Q2 2024 Earnings Presentation 8333 Douglas Avenue, Suite 1100 | Dallas, Texas 75225 | 214.238.5700 | capitalsouthwest.com October 31, 2023 Capital Southwest Corporation

Page 2 Important Notices • These materials and any presentation of which they form a part are neither an offer to sell, nor a solicitation of an offer to purchase, any securities of Capital Southwest. • These materials and the presentations of which they are a part, and the summaries contained herein, do not purport to be complete and no obligation to update or otherwise revise such information is being assumed. Nothing shall be relied upon as a promise or representation as to the future performance of Capital Southwest. Such information is qualified in its entirety by reference to the more detailed discussions contained elsewhere in Capital Southwest’s public filings with the Securities and Exchange Commission (the "SEC"). • There is no guarantee that any of the estimates, targets or projections illustrated in these materials and any presentation of which they form a part will be achieved. Any references herein to any of the Capital Southwest’s past or present investments or its past or present performance, have been provided for illustrative purposes only. It should not be assumed that these investments were or will be profitable or that any future investments by Capital Southwest will be profitable or will equal the performance of these investments. • The information contained herein has been derived from financial statements and other documents provided by the portfolio companies unless otherwise stated. • Past performance is not indicative of future results. In addition, there can be no assurance that unrealized investments will be realized at the expected multiples shown as actual realized returns will depend on, among other factors, future operating results of each of Capital Southwest’s current portfolio companies, the value of the assets and economic conditions at the time of disposition, any related transaction costs, and the timing and manner of sale, all of which may differ from the assumptions on which Capital Southwest’s expected returns are based. In many instances, Capital Southwest will not determine the timing or manner of sale of its portfolio companies. • Capital Southwest has filed a registration statement (which contains the prospectus) with the SEC for any offering to which this communication may relate and may file one or more prospectus supplements to the prospectus in the future. Before you invest in any of Capital Southwest's securities, you should read the registration statement and the applicable prospectus and prospectus supplement(s), including the information incorporated by reference therein, in order to fully understand all of the implications and risks of an offering of Capital Southwest's securities. You should also read other documents Capital Southwest has filed with the SEC for more complete information about Capital Southwest and any offering of its securities. You may get these documents for free by visiting EDGAR on the SEC's website at www.sec.gov. Alternatively, Capital Southwest will arrange to send you any applicable prospectus and prospectus supplement(s) if you request such materials by calling us at (214) 238-5700. These materials are also made available, free of charge, on our website at www.capitalsouthwest.com. Information contained on our website is not incorporated by reference into this communication.

Page 3 • This presentation contains forward-looking statements relating to, among other things, the business, market conditions, financial condition and results of operations of Capital Southwest, the anticipated investment strategies and investments of Capital Southwest, and future market demand. Any statements that are not statements of historical fact are forward-looking statements. Forward-looking statements are often, but not always, preceded by, followed by, or include words such as "believe," "expect," "intend," "plan," "should" or similar words, phrases or expressions or the negative thereof. These statements are made on the basis of the current beliefs, expectations and assumptions of the management of Capital Southwest and speak only as of the date of this presentation. There are a number of risks and uncertainties that could cause Capital Southwest’s actual results to differ materially from the forward-looking statements included in this presentation. • These risks include risks related to: changes in the markets in which Capital Southwest invests; changes in the financial, capital, and lending markets; the impact of rising interest rates on Capital Southwest's business and its portfolio companies; the impact of supply chain constraints and labor difficulties on our portfolio companies; elevated levels of inflation and its impact on Capital Southwest's portfolio companies and the industries in which it invests; regulatory changes; tax treatment and general economic and business conditions; our ability to operate our wholly owned subsidiary, Capital Southwest SBIC I, LP, as a small business investment company ("SBIC"); and an economic downturn and its impact on the ability of our portfolio companies to operate and the investment opportunities available to us. • For a further discussion of some of the risks and uncertainties applicable to Capital Southwest and its business, see Capital Southwest’s Annual Report on Form 10-K for the fiscal year ended March 31, 2023 and its subsequent filings with the SEC. Other unknown or unpredictable factors could also have a material adverse effect on Capital Southwest’s actual future results, performance, or financial condition. As a result of the foregoing, readers are cautioned not to place undue reliance on these forward-looking statements. Capital Southwest does not assume any obligation to revise or to update these forward-looking statements, whether as a result of new information, subsequent events or circumstances, or otherwise, except as may be required by law. Forward-Looking Statements

Page 4 Bowen S. Diehl President and Chief Executive Officer Michael S. Sarner Chief Financial Officer Chris Rehberger VP Finance / Treasurer Conference Call Participants

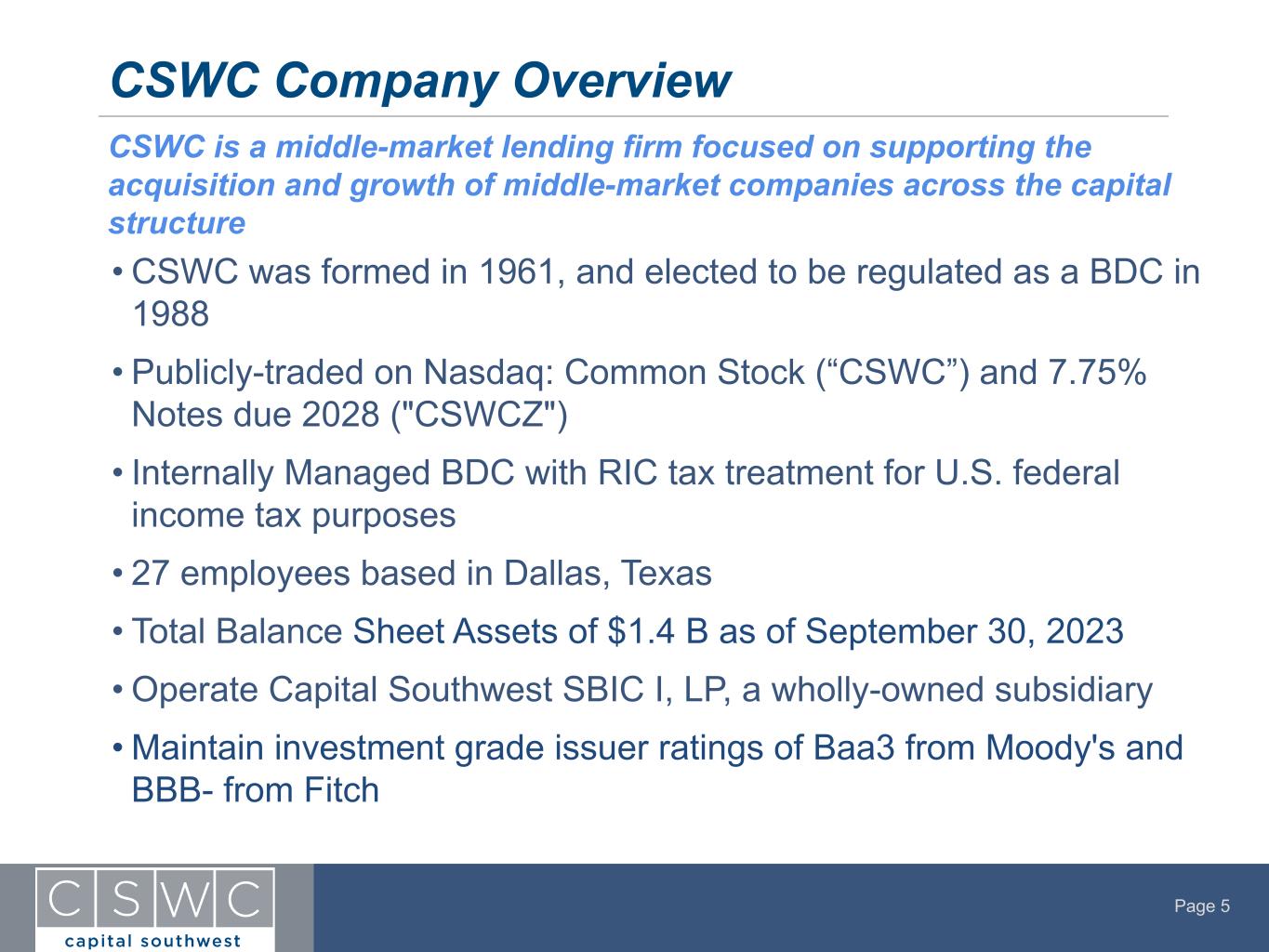

Page 5 • CSWC was formed in 1961, and elected to be regulated as a BDC in 1988 • Publicly-traded on Nasdaq: Common Stock (“CSWC”) and 7.75% Notes due 2028 ("CSWCZ") • Internally Managed BDC with RIC tax treatment for U.S. federal income tax purposes • 27 employees based in Dallas, Texas • Total Balance Sheet Assets of $1.4 B as of September 30, 2023 • Operate Capital Southwest SBIC I, LP, a wholly-owned subsidiary • Maintain investment grade issuer ratings of Baa3 from Moody's and BBB- from Fitch CSWC Company Overview CSWC is a middle-market lending firm focused on supporting the acquisition and growth of middle-market companies across the capital structure

Page 6 • Q2 2024 Pre-Tax Net Investment Income (“NII”) of $26.4 MM or $0.67 per share • Increased Regular Dividend to $0.57 per share for the quarter ending December 31, 2023, an increase of 1.8% compared to the $0.56 per share Regular Dividend paid for the quarter ended September 30, 2023 ◦ Maintained Supplemental Dividend of $0.06 per share for the quarter ending December 31, 2023 • Investment Portfolio at Fair Value increased to $1.35 B from $1.29 B in prior quarter ◦ $110.0 MM in total new committed investments to five new portfolio companies and six existing portfolio companies • Raised $22.8 MM in gross proceeds through Equity ATM Program during the quarter ◦ Sold shares at weighted-average price of $20.77 per share, or 127% of the prevailing NAV per share • Regulatory Debt to Equity ended at 0.92x for the quarter • Increased Credit Facility to $435 MM from $400 MM and extended maturity to August 2028 • $184 MM available on Credit Facility and $23 MM in cash and cash equivalents as of quarter end • Subsequent to quarter end, received shareholder approval to increase authorized shares of common stock to 75 million shares from 40 million shares Q2 2024 Highlights Financial Highlights

Page 7 • In the last twelve months ended 9/30/2023, CSWC generated $2.59 per share in Pre-Tax NII and paid out $2.15 per share in Regular Dividends ◦ LTM Pre-Tax NII Regular Dividend Coverage of 120% • Cumulative Pre-Tax NII Regular Dividend Coverage of 109% since launch of credit strategy in 2015 • Total of $3.83 per share Special and Supplemental Dividends declared since launch of credit strategy in 2015 • Estimated Undistributed Taxable Income ("UTI") of $0.42 per share as of September 30, 2023 Track Record of Consistent Dividends Continues Dividend Yield – Quarterly Annualized Total Dividend / CSWC Share Price at Qtr. End D iv id en d Pe r Sh ar e $0.48 $0.50 $0.44 $0.46 $0.48 $0.49 $0.50 $0.51 $0.51 $0.51 $0.51 $0.52 $0.53 $0.54 $0.97 $0.57 $0.58 $0.59 $0.62 $0.63 $1.25 $0.63 $0.34 $0.36 $0.38 $0.39 $0.40 $0.40 $0.41 $0.41 $0.41 $0.41 $0.42 $0.43 $0.44 $0.47 $0.48 $0.48 $0.50 $0.52 $0.53 $0.54 $0.56 $0.57 $0.10 $0.10 $0.10 $0.10 $0.10 $0.10 $0.10 $0.10 $0.10 $0.10 $0.10 $0.10 $0.10 $0.50 $0.05 $0.05 $0.05 $0.06 $0.06 $0.75 $0.15 Regular Dividend Per Share Supplemental Dividend Per Share Special Dividend Per Share 9/30/2018 12/31/2018 3/31/2019 6/30/2019 9/30/2019 12/31/2019 3/31/2020 6/30/2020 9/30/2020 12/31/2020 3/31/2021 6/30/2021 9/30/2021 12/31/2021 3/31/2022 6/30/2022 9/30/2022 12/31/2022 3/31/2023 6/30/2023 9/30/2023 12/31/2023 $0.00 $0.25 $0.50 $0.75 $1.00 $1.25 $1.50 9.3% 9.6% 9.1% 9.4% 9.2% 24.0% 17.9% 15.1% 14.5% 11.5% 9.4% 9.1% 8.6% 15.3% 8.1% 13.7% 13.3% 13.0% 11.8% 12.0% 10.8%

