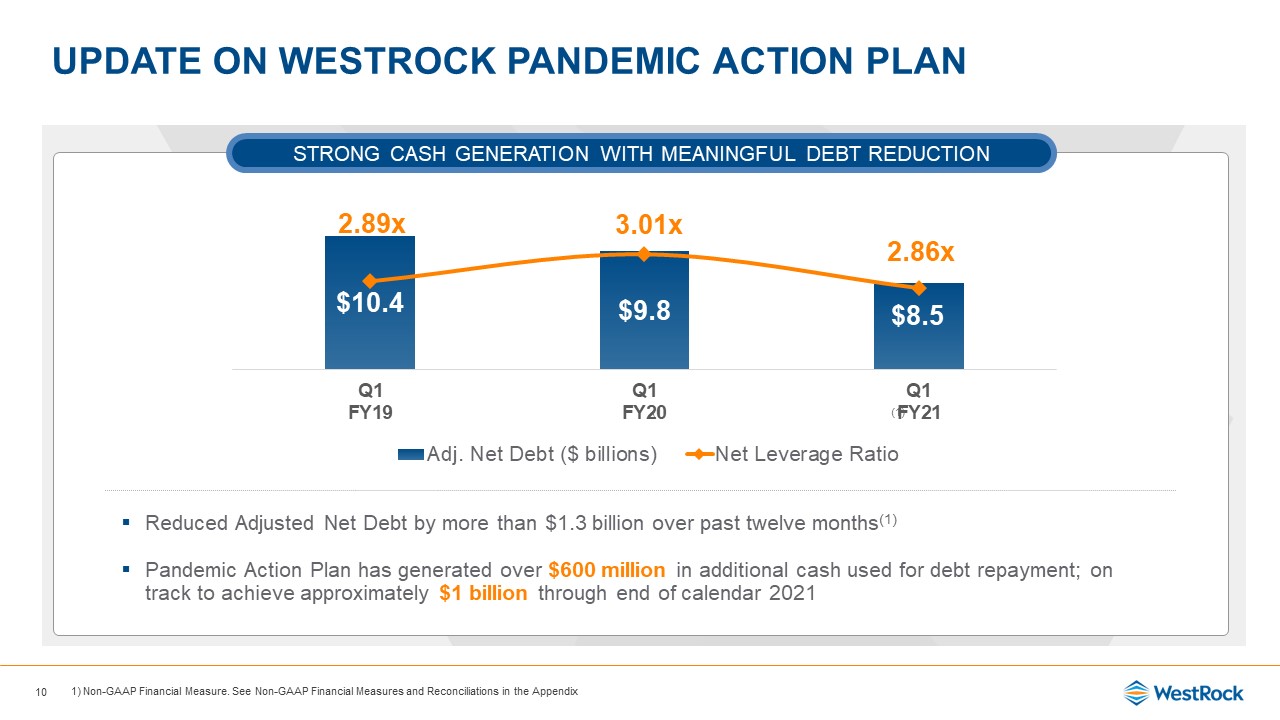

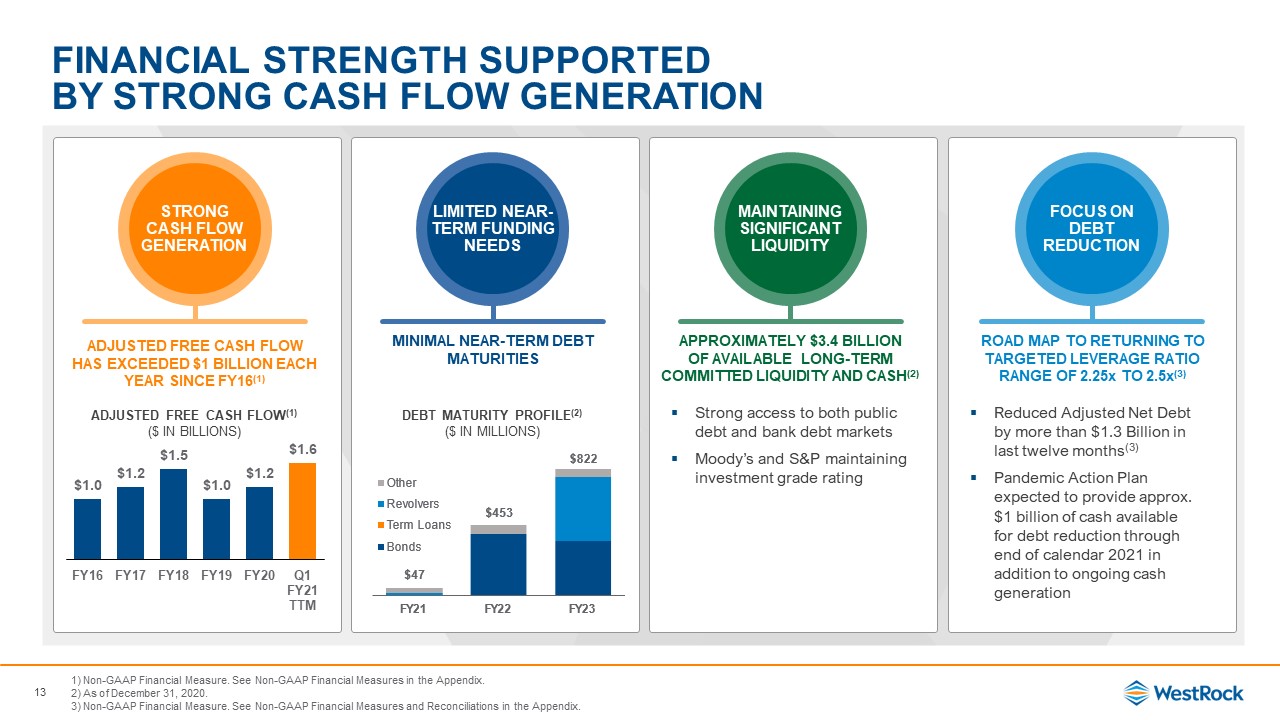

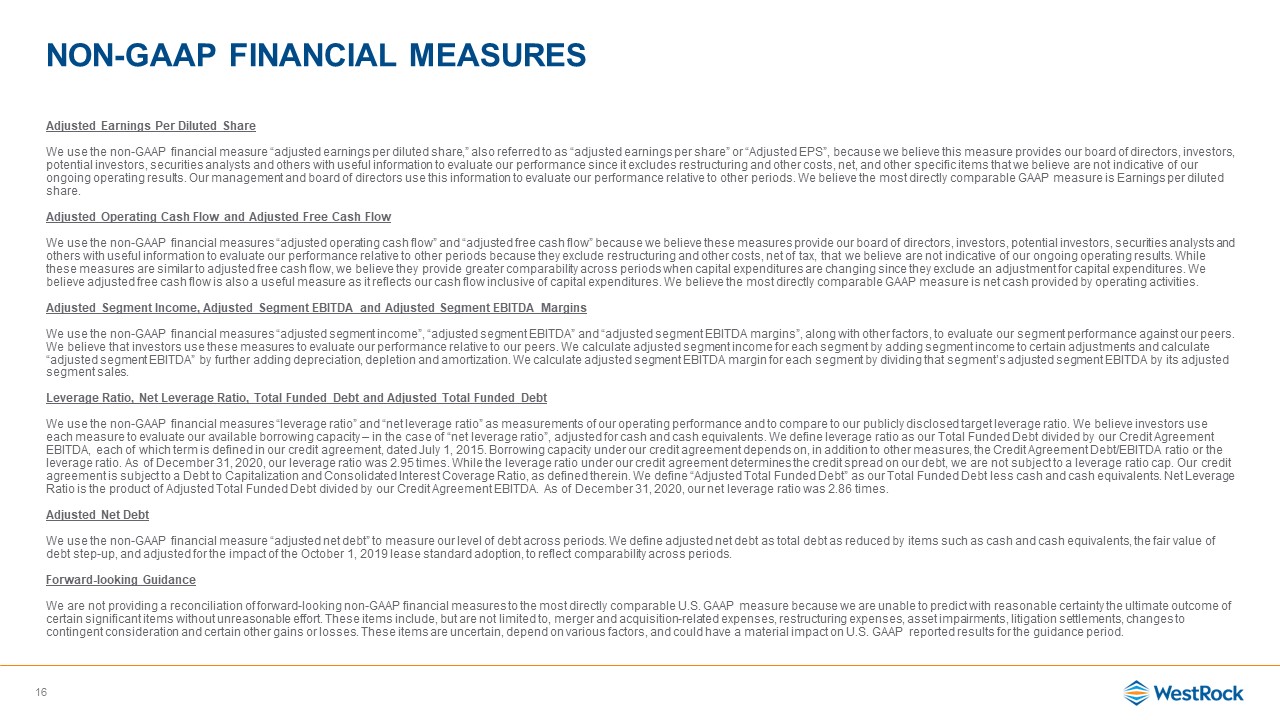

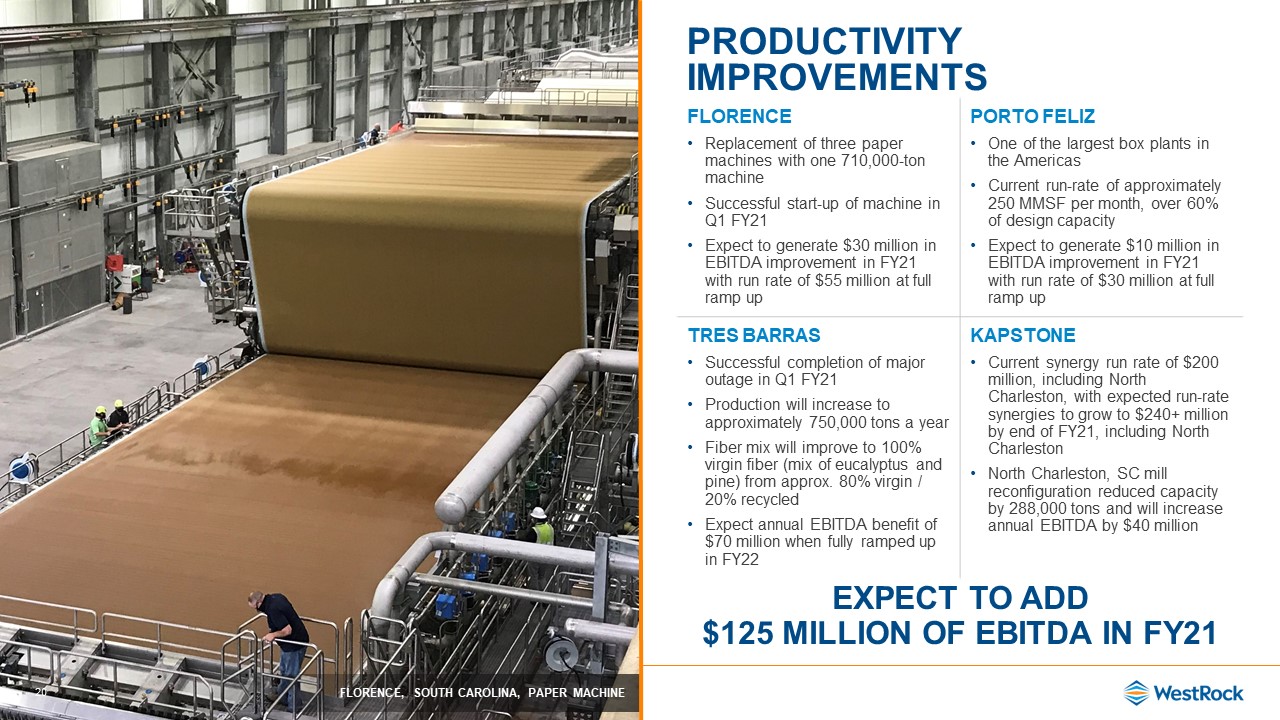

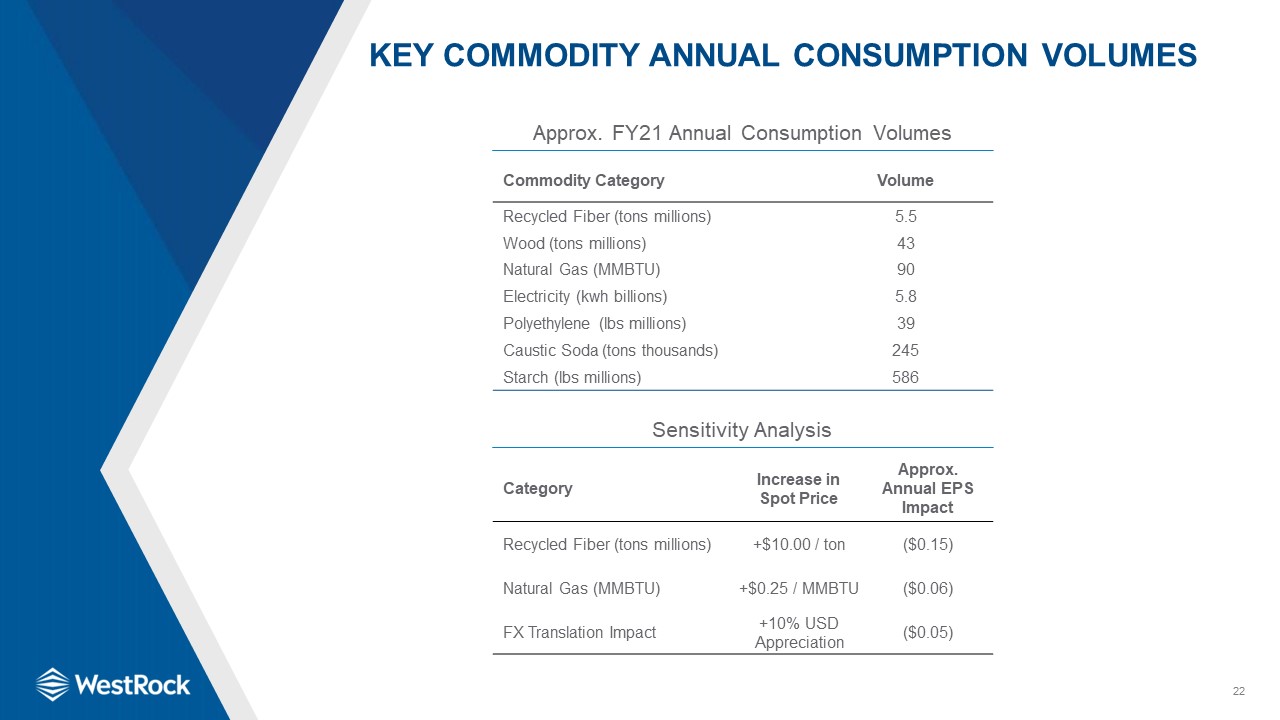

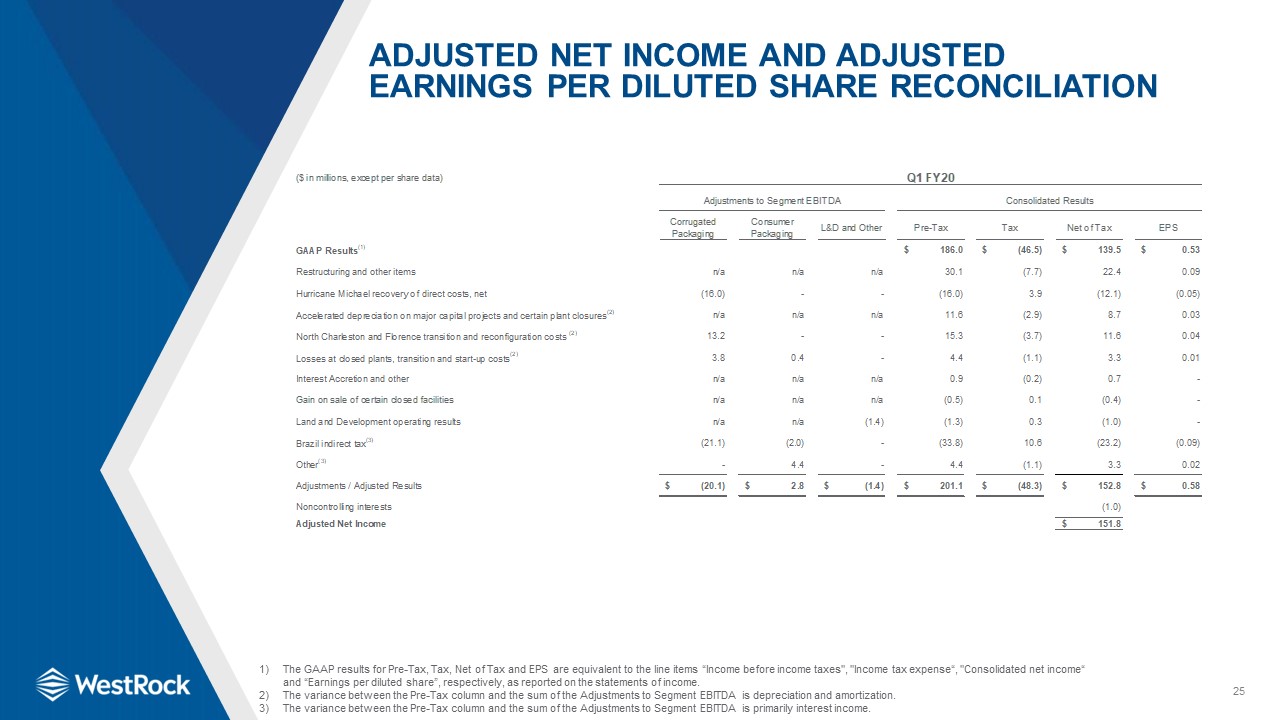

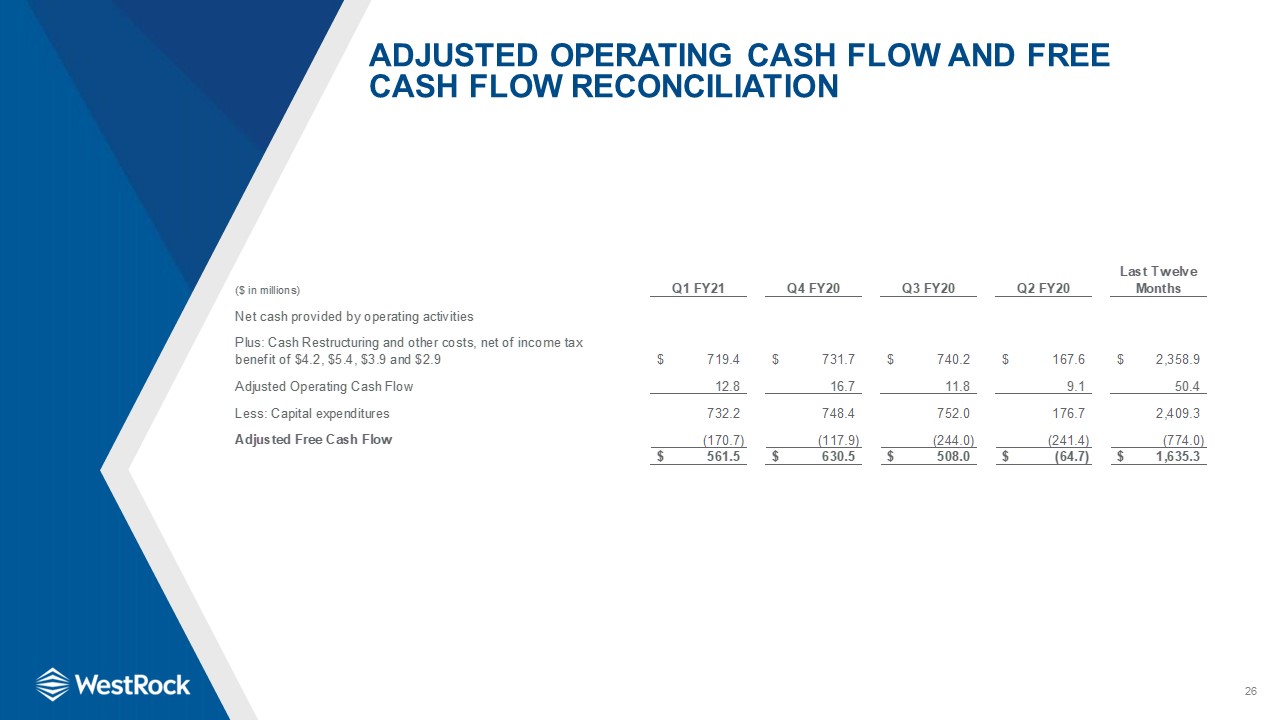

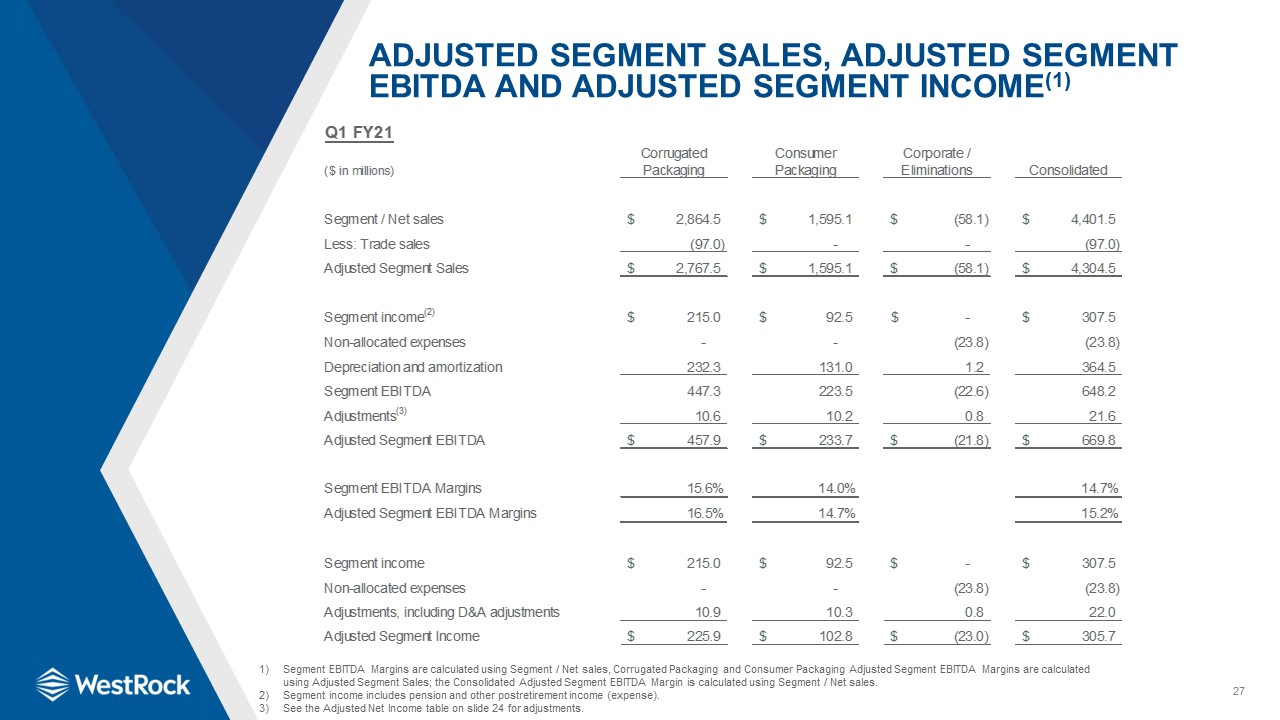

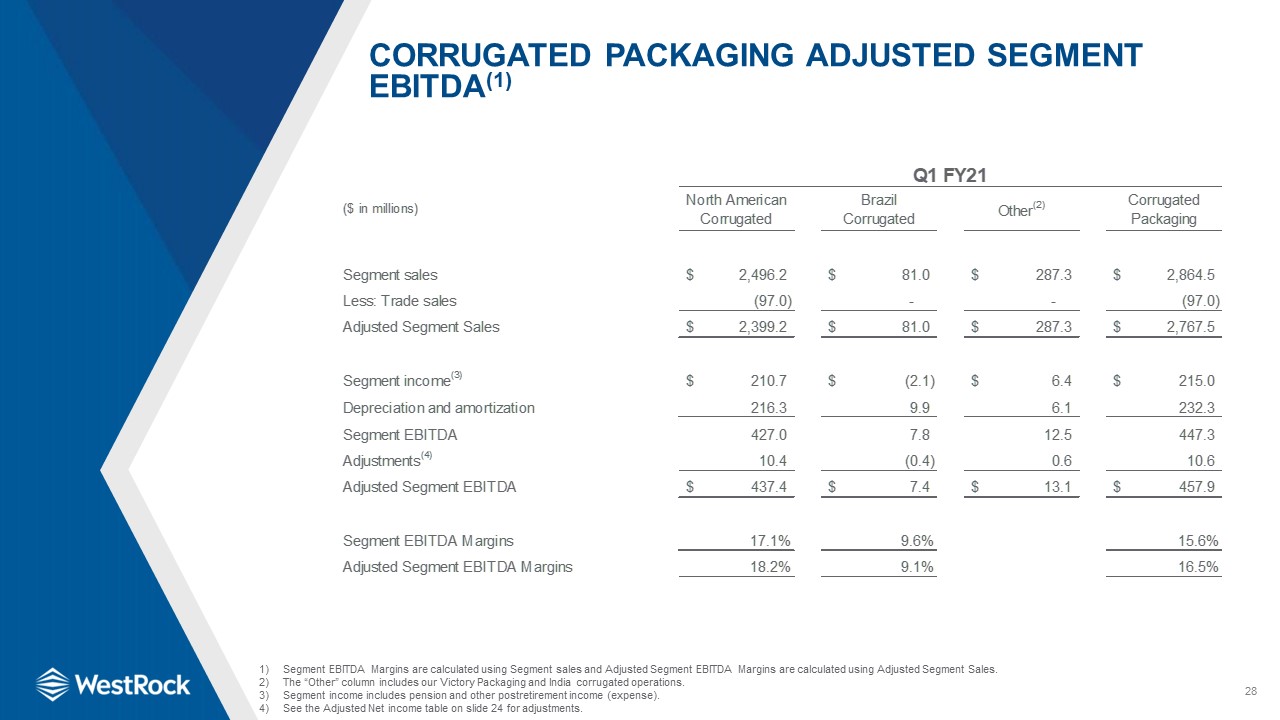

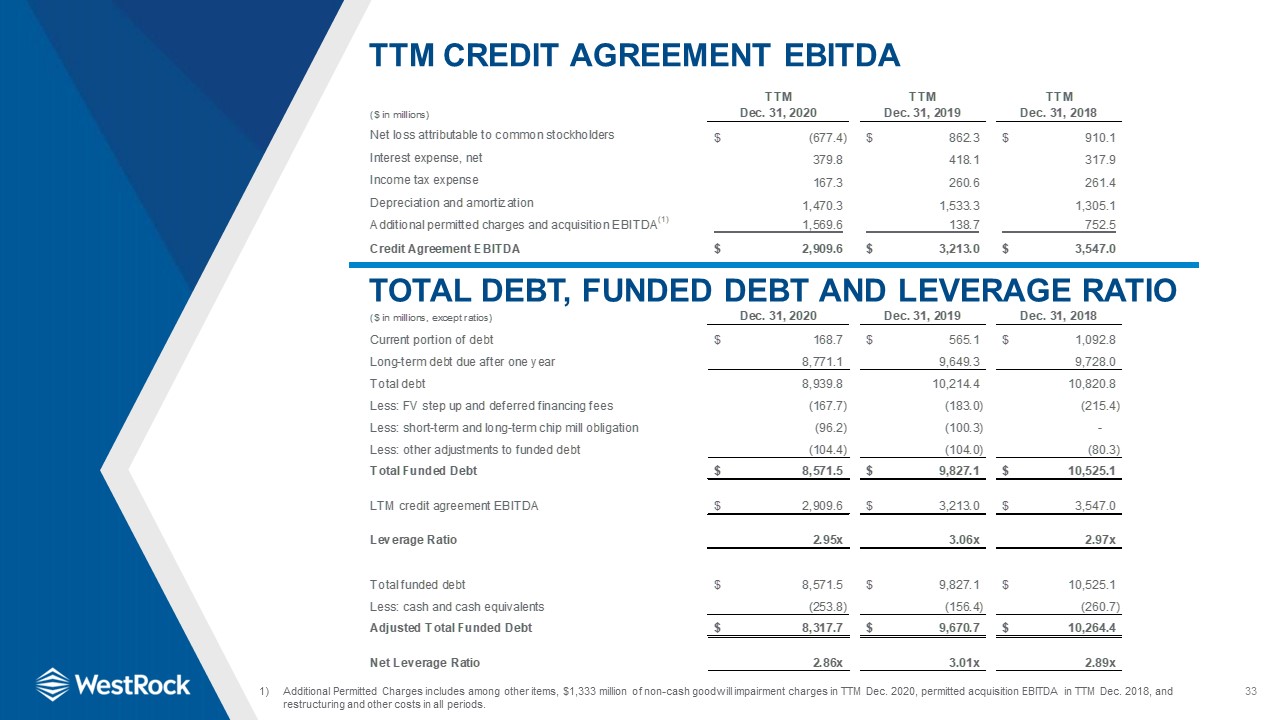

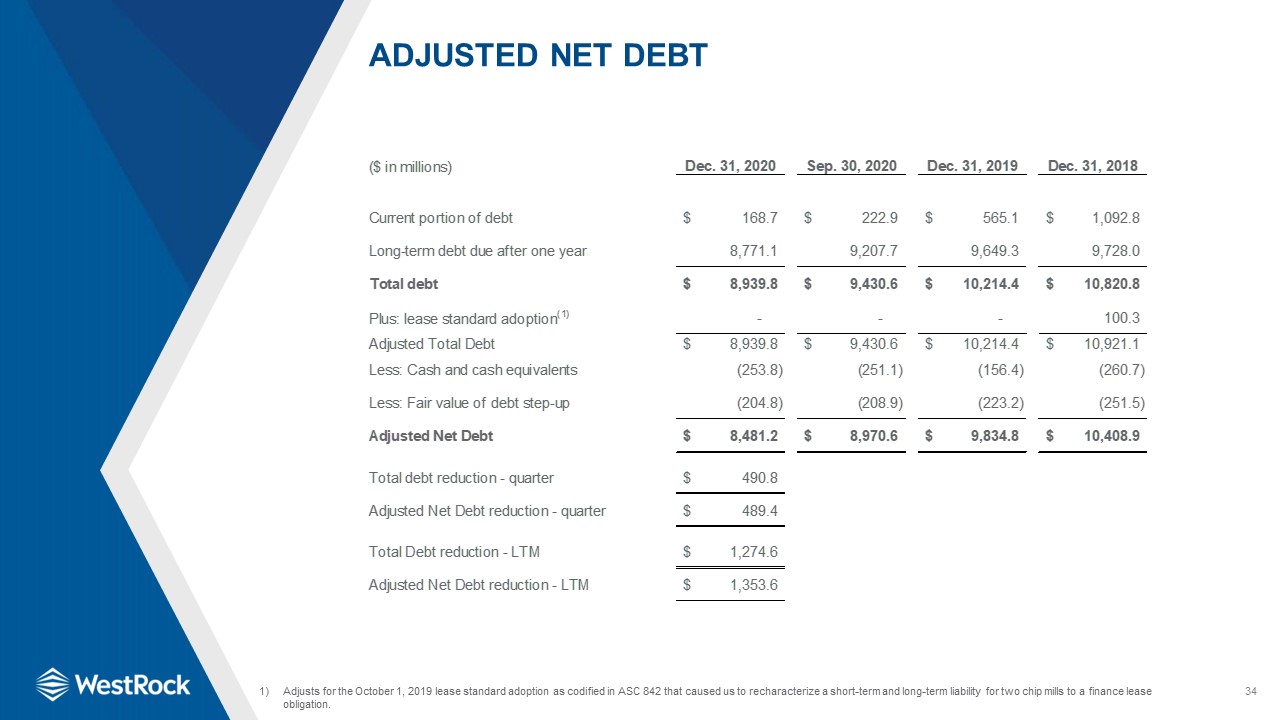

Forward Looking Statements:This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including but not limited to the statements on the slides entitled “Productivity Improvements”, “Update on WestRock Pandemic Action Plan”, “Capital Allocation Priorities”, “Financial Strength Supported by Strong Cash Flow Generation”, “WestRock: Creating Value”, “Key Commodity Annual Consumption Volumes”, and “Mill Maintenance Schedule” that give guidance or estimates for future periods as well as