.38 Medical / Dental Service 11,082 9.6% 76 434,020 24.83 Convenience Stores Service 9,607 8.3% 79 310,421 30.95 Casual Dining Service 7,644 6.6% 57 338,820 22.96 Automotive Service Service 6,999 6.1% 56 382,841 18.55 Family Dining Service 4,253 3.7% 27 157,410 27.02 Pet Care Services Service 2,911 2.5% 22 133,730 19.50 Other Services Service 2,502 2.2% 16 134,753 18.56 Service Subtotal $ 86,013 74.7% 636 3,276,421 $ 26.07 Health and Fitness Experience 8,956 7.8% 20 806,000 10.68 Entertainment Experience 6,300 5.5% 17 597,408 10.55 Movie Theatres Experience 4,299 3.7% 6 293,206 14.66 Experience Subtotal $ 19,555 17.0% 43 1,696,614 $ 11.32 Home Furnishings Retail 6,686 5.8% 10 493,027 13.56 Grocery Retail 212 0.2% 1 32,190 6.58 Retail Subtotal $ 6,898 6.0% 11 525,217 $ 13.13 Building Materials Other 2,643 2.3% 19 896,956 2.95 Total $ 115,109 100.0% 709 6,395,208 $ 17.83

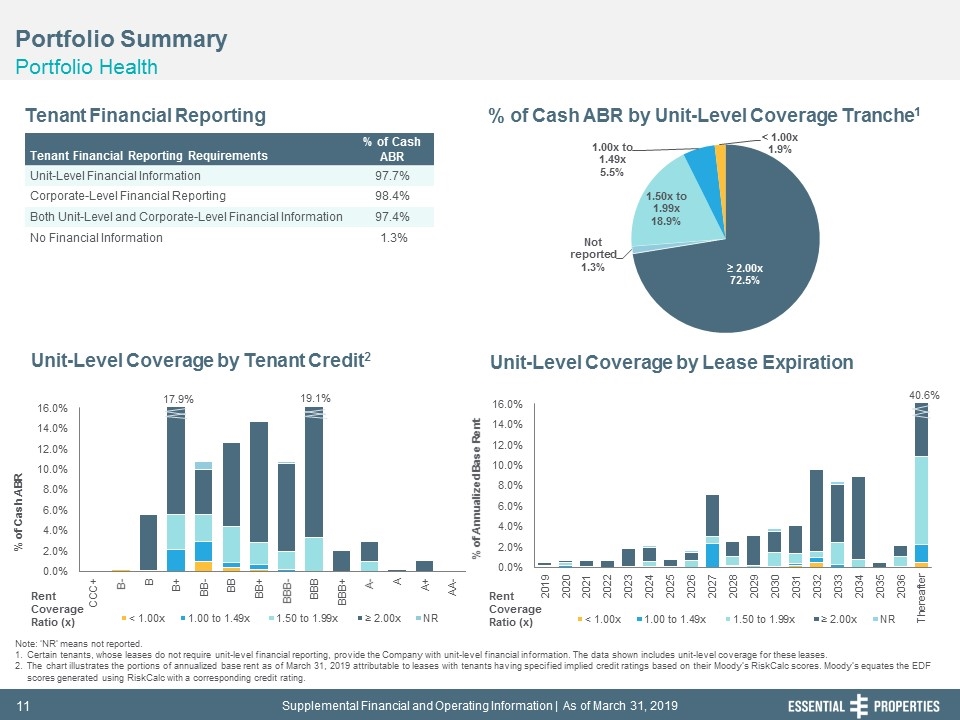

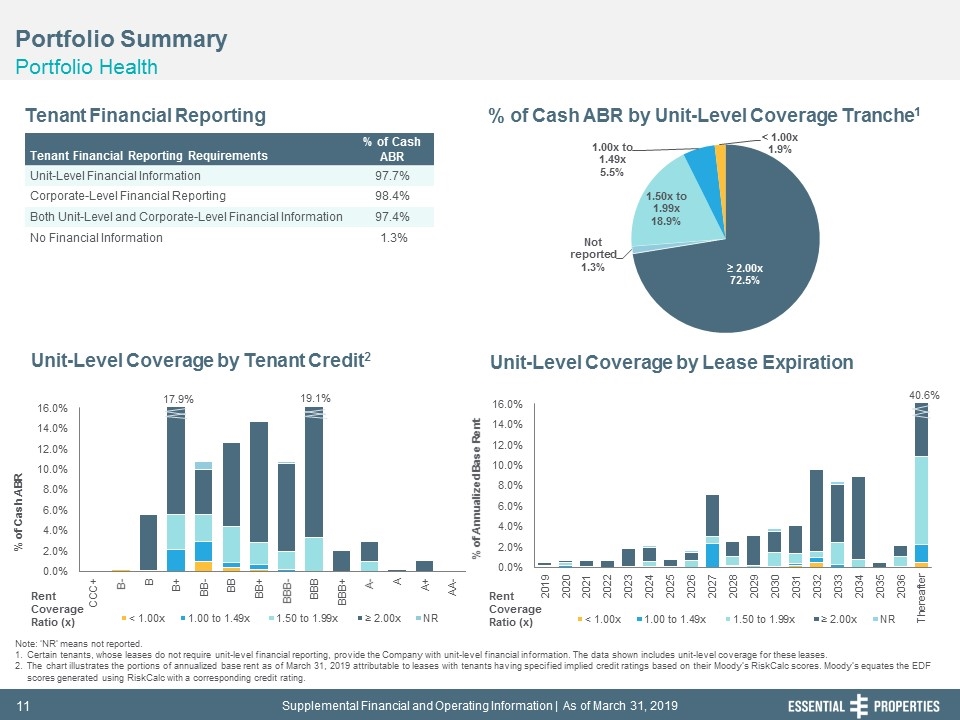

19.1% 40.6% Portfolio Summary Portfolio Health 242, 242, 242 Tenant Financial Reporting % of Cash ABR by Unit-Level Coverage Tranche1 Unit-Level Coverage by Lease Expiration Unit-Level Coverage by Tenant Credit2 Note: ‘NR’ means not reported. Certain tenants, whose leases do not require unit-level financial reporting, provide the Company with unit-level financial information. The data shown includes unit-level coverage for these leases. The chart illustrates the portions of annualized base rent as of March 31, 2019 attributable to leases with tenants having specified implied credit ratings based on their Moody’s RiskCalc scores. Moody’s equates the EDF scores generated using RiskCalc with a corresponding credit rating. Tenant Financial Reporting Requirements % of Cash ABR Unit-Level Financial Information 97.7% Corporate-Level Financial Reporting 98.4% Both Unit-Level and Corporate-Level Financial Information 97.4% No Financial Information 1.3% 17.9% Rent Coverage Ratio (x) Rent Coverage Ratio (x)

