Broadcom Inc. Company Overview September 2018 Exhibit 99.1

This presentation contains forward-looking statements (including within the meaning of Section 21E of the United States Securities Exchange Act of 1934, as amended, and Section 27A of the United States Securities Act of 1933, as amended) concerning Broadcom Inc. (“Broadcom” or the “Company”). These statements include, but are not limited to, statements that address our expected future business and financial performance, about historical results that may suggest trends for our business and financial performance, and other statements identified by words such as “will”, “expect”, “intends”, “believe”, “anticipate”, “estimate”, “should”, “intend”, “plan”, “potential”, “predict” “project”, “aim”, and similar words, phrases or expressions. These forward-looking statements are based on current expectations and beliefs of the management of Broadcom, as well as assumptions made by, and information currently available to, such management, current market trends and market conditions and involve risks and uncertainties, many of which are outside the Company’s and management’s control, and which may cause actual results to differ materially from those contained in forward-looking statements. Accordingly, you should not place undue reliance on such statements. Particular uncertainties that could materially affect future results include risks associated with: our proposed acquisition of CA, Inc., including (1) the acquisition may not be completed in a timely manner or at all, (2) the effect of the announcement or pendency of the proposed acquisition on our business relationships, operating results and business generally, (3) potential difficulties in employee retention, (4) risks related to diverting management’s attention from ongoing business operations, and (5) the outcome of any legal proceedings related to the merger agreement or the proposed acquisition; any loss of our significant customers and fluctuations in the timing and volume of significant customer demand; our dependence on contract manufacturing and outsourced supply chain; our dependency on a limited number of suppliers; any other acquisitions we may make, such as delays, challenges and expenses associated with receiving governmental and regulatory approvals and satisfying other closing conditions, and with integrating acquired companies with our existing businesses and our ability to achieve the benefits, growth prospects and synergies expected by such acquisitions; our ability to accurately estimate customers’ demand and adjust our manufacturing and supply chain accordingly; our significant indebtedness, including the additional significant indebtedness that we expect to incur in connection with the proposed acquisition of CA and the need to generate sufficient cash flows to service and repay such debt; dependence on a small number of markets and the rate of growth in these markets; dependence on and risks associated with distributors of our products; dependence on senior management; quarterly and annual fluctuations in operating results; global economic conditions and concerns; the amount and frequency of our stock repurchases; cyclicality in the semiconductor industry or in our target markets; our competitive performance and ability to continue achieving design wins with our customers, as well as the timing of any design wins; prolonged disruptions of our or our contract manufacturers’ manufacturing facilities or other significant operations; our ability to improve our manufacturing efficiency and quality; our dependence on outsourced service providers for certain key business services and their ability to execute to our requirements; our ability to maintain or improve gross margin; our ability to protect our intellectual property and the unpredictability of any associated litigation expenses; any expenses or reputational damage associated with resolving customer product warranty and indemnification claims; our ability to sell to new types of customers and to keep pace with technological advances; market acceptance of the end products into which our products are designed; our overall cash tax costs, legislation that may impact our overall cash tax costs and our ability to maintain tax concessions in certain jurisdictions; and other events and trends on a national, regional and global scale, including those of a political, economic, business, competitive and regulatory nature. Our filings with the Securities and Exchange Commission (“SEC”), which you may obtain for free at the SEC’s website at http://www.sec.gov, discuss some of the important risk factors that may affect our business, results of operations and financial condition. We undertake no intent or obligation to publicly update or revise any of these forward looking statements, whether as a result of new information, future events or otherwise, except as required by law. Safe Harbor Statement

Broadcom at a Glance One of the industry’s broadest IP portfolios with ~21,000 patents 20 leading franchises in their markets ~75% of all employees are world-class engineers FY17 net revenue of $17.7B* $3.3B investment in R&D in FY17 * FY17 Non-GAAP revenue of Broadcom Limited.

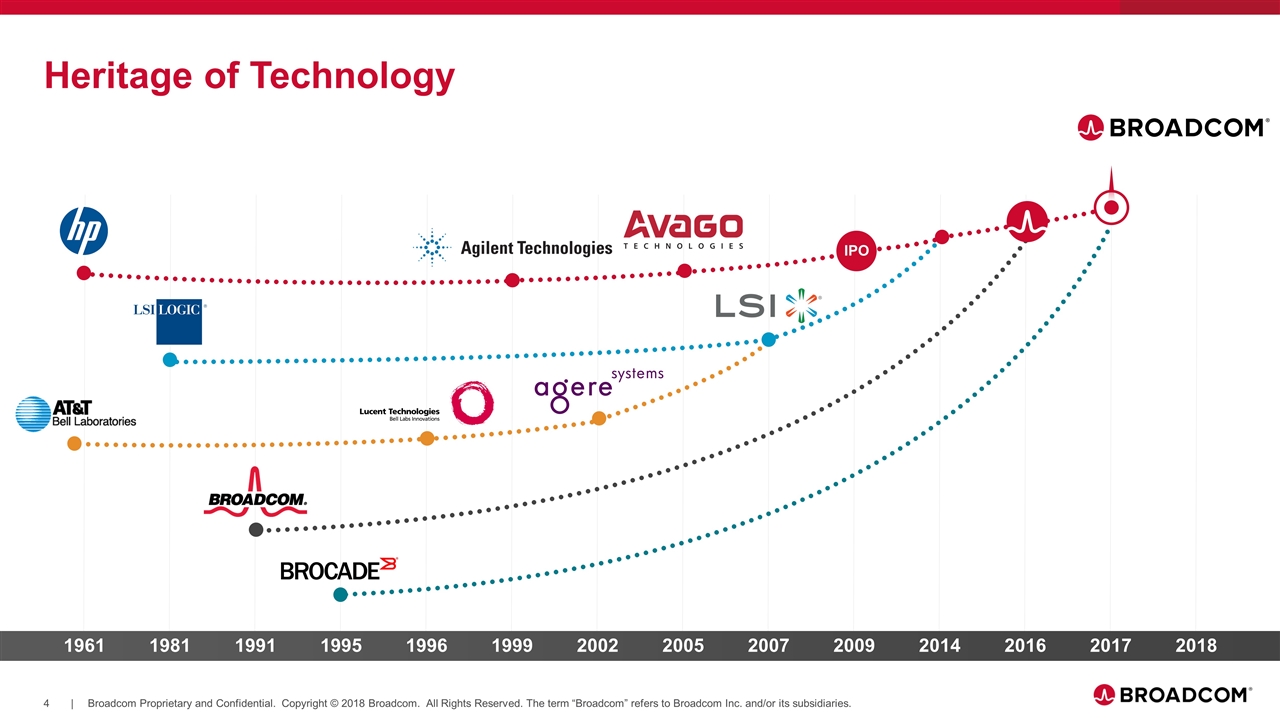

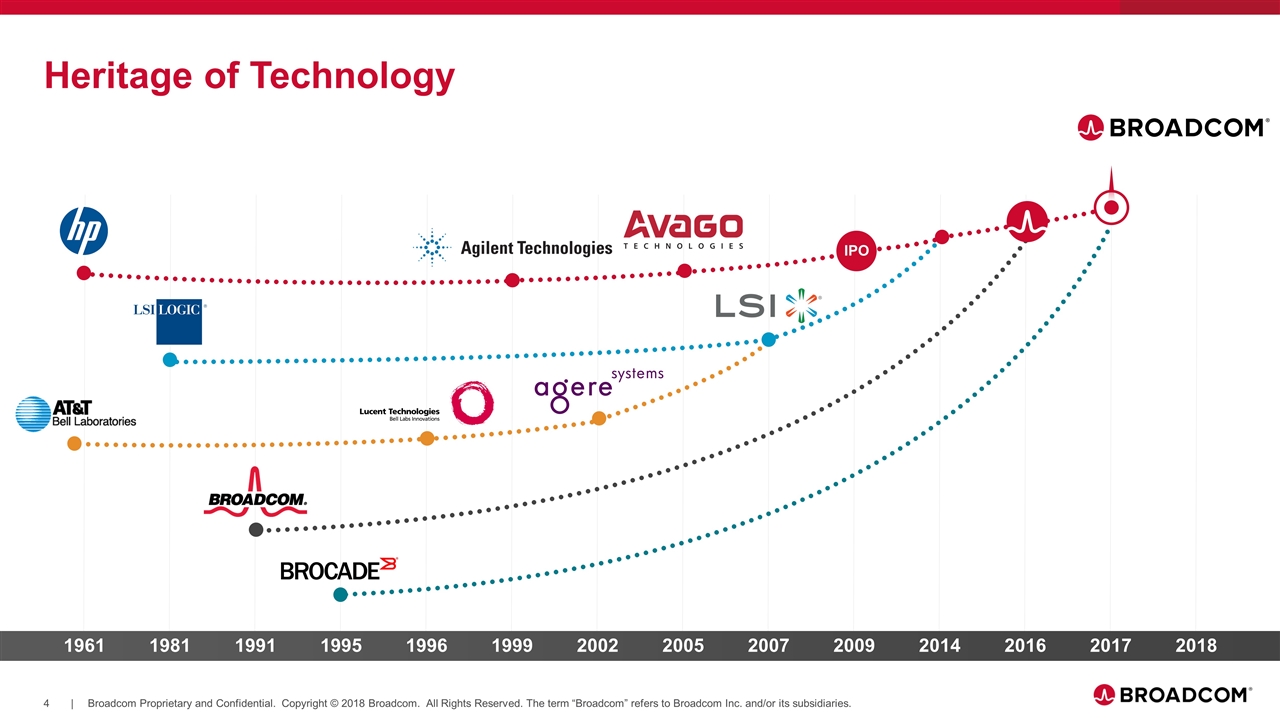

Heritage of Technology IPO 1961 1981 1996 1999 2002 2005 2007 2009 2014 2016 1991 2017 1995 2018

