Q2 2022 Earnings Call Presentation August 16, 2022 Exhibit 99.2

Forward-Looking Statements Forward-Looking Statements This presentation and our accompanying comments include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may be identified by words such as “may,” “will,” “expect,” “intend,” “anticipate,” “believe,” “estimate,” “plan,” “project,” “could,” “should,” “would,” “continue,” “seek,” “target,” “guidance,” “outlook,” “if current trends continue,” “optimistic,” “forecast” and other similar words. Such statements include, but are not limited to, statements about future financial and operating results, the Company’s plans, objectives, estimates, expectations, and intentions, estimates and strategies for the future, and other statements that are not historical facts. These forward-looking statements are based on our current objectives, beliefs and expectations, and they are subject to significant risks and uncertainties that may cause actual results and financial position and timing of certain events to differ materially from the information in the forward-looking statements. These risks and uncertainties include, but are not limited to, those set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 filed on March 31, 2022 with the Securities and Exchange Commission (“SEC”) and in our other reports filed from time to time with the SEC. There may be other factors of which we are not currently aware that may affect matters discussed in the forward-looking statements and may also cause actual results to differ materially from those discussed. We do not assume any obligation to publicly update or supplement any forward-looking statement to reflect actual results, changes in assumptions or changes in other factors affecting these forward-looking statements other than as required by law. Any forward-looking statements speak only as of the date hereof or as of the dates indicated in the statements. Non-GAAP Financial Measures Included in this presentation are certain non-GAAP financial measures designed to complement the financial information presented in accordance with GAAP because management believes such measures are useful to investors. The non-GAAP financial measures are not determined in accordance with GAAP and should not be considered a substitute for performance measures determined in accordance with GAAP. The calculations of the non-GAAP financial measures are subjective, based on management’s belief as to which items should be included or excluded in order to provide the most reasonable and comparable view of the underlying operating performance of the business. We may, from time to time, modify the items used to determine our non-GAAP financial measures. Reconciliation of non-GAAP financial measures are included in the supplemental slides in the Appendix of this presentation. Market & Industry Data This presentation includes industry and trade data, forecasts and information that was prepared based, in part, upon data, forecasts and information obtained from independent trade associations, industry publications and surveys and other independent sources available to the Company. Some data also are based on the Company’s good faith estimates, which are derived from management’s knowledge of the industry and from independent sources. These third-party publications and surveys generally state that the information included therein has been obtained from sources believed to be reliable, but that the publications and surveys can give no assurance as to the accuracy or completeness of such information. The Company has not independently verified any of the data from third- party sources nor has it ascertained the underlying economic assumptions on which such data are based. Backlog Backlog amounts are determined based on, among other things, contracted fixed price and lump sum awards, contracted unit price awards, contracted Byproduct Services awards based on customer- provided CCR projections with the Company’s experience-based estimates of market sales prices, and the recently awarded EnviroSource project. These estimates may prove inaccurate, which could cause estimated revenue to be realized in periods later than originally expected or not at all. We have occasionally experienced postponements, cancellations, and reductions in expected future work due to changes in our customers’ spending plans, estimated plant production, market volatility, supply and demand and regulatory and other factors. In certain volume-based contracts, our customers are not contractually committed to providing certain byproduct volumes. There can be no assurance as to the accuracy of our estimates or that contracts included in our backlog will be profitable. As a result, our backlog as of any particular date is an uncertain indicator of future revenue and earnings.

Table of Contents Our Business ESG Focus 2nd Quarter 2022 Business Update 2nd Quarter 2022 Financial Update Appendix

Our Business August 16, 2022

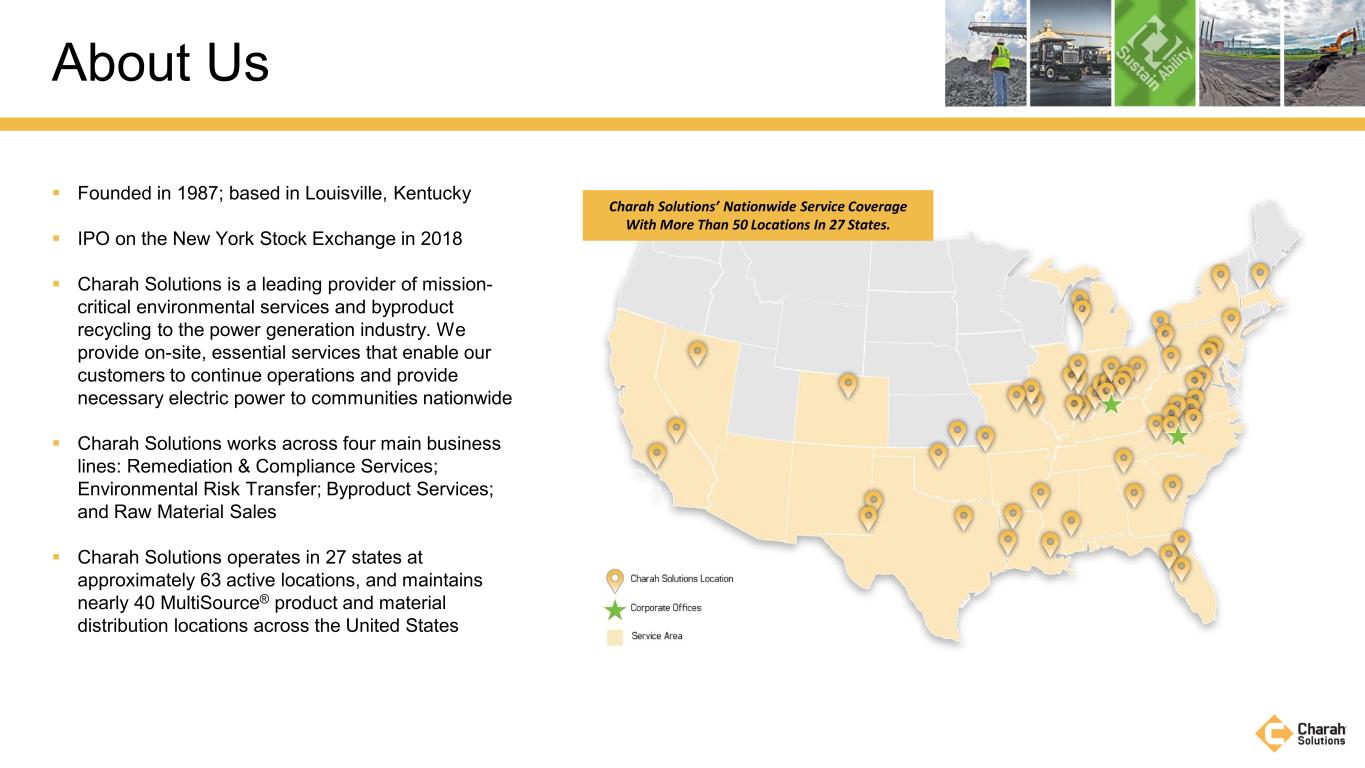

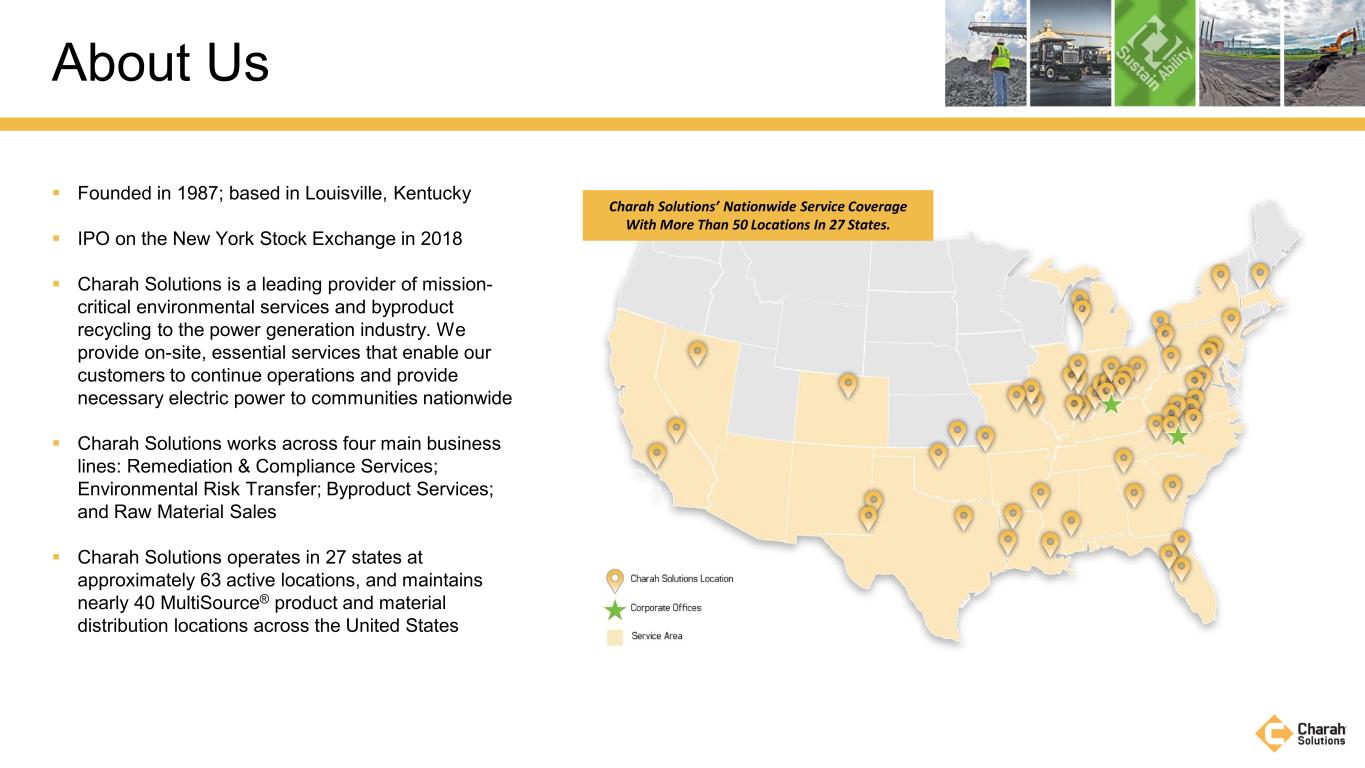

Founded in 1987; based in Louisville, Kentucky IPO on the New York Stock Exchange in 2018 Charah Solutions is a leading provider of mission- critical environmental services and byproduct recycling to the power generation industry. We provide on-site, essential services that enable our customers to continue operations and provide necessary electric power to communities nationwide Charah Solutions works across four main business lines: Remediation & Compliance Services; Environmental Risk Transfer; Byproduct Services; and Raw Material Sales Charah Solutions operates in 27 states at approximately 63 active locations, and maintains nearly 40 MultiSource® product and material distribution locations across the United States About Us Charah Solutions’ Nationwide Service Coverage With More Than 50 Locations In 27 States.