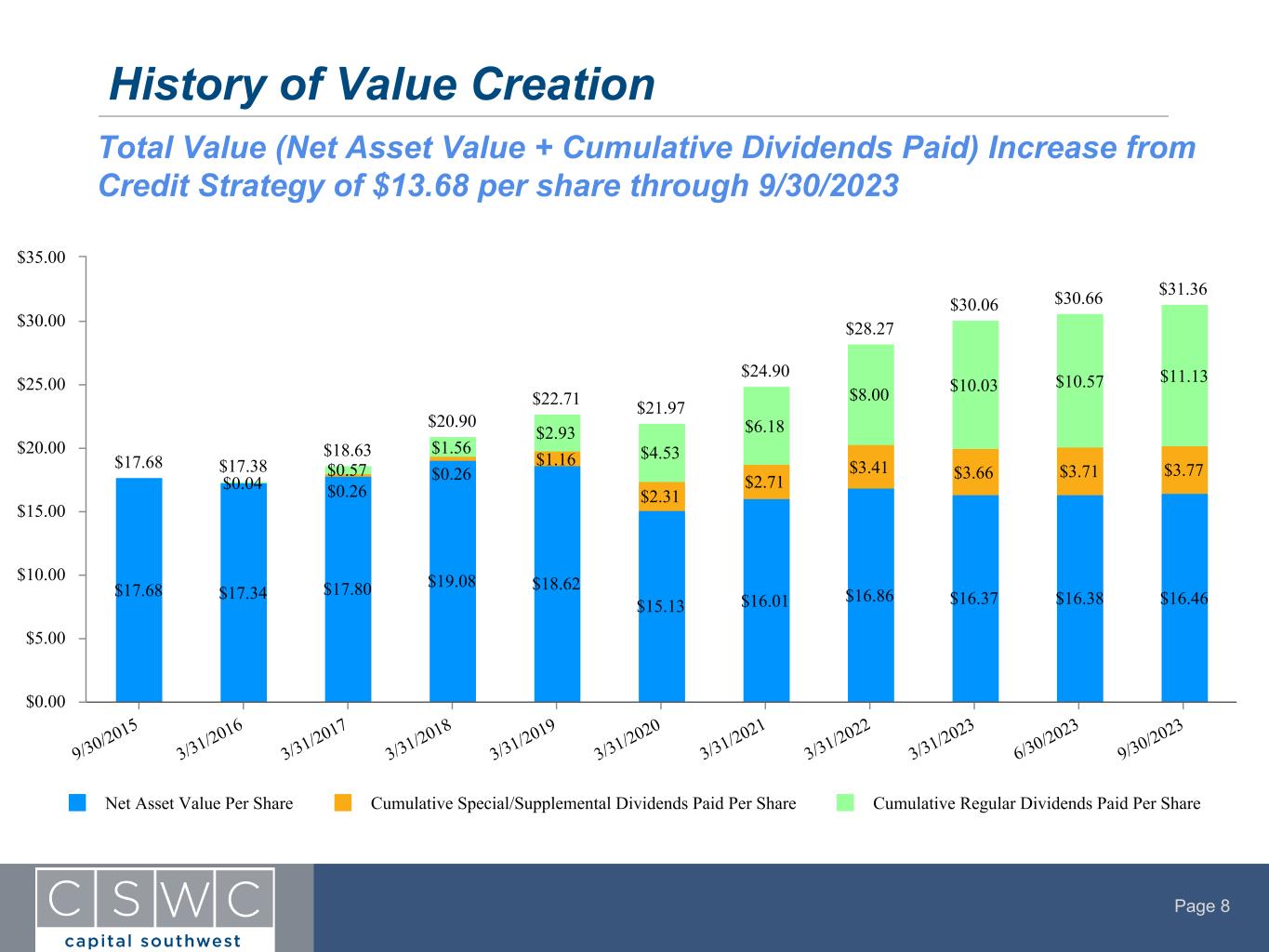

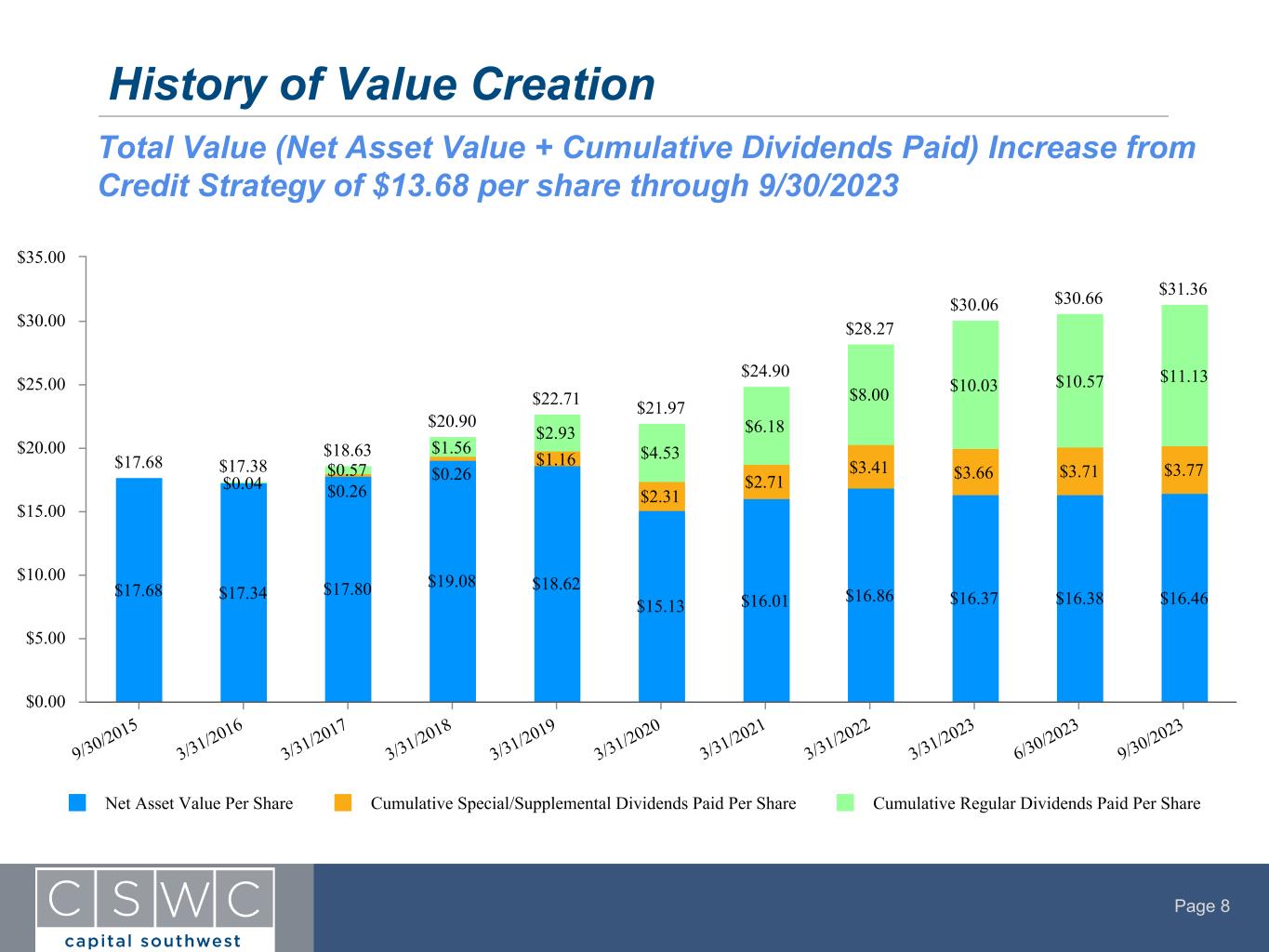

Page 8 History of Value Creation $17.68 $17.38 $18.63 $20.90 $22.71 $21.97 $24.90 $28.27 $30.06 $30.66 $31.36 $17.68 $17.34 $17.80 $19.08 $18.62 $15.13 $16.01 $16.86 $16.37 $16.38 $16.46 $0.26 $0.26 $1.16 $2.31 $2.71 $3.41 $3.66 $3.71 $3.77 $0.04 $0.57 $1.56 $2.93 $4.53 $6.18 $8.00 $10.03 $10.57 $11.13 Net Asset Value Per Share Cumulative Special/Supplemental Dividends Paid Per Share Cumulative Regular Dividends Paid Per Share 9/30/2015 3/31/2016 3/31/2017 3/31/2018 3/31/2019 3/31/2020 3/31/2021 3/31/2022 3/31/2023 6/30/2023 9/30/2023 $0.00 $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 Total Value (Net Asset Value + Cumulative Dividends Paid) Increase from Credit Strategy of $13.68 per share through 9/30/2023

Page 9 CORE: Lower Middle Market (“LMM”): CSWC led or Club Deals ◦ Companies with EBITDA between $3 MM and $20 MM ◦ Typical leverage of 2.0x – 4.0x Debt to EBITDA through CSWC debt position ◦ Commitment size up to $50 MM with hold sizes generally $5 MM to $35 MM ◦ Both sponsored and non-sponsored deals ◦ Floating rate first lien debt securities ◦ Frequently make equity co-investments alongside CSWC debt OPPORTUNISTIC: Upper Middle Market (“UMM”): Club, First and Second Lien ▪ Companies typically have in excess of $20 MM in EBITDA ▪ Typical leverage of 3.5x – 5.0x Debt to EBITDA through CSWC debt position ▪ Hold sizes generally $5 MM to $20 MM ▪ Floating rate first and second lien debt securities Credit Investment Strategy

Page 10 Granular Credit Portfolio Heavily Weighted Towards First Lien Investments 97% of credit portfolio in first lien senior secured loans with an average investment hold size of 1.1% as of 9/30/23 Credit Portfolio Heavily Weighted to First Lien $ (M illi on s) Average H old S ize % $93 $167 $239 $368 $474 $573 $794 $1,038 $1,111 $1,179 5.6% 3.6% 3.8% 2.9% 2.3% 1.9% 1.5% 1.3% 1.2% 1.1% Sub-Debt Second Lien First Lien Average Hold Size % 3/31/2016 3/31/2017 3/31/2018 3/31/2019 3/31/2020 3/31/2021 3/31/2022 3/31/2023 6/30/2023 9/30/2023 $0 $250 $500 $750 $1,000 $1,250 —% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 64% 28% 8% 82% 10% 8% 4% 10% 86% 90% 8% 2% 6% 92% 2% 93% 7% 96% 4% 43% 41% 16% 97% 3% 97% 3%

Page 11 $110.0 MM in total new committed investments to five new portfolio companies and six existing portfolio companies Q2 2024 Originations Portfolio Originations Q2 2024 Name Industry Type Total Debt Funded at Close ($000s) Total Equity Funded at Close ($000s) Unfunded Commitments at Close ($000s) Debt Yield to Maturity CityVet, Inc. Healthcare services First Lien $15,000 $— $5,000 13.7% Swensons Drive-In Restaurants, LLC Restaurants First Lien $16,000 $— $1,500 14.2% Damotech, Inc Industrial products First Lien / Equity $10,200 $1,000 $6,000 13.4% Institutes of Health, LLC Healthcare services First Lien / Equity $15,000 $1,000 $1,000 13.2% Island Pump and Tank, LLC Environmental services First Lien / Equity $16,000 $446 $— 13.3% Jackson Hewitt Tax Services, Inc. Financial services First Lien $10,000 $— $— 13.0% Versicare Management, LLC Healthcare services First Lien $8,500 $— $— 13.8% NeuroPsychiatric Hospitals, LLC Healthcare services First Lien $2,000 $— $— 15.8% Air Conditioning Specialist, Inc. Consumer services First Lien $1,296 $— $— 13.0% Other Equity Co-Investments Various Equity $— $102 $— N/A Total / Wtd. Avg $93,996 $2,548 $13,500 13.6% • $96.5 MM funded at close

