Articles of Agreement. At this point, a formal application would then be made by the applicant, which would be signed by the applicant’s competent authority, such as Head of Government, Head of State or Foreign Minister. Upon receipt of the membership application, the terms and conditions of membership (including the maximum number of shares of the Bank to which the applicant may subscribe) would be recommended by the Board of Directors to the Board of Governors for their approval. Following approval by a special majority of the Board of Governors, the applicant would prepare the necessary domestic authorization and legislation to become a member, and take other steps required for membership, including making payment of a first installment for subscribed paid-in shares, appointing a Governor and Alternate Governor and assigning votes to a Director.

There are 57 signatories to the Articles of Agreement, three of which, as of the date hereof, have not yet ratified, approved or accepted the Articles of Agreement. Consequently, the Bank currently has 54 founding members. As of the date hereof, the Bank has 68 members (44 regional and 24 non-regional). See “Table 1: Membership and Capital Allocation” below. The Bank also has 19 prospective members (six regional and 13 non-regional). Prospective members denote those jurisdictions whose membership applications have already been approved by the Board of Governors, but that have not become members yet. The Bank’s prospective regional members are: Armenia, Cook Islands, Kuwait, Lebanon, Papua New Guinea and Tonga. The Bank’s prospective non-regional members are: Argentina, Belarus, Belgium, Bolivia, Brazil, Chile, Ecuador, Greece, Kenya, Peru, Romania, South Africa and Venezuela.

If a member fails to fulfill any of its obligations to the Bank, the Board of Governors may suspend such member by an affirmative vote of two-thirds of the total number of Governors, representing not less than three-fourths of the total voting power of AIIB’s members (a “super majority” vote). A suspended member automatically ceases to be a member one year from the date of its suspension, unless the Board of Governors decides by a super majority vote to restore the member to good standing. Other than the right of withdrawal, a suspended member is not allowed to exercise any rights under the Articles of Agreement, but remains subject to all the Articles of Agreement’s obligations.

Capital Structure

The authorized capital of the Bank consists of US$100,000,000,000 divided into paid-in shares having an aggregate par value of US$20,000,000,000 and callable shares having an aggregate par value of US$80,000,000,000. As of September 30, 2018, the members had subscribed an aggregate of US$96,186,700,000 of the Bank’s share capital, of which US$19,237,400,000 is paid-in and US$76,949,300,000 is callable.

Payment of subscribed, paid-in capital is due in five installments, except for members designated as less developed countries, which may pay in up to ten installments. As of September 30, 2018, US$12,792,485,043 had been received from members, all in convertible currency, and US$6,443,074,817 was not yet due. Capital subscriptions may be paid in United States dollars or in other convertible currency. However, to the extent that a member is a less developed country, the member may pay a portion of up to 50% of each installment in the currency of the member, with the Bank having discretion as to what amount is equivalent to the full value in terms of U.S. dollars and the member maintaining the value of all such currency held by the Bank should the member’s currency depreciate in the Bank’s opinion.

The authorized capital stock of the Bank may be increased only by a super majority vote by the Board of Governors.

Total voting power of each member consists of the sum of its basic votes, share votes and, in the case of a founding member, its founding member votes. A member’s basic votes equal 12% of the

-6-

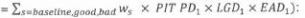

where ws is the weight of each scenario – 50% for Baseline, 25% for both Good and Bad scenarios.

where ws is the weight of each scenario – 50% for Baseline, 25% for both Good and Bad scenarios.