NOTICE OF ANNUAL & SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON JUNE 11, 2020 AND MANAGEMENT INFORMATION CIRCULAR

VIEMED HEALTHCARE, INC. NOTICE OF ANNUAL & SPECIAL MEETING OF SHAREHOLDERS NOTICE IS HEREBY GIVEN that the annual and special meeting (the “Meeting”) of shareholders of Viemed Healthcare, Inc. (the “Corporation”) will be held at the Homewood Suites by Hilton, 201 Kaliste Saloom, Lafayette, Louisiana, on June 11, 2020 at 9:30 a.m. (CDT) for the following purposes: 1. to receive the audited financial statements of the Corporation for the years ended December 31, 2019 and 2018, and the auditors’ reports thereon; 2. to elect directors of the Corporation for the ensuing year; 3. to appoint auditors of the Corporation for the ensuing year and authorize the directors to fix their remuneration; 4. to consider and, if thought appropriate, to pass an ordinary resolution (the text of which is disclosed in Section 11(iv) of the Management Information Circular) to ratify, confirm and approve a security based compensation plan of the Corporation, as more particularly described in the Management Information Circular; and 5. to transact such further or other business as may properly come before the said meeting or any adjournment or postponement thereof. A copy of the Management Information Circular and a form of proxy accompany this Notice of Meeting (collectively, the “Meeting Materials”). A copy of the Corporation’s Annual Report on Form 10-K (encompassing the audited financial statements of the Corporation for the years ended December 31, 2019 and 2018, and the auditors’ reports thereon, and accompanying management discussion and analysis) will be available for review at the Meeting and is available to the public on the SEDAR website at www.sedar.com and on the SEC’s website at www.sec.gov. The record date for the determination of shareholders entitled to receive notice of and to vote at the Meeting is April 29, 2020 (the “Record Date”). Shareholders of the Corporation whose names have been entered on the register of shareholders at the close of business on the Record Date will be entitled to receive notice of and to vote at the Meeting. A shareholder may attend the Meeting in person or may be represented by proxy. Shareholders who are unable to attend the Meeting or any adjournment or postponement thereof in person are requested to date, sign and return the accompanying form of proxy for use at the Meeting or any adjournment or postponement thereof. This year, as described in the notice and access notification mailed to shareholders of the Corporation, the Corporation will deliver the applicable Meeting Materials to shareholders by posting the Meeting Materials online under the Corporation’s profile at www.sedar.com and at https://www.viemed.com/investor-relations, where they will remain for at least one full year thereafter. The use of this alternative means of delivery is more environmentally friendly as it will help reduce paper use and it will also significantly reduce the Corporation’s printing and mailing costs. Unless physical copies have been requested even when notice and access is being utilized, all shareholders will receive a notice and access notification, together with a proxy or voting instruction form, as applicable, which will contain information on how to obtain electronic and paper copies of the Meeting Materials in advance of the Meeting. The Corporation is actively monitoring the coronavirus disease 2019 (COVID-19) situation and is sensitive to the public health and travel concerns shareholders may have and the protocols that all levels of government may impose. We strongly encourage each shareholder to submit a form of proxy or voting instruction form in advance of the Meeting and to not plan on attending the Meeting in person, in order to comply with government and public health directives regarding social distancing. Depending on the circumstances, the Corporation may not be able to accommodate in-person attendance by all eligible shareholders intending on doing so. DATED this 3rd day of May, 2020. BY ORDER OF THE BOARD (signed) “Casey Hoyt” Chief Executive Officer CAN: 32688610.5

INFORMATION CIRCULAR FOR THE ANNUAL & SPECIAL MEETING OF SHAREHOLDERS OF VIEMED HEALTHCARE, INC. (this information is given as of May 3, 2020) 1. SOLICITATION OF PROXIES This management information circular (the “Circular”) and accompanying form of proxy are furnished in connection with the solicitation, by management of Viemed Healthcare, Inc. (the “Corporation”), of proxies to be used at the annual and special meeting of the holders (the “Shareholders”) of common shares (“Common Shares”) of the Corporation (the “Meeting”) referred to in the accompanying Notice of Meeting (the “Notice”) to be held on June 11, 2020, at the time and place and for the purposes set forth in the Notice. The solicitation will be made primarily by mail, subject to the use of Notice- and-Access Provisions (as defined below) in relation to delivery of the Meeting materials, but proxies may also be solicited personally or by telephone by directors and/or officers of the Corporation, or by the Corporation’s transfer agent, Computershare Investor Services Inc. (“Computershare”), at nominal cost. The cost of solicitation by management will be borne by the Corporation. Pursuant to National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer (“NI 54-101”), arrangements have been made with clearing agencies, brokerage houses and other financial intermediaries to forward proxy solicitation material to the beneficial owners of the Common Shares. The cost of any such solicitation will be borne by the Corporation. 2. NOTICE-AND-ACCESS The Corporation is sending out proxy-related materials to Shareholders using the notice-and-access provisions under National Instrument 51-102 – Continuous Disclosure Obligations (“NI 51-102”) and NI 54-101 (the “Notice-and-Access Provisions”). The Corporation anticipates that use of the Notice-and-Access Provisions will benefit the Corporation by reducing the postage and material costs associated with the printing and mailing of the proxy-related materials and will additionally reduce the environmental impact of such actions. Shareholders will be provided with electronic access to the Notice and this Circular on the System for Electronic Document Analysis and Retrieval (“SEDAR”) at www.sedar.com and at https://www.viemed.com/investor-relations. Shareholders are reminded to review the Circular before voting. Shareholders will receive paper copies of a notice package (the “Notice Package”) via pre-paid mail containing a notice with information prescribed by the Notice-and-Access Provisions and a form of proxy (if you are a registered Shareholder) or a voting instruction form (if you are a non-registered Shareholder). The Corporation will not use procedures known as ‘stratification’ in relation to the use of Notice-and-Access Provisions. Stratification occurs when an issuer using Notice-and-Access Provisions sends a paper copy of the Circular to some securityholders with a Notice Package. Shareholders with questions about notice-and-access can call Computershare toll-free at 1-866-964-0492 (Canada and the U.S. only) or direct at (514) 982-8714 (outside Canada and the U.S.) and entering your 15-digit control number as indicated on your voting instruction form or proxy. Shareholders may obtain paper copies of the Circular free of charge by calling 1-866-852-8343 at any time up until and including the date of the Meeting, including any adjournment or postponement thereof. Any Shareholder wishing to obtain a paper copy of the Meeting materials should submit their request no later than 12:00 p.m. (EST) on June 1, 2020 in order to receive paper copies of the Meeting materials in time to vote before the Meeting. Under the Notice-and-Access Provisions, Meeting materials will be available for viewing on the Corporation’s website for one year from the date of posting. 3. RECORD DATE Shareholders of record at the close of business on April 29, 2020 (the “Record Date”) are entitled to receive notice of and attend the Meeting in person or by proxy and are entitled to one vote for each Common Share registered in the name of such Shareholder in respect of each matter to be voted upon at the Meeting. 4. APPOINTMENT OF PROXIES The persons named in the enclosed form of proxy are directors and/or officers of the Corporation. Each Shareholder submitting a proxy has the right to appoint a person or company (who need not be a Shareholder), other than the persons named in the enclosed form of proxy, to represent such Shareholder at the Meeting or any adjournment or postponement thereof. Such right may be exercised by inserting the name of such representative in the blank space provided in the enclosed form of proxy. All proxies must - 1 - CAN: 32676414.8

be executed by the Shareholder or his or her attorney duly authorized in writing or, if the Shareholder is a corporation, by an officer or attorney thereof duly authorized. A proxy will not be valid for the Meeting or any adjournment or postponement thereof unless it is completed and delivered to Computershare no later than 9:30 a.m. (CST) on June 9, 2020 (or, if the Meeting is adjourned or postponed, 48 hours (Saturdays, Sundays and holidays excepted) prior to the time of holding the Meeting) in accordance with the delivery instructions below or delivered to the chairman (the “Chairman”) of the board of directors of the Corporation (the “Board”) on the day of the Meeting, prior to the commencement of the Meeting or any adjournment or postponement thereof. The time limit for deposit of proxies may be waived or extended by the Chairman of the Meeting at his discretion, without notice. A registered Shareholder may submit his/her/its proxy by mail, by telephone or over the internet in accordance with the instructions below. A non-registered Shareholder should follow the instructions included on the voting instruction form provided by his or her Intermediary (as defined below). Voting Instructions for Registered Holders A registered Shareholder may submit a proxy by (i) mailing a copy to Computershare Investor Services Inc., Attention: Proxy Department, 8th Floor, 100 University Avenue, Toronto, Ontario M5J 2Y1, (ii) telephone by entering the 15 digit control number at 1-866-732-8683 (Canada and the U.S. only) or (312) 588-4290 (outside Canada and the U.S.), or (iii) online by entering the 15 digit control number at www.investorvote.com. 5. REVOCATION OF PROXIES Proxies given by Shareholders for use at the Meeting may be revoked at any time prior to their use. Subject to compliance with the requirements described in the following paragraph, the giving of a proxy will not affect the right of a Shareholder to attend, and vote in person at, the Meeting. In addition to revocation in any other manner permitted by law, a proxy may be revoked by instrument in writing executed by the Shareholder or his/her attorney duly authorized in writing, or, if the Shareholder is a corporation, under its corporate seal by an officer or attorney thereof duly authorized and deposited with Computershare, in a manner provided above under “Proxy and Voting Information – Appointment of Proxies”, at any time up to and including 9:30 a.m. (CST) on June 9, 2020 (or, if the Meeting is adjourned or postponed, 48 hours (Saturdays, Sundays and holidays excepted) prior to the holding of the Meeting) or, with the Chairman at the Meeting on the day of such meeting or any adjournment or postponement thereof, and upon any such deposit, the proxy is revoked. 6. NON-REGISTERED HOLDERS Only registered Shareholders, or the persons they appoint as their proxies, are permitted to attend and vote at the Meeting. However, in many cases, Common Shares beneficially owned by a non-registered Shareholder (a “Non-Registered Holder”) are registered either (i) in the name of an intermediary (each, an “Intermediary” and collectively, the “Intermediaries”) that the Non-Registered Holder deals with in respect of the Common Shares, such as, among others, banks, trust companies, securities dealers or brokers and trustees or administrators of self-administered registered savings plans, registered retirement income funds, registered education savings plans and similar plans, or (ii) in the name of a clearing agency (such as CDS Clearing and Depository Services Inc.) of which the Intermediary is a participant. In accordance with the requirements of NI 54-101, the Corporation has distributed copies of the form of proxy and supplemental mailing card (collectively, the “Meeting Materials”) to the clearing agencies and Intermediaries for onward distribution to Non- Registered Holders. Intermediaries are required to forward the Meeting Materials to Non-Registered Holders unless a Non-Registered Holder has waived the right to receive them. Intermediaries will generally use service companies (such as Broadridge Financial Solutions, Inc.) to forward the Meeting Materials to Non-Registered Holders. Generally, a Non-Registered Holder who has not waived the right to receive Meeting Materials will receive either a voting instruction form or, less frequently, a form of proxy. The purpose of these forms is to permit Non-Registered Holders to direct the voting of the Common Shares they beneficially own. Non-Registered Holders should follow the procedures set out below, depending on the type of form they receive: (1) Voting Instruction Form. In most cases, a Non-Registered Holder will receive, as part of the Meeting Materials, a voting instruction form. If the Non-Registered Holder does not wish to attend and vote at the Meeting in person (or have another person attend and vote on the Non- Registered Holder’s behalf), but wishes to direct the voting of the Common Shares they beneficially own, the voting instruction form must be submitted by mail, telephone or over the internet in accordance with the directions on the form. If a Non-Registered Holder wishes to attend and vote at the Meeting in person (or have another person attend and vote on the Non-Registered Holder’s behalf), the Non-Registered Holder must CAN: 32676414.8 - 2 -

complete, sign and return the voting instruction form in accordance with the directions provided and a form of proxy giving the right to attend and vote will be forwarded to the Non-Registered Holder; or (2) Form of Proxy. Less frequently, a Non-Registered Holder will receive, as part of the Meeting Materials, a form of proxy that has already been signed by the Intermediary (typically by facsimile, stamped signature) which is restricted as to the number of Common Shares beneficially owned by the Non-Registered Holder but which is otherwise uncompleted. If the Non-Registered Holder does not wish to attend and vote at the Meeting in person (or have another person attend and vote on the Non-Registered Holder’s behalf) but wishes to direct the voting of the Common Shares they beneficially own, the Non-Registered Holder must complete the form of proxy and submit it to Computershare as described above. If a Non-Registered Holder wishes to attend and vote at the Meeting in person (or have another person attend and vote on the Non-Registered Holder’s behalf), the Non-Registered Holder must strike out the persons named in the proxy and insert the Non-Registered Holder’s (or such other person’s) name in the blank space provided. In either case, Non-Registered Holders should carefully follow the instructions of their Intermediaries, including those regarding when and where the proxy or the voting instruction form is to be delivered. A Non-Registered Holder may revoke a voting instruction form or a waiver of the right to receive Meeting Materials and to vote given to an Intermediary at any time by written notice to the Intermediary, except that an Intermediary is not required to act on a revocation of a voting instruction form or of a waiver of the right to receive materials and to vote that is not received by the Intermediary at least seven days prior to the Meeting. A Non-Registered Holder may fall into two categories – those who object to their identity being made known to the issuers of the securities which they own (“Objecting Beneficial Owners”) and those who do not object to their identity being made known to the issuers of the securities which they own (“Non-Objecting Beneficial Owners”). Subject to the provisions of NI 54-101, issuers may request and obtain a list of their Non-Objecting Beneficial Owners from Intermediaries. Pursuant to NI 54-101, issuers may obtain and use the Non-Objecting Beneficial Owners list in connection with any matters relating to the affairs of the issuer, including the distribution of proxy-related materials directly to Non-Objecting Beneficial Owners. The Corporation is sending Meeting Materials directly to Non-Objecting Beneficial Owners; the Corporation uses and pays Intermediaries and agents to send the Meeting Materials. The Corporation also intends to pay for Intermediaries to deliver the Meeting Materials to Objecting Beneficial Owners. These securityholder materials are being sent to both registered Shareholders and Non- Registered Holders utilizing the Notice- and-Access Provisions. If you are a Non-Registered Holder, and the Corporation or its agent sent these materials directly to you, your name, address and information about your holdings of securities, have been obtained in accordance with applicable securities regulatory requirements from the Intermediary holding securities on your behalf. By choosing to send these materials to you directly utilizing the Notice-and-Access Provisions, the Corporation (and not the Intermediary holding securities on your behalf) has assumed responsibility for (i) delivering these materials to you, and (ii) executing your proper voting instructions. Please return your voting instruction form as specified in the request for voting instructions that was sent to you. 7. EXERCISE OF DISCRETION BY PROXIES Common Shares represented by properly executed proxies in favour of the persons named in the enclosed form of proxy will be voted on any ballot that may be called for and, where the person whose proxy is solicited specifies a choice with respect to the matters identified in the proxy, the Common Shares will be voted or withheld from voting in accordance with the specifications so made. Where Shareholders have properly executed proxies in favour of the persons named in the enclosed form of proxy and have not specified in the form of proxy the manner in which the named proxies are required to vote the Common Shares represented thereby, such shares will be voted in favour of the passing of the matters set forth in the Notice. If a Shareholder appoints a representative other than the persons designated in the form of proxy, the Corporation assumes no responsibility as to whether the representative so appointed will attend the Meeting on the day thereof or any adjournment or postponement thereof. The enclosed form of proxy confers discretionary authority with respect to amendments or variations to the matters identified in the Notice and with respect to other matters that may properly come before the Meeting. At the date hereof, the management of the Corporation and the directors of the Corporation know of no such amendments, variations or other matters to come before the Meeting. However, if any other matters which at present are not known to the management of the Corporation and the directors of the Corporation should properly come before the Meeting, the proxy will be voted on such matters in accordance with the best judgment of the named proxies Unless otherwise indicated in this Circular and in the form of proxy and Notice attached hereto, Shareholders shall mean registered Shareholders. CAN: 32676414.8 - 3 -

8. INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON Except as described elsewhere in this Circular, management of the Corporation is not aware of any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, of (a) any director or executive officer of the Corporation, (b) any proposed nominee for election as a director of the Corporation, and (c) any associates or affiliates of any of the persons or companies listed in (a) and (b), in any matter to be acted on at the Meeting. 9. VOTING SECURITIES AND PRINCIPAL HOLDERS As at the date hereof, the Corporation had 38,486,772 Common Shares outstanding, representing the Corporation’s only securities with respect to which a voting right may be exercised at the Meeting. Each Common Share carries the right to one vote at the Meeting. A quorum for the transaction of business at the Meeting is two shareholders, or one or more proxyholders representing two shareholders, or one shareholder and a proxyholder representing another shareholder, holding or representing not less than five percent (5%) of the issued and outstanding Common Shares enjoying voting rights at the Meeting. To the knowledge of the Board and senior officers of the Corporation as at the date hereof, based on information provided on the System for Disclosure by Insiders (SEDI) and on information filed by third parties on the System for Electronic Document Analysis and Retrieval (SEDAR), no person or corporation beneficially owned, directly or indirectly, or exercised control or discretion over, voting securities of the Corporation carrying more than 10% of the voting rights attached to any class of voting securities of the Corporation. 10. THE ARRANGEMENT WITH PHM The Corporation was incorporated under the Business Corporations Act (British Columbia) (the “BCBCA”) on December 14, 2016 as a wholly-owned subsidiary of Protech Home Medical Corp. (“PHM”) (formerly Patient Home Monitoring Corp.). On December 21, 2017, pursuant to an arrangement under the provisions of Division 5 of Part 9 of the BCBCA (the “Arrangement”) involving the Corporation, PHM and the securityholders of PHM, PHM completed a spin-out of the Corporation. Accordingly, on December 21, 2017, following completion of the Arrangement, the Corporation became a reporting issuer under Canadian securities laws with a financial year end of December 31. Prior to the Arrangement, the operating businesses of the Corporation, Sleep Management, L.L.C. and Home Sleep Delivered, L.L.C., were subsidiaries of PHM. 11. BUSINESS OF THE MEETING To the knowledge of the Board, the only matters to be brought before the Meeting are those set forth in the accompanying Notice. (i) Financial Statements Pursuant to the BCBCA, the Board will place before the shareholders at the Meeting the audited financial statements of the Corporation for the years ended December 31, 2019 and 2018, and the auditors’ reports thereon. Shareholder approval is not required in relation to the financial statements. (ii) Election of Directors The Board presently consists of seven directors. All of the current directors have been directors since the dates indicated below and all will be standing for re-election. The Board has the authority to set the number of directors, such number presently being fixed at seven. The Board recommends that shareholders vote FOR the election of the seven nominees of management listed in the following table. Each director will hold office until his re-election or replacement at the next annual meeting of the shareholders unless he resigns his duties or his office becomes vacant following his death, dismissal or any other cause prior to such meeting. Unless otherwise instructed, proxies and voting instructions given pursuant to this solicitation by the management of the Corporation will be voted for the election of the proposed nominees. If any proposed nominee is unable to serve as a director, the individuals named in the enclosed form of proxy reserve the right to nominate and vote for another nominee in their discretion. Advance Notice Provisions The Corporation’s Articles provide for advance notice of nominations of directors which require that advance notice be provided to the Corporation in circumstances where nominations of persons for election to the Board are made by shareholders of the CAN: 32676414.8 - 4 -

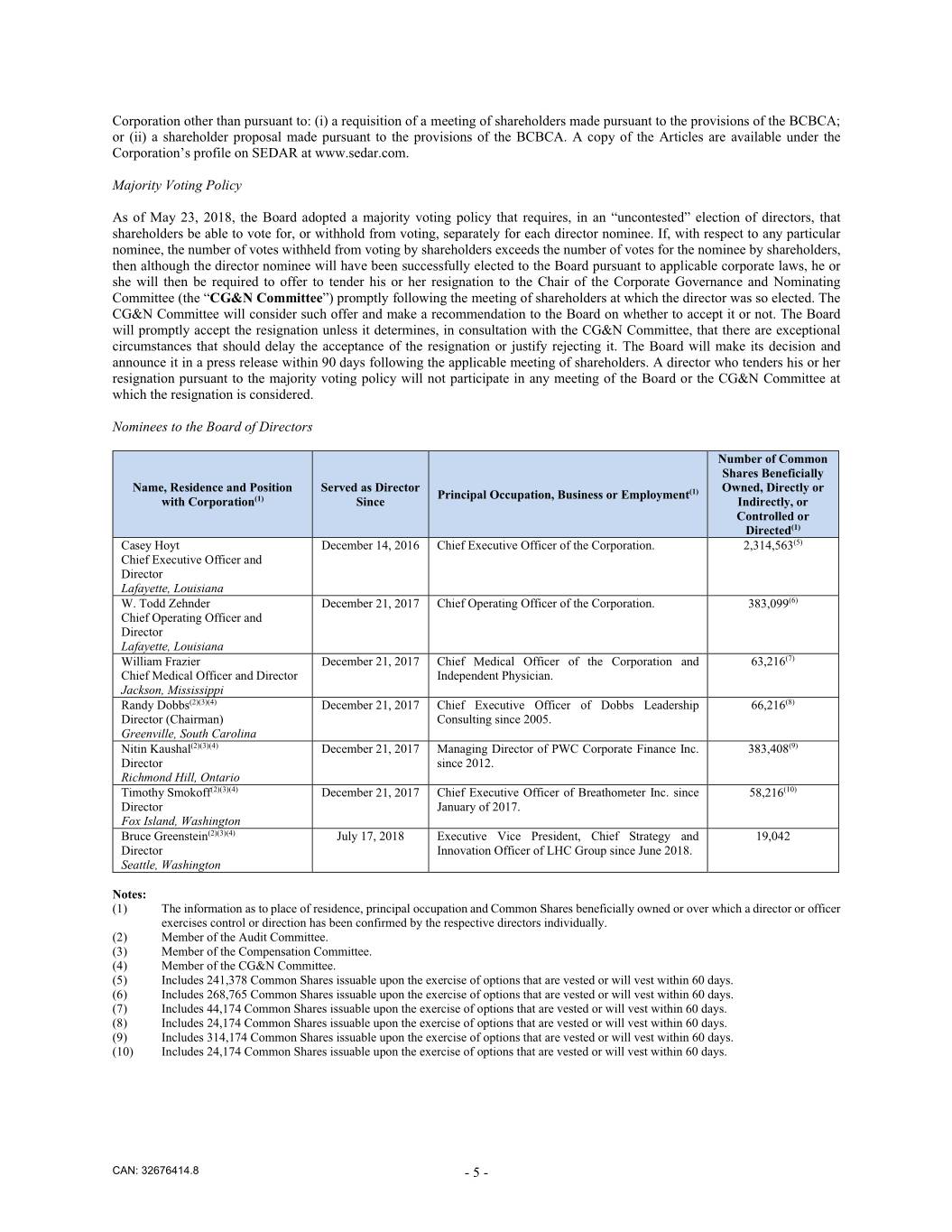

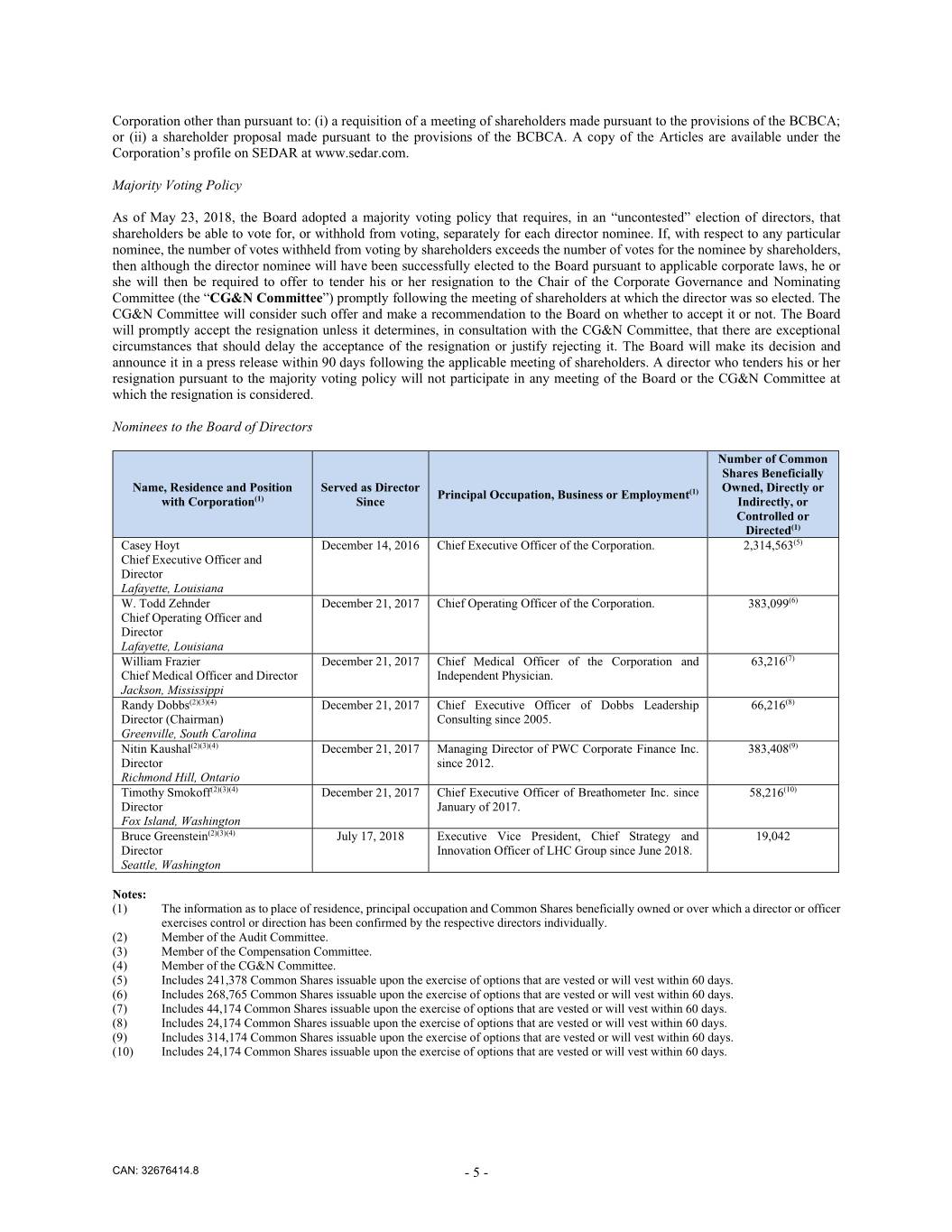

Corporation other than pursuant to: (i) a requisition of a meeting of shareholders made pursuant to the provisions of the BCBCA; or (ii) a shareholder proposal made pursuant to the provisions of the BCBCA. A copy of the Articles are available under the Corporation’s profile on SEDAR at www.sedar.com. Majority Voting Policy As of May 23, 2018, the Board adopted a majority voting policy that requires, in an “uncontested” election of directors, that shareholders be able to vote for, or withhold from voting, separately for each director nominee. If, with respect to any particular nominee, the number of votes withheld from voting by shareholders exceeds the number of votes for the nominee by shareholders, then although the director nominee will have been successfully elected to the Board pursuant to applicable corporate laws, he or she will then be required to offer to tender his or her resignation to the Chair of the Corporate Governance and Nominating Committee (the “CG&N Committee”) promptly following the meeting of shareholders at which the director was so elected. The CG&N Committee will consider such offer and make a recommendation to the Board on whether to accept it or not. The Board will promptly accept the resignation unless it determines, in consultation with the CG&N Committee, that there are exceptional circumstances that should delay the acceptance of the resignation or justify rejecting it. The Board will make its decision and announce it in a press release within 90 days following the applicable meeting of shareholders. A director who tenders his or her resignation pursuant to the majority voting policy will not participate in any meeting of the Board or the CG&N Committee at which the resignation is considered. Nominees to the Board of Directors Number of Common Shares Beneficially Name, Residence and Position Served as Director Owned, Directly or Principal Occupation, Business or Employment(1) with Corporation(1) Since Indirectly, or Controlled or Directed(1) Casey Hoyt December 14, 2016 Chief Executive Officer of the Corporation. 2,314,563(5) Chief Executive Officer and Director Lafayette, Louisiana W. Todd Zehnder December 21, 2017 Chief Operating Officer of the Corporation. 383,099(6) Chief Operating Officer and Director Lafayette, Louisiana William Frazier December 21, 2017 Chief Medical Officer of the Corporation and 63,216(7) Chief Medical Officer and Director Independent Physician. Jackson, Mississippi Randy Dobbs(2)(3)(4) December 21, 2017 Chief Executive Officer of Dobbs Leadership 66,216(8) Director (Chairman) Consulting since 2005. Greenville, South Carolina Nitin Kaushal(2)(3)(4) December 21, 2017 Managing Director of PWC Corporate Finance Inc. 383,408(9) Director since 2012. Richmond Hill, Ontario Timothy Smokoff(2)(3)(4) December 21, 2017 Chief Executive Officer of Breathometer Inc. since 58,216(10) Director January of 2017. Fox Island, Washington Bruce Greenstein(2)(3)(4) July 17, 2018 Executive Vice President, Chief Strategy and 19,042 Director Innovation Officer of LHC Group since June 2018. Seattle, Washington Notes: (1) The information as to place of residence, principal occupation and Common Shares beneficially owned or over which a director or officer exercises control or direction has been confirmed by the respective directors individually. (2) Member of the Audit Committee. (3) Member of the Compensation Committee. (4) Member of the CG&N Committee. (5) Includes 241,378 Common Shares issuable upon the exercise of options that are vested or will vest within 60 days. (6) Includes 268,765 Common Shares issuable upon the exercise of options that are vested or will vest within 60 days. (7) Includes 44,174 Common Shares issuable upon the exercise of options that are vested or will vest within 60 days. (8) Includes 24,174 Common Shares issuable upon the exercise of options that are vested or will vest within 60 days. (9) Includes 314,174 Common Shares issuable upon the exercise of options that are vested or will vest within 60 days. (10) Includes 24,174 Common Shares issuable upon the exercise of options that are vested or will vest within 60 days. CAN: 32676414.8 - 5 -

