LETTER OF TRANSMITTAL

REGARDING SHARES OF COMMON STOCK OF

BNY MELLON ALCENTRA GLOBAL MULTI-STRATEGY CREDIT FUND, INC.

Tendered Pursuant to the Offer to Purchase Dated January 17, 2024

ALL TENDER REQUESTS MUST BE RECEIVED IN PROPER FORM ON OR

BEFORE 5:00 P.M., EASTERN TIME, ON FEBRUARY 13, 2024. |

The Depositary Agent for the Offer is:

Computershare Inc. and its wholly owned subsidiary, Computershare Trust Company, N.A.

| By Mail: | | By Overnight Courier: |

| Computershare Trust Company, N.A. | | Computershare Trust Company, N.A. |

| Voluntary Corporate Actions | | Voluntary Corporate Actions |

| P.O. Box 43011 | | 150 Royall Street, Suite V |

| Providence, RI 02940-3011 | | Canton, MA 02021 |

| DESCRIPTION OF SHARES TENDERED |

Name(s) and Address(es) of Registered Shareholder(s) (Please fill in, if blank, exactly as name(s) appear(s) on Direct Registration System statement) (Attach additional list, if necessary) |

| |

| Total Shares | |

This Letter of Transmittal is to be completed only by shareholders of BNY Mellon Alcentra Global Multi-Strategy Credit Fund, Inc. (the “Purchaser”) whose Shares (as defined below) are registered directly with the Purchaser in their own name(s).

DELIVERY OF THIS LETTER OF TRANSMITTAL TO AN ADDRESS OTHER THAN AS SET FORTH ABOVE WILL NOT CONSTITUTE VALID DELIVERY.

THE INSTRUCTIONS ACCOMPANYING THIS LETTER OF TRANSMITTAL SHOULD BE READ CAREFULLY BEFORE THIS LETTER OF TRANSMITTAL IS COMPLETED.

NOTE: SIGNATURES MUST BE PROVIDED BELOW

SCAN TO CA VOLUNTARY COY AGM

Ladies and Gentlemen:

The undersigned hereby tenders the above-described shares of common stock (“Shares”) of BNY Mellon Alcentra Global Multi-Strategy Credit Fund, Inc. for purchase by the Purchaser at a price equal to the Purchaser’s most recent quarter-end net asset value (“NAV”) per Share—i.e., the NAV per Share determined as of December 31, 2023- upon the terms and subject to the conditions set forth in the Offer to Purchase dated January 17, 2024 and in this Letter of Transmittal (which, together with any amendments or supplements thereto, collectively constitute the “Offer”).

Upon the terms and subject to the conditions of the Offer (and if the Offer is extended or amended, the terms of any such extension or amendment), and subject to, and effective upon, acceptance for payment of Shares tendered herewith, in accordance with the terms of the Offer, the undersigned hereby sells, assigns and transfers to or upon the order of the Purchaser all right, title and interest in and to all Shares that are being tendered hereby and all dividends, distributions (including, without limitation, distributions of additional Shares) and rights declared, paid or distributed in respect of such Shares that are declared, paid or distributed in respect of a record date on or after the Expiration Date (as defined in Section 1 of the Offer to Purchase) (collectively, “Distributions”) and authorizes and instructs Computershare Inc. (“Computershare”) and its wholly owned subsidiary, Computershare Trust Company, N.A. (together with Computershare, the “Depositary Agent”), to (i) deliver all evidences of transfer and authenticity, to or upon the order of the Purchaser, (ii) present such Shares (and all Distributions) for transfer on the books of the Purchaser and (iii) receive all benefits and otherwise exercise all rights of beneficial ownership of such Shares (and all Distributions), all in accordance with the terms of the Offer.