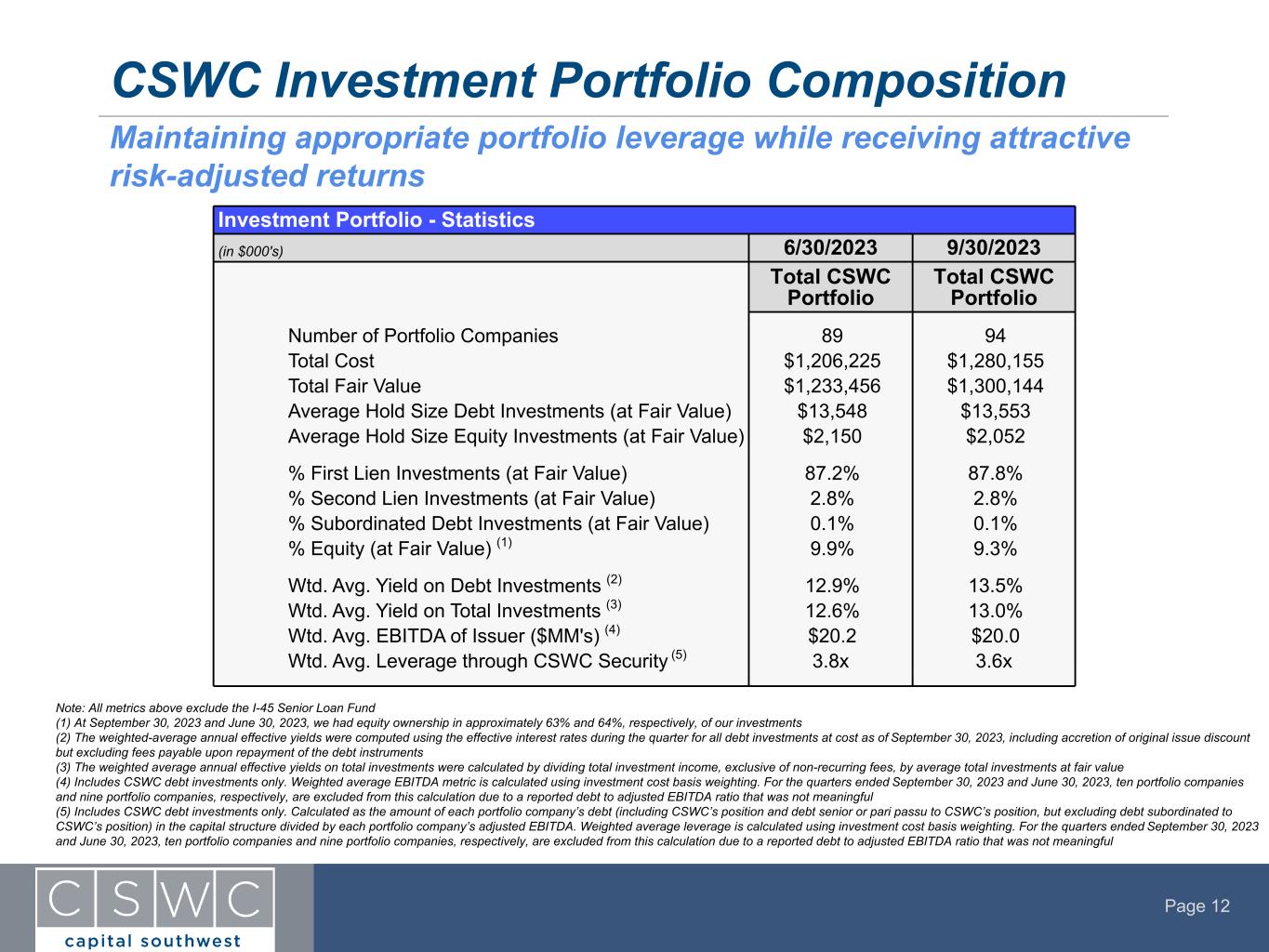

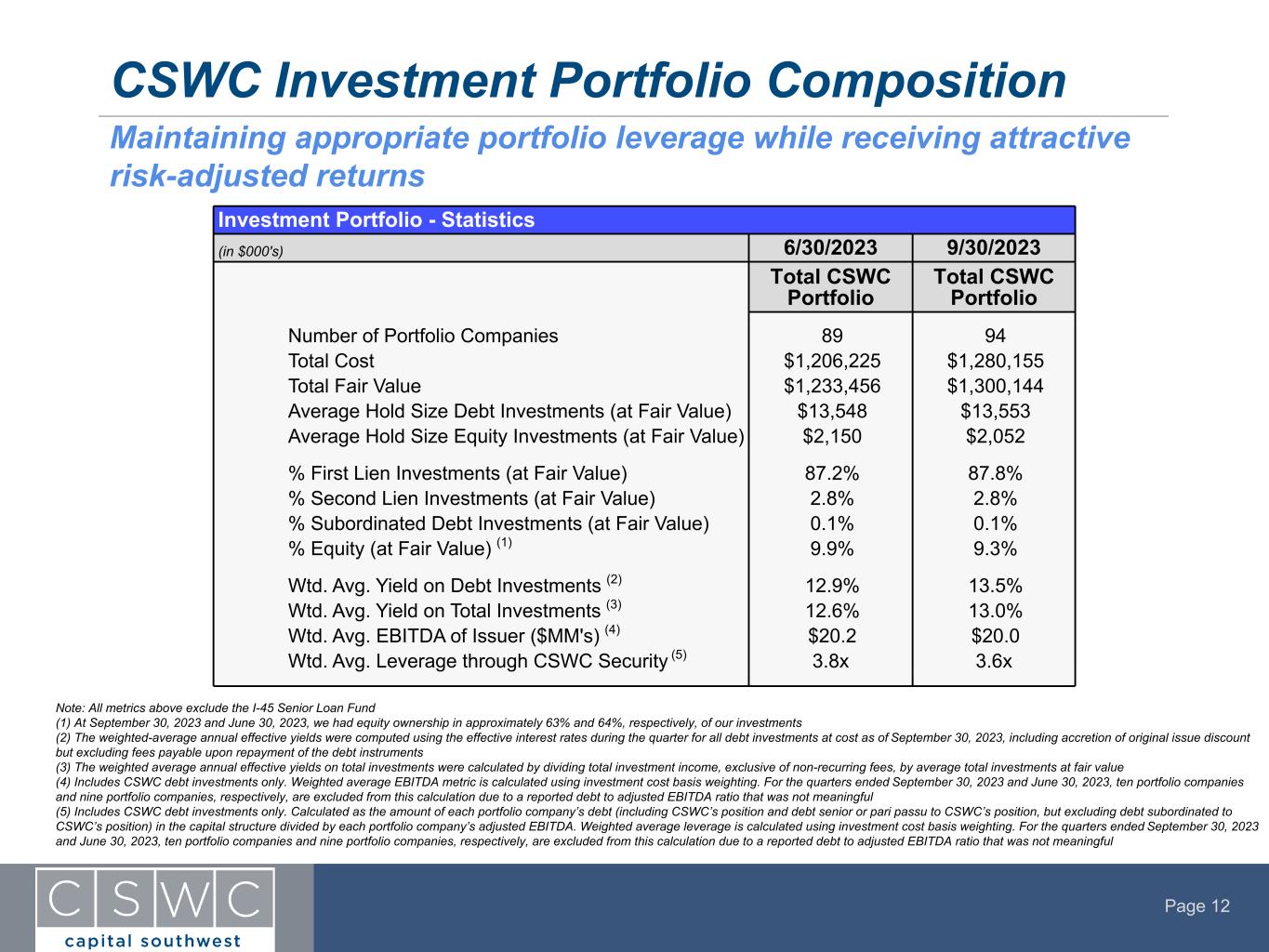

Page 12 CSWC Investment Portfolio Composition Note: All metrics above exclude the I-45 Senior Loan Fund (1) At September 30, 2023 and June 30, 2023, we had equity ownership in approximately 63% and 64%, respectively, of our investments (2) The weighted-average annual effective yields were computed using the effective interest rates during the quarter for all debt investments at cost as of September 30, 2023, including accretion of original issue discount but excluding fees payable upon repayment of the debt instruments (3) The weighted average annual effective yields on total investments were calculated by dividing total investment income, exclusive of non-recurring fees, by average total investments at fair value (4) Includes CSWC debt investments only. Weighted average EBITDA metric is calculated using investment cost basis weighting. For the quarters ended September 30, 2023 and June 30, 2023, ten portfolio companies and nine portfolio companies, respectively, are excluded from this calculation due to a reported debt to adjusted EBITDA ratio that was not meaningful (5) Includes CSWC debt investments only. Calculated as the amount of each portfolio company’s debt (including CSWC’s position and debt senior or pari passu to CSWC’s position, but excluding debt subordinated to CSWC’s position) in the capital structure divided by each portfolio company’s adjusted EBITDA. Weighted average leverage is calculated using investment cost basis weighting. For the quarters ended September 30, 2023 and June 30, 2023, ten portfolio companies and nine portfolio companies, respectively, are excluded from this calculation due to a reported debt to adjusted EBITDA ratio that was not meaningful Maintaining appropriate portfolio leverage while receiving attractive risk-adjusted returns Investment Portfolio - Statistics (in $000's) 6/30/2023 9/30/2023 Total CSWC Portfolio Total CSWC Portfolio Number of Portfolio Companies 89 94 Total Cost $1,206,225 $1,280,155 Total Fair Value $1,233,456 $1,300,144 Average Hold Size Debt Investments (at Fair Value) $13,548 $13,553 Average Hold Size Equity Investments (at Fair Value) $2,150 $2,052 % First Lien Investments (at Fair Value) 87.2% 87.8% % Second Lien Investments (at Fair Value) 2.8% 2.8% % Subordinated Debt Investments (at Fair Value) 0.1% 0.1% % Equity (at Fair Value) (1) 9.9% 9.3% Wtd. Avg. Yield on Debt Investments (2) 12.9% 13.5% Wtd. Avg. Yield on Total Investments (3) 12.6% 13.0% Wtd. Avg. EBITDA of Issuer ($MM's) (4) $20.2 $20.0 Wtd. Avg. Leverage through CSWC Security (5) 3.8x 3.6x

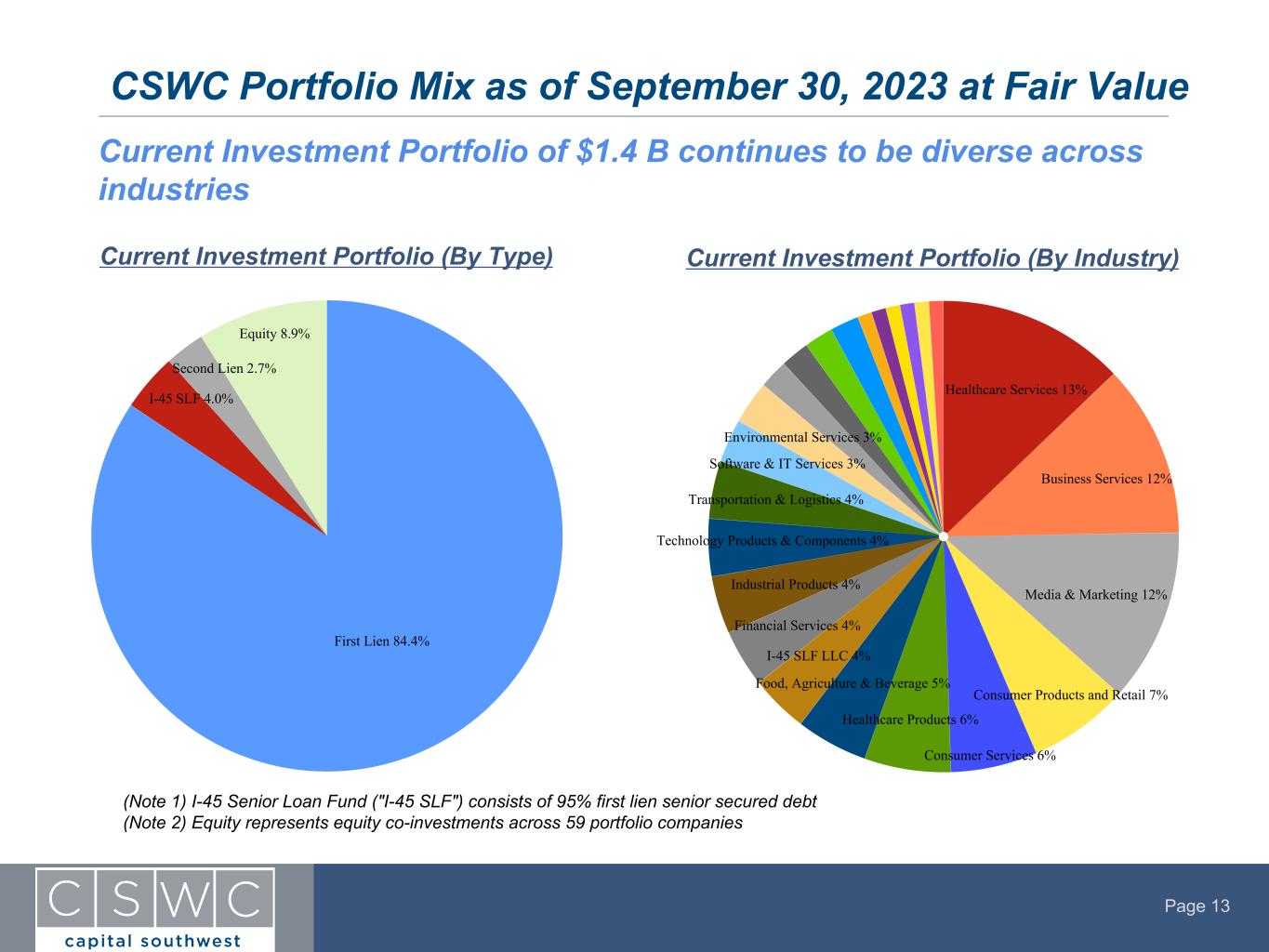

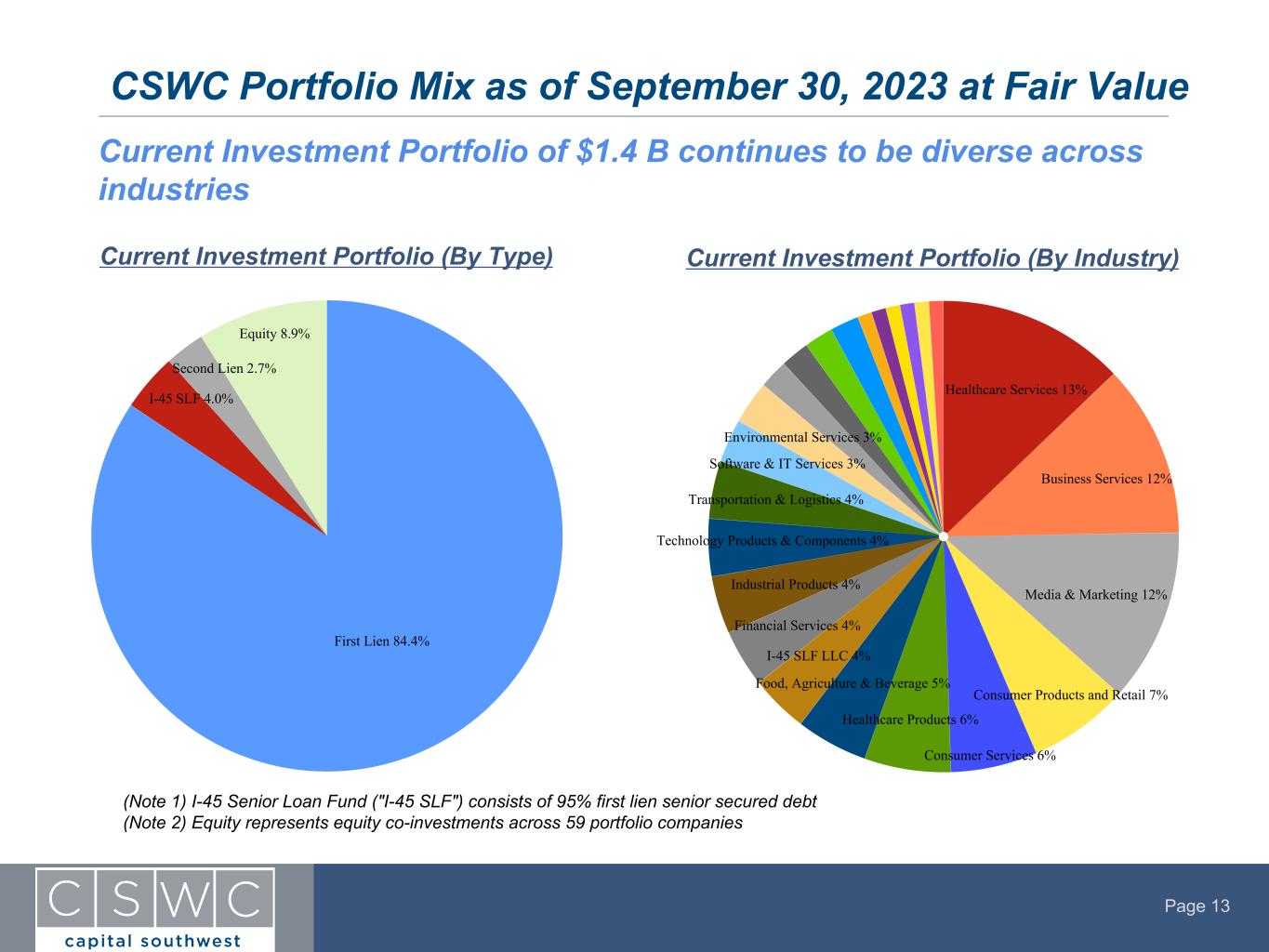

Page 13 CSWC Portfolio Mix as of September 30, 2023 at Fair Value Current Investment Portfolio (By Type) Current Investment Portfolio (By Industry) Current Investment Portfolio of $1.4 B continues to be diverse across industries First Lien 84.4% I-45 SLF 4.0% Second Lien 2.7% Equity 8.9% Healthcare Services 13% Business Services 12% Media & Marketing 12% Consumer Products and Retail 7% Consumer Services 6% Healthcare Products 6% Food, Agriculture & Beverage 5% I-45 SLF LLC 4% Financial Services 4% Industrial Products 4% Technology Products & Components 4% Transportation & Logistics 4% Software & IT Services 3% Environmental Services 3% (Note 1) I-45 Senior Loan Fund ("I-45 SLF") consists of 95% first lien senior secured debt (Note 2) Equity represents equity co-investments across 59 portfolio companies

Page 14 Approximately 97% of all debt investments are currently rated a "1" or "2" as credit portfolio continues to demonstrate strong performance Investment Rating 6/30/2023 Investment Rating Upgrades Investment Rating Downgrades 9/30/2023 # of Loans Fair Value ($MM) % of Portfolio (FV) # of Loans Fair Value ($MM) % of Portfolio (FV) # of Loans Fair Value ($MM) % of Portfolio (FV) # of Loans Fair Value ($MM) % of Portfolio (FV) 1 11 $155.8 14.0% 1 $8.2 0.7% — $— —% 12 $162.9 13.8% 2 91 $912.3 82.1% 2 $21.2 1.8% — $— —% 99 $980.1 83.1% 3 5 $42.9 3.9% — $— —% 2 $16.2 1.4% 4 $29.5 2.5% 4 — $— —% — $— —% 1 $6.6 0.6% 1 $6.6 0.6% Wtd. Avg. Investment Rating (at Cost) 1.91 1.92 Quarter-over-Quarter Investment Rating Migration Note: We utilize an internally developed investment rating system to rate the performance and monitor the expected level of returns for each debt investment in our portfolio. The investment rating system takes into account both quantitative and qualitative factors of the portfolio company and the investments held therein. Investment Ratings range from a rating of 1, which represents the least amount of risk in our portfolio, to 4, which indicates that the investment is performing materially below underwriting expectations

