| An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the Offering Circular filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular may be obtained. |

PART II – PRELIMINARY OFFERING CIRCULAR

29 Court Drive, Shrewsbury, NJ 07702

Phone: (732) 704-4941Date: March 21, 2018

THE COMPANY IS FOLLOWING THE “OFFERING CIRCULAR” FORMAT OF DISCLOSURE UNDER REGULATION A

| Maximum Offering Amount (shares) | 10,000,000 shares of Common Stock par value $.0001 |

| Maximum Offering Amount (Dollars) | $50,000,000 |

| Offering Price | $5 Per Share |

| Minimum Purchase | $500 (100 shares) |

| | | Price to public | | Underwriting discount and commissions | | Proceeds to issuer | | Proceeds to other persons | |

| Per Share: | | $5 | | $0.00 | | $50,000,000 | | $0.00 | |

| Total: 1 | | $50,000,000 | | $0.00 | | $50,000,000 | | $0.00 | |

| | | | | | | | | | |

1The Company will pay all expenses associated with the offering which are estimated at $10,000 - 20,000.

Vermundi Inc. is an emerging growth company incorporated in the State of Delaware on November 27, 2017 as a for profit corporation with a fiscal year end date of December 31 -(Verum Mundi is Latin for Real World). The Company is a financial software/technology company committed to building the digital bridge between the cryptoverse and the legacy financial system. Vermundi will combine blockchain/distributed ledger technology (DLT), a US trust account and together with regulated broker dealers and other authorized entities will deliver the highest-quality digital financial assets to a global audience. These digital assets will include the Vermundi Dollar (VUSD), which will be 100% backed by U.S. dollars (USD) held in trust and the Vermundi Security Token (VST) which will represent whole or fractional digital shares of global companies whose shares are held in trust. This Offering is being conducted on a “Best Efforts” basis. Please seePart II Item 14 “Securities Being Offered”beginning on page 27 within this Offering Circular for the disclosure of the securities being offered.The proposed sale to the public shall commence at a date to-be-determined by the Company following the date this Offering Circular is qualified by the Securities and Exchange Commission. The Offering will close upon the earlier of (1) the sale of 10,000,000 shares of Common Stock, (2) one year from the date this Offering is qualified by the Securities and Exchange Commission, or (3) when the Board of Directors decides that it is in our best interest to terminate the Offering.

You should carefully read this entire Offering Circular, including the section entitled “Risk Factors” before buying any Common Shares. A summary of Risk Factors is available in Item 3 “Summary and Risk Factors” of this Offering Circular beginning on page 3. Generally, no sale may be made to you in this Offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

The United States Securities and Exchange Commission does not pass upon the merits of or give its approval to any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering circular or other solicitation materials. These securities are offered pursuant to an exemption from registration with the Commission; however, the Commission has not made an independent determination that the securities offered are exempt from registration.

Item 2. Table of Contents

| | |

| Item 1. Cover Page of Offering Circular | 1 |

| | |

| Item 2. Table of Contents | 2 |

| Item 3. Summary and Risk Factors | 3 |

| Item 4. Dilution | 4 |

| Item 5. Plan of Distribution and Selling Securityholders | 6 |

| Item 6. Use of Proceeds by Issuer | 7 |

| Item 7. Description of Business | 8 |

| Item 8. Description of Property | 22 |

| Item 9. Management’s Discussion and Analysis of Financial Condition | 22 |

| Item 10. Director and Executive Officers | 24 |

| Item 11. Compensation of Director and Executive Officers | 25 |

| Item 12. Security Ownership of Management and Certain Securityholders | 25 |

| Item 13. Interest of Management and Others in Certain Transactions | 26 |

| Item 14. Securities Being Offered | 27 |

| PART III-EXHIBITS | 34 |

| Item 16. Index to Exhibits | 34 |

| Item 17. Exhibit Description | 34 |

| SIGNATURES | 34 |

Item 3. Summary and Risk Factors

Summary

Vermundi Inc. is an emerging growth company incorporated in the State of Delaware on November 27, 2017 as a for profit corporation with a fiscal year end date of December 31(Verum Mundi is Latin for Real World). The Company is a financial software/technology company committed to building the digital bridge between the cryptoverse and the legacy financial system. Vermundi will combine blockchain/distributed ledger technology (DLT), a US trust account and together with regulated broker dealers and other authorized entities will deliver the highest-quality digital financial assets to a global audience. These digital assets will include the Vermundi Dollar (VUSD), which is 100% backed by U.S. dollars (USD) held in trust and the Vermundi Security Token (VST) which represents whole or fractional digital shares of global companies whose shares are held in trust.Unless we state otherwise, the terms “we,” “us,” “our,” “Company,” “management,” or similar terms collectively refer to Vermundi Inc., a Delaware corporation.

All dollar amounts refer to U.S. dollars unless otherwise indicated.

Table 1

Summary of The Offering

| Securities being offered by Vermundi Inc. | 10,000,000 shares of Common Stock par value $.0001 |

| Offering price per share | $5 per share |

| Number of Common Shares issued and outstanding before the Offering | 40,000,000 |

| Number of Common Shares issued and outstanding after the Offering | 50,000,000 |

| Minimum number of Common Shares to be sold in this Offering | No minimum |

| Market for the Common Shares | 1. | There is no public market for our Common Stock. |

| | 2. | We may not be able to meet the requirements for a public listing or quotation of our Common Stock. Further, even if our Common Stock is quoted or granted a listing, a market for the Common Stock may not develop. |

| | 3. | The offering price for the shares will remain $5 per share for the duration of the Offering. |

| Use of proceeds from this Offering of Common Stock | The Company intends to use the proceeds from this Offering to execute the Company’s vision and business plan. |

| Termination of the Offering | This Offering will terminate upon the earlier to occur of (i) 365 days after this Offering Circular becomes qualified by the Securities and Exchange Commission, or (ii) the date on which all 10,000,000 shares of Common Stock qualified hereunder for sale to the public have been sold or (iii) the Board of Directors determines that it is in the best interest of the Company to terminate the offering. |

| Terms of the Offering | This Offering is being conducted on a BEST EFFORTS basis. |

Risks Factors

| 1. | Emerging Growth Company:The Company has only a limited history upon which an evaluation of its prospects and future performance can be made. Furthermore, past performance of any Director, Officer or Key Employee in any similar venture is no assurance of future success. There is a possibility that the Company could sustain losses in the future or fail to even operate profitably. |

| 2. | The Digital/Crypto Market is a Developing Market:The digital/crypto market is a new market. The market is rapidly developing but there is no guarantee that this market will continue to develop or sustain current levels of interest going forward. The demand for the Company’s products and services depends on our customers’ continued demand for digital/crypto products and services in general. |

| 3. | The Crypto-regulatory Environment is Subject to Change: Today’s regulations vary significantly across jurisdictions. Even within jurisdictions, there are different interpretations of regulations by different regulatory bodies. The Company understands the regulations as they currently stand and has a plan to operate in compliance with today’s regulations. However, failure to comply with existing and future regulatory requirements could adversely affect the Company’s results of operations and financial condition. |

| 4. | There is No Public Market for our Common Stock: The Company intends to seek a listing or quotation for its Common Stock. However, we may not be able to meet the requirement for a public listing or quotation of our Common Stock. Further, even if our Common Stock is quoted or granted a listing, a liquid market for the Common Stock may not develop. |

| 5. | There is Significant Volatility in the Exchange Rate of Cryptocurrency to the U.S. dollar:Increased volatility in the exchange rate of the U.S. dollar and other foreign currencies to cryptocurrencies could have a material adverse effect on our business results and thereby adversely affect our results of operations and financial condition. |

| 6. | Partnerships with Regulated Entities are Critical:The Company’s business is complex and depends on maintaining good relationships with partners who operate in the highly regulated US capital markets. We are dependent on key personnel who are knowledgeable and experienced concerning the constraints under which our partners must operate. |

| 7. | Concentration of Shareholders: After the Offering is complete, even if all the shares offered are sold, a significant percentage of the shares outstanding will be held by very few shareholders. The founder and CEO, Gregory Shinnick, through his holding company, will own over 50% of the common stock (1 vote per share) of the company. Mr. Shinnick will have significant control over the direction and decisions of the Company. |

| 8. | Our Auditor has issued a “Going Concern” Opinion: The Company’s ability to continue is dependent upon management’s plan to raise additional funds and achieve profitable operations. Even if we raise funds through this Offering, we may not accurately anticipate how quickly we may use the funds and if it is sufficient to get the business to profitability. |

Item 4. Dilution

The price of the current offering of Common Stock is fixed at $5 per share.