statements regarding, among other things, (i) our expectation that (A) the Florence, SC mill capital project will generate $30 million in EBITDA improvement in FY21 with a run rate of $55 million at full ramp up, (B) our expectation that the Porto Feliz project will generate $10 million in EBITDA improvement in FY21 with a run rate of $30 million at full ramp up, (C) that, with respect to Tres Barras, production will increase to approximately 750,000 tons a year, fiber mix will improve to 100% virgin fiber and we expect annual EBITDA benefit of $70 million when fully ramped up in FY22 and (D) our expectation that run rate synergies from the KapStone acquisition will grow to more than $240 million by the end of FY21 and (E) that annual EBITDA at the North Charleston, SC mill will increase by $40 million; (ii) that we expect to add $125 million of EBITDA in FY21 as a result of the productivity improvement projects listed on slide 20; (iv) that the Pandemic Action Plan is on track to achieve approximately $1 billion of savings through calendar 2021 and is expected to lead to meaningful debt reduction as set forth on slide 10; (v) that we expect to invest $800 to $900 million in capital investments in FY21; (vi) that we intend to invest to further enhance our cost position while pursuing growth opportunities; that we have an annual capex target of $900 million to $1 billion; (vii) that we have near-term priorities of reducing debt levels and returning to a net leverage ratio of 2.25x to 2.5x and returning capital to stockholders through a competitive annual dividend; (viii) that we have medium-term priorities of maintaining a net leverage ratio of 2.25x to 2.5x, paying a competitive and growing dividend supplemented with opportunistic share repurchases and targeted M&A opportunities focused on improving vertical integration; (ix) that the WestRock Pandemic Action Plan is