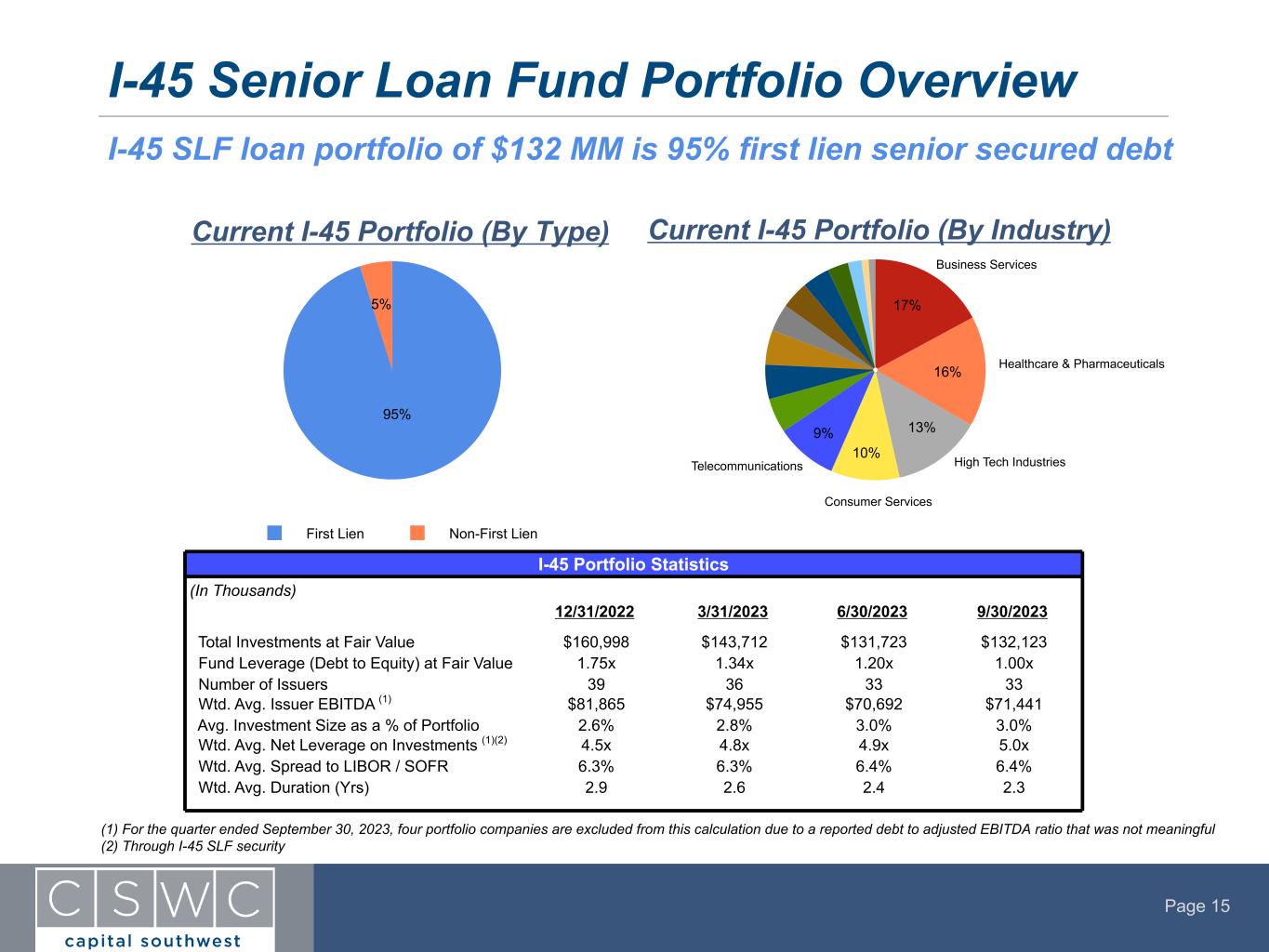

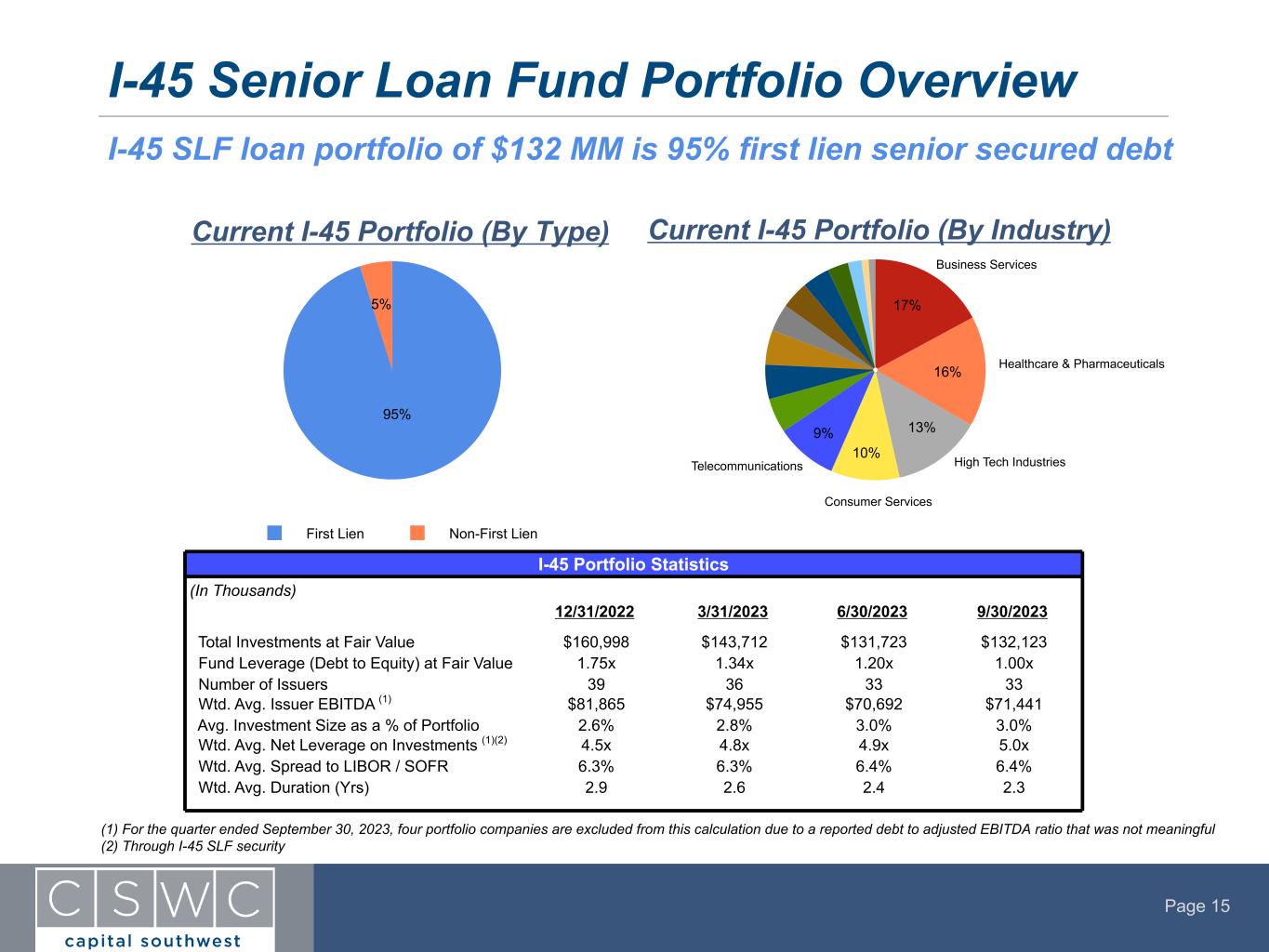

Page 15 I-45 Senior Loan Fund Portfolio Overview Current I-45 Portfolio (By Industry) I-45 SLF loan portfolio of $132 MM is 95% first lien senior secured debt (1) For the quarter ended September 30, 2023, four portfolio companies are excluded from this calculation due to a reported debt to adjusted EBITDA ratio that was not meaningful (2) Through I-45 SLF security Telecommunications Services: Consumer Current I-45 Portfolio (By Type) I-45 Portfolio Statistics (In Thousands) 12/31/2022 3/31/2023 6/30/2023 9/30/2023 Total Investments at Fair Value $160,998 $143,712 $131,723 $132,123 Fund Leverage (Debt to Equity) at Fair Value 1.75x 1.34x 1.20x 1.00x Number of Issuers 39 36 33 33 Wtd. Avg. Issuer EBITDA (1) $81,865 $74,955 $70,692 $71,441 Avg. Investment Size as a % of Portfolio 2.6% 2.8% 3.0% 3.0% Wtd. Avg. Net Leverage on Investments (1)(2) 4.5x 4.8x 4.9x 5.0x Wtd. Avg. Spread to LIBOR / SOFR 6.3% 6.3% 6.4% 6.4% Wtd. Avg. Duration (Yrs) 2.9 2.6 2.4 2.3 95% 5% First Lien Non-First Lien Consumer Services Healthcare & Pharmaceuticals High Tech Industries Business Services 17% 16% 13% 10% 9% Telecommunications