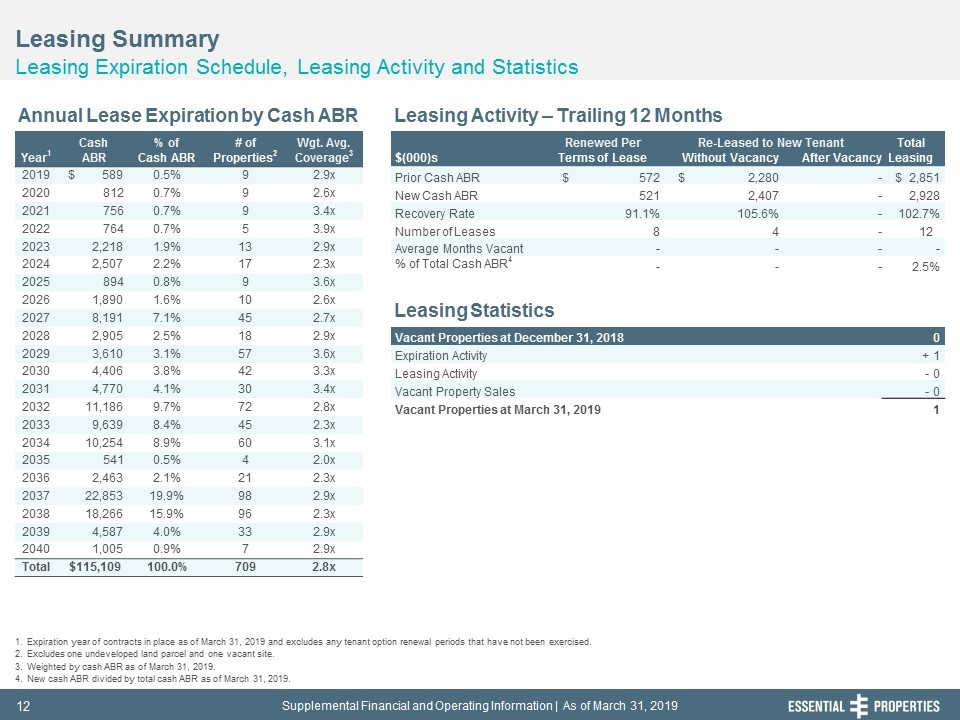

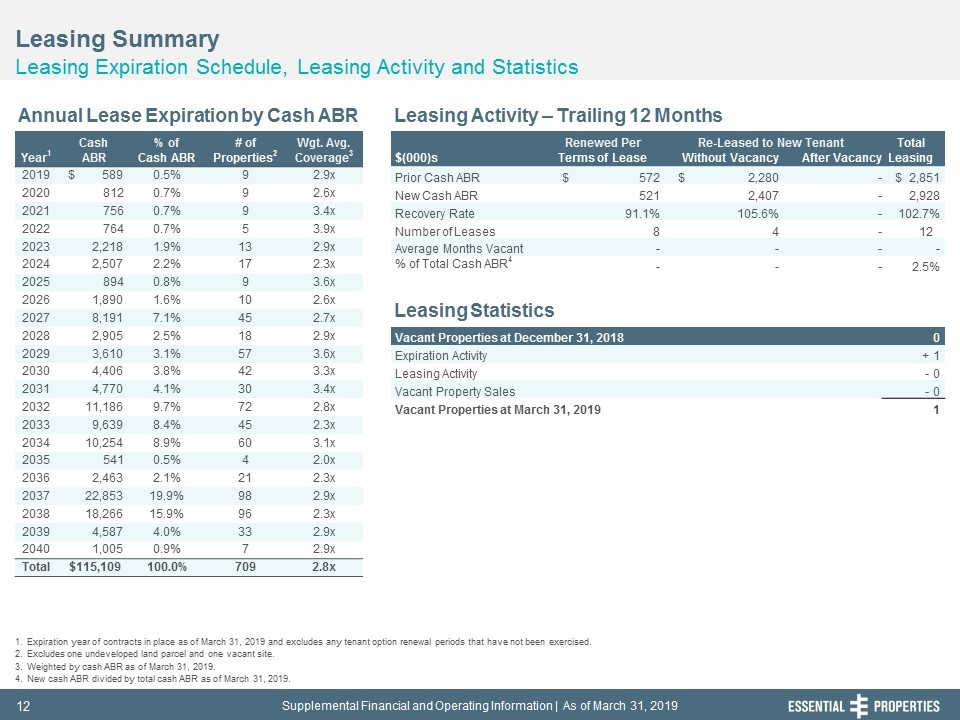

Cash % of # of Wgt. Avg. Renewed Per Re-Leased to New Tenant Total Year1 ABR Cash ABR Properties2 Coverage3 $(000)s Terms of Lease Without Vacancy After Vacancy Leasing 2019 $ 589 0.5% 9 2.9x Prior Cash ABR $ 572 $ 2,280 - $ 2,851 2020 812 0.7% 9 2.6x New Cash ABR 521 2,407 - 2,928 2021 756 0.7% 9 3.4x Recovery Rate 91.1% 105.6% - 102.7% 2022 764 0.7% 5 3.9x Number of Leases 8 4 - 12 2023 2,218 1.9% 13 2.9x Average Months Vacant - - - - 2024 2,507 2.2% 17 2.3x % of Total Cash ABR4 - - - 2.5% 2025 894 0.8% 9 3.6x 2026 1,890 1.6% 10 2.6x 2027 8,191 7.1% 45 2.7x 2028 2,905 2.5% 18 2.9x Vacant Properties at December 31, 2018 0 2029 3,610 3.1% 57 3.6x Expiration Activity + 1 2030 4,406 3.8% 42 3.3x Leasing Activity - 0 2031 4,770 4.1% 30 3.4x Vacant Property Sales - 0 2032 11,186 9.7% 72 2.8x Vacant Properties at March 31, 2019 1 2033 9,639 8.4% 45 2.3x 2034 10,254 8.9% 60 3.1x 2035 541 0.5% 4 2.0x 2036 2,463 2.1% 21 2.3x 2037 22,853 19.9% 98 2.9x 2038 18,266 15.9% 96 2.3x 2039 4,587 4.0% 33 2.9x 2040 1,005 0.9% 7 2.9x Total $115,109 100.0% 709 2.8x Leasing Summary Leasing Expiration Schedule, Leasing Activity and Statistics 242, 242, 242 Expiration year of contracts in place as of March 31, 2019 and excludes any tenant option renewal periods that have not been exercised. Excludes one undeveloped land parcel and one vacant site. Weighted by cash ABR as of March 31, 2019. New cash ABR divided by total cash ABR as of March 31, 2019. Annual Lease Expiration by Cash ABR Leasing Activity – Trailing 12 Months Leasing Statistics