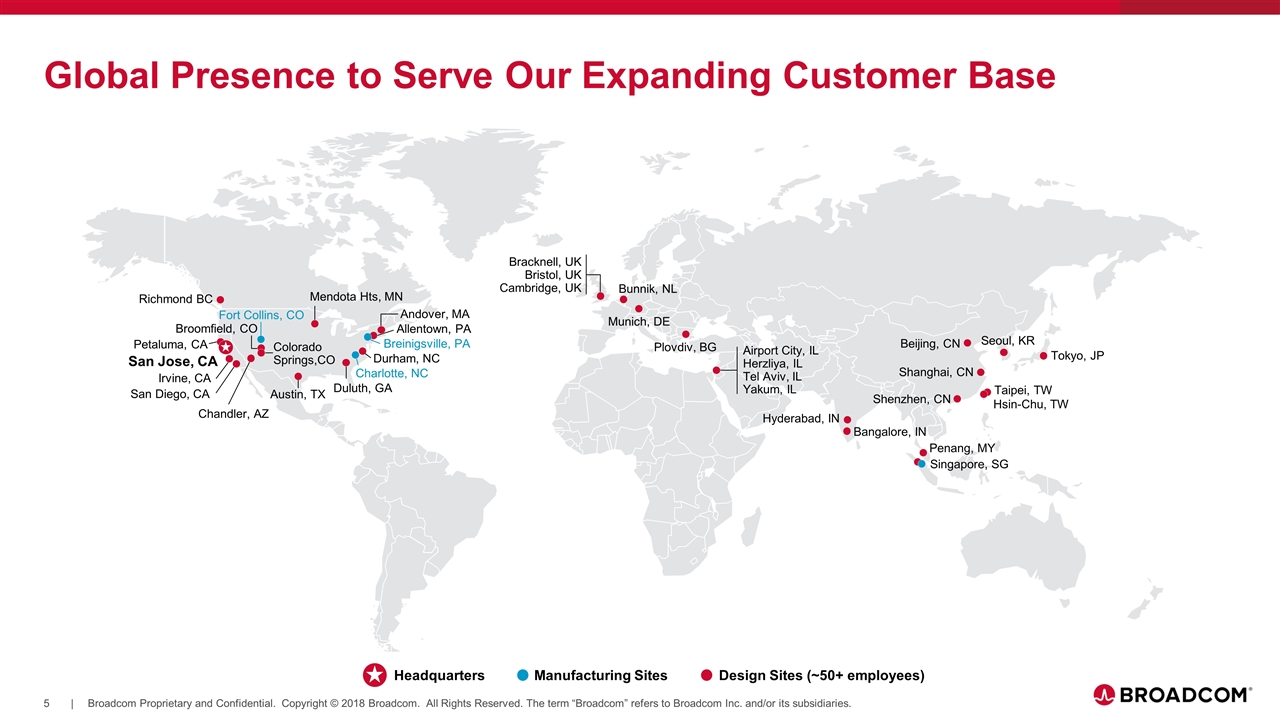

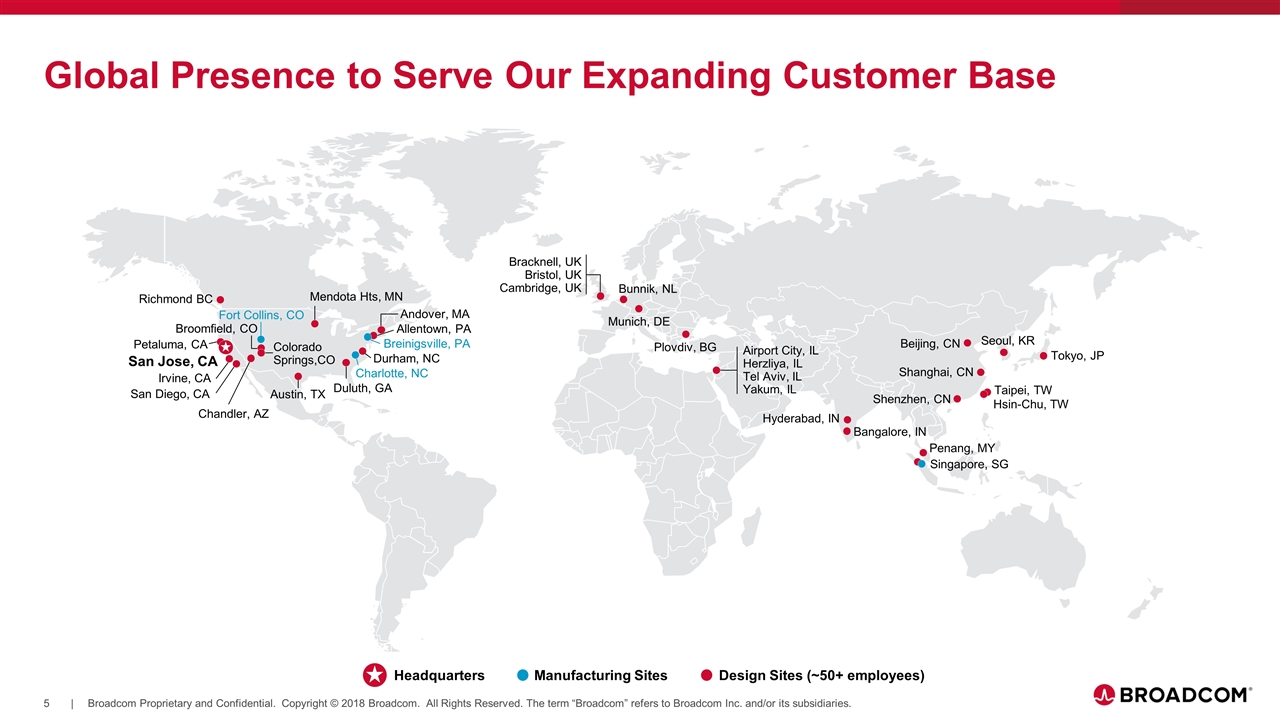

Global Presence to Serve Our Expanding Customer Base Bangalore, IN Hyderabad, IN Seoul, KR Shanghai, CN Penang, MY Taipei, TW Beijing, CN Shenzhen, CN Hsin-Chu, TW Tokyo, JP Singapore, SG Design Sites (~50+ employees) Headquarters Manufacturing Sites Irvine, CA San Diego, CA Fort Collins, CO Colorado Springs,CO Allentown, PA Mendota Hts, MN Breinigsville, PA Richmond BC Andover, MA Duluth, GA Broomfield, CO Charlotte, NC Chandler, AZ Austin, TX Durham, NC San Jose, CA Petaluma, CA Airport City, IL Herzliya, IL Tel Aviv, IL Yakum, IL Bracknell, UK Bristol, UK Cambridge, UK Munich, DE Bunnik, NL Plovdiv, BG

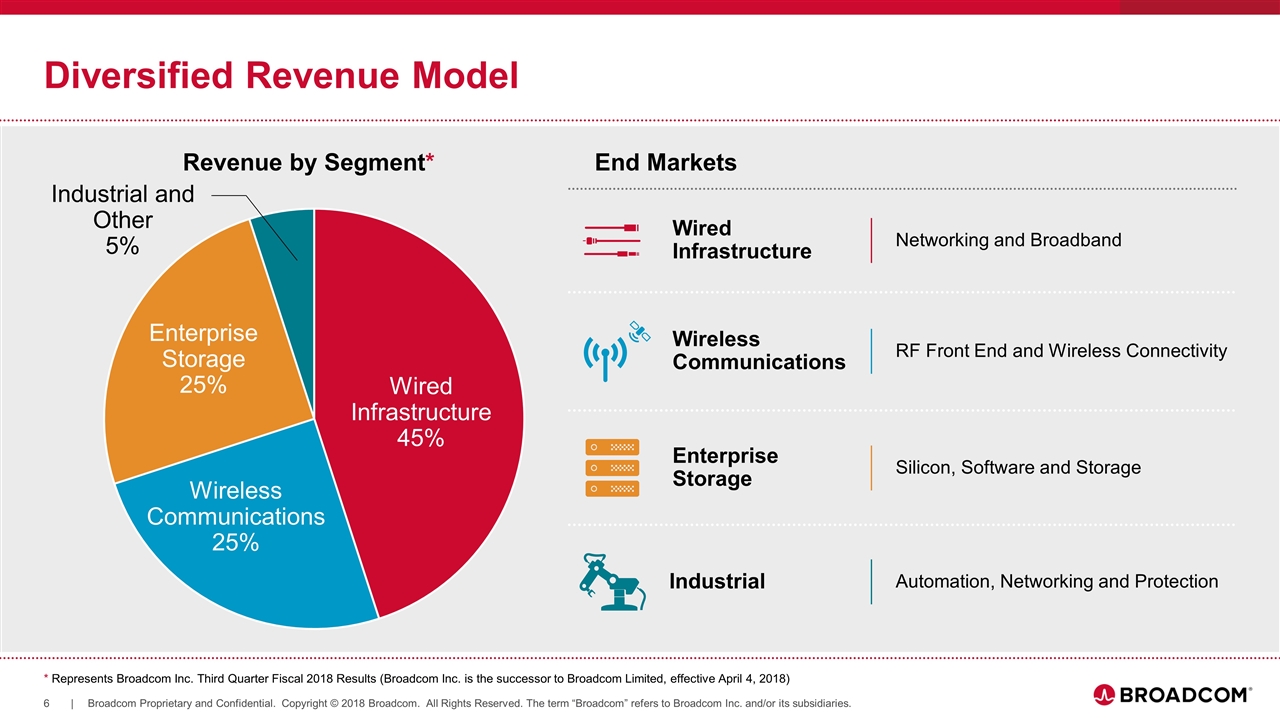

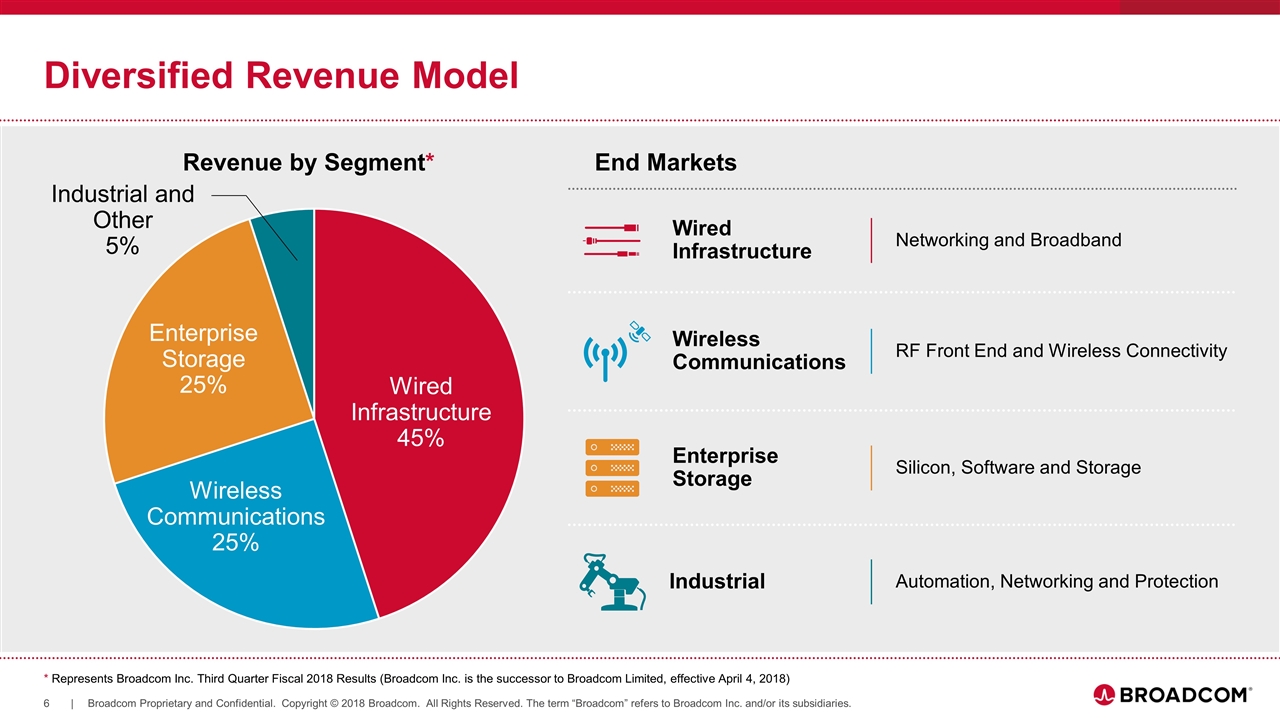

Diversified Revenue Model Revenue by Segment* * Represents Broadcom Inc. Third Quarter Fiscal 2018 Results (Broadcom Inc. is the successor to Broadcom Limited, effective April 4, 2018) End Markets Wired Infrastructure Networking and Broadband Wireless Communications RF Front End and Wireless Connectivity Industrial Automation, Networking and Protection Wired Infrastructure 45% Wireless Communications 25% Enterprise Storage 25% Industrial and Other 5% Enterprise Storage Silicon, Software and Storage