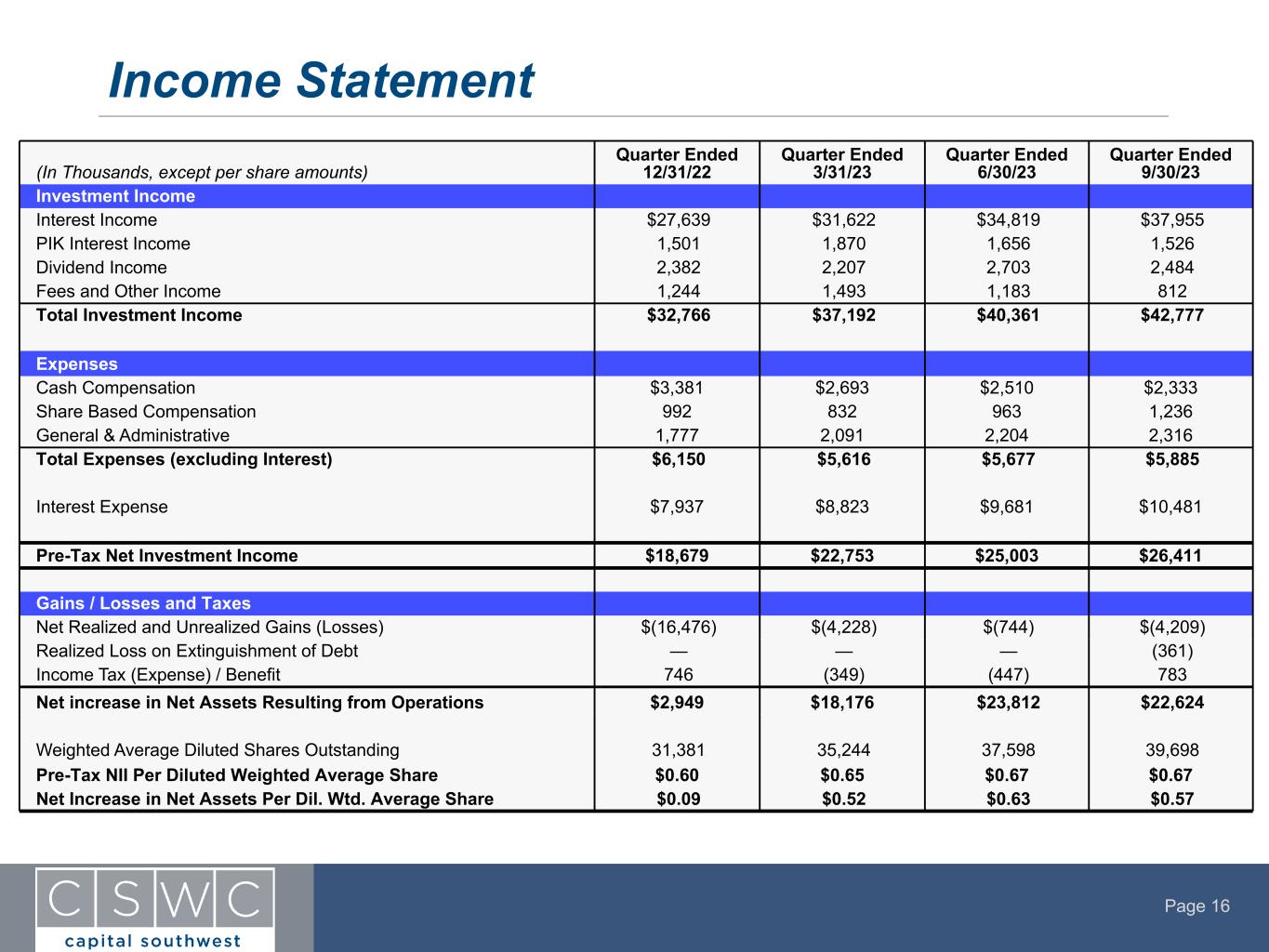

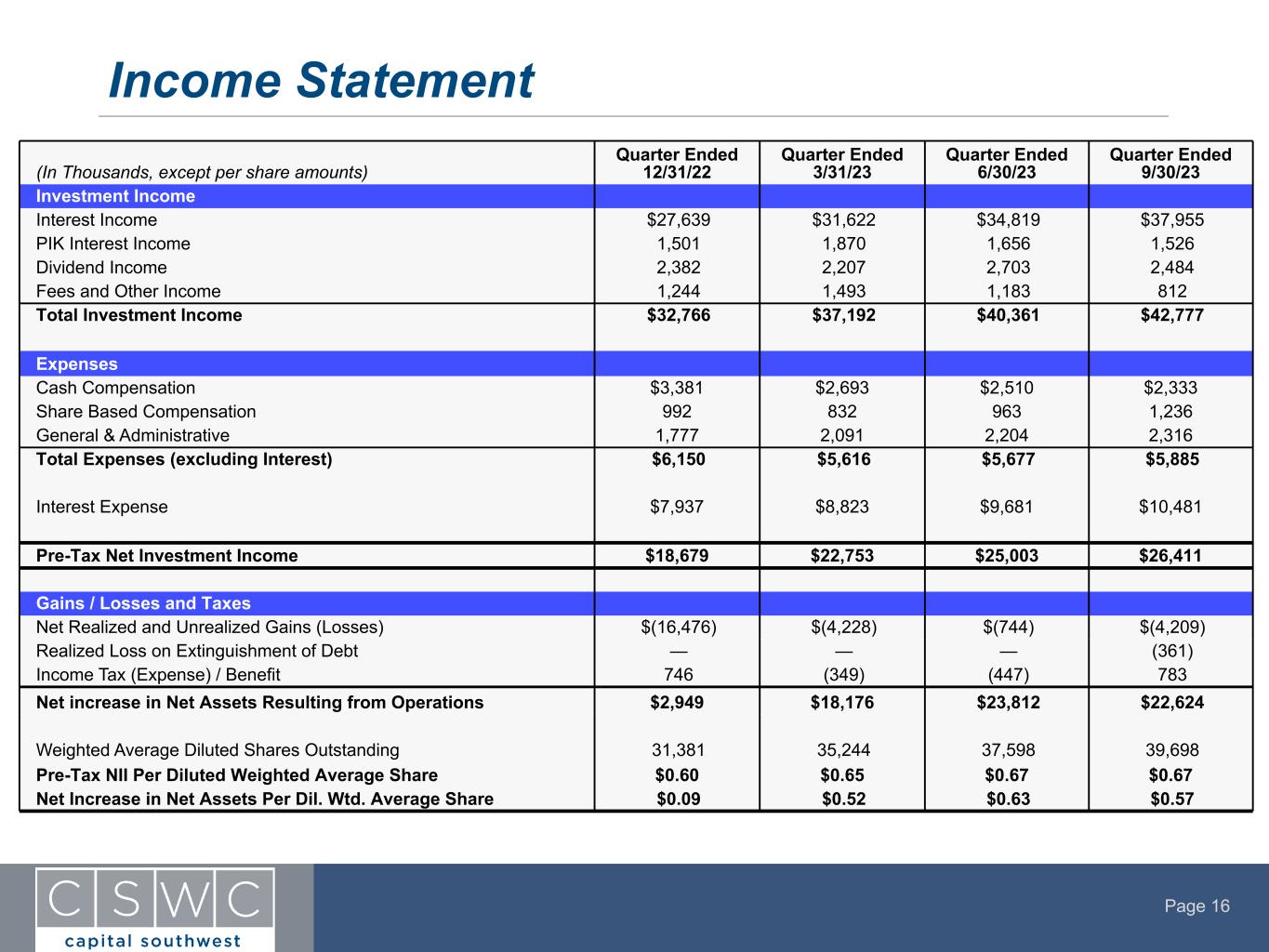

Page 16 Income Statement (In Thousands, except per share amounts) Quarter Ended 12/31/22 Quarter Ended 3/31/23 Quarter Ended 6/30/23 Quarter Ended 9/30/23 Investment Income Interest Income $27,639 $31,622 $34,819 $37,955 PIK Interest Income 1,501 1,870 1,656 1,526 Dividend Income 2,382 2,207 2,703 2,484 Fees and Other Income 1,244 1,493 1,183 812 Total Investment Income $32,766 $37,192 $40,361 $42,777 Expenses Cash Compensation $3,381 $2,693 $2,510 $2,333 Share Based Compensation 992 832 963 1,236 General & Administrative 1,777 2,091 2,204 2,316 Total Expenses (excluding Interest) $6,150 $5,616 $5,677 $5,885 Interest Expense $7,937 $8,823 $9,681 $10,481 Pre-Tax Net Investment Income $18,679 $22,753 $25,003 $26,411 Gains / Losses and Taxes Net Realized and Unrealized Gains (Losses) $(16,476) $(4,228) $(744) $(4,209) Realized Loss on Extinguishment of Debt — — — (361) Income Tax (Expense) / Benefit 746 (349) (447) 783 Net increase in Net Assets Resulting from Operations $2,949 $18,176 $23,812 $22,624 Weighted Average Diluted Shares Outstanding 31,381 35,244 37,598 39,698 Pre-Tax NII Per Diluted Weighted Average Share $0.60 $0.65 $0.67 $0.67 Net Increase in Net Assets Per Dil. Wtd. Average Share $0.09 $0.52 $0.63 $0.57

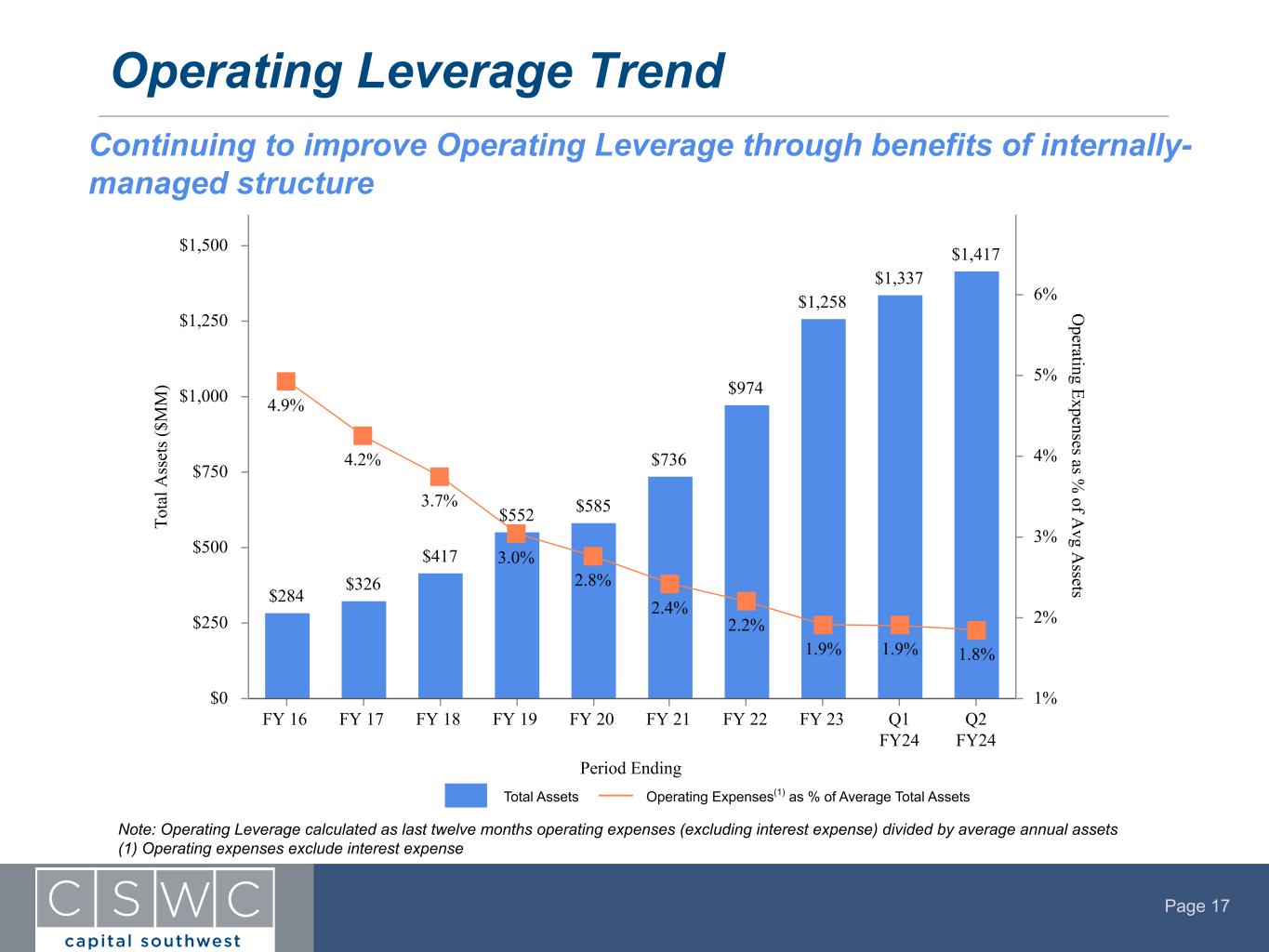

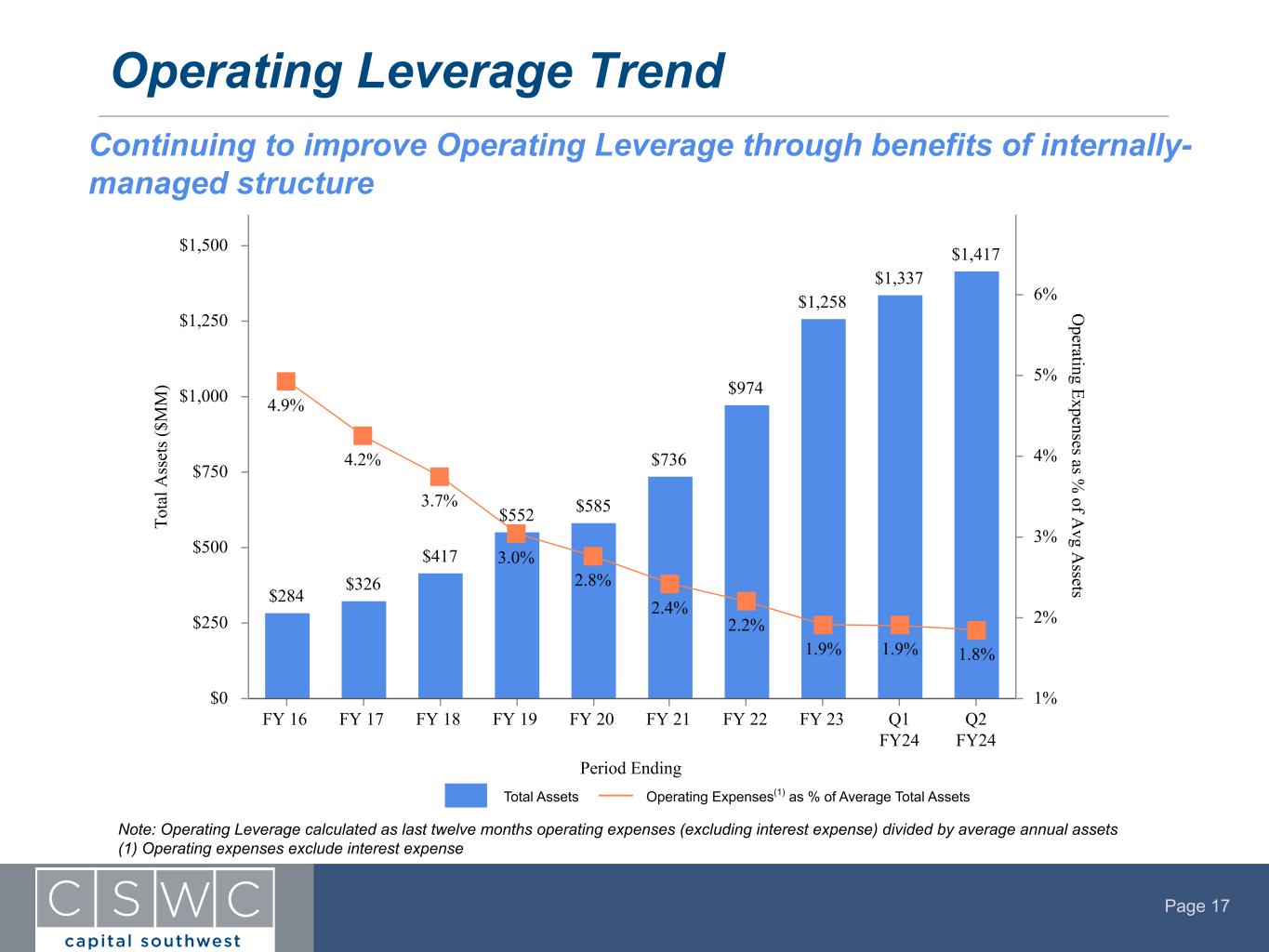

Page 17 Operating Leverage Trend Continuing to improve Operating Leverage through benefits of internally- managed structure Period Ending To ta l A ss et s ( $M M ) O perating Expenses as % of A vg A ssets$284 $326 $417 $552 $585 $736 $974 $1,258 $1,337 $1,417 4.9% 4.2% 3.7% 3.0% 2.8% 2.4% 2.2% 1.9% 1.9% 1.8% FY 16 FY 17 FY 18 FY 19 FY 20 FY 21 FY 22 FY 23 Q1 FY24 Q2 FY24 $0 $250 $500 $750 $1,000 $1,250 $1,500 1% 2% 3% 4% 5% 6% Total Assets Operating Expenses(1) as % of Average Total Assets Note: Operating Leverage calculated as last twelve months operating expenses (excluding interest expense) divided by average annual assets (1) Operating expenses exclude interest expense