By executing this Letter of Transmittal, the undersigned hereby irrevocably appoints the Purchaser as the attorney and proxy of the undersigned, each with full power of substitution, to vote in such manner as each such attorney and proxy or his substitute shall, in its sole discretion, deem proper and otherwise act (by written consent or otherwise) with respect to all Shares tendered hereby which have been accepted for payment by the Purchaser prior to the time of such vote or other action and all Shares and other securities issued in Distributions in respect of such Shares, which the undersigned is entitled to vote at any meeting of shareholders of the Purchaser (whether annual or special and whether or not an adjourned or postponed meeting) or consent in lieu of any such meeting or otherwise. This proxy and power of attorney is coupled with an interest in Shares tendered hereby, is irrevocable and is granted in consideration of, and is effective upon, the acceptance for payment of such Shares by the Purchaser in accordance with the other terms of the Offer. Such acceptance for payment shall revoke all other proxies and powers of attorney granted by the undersigned at any time with respect to such Shares (and all Shares and other securities issued as Distributions in respect of such Shares), and no subsequent proxies, powers of attorney, consents or revocations may be given by the undersigned with respect thereto (and if given will not be deemed effective). The undersigned understands that, in order for Shares (and Distributions) to be deemed validly tendered, immediately upon the Purchaser’s acceptance of such Shares for payment, the Purchaser must be able to exercise full voting and other rights with respect to such Shares (and any and all Distributions), including, without limitation, voting at any meeting of the Purchaser’s shareholders. The undersigned hereby represents and warrants that the undersigned has full power and authority to tender, sell, assign and transfer Shares tendered hereby and all Distributions, that when such Shares are accepted for payment by the Purchaser, the Purchaser will acquire good, marketable and unencumbered title thereto and to all Distributions, free and clear of all liens, restrictions, charges and encumbrances, and that none of such Shares and Distributions will be subject to any adverse claim. The undersigned, upon request, shall execute and deliver all additional documents deemed by the Depositary Agent or the Purchaser to be necessary or desirable to complete the sale, assignment and transfer of Shares tendered hereby and all Distributions. In addition, the undersigned shall remit and transfer promptly to the Depositary Agent for the account of the Purchaser all Distributions in respect of Shares tendered hereby, accompanied by appropriate documentation of transfer, and pending such remittance and transfer or appropriate assurance thereof, the Purchaser shall be entitled to all rights and privileges as owner of each such Distribution and may withhold the entire purchase price of Shares tendered hereby, or deduct from such purchase price, the amount or value of such Distribution as determined by the Purchaser in its sole discretion.

No authority herein conferred or agreed to be conferred shall be affected by, and all such authority shall survive, the death or incapacity of the undersigned. All obligations of the undersigned hereunder shall be binding upon the heirs, personal representatives, successors and assigns of the undersigned. Except as stated in the Offer to Purchase, this tender

is irrevocable.

The undersigned understands that the valid tender of Shares pursuant to any one of the procedures described in the Offer to Purchase and in the instructions hereto will constitute the undersigned’s acceptance of the terms and conditions of the Offer. The Purchaser’s acceptance of such Shares for payment will constitute a binding agreement between the undersigned and the Purchaser upon the terms and subject to the conditions of the Offer (and, if the Offer is extended or amended, the terms or conditions of any such extension or amendment).

Unless otherwise indicated below in the box entitled “Special Payment Instructions,” the undersigned is requesting that the check for the purchase price of all Shares purchased (less the amount of any applicable U.S. withholding taxes) from the undersigned pursuant to the Offer and, if applicable, a Direct Registration System (“DRS”) statement, evidencing Shares held for the undersigned in an electronic book-entry account maintained by the Depositary Agent, representing the number of Shares not accepted for payment, be issued in the name(s) of the registered shareholder(s) appearing above under “Description of Shares Tendered”. Similarly, unless otherwise indicated below in the box entitled “Special Delivery Instructions,” the undersigned is requesting that the check for the purchase price of all Shares purchased (less the amount of any applicable U.S. withholding taxes) from the undersigned pursuant to the Offer and, if applicable, a DRS statement, evidencing Shares held for the undersigned in an electronic book-entry account maintained by the Depositary Agent, representing the number of Shares not accepted for payment, be mailed to the address of the registered shareholder(s) appearing above under “Description of Shares Tendered.”

In the event that the boxes below entitled “Special Payment Instructions” and “Special Delivery Instructions” are both completed, the undersigned is requesting that the check for the purchase price of all Shares purchased (less the amount of any applicable U.S. withholding taxes) from the undersigned pursuant to the Offer and, if applicable, a DRS statement, evidencing Shares held for the undersigned in an electronic book-entry account maintained by the Depositary Agent, representing the number of Shares not accepted for payment be issued and mailed to the person(s) so indicated. The undersigned recognizes that the Purchaser has no obligation, pursuant to the Special Payment Instructions or the Special Delivery Instructions, to make any payment or to transfer any Shares from the name of the registered shareholder(s) thereof if the Purchaser does not accept for payment any Shares tendered by the undersigned pursuant to the Offer. The Shares purchased will be debited from the book-entry account of the undersigned.