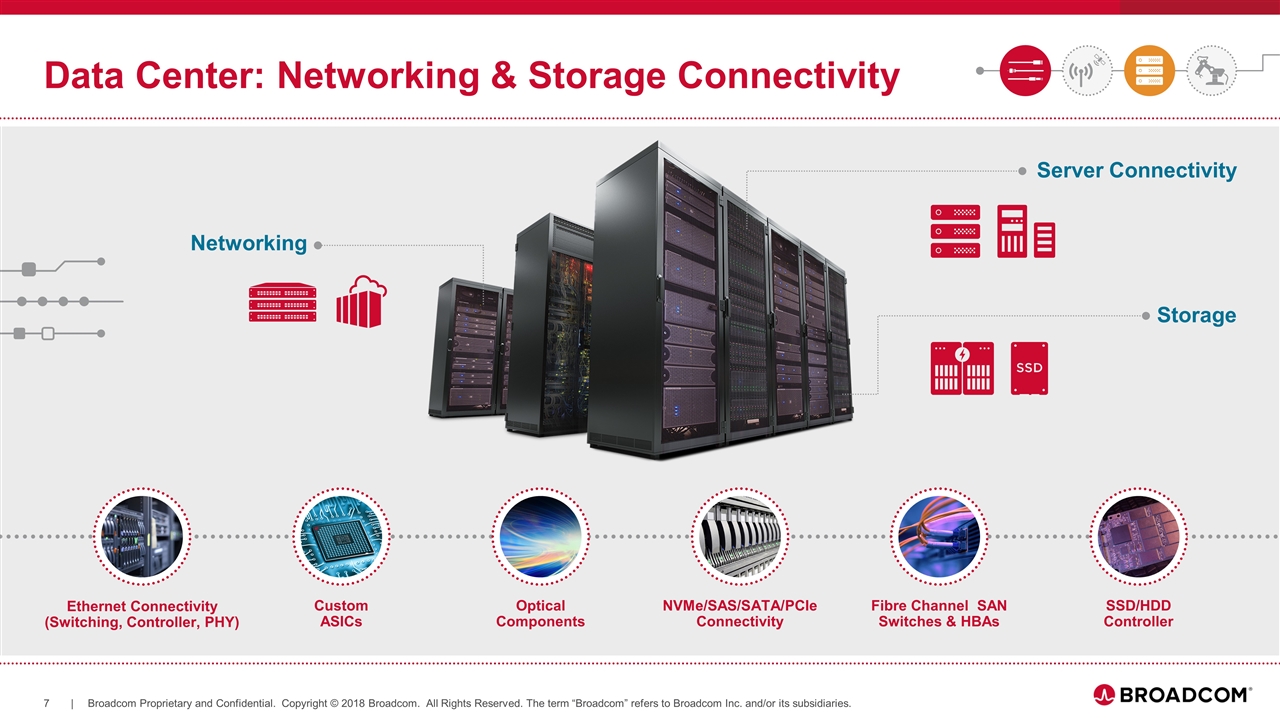

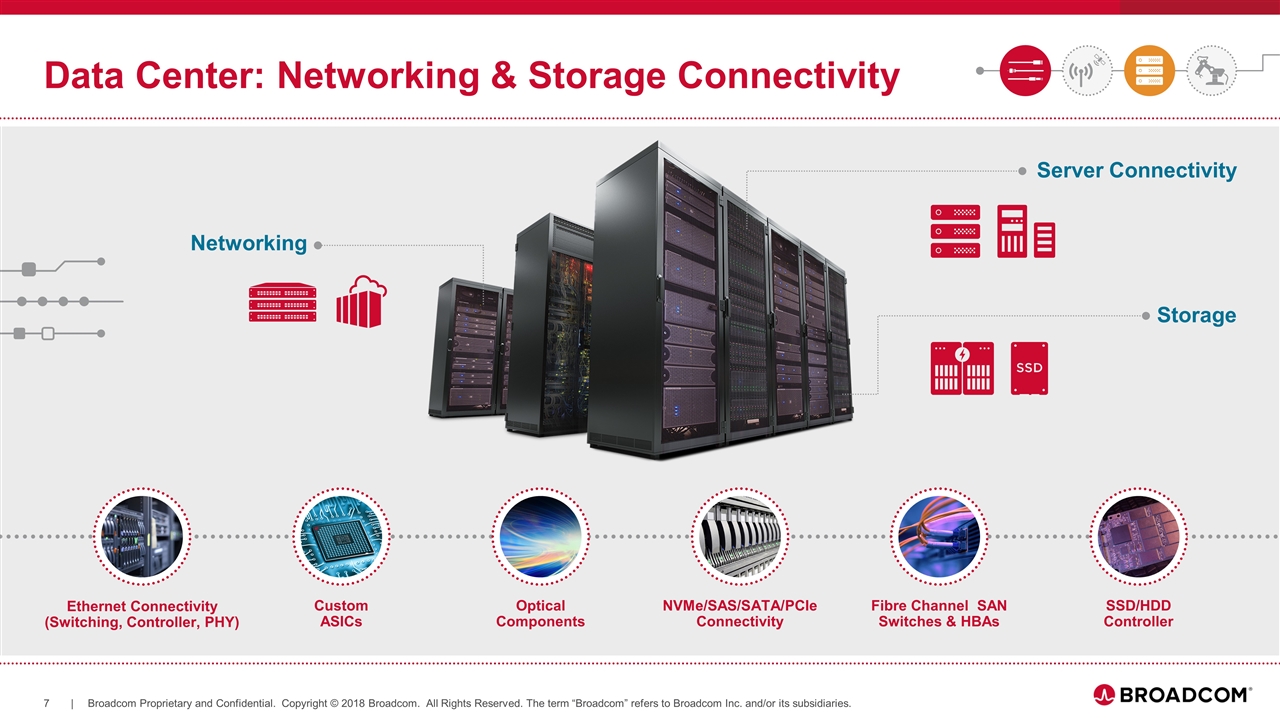

Data Center: Networking & Storage Connectivity Networking Server Connectivity Storage Ethernet Connectivity (Switching, Controller, PHY) Custom ASICs Optical Components SSD/HDD Controller NVMe/SAS/SATA/PCIe Connectivity Fibre Channel SAN Switches & HBAs

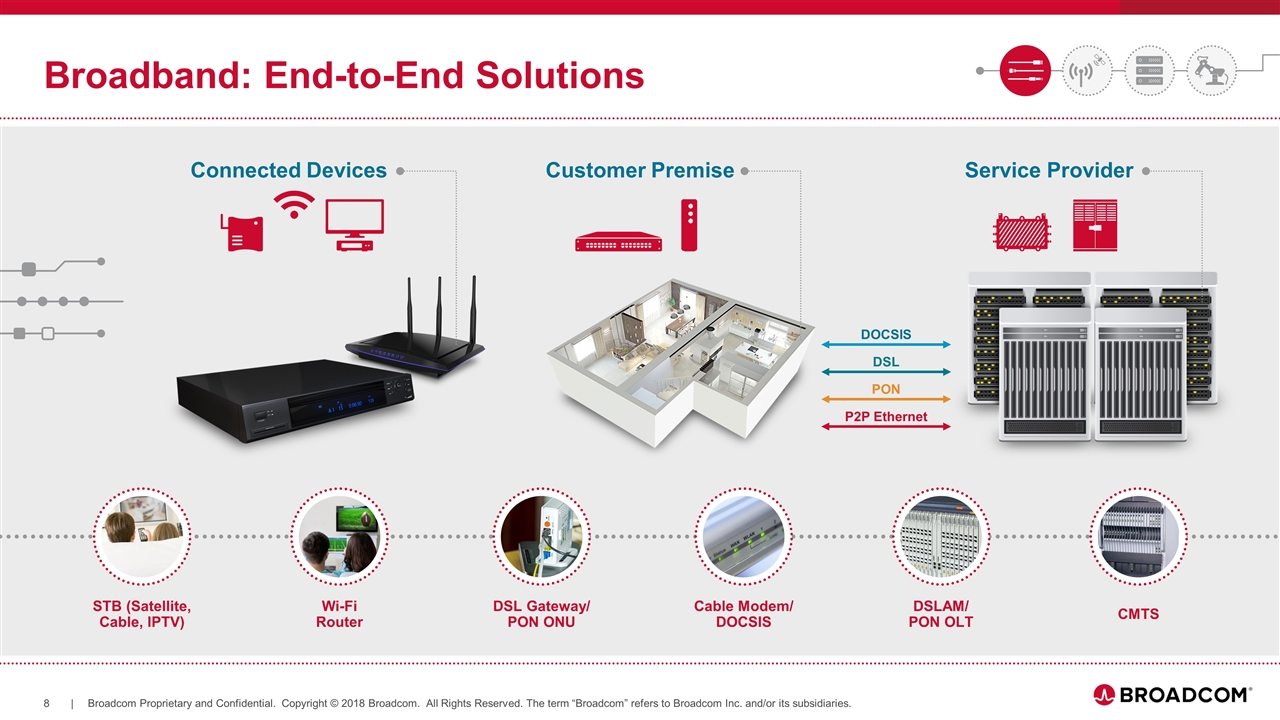

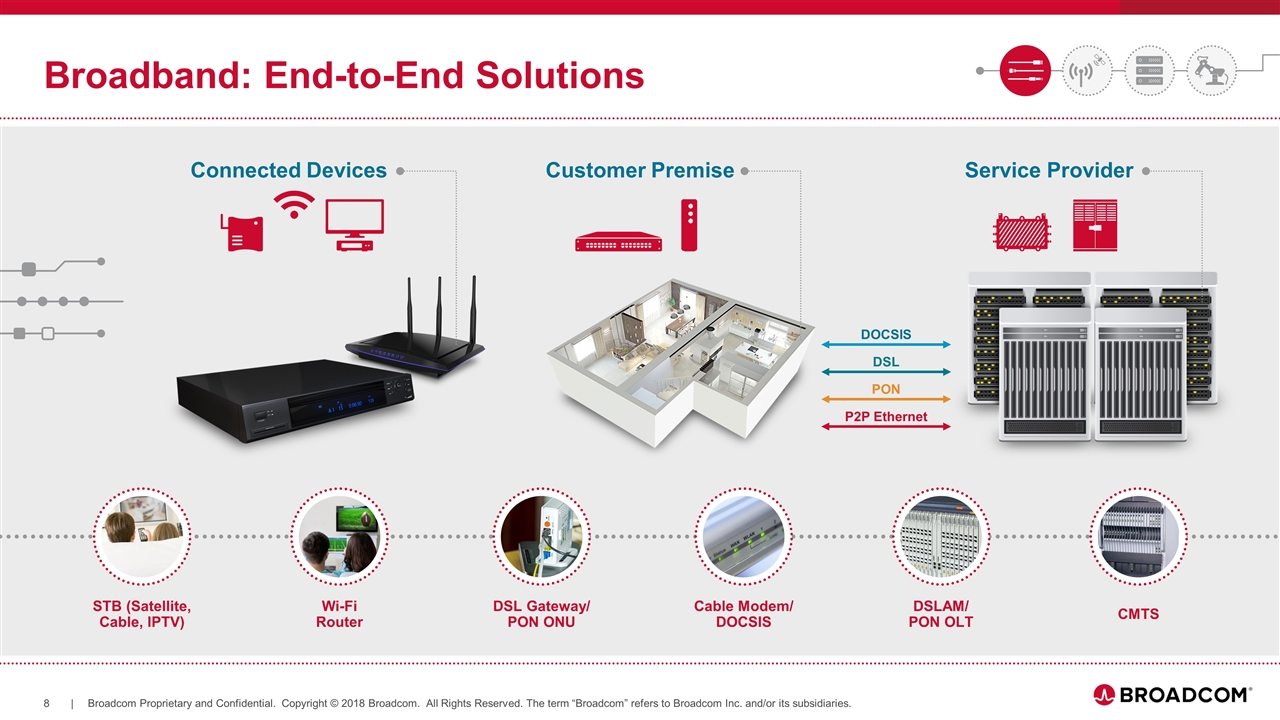

Broadband: End-to-End Solutions Connected Devices Service Provider Customer Premise P2P Ethernet DSL PON DOCSIS CMTS Wi-Fi Router STB (Satellite, Cable, IPTV) DSLAM/ PON OLT DSL Gateway/ PON ONU Cable Modem/ DOCSIS