Dilution represents the difference between the offering price and the net tangible book value per share immediately after completion of this offering. Net tangible book value is the amount that results from subtracting total liabilities and intangible assets from total assets. Dilution arises mainly because of the Company’s determination of the offering price of the shares being offered. Dilution of the value of the shares you purchase is also a result of the lower book value of the shares held by our existing stockholders.

Table 2

Dilution

Average Price Per Share

| | | Shares Issued | Total Consideration | |

| | | Number of Shares | Percent | Amount | Percent | Average

Price

Per

Share |

| Founders | | 40,000,000 | 80% | $48,179 | .096% | $.0012 |

| New Investors | | 10,000,000 | 20% | $50,000,000 | 99.904% | $5 |

| | TOTAL | 50,000,000 | 100% | $50,048,179 | 100% | $1.001 |

Table 3

Dilution Per Share

| | If 25% of

Shares Sold | If 50% of

Shares Sold | If 100% of

Shares Sold |

| Price Per Share of this Offering | $5/share | $5/share | $5/share |

| Book Value Per Share Before Offering | $.0012 | $.0012 | $.0012 |

| Book Value Per Share After Offering | $.2953 | $.5566 | $1.001 |

| Increase (Decrease) in Book Value Per Share | $.2941 | $.5554 | $.9998 |

| Dilution Per Share to New Investors | $4.7059 | $4.4436 | $3.999 |

| Dilution Per Share by Percentage | 94.12% | 88.87% | 79.98% |

Immediate dilution

The Company has awarded shares to its founders, and early employees in exchange for “sweat equity,” expenses and consulting services. When the Company seeks cash investments from outside investors, the new investors typically pay a much larger sum for their shares than the founders or earlier investors which means that the cash value of the new investors’ stake is diluted because each share of the same type is worth the same amount and the new investor paid more for their shares than earlier investors paid for their shares.

Future dilution

Another important way of looking at dilution is that dilution can happen due to future actions by the Company; meaning, an investor’s stake in the Company could be diluted due to the Company issuing additional shares, whether as part of a capital-raising event, or issued as compensation to the Company’s members, employees or marketing partners. As a result, if the Company issues more shares, the percentage of the Company that investors own will go down, even though the value of the company may go up. This means investors may own a smaller piece of a larger company.

This increase in number of shares outstanding could result from a stock offering in any form. If the Company decides to issue more shares, an investor could experience value dilution with each share being worth less than before, and control dilution with the total percentage an investor owns being less than before. There may also be earnings dilution, with a reduction in the amount earned per share which typically occurs when the Company pays dividends.

It is important that investors realize how the value of those shares can decrease by actions taken by the Company. Dilution can make drastic changes to the value of each share, ownership percentage, voting control, and earnings per share.

Item 5. Plan of Distribution and Selling Securityholders

| a) | This offering is being done on a ‘BEST EFFORTS’ basis. This offering does not have underwriters.There are NO securities being offered by any brokers or dealers. |

| b) | There are NO discounts or commissions to be paid to dealers in connection with the sale of the securities. |

| c) | There are NO selling securityholders in this offering. |

| d) | There is NO minimum raise amount. All proceeds from the sale of the securities will be retained by the Company. |

| e) | The Company does NOT expect any material delays in receiving the proceeds from the sale of the securities. |

The shares of Common Stock are being offered directly by the Company to investors. The Company is offering the Common Stock on a ‘BEST EFFORTS’ basis: this means that the Company will use its best efforts to sell the Common Stock to investors. The Company may NOT sell all or any of the Common Stock offered. We shall only deliver our Subscription Documents upon request after a potential investor has an opportunity to review this Offering Circular.

The Company will provide certain technology and administrative services in connection with the offering by which subscribers may receive, review, execute and deliver subscription agreements electronically.

Right to Reject Subscriptions. After we receive your complete, executed subscription agreement, we have the right to review and accept or reject your subscription in whole or in part, for any reason or for no reason. We will return all monies from rejected subscriptions to you without interest and without deduction.

Acceptance of Subscriptions. Upon our acceptance of a subscription agreement, we will countersign the subscription agreement and issue the shares subscribed at closing. Once you submit the subscription agreement and it is accepted, you may not revoke or change your subscription or request your subscription funds. All accepted subscription agreements are irrevocable.

Procedures for Subscribing

If you decide to subscribe for Offering Shares in this offering, you should:

Go to the Company’s website: www.vermundi.com (under construction), click on the “Invest Now” button and follow the procedures as described:

(i) electronically receive, review, execute and deliver to us a subscription agreement; and

(ii) deliver funds as prescribed.

Generally, no sale may be made to you in this Offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth.Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

Item 6. Use of Proceeds by Issuer

The Company intends to use the net proceeds from the sale of its Common Stock to achieve our objective “to build the digital bridge between the cryptoverse and the legacy financial system” as described inItem 7 “Description of Business” beginning on page 8 within this Offering Circular.

Although the Company does not currently plan to change the allocation of the Use of Proceeds as described in the following table, the Company reserves the right to change the Use of Proceeds in the following description as the Company believes warranted.

Table 4

Use of Proceeds1

Total Shares of Common Stock Offered: 10,000,000

Max Proceeds from Offering: $50,000,000

| | If 25% of Shares

Sold | If 50% of

Shares Sold | If 100% of

Shares Sold |

| Length of Operations | 3 Months | 6 months | 12 months |

| | | | |

| GROSS PROCEEDS | $12,500,000 | $25,000,000 | $50,000,000 |

| | | | |

| OFFERING EXPENSES | | | |

| Accounting Fees | $5,000 | $5,000 | $5,000 |

| Other Fees | $5,000 | $5,000 | $5,000 |

| SUB TOTAL | $10,000 | $10,000 | $10,000 |

| | | | |

| OPERATING EXPENSES | | | |

| General & Administrative | $50,000 | $175,000 | $300,000 |

| Management Salaries | $108,000 | $378,000 | $918,000 |

| Key Employee Salaries | $108,000 | $247,000 | $524,000 |

| Other Employee Salaries/Wages | $33,000 | $390,000 | $1,426,000 |

| Marketing & Sales | $2,300,000 | $4,300,000 | $12,000,000 |

| Regulatory & Legal | $250,000 | $625,000 | $1,375,000 |

| | | | |

| | | | |

| TOTAL EXPENSES | $2,859,000 | $6,125,000 | $16,553,000 |

1See the accompanying notes to the Use of Proceeds Table. The Company is paying the Offering Expenses with existing funds.

Notes to the Use of Proceeds Table

| 1. | The Company will attempt to raise a maximum of $50,000,000 from this Offering. The Companybelieves that these funds will be sufficient to sustain the Company through 24 months of operations without having to raise additional capital during this period. For example, at the end of 12 months, the Company’s cash position is expected to be ~ $34 million (if all 10,000,000 (TEN MILLION) qualified shares are sold in this Offering). This money will be used over the ensuing 12 months (months 13-24) to continue executing the Company’s business plan. The information provided is an estimate based on our current business plan. We may find it necessary or advisable to reallocate portions of the net proceeds reserved for one category to another category, and we will have broad discretion in doing so. |

| 2. | No funds from this Offering will be used to compensate or otherwise make payments to officers or directors of the issuer or any of its subsidiaries outside of the normal course of business. An example of a ‘normal course of business’ expenditure would be a salary paid to an officer of the Company in return for employment with the Company. |

| 3. | This Offering is being done on a BEST EFFORTS basis. If all the securities being qualified are not sold, the Company expects to reduce ‘Marketing & Sales’ expenses proportionally to continue to support the development of the Company’s products, the establishment of the trust, the creation of the Master Trust Agreement and the hiring of key officers and employees that will advance the vision of the Company until additional funds can be raised to move Marketing & Sales forward. |

| 4. | The Company’s plan for ‘Use of Proceeds’ is designed to support the Company’s ‘Plan of Operations’. The Company believes the ‘Use of Proceeds’ is consistent with the Company’s ‘Plan of Operations’. Please reviewItem 9. Management’s Discussion and Analysis of Financial Condition beginning on page 22 within this Offering Circular. |

| 5. | The Company does not have any debt, nor does it have any current plans to use any of the proceeds from this Offering to acquire assets outside the ordinary course of business. |

Item 7. Description of Business

The Company

Vermundi Inc. is an emerging growth company incorporated in the State of Delaware on November 27, 2017 as a for profit corporation with a fiscal year end date of December 31(Verum Mundi is Latin for Real World). The Company is committed to building the digital bridge between the cryptoverse and the legacy financial system. Vermundi will combine blockchain/distributed ledger technology (DLT), a US trust account and together with regulated broker dealers and other authorized entities will deliver the highest-quality digital financial assets to a global audience. These digital assets will include the Vermundi Dollar (VUSD), which will be 100% backed by U.S. dollars (USD) held in trust and the Vermundi Security Token (VST) which will represent whole or fractional digital shares of global companies whose shares are held in trust.