| SPECIAL PAYMENT INSTRUCTIONS | | SPECIAL DELIVERY INSTRUCTIONS |

| (See Instructions 1, 5, 6 and 7) | | (See Instructions 1, 5, 6 and 7) |

| | | |

| To be completed ONLY if the check for the purchase price of Shares purchased and, if applicable, a DRS statement, evidencing Shares held for you in an electronic book-entry account maintained by the Depositary Agent representing the number of Shares not accepted for payment, are to be issued in the name of someone other than the undersigned. | | To be completed ONLY if the check for the purchase price of Shares purchased and, if applicable, a DRS statement, evidencing Shares held for you in an electronic book-entry account maintained by the Depositary Agent representing the number of Shares not accepted for payment, are to be mailed to someone other than the undersigned, or to the undersigned at an address other than that shown under “Description of Shares Tendered.” |

| | | |

| Issue Check and DRS Statement to: | | Mail Check and DRS Statement to: |

| Name: ________________________ | | Name: ________________________ |

| (Please Print) | | (Please Print) |

| Address: ____________________ | | Address: ____________________ |

| _____________________________________ | | _____________________________________ |

| (Zip Code) | | (Zip Code) |

| | | |

| (Tax Identification or Social Security Number) (Also Complete Enclosed Form W-9) | | (Tax Identification or Social Security Number) (Also Complete Enclosed Form W-9) |

| | | |

| IMPORTANT |

| SHAREHOLDERS, |

| SIGN HERE: |

| (Please Also Complete Enclosed Form W-9) |

| |

| Sign Here: ______________________________________________________________ |

| |

| Sign Here: ______________________________________________________________ |

| Signature(s) of Shareholder(s) |

| |

| Dated: , 2023. |

| (Must be signed by registered shareholder(s) exactly as name(s) appear(s) on Direct Registration System statement. If signature is by a trustee, executor, administrator, guardian, attorney-in-fact, officer of a corporation or other person acting in a fiduciary or representative capacity, please provide the following information and see Instruction 5.) |

| |

| Name(s): _______________________________________________________________ |

| Please Print |

| Capacity (full title): __________________________________________ |

| Address: __________________________________________________ |

| Include Zip Code |

| |

| Daytime Area Code and Telephone No.: ___________________________________________ |

| |

| Taxpayer Identification or |

| Social Security No.: ___________________________________________________ |

| |

| (Also Complete Enclosed Form W-9) |

| GUARANTEE OF SIGNATURE(S) |

| (See Instructions 1 and 5) |

| FOR USE BY FINANCIAL INSTITUTIONS ONLY. |

| FINANCIAL INSTITUTIONS: PLACE MEDALLION |

| GUARANTEE IN SPACE BELOW |

INSTRUCTIONS

Forming Part of the Terms and Conditions of the Offer

1. Guarantee of Signatures. All signatures on this Letter of Transmittal must be guaranteed by a firm which is a member of the Securities Transfer Agents Medallion Program, or by any other “eligible guarantor institution,” as such term is defined in Rule 17Ad-15 promulgated under the Securities Exchange Act of 1934, as amended (each of the foregoing being an “Eligible Institution”) unless (i) this Letter of Transmittal is signed by the registered shareholder(s) of

Shares tendered hereby and such shareholder(s) has (have) not completed the box entitled “Special Payment Instructions” or “Special Delivery Instructions” in this Letter of Transmittal or (ii) such Shares are tendered for the account of an Eligible Institution. See Instruction 5.

2. Delivery of Letter of Transmittal and Shares. This Letter of Transmittal is to be used only if Shares being tendered are held in book-entry form on the books of the Depositary Agent. A properly completed and duly executed Letter of Transmittal and any other documents required by this Letter of Transmittal must be received by the Depositary Agent at one of its addresses set forth below prior to the Expiration Date (as defined in Section 1 of the Offer to Purchase). Please indicate the number of Shares being tendered in the box titled “Number of Shares Tendered” on this Letter of Transmittal.

The method of delivery of this Letter of Transmittal, Shares and all other required documents is at the option and risk of the tendering shareholder, and the delivery will be deemed made only when actually received by the Depositary Agent. If delivery is by mail, registered mail with return receipt requested, properly insured, is recommended. In all cases, sufficient time should be allowed to ensure timely delivery.

No alternative, conditional or contingent tenders will be accepted and no fractional Shares will be purchased. By execution of this Letter of Transmittal, all tendering shareholders waive any right to receive any notice of the acceptance of their Shares for payment.

3. Inadequate Space. If the space provided under “Description of Shares Tendered” is inadequate, the name(s)

and address(es) of the registered shareholder(s) should be listed on a separate signed schedule and attached hereto.

4. Partial Tenders. If you wish to tender fewer than all of your Shares, fill in the number of Shares that you wish to tender in the row entitled “Total Shares.”