Wireless: Broad Connectivity Portfolio BDS Galileo GLONASS GPS QZSS GSM/CDMA LTE LTE Advanced Bluetooth 4.x Bluetooth 5.x GNSS Receiver Touch Controller LTE/Cellular Filters Wi-Fi/Bluetooth Combo RF Front End GNSS Wi-Fi Bluetooth 802.11ac 802.11ax

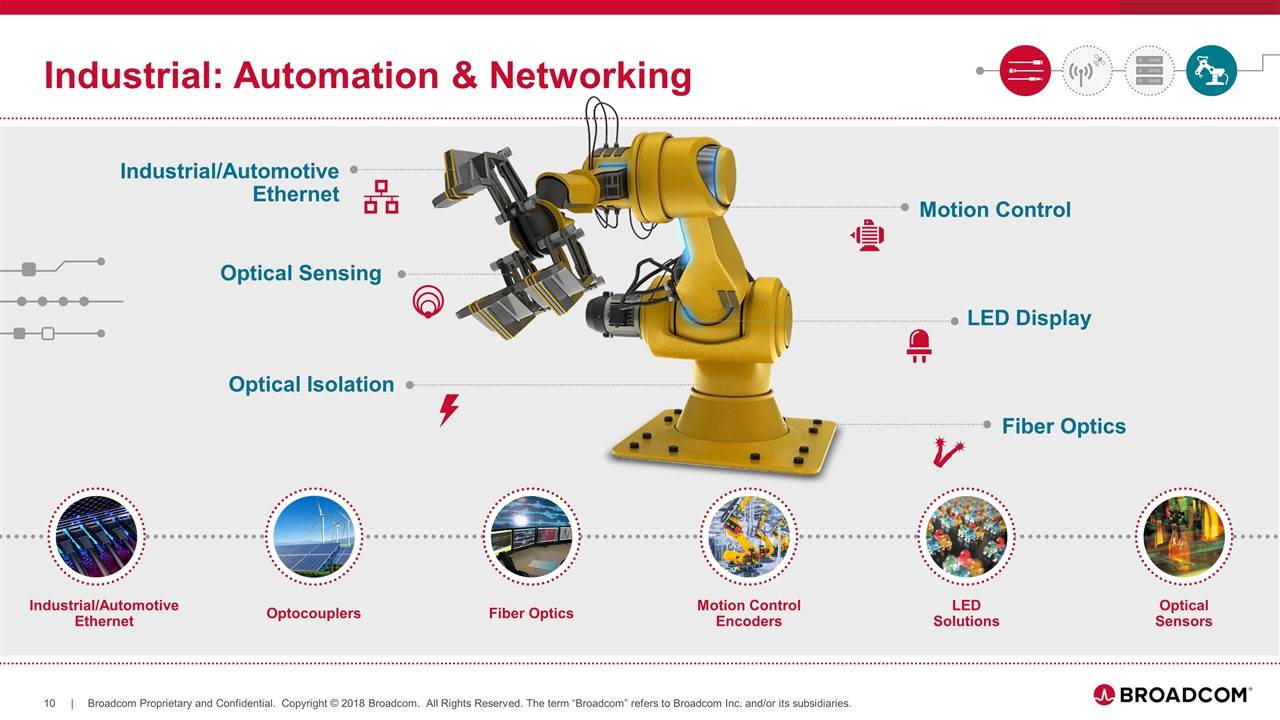

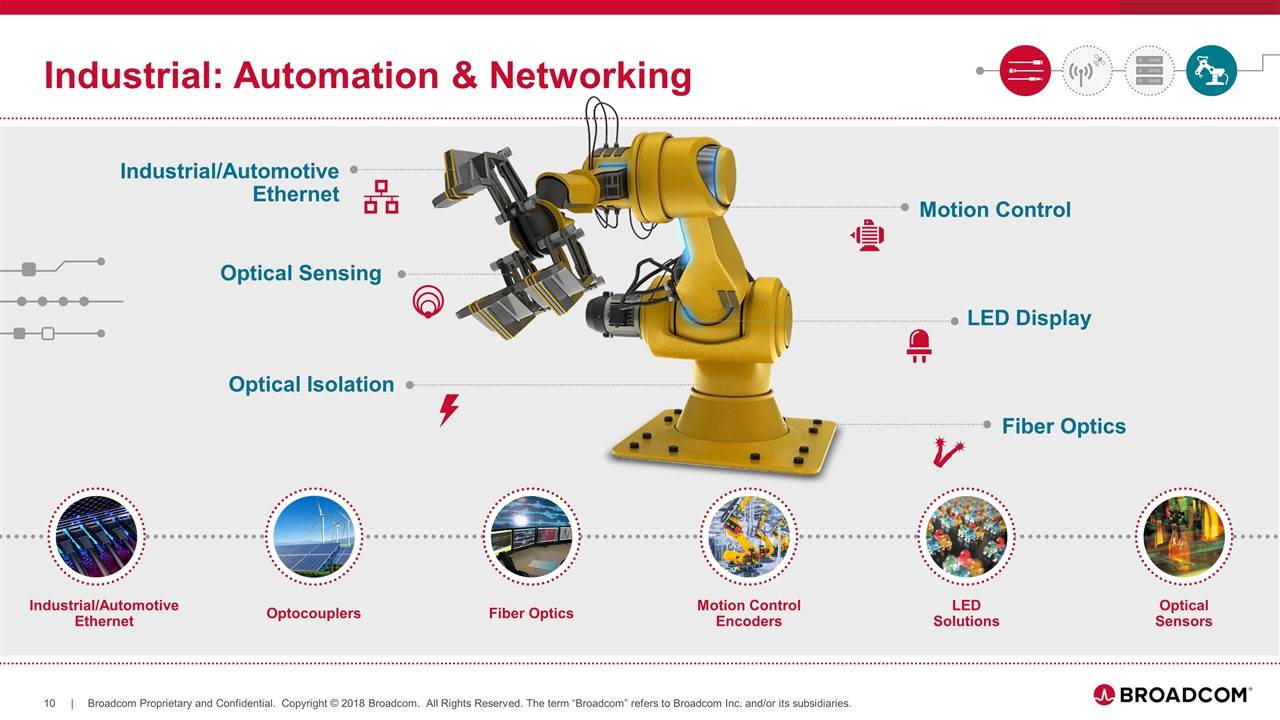

Industrial/Automotive Ethernet Motion Control LED Display Industrial: Automation & Networking Motion Control Encoders LED Solutions Optical Sensing Optical Isolation Industrial/Automotive Ethernet Optocouplers Fiber Optics Optical Sensors Fiber Optics

Corporate Leadership Hock E. Tan President & CEO Henry Samueli, Ph.D. CTO & Board Member B.C. Ooi SVP, Global Operations Kirsten Spears VP, Corporate Controller & Principal Accounting Officer Ivy Pong VP, Global Taxation Debbie Streeter VP, Human Resources Yuan Xing Lee, Ph.D. VP, Central Engineering (R&D) Ah-Chee Neo VP, Worldwide Quality Andy Nallappan VP & CIO, Global Information Technology Thomas Krause CFO Charlie Kawwas, Ph.D. SVP & CSO Mark Brazeal Chief Legal Officer

Greg Fischer SVP & GM, Broadband Carrier Access Products Mark Gonikberg SVP & GM, Wireless Communications and Connectivity Bryan Ingram SVP & GM, Wireless Semiconductor Lorenzo Longo SVP & GM, Physical Layer Products Rich Nelson SVP & GM, Set-top Box/Cable Modem Products Frank Ostojic SVP & GM, ASIC Products Ed Redmond SVP & GM, Compute and Connectivity Jack Rondoni SVP & GM, Brocade Storage Networking Ram Velaga SVP & GM, Switch Products Sally Doherty, Ph.D. VP & GM, PreAmp Components Mitchell Fields, Ph.D. VP & GM, Fiber Optics Products Patrick Henderson VP & Co-GM, Mixed Signal ASICs Products Jeff Hoogenboom VP & GM, Emulex Connectivity Hassan Hussain VP & GM, Motion Control Products Jeyhan Karaoguz, Ph.D. VP & GM, Intellectual Property Francis Khor VP & GM, Optoelectronic Products Gary Tay VP & GM, Isolation Products Mark Terrano, Esq. VP & GM, Intellectual Property and Licensing Jas Tremblay VP & GM, Data Center Solutions Group Myles Wakayama VP & Co-GM, Mixed Signal ASICs Products Martin Weigert VP & GM, Industrial Fiber Products Division Leadership

Well Positioned for the Future Impressive Portfolio of Innovative and Differentiated Products Technology Leadership Across Market Segments Wired Infrastructure Wireless Communications Enterprise Storage Industrial Robust and Sustainable Business and Financial Models Driving Balanced and Diversified Revenue