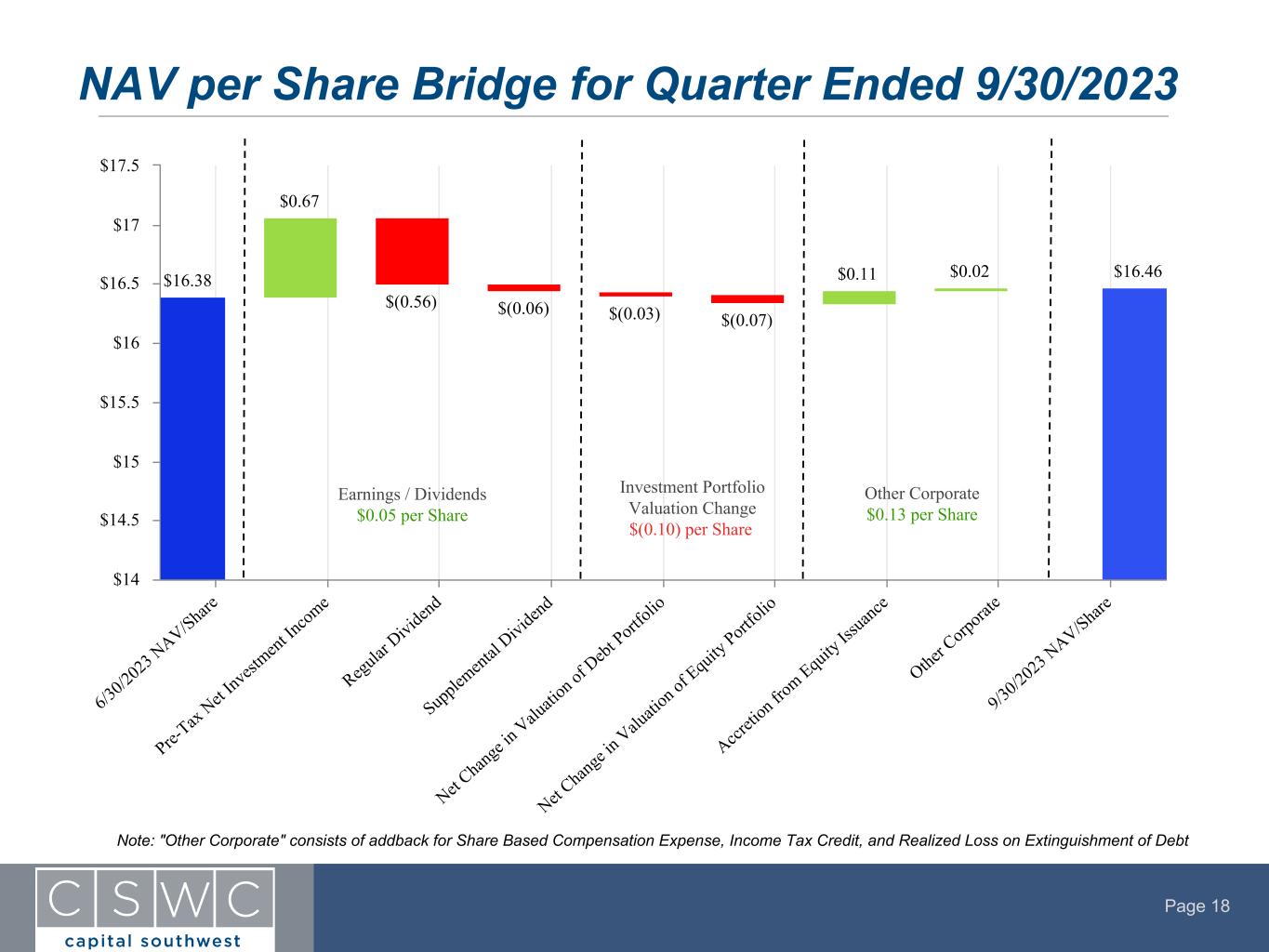

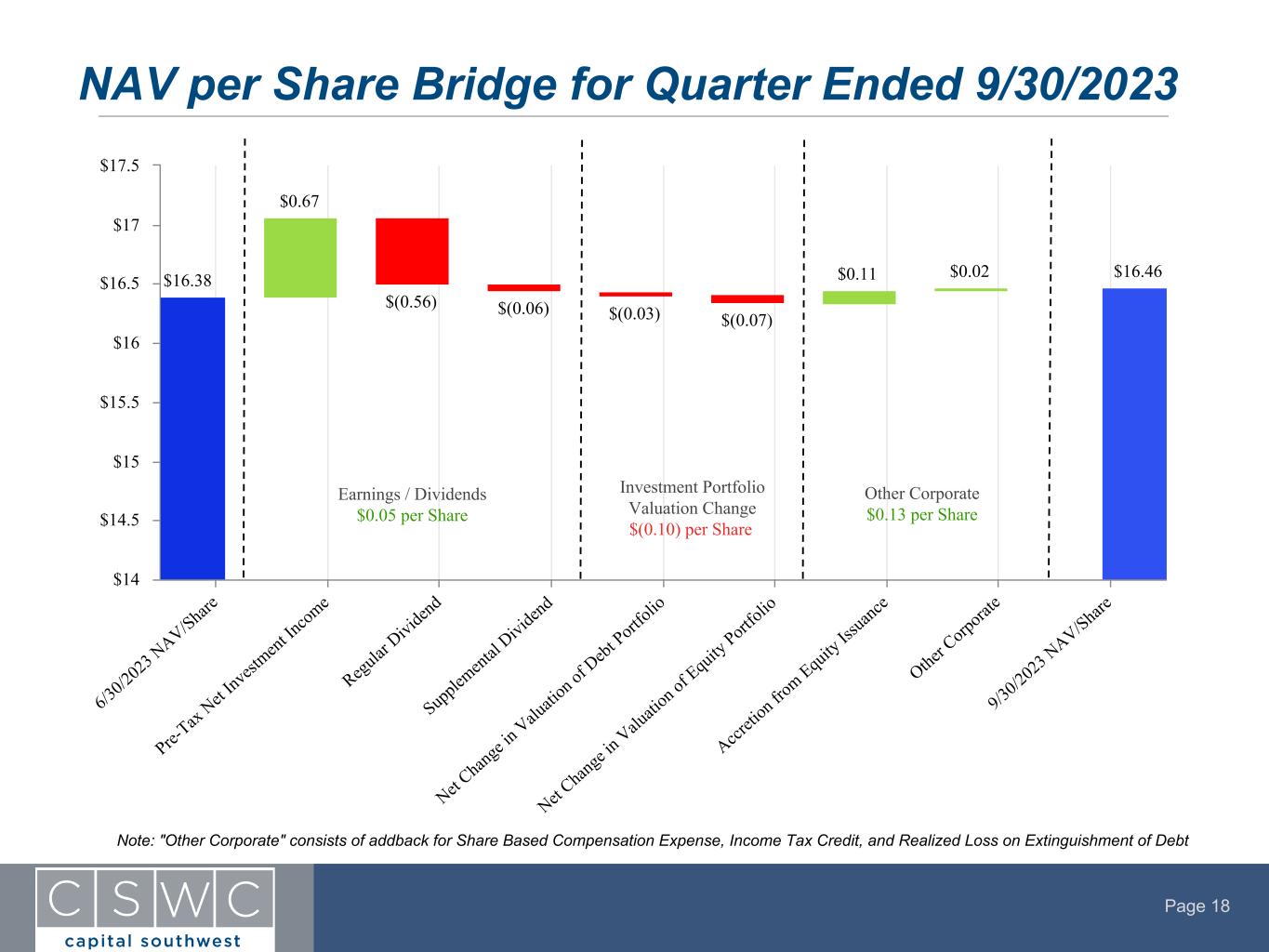

Page 18 $16.38 $0.67 $(0.56) $(0.06) $(0.03) $(0.07) $0.11 $0.02 $16.46 6/3 0/2 02 3 N AV/Shar e Pre- Tax Net I nv est ment In com e Regu lar Divi den d Sup ple ment al D ivi den d Net C han ge in Valu ati on of Debt Port fol io Net C han ge in Valu ati on of Equ ity Port fol io Accr eti on fro m Equ ity Iss uan ce Othe r C orp ora te 9/3 0/2 02 3 N AV/Shar e $14 $14.5 $15 $15.5 $16 $16.5 $17 $17.5 NAV per Share Bridge for Quarter Ended 9/30/2023 Earnings / Dividends $0.05 per Share Investment Portfolio Valuation Change $(0.10) per Share Other Corporate $0.13 per Share Note: "Other Corporate" consists of addback for Share Based Compensation Expense, Income Tax Credit, and Realized Loss on Extinguishment of Debt

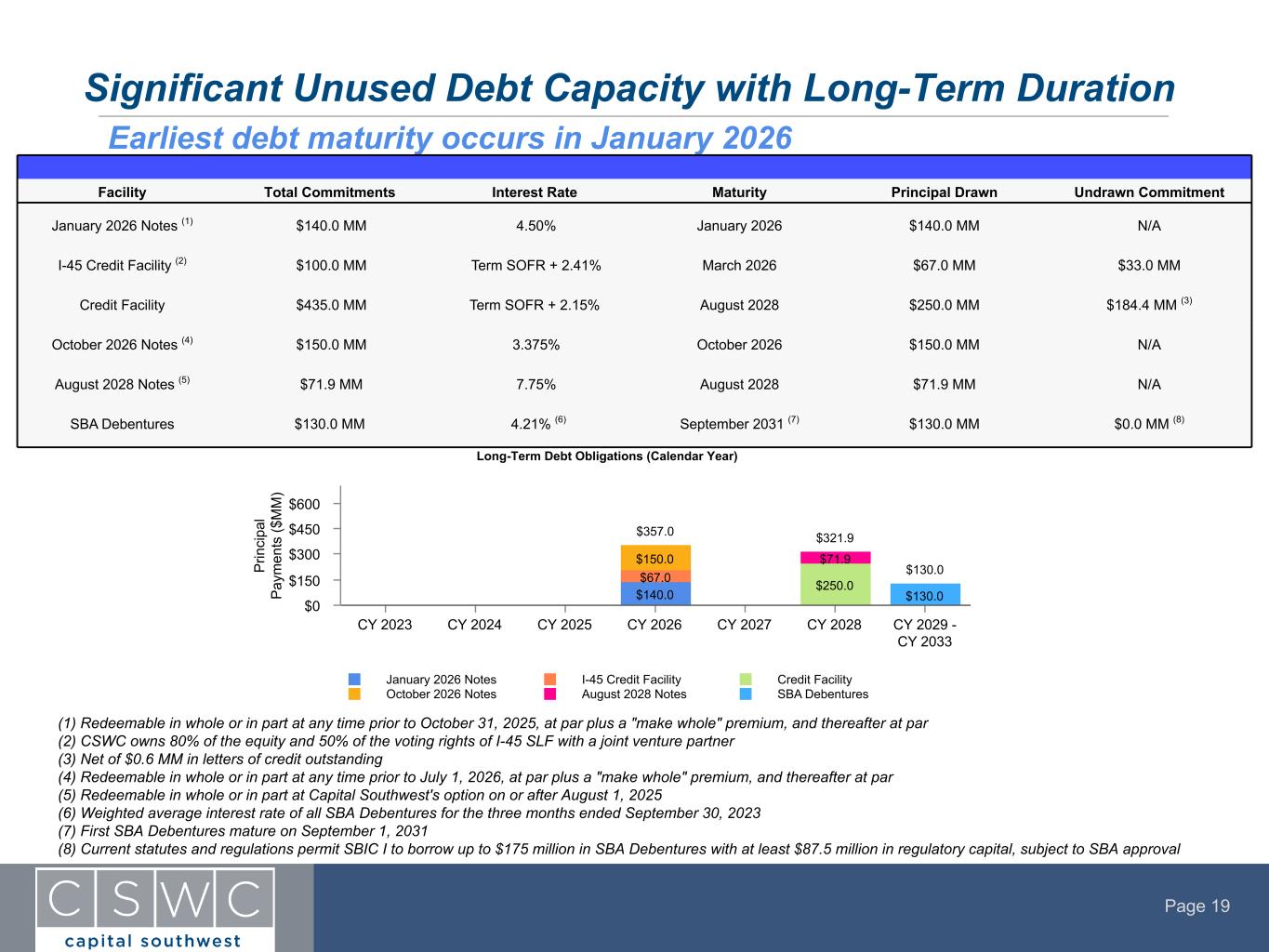

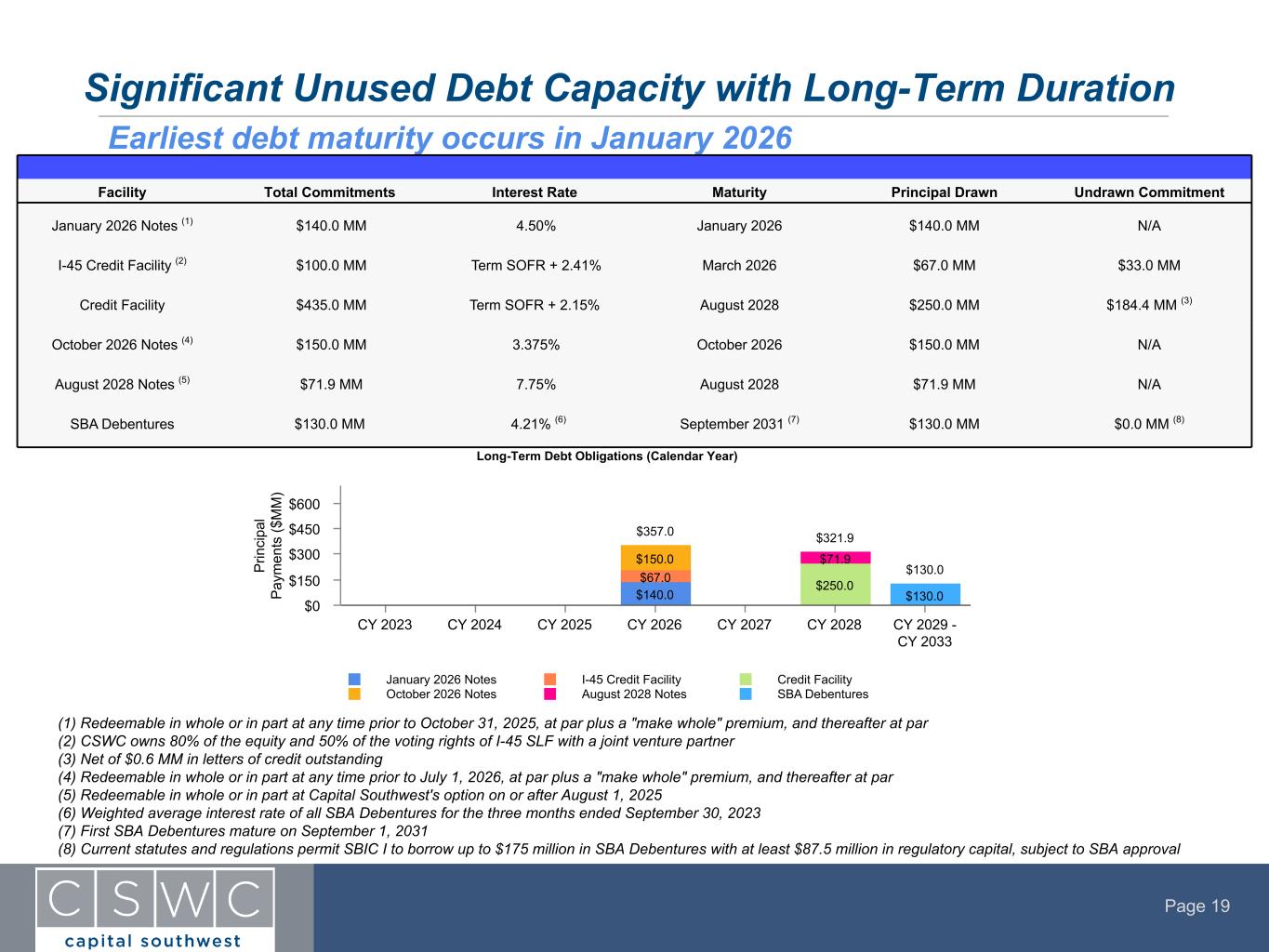

Page 19 Significant Unused Debt Capacity with Long-Term Duration Earliest debt maturity occurs in January 2026 Facility Total Commitments Interest Rate Maturity Principal Drawn Undrawn Commitment January 2026 Notes (1) $140.0 MM 4.50% January 2026 $140.0 MM N/A I-45 Credit Facility (2) $100.0 MM Term SOFR + 2.41% March 2026 $67.0 MM $33.0 MM Credit Facility $435.0 MM Term SOFR + 2.15% August 2028 $250.0 MM $184.4 MM (3) October 2026 Notes (4) $150.0 MM 3.375% October 2026 $150.0 MM N/A August 2028 Notes (5) $71.9 MM 7.75% August 2028 $71.9 MM N/A SBA Debentures $130.0 MM 4.21% (6) September 2031 (7) $130.0 MM $0.0 MM (8) P rin ci pa l P ay m en ts ($ M M ) Long-Term Debt Obligations (Calendar Year) $357.0 $321.9 $130.0 $140.0 $67.0 $250.0 $150.0 $71.9 $130.0 January 2026 Notes I-45 Credit Facility Credit Facility October 2026 Notes August 2028 Notes SBA Debentures CY 2023 CY 2024 CY 2025 CY 2026 CY 2027 CY 2028 CY 2029 - CY 2033 $0 $150 $300 $450 $600 (1) Redeemable in whole or in part at any time prior to October 31, 2025, at par plus a "make whole" premium, and thereafter at par (2) CSWC owns 80% of the equity and 50% of the voting rights of I-45 SLF with a joint venture partner (3) Net of $0.6 MM in letters of credit outstanding (4) Redeemable in whole or in part at any time prior to July 1, 2026, at par plus a "make whole" premium, and thereafter at par (5) Redeemable in whole or in part at Capital Southwest's option on or after August 1, 2025 (6) Weighted average interest rate of all SBA Debentures for the three months ended September 30, 2023 (7) First SBA Debentures mature on September 1, 2031 (8) Current statutes and regulations permit SBIC I to borrow up to $175 million in SBA Debentures with at least $87.5 million in regulatory capital, subject to SBA approval