Problem

Cryptocurrencies and crypto-assets are volatile, often illiquid and highly speculative. They are expensive and cumbersome to use when conducting commercial transactions. They are not backed by real financial instruments and they are not regulated.

Solution

Provide the software and processes for creating a fully digital U.S. dollar and the fully digital securities of global companies. Eliminate the need to move the real-world assets which back the digital assets thereby eliminating the need to utilize the existing payment rails and transfer mechanisms which are very expensive both in terms of time and money.

How

The Company will build a strong network of users, a diversified set of financial products, a deep bench of trusted channel partners and a robust supporting infrastructure and technology. Vermundi will provide the highest utility (accessibility, portability, usability) at a very low cost. Vermundi will provide unparalleled access to the U.S. dollar and the securities of global companies through crypto tokens that have real economic value.

The ‘Vermundi Concept’ has been incubated over the last 5 years and the widespread adoption of blockchain/DLT technology is the final catalyst for igniting this financial product revolution.

Value Proposition

Wealth Building for Society

The Company’s products will help more people build more wealth more securely for less money by minimizing the transactional costs imposed by the legacy financial system. Two primary barriers have historically prevented more people from building wealth in the real-world:

| A. | Total Cost to Service (TCS). It is expensive for real-world financial service providers to acquire new customers and service retail accounts. Advertising and a dedicated sales and compliance force are inefficient and expensive and as a result are targeted only at the wealthiest end of the spectrum leaving most consumers underserved. Furthermore, margins are thin or nonexistent on smaller accounts and service providers impose substantial account fees to subsidize their margins. These account service fees are significant barriers to entry for most of the world’s population and legacy financial institutions deliberately avoid large swaths of the world’s consumers. |

| B. | Transactional Cost of Ownership (TCO). Too often, transaction costs are linked to the value being transferred not to the actual cost of transferring the value. A $5 ATM fee or a $50 wire transfer fee keeps large numbers of the world’s consumers unbanked. A $5 fee per stock trade is very appealing to the investor with $10,000 to invest, but it is a non-starter for the investor with only a portion of that amount to invest. |

Mass Adoption

Cryptocurrency and crypto-asset markets continue to face significant barriers to mass adoption. Two of the top barriers are:

| A. | Store of Value Confusion (SVC). Most consumers do not understand the origins of cryptocurrency, initial coin offerings (ICOs) and their value. This lack of understanding combined with weak liquidity encourages skepticism and uncertainty which prevents widespread adoption. |

| B. | Volatility Acceleration (VA). Cryptocurrency and ICOs are inherently volatile because of the lack of liquidity and the purely speculative nature of the markets. The crypto-assets available today for investment are poorly understood and regularly disparaged by the leaders of legacy financial institutions. This is further undermining consumer confidence and hindering widespread adoption. Cryptocurrency is volatile and the crypto-assets available for investment today are also volatile. Holders of crypto have very few safe-haven options for their cryptocurrency. |

Approach

The Company will overcome these barriers by building the digital bridge to real U.S. dollars and the securities of global companies – the world’s most recognized and sought after financial instruments. Vermundi will use the widely accessible tools of the cryptoverse to deliver value-added products and services to all consumers.

| A. | TCS and TCO to approach Zero. Vermundi will aggregate real-world assets in a secure US trust structure. The Company will spread the costs of managing the underlying real-world assets across an increasing number of participants. The private blockchain/DLT trust structure will support an unlimited number of participants and an unlimited number of interactions. |

| B. | SVC is Reduced. VUSD and VST will be pari passu (1:1) with real-world assets in the trust at all times. |

| C. | VA Decreases. Real-world assets can be volatile, but their volatility is generally much less than the volatility of crypto-assets. VUSD and VST should provide a ’safer harbor�� alternative for cryptocurrency and crypto-asset holders while they are planning their next purchase of non-asset-backed crypto tokens. |