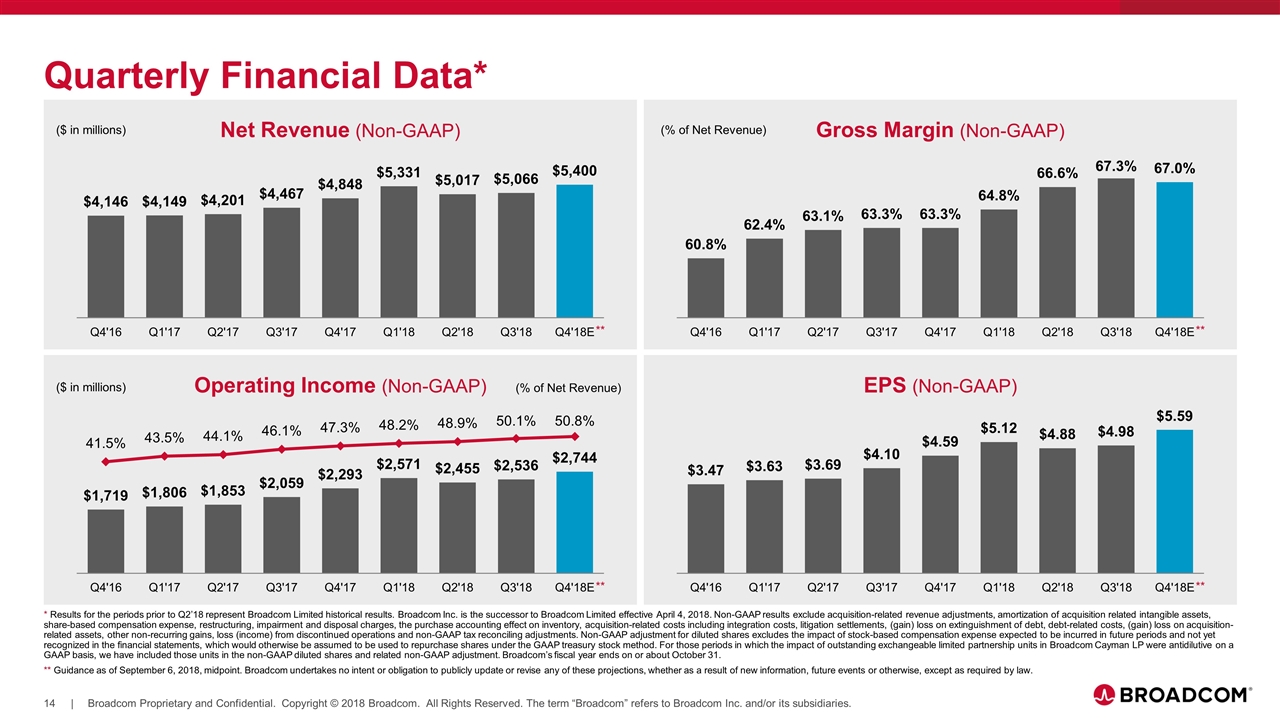

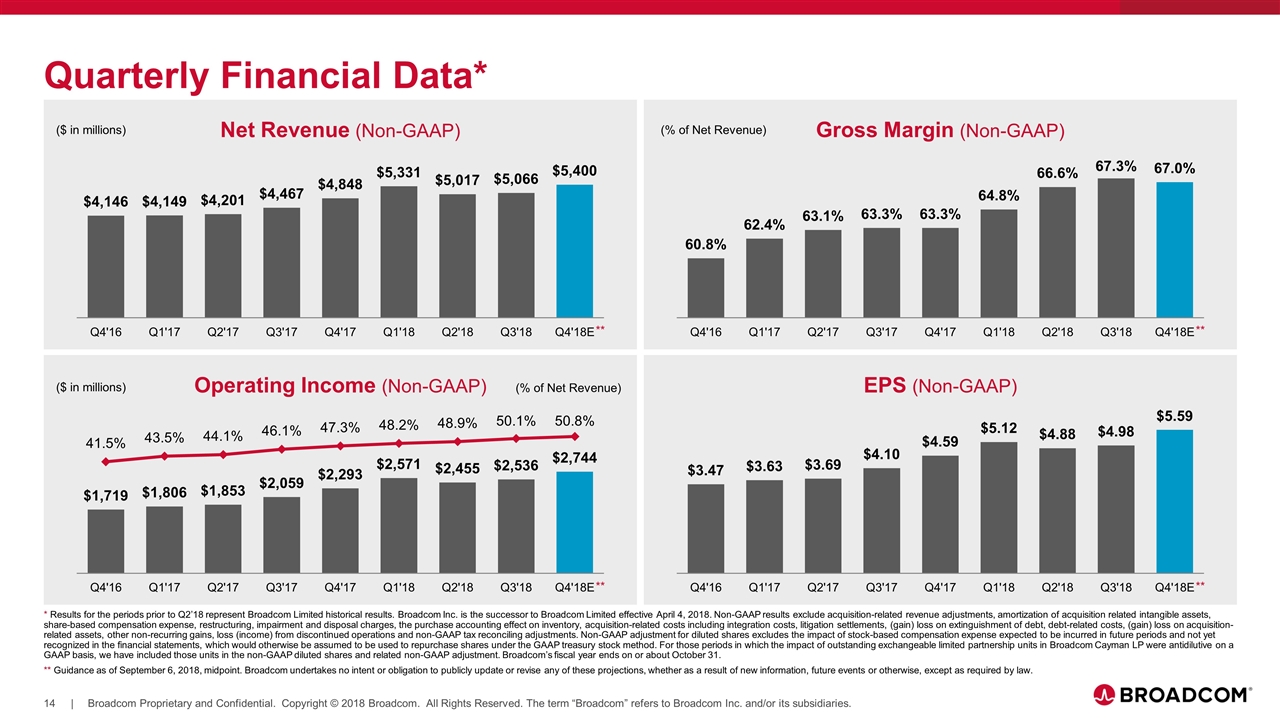

Net Revenue (Non-GAAP) Gross Margin (Non-GAAP) Operating Income (Non-GAAP) EPS (Non-GAAP) Quarterly Financial Data* (% of Net Revenue) * Results for the periods prior to Q2’18 represent Broadcom Limited historical results. Broadcom Inc. is the successor to Broadcom Limited effective April 4, 2018. Non-GAAP results exclude acquisition-related revenue adjustments, amortization of acquisition related intangible assets, share-based compensation expense, restructuring, impairment and disposal charges, the purchase accounting effect on inventory, acquisition-related costs including integration costs, litigation settlements, (gain) loss on extinguishment of debt, debt-related costs, (gain) loss on acquisition-related assets, other non-recurring gains, loss (income) from discontinued operations and non-GAAP tax reconciling adjustments. Non-GAAP adjustment for diluted shares excludes the impact of stock-based compensation expense expected to be incurred in future periods and not yet recognized in the financial statements, which would otherwise be assumed to be used to repurchase shares under the GAAP treasury stock method. For those periods in which the impact of outstanding exchangeable limited partnership units in Broadcom Cayman LP were antidilutive on a GAAP basis, we have included those units in the non-GAAP diluted shares and related non-GAAP adjustment. Broadcom’s fiscal year ends on or about October 31. ** Guidance as of September 6, 2018, midpoint. Broadcom undertakes no intent or obligation to publicly update or revise any of these projections, whether as a result of new information, future events or otherwise, except as required by law. ** ** ** ($ in millions) (% of Net Revenue) ($ in millions) **

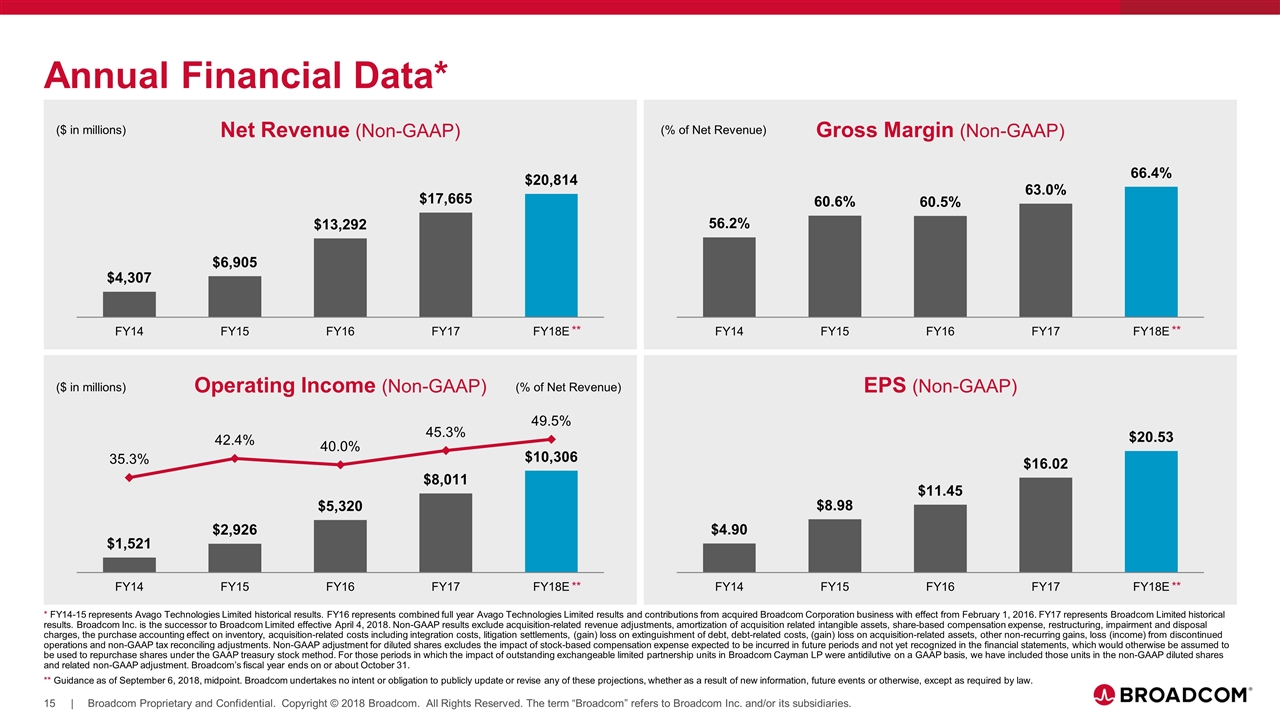

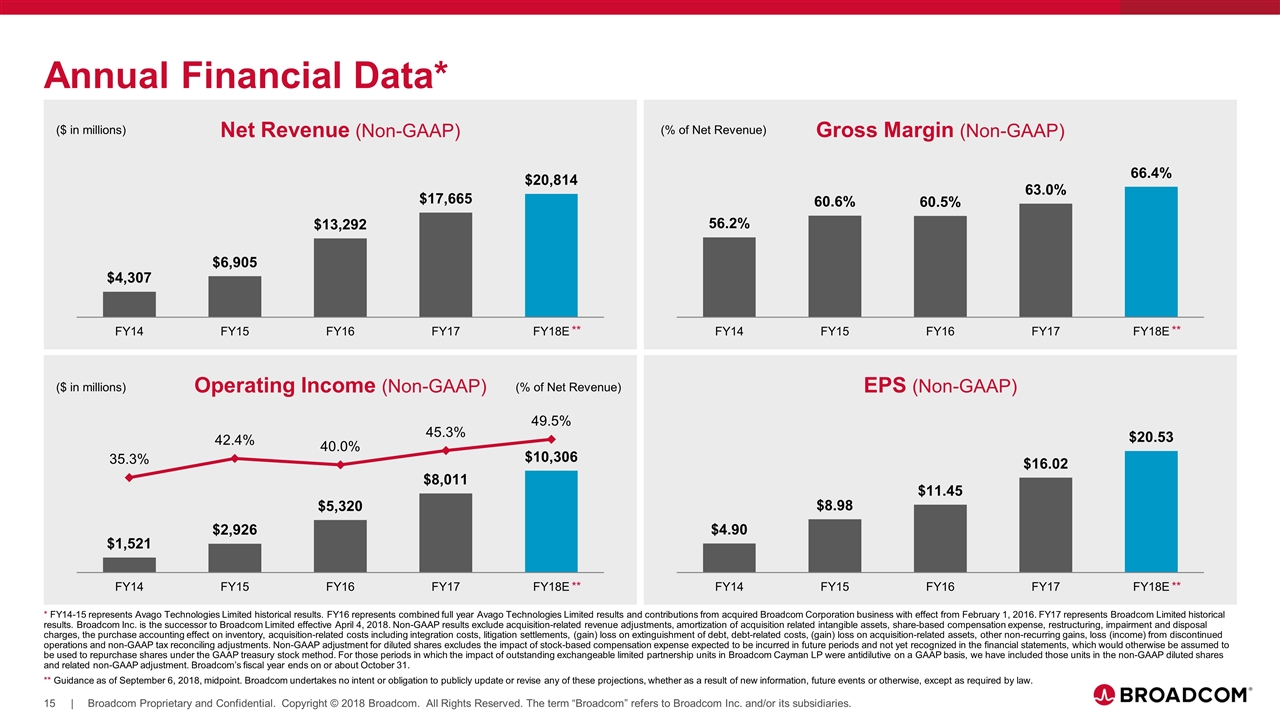

Annual Financial Data* Net Revenue (Non-GAAP) Gross Margin (Non-GAAP) Operating Income (Non-GAAP) EPS (Non-GAAP) ($ in millions) (% of Net Revenue) ($ in millions) (% of Net Revenue) * FY14-15 represents Avago Technologies Limited historical results. FY16 represents combined full year Avago Technologies Limited results and contributions from acquired Broadcom Corporation business with effect from February 1, 2016. FY17 represents Broadcom Limited historical results. Broadcom Inc. is the successor to Broadcom Limited effective April 4, 2018. Non-GAAP results exclude acquisition-related revenue adjustments, amortization of acquisition related intangible assets, share-based compensation expense, restructuring, impairment and disposal charges, the purchase accounting effect on inventory, acquisition-related costs including integration costs, litigation settlements, (gain) loss on extinguishment of debt, debt-related costs, (gain) loss on acquisition-related assets, other non-recurring gains, loss (income) from discontinued operations and non-GAAP tax reconciling adjustments. Non-GAAP adjustment for diluted shares excludes the impact of stock-based compensation expense expected to be incurred in future periods and not yet recognized in the financial statements, which would otherwise be assumed to be used to repurchase shares under the GAAP treasury stock method. For those periods in which the impact of outstanding exchangeable limited partnership units in Broadcom Cayman LP were antidilutive on a GAAP basis, we have included those units in the non-GAAP diluted shares and related non-GAAP adjustment. Broadcom’s fiscal year ends on or about October 31. ** Guidance as of September 6, 2018, midpoint. Broadcom undertakes no intent or obligation to publicly update or revise any of these projections, whether as a result of new information, future events or otherwise, except as required by law. ** ** ** **