5. Signatures on Letter of Transmittal; Share Powers and Endorsements. If this Letter of Transmittal is signed by the registered shareholder(s) of Shares tendered hereby, the signature(s) must correspond with the name(s) as written on the face of the DRS statement, evidencing such Shares without alteration, enlargement or any other change whatsoever.

If any Shares tendered hereby are held of record by two or more persons, all such persons must sign this Letter of Transmittal.

If any Shares tendered hereby are registered in different names, it will be necessary to complete, sign and submit as many separate Letters of Transmittal as there are different registrations of such Shares.

If this Letter of Transmittal is signed by the registered shareholder(s) of Shares tendered hereby, no separate share powers are required, unless payment is to be made to, or DRS statements evidencing Shares not accepted for payment are to be issued in the name of, a person other than the registered shareholder(s). If this Letter of Transmittal is signed by a person other than the registered shareholder(s) of the Shares tendered, the Share(s) tendered hereby must be endorsed or accompanied by appropriate share powers, in either case signed exactly as the name(s) of the registered shareholder(s) appear(s) on the DRS statement. Signatures on such share powers must be guaranteed by an Eligible Institution.

If this Letter of Transmittal or any share power is signed by a trustee, executor, administrator, guardian, attorney-in-fact, officer of a corporation or other person acting in a fiduciary or representative capacity, such person

should so indicate when signing, and proper evidence satisfactory to the Purchaser, in its sole discretion, of such person’s authority so to act must be submitted.

6. Share Transfer Taxes. Share transfer taxes may be applicable under certain circumstances. You should consult your own tax adviser for a complete description of the tax consequences to you of any sale or transfer of Shares pursuant to the Offer.

7. Special Payment and Delivery Instructions. If a check for the purchase price of any Shares tendered hereby is to be issued in the name of, and/or DRS statements evidencing Shares not accepted for payment are to be issued in the name of, a person other than the person(s) signing this Letter of Transmittal or if such check or any such DRS statements are to be sent to a person other than the signer of this Letter of Transmittal or to the person(s) signing this Letter of Transmittal but at an address other than that shown in the box entitled “Description of Shares Tendered,” the boxes entitled “Special Payment Instructions” and “Special Delivery Instructions” herein, as appropriate, must be completed.

8. Questions and Requests for Assistance or Additional Copies. Questions and requests for assistance may be directed to Georgeson LLC (the “Information Agent”) at the telephone number set forth below. Additional copies of the Offer to Purchase, this Letter of Transmittal and the Guidelines for Certification of Taxpayer Identification Number on Form W-9 may be obtained from the Information Agent.