expected to provide approximately $1 billion of cash available for debt reduction through the end of calendar 2021 in addition to ongoing cash generation; (x) that we have a road map to return to our targeted leverage ratio range of 2.25x to 2.5x; and (xi) the key commodity annual consumption volumes on slide 22. Forward-looking statements are based on our current expectations, beliefs, plans or forecasts and are typically identified by words or phrases such as “may,” “will,” “could,” “should,” “would,” “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “target,” “prospects,” “potential” and “forecast,” and other words, terms and phrases of similar meaning. Forward-looking statements involve estimates, expectations, projections, goals, forecasts, assumptions, risks and uncertainties. WestRock cautions readers that a forward-looking statement is not a guarantee of future performance and that actual results could differ materially from those contained in the forward-looking statement. WestRock’s businesses are subject to a number of risks that would affect any such forward-looking statements, including, among others, developments related to the COVID-19 pandemic, including the severity, magnitude and duration of the pandemic, negative global economic conditions arising from the pandemic, impacts of governments’ responses to the pandemic on our operations, impacts of the pandemic on commercial activity, our customers and consumer preferences and demand, supply chain disruptions, and disruptions in the credit or financial markets; decreases in demand for their products; increases in energy, raw materials, shipping and capital equipment costs; reduced supply of raw materials; our ongoing assessment of the recent ransomware incident, adverse legal, reputational and financial effects on us resulting from the incident or additional cyber incidents and the effectiveness of