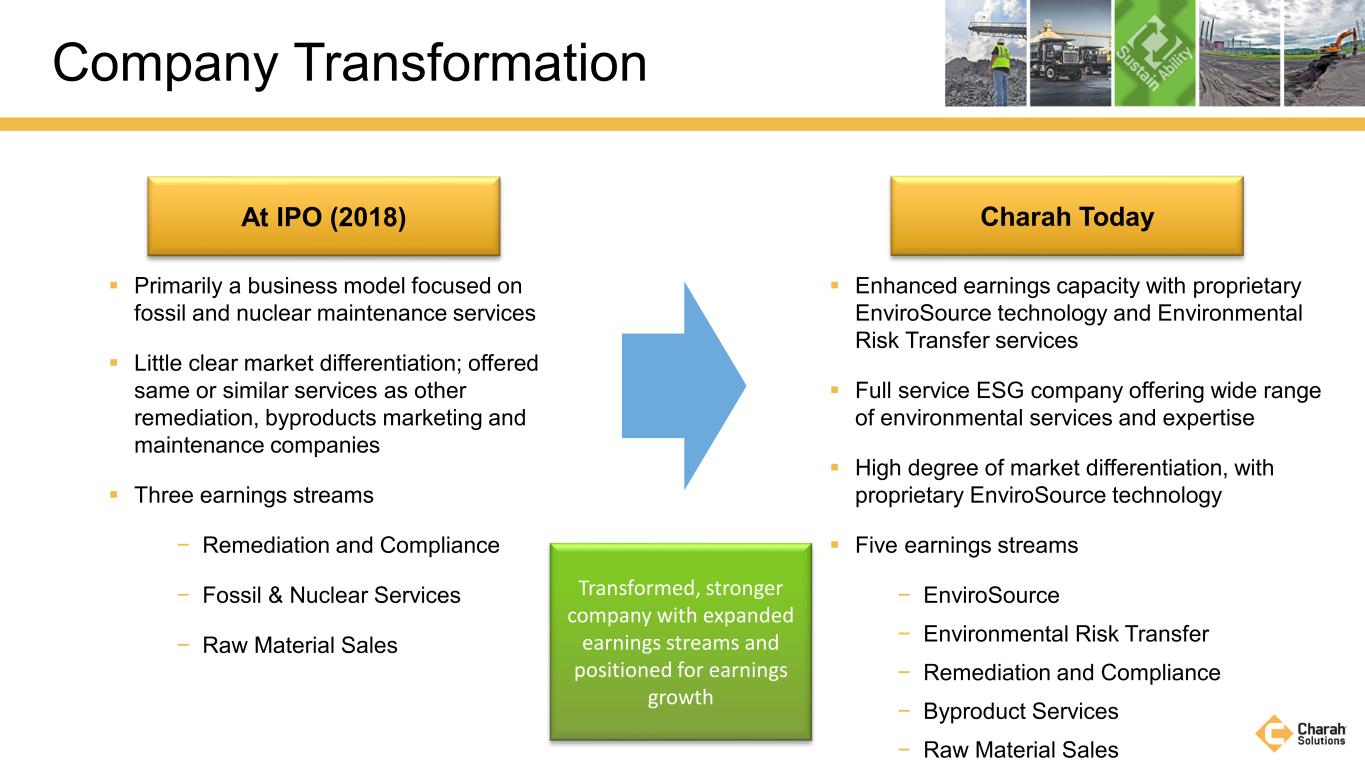

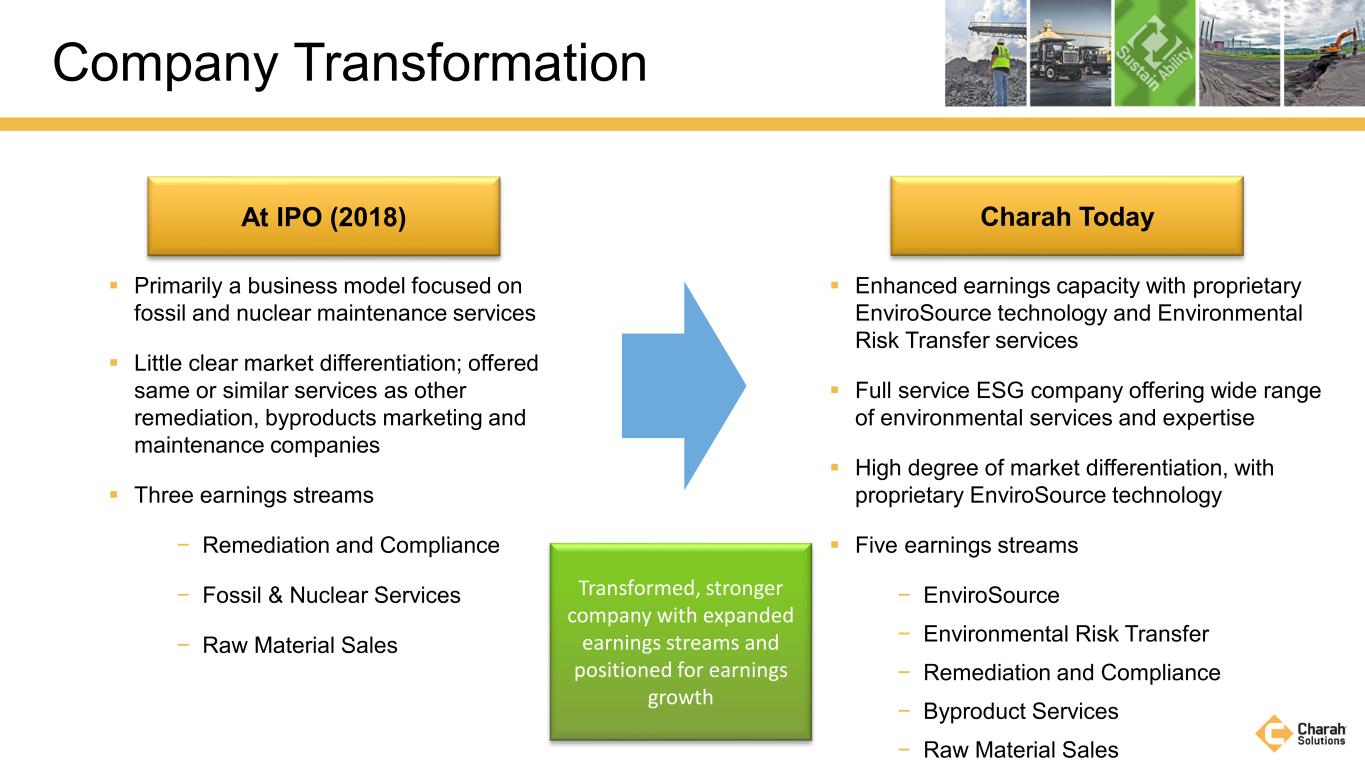

Primarily a business model focused on fossil and nuclear maintenance services Little clear market differentiation; offered same or similar services as other remediation, byproducts marketing and maintenance companies Three earnings streams − Remediation and Compliance − Fossil & Nuclear Services − Raw Material Sales Company Transformation At IPO (2018) Charah Today Enhanced earnings capacity with proprietary EnviroSource technology and Environmental Risk Transfer services Full service ESG company offering wide range of environmental services and expertise High degree of market differentiation, with proprietary EnviroSource technology Five earnings streams − EnviroSource − Environmental Risk Transfer − Remediation and Compliance − Byproduct Services − Raw Material Sales Transformed, stronger company with expanded earnings streams and positioned for earnings growth

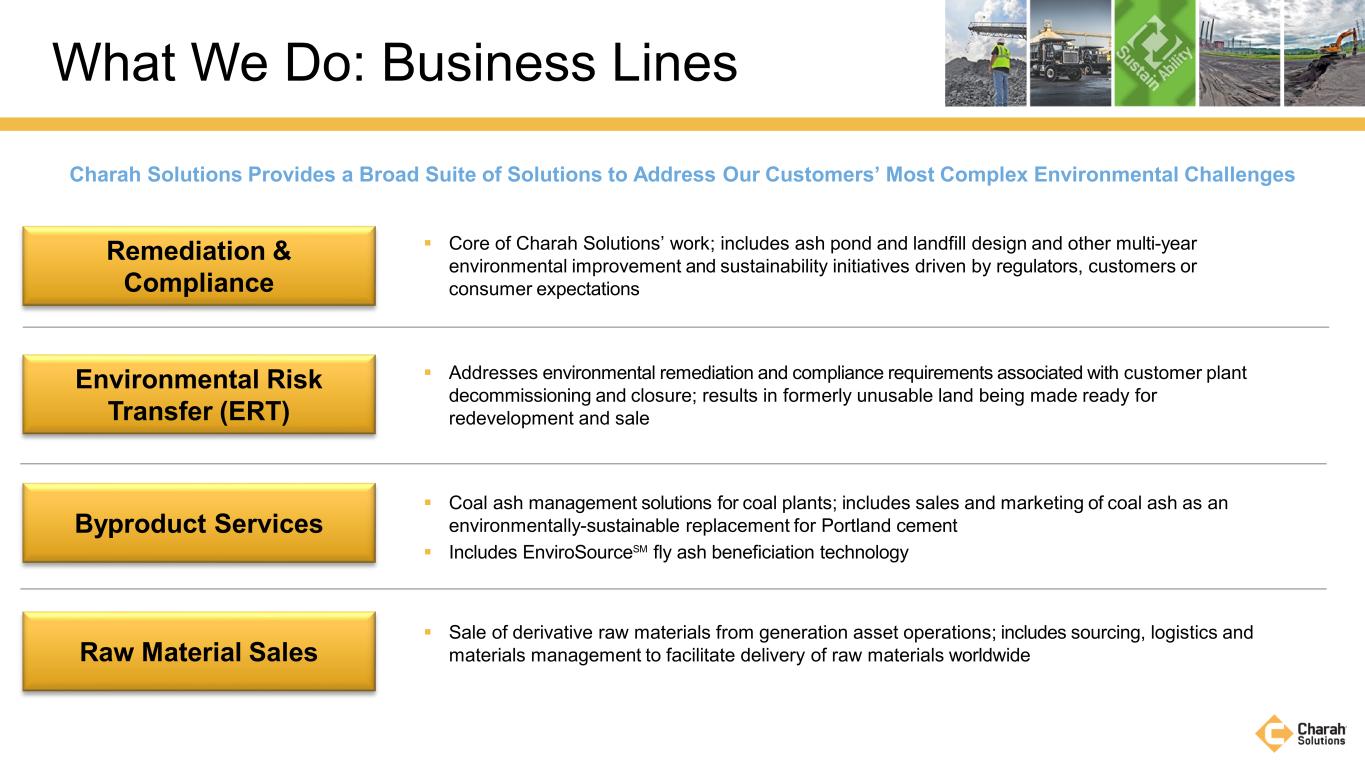

Charah Solutions Provides a Broad Suite of Solutions to Address Our Customers’ Most Complex Environmental Challenges What We Do: Business Lines Remediation & Compliance Environmental Risk Transfer (ERT) Byproduct Services Raw Material Sales Core of Charah Solutions’ work; includes ash pond and landfill design and other multi-year environmental improvement and sustainability initiatives driven by regulators, customers or consumer expectations Addresses environmental remediation and compliance requirements associated with customer plant decommissioning and closure; results in formerly unusable land being made ready for redevelopment and sale Coal ash management solutions for coal plants; includes sales and marketing of coal ash as an environmentally-sustainable replacement for Portland cement Includes EnviroSourceSM fly ash beneficiation technology Sale of derivative raw materials from generation asset operations; includes sourcing, logistics and materials management to facilitate delivery of raw materials worldwide

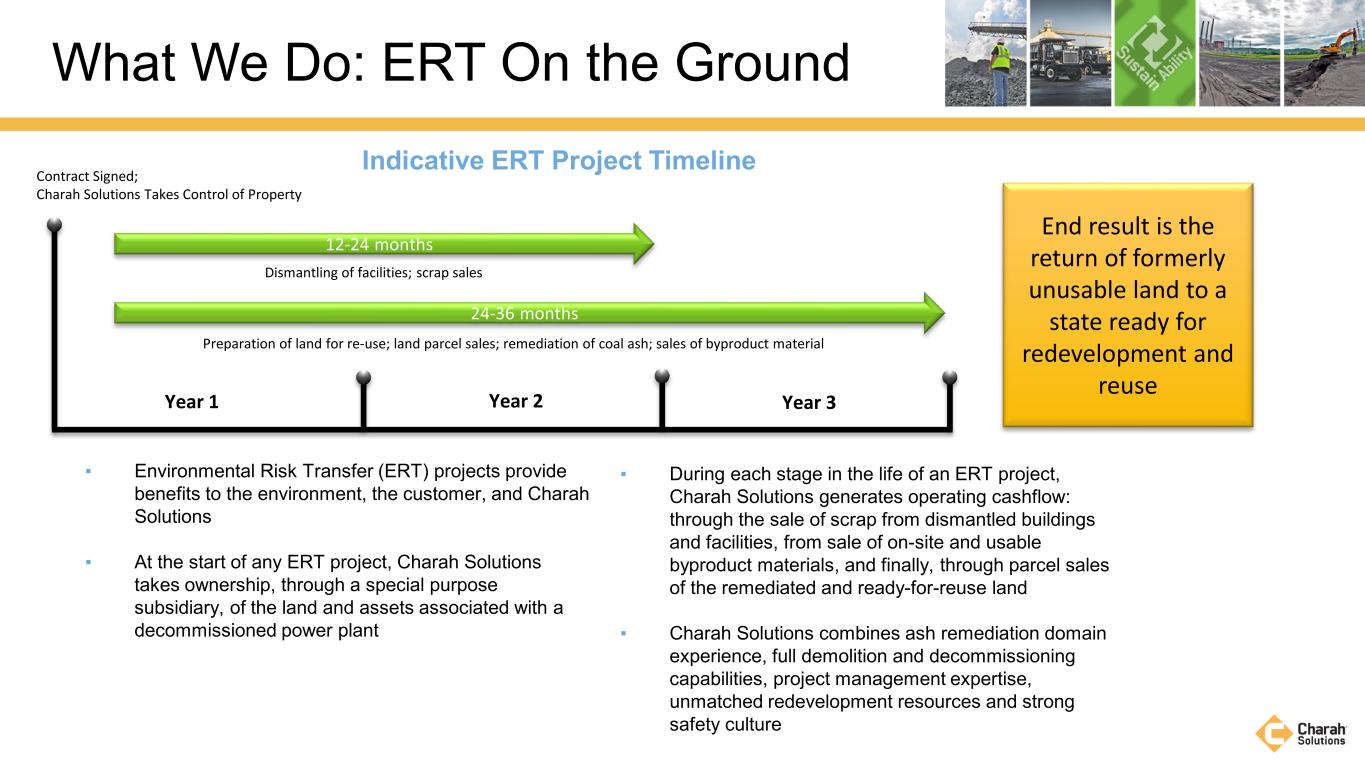

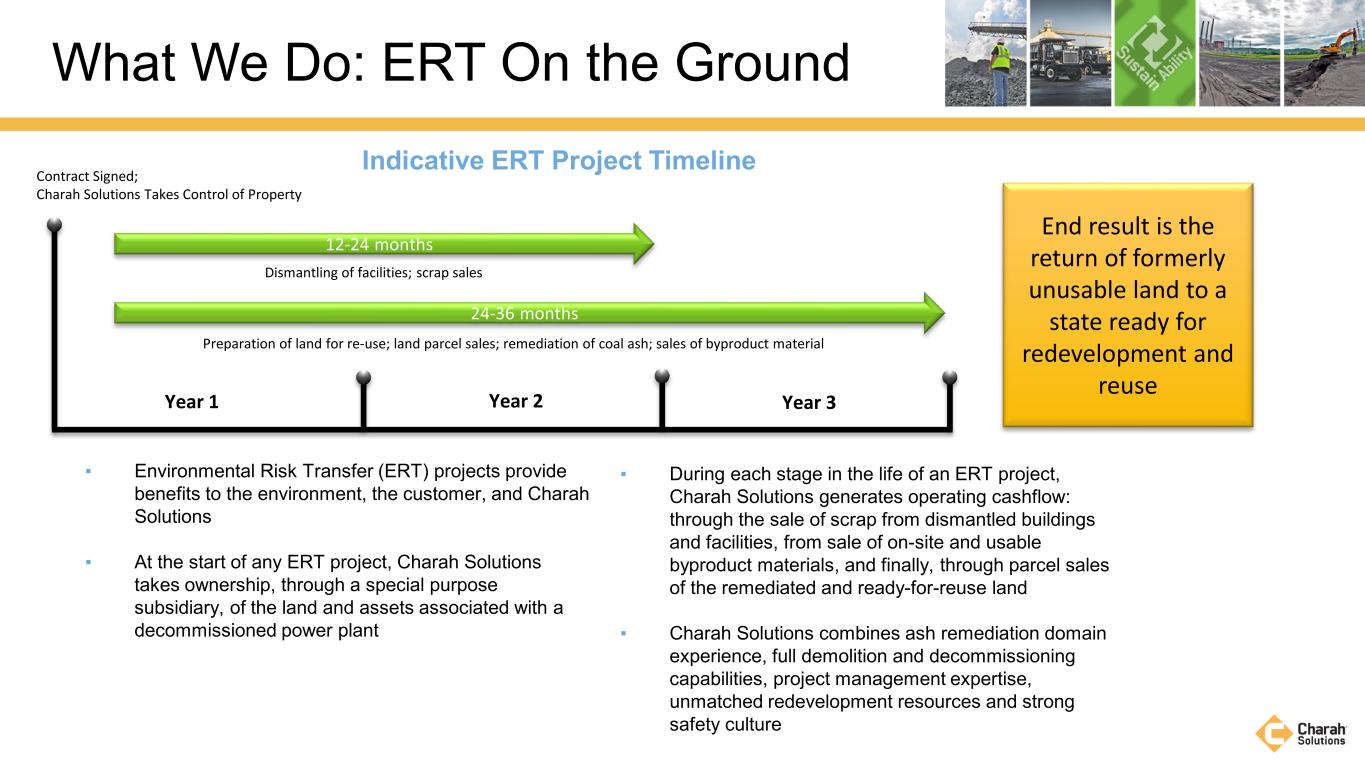

▪ Environmental Risk Transfer (ERT) projects provide benefits to the environment, the customer, and Charah Solutions ▪ At the start of any ERT project, Charah Solutions takes ownership, through a special purpose subsidiary, of the land and assets associated with a decommissioned power plant What We Do: ERT On the Ground Indicative ERT Project Timeline ▪ During each stage in the life of an ERT project, Charah Solutions generates operating cashflow: through the sale of scrap from dismantled buildings and facilities, from sale of on-site and usable byproduct materials, and finally, through parcel sales of the remediated and ready-for-reuse land ▪ Charah Solutions combines ash remediation domain experience, full demolition and decommissioning capabilities, project management expertise, unmatched redevelopment resources and strong safety culture 12-24 months Contract Signed; Charah Solutions Takes Control of Property Dismantling of facilities; scrap sales 24-36 months Preparation of land for re-use; land parcel sales; remediation of coal ash; sales of byproduct material End result is the return of formerly unusable land to a state ready for redevelopment and reuse Year 1 Year 2 Year 3