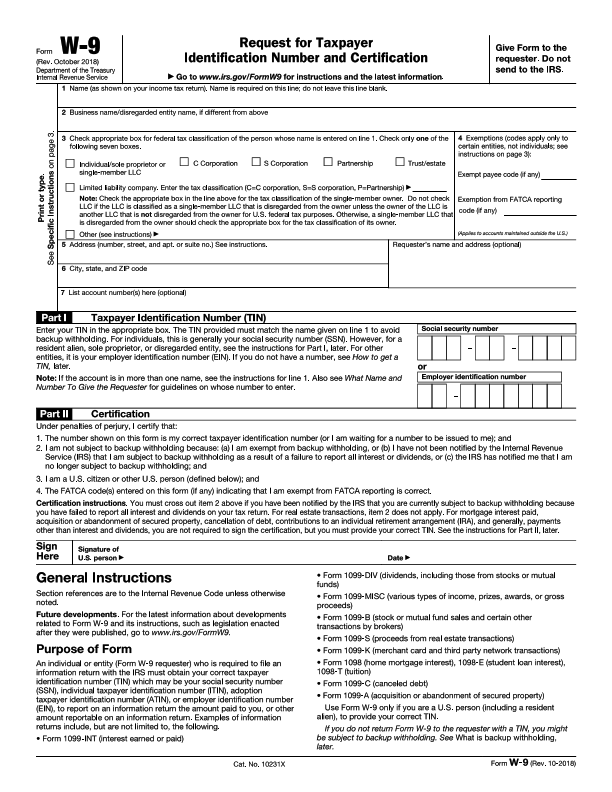

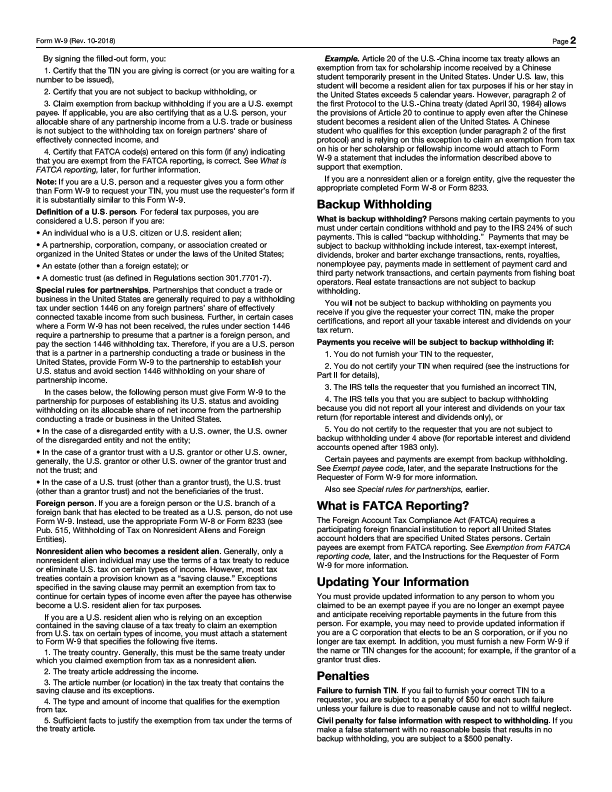

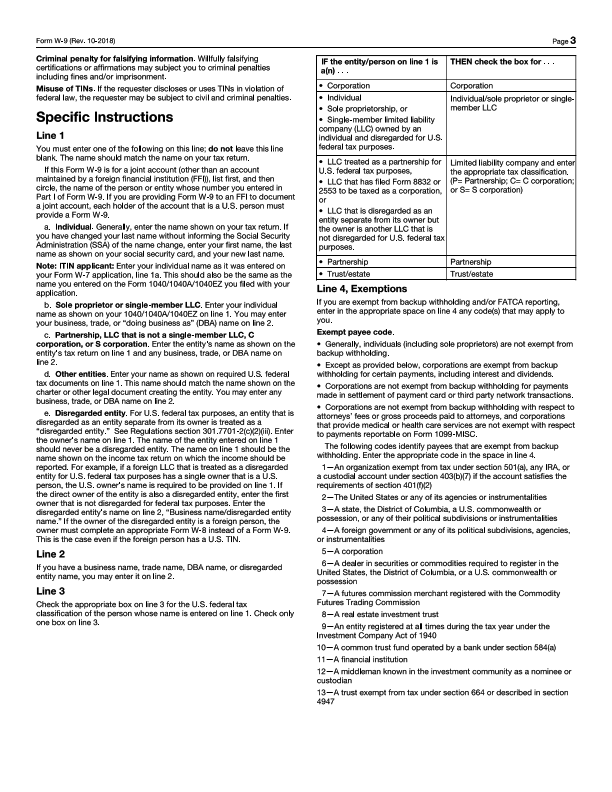

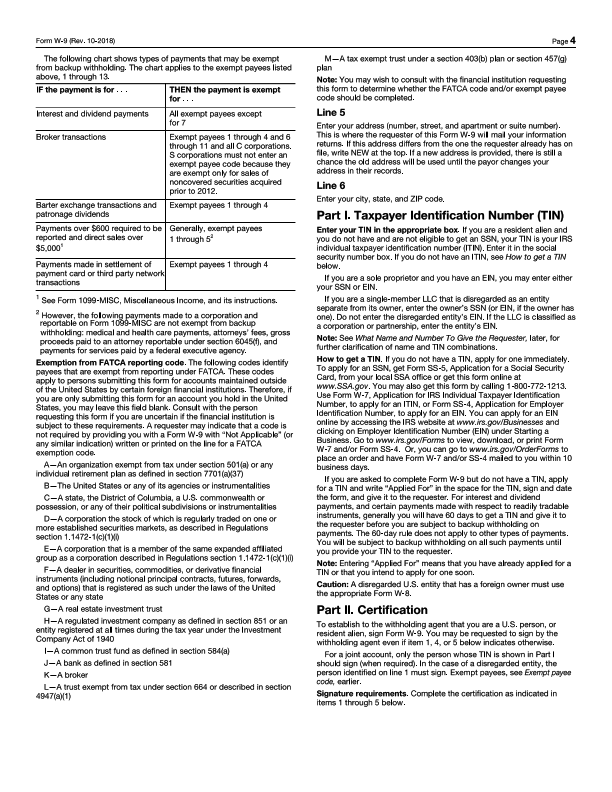

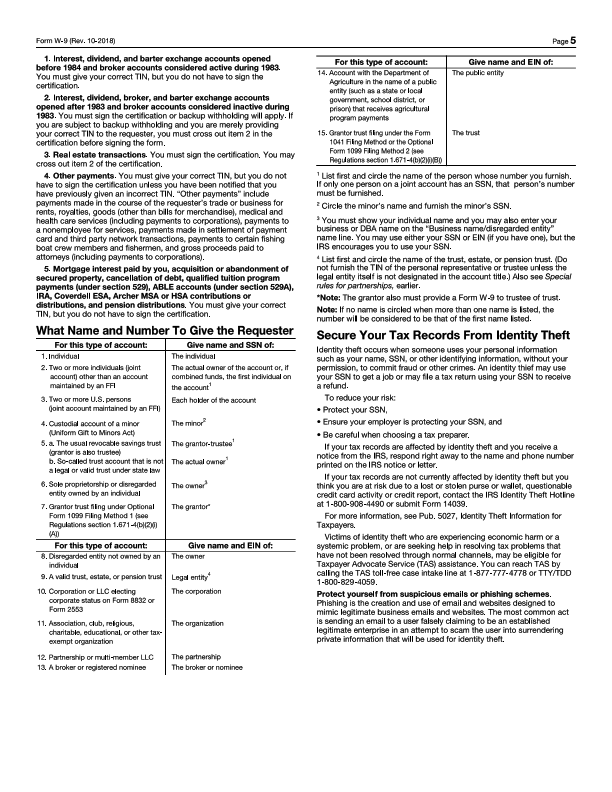

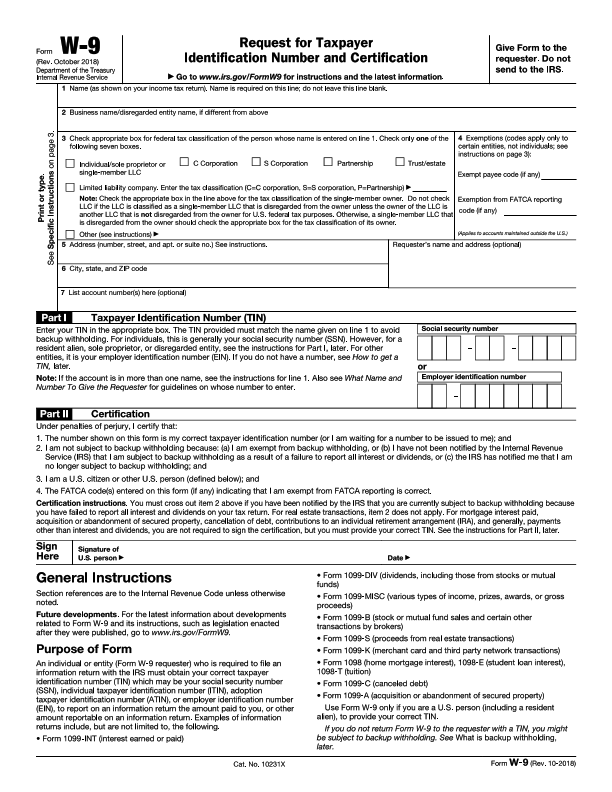

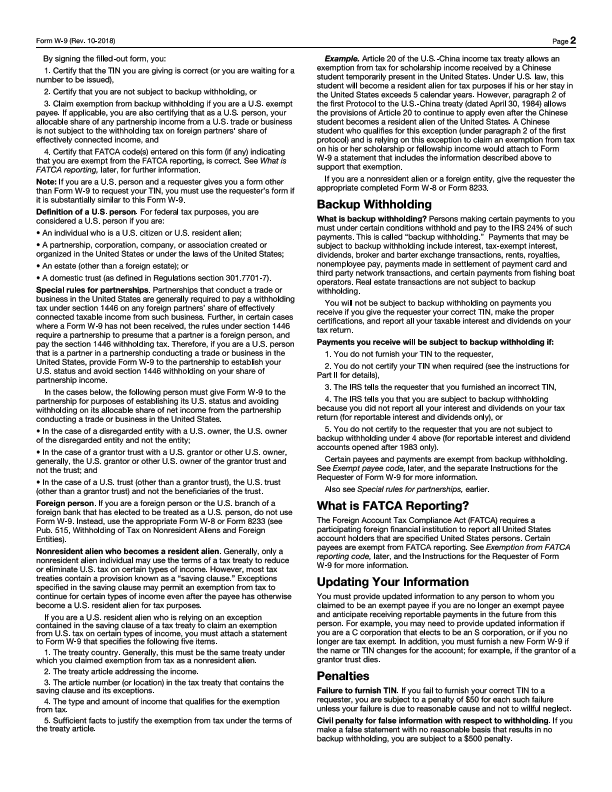

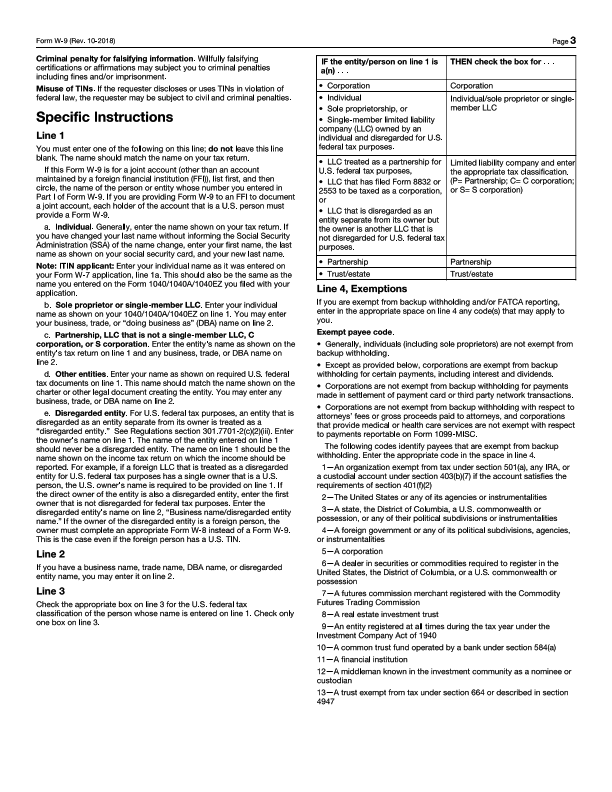

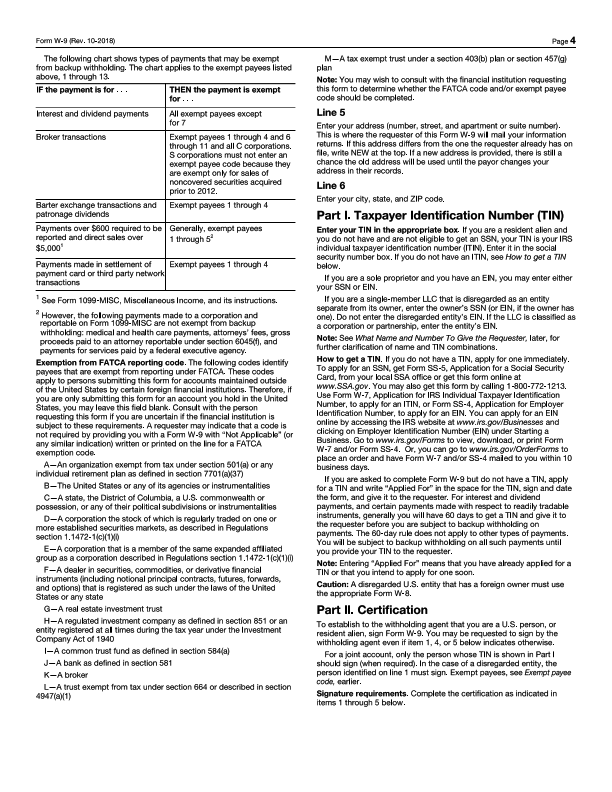

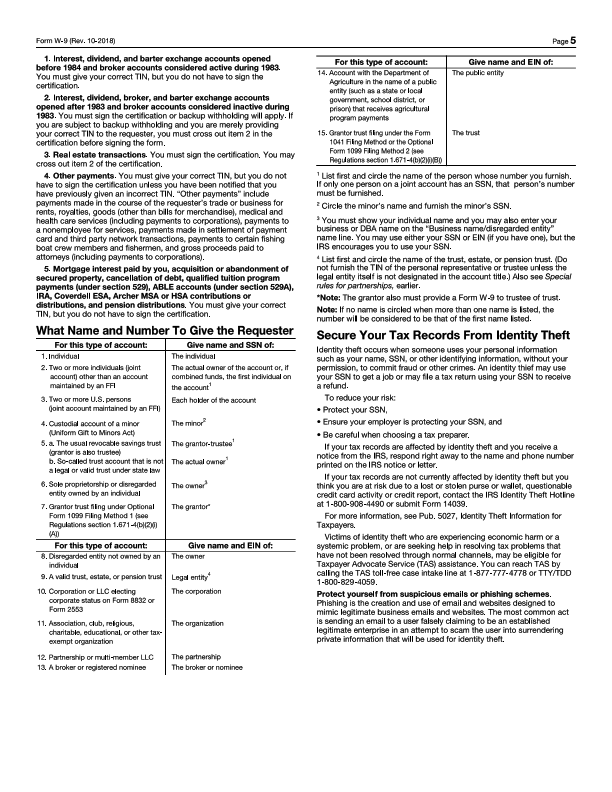

9. Important Tax Information. Under U.S. federal income tax laws, the Depositary Agent will be required to withhold 24% of the gross proceeds otherwise payable to a U.S. individual or certain non-corporate shareholders pursuant to the Offer. In order to avoid such backup withholding, each tendering shareholder that is a United States person for U.S. federal income tax purposes must provide the Depositary Agent with such shareholder’s correct taxpayer identification number (“TIN”) and certify that such shareholder is not subject to backup withholding by completing, signing and dating an Internal Revenue Service (“IRS”) Form W-9 and returning such form to the Depositary Agent.