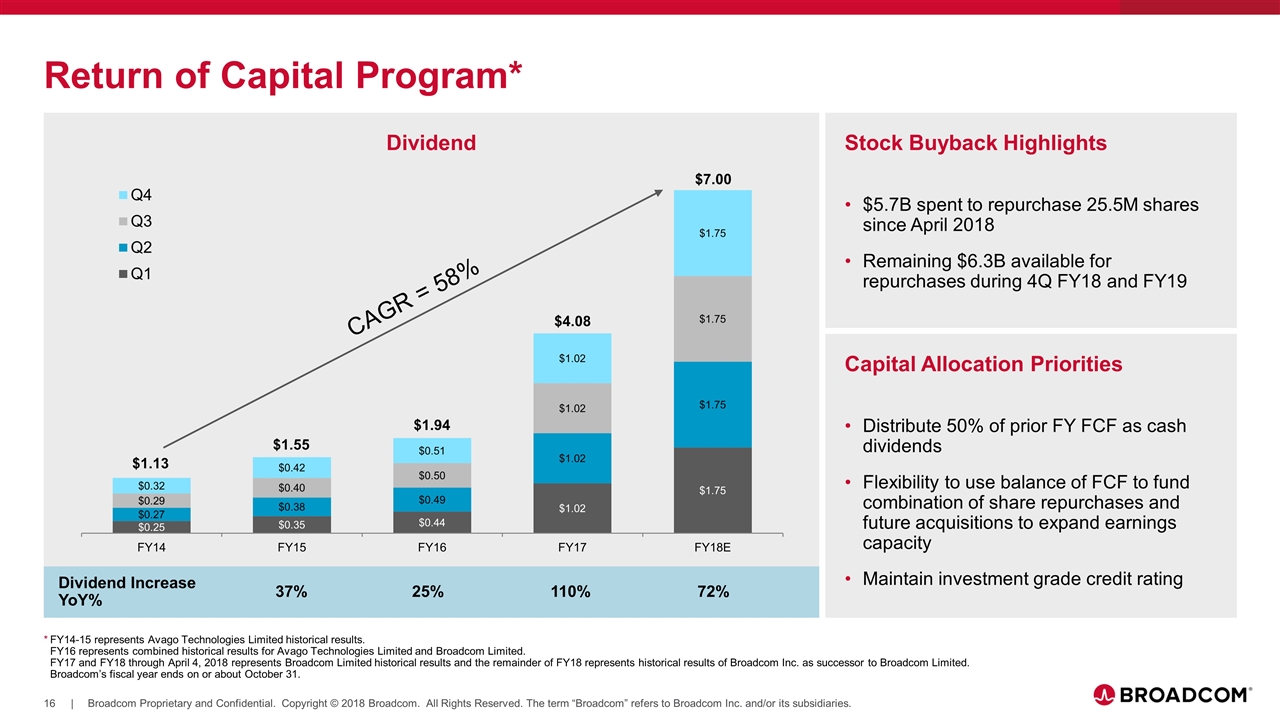

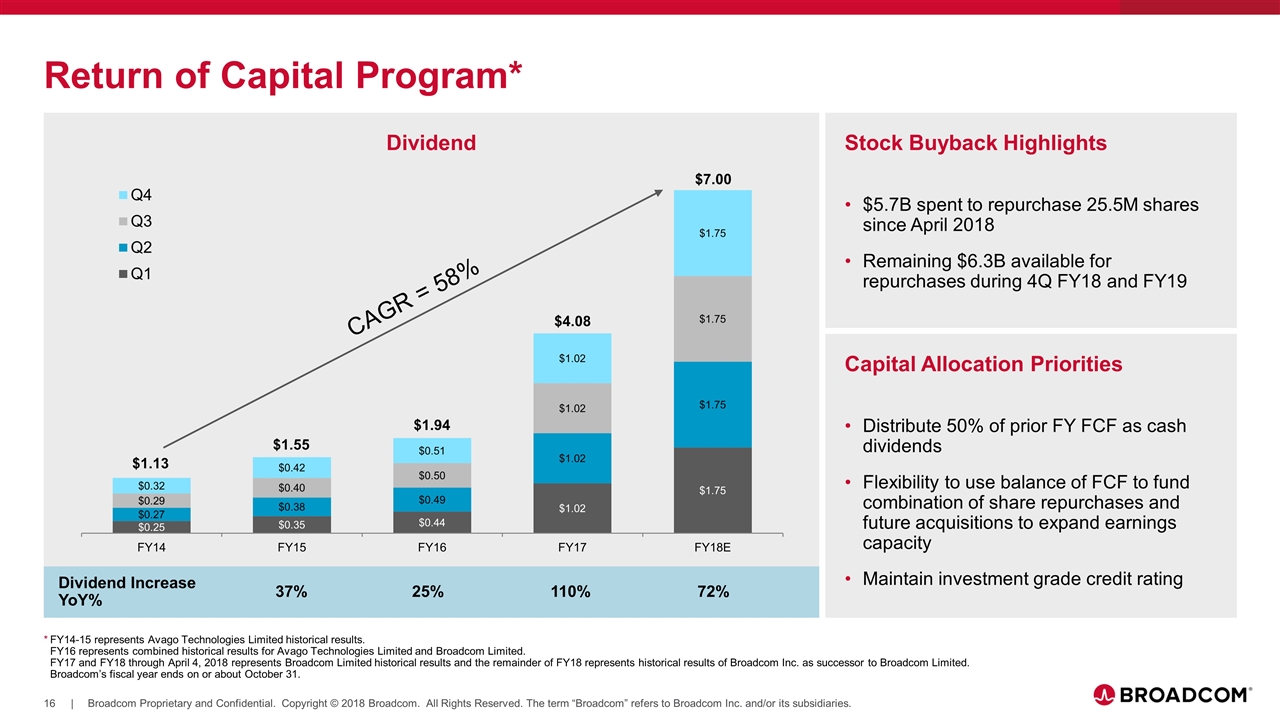

Dividend Return of Capital Program* $1.13 $1.55 $1.94 $4.08 $7.00 *FY14-15 represents Avago Technologies Limited historical results. FY16 represents combined historical results for Avago Technologies Limited and Broadcom Limited. FY17 and FY18 through April 4, 2018 represents Broadcom Limited historical results and the remainder of FY18 represents historical results of Broadcom Inc. as successor to Broadcom Limited. Broadcom’s fiscal year ends on or about October 31. Stock Buyback Highlights $5.7B spent to repurchase 25.5M shares since April 2018 Remaining $6.3B available for repurchases during 4Q FY18 and FY19 Capital Allocation Priorities Distribute 50% of prior FY FCF as cash dividends Flexibility to use balance of FCF to fund combination of share repurchases and future acquisitions to expand earnings capacity Maintain investment grade credit rating CAGR = 58% Dividend Increase YoY% 37% 25% 110% 72%