Corporate Cease Trade Orders or Bankruptcies None of the proposed directors of the Corporation is, as at the date hereof, or has been, within the previous 10 years, a director, chief executive officer or chief financial officer of any company (including the Corporation) that, (i) was subject to an order that was issued while the proposed director was acting in the capacity as director, chief executive officer or chief financial officer, or (ii) was subject to an order that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer. None of the proposed directors of the Corporation is, as at the date hereof, or has been, within the previous 10 years, a director or executive officer of any company (including the Corporation) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets. Penalties or Sanctions None of the proposed directors of the Corporation has been subject to (a) any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or (b) any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable securityholder in deciding whether to vote for a proposed director. Personal Bankruptcies None of the proposed directors of the Corporation has, within the 10 years before the date hereof, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director. (iii) Appointment of Auditor In accordance with NI 51-102, the Corporation changed its auditors from MNP LLP to Ernst & Young LLP effective May 30, 2019. Pursuant to subsection 4.11(5)(c) of NI 51-102 a copy of the “reporting package” is attached hereto as Schedule “A”. As indicated in the notice contained in the “reporting package”, there are no reportable disagreements between the Corporation and MNP LLP. Unless otherwise instructed, the persons named in the enclosed proxy or voting instruction form intend to vote such proxy or voting instruction form in favour of the re-appointment of Ernst & Young LLP, as auditors of the Corporation to hold office until the next annual meeting of shareholders and the authorization of the Board to fix their remuneration. The Board recommends that shareholders vote in favour of the appointment of Ernst & Young LLP, and the authorization of the Board to fix their remuneration. To be adopted, this resolution is required to be passed by the affirmative vote of a majority of the votes cast at the Meeting. (iv) Security Based Compensation Plan On May 3, 2020, the Board approved the 2020 Long Term Incentive Plan of the Corporation (the “Omnibus Plan”) to be effective the date of the Meeting, or any adjournment or postponement thereof (the “Effective Date”), pursuant to which it is able to issue share-based long-term incentives. All directors, officers, employees and consultants of the Corporation and/or its affiliates (“Participants”) are eligible to receive awards under the Omnibus Plan, subject to the terms of the Omnibus Plan. Awards include Common Share purchase options (“Options”), restricted stock (“Restricted Stock”), stock appreciation rights (“Stock Appreciation Rights”), performance awards (“Performance Awards”) or other stock-based awards, including restricted stock units (“RSUs”) and Dividends and Dividend Equivalents (as defined below) (collectively, the “Awards”), under the Omnibus Plan. A copy of the Omnibus Plan is attached as Schedule “B” to this Circular. The Corporation’s current compensation program, described elsewhere in this Circular (see “Executive Compensation”) provides total compensation for employees in various roles that is comprised of base salary (fixed cash amount), short-term performance incentives (variable cash bonuses) and lastly, long-term “at risk” equity-based incentives (phantom shares, stock options, RSUs and DSUs (defined below)) that align employees’ interests with those of shareholders. The use of equity-based compensation as part of a competitive total compensation package for employees in certain roles also allows the Corporation to offer lower base salaries, thereby lowering its fixed cash compensation costs. With a view to extending the cash resources that the Corporation has CAN: 32676414.8 - 6 -

available, it is important for the Corporation to be prudent in the management of its fixed cash expenses across all areas of operations, including in the area of employee compensation. Purpose of Omnibus Plan The Omnibus Plan serves several purposes for the Corporation. One purpose is to advance the interests of the Corporation by developing the interests of Participants in the growth and development of the Corporation by providing such persons with the opportunity to acquire a proprietary interest in the Corporation. All Participants are considered eligible to be selected to receive an Award under the Omnibus Plan. Another purpose is to attract and retain key talent and valuable personnel, who are necessary to the Corporation’s success and reputation, with a competitive compensation mechanism. Finally, the Omnibus Plan will align the interests of Participants with those of shareholders by devising a compensation mechanism which encourages the prudent maximization of distributions to shareholders and long-term growth. With shareholder approval of the Omnibus Plan, the main components of the Corporation’s compensation program will be as follows: (i) base salary (fixed cash amount), (ii) short-term performance incentives (variable cash bonuses), and (iii) a broad range of long-term “at risk” equity-based incentives under the Omnibus Plan. The Omnibus Plan is administered by the Board or a committee of the Board. Omnibus Plan Maximum and Limits If the Corporation’s shareholders approve the Omnibus Plan, no future awards or grants will be made under the Option Plan and the RSU/DSU Plan (as those terms are defined below), and the Common Shares that have not been settled or awarded under those plans on the Effective Date shall be available for Awards and issuance under the Omnibus Plan. The maximum number of Common Shares that shall be available for Awards and issuance under the Omnibus Plan and that may be reserved for issuance, at any time, under the Omnibus Plan and under any other security based compensation arrangements adopted by the Corporation, including the Option Plan and the RSU/DSU Plan, shall not exceed twenty percent (20%) of the issued and outstanding Common Shares on the Effective Date. As of the date of this Circular, such 20% amount is 7,697,354 Common Shares. The maximum amount of the foregoing Common Shares that may be awarded under the Omnibus Plan as “Incentive Stock Options” (as defined in the Omnibus Plan), is 2,600,000 Common Shares. Common Shares underlying outstanding Awards that for any reason expire or are terminated, forfeited or canceled shall again be available for issuance under the Omnibus Plan. Also, any Common Shares forfeited, cancelled or otherwise not issued for any reason under the awards pursuant to the existing Option Plan and RSU/DSU Plan, shall be available for grants under the Omnibus Plan. Any awards outstanding under the Option Plan or the RSU/DSU Plan shall remain subject to the terms of those awards and plans. Awards that by their terms are to be settled solely in cash shall not be counted against the maximum number of Common Shares available for the issuance of Awards under the Omnibus Plan. The number of Common Shares issuable to insiders, at any time, under all security based compensation arrangements of the Corporation, may not exceed 10% of the Corporation’s issued and outstanding Common Shares; and the number of Common Shares issued to insiders within any one-year period, under all security based compensation arrangements of the Corporation, may not exceed 10% of the Corporation’s issued and outstanding Common Shares. The amount of Awards granted to a non-employee director, within a calendar year period, pursuant to the Omnibus Plan shall not exceed US$500,000 in value of the aggregate of Common Share and cash Awards. The Omnibus Plan does not otherwise provide for a maximum number of Common Shares which may be issued to an individual pursuant to the Omnibus Plan and any other share compensation arrangement (expressed as a percentage or otherwise). Cessation of Service and Transferability The Compensation Committee (defined below) may provide the circumstances in which Awards shall be exercised, vested, paid or forfeited in the event a Participant ceases to provide service to the Corporation or any affiliate prior to the end of a performance period or exercise or settlement of such Award. Subject to limited exceptions in the Omnibus Plan for certain Awards, an Award may be assignable or transferable by a Participant only by will or by the laws of descent and distribution following the death of the Participant. Adjustments and Change in Control In the event of any stock dividend or extraordinary cash dividend, stock split, reverse stock split, recapitalization, combination, reclassification or similar change in the capital structure of the Corporation, appropriate adjustments shall be made in the number CAN: 32676414.8 - 7 -

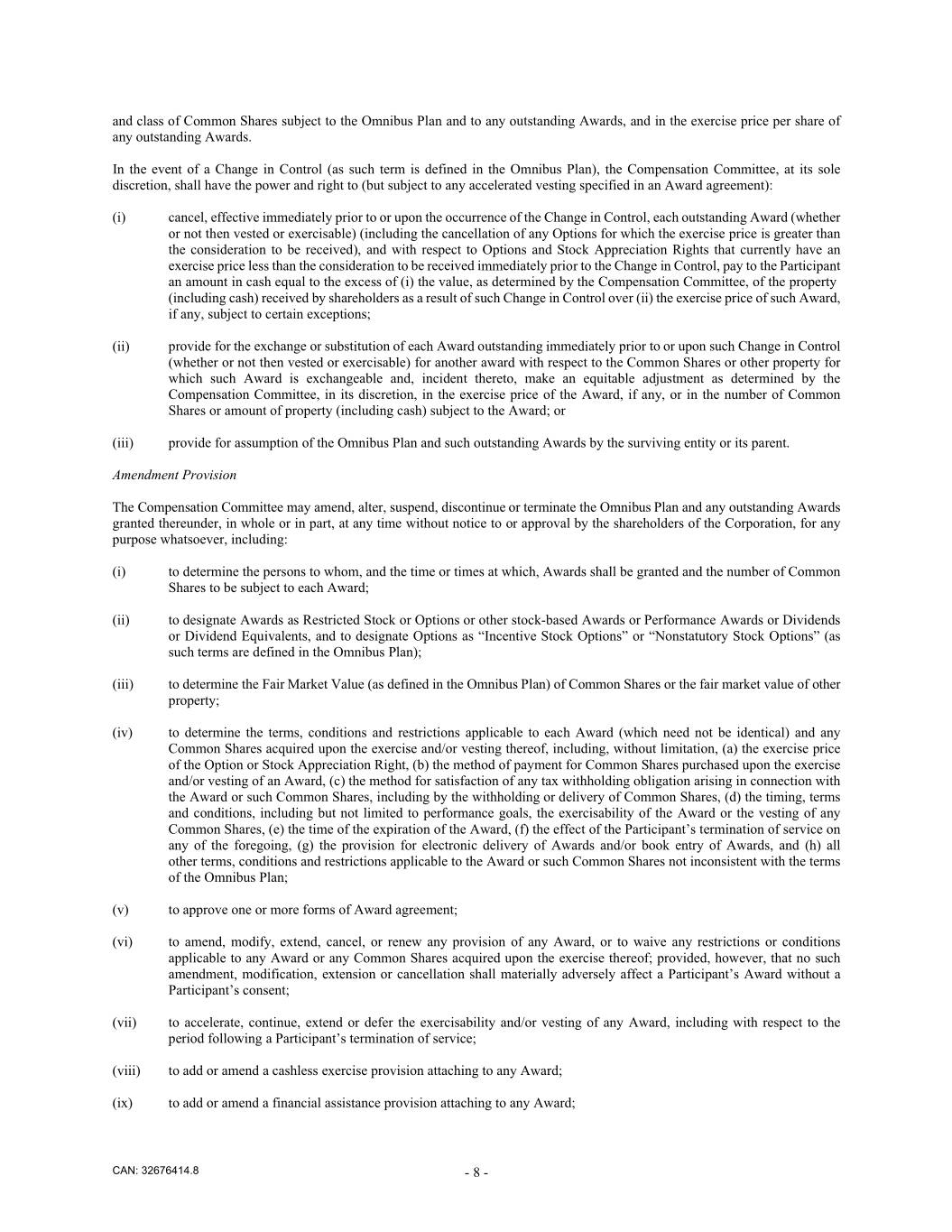

and class of Common Shares subject to the Omnibus Plan and to any outstanding Awards, and in the exercise price per share of any outstanding Awards. In the event of a Change in Control (as such term is defined in the Omnibus Plan), the Compensation Committee, at its sole discretion, shall have the power and right to (but subject to any accelerated vesting specified in an Award agreement): (i) cancel, effective immediately prior to or upon the occurrence of the Change in Control, each outstanding Award (whether or not then vested or exercisable) (including the cancellation of any Options for which the exercise price is greater than the consideration to be received), and with respect to Options and Stock Appreciation Rights that currently have an exercise price less than the consideration to be received immediately prior to the Change in Control, pay to the Participant an amount in cash equal to the excess of (i) the value, as determined by the Compensation Committee, of the property (including cash) received by shareholders as a result of such Change in Control over (ii) the exercise price of such Award, if any, subject to certain exceptions; (ii) provide for the exchange or substitution of each Award outstanding immediately prior to or upon such Change in Control (whether or not then vested or exercisable) for another award with respect to the Common Shares or other property for which such Award is exchangeable and, incident thereto, make an equitable adjustment as determined by the Compensation Committee, in its discretion, in the exercise price of the Award, if any, or in the number of Common Shares or amount of property (including cash) subject to the Award; or (iii) provide for assumption of the Omnibus Plan and such outstanding Awards by the surviving entity or its parent. Amendment Provision The Compensation Committee may amend, alter, suspend, discontinue or terminate the Omnibus Plan and any outstanding Awards granted thereunder, in whole or in part, at any time without notice to or approval by the shareholders of the Corporation, for any purpose whatsoever, including: (i) to determine the persons to whom, and the time or times at which, Awards shall be granted and the number of Common Shares to be subject to each Award; (ii) to designate Awards as Restricted Stock or Options or other stock-based Awards or Performance Awards or Dividends or Dividend Equivalents, and to designate Options as “Incentive Stock Options” or “Nonstatutory Stock Options” (as such terms are defined in the Omnibus Plan); (iii) to determine the Fair Market Value (as defined in the Omnibus Plan) of Common Shares or the fair market value of other property; (iv) to determine the terms, conditions and restrictions applicable to each Award (which need not be identical) and any Common Shares acquired upon the exercise and/or vesting thereof, including, without limitation, (a) the exercise price of the Option or Stock Appreciation Right, (b) the method of payment for Common Shares purchased upon the exercise and/or vesting of an Award, (c) the method for satisfaction of any tax withholding obligation arising in connection with the Award or such Common Shares, including by the withholding or delivery of Common Shares, (d) the timing, terms and conditions, including but not limited to performance goals, the exercisability of the Award or the vesting of any Common Shares, (e) the time of the expiration of the Award, (f) the effect of the Participant’s termination of service on any of the foregoing, (g) the provision for electronic delivery of Awards and/or book entry of Awards, and (h) all other terms, conditions and restrictions applicable to the Award or such Common Shares not inconsistent with the terms of the Omnibus Plan; (v) to approve one or more forms of Award agreement; (vi) to amend, modify, extend, cancel, or renew any provision of any Award, or to waive any restrictions or conditions applicable to any Award or any Common Shares acquired upon the exercise thereof; provided, however, that no such amendment, modification, extension or cancellation shall materially adversely affect a Participant’s Award without a Participant’s consent; (vii) to accelerate, continue, extend or defer the exercisability and/or vesting of any Award, including with respect to the period following a Participant’s termination of service; (viii) to add or amend a cashless exercise provision attaching to any Award; (ix) to add or amend a financial assistance provision attaching to any Award; CAN: 32676414.8 - 8 -