In general, if a shareholder is an individual, the TIN is the social security number of such individual. If the Depositary Agent is not provided with the correct TIN and other required information, or if a false statement is made on the IRS Form W-9, the shareholder may be subject to penalties imposed by the IRS and, in certain cases, criminal penalties, including fines and/or imprisonment. Certain shareholders (including, among others, generally all corporations, non- resident foreign individuals and foreign entities) are not subject to these backup withholding and reporting requirements. However, such shareholders should complete the IRS Form W-9 (or, in the case of a foreign shareholder, an appropriate IRS Form W-8, discussed below) to avoid erroneous backup withholding. For further information concerning backup withholding and instructions for completing the IRS Form W-9 (including how to obtain a TIN if you do not have one and how to complete the IRS Form W-9 if Shares are held in more than one name), consult the instructions included with the IRS Form W-9 set forth below. The Purchaser may also need to withhold on payments to a shareholder if it is notified by the IRS that it is required to do so.

A foreign shareholder that is not a United States person for U.S. federal income tax purposes may be subject to backup withholding, but may qualify as an exempt recipient by providing the Depositary Agent with a properly completed, signed and dated IRS Form W-8BEN or IRS Form W-8BEN-E, as applicable, or other appropriate IRS Form W-8, attesting to such shareholder’s foreign status or by otherwise establishing an exemption. An appropriate IRS

Form W-8 may be obtained from the Depositary Agent or the IRS website (www.irs.gov). In addition, withholding taxes may apply to certain non-U.S. shareholders. Non-U.S. shareholders should consult their own tax advisors regarding the application of the U.S. federal withholding tax, including their potential eligibility for a withholding tax reduction or exemption, and the refund procedure.

Backup withholding is not an additional tax. Rather, the U.S. federal income tax liability of a person subject

to backup withholding will be reduced by the amount of tax withheld. If backup withholding results in an overpayment of taxes, a refund may be obtained from the IRS provided that the required information establishing eligibility is timely furnished to the IRS.