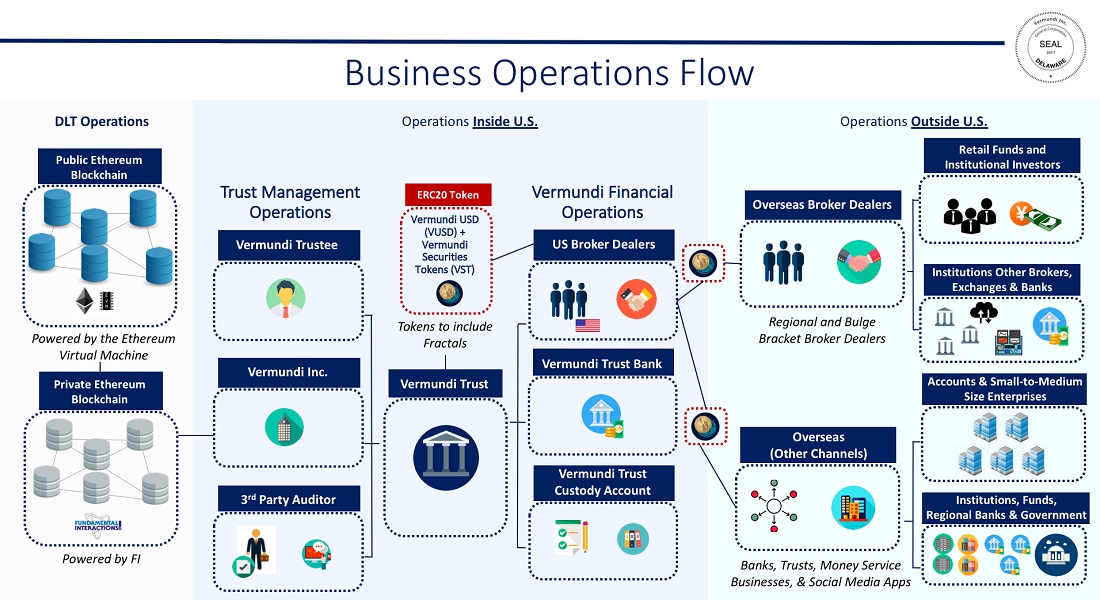

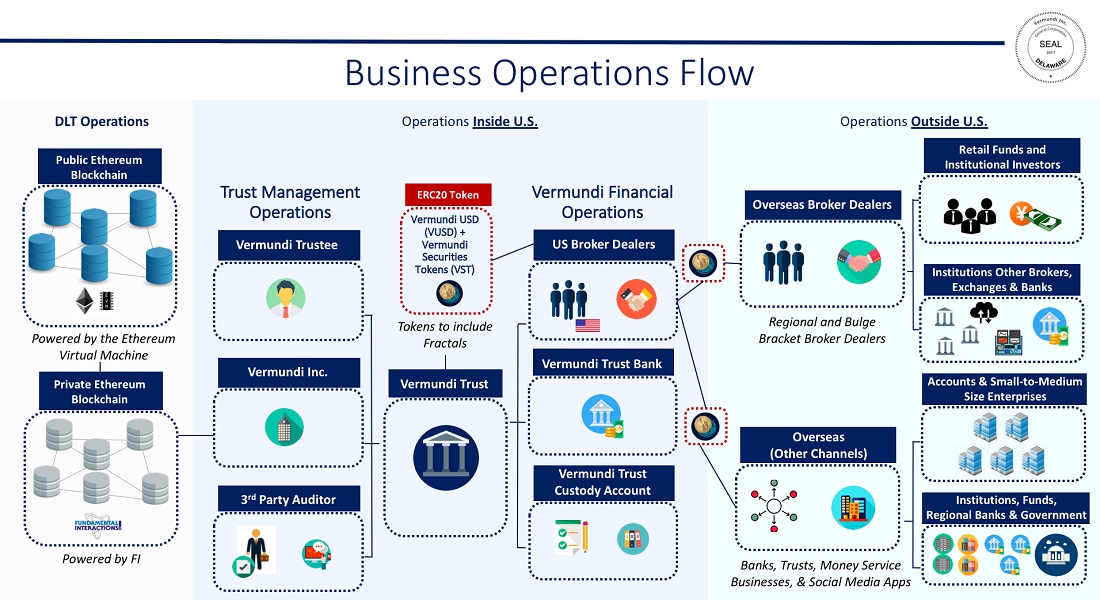

How the Service Will Work: structure and operations

The Company, working with proven financial technology companies like Fundamental Interactions Inc. and regulated broker dealers, will develop the Digital Depositary Trust Account System (DDTAS) which will function as a digital warehouse for new digital assets. DDTAS will leverage three primary elements:

| A. | secure, private and public blockchain/distributed ledger technology (DLT), |

| C. | commercial relationships with regulated broker dealers and other authorized entities. |

DDTAS will help to deliver high quality digital tokens backed by real-world financial assets (in whole or fractional form) to global consumers – for example, the U.S. dollar (USD), Apple Inc. (AAPL), Facebook, Inc. (FB), Alphabet Inc. (GOOG) and SDPR S&P 500 ETF (SPY). Significant value is expected to be realized by all stakeholders. A single share of GOOG is just over $1,000 USD. If a customer wants or can only afford $5, $50 or $500 of GOOG, the Company’s regulated broker dealer relationships or other authorized entities will facilitate the transaction using DDTAS.

DDTAS will be comprised of the following components:

| A. | Origination and Issuance System. This system will create tokens only when the real-world assets are placed in the trust and are in the custody account of the trust. These tokens will be created (issued) and delivered to the digital wallet of the customer who placed the real-world assets in the trust. |

| B. | Crypto Wallet Compatibility. Vermundi will commence operations using Ethereum’s ERC20 compatible wallet system and the digital tokens will be ERC20 standard. Customers may transfer their digital tokens at any time, both within the trust-wallet environment and to wallet environments that are external to the trust-wallet environment. The company will continue to advance its technology and operational procedures. Solutions may emerge that are better than ERC20. The Company will adapt. |

| C. | Digital Token Redemption Mechanism. Digital tokens will be 100% redeemable for the real-world assets held in trust. For example, a participant, also known as aBeneficial Owner of the trust, who is a regulated broker dealer or other authorized entity may directly redeem digital tokens backed by securities. If a participant is not a regulated broker dealer or other authorized entity, they may redeem indirectly through a regulated broker dealer or other authorized entity who is a participant in the trust. |

| D. | Private Blockchain/Distributed Ledger.The private Ethereum ledger will track all creations, redemptions and movement of digital tokens within the trust (dynamic audit). The private ledger allows for a substantially greater number of transactions per second and an historical record separate from the public ledger. This provides a level of scalability that is not available in a purely public blockchain environment. |

| E. | Public Blockchain/Distributed Ledger. The public Ethereum ledger will provide a second immutable record of trust activity and asset ownership. And, the public Ethereum ledger will continue to provide a second immutable record of activity pertaining to VUSD and VST external to the trust. |

| F. | Agnostic Assignment. The Company will provide the tools for authorized users to store, digitize, redeem or transfer their digital assets. The Company will not direct nor determine the mix of assets placed in the trust by authorized users. The Company willNEVER manage assets placed in the trust. The Company will remain focused on the security of the trust, the security of assets placed in the trust, the digital records associated with the assets placed in the trust and the safe movement of assets into and out of the trust by authorized members of the trust. |

US Trust Account

Cryptographically-secure keys negate the need for ‘trusted’ middlemen or third-parties in the cryptoverse. Digital tokens backed by real-world assets require added protection and must be secured. Vermundi will use a ‘best practice’ approach to secure assets in the real-world; this demands the use of a US trust account. Trust accounts, by design, provide additional layers of protection for assets ‘in trust’.

The Company’s US trust accounts will have the following characteristics:

| B. | be a master trust with series; each series will represent a specific real-world asset or asset class; the trust will have an unlimited number of series, |

| C. | be governed by a Master Trust Agreement, the ‘agreement’; |

| D. | participation in the trust will be determined in accordance with regulations set forth by the relevant regulatory and self-regulatory organizations operating within the jurisdictions where the Company will operate; |

| E. | participants will have a percentage (%) claim to the assets in the trust represented by the digital tokens they hold, which are linked to a specific series backed by a specific real-world asset or asset class of the trust; |

| F. | the trust will have its own custody accounts and bank accounts; and |

| G. | the trust will conduct its business in accordance with US tax law as delineated by the Internal Revenue Code of the United States or the tax laws specific to those jurisdictions where it may operate in the future. |

Proof of Reserve Process (PORP)

The Company will maintain indisputable proof of reserves for all real-world assets that are tokenized and held as corresponding digital assets by authorized users. All activity will be recorded and stored using blockchain/distributed ledger technology (DLT). The ledger will be dynamic, transparent, immutable, and subject to third-party audit. Digital tokens in circulation will always, at a minimum, be reserved (backed) 100% with real-world assets in the trust.

The Proof of Reserve Process (PORP) will function in accordance with the following rule set:

| A. | digital token creation will only be initiated after real-world assets have been placed in the custody account of the trust; |

| B. | transaction data recorded on the private blockchain/distributed ledger will be available to internal company stakeholders as required. Bulk transaction data will be hashed and published to the public blockchain ledger and will be accessible to a broader audience via a standard blockchain explorer tool. The Company will use a private instance of the Ethereum blockchain to operate the private ledger; |

| C. | customer data will always be private and will be secured in compliance with the prevailing laws pertaining to privacy for personal data; |

| D. | regulatory authorities who demonstrate a legitimate requirement to access customer data and have the appropriate legal authorization to access the specific data will be afforded the opportunity to do so; and |

| E. | a real-world auditing firm will be engaged to conduct systematic audits of the: |

| • | custody and bank accounts of the trust |

| • | processes for moving real-world assets into and out of the trust |

Key Technology Relationship

Fundamental Interactions Inc., founded in 2011, is a leading technology firm that designs high performance multi-asset trading appliance products for enterprise market centers. The FIN (Fundamental Interactions Neutron) product suite brings together a core set of low latency business functions for interoperability, speed and regulatory compliance. This includes market data, pre-trade risk, algorithmic routing, and order crossing. Through Neutron their trading capabilities have expanded to virtual and nano exchanges across distributed ledger technology (DLT) that can support various exchanges, brokers, vendors, and a multitude of professional services.

Regulated Broker Dealer Relationships (RBDRs)

The term broker dealer is used in US securities regulatory parlance to describe firms who act as both agent and principal. A broker dealer acts as a broker (or agent) when it executes orders on behalf of clients; it acts as a dealer, or principal, when it trades for its own account. The Vermundi team and advisors have extensive capital markets experience and long-standing capital markets relationships. The Company will formalize relationships with regulated broker dealers and other authorized entities to distribute the Company’s products. The regulated broker dealers with whom Vermundi will engage will:

| A. | be regulated by the Financial Industry Regulatory Authority (FINRA) and the US Securities and Exchange Commission (SEC); |

| B. | be authorized to conduct the real-world lines of business necessary for the creation, transfer and redemption of digital tokens which could include but are not limited to trading US securities Over-The-Counter (OTC), market making and operating trading platforms; and |

| C. | have their own clearing and custody accounts. |

The Company’s Marketing and Sales Strategy

Our Marketing Strategy will include social media outlets (Facebook, Instagram, Reddit, Linkedin, Slack, Telegram, Twitter etc.), web advertising and information provided on the Company’s web site when completed.

