Exhibit 99.1 Investor Presentation – September 2020

Disclaimer This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. These forward-looking statements can be identified by the use of words such as “expect,” “plan,” "will," “estimate,” “project,” “intend,” “believe,” “guidance,” and other similar expressions that do not relate to historical matters. These forward-looking statements are subject to known and unknown risks and uncertainties that can cause actual results to differ materially from those currently anticipated due to a number of factors, which include, but are not limited to, our continued ability to source new investments, risks associated with using debt and equity financing to fund our business activities (including refinancing and interest rate risks, changes in interest rates and/or credit spreads, changes in the price of our common shares, and conditions of the equity and debt capital markets, generally), unknown liabilities acquired in connection with acquired properties or interests in real-estate related entities, general risks affecting the real estate industry and local real estate markets (including, without limitation, the market value of our properties, the inability to enter into or renew leases at favorable rates, portfolio occupancy varying from our expectations, dependence on tenants’ financial condition and operating performance, and competition from other developers, owners and operators of real estate), the financial performance of our retail tenants and the demand for retail space, particularly with respect to challenges being experienced by general merchandise retailers, potential fluctuations in the consumer price index, risks associated with our failure to maintain our status as a REIT under the Internal Revenue Code of 1986, as amended, and other additional risks discussed in our filings with the Securities and Exchange Commission. We expressly disclaim any responsibility to update or revise forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Essential Properties Realty Trust, Inc. and the Essential Properties Realty Trust REIT are not affiliated with or sponsored by Griffin Capital Essential Asset Operating Partnership, L.P. or the Griffin Capital Essential Asset REIT, information about which can be obtained at (https://www.gcear.com). 1 Investor Presentation – September 2020

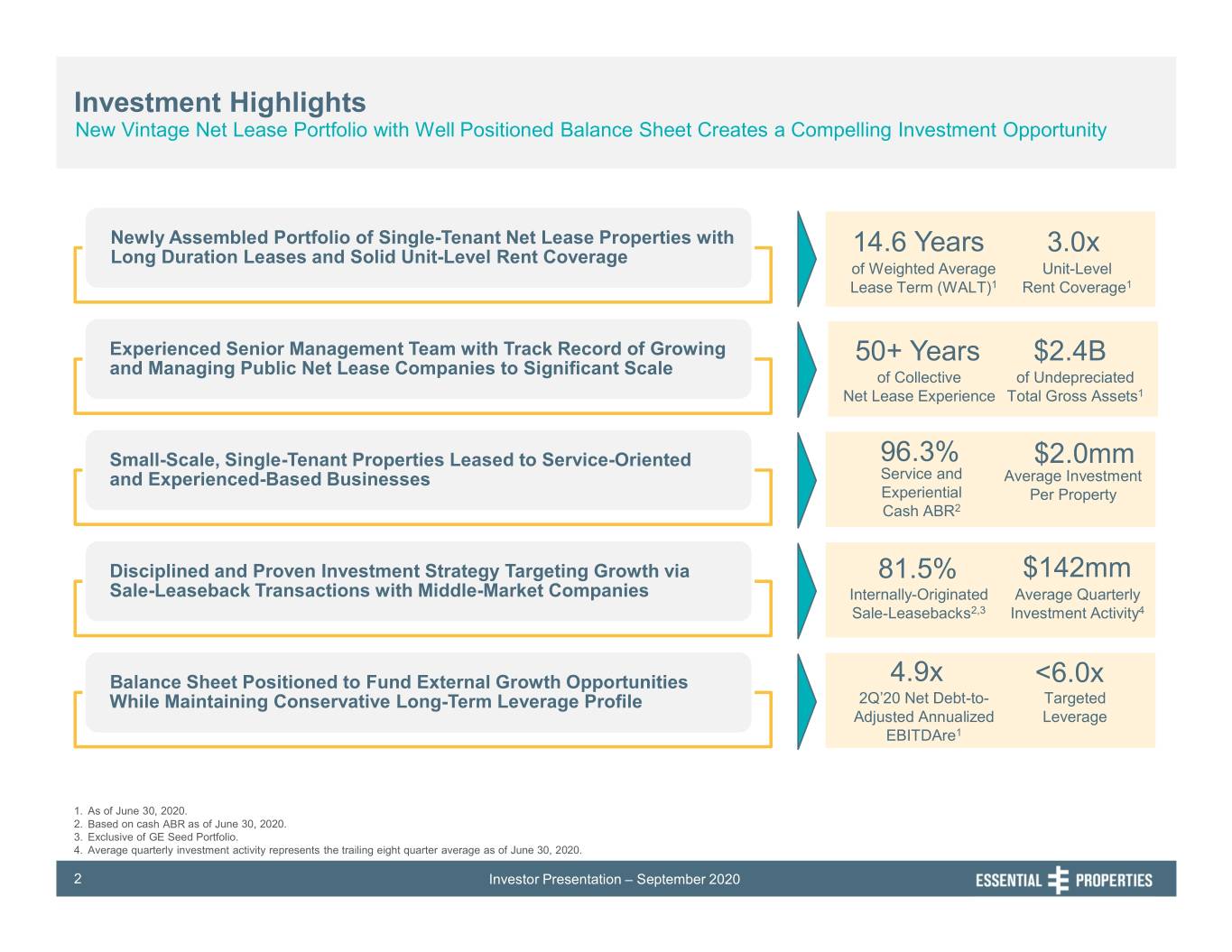

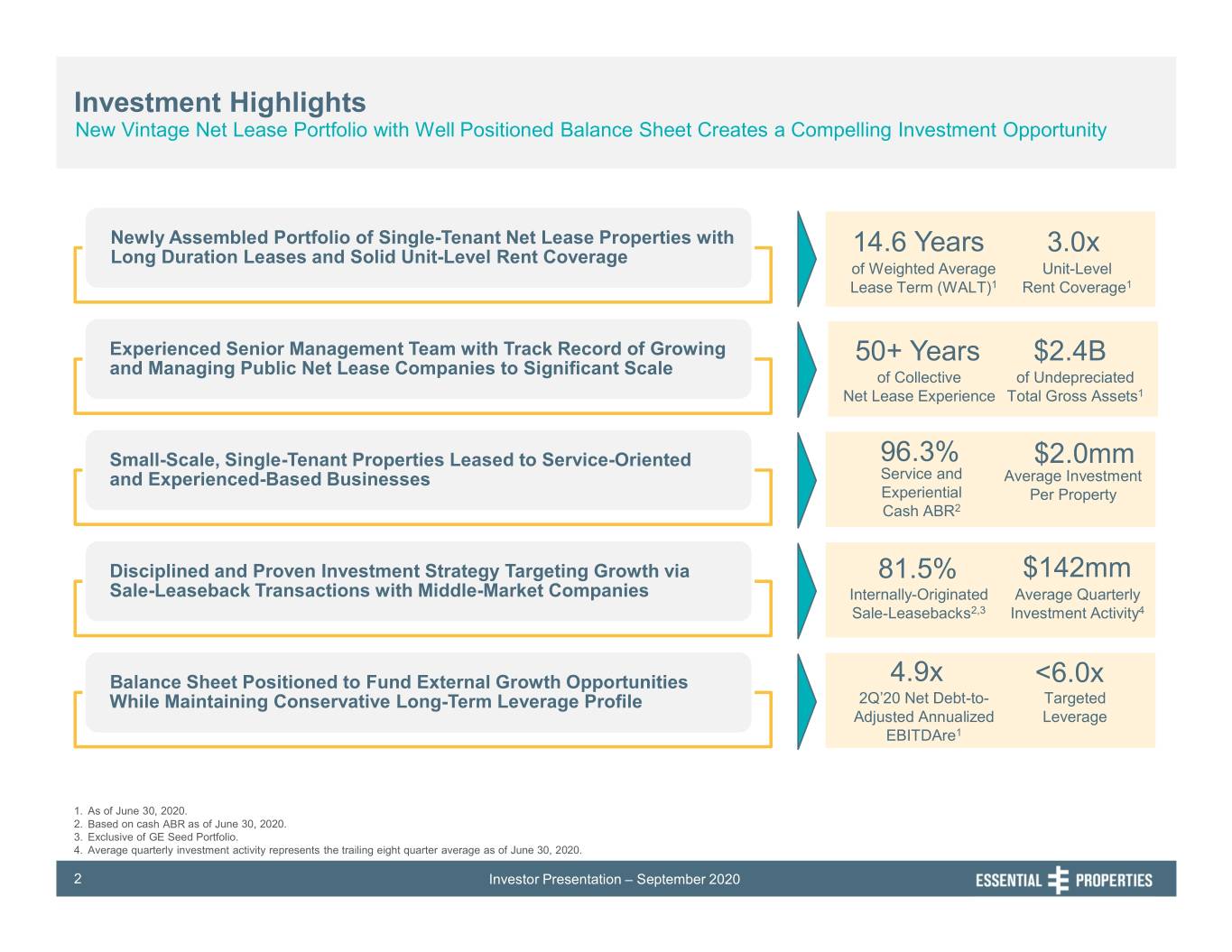

Investment Highlights New Vintage Net Lease Portfolio with Well Positioned Balance Sheet Creates a Compelling Investment Opportunity Newly Assembled Portfolio of Single-Tenant Net Lease Properties with 14.6 Years 3.0x Long Duration Leases and Solid Unit-Level Rent Coverage of Weighted Average Unit-Level Lease Term (WALT)1 Rent Coverage1 Experienced Senior Management Team with Track Record of Growing 50+ Years $2.4B and Managing Public Net Lease Companies to Significant Scale of Collective of Undepreciated Net Lease Experience Total Gross Assets1 Small-Scale, Single-Tenant Properties Leased to Service-Oriented 96.3% $2.0mm and Experienced-Based Businesses Service and Average Investment Experiential Per Property Cash ABR2 Disciplined and Proven Investment Strategy Targeting Growth via 81.5% $142mm Sale-Leaseback Transactions with Middle-Market Companies Internally-Originated Average Quarterly Sale-Leasebacks2,3 Investment Activity4 Balance Sheet Positioned to Fund External Growth Opportunities 4.9x <6.0x While Maintaining Conservative Long-Term Leverage Profile 2Q’20 Net Debt-to- Targeted Adjusted Annualized Leverage EBITDAre1 1. As of June 30, 2020. 2. Based on cash ABR as of June 30, 2020. 3. Exclusive of GE Seed Portfolio. 4. Average quarterly investment activity represents the trailing eight quarter average as of June 30, 2020. 2 Investor Presentation – September 2020

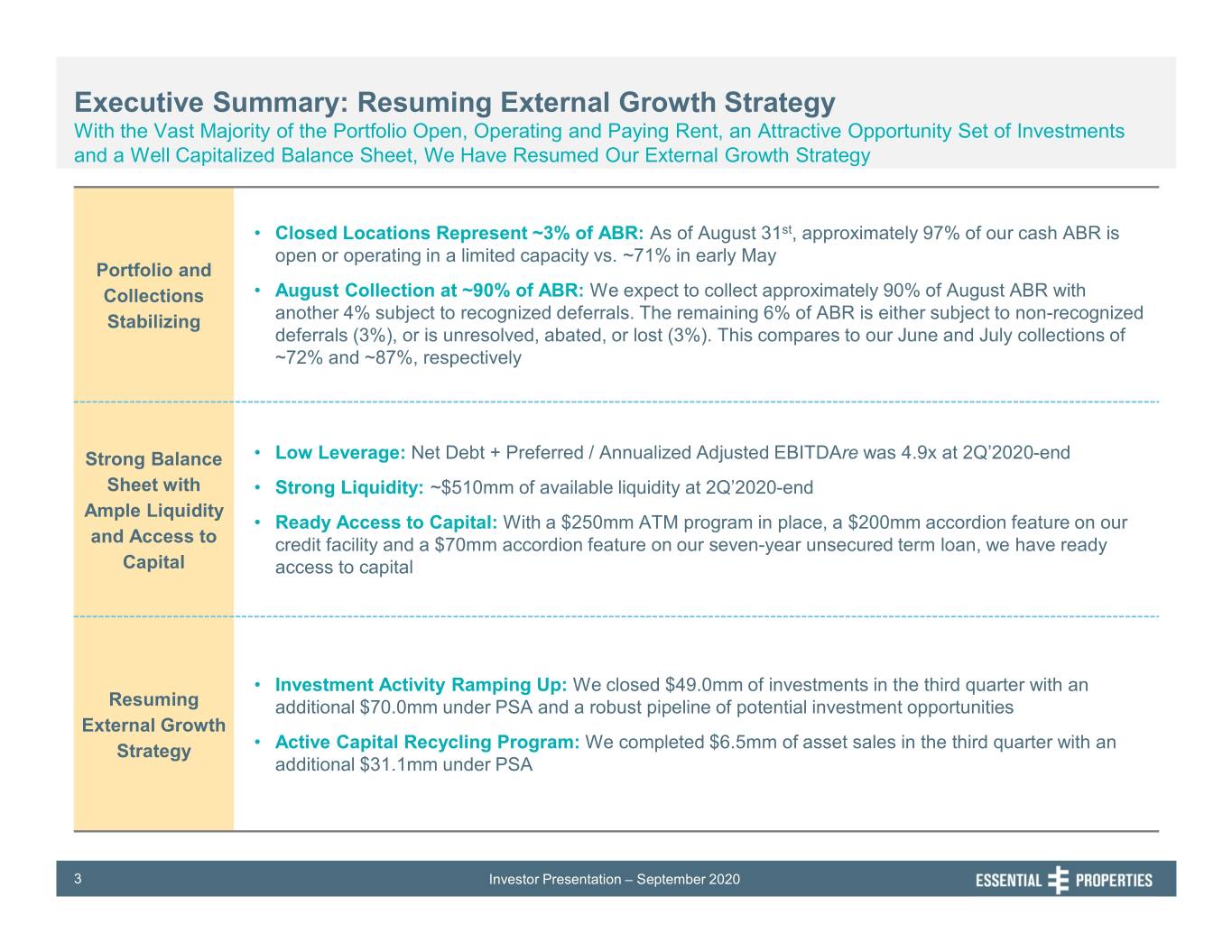

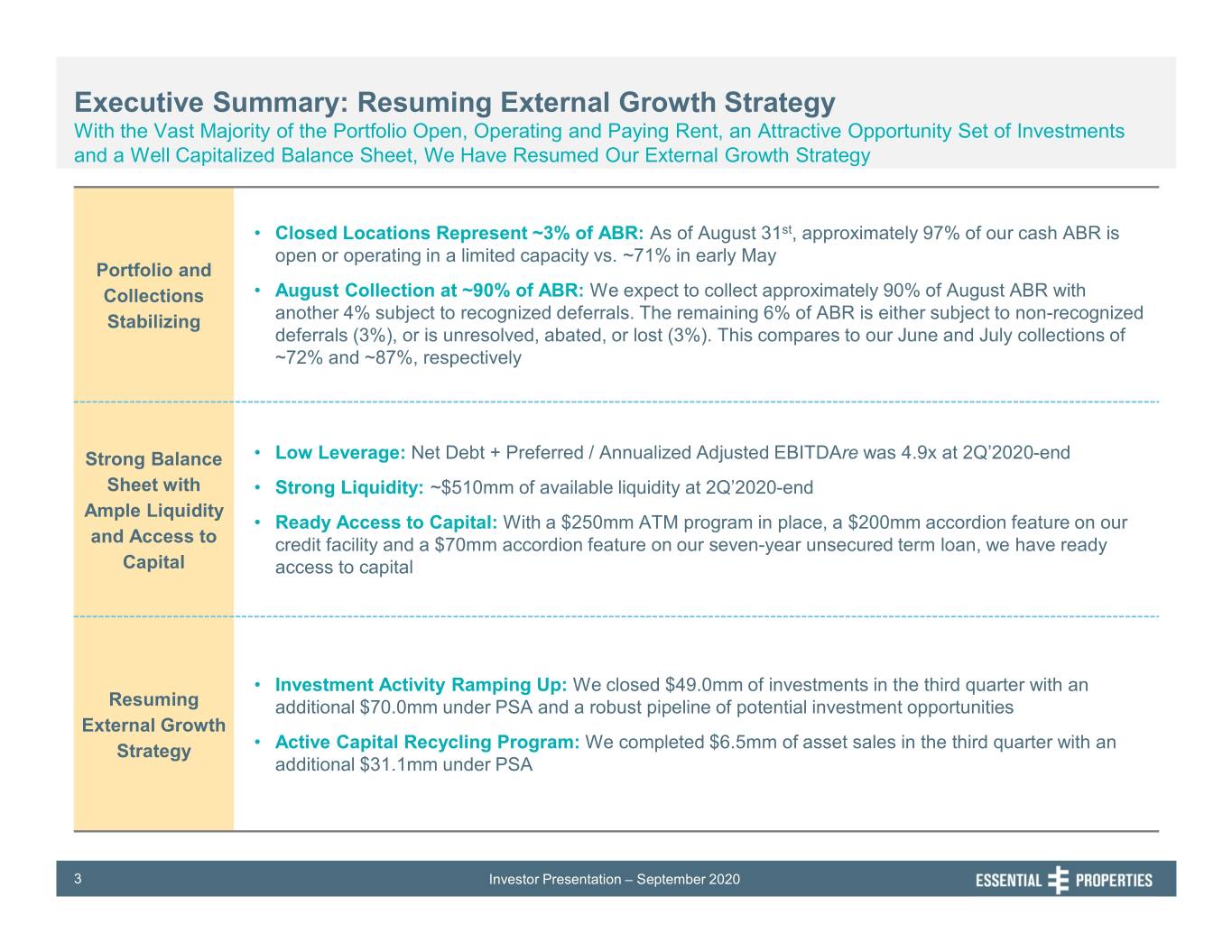

Executive Summary: Resuming External Growth Strategy With the Vast Majority of the Portfolio Open, Operating and Paying Rent, an Attractive Opportunity Set of Investments and a Well Capitalized Balance Sheet, We Have Resumed Our External Growth Strategy • Closed Locations Represent ~3% of ABR: As of August 31st, approximately 97% of our cash ABR is open or operating in a limited capacity vs. ~71% in early May Portfolio and Collections • August Collection at ~90% of ABR: We expect to collect approximately 90% of August ABR with Stabilizing another 4% subject to recognized deferrals. The remaining 6% of ABR is either subject to non-recognized deferrals (3%), or is unresolved, abated, or lost (3%). This compares to our June and July collections of ~72% and ~87%, respectively Strong Balance • Low Leverage: Net Debt + Preferred / Annualized Adjusted EBITDAre was 4.9x at 2Q’2020-end Sheet with • Strong Liquidity: ~$510mm of available liquidity at 2Q’2020-end Ample Liquidity • Ready Access to Capital: With a $250mm ATM program in place, a $200mm accordion feature on our and Access to credit facility and a $70mm accordion feature on our seven-year unsecured term loan, we have ready Capital access to capital • Investment Activity Ramping Up: We closed $49.0mm of investments in the third quarter with an Resuming additional $70.0mm under PSA and a robust pipeline of potential investment opportunities External Growth Strategy • Active Capital Recycling Program: We completed $6.5mm of asset sales in the third quarter with an additional $31.1mm under PSA 3 Investor Presentation – September 2020

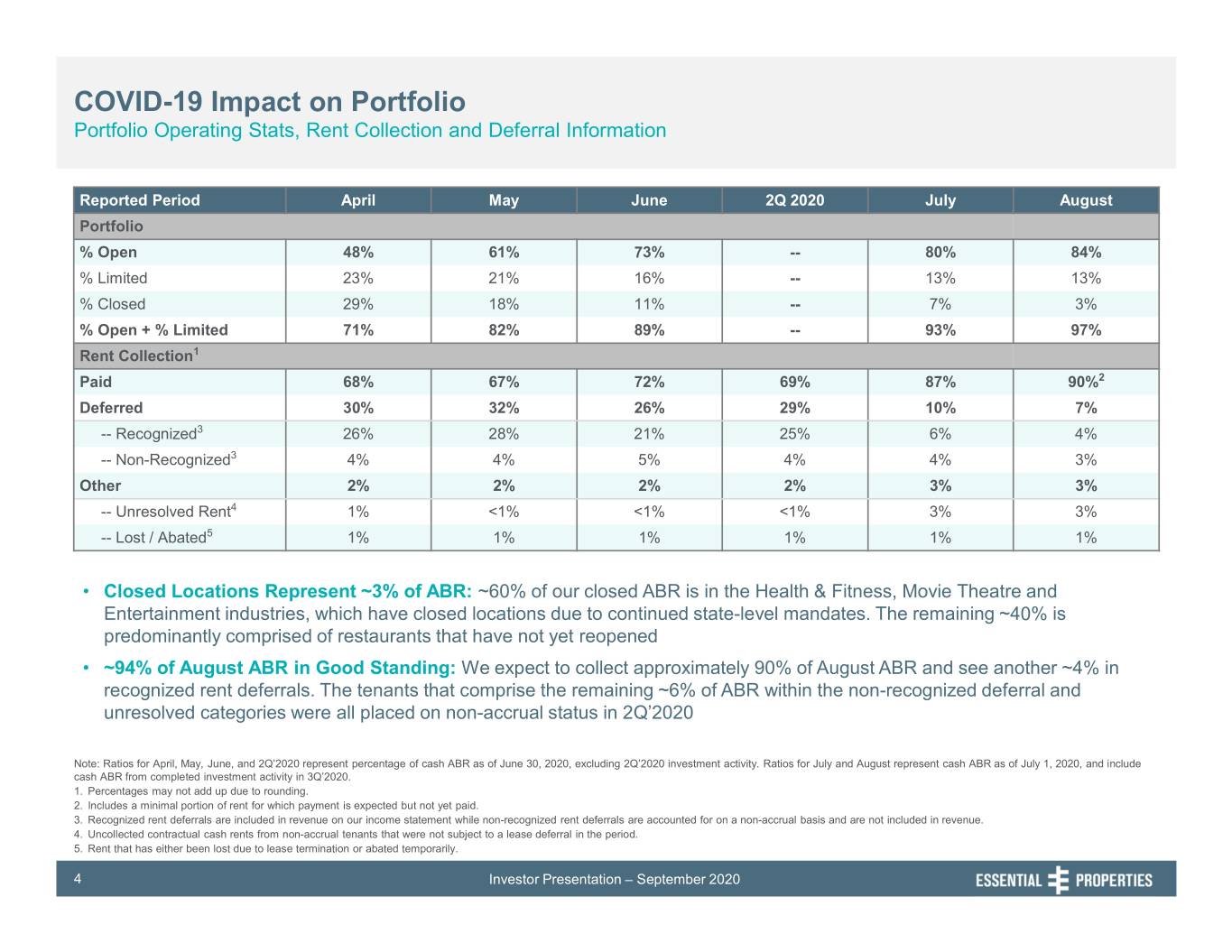

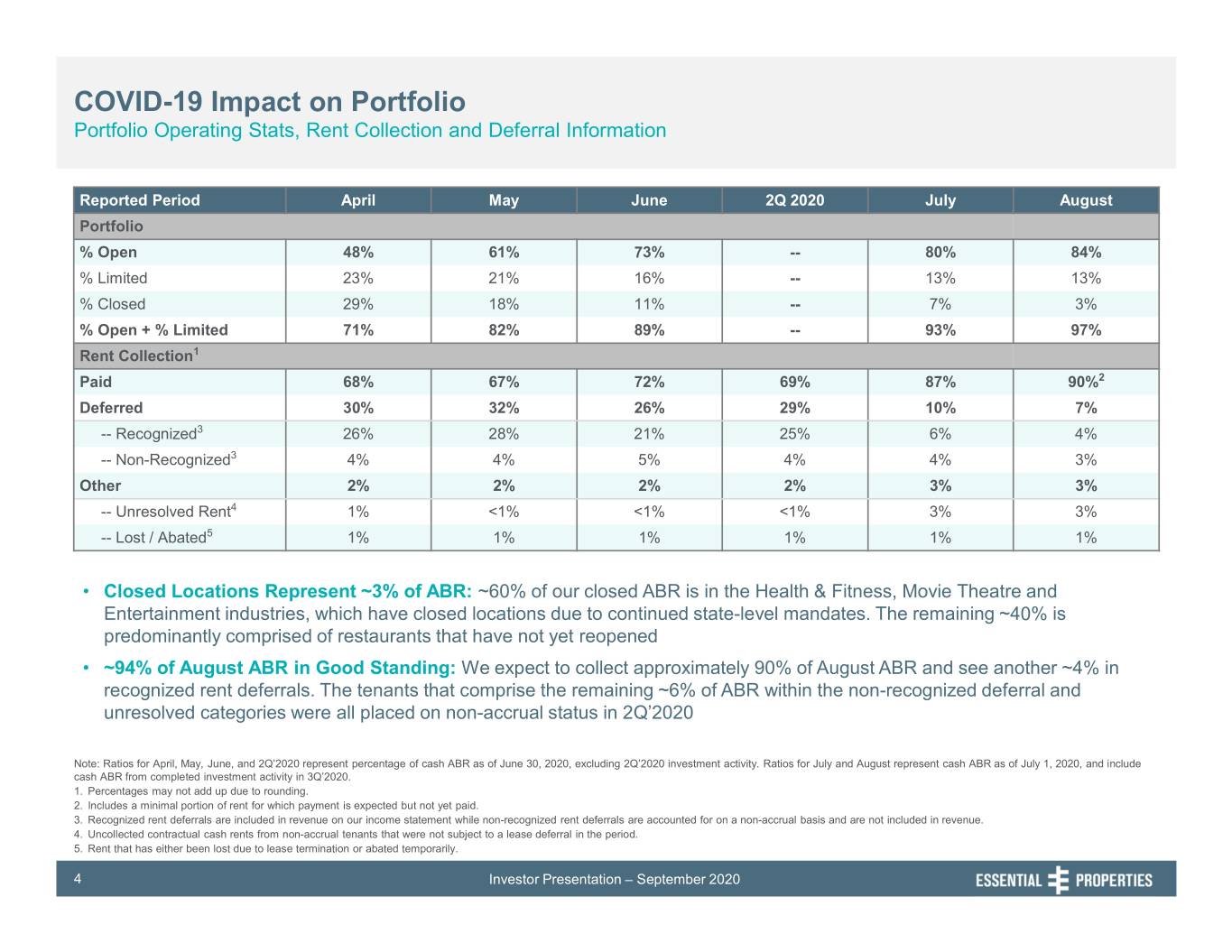

COVID-19 Impact on Portfolio Portfolio Operating Stats, Rent Collection and Deferral Information Reported Period April May June 2Q 2020 July August Portfolio % Open 48% 61% 73% -- 80% 84% % Limited 23% 21% 16% -- 13% 13% % Closed 29% 18% 11% -- 7% 3% % Open + % Limited 71% 82% 89% -- 93% 97% Rent Collection1 Paid 68% 67% 72% 69% 87% 90%2 Deferred 30% 32% 26% 29% 10% 7% -- Recognized3 26% 28% 21% 25% 6% 4% -- Non-Recognized3 4% 4% 5% 4% 4% 3% Other 2% 2% 2% 2% 3% 3% -- Unresolved Rent4 1% <1% <1% <1% 3% 3% -- Lost / Abated5 1% 1% 1% 1% 1% 1% • Closed Locations Represent ~3% of ABR: ~60% of our closed ABR is in the Health & Fitness, Movie Theatre and Entertainment industries, which have closed locations due to continued state-level mandates. The remaining ~40% is predominantly comprised of restaurants that have not yet reopened • ~94% of August ABR in Good Standing: We expect to collect approximately 90% of August ABR and see another ~4% in recognized rent deferrals. The tenants that comprise the remaining ~6% of ABR within the non-recognized deferral and unresolved categories were all placed on non-accrual status in 2Q’2020 Note: Ratios for April, May, June, and 2Q’2020 represent percentage of cash ABR as of June 30, 2020, excluding 2Q’2020 investment activity. Ratios for July and August represent cash ABR as of July 1, 2020, and include cash ABR from completed investment activity in 3Q’2020. 1. Percentages may not add up due to rounding. 2. Includes a minimal portion of rent for which payment is expected but not yet paid. 3. Recognized rent deferrals are included in revenue on our income statement while non-recognized rent deferrals are accounted for on a non-accrual basis and are not included in revenue. 4. Uncollected contractual cash rents from non-accrual tenants that were not subject to a lease deferral in the period. 5. Rent that has either been lost due to lease termination or abated temporarily. 4 Investor Presentation – September 2020