NOTE: FAILURE TO COMPLETE AND RETURN THE IRS FORM W-9 (OR AN APPROPRIATE IRS FORM W-8) MAY RESULT IN PENALTIES AND BACKUP WITHHOLDING ON ANY AMOUNTS OTHERWISE PAYABLE TO YOU PURSUANT TO THE OFFER. PLEASE REVIEW THE INSTRUCTIONS TO THE IRS FORM W-9 (OR APPROPRIATE IRS FORM W-8) FOR ADDITIONAL DETAILS. FOR ADDITIONAL INFORMATION CONTACT YOUR OWN TAX ADVISOR OR THE IRS.

This Letter of Transmittal and any other required documents should be sent or delivered by each shareholder to the Depositary Agent at one of its addresses set forth below:

The Depositary Agent for the Offer is:

By Mail: | By Overnight Courier: |

| Computershare Trust Company, N.A. | Computershare Trust Company, N.A. |

| Voluntary Corporate Actions | Voluntary Corporate Actions |

| P.O. Box 43011 | 150 Royall Street, Suite V |

| Providence, RI 02940-3011 | Canton, MA 02021 |

_____________________________

Questions or requests for assistance may be directed to the

Information Agent at its telephone number listed below.

Additional copies of the Offer to Purchase and this Letter of Transmittal may be obtained from the Information Agent.

The Information Agent for the Offer is:

1290 Avenue of the Americas, 9th Floor

New York, NY 10104

(877) 278-9670 (Toll Free)