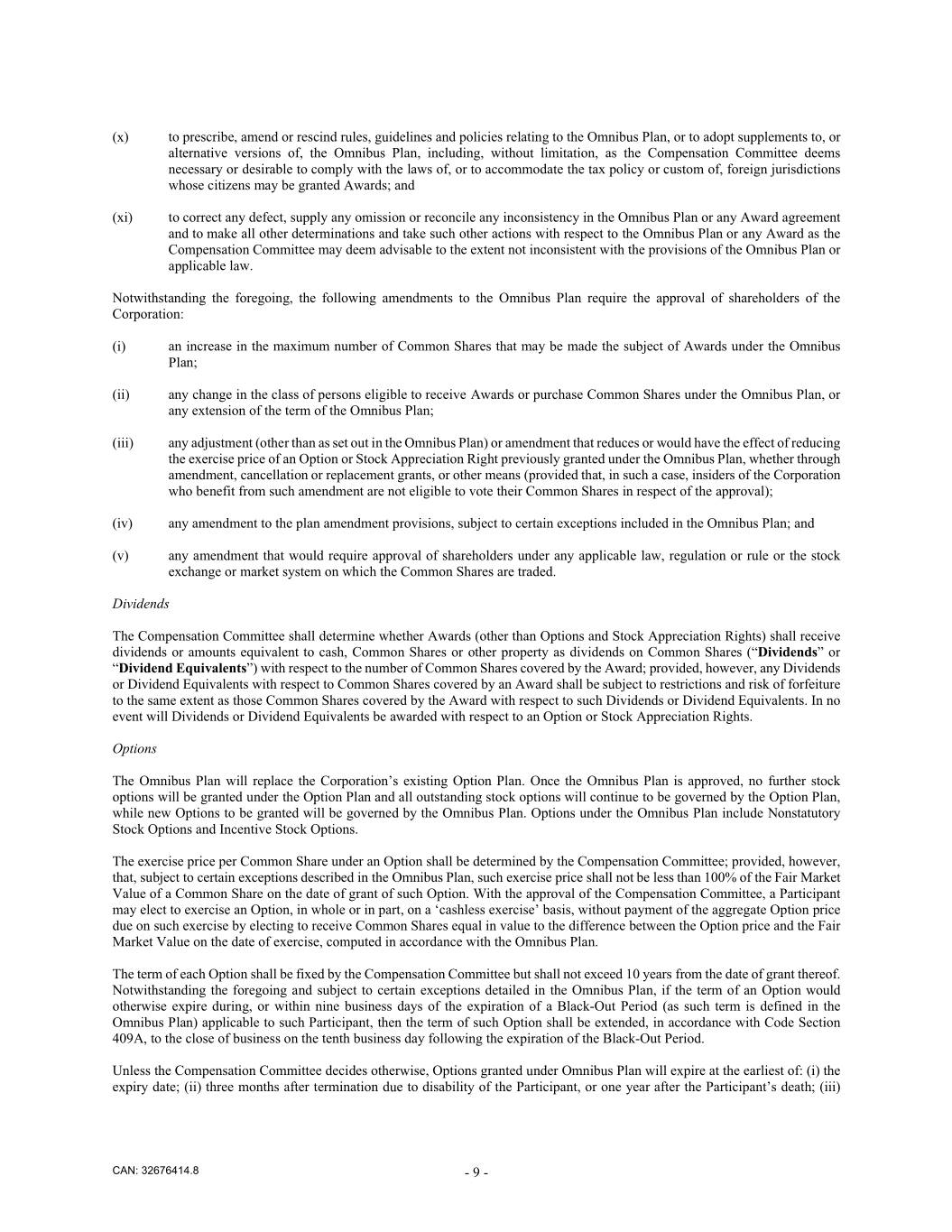

(x) to prescribe, amend or rescind rules, guidelines and policies relating to the Omnibus Plan, or to adopt supplements to, or alternative versions of, the Omnibus Plan, including, without limitation, as the Compensation Committee deems necessary or desirable to comply with the laws of, or to accommodate the tax policy or custom of, foreign jurisdictions whose citizens may be granted Awards; and (xi) to correct any defect, supply any omission or reconcile any inconsistency in the Omnibus Plan or any Award agreement and to make all other determinations and take such other actions with respect to the Omnibus Plan or any Award as the Compensation Committee may deem advisable to the extent not inconsistent with the provisions of the Omnibus Plan or applicable law. Notwithstanding the foregoing, the following amendments to the Omnibus Plan require the approval of shareholders of the Corporation: (i) an increase in the maximum number of Common Shares that may be made the subject of Awards under the Omnibus Plan; (ii) any change in the class of persons eligible to receive Awards or purchase Common Shares under the Omnibus Plan, or any extension of the term of the Omnibus Plan; (iii) any adjustment (other than as set out in the Omnibus Plan) or amendment that reduces or would have the effect of reducing the exercise price of an Option or Stock Appreciation Right previously granted under the Omnibus Plan, whether through amendment, cancellation or replacement grants, or other means (provided that, in such a case, insiders of the Corporation who benefit from such amendment are not eligible to vote their Common Shares in respect of the approval); (iv) any amendment to the plan amendment provisions, subject to certain exceptions included in the Omnibus Plan; and (v) any amendment that would require approval of shareholders under any applicable law, regulation or rule or the stock exchange or market system on which the Common Shares are traded. Dividends The Compensation Committee shall determine whether Awards (other than Options and Stock Appreciation Rights) shall receive dividends or amounts equivalent to cash, Common Shares or other property as dividends on Common Shares (“Dividends” or “Dividend Equivalents”) with respect to the number of Common Shares covered by the Award; provided, however, any Dividends or Dividend Equivalents with respect to Common Shares covered by an Award shall be subject to restrictions and risk of forfeiture to the same extent as those Common Shares covered by the Award with respect to such Dividends or Dividend Equivalents. In no event will Dividends or Dividend Equivalents be awarded with respect to an Option or Stock Appreciation Rights. Options The Omnibus Plan will replace the Corporation’s existing Option Plan. Once the Omnibus Plan is approved, no further stock options will be granted under the Option Plan and all outstanding stock options will continue to be governed by the Option Plan, while new Options to be granted will be governed by the Omnibus Plan. Options under the Omnibus Plan include Nonstatutory Stock Options and Incentive Stock Options. The exercise price per Common Share under an Option shall be determined by the Compensation Committee; provided, however, that, subject to certain exceptions described in the Omnibus Plan, such exercise price shall not be less than 100% of the Fair Market Value of a Common Share on the date of grant of such Option. With the approval of the Compensation Committee, a Participant may elect to exercise an Option, in whole or in part, on a ‘cashless exercise’ basis, without payment of the aggregate Option price due on such exercise by electing to receive Common Shares equal in value to the difference between the Option price and the Fair Market Value on the date of exercise, computed in accordance with the Omnibus Plan. The term of each Option shall be fixed by the Compensation Committee but shall not exceed 10 years from the date of grant thereof. Notwithstanding the foregoing and subject to certain exceptions detailed in the Omnibus Plan, if the term of an Option would otherwise expire during, or within nine business days of the expiration of a Black-Out Period (as such term is defined in the Omnibus Plan) applicable to such Participant, then the term of such Option shall be extended, in accordance with Code Section 409A, to the close of business on the tenth business day following the expiration of the Black-Out Period. Unless the Compensation Committee decides otherwise, Options granted under Omnibus Plan will expire at the earliest of: (i) the expiry date; (ii) three months after termination due to disability of the Participant, or one year after the Participant’s death; (iii) CAN: 32676414.8 - 9 -

three months after termination without cause following a Change in Control; (iv) in the case of a termination for cause, the expiry date set out in the applicable Award agreement; and (v) three months following the Participant’s termination for any other reason. Incentive Stock Options may only be granted to employees. To the extent Options designated as Incentive Stock Options become exercisable for the first time during any calendar year for Common Shares having an aggregate fair market value greater than US$100,000, the portion of such Options which exceeds such amount shall be treated as Nonstatutory Stock Options. Incentive Stock Options are subject to additional requirements and restrictions as provided in the Omnibus Plan and as required by the U.S. Internal Revenue Code. Restricted Stock The Omnibus Plan, if approved, will provide the Compensation Committee with additional equity-based compensation alternatives in the form of Restricted Stock, which provide an “at risk” equity-based incentive and may replace short-term cash based incentives currently provided for in the Corporation’s compensation plan. Restricted Stock consists of Common Shares that are subject to such restrictions as the Compensation Committee may impose (including, without limitation, restrictions on voting and transferability, or that constitute any limitation on the right to receive any Dividend or Dividend Equivalent or other right), which restrictions may lapse separately or in combination at such time or times, in such installments or otherwise, as the Compensation Committee may deem appropriate. Restricted Stock shall be awarded for no additional consideration or such additional consideration as the Compensation Committee may determine, which consideration may be equal to or more than the Fair Market Value of the Common Shares on the grant date. Other Stock-Based Awards Under the Omnibus Plan, the Compensation Committee may grant other stock-based Awards that are denominated or payable in, valued in whole or in part by reference to, or otherwise related to, Common Shares, as deemed by the Compensation Committee to be consistent with the purposes of the Omnibus Plan and the goals of the Corporation, including, without limitation, RSUs, Stock Appreciation Rights, and phantom awards. Stock Appreciation Rights are subject to the same requirements as Nonstatutory Options. Other stock-based Awards may be settled in Common Shares, cash or a combination thereof. Performance Awards may be granted by the Compensation Committee in its sole discretion awarding cash or Common Shares (including Restricted Stock) or a combination thereof based upon the achievement of goals as determined by the Compensation Committee. Types of other stock-based Awards or Performance Awards include, without limitation, purchase rights, phantom stock, Stock Appreciation Rights, RSUs, performance units, Restricted Stock or Common Shares subject to performance goals, Common Shares awarded that are not subject to any restrictions or conditions, convertible or exchangeable debentures related to Common Shares, other rights convertible into Common Shares, Awards valued by reference to the value of Common Shares or the performance of the Corporation or a specified subsidiary, affiliate division or department, Awards based upon performance goals established by the Compensation Committee and settlement in cancellation of rights of any person with a vested interest in any other plan, fund, program or arrangement that is or was sponsored, maintained or participated in by the Corporation or any subsidiary. In its discretion, the Compensation Committee may specify such criteria, periods or performance goals for vesting in the foregoing stock-based Awards or Performance Awards and/or payment thereof to Participants as it shall determine; and the extent to which such criteria, periods or goals have been met shall be determined by the Compensation Committee. All terms and conditions of such stock-based Awards and Performance Awards shall be determined by the Compensation Committee and set forth in the applicable Award agreement. Shareholder Approval The Omnibus Plan is authorized by the Board to be effective the date of the Meeting, or any adjournment or postponement thereof, subject to the approval of shareholders at the Meeting. The Omnibus Plan will continue until the earlier of termination by the Board or 10 years from the Effective Date. As of the Record Date, there were an aggregate of 3,637,976 stock options outstanding and unexercised under the existing Option Plan and 701,493 RSUs and no DSUs outstanding and unexercised under the existing RSU/DSU Plan, representing 9.45%, 1.82% and nil%, respectively, of the issued and outstanding Common Shares as of the Record Date. No other Common Shares are subject to any other security based compensation arrangements. If the Omnibus Plan is approved at the Meeting, a number of Common Shares will be reserved for issuance under the Omnibus Plan which, together with the Common Shares underlying the outstanding and unexercised stock options, RSUs and DSUs currently outstanding, represents 20% of the total issued and outstanding Common CAN: 32676414.8 - 10 -