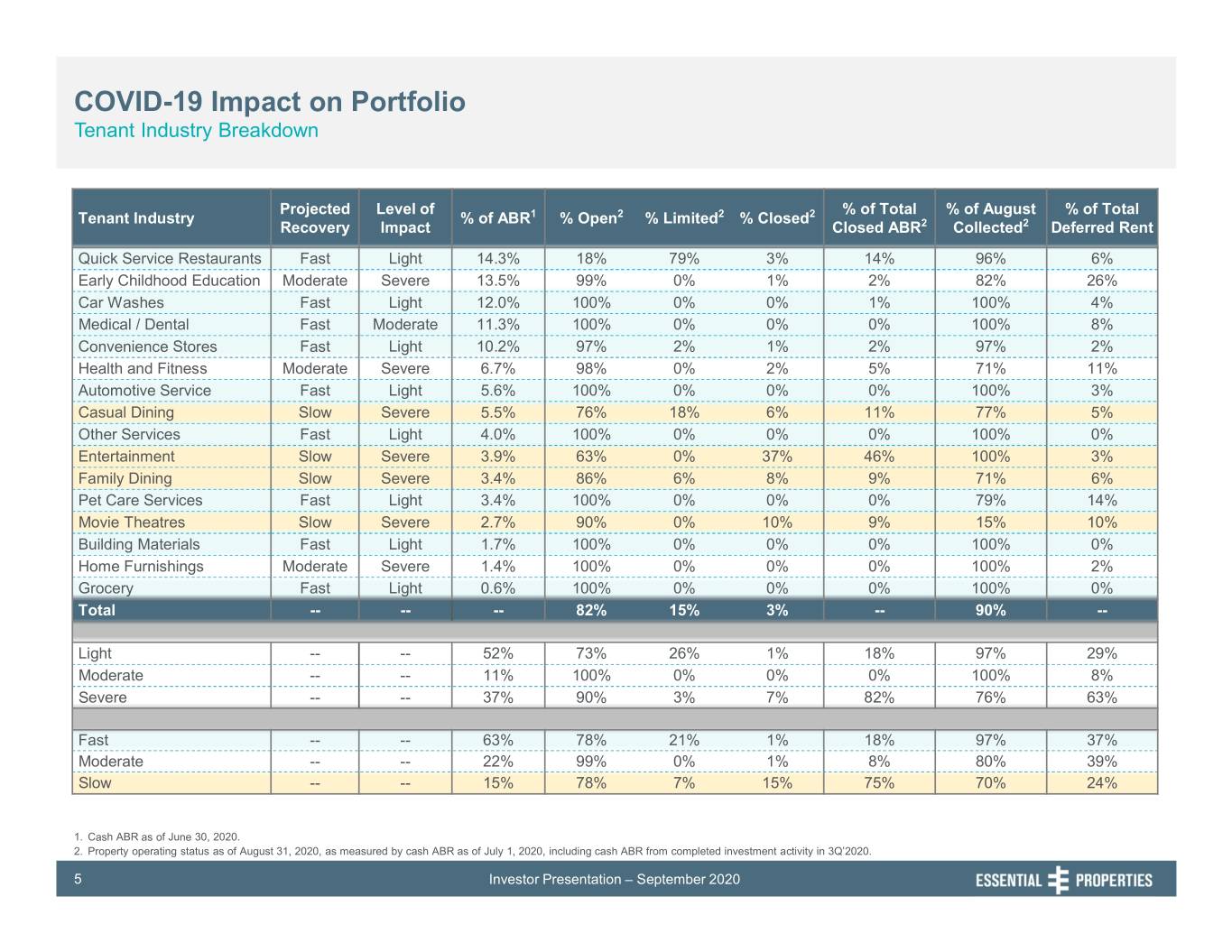

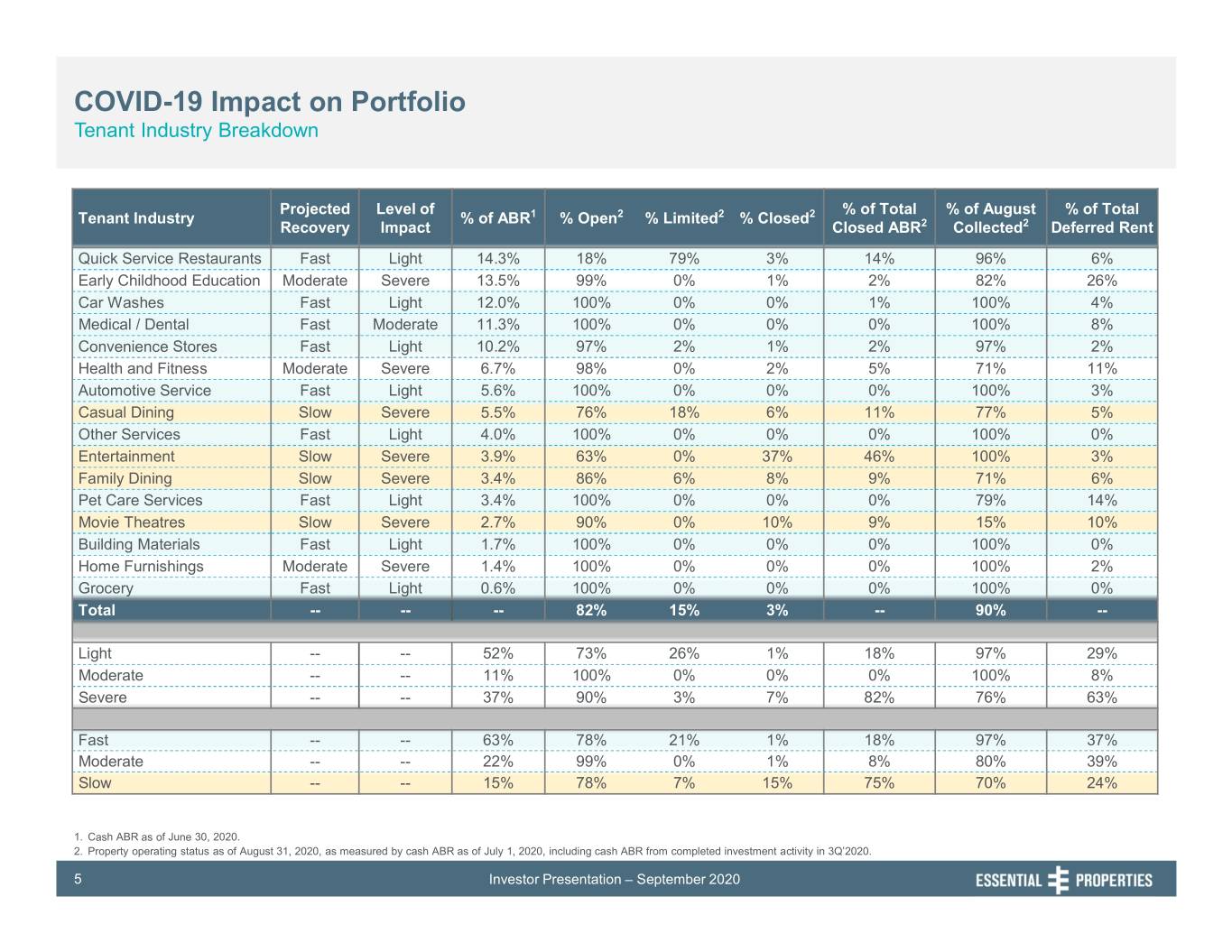

COVID-19 Impact on Portfolio Tenant Industry Breakdown Projected Level of % of Total % of August % of Total Tenant Industry % of ABR1 % Open2 % Limited2 % Closed2 Recovery Impact Closed ABR2 Collected2 Deferred Rent Quick Service Restaurants Fast Light 14.3% 18% 79% 3% 14% 96% 6% Early Childhood Education Moderate Severe 13.5% 99% 0% 1% 2% 82% 26% Car Washes Fast Light 12.0% 100% 0% 0% 1% 100% 4% Medical / Dental Fast Moderate 11.3% 100% 0% 0% 0% 100% 8% Convenience Stores Fast Light 10.2% 97% 2% 1% 2% 97% 2% Health and Fitness Moderate Severe 6.7% 98% 0% 2% 5% 71% 11% Automotive Service Fast Light 5.6% 100% 0% 0% 0% 100% 3% Casual Dining Slow Severe 5.5% 76% 18% 6% 11% 77% 5% Other Services Fast Light 4.0% 100% 0% 0% 0% 100% 0% Entertainment Slow Severe 3.9% 63% 0% 37% 46% 100% 3% Family Dining Slow Severe 3.4% 86% 6% 8% 9% 71% 6% Pet Care Services Fast Light 3.4% 100% 0% 0% 0% 79% 14% Movie Theatres Slow Severe 2.7% 90% 0% 10% 9% 15% 10% Building Materials Fast Light 1.7% 100% 0% 0% 0% 100% 0% Home Furnishings Moderate Severe 1.4% 100% 0% 0% 0% 100% 2% Grocery Fast Light 0.6% 100% 0% 0% 0% 100% 0% Total -- -- -- 82% 15% 3% -- 90% -- Light -- -- 52% 73% 26% 1% 18% 97% 29% Moderate -- -- 11% 100% 0% 0% 0% 100% 8% Severe -- -- 37% 90% 3% 7% 82% 76% 63% Fast -- -- 63% 78% 21% 1% 18% 97% 37% Moderate -- -- 22% 99% 0% 1% 8% 80% 39% Slow -- -- 15% 78% 7% 15% 75% 70% 24% 1. Cash ABR as of June 30, 2020. 2. Property operating status as of August 31, 2020, as measured by cash ABR as of July 1, 2020, including cash ABR from completed investment activity in 3Q’2020. 5 Investor Presentation – September 2020

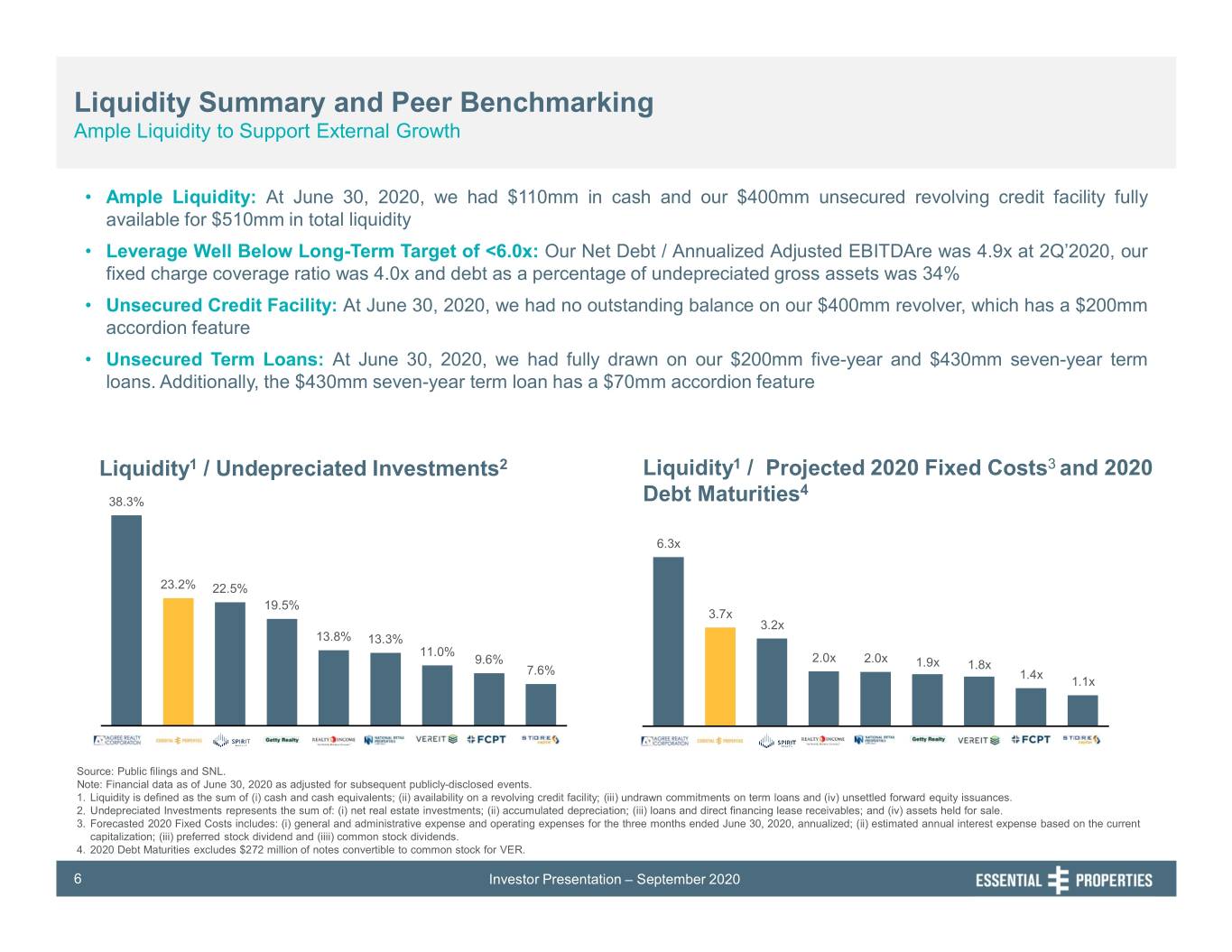

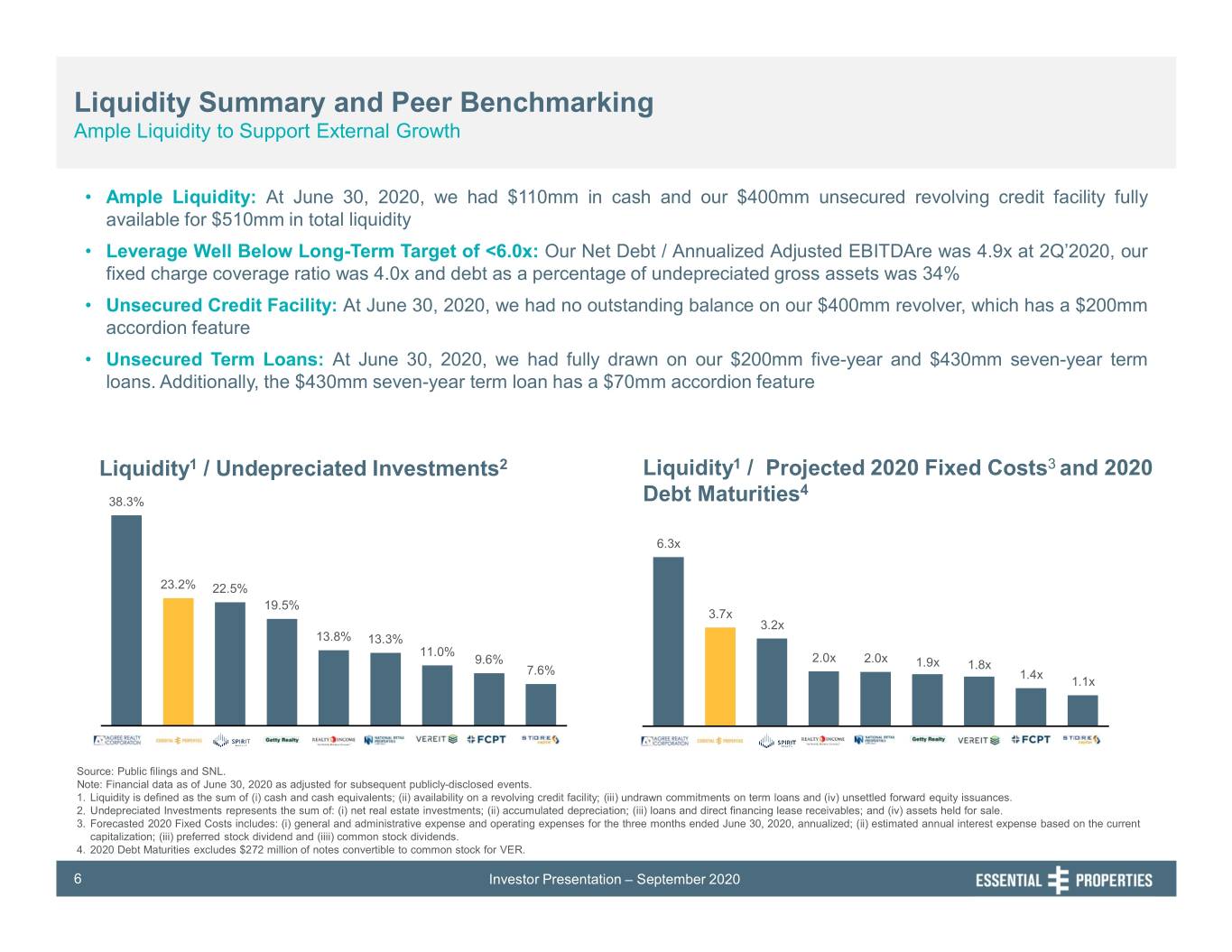

Liquidity Summary and Peer Benchmarking Ample Liquidity to Support External Growth • Ample Liquidity: At June 30, 2020, we had $110mm in cash and our $400mm unsecured revolving credit facility fully available for $510mm in total liquidity • Leverage Well Below Long-Term Target of <6.0x: Our Net Debt / Annualized Adjusted EBITDAre was 4.9x at 2Q’2020, our fixed charge coverage ratio was 4.0x and debt as a percentage of undepreciated gross assets was 34% • Unsecured Credit Facility: At June 30, 2020, we had no outstanding balance on our $400mm revolver, which has a $200mm accordion feature • Unsecured Term Loans: At June 30, 2020, we had fully drawn on our $200mm five-year and $430mm seven-year term loans. Additionally, the $430mm seven-year term loan has a $70mm accordion feature Liquidity1 / Undepreciated Investments2 Liquidity1 / Projected 2020 Fixed Costs3 and 2020 4 38.3% Debt Maturities 6.3x 23.2% 22.5% 19.5% 3.7x 3.2x 13.8% 13.3% 11.0% 2.0x 2.0x 9.6% 1.9x 1.8x 7.6% 1.4x 1.1x Source: Public filings and SNL. Note: Financial data as of June 30, 2020 as adjusted for subsequent publicly-disclosed events. 1. Liquidity is defined as the sum of (i) cash and cash equivalents; (ii) availability on a revolving credit facility; (iii) undrawn commitments on term loans and (iv) unsettled forward equity issuances. 2. Undepreciated Investments represents the sum of: (i) net real estate investments; (ii) accumulated depreciation; (iii) loans and direct financing lease receivables; and (iv) assets held for sale. 3. Forecasted 2020 Fixed Costs includes: (i) general and administrative expense and operating expenses for the three months ended June 30, 2020, annualized; (ii) estimated annual interest expense based on the current capitalization; (iii) preferred stock dividend and (iiii) common stock dividends. 4. 2020 Debt Maturities excludes $272 million of notes convertible to common stock for VER. 6 Investor Presentation – September 2020