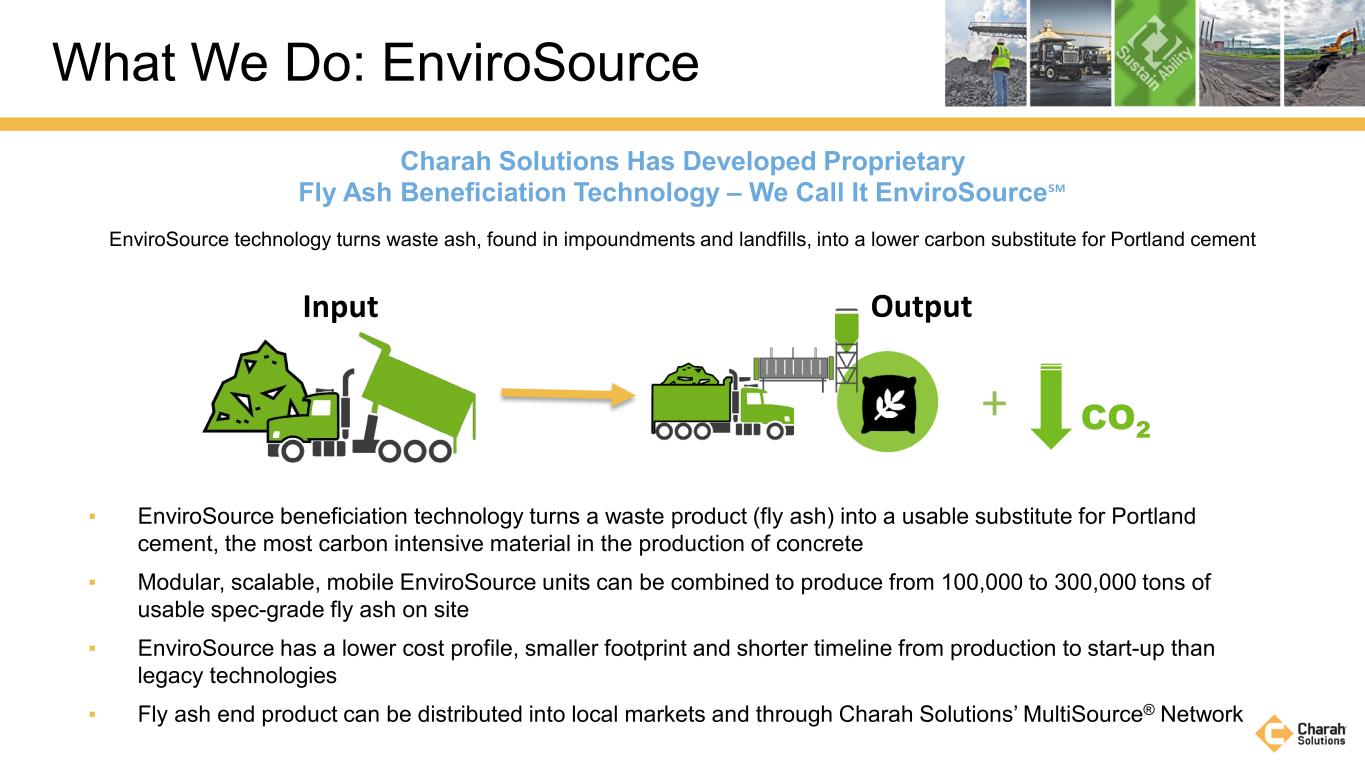

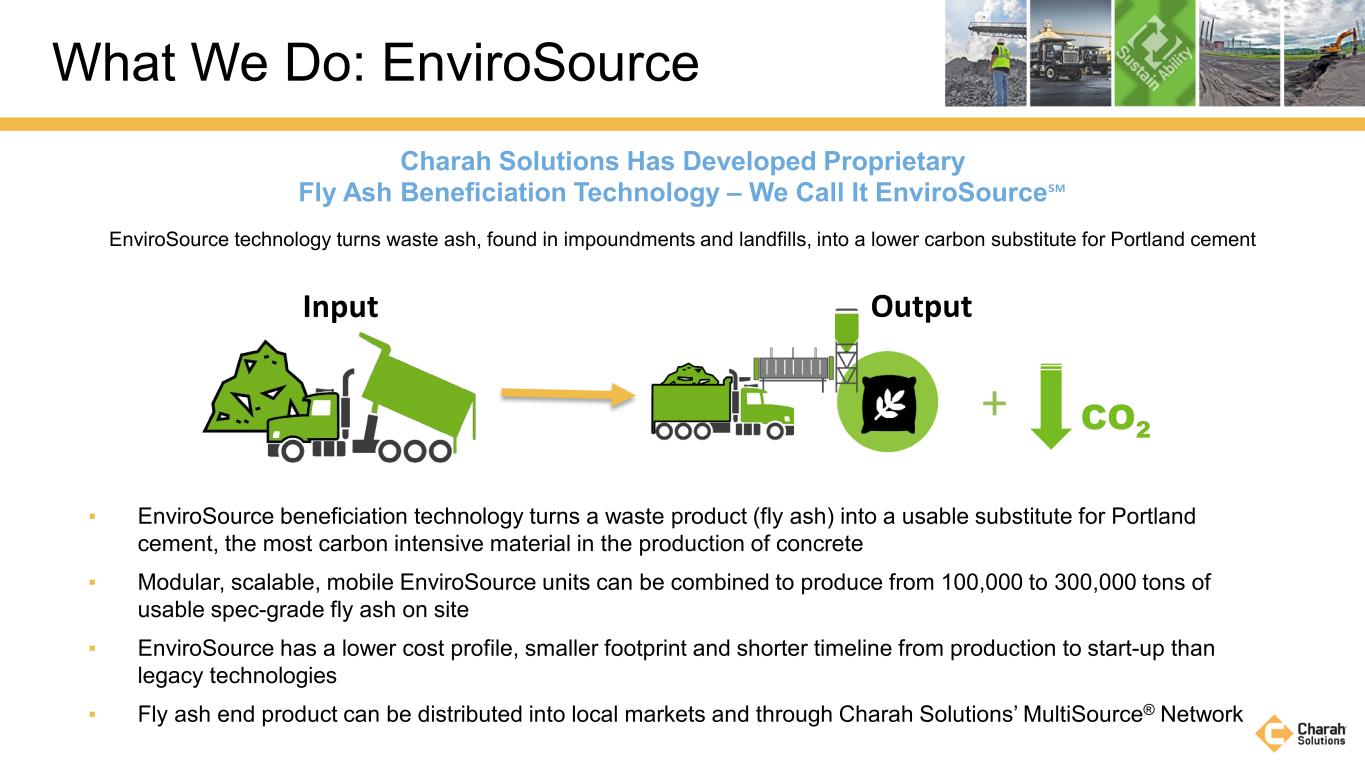

▪ EnviroSource beneficiation technology turns a waste product (fly ash) into a usable substitute for Portland cement, the most carbon intensive material in the production of concrete ▪ Modular, scalable, mobile EnviroSource units can be combined to produce from 100,000 to 300,000 tons of usable spec-grade fly ash on site ▪ EnviroSource has a lower cost profile, smaller footprint and shorter timeline from production to start-up than legacy technologies ▪ Fly ash end product can be distributed into local markets and through Charah Solutions’ MultiSource® Network What We Do: EnviroSource EnviroSource technology turns waste ash, found in impoundments and landfills, into a lower carbon substitute for Portland cement Charah Solutions Has Developed Proprietary Fly Ash Beneficiation Technology – We Call It EnviroSource℠ Input Output CO2 +

• In August 2022, Charah Solutions announced that it has been awarded the first deployment of its EnviroSource technology with a utility customer in the Western U.S. • Charah’s EnviroSource testing unit has been operational and in use for proof of concept and customer ash testing in Louisiana EnviroSource Technology In Action EnviroSource Technology Is “Deployment Ready”

ESG Focus August 16, 2022

ESG: Core to Our Business Reducing Our Customers’ Environmental Impact and Increasing Their Sustainability of Operations Are Central to Everything Charah Solutions Does Class C and Class F fly ash is beneficially used by ready mix concrete producers to make concrete. Structural fill projects in which the land is reclaimed for reuse. Raw gypsum byproduct is beneficially used in the production of drywall. Raw gypsum byproduct beneficially used by growers as agriculture fertilizer. Dry Fly Ash for Ready Mix Concrete Conditioned Fly Ash for Structural Fill Gypsum For Ag Fertilizer Byproducts Recycle/Reuse Remediation Recycled Steel for Industrial Use Remediating Pond Land Reuse Land Remediating Redevelopment Ash Pond Management Steel from the plant is recycled and beneficially used to produce products for the automotive, construction, and other industries. Upon ash pond closure by removal of the ash pond, the land is remediated and redeveloped for community use or other industrial redevelopment opportunities. Design, construction, operation, and remediation of onsite ash ponds to enable the safe and compliant beneficial use of these byproduct materials. Upon demolition of the plant, the land is remediated and redeveloped for community use or other industrial redevelopment opportunities. Gypsum For Drywall

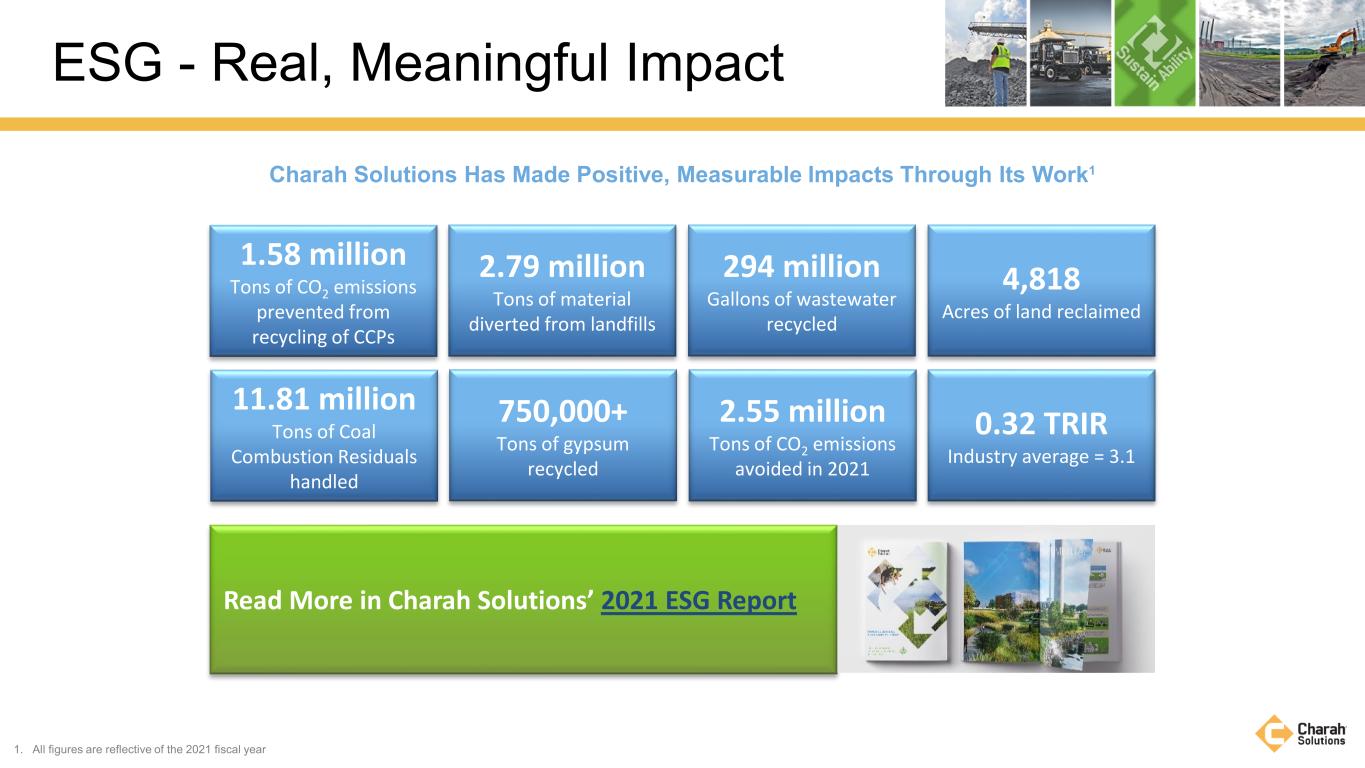

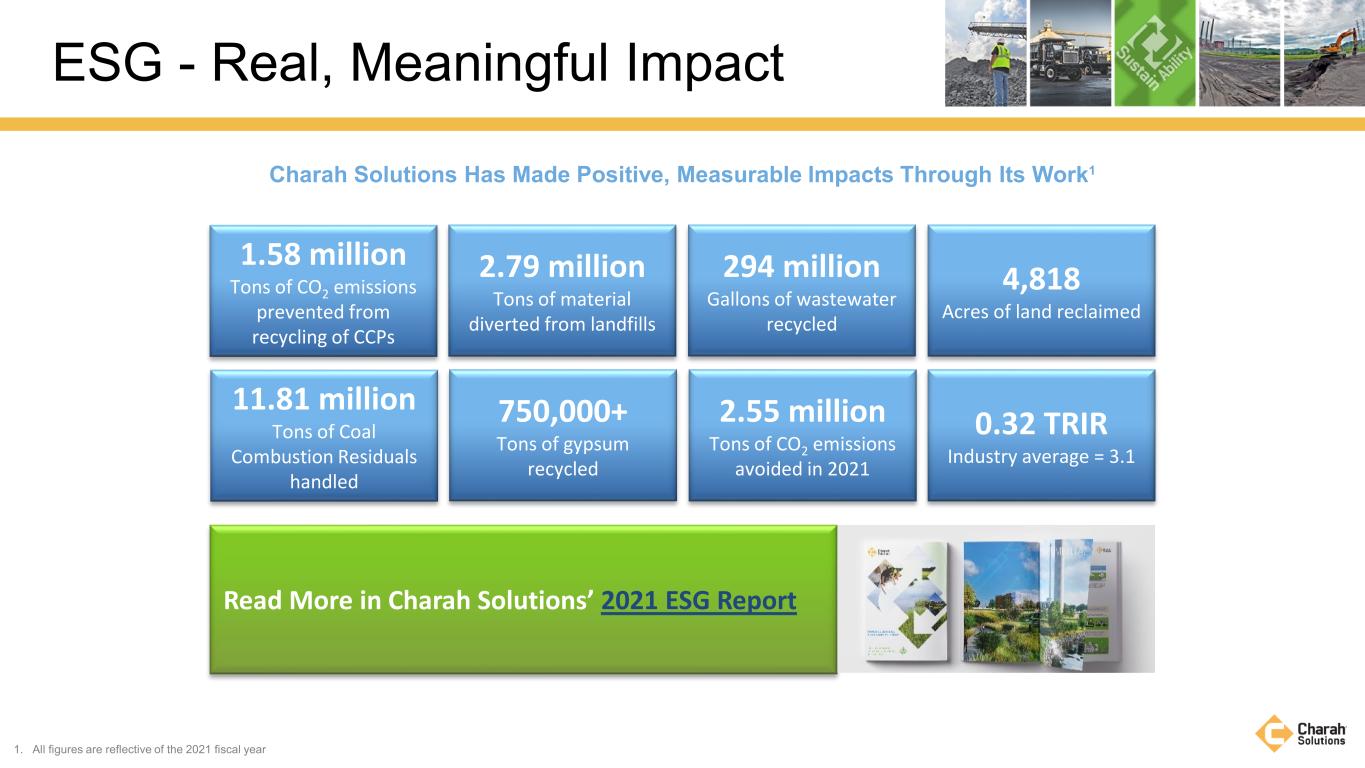

ESG - Real, Meaningful Impact Charah Solutions Has Made Positive, Measurable Impacts Through Its Work1 1.58 million Tons of CO2 emissions prevented from recycling of CCPs 2.79 million Tons of material diverted from landfills 294 million Gallons of wastewater recycled 4,818 Acres of land reclaimed 11.81 million Tons of Coal Combustion Residuals handled 750,000+ Tons of gypsum recycled 2.55 million Tons of CO2 emissions avoided in 2021 0.32 TRIR Industry average = 3.1 Read More in Charah Solutions’ 2021 ESG Report 1. All figures are reflective of the 2021 fiscal year