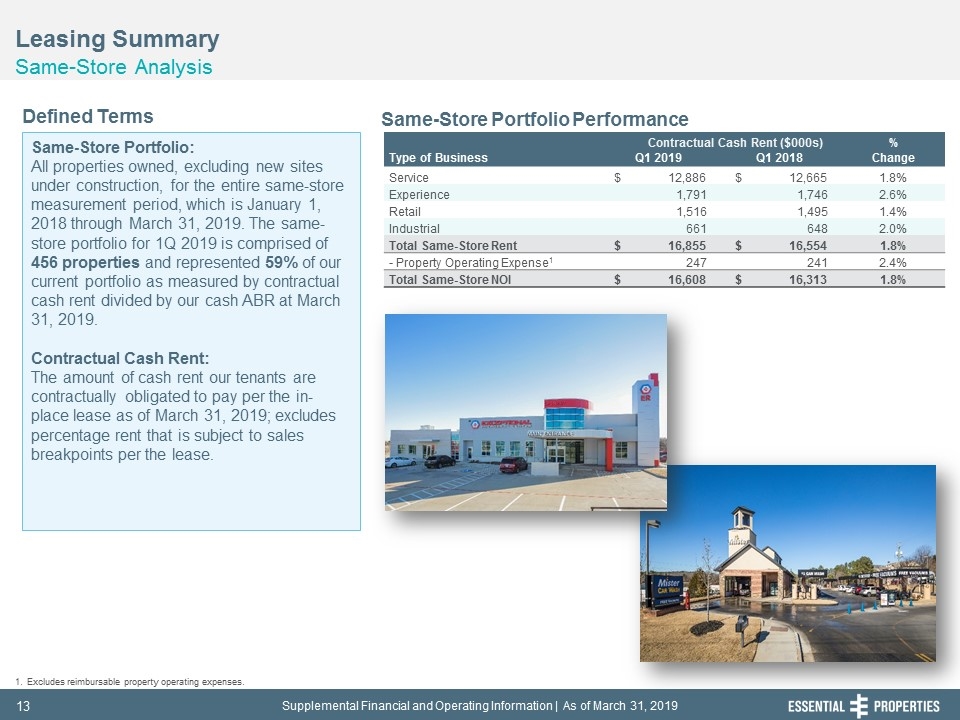

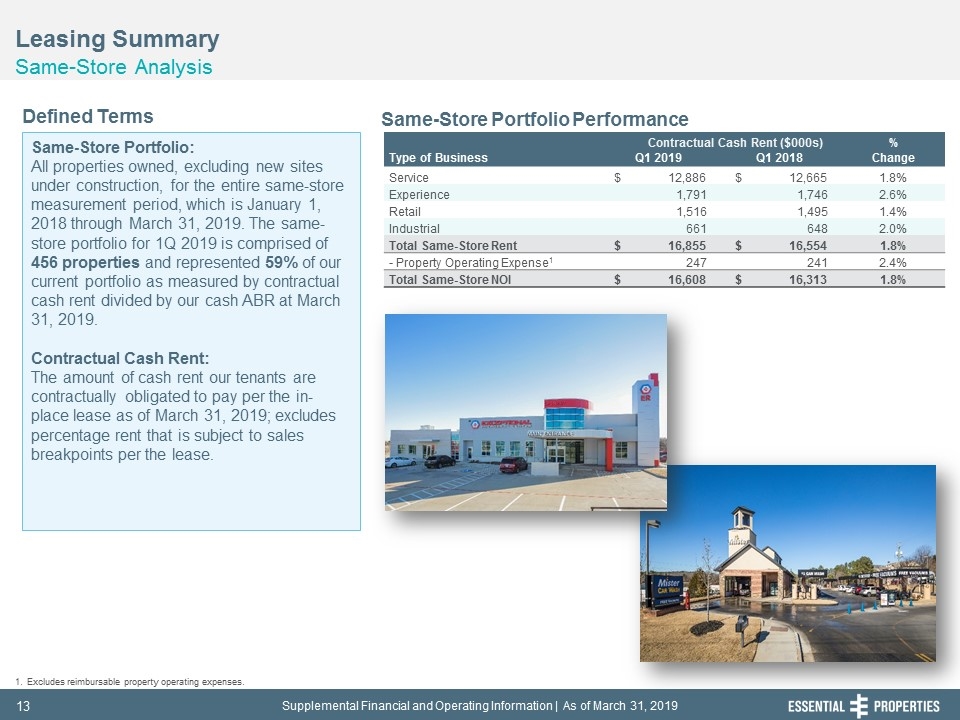

Leasing Summary Same-Store Analysis 242, 242, 242 Same-Store Portfolio: All properties owned, excluding new sites under construction, for the entire same-store measurement period, which is January 1, 2018 through March 31, 2019. The same-store portfolio for 1Q 2019 is comprised of 456 properties and represented 59% of our current portfolio as measured by contractual cash rent divided by our cash ABR at March 31, 2019. Contractual Cash Rent: The amount of cash rent our tenants are contractually obligated to pay per the in-place lease as of March 31, 2019; excludes percentage rent that is subject to sales breakpoints per the lease. Defined Terms Same-Store Portfolio Performance Contractual Cash Rent ($000s) % Type of Business Q1 2019 Q1 2018 Change Service $ 12,886 $ 12,665 1.8% Experience 1,791 1,746 2.6% Retail 1,516 1,495 1.4% Industrial 661 648 2.0% Total Same-Store Rent $ 16,855 $ 16,554 1.8% - Property Operating Expense1 247 241 2.4% Total Same-Store NOI $ 16,608 $ 16,313 1.8% Excludes reimbursable property operating expenses.