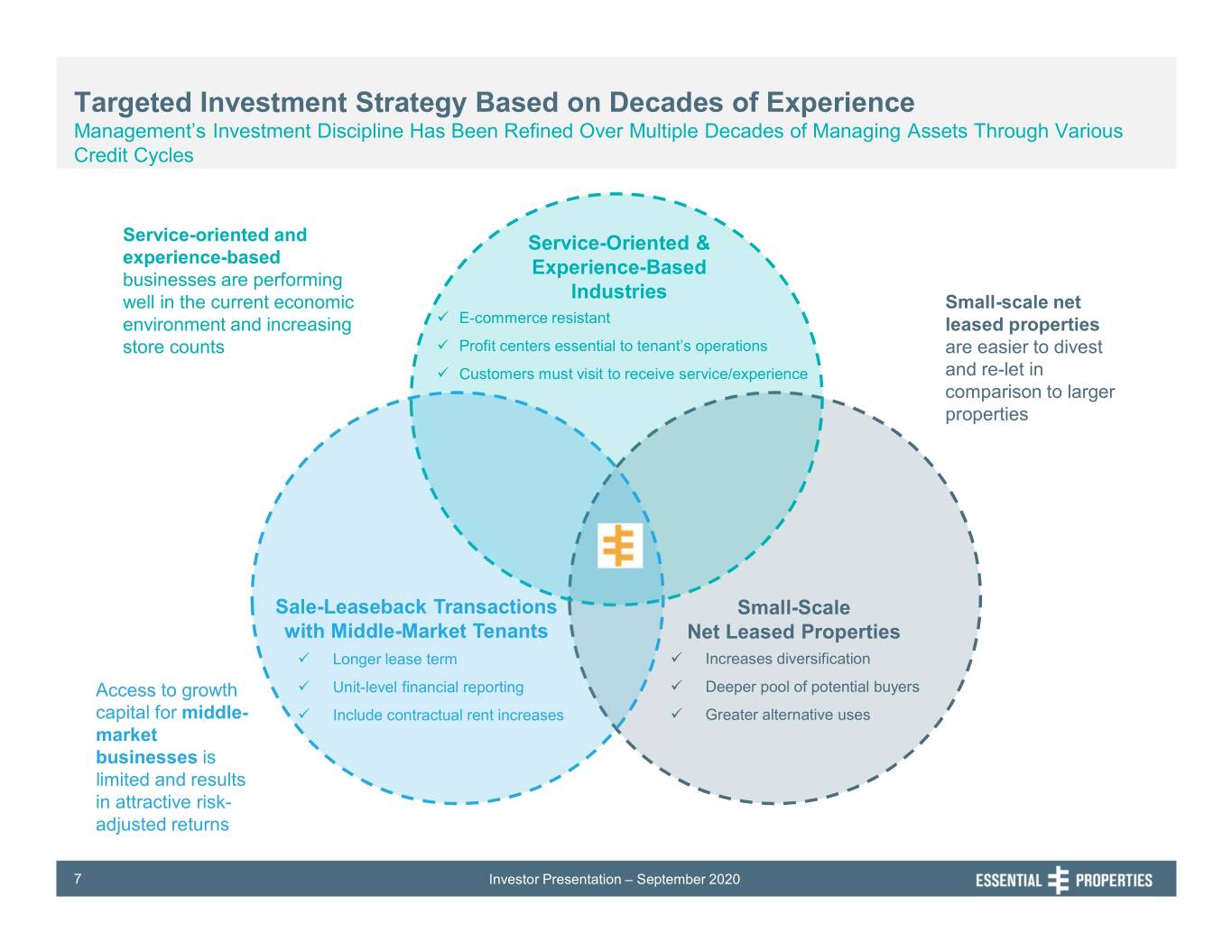

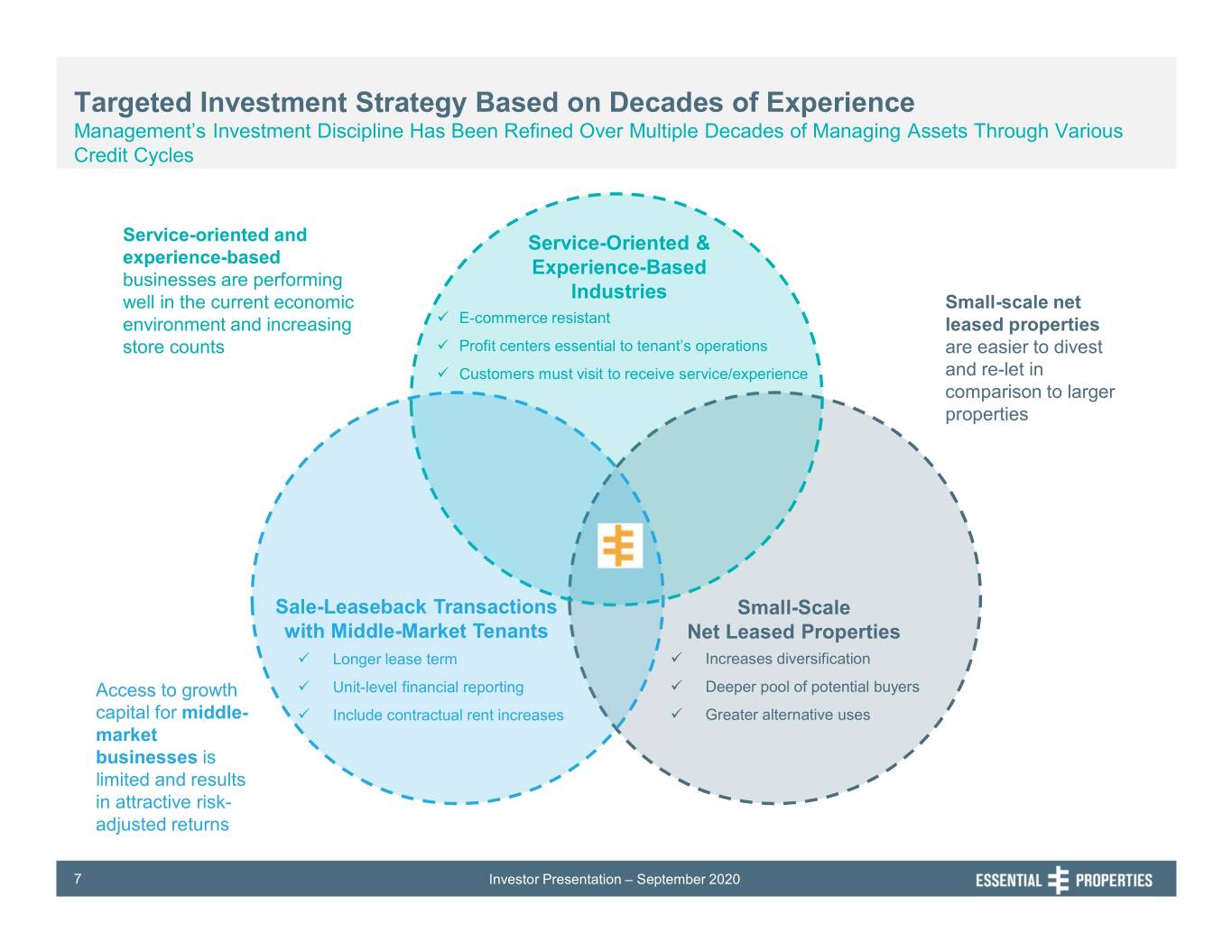

Targeted Investment Strategy Based on Decades of Experience Management’s Investment Discipline Has Been Refined Over Multiple Decades of Managing Assets Through Various Credit Cycles Service-oriented and Service-Oriented & experience-based Experience-Based businesses are performing Industries well in the current economic Small-scale net environment and increasing E-commerce resistant leased properties store counts Profit centers essential to tenant’s operations are easier to divest Customers must visit to receive service/experience and re-let in comparison to larger properties Sale-Leaseback Transactions Small-Scale with Middle-Market Tenants Net Leased Properties Longer lease term Increases diversification Access to growth Unit-level financial reporting Deeper pool of potential buyers capital for middle- Include contractual rent increases Greater alternative uses market businesses is limited and results in attractive risk- adjusted returns 7 Investor Presentation – September 2020

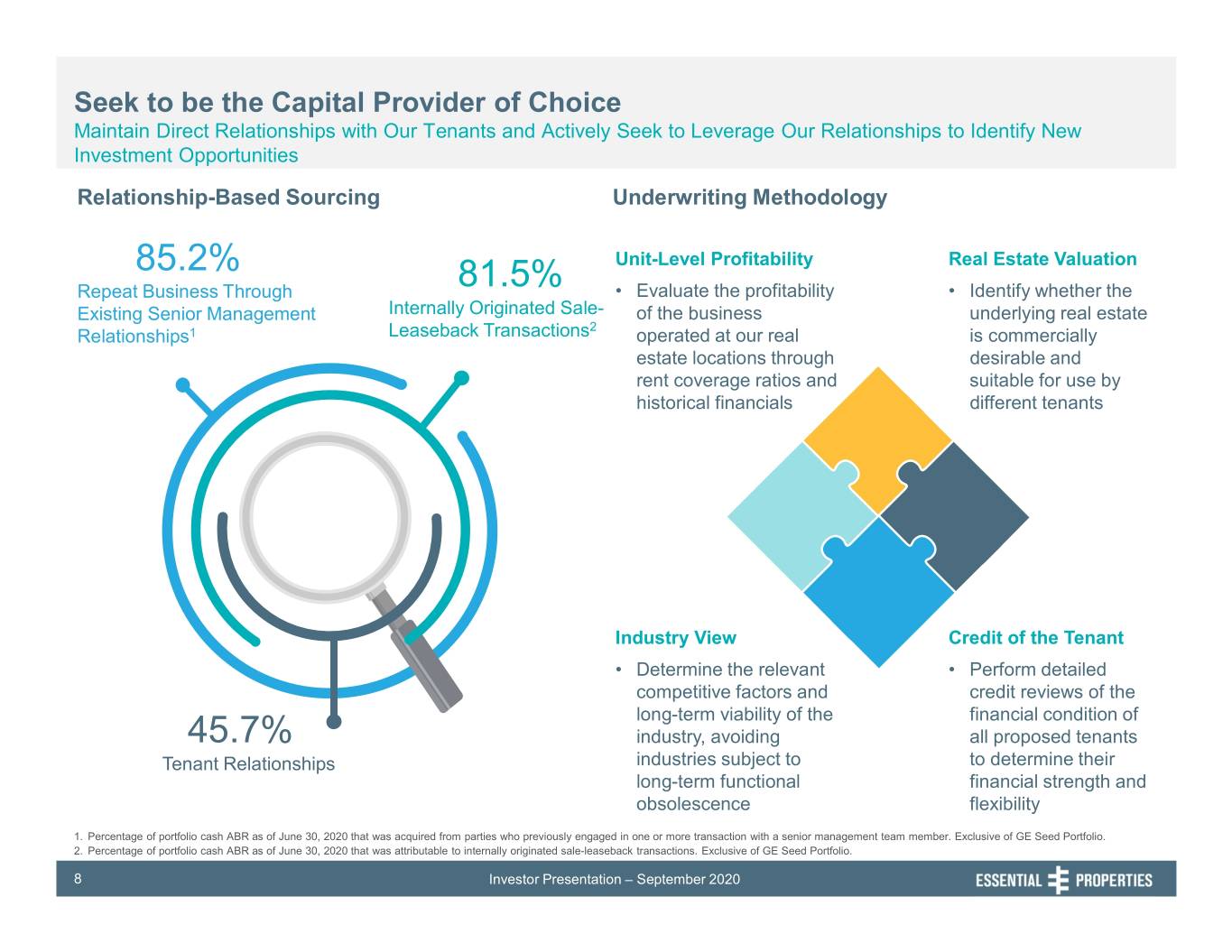

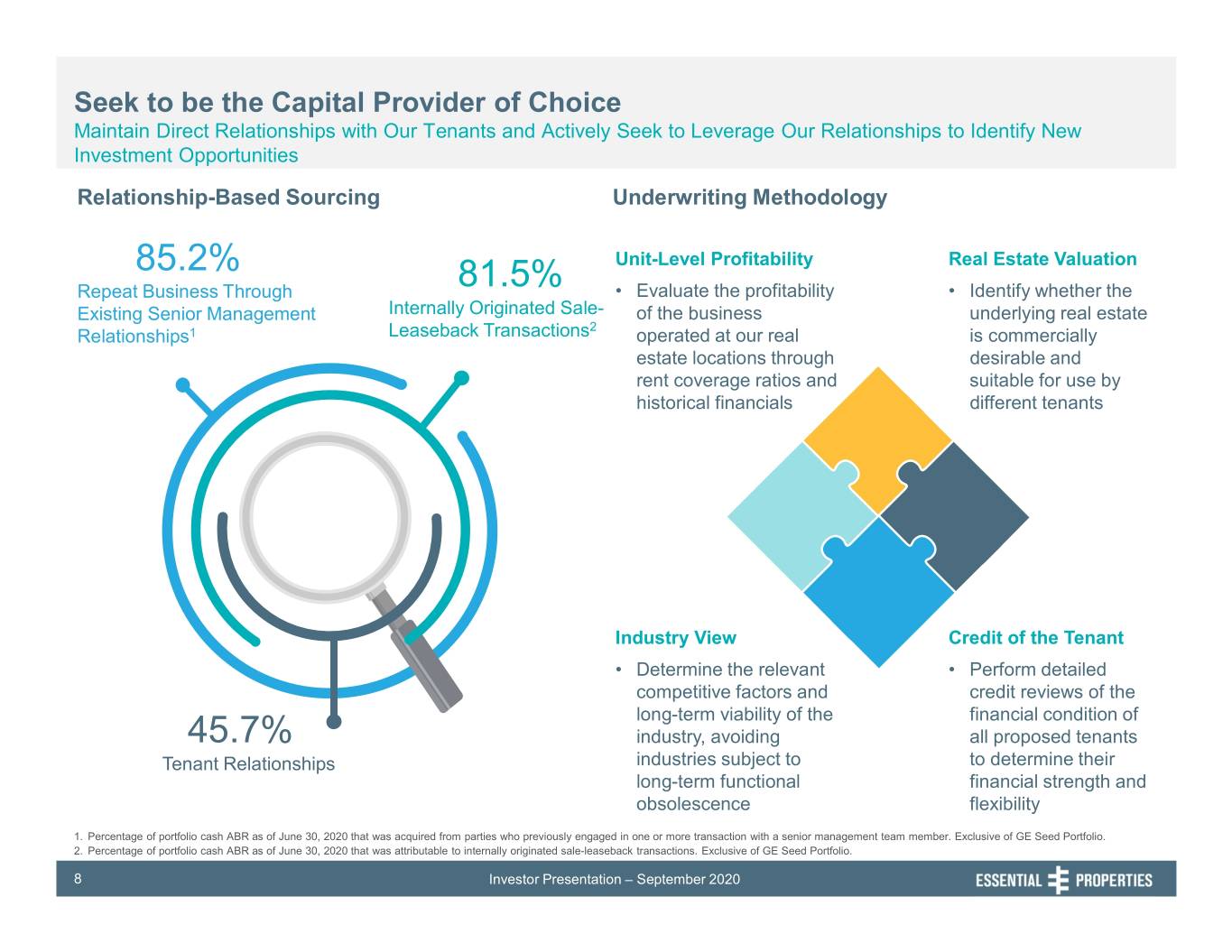

Seek to be the Capital Provider of Choice Maintain Direct Relationships with Our Tenants and Actively Seek to Leverage Our Relationships to Identify New Investment Opportunities Relationship-Based Sourcing Underwriting Methodology 85.2% Unit-Level Profitability Real Estate Valuation Repeat Business Through 81.5% • Evaluate the profitability • Identify whether the Existing Senior Management Internally Originated Sale- of the business underlying real estate 2 Relationships1 Leaseback Transactions operated at our real is commercially estate locations through desirable and rent coverage ratios and suitable for use by historical financials different tenants Industry View Credit of the Tenant • Determine the relevant • Perform detailed competitive factors and credit reviews of the long-term viability of the financial condition of 45.7% industry, avoiding all proposed tenants Tenant Relationships industries subject to to determine their long-term functional financial strength and obsolescence flexibility 1. Percentage of portfolio cash ABR as of June 30, 2020 that was acquired from parties who previously engaged in one or more transaction with a senior management team member. Exclusive of GE Seed Portfolio. 2. Percentage of portfolio cash ABR as of June 30, 2020 that was attributable to internally originated sale-leaseback transactions. Exclusive of GE Seed Portfolio. 8 Investor Presentation – September 2020

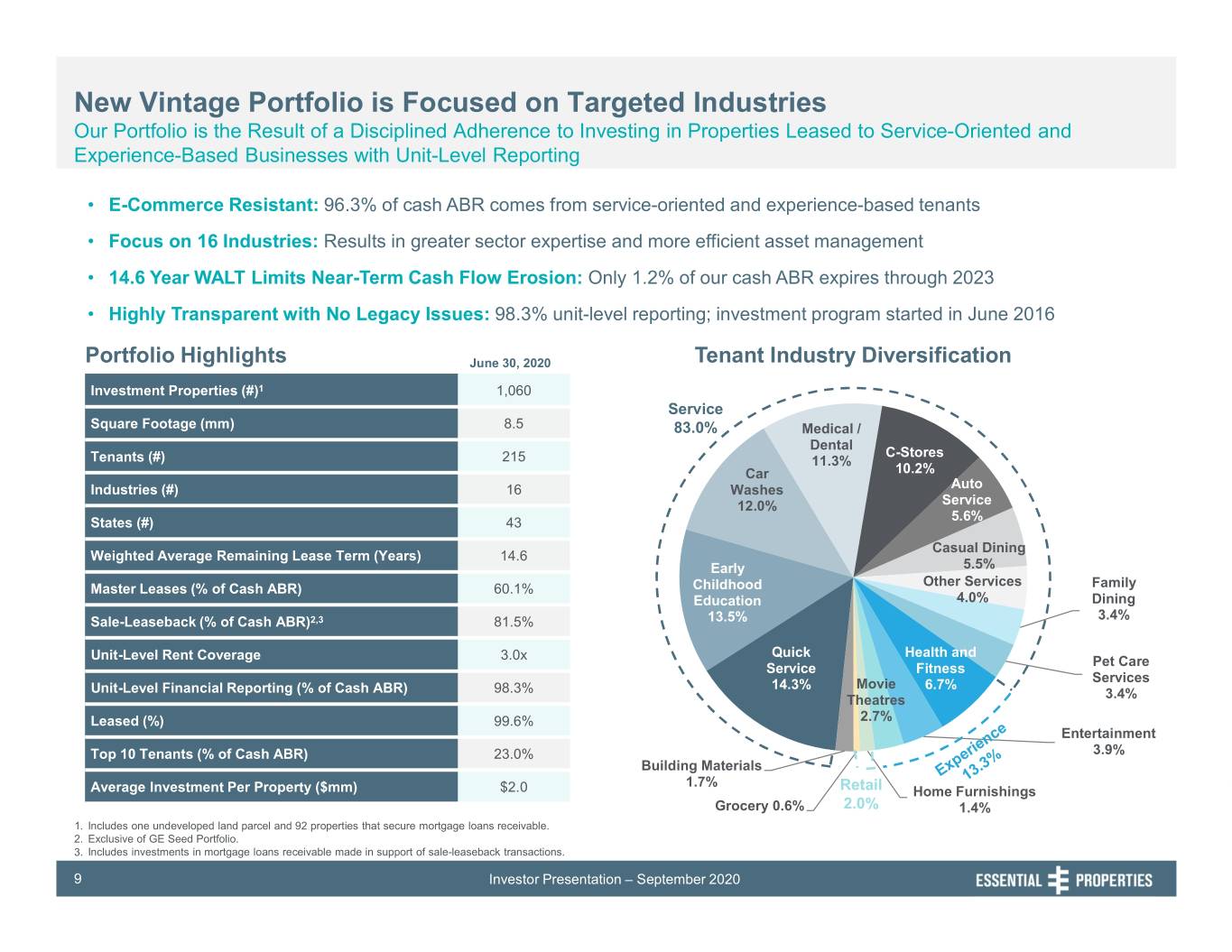

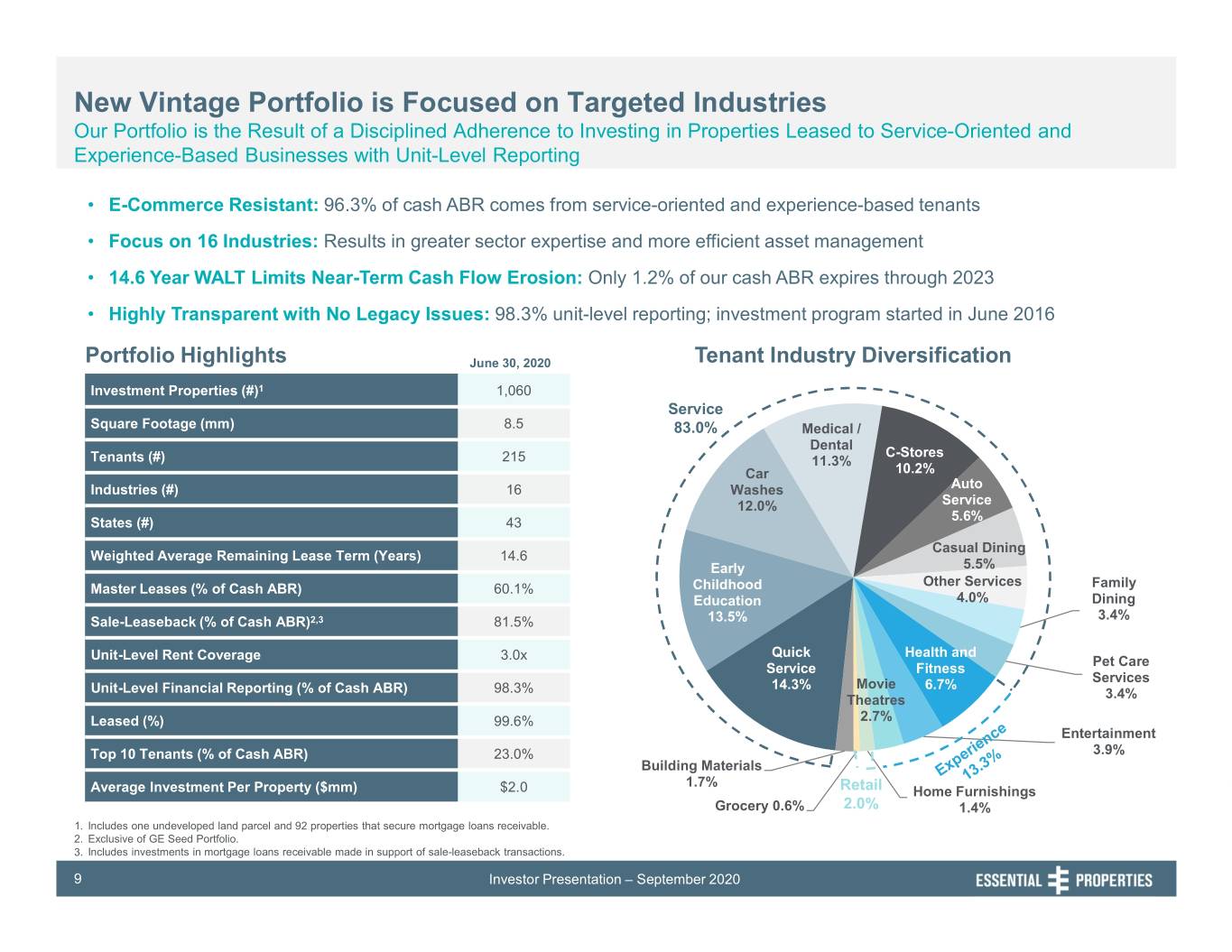

New Vintage Portfolio is Focused on Targeted Industries Our Portfolio is the Result of a Disciplined Adherence to Investing in Properties Leased to Service-Oriented and Experience-Based Businesses with Unit-Level Reporting • E-Commerce Resistant: 96.3% of cash ABR comes from service-oriented and experience-based tenants • Focus on 16 Industries: Results in greater sector expertise and more efficient asset management • 14.6 Year WALT Limits Near-Term Cash Flow Erosion: Only 1.2% of our cash ABR expires through 2023 • Highly Transparent with No Legacy Issues: 98.3% unit-level reporting; investment program started in June 2016 Portfolio Highlights June 30, 2020 Tenant Industry Diversification Investment Properties (#)1 1,060 Service Square Footage (mm) 8.5 83.0% Medical / Dental C-Stores Tenants (#) 215 11.3% Car 10.2% Industries (#) 16 Washes Auto 12.0% Service States (#) 43 5.6% Casual Dining Weighted Average Remaining Lease Term (Years) 14.6 Early 5.5% Other Services Master Leases (% of Cash ABR) 60.1% Childhood Family Education 4.0% Dining 3.4% Sale-Leaseback (% of Cash ABR)2,3 81.5% 13.5% Quick Health and Unit-Level Rent Coverage 3.0x Pet Care Service Fitness Services Unit-Level Financial Reporting (% of Cash ABR) 98.3% 14.3% Movie 6.7% Theatres 3.4% Leased (%) 99.6% 2.7% Entertainment Top 10 Tenants (% of Cash ABR) 23.0% 3.9% Building Materials 1.7% Average Investment Per Property ($mm) $2.0 Retail Home Furnishings Grocery 0.6% 2.0% 1.4% 1. Includes one undeveloped land parcel and 92 properties that secure mortgage loans receivable. 2. Exclusive of GE Seed Portfolio. 3. Includes investments in mortgage loans receivable made in support of sale-leaseback transactions. 9 Investor Presentation – September 2020