The Company will reach out to regulated broker dealers and other authorized entities in the US and in non-US jurisdictions to broaden the reach of the Vermundi products.

Our intended revenue streams will come from three sources:

| ● | Vermundi Dollar (VUSD) digital wallet fees, |

| ● | Vermundi Security Token (VST) digital wallet fees and |

| ● | Vermundi Trust Fees (% of accrued interest on assets in the trust). |

The Company is taking the path WhatsApp took in ‘chat’. WhatsApp messages had the same ‘look and feel’ of existing text/SMS messages but were delivered via a new path that was more secure and substantially cheaper to use. The Company will take already liquid, in-demand, globally-branded products such as the U.S. dollar and the shares of GOOG, AAPL, FB and SPY and make them more liquid and more accessible. The Company will deliver with regulated broker dealers and other authorized entities the same products with the same rights and benefits but deliver them at the price, the speed, the time and in the quantity required by the customer: low cost, fast (near-immediate transfer), anytime (24/7/365) and in whole or fractional amounts.

The Company’s Products and Services

Vermundi Dollar (VUSD) and Vermundi Security Token (VST) will be the first two products offered by the Company. VUSD and VST will provide users the opportunity to hold digital assets backed by either U.S. dollars or the securities of US or global companies on deposit in the US trust account. This is a material difference from crypto coins that are not backed by real-world assets. Crypto coins do not provide transaction value as currency and trading may be at unfavorable pricing or not possible. Holders of VST(s) will also benefit by the opportunity to purchase a token representing a fractional interest in financial assets that carry a high per unit purchase price if purchased in whole.

Users and Use Cases

VUSD and VST will benefit many different types of users. Some of these users will be individuals, business entities and non-business entities like:

| 1. | US consumers and non-US consumers |

| 2. | banked, unbanked and under-banked consumers |

| 3. | merchants (local, national and global), online and bricks & mortar |

| 4. | traditional service providers (local, national and global) |

| 5. | emerging digital service providers |

| 6. | government and non-governmental organizations (direct payment assistance) |

| 7. | industry and banking – supply chain, trade finance, credit |

VUSD and VST are particularly beneficial for participants that want to:

| 1. | conduct non-cash, online and in-store POS (point of sale) transactions without a bank account, |

| 2. | reduce debit card fees for online and in-store point-of-sale (POS) transactions, |

| 3. | transfer money ultra-fast at ultra-low cost inside or outside the US (remittance), |

| 4. | access cash for zero fees regardless of network availability (everyone is an ATM) and |

| 5. | invest directly in the highest quality financial instruments (fractional ownership possible). |

Debit Card

Debit cards are too expensive; merchants are paying too much in fees when consumers pay using a debit card and debit card transactions take too long to settle. The debit card is used for purchasing transactions online and at point-of-sale (POS) and for cash withdrawals at automated teller machines (ATMs). Increasingly, ’the pipes’, which support debit cards, are also the backbone of peer-to-peer (P2P) money payment applications. In 2015 there were:

| 1. | 69.5 billion debit card transactions in the US with a total value of $2.56 trillion with |

| 2. | the fee and float income over $40 billion - the ‘debit card tax’ to the middleman |

The debit card tax is estimated to be as high as 1.5%. To put that in perspective, grocery store profit margins average 1-3%. Merchants bear the brunt of the direct costs but, ultimately, this translates into higher prices paid by consumers.

Debit card transactions are batch settled throughout the day (3 times per day on average). The best-case scenario is a same-day settlement. This still leaves open the possibility that a merchant could have a full 24 hours between the time a transaction is completed and the time when they can spend this ’new’ money. Same-day settlement is not the norm. Three of the leading P2P payment applications have cash-in-cash-out times that range from 2-8 days. This is a ‘promise of money’.

Remittance / P2P

The US international remittance market (from US to international) is large. Market size is estimated from $50B to $130B. Remittance fees average 6% of the amount sent with total fees approaching $6B. Trust, time to deliver / time to receive, cost and convenience are the major factors in selecting a remittance provider.

The internal US gift and transfer market (dominated by cash) is being addressed by a variety of P2P payment systems. This market (total amount transferred) is expected to approach $200B in 2020. Prices range from ‘free’ (must have a bank account which costs money) to as high as 4%. Without a common payments network, growth of the US P2P market will be subject to the same speed limitations as the debit card market.

The number of US users of mobile payment systems is expected to approach 150 million in 2020. But, within US international remittance market, the target audience is more identifiable such as US households that remit money monthly, have a bank account and use a smartphone. Most people are aware of the US to Mexico remittance corridor – roughly 12 million people send over $25 billion a year to Mexico from the United States - but, another good example is the ~ 500,000 Americans of Nigerian decent who send over $5 billion a year to Nigeria. The US to the World is the largest remittance corridor accounting for over 20% of the global remittance market. The Vermundi Dollar (VUSD) is perfectly suited to serve this market with a ‘time to deliver’ that is near instantaneous and ‘cost to deliver’ that is greater than 95% cheaper.

Unbanked and Underbanked

Adults without any formal financial accounts are called the ‘unbanked’. Globally, this number is 2 billion. In the U.S., there are 16 million unbanked. Invariably, the unbanked are poorer than those who are banked. Global mobile phone penetration is rapidly approaching 100% of the population - even the very poor have or will soon have mobile phones. Despite the near-universal availability of this tool, people are still trying to get the unbanked, banked. There are 4 primary service lines associated with banks:

| 1. | A = account(s): opening, oversight, maintenance and closing |

| 2. | C = cash-in-cash-out: the process of dealing with physical cash |

| 3. | T = transactions: banks are best at big but accommodate small |

| 4. | A = adjacencies: interest on deposits, loans, marketing data - the ‘everything else’ |

Banks run different models across the globe depending on different factors. Regulations play a huge part in determining the mix of services provided by banks. However, the one truth in banking is that banks lose money on the account process. They make up this loss on the other service lines. The banks cannot make up this loss on poor peoples’ accounts without subsidy. Subsidies have a very poor record of sustaining services. Services must be provided in a profitable manner to encourage the private sector to continue providing a service and innovating.

A bank account is not money. The global poor need more money. The only way to get them more money is to use better, digital money that can be delivered in scale at a much lower cost. The poorest people generally live in the countries with the weakest currency. People in the US and in the other developed economies love cash. This is a function of the fact that their currencies have been stable for a long time. But, ask a very poor person in a very poor country with very weak currency, if they prefer cash, and they will say they prefer better money regardless of whether it is cash or some other form.

VUSD and VST are geographically and network agnostic. Poor people want better money and want access to real investment opportunities. Give them VUSD and VST. The US market is the place to initiate the propagation of VUSD and VST to the world. This does not need to be done by regulation or edict. VUSD will gravitate to the developing world with US international remittance priming the pump and commerce pushing it further

Use Cases - Example Applications

Transfer money - every person is an ATM

On the flight into Las Vegas,Brianand his 3 new friends from work discussed VUSD, they were all users. This was fortuitous; because, later, as they walked into the casino, Brian realized he left his cash back at his hotel.

| • | Brian immediately sent each of his 3 friends 100 VUSD in exchange for $300 USD |

| • | he remained with the group and avoided a trip back to his hotel |

| • | he avoided the high ATM fees the casino charged |

| • | velocity of money was accelerated, unnecessary fees were avoided, no time was lost |

Dinner - pay a bill at a restaurant

Anna, her 5 friends and the restaurant all use VUSD. The bill for dinner is $300 USD, including tip. At the end of the meal, the 5 friends each send 50 VUSD to Anna’sdigital wallet.She immediately sends 300 VUSD to the restaurant’s VUSD digital wallet.

| • | the funds were immediately available forAnna’suse |

| • | the restaurant avoided debit card fees and avoided having significant cash on hand |

| • | the funds were immediately available for the restaurant’s use and the restaurant paid out tips to staff in VUSD to staff who were VUSD users |

| • | velocity of money accelerates, unnecessary fees avoided, security is increased |

Logistics - connecting money directly with shipping

The US Navy needs to ship 100 crates of meals-ready-to-eat (MRE) to a sub-Sahara location. This is a shipping job that is outside the normal Navy supply chain. A variety of private logistics firms are required for delivery.