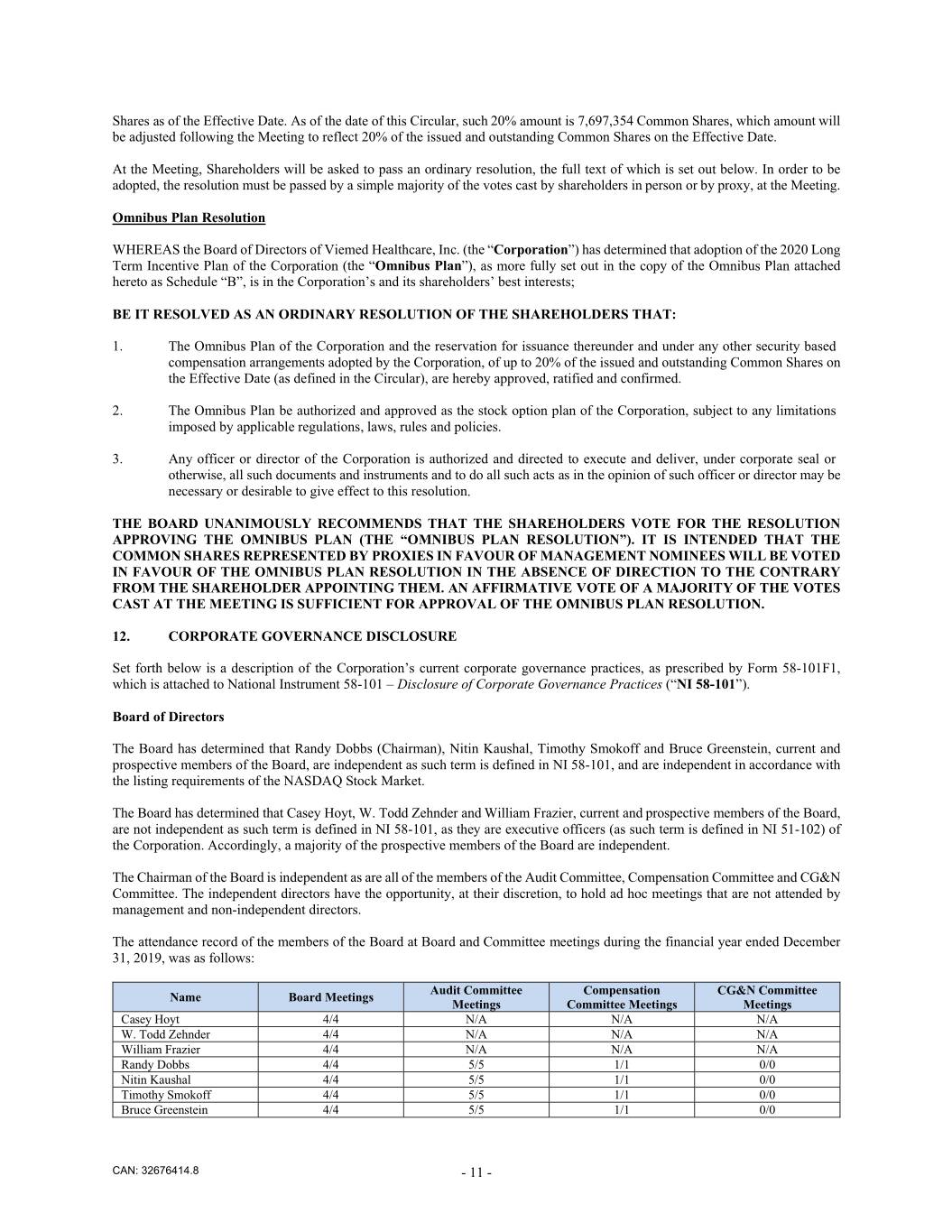

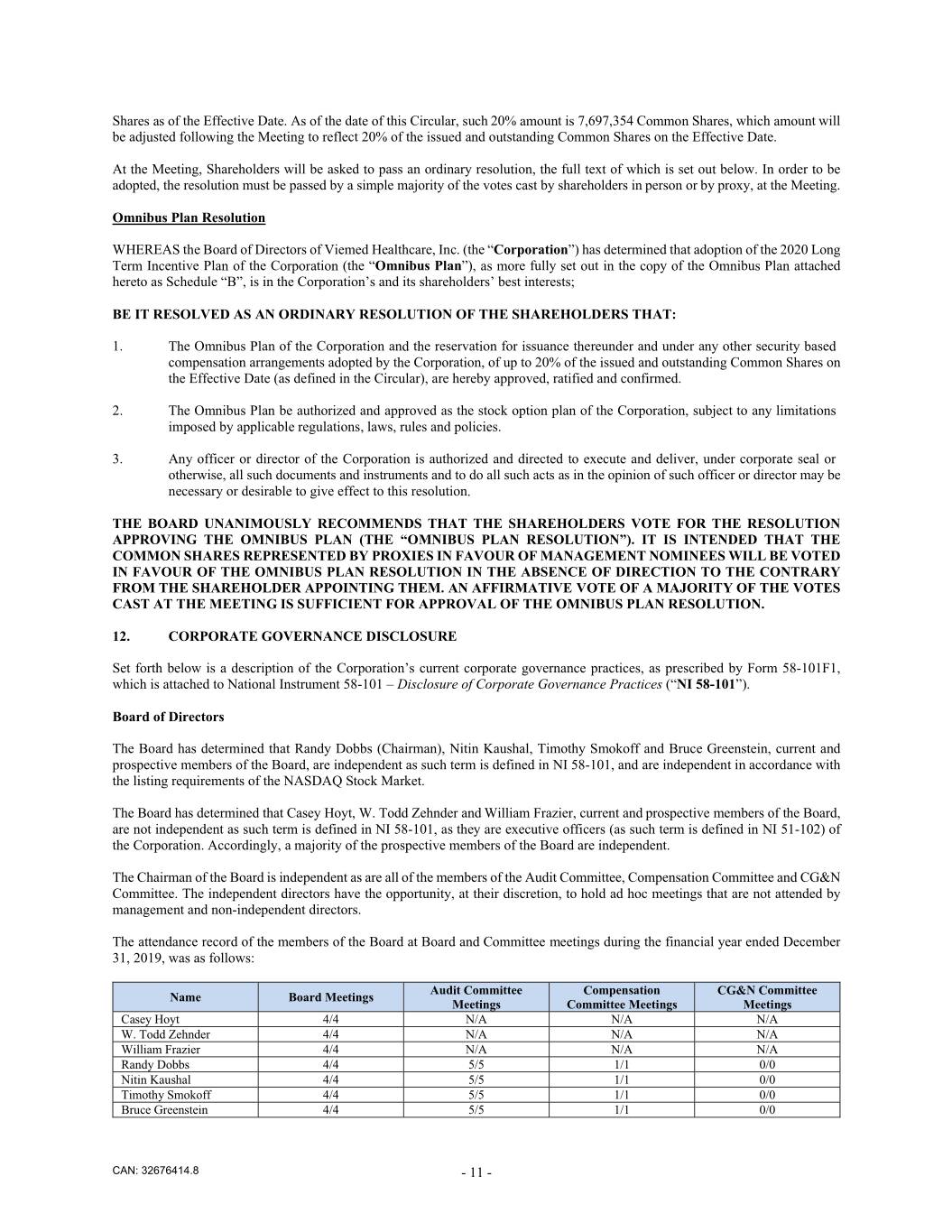

Shares as of the Effective Date. As of the date of this Circular, such 20% amount is 7,697,354 Common Shares, which amount will be adjusted following the Meeting to reflect 20% of the issued and outstanding Common Shares on the Effective Date. At the Meeting, Shareholders will be asked to pass an ordinary resolution, the full text of which is set out below. In order to be adopted, the resolution must be passed by a simple majority of the votes cast by shareholders in person or by proxy, at the Meeting. Omnibus Plan Resolution WHEREAS the Board of Directors of Viemed Healthcare, Inc. (the “Corporation”) has determined that adoption of the 2020 Long Term Incentive Plan of the Corporation (the “Omnibus Plan”), as more fully set out in the copy of the Omnibus Plan attached hereto as Schedule “B”, is in the Corporation’s and its shareholders’ best interests; BE IT RESOLVED AS AN ORDINARY RESOLUTION OF THE SHAREHOLDERS THAT: 1. The Omnibus Plan of the Corporation and the reservation for issuance thereunder and under any other security based compensation arrangements adopted by the Corporation, of up to 20% of the issued and outstanding Common Shares on the Effective Date (as defined in the Circular), are hereby approved, ratified and confirmed. 2. The Omnibus Plan be authorized and approved as the stock option plan of the Corporation, subject to any limitations imposed by applicable regulations, laws, rules and policies. 3. Any officer or director of the Corporation is authorized and directed to execute and deliver, under corporate seal or otherwise, all such documents and instruments and to do all such acts as in the opinion of such officer or director may be necessary or desirable to give effect to this resolution. THE BOARD UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS VOTE FOR THE RESOLUTION APPROVING THE OMNIBUS PLAN (THE “OMNIBUS PLAN RESOLUTION”). IT IS INTENDED THAT THE COMMON SHARES REPRESENTED BY PROXIES IN FAVOUR OF MANAGEMENT NOMINEES WILL BE VOTED IN FAVOUR OF THE OMNIBUS PLAN RESOLUTION IN THE ABSENCE OF DIRECTION TO THE CONTRARY FROM THE SHAREHOLDER APPOINTING THEM. AN AFFIRMATIVE VOTE OF A MAJORITY OF THE VOTES CAST AT THE MEETING IS SUFFICIENT FOR APPROVAL OF THE OMNIBUS PLAN RESOLUTION. 12. CORPORATE GOVERNANCE DISCLOSURE Set forth below is a description of the Corporation’s current corporate governance practices, as prescribed by Form 58-101F1, which is attached to National Instrument 58-101 – Disclosure of Corporate Governance Practices (“NI 58-101”). Board of Directors The Board has determined that Randy Dobbs (Chairman), Nitin Kaushal, Timothy Smokoff and Bruce Greenstein, current and prospective members of the Board, are independent as such term is defined in NI 58-101, and are independent in accordance with the listing requirements of the NASDAQ Stock Market. The Board has determined that Casey Hoyt, W. Todd Zehnder and William Frazier, current and prospective members of the Board, are not independent as such term is defined in NI 58-101, as they are executive officers (as such term is defined in NI 51-102) of the Corporation. Accordingly, a majority of the prospective members of the Board are independent. The Chairman of the Board is independent as are all of the members of the Audit Committee, Compensation Committee and CG&N Committee. The independent directors have the opportunity, at their discretion, to hold ad hoc meetings that are not attended by management and non-independent directors. The attendance record of the members of the Board at Board and Committee meetings during the financial year ended December 31, 2019, was as follows: Audit Committee Compensation CG&N Committee Name Board Meetings Meetings Committee Meetings Meetings Casey Hoyt 4/4 N/A N/A N/A W. Todd Zehnder 4/4 N/A N/A N/A William Frazier 4/4 N/A N/A N/A Randy Dobbs 4/4 5/5 1/1 0/0 Nitin Kaushal 4/4 5/5 1/1 0/0 Timothy Smokoff 4/4 5/5 1/1 0/0 Bruce Greenstein 4/4 5/5 1/1 0/0 CAN: 32676414.8 - 11 -

The following directors and prospective directors are presently directors of other issuers that are reporting issuers (or the equivalent): Name of Director Name of Other Reporting Issuers Nitin Kaushal Valens Groworks Corp. Ventura Cannabis and Wellness Corp. Hide Tide Inc. Delta 9 Cannabis Inc. CannAmerica Brands Corp. Board Mandate The Board does not have a written mandate, however it operates through the leadership of an independent Chairman and three committees of the Board made up of independent directors. Position Descriptions The Board has not adopted a written description for the chair of the Board and the chair of each Board committee. The Chair of the Board is responsible for the administration, development and efficient operation of the Board. The Chair assists the President and Chief Executive Officer in overseeing the operational aspects involved in managing the Corporation. In addition, the Chair ensures that the Board adequately discharges its mandate and that the Board’s responsibilities and lines of delineation between the Board and management are well understood by the directors. The Chair of each committee is to manage efficiently his or her respective committee. Each committee chair must ensure that the committee adequately discharges its mandate pursuant to its written charter. Committee chairs must report regularly to the Board on the business of their committee. The Board and the Chief Executive Officer have not developed a written position description for the Chief Executive Officer. The Board expects the Chief Executive Officer and the Corporation’s senior management team to be responsible for the management of the Corporation’s strategic and operational agenda and for the execution of the decisions of the Board. Orientation and Continuing Education Pursuant to the orientation program put in place by the CG&N Committee, each director upon closing of the Arrangement attended a comprehensive orientation session during which they were provided with product demonstrations and an education as to the nature and operation of the Corporation and its business, and members of senior management from each functional area within the Corporation presented on wide-ranging topics concerning the Corporation, including regarding its corporate structure and financial and legal matters. The CG&N Committee is also responsible for coordinating the continuing education program for directors in order to maintain or enhance their skills and abilities as directors, as well as ensuring that their knowledge and understanding of the Corporation and its business remains current. Internal personnel regularly make presentations to the Board on relevant and material topics. Directors are encouraged to communicate with management, auditors and technical consultants; and to keep themselves current with industry trends and developments and changes in legislation with management’s assistance. Directors have full access to the Corporation’s records. Ethical Business Conduct The Board maintains that the Corporation must conduct and be seen to conduct its business dealings in accordance with all applicable laws and the highest ethical standards. The Board has adopted a Code of Business Conduct and Ethics that applies to our directors, officers and employees. This Code of Business Conduct and Ethics is available on the corporate governance section of our website (which is a subsection of the investor relations section of our website) at the following address: www.viemed.com/investor-relations. The Corporation intends to disclose on its website any amendments or waivers to the code that are required to be disclosed by Securities and Exchange Commission (the “SEC”) rules. The Corporation’s reputation for honesty and integrity amongst its shareholders and other stakeholders will be key to the success of its business. No employee or director will be permitted to achieve results through violation of laws or regulations, or through unscrupulous dealings. CAN: 32676414.8 - 12 -

Any director with a conflict of interest or who is capable of being perceived as being in conflict of interest with respect to the Corporation must abstain from discussion and voting by the Board or any committee of the Board on any motion to recommend or approve the relevant agreement or transaction. The Board must comply with conflict of interest provisions of the BCBCA. Nomination of Directors The CG&N Committee is currently responsible for identifying candidates for election to the Board. For further information regarding the Board nomination procedures under the Corporation’s Advance Notice Provisions see “Election of Directors”. The CG&N Committee is responsible for periodically reviewing the size of the Board, with a view to determining the impact of the number of directors on the effectiveness of the Board, and identifying potential nominees to the Board, reviewing their qualifications and experience, determining their independence as required under all applicable corporate and securities laws, and recommending to the Board the nominees for consideration by, and presentation to, the shareholders at the Corporation’s next annual meeting of shareholders. In making its recommendations, the CG&N Committee considers the competencies and skills that the Board considers to be necessary for the Board as a whole to possess, the competencies and skills that the Board considers each existing director to possess, as well as the competencies and skills each new nominee will bring to the boardroom. The CG&N Committee also considers the amount of time and resources that nominees have available to fulfill their duties as Board members or committee members, as applicable. While the Board has not adopted a written policy concerning Board diversity, the Board believes that diversity is important in providing the necessary range of perspectives, experience and expertise required to achieve objectives. The Board recognizes that gender diversity is a significant aspect of diversity and acknowledges the important contributions that women with the right competencies and skills can make to the diversity of perspective in the boardroom. Accordingly, in order to promote the specific objective of gender diversity, the selection process for Board appointees/nominees by the Corporation will involve trying to identify potential female candidates and if, at the end of the selection process, no female candidates are selected, the Board must be satisfied that there are objective reasons to support this determination. On an annual basis, the CG&N Committee will assess the effectiveness of the Board’s appointment/nomination process at achieving diversity and consider and, if determined advisable, recommend to the Board for adoption, measurable objectives for achieving diversity on the Board. At this time, the Corporation has not adopted a target regarding women on the Board as the Board believes that arbitrary targets are not in the best interests of the Corporation or its shareholders. The Board is committed to nominating the best individuals to be elected as directors. The CG&N Committee is also responsible for periodically examining and making recommendations to the Board in relation to mechanisms of Board renewal. The Corporation currently does not have any policies imposing a term or retirement age limit in connection with individuals nominated for election as directors, as the CG&N Committee and the Board believe that such arbitrary limits are not in the best interests of the Corporation or its shareholders. It is the Board’s intention to strive to achieve a balance between the desirability to have a depth of institutional experience from its members on the one hand, and the need for renewal and new perspectives on the other hand. Board Committees Audit Committee The members of the audit committee (the “Audit Committee”) are: Nitin Kaushal (Chairman), Randy Dobbs, Timothy Smokoff and Bruce Greenstein. All of the members of the Audit Committee are independent and financially literate, as such terms are defined in National Instrument 52-110 – Audit Committees (“NI 52-110”). Each member of the Audit Committee is an independent director within the meaning of the rules of the NASDAQ Stock Market and meets the standards for independence required by U.S. securities law applicable to public companies, including Rule 10A-3 of the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”), with respect to Audit Committee members. In addition, the Board has determined that Nitin Kaushal is qualified as an audit committee financial expert under the SEC’s rules and regulations and that each member of the Audit Committee has the requisite accounting and related financial management expertise under NASDAQ rules. The Audit Committee operates under the Charter of the Audit Committee, pursuant to which the Audit Committee assists the Board in fulfilling its oversight responsibilities with respect to: financial reporting and disclosure; ensuring that an effective risk management and financial control framework has been designed, implemented and tested by management of the Corporation; external audit processes; helping the Board meet their responsibilities; providing better communication between the Board and external auditors; enhancing the independence of the external auditors; increasing the credibility and objectivity of financial reports; and strengthening the role of the Board by facilitating in-depth discussions among the Board, management and the external auditors regarding significant issues involving judgment and impacting quality controls and reporting. CAN: 32676414.8 - 13 -

In accordance with NI 52-110, shareholders of the Corporation may obtain further information concerning the Corporation’s Audit Committee in the Corporation’s most recent Annual Report on Form 10-K/A, which is available under the Corporation’s profile on SEDAR at www.sedar.com. Corporate Governance and Nominating Committee The CG&N Committee is a standing committee appointed by the Board. The members of the CG&N Committee are: Bruce Greenstein (Chairman), Randy Dobbs, Timothy Smokoff and Nitin Kaushal. All of the members of the CG&N Committee are independent, as such term is defined in NI 52-110. The CG&N Committee will act on behalf of and subject to the direction of the Board in all matters pertaining to corporate governance issues, new director nominees, as well as the size and composition of the Board and Board committees. The CG&N Committee operates under the Charter of the CG&N Committee, pursuant to which the CG&N Committee will: develop and enforce policy in the area of corporate governance and the practices of the Board in light of the Corporation’s particular circumstances, the changing needs of investors and the Corporation, and changes in corporate governance guidelines; prepare and recommend to the Board annually a statement of corporate governance practices to be included in the Corporation’s information circular and ensure that such disclosure is complete and provided in accordance with the regulatory requirements; monitor developments in the area of corporate governance and the practices of the Board and advise the Board accordingly; develop, implement and maintain appropriate policies with respect to disclosure, confidentiality and insider trading; adopt a process for determining what competencies and skills the Board as a whole should have, and apply this result to the recruitment process for new directors; in consultation with the Chair of the Board and the Chief Executive Officer, identify individuals qualified to become new Board members and recommend to the Board the new director nominees for the next annual meeting of shareholders; recognize that shareholding by directors is appropriate in aligning director and shareholder interests; annually review credentials of existing Board members to assess suitability for re-election; establish procedures for, and approve and ensure provision of, an appropriate orientation and education program for new recruits to the Board and continuing education for Board members; consider and, if thought fit (and after obtaining the consent of the Chair of the Board, which consent may not be unreasonably withheld), approve requests from individual directors for an engagement of special outside advisors at the expense of the Corporation; and review, on a periodic basis, the size and composition of the Board and Board committees and make appropriate recommendations to the Board. Compensation Committee The members of the compensation committee (the “Compensation Committee”) are: Timothy Smokoff (Chairman), Nitin Kaushal, Randy Dobbs and Bruce Greenstein. Each member of the Compensation Committee is an independent director within the meaning of the rules of the NASDAQ Stock Market and meets the standards for independence required by U.S. securities law applicable to public companies, including Rule 10C-1 of the Exchange Act with respect to Compensation Committee members. The Board has adopted a written charter for the Compensation Committee setting out its responsibilities for compensation matters, as described in the Executive Compensation section below. Assessments The CG&N Committee, in consultation with the Chair of the Board, is responsible for ensuring that an appropriate system is in place to evaluate the effectiveness of the Board, the Board committees and individual directors, with a view to ensuring that they are fulfilling their respective responsibilities and duties and working effectively together as a unit. The GN&C Committee informally monitors director performance throughout the year (noting particularly any directors who have had a change in their primary job responsibilities or who have assumed additional directorships since their last assessment) to ensure that the Board, the Board committees and individual directors are performing effectively. From time to time the GN&C Committee may also choose to complete a formal assessment process consisting of completion of a written survey by each member of the Board, on request, conducting one-on-one discussions in order to assess such matters as the composition of the Board, the conduct of and agendas for meetings of the Board and its committees, and the role and impact of the Board. The results of such surveys and interviews are then summarized to identify strengths, opportunities and further suggestions with respect to each area of discussion and the Chair of the Board is to report on such summary to the GN&C Committee and to the rest of the Board. 13. EXECUTIVE COMPENSATION During the fiscal year ended December 31, 2019, the Corporation’s executive compensation program was administered by the Compensation Committee of the Board. The Corporation’s executive compensation program has the objective of attracting and retaining a qualified and cohesive group of executives, motivating team performance and aligning of the interests of executives with the interests of the Corporation’s shareholders through a package of compensation that is simple and easy to understand and implement. Compensation under the program was designed to achieve both current and longer term goals of the Corporation and CAN: 32676414.8 - 14 -