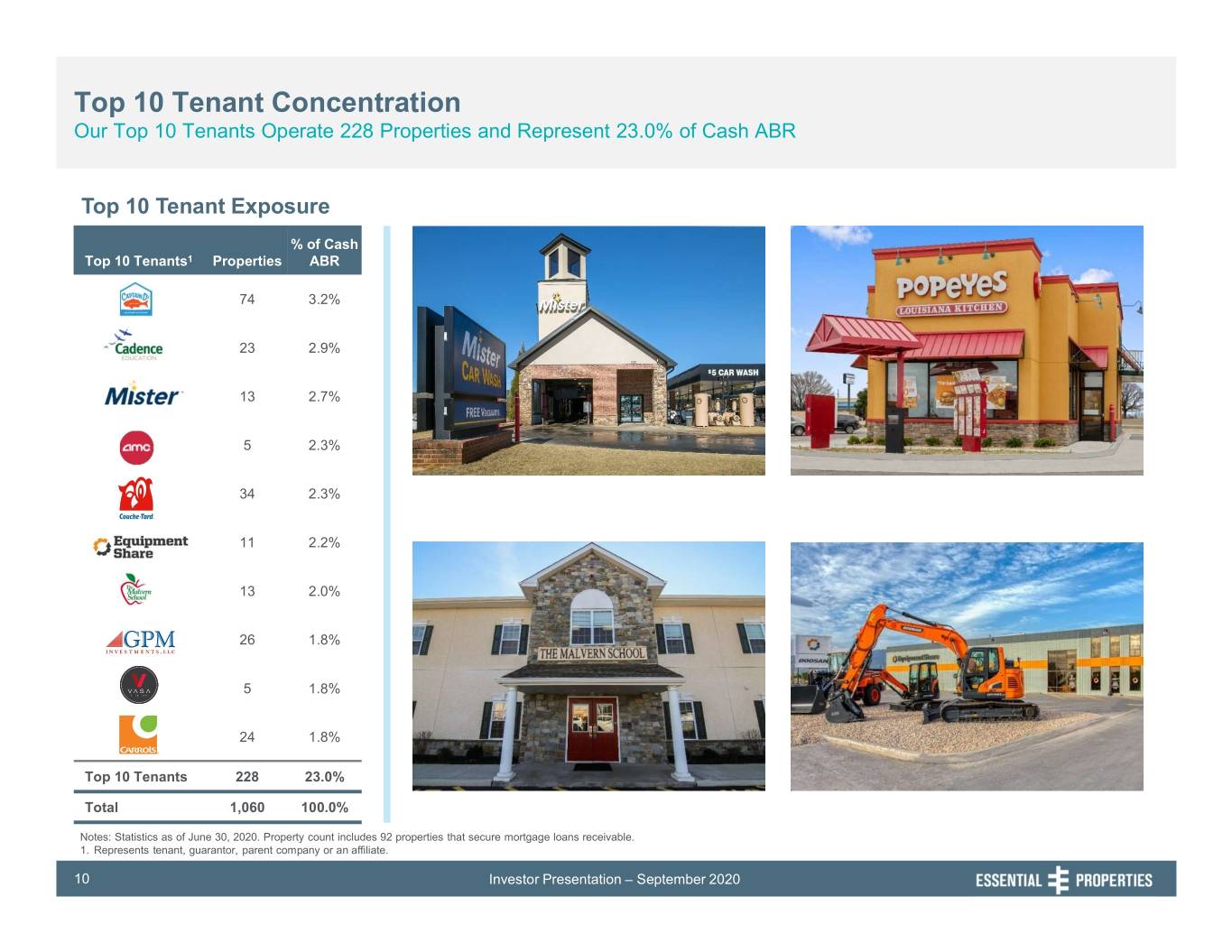

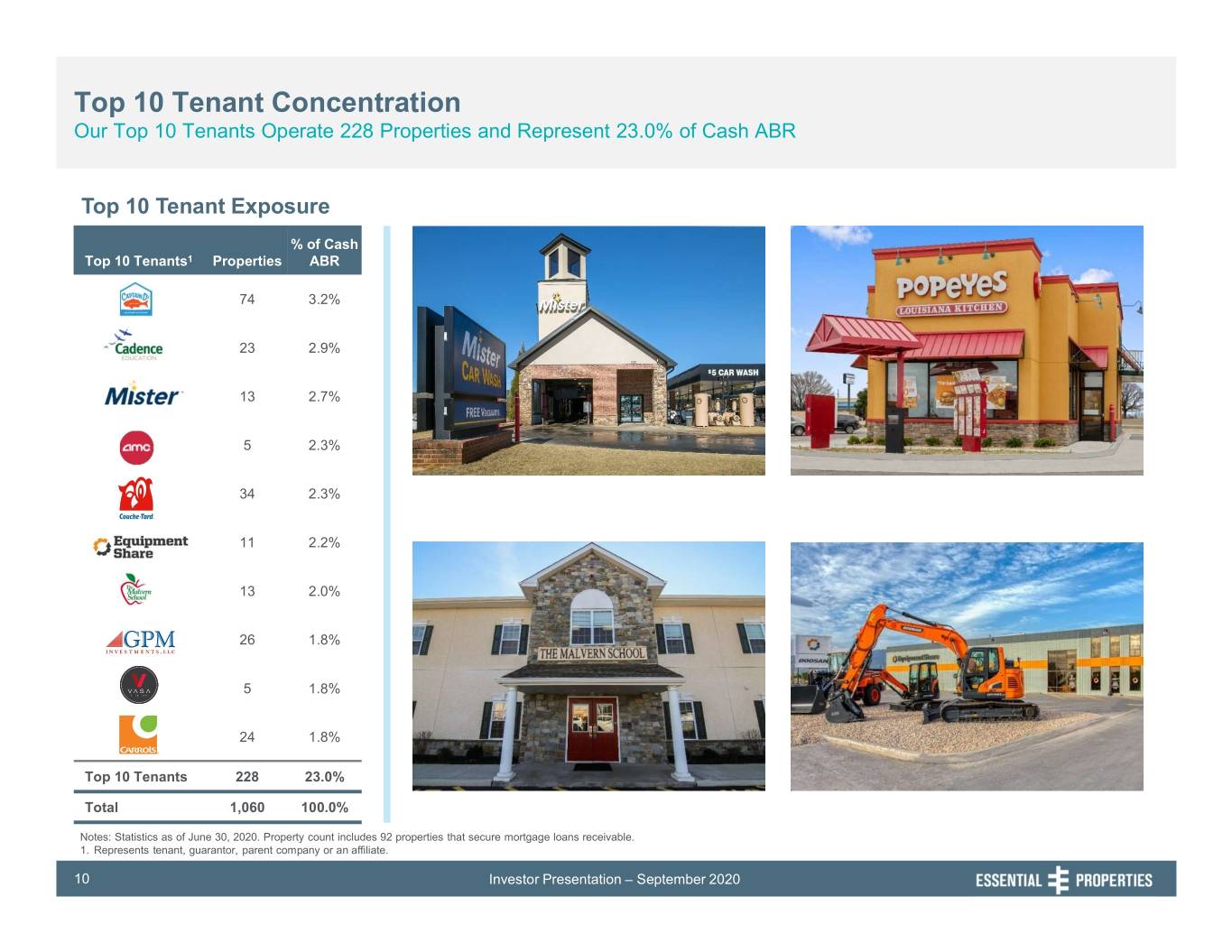

Top 10 Tenant Concentration Our Top 10 Tenants Operate 228 Properties and Represent 23.0% of Cash ABR Top 10 Tenant Exposure % of Cash Top 10 Tenants1 Properties ABR 74 3.2% 23 2.9% 13 2.7% 5 2.3% 34 2.3% 11 2.2% 13 2.0% 26 1.8% 5 1.8% 24 1.8% Top 10 Tenants 228 23.0% Total 1,060 100.0% Notes: Statistics as of June 30, 2020. Property count includes 92 properties that secure mortgage loans receivable. 1. Represents tenant, guarantor, parent company or an affiliate. 10 Investor Presentation – September 2020

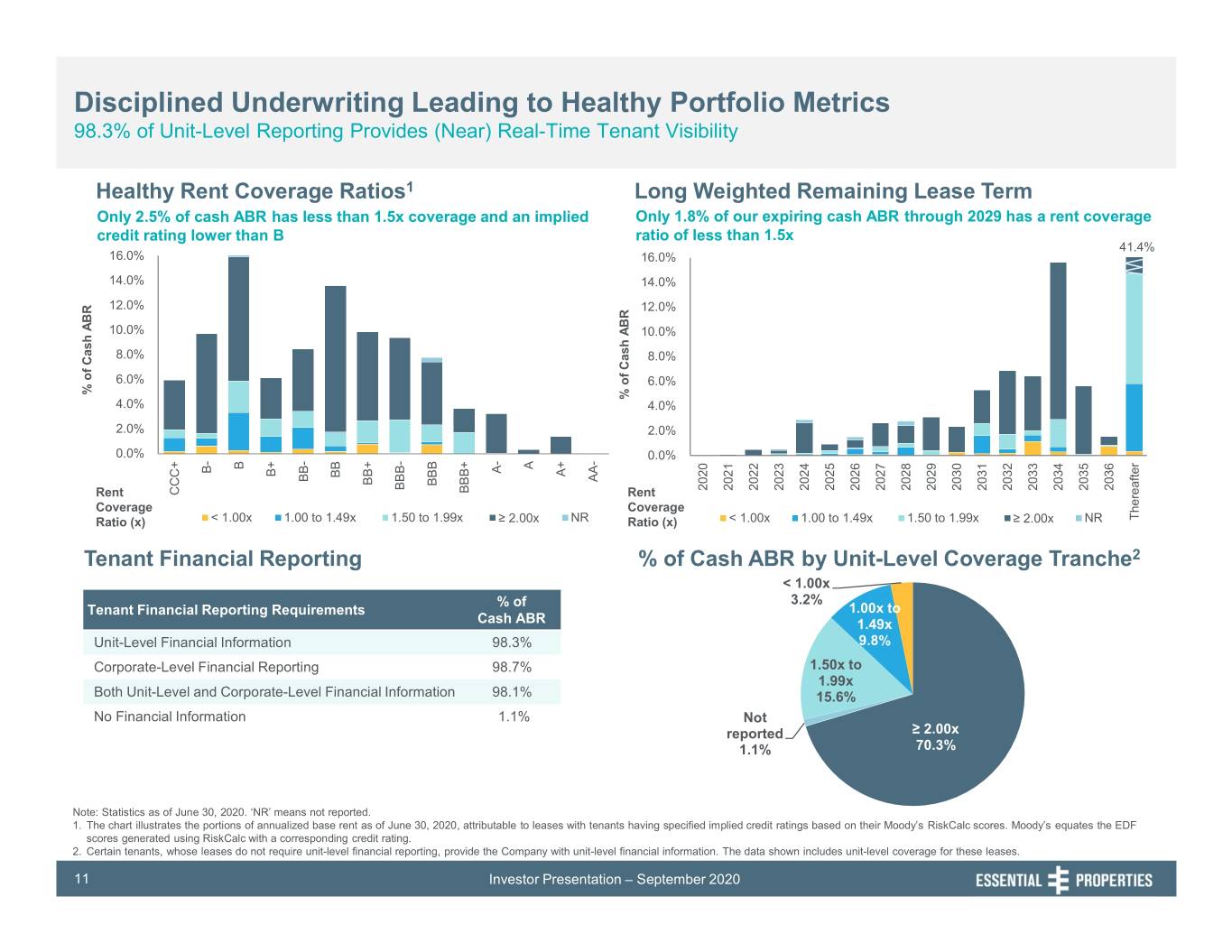

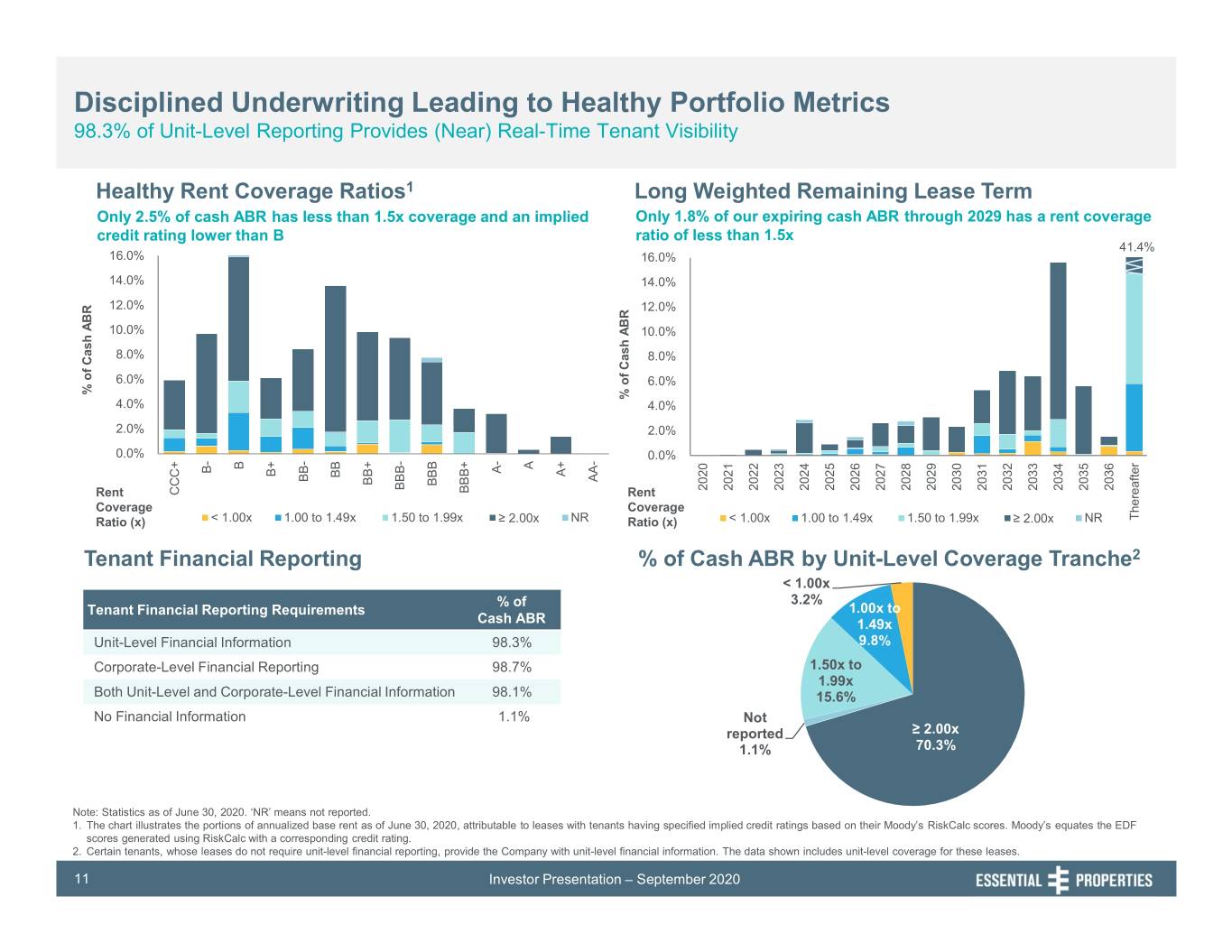

Disciplined Underwriting Leading to Healthy Portfolio Metrics 98.3% of Unit-Level Reporting Provides (Near) Real-Time Tenant Visibility Healthy Rent Coverage Ratios1 Long Weighted Remaining Lease Term Only 2.5% of cash ABR has less than 1.5x coverage and an implied Only 1.8% of our expiring cash ABR through 2029 has a rent coverage credit rating lower than B ratio of less than 1.5x 41.4% 16.0% 16.0% 14.0% 14.0% 12.0% 12.0% 10.0% 10.0% 8.0% 8.0% 6.0% 6.0% % of Cash ABR Cash of % % of Cash ABR Cash of % 4.0% 4.0% 2.0% 2.0% 0.0% 0.0% B A B- A- B+ A+ BB BB- AA- BB+ BBB BBB- 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 BBB+ Rent CCC+ Rent Coverage Coverage Ratio (x) < 1.00x 1.00 to 1.49x 1.50 to 1.99x ≥ 2.00x NR Ratio (x) < 1.00x 1.00 to 1.49x 1.50 to 1.99x ≥ 2.00x NR Thereafter Tenant Financial Reporting % of Cash ABR by Unit-Level Coverage Tranche2 < 1.00x % of 3.2% Tenant Financial Reporting Requirements 1.00x to Cash ABR 1.49x Unit-Level Financial Information 98.3% 9.8% Corporate-Level Financial Reporting 98.7% 1.50x to 1.99x Both Unit-Level and Corporate-Level Financial Information 98.1% 15.6% No Financial Information 1.1% Not reported ≥ 2.00x 1.1% 70.3% Note: Statistics as of June 30, 2020. ‘NR’ means not reported. 1. The chart illustrates the portions of annualized base rent as of June 30, 2020, attributable to leases with tenants having specified implied credit ratings based on their Moody’s RiskCalc scores. Moody’s equates the EDF scores generated using RiskCalc with a corresponding credit rating. 2. Certain tenants, whose leases do not require unit-level financial reporting, provide the Company with unit-level financial information. The data shown includes unit-level coverage for these leases. 11 Investor Presentation – September 2020

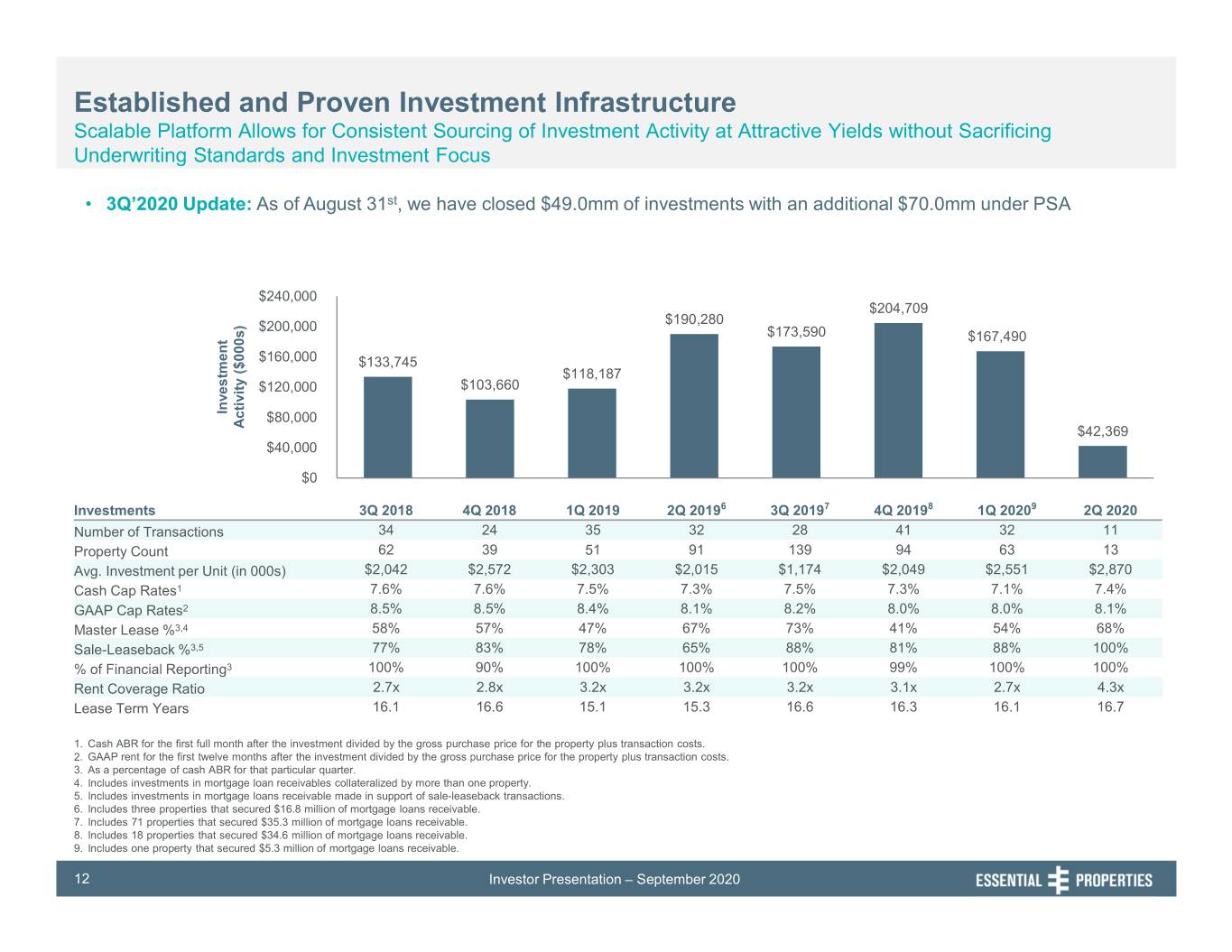

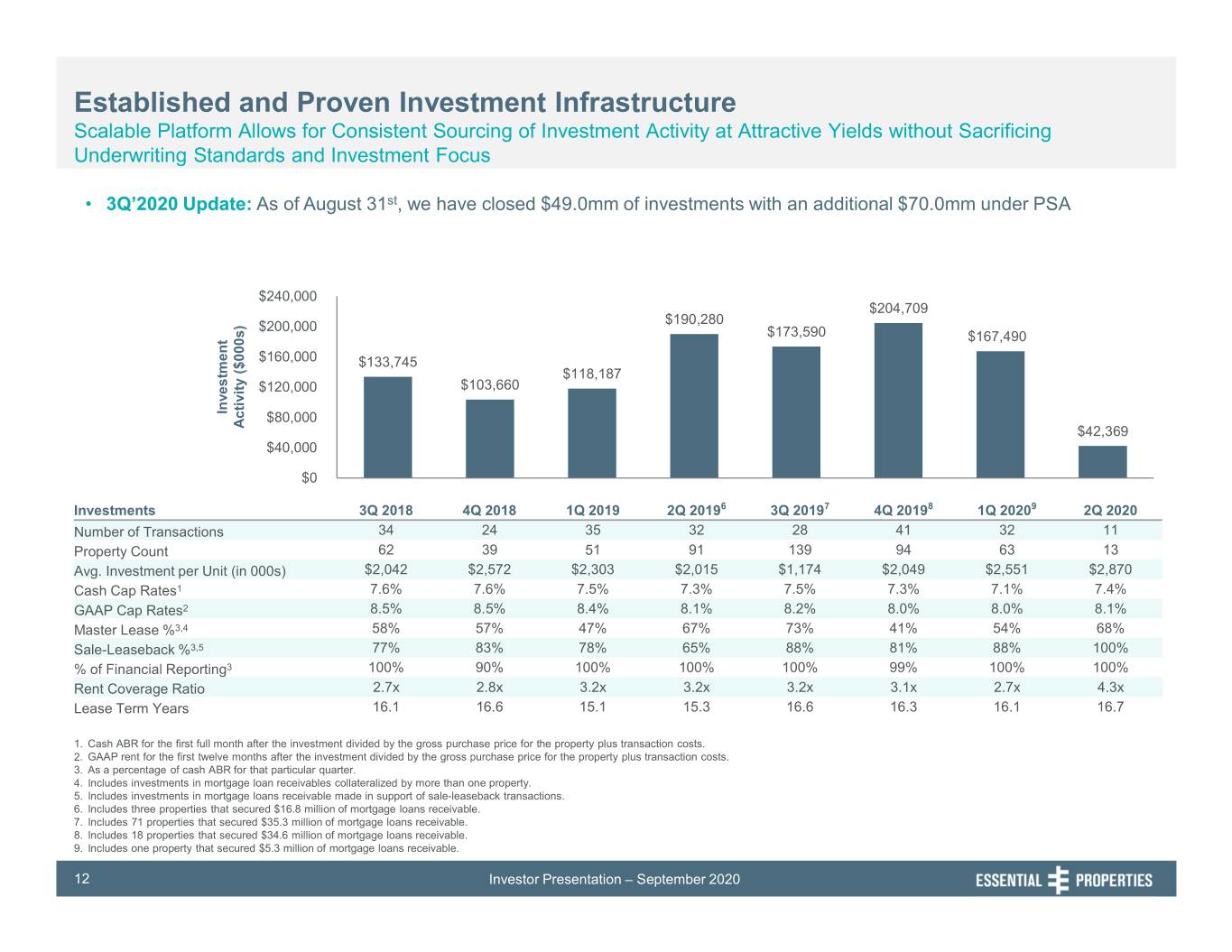

Established and Proven Investment Infrastructure Scalable Platform Allows for Consistent Sourcing of Investment Activity at Attractive Yields without Sacrificing Underwriting Standards and Investment Focus • 3Q’2020 Update: As of August 31st, we have closed $49.0mm of investments with an additional $70.0mm under PSA $240,000 $204,709 $190,280 $200,000 $173,590 $167,490 $160,000 $133,745 $118,187 $120,000 $103,660 Investment $80,000 Activity Activity ($000s) $42,369 $40,000 $0 Investments 3Q 2018 4Q 2018 1Q 2019 2Q 20196 3Q 20197 4Q 20198 1Q 20209 2Q 2020 Number of Transactions 34 24 35 32 28 41 32 11 Property Count 62 39 51 91 139 94 63 13 Avg. Investment per Unit (in 000s) $2,042 $2,572 $2,303 $2,015 $1,174 $2,049 $2,551 $2,870 Cash Cap Rates1 7.6% 7.6% 7.5% 7.3% 7.5% 7.3% 7.1% 7.4% GAAP Cap Rates2 8.5% 8.5% 8.4% 8.1% 8.2% 8.0% 8.0% 8.1% Master Lease %3,4 58% 57% 47% 67% 73% 41% 54% 68% Sale-Leaseback %3,5 77% 83% 78% 65% 88% 81% 88% 100% % of Financial Reporting3 100% 90% 100% 100% 100% 99% 100% 100% Rent Coverage Ratio 2.7x 2.8x 3.2x 3.2x 3.2x 3.1x 2.7x 4.3x Lease Term Years 16.1 16.6 15.1 15.3 16.6 16.3 16.1 16.7 1. Cash ABR for the first full month after the investment divided by the gross purchase price for the property plus transaction costs. 2. GAAP rent for the first twelve months after the investment divided by the gross purchase price for the property plus transaction costs. 3. As a percentage of cash ABR for that particular quarter. 4. Includes investments in mortgage loan receivables collateralized by more than one property. 5. Includes investments in mortgage loans receivable made in support of sale-leaseback transactions. 6. Includes three properties that secured $16.8 million of mortgage loans receivable. 7. Includes 71 properties that secured $35.3 million of mortgage loans receivable. 8. Includes 18 properties that secured $34.6 million of mortgage loans receivable. 9. Includes one property that secured $5.3 million of mortgage loans receivable. 12 Investor Presentation – September 2020