| • | the 100 crates of MRE are located at US Navy Supply Depot Mechanicsburg PA. |

| • | the shipping clerk determines the best route for shipping and she puts RFID (radio-frequency identification) chips in each crate. These RFID chips also have smart contracts that have the necessary funds, in the form of VUSD, embedded |

| • | at each stage of the journey, a new logistics firm picks up the crates, verifies they are sound and accepts handoff. Following handoff of the crates, the firm that has completed their portion of the journey receives their fee in VUSD. The payment is done immediately and without any intervention by the Navy – the RFID chip with smart contract and VUSD embedded execute all transactions immediately |

| • | Each shipper, as part of the smart contract process, would have its own liability coverage. During the different ‘handovers’ of goods, shippers would turn on or off their liability depending on whether they were receiving or handing over the goods |

| • | once the Navy receives the shipment in the sub-Sahara location, the receiving clerk closes out the last portion of the smart contract and releases or holds back any funds held in escrow (early delivery bonus, late delivery penalty etc.) |

| • | velocity of money accelerates, workloads are reduced, liability is aligned with custody |

Micro-insurance

Driver ‘X’ is a freelancer. He engages with customers at will. Each time driver ‘X’ picks up a passenger, driver ‘X’ assumes additional liability for the passenger(s) in his vehicle.

| • | digital underwriters will compete to provide insurance based on where driver ‘X’ is picking up the passenger and which route they are taking |

| • | GPS technology could provide tracking such that as driver ‘X’ proceeds, the liability could be adjusted based on passing into or out of higher or lower liability ‘zones’ |

| • | for digital underwriters, the key to providing this service is surety of payment. The faster the underwriters receive payment and know their liabilities across all drivers, the more competitive their rates will be |

| • | velocity of money accelerates, costs are avoided by driver and insurer (no debit card fees), liability is aligned with payment, security is increased – passengers could base hiring decision on the liability coverage of the driver – no coverage, select another service provider |

Invoicing with audit trail - pay for a service

David was a budding entrepreneur with a growing landscape business. A new job came up with a large company that used many sub-contractors. The large company only paid via check or bank-to-bank transfer (ACH - automated clearing house) to maintain a strict audit trail.David couldn’t stand paying the very high check cashing fees at the near-by money service business (MSB) –Your Cash Now. He decided to get a business account at the local bank. The new job was going fine but:

| 1. | it was his only job that paid by check, |

| 2. | the job paid $100 per month, |

| 3. | his bank balance was never enough to waive the monthly bank charge of and |

| 4. | after 3 months, he paid more in fees than he would have at Your Cash Now. |

David joined Vermundi. He asked the large company to join Vermundi. They did. As a result, he:

| 1. | closed his bank account and eliminated the monthly fee, |

| 2. | avoidedYour Cash Now,accelerated his receivable for the job and |

| 3. | the large company maintained their need for strict audit while keeping a valued sub-contractor on the job. |

Messaging Platforms

There are numerous channels for communicating with, providing service to and offering products to people around the globe. Tencent’s ‘WeChat’ social media platform did not exist a decade ago. It now serves 900 million users monthly for everything from person to person communications, to paying a utility bill, to ordering a pizza. MTN Group along with Vodacom are now considered some of the largest ‘digital’ banks in Africa’, however, they’re not banks; they’re telecom companies. Regardless, together, they have over 30 million customers (growing by 500,000 per month) banking with them.

Vermundi will partner with mobile telecommunication companies in the developing markets to bring value added financial services. Telecommunication companies will become Vermundi users and will extend the Vermundi infrastructure to their customers. Telecommunication companies will:

| 1. | act as aggregators of demand that exists within their extended network, |

| 2. | participate in the trust as business entities or another trust, |

| 3. | conduct KYC/AML on their extended networks in accordance with the local law and regulations (which they are already doing for their ‘digital’ banking service), |

| 4. | have the same visibility of physical assets in the Vermundi trust and will, if they choose, be able to move their assets to the digital wallets of their customers outside of the control of Vermundi and |

| 5. | have legal claim to the physical assets in the trust. The physical assets in the trustNEVER MOVE only the digital records (VUSD and VST) move. |

The distribution channels required to deliver VUSD and VST to a global audience are already in place. During Lunar New Year 2017, 46 billion ‘digital’ Red Envelopes were exchanged between WeChat users. Each contained a small amount of money. Vermundi wants to put VUSD and VST in the ‘Red Envelopes’ of WeChat, Alipay, Baidu and any other social media platform looking to transfer digital assets. The users of these platforms do not require a bank account to hold US dollars or the securities of global companies, a digital wallet will suffice.

| 1. | Chinese social media platforms would be aggregators of demand and the single point for redistribution of these exciting new digital assets |

| 2. | in addition to sending local currency to their grandchildren for Lunar New Year, grandparents could send fractional shares of global companies in the form of VST - build wealth and have fun. |

The Competition

Other new market entrants are offering a broad spectrum of services which includes the digitization of different asset classes. Rather than thinking in terms of ‘direct competitors’ i.e. (McDonalds versus Burger King), Vermundi views the market in terms of ’system competition’ i.e. ‘new world versus old world’, ‘automobile versus horse & buggy’, ‘digital versus analog’ etc. Vermundi is not in competition with legacy banks, brokerages or money service businesses, Vermundi is in competition with ‘legacy system money’ and ‘legacy system securities’. It may very well be, for the foreseeable future, that intermediaries (such as banks brokerages and money service businesses) continue to play a very important role in financial and commercial transactions. Vermundi is providing better digital money and better digital securities for use by everyone. Regulation will be the driving force behind or the biggest hinderance to the adoption of these tools.

For example, a common definition of money is a store of value, a medium of exchange and a unit of account. Electronic legacy system money, when it is moving between locations, is not available as a medium of exchange. Therefore, electronic legacy system money, when it is moving between locations, is not money; it is the ‘promise of money’.

The U.S. dollar is the closest instrument we have to a global currency:

| A. | near-universal acceptance, |

| B. | $1,500,000,000,000 (1.5 trillion) physical cash in circulation (with > 50% outside the US) and |

| C. | trillions more in ‘electronic’, legacy system dollars sitting in depositories around the world. |

The term, electronic legacy system dollars, conjures up visions of U.S. dollars waiting patiently in the ‘cloud’ ready to spring into action. In practice, an electronic legacy system dollar is a ledger entry that identifies a known quantity of ’stored value’ in a depository institution which is associated with a specific account (person or entity). This stored value becomes ‘electronic legacy system money’ when electronic messages are sent between depositories over proprietary networks and request this stored value be moved from its present location to a new location.

Some general rules for electronic legacy system money are:

| A. | a depository account is required, |

| B. | it costs money to move money, |

| C. | it takes time to move money and |

| D. | it costs more money to move money faster. |

New mobile applications for payment, whether peer-to-peer (P2P), consumer-to-business (C2B) or business-to-business (B2B), are reliant on using existing networks to move electronic legacy system money from location to location. These networks have substantial legacy costs and constraints that cannot be reduced or eliminated with ’slick’ front-ends. Cryptocurrency (over 1,000 cryptocurrencies and ‘alt-coins’) competes in this space. But, after 9 years in the spotlight, with untold billions in free publicity, the total market value of the cryptoverse is < 50% of US physical cash in circulation. During this golden age of ‘crypto’, US cash in circulation has grown by more than 50% or $600B (~ 3x the market capitalization of Bitcoin (BTC)). For now, the verdict is in; global consumers either don’t understand the underlying stores of value for the different cryptocurrencies or they understand them but reject them. If users do not understand or reject a money’s store of value, it has little chance to become a utility for commerce.

A Vermundi Dollar (VUSD) is a digital U.S. dollar (USD). Digital tokens are created on a 1:1 basis with U.S. dollars placed in the trust. Participants (members of the trust) self-select to deposit dollars in the trust and receive VUSD in their digital wallet(s).

A Vermundi Security Token (VST) is a digital record of a security placed in the trust. Regulated broker dealers and other authorized entities self-select to deposit securities in the trust and remove securities from the trust (after redeeming their digital tokens).