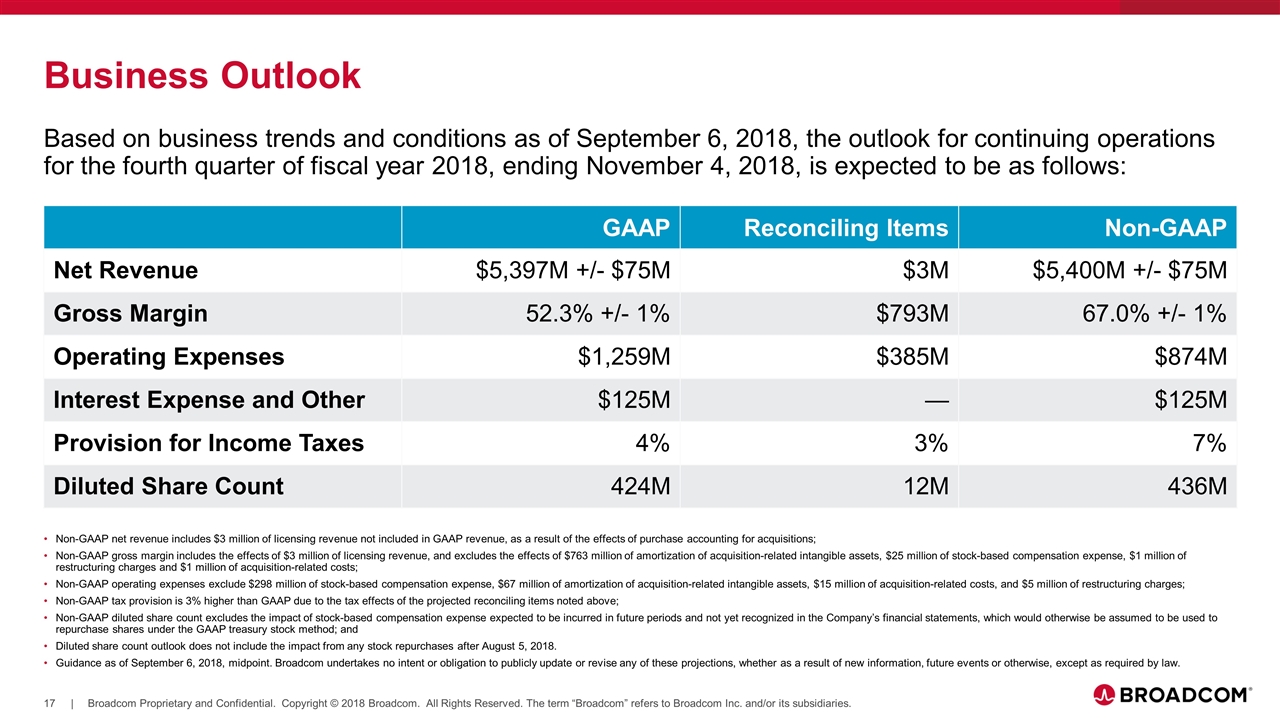

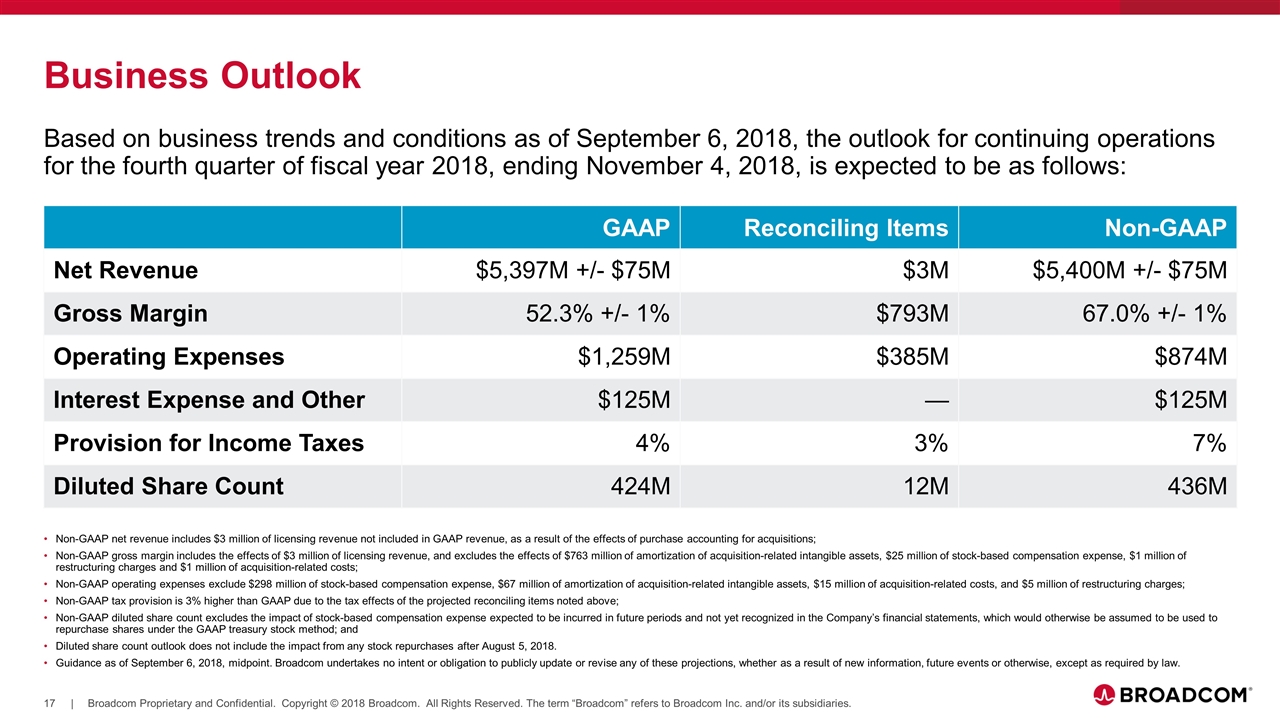

Business Outlook Based on business trends and conditions as of September 6, 2018, the outlook for continuing operations for the fourth quarter of fiscal year 2018, ending November 4, 2018, is expected to be as follows: GAAP Reconciling Items Non-GAAP Net Revenue $5,397M +/- $75M $3M $5,400M +/- $75M Gross Margin 52.3% +/- 1% $793M 67.0% +/- 1% Operating Expenses $1,259M $385M $874M Interest Expense and Other $125M — $125M Provision for Income Taxes 4% 3% 7% Diluted Share Count 424M 12M 436M Non-GAAP net revenue includes $3 million of licensing revenue not included in GAAP revenue, as a result of the effects of purchase accounting for acquisitions; Non-GAAP gross margin includes the effects of $3 million of licensing revenue, and excludes the effects of $763 million of amortization of acquisition-related intangible assets, $25 million of stock-based compensation expense, $1 million of restructuring charges and $1 million of acquisition-related costs; Non-GAAP operating expenses exclude $298 million of stock-based compensation expense, $67 million of amortization of acquisition-related intangible assets, $15 million of acquisition-related costs, and $5 million of restructuring charges; Non-GAAP tax provision is 3% higher than GAAP due to the tax effects of the projected reconciling items noted above; Non-GAAP diluted share count excludes the impact of stock-based compensation expense expected to be incurred in future periods and not yet recognized in the Company’s financial statements, which would otherwise be assumed to be used to repurchase shares under the GAAP treasury stock method; and Diluted share count outlook does not include the impact from any stock repurchases after August 5, 2018. Guidance as of September 6, 2018, midpoint. Broadcom undertakes no intent or obligation to publicly update or revise any of these projections, whether as a result of new information, future events or otherwise, except as required by law.

Appendix

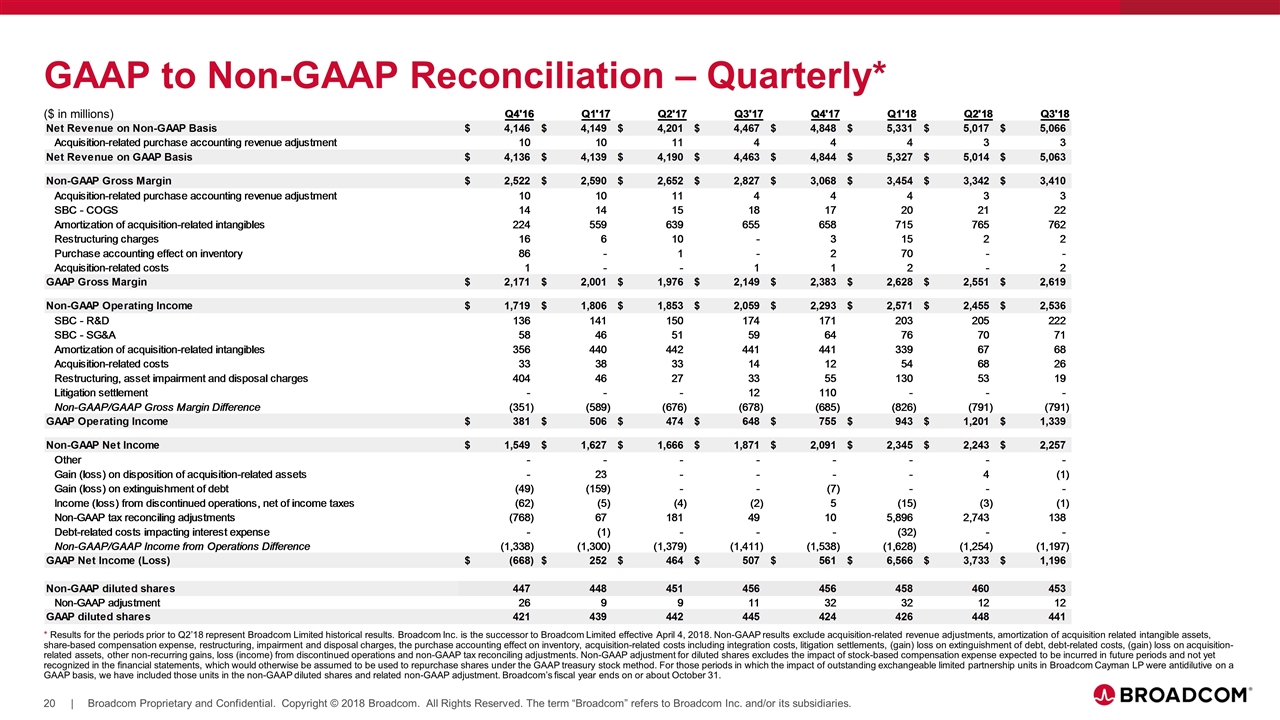

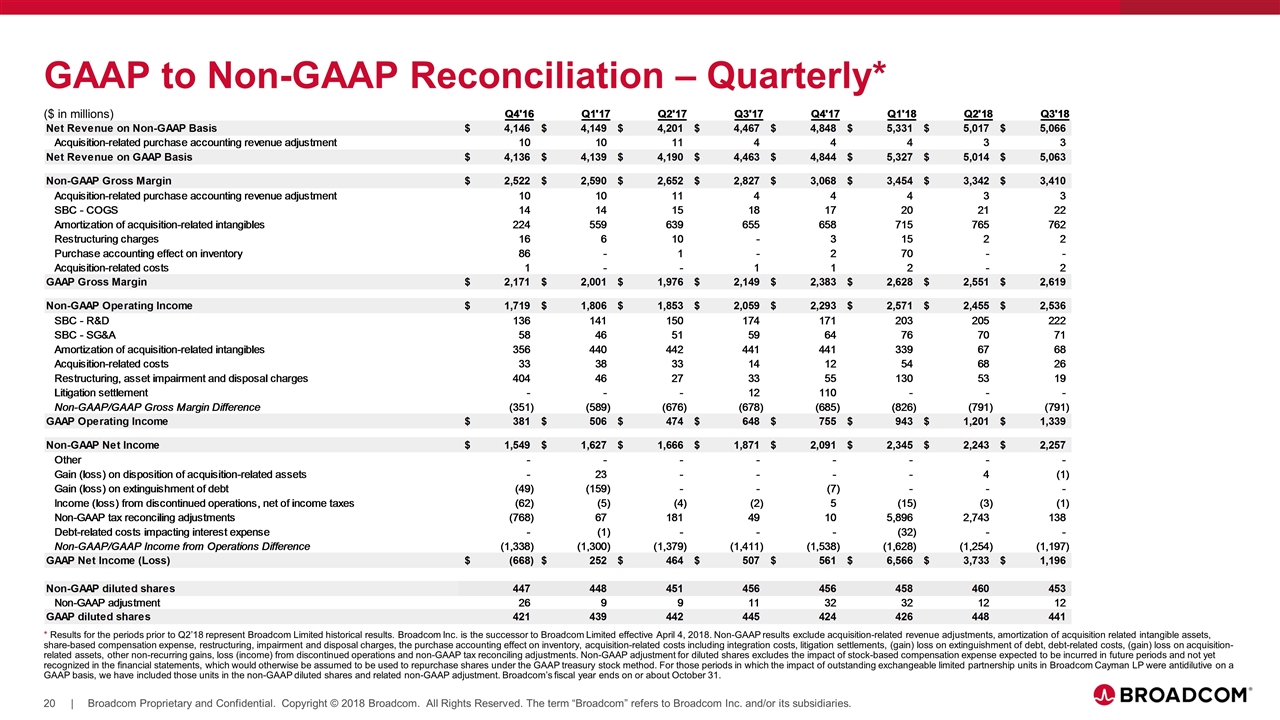

GAAP to Non-GAAP Reconciliation – Quarterly* ($ in millions) * Results for the periods prior to Q2’18 represent Broadcom Limited historical results. Broadcom Inc. is the successor to Broadcom Limited effective April 4, 2018. Non-GAAP results exclude acquisition-related revenue adjustments, amortization of acquisition related intangible assets, share-based compensation expense, restructuring, impairment and disposal charges, the purchase accounting effect on inventory, acquisition-related costs including integration costs, litigation settlements, (gain) loss on extinguishment of debt, debt-related costs, (gain) loss on acquisition-related assets, other non-recurring gains, loss (income) from discontinued operations and non-GAAP tax reconciling adjustments. Non-GAAP adjustment for diluted shares excludes the impact of stock-based compensation expense expected to be incurred in future periods and not yet recognized in the financial statements, which would otherwise be assumed to be used to repurchase shares under the GAAP treasury stock method. For those periods in which the impact of outstanding exchangeable limited partnership units in Broadcom Cayman LP were antidilutive on a GAAP basis, we have included those units in the non-GAAP diluted shares and related non-GAAP adjustment. Broadcom’s fiscal year ends on or about October 31.