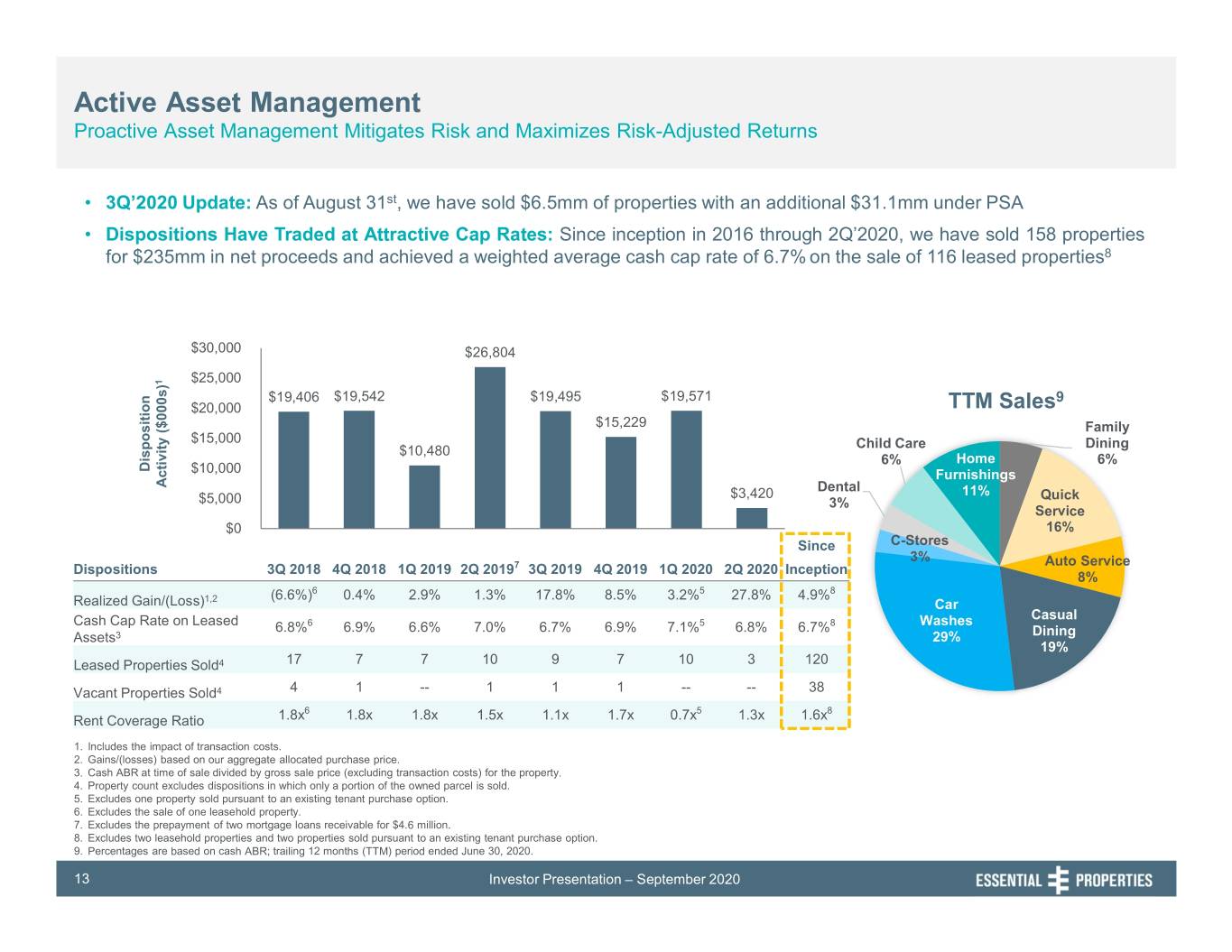

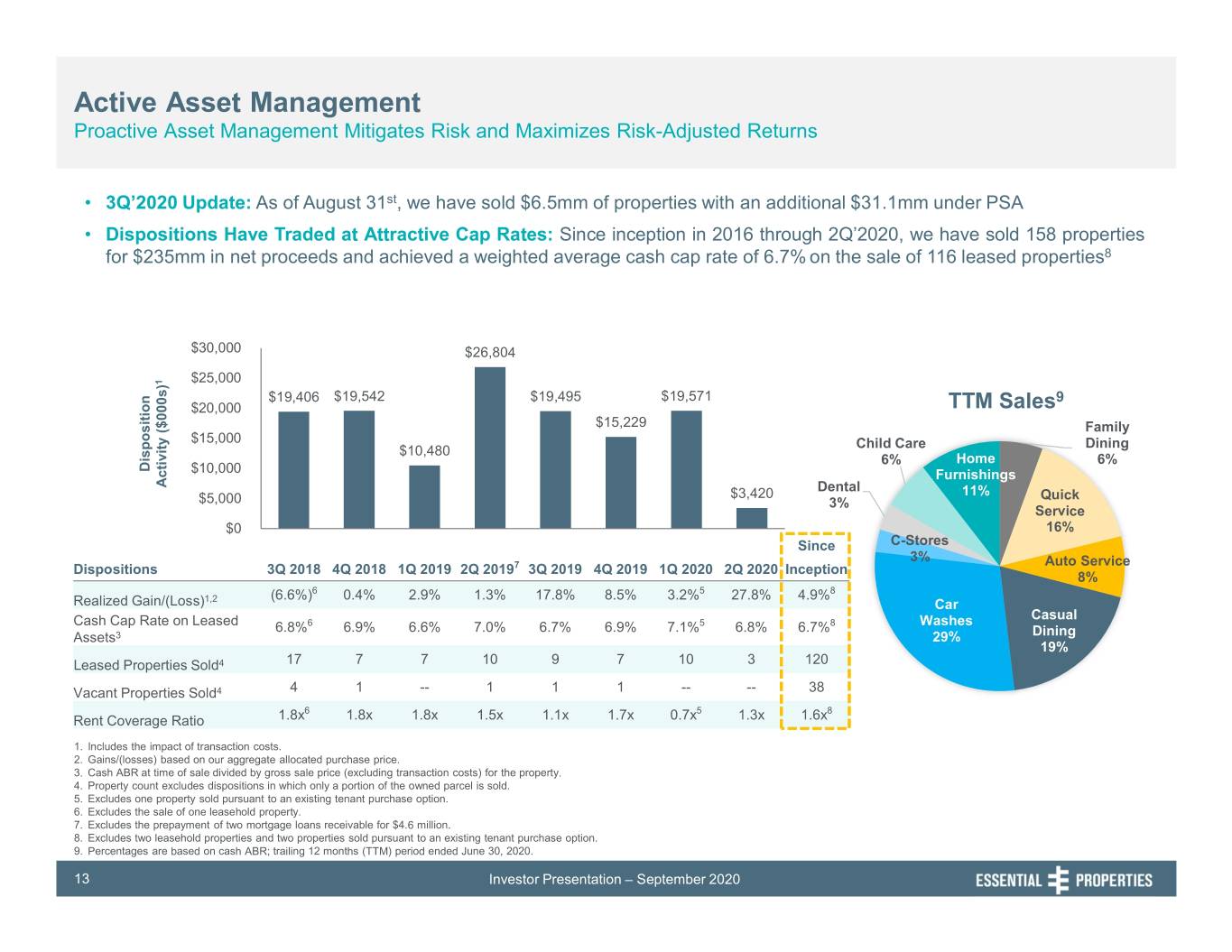

Active Asset Management Proactive Asset Management Mitigates Risk and Maximizes Risk-Adjusted Returns • 3Q’2020 Update: As of August 31st, we have sold $6.5mm of properties with an additional $31.1mm under PSA • Dispositions Have Traded at Attractive Cap Rates: Since inception in 2016 through 2Q’2020, we have sold 158 properties for $235mm in net proceeds and achieved a weighted average cash cap rate of 6.7%on the sale of 116 leased properties8 $30,000 $26,804 1 $25,000 $19,406 $19,542 $19,495 $19,571 9 $20,000 TTM Sales $15,229 Family $15,000 Child Care Dining $10,480 6% Home 6% Disposition $10,000 Furnishings Activity Activity ($000s) Dental $3,420 11% Quick $5,000 3% Service $0 16% Since C-Stores 3% Auto Service Dispositions 3Q 2018 4Q 2018 1Q 2019 2Q 20197 3Q 2019 4Q 2019 1Q 2020 2Q 2020 Inception 8% (6.6%)6 0.4% 2.9% 1.3% 17.8% 8.5% 3.2%5 27.8% 4.9%8 Realized Gain/(Loss)1,2 Car Casual Cash Cap Rate on Leased 6.8%6 6.9% 6.6% 7.0% 6.7% 6.9% 7.1%5 6.8% 6.7%8 Washes Assets3 29% Dining 19% Leased Properties Sold4 17 7 7 10 9 7 10 3 120 Vacant Properties Sold4 4 1 -- 1 1 1 -- -- 38 6 5 8 Rent Coverage Ratio 1.8x 1.8x 1.8x 1.5x 1.1x 1.7x 0.7x 1.3x 1.6x 1. Includes the impact of transaction costs. 2. Gains/(losses) based on our aggregate allocated purchase price. 3. Cash ABR at time of sale divided by gross sale price (excluding transaction costs) for the property. 4. Property count excludes dispositions in which only a portion of the owned parcel is sold. 5. Excludes one property sold pursuant to an existing tenant purchase option. 6. Excludes the sale of one leasehold property. 7. Excludes the prepayment of two mortgage loans receivable for $4.6 million. 8. Excludes two leasehold properties and two properties sold pursuant to an existing tenant purchase option. 9. Percentages are based on cash ABR; trailing 12 months (TTM) period ended June 30, 2020. 13 Investor Presentation – September 2020

Differentiated Net Lease Investment Opportunity Portfolio Mix and Underlying Fundamentals are Favorable Relative to Peers Service-Oriented & Experience-Based Less Reliance on Top 10 Tenancy with Smaller Industries (% of ABR) Scale Properties (% of ABR) Total Number of Tenant Industries1 Average Investment Per Property ($mm) 2 3 10 16 37 113 50 28 41 32 $3.6 $3.3 $2.0 $3.8 $2.7 $3.0 $3.0 $17.9 $1.3 $2.8 100% 100% 100% 96% 89% 80% 73% 72% 64% 49% 46% 39% 35% 37% 38% 27% 25% 22% 23% 17% Strong Unit-Level Coverage2 & Transparency Limited Immediate-Term Lease Maturities (% of Rent Expiring through 2023) % Unit-Level Financial Reporting3 Weighted Average Lease Term (# of Years) 98% NR50% 98% 45% NR NR NR NR NR 14.8 14.6 14.0 10.5 9.7 10.0 10.9 9.9 9.0 8.5 3.0x 2.7x 2.6x 2.5x 2.5x 2.3x 19% 16% 17% 13% 7% 7% 3% 1% 2% NR NR NR NR 0% Source: Public filings and press releases. Note: Essential Properties data as of June 30, 2020. Public net lease REIT data as of most recent reported quarter. ‘NR’ means not reported. Companies may define service-oriented and experienced-based tenants differently, may calculate weighted average remaining lease term differently, may calculate unit-level coverage differently (including peers on a mean or median basis with EPRT representing a weighted average) and may calculate the percentage of their tenants reporting differently than EPRT. Accordingly, such data for these companies and EPRT may not be comparable. 1. Designations entitled “other” are counted as one industry, even though the “other” segment could represent multiple industries. 2. EPRT, GTY, O, SRC and STOR coverage based on four-wall. 3. VER property level sales data was collected for 93.1% of retail and restaurant properties required to provide unit level sales reports, representing 45.1% of retail and restaurant properties owned. 14 Investor Presentation – September 2020

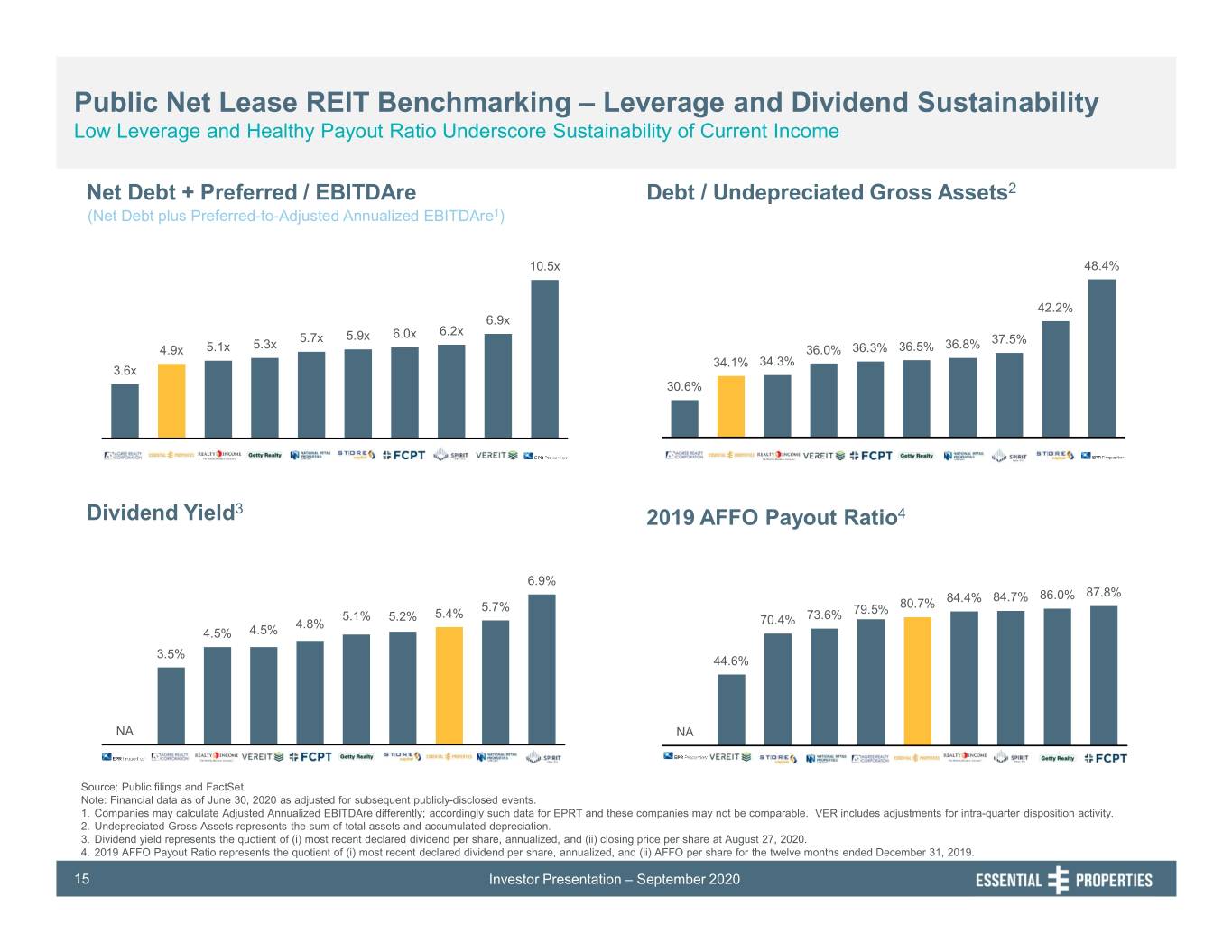

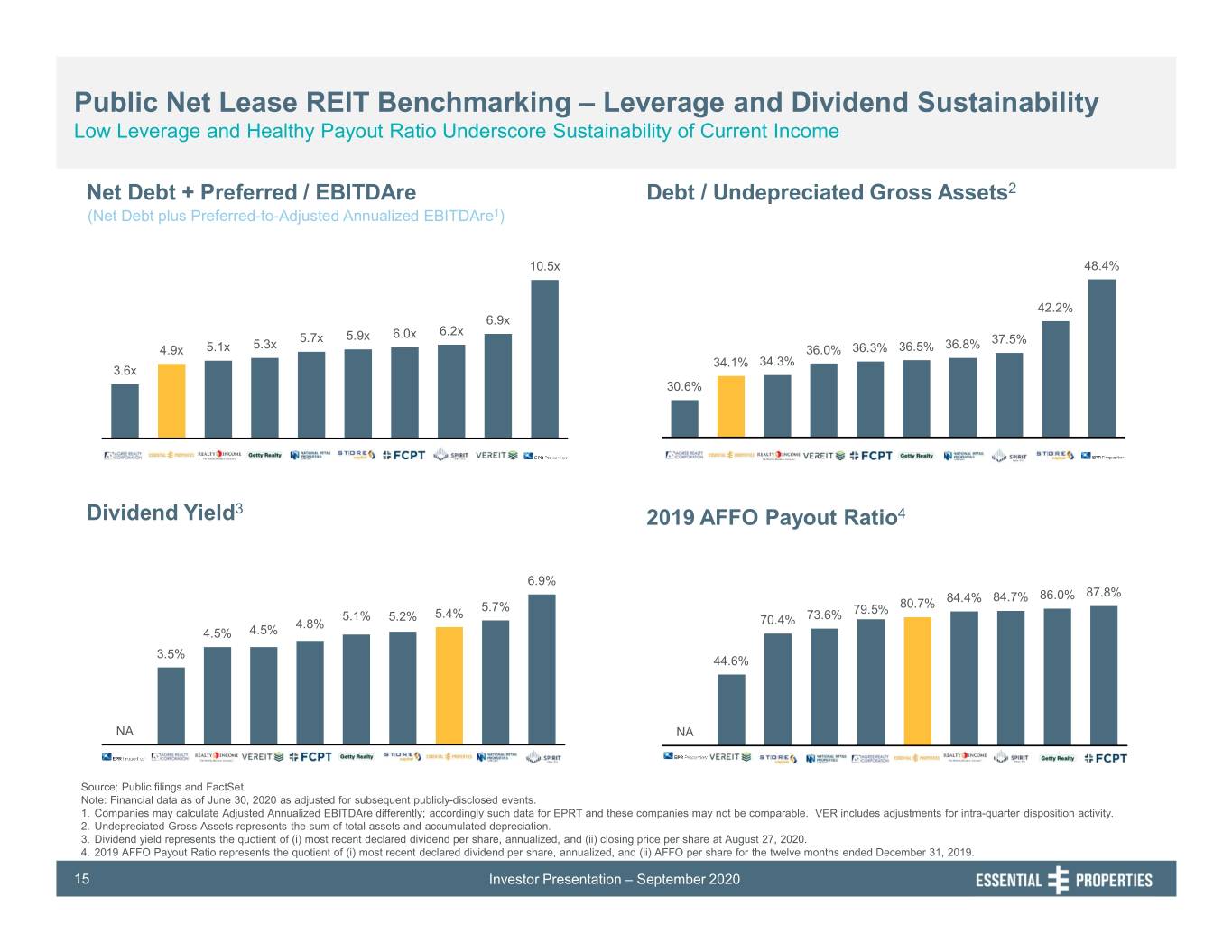

Public Net Lease REIT Benchmarking – Leverage and Dividend Sustainability Low Leverage and Healthy Payout Ratio Underscore Sustainability of Current Income Net Debt + Preferred / EBITDAre Debt / Undepreciated Gross Assets2 (Net Debt plus Preferred-to-Adjusted Annualized EBITDAre1) 10.5x 48.4% 42.2% 6.9x 6.2x 5.7x 5.9x 6.0x 37.5% 4.9x 5.1x 5.3x 36.0% 36.3% 36.5% 36.8% 34.1% 34.3% 3.6x 30.6% Dividend Yield3 2019 AFFO Payout Ratio4 6.9% 84.4% 84.7% 86.0% 87.8% 5.7% 79.5% 80.7% 5.1% 5.2% 5.4% 73.6% 4.8% 70.4% 4.5% 4.5% 3.5% 44.6% NA NA Source: Public filings and FactSet. Note: Financial data as of June 30, 2020 as adjusted for subsequent publicly-disclosed events. 1. Companies may calculate Adjusted Annualized EBITDAre differently; accordingly such data for EPRT and these companies may not be comparable. VER includes adjustments for intra-quarter disposition activity. 2. Undepreciated Gross Assets represents the sum of total assets and accumulated depreciation. 3. Dividend yield represents the quotient of (i) most recent declared dividend per share, annualized, and (ii) closing price per share at August 27, 2020. 4. 2019 AFFO Payout Ratio represents the quotient of (i) most recent declared dividend per share, annualized, and (ii) AFFO per share for the twelve months ended December 31, 2019. 15 Investor Presentation – September 2020

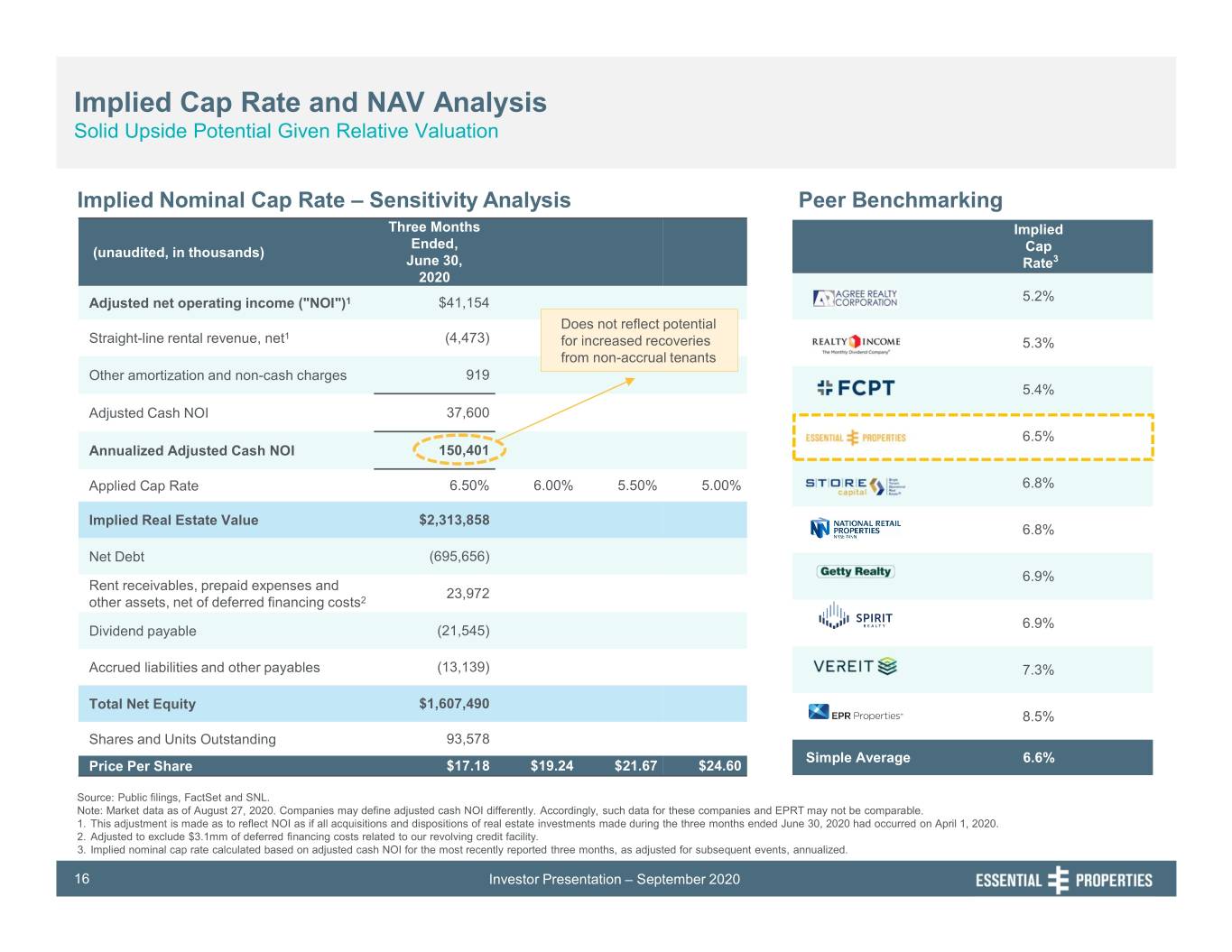

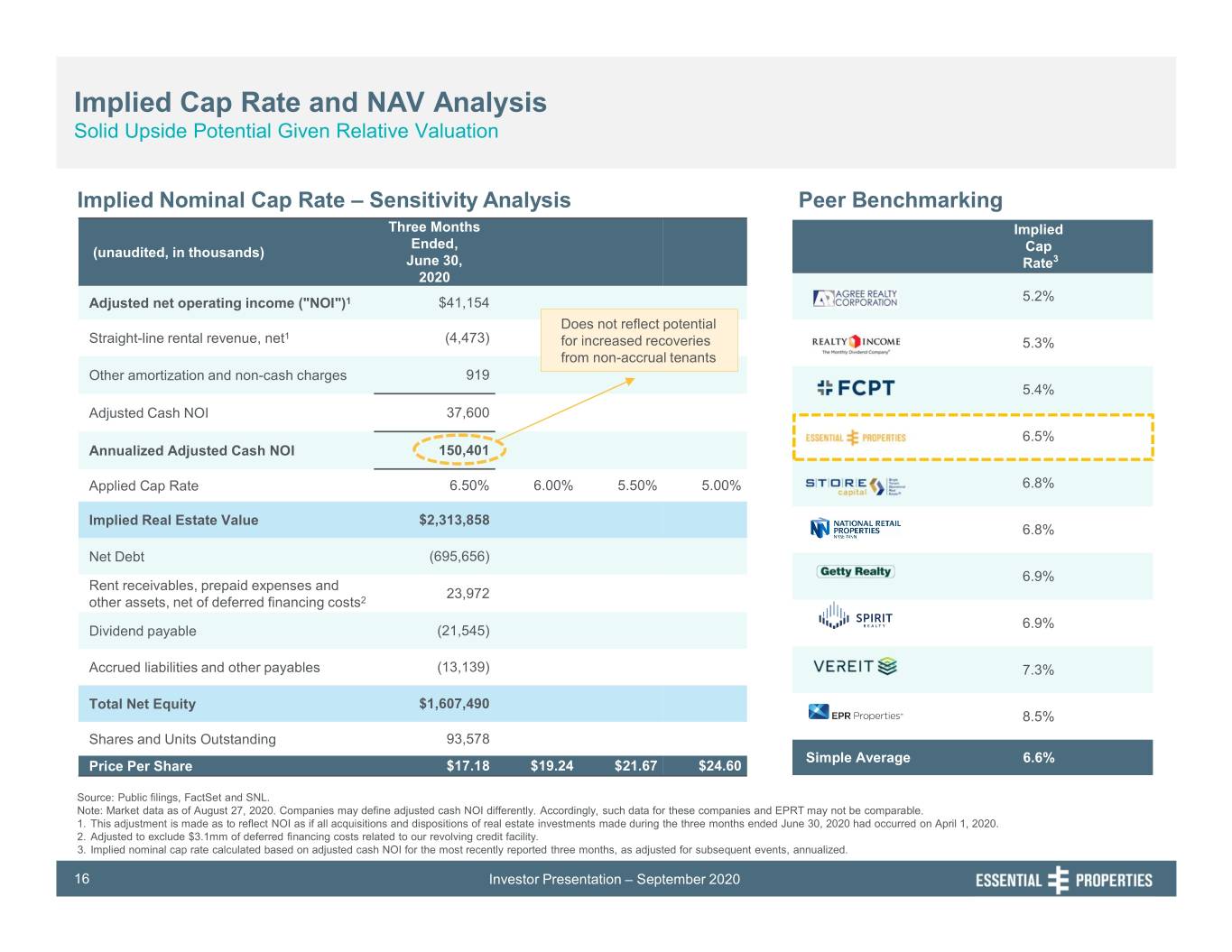

Implied Cap Rate and NAV Analysis Solid Upside Potential Given Relative Valuation Implied Nominal Cap Rate – Sensitivity Analysis Peer Benchmarking Three Months Implied Ended, (unaudited, in thousands) Cap June 30, Rate3 2020 Adjusted net operating income ("NOI")1 $41,154 5.2% Does not reflect potential 1 Straight-line rental revenue, net (4,473) for increased recoveries 5.3% from non-accrual tenants Other amortization and non-cash charges 919 5.4% Adjusted Cash NOI 37,600 6.5% Annualized Adjusted Cash NOI 150,401 Applied Cap Rate 6.50% 6.00% 5.50% 5.00% 6.8% Implied Real Estate Value $2,313,858 6.8% Net Debt (695,656) 6.9% Rent receivables, prepaid expenses and 23,972 other assets, net of deferred financing costs2 6.9% Dividend payable (21,545) Accrued liabilities and other payables (13,139) 7.3% Total Net Equity $1,607,490 8.5% Shares and Units Outstanding 93,578 Simple Average 6.6% Price Per Share $17.18 $19.24 $21.67 $24.60 Source: Public filings, FactSet and SNL. Note: Market data as of August 27, 2020. Companies may define adjusted cash NOI differently. Accordingly, such data for these companies and EPRT may not be comparable. 1. This adjustment is made as to reflect NOI as if all acquisitions and dispositions of real estate investments made during the three months ended June 30, 2020 had occurred on April 1, 2020. 2. Adjusted to exclude $3.1mm of deferred financing costs related to our revolving credit facility. 3. Implied nominal cap rate calculated based on adjusted cash NOI for the most recently reported three months, as adjusted for subsequent events, annualized. 16 Investor Presentation – September 2020

