Asian Infrastructure Investment Bank

Notes to the Financial Statements

For the nine months ended Sep. 30, 2019

(All amounts in thousands of US Dollars unless otherwise stated)

| D | Financial Risk Management |

| D3 | Credit risk (Continued) |

Credit risk management (Continued)

| | • | | Nonsovereign-backed financings |

The Bank provides private enterprises and state-owned or state-controlled enterprises with loans and investments that do not have a full member guarantee. However, the Bank retains the right, when it deems it advisable, to require a full or partial sovereign guarantee.

The Bank assigns an internal credit rating taking into account specific project, sector, macro and country credit risks. For nonsovereign projects, risk ratings are normally capped by the sovereign credit rating, except where the Bank has recourse to a guarantor from outside the country which may have a better rating than the local sovereign credit rating.

As at Sep. 30, 2019, the rating of nonsovereign-backed loans ranged from 1 to 10 and the related annualized PD was 0.03%-8.67%.

| | • | | LP Fund, investment in Trust and other fund investments |

As at Sep. 30, 2019, the investment operations portfolio includes a LP Fund, investment in Trust and other fund investments described in Note C6. The investments are measured at fair value through profit or loss. The fair value related information is described in Note E.

As at Sep. 30, 2019, the investment operations portfolio includes bond portfolio investments described in Note C8. The investments are measured at amortized cost and subject to ECL assessment.

(ii) Credit risk in the treasury portfolio

Treasury activities and risk appetite are managed in line with the Bank’s Risk Management Framework. The Bank has a limits policy which determines the maximum exposure to eligible counterparties and instruments. Eligible counterparties must have a single-A credit rating or higher. All individual counterparty and investment credit lines are monitored and reviewed by the Risk Management Department periodically.

As at Sep. 30, 2019, the credit risk of the treasury portfolio is mainly from the deposits, MMFs and External Managers Program. Given the high credit quality, no significant loss provisions were made for the investments in the treasury portfolio for the nine months ended Sep. 30, 2019.

29

:

:

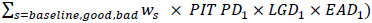

, where Ws is the weight of each scenario – 46.6%% for Baseline, 26.7% for both Good and Bad scenarios.

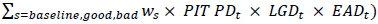

, where Ws is the weight of each scenario – 46.6%% for Baseline, 26.7% for both Good and Bad scenarios.