CHARAH, LLC AND ALLIED POWER MANAGEMENT, LLC

Notes to Combined Financial Statements, continued

(dollars in thousands unless otherwise indicated)

14. Members’ Equity

During 2016, 49,860 shares ofnon-voting common stock were issued in accordance with the Deferred Stock Plan (see Note 17).

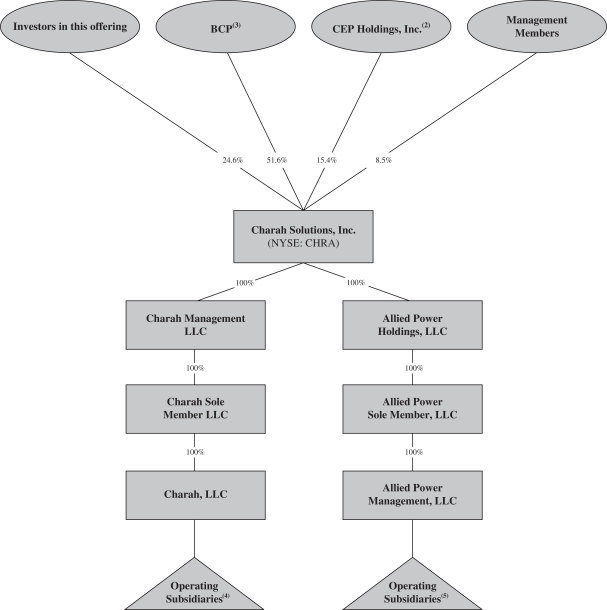

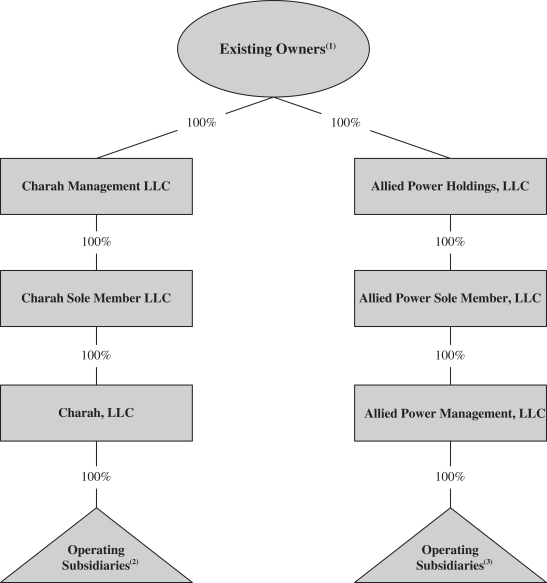

Charah, LLC’s voting and non-voting shares at January 12, 2017 were cancelled in connection with the BCP transaction (see Note 3) and Series A and Series B members’ interests were issued. Charah, LLC has 200,000,000 of Series A members’ interest authorized, of which 104,109,890 are issued and outstanding as of December 31, 2017. The Series A members’ interests were issued between January 13, 2017 and December 31, 2017 (Successor) in connection with the BCP transaction in exchange for BCP’s investment of $104.1 million. Charah, LLC has 100,000,000 of Series B members’ interest authorized, of which 35,199,063 are issued and outstanding as of December 31, 2017. The Series B members’ interests were issued between January 13, 2017 and December 31, 2017 (Successor) in connection with the BCP transaction in exchange for an investment of $32.8 million from members of Charah, LLC’s management and $2.4 million with the formation of Allied Power Management, LLC, as described below. Series A and Series B both participate in distributions.

Allied Power Management, LLC has 200,000,000 of Series A members’ interest authorized, of which 7,210,555 are issued and outstanding as of December 31, 2017. The Series A members’ interests were issued between January 13, 2017 and December 31, 2017 (Successor) in exchange for an investment of $7.2 million. Allied Power Management, LLC has 100,000,000 of Series B member’s interest authorized, of which 2,437,855 are issued and outstanding as of December 31, 2017. The Series B members’ interests were issued between January 13, 2017 and December 31, 2017 (Successor). The Series B members’ interests were issued in connection with the formation of Allied Power Management, LLC in exchange for an investment of $2.4 million by the existing shareholders of Charah, LLC and members of Allied Power Management, LLC, with the purpose of creating common ownership of the two entities. Series A and Series B both participate in distributions.

15. Distributions to Stockholder

The stockholders may require the Companies to make distributions to cover the stockholders’ tax liabilities. During the period from January 13, 2017 through December 31, 2017 (Successor), the period from January 1, 2017 through January 12, 2017 (Predecessor), and during the year ended December 31, 2016 (Predecessor), the Companies made distributions of $136,085, $20,660, and $25, respectively, a portion of which was used to pay for income taxes.

16. Major Customers

The Companies derived approximately 49% and 32% of its combined revenue from two customers during the period from January 13, 2017 through December 31, 2017 (Successor), and approximately 68% and 70% from one customer, during the period from January 1, 2017 through January 12, 2017 (Predecessor) and during the year ended December 31, 2016 (Predecessor), respectively. Accounts receivable from the two customers at December 31, 2017 (Successor) was $30,556 and from the one customer at December 31, 2016 (Predecessor) was $33,588.

17. Stock/Unit Based Compensation

Effective January 1, 2009, Charah established a Deferred Stock Plan (the Plan), whereby of certain key employees were issued units that settle in shares ofnon-voting common stock upon the occurrence of certain specified events. Units issued under the Plan are classified as liabilities, due to a call option which allowed

F-32