2nd Quarter 2022 Business Update August 16, 2022

Q2 Business Updates Second Quarter 2022 Highlights Completed acquisition of Avon Lake and Cheswick Generating Stations ERT projects for environmental remediation and redevelopment Subsequent 2022 Highlights Announced award of first EnviroSource award with utility customer Awarded multi-year fly ash sales and marketing contract from regulated Indiana utility Awarded 9-year, multi-pond ash excavation contract from long-term utility partner in the Southeast Awarded multiple remediation & compliance contracts in Louisiana and Arkansas by three Southeast utilities Received four gold-level employee safety awards from the North Carolina Department of Labor

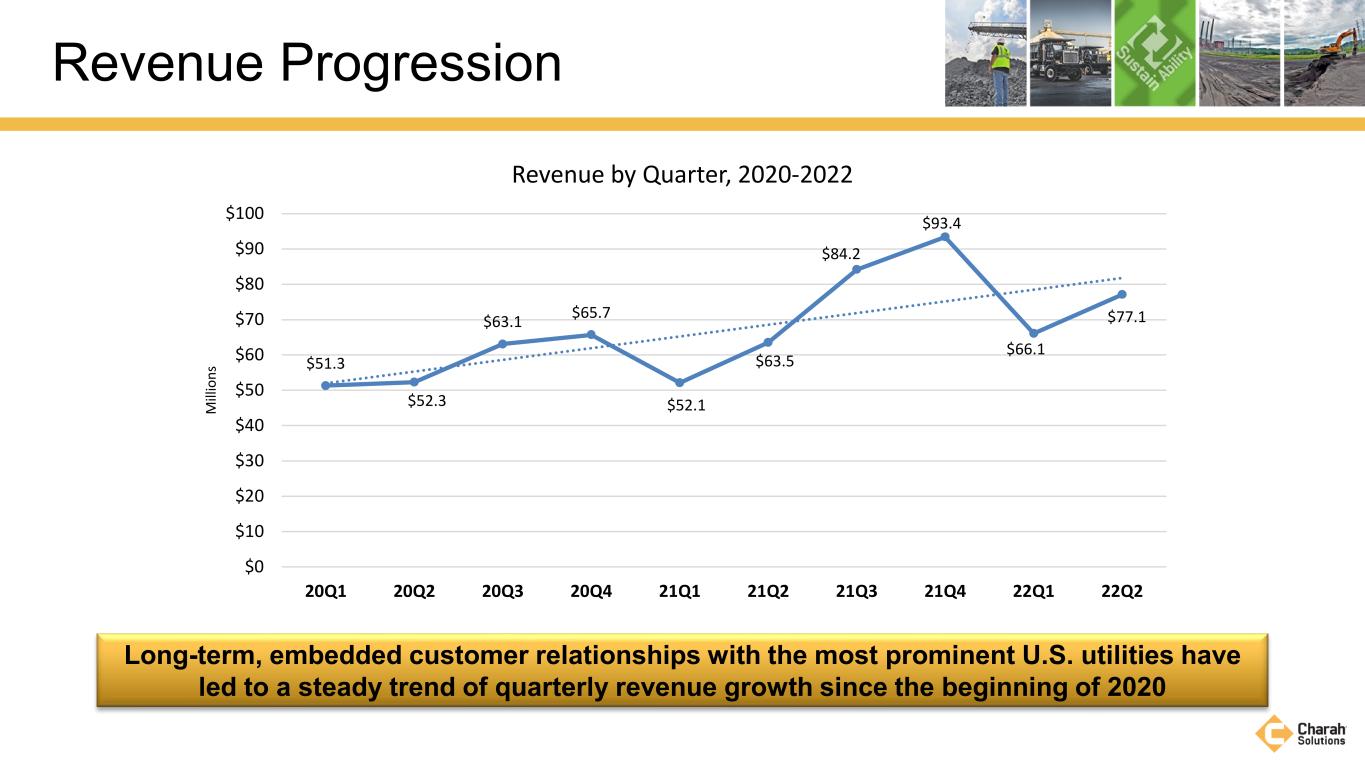

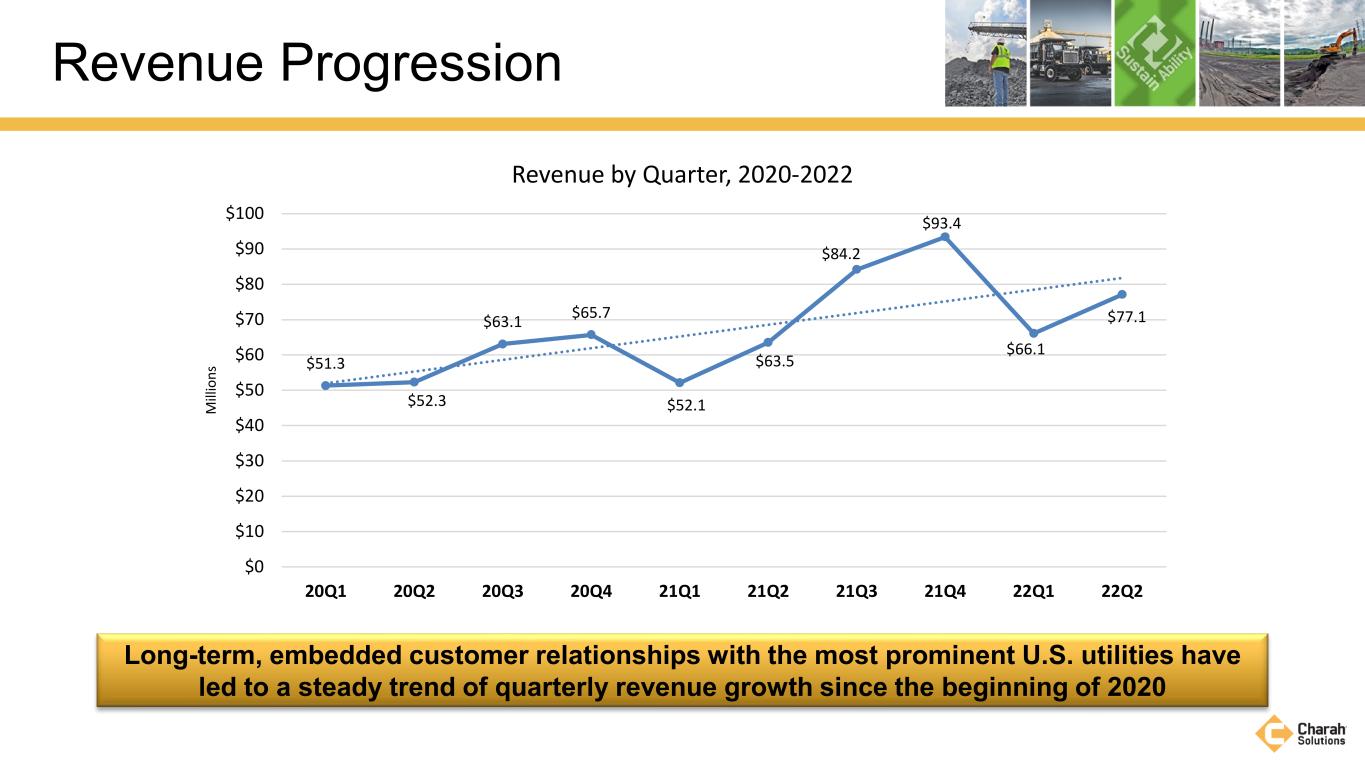

Revenue Progression $51.3 $52.3 $63.1 $65.7 $52.1 $63.5 $84.2 $93.4 $66.1 $77.1 $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 20Q1 20Q2 20Q3 20Q4 21Q1 21Q2 21Q3 21Q4 22Q1 22Q2 M ill io ns Revenue by Quarter, 2020-2022 Long-term, embedded customer relationships with the most prominent U.S. utilities have led to a steady trend of quarterly revenue growth since the beginning of 2020

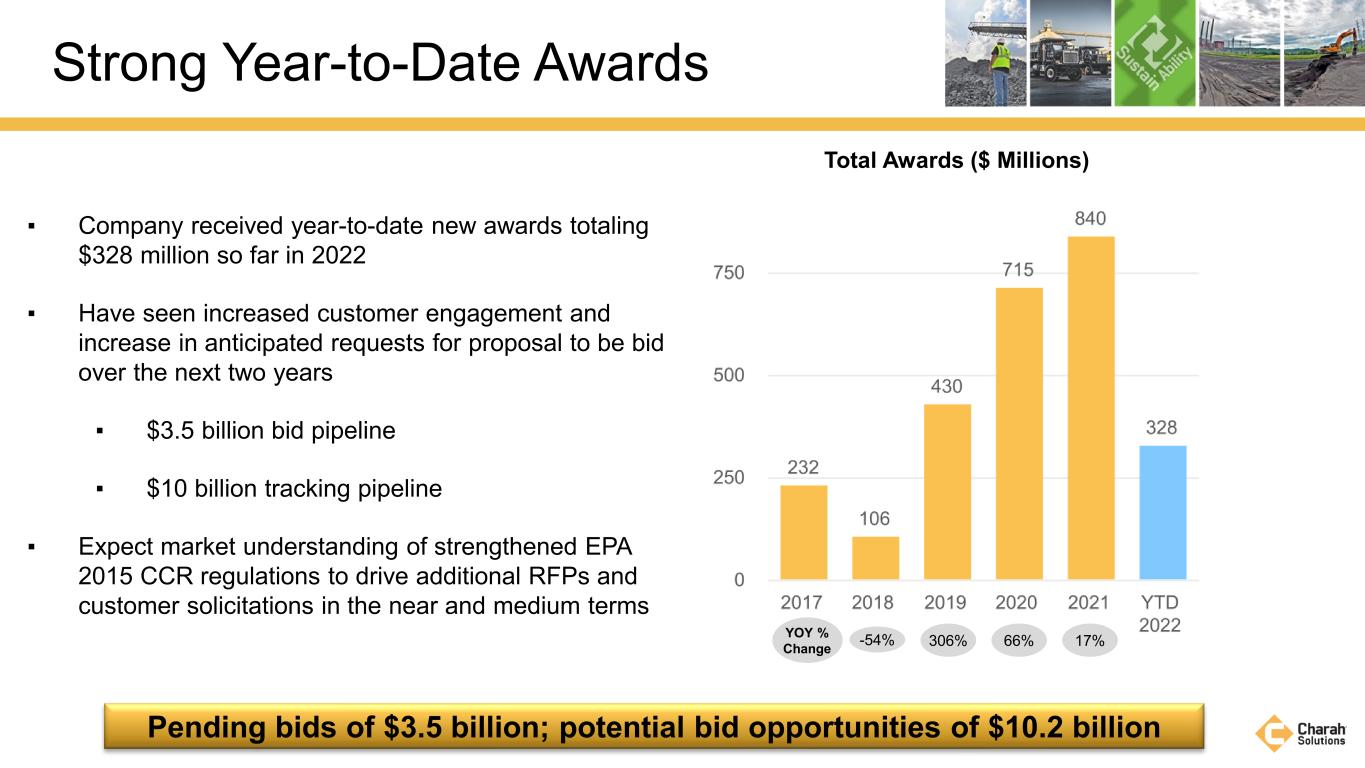

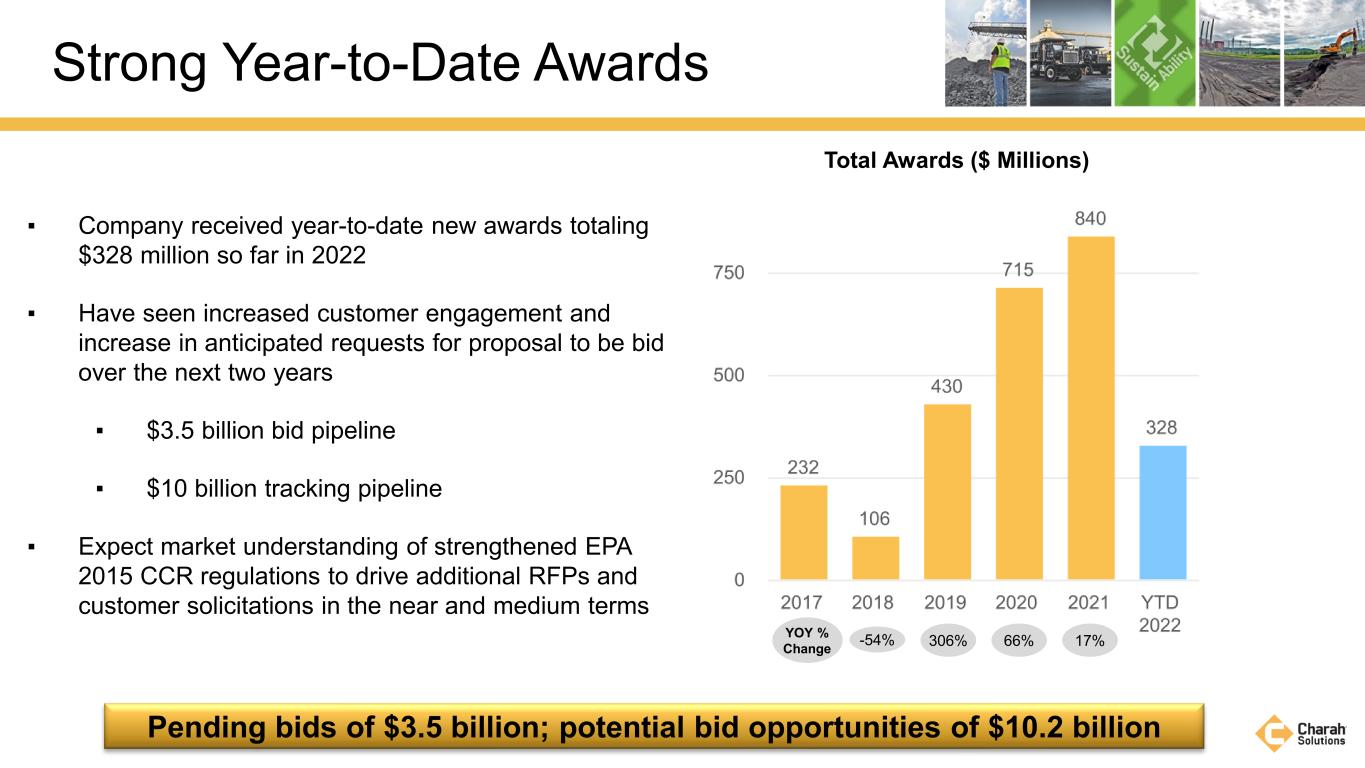

▪ Company received year-to-date new awards totaling $328 million so far in 2022 ▪ Have seen increased customer engagement and increase in anticipated requests for proposal to be bid over the next two years ▪ $3.5 billion bid pipeline ▪ $10 billion tracking pipeline ▪ Expect market understanding of strengthened EPA 2015 CCR regulations to drive additional RFPs and customer solicitations in the near and medium terms Strong Year-to-Date Awards Total Awards ($ Millions) 66%306%YOY % Change -54% 17% Pending bids of $3.5 billion; potential bid opportunities of $10.2 billion