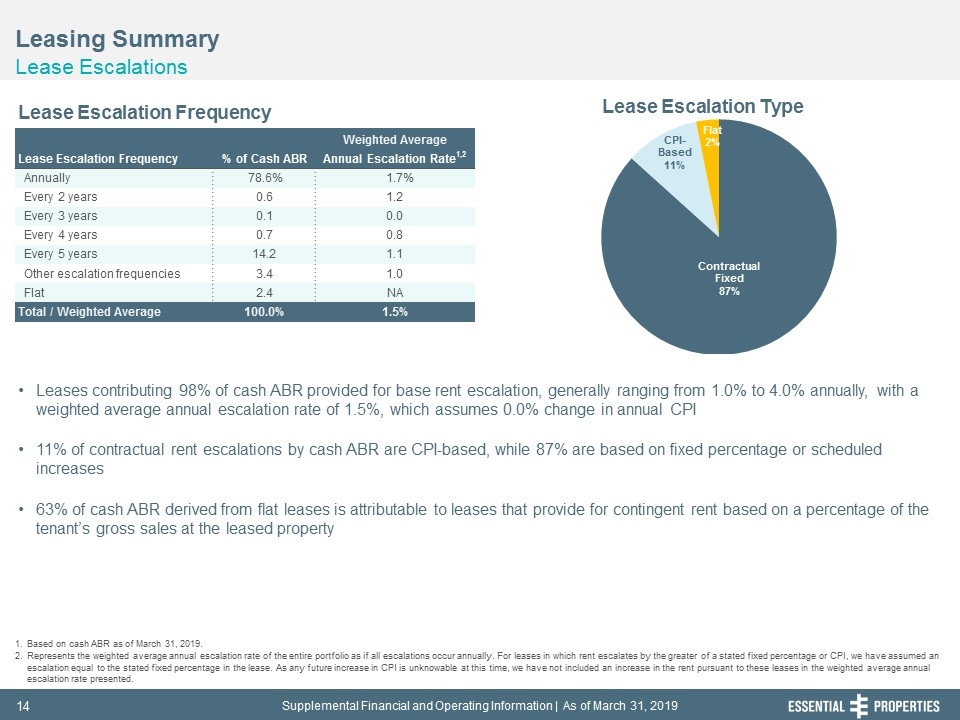

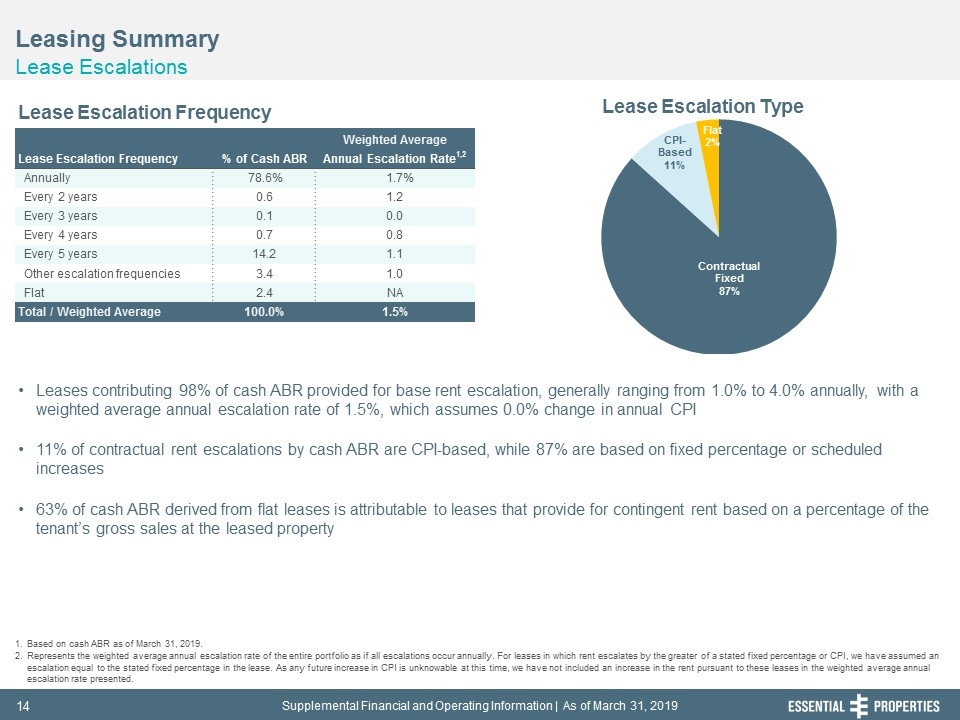

Leasing Summary Lease Escalations 242, 242, 242 Leases contributing 98% of cash ABR provided for base rent escalation, generally ranging from 1.0% to 4.0% annually, with a weighted average annual escalation rate of 1.5%, which assumes 0.0% change in annual CPI 11% of contractual rent escalations by cash ABR are CPI-based, while 87% are based on fixed percentage or scheduled increases 63% of cash ABR derived from flat leases is attributable to leases that provide for contingent rent based on a percentage of the tenant’s gross sales at the leased property Based on cash ABR as of March 31, 2019. Represents the weighted average annual escalation rate of the entire portfolio as if all escalations occur annually. For leases in which rent escalates by the greater of a stated fixed percentage or CPI, we have assumed an escalation equal to the stated fixed percentage in the lease. As any future increase in CPI is unknowable at this time, we have not included an increase in the rent pursuant to these leases in the weighted average annual escalation rate presented. Lease Escalation Frequency Lease Escalation Type Weighted Average Lease Escalation Frequency % of Cash ABR Annual Escalation Rate1,2 Annually 78.6% 1.7% Every 2 years 0.6 1.2 Every 3 years 0.1 0.0 Every 4 years 0.7 0.8 Every 5 years 14.2 1.1 Other escalation frequencies 3.4 1.0 Flat 2.4 NA Total / Weighted Average 100.0% 1.5%

Glossary Supplemental Reporting Measures 242, 242, 242 FFO and AFFO Our reported results are presented in accordance with U.S. generally accepted accounting principles ("GAAP"). We also disclose funds from operations (“FFO”) and adjusted funds from operations (“AFFO”), both of which are non-GAAP financial measures. We believe these non-GAAP financial measures are accepted industry measures used by analysts and investors to compare the operating performance of REITs. We compute FFO in accordance with the definition adopted by the Board of Governors of the National Association of Real Estate Investment Trusts ("NAREIT"). NAREIT defines FFO as GAAP net income or loss adjusted to exclude