Page 20 Balance Sheet (In Thousands, except per share amounts) Quarter Ended 12/31/22 Quarter Ended 3/31/23 Quarter Ended 6/30/23 Quarter Ended 9/30/23 Assets Portfolio Investments $1,150,046 $1,206,388 $1,285,318 $1,353,566 Cash & Cash Equivalents 21,686 21,585 21,278 23,020 Other Assets 30,425 29,711 30,407 40,327 Total Assets $1,202,157 $1,257,684 $1,337,003 $1,416,913 Liabilities SBA Debentures $100,582 $116,330 $121,352 $126,376 January 2026 Notes 138,967 139,051 139,135 139,220 October 2026 Notes 147,078 147,263 147,448 147,633 August 2028 Notes — — 69,327 69,438 Credit Facility 225,000 235,000 195,000 250,000 Other Liabilities 29,043 29,632 28,540 26,472 Total Liabilities $640,670 $667,276 $700,802 $759,139 Shareholders Equity Net Asset Value $561,487 $590,408 $636,201 $657,774 Net Asset Value per Share $16.25 $16.37 $16.38 $16.46 Regulatory Debt to Equity 0.91x 0.88x 0.87x 0.92x

Page 21 Portfolio Statistics (1) CSWC utilizes an internal 1 - 4 investment rating system in which 1 represents material outperformance and 4 represents material underperformance. All new investments are initially set to 2. Weighted average investment rating calculated at cost (2) Excludes CSWC equity investment in I-45 SLF (3) At Fair Value Continuing to build a well performing credit portfolio (In Thousands) Quarter Ended 12/31/22 Quarter Ended 3/31/23 Quarter Ended 6/30/23 Quarter Ended 9/30/23 Portfolio Statistics Fair Value of Debt Investments $990,298 $1,037,595 $1,110,915 $1,179,074 Average Debt Investment Hold Size $13,382 $13,303 $13,548 $13,553 Fair Value of Debt Investments as a % of Par 96% 96% 97% 97% % of Investment Portfolio on Non-Accrual (at Fair Value) 0.3% 0.3% 1.7% 2.0% Weighted Average Investment Rating (1) 1.96 1.93 1.91 1.92 Weighted Average Yield on Debt Investments 11.97% 12.78% 12.94% 13.50% Fair Value of All Portfolio Investments $1,150,046 $1,206,388 $1,285,318 $1,353,566 Weighted Average Yield on all Portfolio Investments 11.70% 12.11% 12.64% 12.97% Investment Mix (Debt vs. Equity) (2)(3) 90% / 10% 90% / 10% 90% / 10% 90% / 10%

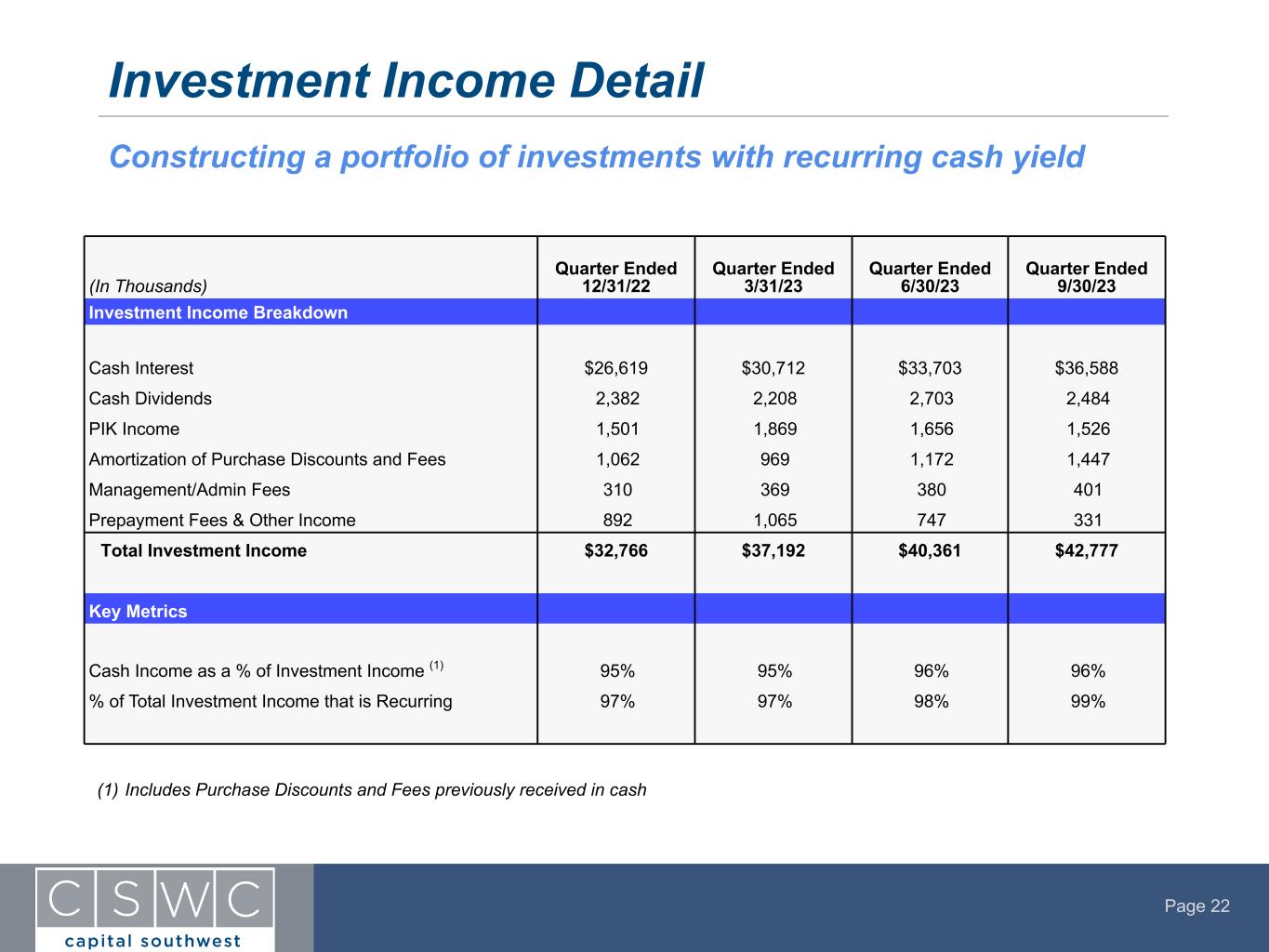

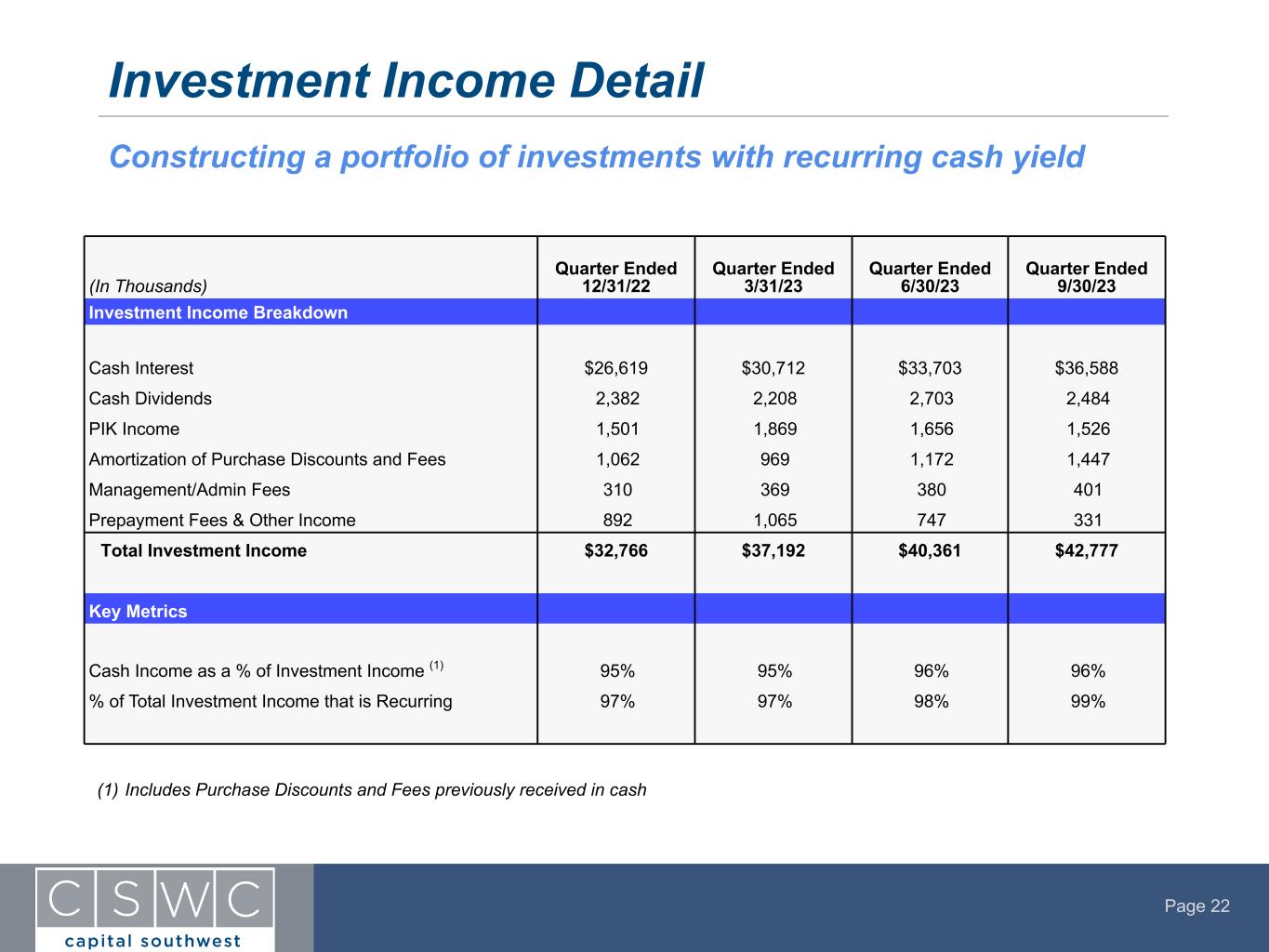

Page 22 Investment Income Detail Constructing a portfolio of investments with recurring cash yield (In Thousands) Quarter Ended 12/31/22 Quarter Ended 3/31/23 Quarter Ended 6/30/23 Quarter Ended 9/30/23 Investment Income Breakdown Cash Interest $26,619 $30,712 $33,703 $36,588 Cash Dividends 2,382 2,208 2,703 2,484 PIK Income 1,501 1,869 1,656 1,526 Amortization of Purchase Discounts and Fees 1,062 969 1,172 1,447 Management/Admin Fees 310 369 380 401 Prepayment Fees & Other Income 892 1,065 747 331 Total Investment Income $32,766 $37,192 $40,361 $42,777 Key Metrics Cash Income as a % of Investment Income (1) 95% 95% 96% 96% % of Total Investment Income that is Recurring 97% 97% 98% 99% (1) Includes Purchase Discounts and Fees previously received in cash