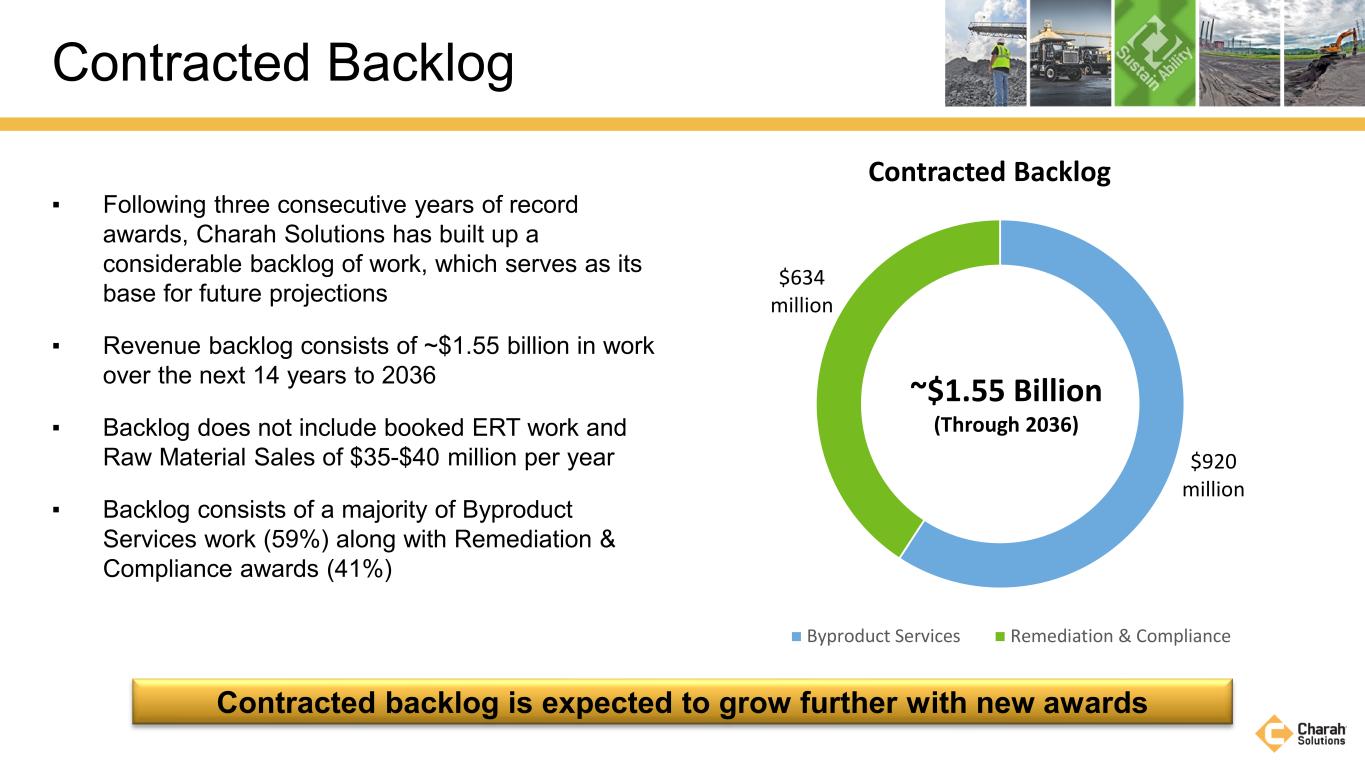

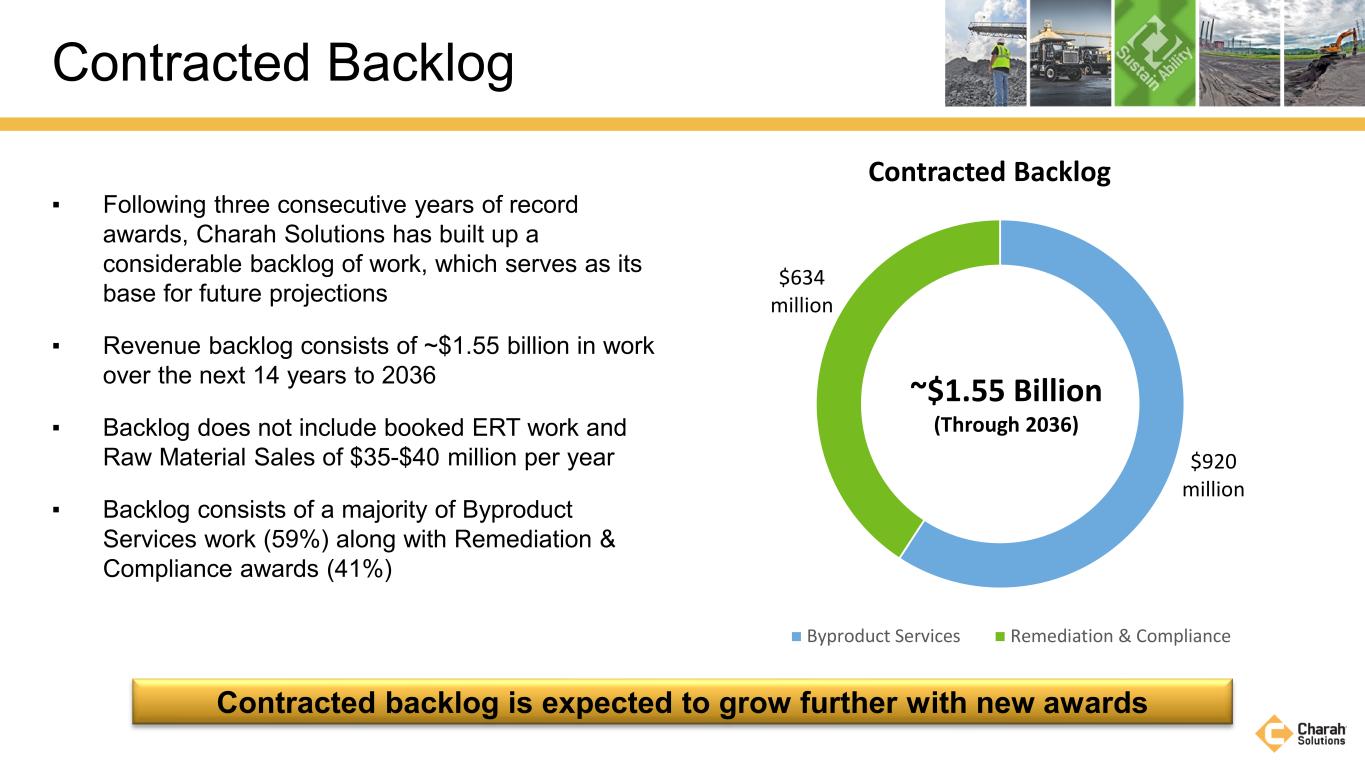

▪ Following three consecutive years of record awards, Charah Solutions has built up a considerable backlog of work, which serves as its base for future projections ▪ Revenue backlog consists of ~$1.55 billion in work over the next 14 years to 2036 ▪ Backlog does not include booked ERT work and Raw Material Sales of $35-$40 million per year ▪ Backlog consists of a majority of Byproduct Services work (59%) along with Remediation & Compliance awards (41%) Contracted Backlog $920 million $634 million Contracted Backlog Byproduct Services Remediation & Compliance ~$1.55 Billion (Through 2036) Contracted backlog is expected to grow further with new awards

2nd Quarter 2022 Financial Update August 16, 2022

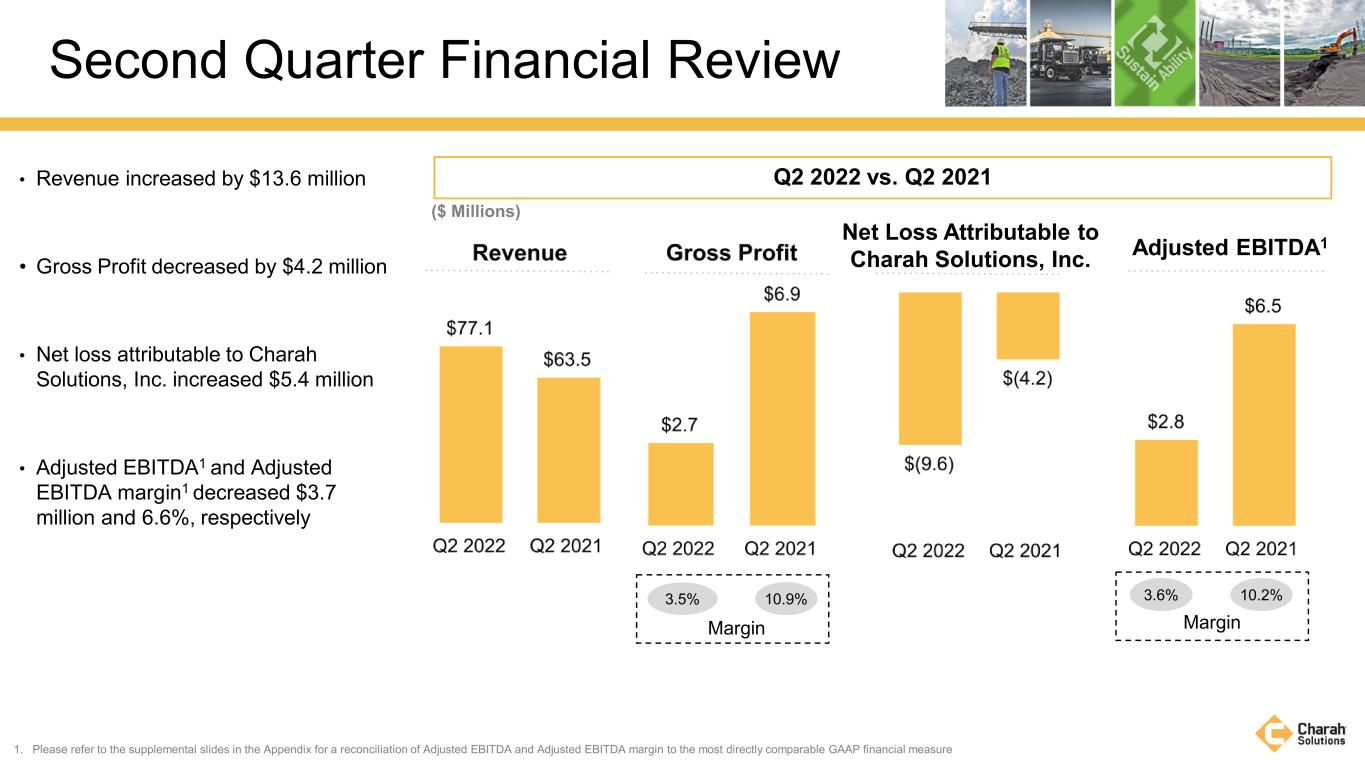

▪ Revenues increased $13.6 million as compared to Q2 2021 – Primarily due to: ▪ An increase in remediation and compliance services revenue from new projects ▪ An increase in byproduct services revenue from new project work and increased production; and ▪ An increase in raw material sales of $5.2 million from an increase in shipments. ▪ Gross profit decreased $4.2 million as compared to Q2 2021 – Primarily due to several factors, including: ▪ supply chain and logistics issues affected the expected ramp of two long-term beneficial use projects; and ▪ significant weather challenges that delayed the completion of three projects during the quarter, resulting in cost overruns; ▪ Net loss attributable to Charah Solutions, Inc. increased $5.4 million as compared to Q2 2021 – Primarily due to: ▪ The previously mentioned decrease in gross profit; and ▪ An increase in interest expense, net, ▪ Partially offset by increased gain on ARO settlement at our Gibbons Creek ERT project ▪ Adjusted EBITDA1 decreased $3.7 million as compared to Q2 2021 Q2 2022 Financial Highlights 1. Please refer to the supplemental slides in the Appendix for a reconciliation of Adjusted EBITDA to the most directly comparable GAAP financial measure

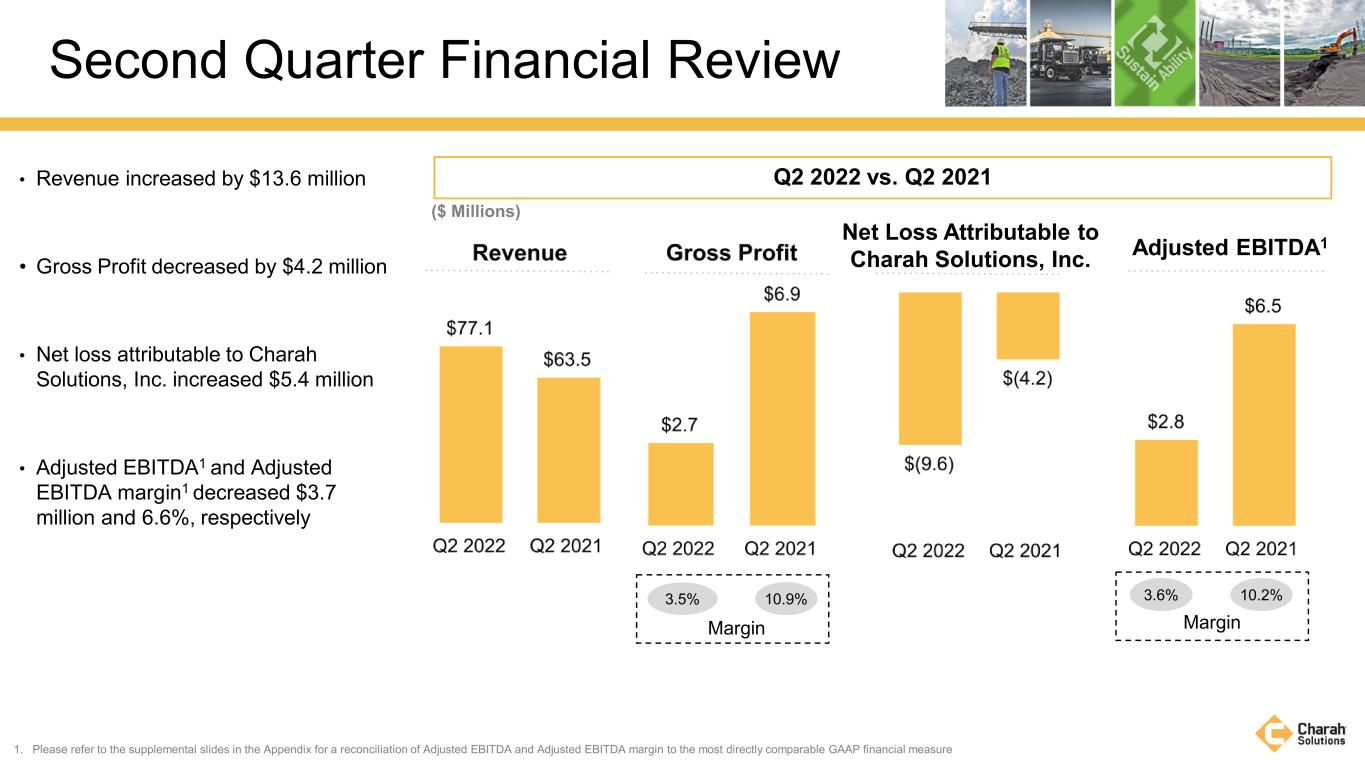

1. Please refer to the supplemental slides in the Appendix for a reconciliation of Adjusted EBITDA and Adjusted EBITDA margin to the most directly comparable GAAP financial measure Second Quarter Financial Review Q2 2022 vs. Q2 2021 10.2%3.6%10.9%3.5% Margin ($ Millions) Adjusted EBITDA1Net Loss Attributable to Charah Solutions, Inc. • Revenue increased by $13.6 million • Gross Profit decreased by $4.2 million • Net loss attributable to Charah Solutions, Inc. increased $5.4 million • Adjusted EBITDA1 and Adjusted EBITDA margin1 decreased $3.7 million and 6.6%, respectively Margin