Appendix

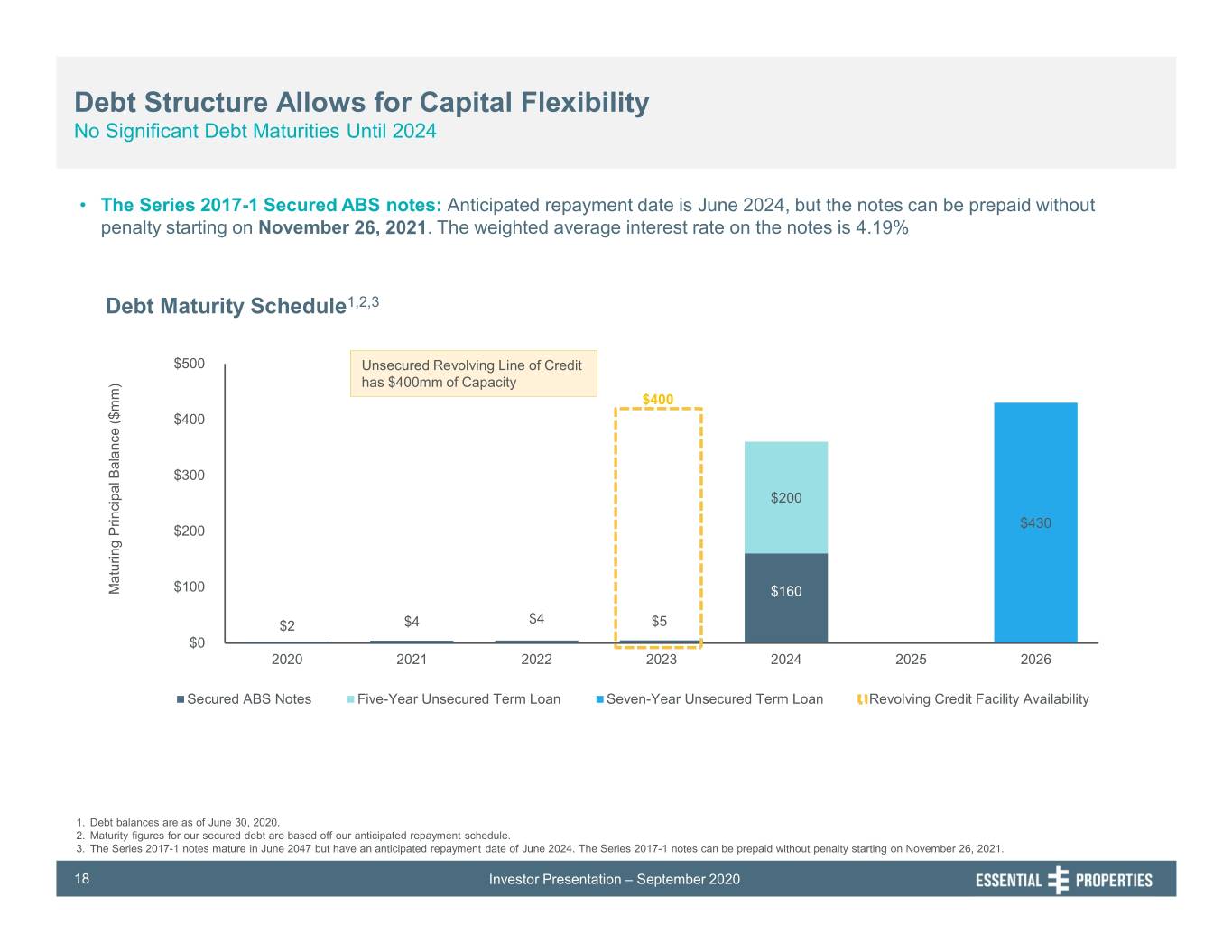

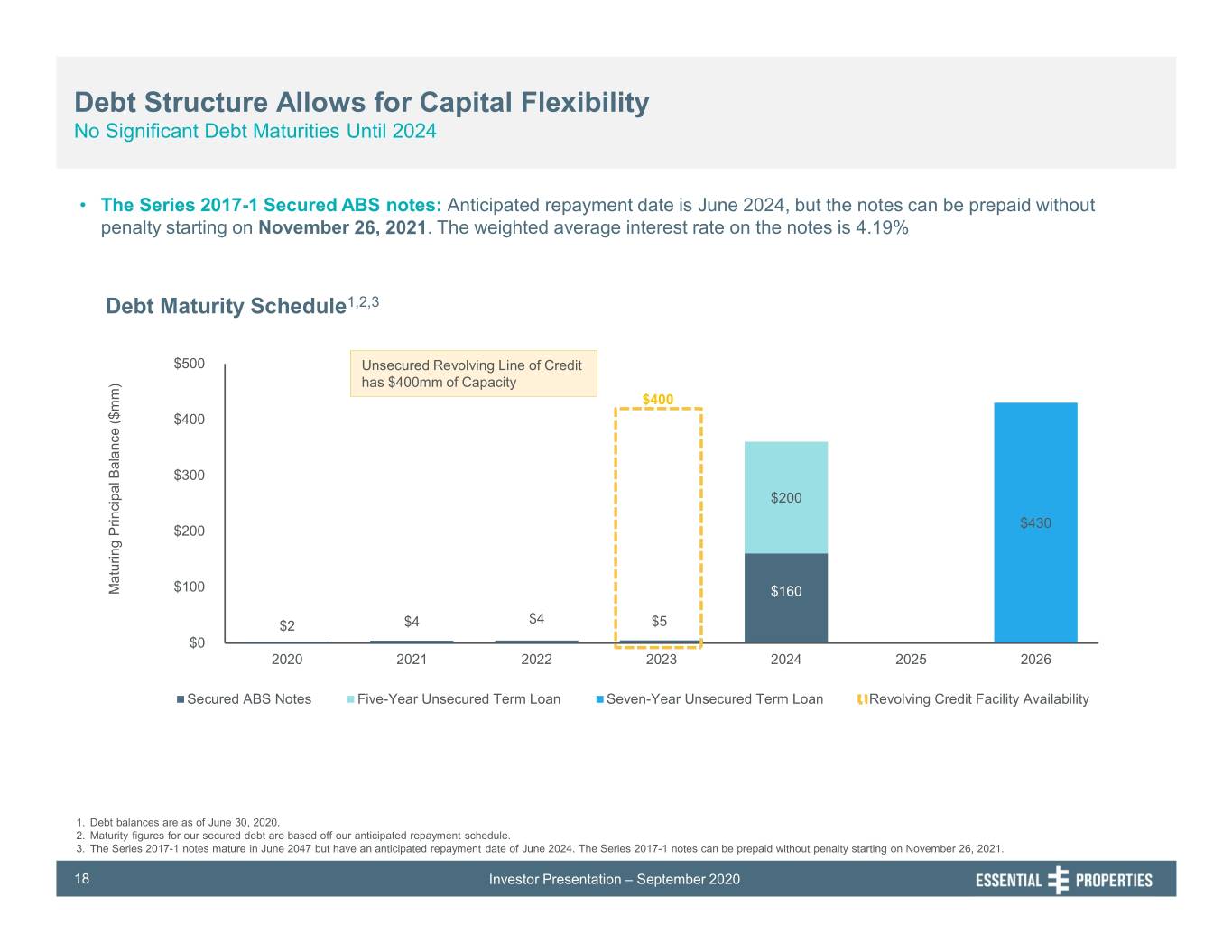

Debt Structure Allows for Capital Flexibility No Significant Debt Maturities Until 2024 • The Series 2017-1 Secured ABS notes: Anticipated repayment date is June 2024, but the notes can be prepaid without penalty starting on November 26, 2021. The weighted average interest rate on the notes is 4.19% Debt Maturity Schedule1,2,3 $500 Unsecured Revolving Line of Credit has $400mm of Capacity $400 $400 $300 $200 $430 $200 $100 Maturing PrincipalBalance($mm) $160 $4 $2 $4 $5 $0 2020 2021 2022 2023 2024 2025 2026 Secured ABS Notes Five-Year Unsecured Term Loan Seven-Year Unsecured Term Loan Revolving Credit Facility Availability 1. Debt balances are as of June 30, 2020. 2. Maturity figures for our secured debt are based off our anticipated repayment schedule. 3. The Series 2017-1 notes mature in June 2047 but have an anticipated repayment date of June 2024. The Series 2017-1 notes can be prepaid without penalty starting on November 26, 2021. 18 Investor Presentation – September 2020

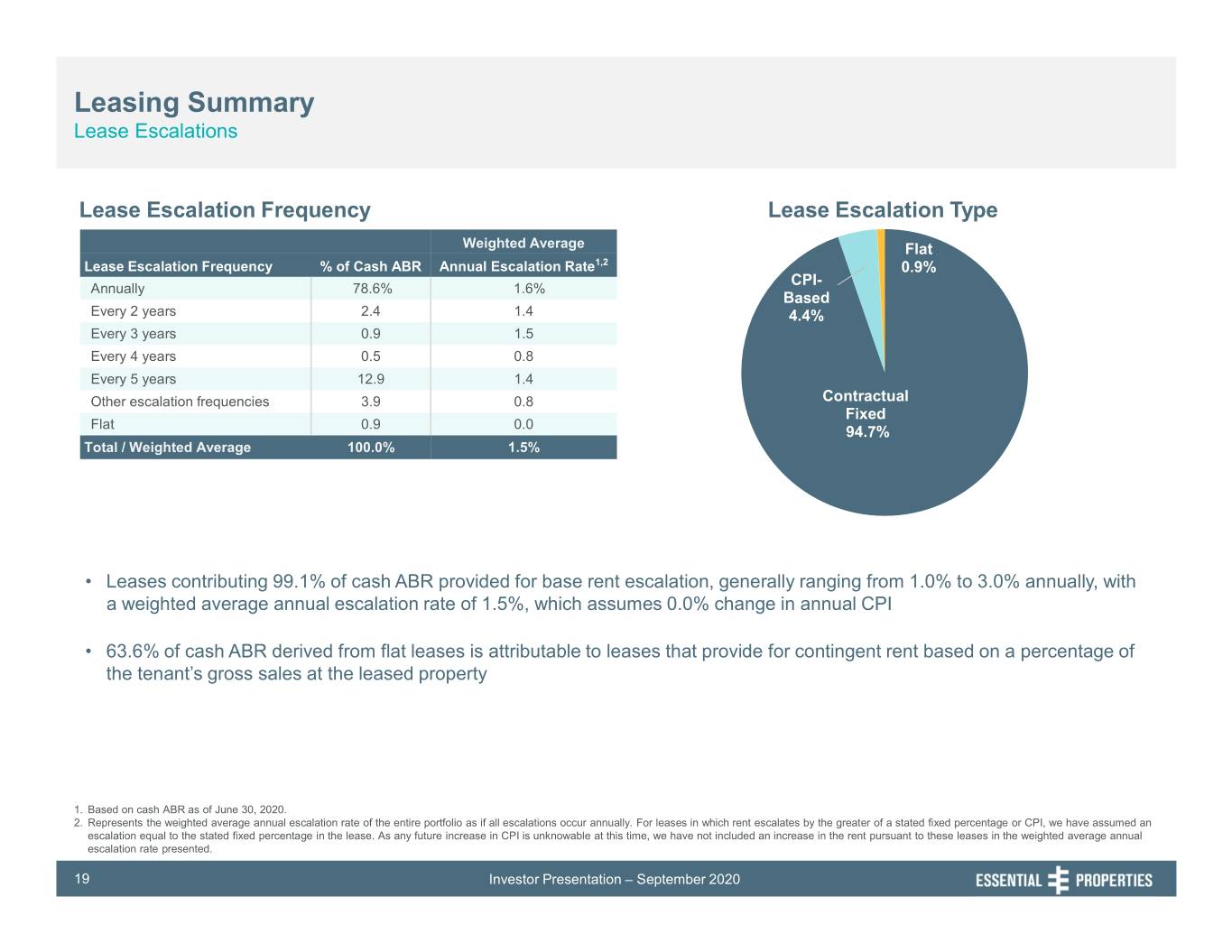

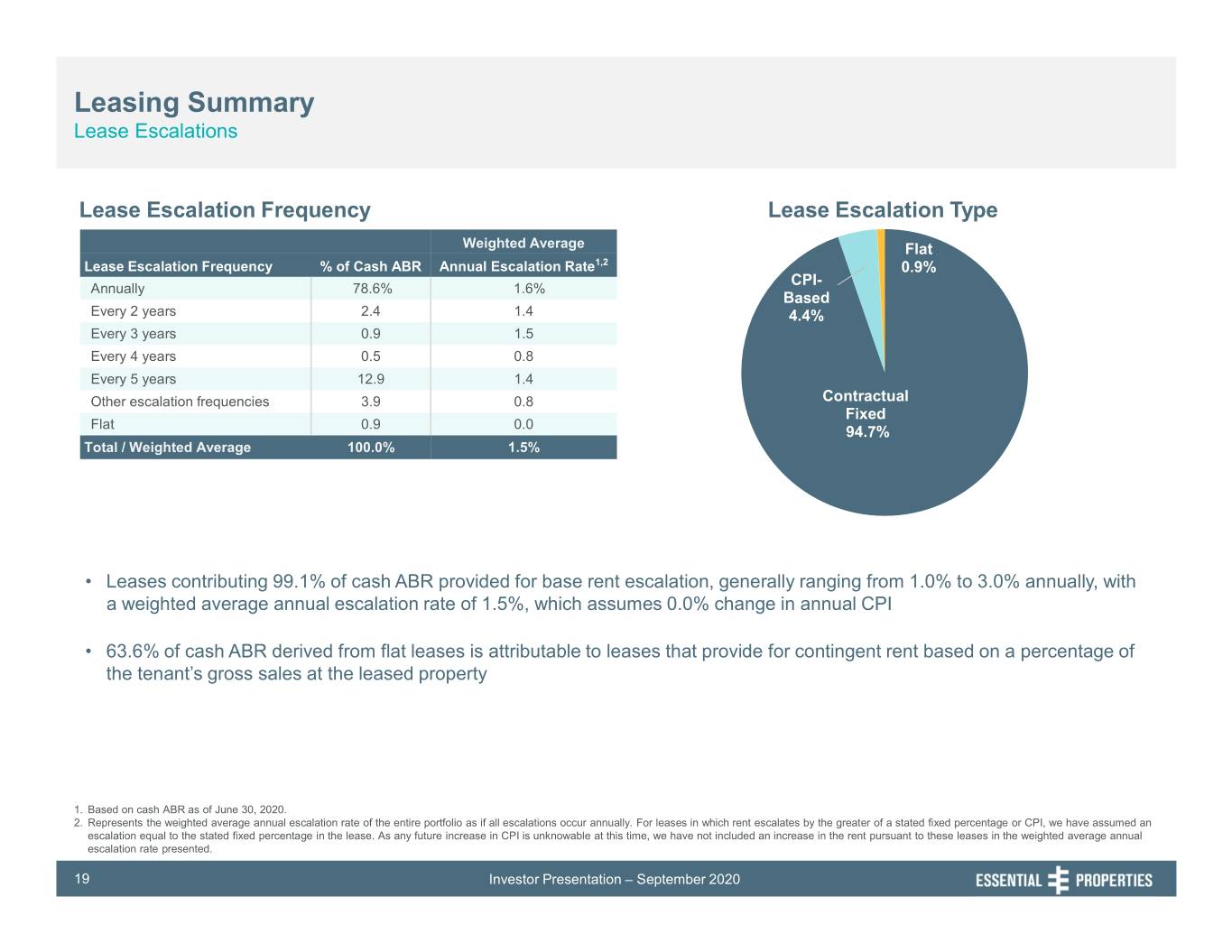

Leasing Summary Lease Escalations Lease Escalation Frequency Lease Escalation Type Weighted Average Flat Lease Escalation Frequency % of Cash ABR Annual Escalation Rate1,2 0.9% CPI- Annually 78.6% 1.6% Based Every 2 years 2.4 1.4 4.4% Every 3 years 0.9 1.5 Every 4 years 0.5 0.8 Every 5 years 12.9 1.4 Other escalation frequencies 3.9 0.8 Contractual Fixed Flat 0.9 0.0 94.7% Total / Weighted Average 100.0% 1.5% • Leases contributing 99.1% of cash ABR provided for base rent escalation, generally ranging from 1.0% to 3.0% annually, with a weighted average annual escalation rate of 1.5%, which assumes 0.0% change in annual CPI • 63.6% of cash ABR derived from flat leases is attributable to leases that provide for contingent rent based on a percentage of the tenant’s gross sales at the leased property 1. Based on cash ABR as of June 30, 2020. 2. Represents the weighted average annual escalation rate of the entire portfolio as if all escalations occur annually. For leases in which rent escalates by the greater of a stated fixed percentage or CPI, we have assumed an escalation equal to the stated fixed percentage in the lease. As any future increase in CPI is unknowable at this time, we have not included an increase in the rent pursuant to these leases in the weighted average annual escalation rate presented. 19 Investor Presentation – September 2020

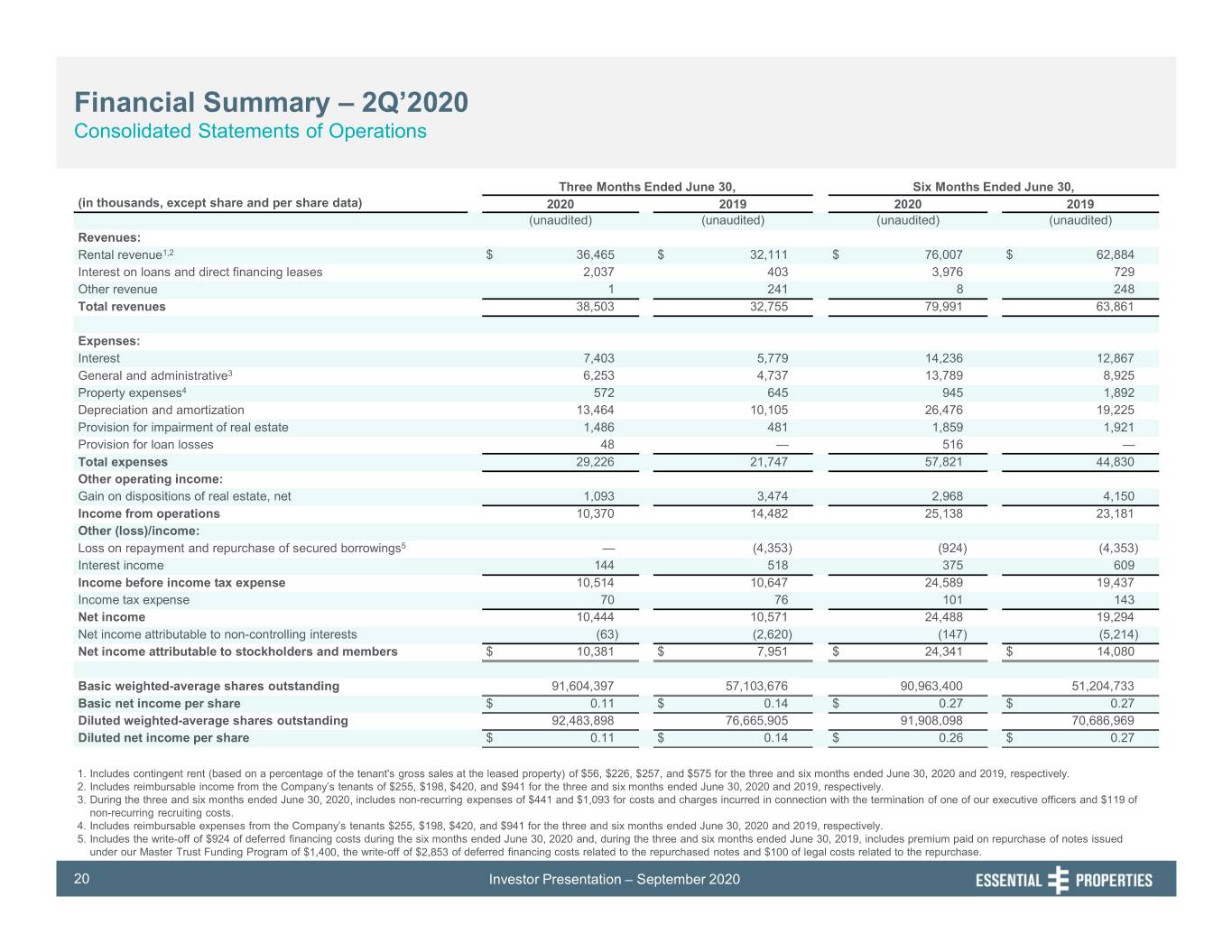

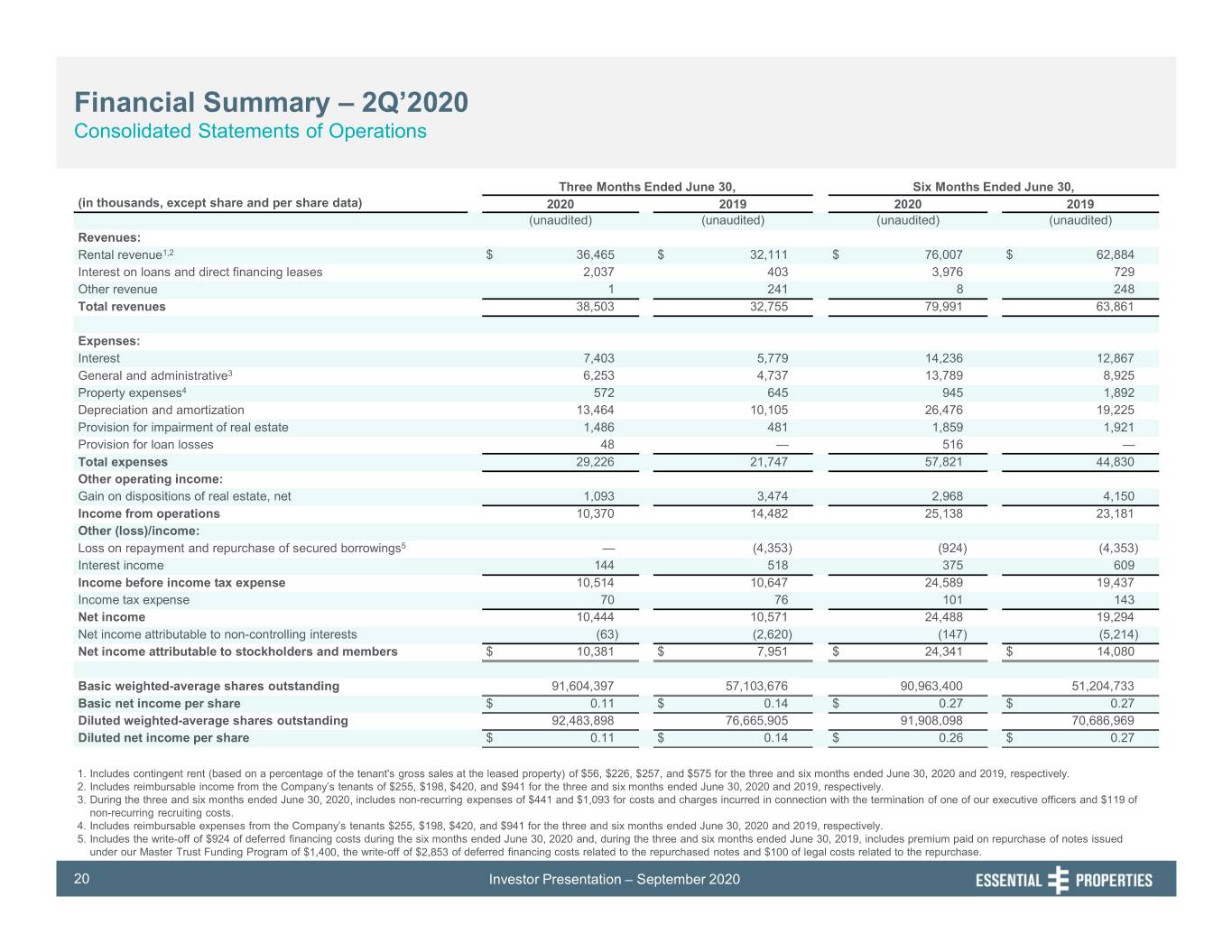

Financial Summary – 2Q’2020 Consolidated Statements of Operations Three Months Ended June 30, Six Months Ended June 30, (in thousands, except share and per share data) 2020 2019 2020 2019 (unaudited) (unaudited) (unaudited) (unaudited) Revenues: Rental revenue1,2 $ 36,465 $ 32,111 $ 76,007 $ 62,884 Interest on loans and direct financing leases 2,037 403 3,976 729 Other revenue 1 241 8 248 Total revenues 38,503 32,755 79,991 63,861 Expenses: Interest 7,403 5,779 14,236 12,867 General and administrative3 6,253 4,737 13,789 8,925 Property expenses4 572 645 945 1,892 Depreciation and amortization 13,464 10,105 26,476 19,225 Provision for impairment of real estate 1,486 481 1,859 1,921 Provision for loan losses 48 — 516 — Total expenses 29,226 21,747 57,821 44,830 Other operating income: Gain on dispositions of real estate, net 1,093 3,474 2,968 4,150 Income from operations 10,370 14,482 25,138 23,181 Other (loss)/income: Loss on repayment and repurchase of secured borrowings5 — (4,353) (924) (4,353) Interest income 144 518 375 609 Income before income tax expense 10,514 10,647 24,589 19,437 Income tax expense 70 76 101 143 Net income 10,444 10,571 24,488 19,294 Net income attributable to non-controlling interests (63) (2,620) (147) (5,214) Net income attributable to stockholders and members $ 10,381 $ 7,951 $ 24,341 $ 14,080 Basic weighted-average shares outstanding 91,604,397 57,103,676 90,963,400 51,204,733 Basic net income per share $ 0.11 $ 0.14 $ 0.27 $ 0.27 Diluted weighted-average shares outstanding 92,483,898 76,665,905 91,908,098 70,686,969 Diluted net income per share $ 0.11 $ 0.14 $ 0.26 $ 0.27 1. Includes contingent rent (based on a percentage of the tenant's gross sales at the leased property) of $56, $226, $257, and $575 for the three and six months ended June 30, 2020 and 2019, respectively. 2. Includes reimbursable income from the Company’s tenants of $255, $198, $420, and $941 for the three and six months ended June 30, 2020 and 2019, respectively. 3. During the three and six months ended June 30, 2020, includes non-recurring expenses of $441 and $1,093 for costs and charges incurred in connection with the termination of one of our executive officers and $119 of non-recurring recruiting costs. 4. Includes reimbursable expenses from the Company’s tenants $255, $198, $420, and $941 for the three and six months ended June 30, 2020 and 2019, respectively. 5. Includes the write-off of $924 of deferred financing costs during the six months ended June 30, 2020 and, during the three and six months ended June 30, 2019, includes premium paid on repurchase of notes issued under our Master Trust Funding Program of $1,400, the write-off of $2,853 of deferred financing costs related to the repurchased notes and $100 of legal costs related to the repurchase. 20 Investor Presentation – September 2020