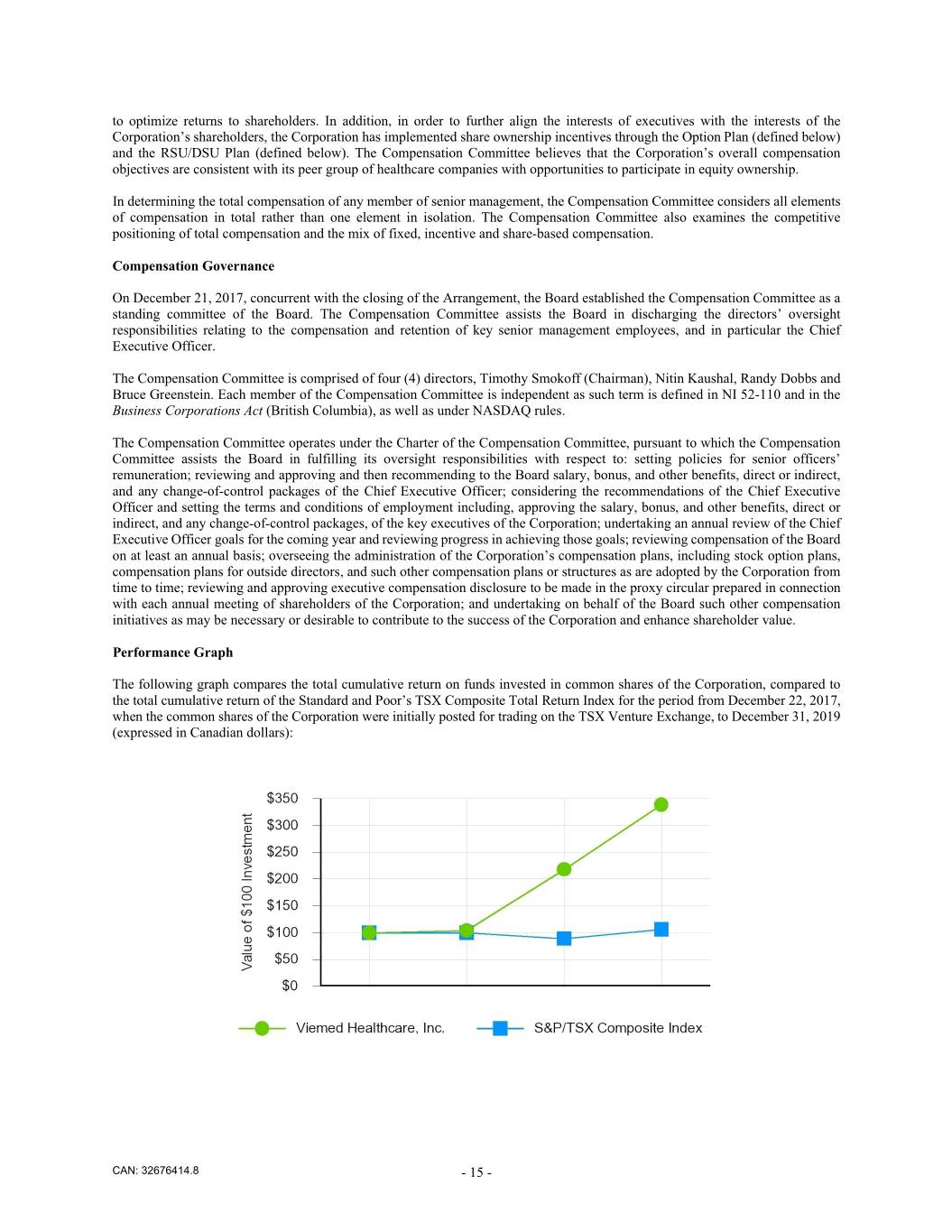

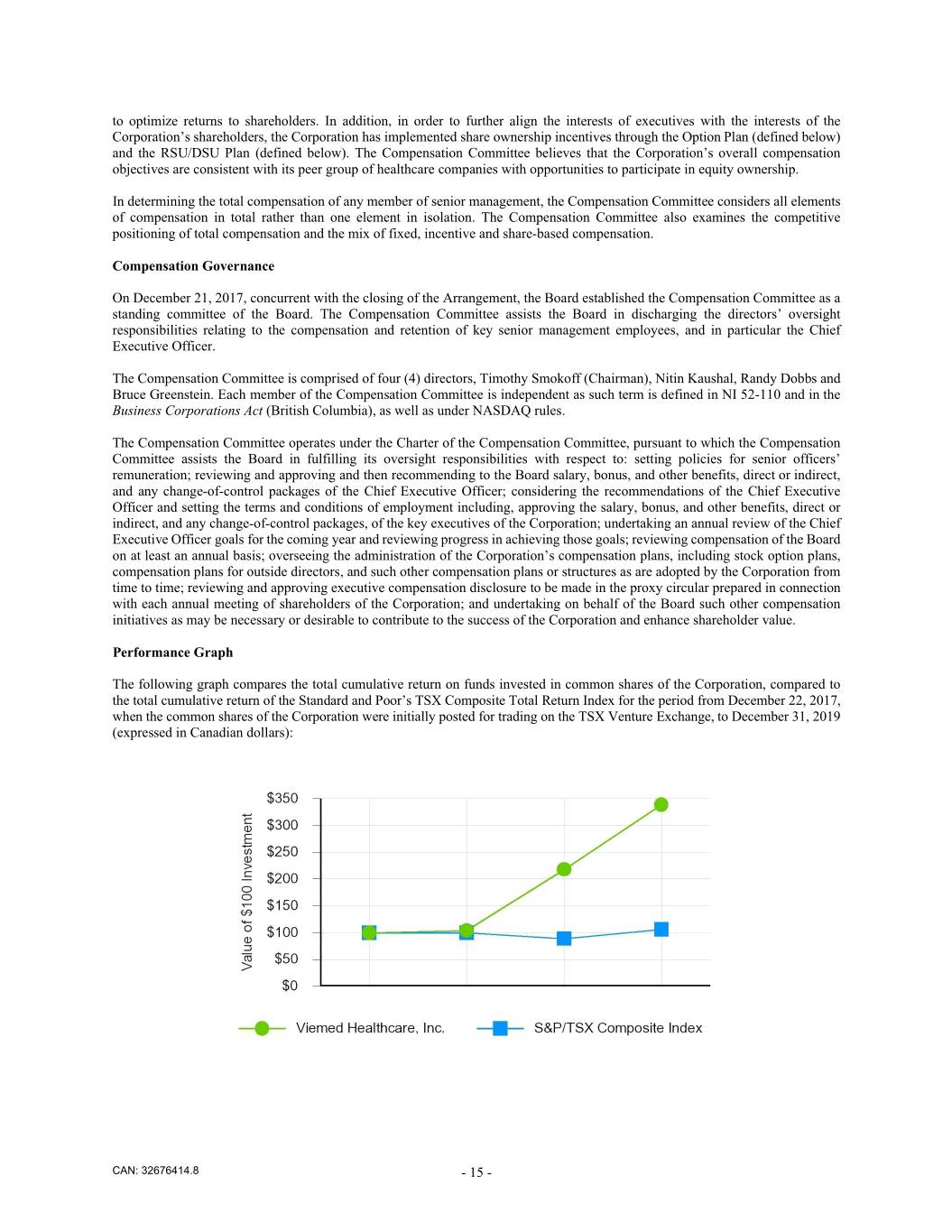

to optimize returns to shareholders. In addition, in order to further align the interests of executives with the interests of the Corporation’s shareholders, the Corporation has implemented share ownership incentives through the Option Plan (defined below) and the RSU/DSU Plan (defined below). The Compensation Committee believes that the Corporation’s overall compensation objectives are consistent with its peer group of healthcare companies with opportunities to participate in equity ownership. In determining the total compensation of any member of senior management, the Compensation Committee considers all elements of compensation in total rather than one element in isolation. The Compensation Committee also examines the competitive positioning of total compensation and the mix of fixed, incentive and share-based compensation. Compensation Governance On December 21, 2017, concurrent with the closing of the Arrangement, the Board established the Compensation Committee as a standing committee of the Board. The Compensation Committee assists the Board in discharging the directors’ oversight responsibilities relating to the compensation and retention of key senior management employees, and in particular the Chief Executive Officer. The Compensation Committee is comprised of four (4) directors, Timothy Smokoff (Chairman), Nitin Kaushal, Randy Dobbs and Bruce Greenstein. Each member of the Compensation Committee is independent as such term is defined in NI 52-110 and in the Business Corporations Act (British Columbia), as well as under NASDAQ rules. The Compensation Committee operates under the Charter of the Compensation Committee, pursuant to which the Compensation Committee assists the Board in fulfilling its oversight responsibilities with respect to: setting policies for senior officers’ remuneration; reviewing and approving and then recommending to the Board salary, bonus, and other benefits, direct or indirect, and any change-of-control packages of the Chief Executive Officer; considering the recommendations of the Chief Executive Officer and setting the terms and conditions of employment including, approving the salary, bonus, and other benefits, direct or indirect, and any change-of-control packages, of the key executives of the Corporation; undertaking an annual review of the Chief Executive Officer goals for the coming year and reviewing progress in achieving those goals; reviewing compensation of the Board on at least an annual basis; overseeing the administration of the Corporation’s compensation plans, including stock option plans, compensation plans for outside directors, and such other compensation plans or structures as are adopted by the Corporation from time to time; reviewing and approving executive compensation disclosure to be made in the proxy circular prepared in connection with each annual meeting of shareholders of the Corporation; and undertaking on behalf of the Board such other compensation initiatives as may be necessary or desirable to contribute to the success of the Corporation and enhance shareholder value. Performance Graph The following graph compares the total cumulative return on funds invested in common shares of the Corporation, compared to the total cumulative return of the Standard and Poor’s TSX Composite Total Return Index for the period from December 22, 2017, when the common shares of the Corporation were initially posted for trading on the TSX Venture Exchange, to December 31, 2019 (expressed in Canadian dollars): CAN: 32676414.8 - 15 -