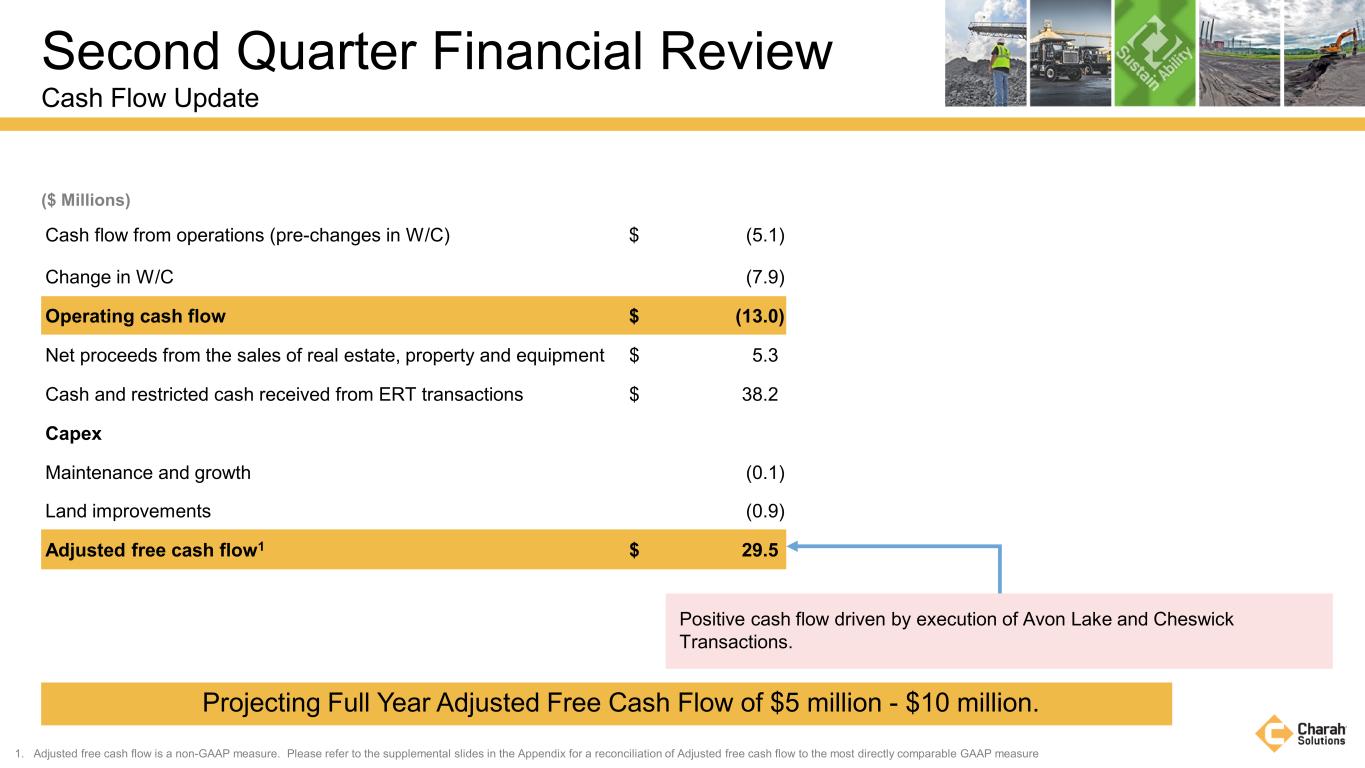

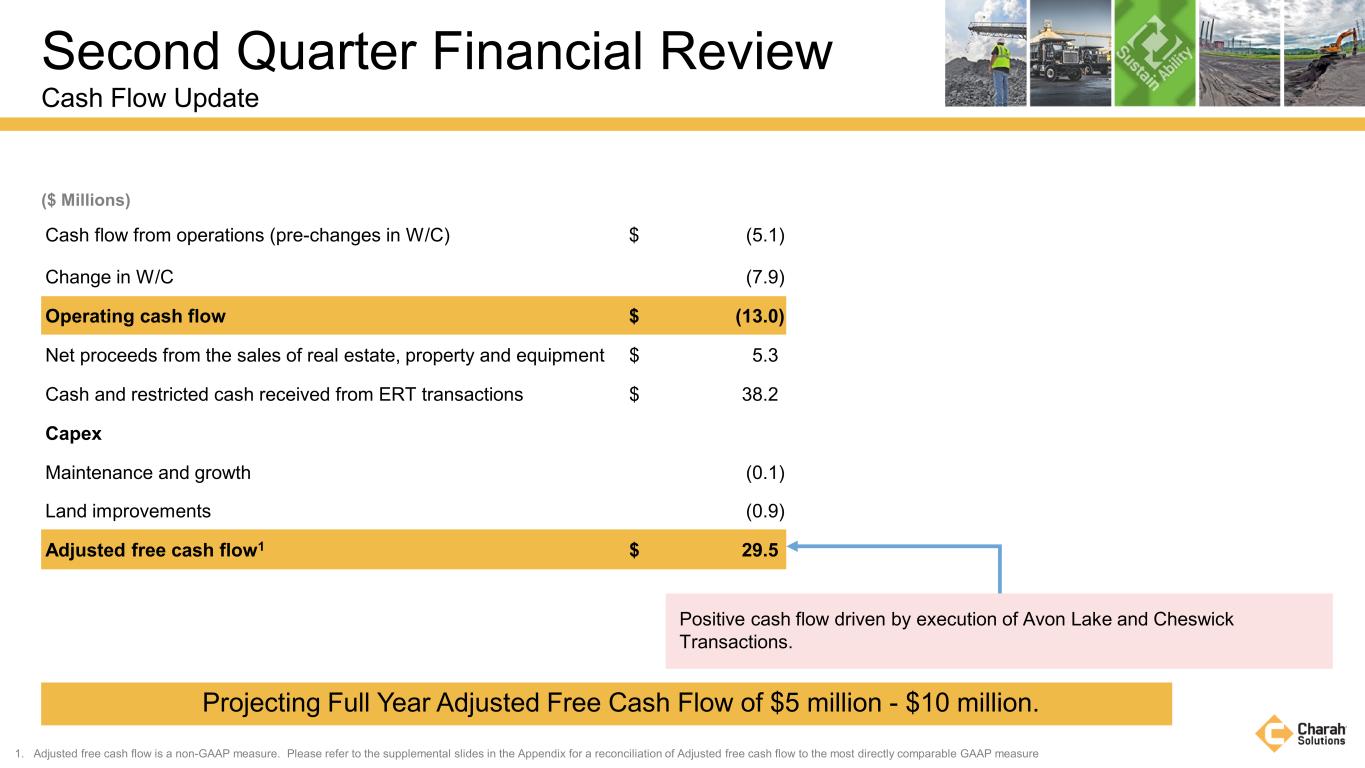

Second Quarter Financial Review Cash Flow Update Cash flow from operations (pre-changes in W/C) $ (5.1) Change in W/C (7.9) Operating cash flow $ (13.0) Net proceeds from the sales of real estate, property and equipment $ 5.3 Cash and restricted cash received from ERT transactions $ 38.2 Capex Maintenance and growth (0.1) Land improvements (0.9) Adjusted free cash flow1 $ 29.5 ($ Millions) 1. Adjusted free cash flow is a non-GAAP measure. Please refer to the supplemental slides in the Appendix for a reconciliation of Adjusted free cash flow to the most directly comparable GAAP measure Projecting Full Year Adjusted Free Cash Flow of $5 million - $10 million. Positive cash flow driven by execution of Avon Lake and Cheswick Transactions.