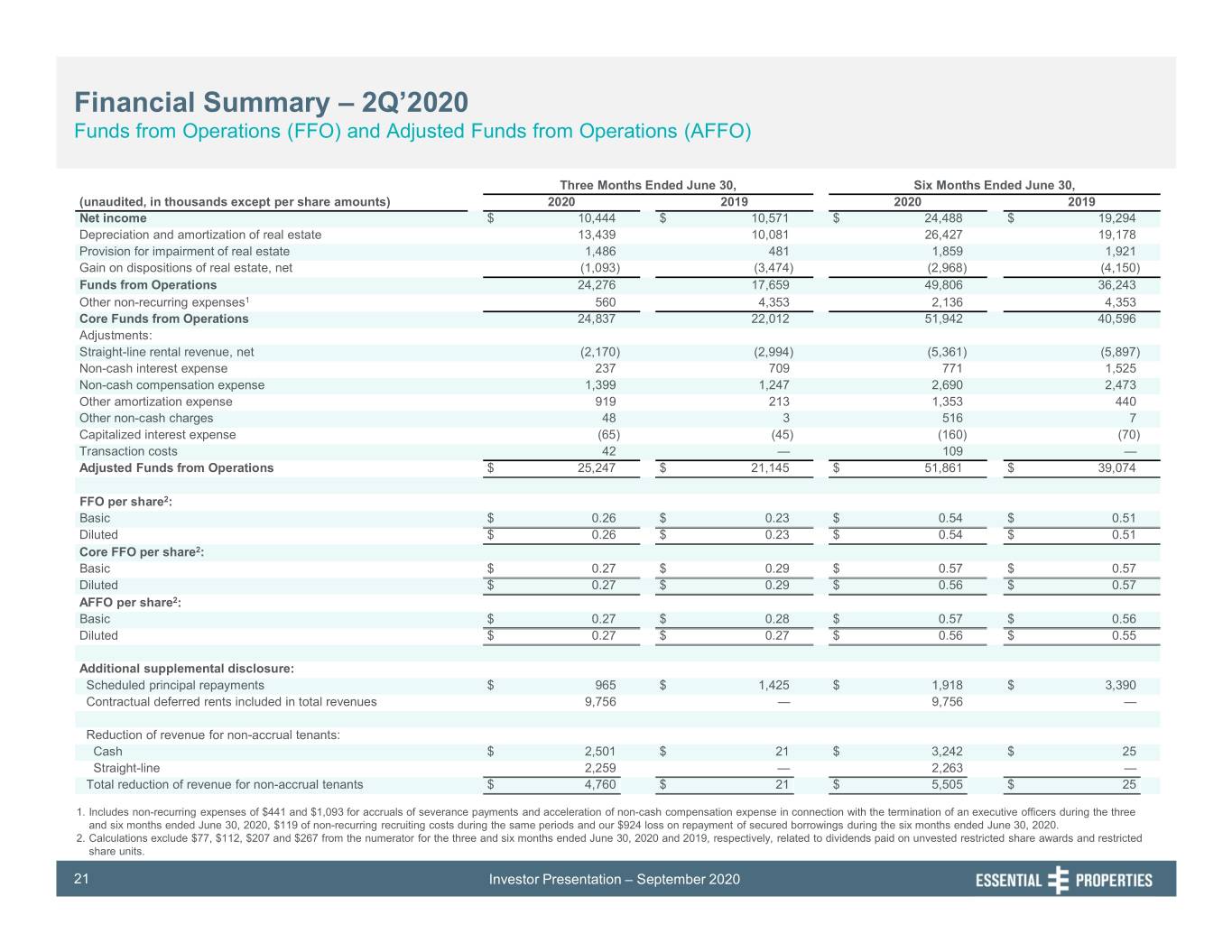

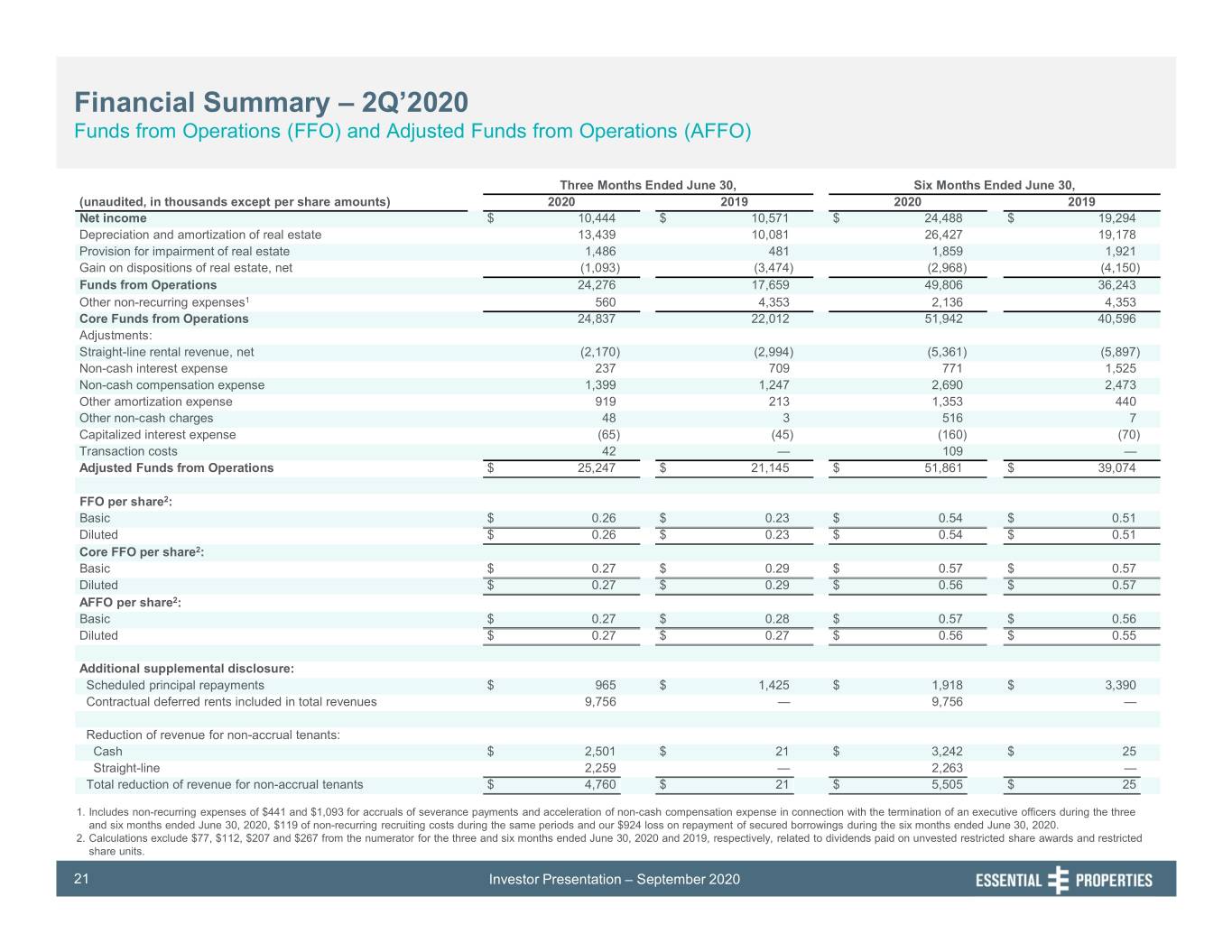

Financial Summary – 2Q’2020 Funds from Operations (FFO) and Adjusted Funds from Operations (AFFO) Three Months Ended June 30, Six Months Ended June 30, (unaudited, in thousands except per share amounts) 2020 2019 2020 2019 Net income $ 10,444 $ 10,571 $ 24,488 $ 19,294 Depreciation and amortization of real estate 13,439 10,081 26,427 19,178 Provision for impairment of real estate 1,486 481 1,859 1,921 Gain on dispositions of real estate, net (1,093) (3,474) (2,968) (4,150) Funds from Operations 24,276 17,659 49,806 36,243 Other non-recurring expenses1 560 4,353 2,136 4,353 Core Funds from Operations 24,837 22,012 51,942 40,596 Adjustments: Straight-line rental revenue, net (2,170) (2,994) (5,361) (5,897) Non-cash interest expense 237 709 771 1,525 Non-cash compensation expense 1,399 1,247 2,690 2,473 Other amortization expense 919 213 1,353 440 Other non-cash charges 48 3 516 7 Capitalized interest expense (65) (45) (160) (70) Transaction costs 42 — 109 — Adjusted Funds from Operations $ 25,247 $ 21,145 $ 51,861 $ 39,074 FFO per share2: Basic $ 0.26 $ 0.23 $ 0.54 $ 0.51 Diluted $ 0.26 $ 0.23 $ 0.54 $ 0.51 Core FFO per share2: Basic $ 0.27 $ 0.29 $ 0.57 $ 0.57 Diluted $ 0.27 $ 0.29 $ 0.56 $ 0.57 AFFO per share2: Basic $ 0.27 $ 0.28 $ 0.57 $ 0.56 Diluted $ 0.27 $ 0.27 $ 0.56 $ 0.55 Additional supplemental disclosure: Scheduled principal repayments $ 965 $ 1,425 $ 1,918 $ 3,390 Contractual deferred rents included in total revenues 9,756 — 9,756 — Reduction of revenue for non-accrual tenants: Cash $ 2,501 $ 21 $ 3,242 $ 25 Straight-line 2,259 — 2,263 — Total reduction of revenue for non-accrual tenants $ 4,760 $ 21 $ 5,505 $ 25 1. Includes non-recurring expenses of $441 and $1,093 for accruals of severance payments and acceleration of non-cash compensation expense in connection with the termination of an executive officers during the three and six months ended June 30, 2020, $119 of non-recurring recruiting costs during the same periods and our $924 loss on repayment of secured borrowings during the six months ended June 30, 2020. 2. Calculations exclude $77, $112, $207 and $267 from the numerator for the three and six months ended June 30, 2020 and 2019, respectively, related to dividends paid on unvested restricted share awards and restricted share units. 21 Investor Presentation – September 2020

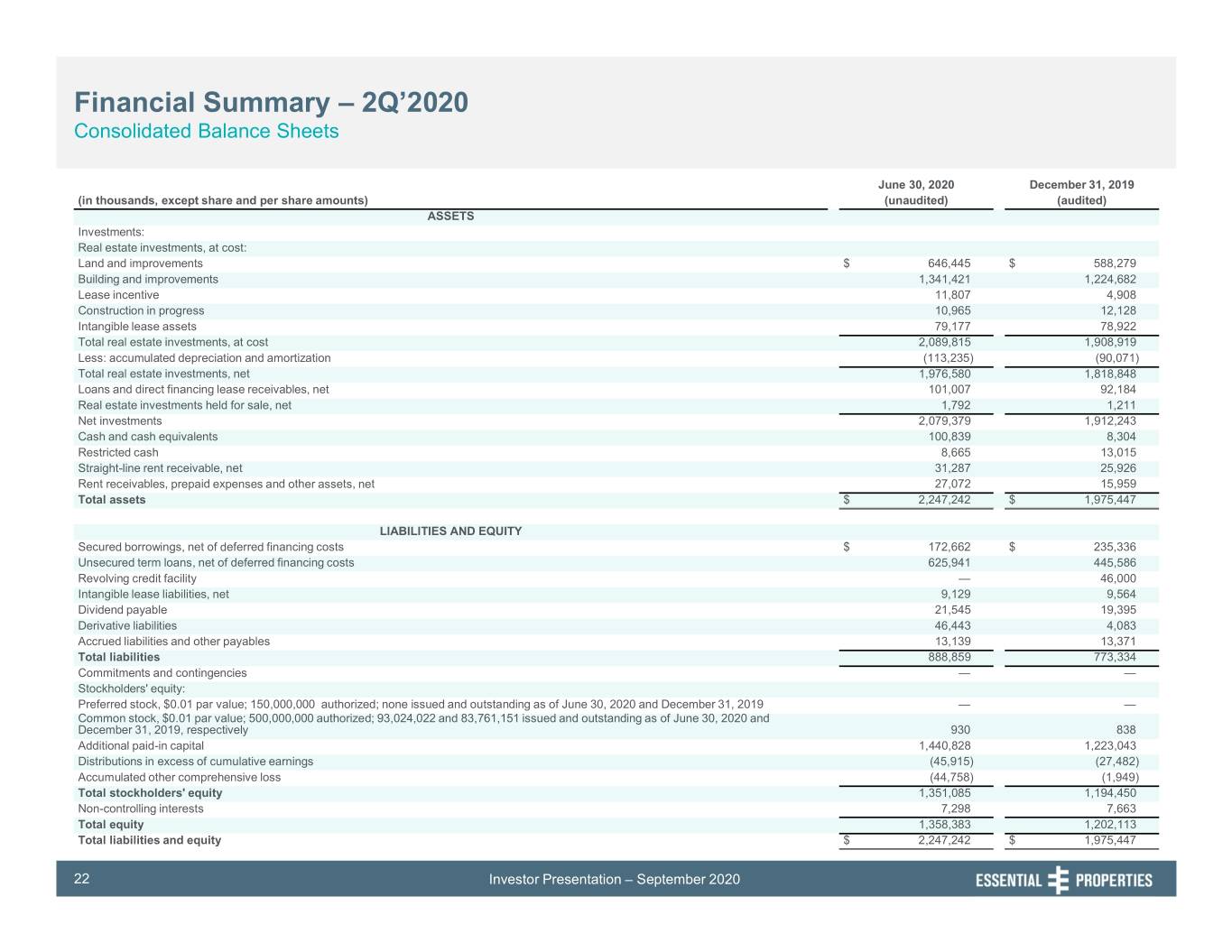

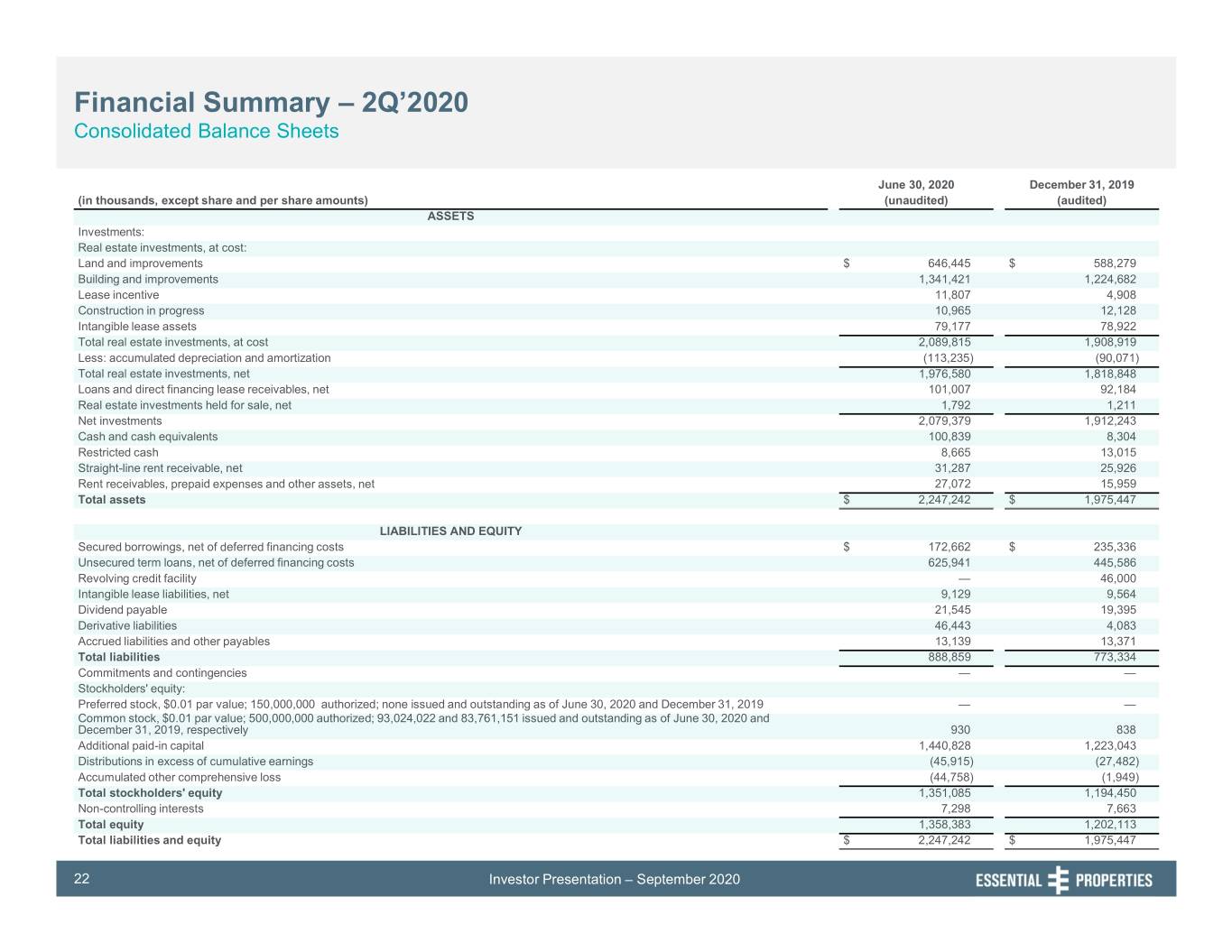

Financial Summary – 2Q’2020 Consolidated Balance Sheets June 30, 2020 December 31, 2019 (in thousands, except share and per share amounts) (unaudited) (audited) ASSETS Investments: Real estate investments, at cost: Land and improvements $ 646,445 $ 588,279 Building and improvements 1,341,421 1,224,682 Lease incentive 11,807 4,908 Construction in progress 10,965 12,128 Intangible lease assets 79,177 78,922 Total real estate investments, at cost 2,089,815 1,908,919 Less: accumulated depreciation and amortization (113,235) (90,071) Total real estate investments, net 1,976,580 1,818,848 Loans and direct financing lease receivables, net 101,007 92,184 Real estate investments held for sale, net 1,792 1,211 Net investments 2,079,379 1,912,243 Cash and cash equivalents 100,839 8,304 Restricted cash 8,665 13,015 Straight-line rent receivable, net 31,287 25,926 Rent receivables, prepaid expenses and other assets, net 27,072 15,959 Total assets $ 2,247,242 $ 1,975,447 LIABILITIES AND EQUITY Secured borrowings, net of deferred financing costs $ 172,662 $ 235,336 Unsecured term loans, net of deferred financing costs 625,941 445,586 Revolving credit facility — 46,000 Intangible lease liabilities, net 9,129 9,564 Dividend payable 21,545 19,395 Derivative liabilities 46,443 4,083 Accrued liabilities and other payables 13,139 13,371 Total liabilities 888,859 773,334 Commitments and contingencies — — Stockholders' equity: Preferred stock, $0.01 par value; 150,000,000 authorized; none issued and outstanding as of June 30, 2020 and December 31, 2019 — — Common stock, $0.01 par value; 500,000,000 authorized; 93,024,022 and 83,761,151 issued and outstanding as of June 30, 2020 and December 31, 2019, respectively 930 838 Additional paid-in capital 1,440,828 1,223,043 Distributions in excess of cumulative earnings (45,915) (27,482) Accumulated other comprehensive loss (44,758) (1,949) Total stockholders' equity 1,351,085 1,194,450 Non-controlling interests 7,298 7,663 Total equity 1,358,383 1,202,113 Total liabilities and equity $ 2,247,242 $ 1,975,447 22 Investor Presentation – September 2020