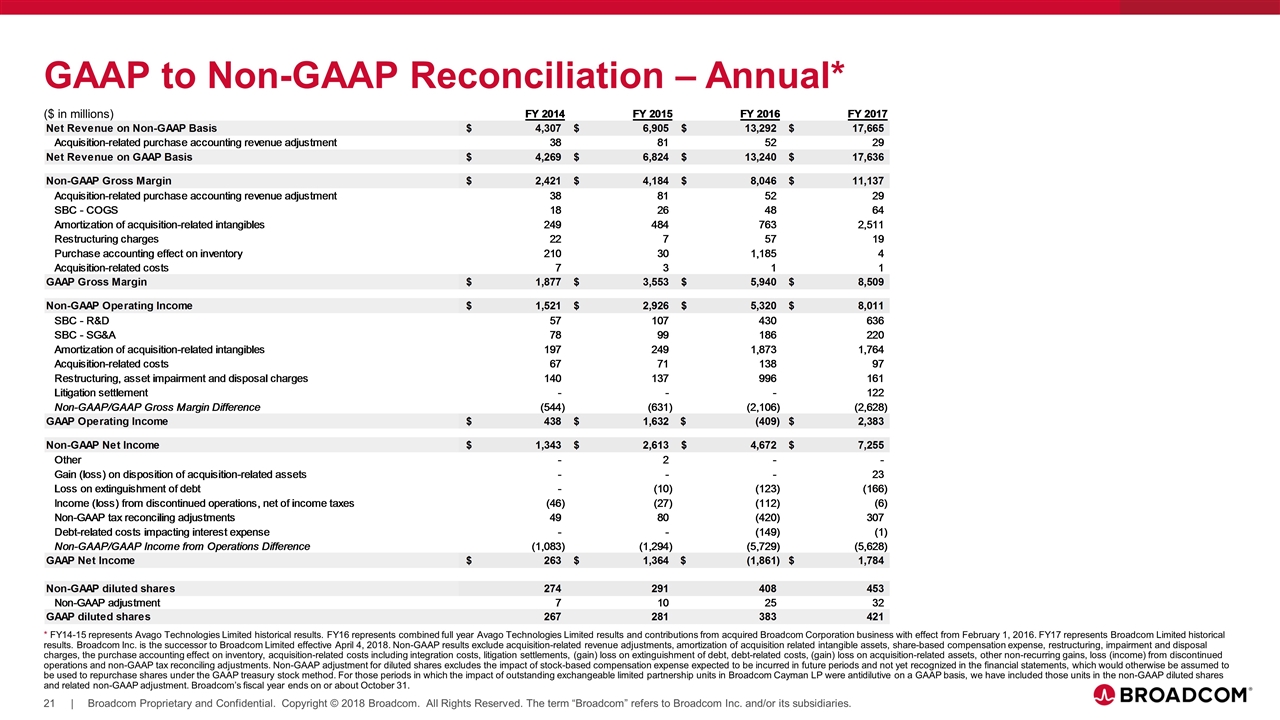

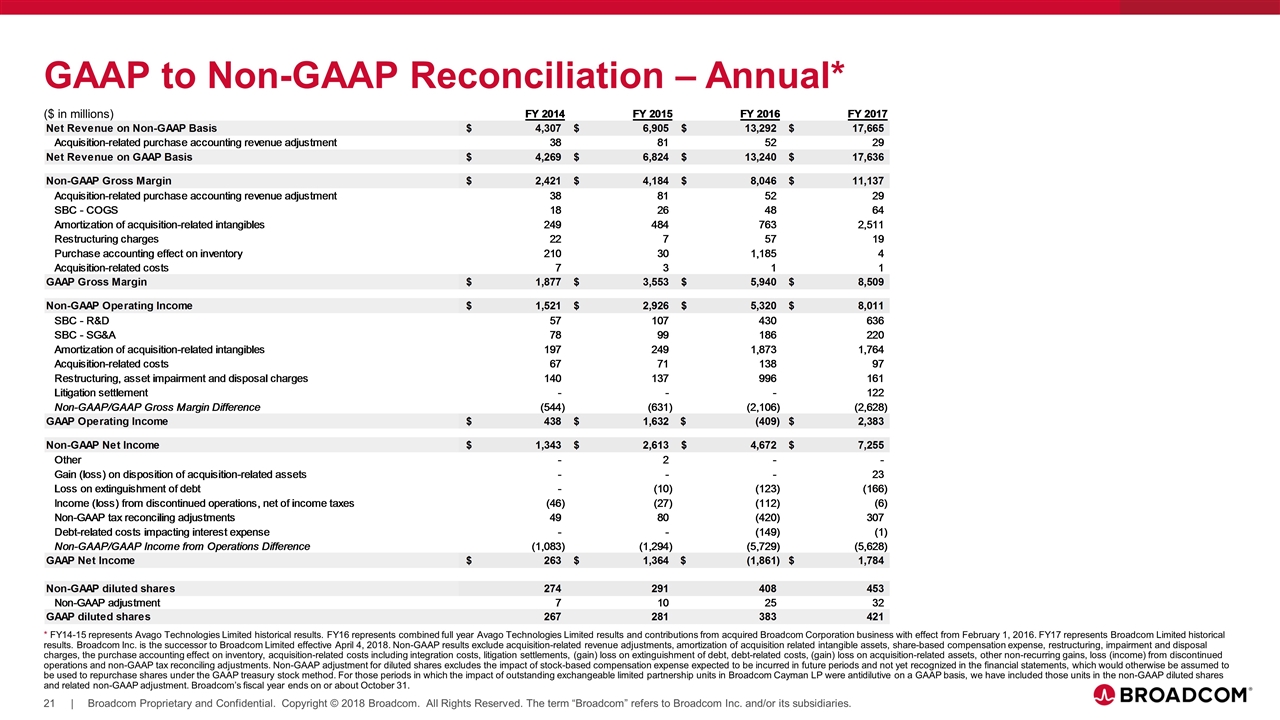

GAAP to Non-GAAP Reconciliation – Annual* ($ in millions) * FY14-15 represents Avago Technologies Limited historical results. FY16 represents combined full year Avago Technologies Limited results and contributions from acquired Broadcom Corporation business with effect from February 1, 2016. FY17 represents Broadcom Limited historical results. Broadcom Inc. is the successor to Broadcom Limited effective April 4, 2018. Non-GAAP results exclude acquisition-related revenue adjustments, amortization of acquisition related intangible assets, share-based compensation expense, restructuring, impairment and disposal charges, the purchase accounting effect on inventory, acquisition-related costs including integration costs, litigation settlements, (gain) loss on extinguishment of debt, debt-related costs, (gain) loss on acquisition-related assets, other non-recurring gains, loss (income) from discontinued operations and non-GAAP tax reconciling adjustments. Non-GAAP adjustment for diluted shares excludes the impact of stock-based compensation expense expected to be incurred in future periods and not yet recognized in the financial statements, which would otherwise be assumed to be used to repurchase shares under the GAAP treasury stock method. For those periods in which the impact of outstanding exchangeable limited partnership units in Broadcom Cayman LP were antidilutive on a GAAP basis, we have included those units in the non-GAAP diluted shares and related non-GAAP adjustment. Broadcom’s fiscal year ends on or about October 31.

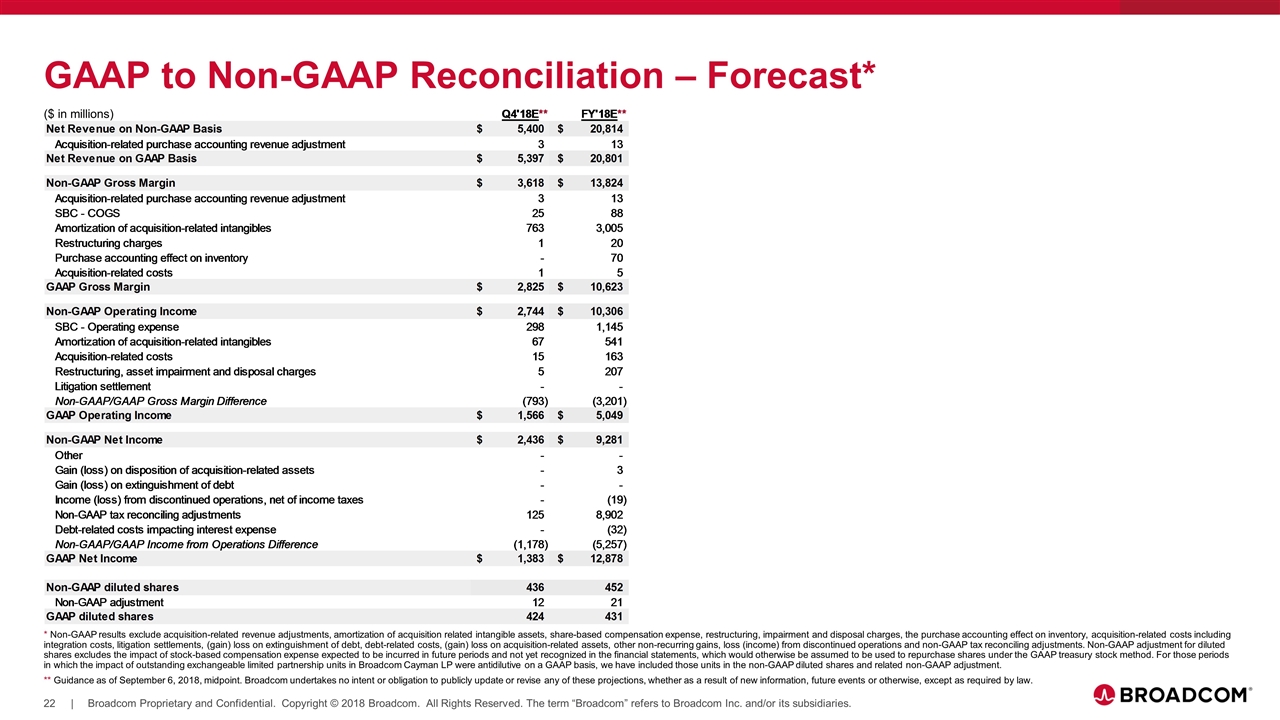

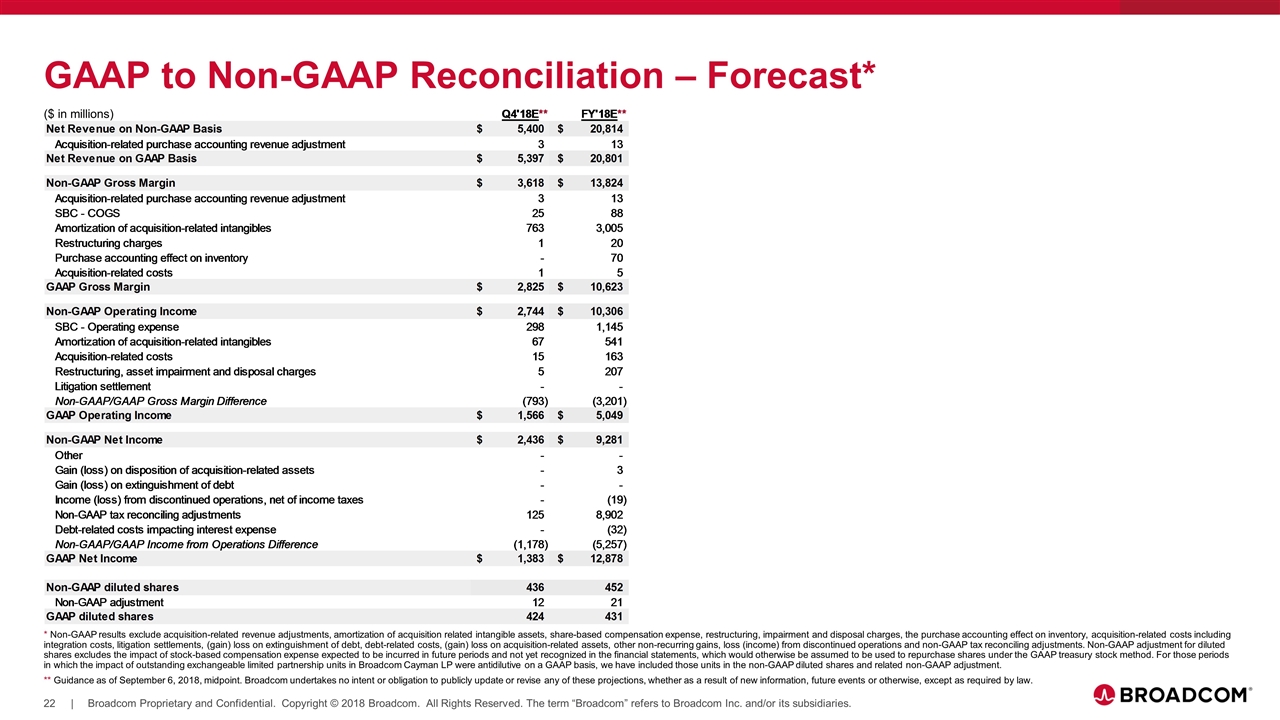

GAAP to Non-GAAP Reconciliation – Forecast* ($ in millions) * Non-GAAP results exclude acquisition-related revenue adjustments, amortization of acquisition related intangible assets, share-based compensation expense, restructuring, impairment and disposal charges, the purchase accounting effect on inventory, acquisition-related costs including integration costs, litigation settlements, (gain) loss on extinguishment of debt, debt-related costs, (gain) loss on acquisition-related assets, other non-recurring gains, loss (income) from discontinued operations and non-GAAP tax reconciling adjustments. Non-GAAP adjustment for diluted shares excludes the impact of stock-based compensation expense expected to be incurred in future periods and not yet recognized in the financial statements, which would otherwise be assumed to be used to repurchase shares under the GAAP treasury stock method. For those periods in which the impact of outstanding exchangeable limited partnership units in Broadcom Cayman LP were antidilutive on a GAAP basis, we have included those units in the non-GAAP diluted shares and related non-GAAP adjustment. ** Guidance as of September 6, 2018, midpoint. Broadcom undertakes no intent or obligation to publicly update or revise any of these projections, whether as a result of new information, future events or otherwise, except as required by law.