Asian Infrastructure Investment Bank

Notes to the Financial Statements

For the year ended Dec. 31, 2018

(All amounts in thousands of US Dollars unless otherwise stated)

A General Information

The Asian Infrastructure Investment Bank (the “Bank” or “AIIB”) is a multilateral development bank. By the end of year 2015, representatives from 57 countries signed AIIB’s Articles of Agreement (AOA) which entered into force on Dec. 25, 2015. The Bank commenced operations on Jan. 16, 2016. AIIB’s principal office is in Beijing, the People’s Republic of China (PRC).

For the year ended Dec. 31, 2018, AIIB has approved nine new membership applications. As at Dec. 31, 2018, the Bank’s total approved membership is 93, of which 69 have completed the membership process and have become members of AIIB in accordance with the AOA.

AIIB’s purpose is to (i) foster sustainable economic development, create wealth and improve infrastructure connectivity in Asia by investing in infrastructure and other productive sectors; and (ii) promote regional cooperation and partnership in addressing development challenges by working in close collaboration with other multilateral and bilateral development institutions.

The legal status, privileges and immunities for the operation and functioning of AIIB in the PRC are agreed in the AOA and further defined in the Headquarters Agreement between the government of the People’s Republic of China (the “Government”) and the Bank on Jan. 16, 2016.

These financial statements were signed by the President, the Vice President and Chief Financial Officer, and the Acting Controller on April 3, 2019.

B Accounting Policies

B1 Basis of preparation

These financial statements for the Bank have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). According to By-Laws of AIIB, the financial year of the Bank begins on Jan.1 and ends on Dec. 31 of each year.

The Bank has adopted all of the IFRS standards and interpretations effective for annual periods beginning on Jan. 1, 2018. In addition, the Bank has adopted IFRS 9 Financial Instruments (full version issued in July 2014 and mandatorily effective on Jan. 1, 2018), IFRS 15 Revenue from Contracts with Customers (mandatorily effective on Jan. 1, 2018), and IFRS 16 Leases (mandatorily effective on Jan. 1, 2019) from the commencement of operations.

The financial statements have been prepared under the historical cost convention, except for those financial instruments measured at fair value.

The preparation of financial statements in conformity with IFRS requires the use of certain critical accounting estimates. It also requires management to exercise judgment in its process of applying the Bank’s accounting policies. The areas involving a higher degree of judgment or complexity, or areas where judgments or estimates are significant to the financial statements are disclosed in Note B4. The financial statements have been prepared on a going concern basis.

9

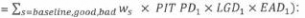

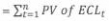

where ws is the weight of each scenario – 50% for Baseline, 25% for both Good and Bad scenarios.

where ws is the weight of each scenario – 50% for Baseline, 25% for both Good and Bad scenarios.