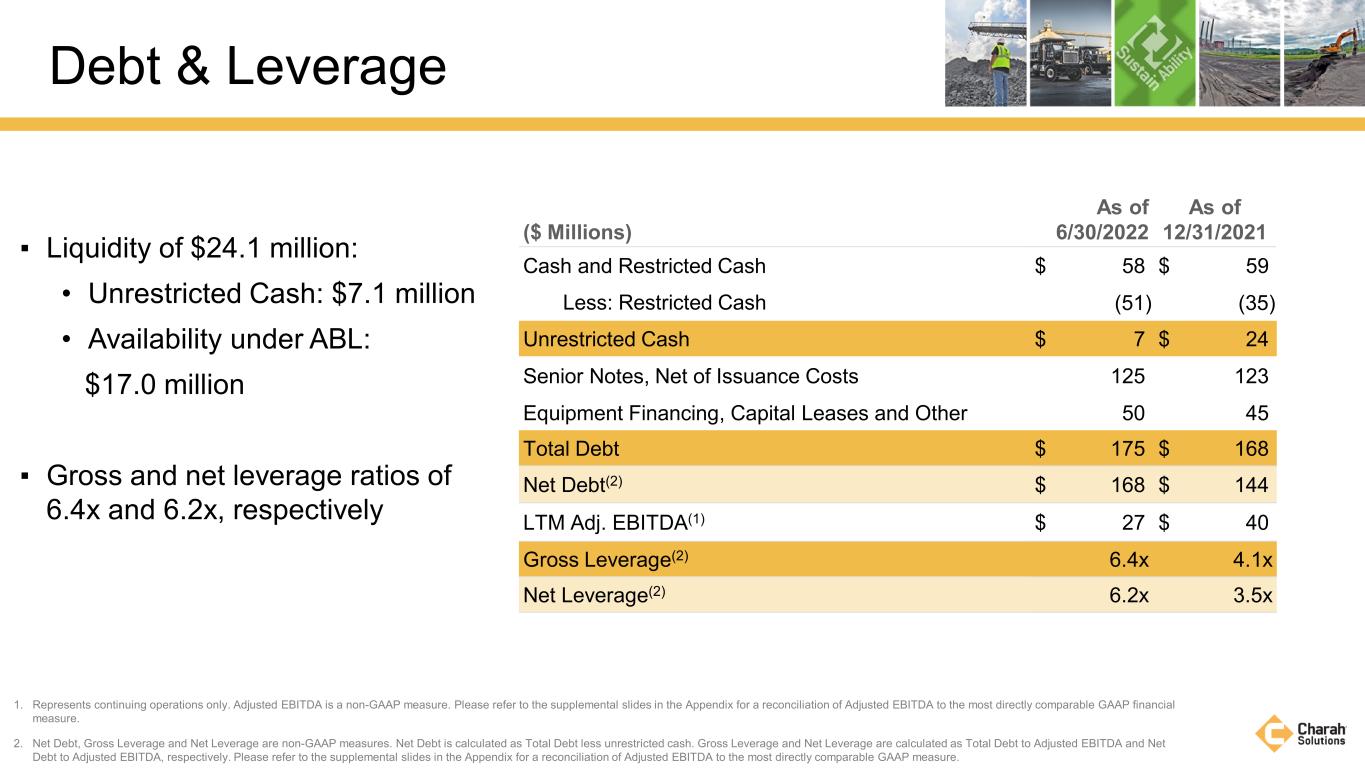

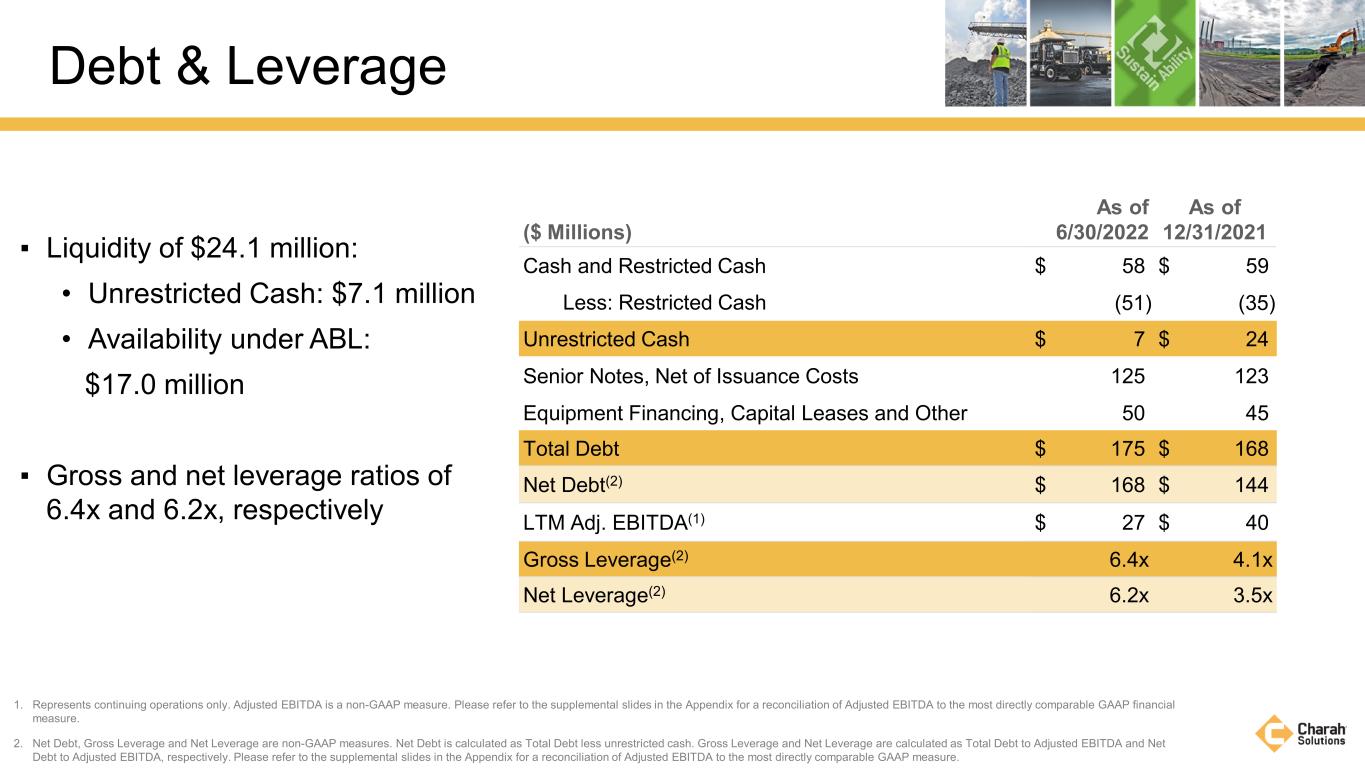

▪ Liquidity of $24.1 million: • Unrestricted Cash: $7.1 million • Availability under ABL: $17.0 million ▪ Gross and net leverage ratios of 6.4x and 6.2x, respectively 1. Represents continuing operations only. Adjusted EBITDA is a non-GAAP measure. Please refer to the supplemental slides in the Appendix for a reconciliation of Adjusted EBITDA to the most directly comparable GAAP financial measure. 2. Net Debt, Gross Leverage and Net Leverage are non-GAAP measures. Net Debt is calculated as Total Debt less unrestricted cash. Gross Leverage and Net Leverage are calculated as Total Debt to Adjusted EBITDA and Net Debt to Adjusted EBITDA, respectively. Please refer to the supplemental slides in the Appendix for a reconciliation of Adjusted EBITDA to the most directly comparable GAAP measure. ($ Millions) As of 6/30/2022 As of 12/31/2021 Cash and Restricted Cash $ 58 $ 59 Less: Restricted Cash (51) (35) Unrestricted Cash $ 7 $ 24 Senior Notes, Net of Issuance Costs 125 123 Equipment Financing, Capital Leases and Other 50 45 Total Debt $ 175 $ 168 Net Debt(2) $ 168 $ 144 LTM Adj. EBITDA(1) $ 27 $ 40 Gross Leverage(2) 6.4x 4.1x Net Leverage(2) 6.2x 3.5x Debt & Leverage

2022 Guidance ($ Millions) Updated Full Year 2022 Guidance Previous Guidance Revenue $310 - $340 $325 - $365 Net loss attributable to Charah Solutions, Inc. $10 - $30 $8 - $12 Adjusted EBITDA1 $25 - $30 $35 - $40 Adjusted free cash flow1 $5 - $10 $5 - $15 ▪ Charah Solutions has issued updated full year financial guidance 1. The forward-looking measures of 2022 Adjusted EBITDA and 2022 Adjusted free cash flow are non-GAAP financial measures that cannot be reconciled to net income attributable to Charah Solutions, Inc. and cash flows from operating activities, respectively, as the most directly comparable GAAP financial measure without unreasonable effort primarily because of the uncertainties involved in estimating forward-looking measures.

APPENDIX

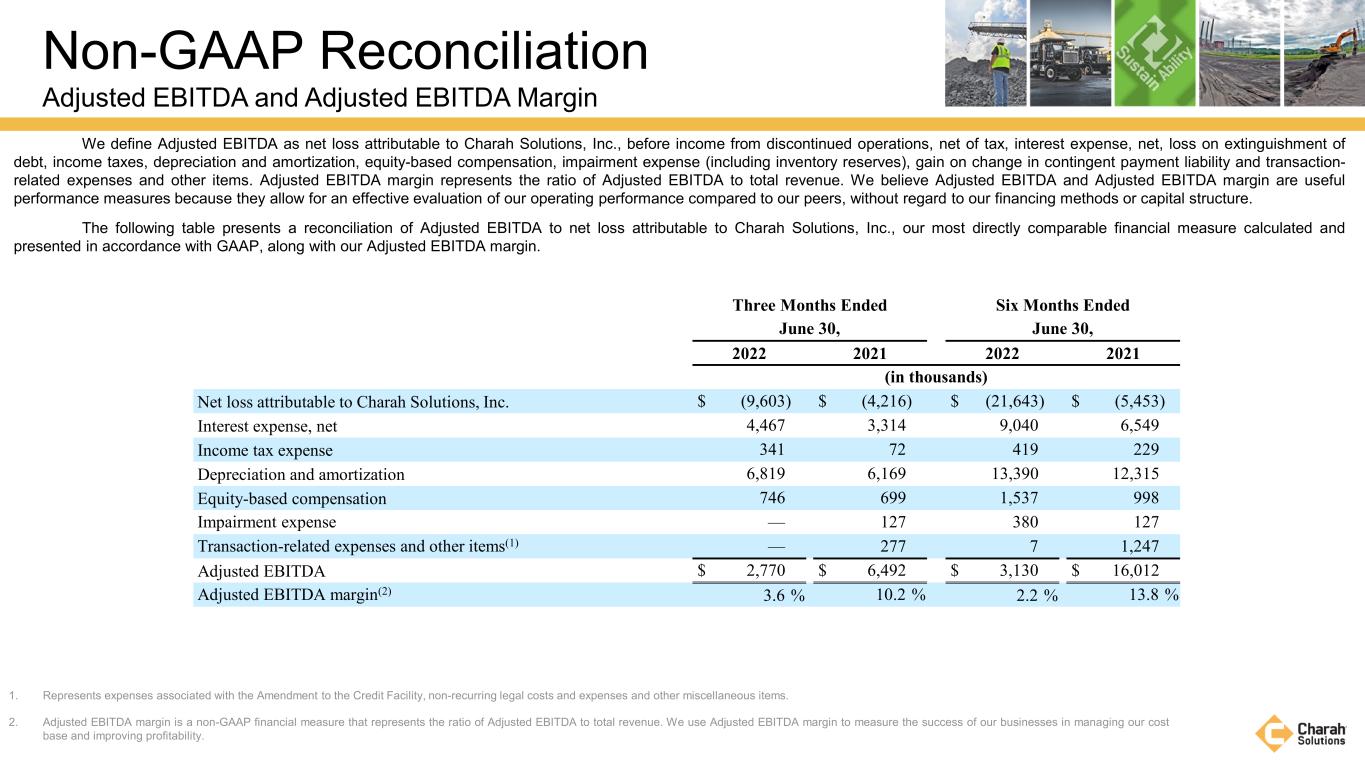

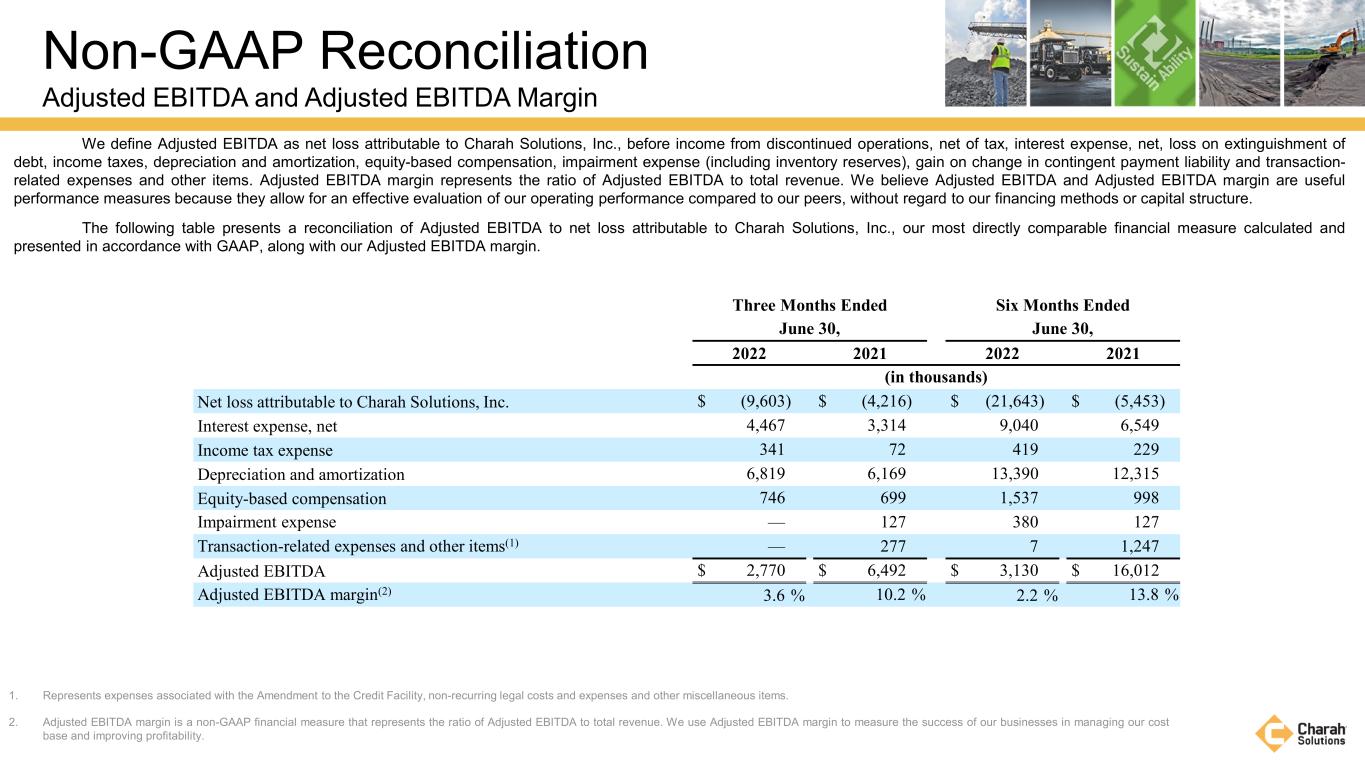

Non-GAAP Reconciliation Adjusted EBITDA and Adjusted EBITDA Margin 1. Represents expenses associated with the Amendment to the Credit Facility, non-recurring legal costs and expenses and other miscellaneous items. 2. Adjusted EBITDA margin is a non-GAAP financial measure that represents the ratio of Adjusted EBITDA to total revenue. We use Adjusted EBITDA margin to measure the success of our businesses in managing our cost base and improving profitability. Three Months Ended Six Months Ended June 30, June 30, 2022 2021 2022 2021 (in thousands) Net loss attributable to Charah Solutions, Inc. $ (9,603) $ (4,216) $ (21,643) $ (5,453) Interest expense, net 4,467 3,314 9,040 6,549 Income tax expense 341 72 419 229 Depreciation and amortization 6,819 6,169 13,390 12,315 Equity-based compensation 746 699 1,537 998 Impairment expense — 127 380 127 Transaction-related expenses and other items(1) — 277 7 1,247 Adjusted EBITDA $ 2,770 $ 6,492 $ 3,130 $ 16,012 Adjusted EBITDA margin(2) 3.6 % 10.2 % 2.2 % 13.8 % We define Adjusted EBITDA as net loss attributable to Charah Solutions, Inc., before income from discontinued operations, net of tax, interest expense, net, loss on extinguishment of debt, income taxes, depreciation and amortization, equity-based compensation, impairment expense (including inventory reserves), gain on change in contingent payment liability and transaction- related expenses and other items. Adjusted EBITDA margin represents the ratio of Adjusted EBITDA to total revenue. We believe Adjusted EBITDA and Adjusted EBITDA margin are useful performance measures because they allow for an effective evaluation of our operating performance compared to our peers, without regard to our financing methods or capital structure. The following table presents a reconciliation of Adjusted EBITDA to net loss attributable to Charah Solutions, Inc., our most directly comparable financial measure calculated and presented in accordance with GAAP, along with our Adjusted EBITDA margin.