extraordinary items (as defined by GAAP), net gain or loss from sales of depreciable real estate assets, impairment write-downs associated with depreciable real estate assets and real estate-related depreciation and amortization (excluding amortization of deferred financing costs and depreciation of non-real estate assets), including the pro rata share of such adjustments of unconsolidated subsidiaries. FFO is used by management, investors and analysts to facilitate meaningful comparisons of operating performance between periods and among our peers primarily because it excludes the effect of real estate depreciation and amortization and net gains on sales (which are dependent on historical costs and implicitly assume that the value of real estate diminishes predictably over time, rather than fluctuating based on existing market conditions). To derive AFFO, we modify the NAREIT computation of FFO to include other adjustments to GAAP net income related to certain items that we believe are not indicative of our core operating performance, including straight-line rental revenue, non-cash interest expense, non-cash compensation expense, other amortization and non-cash charges, capitalized interest expense and transaction costs. Such items may cause short-term fluctuations in net income but have no impact on operating cash flows or long-term operating performance. We believe that AFFO is an additional useful supplemental measure for investors to consider because it will help them to better assess our operating performance without the distortions created by non-cash and certain other revenues and expenses. FFO and AFFO do not include all items of revenue and expense included in net income, nor do they represent cash generated from operating activities, and they are not necessarily indicative of cash available to fund cash requirements; accordingly, they should not be considered alternatives to net income as a performance measure or cash flows from operations as a liquidity measure and should be considered in addition to, and not in lieu of, GAAP financial measures. FFO and AFFO may not be comparable to similarly titled measures reported by other companies.