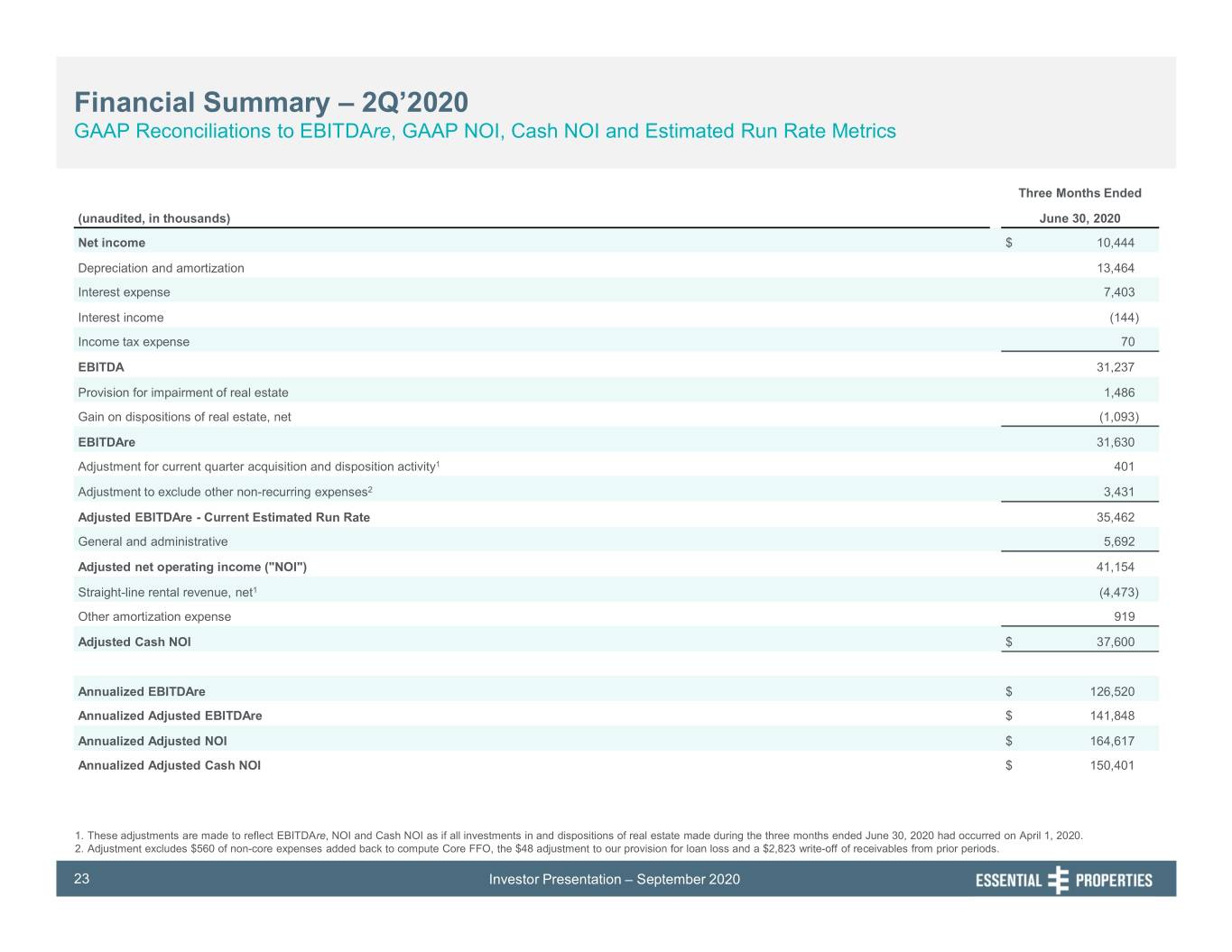

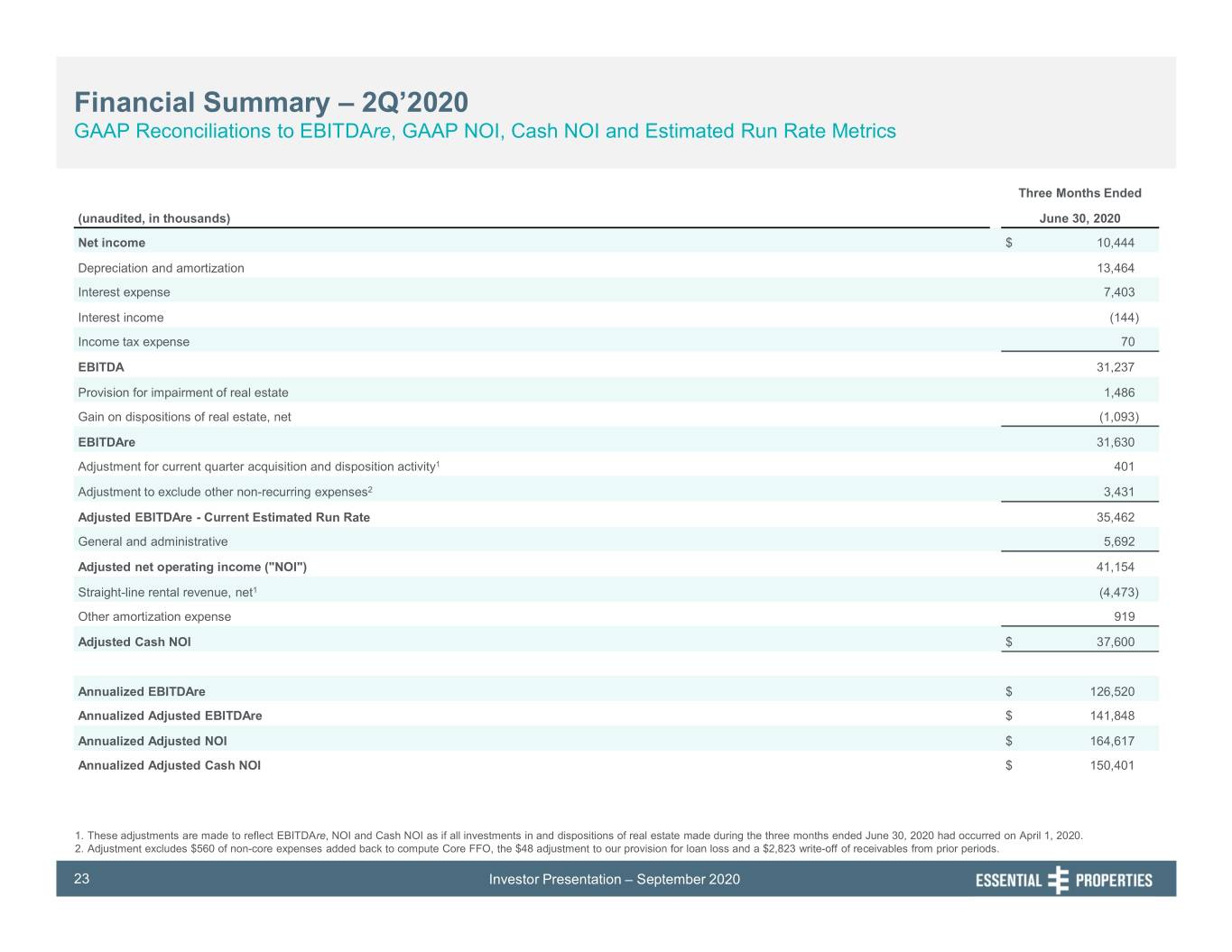

Financial Summary – 2Q’2020 GAAP Reconciliations to EBITDAre, GAAP NOI, Cash NOI and Estimated Run Rate Metrics Three Months Ended (unaudited, in thousands) June 30, 2020 Net income $ 10,444 Depreciation and amortization 13,464 Interest expense 7,403 Interest income (144) Income tax expense 70 EBITDA 31,237 Provision for impairment of real estate 1,486 Gain on dispositions of real estate, net (1,093) EBITDAre 31,630 Adjustment for current quarter acquisition and disposition activity1 401 Adjustment to exclude other non-recurring expenses2 3,431 Adjusted EBITDAre - Current Estimated Run Rate 35,462 General and administrative 5,692 Adjusted net operating income ("NOI") 41,154 Straight-line rental revenue, net1 (4,473) Other amortization expense 919 Adjusted Cash NOI $ 37,600 Annualized EBITDAre $ 126,520 Annualized Adjusted EBITDAre $ 141,848 Annualized Adjusted NOI $ 164,617 Annualized Adjusted Cash NOI $ 150,401 1. These adjustments are made to reflect EBITDAre, NOI and Cash NOI as if all investments in and dispositions of real estate made during the three months ended June 30, 2020 had occurred on April 1, 2020. 2. Adjustment excludes $560 of non-core expenses added back to compute Core FFO, the $48 adjustment to our provision for loan loss and a $2,823 write-off of receivables from prior periods. 23 Investor Presentation – September 2020

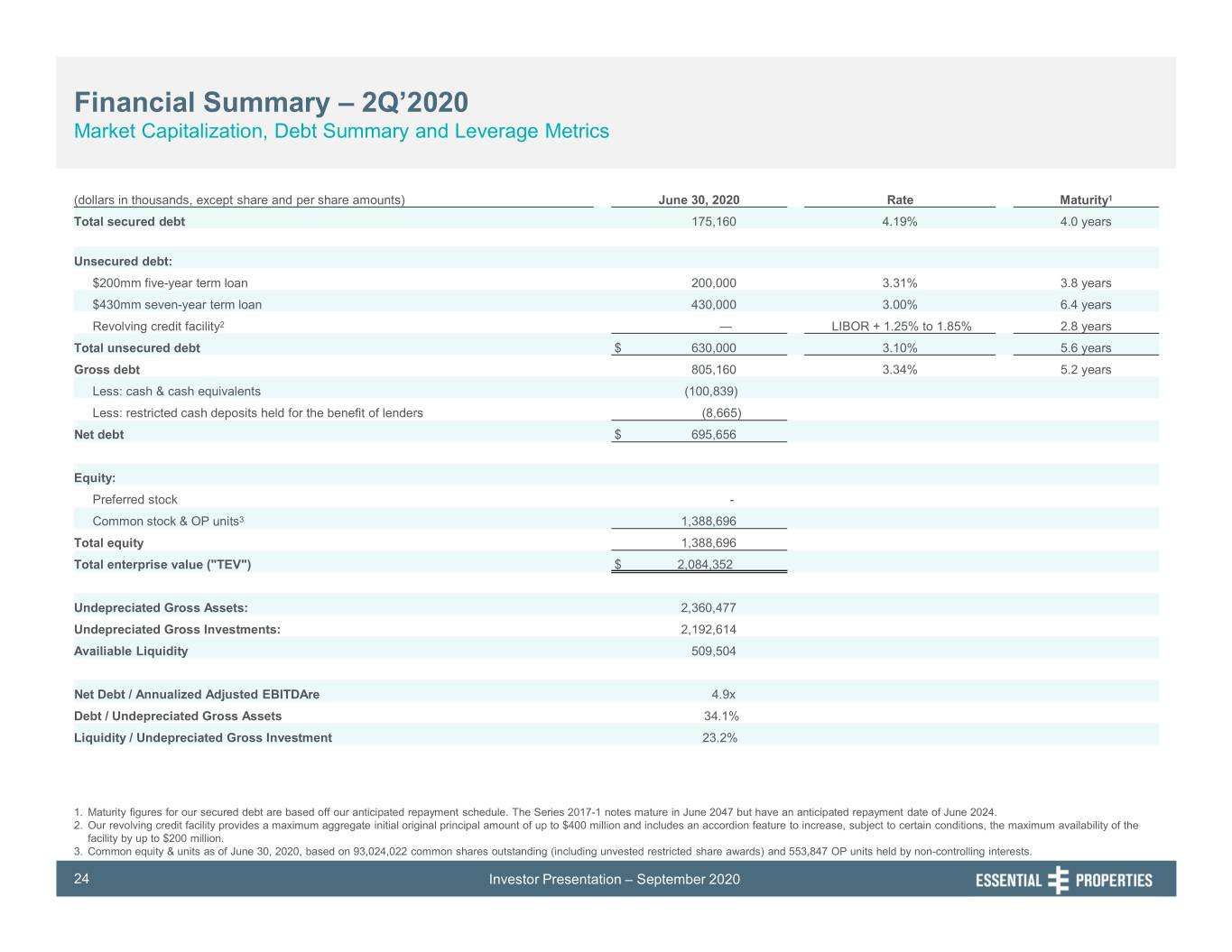

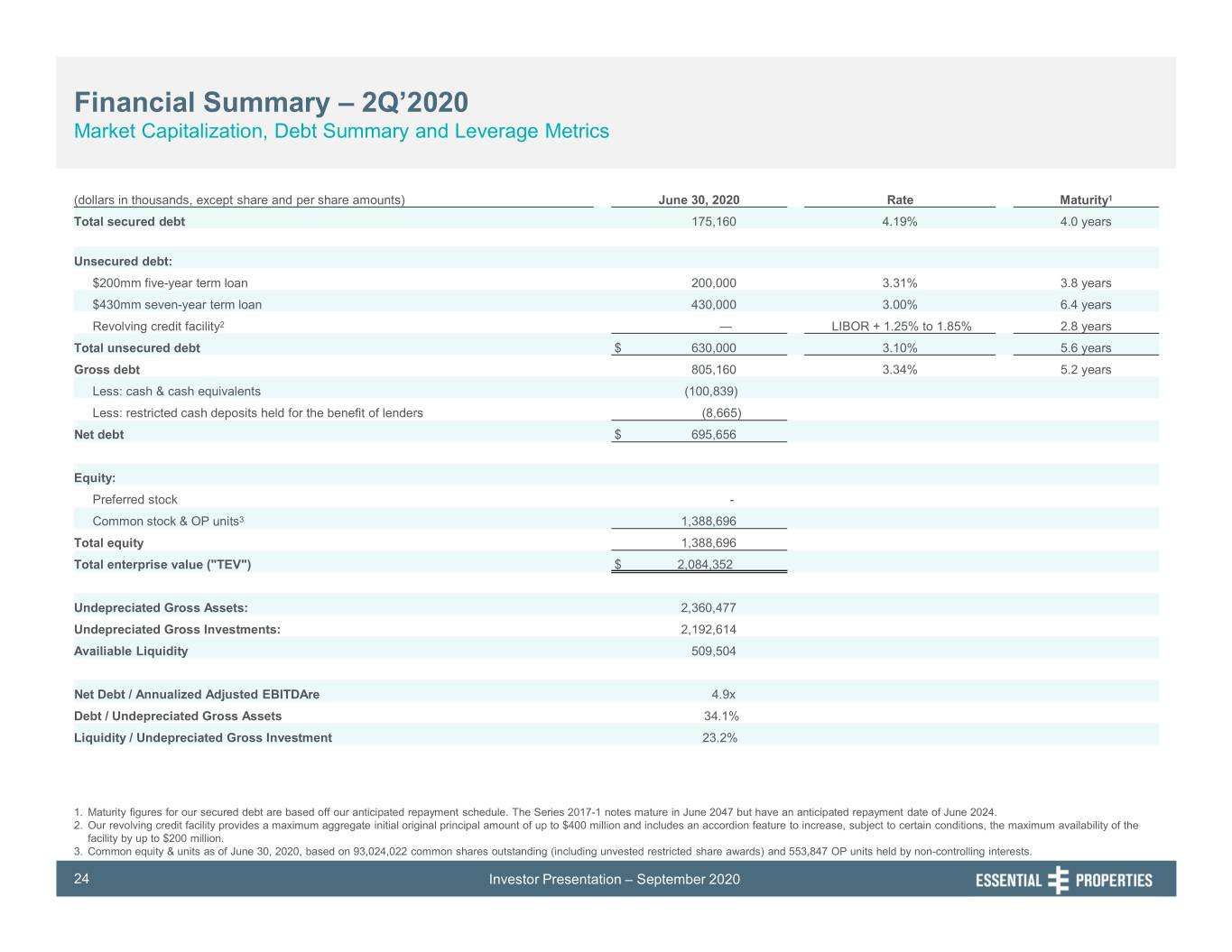

Financial Summary – 2Q’2020 Market Capitalization, Debt Summary and Leverage Metrics (dollars in thousands, except share and per share amounts) June 30, 2020 Rate Maturity1 Total secured debt 175,160 4.19% 4.0 years Unsecured debt: $200mm five-year term loan 200,000 3.31% 3.8 years $430mm seven-year term loan 430,000 3.00% 6.4 years Revolving credit facility2 — LIBOR + 1.25% to 1.85% 2.8 years Total unsecured debt $ 630,000 3.10% 5.6 years Gross debt 805,160 3.34% 5.2 years Less: cash & cash equivalents (100,839) Less: restricted cash deposits held for the benefit of lenders (8,665) Net debt $ 695,656 Equity: Preferred stock - Common stock & OP units3 1,388,696 Total equity 1,388,696 Total enterprise value ("TEV") $ 2,084,352 Undepreciated Gross Assets: 2,360,477 Undepreciated Gross Investments: 2,192,614 Availiable Liquidity 509,504 Net Debt / Annualized Adjusted EBITDAre 4.9x Debt / Undepreciated Gross Assets 34.1% Liquidity / Undepreciated Gross Investment 23.2% 1. Maturity figures for our secured debt are based off our anticipated repayment schedule. The Series 2017-1 notes mature in June 2047 but have an anticipated repayment date of June 2024. 2. Our revolving credit facility provides a maximum aggregate initial original principal amount of up to $400 million and includes an accordion feature to increase, subject to certain conditions, the maximum availability of the facility by up to $200 million. 3. Common equity & units as of June 30, 2020, based on 93,024,022 common shares outstanding (including unvested restricted share awards) and 553,847 OP units held by non-controlling interests. 24 Investor Presentation – September 2020

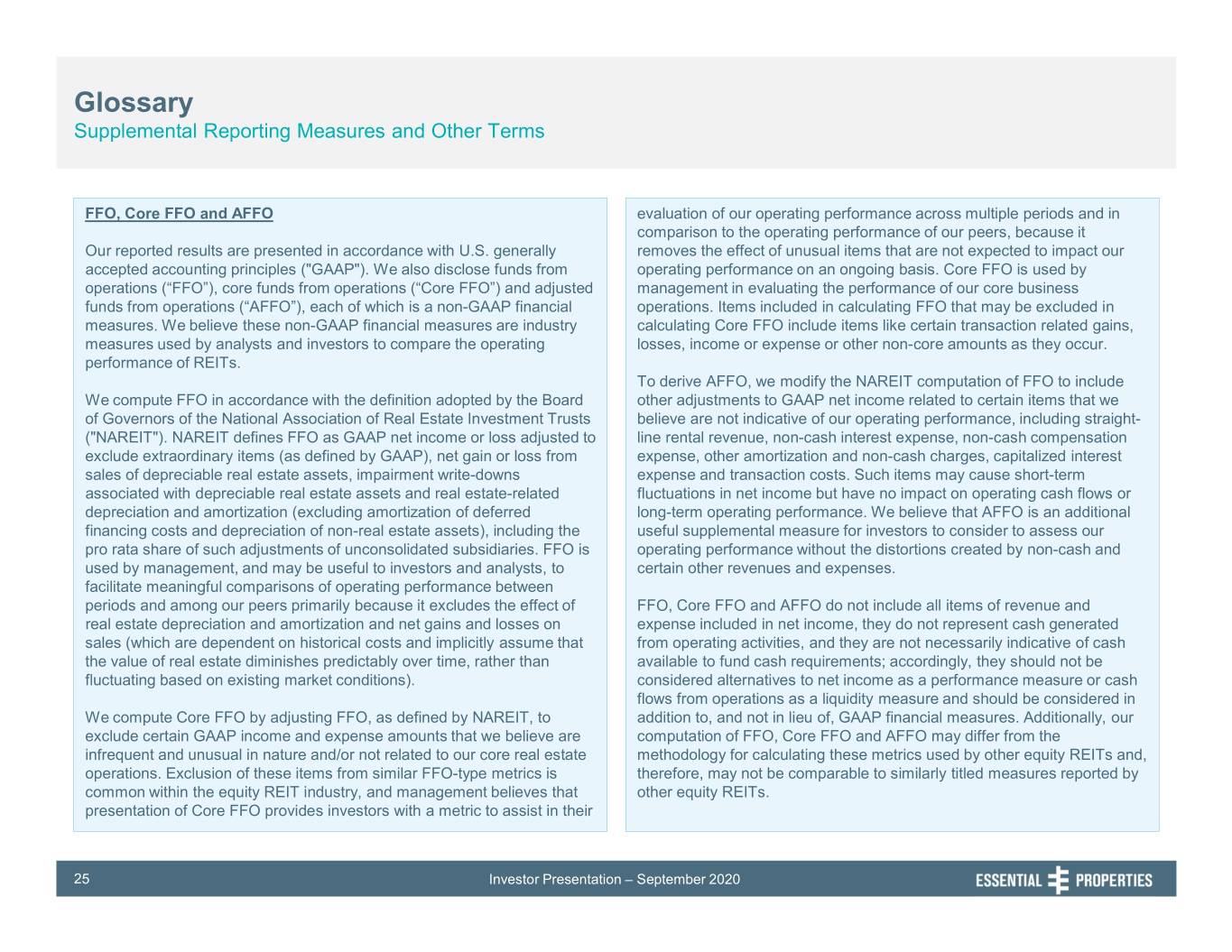

Glossary Supplemental Reporting Measures and Other Terms FFO, Core FFO and AFFO evaluation of our operating performance across multiple periods and in comparison to the operating performance of our peers, because it Our reported results are presented in accordance with U.S. generally removes the effect of unusual items that are not expected to impact our accepted accounting principles ("GAAP"). We also disclose funds from operating performance on an ongoing basis. Core FFO is used by operations (“FFO”), core funds from operations (“Core FFO”) and adjusted management in evaluating the performance of our core business funds from operations (“AFFO”), each of which is a non-GAAP financial operations. Items included in calculating FFO that may be excluded in measures. We believe these non-GAAP financial measures are industry calculating Core FFO include items like certain transaction related gains, measures used by analysts and investors to compare the operating losses, income or expense or other non-core amounts as they occur. performance of REITs. To derive AFFO, we modify the NAREIT computation of FFO to include We compute FFO in accordance with the definition adopted by the Board other adjustments to GAAP net income related to certain items that we of Governors of the National Association of Real Estate Investment Trusts believe are not indicative of our operating performance, including straight- ("NAREIT"). NAREIT defines FFO as GAAP net income or loss adjusted to line rental revenue, non-cash interest expense, non-cash compensation exclude extraordinary items (as defined by GAAP), net gain or loss from expense, other amortization and non-cash charges, capitalized interest sales of depreciable real estate assets, impairment write-downs expense and transaction costs. Such items may cause short-term associated with depreciable real estate assets and real estate-related fluctuations in net income but have no impact on operating cash flows or depreciation and amortization (excluding amortization of deferred long-term operating performance. We believe that AFFO is an additional financing costs and depreciation of non-real estate assets), including the useful supplemental measure for investors to consider to assess our pro rata share of such adjustments of unconsolidated subsidiaries. FFO is operating performance without the distortions created by non-cash and used by management, and may be useful to investors and analysts, to certain other revenues and expenses. facilitate meaningful comparisons of operating performance between periods and among our peers primarily because it excludes the effect of FFO, Core FFO and AFFO do not include all items of revenue and real estate depreciation and amortization and net gains and losses on expense included in net income, they do not represent cash generated sales (which are dependent on historical costs and implicitly assume that from operating activities, and they are not necessarily indicative of cash the value of real estate diminishes predictably over time, rather than available to fund cash requirements; accordingly, they should not be fluctuating based on existing market conditions). considered alternatives to net income as a performance measure or cash flows from operations as a liquidity measure and should be considered in We compute Core FFO by adjusting FFO, as defined by NAREIT, to addition to, and not in lieu of, GAAP financial measures. Additionally, our exclude certain GAAP income and expense amounts that we believe are computation of FFO, Core FFO and AFFO may differ from the infrequent and unusual in nature and/or not related to our core real estate methodology for calculating these metrics used by other equity REITs and, operations. Exclusion of these items from similar FFO-type metrics is therefore, may not be comparable to similarly titled measures reported by common within the equity REIT industry, and management believes that other equity REITs. presentation of Core FFO provides investors with a metric to assist in their 25 Investor Presentation – September 2020

Glossary Supplemental Reporting Measures and Other Terms We also present our earnings before interest, taxes and depreciation and may not be comparable to similarly titled measures reported by other amortization for real estate (“EBITDA”), EBITDA further adjusted to equity REITs. exclude gains (or losses) on sales of depreciable property and real estate impairment losses (“EBITDAre”), net debt, net operating income (“NOI”) Net Debt and cash NOI (“Cash NOI”), all of which are non-GAAP financial measures. We believe these non-GAAP financial measures are accepted We calculate our net debt as our gross debt (defined as total debt plus net industry measures used by analysts and investors to compare the deferred financing costs on our secured borrowings) less cash and cash operating performance of REITs. equivalents and restricted cash deposits held for the benefit of lenders. EBITDA and EBITDAre We believe excluding cash and cash equivalents and restricted cash deposits held for the benefit of lenders from gross debt, all of which could We compute EBITDA as earnings before interest, income taxes and be used to repay debt, provides an estimate of the net contractual amount depreciation and amortization. In 2017, NAREIT issued a white paper of borrowed capital to be repaid, which we believe is a beneficial recommending that companies that report EBITDA also report EBITDAre. disclosure to investors and analysts. We compute EBITDAre in accordance with the definition adopted by NAREIT. NAREIT defines EBITDAre as EBITDA (as defined above) NOI and Cash NOI excluding gains (or losses) from the sales of depreciable property and real estate impairment losses. We present EBITDA and EBITDAre as they are We compute NOI as total revenues less property expenses. NOI excludes measures commonly used in our industry and we believe that these all other items of expense and income included in the financial statements measures are useful to investors and analysts because they provide in calculating net income or loss. Cash NOI further excludes non-cash important supplemental information concerning our operating items included in total revenues and property expenses, such as straight- performance, exclusive of certain non-cash and other costs. We use line rental revenue and other amortization and non-cash charges. We EBITDA and EBITDAre as measures of our operating performance and believe NOI and Cash NOI provide useful and relevant information not as measures of liquidity. because they reflect only those income and expense items that are incurred at the property level and present such items on an unlevered EBITDA and EBITDAre do not include all items of revenue and expense basis. included in net income, they do not represent cash generated from operating activities and they are not necessarily indicative of cash NOI and Cash NOI are not measurements of financial performance under available to fund cash requirements; accordingly, the should not be GAAP. You should not consider our NOI and Cash NOI as alternatives to considered alternatives to net income as a performance measure or cash net income or cash flows from operating activities determined in flows from operations as a liquidity measure and should be considered in accordance with GAAP. Additionally, our computation of NOI and Cash addition to, and not in lieu of, GAAP financial measures. Additionally, our NOI may differ from the methodology for calculating these metrics used by computation of EBITDA and EBITDAre may differ from the methodology other equity REITs and, therefore, may not be comparable to similarly for calculating these metrics used by other equity REITs and, therefore, titled measures reported by other equity REITs. 26 Investor Presentation – September 2020

Glossary Supplemental Reporting Measures and Other Terms Adjusted EBITDAre / Adjusted NOI / Adjusted Cash NOI GE Seed Portfolio We further adjust EBITDAre, NOI and Cash NOI i) based on an estimate GE seed portfolio means our acquisition of a portfolio of 262 net leased calculated as if all investment and disposition activity that took place properties on June 16, 2016, consisting primarily of restaurants, that were during the quarter had been made on the first day of the quarter, ii) to being sold as part of the liquidation of General Electric Capital Corporation exclude certain GAAP income and expense amounts that we believe are for an aggregate purchase price of $279.8 million (including transaction infrequent and unusual in nature and iii) to eliminate the impact of lease costs). termination fees and contingent rental revenue from our tenants which is subject to sales thresholds specified in the lease. We then annualize these GAAP Cap Rate estimates for the current quarter by multiplying them by four, which we believe provides a meaningful estimate of our current run rate for all GAAP Cap Rate means annualized rental income computed in investments as of the end of the current quarter. You should not unduly accordance with GAAP for the first full month after investment divided by rely on these measures, as they are based on assumptions and estimates the purchase price, as applicable, for the property. that may prove to be inaccurate. Our actual reported EBITDAre, NOI and Cash NOI for future periods may be significantly less than these estimates Cash Cap Rate of current run rates. Cash Cap Rate means annualized contractually specified cash base rent Cash ABR for the first full month after investment or disposition divided by the purchase or sale price, as applicable, for the property. Cash ABR means annualized contractually specified cash base rent in effect as of the end of the current quarter for all of our leases (including Disclaimer those accounted for as direct financing leases) commenced as of that date and annualized cash interest on our mortgage loans receivable as of that Essential Properties Realty Trust, Inc. and the Essential Properties Realty date. Trust REIT are not affiliated with or sponsored by Griffin Capital Essential Asset Operating Partnership, L.P. or the Griffin Capital Essential Asset Rent Coverage Ratio REIT, information about which can be obtained at (https://www.gcear.com). Rent coverage ratio means the ratio of tenant-reported or, when unavailable, management’s estimate based on tenant-reported financial information, annual EBITDA and cash rent attributable to the leased property (or properties, in the case of a master lease) to the annualized base rental obligation as of a specified date. 27 Investor Presentation – September 2020