VUSD and VST will be set apart from the competition by:

| ● | Compliance– will be compliant in the most important regulated markets – starting with the U.S. |

| ● | Stability- VUSD and VST will be backed by real-world assets of the highest quality |

| ● | Frictionless – real-world assets placed in the trust will not move within the trust. Legacy pipes will not be required |

| ● | Cost –will be ultra-low cost to spend, send and hold |

| ● | Familiarity and Predictability – there will be an easy to understand relationship between the digital tokens in circulation and the real-world assets placed in the trust which will back the digital tokens |

| ● | Transparency and Security– ‘What is in the jar?’ - all participants will see all assets in the trust and all digital tokens in circulation at all times |

| ● | Proof of Ownership – digital token holders will have legal claim to the percentage interest of the assets placed in the trust which will be represented by the digital tokens in circulation |

| ● | Proof of Reserve– will be transparent, dynamic, immutable and auditable |

| ● | Fungibility– digital tokens will be fully fungible with the real-world assets placed in the trust |

Company Management and Advisors

Senior Management

The evolution from legacy assets and pipes to digital requires an in-depth understanding of financial products, market structure and technology. It is not enough just to marry technology and products. Developing a liquid marketplace is a crucial step in successful adoption. The Vermundi team has the core skills to develop digital financial technology, launch financial products and build liquid markets.

Gregory Shinnick (Chief Executive Officer, founder) - A US and international financial services industry veteran with more than 20+ years expertise in electronic trading systems, market making, and derivative products. While at Creditex (2001-2008), he was a leading member of the team that launched the first electronic marketplace for credit derivatives. Greg was the founder, owner and principal of a US broker dealer (Global Trading Offshore later Kelson) which he successfully sold in 2012. He is a founder of Blue Ocean Financial Technologies Pte. Ltd. in Singapore (BOFT). In December of 2016, he completed an asset sale/purchase transaction with tZERO forming Blue Ocean Technologies LLC (BOT). BOT is the first transparent, electronic market center for trading US-listed securities during non-US trading hours, creating new opportunities for investment firms, traders, and individual investors to manage risk and take advantage of opportunities outside of US regular trading hours. He is a managing member of BOT. He is a US Navy veteran and holds a BS (Political Science) from the United States Naval Academy and an MBA (Finance) from the University of Pittsburgh.

Matthew O’Brien (Chief Strategy Officer, co-founder) - A financial services industry veteran of 20+ years with specialties in institutional international equity sales trading, market data, marketing, operations and product development. Developed and integrated online solutions for major financial services companies. Held capital market securities licenses in Hong Kong, Singapore and the US. He is a founder of Blue Ocean Financial Technologies Pte. Ltd. in Singapore (BOFT). In December of 2016, he completed an asset sale/purchase transaction with tZERO forming Blue Ocean Technologies LLC (BOT). BOT is the first transparent electronic market center for trading US-listed securities during non-US trading hours, creating new opportunities for investment firms, traders, and individual investors to manage risk and take advantage of opportunities outside of US regular trading hours. He holds a BS in Business Administration and Finance from Georgetown University.

Marcus Chad Arroyo (Chief Marketing Officer, co-founder)- A blockchain strategist and technology entrepreneur with specializations in IT project management, business strategy and marketing, operations management, and software development and implementation. Chad first recognized the importance of blockchain technology and the power of cryptocurrency in 2013, and he has been an evangelist for the technology ever since. He developed expertise in enterprise applications and networking technologies from his work at the Defense Information Systems Agency. He has extensive experience implementing strategy from his management consulting work at Deloitte. He has worked with small to large scale organizations in the public, private, and defense sectors. He is the former Executive Director of Bunker Labs New York City and current advisor and mentor where he supports numerous military veteran startups on growth and scaling, product development, marketing, execution, and fundraising. He is a US Navy veteran and holds a BS in Information Technology from the United States Naval Academy and an MBA from the University of Notre Dame.

Technology Advisory Team

Shawn Sloves (Chief Executive Officer and co-founder of Fundamental Interactions) - Shawn has over 20 years of experience in the financial services industry. He co-founded and was Head of Product & Strategy at Mantara Inc. In his five years at the firm he developed a suite of low latency trading and infrastructure products, widely deployed across firms and backed by over $40 million in invested venture capital. Prior to Mantara, as a senior executive at SunGard, he ran product management and development for their market making direct access platforms that were widely deployed across tier-one brokers - during that period, over 70% of over-the-counter (OTC) trading volume was executed thru their direct market access (DMA) systems. In addition, he was the product manager of BRUT, the electronic communications network (ECN), where he developed the listed trading capabilities of the ECN. Shawn also worked at Optimark Technologies, a pioneer in dark pools. He holds degrees from Ohio State University & the University of Massachusetts at Lowell and a graduate degree from Montclair State University.

Julian Jacobson (President and Chief Operating Officer of Fundamental Interactions) - He is a business partnerships and institutional sales professional with significant experience in financial technologies with large global prime brokers and global execution management systems. Julian has over 18 years of experience in the electronic trading industry and holds his MBA from the Kelley School of Business in Marketing & Finance and BA from the University of Colorado Boulder.

Kun Luo (Chief Technology Officer of Fundamental Interactions) – A seasoned engineering leader with specialties in alternative trading systems (ATS), algorithms, smart order routers, and sponsored access products. Kun has built and delivered order gateway and high-volume trading systems. He holds an MS in Electrical Engineering and Computer Information Sciences as well as a BS in Applied Physics.

Capital Markets Advisory Team

Peter Jardine - An international investment banker with almost 40 years of experience in financial global capital markets. Peter has listed more than 50 companies on 4 different exchanges; including IBM, Prudential, Sun International, Iscor and Tanzanian Breweries. He advised on the setting up of 3 African Stock Exchanges and has advised companies, governments, regulators and exchanges on 3 continents. He helped establish a boutique West African investment bank, Constant Capital Partners in 2009 before heading up Constant Capital South Africa. He established the first broker dealer and sponsor advisory firm in the Seychelles and listed the first four companies on the Seychelles Securities Exchange. Most recently, he was the CEO of Marco Polo Securities a US registered broker dealer that specialized in chaperoning foreign financial institutions promoting their products and services to US Institutional Investors. In 2001, he co-founded Marco Polo Network, ran the broker network and he was responsible for getting 200+ local brokers from 60 emerging markets on the network. He is a graduate of Stellenbosch University with a Bachelor of Arts and a Bachelor of Laws (BA) (LL.B.). He is a FINRA-registered principal holding Series 24, 7 and 63 licenses.

Brian Rathjen -A financial services industry veteran with more than 20+ years expertise in capital placement, fixed income sales and new brokerage development. Brian raised over USD $11 billion from the institutional marketplace while at Marwood Group (9 years) and Kelson Group (7 years, founding partner). He purchased his first brokerage, Kelson Capital (formerly Global Trading Offshore), in 2012. He is the Executive Manager and driving force behind the revitalization of Roberts & Ryan – one of the oldest service-disabled, veteran owned brokerages in the United States. In 2017, he put together the team, raised the capital and repositioned Roberts & Ryan to compete across several institutional products including debt capital markets, secondary trading of fixed income and equity securities and municipal finance. He is on the Board of Directors for Boulder Crest Retreat an organization dedicated to improving the health and wellness of combat veterans. He is a Trustee of the Athletic Scholarship Foundation for the United States Naval Academy. He is a US Navy veteran and holds a Bachelor of Science (Economics) from the United States Naval Academy. He is a FINRA registered principal holding Series 24, 7, 63, 66 and 3 licenses.

John Shinnick -A 25-year financial industry professional with extensive international experience. John is currently Senior Vice President Allied World Assurance, Hamilton Bermuda. He is an expert in using traditional and non-traditional reinsurance structures to manage natural hazard, systemic insurance exposures, syndicate risk and to preserve capital. He has developed and executed the strategy for company enterprise risk management. He has extensive experience with insurance linked securities (ILS), industry loss warranties and alternative capital providers. John is a proven and skilled negotiator actively managing an extensive network of long-standing, relationships with international financial institutions. He is a former US Marine Corps officer and a decorated naval aviator. He received his B.A. from the University of Pennsylvania and completed numerous courses of study at the College of Insurance, New York, New York includingARe 141 and 142.