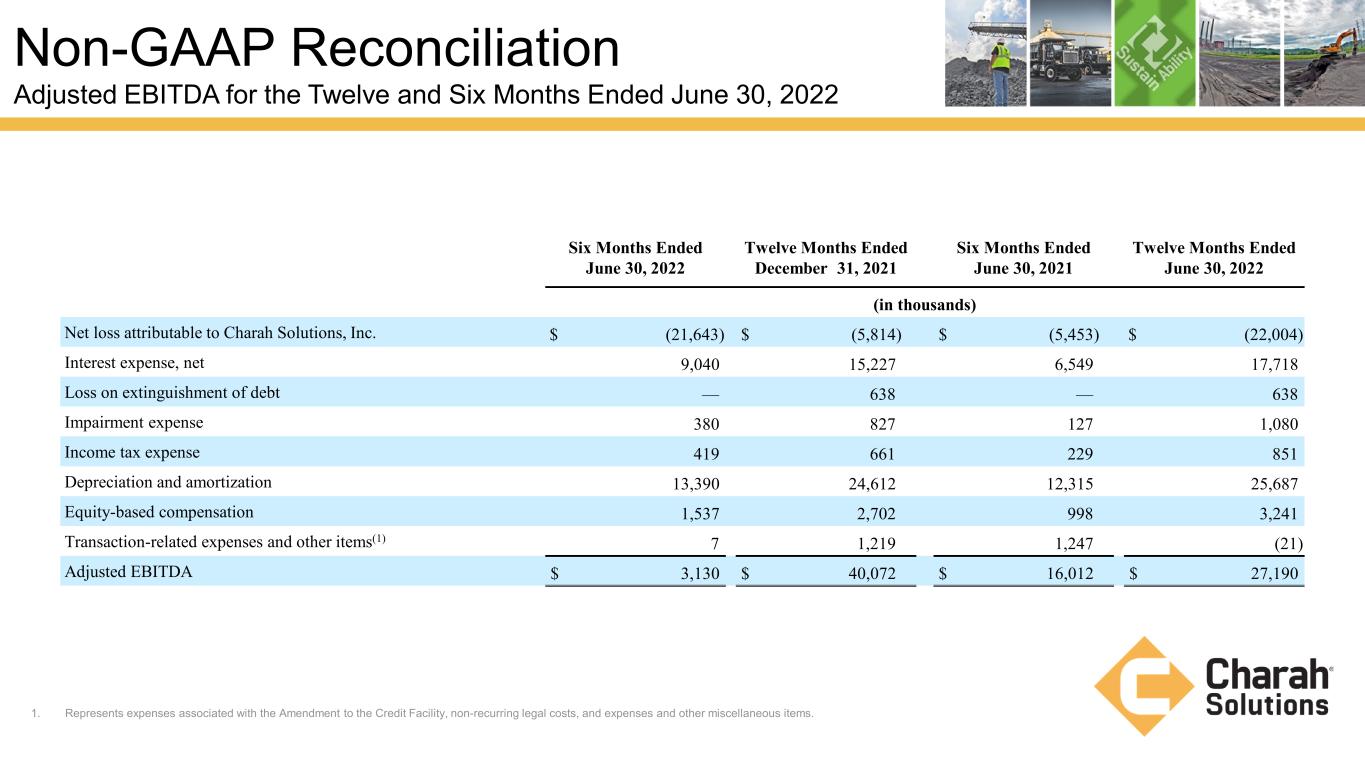

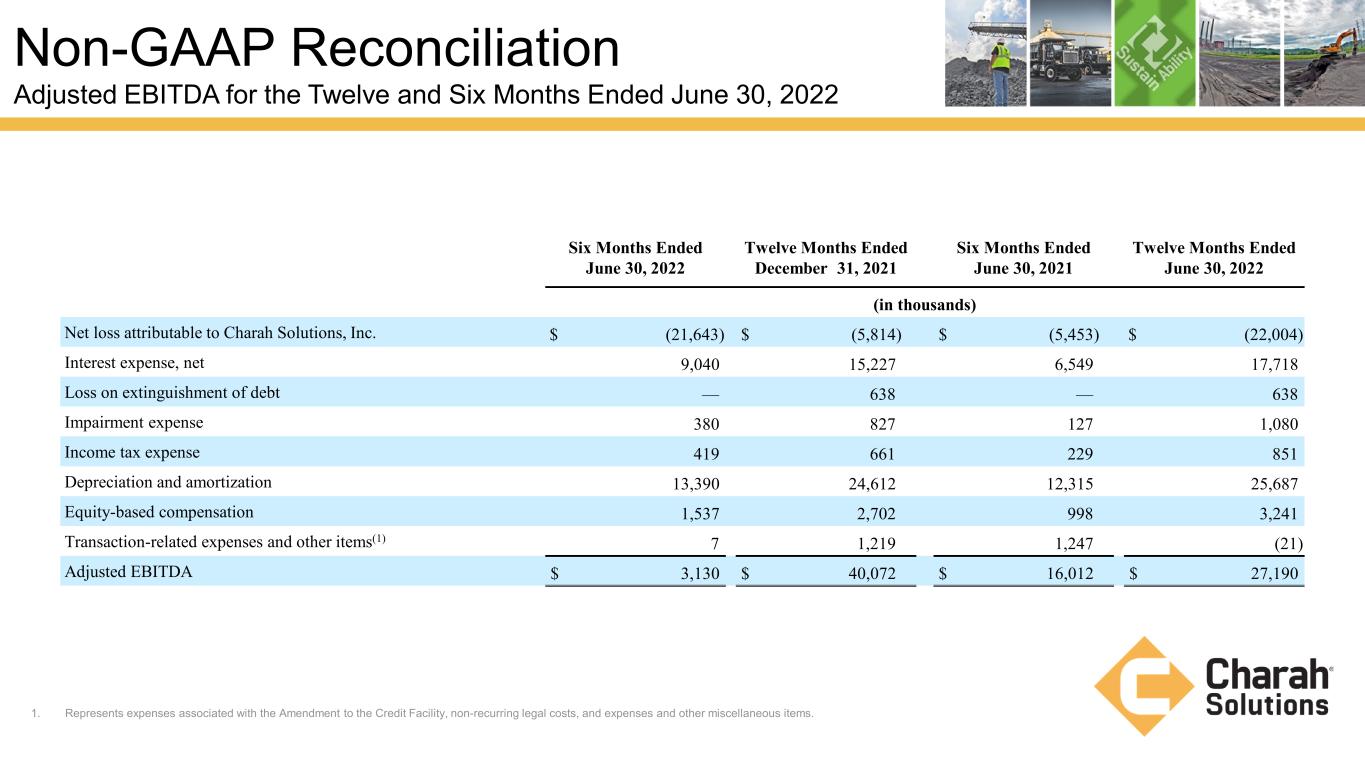

1. Represents expenses associated with the Amendment to the Credit Facility, non-recurring legal costs, and expenses and other miscellaneous items. Non-GAAP Reconciliation Adjusted EBITDA for the Twelve and Six Months Ended June 30, 2022 Six Months Ended June 30, 2022 Twelve Months Ended December 31, 2021 Six Months Ended June 30, 2021 Twelve Months Ended June 30, 2022 (in thousands) Net loss attributable to Charah Solutions, Inc. $ (21,643) $ (5,814) $ (5,453) $ (22,004) Interest expense, net 9,040 15,227 6,549 17,718 Loss on extinguishment of debt — 638 — 638 Impairment expense 380 827 127 1,080 Income tax expense 419 661 229 851 Depreciation and amortization 13,390 24,612 12,315 25,687 Equity-based compensation 1,537 2,702 998 3,241 Transaction-related expenses and other items(1) 7 1,219 1,247 (21) Adjusted EBITDA $ 3,130 $ 40,072 $ 16,012 $ 27,190

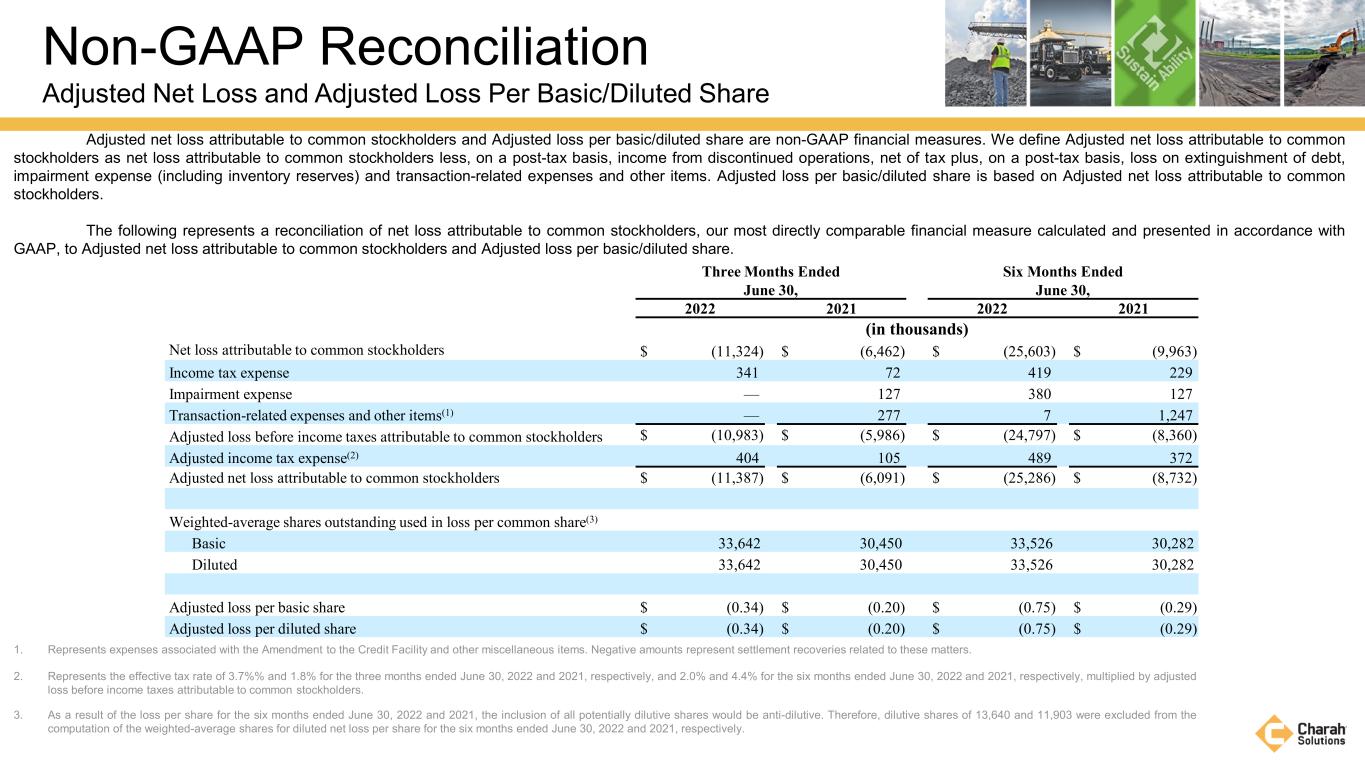

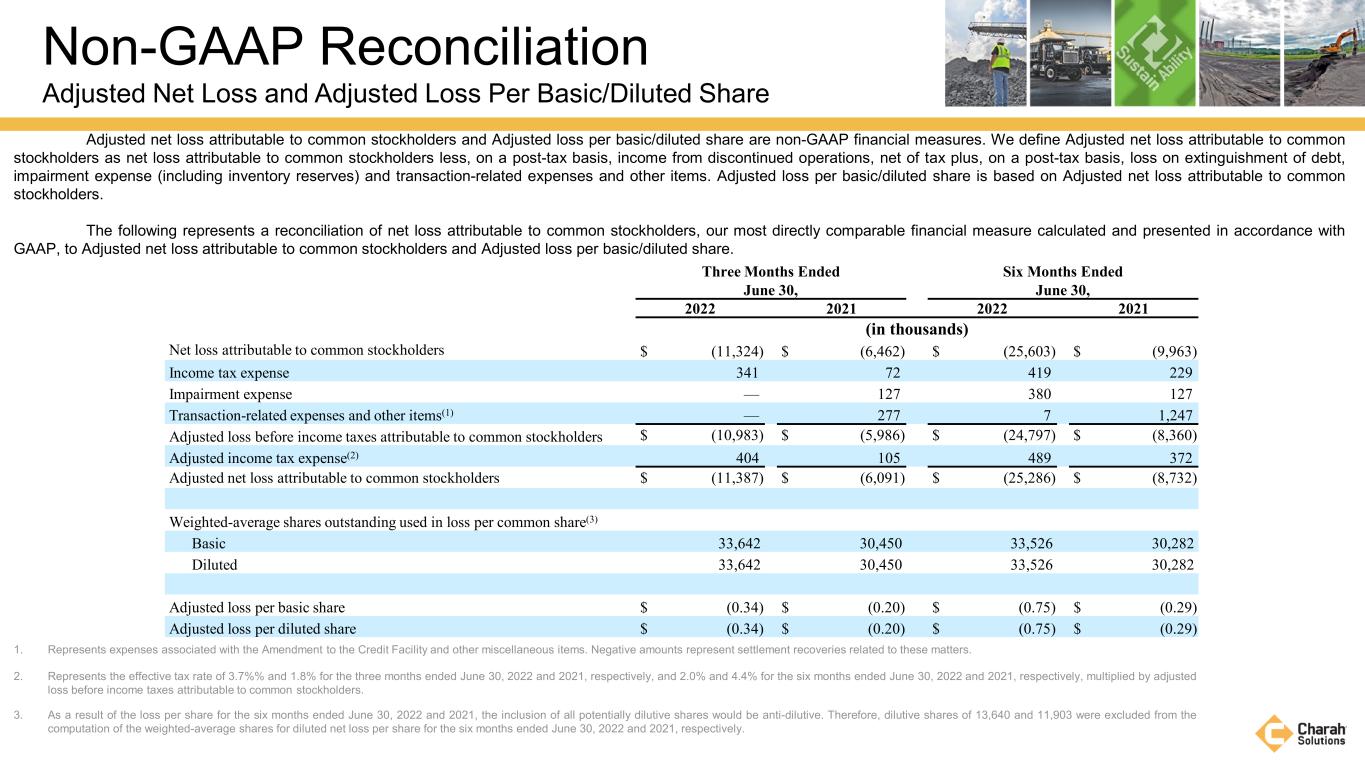

Non-GAAP Reconciliation Adjusted Net Loss and Adjusted Loss Per Basic/Diluted Share 1. Represents expenses associated with the Amendment to the Credit Facility and other miscellaneous items. Negative amounts represent settlement recoveries related to these matters. 2. Represents the effective tax rate of 3.7%% and 1.8% for the three months ended June 30, 2022 and 2021, respectively, and 2.0% and 4.4% for the six months ended June 30, 2022 and 2021, respectively, multiplied by adjusted loss before income taxes attributable to common stockholders. 3. As a result of the loss per share for the six months ended June 30, 2022 and 2021, the inclusion of all potentially dilutive shares would be anti-dilutive. Therefore, dilutive shares of 13,640 and 11,903 were excluded from the computation of the weighted-average shares for diluted net loss per share for the six months ended June 30, 2022 and 2021, respectively. Adjusted net loss attributable to common stockholders and Adjusted loss per basic/diluted share are non-GAAP financial measures. We define Adjusted net loss attributable to common stockholders as net loss attributable to common stockholders less, on a post-tax basis, income from discontinued operations, net of tax plus, on a post-tax basis, loss on extinguishment of debt, impairment expense (including inventory reserves) and transaction-related expenses and other items. Adjusted loss per basic/diluted share is based on Adjusted net loss attributable to common stockholders. The following represents a reconciliation of net loss attributable to common stockholders, our most directly comparable financial measure calculated and presented in accordance with GAAP, to Adjusted net loss attributable to common stockholders and Adjusted loss per basic/diluted share. Three Months Ended Six Months Ended June 30, June 30, 2022 2021 2022 2021 (in thousands) Net loss attributable to common stockholders $ (11,324) $ (6,462) $ (25,603) $ (9,963) Income tax expense 341 72 419 229 Impairment expense — 127 380 127 Transaction-related expenses and other items(1) — 277 7 1,247 Adjusted loss before income taxes attributable to common stockholders $ (10,983) $ (5,986) $ (24,797) $ (8,360) Adjusted income tax expense(2) 404 105 489 372 Adjusted net loss attributable to common stockholders $ (11,387) $ (6,091) $ (25,286) $ (8,732) Weighted-average shares outstanding used in loss per common share(3) Basic 33,642 30,450 33,526 30,282 Diluted 33,642 30,450 33,526 30,282 Adjusted loss per basic share $ (0.34) $ (0.20) $ (0.75) $ (0.29) Adjusted loss per diluted share $ (0.34) $ (0.20) $ (0.75) $ (0.29)

Non-GAAP Reconciliation Adjusted Free Cash Flow We define Adjusted free cash flow as cash flows from operating activities, cash and restricted cash received from ERT transactions and proceeds from the sales of real estate, property and equipment, less cash used for capital expenditures. We include cash and restricted cash received from ERT transactions and proceeds from the sales of property and equipment and exclude capital expenditures because we consider them to be a necessary component of our ongoing operations. We consider Adjusted free cash flow to be a measure that provides useful information to management and investors about the amount of cash generated by the business that can be used for investing in our business and strengthening our balance sheet, but it is not intended to represent the amount of cash flow available for discretionary expenditures since other non-discretionary expenditures, such as mandatory debt service requirements, are not deducted from this measure. The following represents a reconciliation of net cash (used in) provided by operating activities, our most directly comparable financial measure calculated and presented in accordance with GAAP, to Adjusted free cash flow. The presentation of Adjusted free cash flow is not meant to be considered in isolation or as an alternative to net cash provided by (used in) operating activities as a measure of liquidity. Three Months Ended Six Months Ended June 30, June 30, 2022 2021 2022 2021 (in thousands) Net cash (used in) provided by operating activities (12,969) (3,824) (36,881) 10,242 Cash and restricted cash received from ERT transaction 38,239 — 38,239 34,900 Net proceeds from the sales of real estate, property and equipment 5,299 3,786 8,394 4,232 Capital expenditures: Maintenance and growth (133) (413) (521) (1,799) Land improvements (889) (882) (2,627) (1,030) Total capital expenditures (1,022) (1,295) (3,148) (2,829) Adjusted free cash flow $ 29,547 $ (1,333) $ 6,604 $ 46,545