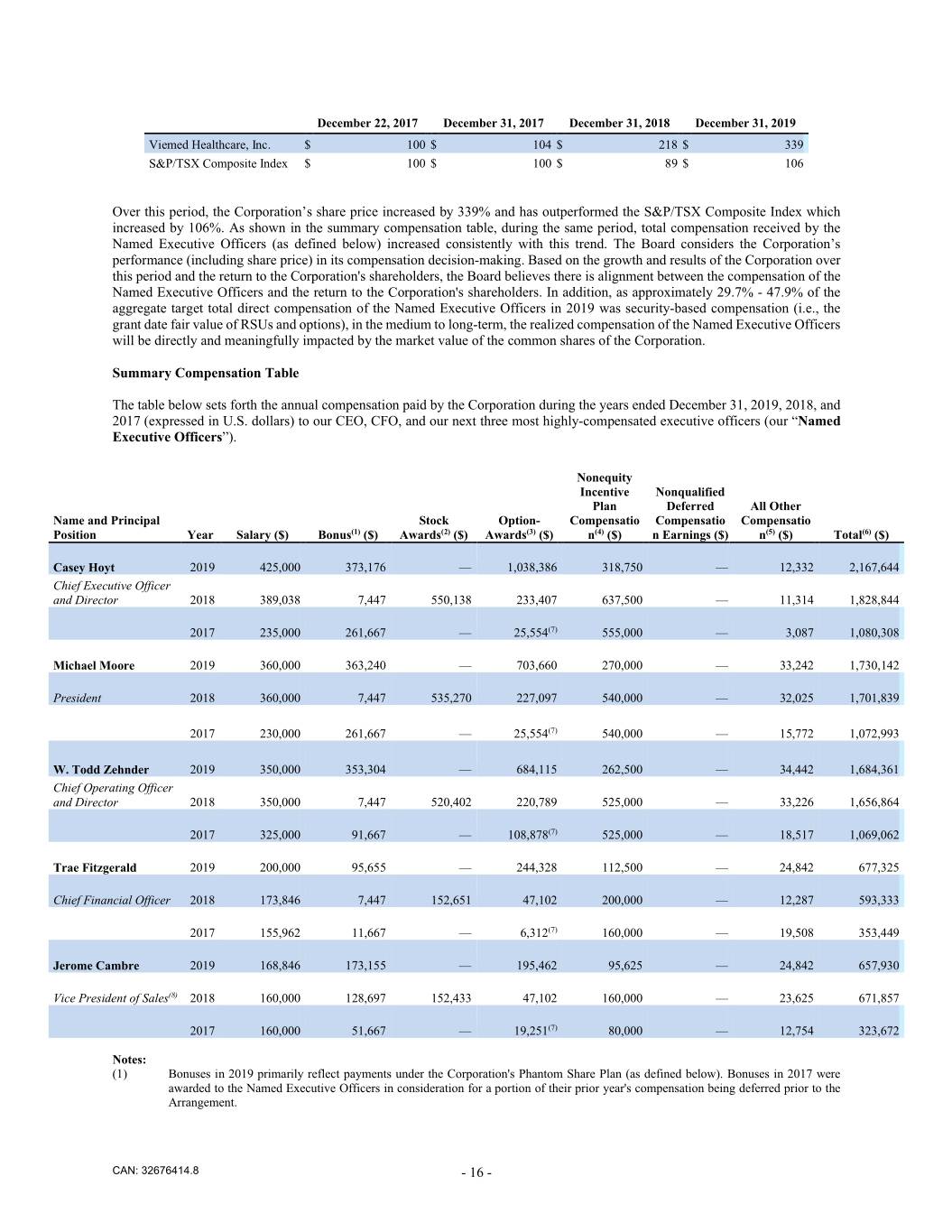

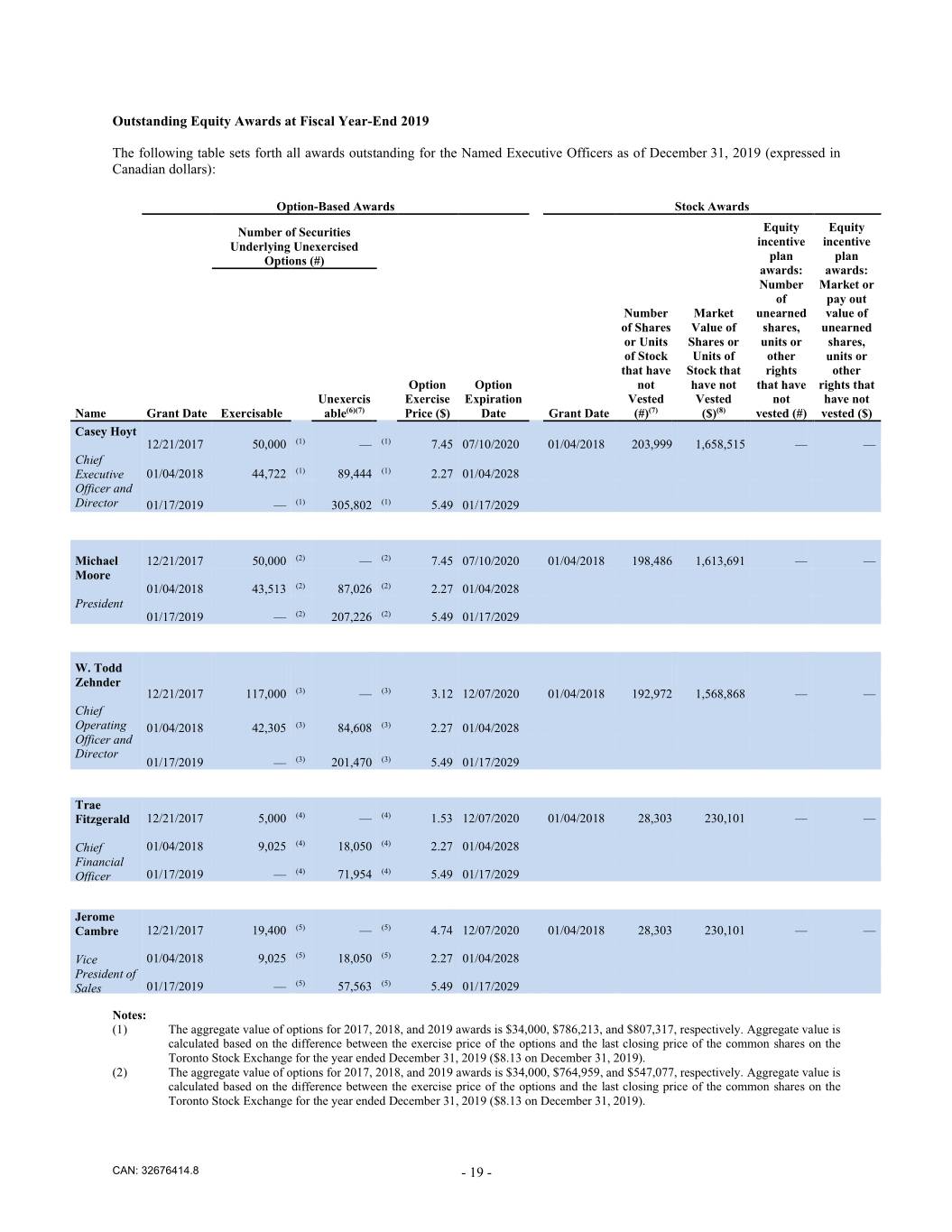

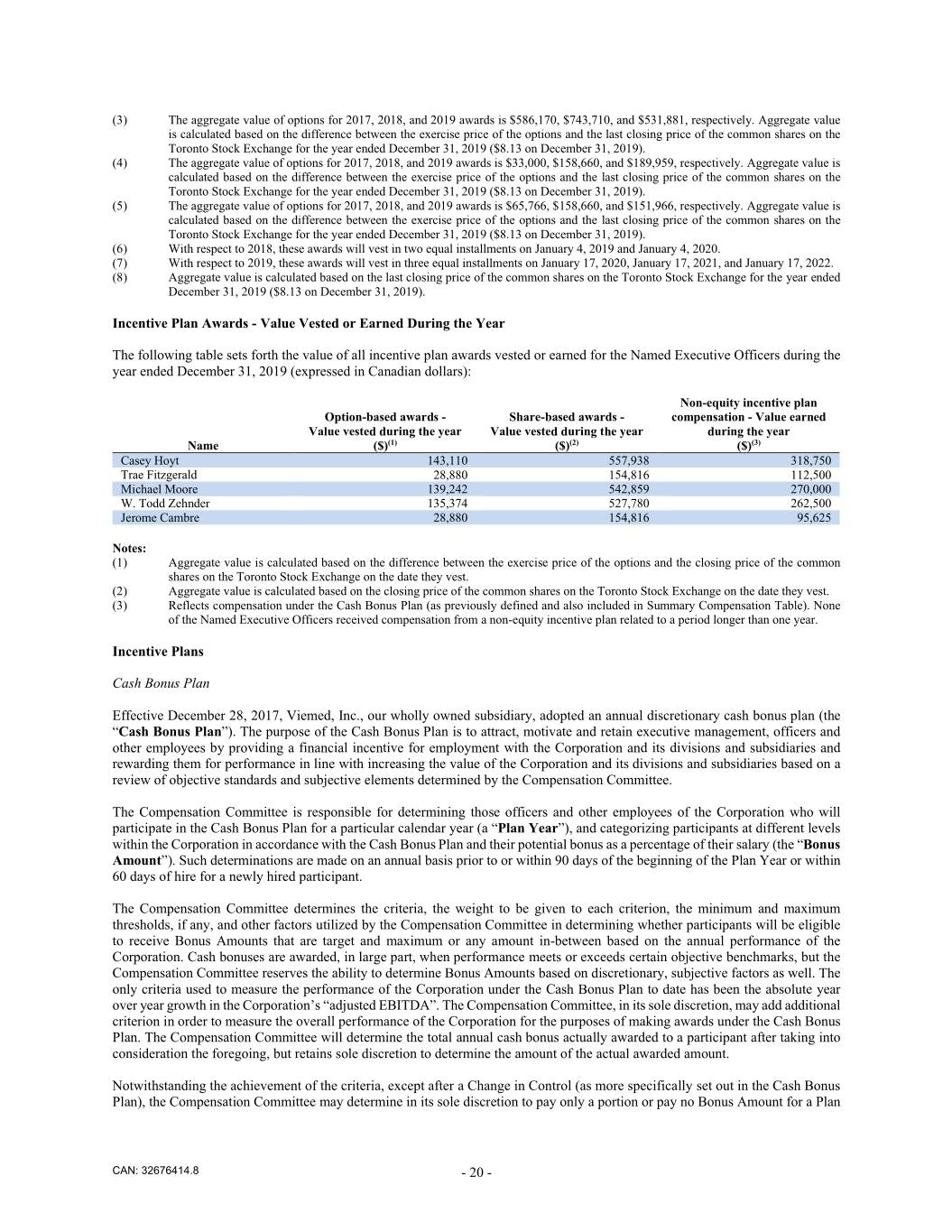

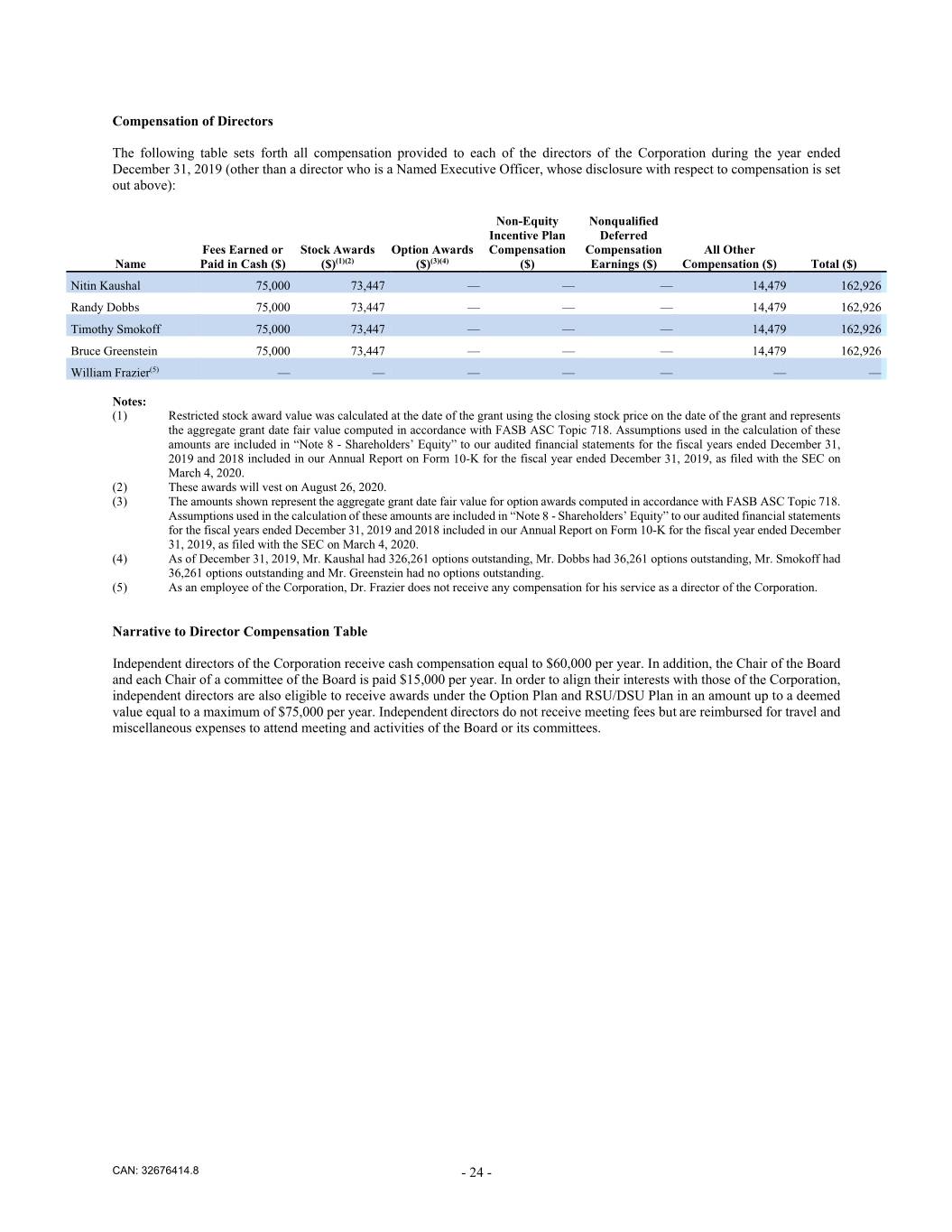

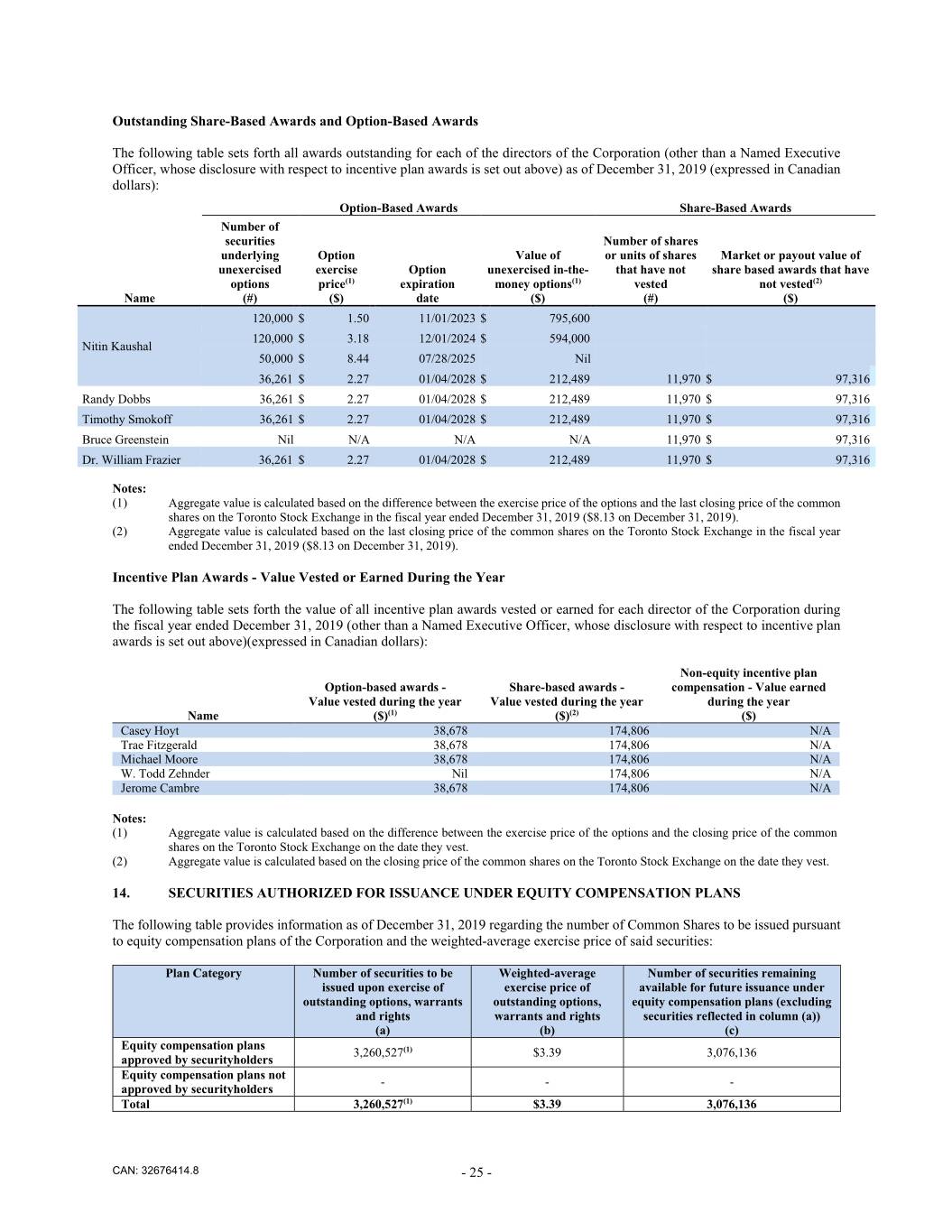

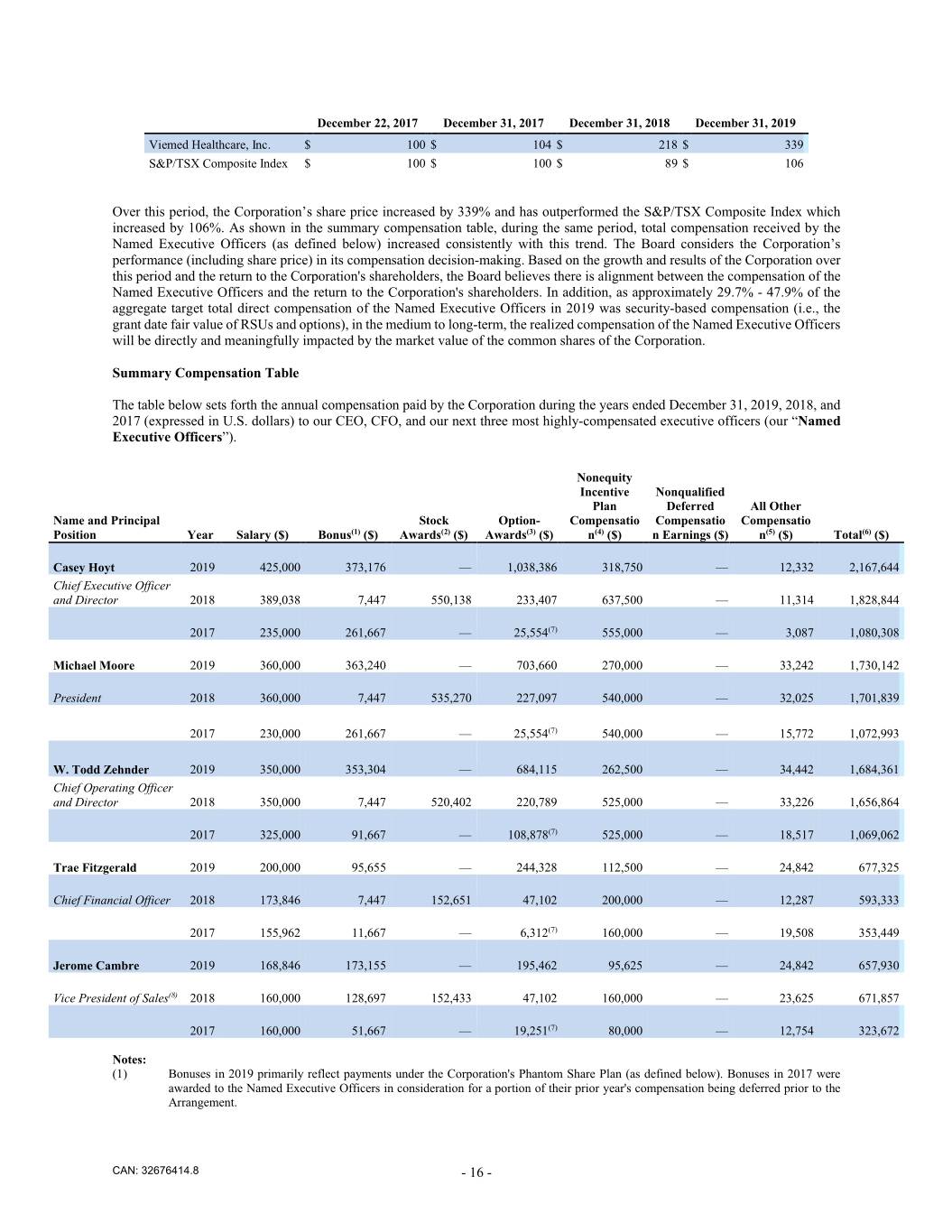

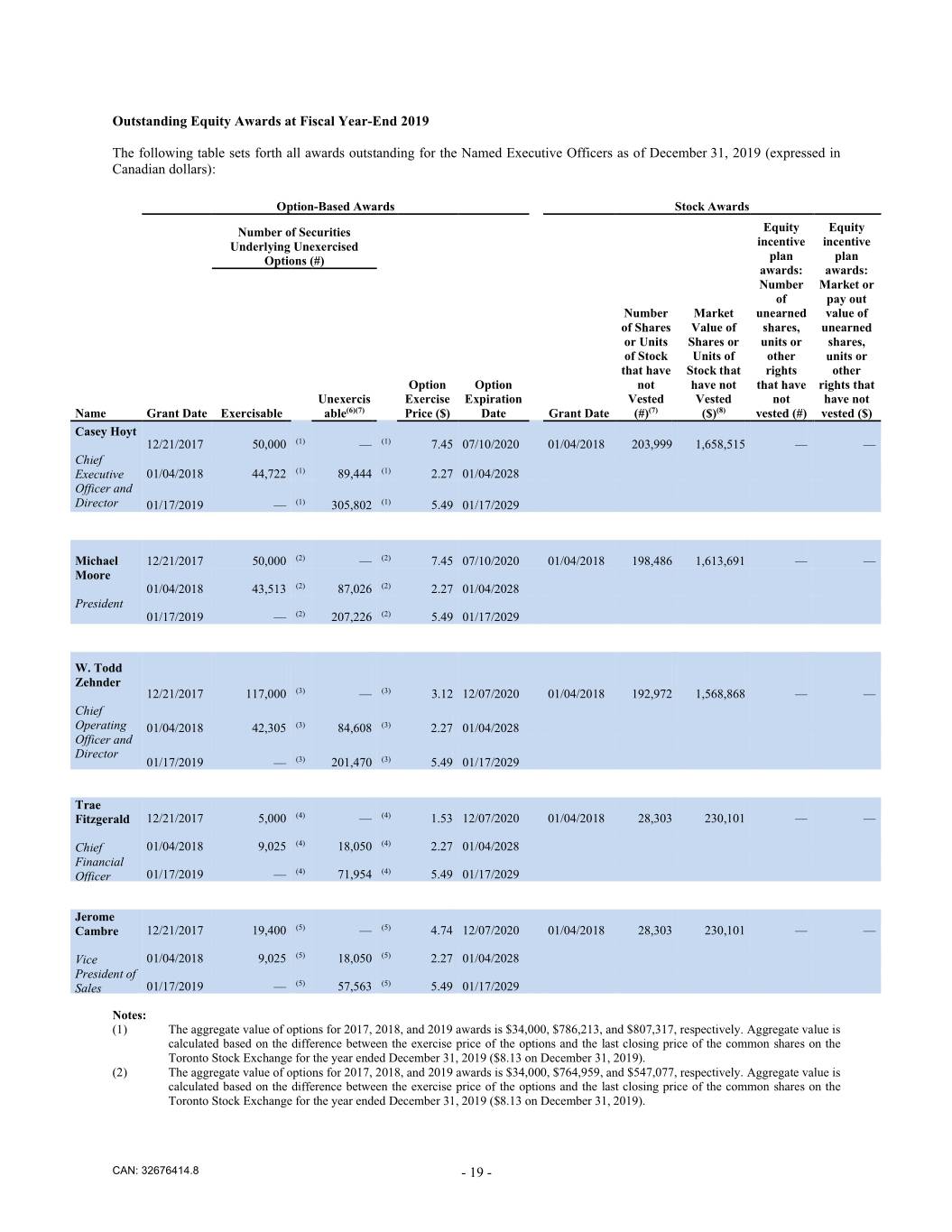

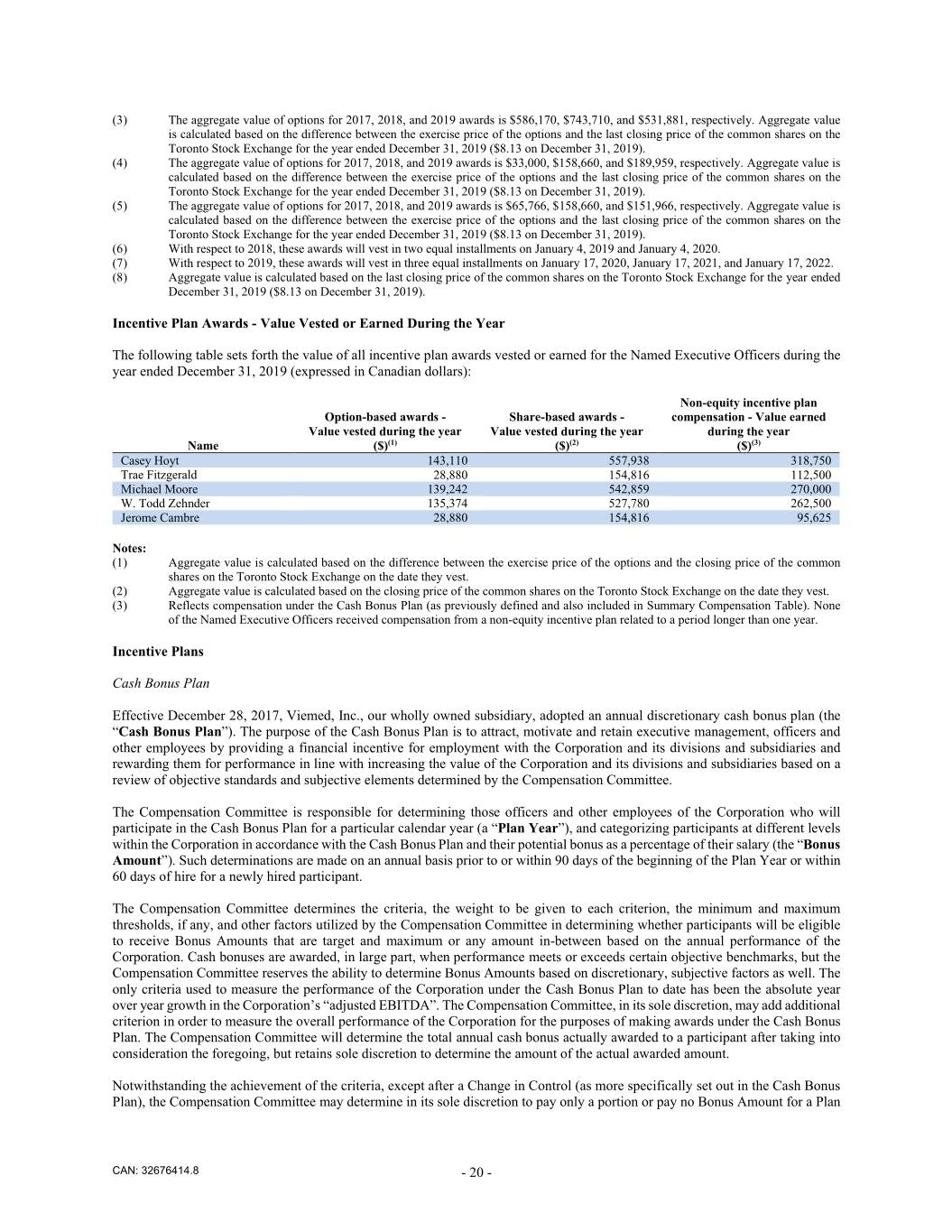

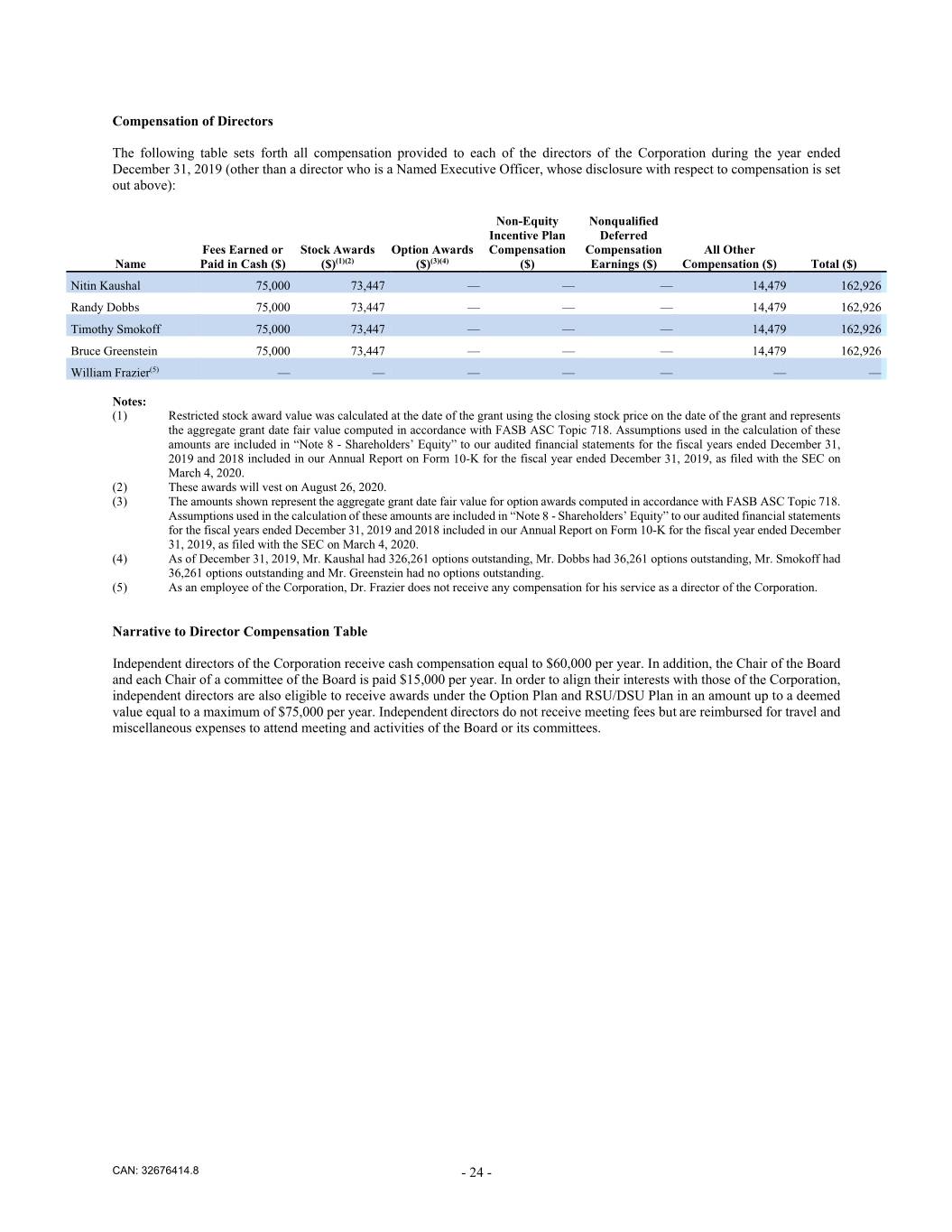

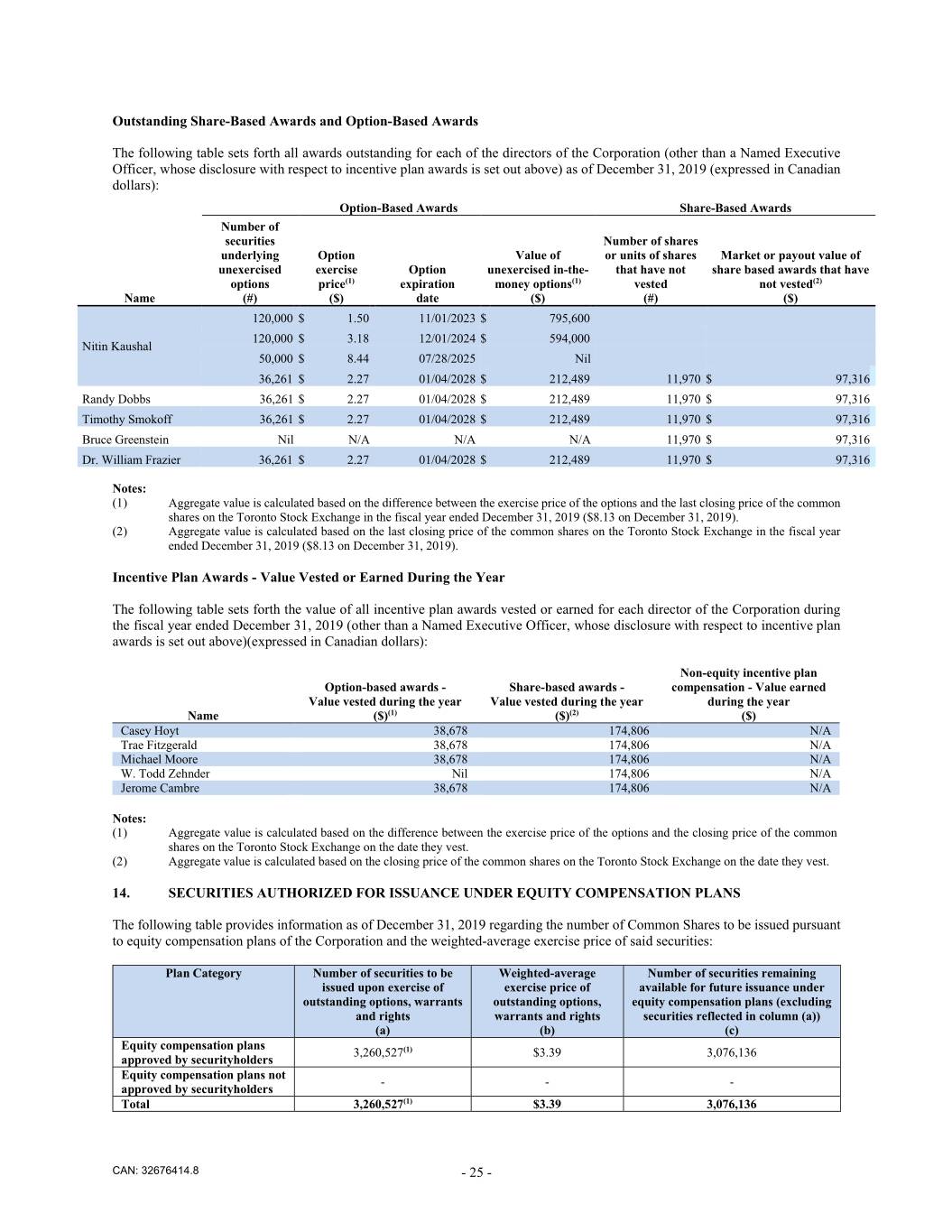

December 22, 2017 December 31, 2017 December 31, 2018 December 31, 2019 Viemed Healthcare, Inc. $ 100 $ 104 $ 218 $ 339 S&P/TSX Composite Index $ 100 $ 100 $ 89 $ 106 Over this period, the Corporation’s share price increased by 339% and has outperformed the S&P/TSX Composite Index which increased by 106%. As shown in the summary compensation table, during the same period, total compensation received by the Named Executive Officers (as defined below) increased consistently with this trend. The Board considers the Corporation’s performance (including share price) in its compensation decision-making. Based on the growth and results of the Corporation over this period and the return to the Corporation's shareholders, the Board believes there is alignment between the compensation of the Named Executive Officers and the return to the Corporation's shareholders. In addition, as approximately 29.7% - 47.9% of the aggregate target total direct compensation of the Named Executive Officers in 2019 was security-based compensation (i.e., the grant date fair value of RSUs and options), in the medium to long-term, the realized compensation of the Named Executive Officers will be directly and meaningfully impacted by the market value of the common shares of the Corporation. Summary Compensation Table The table below sets forth the annual compensation paid by the Corporation during the years