Government Regulation: Crypto-regulatory Environment

The crypto-regulatory environment is dynamic. Today’s regulations will likely be updated across jurisdictions to address the new crypto landscape and the complexities associated with it. Many digital/crypto enterprises are taking an ‘eyes wide shut’ approach – ‘if I don’t make too much noise, maybe they won’t see me’.

Vermundi will position itself as a top tier financial software, technology and service provider. By seeking out relationships with US regulated broker dealers and other authorized entities, the Company will be operating in proximity to the largest capital market in the world. Some of the best and most in-demand securities originate in this market. The US securities market is overseen by numerous regulatory agencies and self-regulatory organizations (SRO). The two most important are the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). Although the Company is not a regulated entity, it must always operate in such a way so as not to encroach on those areas of business which are the purview of regulated entities.

It is important that a firm operate in accordance with its home regulatory requirements first and then create the right structure in other jurisdictions as operations expand. This is precisely the Company’s plan. It is conceivable that the SEC will choose to view VUSD and VST as securities or derivative financial instruments. An alternative view, from the perspective of the US Department of the Treasury and FinCEN (Financial Crimes Enforcement Network), is that VUSD and VST could be viewed as convertible virtual currencies.

It is incumbent on Vermundi to take the right approach and to prepare to be regulated by different regulatory authorities until the law catches up with the technology. The world view of regulators is informed by ‘fact and circumstance’ – it’s not what you say you are, it’s what you are doing. Many existing and soon-to-be launched crypto-technology companies may be subject to investigation by their fact and circumstance.

Vermundi will form relationships with regulated broker dealers and other authorized entities. The Company will adjust its posture in response to the regulations set forth by regulators and will be well positioned to be viewed as agood-actor as the regulatory environment evolves:

| A. | when a partnership is required it will form one, |

| B. | when a license is required, it will obtain one and |

| C. | when the law does not apply, Vermundi will seek exemption or ‘no action’ letters. |

Intellectual Property

We do not currently hold any patents. It is very difficult to obtain patent protection for financial software, financial technology and financial industry processes. We will evaluate opportunities for securing patent protection as they present themselves but, the Company does not believe it is likely that such patent protection will be granted. We do intend to trademark the Company name, product names and any logos we create.

Item 8. Description of Property

The Company does not own any real property such as land, buildings or physical plants. The Company has not entered into any lease agreement or any other major property encumbrance.

Item 9. Management’s Discussion and Analysis of Financial Condition

You should read the following discussion and analysis of our financial condition together with our financial statements and the related notes and other financial information included elsewhere in this Offering Circular You should review the “Risk Factors” section of this prospectus for a discussion of important factors that could cause actual future results to differ materially from the results described in or implied by the statements contained in the following discussion and analysis.

Our financial statements are stated in United States Dollars (USD or US$) and are prepared in accordance with United States Generally Accepted Accounting Principles (GAAP). All references to “common shares” refer to the Common Shares of our authorized capital stock.

Operating Results

Vermundi Inc. is an emerging growth company withNO Operating History. The Company’s proposed operations are subject to all the business risks associated with early, growth stage companies. The likelihood of the Company’s success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered in connection with the launch of a new business and the continued development of the business method. We may never operate profitably. To date, there has been no revenue and no significant expense related to the operations of the Company.

Liquidity and Capital Resources

The Company has limited capital resources. In January 2018, the Company received $48,000 in paid in capital to fund the Offering and support other general and administrative activities of the Company. The Company’s capital resources are in the form of cash (US dollars) held in in a U.S. bank account that has FDIC insurance up to $250,000. In January 2018, the Company filed a Certificate of Amendment Certificate of Incorporation changing the Article thereof numbered “FOURTH:” so that as amended said Article shall be read as follows:“The amount of total authorized capital stock of the corporation shall be divided into 100,000,000 shares of common stock having a par value of $.0001 each.”. Therefore, the Company is offering, through this Offering Circular, 10,000,000 shares of Common Stock in the Company at $5 per share to investors to raise up to $50,000,000 in new capital. The expenses of this offering include the preparation of this Offering Circular, the filing of this Offering Circular and developing the business plan.

Plan of Operations

The Company is an American financial software / technology company committed to building the digital bridge between the cryptoverse and the legacy financial system. Vermundi will combine blockchain/distributed ledger technology (DLT), a US trust account and together with regulated broker dealers and other authorized entities will deliver the highest-quality digital financial assets to a global audience.

We anticipate that the $50,000,000 we intend to raise in this offering will be sufficient to enable us to execute our business plan, including, but not limited to securing our base of operations and any updates and/or modifications to the business plan; acquiring equipment and infrastructure; strengthening the management team, adding key personnel; and achieving growth by way of licensing and key partnerships.

It is the opinion of Company management that the proceeds from this proposed offering will satisfy the Company’s need for liquidity and cash requirements and put the Company in a position to grow its business in accordance with its business plan. The proceeds from this offering are expected to satisfy our cash requirements for up to 24 months. Please refer toTable 4 (Item 6 Use of Proceeds), for the Company’s planned use of proceeds to be generated from this proposed offering.

Phase 1: Month 1 to Month 6 – Infrastructure, Management and Key Personnel

First, we intend to identify suitable property for offices and product development in/around New York City. At this time, we have not entered into any negotiations or agreements for the lease of real property. Fundamental Interactions, a key relationship of the Company, is providing interim office space.

Concurrent with securing our base of operations, we intend to expand the Board of Directors, hire additional management team members and hire additional key personnel. Gregory Shinnick will serve as Chief Executive Officer.

We intend to secure a US trust account with a highly rated trust company or bank. We will engage a law firm that specializes in trust law and complete the Master Trust Agreement, ‘the agreement’, which will govern the activities of our US trust account. The agreement will be, in its most basic form, a Master Trust Agreement with Series.

We will integrate private, distributed ledger technology (private blockchain) with the reporting tools provided by the trust company or bank where we will have our US trust accounts. The private, distributed ledger technology (private blockchain) will then be integrated with the public blockchain to provide an immutable record of the state of the trust at all times.

Phase 2: Month 7 to Month 12 – Customer Acquisition and Product Distribution

Our Marketing Strategy will include social media outlets (Facebook, Instagram, Reddit, Linkedin, Slack, Telegram, Twitter etc.), web advertising as well as information provided on the Company’s web site when completed.

Prior to Phase 2: Month 7 to Month 12, the Company will begin its Marketing & Sales efforts. However, during Months 7 to Month 12, the Company will aggressively step up its outreach to potential customers. Marketing will focus on end-users, additional regulated broker dealers and other authorized entities in the US and in non-US jurisdictions and actual sales will begin in the US together with regulated broker dealers and authorized entities.

Trend Information

The Vermundi team closely analyzed the initial coin offering market (ICO). Rather than conduct an ICO, the Company decided to conduct a public offering using the Regulation A qualification standard which the Company believes provides greater investor protection than comparable ICOs.

The ICO market is seeing many utility coin offerings. Many of these offerings are being done from jurisdictions and under regimens that are considered less ‘onerous’ and they often prohibit participation by US citizens – because they know they do not meet US regulatory requirements. The amount of money being raised from these coin/token sales is significant.

Typical ICO sellers offer their coins to early investors at large ‘discounts’. There is the unspoken implication these tokens will trade in the secondary markets at much higher values. Some of these tokens do provide alternative value such as data storage and future price discounts but, most early stage investors are speculating exclusively on the value of these tokens in a secondary market. In many jurisdictions, the sale of a utility token is a revenue event as opposed to a capital raise. Revenue events can trigger tax consequences. Some ICO entrepreneurs take the approach that they can counter their tax bill by maximizing their expenses – an unproven and uneconomic approach. This begs the question: is the objective to be a great business or to have a successful capital raise with a justifiable deployment of proceeds?

Item 10. Director and Executive Officers

The following table lists the current Director and Officers of the Company. Our plan is to expand the Board of Directors, add a full time Chief Technology Officer and a full time Chief Financial Officer and other top-level positions that will help the Company grow.

Table 5

Director and Executive Officers

| Name1 | Position | Age | Term of Office | Approximate Hours Per Week for Part-Time Employees |

| Gregory Shinnick | Director & CEO | 54 | Inception to Present | |

| Matthew O’Brien | Chief Strategy Officer | 48 | Inception to Present | |

| Chad Arroyo | Chief Marketing Officer | 34 | Inception to Present | |