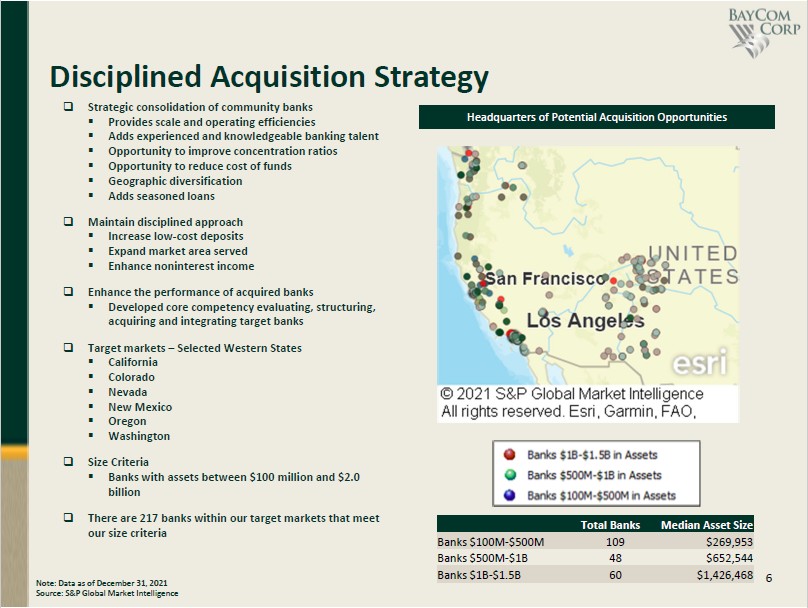

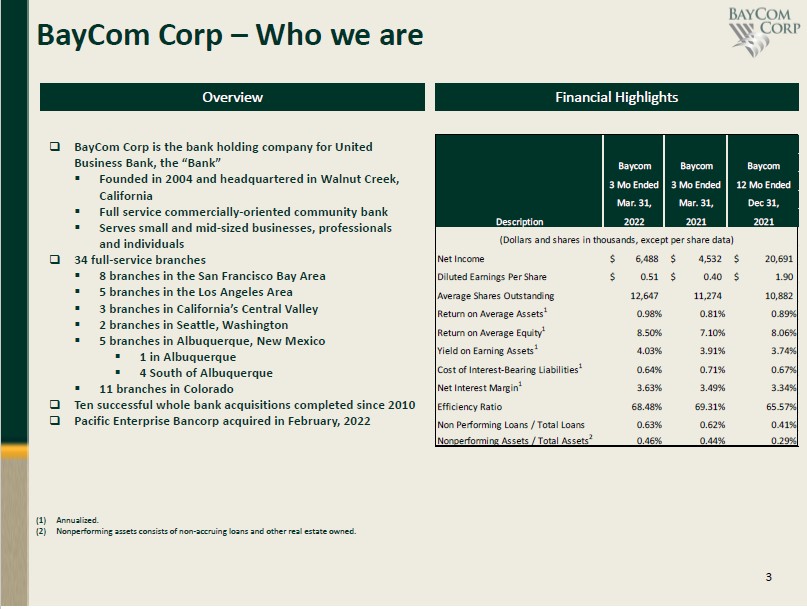

| Further, statements about the potential effects of the proposed acquisition of Pacific Enterprise Bancorp (“PEB”) on our busi ness, financial results, and condition may constitute forward-looking statements and are subject to the risk that the actual effects may differ, possibly materially, from what is reflected in the forward-looking statements due to factors and future developments which are uncertain, unpredictable and in many cases beyon d our control, including the possibility that expected revenues, cost savings, synergies and other benefits from the proposed merger might not be real ized within the expected time frames or at all including but not limited to customer and employee retention, and costs or difficulties relating to integrat ion matters, might be greater than expected including as a result of changes in general economic and market conditions, interest and exchange rates, monetary po licy, laws and regulations and their enforcement, and the degree of competition in the geographic and business areas in which BayCom and PEB operate; the possibility that the proposed merger does not close when expected or at all because required regulatory, shareholder or other approvals, financial tests or other conditions to closing are not received or satisfied on a timely basis or at all; the risk that the benefits from the proposed merger may not be fully r ealized or may take longer to realize than expected or be more costly to achieve; the failure to attract new customers and retain existing customers in the manner anticipated; reputational risks and the potential adverse reactions or changes to business, customer or employee relationships, including those resulting fro m the announcement or completion of the proposed merger; BayCom’s or PEB’s businesses may experience disruptions due to transaction-related uncertainty or other factors making it more difficult to maintain relationships with employees, customers, other business partners or governmental entities; depo sit attrition, operating costs, customer loss and business disruption following the transaction, including difficulties in maintaining relationships with emp loyees, may be greater than expected; the diversion of managements' attention from ongoing business operations and opportunities as a result of the propo sed merger or otherwise; changes in BayCom’s or PEB’s stock price before closing, including as a result of its financial performance prior to closing or transaction -related uncertainty, or more generally due to broader stock market movements, and the performance of financial companies and peer group companies; th e occurrence of any event, change or other circumstance that could give risk to the right of one or both of the parties to terminate the merger a greement; the outcome of pending or threatened litigation, or of matters before regulatory agencies, whether currently existing or commencing in the future, i ncluding litigation related to the merger; changes in interest rates which may affect BayCom’s and PEB’s expected revenues, credit quality deterioration, reductions in real estate values, or reductions in BayCom’s and PEB’s net income, cash flows or the market value of assets, including its investment securities; each of BayCom’s and PEB’s potential exposure to unknown or contingent liabilities of the other party; dilution caused by BayCom’s issuance of additional shares of BayCom common stock in connection with the proposed merger; the possibility that the proposed merger is more expensive to complete than anticipat ed, including as a result of unexpected factors or events; future acquisitions by BayCom of other depository institutions or lines of business; and that the COVID-19 pandemic, including uncertainty and volatility in financial, commodities and other markets, and disruptions to banking and other financial activi ty, could harm BayCom’s or PEB’s business, financial position and results of operations, and could adversely affect the timing and anticipated benefits of the proposed merger. The factors listed above could materially affect the Company’s financial performance and could cause the Company’s actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods in any current statements. The Company does not undertake - and specifically declines any obligation - to publicly release the result of any revisions, which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of antic ipated or unanticipated events whether as a result of new information, future events or otherwise, except as may be required by law or NASDAQ rules. When co nsidering forward-looking statements, you should keep in mind these risks and uncertainties. You should not place undue reliance on any forward -looking statement, which speaks only as of the date made. 3 |