our business continuity plans during the ransomware incident; fluctuations in selling prices and volumes; intense competition; the potential loss of certain customers; the scope, costs, timing and impact of any restructuring of our operations and corporate and tax structure; the occurrence of a natural disaster, such as hurricanes or other unanticipated problems, such as labor difficulties, equipment failure or unscheduled maintenance and repair; risks associated with integrating KapStone’s operations into our operations and our ability to realize anticipated synergies and productivity improvements; risks associated with completing our strategic capital projects on the anticipated timelines and realizing our anticipated EBITDA improvements; benefits that we expect to realize from actions that we are taking and plan to take in response to COVID-19; and adverse changes in general market and industry conditions. Such risks and other factors that may impact management’s assumptions are more particularly described in our filings with the Securities and Exchange Commission, including in Item 1A under the caption “Risk Factors” in our Annual Report on Form 10-K for the year ended September 30, 2020. The information contained herein speaks as of the date hereof and WestRock does not have or undertake any obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise.Non-GAAP Financial Measures:We report our financial results in accordance with accounting principles generally accepted in the United States (“GAAP”). However, management believes certain non-GAAP financial measures provide users with additional meaningful financial information that should be considered when assessing our ongoing performance. Management also uses these non-GAAP financial measures in making financial, operating and planning decisions and in evaluating our performance. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, our GAAP results. The non-GAAP financial measures we present may differ from similarly captioned measures presented by other companies.We may from time to time be in possession of certain information regarding WestRock that applicable law would not require us to disclose to the public in the ordinary course of business, but would require us to disclose if we were engaged in the purchase or sale of our securities. This presentation shall not be considered to be part of any solicitation of an offer to buy or sell WestRock securities. This presentation also may not include all of the information regarding WestRock that you may need to make an investment decision regarding WestRock securities. Any investment decision should be made on the basis of the total mix of information regarding WestRock that is publicly available as of the date of the investment decision. Forward Looking Statements; Non-GAAP Financial Measures 2