ended December 31, 2019, 2018, and 2017 (expressed in U.S. dollars) to our CEO, CFO, and our next three most highly-compensated executive officers (our “Named Executive Officers”). Nonequity Incentive Nonqualified Plan Deferred All Other Name and Principal Stock Option- Compensatio Compensatio Compensatio Position Year Salary ($) Bonus(1) ($) Awards(2) ($) Awards(3) ($) n(4) ($) n Earnings ($) n(5) ($) Total(6) ($) Casey Hoyt 2019 425,000 373,176 — 1,038,386 318,750 — 12,332 2,167,644 Chief Executive Officer and Director 2018 389,038 7,447 550,138 233,407 637,500 — 11,314 1,828,844 2017 235,000 261,667 — 25,554(7) 555,000 — 3,087 1,080,308 Michael Moore 2019 360,000 363,240 — 703,660 270,000 — 33,242 1,730,142 President 2018 360,000 7,447 535,270 227,097 540,000 — 32,025 1,701,839 2017 230,000 261,667 — 25,554(7) 540,000 — 15,772 1,072,993 W. Todd Zehnder 2019 350,000 353,304 — 684,115 262,500 — 34,442 1,684,361 Chief Operating Officer and Director 2018 350,000 7,447 520,402 220,789 525,000 — 33,226 1,656,864 2017 325,000 91,667 — 108,878(7) 525,000 — 18,517 1,069,062 Trae Fitzgerald 2019 200,000 95,655 — 244,328 112,500 — 24,842 677,325 Chief Financial Officer 2018 173,846 7,447 152,651 47,102 200,000 — 12,287 593,333 2017 155,962 11,667 — 6,312(7) 160,000 — 19,508 353,449 Jerome Cambre 2019 168,846 173,155 — 195,462 95,625 — 24,842 657,930 Vice President of Sales(8) 2018 160,000 128,697 152,433 47,102 160,000 — 23,625 671,857 2017 160,000 51,667 — 19,251(7) 80,000 — 12,754 323,672 Notes: (1) Bonuses in 2019 primarily reflect payments under the Corporation's Phantom Share Plan (as defined below). Bonuses in 2017 were awarded to the Named Executive Officers in consideration for a portion of their prior year's compensation being deferred prior to the Arrangement. CAN: 32676414.8 - 16 -