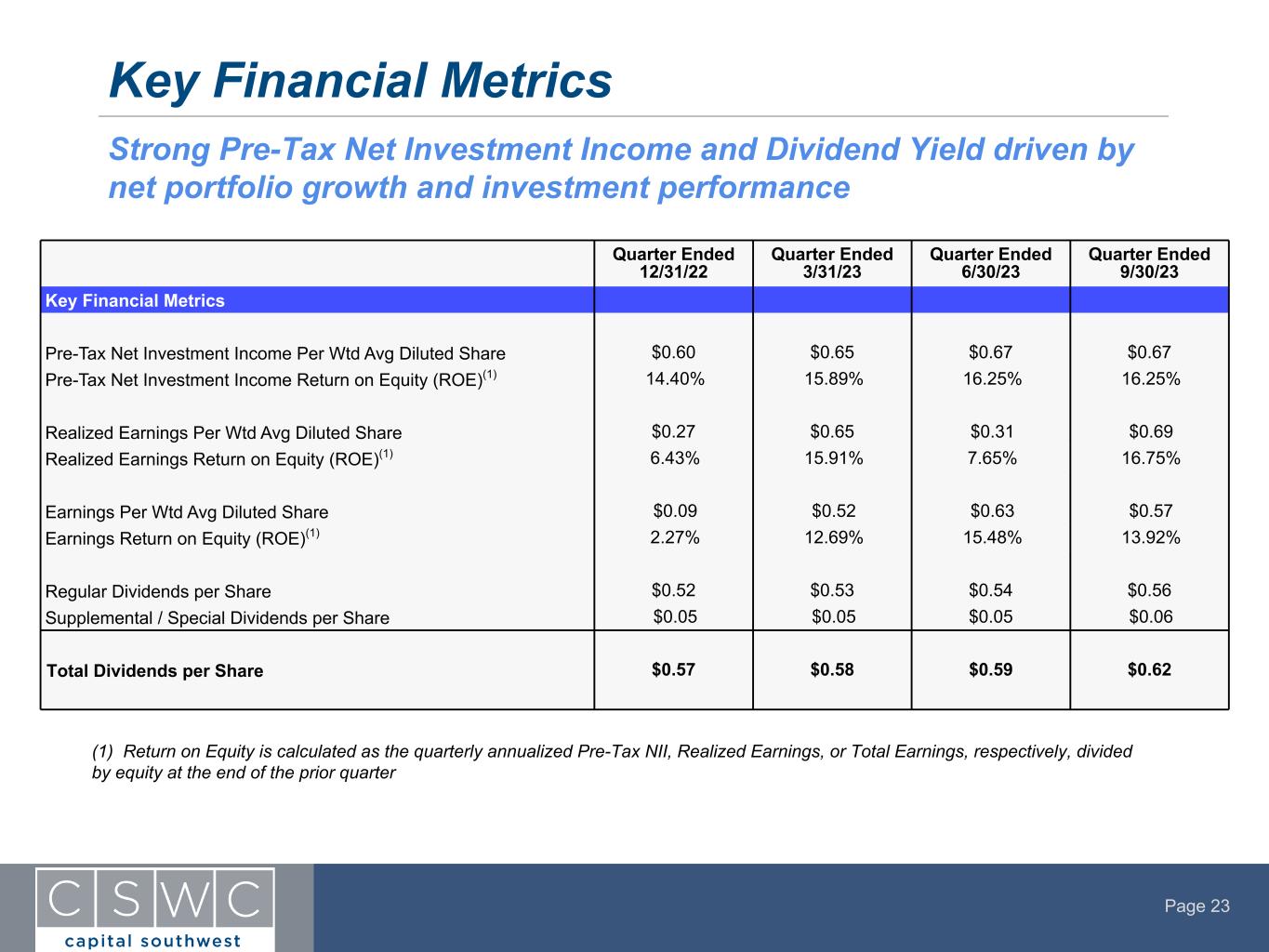

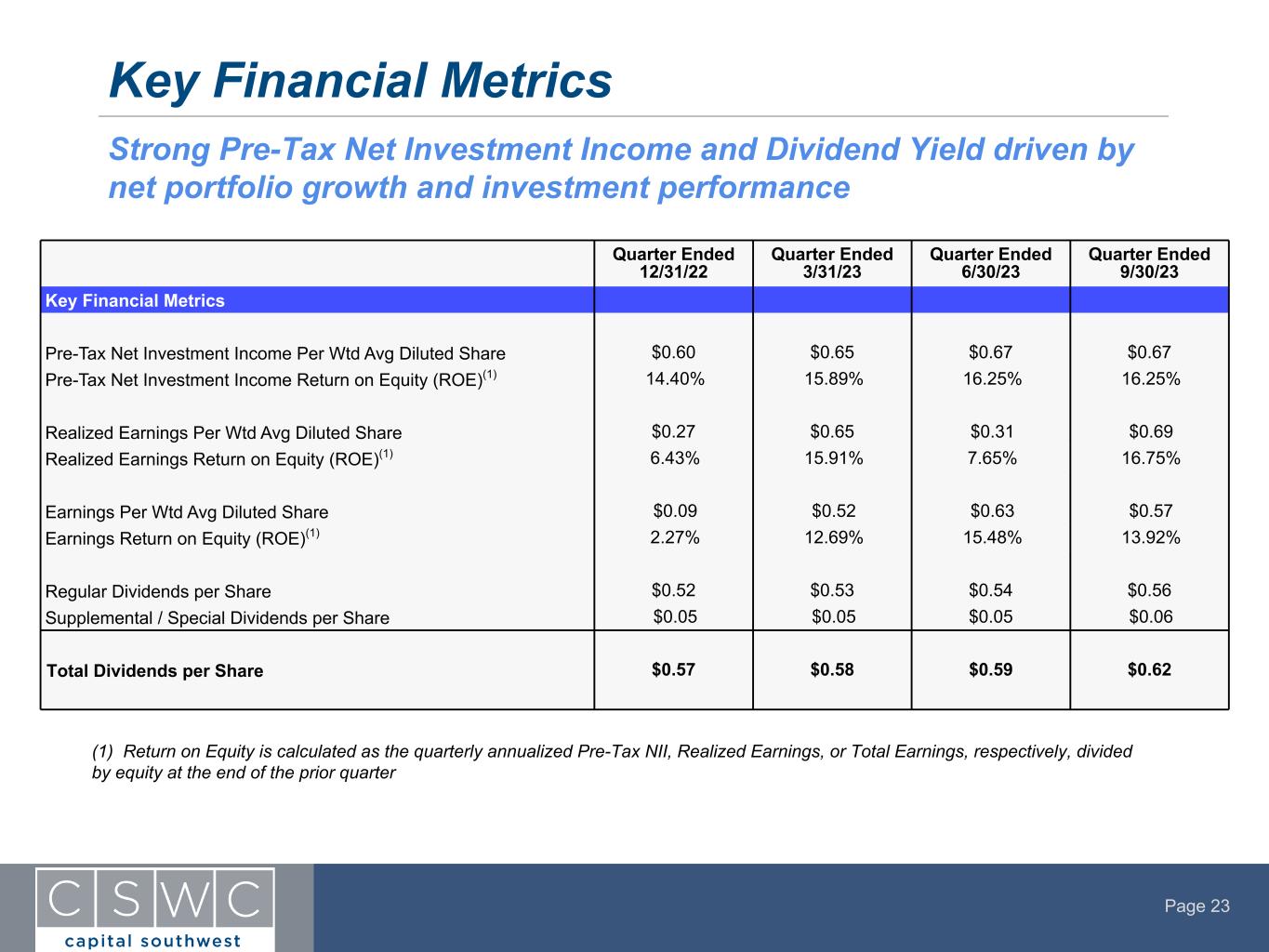

Page 23 Key Financial Metrics Strong Pre-Tax Net Investment Income and Dividend Yield driven by net portfolio growth and investment performance (1) Return on Equity is calculated as the quarterly annualized Pre-Tax NII, Realized Earnings, or Total Earnings, respectively, divided by equity at the end of the prior quarter Quarter Ended 12/31/22 Quarter Ended 3/31/23 Quarter Ended 6/30/23 Quarter Ended 9/30/23 Key Financial Metrics Pre-Tax Net Investment Income Per Wtd Avg Diluted Share $0.60 $0.65 $0.67 $0.67 Pre-Tax Net Investment Income Return on Equity (ROE)(1) 14.40% 15.89% 16.25% 16.25% Realized Earnings Per Wtd Avg Diluted Share $0.27 $0.65 $0.31 $0.69 Realized Earnings Return on Equity (ROE)(1) 6.43% 15.91% 7.65% 16.75% Earnings Per Wtd Avg Diluted Share $0.09 $0.52 $0.63 $0.57 Earnings Return on Equity (ROE)(1) 2.27% 12.69% 15.48% 13.92% Regular Dividends per Share $0.52 $0.53 $0.54 $0.56 Supplemental / Special Dividends per Share $0.05 $0.05 $0.05 $0.06 Total Dividends per Share $0.57 $0.58 $0.59 $0.62

Page 24 Interest Rate Sensitivity Fixed vs. Floating Credit Portfolio Exposure (1) Note: Illustrative change in annual NII is based on a projection of CSWC’s existing debt investments as of 9/30/2023, adjusted only for changes in Base Interest Rate. Base Interest Rate used in this analysis is 3-Month SOFR of 5.39% at 9/30/2023. The results of this analysis include the I-45 Senior Loan Fund, which is comprised of 97% floating rate debt assets and 100% floating rate liabilities (1) Portfolio Exposure includes I-45 SLF assets pro rata as a % of CSWC’s equity investment in the fund Change in Base Interest Rates Illustrative Annual NII Change ($'s) Illustrative Annual NII Change ($ Per Share) (200 bps) (19,110,036) (0.48) (150 bps) (14,332,527) (0.36) (100 bps) (9,555,018) (0.24) (50 bps) (4,777,509) (0.12) 50 bps 4,777,509 0.12 3% 97% Fixed Floating

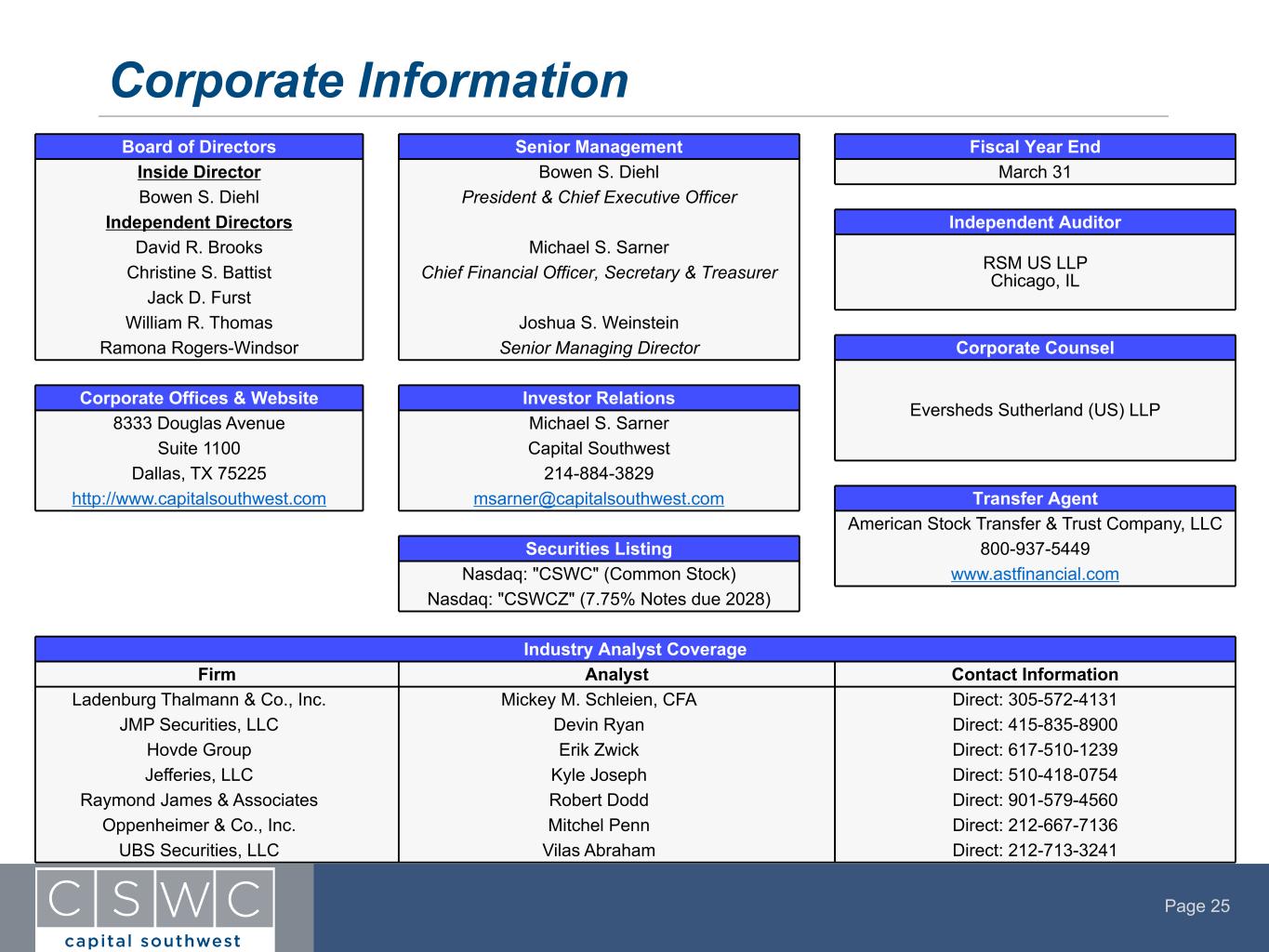

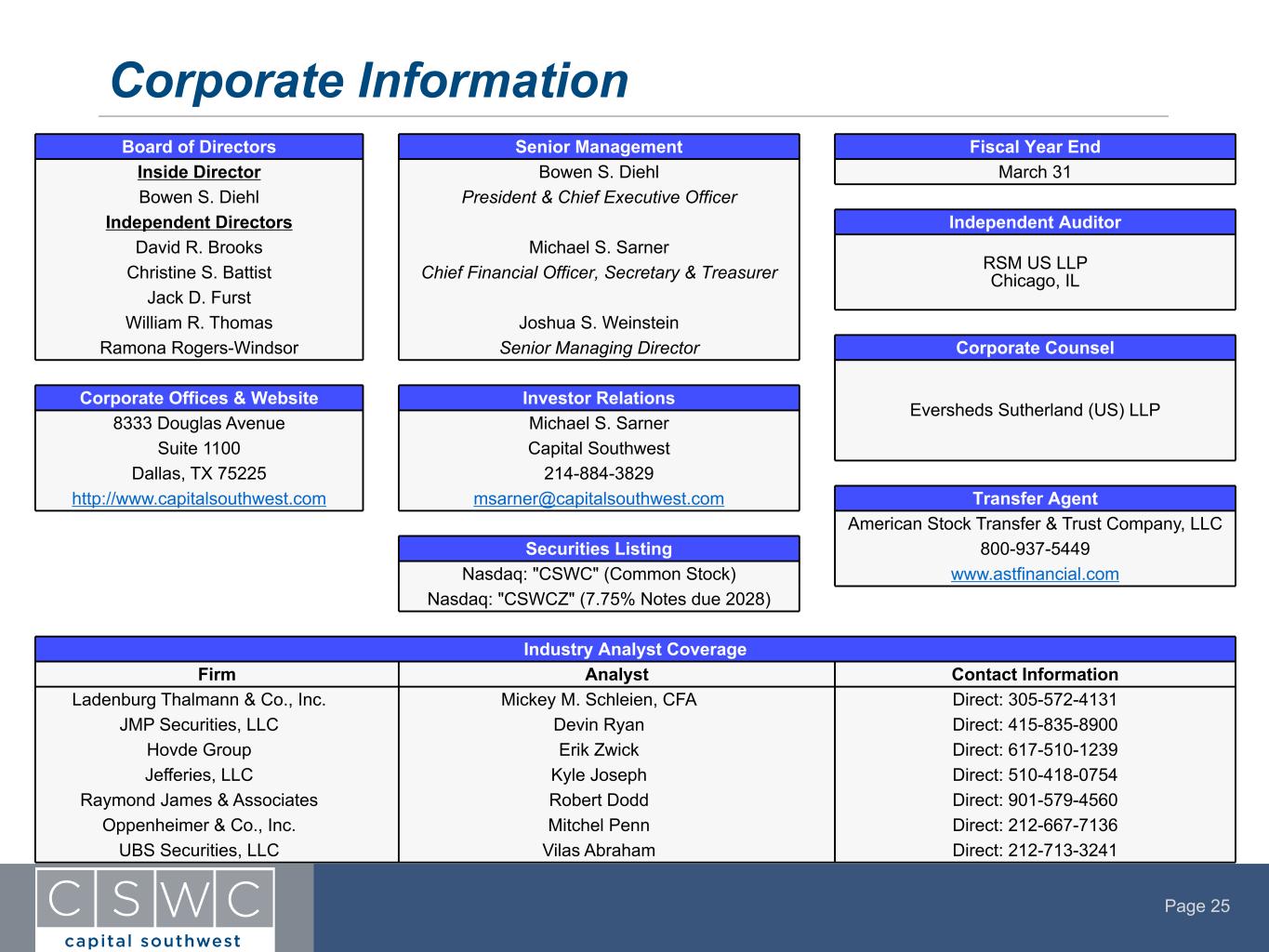

Page 25 Corporate Information Board of Directors Senior Management Fiscal Year End Inside Director Bowen S. Diehl March 31 Bowen S. Diehl President & Chief Executive Officer Independent Directors Independent Auditor David R. Brooks Michael S. Sarner RSM US LLP Chicago, ILChristine S. Battist Chief Financial Officer, Secretary & Treasurer Jack D. Furst William R. Thomas Joshua S. Weinstein Ramona Rogers-Windsor Senior Managing Director Corporate Counsel Eversheds Sutherland (US) LLP Corporate Offices & Website Investor Relations 8333 Douglas Avenue Michael S. Sarner Suite 1100 Capital Southwest Dallas, TX 75225 214-884-3829 http://www.capitalsouthwest.com msarner@capitalsouthwest.com Transfer Agent American Stock Transfer & Trust Company, LLC Securities Listing 800-937-5449 Nasdaq: "CSWC" (Common Stock) www.astfinancial.com Nasdaq: "CSWCZ" (7.75% Notes due 2028) Industry Analyst Coverage Firm Analyst Contact Information Ladenburg Thalmann & Co., Inc. Mickey M. Schleien, CFA Direct: 305-572-4131 JMP Securities, LLC Devin Ryan Direct: 415-835-8900 Hovde Group Erik Zwick Direct: 617-510-1239 Jefferies, LLC Kyle Joseph Direct: 510-418-0754 Raymond James & Associates Robert Dodd Direct: 901-579-4560 Oppenheimer & Co., Inc. Mitchel Penn Direct: 212-667-7136 UBS Securities, LLC Vilas Abraham Direct: 212-713-3241