Glossary Supplemental Reporting Measures 242, 242, 242 We also present our earnings before interest, taxes and depreciation and amortization for real estate (“EBITDA”), EBITDA further adjusted to exclude gains (or losses) on sales of depreciable property and real estate impairment losses (“EBITDAre”), net debt, net operating income (“NOI”) and cash NOI (“Cash NOI”), all of which are non-GAAP financial measures. We believe these non-GAAP financial measures are accepted industry measures used by analysts and investors to compare the operating performance of REITs. EBITDA and EBITDAre We calculate EBITDA as earnings before interest, income taxes, and depreciation and amortization. In 2017, NAREIT issued a white paper recommending that companies that report EBITDA also report EBITDAre. We compute EBITDAre in accordance with the definition adopted by NAREIT. NAREIT defines EBITDAre as EBITDA (as defined above) excluding gains (or losses) from the sales of depreciable property and real estate impairment losses. We present EBITDA and EBITDAre as they are measures commonly used in our industry and we believe that these measures are useful to investors and analysts because they provide important supplemental information concerning our operating performance, exclusive of certain non-cash and other costs. We use EBITDA and EBITDAre as measures of our operating performance and not as measures of liquidity. EBITDA and EBITDAre are not measures of financial performance under GAAP, and our EBITDA and EBITDAre may not be comparable to similarly titled measures reported by other companies. You should not consider EBITDA and EBITDAre as alternatives to net income or cash flows from operating activities determined in accordance with GAAP. Net Debt We calculate our net debt as our gross debt (defined as total debt plus net deferred financing costs on our secured borrowings) less cash and cash equivalents and restricted cash deposits held for the benefit of lenders. We believe excluding cash and cash equivalents and restricted cash deposits held for the benefit of lenders from gross debt, all of which could be used to repay debt, provides an estimate of the net contractual amount of borrowed capital to be repaid, which we believe is a beneficial disclosure to investors and analysts. NOI and Cash NOI We calculate NOI as total revenues less property expenses. NOI excludes all other items of expense and income included in the financial statements in calculating net income or loss. Cash NOI further excludes non-cash items included in total revenues and property expenses, such as straight-line rental revenue and other amortization and non-cash charges. We believe NOI and Cash NOI provide useful and relevant information because they reflect only those income and expense items that are incurred at the property level and present such items on an unlevered basis. NOI and Cash NOI are not measurements of financial performance under GAAP, and our NOI and Cash NOI may not be comparable to similarly titled measures reported by other companies. You should not consider our NOI and Cash NOI as alternatives to net income or cash flows from operating activities determined in accordance with GAAP. Adjusted EBITDAre / Adjusted NOI / Adjusted Cash NOI We adjust EBITDAre, NOI and Cash NOI based on an estimate calculated as if all acquisition and disposition activity that took place during the current quarter had been made on the first day of the quarter. We then annualize these estimates for the current quarter by multiplying them by four, which we believe provides a meaningful estimate of our current run rate for all properties owned as of the end of the current quarter. You should not unduly rely on these metrics as they are based on assumptions and estimates that may prove to be inaccurate. Our actual reported EBITDAre, NOI and Cash NOI for future periods may be significantly less than these estimates of current run rates for a variety of reasons.

Glossary of Supplemental Reporting Measures Other Terms 242, 242, 242 Cash ABR Cash ABR means annualized contractually specified cash base rent in effect as of the end of the current quarter for all of our leases (including those accounted for as direct financing leases) commenced as of that date and annualized cash interest on our mortgage loans receivable as of that date. Rent Coverage Ratio Rent coverage ratio means the ratio of tenant-reported or, when unavailable, management’s estimate based on tenant-reported financial information, annual EBITDA and cash rent attributable to the leased property (or properties, in the case of a master lease) to the annualized base rental obligation as of a specified date. GE Seed Portfolio GE seed portfolio means our acquisition of a portfolio of 262 net leased properties on June 16, 2016, consisting primarily of restaurants, that were being sold as part of the liquidation of General Electric Capital Corporation for an aggregate purchase price of $279.8 million (including transaction costs). GAAP Cap Rate GAAP Cap Rate means annualized rental income computed in accordance with GAAP for the first full month after acquisition divided by the purchase price, as applicable, for the property. Cash Cap Rate Cash Cap Rate means annualized contractually specified cash base rent for the first full month after acquisition or disposition divided by the purchase or sale price, as applicable, for the property.